Gold World News Flash |

- International Forecaster April 2012 (#4) - Gold, Silver, Economy + More

- Europe Will Collapse in May-June

- Gold and an update on Silver and Copper

- Batero Gold Announces Upsize to Proposed Special Warrant Financing for Gross Proceeds of C$6.4 million

- Hype vs Hope

- "There Is No Chinese Wall. Please. Come On. This Is Wall Street"

- Gold: Return Of The King

- FINANCIAL Collapse, WHEN?

- The Man Who Should Be President

- SMX announces new E-Gold, E-Silver contracts

- Joseph Stiglitz: Is Mercantilism Doomed to Fail? And With It the US Dollar?

- How Serious are China and India About Their Gold?

- Another Russian Chartered, German Ship Intercepted Delivering Weapons To Syria

- Richard Russell?s Alarming (Alarmist?) Views on the VERY Near Future: Crime, Chaos, Collapse & Skyrocketing Gold

- Pento - Inflationary Death Spiral & The Global Credit Card

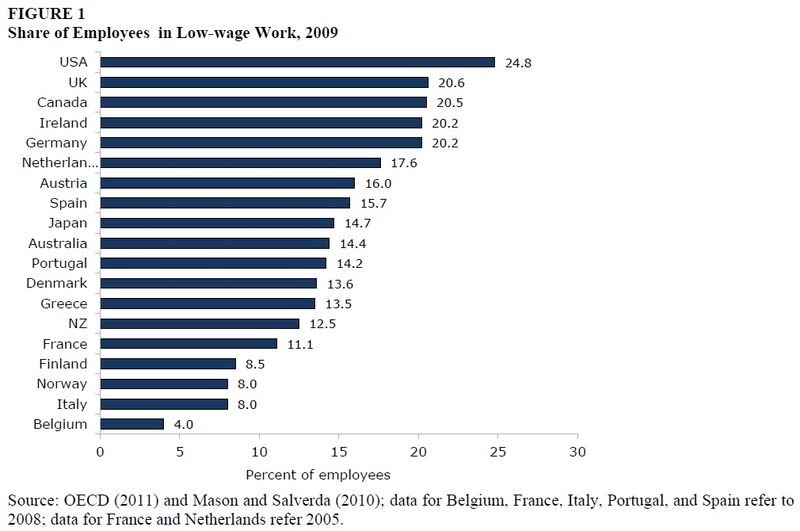

- U.S. has one of the highest number of employed working in low wage jobs among industrialized nations.

- Watch for SILVER to SPIKE lower, and buy…

- Bernanke and Germany Wake Up to a Merda Storm

- Soros On Europe: Iceberg Dead Ahead

- Why The Market Is Slowly Dying

- Strange Dumping of Gold at Comex Close, Fund Manager Bryan Says

- Untitled

- This Past Week in Gold

- Some Answers to Doug Casey’s Questions

- Postage prices to rise 30% as inflation wrecks UK living standards

- Frustrated Safe Haven Swiss Franc Investors May Soon Turn to Gold and Silver

- Friday's gold dumping, general volatility covered in KWN weekly review

- Gold and Silver Wait Patiently for More Easing

- Wider trading band for yuan may facilitate gradual devaluation

- The Inter-market Correlations May Prove Insightful for Gold and Silver Investors

| International Forecaster April 2012 (#4) - Gold, Silver, Economy + More Posted: 15 Apr 2012 03:30 AM PDT "War is a racket. It always has been." These words are as true now as they were when Major General Smedley Butler first delivered them in a series of speeches in the 1930s. And he should have known. As one of the most decorated and celebrated marines in the history of the Corps, Butler drew on his own experiences around the globe to rail against the business interests that use the U.S. military as muscle men to protect their racket from perceived threats. |

| Europe Will Collapse in May-June Posted: 15 Apr 2012 03:12 AM PDT |

| Gold and an update on Silver and Copper Posted: 15 Apr 2012 03:04 AM PDT I have been saying this for some time that gold's fairest price or current value in terms of auction market analysis is $1,650. I am aware of the "fundamentals" for precious metals such as "increasing currency supply", "paper assets", "debt", "default" etc, but the fundamentals are for "investing" NOT "trading". If I trade by listening to any other voice other than the market, I know I am finished in this business. |

| Posted: 15 Apr 2012 02:00 AM PDT Batero Gold Corp. ("the Company") (TSX-V: BAT, BELDF.PK) wishes to announce that in order to satisfy additional demand it has increased the size of its special warrant financing, previously announced on April 11, 2012, to up to 9,802,000 Special Warrants (the "Special Warrants") for aggregate gross proceeds of up to $6,371,300 (the "Offering"). |

| Posted: 14 Apr 2012 05:27 PM PDT There has been a lot of articles written recently about an immediate major bottom in gold and silver, strong hidden buying interest by unnamed entities and outrageous future price projections. All provide a false flag of hope without foundation. More Hype A current fascination is the head and shoulders pattern in gold which is far from complete. One can be assured that since everybody and his brother has noted this potential pattern, a positive resolution, if any, is a long way off. Cheerleader predictions about moon shots or turnarounds without supporting evidence should be regarded as mere speculation. Hoping, wishing and praying are not viable investment options. Fundamentals vs Technicals Based on fundamentals we are all familiar with, the bull market in Gold and Silver is not over. If it were over, someone, somewhere, somehow reinvented the economic wheel of true value and I missed the memo. However, current technical results do not presently the match the fundamen... |

| "There Is No Chinese Wall. Please. Come On. This Is Wall Street" Posted: 14 Apr 2012 03:52 PM PDT Remember the look on one's face when one hears there is no Santa Claus, or tooth fairy? That, more or less, is what the visage on everyone's favorite CNBC anchors Becky Quick, Joe Kernen and Andrew Ross Sorkin was, when Chris Whalen matter of fact (because it is a fact) let a rare glimpse of reality on the NBC Universal distraction and entertainment show, when he said "There is no Chinese Wall. Please. Come on. This is Wall Street." Awkward silence follows. And why not: if the banks officially call frontrunning an "Asymmetric Information Initiative" to mask the simple illegality from the idiot regulators, why not call a spade a spade, and expose one more aspect of the lies and crime that is shoved down investors' throats every single day. Yet once again, this is certainly not news. From January 2011:

Q.E.D. Fast forward to 9:30 into the clip below. |

| Posted: 14 Apr 2012 03:33 PM PDT from thevictoryreport1 : The world has never been better positioned to use gold as a medium of exchange than it is right now. |

| Posted: 14 Apr 2012 03:14 PM PDT |

| The Man Who Should Be President Posted: 14 Apr 2012 02:12 PM PDT by Chuck Baldwin, Chuck Baldwin Live:

Read the following. This is a man who understands the Constitution. This is a man who understands sound economic principles. This is a man who understands liberty and freedom. This is a man who has the guts to tell the truth. This is a man who has put his life and career on the line for the principles of liberty for more than two decades. This is a man who has returned every dollar that he has been paid as a US congressman to the taxpayers. This is the man who should be President of the United States. |

| SMX announces new E-Gold, E-Silver contracts Posted: 14 Apr 2012 01:55 PM PDT from Bullion Street:

According to Vaidyalingam Hariharan,Chief Executive of the Singapore Mercantile Exchange,the bourse will start these futures on May 8 and also considering rubber and sugar contracts in the near future. The contracts will be cash-settled against the benchmark gold and silver futures contracts in India's Multi Commodity Exchange. Established in August 2010, SMX said trading volumes on all its contracts surged to more than 800,000 lots in the first quarter of the year, valued at nearly $30 billion, from around 37,000 lots in the same period in 2011. |

| Joseph Stiglitz: Is Mercantilism Doomed to Fail? And With It the US Dollar? Posted: 14 Apr 2012 01:55 PM PDT |

| How Serious are China and India About Their Gold? Posted: 14 Apr 2012 01:48 PM PDT by Eric McWhinnie, Wall St Cheat Sheet:

Outside of the United States, countries take their gold business very seriously. Earlier this week, a 30 year old Chinese woman was given the death sentence by a court in Wenzhou. According to Xinhua news agency, Wang Caiping cheated investors out of 100.11 million yuan, losing 94 million yuan in futures and gold trading. Xinhua explained that she borrowed the money in 2010 promising to invest in equipment and property, but used the money instead to speculate in futures and gold trading with her brother. |

| Another Russian Chartered, German Ship Intercepted Delivering Weapons To Syria Posted: 14 Apr 2012 01:23 PM PDT Two months ago we explained very diligently, why courtesy of the strategic Russian Naval base in Tartus, Syria, the Russian regime will never, repeat never, let the Syrian government be replaced by various insurgent forces (very much like in other parts of MENA, which now are suffering from an absolute political vacuum and even greater corruption in the aftermath of the Arabian Spring). Granted, while Ambassador Rice may say she is "disgusted" with the subsequent Security Council vote which courtesy of Russia and China halted a intervention in Syria based on unbiased media reports showing one side of the story, one can only imagine how disgusted the rest of the world may have be with the stupid placement of Iran in such close proximity to all those US army bases. Subsequently there were various reports of Russian troops arriving in Tartus, both confirmed and denied by Russia, which were promptly forgotten: after all distractions from other, far greater problems can not become too repetitive or else the general audience will habituate. But all that was a month ago, and attention spans these days are short, so it is time to once again escalate, and sure enough yesterday the AP reported that Obama has approved an aid package to the Syrian rebels. Naturally, since this whole theater is all about severing strategic Russian national interests in the Mediterranean, and thus, into the Suez, Arabian Gulf, and ultimately Persian Gulf, German Spiegel reports of the immediate tat to America's tit (not to be confused with the Colombian legal prostitution tit, where it now appears whoregate is about to become a national pastime courtesy of upcoming congressional hearings involving the 12 men from Obama's staff who were Secretly Serviced on taxpayer dimes), as apparently yet another Russian-chartered, German ship has been intercepted carrying military equipment and munitions into Syria. From Spiegel:

It appears that the Russians have once again dared to protect their strategic interests.

Said otherwise, it is time to unscab the Persian foreign relations wound just in time for, as Reuters puts it, "Iran, big powers agree - to keep talking."

Basically they all sat down... and agreed to sit down again. So why the tension? Well recall that just like it is in the Fed's best interest to keep the Schrodinger economy both alive and dead so it has an excuse to dump another trillion in electronic dollar signs into US banks (just as BofA - there is no greater fan of this plan than them), so it is America's general interest to push oil lower, but to have a loophole to bomb the living daylights out of anything that moves in the Middle East. Hence the gambit: diffuse Iran modestly so Brent falls another $3, $4, or hopefully $5/barrel, because with the summer approaching gas prices ain't going any lower, and with the economy sputtering yet again, having more QE with gas at $4.00 would result in a rerun of the late summer of 2008. But don't diffuse it completely: de-escalate if possible so that while Iran is seemingly better, Syria is once again all the humanist rage: we are likely hours away from finding weapons of mass destruction in Syria next. And so on, and so on, and so on: both US domestic and foreign policy continue to drone on like a broken record, something we remarked on yesterday when we noted how 2012 is just like 2011... and just like 2010. Unfortunately, Hollywood is not the only place devoid of new and original ideas and forced to settle for endless sequels: so is now US fiscal, monetary and foreign policy. |

| Posted: 14 Apr 2012 11:29 AM PDT Get ready…Save some cash, load up with gold and silver, and be patient…Start by buying top-grade dividend-paying stocks and gold on dips or corrections, and hold your gold. This era will see the catastrophic collapse of all fiat money. Gold should skyrocket. Get ready for crime and violence… So says*Richard Russell*in edited excerpts from a King World News interview, as provided by Lorimer wilson, editor of www.munKNEE.com (Your Key to Making Money!). This paragraph must be included in its entirety in any re-posting to avoid copyright infringement. Russell*concludes the interview [it can be read in its entirety here] by saying: The eurozone will come apart. The barter system will be king. Real estate, gold, silver and diamonds will be the main vehicles of wealth (along with weapons). Start now watching the stocks of Sturm Ruger… and Smith & Wesson. [INDENT][COLOR=#ff0000]Daily Delivery Available! If you enjoy this site and would like to have every article se... |

| Pento - Inflationary Death Spiral & The Global Credit Card Posted: 14 Apr 2012 11:07 AM PDT  With investors nervous about the action in global stock markets, gold and silver, today Michael Pento, of Pento Portfolio Strategies, writes for King World News to warn that central planners have us headed into an "inflationary death spiral." Pento had this to say about the situation: "The three primary factors that determine the interest rate level a nation must pay to service its debt in the long term are; the currency, inflation and credit risks of holding the sovereign debt. All three of those factors are very closely interrelated." With investors nervous about the action in global stock markets, gold and silver, today Michael Pento, of Pento Portfolio Strategies, writes for King World News to warn that central planners have us headed into an "inflationary death spiral." Pento had this to say about the situation: "The three primary factors that determine the interest rate level a nation must pay to service its debt in the long term are; the currency, inflation and credit risks of holding the sovereign debt. All three of those factors are very closely interrelated." This posting includes an audio/video/photo media file: Download Now |

| Posted: 14 Apr 2012 09:42 AM PDT [Ed. Note: Remember that time Al Gore told us that NAFTA and Globalization would be a "good deal" for America and increase the number of jobs in the U.S.? Well, here's the result:] 1 out of 4 Americans employed work in jobs that pay less than $10 per hour.

|

| Watch for SILVER to SPIKE lower, and buy… Posted: 14 Apr 2012 09:18 AM PDT |

| Bernanke and Germany Wake Up to a Merda Storm Posted: 14 Apr 2012 09:03 AM PDT If you don't know the meaning of merda, just let your mind wander. Bernanke and Germany Wake Up to a Merda StormCourtesy of Russ Winter of Winter Watch at Wall Street Examiner The realization has been shockingly slow, but the lamestream media, such as Bloomberg, is picking up on how toxic the LTRO program has been to the merda-storm countries' banks. Today, they ran a clip on how Spanish banks borrowed LTRO funds to speculate on Spanish sovereigns at prices that are now well underwater. That's what happens when the artificial buying frenzy has come and gone. The fact that the Spanish 5-year CDS hit 500 basis points for first time, up 23 basis points, and Italy CDS rose 15 basis points on the day to 433 basis points, signals that those countries will not be able to absorb the blow of all their bankster guarantees, let alone their normal sovereign obligations. Italian banks took €354 billion in LTRO cash and Spanish banks took around €300 billion. Portuguese bank dependence on ECB borrowing rose to a record €56 billion. So in total, these countries' insolvent banks have now placed over €710 billion in merda collateral with the ECB. The fact that these infected banks are halting trading about every other day should also be transmitting in spades the signal that the ECB literally owns said banks and inherits their losses and their merda collateral, which has been pawned off. There are really only four European countries that backstop all of the ECB, EFSF, etc., etc., schemes. Unfortunately, two of them are the merda-storm countries of Spain and Italy. That means all of the losses that would normally be distributed across a number of larger nations will now fall on the remaining two: Germany and France. I've been writing that key European countries are about to toss out bankster agents and proponents of even more austerity in soon-to-be-held elections. May 6 is the key date in Greece and Germany. France's first round of elections begins on April 22. Tying all the loose ends together is Wizard of Oz Ben Bernanke's sudden attention to words like "shadow banking," "collateral" and "vulnerabilities" in his speeches. For those with an elementary ability to connect the dots, this suggests that collateral in general -- including the merda-storm variety -- has been the subject of some late-night calls during Weekend at Benny's. And then there's Ben, the master of obfuscation and butt covering. When this crisis soon hits, Ben will attempt to disassociate the bad collateral as a European problem and nothing with which he would ever be involved. He will argue that owning several trillion in 1-2%-yielding long-duration sovereigns in a country (the US) with a 105% debt to GDP is nothing like what the ECB has done. A few years ago, a trillion-dollar portfolio of housing mortgages would've been considered a big deal. Ben should call this European ploy "nossa merda nao fede," which is Portuguese for "our shit doesn't stink." Like chickens with their bungholes ripped out, money will go into a frenzy. From the annals of history, here are some of Brilliant Ben's priceless insights. Only in the most corrupt systems would someone like this be treated like a demi-god, let alone still have a job. There are other smoking guns. For instance, the Ministry of Truth apparatchik, Moodys, postponed its European bank ratings announcement until early May. For the Sherlocks among you, Italy was scheduled for April 16 and Spain for April 23. Additionally, rumors floated that the ECB will engage in more can kicking by buying even more Spanish and Italian bonds. Spain will sell two-year and 10-year bonds on April 19, which will verify the rumor. The shelf life of the ECB as bond buyer may be very short lived, however, because of the aforementioned German elections. Merkel's opposition is staunchly anti-bailout, and the Germans know full well that this merda storm of debt buying just gets added to their tab at the end of a ruckus night. Spanish and Italian bondholders, which are a much larger group, will be totally aware of how the game is played, having seen how Greek private debt holders were subordinated to the ECB in the restructuring. Other clues: the increasing sound and fury from money managers who went along for the ride and now realize this constant central bank exposure doesn't work. First, Barton Biggs washed his hands of it this week, then Michael Steinhardt and Pimco's El-Erian. The chorus on this script keeps building because these guys are the dot connectors, and their lawyers are advising candor now, before the pitchforks arrive. It reminds me of Angelo Mozillo's after-the-fact warnings on housing just before that merda storm blew. This hurricane is even worse: The Central Banker Demi-God Bubble. Don't get too cute on the timing either, as Herb Stein's Law is in full alert: "If it isn't sustainable, it will end." In this case, we're talking about the system itself. For additional analysis on many topics, including trading ideas, subscribe to Russ Winter's Actionable – risk free for 30 days. Click here for more information. |

| Soros On Europe: Iceberg Dead Ahead Posted: 14 Apr 2012 07:04 AM PDT George Soros has been a busy man the last few days. Appearing at the INET Conference a number of times and penning detailed articles for the FT (and here at Project Syndicate) describing the terrible situation in which Europe finds itself - and furthermore offering a potential solution. Critically, he opines, the European crisis is complex since it is a vicious circle of competing crises: sovereign debt, balance of payments, banking, competitiveness, and structurally defective non-optimal currency union. The fact is 'we are very far from equilibrium...of the Maastricht criteria' with his very clear insight that the massive gap, or cognitive dissonance, between the 'official authorities' hope and the outside world who see how abnormal the situation is, is troublesome at best. Analogizing the periphery countries as third-world countries that are heavily indebted in a foreign currency (that they cannot print), his initial conclusion ends with the blunt statement that "the euro has really broken down" and the ensuing discussion of just what this means from both an economic and socially devastating perspective: the destruction of the common market and the European Union and how this will end in acrimonious recriminations with worse conflicts between European states than before. However, he offers some hope and a potential solution to the fact that these nations have implicitly handed their 'seignorage rights' to the ECB, in the potential for a balance between fiscal austerity and deflation (or at minimum new rules that would remove to a greater extent the vicious circle of the fiscal compact as deflationary debt trap). The punchline being the creation of an SPV that 'owns the ECB's seignorage rights - estimated to be worth $2-3 trillion' that could explicitly be used to acquire bonds without violating the Lisbon Treaty. The sad truth of this admittedly smart financial engineering (pretend austerity and optically no money printing when exactly that is occurring) is that the Bundesbank will never agree to it (as implicitly it ends up at the foot of the German taxpayer to a greater or lesser extent) even though, as he concludes, the future of the Euro is a political one and thus "beyond the Bundesbank's competence to decide." Just as we noted back in December and reiterated here as likely given TARGET-2 imbalances (also confirmed by Deutsche Bank), Soros points out that the Bundesbank has "started taking measures to limit the losses that it would sustain in case of a A must-watch harsh reality check on Europe and a man trying to find answers when the authorities remain blind to the endgame...

Project Syndicate: Reversing Europe's Renationalization George Soros NEW YORK – Far from abating, the euro crisis has taken a turn for the worse in recent months. The European Central Bank managed to relieve an incipient credit crunch through its long-term refinancing operation (LTRO)... The fundamental problems have not been resolved; indeed, the gap between creditor and debtor countries continues to widen. The crisis has entered what may be a less volatile but potentially more lethal phase. At the onset of the crisis, the eurozone's breakup was inconceivable...

If [ECB encumbrance] continues for a few more years, a eurozone breakup would become possible without a meltdown – the omelet could be unscrambled – but it would leave the creditor countries' central banks holding large, difficult-to-enforce claims against the debtor countries' central banks. The Bundesbank has become aware of the danger. It is now engaged in a campaign against the indefinite expansion of the money supply, and it has started taking measures to limit the losses that it would sustain in case of a breakup. This is creating a self-fulfilling prophecy: once the Bundesbank starts guarding against a breakup, everybody will have to do the same. Markets are beginning to reflect this. The Bundesbank is also tightening credit at home. This would be the right policy if Germany was a freestanding country, but the eurozone's heavily indebted member countries badly need stronger demand from Germany to avoid recession. Without it, the eurozone's "fiscal compact," agreed last December, cannot possibly work. The heavily indebted countries will either fail to implement the necessary measures, or, if they do, they will fail to meet their targets, as collapsing growth drives down budget revenues. Either way, debt ratios will rise, and the competitiveness gap with Germany will widen. Whether or not the euro endures, Europe faces a long period of economic stagnation or worse. Other countries have gone through similar experiences. Latin American countries suffered a lost decade after 1982, and Japan has been stagnating for a quarter-century; both have survived. But the European Union is not a country, and it is unlikely to survive. The deflationary debt trap is threatening to destroy a still-incomplete political union. The only way to escape the trap is to recognize that current policies are counterproductive and change course. I cannot propose a cut-and-dried plan, but three observations stand out. First, the rules governing the eurozone have failed and need to be radically revised. Defending a status quo that is unworkable only makes matters worse. Second, the current situation is highly anomalous, and some exceptional measures are needed to restore normalcy. Finally, the new rules must allow for financial markets' inherent instability. ... Most importantly, some extraordinary measures need to be invented to bring conditions back to normal. The EU's fiscal charter compels member states annually to reduce their public debt by one-twentieth of the amount by which it exceeds 60% of GDP. I propose that member states jointly reward good behavior by taking over that obligation. The member states have transferred their seignorage rights to the ECB, and the ECB is currently earning about €25 billion ($32.7 billion) annually. The seignorage rights have been estimated by Willem Buiter of Citibank and Huw Pill of Goldman Sachs, working independently, to be worth between €2-3 trillion, because they will yield more as the economy grows and interest rates return to normal. A Special Purpose Vehicle (SPV) owning the rights could use the ECB to finance the cost of acquiring the bonds without violating Article 123 of the Lisbon Treaty. Should a country violate the fiscal compact, it would wholly or partly forfeit its reward and be obliged to pay interest on the debt owned by the SPV. That would impose tough fiscal discipline, indeed. By rewarding good behavior, the fiscal compact would no longer constitute a deflationary debt trap, and the outlook would radically improve. In addition, to narrow the competitiveness gap, all members should be able to refinance their existing debt at the same interest rate. But that would require greater fiscal integration, so it would have to be phased in gradually. The Bundesbank will never accept these proposals, but the European authorities ought to take them seriously. The future of Europe is a political issue, and thus is beyond the Bundesbank's competence to decide.

And incidentally speaking of the Bundesbank, recall back in December Zero Hedge's view on the endgame via "Has The Imploding European Shadow Banking System Forced The Bundesbank To Prepare For Plan B?" where we said, focusing on the TARGET2 issue :

Four months later, here comes Deutsche Bank's Thomas Mayer with "Why the Buba Wants To Exit." Excerpts (full link):

Which, alas won't happen, and the Bundesbank will be even more on the hook. Just as we further elaborated in "Explaining The European €2.5 Trillion Liquidity Catch 22 Closed Loop." So yeah: tin foil hat conspiracy and all that jazz. |

| Why The Market Is Slowly Dying Posted: 14 Apr 2012 06:03 AM PDT Three years ago, when virtually nobody had yet heard of High Frequency Trading, Zero Hedge wrote "The Incredibly Shrinking Market Liquidity, Or The Upcoming Black Swan Of Black Swans" in which we asked "what happens in a world where the very core of the capital markets system is gradually deleveraging to a point where maintaining a liquid and orderly market becomes impossible: large swings on low volume, massive bid-offer spreads, huge trading costs, inability to clear and numerous failed trades?" Subsequent to this, our observation was proved right on both an acute (the May 6, 2010 Flash Crash), and chronic (the nearly 50% collapse in average daily volumes since the 2008 top) secular basis. And while we are not happy to have been proven correct in this particular forecast, as it ultimately means the days of equity capital markets in their current configuration are numbered, we now note that none other than Morgan Stanley's Quantitative and Derivative Strategies released a note which, with a three year delay, effectively predicts the end of capital markets in a world where every declining retail participation (another topic we have been hammering for the past 3 years as it is only the most natural response to a world in which not only equities are openly manipulated by central banks, but in which perpetrators for massive market disturabances are neither identified nor prosecuted) is replaced by artificial high frequency trading churn, which never was and never will be a true liquidity provider on a long-term basis. To wit from Morgan Stanley: "In our mind, many of the approaches to algorithmic execution were developed in an environment that is substantially, structurally different from today's environment. In particular, the early part of the last decade saw households as significant natural liquidity providers as they sold their single stock positions over time to exchange them for institutionally managed products... While the time horizon over which liquidity is provided can range from microseconds to months, it is particularly shorter-term liquidity provisioning that has become more common." Translation: as retail investors retrench more and more, which they will due to previously discussed secular themes as well as demographics, and HFT becomes and ever more dominant force, which it has no choice but to, liquidity and investment horizons will get ever shorter and shorter and shorter, until eventually by simple limit expansion, they hit zero, or some investing singularity, for those who are thought experiment inclined. That is when the currently unsustainable course of market de-evolution will, to use a symbolic 100 year anniversary allegory, finally hit the iceberg head one one final time. How does Morgan Stanley frame their analysis? First, MS notes the ever increasing ownership of the stock market by big institutions, as retail investors took a back seat to investment allocation decisions, a secular theme until 2008, which however has subsequently plateaued:

As more and more "equity capital" was concentrated into the hands of fewer and fewer people, the only logical outcome took place:

As a result, reports of the market's evaporating volume are not greatly exaggerated.

While it will not come as news to any of our regular readers, the disappearance of retail investors has meant the incursion of electronic trading in the form of relentless rise in HFT dominance.

Next Morgan Stanley explains precisely why the current market is no longer fit to deal with the existing roster of players, fit for a previous iteration of capital market topology such as that which prevailed when Reg-NMS was conceived, but certainly not the current one, especially if retail continues to withdraw from trading equities and invest its cash forcibly into that other terminally epic bubble - bonds.

But...

Let's repeat that for the cheap seats: "As a result, execution strategies that were calibrated on the earlier market environment may no longer be optimal" and we could in theory just end it here. We all know that the bulk of HFTs close each day flat to avoid overnight holding risk, which they do by increasing churn amongst each other to unprecedented levels, in the process generating massive momentum swings as every player piggybacks on either side of the move. End result: even Moran Stanley admits that churn is not liquidity, and that the inability of HFT to carry inventory and have a longer-term bias is the fatal flaw in the current market topology, precisely as we warned back in April 2009!

From here, everything else follows:

Thus: lim investing time horizons approaches 0 as HFT -> infinity

Unfortunately, the "High Frequency Trader" is NOT, as implicitly explained, a liquidity provider in the conventional sense: it is an ultra-short time horizon churn facilitator and nothing else. Which is why just like the Fed has become the artificial lender of last resort in a regime that is unsustainable and where central banks are forced to grow their assets exponentially (as shown on Zero Hedge) just to preserve the flow so very needed to keep equities from collapsing, so HFT has become the artificial provider of fake liquidity. The problem is that just like the half lives of central bank intervention, so the incremental benefits of ever greater HFT penetration are becoming less and less. What happens next? Here Morgan Stanley, while trying to be diplomatically correct, comes to precisely our conclusion - trade while you can.

Where Morgan Stanley stops short is the logical next question: what will detour this transition to a market driven by quantized incremental binary decision-making, aka RISK ON, RISK OFF, where with every passing day, we get greater and greater volatility shifts? The answer: nothing, unless of course, for some reason retail investors do come back, however with Lehman, the Flash Crash, MF Global, central planning, forced media propaganda telling everyone "it is a once in a lifetime opportunity to buy", even as markets in real terms are still down nearly 40% from 2000, retail has had enough of the rigged stock market casino. Simply said: they are done. Hence HFT will have no choice but to become a greater and greater role in equity trading, pardon, churning. Until one day, by logical extrapolation, only HFT is the marginal setter of prices, with no regard for value, logic or analysis, and a price-determining function set purely by historical precedent yet a precedent which will be no longer applicable in the least as the paradigm shift to a conceptually different "market" will have then happened. Or said otherwise: "large swings on low volume, massive bid-offer spreads, huge trading costs, inability to clear and numerous failed trades"... just as we predicted back in April 2009. Just as simply said: with its advent, HFT sowed the seeds of its own self-cannibalization. Which also goes back to another key concept, and arguably the biggest flaw in all of modern economics: it is never about the stock. It is all, and always has been, about the flow. Last week Goldman tacitly acknowledged it for the first time. Expect more and more economic hacks to follow suit. The irony that ties it all together, is that if indeed for some reason retail investors do come back, and do pile their over $8.1 trillion in fungible money currently stored under the electronic cushion as we described in This Is Where "The Money" Really Is - Be Careful What You Wish For, which in turn would also unleash the titanic wall of money hidden behind the Shadow Banking dam wall (at last count about $35 trillion contained among the custodial holders of all securities why are quietly swept into the shadow banking system's re-re-rehypothecated pseudo asset pyramid and regulated by exactly nobody), which no conventional economic theories account for, yet which as Ben Bernanke this week, and Zero Hedge for the past 2 years, has been warning is the real catalyst of the (hyper) inflationary spark, then the Fed will be powerless to stop the biggest avalanche of empty artificially created fiat currency ones and zeros to ever hit the monetary system in the history of the world since Weimar. Only this time it will have the added benefit of HFT to accentuate every move imaginable as cash transitions from an inert form to an active, asset managed one. But this is far beyond what one learns in Econ 101, which is why we will have to wait at least another 3 years before the Morgan Stanleys and all other bandwagon chasers of the world close the loop on what we are (and have been for a while) warning right now. In the meantime, we are confident readers will enjoy the supreme irony: in their attempt to perpetuate the insolvent status quo farce, the central planners are now forced to choose between the terminal Scylla and Charbydis: a pyrrhic Schrödinger [alive|dead] market, or an even more pyrrhic Schrödinger [alive|dead] monetary regime. We hope they choose wisely. |

| Strange Dumping of Gold at Comex Close, Fund Manager Bryan Says Posted: 14 Apr 2012 05:04 AM PDT |

| Posted: 14 Apr 2012 04:25 AM PDT The following article has been posted at GoldMoney, here. TARGETing problems in eurozone2012-APR-14It seems that every time you turn over a stone on the rocky shore that is the financial condition of the Eurozone you find yet another nasty creature underneath. This time it is to be found across the accounts of the individual national central banks. The problem has arisen in the cross-border settlement system known as TARGET (an acronym for the Trans-European Automated Real-time Gross settlement Express Transfer System). Money flowing, say, from Greece to Germany is replaced by the Bank of Greece electronically issuing euros, and the inflow into Germany is neutralised by the Bundesbank withdrawing euros from circulation. Both trade imbalances and capital flight are accommodated by these means, and there is no net currency issuance to cover the imbalances. The new currency in Greece would be accounted for by the Bank of Greece showing a liability in its books in favour of the Bundesbank, and the Bundesbank would record an asset in the form of a corresponding loan to the Bank of Greece. In the past this has not been a problem because the capital flows in the form of commercial bank credit were readily available to fund, for example, purchases of Mercedes buses by a Greek tour operator. However, since the financial crisis capital flows to the peripheral Eurozone members have been disrupted, so that trade imbalances within the Eurozone have not been financed by capital flows. The result is that liabilities have been piling up at the central banks in Germany, the Netherlands, Luxembourg and Finland. The chart below, taken from a recent Bundesbank press release, illustrates the situation. These are extra inter-government debts that happen to have accrued at the central bank level, and so far have been missed in all estimates of debt-to-GDP ratios. Since the year-end, over the last three months these imbalances must have deteriorated further, with the possible exception of Ireland, whose position appears to be stabilising. The build-up of imbalances through TARGET has prevented the immediate financial collapses of Greece et al from capital flight. None of this would have come to light if it hadn't been for some detailed research by Messrs Sinn and Wollmwershaeuser of the Ifo Institute in Munich. Their investigations prompted a press release from the Bundesbank president dated March 15 that states there is no risk because "the idea that monetary union may fall apart is quite absurd". Others, including the citizens of Germany, the Netherlands, Luxembourg and Finland might think the idea of the Bundesbank ever getting repaid to be even more absurd. Tags: central banks, euro crisis, Germany, Greece Alasdair Macleod |

| Posted: 14 Apr 2012 02:23 AM PDT |

| Some Answers to Doug Casey’s Questions Posted: 14 Apr 2012 02:00 AM PDT |

| Postage prices to rise 30% as inflation wrecks UK living standards Posted: 14 Apr 2012 01:21 AM PDT Stretched Britons Begin Stampede for Stamps By Yeganeh Torbati http://uk.reuters.com/article/2012/04/13/uk-britain-stamps-idUKBRE83C11L... LONDON -- The latest round of panic buying sweeping British consumers isn't for fuel, as it was earlier this year when threats of a strike by the tanker drivers' union led to long queues of cars snaking their way around filling stations. Instead, the commodity Britons are desperately snapping up in bulk this month is stamps, after Royal Mail, the British postal service provider, announced it would raise prices after April 30 to make up for falling revenues. The price increase -- which will raise the cost of sending a letter first class by a huge 30 percent to 60 pence ($0.96), and the slower, second class by 39 percent to 50 pence -- has sparked alarm across the country, where consumers are facing slow wage growth and high inflation. Royal Mail has limited the number of stamps supplied to retailers in advance of the price rise to "protect Royal Mail's revenues," said a statement from the service. ... Dispatch continues below ... ADVERTISEMENT Be Part of a Chance to Discover Northaven Resources Corp. (TSX-V:NTV) is advancing five gold and silver projects in highly prospective and politically stable British Columbia, Canada. Check out the exploration program on our Allco gold/silver project : -- A large (13,000 hectare) property, covering more than 15 square kilometers of a regional mineralized trend just 3km from a recently announced 1.2-million-ounce gold and 15-million-ounce silver deposit. -- The property hosts historic high-grade silver workings and many mineral showings as well as former mines at the property's northern and southern boundaries. -- A deep-penetrating airborne geophysics survey has just been completed on the entire property and neighboring deposits and its results are eagerly awaited. To learn more about the Allco property or Northaven's other gold and silver projects, please visit: http://www.northavenresources.com Or call Northaven CEO Allen Leschert at 604-696-3600. "We put arrangements in place in February with all our major retailers to ensure that they have adequate stocks of stamps to meet genuine customer demand," Royal Mail said. Walking out of the Houndsditch post office in the City of London financial district around lunch time with a thick stack of 20 stamp books in hand, Sanjeev said the supply of 240 stamps would last him a good while, even given his preference for writing letters over emails. "I thought, 'OK, I know the prices are going to go up,'" said the IT worker, who declined to give his last name. "But if ... I could afford it, I would buy a lot more." Britain boasts a proud postal history, including introducing the world's first adhesive postage stamp, the Penny Black, which in 1840 helped to make the country's complex postal system cheaper and easier to use. Like the U.S. Postal Service, Royal Mail has struggled to maintain its revenues in recent years, battered by a double-whammy of decreasing volumes driven by the rise of email and electronic bill-paying and more addresses to deliver to. Royal Mail said it has lost 1 billion pounds over the last four years. But British consumers are feeling the pain too. Data from the Office for National Statistics released last month showed the UK economy shrank by more than expected in the last quarter of 2011, with real household disposable incomes falling by 1.2 percent last year, the biggest drop since 1977. "At the end of the day, when you get paid, everything is gone," said security officer George Osei, 54, walking out of a post office near Liverpool Street railway station in central London. "Everything is going up -- rent is going up, transportation is going up, fuel is going up. But wages are not going up." Vasanti Jethwa, manager of the Houndsditch post office, said her branch had seen about 25 percent more demand for stamps in recent weeks compared to last year. "But how much can they buy?" she asked. "People are saying 'when are they going up, when are they going up?' People are worried because of the economy. At the moment some people are out of jobs and they can't really afford stamps." Sanjeev said he thought the hubbub over stamps was misplaced, as postage in the age of email represents just a small portion of the rising cost of living for most. "I think there are a lot bigger things going on than stamps," he said, citing rising fuel prices. "The price of stamps is nothing." Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Golden Phoenix Discusses Royalty Mining Growth Strategy Golden Phoenix Minerals Inc. has discussed its royalty mining growth strategy on the Fox Business Network program "21st Century Business" with host Jackie Bales. Golden Phoenix's director of corporate communications, Robert Ian, told how the company narrows its focus to project generation and future royalty streams. He explained why Golden Phoenix believes it's better to own joint-venture interests in several producing mines instead of full exposure to just one project. "21st Century Business" has been airing for 15 years. Previous hosts have included Gen. Alexander Haig, Gen.l Norman Schwarzkopf, and Secretary of Defense Caspar Weinberger. Golden Phoenix appeared as paid programming on this broadcast. To view the program with Golden Phoenix, please visit Golden Phoenix's Internet site here: http://www.goldenphoenix.us/company-videos.html |

| Frustrated Safe Haven Swiss Franc Investors May Soon Turn to Gold and Silver Posted: 14 Apr 2012 01:18 AM PDT The resurgence of concerns over the long term solvency of debt laden Eurozone countries like Greece, Spain, Portugal, Italy and Ireland has led to refreshed selling of the Euro against the other major currencies since early April. Although the market in EUR/USD now seems to have stabilized just over the psychological 1.3000 level, deep questions remain among international investors as to whether the European Central Bank or ECB will be able to manage the ongoing European debt crisis over the coming few years without the trade bloc disintegrating or the common currency being further devalued by the forex market. |

| Friday's gold dumping, general volatility covered in KWN weekly review Posted: 14 Apr 2012 01:10 AM PDT 9:10a ET Saturday, April 14, 2012 Dear Friend of GATA and Gold (and Silver): The King World News weekly precious metals review finds Bill Haynes of CMI Gold & Silver commenting on Friday's last-minute dumping of gold on the Comex to knock the price down and futures market analyst Dan Norcini marveling at the volatility in all markets, which he says is turning futures traders into day traders. The interviews together are 19 minutes long and you can listen to them here: http://www.kingworldnews.com/kingworldnews/Broadcast/Entries/2012/4/14_K... Please note that Thursday's dispatch calling attention to the excellent commentary by The Real Asset Co.'s Jan Skoyles, "Vietnam Goes Nuclear on Gold," inadvertently performed a sex change operation on the author. This Jan is female and the dispatch has been corrected here: http://www.gata.org/node/11242 CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Sona Discovers Potential High-Grade Gold Mineralization From a Company Press Release VANCOUVER, British Columbia -- With its latest surface diamond drilling program at its 100-percent-owned, formerly producing Blackdome gold mine in southern British Columbia, Sona Resources Corp. has discovered a potentially high-grade gold-mineralized area, with one hole intersecting 13.6 grams of gold in 1.5 meters of core drilling. "We intersected a promising new mineralized zone, and we feel optimistic about the assay results," says Sona's president and CEO, John P. Thompson. "We have undertaken an aggressive exploration program that has tested a number of target zones. Our discovery of this new gold-bearing structure is significant, and it represents a positive development for the company." Sona aims to bring its permitted Blackdome mill back into production over the next year and a half, at a rate of 200 tonnes per day, with feed from the formerly producing Blackdome mine and the nearby Elizabeth gold deposit property. A positive preliminary economic assessment by Micon International Ltd., based on a gold price of $950 per ounce over eight years, has estimated a cash cost of $208 per tonne milled, or $686 per gold ounce recovered. For the company's complete press release, please visit: http://www.sonaresources.com/_resources/news/SONA_NR18_2011-opt.pdf Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Prophecy Platinum (TSXV: NKL) and Ursa Major Minerals Company Press Release VANCOUVER, British Columbia, Canada -- Prophecy Platinum Corp. (TSX-V: NKL, OTC-QX: PNIKF, Frankfurt: P94P) and Ursa Major Minerals Inc. have signed a binding letter of agreement for a business combination through a proposed all-share transaction. In doing so Prophecy and Ursa have acted at arm's length and the transaction has been negotiated at arm's length. Prophecy will issue one common share in exchange for every 25 outstanding common shares of Ursa. Ursa options and warrants will be exchanged for options and warrants of Prophecy on an agreed schedule. Prophecy's offer represents a value of about $0.15 per each common share of Ursa based on Prophecy's share price of $3.70 as at March 1, representing a premium of 130 percent to Ursa's March 1 closing price of $0.065. Prophecy is to subscribe for $1 million common shares of Ursa by way of private placement financing at $0.06 per share, subject to regulatory approval. Upon placement completion, John Lee and Greg Hall, current Prophecy directors, will be appointed to Ursa's board. Prophecy thus will become a mid-tier resource company with a robust and -- The fully permitted open-pit Shakespeare PGM-Ni-Cu mine close to Sudbury, Ontario, infrastructure with near-term production capabilities. -- The flagship Wellgreen (Yukon) PGM-Ni-Cu project with more than 10 million ounces of Pt-Pd-Au inferred resource. Drilling is under way and a preliminary economic assessment study is pending. -- Manitoba's Lynn Lake Ni-Cu project with more than 262 million pounds Ni and 138 million pounds Cu measured and indicated. For the complete announcement, please visit Prophecy Platinum's Internet site here: http://www.prophecyplat.com/news_2012_mar02_prophecy_platinum_ursa_major... |

| Gold and Silver Wait Patiently for More Easing Posted: 14 Apr 2012 01:03 AM PDT After having a strong performance the prior day, the markets experienced a broad pullback as growth data from China disappointed investors. Gold prices fell more than 1.5 percent, while silver dropped 3.3 percent. On Friday, the National Bureau of Statistics in Beijing announced that China’s economy grew at 8.1 percent in the first quarter of 2012, its slowest pace in about three years. Economists were expecting growth of about 8.3 percent and the whisper number was around 9 percent. In comparison, China grew at 8.9 percent in the previous quarter, and 11.9 percent in the first quarter of 2010. Song Yu, China economist at Goldman Sachs explained, “Growth in the first two months was weak. We had some loosening of monetary and fiscal policy in March, but it wasn’t enough to save the quarterly number,” according to the WSJ. |

| Wider trading band for yuan may facilitate gradual devaluation Posted: 14 Apr 2012 12:45 AM PDT China Gives Currency More Freedom with New Reform By Koh Gui Qing http://uk.reuters.com/article/2012/04/14/uk-china-cbank-yuan-band-idUKBR... BEIJING -- China took a milestone step in turning the yuan into a global currency on Saturday by doubling the size of its trading band against the dollar, pushing through a crucial reform that further liberalizes its nascent financial markets. The People's Bank of China said it would allow the yuan to rise or fall 1 percent from a mid-point every day, effective Monday, compared with its previous 0.5 percent limit. Analysts said the timing of the move underlines Beijing's belief that the yuan is near its equilibrium level and that China's economy, although cooling, is sturdy enough to handle important, long-promised, structural reforms. The move could also help China deflect criticism of its currency policy ahead of the annual spring meeting of the International Monetary Fund in Washington next week. ... Dispatch continues below ... ADVERTISEMENT Prophecy Platinum (TSXV: NKL) and Ursa Major Minerals Company Press Release VANCOUVER, British Columbia, Canada -- Prophecy Platinum Corp. (TSX-V: NKL, OTC-QX: PNIKF, Frankfurt: P94P) and Ursa Major Minerals Inc. have signed a binding letter of agreement for a business combination through a proposed all-share transaction. In doing so Prophecy and Ursa have acted at arm's length and the transaction has been negotiated at arm's length. Prophecy will issue one common share in exchange for every 25 outstanding common shares of Ursa. Ursa options and warrants will be exchanged for options and warrants of Prophecy on an agreed schedule. Prophecy's offer represents a value of about $0.15 per each common share of Ursa based on Prophecy's share price of $3.70 as at March 1, representing a premium of 130 percent to Ursa's March 1 closing price of $0.065. Prophecy is to subscribe for $1 million common shares of Ursa by way of private placement financing at $0.06 per share, subject to regulatory approval. Upon placement completion, John Lee and Greg Hall, current Prophecy directors, will be appointed to Ursa's board. Prophecy thus will become a mid-tier resource company with a robust and diversified pipeline of platinum nickel projects, including: -- The fully permitted open-pit Shakespeare PGM-Ni-Cu mine close to Sudbury, Ontario, infrastructure with near-term production capabilities. -- The flagship Wellgreen (Yukon) PGM-Ni-Cu project with more than 10 million ounces of Pt-Pd-Au inferred resource. Drilling is under way and a preliminary economic assessment study is pending. -- Manitoba's Lynn Lake Ni-Cu project with more than 262 million pounds Ni and 138 million pounds Cu measured and indicated. For the complete announcement, please visit Prophecy Platinum's Internet site here: http://www.prophecyplat.com/news_2012_mar02_prophecy_platinum_ursa_major... A slowing world economy that has pared investor expectations of a steadily rising yuan likely also gave Beijing the confidence to proceed, knowing that a larger band would not necessarily lead to a stronger currency. "The central bank chose a good time window to enlarge the trading band. The market's expectation for a stronger yuan is weakening," said Dong Xian'an, chief economist at Peking First Advisory in Beijing. "The move partially clears away doubts on whether China can manage a soft landing in its economy, and makes clear China's reform roadmap." Investors have widely expected China to widen the yuan's trading band this year, thanks to repeated hints from Beijing that the change would take China one step closer to its financial goal: a basically convertible yuan by 2015. Having a currency that trades with fewer restrictions also enhances Shanghai's status as a financial center. China envisions turning the city into a global banking hub by 2020. "From April 16, 2012, the renminbi exchange rate against the dollar in the spot interbank currency market will be widened from 0.5 percent to 1 percent," the People's Bank of China said in a short statement on its website. "China's foreign exchange market is maturing. The market's ability to price and manage risks is growing," the bank said. Lan Shen, an economist at Standard Chartered Bank in Shanghai, said given that the yuan was estimated to be close to its equilibrium level, the currency was likely to gain only 1.4 percent against the dollar this year. The yuan, which hit a record high of 6.2884 against the dollar on Feb 10, is little changed against the U.S. currency for the year, softening 0.14 percent since January. The yuan rallied by about 5 percent in 2011 and nearly 4 percent in 2010, giving economists and markets the impression that Beijing was comfortable with a steadily appreciating currency. It has gained about 30 percent in nominal terms against the U.S. dollar since the landmark move in the summer of 2005 to de-peg the yuan from the greenback. Premier Wen Jiabao and Central Bank Governor Zhou Xiaochuan both said in March conditions were ripe for the yuan to float more freely to better reflect market demand and supply. Their repeated calls for reforms came even as China is set to confront its slowest economic growth in a decade this year, leading many to believe Beijing is ready to tolerate less heady growth in exchange for a restructured economy that is driven more by domestic than export demand and has greater flexibility to withstand fallout from external economic shocks. Some analysts say a more flexible yuan, also known as the renminbi, works in China's favour in turbulent times as it gives it more room to guide the currency lower to aid exports. "The message of this move is that RMB's appreciation story is over. Greater two-way volatility will be the name of the game going forward," said Qu Hongbin, an economist at HSBC. Data showed on Friday that China's economy suffered its weakest growth since the global financial crisis in the first quarter by expanding just 8.1 percent, below forecasts for 8.3 percent. The last time China changed its currency policy was in June 2010, after a two-year period in which the yuan had effectively been re-pegged to the dollar to help shield China from the 2008-09 global financial crisis. The yuan's value has always been a point of contention between China and its trading partners, notably the United States, which say China suppresses the currency to boost exports. China has repeatedly rejected the accusation. Instead, Chinese leaders say the yuan is near its equilibrium level and that authorities aim to keep its value "basically stable," more flexibility notwithstanding. "I think the step should be welcomed by foreign countries, especially the United States, which have been calling for reforms. This is also related to growing domestic calls for economic reforms," said Dongming Xie, China economist at OCBC Bank in Singapore. Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Sona Discovers Potential High-Grade Gold Mineralization From a Company Press Release VANCOUVER, British Columbia -- With its latest surface diamond drilling program at its 100-percent-owned, formerly producing Blackdome gold mine in southern British Columbia, Sona Resources Corp. has discovered a potentially high-grade gold-mineralized area, with one hole intersecting 13.6 grams of gold in 1.5 meters of core drilling. "We intersected a promising new mineralized zone, and we feel optimistic about the assay results," says Sona's president and CEO, John P. Thompson. "We have undertaken an aggressive exploration program that has tested a number of target zones. Our discovery of this new gold-bearing structure is significant, and it represents a positive development for the company." Sona aims to bring its permitted Blackdome mill back into production over the next year and a half, at a rate of 200 tonnes per day, with feed from the formerly producing Blackdome mine and the nearby Elizabeth gold deposit property. A positive preliminary economic assessment by Micon International Ltd., based on a gold price of $950 per ounce over eight years, has estimated a cash cost of $208 per tonne milled, or $686 per gold ounce recovered. For the company's complete press release, please visit: http://www.sonaresources.com/_resources/news/SONA_NR18_2011-opt.pdf |

| The Inter-market Correlations May Prove Insightful for Gold and Silver Investors Posted: 14 Apr 2012 12:34 AM PDT Tuesday marked the worst day of the year for U.S. markets. Stocks fell amid anxiety ahead of earnings season and rising bond yields for Spain and Italy, along with sharp losses for those markets. The Dow Jones Industrial Average closed down 213.66 points, or 1.7%, resulting in a five-session losing streak. That’s the longest such run of losses since August. It was also the biggest one-day point and percentage drop for the index since Nov. 23. But Wednesday, U.S. stocks rose sharply after an extended losing run as Spanish and Italian bond yields fell. |

| You are subscribed to email updates from Save Your ASSets First To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

Today, I am going to do something that I have never done: I am going to devote virtually my entire column to posting another man's words. That man is the man who should be President of the United States: Congressman Ron Paul of Texas. The following is a written transcript of a speech Dr. Paul gave on the floor of the US House of Representatives back in 2007. Had Congressman Paul been elected President in 2008, the country would be four years into the greatest economic, political, and, yes, spiritual recovery in the history of America. As it is, the US is on the brink of totalitarianism and economic ruin. And you can mark it down, four years from now it won't matter to a tinker's dam whether Barack Obama or Mitt Romney was elected President this November. Neither man has the remotest understanding of America's real problems nor the courage and backbone to do anything about it if they did understand.

Today, I am going to do something that I have never done: I am going to devote virtually my entire column to posting another man's words. That man is the man who should be President of the United States: Congressman Ron Paul of Texas. The following is a written transcript of a speech Dr. Paul gave on the floor of the US House of Representatives back in 2007. Had Congressman Paul been elected President in 2008, the country would be four years into the greatest economic, political, and, yes, spiritual recovery in the history of America. As it is, the US is on the brink of totalitarianism and economic ruin. And you can mark it down, four years from now it won't matter to a tinker's dam whether Barack Obama or Mitt Romney was elected President this November. Neither man has the remotest understanding of America's real problems nor the courage and backbone to do anything about it if they did understand. Singapore Mercantile Exchange (SMX) announced launching E-Gold and E-Silver contracts this May.

Singapore Mercantile Exchange (SMX) announced launching E-Gold and E-Silver contracts this May. Despite the Dow Jones Industrial Average and the S&P 500 suffering their worst day of the year on Tuesday, precious metals were able to decouple and climb higher. Gold futures for June delivery increased almost $17 to settle at $1,660, while silver gained 16 cents to close at $31.68. Although gold prices declined in March and had the media buzzing once again about a possible bubble, the world continues to be more interested in precious metals than ever before.

Despite the Dow Jones Industrial Average and the S&P 500 suffering their worst day of the year on Tuesday, precious metals were able to decouple and climb higher. Gold futures for June delivery increased almost $17 to settle at $1,660, while silver gained 16 cents to close at $31.68. Although gold prices declined in March and had the media buzzing once again about a possible bubble, the world continues to be more interested in precious metals than ever before. Low wage jobs have been a big part of the so-called recovery. What they also signify is a more troublesome trend that continues to eat away at the

Low wage jobs have been a big part of the so-called recovery. What they also signify is a more troublesome trend that continues to eat away at the

No comments:

Post a Comment