saveyourassetsfirst3 |

- Yet Another Make-Or-Break Week For Europe

- DANGEROUS TIMES AHEAD

- Did The Liquidity Trap Cause The Hike In Gold?

- Which Way Now For Precious Metals?

- Canadian Housing Market Collapse: Part II

- Canadian Housing Market Collapse: Part I

- James Turk on “This Week in Money”

- Schneiderman MERS Suit and HUD’s Donovan Remarks Confirm That Mortgage “Settlement” is a Stealth Bank Bailout

- Junior Gold Producers 2

- Feb 4, 1965 De Gaulles threat to accept gold as payment for his dollar surpluses

- Is gold in a bubble?

- By the Numbers for the Week Ending February 3

| Yet Another Make-Or-Break Week For Europe Posted: 05 Feb 2012 04:05 AM PST Nobody expects Greece to default on its debt and leave the eurozone. But Greek leaders do seem to be squeezing as much drama as possible from the bailout process:

Recordings of these conference calls would be instant YouTube hits. And with all the threats flying around you'd think that Greece would have long since been cowed into submission and forced to accept German control over its budget in return for credit it needs to cover its short-term debts. That they're holding out implies that they're really not that worried and believe they can get better terms, which in this case means smaller cuts in domestic spending, less of a decline in local wages, and more cash from the ECB. They're probably right. Over the past few months major brokerage houses have been churning out reports on what would happen if Greece or another eurozone country leaves the currency union and reverts to its old money. And without exception the predictions are apocalyptic. Here's a general scenario: Greece can't come to terms with the IMF, ECB, Germany, et al, and announces that it's leaving the euro and returning to the drachma. Instantly, everyone with a Greek bank account empties it and moves the proceeds out of the country. Greek banks close, oil imports stop, the national health ministry runs out of pharmaceuticals, etc., etc. Chaos leads to depression and, probably, to some sort of authoritarian government. So far, this sounds like Greece's problem, and a damn good reason to accept a bailout on pretty much any terms. But what happens next changes everything. The minute Greece announces that it's leaving, investors instantly start looking around for the next domino, decide that pretty much all the PIIGS countries qualify, and pull money out of their banks, causing them to collapse and sending those economies into free-fall. Then, since French and German banks have lent hundreds of billions of euros to those now-bankrupt countries, and are on the hook for untold trillions of credit default and currency swaps, they fail as well. The entire continent is plunged into chaos, with no obvious exit. The eurozone dissolves, all because one tiny country decides to leave. Greece, of course, has read these reports and understands the its own power — and knows that Europe's leaders understand it too. So the Greek finance minister spending his time campaigning rather than waiting by the phone for yet another conference call should be seen as a classic bargaining tactic. Like George Bush Sr. going on vacation as the first Gulf War ramped up, he's saying that he's not worried, that this is the other guy's problem and that by the time he gets back to the office the other guy should have some nice answers waiting. Given the stakes, expect a deal more to Greece's liking next week. Enter Portugal In the end, so runs the analyst consensus, the only alternative will be a "fiscal union" where Germany and a handful of other core countries assume the debts of the periphery, in the same way that Washington absorbed Fannie Mae and Freddie Mac's $5 trillion of mortgage paper. The ECB meanwhile, will have no choice but to finance the whole mess by buying ten or so trillion euros of low-grade paper with newly-created currency. The euro will fall versus the dollar, yen and yuan, which will be great for German exports and Greek tourism, but bad for the eurozone's trading partners. They'll respond with inflation of their own, and so on, as the currency war really gets going. In this scenario it's hard to see an upside limit for gold and silver. |

| Posted: 05 Feb 2012 04:05 AM PST Friday's big rally on the better than expected employment report has now generated the kind of euphoria that often creates intermediate degree tops. This coming week will be the 18th week of the current intermediate cycle. As you can see in the chart below the intermediate cycle runs on average 18-25 weeks from trough to trough. The time to buy "anything" is when the stock market puts in one of these intermediate degree bottoms. It's way too late in the intermediate cycle, especially with the NASDAQ stretched 9% above its 50 day moving average, for anyone to be buying now. Now is the time for investors to be taking profits. And by taking profits I don't mean selling short. I mean moving to cash. The simple fact is that selling short is a fool's game designed to take money away from retail investors. The only people that will ever make any consistent long-term gains by selling short are the very elite traders of the world, or big funds with massive research departments that can ferret out and find sick or failing companies. What most traders who try to sell short fail to understand is that markets go down differently than they go up. This fact makes it very difficult to make, and more importantly keep, any profits garnered by selling short. First off, tops are often a long drawn out process. They tend to whipsaw short-sellers to death before finally rolling over. I would say we have seen a very good example of that over the last four weeks. Then even if one does manage to catch the top the intraday moves are often so violent that they knock one out of their positions. And finally, if you mistime the bottom you will give back most if not all of your meager profits during the first couple of days of the new rally. All in all, the best position for 99% of traders is to go to cash when a correction is due. As you can see by that first chart a correction is now due. That doesn't mean that it will begin Monday morning or even this week. What it does mean is that it is now too dangerous to continue playing musical chairs with a market that is at great risk of a sharp corrective move. The fact is that ever since the dollar put in its three year cycle low in May, trading conditions have changed. Trades have had to become much shorter in duration and profits taken much more quickly. Until the dollar's major three year cycle tops this trading condition isn't going to change. As you can see in the chart below we still have no confirmation of a major trend reversal yet. The dollar is still making higher highs and higher lows. It's still holding well above a rising 200 day moving average and hasn't even turned the 50 day moving average down yet. Once the stock market begins moving down into its intermediate cycle low it will almost certainly force another rally in the dollar, possibly (probably) back to new 52 week highs. That should, at the very minimum, pressure gold to retest the December lows, and if the selling pressure from the stock market is intense enough we could see another marginal new low somewhere in the high $1400s to low $1500 level. I should point out that gold still has not broken the pattern of lower lows and lower highs despite the powerful rally out of the December 29 bottom. Technically, gold is still in a down trend. That down trend may be reconfirmed when the stock market drops down into its intermediate degree bottom. I know we all want gold to immediately return to the days of strong trending moves, long trade durations, and easy money. It's only natural for investors to long for the good old days. It's what causes investors to chase (in vain) the last bull market. Think of all the investors that are still chasing the tech bubble of 2000, or the millions of investors still trying to pick the bottom of the housing market, or more recently energy investors struggling to figure out why solar and oil service stocks have underperformed so badly for the last three years. These are bubbles that have already had their day. They are never going to see those glory days again. Living in the past never made anyone rich. The people that get rich are the ones that figure out early where the next bull market is going to be. That being said, gold is most certainly not in a bubble yet. But the last massive C-wave obviously topped in September. That was the largest and longest C-wave of this entire secular bull market. Once something like that tops it takes months if not a year or more to consolidate those gains before the next leg up can begin. Analysts that are predicting $2000 plus gold for this year are just kidding themselves. Gold is almost certainly going to be locked in a very choppy, extended trading range till at least the fall and probably into next spring before the next C-wave can breakout to new highs. As distasteful as it is, investors need to accept the fact that it's going to be very hard to make money in the precious metals sector this year, and the only way to do so will continue to be with short-term trading strategies until we have confirmation that the dollar's three year cycle has topped. At the moment precious metal investors have the guillotine of the stock market hanging over them just like everyone else. Historically the selling pressure from an intermediate degree decline in the stock market will force an average decline of about 19% from peak to trough in mining stocks. Right now the mining sector is in a weakened state with the HUI holding below a declining 200 day moving average. That's not exactly the best position to weather the intense selling pressure generated by an intermediate degree decline in the stock market. My advice for precious metals investors is the same as it is for everyone else. Go to cash and be prepared to buy when the stock market puts in an intermediate bottom in late February to mid-March. This posting includes an audio/video/photo media file: Download Now |

| Did The Liquidity Trap Cause The Hike In Gold? Posted: 05 Feb 2012 03:07 AM PST By Lior Cohen: I have stumbled upon an interesting article by Paul Krugman, a Nobel laureate in economics; the article offers an explanation for the hike in gold of recent years. Krugman, who considers himself a deflationista, i.e. a person who believes the U.S. is currently in a liquidity trap, thinks the gains in gold is another confirmation for a liquidity trap: basically in a liquidity trap people and businesses "sit on their money" and even if interest rates plunge to zero (and U.S. interest rate has been at zero for the past couple of years), investors are still reluctant to invest their funds. It's hard to prove that we are in a liquidity trap because even if rates are low and the economy is slowing down, there is still no evidence of deflation, especially after the recent CPI report showed the U.S. inflation rate stands at 2.2% in annual terms. But let's Complete Story » |

| Which Way Now For Precious Metals? Posted: 05 Feb 2012 02:16 AM PST  By Tim Iacono: By Tim Iacono: After marching steadily higher early in the week, gold and silver saw their biggest one-day losses in more than a month on Friday as hopes for more Fed money printing were dashed after the better-than-expected labor report. Still, both metals maintain impressive gains for 2012 after a disappointing end to 2011 as more attention is focused on precious metals demand in China and actions by central banks, two of the most important price drivers in recent months. After rising above $1,760 an ounce for the first time since November, the spot gold price ended the week 0.7 percent lower, down from $1,737.30 an ounce to $1,725.90, as the silver price surged past the $34 mark before reversing course, ending the week down 0.9 percent, from $33.99 an ounce to $33.67. The gold price is now up 10.2 percent for the year, but down 10.3 percent from its 2011 high, and Complete Story » |

| Canadian Housing Market Collapse: Part II Posted: 05 Feb 2012 02:04 AM PST By Rodney Burley: As mentioned Part-1, Canadians like to think they are 'different' than their southern neighbors. That is certainly true in some respects, but not in the accumulation of debt. Canadian households debt to disposable income versus that in the USA is shown in the below chart, however Canadians went quite a bit further in debt! Well at least that's different, right? Chart-5: Credit Market Debt to Household Disposable Income (%). This chart shows how Canadian households compare to their American counterparts. Canadian households held more debt (to disposable income) than Americans for every single year of data shown. American households started the process of deleveraging in 2007, but Canadians have yet to start. Click images to enlarge Source: Statistics Canada & Federal Reserve (Flow of Funds Accounts of the USA) Mark Carney, the Governor of the Bank of Canada (BoC), made a speech last year at the Vancouver Board of Trade Complete Story » |

| Canadian Housing Market Collapse: Part I Posted: 05 Feb 2012 01:58 AM PST By Rodney Burley: The purpose of this article is to discuss just how much of a decline in Canadian real estate prices can be expected in the coming years based on observations in the US housing market, and what that means for housing values. The US Housing Market All US housing price data comes from the non-seasonally adjusted S&P/Case-Shiller Home Price Indices (which I will denote CS-HPI). Inflation figures come from the BLS. Chart-1: USA All CS-HPI Markets from 1987 to present. The CS-HPI data extends back to 1987 for most of the US markets, but not all. I've plotted everything that is available, including the C-10 and C-20 (composites), and an inflation curve that is based on BLS inflation values multiplied by a 'baseline value,' which is taken to be 100 at January 2000. Click to enlarge images The most interesting thing about the above chart is that it's pretty clear that Complete Story » |

| James Turk on “This Week in Money” Posted: 04 Feb 2012 10:31 PM PST James Turk interview talks about… on This Week In Money from February 3, 2012. ~TVR |

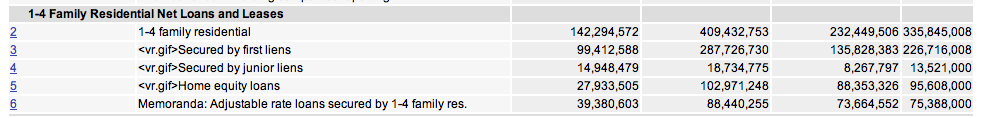

| Posted: 04 Feb 2012 09:14 PM PST In case you had any doubts about what the mortgage settlement was really about and why banks that were so keenly opposed to it are now willing to go ahead, the news of the last two days should settle any doubts. As we had indicated earlier, one of the many leaks about the settlement showed that there had been a major shift its parameters. Of the $25 billion that has been bandied about as a settlement total for the biggest banks, comparatively little (less than $5 billion) is in cash. The rest comes in the form of credits for principal modifications of mortgages. Originally, that was originally to come only from mortgages held by banks, meaning they would bear the costs. The fact that this meant that whether a homeowner might benefit would be random (were you one of the lucky ones whose mortgage had not been securitized?) was apparently used as an excuse to morph the deal into a huge win for them: allowing the banks to get credit for modifying mortgages that they don't own. The first rule of finance (well, maybe second, "fees are not negotiable" might be number one) is always use other people's money before your own. So giving the banks permission to modify loans they don't own guarantees that that is where the overwhelming majority of mortgage modifications will take place, ex those the banks would have done anyhow on their own loans. And the design of the program, that securitized loans will be given only half the credit towards the total, versus 100% for loans the banks own, merely assures that even more damage will be done to investors to pay for the servicers' misdeeds. Let me stress: this is a huge bailout for the banks. The settlement amounts to a transfer from retirement accounts (pension funds, 401 (k)s) and insurers to the banks. And without this subsidy, the biggest banks would be in serious trouble Why? As leading mortgage analyst Laurie Goodman pointed out in a late 2010 presentation, just over half of the private label (non Fannie/Freddie) securitizations have second liens behind them (overwhelmingly home equity lines of credit). Moreover, homes with first liens only have far lower delinquency rates than homes with both first and second liens. Separately, various studies have found that defaults are also correlated with how far underwater a borrower is. If a borrower is too far in negative equity territory, it makes less sense for them to struggle to stay current, no matter how much they love their home. The second liens pose a huge problem to the banks. Courtesy Josh Rosner, this is data as of September 30 for Citi, Bank of America, JP Morgan, and Wells, respectively: Compare these totals with the book value of their equity as of the same date: $42 billion in seconds for Citi versus $177 billion in equity; BofA, $121 billion in seconds versus $230 billion in equity: JP Morgan, $97 billion in seconds versus $182 billion in equity; Well, $109 billion in seconds versus $139 billion in equity. One of my mortgage investor mavens says that BofA's seconds should bve written down by about $100 billion and JP Morgan's by $60 billion. That writeoff would exceed BofA's market cap and would make a major dent in Jamie Dimon's touted "fortress balance sheet." And a similar magnitude of haircut to Wells would expose it as being grossly undercapitalized. Now the banks contend that the seconds are current or not all that delinquent, and hence no writeoffs are warranted. Please. Banks are doing everything in their power to preserve that fiction. First, they are engaging in far more aggressive debt collection against seconds than firsts, even though they service both. In addition, they can and do make insolvent borrowers look whole. They will reduce the minimum payment due when a borrower is close to being officially delinquent, and tell them to send a small amount and declare the loan current. Or they simply increase the credit line on the home equity line and let the borrower pay them with new funds lent to them. Neat, eh? Finally, they also have been modifying first liens to preserve their second liens. If you reduce the payments on the first mortgage, the borrower has more money left to pay the second lien. From the transcript of Goodman's 2010 presentation:

Legally, the hierarchy of payment OUGHT to be clear: a second should be wiped out before a first lien is touched. That's how it works in a foreclosure or a bankruptcy: only after the first lien was paid in full would a second lien get anything. But that isn't what is happening now. An important post by Dave Dayen, "HUD Secretary Expects "Substantial" Payment of Foreclosure Fraud Settlement with MBS Investor Money," on a small group interview of Shaun Donovan, makes it clear that the Administration is well aware of, indeed almost giddy, about the way investor oxen are about to be gored. Guess they haven't given enough to Obama to save their hides. Per Dayen:

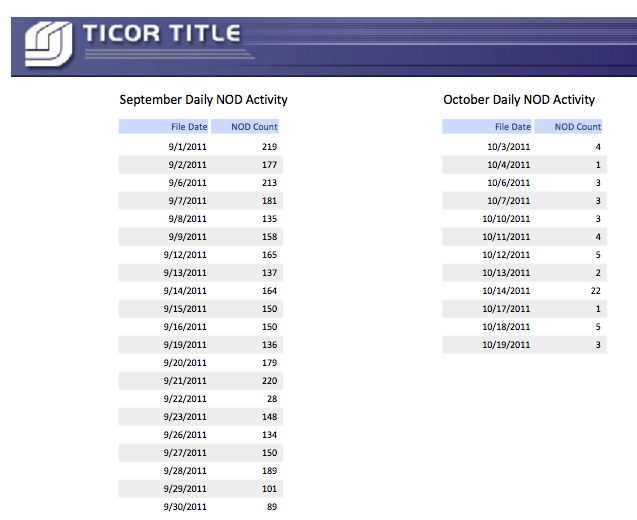

Notice that Donovan skips over the biggest item that will lead to bigger reductions than the nominal amount: the 50% credit that we noted above and in earlier posts, per a report by Shahien Nasiripour of the Financial Times, for modifications of loans that the banks don't own. Donovan tried to tell the journalists that there would be no problem with banks modifying these loans. That seems like a big stretch. The Pooling and Servicing Agreements all have a provision that says that the servicer is required to service the loan in the best interest of the certificateholders, meaning the investors. Modifying first liens owned by those investors pursuant to a settlement of legal and regulatory violations would not seem to pass muster. In addition, as we have reported earlier, a "safe harbor" provision, which was intended to provide air cover for banks to make mods as part of HAMP, was removed during reconciliation even though it had passed both houses. Why? Some investors had said that that provision amounted to a 5th Amendment violation, since it was taking property from private investors without providing compensation (note this is arguably a taking by government because preventing losses at BofA and Wells, which would be next in line if BofA were revealed to be insolvent, has the effect of benefitting the FDIC). How does the Schneiderman MERS suit play into this? The consensus reaction to his Friday filing of a suit on MERS abuses seemed to be that he had at a minimum redeemed himself for taking the wind out of the dissenting AG effort by joining a Federal task force that looks likely to produce little and becoming coy on where he stood on the settlement deal. After Friday's filing, some even thought he had outplayed Obama, by getting him to commit in a very public way to investigations and then filing a suit that put robosigning and other foreclosure abuses front and center. It looked as if he had gotten to have his cake and eat it too. I'm skeptical of this cheery view. As readers know, I doubt that this investigation will produce much except some suits against small or at best medium fry. As Charles Ferguson of Inside Job put it, "Let Them Eat Task Forces." There is a well established art form to stymieing people like Schneiderman: do the least important 60% of what they asked you to do, slowly. Schneiderman got to be on a not-likely-to-do-much task force. What did he get? He allegedly gets more resources, and he might get more information, but the Administration scored a huge win by dragging out the settlement talks over a year and running out the statute of limitations on some of the best legal theories. I have to admit I was snookered. I thought the ongoing joke of the Tom Miller "we're gonna have a deal any day now" was an embarrassing bug, but it was a feature. The AGs were being strung along as long as possible to keep them from filing suits. A few like Beau Biden, Martha Coakley, and Catherine Cortez Masto still did, but not soon enough or in enough numbers to embarrass some of the other fence-sitters into action (Lisa Madigan is an exception that proves the rule). So what does his MERS suit mean? I'm mainly focusing on how it relates to the bigger game of the settlement, but let me make a few observations about his filing qua filing. It is gratifying to see a long form description of the MERS horrorshow. And this suit could be used to shift focus back to an issue that everyone in the mortgage industrial complex seems to want to push aside: servicers seem unable to foreclose legally and chain of title is a mess. Settlement deals and compensation to abused homeowners could be useful, but they don't address the underlying mess (and neither do phony baloney OCC consent decrees). And the media keeps taking the industry line on foreclosure problems. It keeps touting how long it takes to foreclose in New York as if this is the fault of the borrowers and the courts. In fact, it is the fault of the industry. In October 2010, New York implemented a requirement that all attorneys in residential foreclosures certify that they take "reasonable" measures to verify the accuracy of documents submitted to the court. From a formal standpoint, all this did was reaffirm existing law, but procedurally, it makes it much easier for borrower's counsel to get attorneys who play fast and loose sanctioned. Look what has happened to foreclosure activity before the requirement was put in place versus this past October: So foreclosures had already effectively stopped because there are now real consequences to submitting bogus documentation. The Schneiderman filing ups the ante by telling servicers that they are subject to fines of $5,000 per violation (arguably, per each piece of improper paperwork submitted). But how does this suit move forward in practice? Even though the filing mentioned $2 billion lost recording fees, his filing does not seek any damages for that. Readers are invited to chime in, but I see that he has two big hurdles. The first is pinning liability on the banks, as opposed to MERS. MERS has fewer than 50 employees and I guarantee its only meaningful asset is its screwed-up database. It can't pay any meaningful damages or do much of anything to fix the mess it created. The banks will seek to argue that any liability sits with MERS, LPS and its ilk, and the foreclosure mills. It will probably take some doing to establish bank culpability. Second is establishing the number of violations per bank. In aggregate, it looks to be massive, but the AG needs to come up with some basis for arguing at least roughly how many violations took place. That probably means establishing how many foreclosures in the relevant time frame had liens recorded in the MERS system and coming up with a solid minimum number of violations per foreclosure. How do you do that? Maybe sampling 100 foreclosures with MERS assignments per bank? The only good news is the foreclosure procedures were so awful that the banks would be hard pressed to find any foreclosures that didn't have document problems. Let's do some rough math. The chart above shows 153 foreclosures a day for September 2010. Let's assume an average of 150 a day for 2008-2010 and half that for 2007, with 250 work days a year (the court calendar does drop to nada in late August and December). Further assume that the three big banks listed accounted for 30% of the foreclosure filings, and half of those used MERS. That's roughly 20,000 foreclosures. Assume 2 violations per foreclosure, which is $10,000, plus the $2,000 in expenses per homeowner (this was a separate claim in the filing). $12,000 X 20,000 is $240 million, or $80 million per bank. If you think I've been conservative, double that. The point is you don't get to bank-crippling numbers from this suit. And remember, this litigation will probably be settled, and settlements are for less that the full value of what the plaintiff might win (there's no reason to settle if the defendant has to pay out the full amount he's exposed to if he loses in court). That means it might be better for Schneiderman to use this suit to keep the negative PR about the banks coming (the reputational damage is likely to sting more than the amount they'd need to pay to make the case go away) and to press for real solutions to servicing and foreclosure practices. That has FAR more value than what he looks likely to recover. This is a long-winded digression. Back to the settlement jousting. Obama succeeded in getting Schneiderman on the sidelines as a leader of the dissenting AGs as the Administration mounted a final push. That destablized the opposition and fed the now widespread impression that the settlement is inevitable (remember, before the Schneiderman announcement, it looked like the Administration would have significant defections of Democratic AGs. At least one AG who had met with the dissenters, Oregon's John Kroger, has now joined the settlement). But does the Schneiderman MERS suit hinder or help the settlement effort? Perversely, it may help the Administration push it over the line. If the leak about the scope of the release via Mike Lux is to be believed, MERS-related liability is excluded from the waiver. Schneiderman has just demonstrated you can file what amounts to a robosigning lawsuit using the MERS exclusion. You won't get the securitizations outside of MERS where the notes weren't transferred properly, but you'll get a large proportion of the defective securitizations. Now why should the banks sign onto a deal to settle robosigning claims that leaves them exposed in a big way to robosiging claims? If they thought the Schneiderman suit revealed a problem in the release, you'd expect them to demand that the negotiations be reopened. It may be too soon to tell, but I've seen no sign of bank pushback, and this deal has been so heavily lawyered I am sure the banks were well aware of this issue. Similarly, as reader Pwelder pointed out, all the banks that were targeted in the suit were up on Friday markedly more than the market overall, indicating that investors do not see this suit as threatening. So the fact that they seem so keen to go ahead on a deal that does not very much to shield them from attorney general suits on robosigning confirms our suspicions: the banks are willing to pay several billion of hard cash among themselves to create the impression that they are Doing Something for Homeowners as cover for a bailout. Nicely played all around. And Donovon's cheerleading confirms the Administration's sense of priorities. He regards robo-signing, foreclosure fraud, and making a mess of title as unimportant, and applauds the this settlement as a way to get principal reductions and allow the banks to escape any meaningful liability or responsibility. The Obama Administration may have decided that investors have acted enough like patsies, given how they have failed to react to rampant servicer abuses, that they judge the risk of investor litigation and a related PR embarrassment to be small. But this battle is not yet over. The rumblings I am hearing from investor-land remind of the sections of the Lord of the Rings when the Ents were finally roused. It isn't yet clear that investors will act, but if they do, the Administration will be unprepared for the vehemence of their response. |

| Posted: 04 Feb 2012 05:13 PM PST |

| Feb 4, 1965 De Gaulles threat to accept gold as payment for his dollar surpluses Posted: 04 Feb 2012 04:45 PM PST Routledge |

| Posted: 04 Feb 2012 11:00 AM PST Every once in a while a bubble forms in a market. Bubbles can occur in any market, whether stocks, commodities, real estate or as we know from history, even tulip bulbs. Market bubbles are, as the ... |

| By the Numbers for the Week Ending February 3 Posted: 04 Feb 2012 05:27 AM PST HOUSTON -- After a short technical glitch caused a delay, just below is this week's closing table followed by the CFTC disaggregated commitments of traders (DCOT) recap table for the week ending February 3, 2012.

Vultures, (Got Gold Report Subscribers) please note that updates to our linked technical charts, including our comments about the COT reports and the week's technical changes, should be completed by the usual time on Sunday evening (by 18:00 ET). As a reminder, the linked charts for gold, silver, mining shares indexes and important ratios are located in the subscriber pages. In addition Vultures have access anytime to all 30-something Vulture Bargain (VB) and Vulture Bargain Candidates of Interest (VBCI) tracking charts – the small resource-related companies that we attempt to game here at Got Gold Report. Continue to look for new commentary often. This was yet another very good week for many of our "Faves," but a late-week outside reversal on gold and silver and sharply contracting hi-lo spreads for gold and silver suggest the metals "want" to take a breather. They may or may not take that breather, but they seem to want to.

Finally, we have just emailed out the full Vulture Bargain Roundup Update for February-March and have posted it to the password protected subscriber pages. Kindly log in to view the report in the Vulture Bargain Section. We updated all of our fully fledged Vulture Bargain Issues, including our targets for going to "Free Shares," as well as our review of the various, very busy happenings underway. It's an exciting time to be a Bargain Hunting Vulture.

In the DCOT table below a net short position shows as a negative figure in red. A net long position shows in black. In the Change column, a negative number indicates either an increase to an existing net short position or a reduction of a net long position. A black figure in the Change column indicates an increase to an existing long position or a reduction of an existing net short position. The way to think of it is that black figures in the Change column are traders getting "longer" and red figures are traders getting less long or shorter. All of the trader's positions are calculated net of spreading contracts as of the Tuesday disaggregated COT report.

*** We will have more about the COT in the linked technical charts for Vultures by Sunday evening, including a very large jump in the Swap Dealer net short positioning for gold, which gives an artificially bearish skew to the legacy gold LCNS. As shown above, the Producer/Merchants added a small 3,850 lots net short on a $72.46 jump in the gold price Tues/Tues. Pay attention. Silver COT is consistent with historic norms for a $1.13 advance in our opinion. More in the linked charts for subscribers by Sunday evening… *** |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment