Gold World News Flash |

- International Forecaster March 2012 (#5) - Gold, Silver, Economy + More

- Canada Sees Mining Resurgence

- Silver Update

- Economic Money And The Rearing Of The Ugly Head Of Price Inflation

- Puplava - Eric Sprott and David Morgan Respond to CFTC Commissioner Bart Chilton on Silver Manipulation

- Chinese gold imports will keep increasing

- Greg Smith vs Goldman Sachs

- As Retail Sells, Central Banks Wave Gold In With Both Hands

- Ugly = Beautiful; Beautiful = Ugly: Ray Dalio On Deleveraging

- “We Are This Far From A Turnkey Totalitarian State" - Big Brother Goes Live September 2013

- Should Investors Sweat Gold’s Losing Streak?

- Ted Butler: How the Silver Manipulation Scheme Works

- Eric Sprott and David Morgan Respond to CFTC Commissioner Bart Chilton on Silver Manipulation

- Spring 2012: Escalation of the Precious Metal Wars

- This Past Week in Gold

- Canada Sees Gold Mining Resurgence

- Financial Sense Newshour interviews Ted Butler on silver market rigging

- What the End Result of the Fed’s Cancerous Policies Will Be and When It Will Hit

- Another Healthy Correction for Gold and Silver Price

- Counterintuitive takedowns in gold drawing notice, Norini tells King World News

- Central banks pounce on falling gold, buying it through BIS

- Court overturns order to slash Dutch pension fund's gold allocation

- Chris Martenson And Marc Faber: The Perils of Money Printing's Unintended Consequences

- Jacques – Understanding China Video

- Weekly article posted at GoldMoney

- Churches Foreclosed - Gold & Silver Weekly News with Christian Garcia March 16

| International Forecaster March 2012 (#5) - Gold, Silver, Economy + More Posted: 18 Mar 2012 03:05 AM PDT A report by the London-based Lombard Street Research, which says the Netherlands is badly handicapped by euro membership, and as a result the Dutch Freedom Party has called for a return to the Guilder. Leader Geert Wilders has become the first political movement in the euro zone with a large popular base to opt for withdrawal from the single currency. The Freedom Party is a conservative populist party. We do not read Dutch, but the very fact that this information was only picked up by a few sources outside of the Netherlands shows you what managed news is all about. |

| Posted: 18 Mar 2012 02:00 AM PDT Amid the bustle of the 80th Prospectors and Developers Association of Canada (PDAC) convention in Toronto, The Gold Report sat down with PDAC President Scott Jobin-Bevans for his take on the challenges the mining industry faces. In this exclusive interview, he covers a wide range of topics, from skilled labor shortages to the trials of mining in remote northern Canada. |

| Posted: 17 Mar 2012 07:34 PM PDT |

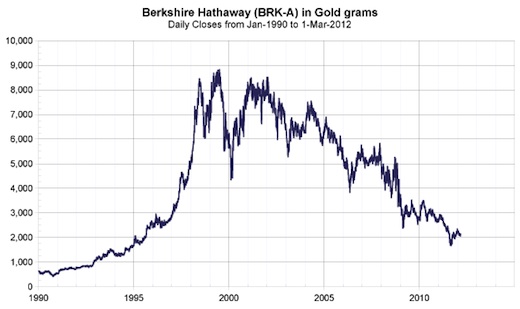

| Economic Money And The Rearing Of The Ugly Head Of Price Inflation Posted: 17 Mar 2012 05:43 PM PDT Tweet Reading time: 6 – 10 minutes The central banks of the world are engaged in financial repression and bloating their balance sheets through quantitative easing. This deranged monetary policy is resulting in negative effects of inflation on the economy, like pink slime, and showing just how poorly famed investors like Warren Buffett have performed by destroying billions of dollars of shareholder value. This has resulted in a manipulated boom that is starting to manifest itself. The result will be that price inflation will begin rearing its ugly head in a nasty way. JIM GRANT ON FEDERAL RESERVE INSANITY LEGAL VERSUS ECONOMIC MONEY AND CURRENCY Individuals acting in their own self interest determine what goods and services are available in the market. Before consumption and savings must come production. Billions of lifetimes of savings has resulted in a tremendous accumulation of capital that has been allocated to generate productive capacity which has allowed humanity's standard of living to be lifted from the swamp to the stars. But no matter how complicated a good the space shuttle is, and it is a highly complex good, it pales in comparison to the most complex of all goods humanity has produced: money. The Federal Reserve is interfering with the pricing of money and by consequence all other prices in the economy. The State can do this because it is such a large economic actor but it is still constrained by economic law. As Ludwig Von Mises wrote in 1912: As a buyer or seller the state has to conform to the conditions of the market. If it wishes to alter any of the exchange ratios established in the market, it can only do this through the market's own mechanism. As a rule it will be able to act more effectively than anyone else, thanks to the resources at its command … The fact that the law regards money only as a means of cancelling outstanding obligations has important consequences for the legal definition of money. What the law understands by money is in fact not the common medium of exchange but the legal medium of payment. It does not come within the scope of the legislator or jurist to define the economic concept of money. [emphasis added] The Information Age is resulting in tremendous advances in monetary evolution with things like BitCoin which is much more efficient at transferring value than fiat currency, fractional reserve banking or credit cards. These increasingly useful monetary goods will enervate demand for sterile assets like FRN$s, Euros and Yen. WARREN BUFFETT ON GOLD In the 2011 Berkshire Hathaway letter to shareholders Warren Buffett opined on page 18: Gold, however, has two significant shortcomings, being neither of much use nor procreative. … Meanwhile, if you own one ounce of gold for an eternity, you will still own one ounce at its end. … Beyond the staggering valuation given the existing stock of gold, current prices make today's annual production of gold command about $160 billion. … The 170,000 tons of gold will be unchanged in size and still incapable of producing anything. You can fondle the cube, but it will not respond. … I'm confident, however, that the $9.6 trillion current valuation of pile A will compound over the century at a rate far inferior to that achieved by pile B (all 400 million acres of U.S. cropland, 16 Exxon Mobils and $1T). The annual production of gold around $160 billion pales in comparison to the increase in worldwide debt in the last decade from $80 trillion to $200 trillion. JAMES TURK ON GOLD Buffett is correct that gold is a sterile asset that does not produce anything. In fact, it is even worse than sterile in that it has a negative interest rate due to storage and insurance costs. Fortunately that interest rate is less costly than alternatives. In a 3 Feb 2012 interview on King World News James Turk explained gold's role as a sterile asset: Gold doesn't really create wealth, it's just a sterile asset. It doesn't have a cash flow and it doesn't have a balance sheet or a P/E ratio. When the gold price is rising, what you are doing is taking wealth that's already been created and is in the hands of people who own a fiat currency and it's taking the wealth away from the people who own that fiat currency and putting it into the hands of people who own gold. So you have this wealth transfer taking place. My expectation is that this wealth transfer is going to be one of the most phenomenal ones in monetary history. And to be part of it you have to own physical gold and silver, this is what you need to do to take advantage of it. BUFFETT'S SCOREBOARD

IT'S HUMILIATING As James Grant said in the interview at 7:39: We went back and looked at the performance of gold and the humblest of things, a cup of sugar, and a share of common Coca Cola since 1996. …

Warren Buffett should be really embarrassed. As the charts show he should have retired around the time he hit his peak in 1999 and bought a cube of gold to fondle as its non-response would be better than the loss of shareholder value in Berkshire. To put some figures to it on 4 Jan 1999 it took 226.4 ounces of gold to buy one share of BRK-A with the gold fix at $287.15 and BRK-A at $65,000 per share. Today it takes a mere 73.7 ounces of gold to buy one share of BRK-A with the gold fix at $1,658 and BRK-A at $122,190; a 67% loss. Before Warren Buffett denigrates gold again he should either put up or shut up because the charts show just how much shareholder wealth he is destroying. Perhaps Buffett should take a look at Anthony Weiner's scoreboard since they both perform about the same. But perhaps I should give Buffett thanks because the loss of wealth from his scoreboard has showed up on mine!

CONCLUSION The Federal Reserve's attempt to interfere with the pricing mechanism of money and currency is doomed to fail. Their suppressive manipulation of the precious metals markets in an attempt to maintain their fiat currency monopolies will only result in the transfer of physical bullion and a weakening of the central bank balance sheets. Monetary evolution is in full advance in the Information Age which is causing a loss of demand for little colored coupons. The State must conform to the dictates of the market with regard to monetary goods. The performance of bonds, equities and real estate have all been greatly overstated as a result of this financial repression. The greatest wealth transfer in the history of the world is ongoing. One consequence over the near term will be some nasty price inflation of 5-15% which will lower standards of living due to a destruction in productive capacity of the economy. Beware of the Pink Slime which has been substituted into the CPI! Copyright © 2008. This article was published on http://www.RunToGold.com by Trace Mayer, J.D. on March 17, 2012. This feed is for personal and non-commercial use only. Applicable legal information and disclosures are available. The use of this feed on other websites may breach copyright. If this content is not in your news reader then it may make the page you are viewing an infringement of the copyright. Please inform us at legal@runtogold.com so we can determine what action, if any, to take. If you are interested in how to buy gold or silver then you may consider GoldMoney.(Digital Fingerprint: 1122aabbLittleBrotherIsWatching3344ccdd) Copyright © 2012 RunToGold.com. This Feed is for personal non-commercial use only. If you are not reading this material in your news aggregator then the site you are looking at may be guilty of copyright infringement. Please contact legal@runtogold.com so we can take legal action immediately. Plugin by Taragana |

| Posted: 17 Mar 2012 02:45 PM PDT The introduction of this audio clip reads: "In a "virtual" roundtable with Jim Puplava, Eric Sprott of Sprott Asset Management and David Morgan of Silver-Investor.com each respond to excerpts from Jim's earlier interview with CFTC Commissioner Bart Chilton on silver price manipulation." To Listen follow the link below and choose an audio player. Source: Financial Sense

Mr. Chilton makes the assertion that exemptions to position and accountability limits will be granted by the CFTC instead of the CME looking ahead. As we have written in the past, exemptions were, in our opinion, the vehicle by which a few very large entities could amass size in the market multiples of the position and accountability limits and thus the potential to command unfair influence over the price from time to time... Continued ... Unfortunately Mr. Puplava misunderstood Chilton to mean exemptions would not be granted in the future. Instead, exemptions will be granted by the CFTC not the exchanges. Mr. Chilton put the best face on it, saying that they would only grant exemptions to traders who can demonstrate an economic need for it. We find that to be of little comfort. It should be obvious that bullion banks can easily demonstrate an economic need by virtue of the inventory they hold, store and manage for themselves and clients. Better would have been a proviso that no trader would be granted exemptions to the new position limit regime, period. Exemptions are a way for one entity to receive favoritism by a government agency and will likely be gamed by those with the influence to do so over time. Not that it matters for the price of silver over time.

|

| Chinese gold imports will keep increasing Posted: 17 Mar 2012 01:00 PM PDT |

| Posted: 17 Mar 2012 12:06 PM PDT

When I read Greg Smith's op ed in the New York Times my very strong impression was, "Nothing new here, so what, not worth reading." That's certainly true as far as I was concerned, but when a friend not in finance told me the contents of the editorial was a surprise, I thought I had better weigh in. I even feel somewhat duty-bound to do so, because I spent many years on the "sell side," that is, at firms like Goldman Sachs. In fact I started my career at Salomon Brothers, the setting of Michael Lewis' "Liar's Poker." Lewis was three years ahead of me, and spoke to my training class, as mentioned in his book, around the time of the great crash of '87. Anyone who thought Smith's litany of complaints about Goldman Sachs were new or surprising has either not read Lewis' book, or has forgotten the contents--which is fair enough, since the book was published more than twenty years ago. For those of us who were working at Salomon Brothers when Liar's Poker was published in 1989, the contents of the book came as no surprise. In fact, we all thought he nailed it. Salomon in the day was a rough and tumble place where foul language, sports analogies, and ruthless internal competition ruled every day. This was not a place for brainy professors to come to share their knowledge and help client CFOs benefit society. This was a place to out-sell the guy sitting next to you so you would get a bigger piece of the bonus pool at the end of the each year. How you did that was your problem. The idea at Salomon then and at Goldman now is that you as a salesman have to make as many sales as you possibly can. That means you have to get your customer to like you so that he will want to trade with you. But for most of the products that Salomon sold (and Goldman Sachs sells), the products were OTC--over the counter. There is no commission per se, there is just the bid and offer price. So it's not only a volume game, it's also a price mark-up game. If you think your customer will pay 101 rather than 100 for bonds, you can offer them at 101 and see if he bites. This is all in Michael Lewis' book. Here's an excerpt from page 35:

Or let's hear from Larry Fink, now the head of Blackrock, as quoted in Liar's Poker, talking about the savings and loan customers who traded with the big investment banks like Salomon:

So now, 23 years later, for Greg Smith to raise eyebrows by "exposing" some of the less palatable aspects of Goldman's business practices seems a bit much. For one thing, Liar's Poker was a #1 bestseller. Everyone has read it. For another, anyone who pays the least bit of attention to the news knows that Goldman got into some very hot water three years ago for helping a hedge fund manager "short" subprime mortgage securities to a Goldman client. But if you're truly worried about Goldman now, you certainly should have been concerned in 2000, when Roger Lowenstein published his book on the collapse of mega-hedge fund Long-Term Capital Management (LTCM), "When Genius Failed." In that book, Lowenstein describes the scene when employees of Goldman Sachs were at LTCM's office in Greenwich, Connecticut, as LTCM tried to avert collapse from a concentration of too many trading positions all going bad at once. Goldman was there to do "due diligence," that is, to conduct an inspection of LTCM's books so that they could represent LTCM's condition to investors to help LTCM secure financing. It's like a large-scale credit check. As Lowenstein portrays it:

In other words, Goldman was exploiting its priviledged position of trust and confidentiality to identify exactly what LTCM would need to dump in a massive fire sale, and beat them to the punch, profiting from the deluge of liquidation that surely would follow. Lowenstein's book is in its sixth print as of 2008, and was a Business Week "Best Book of the Year" in the year it was published. This is not "new news." It's not that Goldman's comportment is unusually bad. Nor, obviously, is it particularly good. But scolding Goldman because some salespeople referred to clients as "muppets," to paraphrase Martin Sheen in "Apocalypse Now," is like handing out speeding tickets at the Indy 500. It's the nature of the beast. As a fresh college graduate years before working for Salomon Brothers, I spent a year treading water in the town of my university before embarking on a short stint as a teacher. Job pickings were slim, so I decided to try my hand at being a waiter at the best restaurant in town. It was no lay-up. To be merely considered for a waiter slot, I first had to be a busboy. To be a busboy, I had to work for free, for some undetermined period of time, in a sort of busboy audition. After one day I threw in the towel. I didn't make any money, but I got a good glimpse behind the scenes. In the confines of the tables, all was well, and elegant. In the kitchen, it was a swearfest. "Where is the f*cking side of potatoes," and "That SOB at Table 14 is gonna be wearing his soup" is all you could hear, all night long, on the other side of the metal doors leading to the kitchen. Greg Smith was a waiter at the restaurant that is Goldman Sachs. He was a salesman, and worse than that, he pedaled equity derivatives. To say the least, equity derivatives are not the flavor of the month. Volumes have dried up, and the money that banks are making is coming from fixed income, not equities. Smith was a Vice President among thousands of vice presidents at Goldman Sachs. The interesting question is not who is right in the "he said, she said" duel between Smith and Goldman Sachs, but rather, why did the New York Times give Smith prime time status? If you're in the market for a home, you seek out the services of a real estate agent. You develop a relationship with that person. You talk about your kids, you talk about where you went for vacation. Do you expect that the realtor, knowing all too well the seller is paying the full fee, is going to work tirelessly to reduce the sale price for you? Do you think the realtor is going to tell you, hang tight, I think they will come down by 5 percent? Of course you don't. Greg Smith seems to have mistaken his employer for the Red Cross, even though he managed to sell quite a few Goldman products over the years. His efforts will be seen for what they are: Sour grapes, and small, petty ones at that. It's a shame, because the world of finance is sorely in need of a higher ethical standard. But for now it's business as usual, and anyone who thinks otherwise is a muppet, not an muppeteer. |

| As Retail Sells, Central Banks Wave Gold In With Both Hands Posted: 17 Mar 2012 10:42 AM PDT As recent entrants in the gold market watched paralyzed in fear as gold tumbled by over $100 on the last FOMC day, on the idiotic notion that Ben Bernanke will no longer ease (oh we will, only after Iran is glassified, and not before Obama is confident he has the election down pat), resulting in pervasive sell stop orders getting hit, others were buying. Which others? The same ones whose only response to a downtick in the market is to proceed with more CTRL+P: the central banks. FT reports that the recent drop in gold has triggered large purchases of bullion by central banks in recent weeks. "The buying activity highlights the trend among central banks in emerging economies to buy gold, even as some western investors are losing patience with the metal. Gold prices have dropped 13.8 per cent from a nominal record high of $1,920 a troy ounce reached in September, and on Friday were trading at $1,655.60." Well, as we said a few days ago, "In conclusion we wish to say - thank you Chairman for the firesale in physical precious metals. We, and certainly China, thank you from the bottom of our hearts." Once again, we were more or less correct. And since past is prologue, we now expect any day to see a headline from the PBOC informing the world that the bank has quietly added a few hundred tons of the yellow metal since the last such public announcement in 2009: a catalyst which will quickly send it over recent record highs. More on what was perfectly obvious to most except the propaganda pushers:

Of course, central banks are well aware what they are doing. In fact, they have been buying up gold pretty much non-stop in the past few years.

The irony is that as has been pointed out repeatedly, gold will ultimately do well both in extreme deflation and inflation cases. And anyone who believes the Fed has the situation balanced properly, even as the global liquidity providing machine swings to ever greater exponential extremes, well, they likely also believed Bernanke when he told Maria Bartiromo that a home price decline is a "pretty unlikely possibility... we have never had a decline of house prices on a nationwide basis." And if it wasn't for Bernanke's endless bailouts, they would all be broke now. |

| Ugly = Beautiful; Beautiful = Ugly: Ray Dalio On Deleveraging Posted: 17 Mar 2012 07:35 AM PDT This article originally appeared on The Daily Capitalist. I've been working on an article about the state of economic recovery and have been studying deleveraging, debt levels, bank balance sheets, foreclosures, and the like. So I was very pleased to find a long research piece put out by Bridgewater's Ray Dalio on that topic. As readers may know, I am a fan of Dalio and I appreciate his often unique and out-of-the-box view of the markets and the economy. Bridgewater also agrees with my belief that the economy is heading for stagnation and decline this year.

Dalio's article, "An In-Depth Look at Deleveragings" is apparently authored by him. It concludes that the best way to "deleverage" is a "proper" combination of debt reduction (defaults and restructurings) and debt monetization (monetary inflation). This is what he considers to be a "beautiful" deleveraging whereas deleveraging by debt reduction and austerity are "ugly." The ugly ones cause recessions/depressions and deflation which is bad. Beautiful deleveragings minimize debt reduction and revive economies with monetary stimulation. Unfortunately this is a very conventional view and it is wrong. I'm not going to get into the entire 31 page article, but he examines six historical events that supposedly exemplify "beautiful" and "ugly" deleveragings. They are the U.S. Great Depression (1930-1932), Japan (1990 to present), Spain (9/2008 to present), UK (1947-1969), and U.S. 9/2008 to 2/2009 (pre-QE). At the end he tackles an analysis of the Weimar hyperinflation. I'm not as familiar with the UK and Spain, but I am familiar with both U.S. events and the Weimar hyperinflation. Dalio unfortunately accepts the conventional wisdom of contemporary neo/Keynesian-Classical-Monetarist econometric analysis of these events and fails to understand most of the real causes underlying these crises. To save you the suspense, he believes that the current boom-bust cycle is an example of a "beautiful" deleveraging. Dalio defines a beautiful deleveraging as one "in which enough 'printing' occurred to balance the deflationary forces of debt reduction and austeri9ty in a manner in which there is positive growth, a falling debt/income ratio and nominal GDP growth above nominal interest rates." He says,

What he is saying is that the Fed's policy of ZIRP, debt guarantees, and QE avoided a disaster, prevented a collapse of the credit markets, and has allowed deleveraging to occur on a more or less orderly basis, and has promoted growth. He notes that the credit markets are "largely healed" and that "private section credit growth is improving." This is the Conventional View of the Crisis and he, like most people holding this view, are engaging in a wishful thinking analysis of how things occurred. One could believe that a chariot pulled the sun across the heavens every day, and because the sun came up every day, this analysis is correct. We understand that there are other forces at work. But he is not alone in his conclusions. He uses a monetarist view which says that tinkering with money supply can prevent the worst from happening. He sees the problem as one in which there was a shortage of money which caused the bust, rather than it being the result of "money printing". If the Fed could have prevented the worst from happening by printing money, then all of our problems would be solved. Unfortunately for the monetarists at the Fed, including Mr. Bernanke, they have yet to achieve their goal. Dalio also takes a classical view of the economy as one big aggregate machine which can be properly measured by GDP. His main measure of the problem is the amount of debt to GDP, a measure which really doesn't tell us much. All GDP can tell us is how much money was spent at any given time. At best it is a rough measure; at worst it is a misleading measure because the data is not revealing of what really happened in an economy where millions of individual decisions are made every day. The amount of debt versus GDP tells us nothing about the role of debt, the value of underlying assets, the ability of pay debt, whether the debt was built on monetary steroids or real economic activity, or really anything. "Economies" don't incur debt, people do. Further he measures everything in nominal terms which makes any conclusion misleading without at least trying to apply a deflator to the measure. Then one has to choose the right deflator to determine if the measured activity was really positive or negative. It is many Austrians' belief that price inflation is actually much higher than officially stated and that there are a number of ways to game the data to make it look better. I have written many times about this and my conclusion is that what we are seeing as "growth" is actually a data fiction because it fails to properly measure the impact of price inflation. In fact what we are seeing as "growth" now is really a further destruction of capital by investors and businesses. He then uses a neo-Keynesian econometric methodology to interpret and analyze the results. That is, tinkering with the big machine called "the economy" can more or less solve our problems if it is done just right. And we all know that the tinkerers have done a great job of "running" the economy. In fact the current policies proposed and implemented by mainstream economists have been failures and have resulted in an increasingly unstable and fragile economy. Thus faith in all that tinkering, especially by the Fed, caused the boom-bust credit cycle, and further tinkering with QE and ZIRP, plus the Fed's and the federal government's role in preventing a liquidation of malinvestment has only caused the economic pain to be stretched out much longer than it otherwise would have had the government had not interfered. Further, these policies have only served to create further future instability and economic risk. Other than that his analysis is fine. What he calls "ugly", an austerity and debt reduction, is actually "beautiful". While it is painful, it is painful for a much shorter period of time and enables the "economy", i.e., people, to go bankrupt, repair their finances, start saving again, create new capital, and then create new economic growth and jobs. By preventing or delaying this process the policy makers only doom us to economic stagnation, inflation, and permanent high unemployment. And I fear that is exactly where we are headed. |

| “We Are This Far From A Turnkey Totalitarian State" - Big Brother Goes Live September 2013 Posted: 17 Mar 2012 06:56 AM PDT George Orwell was right. He was just 30 years early. In its April cover story, Wired has an exclusive report on the NSA's Utah Data Center, which is a must read for anyone who believes any privacy is still a possibility in the United States: "A project of immense secrecy, it is the final piece in a complex puzzle assembled over the past decade. Its purpose: to intercept, decipher, analyze, and store vast swaths of the world's communications as they zap down from satellites and zip through the underground and undersea cables of international, foreign, and domestic networks.... Flowing through its servers and routers and stored in near-bottomless databases will be all forms of communication, including the complete contents of private emails, cell phone calls, and Google searches, as well as all sorts of personal data trails—parking receipts, travel itineraries, bookstore purchases, and other digital "pocket litter."... The heavily fortified $2 billion center should be up and running in September 2013." In other words, in just over 1 year, virtually anything one communicates through any traceable medium, or any record of one's existence in the electronic medium, which these days is everything, will unofficially be property of the US government to deal with as it sees fit. The codename of the project: Stellar Wind. As Wired says, "there is no doubt that it has transformed itself into the largest, most covert, and potentially most intrusive intelligence agency ever created." And as former NSA operative William Binney who was a senior NSA crypto-mathematician, and is the basis for the Wired article (which we guess makes him merely the latest whistleblower to step up: is America suddenly experiencing an ethical revulsion?), and quit his job only after he realized that the NSA is now openly trampling the constitution, says as he holds his thumb and forefinger close together. "We are, like, that far from a turnkey totalitarian state." There was a time when Americans still cared about matters such as personal privacy. Luckily, they now have iGadgets to keep them distracted as they hand over their last pieces of individuality to the Tzar of conformity. And there are those who wonder just what the purpose of the NDAA is. In the meantime please continue to pretend that America is democracy... Here are some of the highlights from the Wired article: The Utah Data Center in a nutshell, and the summary of the current status of the NSA's eavesdropping on US citizens.

...Shrouded in secrecy:

Presenting the Yottabyte, aka 500 quintillion (500,000,000,000,000,000,000) pages of text:

Summarizing the NSA's entire spy network:

Luckily, we now know, courtesy of yet another whistleblower, who has exposed the NSA's mindblowing efforts at pervasive Big Brotherness:

In other words, the NSA has absolutely everyone covered. We now know all of this, courtesy of yet another person finally stepping up and exposing the truth:

Everyone is a target.

Can you hear me now? The NSA sure can:

In fact, as you talk now, the NSA's computers are listening, recording it all, and looking for keywords.

There is a simple matter of encryption... Which won't be an issue for the NSA shortly, once the High Productivity Computing Systems project goes online.

So kiss PGP goodbye. In fact kiss every aspect of your privacy goodbye.

As for the Constitution... What Constitution?

In conclusion, the NSA's own whistleblower summarizes it best.

|

| Should Investors Sweat Gold’s Losing Streak? Posted: 17 Mar 2012 04:58 AM PDT |

| Ted Butler: How the Silver Manipulation Scheme Works Posted: 17 Mar 2012 04:43 AM PDT Ted Butler responds to CFTC Commissioner Bart Chilton from FinancialSense.com:

Click Here to Listen to the Interview This posting includes an audio/video/photo media file: Download Now |

| Eric Sprott and David Morgan Respond to CFTC Commissioner Bart Chilton on Silver Manipulation Posted: 17 Mar 2012 04:34 AM PDT Silver industry experts Eric Sprott and David Morgan take on the silver manipulation controversy from FinancialSense.com:

Click Here to Listen to the Interview This posting includes an audio/video/photo media file: Download Now |

| Spring 2012: Escalation of the Precious Metal Wars Posted: 17 Mar 2012 04:28 AM PDT from MilesFranklin.com:

In that report, I listed my credentials in Precious Metals and the financial markets — as well as some personal information — to give you an idea how I got here and why I am qualified to guide you down the treacherous path of the global monetary system. If that information wasn't enough, I publish FREE missives five days a week about the markets and the world in general, called "Rants," accessible at blog.milesfranklin.com. At Miles Franklin's Blog site you can sign up to receive my daily newsletters via email, as well as the Daily Gold & Silver Summary from Miles Franklin's founder, David Schectman. |

| Posted: 17 Mar 2012 04:25 AM PDT |

| Canada Sees Gold Mining Resurgence Posted: 17 Mar 2012 04:24 AM PDT Amid the bustle of the 80th Prospectors and Developers Association of Canada (PDAC) convention in Toronto, The Gold Report sat down with PDAC President Scott Jobin-Bevans for his take on the challenges the mining industry faces. In this exclusive interview, he covers a wide range of topics, from skilled labor shortages to the trials of mining in remote northern Canada. The Gold Report: What are the key challenges the mining industry faces in 2012–2013? |

| Financial Sense Newshour interviews Ted Butler on silver market rigging Posted: 17 Mar 2012 04:08 AM PDT 12:10p ET Saturday, March 17, 2012 Dear Friend of GATA and Gold (and Silver): Silver market analyst Ted Butler, discoverer of the long-term rigging of the silver market via the concentrated short position in the futures market, is interviewed about the market rigging today by Jim Puplava on the Financial Sense Newshour. You can listen to it here: http://www.financialsense.com/financial-sense-newshour/big-picture/2012/... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT A Rare Opportunity with Collectible Gold Coins Sovereign debt problems in the United States as well as Europe will worsen this year. The mainstream financial media may never report about the likely inflationary consequences of bailouts and "quantitative easing," nor are they likely ever to recommend tangible assets for financial protection. But at Swiss America Trading Corp. we believe that it is no longer a luxury to own gold and silver coins but rather a necessity. At the moment the public is showing little interest in Double Eagle U.S. $20 gold coins, so the price premiums above the intrinsic melt values (.9675 ounce of gold in each coin) are historically low. The ratio of price to bullion content for these coins has been 2:1 but today it is only about 1.25:1. This is a real opportunity. So give us a call or e-mail and we will be glad to discuss the potential of these coins and how to use a ratio strategy to increase your gold ounces without money out of pocket. In the January edition of his Early Warning Report, Richard Maybury writes: "As they are inherently in very limited supply, I believe that high-quality numismatics will become tulips, eventually rising a thousand percent or more in real terms, when money velocity goes into mid-second stage. In late stage, who knows -- 2,000 percent? 3,000?" All inquiries will receive without charge (while supplies last) our latest book, "The Inflation Deception," as well as our newsletter "Real Money Perspectives." -- Tim Murphy, trmurphy@swissamerica.com -- Fred Goldstein, figoldstein@swissamerica.com Telephone: 1-800-289-2646 Swiss America Trading Corp., 15018 North Tatum Blvd., Phoenix, AZ 85032 Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Free Month Subscription to Market Force Analysis for GATA Supporters Market Force Analysis is a unique, patent-pending approach to commodity market analysis. An algorithm has been developed to extract supply and demand weightings from futures market data. The difference between supply and demand is the market imbalance that is called "market force," so named because it is what drives price. It brings clarity to past market action and predicts market trends. Because it is derived from accurate futures market data it is not subject to the errors inherent in macro-level estimates of supply and demand. Learn more here: https://marketforceanalysis.com/About_MFA.html Market Force Analysis focuses on short-term (15 days) and medium-term price predictions to help both short-term traders and long-term investors understand market moves and benefit from the generated prediction of prices. To read subscriber comments that show how much the service is appreciated, visit: https://marketforceanalysis.com/Testimonials.html The MFA service has been pioneered by market analyst and Gold Anti-Trust Action board member and researcher Adrian Douglas. The Market Force Analysis premium service provides: -- A bi-weekly report. -- Access to the MFA hot list of junior mining stocks derived from analysis of more than 800 mining stocks. The MFA hot list consistently outperforms well-known mining share indices like the HUI, GDX, and GDXJ. -- E-mail alerts about actionable trades. -- E-mail updates with important information. To obtain your 1-month free trial subscription to the Market Force Analysis letter, e-mail info@marketforceanalysis.com and put "MFA Free Trial" in the subject field. |

| What the End Result of the Fed’s Cancerous Policies Will Be and When It Will Hit Posted: 17 Mar 2012 04:04 AM PDT Yesterday I noted that the “addict/ dealer” metaphor for the Fed’s intervention in the markets was in fact not accurate and that the Fed’s actions would be more appropriately described as permitted cancerous beliefs to spread throughout the financial system, thereby killing Democratic Capitalism which is the basis of the capital markets.

Today I’m going to explain what the “final outcome” for this process will be. The short version is what happens to a cancer patient who allows the disease to spread unchecked (death).

In the case of the Fed’s actions we will see a similar “death” of Democratic Capitalism and the subsequent death of the capital markets. I am, of course, talking in metaphors here: the world will not end, and commerce and business will continue, but the form of capital markets and Capitalism we are experiencing today will cease to exist as the Fed’s policies result in the market and economy eventually collapsing in such a fashion that what follows will bear little resemblance to that which we are experiencing now.

The focus of this “death” will not be stocks, but bonds, particularly sovereign bonds: the asset class against which all monetary policy and investment theory has been based for the last 80+ years.

Indeed, basic financial theory has proposed that sovereign bonds are essentially the only true “risk-free” investment in the world. While history shows this theory to be false (sovereign defaults have occurred throughout the 20th century) this has been the basic tenant for all investment models and indeed the financial system at large going back for 80 some odd years.

The reason for this is that the Treasury (US sovereign bond) market is the basis of the entire monetary system in the US and the Global financial system in general. Indeed, US Treasuries are the senior most assets on the Primary Dealers’ (world’s largest banks) balance sheets. To understand why this is as well as why the Fed’s policies will ultimately destroy this system, you first need to understand the Primary Dealer system that is the basis for the US banking system at large.

If you’re unfamiliar with the Primary Dealers, these are the 18 banks at the top of the US private banking system. They’re in charge of handling US Treasury Debt auctions and as such they have unprecedented access to US debt both in terms of pricing and monetary control.

The Primary Dealers are:

I’m you’ll sure you’ll recognize these names by the mere fact that they are the exact banks that the Fed focused on “saving” thereby removing their “risk of failure” during the Financial Crisis.

These banks are also the largest beneficiaries of the Fed’s largest monetary policies: QE 1, QE lite, QE 2, etc. Indeed, we now know that QE 2 was in fact was meant to benefit those Primary Dealers in Europe, not the US housing market.

The Primary Dealers are the firms that buy US Treasuries during debt auctions. Once the Treasury debt is acquired by the Primary Dealer, it’s parked on their balance sheet as an asset. The Primary Dealer can then leverage up that asset and also fractionally lend on it, i.e. create more debt and issue more loans, mortgages, corporate bonds, or what have you.

Put another way, Treasuries are not only the primary asset on the large banks’ balance sheets, they are in fact the asset against which these banks lend/ extend additional debt into the monetary system, thereby controlling the amount of money in circulation in the economy.

When the Financial Crisis hit in 2007-2008, the Fed responded in several ways, but the most important for the point of today’s discussion is the Fed removing the “risk of failure” for the Primary Dealers by spreading these firms’ toxic debts onto the public’s balance sheet and funneling trillions of dollars into them via various lending windows.

In simple terms, the Fed took what was killing the Primary Dealers (toxic debts) and then spread it onto the US’s balance sheet (which was already sickly due to our excessive debt levels). This again ties in with my “cancer” metaphor, much as cancer spreads by infecting healthy cells.

When the Fed did this it did not save capitalism or the Capital Markets. What it did was allow the “cancer” of excessive leverage, toxic debts, and moral hazard to spread to the very basis of the US, indeed the entire world’s, financial system: the US balance sheet/ Sovereign Bond market.

These actions have already resulted in the US losing its AAA credit rating. But that is just the beginning. Indeed, few if any understand the real risk of what the Fed has done.

The reality is that the Fed has done the following:

The Financial System requires trust to operate. Having changed the risk profile of US sovereign debt, the Fed has undermined the very basis of the US banking system (remember Treasuries are the senior most asset against which all banks lend).

Moreover, the Fed has undermined investor confidence in the capital markets as most now perceive the markets to be a “rigged game” in which certain participants, namely the large banks, are favored, while the rest of us (including even smaller banks) are still subject to the basic tenants of Democratic Capitalism: risk of failure.

This has resulted in retail investors fleeing the markets while institutional investors and those forced to participate in the markets for professional reasons now invest based on either the hope of more intervention from the Fed or simply front-running those Fed policies that have already been announced.

Put another way, the financial system and capital markets are no longer a healthy, thriving system of Democratic Capitalism in which a multitude of participants pursue different strategies. Instead they are an environment fraught with risk in which there is essentially “one trade,” and that trade is based on cancerous policies and beliefs that undermine the very basis of Democratic Capitalism, which in the end, is the foundation of the capital markets.

In simple terms, by damaging trust and permitting Wall Street to dump its toxic debts on the public’s balance sheet, the Fed has taken the Financial System from a status of extremely unhealthy to terminal.

The end result will be a Crisis that makes 2008 look like a joke. It will be a Crisis in which the US Treasury market implodes, taking down much of the US banking system with it (remember, Treasuries are the senior most assets on US bank balance sheets).

I cannot say when this will happen. But it will happen. It might be next week, next month, or several years from now. But we’ve crossed the point of no return. The Treasury market is almost entirely dependent on the Fed to continue to function. That alone should make it clear that we are heading for a period of systemic risk that is far greater than anything we’ve seen in 80+ years (including 2008).

The Fed is not a “dealer” giving “hits” of monetary morphine to an “addict”… the Fed has permitted cancerous beliefs to spread throughout the financial system. And the end result is going to be the same as that of a patient who ignores cancer and simply acts as though everything is fine.

That patient is now past the point of no return. There can be no return to health. Instead the system will eventually collapse and then be replaced by a new one.

For more market insights and economic commentary, swing by www.gainspainscapital.com. We offer a number of FREE Special Reports designed to help investors prepare for the inevitable collapse I’ve described above.

Graham Summers Chief Market Strategist Phoenix Capital Research |

| Another Healthy Correction for Gold and Silver Price Posted: 17 Mar 2012 03:53 AM PDT I have received several emails this week asking my thoughts on the current price action in precious metals. Some subscribers are asking how low gold and silver might go in the short term and my honest response is “I have no idea.” Anyone that claims they can predict the short-term price movements in a market as manipulated as this one is blowing hot air. The banks can utilize leveraged paper contracts to take gold down to $1,200 and silver to $20 if they want to, in the short term. |

| Counterintuitive takedowns in gold drawing notice, Norini tells King World News Posted: 17 Mar 2012 03:50 AM PDT 11:49a ET Saturday, March 17, 2012 Dear Friend of GATA and Gold (and Silver): Futures market analyst Dan Norcini tells the weekly precious metals review at King World News that more traders are getting suspicious of the counterintuitive takedowns in gold even as inflation keeps showing up in other markets. Central banks, Norcini says, want their money creation flowing into stock markets but not into commodities. Gold mining shares, Norcini says, are now extremely undervalued. Meanwhile CMI Gold and Silver's Bill Haynes tells the review that while larger purchasers have been buying the dip in gold, there isn't any heavy retail buying. Haynes figures that this shows there is still no gold mania. Full audio of the review is posted at King World News here: http://kingworldnews.com/kingworldnews/Broadcast/Entries/2012/3/17_KWN_W... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Prophecy Platinum (TSXV: NKL) and Ursa Major Minerals Company Press Release VANCOUVER, British Columbia, Canada -- Prophecy Platinum Corp. (TSX-V: NKL, OTC-QX: PNIKF, Frankfurt: P94P) and Ursa Major Minerals Inc. have signed a binding letter of agreement for a business combination through a proposed all-share transaction. In doing so Prophecy and Ursa have acted at arm's length and the transaction has been negotiated at arm's length. Prophecy will issue one common share in exchange for every 25 outstanding common shares of Ursa. Ursa options and warrants will be exchanged for options and warrants of Prophecy on an agreed schedule. Prophecy's offer represents a value of about $0.15 per each common share of Ursa based on Prophecy's share price of $3.70 as at March 1, representing a premium of 130 percent to Ursa's March 1 closing price of $0.065. Prophecy is to subscribe for $1 million common shares of Ursa by way of private placement financing at $0.06 per share, subject to regulatory approval. Upon placement completion, John Lee and Greg Hall, current Prophecy directors, will be appointed to Ursa's board. Prophecy thus will become a mid-tier resource company with a robust and -- The fully permitted open-pit Shakespeare PGM-Ni-Cu mine close to Sudbury, Ontario, infrastructure with near-term production capabilities. -- The flagship Wellgreen (Yukon) PGM-Ni-Cu project with more than 10 million ounces of Pt-Pd-Au inferred resource. Drilling is under way and a preliminary economic assessment study is pending. -- Manitoba's Lynn Lake Ni-Cu project with more than 262 million pounds Ni and 138 million pounds Cu measured and indicated. For the complete announcement, please visit Prophecy Platinum's Internet site here: http://www.prophecyplat.com/news_2012_mar02_prophecy_platinum_ursa_major... Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Sona Discovers Potential High-Grade Gold Mineralization From a Company Press Release VANCOUVER, British Columbia -- With its latest surface diamond drilling program at its 100-percent-owned, formerly producing Blackdome gold mine in southern British Columbia, Sona Resources Corp. has discovered a potentially high-grade gold-mineralized area, with one hole intersecting 13.6 grams of gold in 1.5 meters of core drilling. "We intersected a promising new mineralized zone, and we feel optimistic about the assay results," says Sona's president and CEO, John P. Thompson. "We have undertaken an aggressive exploration program that has tested a number of target zones. Our discovery of this new gold-bearing structure is significant, and it represents a positive development for the company." Sona aims to bring its permitted Blackdome mill back into production over the next year and a half, at a rate of 200 tonnes per day, with feed from the formerly producing Blackdome mine and the nearby Elizabeth gold deposit property. A positive preliminary economic assessment by Micon International Ltd., based on a gold price of $950 per ounce over eight years, has estimated a cash cost of $208 per tonne milled, or $686 per gold ounce recovered. For the company's complete press release, please visit: http://www.sonaresources.com/_resources/news/SONA_NR18_2011-opt.pdf |

| Central banks pounce on falling gold, buying it through BIS Posted: 17 Mar 2012 03:17 AM PDT By Jack Farchy http://www.ft.com/intl/cms/s/0/4f9a6076-6f92-11e1-b3f9-00144feab49a.html A sharp fall in gold prices has triggered large purchases of bullion by central banks in recent weeks, according to several traders with knowledge of the transactions. The buying activity highlights the trend among central banks in emerging economies to buy gold, even as some Western investors are losing patience with the metal. Gold prices have dropped 13.8 per cent from a nominal record high of $1,920 a troy ounce reached in September, and on Friday were trading at $1,655.60. The Bank for International Settlements, which acts on behalf of central banks, has been buying significant quantities of gold on the international market amid falling prices, traders said. According to several estimates, the BIS bought 4 to 6 tonnes of gold, worth roughly $250 million to $300 million at current prices, in the over-the-counter physical market last week, with purchases particularly strong at the end of the week. The total purchases over the past three or four weeks was likely to be as much as double that, the traders added. ... Dispatch continues below ... ADVERTISEMENT Sona Discovers Potential High-Grade Gold Mineralization From a Company Press Release VANCOUVER, British Columbia -- With its latest surface diamond drilling program at its 100-percent-owned, formerly producing Blackdome gold mine in southern British Columbia, Sona Resources Corp. has discovered a potentially high-grade gold-mineralized area, with one hole intersecting 13.6 grams of gold in 1.5 meters of core drilling. "We intersected a promising new mineralized zone, and we feel optimistic about the assay results," says Sona's president and CEO, John P. Thompson. "We have undertaken an aggressive exploration program that has tested a number of target zones. Our discovery of this new gold-bearing structure is significant, and it represents a positive development for the company." Sona aims to bring its permitted Blackdome mill back into production over the next year and a half, at a rate of 200 tonnes per day, with feed from the formerly producing Blackdome mine and the nearby Elizabeth gold deposit property. A positive preliminary economic assessment by Micon International Ltd., based on a gold price of $950 per ounce over eight years, has estimated a cash cost of $208 per tonne milled, or $686 per gold ounce recovered. For the company's complete press release, please visit: http://www.sonaresources.com/_resources/news/SONA_NR18_2011-opt.pdf In a note to clients this week, Credit Suisse referred to "aggressive central bank buying seen last Friday." The BIS declined to comment. Central banks are one of the most important drivers of the gold market, holding one-sixth of all the gold ever mined in their reserves, but they disclose few details about their activities. As a group, they made their largest purchases of gold in more than four decades last year, led by emerging economies such as Mexico, Russia, and South Korea intent on diversifying their dollar-heavy foreign exchange reserves. The World Gold Council has also pointed to the possibility of significant unreported purchases by China at the end of last year. At the same time, European central banks have all but halted a run of large sales. "Central banks have definitely been looking at gold as an asset class much more closely ever since European central banks stopped selling," a senior gold banker said. "There has been a huge interest." While some countries, such as Russia, China, or the Philippines, have traditionally accumulated gold produced by their domestic mining industry, others use the BIS as an agent to carry out purchases and sales on their behalf, preserving anonymity. The central bank buying comes as gold prices have slid in the past three weeks as strong economic data from the US has lowered investors' expectations of quantitative easing by the Federal Reserve and made other investments, such as equities, appear more attractive. Gold prices this week fell to their lowest since mid-January after the Fed struck an optimistic tone on the US economic recovery. "It's clear that the market trend right now is an unwinding of safe-haven exposures, like gold, and a preference for growth assets," said Edel Tully, precious metals strategist at UBS. Buying from large physical consumers of gold such as China and India remains sparse, despite the fall in prices. India on Friday announced it would double import tariffs for gold, a move analysts said could damp demand. "Asian physical demand remains lacklustre," Credit Suisse said, arguing that gold prices could fall below $1,600. "Gold has now slipped back toward the middle of its long-term trend and has room to drop further." Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Prophecy Platinum (TSXV: NKL) and Ursa Major Minerals Company Press Release VANCOUVER, British Columbia, Canada -- Prophecy Platinum Corp. (TSX-V: NKL, OTC-QX: PNIKF, Frankfurt: P94P) and Ursa Major Minerals Inc. have signed a binding letter of agreement for a business combination through a proposed all-share transaction. In doing so Prophecy and Ursa have acted at arm's length and the transaction has been negotiated at arm's length. Prophecy will issue one common share in exchange for every 25 outstanding common shares of Ursa. Ursa options and warrants will be exchanged for options and warrants of Prophecy on an agreed schedule. Prophecy's offer represents a value of about $0.15 per each common share of Ursa based on Prophecy's share price of $3.70 as at March 1, representing a premium of 130 percent to Ursa's March 1 closing price of $0.065. Prophecy is to subscribe for $1 million common shares of Ursa by way of private placement financing at $0.06 per share, subject to regulatory approval. Upon placement completion, John Lee and Greg Hall, current Prophecy directors, will be appointed to Ursa's board. Prophecy thus will become a mid-tier resource company with a robust and -- The fully permitted open-pit Shakespeare PGM-Ni-Cu mine close to Sudbury, Ontario, infrastructure with near-term production capabilities. -- The flagship Wellgreen (Yukon) PGM-Ni-Cu project with more than 10 million ounces of Pt-Pd-Au inferred resource. Drilling is under way and a preliminary economic assessment study is pending. -- Manitoba's Lynn Lake Ni-Cu project with more than 262 million pounds Ni and 138 million pounds Cu measured and indicated. For the complete announcement, please visit Prophecy Platinum's Internet site here: http://www.prophecyplat.com/news_2012_mar02_prophecy_platinum_ursa_major... |

| Court overturns order to slash Dutch pension fund's gold allocation Posted: 17 Mar 2012 03:04 AM PDT By Leen Preesman http://www.ipe.com/news/court-overturns-dutch-regulators-order-to-slash-... A Rotterdam, Netherlands, court has overturned the Dutch pensions regulator's recent demand that SPVG, the pension fund for glass manufacturers, divest more than three-quarters of its 13% gold allocation. The regulator is now facing a claim for damages, estimated at E10 million to E11 milion, the difference between the current gold price and the price when the gold was sold a year ago, according to Rob Daamen, the scheme's deputy secretary. The court said it was not convinced the regulator had fully taken into account the scheme's specific conditions or the entirety of its investment portfolio. It also concluded that interpretation of the so-called "prudent person" rule should be the sole prerogative of the pension fund, and that the regulator's task was simply to ascertain whether this standard had been applied correctly. ... Dispatch continues below ... ADVERTISEMENT Golden Phoenix Discusses Royalty Mining Growth Strategy Golden Phoenix Minerals Inc. has discussed its royalty mining growth strategy on the Fox Business Network program "21st Century Business" with host Jackie Bales. Golden Phoenix's director of corporate communications, Robert Ian, told how the company narrows its focus to project generation and future royalty streams. He explained why Golden Phoenix believes it's better to own joint-venture interests in several producing mines instead of full exposure to just one project. "21st Century Business" has been airing for 15 years. Previous hosts have included Gen. Alexander Haig, Gen.l Norman Schwarzkopf, and Secretary of Defense Caspar Weinberger. Golden Phoenix appeared as paid programming on this broadcast. To view the program with Golden Phoenix, please visit Golden Phoenix's Internet site here: http://goldenphoenix.us/fox-business-network/ The regulator "has not made clear in any way why a gold allocation of 13% is not in conformity with the prudent person rule, and that an allocation of 3% is," the court said. It also dismissed the watchdog's reference to the drop in the gold price in 1980, or its standard deviation estimate of 33.7%. Instead, it pointed to the scheme's statement that the gold price had increased steadily over the last 10 years and that the standard deviation between 2000 and 2010 had been no more than 13.1%. In its verdict, the court said it would re-open the investigation before it delivered a verdict on the damages. Spokesman Cees Verhagen said the regulator would look over the verdict closely before deciding whether to appeal the ruling. Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Be Part of a Chance to Discover Northaven Resources Corp. (TSX-V:NTV) is advancing five gold and silver projects in highly prospective and politically stable British Columbia, Canada. Check out the exploration program on our Allco gold/silver project : -- A large (13,000 hectare) property, covering more than 15 square kilometers of a regional mineralized trend just 3km from a recently announced 1.2-million-ounce gold and 15-million-ounce silver deposit. -- The property hosts historic high-grade silver workings and many mineral showings as well as former mines at the property's northern and southern boundaries. -- A deep-penetrating airborne geophysics survey has just been completed on the entire property and neighboring deposits and its results are eagerly awaited. To learn more about the Allco property or Northaven's other gold and silver projects, please visit: http://www.northavenresources.com Or call Northaven CEO Allen Leschert at 604-696-3600. |

| Chris Martenson And Marc Faber: The Perils of Money Printing's Unintended Consequences Posted: 17 Mar 2012 02:59 AM PDT Submitted by Chris Martenson Marc Faber: The Perils of Money Printing's Unintended Consequences

The dangers of money printing are many in his eyes. But in particular, he worries about the unintended consequences it subjects the populace to. Beyond currency devaluation, it creates malinvestment that leads to asset bubbles that wreak havoc when they burst. And even more nefarious, money printing disproportionately punishes the lower classes, resulting in volatile social and political tensions. It's no surprise then that he's feeling particularly defensive these days. While he generally advises those looking to protect their purchasing power to invest capital in precious metals and the equity markets (the rationale being inflation should hurt equity prices less than bond prices), he warns that equities appear overbought at this time. On Inflation

On His Love for Central Bankers

On The Unintended Consequences of Money Printing

Click the play button below to listen to Chris' interview with Marc Faber (runtime 40m:45s):

Download/Play the Podcast (mp3) |

| Jacques – Understanding China Video Posted: 17 Mar 2012 02:31 AM PDT We found the video below thought provoking and worthy of sharing. The introduction, courtesy of TED.com reads: "Speaking at a TED Salon in London, economist Martin Jacques asks: How do we in the West make sense of China and its phenomenal rise? The author of "When China Rules the World," he examines why the West often puzzles over the growing power of the Chinese economy, and offers three building blocks for understanding what China is and will become."

"Martin Jacques is the author of "When China Rules the World," and a columnist for the Guardian and New Statesman. He was a co-founder of the think tank Demos." Source: TED.com http://www.ted.com/talks/martin_jacques_understanding_the_rise_of_china.html

|

| Weekly article posted at GoldMoney Posted: 16 Mar 2012 11:39 PM PDT The following article has been posted at GoldMoney, here. Eurozone banks and contagion risk2012-MAR-17Greece has now defaulted, and other eurozone governments as well as agencies such as the International Monetary Fund, European Central Bank and European Investment Bank have retrospectively inserted themselves as senior creditors, a precedent that should be of great concern and which has profound implications for private sector banks. Furthermore, when a state defaults it is only a small part of the whole story, because governments today are major participants in their economies. The consequences of a central government default extend to state guarantees for other entities and related businesses: in the case of Greece its default has altered the assumptions behind all non-central government public-sector loans, such as railway bonds. And the private sector not directly dependent on government subsidies or contracts is also affected by the prospect of excessive taxes. For this reason, the consequence of Greece’s default goes considerably beyond the loans directly involved, and all other eurozone nations are in a similar position. The headline numbers are a fraction of the total involved. This brings us to a fundamental truth. Government debt is the basis for fiat money systems. This basis is now being questioned. It is the key component of the capital held by banks, as well as cash and deposits at central banks – both of which are also government creations ultimately backed by government debt. Ever since gold was legislated out of the monetary system, confidence has become totally dependent on the validity of government debt. The insolvent position of a number of eurozone nations invalidates the general assumption that government paper provides a solid foundation for eurozone banks. That the stronger euro-countries can underwrite the weak is now also doubtful. The precedent that has been set by the retrospective interposition by governments and their agencies as senior creditors undermines the value of government debt even further for private-sector banks, who become junior creditors. It is not surprising that they have re-deposited the bulk of the money lent to them by the ECB with the ECB itself. Euros held at the ECB only give refuge from exposure to specific government paper and is the best of a bad choice. Banks outside the region are exercising the option of opting out altogether. It may seem unnecessary to question the very basis of the European financial system in this way. But this is bound to be debated in boardrooms across the entire banking network, inside and outside the euro area, and banks will react. It is also the underlying reason why the situation remains so precarious regarding Europe’s debt crisis. The way Greece’s default has been handled brings an increased risk of capital flight from the region at the worst possible time. Funding for all eurozone nations has become a lot more difficult. The ECB will come under growing pressure to not only rescue banks, whose balance sheets are imploding, but also to directly bailout governments as well. Because of the systemic role of government debt, the crisis can be expected to spread rapidly from the insolvent weaker euro-nations to all the others. In short, the mishandling of Greece’s debt problems has made things worse. Tags: debt crisis, ECB, euro crisis, Europe, government bonds Alasdair Macleod |

| Churches Foreclosed - Gold & Silver Weekly News with Christian Garcia March 16 Posted: 16 Mar 2012 10:03 PM PDT |

| You are subscribed to email updates from Save Your ASSets First To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

Jim is pleased to welcome silver analyst Ted Butler of Butler Research LLC. Ted is noted for his comprehensive analysis on silver price manipulation and has been publishing unique precious metals commentaries on the internet since 1996.

Jim is pleased to welcome silver analyst Ted Butler of Butler Research LLC. Ted is noted for his comprehensive analysis on silver price manipulation and has been publishing unique precious metals commentaries on the internet since 1996. It's late March, and I can hardly believe three months have passed since the last Miles Franklin Report — much less the nearly five months since I joined as Marketing Director.

It's late March, and I can hardly believe three months have passed since the last Miles Franklin Report — much less the nearly five months since I joined as Marketing Director. Marc Faber does not mince words. He believes the money printing policies of the Federal Reserve and its sister central banks around the globe have put the world's currencies on an inexorable, accelerating inflationary down slope.

Marc Faber does not mince words. He believes the money printing policies of the Federal Reserve and its sister central banks around the globe have put the world's currencies on an inexorable, accelerating inflationary down slope.

No comments:

Post a Comment