Gold World News Flash |

- Gold Standard Thoughts

- Ongoing European Crisis to Result in Higher Inflation and Higher Gold Prices ? Here?s Why

- Gold Market Like a Coiled Spring Ready to Explode to the Upside

- How Do I Buy Gold and Silver?

- My Prediction of a Global Economic Depression by 2012 Is Being Terribly Vindicated

- Gold & Silver Acceptance Growing as Distrust in US Increases

- Gold Seeker Closing Report: Gold and Silver Gain With Stocks and Oil

- Beyond Currency Wars, the Coming Global Gold Standard

- Europe trading this morning/ Europe trying to create new firewall/English law Greek bonds/Gold and silver rise

- World Bank President Robert Zoellick Calls for BRICS Bank

- Will U.S. Troops Fire On American Citizens?

- Gold Chart

- VB Update Notes for April - May 2012 - Support?

- Guest Post: Open Letter To Ben Bernanke

- Gold is coiled spring about to snap, Sinclair tells King World News

- Under Pressure (Stock World Weekly)

- World's Largest Solar Plant, With Second Largest Ever Department of Energy Loan Guarantee, Files For Bankruptcy

- Australian Gold Offers Good Protection: Richard Karn

- I Believe the Gold Price Bottomed Last Week Targeting at Least $1,730

- How Empires Really Work

- Bad Banking, Not Gold Money Destabilizes our World

- Tax-Out Day

- Jewellery strike ends as India defers excise duty on non-branded gold

- Gold - Is It About Price or About Value - ...

- VIX Pops As AAPL Snaps Stops With Action Between US Open And EUR Close

- Did Gold Stocks Bottom Last Week?

- Interview with legalise-freedom.com

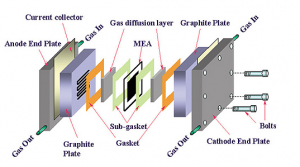

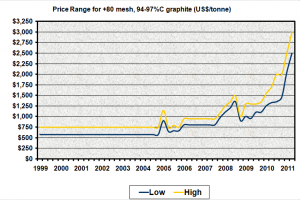

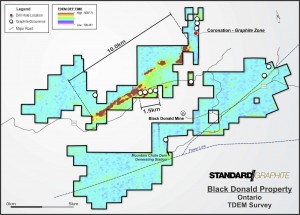

- Why Graphite Stocks May Continue To Outperform In 2012

- My Response to Bernanke

- Rosenberg Recaps The Record Quarter

| Posted: 02 Apr 2012 06:50 PM PDT | |||

| Ongoing European Crisis to Result in Higher Inflation and Higher Gold Prices ? Here?s Why Posted: 02 Apr 2012 05:16 PM PDT On the surface things may appear to be calm, but I don't think the European crisis is anywhere near its conclusion. Losses still have to be taken from Ireland, Spain, Portugal and possibly even Italy…There are a number of ways out of Europe's problems. One of them is higher inflation…[which] is going to be very positive for gold… because the central banks will be under pressure to print. So says*Caesar Bryan in edited excerpts from a King World News interview, as provided by Lorimer wilson, editor of www.munKNEE.com (Your Key to Making Money!). This paragraph must be included in its entirety in any re-posting to avoid copyright infringement. [INDENT][COLOR=#ff0000]Home Delivery Available! If you enjoy this site and would like to have every article posted on www.munKNEE.com (approx. 3 per day of the most informative articles available) sent automatically to you then [COLOR=#ff0000]go HERE and and join “the mun-KNEE-club” to receive Your Daily Intelligence... | |||

| Gold Market Like a Coiled Spring Ready to Explode to the Upside Posted: 02 Apr 2012 05:02 PM PDT Dear CIGAs, Eric King of www.KingWorldNews.com has been kind enough to interview me once again on the actions in the gold market and how it has turned after hitting the low two weeks ago. Click here to listen to the full interview on KingWorldNews.com… The following is courtesy of KingWorldNews.com: Today legendary trader and Continue reading Gold Market Like a Coiled Spring Ready to Explode to the Upside | |||

| Posted: 02 Apr 2012 04:35 PM PDT  I am hearing more and more questions about how to buy gold and silver: I am hearing more and more questions about how to buy gold and silver:

Including the following important questions: Will the government confiscate my gold and silver? Can the government make owning gold illegal? How do I know if my gold and silver dealer is reputable? Do buyers get some kind of confirmation that what they are buying from these shops is real and certified? These are just some of the questions I will try to answer in this post. Why You Should Own Gold and Silver First off, why should you own precious metals? Read this: "In the absence of the gold standard, there is no way to protect savings from confiscation through inflation. There is no safe store of value. If there were, the government would have to make its holding illegal, as was done in the case of gold. If everyone decided, for example, to convert all his bank deposits to silver or copper or any other good, and thereafter declined to accept checks as payment for goods, bank deposits would lose their purchasing power and government-created bank credit would be worthless as a claim on goods. The financial policy of the welfare state requires that there be no way for the owners of wealth to protect themselves. Read more..... This posting includes an audio/video/photo media file: Download Now | |||

| My Prediction of a Global Economic Depression by 2012 Is Being Terribly Vindicated Posted: 02 Apr 2012 04:25 PM PDT  In 2009, I published a short book entitled "Global Economic Forecast 2010-2015: Recession Into Depression." At the time I made my original forecast, sovereigns across the globe were accumulating massive levels of public debt, unprecedented in economic history, with supposedly two objectives in mind: 1.) Stabilize the world's banking and financial systems, which were in danger of total collapse after the implosion of Lehman Brothers and the near extinction of other investment banks. 2.) Compensate for a fall-off in private sector demand through stimulus spending in order to halt the free-fall contraction in GDP. In 2009, I published a short book entitled "Global Economic Forecast 2010-2015: Recession Into Depression." At the time I made my original forecast, sovereigns across the globe were accumulating massive levels of public debt, unprecedented in economic history, with supposedly two objectives in mind: 1.) Stabilize the world's banking and financial systems, which were in danger of total collapse after the implosion of Lehman Brothers and the near extinction of other investment banks. 2.) Compensate for a fall-off in private sector demand through stimulus spending in order to halt the free-fall contraction in GDP.The policymakers cheered their actions, which essentially transferred the bad debts of the private sector onto the public's balance sheet, and created a new modality in sovereign fiscal policy, which I named "structural mega-deficits." I did not share the optimism of the policymakers in the United States, United Kingdom and across the Eurozone. The premise of my forecast was that this massive rise in public debt to GDP ratios among the advanced economies would at best buy, at very high cost, a short period of stabilization at a level below peak economic performance. Eventually, however, the level of sovereign debt would exceed the capacity of the afflicted economies to sustain, leading to a full-fledged sovereign debt crisis towards the latter part of 2011. This would precipitate, by 2012, a global economic depression. Read more...... This posting includes an audio/video/photo media file: Download Now | |||

| Gold & Silver Acceptance Growing as Distrust in US Increases Posted: 02 Apr 2012 04:16 PM PDT  With gold, silver and oil on the move, today King World News interviewed Rick Rule, President of Sprott Asset Management USA. Rule told KWN that resource wars are heating up and an acquisition binge looks ready to take place, led by Asian countries. Rule discussed gold, silver, oil, natural gas & acquisitions, but first, here is what he had to say about the proposed BRIC Bank and increasing distrust of the US: "I believe the concept of a BRIC's Bank is a good idea. The move to have more multi-lateral competition in the world is appropriate. The fact that it's being backed by the World Bank is something the BRIC countries need to be worried about." With gold, silver and oil on the move, today King World News interviewed Rick Rule, President of Sprott Asset Management USA. Rule told KWN that resource wars are heating up and an acquisition binge looks ready to take place, led by Asian countries. Rule discussed gold, silver, oil, natural gas & acquisitions, but first, here is what he had to say about the proposed BRIC Bank and increasing distrust of the US: "I believe the concept of a BRIC's Bank is a good idea. The move to have more multi-lateral competition in the world is appropriate. The fact that it's being backed by the World Bank is something the BRIC countries need to be worried about." This posting includes an audio/video/photo media file: Download Now | |||

| Gold Seeker Closing Report: Gold and Silver Gain With Stocks and Oil Posted: 02 Apr 2012 04:00 PM PDT | |||

| Beyond Currency Wars, the Coming Global Gold Standard Posted: 02 Apr 2012 03:23 PM PDT from CapitalAccount:

The S&P 500 stock index has had its best yearly start vis-à-vis gold in over a decade, and bond traders see a rebound for treasuries after the most tumultuous quarter since 2010. Meanwhile, Greenspan going to bat for his old right-hand at the Federal Reserve, Ben Bernanke, for all the criticism he has taken in recent months, in particular for criticism he has received by the republican primary candidates. But what does all this say about the direction of the us economy. Should we be optimistic or pessimistic, and what to make the dollar? After all, the performance of treasuries, as well as that of gold, is directly related to the value of the dollar. | |||

| Posted: 02 Apr 2012 03:12 PM PDT by Harvey Organ, HarveyOrgan.Blogspot.ca: Good evening Ladies and Gentlemen: Gold closed down today up to the tune of $7.20 by comex closing time. Silver had a stellar day rising by $.61 on the day to $33.08. During the weekend, the Europeans were preparing another firewall no doubt to try and rescue Portugal and Spain as they are well aware that contagion is upon us. Also we learned today that we had 11 billion euros worth of English law Greek bonds not tendered and thus setting up a dilemma for the Greece government. Mark Grant does a great job dissecting France today and he shows that the real Debt/GDP for this nation is 146%. We will go through all of this but first the gold and silver trading: Let us head over to the Comex and assess trading: The total gold comex OI fell by 1780 contracts from 406,388 to 404,680 as many investors are fleeing the gold arena as they realize the game is rigged. | |||

| World Bank President Robert Zoellick Calls for BRICS Bank Posted: 02 Apr 2012 02:45 PM PDT [Ed. Note: Wow. That endorsement didn't take long.] from Silver Doctors: Outgoing World Bank President Robert Zoellick has stated that the World Bank would support a BRICS bank. It appears that using the SWIFT system as a weapon against Iran has MAJORLY backfired. The result will see the dollar lose its reserve currency status much sooner than it otherwise might have. Robert Zoellick said the World Bank would support a Brics bank, an idea formally proposed at a summit in New Delhi last week. The World Bank has previously backed the creation of the Islamic Development Bank and the Opec Fund to build financing and analytical capabilities.

| |||

| Will U.S. Troops Fire On American Citizens? Posted: 02 Apr 2012 02:39 PM PDT by Avalon & Shepard Ambellas, The Intel Hub:

Who would believe that in the year 2012 one would have to ask if the U.S. Military would fire on American Citizen's? The question of troop involvement in a possible upcoming Martial Law scenario that is being predicted is no imaginary possibility – nor is it a 'conspiracy theory'. Other tough questions are being discussed such as, "Will the U.S. government confiscate Gold and Silver in an economic collapse?" and "Will there be a round-up of American Citizens to be put into FEMA Camps?" Many believe that the United Nations will be given authority to step in to keep the peace in any civil unrest or economic collapse. This is a strong possibility. Readers should be familiar with the term 'Hidden In Plain Sight'. How this applies to the United Nations is simple. | |||

| Posted: 02 Apr 2012 02:25 PM PDT [url]http://www.traderdannorcini.blogspot.com/[/url] [url]http://www.fortwealth.com/[/url] Gold managed to claw its way back above important technical resistance near the $1680 level in today's trade and is thus far holding above that number, albeit just barely. The market needs to push away from $1680 with some conviction and demonstrate that it can attract enough buyers at this level to take it firmly up and then through $1700. If it can do that, we have a solid shot at the $1720 level. If it fails to sustain its footing above $1680, it will fall back within the recent trading range that it has been carving out with the bottom down near $1650 - $1640. By the way, the Dollar continues to sink and unless it can recapture the 79 level immediately, it looks like it is heading for a test of support down near 78. Note that all of the shorter term moving averages and the 50 day are now all trending lower in sync again. ... | |||

| VB Update Notes for April - May 2012 - Support? Posted: 02 Apr 2012 01:49 PM PDT HOUSTON – The year got off to a better start for the smaller, less liquid and more speculative miners and explorers as they turned in a decent bounce in January after a horrid 2011. They more or less paused in February, but began weakening again and traded weaker throughout the month of March. Just recently we thought we saw the signs of hidden strength in the junior miners, prompting us to pen an essay on the subject in two parts. Part 1 can be found on the public GGR blog here, and Part 2 at this link. If The Little Guys, as we call them, are going to find support; if the signals we think we see are foretelling a better period for the juniors, now would be an excellent time for it. Looking at the chart above, for example, if support were to form here for both the GDXJ and the CDNX it would mark the third higher turning low since the nasty, panic-inspired October nadir for the CDNX and it could be a right shoulder forming in an inverted head/shoulders pattern for the GDXJ. Both goals are laudable from a technical perspective. So whereas January was very encouraging and February tracked more or less sideways, March was another case of negative liquidity. As Vultures who keep up with the technical VB and VBCI charts know, we have used this 'echo of weakness' to increase and improve our own positioning in several of our Faves. Northern Tiger, Millrock Resources and Guyana Goldfields chief among them. Recall that in the last full update we disclosed that we had taken the opportunity to lighten our positioning in some issues opportunistically in the January/February rally (as disclosed in the individual charts). Those resources came in handy as we increased our stakes in others that reached our lower-than-low targeting, and in one case, a super-stink bid on an out-of-the-blue spike lower for one issue we will mention a bit later. We will continue to try to be extra diligent about putting notations in the various VB and VBCI charts as we make additional changes just ahead. Our view is that there has already been too much liquidity sucked out of the juniors, and therefore we look for the negative liquidity to end with its opposite replacing that condition immediately and potentially violently thereafter. As always, the first place to look for new commentary is directly in the charts themselves (available to Subscribers). As we move forward the charts will become more and more the focus and these too-long reports less and less the focus. More about that in a future report. On to this spring edition of our Vulture Bargain (VB) notes, then… for our tenacious Vulture members. To continue reading, please log in or click here to subscribe to a Got Gold Report Membership. | |||

| Guest Post: Open Letter To Ben Bernanke Posted: 02 Apr 2012 01:48 PM PDT Submitted by Keith Weiner New Austrian School of Economics Benjamin Bernanke Mar 25, 2012 Dear Ben: You have publicly gone on record with some off-the-wall assertions about the gold standard. What made you think you could get away with it? Your best strategy would have been to ignore gold. Although I concede that with the endgame of the regime of irredeemable paper money near, you might not be able to pretend that people aren't talking and thinking about gold. You can't win, Ben. In this letter I will address your claims and explain your errors so that the whole world can see them, even if you cannot. Before I get into your specious claims, I want to point out two of important facts. First, the gold standard exists when people are free to choose what they wish to use for money. Gold has won this market competition over thousands of years, but the key is that when people are not forced to use government-issued scrip they choose gold. And that's the shabby little secret of your irredeemable paper money, Ben. You have legal tender laws to force creditors to accept it, whether they would or not. Will you please let people be free? Second, central planning does not work. The Politburo in the since-collapsed Soviet Union did not know how many shoes to make of what sizes. And you don't know what rate of interest to set. Central planning has always led to the collapse of the specialization of labor and the economy with it, to the degree that it is attempted. The Federal Reserve, the central bank of the USA, is the central planner for money, credit, interest, and discount. Given the importance of money to every single aspect of the economy, it is no exaggeration to say that there is no such thing as a free market built on top of a centrally planned monetary system. In your speech at George Washington University, you made the following claims:

Please forgive me if my takedown runs a little bit long. I've found that it is much easier to commit a logical fallacy in a sound bite than it is to explain the full context. I will take your assertions in order. 1. The gold standard hasn't really worked since the end of WWI. This is true. Just prior to Christmas in 1913 (which is before the beginning of the war, by the way) the Federal Reserve Act was passed into law. Ever since, the Fed has taken for itself and been granted more and more power to try to centrally plan money and credit. You and your predecessors have been in power for a century, but this fact is in no way an argument against the gold standard. 2. To have a gold standard, you have to go dig up gold in South Africa and put it in a basement in New York. It's nonsensical. The fact is that for thousands of years, people have been digging gold up and putting it in basements. To call the behavior of so many people over so many years "nonsense" is arrogant. A free country has room for arrogant men, but no place for arrogant men to back their whims with a gun. From 1933 until 1975, one could be imprisoned for the "crime" of possessing gold. To this day, it is not legal for a creditor to demand payment in gold. If you are so confident that you are right and all good men should be happy that you print dollars at your discretion, can we agree on an experiment? Let's repeal the laws that force creditors to accept paper, and the laws that nullify gold clauses in contracts, and the taxes on the "gains" in gold, and the laws that force taxpayers to use dollars as their unit of account for bookkeeping purposes, and see what people choose when the gun is not compelling them. I will wager one ounce of good gold against a frayed old dollar bill that people will choose gold if you let them. Should I book my flight to Washington to pinky-shake on our bet? 3. The gold standard links the currencies of every country, causing policy in one country to transmit to another. So for example, if the U.K. fixes the number of pounds to an ounce of gold, and the U.S. fixes the number of dollars to an ounce of gold, then the pound and the U.S. dollar inadvertently become linked. Actually, Ben, you are describing the gold exchange standard that prevailed from the insane treaty at Bretton Woods until it collapsed in 1971 with Nixon's default. The choice is not between price fixing vs. excluding gold altogether. The choice is between the freedom for people to choose gold vs. your smart and efficient central planning. 4. It creates deflation, as William Jennings Bryan noted. The meaning of the "cross of gold" speech: Because farmers had debts fixed in gold, loss of pricing power in commodities killed them. By the way, Ben, the Coinage Act of 1792 fixed the price of silver in terms of gold at (15:1). Like every instance of laws that attempt to interfere with the markets, this provision was an unmitigated disaster. Whichever metal is officially valued at less than its market value will be pulled out of circulation and sent elsewhere for its market price. Whichever metal is overvalued will be imported from every corner of the earth and come flooding into the country. In 1873, the government was ready to open the US Mint again. But when they wrote the list of which coins the Mint was authorized to coin, they somehow "forgot" to include the one ounce silver coin. Silver was demonetized. I am sure it had nothing to do with lust for power by the good men who ran the government, nor with any lobbying that might have occurred around that time. This was dubbed the "Crime of '73". Demonetizing silver destroyed enormous amounts of capital, Ben. Just imagine that a farmer, to use your example, has been working hard and saving all his life. And then the government, in callous and cavalier fashion, passes a law that destroys the value of his savings. But this is the power you crave, isn't it? This is the power of central planning, to sit in an office in Washington, taking into account your whims, pet theories, and the desires of lobbyists and casually dispose of the income and wealth of the people without their consent. You have pushed interest rates down to zero on the short end. This has achieved nothing good, and yet you are unwilling to consider that, just maybe, your pet theory is wrong? Good thing your pet theory is enforced on the rest of us at gunpoint, eh Ben? We should pause for a moment to reflect on the nature of downturns. The original promise of the central bank was that it would prevent downturns! As recently as the "Great Moderation" which abruptly ended in 2001, this myth was widely believed. But we see that downturns are not prevented by the central bank. Instead, much larger downturns (such as the one which began in 2008) are caused by the central bank. Let us look at the nature of these downturns. For a while, the bank encourages credit expansion by various means. The bond speculators (which did not exist under the gold standard) jump onto the bandwagon and the result is that interest rates have fallen for more than 30 years in a row. During this long period, as you can imagine, much counterfeit credit is created. By counterfeit credit, I mean where either the saver is unwilling to lend or even unknowing (such as anyone who deposits in a bank nowadays) or when the borrower lacks either the means or intent to repay (such as the government, or many bond issuers and banks). Sooner or later, the game is up. The borrower can no longer keep current on the interest payments. Not even by "rolling" the debt. As an aside, Ben, this is another dirty secret of the irredeemable currency: there is no way for any debt, ever, to be repaid; it only moves from one debtor to another and ultimately ends up at the Fed or the Treasury. So what you blithely call a "downturn" is the painful process of writing off bad loans. Capital has been destroyed, and everyone who made bad loans must write it off. You are correct that interest rates should rise as a result! Capital is far more scarce than people believed during the boom. 6. The economy was far more volatile under the gold standard. I don't think even you believe this, so I will not comment further except to note that the 1929 crash occurred under the tender ministrations and brilliant central planning of the Fed. 7. The only way the gold standard works is if people are convinced that the central bank ONLY cares about maintaining the gold standard. The moment there's a hint of another priority (like falling unemployment) it all falls apart. 8. Gold standards leave central banks open to speculative runs, since they usually don't hold all the gold. No, Ben. I will address these points together: a gold standard is when there is no central bank. What you are substituting in your confusion is if the Fed were to somehow try to centrally plan gold. But you know that doesn't work, so I need not spend time arguing against it. Speaking of unemployment, as you know, if the portion of the population who is deemed to be "in the workforce" hadn't been shrinking so much, the unemployment rate right now would be just below "staggering." And this is despite (or perhaps because of) your central planning activities. 9. The gold standard is based on the "desire to maintain the value of the dollar"—implying a "desire to have very low price stability." The gold standard is about many things. Speaking of the value of the dollar, you are aware, I am sure, that it has lost about 98% of its value in the 100 years since your organization began centrally planning. Under gold, prices do not remain constant. That kind of stasis is neither possible nor desirable. Prices, and more importantly changes in prices, signal to consumers and entrepreneurs what is scarce and what is in demand. No, what remains stable is the rate of interest. And it is this rate that is manifestly unstable under the Fed's careful designs. As recently as 30 years ago, the rate on the 10-year US Treasury was almost 16%. Today it is 2.2%, having recently hit a low under 1.8% (and this rise of more than 22% in a short period of time is both staggering and revealing). Changes in the rate of interest cause enormous destruction to industry. A rising rate destroys businesses one by one as each looks at financing new capital projects, or replacement for worn plant. But at each higher interest rate, fewer and fewer capital projects make any sense. So factories shut down, and ever more workers join the unemployment line. Does this strike a note, Ben? Falling interest rates cause a more pernicious and subtle damage. Bond speculators make risk-free gains on their bonds. This money does not come out of thin air, however. Each bond issuer now has a higher present value of their liabilities. Good thing that FASB does not require them to mark liabilities to market when the bond price rises, or else there would be a serious problem! Actually, there is a serious problem even if we all close our eyes and pretend otherwise. Is that a fair characterization, Ben: that the purpose of the Fed is to help everyone play make-believe? Under paper, neither prices nor interest rates have been stable. Have you taken a look at the chart for crude oil or most other commodities, Ben? 10. The gold standard is based on an aversion to allowing the central bank to respond with monetary policy to booms and busts, and a desire not to give the central bank that power. Here you are correct, Ben. You should not have that power. No one should have that power. A brilliant author by the name of JRR Tolkien wrote a story about power. Have you ever read The Lord of the Rings or seen the version Peter Jackson made into film? 11. There's simply not "enough" gold How much gold do you think there is, Ben? How much gold do you think a gold standard would need? You don't know either number, of course. This is just an old wives' tale. Do you also wear copper bracelets to ward off the common cold, or is that vampires (I forget)? 12. The commitment to the gold standard is that no matter how bad the economy gets, we're going to stick to the gold standard. This is an interesting logical fallacy. You are lumping together commitment to gold with bad economy. This called "begging the question". You are presuming what you ought to be asking. 13. The gold standard was one of the main reasons the Great Depression was so bad and so long. So you think that the disastrous adventure that combined both taxes and protectionism that led to a trade war and thence to collapsing trade had nothing to do with it? Or FDR's constant threats to change the rules of the game, thus rendering investments previously made worthless (there's that problem again)? What about the various other central planning interventions of both Hoover and the New Deal? Or how about the falling interest rate structure that I mentioned above? When the government outlawed the ownership of gold, that herded people into the next-best choice: US Treasurys. This caused the interest rate to fall. Have you ever stopped to think what this does to savers, such as the small farmer for whom you weep crocodile tears?

Ben, I wrote a paper entitled "Gold Bonds: Averting Financial Armageddon" (http://keithweiner.posterous.com/gold-bonds-to-avert-financial-armageddon) because I am convinced that the regime of irredeemable paper money and hence the Fed is going to come to a sudden and catastrophic end. One way or the other, your power and the power of the Fed will be ended. I would prefer that it be ended without also ending western civilization, which is the course we're headed on right now. You remember that bit earlier about capital being rare and precious? Your policies are helping accelerate an unprecedented destruction of capital. When the capital is gone (if not sooner) the game will be up. I would like to avoid plunging into a new Dark Age. Can we agree at least on this, Ben? Sincerely, Keith © Keith Weiner 2012 | |||

| Gold is coiled spring about to snap, Sinclair tells King World News Posted: 02 Apr 2012 01:23 PM PDT 9:20p ET Monday, April 2, 2012 Dear Friend of GATA and Gold: Gold advocate and mining entrepreneur Jim Sinclair tonight tells King World News that gold is becoming an ever-more-tightly coiled spring, that its snapping release will be wondrous, that central banks will restore their solvency with gold, and that "quantitative easing to infinity" will underwrite the whole process. An excerpt from the interview is posted at the King World News blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2012/4/2_Jim... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT A Rare Opportunity with Collectible Gold Coins Sovereign debt problems in the United States as well as Europe will worsen this year. The mainstream financial media may never report about the likely inflationary consequences of bailouts and "quantitative easing," nor are they likely ever to recommend tangible assets for financial protection. But at Swiss America Trading Corp. we believe that it is no longer a luxury to own gold and silver coins but rather a necessity. At the moment the public is showing little interest in Double Eagle U.S. $20 gold coins, so the price premiums above the intrinsic melt values (.9675 ounce of gold in each coin) are historically low. The ratio of price to bullion content for these coins has been 2:1 but today it is only about 1.25:1. This is a real opportunity. So give us a call or e-mail and we will be glad to discuss the potential of these coins and how to use a ratio strategy to increase your gold ounces without money out of pocket. In the January edition of his Early Warning Report, Richard Maybury writes: "As they are inherently in very limited supply, I believe that high-quality numismatics will become tulips, eventually rising a thousand percent or more in real terms, when money velocity goes into mid-second stage. In late stage, who knows -- 2,000 percent? 3,000?" All inquiries will receive without charge (while supplies last) our latest book, "The Inflation Deception," as well as our newsletter "Real Money Perspectives." -- Tim Murphy, trmurphy@swissamerica.com -- Fred Goldstein, figoldstein@swissamerica.com Telephone: 1-800-289-2646 Swiss America Trading Corp., 15018 North Tatum Blvd., Phoenix, AZ 85032 Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Free Month Subscription to Market Force Analysis for GATA Supporters Market Force Analysis is a unique, patent-pending approach to commodity market analysis. An algorithm has been developed to extract supply and demand weightings from futures market data. The difference between supply and demand is the market imbalance that is called "market force," so named because it is what drives price. It brings clarity to past market action and predicts market trends. Because it is derived from accurate futures market data it is not subject to the errors inherent in macro-level estimates of supply and demand. Learn more here: https://marketforceanalysis.com/About_MFA.html Market Force Analysis focuses on short-term (15 days) and medium-term price predictions to help both short-term traders and long-term investors understand market moves and benefit from the generated prediction of prices. To read subscriber comments that show how much the service is appreciated, visit: https://marketforceanalysis.com/Testimonials.html The MFA service has been pioneered by market analyst and Gold Anti-Trust Action board member and researcher Adrian Douglas. The Market Force Analysis premium service provides: -- A bi-weekly report. -- Access to the MFA hot list of junior mining stocks derived from analysis of more than 800 mining stocks. The MFA hot list consistently outperforms well-known mining share indices like the HUI, GDX, and GDXJ. -- E-mail alerts about actionable trades. -- E-mail updates with important information. To obtain your 1-month free trial subscription to the Market Force Analysis letter, e-mail info@marketforceanalysis.com and put "MFA Free Trial" in the subject field. | |||

| Under Pressure (Stock World Weekly) Posted: 02 Apr 2012 01:23 PM PDT This week's Stock World Weekly includes many trade ideas discussed over the weekend by Pharmboy, Scott of Sabrient and Allan of Allan Trends and Phil of Phil's Stock World. The short positions Phil outlined (below) are hedges against long positions - part of a balanced strategy, NOT isolated trade ideas. Phil likes buying puts on companies/stocks that he thinks have a lot of room to fall. But currently, the market is in a bullish mode. Predicting when a reversal will happen is very difficult. Moreover, Lee Adler's research suggests that the "reversal" is at least a month or more out. On to the newsletter. ******** This week, Allan is sharing his weekend subscriber update with us: New Signals USO Daily———>SHORT Allan's Market Analysis Periodically it's helpful to stand back and look at the big picture. No better time to do so than at the end of the first quarter of the year. We follow over fifty indices, stocks, commodity ETF's in various time frames. This snapshot focuses on the major market indexes, not so much because the system did so well the past three months (although it helps), but because I don't want to clutter nor confuse my point. The major stock market indexes, e.g., the DJIA, SPX, NASDAQ and IWM, have been LONG the entire first quarter. Being long was the easiest way to play the market. Not a single trade the entire quarter - simply buy and hold LONG. Throw in a little leverage with a popular and liquid leveraged ETF like TNA and the gain was 35% for the quarter. The same simple approach also worked for the most highly visible stocks. AAPL. Our brand of trend following has been LONG AAPL for the entire quarter, for a gain of 50%. This is the essence of the underlying principle of trend following: Identify the dominate trend and align your money with it. Just knowing what side of the market to be on, as these returns suggest, is worth of the price of admission. Which brings up the subject of the current trend and the beginning of the next trend, the one down. As much as I have anticipated that next trend, the truth is anticipation has nothing to do with trend following. Notwithstanding a severely overbought market with excessive bullishness, the trend has yet to turn down. When it does, whatever may have been missed by not participating fully in the first quarter's rally, will be made up and maybe dwarfed by that next trend. The price of catching that trend is waiting out a few daily bars of the decline before the algorithm places the red arrows on the daily charts. This trend hasn't changed the entire first quarter and it has been right in not doing so. It has beaten the doomsayers and roaring bears and eventually, when their bear market does assert itself, it will join in the fireworks. My takeaway from the first quarter is to trust these major market trend models and let them identify our next trade opportunity. Another three-month trend, especially if it is down, is just what we need to lock in a profitable 2012. So far, so good, and we have 3/4 of the year to go, plenty of time to build upon the gains above. Below are a few charts that were highlighted in the Premium Trading Service on Friday: First of all, AAPL is due for a walloping (I lived in the South for 25 years). The 60-minute model triggered SHORT on Friday. I sent it out. Along with the hourly charts, I use 30-minute charts in my own trading. The TZA 30-minute chart triggered LONG on Wednesday and has now hit its trend line twice and refuses to break down through it. It hit the trend line on Friday and closed near its highs. I think its trying to tell us something, we should know early next week. That's the kind of analysis and trade ideas that I'm starting with in the new service...some subscribers want to trade more….it's in our blood. For a risk-free trial, click here for Allan's standard service, or click here for the premium service. The premium is for more active traders. For more information, see "Can you trade a chart like this."] Note: Phil is also bearish on oil: "Speaking of people who are soon to be screwed, oil speculators are about to get their gas handed to them as there are over 570M barrels worth of open contracts at the NYMEX scheduled for delivery in the next 3 months alone and we're already way over any prior level of storage capacity." (Bespoke chart)." ***** Scott Brown of Sabrient likes buying Assurant Inc. (AIZ, $40.50) and selling a call against the shares. For example, buying 100 shares and selling a June call with a $42.5 strike price. The company's forward p/e is 6.6, and Scott expects a 5-year growth rate of around 10%. AIZ is rated a strong buy according to Sabrient's rating system. Update: Monday, Walter of Sabrient presented several long trade ideas, based on searching for GARP stocks (growth at reasonable prices) in Sabrient's "My Stock Finder." General Motors, Co. (GM) Cyclical ConsumerDeckers Outdoor Corp. (DECK) Cyclical ConsumerCVR Energy Inc. (CVI) EnergyUnited Therapeutics Corp. (UTHR)—Healthcare In Sabrient's Macro Report, Sabrient examines various economic scenarios and economic factor-based portfolios (click link for a free report). ***** Pharmboy submitted a biotech trade idea for next week. "Our biotechs have been on a huge run. I expect it to end soon. The biotechs should begin a holding pattern. Seattle Genetics (SGEN), Curis (CRIS), Infinity (INFI) and Protalix (PLX) are part of our core holdings, and all doing well. "A new stock I like is Neurocrine Biosciences (NBIX, $7.97). NBIX is back with two more drugs, one for endometriosis (elagolix) and the other for tardive dyskinesia (VMAT2 inhibitor NBI-98854). The stock took a hit on abnormal results for NBI-98854, but that spells opportunity. The drug appears to work. The clinical trial sites need to do the work correctly (read more here). I like a speculative play, buying 3 November $6/8 bull call spreads and selling 3 $6 puts for a net $0.55 debit. If NBIX holds where it is now, it would be a net gain of $1.45." [Click here for Pharmboy's portfolio to date.] ***** Phil provides a number of speculative short trade ideas. He likes buying puts in overpriced companies to offset long positions in companies that are trading at more reasonable valuations. Many of these puts are trading lower than when Phil initially mentioned them - i.e., trading at losses. The stocks listed below are still stocks that Phil would be comfortable shorting or buying puts on as hedges for long-term bullish positions. These are not trades to be taken in isolation. Phil is using puts as hedges for bullish positions. Shorts on the companies below may do well if the market decides to stage an overdue "correction." ***** By Phil Davis (Friday, March 30, 2012) The following is a Long Put List Update with my original 3/15 commentary (rather than rephrasing it – you get the idea) and possible roll suggestions, or new entries: [From March 15]: We're not likely to get any real bearish fireworks until the Euro fails $1.30 (now $1.3046). Keep in mind that the Swiss absolutely do not want that to happen so there's at least one Central Bank on a mission to support the Euro (and thus keep the Dollar below 81) but, it's a relatively small Central Bank. So we turn our attention to the BOJ, which doesn't care if the Dollar or the Euro goes up, as long as the Yen gets weaker against one of them. Obviously the BOJ prefers both and it has been alternating its Dollar and Euro purchases. It's been working great with the Yen now at 83.26 and the Nikkei up like a rocket at 10,050. Anyway, it doesn't matter WHY the market is going up, we just have to buy stocks and hold it until these levels crack (which may be tomorrow or Monday - we have to be patient). Assuming no big collapse tomorrow, we will redraw the Big Chart over the weekend and the 10% lines will become the Must Hold lines with some possible adjustments. Our top 10 list that has now run its course for S&P over 1,360 will give way to a new top 10 list for S&P over 1,400 and, no matter how silly it seems – we need to follow the market. HOWEVER, we can use that low VIX and insane attitudes to place a few outlying bearish bets, like yesterday's Long Put List. I mentioned PCLN in the above post but here's the list and the idea is to buy puts that are CHEAPER than they were when I originally picked them, and to take profits when they work, and then switch to a fresh horse of the ones that are CHEAPER again. This way, we keep betting on stocks to fall that are even higher than they were when we first thought that they were overbought. PCLN, CMG and LVS are on the top of my list with PCLN and LVS both plays on China slowing, while CMG is just annoying. Here's my whole list: Note: the "was" prices are old, low prices; the first "now" prices are from March 15, and the "currently trading" at price is from Friday, March 30, 2012. AXP (was $12, now $56) July $49 puts at $1, now $0.76 – down 24% – roll to $52.50 puts ($1.38) for $0.62. [It will cost $0.62 to "roll" the July $49 puts to higher strike price puts, the July $52.50, i.e. sell the $49 strike price puts and buy the $52.50 strike price puts.] AXP is currently (Friday, March 30) trading at $57.86. BIDU (was $11, now $139) June $100 puts at $1.05, now $0.55 – down 47% – roll to $115 puts ($1.60) for a cost of $1.05. BIDU is currently at $145.77. CAT (was $24, now $113) May $95 puts at $0.95, now $1.50 – up 58%. CAT is currently at $106.52. CMG (was $40, now $401) June $300 puts at $2, now $1.10 – down 45% – roll to $330 put ($2.25) for $1.15. CMG is now at $418.00. FAS (was $8, now $103) July $60 puts at $2, now $1.70 – down 15%. FAS is currently trading at $109.15. GE (was $6, now $20) Sept $19 puts at $1, now $0.94 – down 6%. GE is now trading at $20.07. GOOG (was $250, now $620) Jun $500 puts at $2.80, rolled to June $540 puts for $2.65 on 3/20, now $4.10 – down 18%. GOOG is currently at $641.24. HD (was $18, now $50) Aug $43 puts at $1, now .72 – down 28% – roll to $46 puts ($1.22) for $0.50. HD is trading at $50.31. IBM (was $70, now $205) Jul $155 puts at $1.05, now $).70 – down 33% – roll to $180 puts ($1.65) for $1. IBM is trading at $208.65. ISRG (was $80, now $531) July $375 puts at $3, now $2.50 – down 16% – roll to $430 puts ($4.70) for $2.20 [costs $2.20 to roll the puts, i.e. sell and buy new ones]. ISRG is currently at $541.75. IWM (was $35, now $70) Aug $65 puts at $1.25, rolled to Aug $71 puts for $0.85 on 3/20, now $1.67 – down 20% – roll to $76 puts ($2.70) for $1.03. IWM is now trading at $82.81. KO (was $40, now $70) Aug $65 puts at $1, now $0.50 – down 50% – roll to Aug $70 puts ($1.20) for $0.70. KO is now trading at $74.01. LVS (was $2, now $55) June $50 puts at $1.85, rolled to June $55 puts for $1.50 on 3/20, still $3 – down 10%. LVS is currently at $57.57. MA (was $120, now $425) July $320 puts at $3, now $2.60 – down 13% – roll to $350 puts ($5.40) for $2.80. [It costs $2.80 to move to the higher strike price puts.] MA is currently at $420.54. It dropped $7.68 on Friday, March 30. MMM (was $42, now $89) July $77.50 puts at $1.10, now $0.90 – down 27% – roll to $82.50 puts ($1.62) for a cost of $0.72. MMM is now at $89.21. PCLN (was $150, then $30, now $650) July $520 puts at $7.10 (see yesterday's post re. adjustment history), now $5.40 – down 24% – roll to $550 puts ($7.60) for a cost of $2.20. PCLN is currently trading at $717.50. QQQ (was $26, now $66) July $61 puts at $1, still $1 – even. QQQ is now at $67.55. V (was $42, now $117) Sept $95 puts at $2, now $1.90 – down 5%. V is currently at $118.00. XRT (was $15, now $61) June $59 puts at $1.90, now $1.60 – down 16% – roll to $62 puts ($2.75) for $1.15. XRT is currently trading at $61.25. We'll touch base on these on a regular basis but understand these are SPECULATIVE shorts. We pick a few and the market goes up and we lose 50% and we pick a few more next month and we lose 50%, and a few more next time, and we lose 50% and then it's July and the S&P is at 1,500 and all we need is a nice 150% gain on something and we've got our losses back. If we never win – then we'd damned well better have some bullish bets that are making good money to offset it because these are now the hedges as we are forced to be bullish until the Fed runs out of money or that asteroid hits the Earth – whichever comes first… The trick is to SCALE into shorts and DIVERSIFY the risk so that a winner can help fund your rolls on losers. When we roll or double down on a position, our primary goal is to get 1/2 back out even. That puts us back to a smaller entry with cash on the side which we can put into the next roll, if necessary. We keep putting ourselves "in the right place" and, eventually, if we catch it at the right time, we have very strong put positions that can catch a major selloff.

**** Disclaimer Hypothetical or simulated performance results have certain limitations unlike an actual performance report. Simulated results do not represent actual trading. Also, since the trades have not actually been executed, the results may have under or over compensated for the impact, if any, of certain market factors such as lack of liquidity. Simulated trading programs in general are also subject to the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. | |||

| Posted: 02 Apr 2012 12:14 PM PDT Solyndra was just the appetizer. Earlier today, in what will come as a surprise only to members of the administration, the company which proudly held the rights to the world's largest solar power project, the hilariously named Solar Trust of America ("STA"), filed for bankruptcy. And while one could say that the company's epic collapse is more a function of alternative energy politics in Germany, where its 70% parent Solar Millennium AG filed for bankruptcy last December, what is relevant is that last April STA was the proud recipient of a $2.1 billion conditional loan from the Department of Energy, incidentally the second largest loan ever handed out by the DOE's Stephen Chu. That amount was supposed to fund the expansion of the company's 1000 MW Blythe Solar Power Project in Riverside, California. From the funding press release, "This project construction is expected to create over 1,000 direct jobs in Southern California, 7,500 indirect jobs in related industries throughout the United States, and more than 200 long-term operational jobs at the facility itself. It will play a key role in stimulating the American economy," said Uwe T. Schmidt, Chairman and CEO of Solar Trust of America and Executive Chairman of project development subsidiary Solar Millennium, LLC." Instead, what Solar Trust will do is create lots of billable hours for bankruptcy attorneys (at $1,000/hour), and a good old equity extraction for the $22 million DIP lender, which just happens to be NextEra Energy Resources, LLC, another "alternative energy" company which last year received a $935 million loan courtesy of the very same (and now $2.1 billion poorer) Department of Energy, which is also a subsidiary of public NextEra Energy (NEE), in the process ultimately resulting in yet another transfer of taxpayer cash to NEE's private shareholders. As Bloomberg notes: "The company joins Energy Conversion Devices Inc., a U.S. solar manufacturer that suspended production last year; LSP Energy LP, the owner of a natural-gas-fired power plant in Mississippi; Ener1 Inc., maker of lithium-ion batteries for plug-in electric cars; solar-panel maker Solyndra LLC; and energy storage company Beacon Power Corp. (BCONQ) in bankruptcy." And so central planning fails again, and again, and again, and again. But it sure will be better with the centrally planned monetary (and in the absence of a working Congress - also fiscal) policy. Because this time it really will be different. From Reuters:

At least someone's reputation will be tarnished as a result of this latest epic failure of the Obama administration to misallocate capital :

Two people, however, who won't be humiliated at all are California Governor Jerry Brown, and Secretary of the Interior Ken Salazar, who reprise the role of Joe Biden, last seen praising not only MF Global's Jon Corzine, but that other epic administration failure: Solyndra. Watch them praise the groundbreaking for the Blythe facility. Epic embarrassment. And not even a full year ago. But before that, of course, we had the funding of the plant with a $2.1 billion loan guarantee from the US Department of Energy, the second largest ever, smaller only than Georgia Power's $8.33 billion loan guarantee. From the DOE:

And while we do not know just how much the government will have to pay out of pocket, we do know that STA had at least $50 million in debt at filing. What we do know for sure is that at least the firm's financial advisors made money on the deal. From the company's Investors page:

Great job there Citi and Deutsche: can you please advise us how much in taxpayer cash you received as part of your incalculable "advice" please? Also, as noted earlier on, as part of its first day filings, the company was prompt announce the procurement of DIP funding (link), which will come in the form of a $22.3 million secured loan (against what assets?) at Libor + 800bps, courtesy of NextEra Energy Resource, LLC. The same NextEra featured in the following press release:

That's right: one ward of the state, bailing out another ward of the state, all to reduce those evil carobn emissions. Although that is not all. NextEra is also a subsidiary of the publicly traded, albeit with very private investors, NextEra Energy (NEE). Which means that every dollar extracted out of Solar Trust via the DIP, and ultimately via a Credit Bid in which NextEra will acquire the STA assets at pennies on the dollar, will go straight to NEE's shareholders. Who are these shareholders you ask? Here they are: spot the odd one(s) out. And that is how in crony America taxpayer money goes from one insolvent pocket, to another, to Wall Street, all under the guise of idealistic pursuits and clean energy. There is more to this story but we will stop here as we have had enough. For those interest here is the first day affidavit, as well as the DIP term sheet. And the last time we saw an Org Chart this fun, the company's name started with En and ended in ron. | |||

| Australian Gold Offers Good Protection: Richard Karn Posted: 02 Apr 2012 11:14 AM PDT The Gold Report: Richard, at the Gold Symposium in Sydney, Australia, last November, one of your charts tracked the erosion of U.S. dollar purchasing power. Can you give us a summary? Richard Karn: It's interesting that if you go back to the late 18th century, the dollar has been on the gold standard roughly the same amount of time it has been on the Federal Reserve System, which presents us with a wonderful opportunity to compare the dollar's purchasing power over time. Throughout the 19th century with all of the booms and busts, the wars, and the incredible territorial and industrial expansions, the dollar maintained its purchasing power very well on the gold standard. Since 1914, when the U.S. went to the Federal Reserve System and especially since it has become a purely fiat currency system since closing the gold window in 1971, the dollar's purchasing power has collapsed. Under the Fed's administration, the dollar has lost well over 95% of its purchasing power. We show this... | |||

| I Believe the Gold Price Bottomed Last Week Targeting at Least $1,730 Posted: 02 Apr 2012 10:44 AM PDT Gold Price Close Today : 1677.50 Change : 8.20 or 0.49% Silver Price Close Today : 33.083 Change : 0.614 cents or 1.89% Gold Silver Ratio Today : 50.706 Change : -0.706 or -1.37% Silver Gold Ratio Today : 0.01972 Change : 0.000271 or 1.39% Platinum Price Close Today : 1649.90 Change : 10.50 or 0.64% Palladium Price Close Today : 655.65 Change : 1.75 or 0.27% S&P 500 : 1,419.04 Change : 10.57 or 0.75% Dow In GOLD$ : $163.46 Change : $ (0.14) or -0.08% Dow in GOLD oz : 7.907 Change : -0.007 or -0.08% Dow in SILVER oz : 400.95 Change : -5.97 or -1.47% Dow Industrial : 13,264.49 Change : 52.45 or 0.40% US Dollar Index : 78.88 Change : -0.126 or -0.16% The GOLD PRICE targets a move to $1,730 at least, and right now I'm about the only soul (other than the perennial gold and silver bulls who always see higher prices tomorrow) who noticed that silver and gold bottomed last week. Left behind on both charts is a V-bottom Thursday, and a climb out of that. Resembles an angular upside down head and shoulders, but a reversal formation it certainly is. But I'm nervous because I am only a natural born fool from Tennessee, well known for out- smarting myself. Take enough whippings, and it'll make you keerful. GOLD PRICE today rose $8.20 to $1,677.50 when Comex hit the closing bell. High reached for $1,683.20, while the low fell no further than $1,663. If gold's chart looks good, SILVER's looks STERLING. (Owch. Pun penalty!) V-bottom drawn last week targets at least 3360, and it jumped 61.4c today to close at 3308.3. High came at 3320, low at 3235.6c. All that's okay, it was 3300c we had to pass first. I believe silver and gold bottomed last week and will not post lower bottoms, so it's time to buy, while the public's delusional follies of Happy Days Are Here Again are depressing the SILVER and GOLD PRICE. 'Twas a good day for stocks, but better for gold, and better still for silver. US Dollar index? Kinda scabby. Stocks bee-barely made a new high today. Dow rose 52.45 (+0.465) to 13,264.49, versus 15 March's 13,252.75. S&P excelled the Dow, up 10.57 (0.75%) to 1,419.04 vs. 1,416.51 on 26 March. Surprise, that clears up nothing. Stocks yet speak with forkéd tongue (bifurcated lingual organ, for you Latinists), for the one month chart showeth no more than a deadly triple top. Thus to prove themselves themselves genuinely rallying, stocks must clear that (roughly 13,250 hurdle convincingly, i.e., by 2 or 3%, not two or three points. Y'all already know my opinion on stocks, formed as it is by a longstanding and unbroken bear market (primary down trend), but I will leave it there lest I break my own rules and descend to the scatological. Basing a nation's money supply on a paper currency created at will by a private central bank makes about as much sense as putting the nation on a cocaine standard. Right now the US dollar index is only vibrating and oscillating, maybe breaking down, maybe not, but really doing nothing. Dropped today 12.6 basis points (0.16% to 78.878), but that adds nothing to the violation of support long ago noted. No direction. I know loads of folks believe the euro is better than the US dollar, which only goes to explain why people like Karl Marx, Josef Stalin, and Adolf Hitler were able to collect so many followers. Euro can't go forward and won't go back, but I reckon it will resolve this by disappointing the hopers. Closed today down 0.16% at 1.3321. Japanese yen continues to confirm that it has bottomed after that nearly 2 month slide. Closed above its 20 DMA today, up 0.95% to 121.84c (82.07). Should keep on gaining. On this great day, 2 April 1792 the US Congress passed the Coinage Act, authorizing the "dollar" of silver of 371.25 grains fine silver as the country's standard coin against which all other coins would be valued, including the roughly half ounce gold Eagle ("valued at ten dollars"), half-eagle, and quarter eagle. 1/10 dollars -- "dismes" -- quarters, and halves were also to be minted, at precisely 1/10, 1/4, and 1/2 the silver content of the dollar. As I have studied this act for more than 40 years, I have been continuously impressed by these legislators' depth of monetary understanding. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com 888-218-9226 10:00am-5:00pm CST, Monday-Friday © 2012, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | |||

| Posted: 02 Apr 2012 10:30 AM PDT Great empires, such as the Roman and British, were extractive. The empires succeeded, because the value of the resources and wealth extracted from conquered lands exceeded the value of conquest and governance. The reason Rome did not extend its empire east into Germany was not the military prowess of Germanic tribes but Rome's calculation that the cost of conquest exceeded the value of extractable resources. The Roman empire failed, because Romans exhausted manpower and resources in civil wars fighting amongst themselves for power. The British empire failed, because the British exhausted themselves fighting Germany in two world wars. In his book, The Rule of Empires (2010), Timothy H. Parsons replaces the myth of the civilizing empire with the truth of the extractive empire. He describes the successes of the Romans, the Umayyad Caliphate, the Spanish in Peru, Napoleon in Italy, and the British in India and Kenya in extracting resources. To lower the cost of governing Kenya, the British instigated tribal consciousness and invented tribal customs that worked to British advantage. Parsons does not examine the American empire, but in his introduction to the book he wonders whether America's empire is really an empire as the Americans don't seem to get any extractive benefits from it. After eight years of war and attempted occupation of Iraq, all Washington has for its efforts is several trillion dollars of additional debt and no Iraqi oil. After ten years of trillion dollar struggle against the Taliban in Afghanistan, Washington has nothing to show for it except possibly some part of the drug trade that can be used to fund covert CIA operations. America's wars are very expensive. Bush and Obama have doubled the national debt, and the American people have no benefits from it. No riches, no bread and circuses flow to Americans from Washington's wars. So what is it all about? The answer is that Washington's empire extracts resources from the American people for the benefit of the few powerful interest groups that rule America. The military-security complex, Wall Street, agri-business and the Israel Lobby use the government to extract resources from Americans to serve their profits and power. The US Constitution has been extracted in the interests of the Security State, and Americans' incomes have been redirected to the pockets of the 1 percent. That is how the American Empire functions. The New Empire is different. It happens without achieving conquest. The American military did not conquer Iraq and has been forced out politically by the puppet government that Washington established. There is no victory in Afghanistan, and after a decade the American military does not control the country. In the New Empire success at war no longer matters. The extraction takes place by being at war. Huge sums of American taxpayers' money have flowed into the American armaments industries and huge amounts of power into Homeland Security. The American empire works by stripping Americans of wealth and liberty. This is why the wars cannot end, or if one does end another starts. Remember when Obama came into office and was asked what the US mission was in Afghanistan? He replied that he did not know what the mission was and that the mission needed to be defined. Obama never defined the mission. He renewed the Afghan war without telling us its purpose. Obama cannot tell Americans that the purpose of the war is to build the power and profit of the military/security complex at the expense of American citizens. This truth doesn't mean that the objects of American military aggression have escaped without cost. Large numbers of Muslims have been bombed and murdered and their economies and infrastructure ruined, but not in order to extract resources from them. It is ironic that under the New Empire the citizens of the empire are extracted of their wealth and liberty in order to extract lives from the targeted foreign populations. Just like the bombed and murdered Muslims, the American people are victims of the American empire. Paul Craig Roberts How Empires Really Work originally appeared in the Daily Reckoning. The Daily Reckoning, published by Agora Financial provides over 400,000 global readers economic news, market analysis, and contrarian investment ideas. Recently Agora Financial released a video titled "What is Fracking?". | |||

| Bad Banking, Not Gold Money Destabilizes our World Posted: 02 Apr 2012 10:17 AM PDT Mark J. Lundeen [EMAIL="Mlundeen2@Comcast.net"]Mlundeen2@Comcast.net[/EMAIL] 30 March 2012 What causes bull and bear markets? The foolish expansion of credit; via bank loans. In this article, foolish is understood as a financial-industry wide practice of approving loans on a massive scale to people, or businesses that historically-sound banking practices would never have allowed. In other words; it's nice having friends in high places when you want to make money, with other people's money. Show me a significant sector of the economy with rapidly rising valuations, or hot foreign market, and I'll show you a banking system, somewhere, taking on risks it will regret in due time. People who know little about monetized gold (economists and the banks they work for), fail to see the humor of their blaming the financial panics of the 18th & 19th centuries on the gold standard. What caused these long ago panics and rolling banks failures were the banking system's f... | |||

| Posted: 02 Apr 2012 10:00 AM PDT Addison Wiggin – April 2, 2012

The 100 euro ($130) "austerity measure" was meant to close a gap in funding for local services provided by the government. "Unlike other European countries," The Christian Science Monitor reports, "Ireland has had no ongoing property tax since 'residential rates' were abolished in 1977. A stamp duty tax is paid on buying a property, while a flat annual charge of €200 ($266) is levied on second homes." Upon reading the story, we couldn't help wonder what would happen in the United Sates if the IMF or some centralized foreign government outside the U.S. borders tried to impose a one-shot tax for local services. What if Washington, our internal centralized foreign government, tried it? Heh. Only half of Ireland's 1.6 million households paid the tax by Saturday's deadline.

In the United States this morning, we see a another example: Passaic, N.J., is looking to bill insurance companies every time the city responds to a fire or a car crash: $1,000 for a fire call, $600 for a wreck. "If you are a policy owner, you are already paying for it — this fire department service charge provision," says Mayor Alex Blanco. The mayor's no fool. He knows how two years ago, the city of Tracy, Calif., had to backtrack when it tried to charge people $300 for a 911 call. So in Passaic, the insurance companies would eat the cost. And raise premiums, of course. "I feel that it would be unethical on their part," says the mayor, feigning sympathy for policyholders. Really. "We have lost $2 million in [state] aid," he then adds, getting to real core of the matter.

Or raise taxes. Or impose new taxes and weird fees. "When a city or a school district has to cut its budget, it is not passing it along to another entity," says Robert Ward of the Rockefeller Institute of Government. "It's reducing services or compensation to employees." "Municipalities are reducing the number of police officers, reducing library hours and reducing staffing at municipal parks." Things you took for granted, like trash pickup, become less of a sure thing. If it's happening in your neighborhood, consider it an early warning sign. What comes next won't be pretty.

"Since these stem cells originated from Patrick, there are none of the ethical considerations that have plagued embryonic stem cells. "The most amazing thing was how quick and easy this procedure was. It almost defies belief: that a small patch of skin holds the promise of healing, healing for the entire body. The five of us witnessed this stunning act of creation in a very normal-looking doctor's office."

Four years ago, when Patrick first tipped us off to the possibilities, this research was entirely hypothetical, pie-in-the-sky stuff. Now it's coming together with incredible speed. Today's procedure comes on the heels of his keynote address to the Personalized Life Extension Conference in San Francisco on Saturday. The event afforded him the chance to meet face-to-face with some of the top researchers in human longevity. Look for the fruits of his research in the months to come. In the meantime, Patrick's already uncovered one opportunity that could build new fortunes for early investors.

"China's economy hasn't contracted since 1976," Mr. Mayer reminded us last July 20. "That's 35 years, a long time between economic bowel movements." His recommendation at the time: Steer clear of commodities where China makes up large percentages of total world consumption. "I took a quick chart," Chris wrote during his recent update, "comparing the stock prices of four large commodity firms: Vale in iron ore, Freeport for copper, Consol Energy for coal and ArcelorMittal for steel. All four lost at least a third of their value since my call in July":  "This may seem at odds with what you've seen elsewhere," Chris concedes. "Isn't China still growing 7.5%? Yes, according to official Chinese figures, which are a cut above worthless."

The PMI is a measure of manufacturing activity. A number higher than 50 indicates expansion. Less than 50, contraction. The government's figure grew for the fourth straight month, to 53.1. HSBC does its own private survey. It fell deeper into contraction territory at 48.3.

"I have little doubt China's economy will be bigger than it is today five years from now. But in the short term, say the rest of the year, I would be careful counting on China's growth, which the consensus takes for granted." "Whatever commodity producers you own, they should be ones you don't mind owning for the long haul. They should be ones you don't mind adding to at current prices. Otherwise, sit out and wait. You'll have a better entry price."

And now's the time: Myanmar — or Burma, as it's still known — is coming in from the cold. The military government is loosening its grip. Aung San Suu Kyi — a woman who'd been kept under house arrest for 15 years — was elected to parliament over the weekend. Her opposition party won 40 of 45 available seats. In addition, the country moved to a floating currency — as of today. The previous official exchange rate was 6.4 kyat to the U.S. dollar — a completely unrealistic rate that fomented a black market and deterred companies from investing in Burma. How unrealistic? The rate this morning is 818 kyat. "Foreign investors," says IHS Global managing director Tony Nash, "can now have a certainty about the security of their investments in the country."

Right now, the Thai economy is 10 times bigger. "The gap between these historical peers," says Doug, "seems likely to narrow as Myanmar introduces a political system more similar to Thailand's." We've been invited to join Leopard Capital on a tour of their projects in Burma in May. Again, we'll keep you posted. In the meantime, we urge you to register for a free webinar Laissez Faire Books' Jeffrey Tucker will be hosting with Chris Mayer on April 12. With The World Right Side Up, you'll get an expansive overview of the most-important investing trends in the global market following two years of extensive boots-on-the-ground research… free of charge.

"The market traded flat for the final three days of last week," wrote Jonas Elmerraji in an April Fools' Day missive to his readers, "as money flows from stock investors poured into lottery tickets for the record $640 million Mega Millions drawing. "On Friday afternoon, I counted seven different lottery articles on the Wall Street Journal's home page. Seven!" Lotto stories abounded at Bloomberg and CNNMoney, too. Almost as ludicrous as Jonas' lottery headline was, there was also this real Reuters story from Friday: "Investors flocked to consumer-oriented shares after data showed U.S. consumer spending rose by the most in seven months in February, even as personal income increased only modestly." "How much 'flocking' were those investors doing?" Jonas asks. "They added 0.4% to the S&P Consumer Discretionary Sector Index." "I've said for a long time that Wall Street has an attribution problem. Investors see a big pop in stocks and they look for the nearest headline as a reason for the move."

Hmmm… $1.5 billion in a $15 trillion economy? That's 0.01% of GDP. And that's only two months worth of ticket sales. Imagine the stimulus effect of even bigger jackpots! And spread across an entire calendar year! On the other hand, we don't want to give anyone any ideas…

Nothing stands out within the figures, except exports. They're still growing, but at a sharply slower pace than last month. Worth keeping an eye on…

"When our kids where in their first years of school we were shocked at the dung heap they picked up there. What do you do when a kid comes home from his first week of kindergarten asking what XXX movies are?" "Ain't happenin' to my kids. We brought ours home and taught them well. It was hard work, on one hand. But it was easier too, because we no longer had to live our lives by the standards and schedule of an institution. We could more readily teach them what is important in life, rather than all the social engineering nonsense of Billy having two dads, and make sure to tell us if your parents ever spank you." "Rather than teaching them how to pass tests, we taught them how to learn. Instead of regurgitating the manure pile that they call textbooks, we gave them resources to feed their minds and taught them how to teach themselves anything they wanted, or needed, to learn." "Today, they're among the few men in their early 20s who have not graduated from a university, work hard, make decent livings because of the skills they pursued, married young and are already raising their own families. Hey, they're not in debt, either." "Make no mistake, there are excellent teachers in the system. But the system is a menace. Get your kids out before it's too late."

"I strongly suggest you watch Gasland — a documentary film showing where and how often fracking goes awry and how devastating the results are. I had the feeling all thru the blurb that the same maker could have made a lighthearted blurb for Hitler extolling the benefits of gas, ovens and population control." "I also am in pursuit of profits. But not at any cost. If the worst outcome happens, in a generation, we will have all the gas and oil we need right here in the I.O.U.S.A. and not a drop of safe drinking water." "Be careful what you wish for." The 5: "Gasland is to the energy industry what Keynesian economics are to free market," responds our Matt Insley on the resource beat. "Both are filled with fallacies and have amassed a following that slows greater good of the latter." "It's just amazing that someone is actually using Gasland as a crutch to stand on. It's amazing what a sticky idea of 'fire-filled tap water' will do for the wild imagination. That propaganda-filled documentary has been poked through with so many holes that debunking sites like this have become commonplace." Hmnnn… Cheers, Addison Wiggin P.S. For the coming week, Abe Cofnas expects the Dow to stay within a wide range of 300 points. Thus, his "mock" trade of the week: Look for the Dow to stay below 13,275 but above 12,975 this week.  "The attractive thing about range trades," says Abe, "is that we can't be wrong on both sides. One side always wins, and very often we win on both sides if the price stays within the binary barrier." One side of the trade would deliver a 14.9% gain by Friday. The other would generate a 16.2% gain. So far, Abe's 5 for 5 on trades he's conducting for our amusement. Stay tuned… | |||

| Jewellery strike ends as India defers excise duty on non-branded gold Posted: 02 Apr 2012 09:23 AM PDT 02-Apr (MINEWEB) — With the Indian government stating that it would delay the implementation of hiking the excise duty on non-branded gold jewellery, the bullion strike in India has been officially called off. Jewellers in Mumbai and several parts of the country were back to their stores Monday afternoon, expecting a revival in demand. [source] | |||

| Gold - Is It About Price or About Value - ... Posted: 02 Apr 2012 09:05 AM PDT | |||

| VIX Pops As AAPL Snaps Stops With Action Between US Open And EUR Close Posted: 02 Apr 2012 09:00 AM PDT As AAPL surges over 3% on the second lowest volume in 3 weeks, the start of Q2 was exuberance-exemplified as stocks, commodities, and Treasuries all enjoyed a bid - though most of the excitement was from the US open to the European close only. A weak start as European credit and equity markets leaked lower (as did ES - S&P 500 e-mini futures) was extinguished as the US day session opened and while construction spending was a bust, ISM managed a small beat. This didn't seem like the catalyst really but we were off to the races as everything rapidly levitated into the European close - except US credit markets which were far less sanguine once again. Stocks stalled at that point and limped on to test last Tuesday's overnight highs before sliding back 6pts or so into the close. Typical high-beta QE-driven sectors outperformed with Energy and Materials heavily bid but even they gave back some advantage into the close as did Tech and Financials. Oil staged a magnificent recovery (best performance from low to high today) topping out over $105 but just outperformed (from Friday's close) by Copper and Silver which ended up around 2.4%. Treasuries rallied 8bps from overnight weakness to their best of the day but son after the macro data, TSYs sold off with the long-end underperforming - though the entire complex ended lower in yield on the day. AUD and JPY strength matched on another providing little support from carry FX as the USD limped weaker - though Gold tripled the USD's performance managing +0.47% and a close above $1675 once again. VIX gapped notably higher at the open but rapidly compressed but from the close of the European session it pushed considerably higher to end the day fractionally higher (oddly on a decently higher equity market performance). Equities (blue) continue to sustain their separation from a seemingly more reasoning credit market - with high-yield as 'cheap' as it is currently relative to both stocks and vol, it remains odd that those risk-seeking bandits that are backing up the truck in stocks don't dip their toes into HY? or is it simply the same pattern of the last few cycles where credit market's focus on more than simply momentum and the next headline (instead focused on real cash flows for more than one quarter) that is holding back the ebullience in bond-land.

It certainly didn't have the feel of asset allocation or rotation as Treasuries rallied (red) from the US open to Europe close at the same time as stocks and commodities surged. Contrarian-wise, shouldn't the 'strength' of ISM mean less probability of QE? though this action had the feeling of a QE-trade all over it.

Nowhere more exemplified than in the commodity complex but as is clear in the chart above, most of the exuberance in the metals was from US open to Europe close with only Oil continuing to glide higher into the close. After the European close, Treasuries leaked higher in yield with the long-bond underperforming - but they all closed lower in yield on the day.