Gold World News Flash |

- Whats the central bank endgame in gold?

- Gold Seeker Closing Report: Gold and Silver End Mixed

- John Williams - Real Earnings Collapse, Nearly 50% Below 1973

- Miraculous Movement Masks Momentum

- GATA tells the past well enough, but we're not in charge of the future

- The Financial System is a Hollow Shell Waiting to Collapse

- Another Oil Price Stock, Another Global Recession?

- Embry – What’s Happening in China is Wildly Bullish for Gold

- "Sic Transit Gloria Pecuni" - LME Considering Ending Sterling, Allowing Renminbi Settlement

- Spanish Yields

- Why This Gold Miner Has Considerably Outperformed The Sector Since 2008

- Are Gold Stock Fundamentals Still Bullish?

- Dr. Nu Yu?s Latest Market Update on Gold, Silver, USD Index, Bonds and Stock Market

- Eurocalypse Now: I Love The Smell Of Repatriation In The Afternoon

- The Gold Price Fell $10.40 to $1,648.70 Trading Over $1,650 in the After Market

- Where's the Beef for Gold Equities?

- Gold Slips Under 20 Day Average

- Where’s the Beef for Gold Equities?

- The Fundamentals of Gold, Silver and Copper Investing Strategies

- Gold Daily and Silver Weekly Charts

- Expect Another $17 Trillion of QE & War in Gold

- Free People of the World UNITE: The Use of Gold Dinars and Silver Dirhams GOES VIRAL!

- Living Off Your Tax Money And Hard Work: Atlas Shrugs...

- Embry - What’s Happening in China is Wildly Bullish for Gold

- Bargains Abound

- LGMR: "Euro Crisis Back" as Spanish Yields Spark "Renewed Market Panic" while "Less Gold Fever" Seen in China than Last Year

- Where’s the Beef for Gold Stocks?

- Does Gold Ever Pay?

- Jim's Mailbox

- Gold, Silver and Copper Stocks Investing Strategie

| Whats the central bank endgame in gold? Posted: 16 Apr 2012 06:00 PM PDT | ||

| Gold Seeker Closing Report: Gold and Silver End Mixed Posted: 16 Apr 2012 04:00 PM PDT Gold fell to $1641.30 in Asia before it climbed back up to $1657.50 by a little after 9:30AM EST, but it then chopped back lower midday and ended with a loss of 0.27%. Silver slipped to $31.113 before it rebounded to $31.679 and then also fell back off a bit, but it still ended with a gain of 0.03%. | ||

| John Williams - Real Earnings Collapse, Nearly 50% Below 1973 Posted: 16 Apr 2012 03:01 PM PDT  John Williams, of Shadowstats, has warned that real earnings continue to literally collapse. Also note that the above graph illustrates consumer sentiment still remains below the 2003 market crash levels. Williams' graphs are excellent depictions of what a collapsed economy truly looks like. They also show why the middle class in the Western world continues to be destroyed. Williams also shocked KWN with his graph showing real earnings tumbling, now nearly 50% below 1973. Here is what Williams had to say: "The latest consumer earnings and credit numbers show ongoing structural deterioration in consumer liquidity. With lack of positive, real (inflation-adjusted) growth in income, there can be no sustainable growth in real personal consumption (71% of GDP)." John Williams, of Shadowstats, has warned that real earnings continue to literally collapse. Also note that the above graph illustrates consumer sentiment still remains below the 2003 market crash levels. Williams' graphs are excellent depictions of what a collapsed economy truly looks like. They also show why the middle class in the Western world continues to be destroyed. Williams also shocked KWN with his graph showing real earnings tumbling, now nearly 50% below 1973. Here is what Williams had to say: "The latest consumer earnings and credit numbers show ongoing structural deterioration in consumer liquidity. With lack of positive, real (inflation-adjusted) growth in income, there can be no sustainable growth in real personal consumption (71% of GDP)." This posting includes an audio/video/photo media file: Download Now | ||

| Miraculous Movement Masks Momentum Posted: 16 Apr 2012 02:21 PM PDT Miraculous Movement Masks Momentum

Despite Asia continuing its downhill slide, despite the Bank of Korea lowering their Economic Outlook, despite Swiss PPI showing DEflation, despite Spain's 10-year bonds rising to 6.07%, despite India's inflation at 6.89%, despite the 5-year CDS spread on Spanish debt hitting new records, despite James Galbraith warning that the EU periphery will collapse, despite the Saudi TASI Index dropping 4% in the last two days, despite the biggest weekly drop in Copper Futures of the year, despite Credit Suisse cutting 5,000 jobs and Best Buy closing 42 stores, and even BMW sales off 30% in Brazil.... Despite ALL these weekend news items and DESPITE our Depressing Weekend Reading - the bears, as Steve Martin says in the above clip, still have DOUBT in their heart and are allowing the Futures to rise this morning as Europe bounces up 1% from its 30-day lows in this traveling revival show known as the stock market.

Faith is a wonderful thing and we may like to believe in miracles but a good investor demands PROOF - much the way many of our biblical heroes required signs from the Lord before making commitments. We don't need a burning bush but we do need more than vague promises of EU action before we believe their 5 loaves and 2 fish will be enough to bail out the entire continent, right?

The EU markets were off to the races on rumors that US Retail Sales will save the World at 8:30 am with an upside surprise off very low expectations. Even if we got a bump - so what? Retail sales were anemic last month except Gasoline, which was up 3.3% while General Merchandise was DOWN 0.1%. Gasoline was up 10% in March so YAY!, I guess - but is that really the basis for a rally? How many times will the bulls be sucked in by the same empty promises? How many times will they reach into their pockets and BUYBUYBUY the snake oil valuations sold by the Reverend James Cramer at the Church of "Whatever is Working Now" - as the late, great Mark Haines used to call him (before he died just days after Cramer got him to taste test Soda Stream!). You may have noticed the recent LACK of miracles from our Central Banksters - who used to be able to rain money from heaven at the drop of a hat but now rely on hot air from their speeches to keep this market balloon inflated. Has the monetary well run dry already or is it just that we have reached the promised land of our 2007 highs and now it's the faith of the bulls that is being tested by the self-appointed economic Gods of the Global Economy? 6.5% and 7.5% are the key, preaches JPMorgan's Pawan Wadhwa. If the Spanish 10-year yield hits 6.5% (this week if momentum holds), look for the ECB to restart its bond-purchase program. If (when) it hits 7.5%, get ready for LTRO 3. In other words - look for the signs and expect miraculous things. Bad (6.5% yields on debt) shall be good and, if things get worse - expect divine intervention in the form of another multi-Trillion Dollar bailout - Hallelujah! Speaking of bailing out the rich. Grover Norquist was on CNBC this morning and he claims A) the top 1% pay 40% of all Income Taxes and B) that the Buffett Rule, which would take the average tax rate paid by the top 1% from 16% to 35% would only generate $40Bn a year in taxes. This would lead anyone with a calculator to believe that EITHER A) The Federal Government only collects $100Bn in taxes or that B) Since 40% of $2.2Tn actually collected is $880Bn and since Norquist himself says we are unfairly doubling the tax rate of the top 1% - that 2 times $880Bn = $40Bn - IT'S A MIRACLE!!! No wonder the GOP keeps voting to cut education - anyone getting past 5th grade math can see right through their BS... 8:30 am: Retail Sales up 0.8%! WOW!!! Forget the fact that that's down from 1.1% last month and forget the fact that it's the same as last March and forget the fact that the March before that we were up 2.2% and forget the fact that Gasoline Sales were up 10.3% and please, please, PLEASE forget the FACT that, Electronics and Appliances FELL 0.6% - let's just focus on the fact that expectations were for 0.3% DESPITE the exceptionally warm month that historically leads to more sales. And, whatever we do, let us not be tempted to look at the April (more recent) Empire State Manufacturing Survey as that one MISSED by 60% with a 6.6 reading vs 18 expected and 20.21 prior. The general business conditions index dropped fourteen points, suggesting that while growth continued, the pace slowed over the month. The new orders index was little changed at 6.5, indicating a modest increase in orders, and the shipments index fell twelve points to 6.4, indicating a slower pace of growth for shipments. Input price increases remained significant. After rising sharply last month, the prices paid index fell five points to 45.8. Though somewhat lower than in March, this reading was well above the index's level in the preceding several months. Selling prices also rose noticeably, with the prices received index climbing six points to 19.3. Ah, inflation - I wonder if that might have been a factor in increased retail sales as well? For instance - we're buying 20% less gas than last year, but we're paying 30% more for it:

Nonetheless, the Bulls have the sign they were looking for (there's always a sign if you look for one) but you'll have to forgive me if I want PROOF! I want to see 3 of our 5 major indexes over those 50% lines and hold them for a day. If we do catch our 3 of 5 lines, then we can add a few upside hedges like DDM (ultra-Dow) May $67/70 bull call spreads at $1, selling something like BTU May $26 puts for $0.90. That puts you in the $3 spread for net .10 with a 2,900% upside if DDM gets back to just $70 (it topped out at $71.43 in March). We don't need a lot of faith to risk a dime to make $3 - other than our faith in owning BTU at its 2009 lows as a long-term hold. [Note: if the BTU put ($0.90) is sold to offset the price of the bull call spread ($1), there is also risk that BTU will drop in price and the stock will get put to the seller. This would result in owning BTU at $26. It is currently trading at $27.94. A potential loss on BTU could be way more than the .10 cents at risk not counting a long position in BTU.] Me, I'm still waiting for a sign.

| ||

| GATA tells the past well enough, but we're not in charge of the future Posted: 16 Apr 2012 02:07 PM PDT 10:14p ET Monday, April 16, 2012 Dear Friend of GATA and Gold (and Silver): Our friend T.R. writes: "It's increasingly difficult to grit my teeth and hang onto my positions in gold and silver, in the gold and silver exchange-traded funds GLD and SLV, and even actual bullion (like American eagle coins). I fully agree with GATA's views on bankster manipulation of these markets, but the breakout forecast for the metals has been thwarted for decades, with no lasting loss of bankster control in more than 30 years. Can you give any encouragement beyond the predictions by various analysts that reality will prevail in these markets any day now? Thanks for your diligence and truth telling." ... Dispatch continues below ... ADVERTISEMENT Be Part of a Chance to Discover Northaven Resources Corp. (TSX-V:NTV) is advancing five gold and silver projects in highly prospective and politically stable British Columbia, Canada. Check out the exploration program on our Allco gold/silver project : -- A large (13,000 hectare) property, covering more than 15 square kilometers of a regional mineralized trend just 3km from a recently announced 1.2-million-ounce gold and 15-million-ounce silver deposit. -- The property hosts historic high-grade silver workings and many mineral showings as well as former mines at the property's northern and southern boundaries. -- A deep-penetrating airborne geophysics survey has just been completed on the entire property and neighboring deposits and its results are eagerly awaited. To learn more about the Allco property or Northaven's other gold and silver projects, please visit: http://www.northavenresources.com Or call Northaven CEO Allen Leschert at 604-696-3600. A reply: GATA can't offer as much encouragement as we'd like, since we're not an investment adviser and since the price suppression can continue indefinitely, even forever, as long as enough institutions and individuals who think they're buying gold and silver purchase only paper claims and never take delivery from the purported sellers and move the metal outside the banking system. Such investment behavior facilitates the infinite increase of imaginary gold, the mechanism of price suppression. The evidence is that Asia is changing things, but does GATA know how much more gold the Western central banks are prepared to dishoard to help keep the price down, or how many payoffs the U.S. government is ready to work in the futures and derivatives markets through JPMorganChase to discourage investors from taking delivery? They don't tell us their plans. We just pick up on their traces. On the other hand, gold has been up virtually every year since GATA was founded in 1999, from $260 to more than $1,600 today. If you can find a better-performing market sector, please let us know about it. If you've gotten into the monetary metals only lately and have been disappointed, all we can do is promise to try to keep working against the market rigging. But anyone who wants a little encouragement tonight can read the Got Gold Report's Gene Arensberg, who writes that if commodities market analyst Dennis Gartman is denouncing investment in the junior gold and silver miners as "a mug's game" when they've already fallen 50 percent, capitulation may have happened already: http://www.gotgoldreport.com/2012/04/gartman-abandon-junior-miners-mugs-... And interviewed today by King World News, Sprott Asset Management's John Embry sees China's growing internationalization of its currency as bullish for gold because it likely will involve gold backing for the yuan: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2012/4/16_Em... But the Western central banks and particularly the U.S. Treasury Department and Federal Reserve are not going to give up easily and let their immense power -- tyrannical power, really -- be democratized by free markets. This struggle isn't for the faint of heart, and it has so many political ramifications that there is no telling how it will turn out. The gold price suppression scheme is being exposed -- indeed, has been exposed to an audience that well may be decisive, and like all lies it will fail eventually. But this still doesn't mean that anyone in any particular country will be allowed to profit from being right about it. What we know has been placed in our "Documentation" file here: http://www.gata.org/taxonomy/term/21 It tells only the past, not the future. That's the best we can do, and for the time being it seems that we're the only ones doing it. Make whatever you can of it. CHRIS POWELL, Secretary/Treasurer Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Golden Phoenix Discusses Royalty Mining Growth Strategy Golden Phoenix Minerals Inc. has discussed its royalty mining growth strategy on the Fox Business Network program "21st Century Business" with host Jackie Bales. Golden Phoenix's director of corporate communications, Robert Ian, told how the company narrows its focus to project generation and future royalty streams. He explained why Golden Phoenix believes it's better to own joint-venture interests in several producing mines instead of full exposure to just one project. "21st Century Business" has been airing for 15 years. Previous hosts have included Gen. Alexander Haig, Gen.l Norman Schwarzkopf, and Secretary of Defense Caspar Weinberger. Golden Phoenix appeared as paid programming on this broadcast. To view the program with Golden Phoenix, please visit Golden Phoenix's Internet site here: http://www.goldenphoenix.us/company-videos.html | ||

| The Financial System is a Hollow Shell Waiting to Collapse Posted: 16 Apr 2012 01:21 PM PDT by Monty Pelerin, The Daily Sheeple:

No one, especially the Fed, knows how insolvent the banking system truly is. The magnitude of the problem has been deliberately hidden. Banks themselves probably don't know the value of many assets on their balance sheets. They were ordered/allowed/instructed to keep assets valued at original costs rather than market values. This dictate/allowance was an attempt to hide the true condition of financial institutions. While valuations are grossly overstated, no one has any reasonable way to estimate by how much. The Federal Reserve has taken many of these toxic assets off the books of banks and put them on their own balance sheet at original value. This action was taken to prevent a collapse of the banking system and reliquify the banks. Now the Federal Reserve's balance sheet is also meaningless to the extent of these (and other) overvalued assets. Even the Fed doesn't know how bad their balance sheet is overstated. | ||

| Another Oil Price Stock, Another Global Recession? Posted: 16 Apr 2012 01:10 PM PDT

Brent crude ended trading above $120 a barrel on Friday, April 13, while WTI crude on NYMEX for May delivery settled at $102.83 a barrel. Oil has traded above $100 for all but a couple of days in the past year (see chart below). This persistent high oil price has many concerned to start threatening a nascent recovery of the global economy.

Studies show that historically, around 90% of US recessions post World War II were preceded by oil price shocks. The most recent occurrence took place when oil more than doubled in price from January 2007 to July 2008 due to a sharp increase in Chinese demand. The pullback of US consumer and corporate spending already put a drag on economic growth before the subprime-induced financial crisis closed the deal on the Great Recession.

Analysts generally see the $120-130 level as a price that would prompt consumer and corporate to cut back on spending sharply, and hurt the recovery and growth of key economic sectors. A recent Reuters survey of 20 equity strategists put $125 a barrel as the point economy and stock markets could start to suffer.

The most recent study on the link between oil price and economic recession came from energy industry consultancyWood Mackenzie (WoodMac) published earlier this month. The chart below from WoodMac illustrates "the mechanism" of how an oil price shock would derail the global economy.

According to WoodMac's model,

U.S. domestic petroleum products are priced off of Brent since WTI has become a less relevant oil price marker due to the inventory glut atpipeline-capacity-challenged Cushing, OKdepressing the WTI price. So using the current spread between WTI and Brent of around $20, WTI $130 would suggest Brent at about $150. Brent futures already hit $128.40 a barrel, the highest since 2008, in early March, but has since given back some of the gains..

However, the difference between now and 2008 is that when oil spiked to almost $150 in 2008, there was a strong demand from China and a real shortage of supply, whereas the current world oil market is a lot more balanced than the current Brent oil price suggests.

IEA (International Energy Agency)saidin its monthly report that there had potentially been a rise in global oil stocks of 1 million barrels per day (bpd) over the last quarter, and the impact on prices had not yet been fully realised. Reuters quoted the IEA that:

Rather than reflecting market fundamentals, dollar prices for Brent crude, up more than 15% this year, has been pushed up mainly by fears about Iran, and the loss of supply from three relatively small oil producing countries--Syria, Yemen and South Sudan--adding to the supply worries. In other words, the oil price is bid up primarily by trading actions on the geopolitical factors (chiefly Iran).

Meanwhile, Saudi Oil Minister Ali Al Naimisaidon Friday, April 13 in a statement during a visit to Seoul that

Naimi earlier this year indicated $100 a barrel as an ideal price for producers and consumers earlier this year.

Typically, oil price shock occurs when price goes out of the normal range. Currently, oil is not trading at an unprecedented level as in the case of 2008, which is hard to hit given the projection of a subdued global GDP, weak oil demand outlook, and an eventual resolution of the Iran situation.

Thus we believe oil has gotten way ahead of itself, and could experience a correction later this year and in the next three years or so. End user behavior change is starting to manifest, and the latest CFTC trading position reports already showed that money managers cut their net-long position roughly 12% in light, sweet crude-oil futures and options (see chart above). (Brent already went down to $118.57 on Monday, April 16.)

So no, unless something totally unexpected shocks the oil price into no man's land, WTI and Brent are unlikely to hit the levels that could possibly bring about a global recession any time soon. In fact, among the major possible drivers of a global recession,European economic and debt crisis looks to be the greater risk than an oil price shock.

©EconMattersAll Rights Reserved |Facebook|Twitter|Post Alert|Kindle | ||

| Embry – What’s Happening in China is Wildly Bullish for Gold Posted: 16 Apr 2012 01:03 PM PDT from KingWorldNews:

| ||

| Posted: 16 Apr 2012 12:47 PM PDT On a long enough timeline, all things come to an end. Even for such venerable venues as the London Metals Exchange, with its 130 year history, and its annual turnover of over $11 trillion in metal contracts, which also makes it the largest market for non-ferrous metals. As the English FT reminisces, "When the LME was established in 1877, Britain was one of the world's most important manufacturing powerhouses, and the LME's benchmark contracts for delivery in three months were designed to mirror the length of time needed to reach British ports for shipments of copper from Chile and tin from Malaysia." Furthermore, in the beginning, and all the way through 1993, the flagship copper contract was denominated in sterling, at which point it was switched to the USD following the "Black Wednesday" ERM sterling crisis, courtesy of George Soros who made about $1 billion by shorting the GBP, and formally ended the sterling's role as even an informal backup reserve currency. As of today, insult follows inury, as the LME has formally asked the members of the exchange to drop the sterling contract denomination (in addition to USD, EUR, and JPY contracts) and replace it with the Chinese renminbi. Why this sudden and dramatic, if gradual and tacit, admission that the CNY is the ascendent reserve currency? Because, as the FT reminds us, China has become the market for non-ferrous metals: it is "the dominant force in the market, accounting for more than 40 per cent of global demand for most metals and a rapidly increasing share of trading in LME futures." Add that to yesterday's news of a widening in the CNY band (which incidentally is much ado about nothing, at least for now: at best it will allow China to devalue its currency when and if it so desires much faster than before, much to Geithner's final humiliation), and to the previously reported extensive network of bilateral CNY-based trade agreements already cris-crossing Asia, and one can see why if America is not worried about the reserve status of the dollar, it damn well should be.

Why China? Because, for better or worse, it has become the marginal buyer.

The implications, at least optically, need no further explanation. We would like to conclude with our favorite chart from JPMorgan, which we have dubbed sic transit gloria pecuni. At this point we are fairly confident which currency is coming next in the new top right space (whether backed by hard assets, and in joint execution with Russia and/or Germany, or not). | ||

| Posted: 16 Apr 2012 12:27 PM PDT by Harvey Organ, HarveyOrgan.Blogspot.ca: Good evening Ladies and Gentlemen; Gold finished down by $7.50 to $1648.070 at comex closing time. Silver joined gold as it lowered The total gold comex open interest continues to contract as the CME have now wiped out many of the paper gold players. The leverage game in gold has now come to an end. | ||

| Why This Gold Miner Has Considerably Outperformed The Sector Since 2008 Posted: 16 Apr 2012 12:12 PM PDT New Gold (NGD) and its world class gold/copper project El Morro partnered with mining titan Goldcorp (GG) has decided to commence construction of one of the world's largest gold-copper projects after the Chilean winter.

Quoting Randall Oliphant, Chairman of NGD, ""Our 30 percent interest in El Morro positions us very well as we have a meaningful share of this great project, with a proven mine developer and operator as a partner and a favorable financing arrangement that carries us through production."

China is easing financial and fiscal policies for at least the first 6 months of this year. This action is letting the world financial markets know that carefully chosen mining equities are the place to be. China has flipped the "risk on"switch for precious metal equities.

Inflationary forces, possibly gut wrenching are in the cards. The losers may well be the possessors of dollars and purportedly safe treasuries. This will be the impetus to move capital out of cash,treasuries and overvalued banks into mining equities and commodities.

The gold mining stocks have recently underperformed gold bullion since 2011. Since the 2008 credit crisis, one company New Gold has delivered on its stated promises and has rewarded original GST subscribers of more than a 1,000% gain since highlighting it in May of 2009 outperforming the gold mining index and gold bullion by a wide margin. See our original recommendation from 2009. In this recent interview with Randall Oliphant, Executive Chairman of New Gold (NGD), we discuss why the company has outperformed its peers and why it has one of the best resource growth profiles in the business with El Morro, New Afton and their recently acquired Blackwater Project in British Colombia.

See the interview below:

| ||

| Are Gold Stock Fundamentals Still Bullish? Posted: 16 Apr 2012 11:58 AM PDT | ||

| Dr. Nu Yu?s Latest Market Update on Gold, Silver, USD Index, Bonds and Stock Market Posted: 16 Apr 2012 11:40 AM PDT [B][B][/B][/B][B][B]In this update*I analyze the developing trends in gold, silver, the broad [/B]stock market, the US Dollar Index and 30-year U.S. Treasury bonds. Take a look.[/B] Words: 754 So says Dr. Nu Yu ([url]http://fx5186.wordpress.com[/url]) in edited excerpts from his original article* (which Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), has further edited below for length and clarity – see Editor's Note at the bottom of the page. This paragraph must be included in any article re-posting to avoid copyright infringement.) Yu goes on to say, in part: The Broad Stock Market (Wilshire 5000 Index) The Dow Jones Wilshire 5000 index, as an average or a benchmark of the total equity market, finally resolved its 4-month Rising Wedge pattern last week. Now it is emerging to a 2-month “Ascending Broadening Formation” (see here) that is a widening pattern confined by an upper rising resistance line and a lower support line. Within this formation,... | ||

| Eurocalypse Now: I Love The Smell Of Repatriation In The Afternoon Posted: 16 Apr 2012 11:29 AM PDT Sniffing around the moves in today's market suggest one very strong trend - that of European bank repatriation flows gathering pace. We pointed this out during the day as it occurred but looking back now, and remembering our critical analysis of these same flow patterns back in October of last year as the crisis was surging to crescendo, brings back some concerning memories. Today's cross asset-class price action had five very clear phases with the period around the European close and the afternoon in the US day session most directly evident of the generalized selling of USD-based assets and repatriating EURs in whatever format can be found. A picture paints a thousand words (perhaps more if it's scratch'n'sniff) and this one smells like forced selling - which combined with ECB margin calls and the rapidly worsening EUR-USD basis swap (funding issues) paints a rather concerning picture for (already collateral starved) European banks. As Europe faces bank downgrades (collateral calls) and auctions (real-money needed to bid in the reach-around), we suspect we will see more repatriation of EUR and understanding the flows these movements may cause will help make sense of the markets' movements during the day Today's market action in USD (DXY Inverted - green), TSY yields (red), S&P 500 futures (blue), and Gold (gold) broke into 5 specific phases... Phase 1 - markets were drifting until the release of the major US macro data (retail sales beat and empire manufacturing missed). The better-than-expected retail sales data spurred risk-on and Treasuries were sold and Stocks bought as the USD was reflexively sold (on correlations) and gold rallied (a little odd but looked like modest high USD beta move). Consistent Phase 2 - US markets opened and started to slide, only helped by a notable miss on NAHB and commentary - risk-off. This Long USD, Short Stocks, Long Treasuries, Short Gold move all fit as bad news is bad news (no longer good enough to prompt a pre-emptive QE3 hope trade). The move was nicely in sync and these risk-off flows petered out after the first hour or so of the day-session. Consistent Phase 3 - From mid-morning to the European close, markets generally drifted sideways but the sniff of USD selling was apparent and picking up. Consistent Phase 4 - From the close of Europe's equity markets to shortly after their FX market closed (and notably market sweeps and funding needs are comprehended), the USD was sold hard and aggressively. The reflexive move of this forced USD selling / EUR repatriation flow was to push risk-assets up (as correlation algos reacted). The significant thing is that stocks moved on little volume (algos not flow) and the selling in FX was heavy and rapid (we need these EUR now). Inconsistent Phase 5 - After the European markets had closed is when the effect of the real asset selling and repatriation flows hits the US markets. The need to bring EURs home in a hurry likely meant European banks traded away their US stocks and US Treasuries but this selling pressure was held back by the algos reacting to USD weakness. As soon as the FX trades were done and the USD stabilized the buying pressure disappeared at the margin and so Treasuries and equities sold off as the marginal algo buyer had gone and all was left was the flow of the EUR-based sellers left with dealers trying to unwind their positions. Also note that there was no flow back to Gold or the USD safety as USD-assets sold off (as they had already been shifted and were now being reracked by dealers offloading). Inconsistent

The selling of US equities and US Treasuries simultaneously and on a pick up in volume (and block size) even after the USD selling had abated strongly suggests US dealers had soaked up some of the selling pressure (knowing full well stocks would get a lift in the USD-correlation-sense) and then sold into that strength. We will be watching for similar flows this week and keeping a close eye on the EUR-USD basis swap - especially ahead of auctions and possible downgrades (both of which need real money to make a difference - bids at auction for Spanish banks and higher collateral calls on downgrades). Is that the smell of napalm in the morning repatriation in the afternoon? | ||

| The Gold Price Fell $10.40 to $1,648.70 Trading Over $1,650 in the After Market Posted: 16 Apr 2012 11:18 AM PDT Gold Price Close Today : 1648.70 Change : (10.40) or -0.63% Silver Price Close Today : 3136.40 Change : 1.6 cents or -0.05% Gold Silver Ratio Today : 52.567 Change : -0.305 or -0.58% Silver Gold Ratio Today : 0.01902 Change : 0.000110 or 0.58% Platinum Price Close Today : 1573.20 Change : -8.40 or -0.53% Palladium Price Close Today : 652.05 Change : 8.85 or 1.38% S&P 500 : 1,369.57 Change : -0.69 or -0.05% Dow In GOLD$ : $162.01 Change : $ 1.93 or 1.20% Dow in GOLD oz : 7.837 Change : 0.093 or 1.20% Dow in SILVER oz : 411.98 Change : 2.50 or 0.61% Dow Industrial : 12,921.41 Change : 71.82 or 0.56% US Dollar Index : 79.52 Change : -0.366 or -0.46% The GOLD PRICE dropped $10.40 to $1,648.70, still holding on comfortably above my $1,630 drop-dead line. Silver lost only 1.6c, closing 3136.4, well above the 3100c downside trigger. (Low was 3116c) I glanced at GOLD in yen and in euro, and was gratified to see that in both currencies it is bouncing along its 200 day moving average. Why is that welcome news? Well, in bull markets the 200 DMA often serves as the target for downside corrections, so if gold has reached that point already after a month and a half/two month decline, then the correction has pretty well worn itself out. Gold in euros is looking plumb perky, like it's itching to rise. The GOLD PRICE stumbled through that support at $1,650 and fell clean to $1,642, then thought better of itself and bounced up to close at $1,648.70. Trading over $1,650 in the aftermarket. The GOLD PRICE decline in December and early April touched or pierced that 300 DMA (now 1,618.36), but I mean "touched" solely and then ran away. On the other hand, gold stands below its 160 (now 1,691.82). I'd have to say that whenever gold reaches that (now rising) 300 DMA, it sucks buyers out of the woodwork. Oh, and GOLD closed below its 20 DMA (1658.39) today, which is a little fishy. Other indicators show no sign of further steep or sudden declines. The SILVER PRICE chart just don't look right. Looks crazy, like a New Mexican mesa rising out of the desert floor of 3150c. Folks, that just doesn't normally happen. Looks like somebody hit silver in the head with a ball peen hammer. Never mind. the SILVER PRICE continues to hang on above 3100c, positive for us. MACD and RSI are flat and offer no clues. Working in our favor is silver's 7 month dance with its 300 DMA, now under, now over, and under again. Stands today at 3520c. Silver needs to pull out of this pretty soon. I know a bunch of y'all will grow exceeding wrathful with me, but I believe that the Stupid Party is setting Bernard O'Bama up for a win this fall by running Mitt "I Have No Personality" Romney. CFR candidate Romney differs not a whit from CFR candidate O'Bama, and surprise, both will appoint more CFR functionaries, wage more wars, and blow more money. Question is, how do you like your hogwash? Full strength from the Stupider Party, or watered down from the Stupid Party? The Stupid Party and the media have buried the only candidate who differed from the CFR Establishment, Ron Paul, so once again you have no choice in the Potemkin Election. I have no tears left to cry, I just grit my teeth and pray Tennessee will survive these foreign fools. But on to pleasanter things, like markets today. Stock indices diverged. Dow rose 71.82 points (0.56%) to 12,921.41 while the NASDAQ composite and S&P500 fell. S&P500 lost 0.69 to 1,369.57. Seems that Apple is on a tear -- a downward tear - and it lost 4.2% today, weighing heavily on those indices since Apple is not in the 30 blue chip Dow Jones Industrial Average. Now none of them smart folks on Wall Street had any clue that Apple was about to tank. Why, its market capitalization passed the whole GDP of Poland and Belgium, and then of Spain, Greece, and Portugal combined, and then of all the rest of US retail stocks, but them smart boys with the pointy shoes never dreamed Apple wouldn't keep on rising everlastingly. Y'all, you don't need to be a genius to beat these boys, you just have to bridle your greed and remember this: if something sounds too good to be true, it probably is. Or if that's too complicated for your memory, try this: when everybody finally agrees, they are likely every one wrong. But, shucks, I'm no more'n a natural born fool from Tennessee, and ain't never even seen a pair of them Gucci pointy-toed shoes, let alone owned one. Mercy, we just got shoes here two years ago! Stocks today, even the Dow Industrials, look toppy again. If the Dow can't pierce 13,000 tomorrow, then it has painted out another double top as it fixes to slide again. S&P500 don't even look that good. See-saw, see-saw, which way rocked currencies today? Dollar index lost 36.6 basis points, 2/3 of what it gained on Friday, and nobody even winced. Left the scabby dollar index at 79.522, and its course sideways. 50 DMA at 79.33, 20 DMA at 79.48, so it barely has a positive momentum, but other indicators are flat as a gridiron, so don't look for the dollar to run off to the upside. Be lucky if it even wakes up tomorrow. The euro, the bottom-feeding catfish of currencies, fell off badly when the day opened but rose nearly to the downtrend line. Remains below crucial 62 DMA, and looks sorry as gully dirt. Ain't no future there, although it rose today 0.45% to $1.3136. The rising sun smiled on the yen today. It gained 0.65% to 124.39c (Y80.39/$US1), and closed above its 50 DMA (123.58). Lay all that aside and look at the chart with a big old slide from 131.52 in February to 118.93 in March, like a ski jump, then a recovery to 124. It's so far below the 200 DMA (127.77) it would need field glasses to spot it from where it sits. Looks weak. 125.2 is the 50% correction, and as a FIRST measure the yen will have to conquer that level before it gets much attention. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com 888-218-9226 10:00am-5:00pm CST, Monday-Friday © 2012, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||

| Where's the Beef for Gold Equities? Posted: 16 Apr 2012 09:52 AM PDT | ||

| Gold Slips Under 20 Day Average Posted: 16 Apr 2012 09:45 AM PDT courtesy of DailyFX.com April 16, 2012 01:13 PM Daily Bars Prepared by Jamie Saettele, CMT “Price is testing a long term trendline that extends off of the 2008, 2010, and December 2011 lows. A break of such a well-defined trendline would signal a significant shift. The downside is favored below the April high of 1683.35. Exceeding the April high would shift focus to pivots throughout March (1696.88, 1716.55, 1726.05).” Bottom Line (next 5 days) – lower... | ||

| Where’s the Beef for Gold Equities? Posted: 16 Apr 2012 09:09 AM PDT Gold bulls have plenty of room to graze in the stockyard these days as the investing herd migrated to other assets during the market's steep climb in 2012. For the fourth time in the past year, gold bears outnumbered the bulls in Bloomberg's weekly Gold Bull/Bear Sentiment Survey. In fact, the bears had the bulls outnumbered by almost 2-to-1. | ||

| The Fundamentals of Gold, Silver and Copper Investing Strategies Posted: 16 Apr 2012 09:04 AM PDT Precious and base metal companies both have to obey the basic laws of physics and economics to be profitable. In this exclusive interview with The Gold Report, geologist turned analyst Vishal Gupta of Fraser Mackenzie discusses how small-cap companies can successfully take advantage of the marketplace to produce profits. | ||

| Gold Daily and Silver Weekly Charts Posted: 16 Apr 2012 08:23 AM PDT | ||

| Expect Another $17 Trillion of QE & War in Gold Posted: 16 Apr 2012 08:10 AM PDT Jim Sinclair's Mineset Dear CIGAs, Click here to listen to the full audio interview on KingWorldNews.com... On the heels of the Fed members commenting publicly, legendary trader and investor, Jim Sinclair, told King World News that even though we have already seen $17 trillion of money printing, we should expect another $17 trillion going forward. KWN also asked Sinclair how he knew, from the beginning, that there would be 'QE to infinity,' before anyone else. But first, here is what Sinclair had to say about the action in gold: "$1,650 is a comfortable number (for central planners). Haven't you seen the tremendous jawboning and market intervention to hold gold in that range at $1,650? $1,764 and they lose control. That begins the move which is exponential." Jim Sinclair continues: "It's a formidable challenge (keeping gold below $1,800). The true range of gold is $1,700 to $2,111, but these guys are going to try to fight it like nobody's busines... | ||

| Free People of the World UNITE: The Use of Gold Dinars and Silver Dirhams GOES VIRAL! Posted: 16 Apr 2012 07:55 AM PDT by SGT Well friends, things are looking up for free people around the world who value REAL money. I just received an update from reader and physical precious metals stacker Dean Arif, the Program Director of Dinihari Dinar (The Dawn of the Dinar) in Malaysia. Dean reports that the use of physical gold and physical silver in the form of gold dinars and silver dirhams, has spread from Malaysia to Indonesia and has now gone viral in Singapore, Brunei and Philippines! Dean writes, "The silver dirham coins will unite the people of this region (Southeast Asia) as the dirhams from Indonesia can be used in Malaysia and the ones from Malaysia can be used in Singapore WITHOUT THE NEED FOR THE MONEY CHANGER'S fiat! And the coins follow WIM (World Islamic Mint) standards (consistent weight, purity and size), so they are fully interchangeable anywhere in the world, making it a true global mode of payment. If you don't think that's bad news for the Central Banking criminals, check this out. Dean reports that exchanging physical silver for everyday goods is simple, and one ounce of silver – while still representing a ridiculous 50 to 1 silver to gold ratio – goes FAR. There are 31.1 grams of silver in one troy ounce, so 1/10th of an ounce, around $3.10 in silver value (USD) will buy 5 loaves of organic wholewheat bread. 1 dirham (2.975g of 999 silver) = 1 dinar (4.25g of 917 gold) = Dean writes, "Suddenly, we see true freedom on a whole new level as more and more people awaken to the nature of "divide-and-conquer" paper currencies!" Once again we say, take THAT criminal Banksters. Good luck trying to put the genie back in the bottle now. | ||

| Living Off Your Tax Money And Hard Work: Atlas Shrugs... Posted: 16 Apr 2012 07:32 AM PDT While the government struggles to save one crumbling enterprise at the expense of the crumbling of another, it accelerates the process of juggling debts, switching losses, piling loans on loans, mortgaging the future and the future's future. As things grow worse, the government protects itself not by contracting this process, but by expanding it. - Ayn RandFor those of you who advocate a generous Welfare State, you should know that general reliance on Government handouts is bankrupting this country. And the rate at which it is doing so is accelerating. Defense spending is also contributing to the demise of our system, but right now the ranks of those who take from those who produce is growing quickly. Obama's Administration has been instrumental in expanding the base of people who suck from the system. This scenario is very similar to the scenario that unfolded in "Atlas Shrugged." I wanted to link an excellent blog post from Economic Collapse that details just how egregious the situation has become. Caution, only read this if you are prepared to get angry or sick. I read it this morning and I've had a case of stomach flu ever since: LINK To make matters worse, I'm sure many of you have now heard about the unbelievable spending junket that a GSA conference in Vegas turned into. Apparently the GSA spent close $150 grand on food and drinks and $6300 on commemorative coins for participants. Gee, I guess those coins really help GSA personnel do their jobs. It turns out that the regional commissioner who planned this conference was subpoenaed to testify before Congress and, of course, he invoked the 5th Amendment. He did this even in response to a a basic question about whether he attended. LINK If I lived near this Jeff Neely, I would make sure that I left a big pile of my dog's shit on his front porch every morning. If I were on the House panel that was grilling him, I would have asked him he if patronized a prostitute while he was there and whether or not that cost was expensed. This is YOUR taxpayer people. It really makes me feel good about getting out of bed everyday early and working late most week nights in order to make a living to pay for my housing and food AND to pay for Jeff Neely's commemorative coin and hooker at a Vegas junket that pissed away close $1 million in taxpayer money. Thanks Barack! | ||

| Embry - What’s Happening in China is Wildly Bullish for Gold Posted: 16 Apr 2012 07:17 AM PDT  With gold near the $1,650 level and silver firmly above $31, today King World News interviewed John Embry, Chief Investment Strategist of the $10 billion strong Sprott Asset Management. Embry told KWN the financial system is built on an unsustainable mountain of debt, and over time this will create a more siginficant shift from paper markets to hard assets. He also stated that what is taking place in China right now is wildly bullish for gold. But first, here is what Embry had to say about what is happening with the gold and silver markets: "The gold and silver situation is under control of the paper manipulators at this time. I think they have an agenda to keep the gold and silver space as quiet as possible, in order to keep people away from it." With gold near the $1,650 level and silver firmly above $31, today King World News interviewed John Embry, Chief Investment Strategist of the $10 billion strong Sprott Asset Management. Embry told KWN the financial system is built on an unsustainable mountain of debt, and over time this will create a more siginficant shift from paper markets to hard assets. He also stated that what is taking place in China right now is wildly bullish for gold. But first, here is what Embry had to say about what is happening with the gold and silver markets: "The gold and silver situation is under control of the paper manipulators at this time. I think they have an agenda to keep the gold and silver space as quiet as possible, in order to keep people away from it." This posting includes an audio/video/photo media file: Download Now | ||

| Posted: 16 Apr 2012 07:17 AM PDT April 16, 2012 [LIST] [*]Depressed gold stockholders can take cheer from Frank Holmes and two charts [*]"A fundamental disconnect from value"... Byron King on your chance to pick up attractive assets at bargain-basement prices [*]Renminbi floats more freely today: Chuck Butler, Abe Cofnas suss out the latest move by Chinese leaders [*]The story that got lost in the scandal-shuffle when the president visited Colombia [*]All that glitters at the Olympics is only 1.5% gold... your fellow readers weigh in on the gold price... your last chance to grab a signed copy of Chris Mayer's book... and more! [/LIST] "After a year of neglect from investors who favored bullion, gold equities need resuscitation," says Vancouver favorite Frank Holmes. Frank has his own thoughts to add to Friday's issue about gold stocks... and he brings his own paddles to today's 5 to help revive the patient. "At the end of March," says Frank, "the spread between the NYSE Arca Gold Miners Index a... | ||

| Posted: 16 Apr 2012 07:16 AM PDT London Gold Market Report from Ben Traynor BullionVault Monday 16 April 2012, 08:00 EDT WHOLESALE gold bullion prices traded just below $1650 an ounce for most of Monday morning's London session – well within the past month's range – as European stock markets edged higher while commodities fell. The Euro meantime sank to a two-month low against the Dollar, as investors turned their attention to rising Spanish government borrowing costs. On China's Shanghai Gold Exchange, contracts equivalent to around 7.3 tonnes of gold bullion changed hands in Monday's trading. "Current levels are by no means excessively weak," says a note from investment bank UBS, "but the fact that average daily turnover sits at just about half of the 18 tonne all-time high seen last year is in itself confirmation that there is less gold fever in China this year versus last." Authorities in Beijing meantime have widened the Yuan's trading band against the Dollar from a 0.5% maximum daily move to 1%.... | ||

| Where’s the Beef for Gold Stocks? Posted: 16 Apr 2012 06:56 AM PDT Gold bulls have plenty of room to graze in the stockyard these days as the investing herd migrated to other assets during the market’s steep climb in 2012. For the fourth time in the past year, gold bears outnumbered the bulls in Bloomberg’s weekly Gold Bull/Bear Sentiment Survey. In fact, the bears had the bulls outnumbered by almost 2-to-1. | ||

| Posted: 16 Apr 2012 06:50 AM PDT | ||

| Posted: 16 Apr 2012 06:50 AM PDT Rising Consumer Expectations Imply Higher Gold Prices CIGA Eric But the measure of consumer expectations rose to 72.5 from 69.8, hitting its highest level since September 2009. Rising expectations has the media giddy about the prospects for future economic growth and the gold crowd huddled together in fear. While perception sets short-term reality, it Continue reading Jim's Mailbox | ||

| Gold, Silver and Copper Stocks Investing Strategie Posted: 16 Apr 2012 06:45 AM PDT Precious and base metal companies both have to obey the basic laws of physics and economics to be profitable. In this exclusive interview with The Gold Report, geologist turned analyst Vishal Gupta of Fraser Mackenzie shares names of small-cap companies that could successfully take advantage of unique mineralogy to produce profitable mines. The Gold Report: You are an analyst and a geologist. Can you explain the fundamentals behind investing in base metals compared to precious metals? |

| You are subscribed to email updates from Save Your ASSets First To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

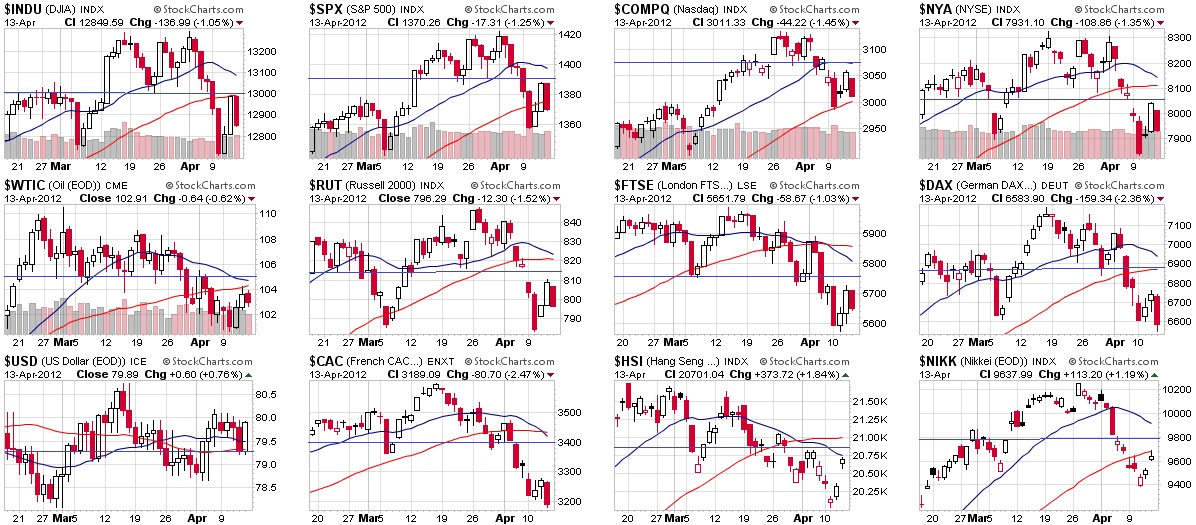

On the chart above, I drew a blue line across the 50% levels between the tops of the last 6 days and the bottom. Not reflected on these charts is the fact that the Nikkei FELL another 1.74% this morning or that the Hang Seng dropped 0.44% - pushing them further from their goals.

On the chart above, I drew a blue line across the 50% levels between the tops of the last 6 days and the bottom. Not reflected on these charts is the fact that the Nikkei FELL another 1.74% this morning or that the Hang Seng dropped 0.44% - pushing them further from their goals.

The incorrect belief that our financial system has passed its crisis continues.

The incorrect belief that our financial system has passed its crisis continues.

With gold near the $1,650 level and silver firmly above $31, today King World News interviewed John Embry, Chief Investment Strategist of the $10 billion strong Sprott Asset Management. Embry told KWN the financial system is built on an unsustainable mountain of debt, and over time this will create a more siginficant shift from paper markets to hard assets. He also stated that what is taking place in China right now is wildly bullish for gold. But first, here is what Embry had to say about what is happening with the gold and silver markets: "The gold and silver situation is under control of the paper manipulators at this time. I think they have an agenda to keep the gold and silver space as quiet as possible, in order to keep people away from it."

With gold near the $1,650 level and silver firmly above $31, today King World News interviewed John Embry, Chief Investment Strategist of the $10 billion strong Sprott Asset Management. Embry told KWN the financial system is built on an unsustainable mountain of debt, and over time this will create a more siginficant shift from paper markets to hard assets. He also stated that what is taking place in China right now is wildly bullish for gold. But first, here is what Embry had to say about what is happening with the gold and silver markets: "The gold and silver situation is under control of the paper manipulators at this time. I think they have an agenda to keep the gold and silver space as quiet as possible, in order to keep people away from it."

No comments:

Post a Comment