saveyourassetsfirst3 |

- VB Update Notes for February - March 2012

- Corrective Action in Gold is Prelude to Bullish Explosion: James Turk

- Les 50 chiffres les plus étonnants de l'économie américaine

- Another ‘Camouflage’ Trade, This Time in Silver…

- Corvus Gold 2-2

- The History of Money : Peru

- Junior Gold Producers 2

- Analyzing Noteworthy Buys And Sells Among Mega-Cap Stocks Thursday

- Do you have to pay income tax on money you get for sending gold/silver refinery

- Why Are Economists Allergic To Gold?

- Gold and silver price shakeout

- Gold Juniors Poised to Rebound: Joe Mazumdar

- Friday ETF Roundup: XLY Surges On Jobs Report, VXX Tumbles On Market Strength

- Bob Chapman : we are experiencing Peak Gold and Silver

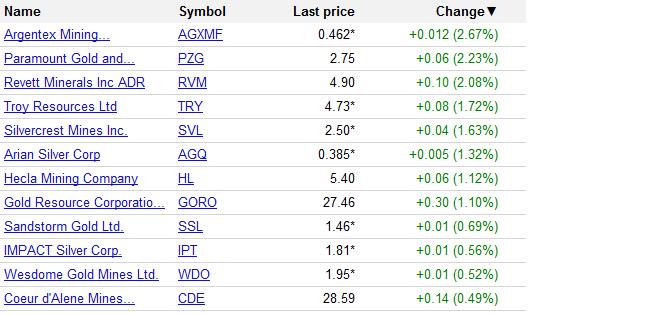

- Today’s Winners and Losers

- Walgreen Stock Continuing Collapse In ExpressScripts Fallout

- Bernanke’s Comments “Lend Support” to Gold, But Precious Metals Dip Following Strong US Jobs News

- Local Top in Mining Stocks Might Be Just Around the Corner

- Gold bull bigger than ever

- The First Casualty of the Currency Wars

- The Fed's Old New BFF

- Gold and Silver Financial Review With Bob Chapman by Gold Radio Cafe

- New data show the Fed's huge inflation could now be spilling into the economy

- Farms In Greater Depression I Wiped Out On Bad Farm Policy And No Safety Nets

- Must-listen:Porter Stansberry interviews master speculator Doug Casey

- Silver bullet for cancer

| VB Update Notes for February - March 2012 Posted: 04 Feb 2012 03:21 AM PST HOUSTON – Recall that we began the last full Vulture Bargain (VB) Update with a look at the graph for the Market Vectors Junior Gold Miners Index (GDXJ), which we chose as our Top Pick for 2012 following its 2011 hammering back to 2010 levels. That seemed to "work" in the luck department, so let's have another look to start this update. Since December 30 the GDXJ has advanced $4.91 or 19.9%, closing Friday, February 3 at $29.61. We can definitely say that the month of January was a good start to 2012 for this beaten up space, can we not? We can say that the GDXJ ended up respecting the support zone we thought it might (in the green), and it is now moving into an area that represents a potential resistance zone (yellow). How it acts in and around that zone just ahead should tell us a lot. Now let's look at GDXJ's Canadian counterpart, the S&P/TSX Canadian Venture Exchange Index (CDNX), which we also looked at last time. Recall that we said then: "Although it is still less than certain, we have the potential for the first higher turning low since January, 2011." Houston, we have a higher turning low on the CDNX. We are "go" for liftoff. And now the CDNX is challenging the gap from back in September. We'd be fairly surprised if the gap ends up holding. Indeed, we expect the gap to give way just ahead, maybe after a brief retreat to allow the market to catch its breath. The brutal buyer's strike and Negative Liquidity Event (NLE) which dominated 2011 may have officially ended in January of 2012. In the words of Jack Lord, "Book 'em Dano." To continue reading, please log in or click here to subscribe to a Got Gold Report Membership.

|

| Corrective Action in Gold is Prelude to Bullish Explosion: James Turk Posted: 04 Feb 2012 01:26 AM PST ¤ Yesterday in Gold and SilverWell, the little rally that began shortly after London opened yesterday morning topped out about 9:30 a.m. GMT...and that was the high for the day. From there, the price declined until just before 1:00 p.m. in London..and then rallied a bit into the Comex open at 8:20 a.m. Eastern time, about half an hour later. That tiny rally lasted until the jobs numbers came out at 8:30 a.m. Eastern...and by the time the selling was over at the London p.m. fix shortly after 10:00 a.m. in New York, about $27 had been pealed of the price since the London high earlier in the day. The gold price then more or less traded sideways around the $1,740 mark until an hour into the thinly-traded New York Access Market, when a not-for-profit seller sliced another $15 off the price in a thirty minute time frame. The gold price closed at $1,725.90 spot...down $32.50 on the day. Net volume was pretty impressive at 179,000 contracts. Silver got sold off about 20 cents or so in overnight trading...and, like gold, the top of the smallish rally that began shortly after the London open proved to be the high in silver as well. The sell-off in silver after that was far more pronounced that in gold...and by 1:00 p.m. in London, 7:00 a.m. in New York, silver was down almost two percent from its London high price. Then a rip-roaring [short covering?] rally began at that point..and within half an hour, the silver price had tacked on 40 cents. At 8:30 a.m. Eastern, the selling began, and within a couple of hours silver was down about 70 cents...and every subsequent rally attempt after that got sold off in short order. Silver finished the Friday trading day at $33.67 spot...down 69 cents. Net volume was pretty chunky at about 41,000 contracts. The dollar index didn't do much on Friday, spending most of the Far East and London trading session just under the 79.00 cent mark. If you look at the chart closely, you'll note that the dollar was actually heading lower on the jobs announcement at 8:30 a.m. Eastern, but someone stepped in to catch a falling knife moments later...and in about thirty minutes, the dollar index had jumped 45 basis points. But it is was all for naught, as the all that gain vanished by the 5:15 p.m. New York close...and the dollar index finished basically unchanged on the day. Not surprisingly, the gold stocks gapped down at the open of the equity markets at 9:30 a.m...and the low of the day was at the London p.m. gold fix just minutes after 10:00 a.m. Eastern time, which was minutes after 3:00 p.m. in London. After that, the gold stocks pretty much followed the gold price, but it was nice to see the tiny rally into the close that cut the HUI's loss to only 1.78% on the day. It could have been worse. The silver stocks did not fare well, either...but Nick Laird's Silver Sentiment Index only closed down 0.76%. (Click on image to enlarge) The CME's Daily Delivery Report showed that only 3 gold, along with 67 silver contracts, were posted for delivery on Tuesday. In silver, it was the Jefferies, Bank of Nova Scotia, JPMorgan ménage à trois once again, as Jefferies was the short/issuer on 66 of those contracts...and the major long/stoppers were the Bank of Nova Scotia and JPMorgan, as they gobbled up 60 of those contracts. The Issuers and Stoppers Report is worth a look...and the link is here. Four hundred silver contracts have already been delivered so far in the first three days of February...along with the approximately 1,300 that were delivered in January. These are big numbers for what are, traditionally, non-delivery months in silver. There were no reported changes in GLD yesterday, but that was not the case in SLV, as authorized participants deposited another 874,678 troy ounces. Here's the link to that action. There was a tiny sales report from the U.S. Mint yesterday. They sold another 50,000 silver eagles...and that was it. Month-to-date the Mint has reported selling 1,000 ounces of gold eagles...no one-ounce 24K gold buffaloes...and only 95,000 silver eagles, which is a very slow start to the month. Ted Butler has mentioned a couple of times this week that February sales numbers may be a disappointment when compared to what happened in January. He may be right, as the month has started out pretty ugly. The Comex-approved depositories had a much quieter time of it on Thursday compared the record day they had on Wednesday. They reported receiving only 867,826 troy ounces of silver...and shipped 181,735 ounce out the door. As of the close of the Thursday business day, the five Comex silver depositories held a combined total of 130,862,159 troy ounces. As expected, yesterday's Commitment of Traders Report did not make for happy reading. In silver, the Commercial net short position increased by 3,708 contracts, or 18.54 million ounces...and the total Commercial net short position is now up to 143.6 million ounces. This is a 100% increase from its absolute low of late December of 2011. As bad as it was in silver, gold was much worse. The Commercial traders increased their net short position by an eye-watering 30,094 contracts...or 3.01 million ounces. They sold 16,493 long positions and added 13,601 contracts to their short positions. The total Commercial net short position in gold is now 21.0 million ounces. Ted Butler said that the small commercial traders [the raptors] are now short the gold market as of this week's report...and that's never a good sign. Ted also said that the COT in gold is now neutral at best. Here's a chart that Nick Laird sent me shortly after midnight. It's the "Global Indices" chart...a compilation of seventeen global indices with a 41% weighting to the USA. (Click on image to enlarge) I have the usual number of stories, some of which I've been saving all week, so I hope you can find the time to read them all. The sell offs in gold and silver [about 2% apiece] were specific only to those two precious metals, as platinum barely moved...and palladium was unchanged. States seek currencies made of silver and gold. Bank of England's glittering stash of £156 BILLION in gold bars. How to Start a War: The American Use of War Pretext Incidents ¤ Critical ReadsSubscribeRecord 1.2 Million People Fall Out Of Labor Force In One Month, Labor Force Participation Rate Tumbles To Fresh 30 Year LowA month ago, we at Zero Hedge joked when we said that for Obama to get the unemployment rate to negative by election time, all he has to do is to crush the labor force participation rate to about 55%. Looks like the good folks at the BLS heard us: it appears that the people not in the labor force exploded by an unprecedented record 1.2 million. Australian reader Wesley Legrand sent me this must read zerohedge.com story from yesterday...and the three charts are worth the trip. The link is here.  The Real Economic Picture: Paul Craig Roberts/John WilliamsThis Paul Craig Roberts column came out on his website on Thursday, the day before the 'jobs' report. Paul was Assistant Secretary of the Treasury for Economic Policy and associate editor of the Wall Street Journal. He was columnist for Business Week, Scripps Howard News Service, and Creators Syndicate. He has had many university appointments. His internet columns have attracted a worldwide following. Sometime Paul can be a little over the top in his ideas and comments...but this is not one of those times. Armed with John Williams' charts from over at the shadowstats.com website, he really tears the cover off the ball in this scathing indictment of government statistics. I thank reader Rob Bentley for bringing this article to my attention...and now to yours. It's well worth the read...and it's posted over at the paulcraigroberts.org website. The link is here.  U.S. indicts Wegelin bank for helping Americans avoid taxThe United States indicted Wegelin, the oldest Swiss private bank, on charges that it enabled wealthy Americans to evade taxes on at least $1.2 billion hidden in offshore bank accounts, the U.S. Justice Department said on Thursday. The announcement, by federal prosecutors in Manhattan, represents the first time an overseas bank has been indicted by the United States for enabling tax fraud by U.S. taxpayers. The indictment said the U.S. government had seized more than $16 million from Wegelin's correspondent bank, the Swiss giant UBS AG, in Stamford, Connecticut, via a separate civil forfeiture complaint. Because Wegelin has no branches outside Switzerland, it used correspondent banking services, a standard industry practice, to handle money for U.S.-based clients. This Reuters piece that was posted over at the news.yahoo.com website yesterday was sent to me by reader Jerome Cherry...and the link is here.  Italian Bonds Tumble As Greece Talks Drag On; Bunds Decline on U.S. JobsItalian and Spanish government bonds fell as Greece struggled to reach accords with European officials and its creditors to avoid a default next month, sapping demand for the region's higher-yielding assets. German bonds fell, posting a weekly decline, as U.S. employment climbed more than economists forecast in January and the jobless rate slipped to the lowest in three years. Italian 10-year yields rose from the least since October after a report showed the country's services sector contracted more than estimated. The French-German 10-year yield difference dropped below 100 basis points for the first time in almost two months. "There's an element of caution out here with regards to Greece," said Marc Ostwald, a fixed-income strategist at Monument Securities Ltd. in London. "The Italian data was very poor and the underlying picture is that the non-core economies are in a pretty dire state." This Bloomberg story was filed from London yesterday...and is Roy Stephens first offering of the day. The link is here.  For Greek Tax Reformers, Good Ideas Aren't EnoughFor nearly two years, as the debt crisis worsened, Diomidis Spinellis led a team that devised innovative software to help Greece crack down on tax cheats. He sent daily reports to his superiors showing which regional tax offices lagged in closing cases and collecting tax revenue. But last September, Mr. Spinellis, who interrupted a brilliant career as a computer science professor in 2009 to work for the Greek Finance Ministry, resigned, frustrated that officials did little or nothing with the data he generated. "I cannot remember getting an enthusiastic response," Mr. Spinellis, 45, said with characteristic understatement in an interview in his tiny, book-filled office at Athens University of Economics and Business, where he has returned to teaching. I knew that things were bad in Greece, but I had no idea how much the rot had become institutionalized in its culture and it's government. This very interesting article in the Thursday edition of The New York Times was originally titled "The Powerful Resist Change to Greek Tax System"...and is Roy Stephen's second offering of the day. The link is here.  |

| Les 50 chiffres les plus étonnants de l'économie américaine Posted: 04 Feb 2012 12:50 AM PST Sur son blog, Olivier Berruyer publie les cinquante chiffres "les plus "incroyables" de l'économie américaine, une traduction d'un article du site The Economic Collapse... Lire |

| Another ‘Camouflage’ Trade, This Time in Silver… Posted: 03 Feb 2012 08:55 PM PST |

| Posted: 03 Feb 2012 06:51 PM PST |

| Posted: 03 Feb 2012 06:00 PM PST Dollar Daze |

| Posted: 03 Feb 2012 05:13 PM PST Zealllc |

| Analyzing Noteworthy Buys And Sells Among Mega-Cap Stocks Thursday Posted: 03 Feb 2012 04:01 PM PST By Ganaxi Small Cap Movers: We covered Thursday's noteworthy insider buys and sells in a prior article earlier today. The following are additional noteworthy insider trades reported on Thursday, but limited to extremely large-cap or mega-cap companies. Mega-caps are usually the biggest companies in the investment universe, and are generally household names. There is no exact definition, but generally they are thought of as companies with market-caps in excess of $100 billion, which number between 80 and 90 among U.S. exchange traded equities. For the purposes of this article, we have extended that range to over $50 billion, and present below the most notable trades reported on Thursday among extremely large-cap or mega-cap stocks; notable based on the dollar amount sold, the number of insiders selling, and based on whether the overall buying or selling represents a strong pick-up based on historical buying and selling in the stock (for more info on how to interpret Complete Story » |

| Do you have to pay income tax on money you get for sending gold/silver refinery Posted: 03 Feb 2012 01:05 PM PST I was thinking about sending some silver and gold to Marketharmony to get it refined and wanted to know if you have to pay income tax on the money you get? |

| Why Are Economists Allergic To Gold? Posted: 03 Feb 2012 11:59 AM PST As the old saying goes, the more things change, the more they stay the same. Some 32 years ago, Ronald Reagan ran for U.S. President, in part, on a promise to appoint a "gold commission" to study the issue of whether and how the United States should return to some variation of the gold standard. The nation had just come through a couple of tough decades during which, at times, it seemed as if the whole fabric of American society was being ripped apart. Devastating inflation and a lagging economy only made worse the social and emotional turmoil created by changing mores and standards surrounding civil rights, gender roles and military intervention. President Richard Nixon's shocking act of severing the U.S. dollar's ties to gold had failed to bring economic prosperity to the nation, and the Republican Party was feeling a bit of buyers' remorse. The idea of a return to a gold-based monetary system gained steam. |

| Gold and silver price shakeout Posted: 03 Feb 2012 11:00 AM PST The consolidation of gold's bull phase from October 2008 to the peak last September was a classic three-leg correction: an initial slide, rally, and final sell-off. Silver followed a similar but ... |

| Gold Juniors Poised to Rebound: Joe Mazumdar Posted: 03 Feb 2012 10:26 AM PST

TICKERS: ABX, CPN, GBU, MAX, MDW, NEM, ORV, PDG, RV; RVRCF, R Source: Brian Sylvester of The Gold Report (2/3/12) Companies Mentioned: Barrick Gold Corp. – Carpathian Gold Inc. – Gabriel Resources Ltd. – Midas Gold Corp. – Midway Gold Corp. – Newmont Mining Corp. – Orvana Minerals Corp. – Prodigy Gold Inc. – Revolution Resources Corp. – Romarco Minerals Inc. The Gold Report: What is the consensus among Haywood analysts on what 2012 will bring for mine commodities, particularly precious metals? Joe Mazumdar: Last year, risk aversion was a common market theme. In 2012, some of the same global economic concerns, such as the ongoing Eurozone crisis and the future of the euro, will continue to draw attention. But we also believe there is potential for positive economic indicators, primarily from the U.S., where there have been upticks in manufacturing and GDP growth. Also, unemployment in the U.S. is down to 8.5%, generating some consumer confidence. Recently, GDP growth for Q411 came in at 2.8%, which was slower than consensus forecasts—3%—but still the strongest in over a year. Political factors will play a role in 2012. There could be a change in leadership among four of the five permanent members of the U.N. Security Council. The presidential election will be a key focus of the U.S. and global market. There are also presidential elections in Russia, France and Mexico. There also may be a changing of the guard in China in the latter part of 2012. The potential for changes in leadership in these key nations will generate a bid to market volatility in 2012. Beyond gold and silver, our preferred commodity sectors include copper, iron ore and coal. Gold continues to be adversely affected by its own volatility, which continues to tarnish its reputation as a safe-haven asset. We note that during 2011, U.S. Treasury securities, the most liquid safe-haven asset, was a preferred recipient of capital investment, providing a ~10% return, its highest annual return since 2008 when it was 14%. TGR: Will the strengthening American economy have an adverse effect on the gold price? JM: Yes, the gold price quoted in U.S. dollars will be hindered by any U.S. dollar strength based on economic growth and increasing consumer confidence. In the current environment, gold, quoted in U.S. dollars, is still holding up well at price levels over $1,700/ounce (oz). We note that the Federal Reserve said recently that it remains concerned about the "vigor" of U.S. economic growth and pledged to maintain low interest rates until at least 2014. The latter is a positive for gold prices. In the medium to long term, increasing confidence levels in U.S. economic growth we believe will drive higher capital investments domestically and potentially raise inflation expectations, which would be a positive for gold. TGR: What about silver and copper? JM: We see copper on the brink of a rebound in 2012. The London Metals Exchange inventories are at low levels and Chinese imports of refined copper accelerated in the latter part of 2011. Copper is covered by Stefan Ioannou/Kerry Smith of Haywood Securities and they highlight a structural tightness in the copper market as supply growth remains constrained while a portion of future production growth resides in higher geopolitical risk jurisdictions. They note that the GFMS has estimated a deficit of 372 Kt copper in 2011 and forecast yet another deficit for 2012, 101 Kt. Chris Thompson covers the silver sector for Haywood Securities and has commented that despite the growth in investment demand over the past five years, silver is still very much an industrial metal. Volatility, he believes, will be underpinned by potential contradictory moves by those who see silver as an industrial metal and others who seek it as an investment asset. TGR: Did the junior mining sector hit bottom in 2011? JM: Within the current cycle, I think it has hit bottom. For me, the question remains: What are the catalysts that will move individual stocks up within the sector? For a number of the majors, growth has been increasingly difficult to achieve given the higher amounts of reserves they must replete on an annual basis. Companies such as Newmont Mining Corp. (NEM:NYSE) have been offering higher and more levered dividend payout structures to attract investors. In 2012, we see the potential for more merger and acquisition (M&A) activity, specifically in the junior to intermediate sector, given the plethora of small-cap stories in the gold sector. Producers have performed better with respect to their paper in 2011, compared to development stocks, and boast healthier balance sheets. M&A activity will be driven not only by a desire for growth but also motivated by financing risk to capture any synergistic opportunities such as sharing infrastructure and the potential to merge critical skill sets. There is a paucity of people who can bring projects into production and operate them. Merging structures and management is very important right now in the junior and intermediate sector. Without it, a lot of these companies with development assets may continue to struggle. TGR: Do you expect the Kinross Gold Corp. (K:TSX; KGC:NYSE, Not Rated) write-down to have an adverse effect on M&A? JM: Large projects that are required to move the needle in the growth strategy of a large gold producer have a scale and scope that naturally expose them to significant execution risk. So, in a nutshell, escalating capital costs for projects of this magnitude are nothing new. The M&A opportunities I refer to are at a scale that would be accretive to a junior to intermediate company from a growth perspective and offer opportunities to capture synergistic value. From a valuation perspective, many companies with development stage assets are trading well below their underlying asset valuations. M&A activity allows also for some consolidation in the junior sector given the plethora of small-cap gold plays. TGR: Did you make any adjustments to your investment thesis following the dip in precious metals equities late in 2011? JM: In our top picks, which we put out on Jan. 9, we focused on producers generating cash flow and developers with permitted or on a clear path-to-permitted projects in low geopolitical risk jurisdictions. One pick was Midas Gold Corp. (MAX:TSX, Not Rated), whose flagship asset, the Golden Meadows project, hosts a global resource of 5.8 million ounce (Moz) in the Yellow Pine Stibnite area on a large land package (11,600 hectares) in west-central Idaho, a re-emerging gold district. The company is working toward an updated gold resource estimate before the end of Q112, leading to a preliminary economic assessment (PEA) by Q312. TGR: Can you give us another name on your list? JM: Yes, Midway Gold Corp. (MDW:TSX.V; MDW:NYSE.A, Sector Outperform, CA$3.25 Target Price). It has the Spring Valley gold project, an intrusive-hosted gold deposit with a global resource, we estimate at over 5 Moz, in a district close to Lovelock, Nevada, where Barrick Gold Corp. (ABX:TSX; ABX:NYSE, Sector Outperform, CA$61 Target Price), is earning in up to 70% by 2013 by cumulatively spending US$38M. From a metallurgic perspective, the gold is free, not occluded in pyrite and potentially amenable to be economically extracted via a heap-leach process. Barrick, the joint-venture operator, is currently drilling the edges of the deposit to find out how big it could be. This means the near-term news flow will be linked to drilling results and less about a resource update in 2012. Midway has a portfolio of projects that it is capable of bringing on-line. Its Pan project, a low strip open-pit, heap-leach gold project in Nevada, has submitted a completed bankable feasibility study and a plan of operations. Its Gold Rock project, only 8 kilometers from Pan, is in an earlier stage where we anticipate a resource by Q112 with additional drilling in Q2–Q312, leading to another resource update by Q412 and a PEA by 2013. Additionally, Midway is working a low-sulphidation, high-grade gold project in the Tonopah District. Midway has a portfolio of projects and is assembling a team to build and operate them. Its COO, Ken Brunk, formerly with Newmont and Romarco, is very familiar with the permitting process and developing/operating projects in Nevada. I believe the company can manage this project pipeline of financeable projects in the low geopolitical risk jurisdiction of Nevada. TGR: Your target price for Midway is $3.25, up $0.25 from your last report. With that many projects in the development stage, it seems that Midway would be a prime takeover target, especially given its joint venture with Barrick. JM: Barrick is looking at a number of projects in Nevada, some of which are billion-dollar-plus projects that would add significant ounces to its production profile including Spring Valley, Goldstrike and an expansion at Turquoise Ridge. I believe that Spring Valley may be a target for Barrick going forward as it has potential to contain a +5 Moz global resource and lies in Nevada where Barrick has a significant infrastructure and asset base. However, the other components of the company's portfolio, which include smaller open-pit, heap-leach projects, such as Pan and Gold Rock, that could potentially produce between 70–90 thousand ounces (Koz)/year, would not move the needle for most majors. These smaller projects do generate cash flow and are more readily financeable by a company the size of Midway. They could also be attractive to an intermediate operating group looking at accretive transactions with junior developers. TGR: You cover Orvana Minerals Corp. (ORV:TSX, Sector Outperform, CA$2.25 Target Price), which is in production at its Don Mario mine in Bolivia and its El Valle-Boinás/Carlés (EVBC) mine in Spain. From June to October 2011, gold grades there increased incrementally from 1.4 to 2.17 grams per tonne (g/t). Nevertheless, Orvana's throughput at EVBC is below your forecast. Results at Don Mario in Bolivia also were below estimates. Is this a make-or-break year for Orvana? JM: It is a critical year for the company. Bill Williams, formerly Orvana's vice president of corporate development, is now the CEO. He is an ex-Phelps Dodge vice president and has been instrumental in generating the revised technical reports on both operations, EVBC and Don Mario Upper Mineralized Zone (UMZ), while advancing the Copperwood project. We believe his appointment reflects the company's focus on getting the operations back on track. Orvana is currently in the process of re-benchmarking both EVBC and Don Mario UMZ. For Don Mario—an open-pit mine with an upper mineralized zone containing a lot of copper, as well as gold and silver—Orvana has delivered a new life-of-mine forecast that addresses the difficulty of getting copper out using a leach precipitation flotation circuit on a much bigger scale than has been used before. The Don Mario operation also has been troubled by high costs of reagents for the circuit, which has raised the processing costs. We had originally forecast an annual production profile of 10–15 Koz per year of gold and 10–15 million pounds (Mlb) of copper. We are now looking at a production profile of 9–10 Mlb copper and 8–9 Koz of gold, whereas Orvana is still signaling 13 Mlb of copper and 12 Koz of gold. In Q411, the Don Mario UMZ operation produced 2.5 Mlb of copper and 2.3 Koz of gold, which is a positive. Now, it has to consistently achieve its new benchmarks over the next few quarters so the market can gain confidence in its operational abilities. At Orvana's flagship, the EVBC gold-copper project in northwest Spain, the operational issues have been related to head grades. Underground bottlenecks have hindered the company's ability to blend higher grade feed to the processing plant. We anticipate that a shaft will be in place by April/May 2012, which should alleviate some of the bottlenecks. We had originally forecast that the feed grade, at steady state levels, would be in the area of 5 g/t. However, revised guidance indicated that it would be lower, 3–3.5 g/t gold, which also conspired to lower our target. We anticipate a revised technical report for EVBC prior to March 2012 with updated life-of-mine forecasts. Orvana's Copperwood project in upper Michigan is a 50 Mlb/year copper project, now in bankable feasibility study, and Orvana is seeking to permit this year. Even with up to 800 Mlb of copper reserves, we believe that the Copperwood asset is not being valued at its current price levels as Orvana has been heavily discounted in the market due to poor operational performance. TGR: Given the lower recoveries and production estimates at Don Mario UMZ released in late January, you lowered your target price by $0.15 to $2.25. Yet you still give it a sector outperform rating. Why? JM: Due to the heavy market discounting related to disappointing results from both operations over the past few quarters, Orvana still provides about a 100% return to our target from where it is trading right now. I continue to believe that management can redeem themselves by achieving the revised benchmarks consistently over the next few quarters. As Orvana meets its goals, I believe the market will appreciate the cash flow being generated, worry less about its working capital position and give the company credit for its advancement of the Copperwood project. TGR: Prodigy Gold Inc. (PDG:TSX.V, Sector Outperform, CA$1.20 Target Price) recently published an updated PEA on its flagship Magino gold project in northern Ontario. Your model for Prodigy, using the updated PEA, projects a 20,000-ton/day operation, producing 222 Koz of gold per year over 13 years at total cash cost of roughly $775/oz. That would generate annual earnings before interest, taxes, depreciation and amortization margin of more than 50%. Yet, your target price of $1.20 is only about 40% above where Prodigy is trading. Why so conservative? JM: Given that gold indices provided a negative return in 2011 ranging from 13% to 20%, I think that a positive 40% return to target is probably not conservative in the current market environment. With respect to the valuation, I have adjusted for the technical and execution risk of the study level (PEA) and the fact that I have modeled a larger mineable resource base than that used in the December 2011 PEA. As a company derisks the project from PEA to a feasibility study, I revise the multiples applied to the asset valuation. Prodigy is planning a significant drill program of 60,000m in 2012 to infill/upgrade and expand the resource base while condemning areas for locating site facilities. We also anticipate an updated resource by Q312 leading to a feasibility study by Q412. TGR: Do you expect a takeover offer for Prodigy? JM: I try not to work off the takeover model because it is highly uncertain but focus on the underlying valuation. While I do believe that the Magino asset would be a good takeover candidate for an intermediate, I think that there are opportunities for consolidation and capturing some synergies with Richmont Mines Inc. (RIC:TSX; RIC:NYSE.A), which has an underground operation that abuts Prodigy's land package. Consolidation would probably be a good idea, given that Prodigy could have underground targets within the same host rocks as Richmont, which has a fully permitted and functional process plant. TGR: In your last interview with The Gold Report, you talked about Revolution Resources Corp. (RV:TSX; RVRCF:OTCQX, Not Rated). You said it was looking for analogs of Romarco Minerals Inc.'s (R:TSX, Not Rated) Haile Deposit in the Carolina Slate Belt. What's happening with Revolution now? JM: Revolution still occupies a significant land package of 7,500 acres along a 25-kilometer corridor within the Carolina Slate Belt at its Champion Hills Gold project in North Carolina. It drilled 19,150m in 2011 and is working on a resource estimate in 2012. Currently, gold equity plays exploring in the Carolina Slate Belt are strongly tied to news flow from Romarco's multimillion-ounce Haile gold development project in South Carolina and its ability to permit it. In an effort to diversify its portfolio, Revolution acquired a significant land package (~400,000 hectares) in two prospective regions in Mexico from Lake Shore Gold (LSG:TSX, Sector Outperform, CA$3.50 Target Price) in 2011. These assets host high-level low-sulphidation epithermal, gold and silver mineralization and we anticipate news flow from drilling results by Q1–Q212. The company wanted to present the market with multiple catalysts from a diversified asset base and this project has allowed it to achieve that goal. TGR: In late December 2011, Eldorado Gold Corp. (ELD:TSX; EGO:NYSE, Sector Outperform, CA$19.00 Target Price), made a takeover bid for European Goldfields Ltd. (EGU:TSX; EGU:AIM), which has gold exploration and development properties in Greece, Turkey and Romania. Last year, you discussed Carpathian Gold Inc. (CPN:TSX, Sector Outperform, CA$0.90 Target Price) and its Rovina Valley copper-gold-porphyry project, which contains about 10.7 Moz gold equivalent in Romania's Golden Quadrilateral. Does the proposed European Goldfields takeover make Carpathian Gold more attractive to larger suitors? JM: Barrick's private placement in August 2011 into Carpathian to fund additional drilling at Rovina Valley already speaks to the attractiveness of these gold rich porphyry systems to larger suitors. Mining activity in Romania is heavily linked to news flow on the permitting activities at Rosia Montana operated by Gabriel Resources Ltd. (GBU:TSX, Not Rated). Eldorado Gold's proposed takeover bid for European Goldfields does put in a bid for assets in Europe, however, the majority of European Goldfields' assets are located in Greece (Olympias/Skouries) and less so in Romania (Certej). For me, the takeover trigger was related to the receipt of permits to develop its Greek projects in July 2011. Permitting of those projects took an extended period of time. A positive permitting environment in Europe bodes well for Carpathian at Rovina Valley and it will benefit from any positive news flow from Gabriel. The risks include royalty increases and potential free carried interest that the government wants to negotiate. TGR: Royalties are going from 4% to 8%. That certainly is not positive, but to get those revenues the government has to permit the mines. JM: Herein lies the rub. On Jan. 3, we lowered our target by $0.10 on Carpathian to $0.90 to accommodate an increase in the gold and copper royalties to 8% at Rovina Valley. However, on the positive side, by defining the mining royalty rates and the tax structure and negotiating a free carried interest, the Romanian government has shown its desire to have these companies invest in these projects and generate the revenue streams within a restructured rent-sharing framework. We note that the local government is also looking to privatize some state-owned mining assets to raise revenue. TGR: What do analysts, investors and companies need to look out for in terms of geopolitical risk? JM: I would highlight countries—emerging or developed—that are in economic dire straits with prospective geology whose mining sector is underdeveloped and has untested mining laws and poor infrastructure. Geopolitical risk carries a few facets including outright expropriation to creeping nationalism, which is linked inextricably to a company's ability to develop/permit the project. These countries will continue to seek foreign direct investment to explore/develop these assets. Outright expropriation is difficult in countries where there is no mining history and a paucity of critical skill sets locally, unless of course it is looking to sell the asset to another bidder. Alternatively, the country may alter its mining laws to increase its share of resource rents derived from the exploitation of these assets. We have observed higher rent sharing globally via increased royalty payments, higher taxes and/or the introduction of windfall tax structures in countries such as Peru, Argentina and Romania, to name a few. Assets in higher geopolitical risk jurisdictions must provide the investor a high return and quick payback commensurate with the elevated risk profile. Note that assets within higher geopolitical risk jurisdictions may be more difficult to finance and there may be a limit on potential takeover suitors, depending on their risk appetite. To properly risk adjust and quantify these uncertainties remains a challenge. TGR: Is that because it is not going away? JM: Let's not forget that mining is a great way to get an injection of direct investment into an economy and generate employment. For example, high rates of unemployment in developed countries such as the U.S. and European countries are driving mining activity in places where permits have historically been difficult to attain. TGR: Joe, thank you for your time and your insights. Friday ETF Roundup: XLY Surges On Jobs Report, VXX Tumbles On Market Strength Posted: 03 Feb 2012 10:21 AM PST Today was one of the best trading days in recent memory. The Dow rose 1.2%, hitting its highest levels since 2008, while the Nasdaq surged 1.6% to its highest level in 11 years. The S&P 500′s return of 1.5% wasn't too shabby either. The big day was spurned by a better than expected unemployment report for January, which showed signs of an economic turnaround, though many analysts have warned that we need several more months like this in order to classify ourselves as recovering. On the commodity side of things, gold futures were slaughtered with the price of the precious metal dropping by 1.8% as investors piled into equities. But the losses for gold were oil's gain, as crude jumped by 1.5% to close out this week. Many had feared that the rally that 2012 has enjoyed was screeching to halt this week, as a few flat trading days did |

| Bob Chapman : we are experiencing Peak Gold and Silver Posted: 03 Feb 2012 10:15 AM PST Bob Chapman Financial survival 03 February 2012 : we are experiencing peak gold... [[ This is a content summary only. Visit my blog http://www.bobchapman.blogspot.com for the full Story ]] This posting includes an audio/video/photo media file: Download Now |

| Posted: 03 Feb 2012 09:37 AM PST |

| Walgreen Stock Continuing Collapse In ExpressScripts Fallout Posted: 03 Feb 2012 09:35 AM PST By Dana Blankenhorn: The last time I wrote about Walgreens (WAG), I was long Medco (MHS), which ExpressScripts (ESRX) was preparing to acquire. The news then was that Walgreens would lose any pharmacy benefit tied to the ExpressScripts Pharmacy Benefit Management (PBM) plans in January, and likely all of Medco's business soon afterward. I have since closed out my MHS position at a profit, but it may be time to consider an outright short on WAG. The business is rapidly losing its "moat," according to Morningstar. Sales were down 2.6% for January, same-store sales down 4.6%, as the pain of the ESRX cancellation started to kick in. These losses are keeping Walgreens from executing on its other plans, like expanding its network of Take Care Clinics, which are becoming a first-line of care for more-and-more people. (Getting deals with foreign nationals doesn't make the pain go away.) Walgreens is now pitching its pharmacies Complete Story » |

| Bernanke’s Comments “Lend Support” to Gold, But Precious Metals Dip Following Strong US Jobs News Posted: 03 Feb 2012 09:29 AM PST Bernanke's Comments "Lend Support" to Gold, But Precious Metals Dip Following Strong US Jobs News SPOT MARKET gold prices slipped back below $1750 an ounce while stock markets rallied strongly following the release of better-than-expected US jobs figures on Friday. The Bureau of Labor Statistics nonfarm payrolls report, published on Friday, shows that the US added a net 243,000 nonagricultural private sector jobs last month. In addition, both November and December's nonfarm figures were revised upwards. The unemployment rate fell to 8.3%, down from 8.5% the previous month. Silver prices also fell following the nonfarm announcement, while the US Dollar saw an immediate gain against major currencies such as the Pound, Euro and Yen. Earlier on Friday Dollar gold prices hit their highest level in 11 weeks at $1762 per ounce, a level not seen since mid-November, following US Federal Reserve chairman Ben Bernanke's appearance before Congress on Thursday. "We are not seeking higher inflation," Bernanke told the House Budget Committee, in response to comments from Republican representative Paul Ryan, who said he was "greatly concerned to hear the Fed recently announce that it would be willing to accept higher-than-desired inflation in order to focus on the [employment] side of its dual mandate." "We do not want higher inflation and we're not tolerating higher inflation," responded Bernanke, although elsewhere in his testimony he warned that "risks remain that developments in Europe or elsewhere may unfold unfavorably and could worsen economic prospects here at home." Fed policymakers revealed last week that a majority of them expects interest rates to remain near zero for at least the next three years. Bernanke added yesterday that the speed and aggressiveness of any future rate rises "may depend to some extent on the balance" between maintaining employment and pursuing price stability. "These comments lent support to gold," reckons James Steel, chief commodities analyst at HSBC in New York, noting that the Fed could opt for additional quantitative easing if progress towards full employment was inadequate. US inflation as measured by the consumer prices index fell to 3.0% in December, down from 3.4% the previous month, but up from 1.1% 12 months earlier. "As every day goes by, I see deflation in the things you own and inflation in the things you need," said hedge-fund partner Kyle Bass at a meeting of the University of Texas's $25.7 billion Investment Management Co. (Utimco) in Austin, Texas on Thursday. "I'm against selling any of the gold," Bass said, referring to the $1.2bn which Utimco now owns in physical gold bars after switching out of futures contracts then worth $992m in April 2011. Over in Europe, Greece's finance minister Evangelos Venizelos said Thursday that the European Central Bank would need to take losses on its Greek government debt holdings if Greece is to achieve the goal of reducing its debt-to-GDP ratio to 120% by 2020. Greece is yet to agree a deal with its private creditors over the size of losses they will take. The lack of a deal throws into doubt Greece's €130 billion second bailout, without which it will be unable to pay out on maturing bonds next month. "Greece needs a new program, there's no question about that, but Greece must create the conditions for it," German finance minister Wolfgang Schaeuble said Thursday. "We can't pay into a bottomless pit." "Precious metals are enjoying some support from safe-haven demand as issues in the Eurozone once again weigh on investors' minds," says Marc Ground, commodities strategist at Standard Bank, who sees resistance for gold prices at $1768 per ounce. Gold jewelers in India meantime the government to raise the duty drawback – the amount of duty exporters can claim back from the Department of Revenue – applicable to the gems and jewelry sector. The request from the Federation of Indian Exports Organisations follows the government's decision last month to increase duty on gold bullion imports and switch to an ad valorem tax, which takes the form of a percentage of value rather than a discrete amount by weight. Heading into the weekend, Dollar gold prices looked set to record their fifth straight weekly gain. Like those for gold, Dollar silver prices also hit their highest levels since November Friday morning, at $34.44 per ounce. Based on London Fix prices, gold is up nearly 15% since the end of 2011, while silver is up by more than 19%. Despite silver's rise, however, the world's largest silver ETF, the iShares Silver Trust (ticker: SLV) has seen its holdings of bullion rise just 0.2% since the start of 2012. By contrast, the amount of gold held to back shares in the SPDR Gold Trust (ticker: GLD), the world's largest gold ETF has grown 1.8% over the same period, rising to its highest level since December 20 yesterday at 1277 tonnes. Ben Traynor Gold value calculator | Buy gold online at live prices Editor of Gold News, the analysis and investment research site from world-leading gold ownership service BullionVault, Ben Traynor was formerly editor of the Fleet Street Letter, the UK's longest-running investment letter. A Cambridge economics graduate, he is a professional writer and editor with a specialist interest in monetary economics. (c) BullionVault 2011 Please Note: This article is to inform your thinking, not lead it. Only you can decide the best place for your money, and any decision you make will put your money at risk. Information or data included here may have already been overtaken by events – and must be verified elsewhere – should you choose to act on it. |

| Local Top in Mining Stocks Might Be Just Around the Corner Posted: 03 Feb 2012 09:28 AM PST

This December gold prices swooned by more than 10 per cent in their biggest monthly fall since the collapse of Lehman Brothers. For some insecure gold investors it was like a bad dream. They were happy to wake up to a bright, crisp January whose performance was more than enough to warm the heart of any gold investor. It was the metal's strongest starting month in 32 years giving a resounding answer to those who wondered if the 11-year rally in gold had ended (and they always seem to come out of the woodwork every time gold experiences a correction.)

Gold rose 11 percent in January, taking off like an Olympic hurdle racer easily jumping over the obstacles along the way for the largest gain for the month since 1980. The financial press attributed the rally to the regular list of "round up the usual suspects": a Federal Reserve commitment to keep U.S. rates near zero, dollar weakness, investor and consumer demand and central bank purchases.

On Tuesday, the last trading day of the month, the market produced a technically bullish monthly high close, and on Wednesday, gold prices climbed even higher only to continue its ascend Thursday to reach $1760 per ounce. Some gold investors are even starting to think that gold may post fresh highs this year sooner than later.

There is no question that the Fed announcement that interest rates would be held at current levels through to the end of 2014 helped fuel the rally. The market took into consideration that gold investment in this environment would pose no missed opportunity cost since the dollar will earn nothing, so risk assets should outperform dollar deposits.

The almighty US dollar (not so mighty anymore) is not the only answer to explain the strength of the rally in the precious metals sector. Earlier this week, we focused on the technical situation in the mining stocks and in this essay we will continue with this topic. Let's start with the HUI Index chart (charts courtesy by http://stockcharts.com.)

In the long-term HUI Index chart, we see that the index has rallied sharply and is now approaching a resistance line. So far this year, its performance has been quite similar to what we saw last October, when a pause was not seen until the 580 level was reached. Back then, however, there were no resistance lines in play prior to reaching that level. This is not the case today as there is a declining resistance line created by previous local tops. It therefore seems likely that the current rally will top around the 570 level.

In the short-term GDX chart, we see that miners are close to reaching our defined target level for this rally. In our last essay on gold and silver mining stocks (31st January, 2012), we stated that:

The recent decline took miners to the October 2011 level. If the correction is over, then expect a move to the upside similar to the previous one. Calculating the medium-term resistance line brings us to a likely target around $58.

The miners appear to be heading to the $58 level where the declining resistance line and the 50% Fibonacci level coincide. Once this short-term resistance line is reached, a pause in the rally is probable after which an additional period of rally seems likely.

The shape of this rally is almost an exact self-similar pattern compared to last October.

Mining stocks are quite close to their resistance line, but if gold and silver rally from here, then miners will likely move higher as well. However, the maximum price that we see GDX achieving without correcting first is $60 (the upper Fibonacci retracement level).

The additional confirmation of the coming correction comes from the Gold Miners Bullish Percent Index.

On the above chart we continue to see that both the RSI and the Williams %R are overbought and consequently a "top is near" signal is in place. In fact, a local top now appears to be just around the corner. Please note that whenever both indicators based on the index (main part of the chart) became overbought a local top in gold stocks soon followed – as seen at the bottom of the chart.

Having discussed big senior mining stocks, let's take a look at the small, low-cap juniors.

In the GDXJ:GDX ratio chart, we see how juniors (GDXJ being the proxy for the sector) are performing compared to seniors (GDX being the proxy for the sector). The ratio here has broken out above the medium-term declining resistance line and rallied sharply. Juniors are now outperforming seniors and this is consistent with the outlook which we have discussed in our reviews of the sector over the past few months. It is a situation which will likely continue for the month ahead as well.

Summing up, the medium- and long-term outlook for the gold and silver mining stocks is positive, however a correction is likely to be seen soon – perhaps it will start next week. Long-term investors should consider purchasing junior mining stocks, while short-term traders might want to trade the coming correction.

Thank you for reading. Have a great and profitable week! P. Radomski * * * * *

Sunshine Profits provides professional support for Gold & Silver Investors and Traders.

All essays, research and information found above represent analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mr. Radomski and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above belong to Mr. Radomski or respective associates and are neither an offer nor a recommendation to purchase or sell securities. Mr. Radomski is not a Registered Securities Advisor. Mr. Radomski does not recommend services, products, business or investment in any company mentioned in any of his essays or reports. Materials published above have been prepared for your private use and their sole purpose is to educate readers about various investments. By reading Mr. Radomski's essays or reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these essays or reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise that you consult a certified investment advisor and we encourage you to do your own research before making any investment decision. Mr. Radomski, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice. |

| Posted: 03 Feb 2012 09:21 AM PST Gold bull bigger than ever

We recently wrote about the difference between gold's price and its value, demonstrating a significant difference between the two. We asked many fundamental questions which show whether or not the gold price is proximate to its value. The answer was it was not. Late last year we wrote of the on-going 'Gold Wars' between so-called industry experts and gold investors. We repeatedly found 'experts', who write in the mainstream media, were calling the end of the gold bubble whenever the price of gold dipped slightly. For many commentators, the rapid increase in the price of gold over the last decade has led them to conclude that we must be coming to the end of the gold bull market. However, as we pointed out, those that are bearish on gold are failing to look at the fundamentals which drove the gold price upwards in the first place. Our friend Ronald Stoeferle has emailed us some compelling evidence which suggests the gold bull market is far from over. In fact, his work shows that gold is still significantly undervalued. Rather than looking at the nominal prices, Mr Stoeferle has decided to carry out comparisons against monetary aggregates and other asset classes. This is key in gold price analysis as it puts the price of the metal into perspective alongside fundamentals which are heavily influenced by both monetary policy and confidence in the economy. Measuring gold price against M2 money supply

The first chart shows the Gold/M2 ratio. The ratio currently trades at 0.16, which as Mr Stoeferle points out:

In order to reach a similar ratio to that seen in 1980, gold would now have to rise to more than $4,500. Measuring gold price against the MZM supply

MZM, the Money Zero Maturity measure, measures the liquid money supply in an economy. For some countries it is the preferred money supply as it measures the money which is readily available in the economy. This demonstrates the difference between the value of gold and the money supply as even more extreme version of the earlier graph; the ratio of gold price to MZM is trading at the long term mean of 0.16. This again, is significantly off the 1980 ratio of 0.8. Mr Stoeferle states that in order for the 1980 ratio to be matched today, the gold price would need to increase to $8,500. Measuring the gold price against the S&P 500As is clear from the graph, the current gold/S&P ratio is only just above the long term mean of 1.2. In order to reach the 1980s ratio of 6, the gold price (again, according to Mr Stoeferle) would have to reach in excess of $8,500. Is this gold bull the same as the last one?The last bull market ended in 1980 at a peak of $850. Are the fundamentals which both drove the gold bull market and stopped it in its tracks the same for today? We don't think so. In the years prior to 1971, when the dollar had operated on a gold exchange standard, individuals were savers. They had faith in their currency. However, when gold was removed from the dollar, there was little reason to save. In the US, the CPI increased to 15% after the removal of the gold exchange standard. Add to this the issue of the oil shocks, ailing stock markets and loss of purchasing power in other currencies. As Ferdinand Lips states in Gold Wars, 'It was not surprising that Americans started to vote by buying gold in whatever form they were legally allowed to do so.' The reason the gold bull market peaked at $850 is due to Paul Volcker, Chairman of the US Federal Reserve, increasing the interest rate to 20%. This gave stability to the US Dollar at home and improved exchange rates on the international currency markets. Is our situation today a mirror image of that seen in the 1980s? Back then inflation was rampant, as it is today (unofficially). Back then, the stock markets were shaky, as they are today. Back then, currencies are losing the trust of the international market, as they are today. Greater extremes for gold investmentBut the extremes of today are much greater than in the 1970s, currency imbalances especially. For a start, the participants in the global marketplace were only represented by the Western World. We looked at this previously. In the 1970s the USSR, India, South America and China were not the significant players they are today. Their roles have now expanded to such a degree that the number of players in the global market has increased tenfold and there is ten times more currency in circulation. We are now a far more integrated market place. With much more paper money; controlled by governments, who like this easy money as it means they can promise lots of things their countries cannot afford. Back in 1980 there was no Eurozone crisis, no repeat rounds of quantitative easing, no trillion dollar government debts and the real interest rates were positive. Do we think there is a chance of Bernanke, or the ECB, or the Bank of England inflicting a Volcker flavoured medicine on the US economy? No, we don't. With news last week of the Fed's decision to keep interest rates at a minimum for the next two years, and with rumours of QE3 just around the corner, the Volcker treatment does not seem likely. This gold bull can only get biggerThe gold price is climbing because of a loss of confidence in the fiat money system – as we looked at previously with Detlev Schlichter, confidence is the only thing which backs such money. 2011 did not end brilliantly for gold investors according to the mainstream commentators, but it still ended 14% higher than the previous year. At the time of writing the yellow metal is sitting comfortably above $1700. It has responded to Federal Reserve reassurances of further money printing and low interest rates, as it should have – by going up in price and demonstrating its role as a safe haven. As Mr Stoeferle demonstrates, the gold price needs to go much, much higher in order to even begin to match 1980 levels, and even then the situation today is much, much worse. The gold price rising is merely the monetary system resetting itself from a state of imbalance that is far greater than in the 1970s. Our thanks to Mr Stoeferle for sending us his graphs and analysis.

Jan Skoyles contributes to The Real Asset Co research desk. Jan has recently graduated with a First in International Business and Economics. In her final year she developed a keen interest in Austrian economics, Libertarianism and particularly precious metals. The Real Asset Co. is a secure and efficient way to invest precious metals. Clients typically use our platform to build a long position and are using gold and silver bullion as a savings mechanism in the face on currency debasement and devaluations. The Real Asset Co. holds a distinctly Austrian world view and was launched to help savers and investors secure and protect their wealth and purchasing power. |

| The First Casualty of the Currency Wars Posted: 03 Feb 2012 09:00 AM PST Your editor's Kindle e-reader has become the first casualty of the currency wars. We did the old 'put it on the roof of your car and then forget about it' trick. What does that have to do with currency wars? Well, that's the name of the book we couldn't put down at the time - Currency Wars by James Rickards. So if you found a white Kindle in Noosa's main beach car park, please return it to: Port Phillip Publishing PO Box 899 Our Kindle may have been the first casualty. But it won't be the last. Australia's car industry is all over the papers and the news. It's struggling with the strong Australian dollar. Clive Matthew-Wilson, editor of the car review website dogandlemon.com told the BBC that 'Australia's car assembly industry loses money on every vehicle it assembles. That harsh economic fact spells absolutely inevitable doom.' We presume Australia's other less newsworthy export industries are struggling too. Can Australia's currency continue its rampage while exporters burn? Over in Canberra, there's plenty of confusion about where the Aussie dollar could go. According to the Australian Financial Review, Manufacturing Minister (a job title worthy of a George Orwell book) Kim Carr reckons the car industry will be fine when the Aussie dollar falls back to 90 cents. But Treasury economist (another suspicious job title) Dr Gruen reckons it will keep going up. If the Aussie dollar does keep rising, will Australia's movers and shakers do some moving and shaking to weaken it in the name of national prosperity? Will Australia join in the currency wars with a volley of its own cash to shoot down the exchange rate? Well, it sort of already is. You see, every time Glenn Stevens of Reserve Bank Governorship lowers interest rates, he does so in much the same way that currency war broadsides are fired. He creates new money, or releases money that wasn't previously circulating in the economy. That addition of funds doesn't just make borrowing cheaper. It also makes the Aussie dollar more plentiful relative to other currencies. Of course, there is another 'relative' to keep in mind here. If other central banks are outpacing the RBA's efforts, the Aussie could stay sky high in terms of other currencies. So, unless Glenn Stevens is willing to really fire up the Australian printing presses, he won't be able to counter the high Aussie dollar. That leaves politicians Julia and Tony to cause trouble. Probably with tariffs and subsidies. Surprise, surprise, those are already in place too. Especially for the controversial car industry. Yes, the currency wars have been going on quietly here at home for some time now. And going by the state of our exporters, we're losing. What's worrying is that the global tide of currency flows has pushed Australia up a creek. We didn't get to $1.07 USD per Aussie dollar by paddling there ourselves. We got there on a surge of printed US dollars, euros, pounds, yen and Swiss francs. When the tide turns, we'll be just as much at its mercy as we were on the way up. In other words, the Aussie dollar could tank anyway. Regardless of what the RBA and politicians come up with. Exporters won't like a falling dollar environment any more than the current one. That's because it will probably be accompanied by a re-run of 2008's economic weakness. Or worse. The Other Half of the Money Manipulation Machination Apart from the fact that it might not work for Australia, there is a conceptual problem with currency manipulation. The gains from more exports are offset by the losses of others in the economy. That's a solid dose of the obvious that's never fully occurred to those who see currencies as a weapon. And it comes from Encima Global president David Malpass. Although his quote discusses the issue from the US perspective, with the US central bank as the culprit, the story is the same: 'Dollar weakness doesn't work at all for economic well-being. The corollary to the Fed's policy of manipulating interest rates downward at the expense of savers is declining median incomes. When the currency weakens, the prices of staples rise faster than wages, hurting all but the rich who buy protection.' In other words, currency manipulation is not beneficial to the economy as a whole. It's nothing but a shameful redistribution of wealth. Or perhaps shameless. And it just so happens that this manipulation would be at the expense of a growing voting block of Australians - those with accumulated retirement savings. For every dollar of export benefit from a lower Australian dollar, how much are those holding dollars losing? How much will their cost of living rise? How much return will they lose on savings accounts as interest rates fall? Savers in Europe and the US have been stung badly by currency war policies there. And, apart from in Germany, there doesn't seem to be much of an export boom despite a plunging euro. (We've done our bit by buying Greek olives.) So does the policy of printing money to lower your currency work at all? It definitely has various other effects. They outweigh any export benefit in our opinion. But don't worry too much about all these worldly concerns. Our friends at the following institutions are working hard to solve the problems: International Monetary Fund, European Parliament, European Commission, World Bank, Bank of International Settlements, European Central Bank, Bundesbank, Reserve Bank of Australia, Bank of England, Federal Reserve, European Financial Stability Fund, Australian Prudential Regulation Authority, Australian Securities and Investments Commission, Financial Services Authority, Securities and Exchange Commission, Federal Deposit Insurance Corporation, International Swaps and Derivatives Association, Institute of International Finance, Financial Industry Regulatory Authority, World Trade Organisation, Organisation for Economic Cooperation and Development, Committee of European Securities Regulators , the Committee of European Banking Supervisors the Committee of European Insurance and Occupational Pensions Supervisors, the International Organization of Securities Commissions, the Basel Committee on Banking Supervision and, our personal favourite, the Plunge Protection Team. What could possibly go wrong? Iran's Solution to Western Meddling Is Your Solution We prefer to answer a different question to 'what could go wrong?' Instead, 'what could go well when things go wrong?' And we've found something. In fact, it could go gangbusters. The gold price is a barometer of monetary instability. Or irresponsibility if you prefer. And there is plenty of that going around. While central bankers are busy trashing their currency, why not own the 'anti-currency'? Jim Rickards, author of Currency Wars, which we were reading when our Kindle took a tumble, suggests as much in this interview. King World News gave it the transparent title of 'GOLD MAY SUPER SPIKE on PANIC BUYING as WE SEE the END of the DOLLAR & MUCH MORE'. You can guess what most of the interview was about. But the second half took us by surprise. If you think currency wars are an abstract concept impacting you only indirectly, or only directly if you work in an export industry, consider these comments from Rickards:

The next time you see some crackpot dictator blaming political turmoil on insidious outside forces, you might not want to scoff quite as much. They might be idiots, but that doesn't make them wrong. And they aren't necessarily dumb either. Iran is one-upping Saddam Hussein's 'food for oil' program with a 'gold for oil' deal. India is rumoured to be on the receiving end of the oil. Rickards continues:

Is this the beginning of a return to the gold standard? If it is, what do you think that means for the demand for gold? And what will that do to its price? We'd rather be holding the currency of the future than the past. Oh, by the way, Rickards' book isn't the only Currency Wars out there. The Chinese have their own version with the same title. This from Wikipedia:

The Chinese know what's going on. That's why they are accumulating gold. At what point will they turn the tables on the US and implement the same currency war strategies the global superpower currently uses for itself? Until next week, Nickolai Hubble.

ALSO THIS WEEK in The Daily Reckoning Australia... How the US Tax Code is Creating a Chicken Run Well, what did you expect, Fellow Reckoner? It's called honour among thieves, not honourable thieves. These are people who would turn in their own grandmothers if they found a dotless "i" or a crossless "t" on the ol' dear's tax return. You have to be among them if you don't want your own pockets picked. The Most Common and Costly Investment Mistake That a man writing in 1917 could speak to us so clearly and usefully is one of the charms of markets. No matter what time or place, people are people, markets are markets, and they seem to behave in a universal manner. Therefore, if we know what kind of behaviour loses, we should do something different if we want better results. On the Edge of Evolution: An Investment Story in Three Acts Today's story is how the investment world you live in came to be...and how we're on the edge of a great leap forward...or a great leap into a deep abyss. If you don't have time to read it, go over to Facebook and tell everyone you're too busy to read about the most important investment story of your life. Why the Latest Global Manufacturing Data is Not Very Good, Just Less Worse Bear market rallies are fascinating to watch. They're sneaky, deceptive, and utterly believable. Those on the sidelines watch with regret as markets slowly move up. One by one, they get sucked in to 'participating' in the rally. Similar Posts: |

| Posted: 03 Feb 2012 08:39 AM PST Facebook, the Gold Price, and the inevitable mischief caused by cheap-money love... |

| Gold and Silver Financial Review With Bob Chapman by Gold Radio Cafe Posted: 03 Feb 2012 08:29 AM PST Listen to internet radio with Gold Radio Cafe on Blog Talk Radio Bob... [[ This is a content summary only. Visit my blog http://www.bobchapman.blogspot.com for the full Story ]] This posting includes an audio/video/photo media file: Download Now |

| New data show the Fed's huge inflation could now be spilling into the economy Posted: 03 Feb 2012 08:18 AM PST From Economic Policy Journal: Here's some very scary anecdotal evidence on price direction from the ISM's release today: Commodities Up in Price Airfares; Beef; Chemical Products; Chicken; Crab; Coffee (2); #1 Diesel Fuel (2); #2 Diesel Fuel (3); Fuel; Gasoline; Medical Supplies (2); Paper; Petroleum Based Products; Resin Based Products; Vehicles; and Wire. Commodities Down in Price Corrugated Cartons is the only commodity reported down in price. Commodities in Short Supply Crab; #2 Diesel Fuel (2); Fiber Cable; and Pharmaceuticals. Note: The number of consecutive months the commodity is listed is indicated after each item. Bottom line, If you... Read full article... More on inflation: Ben Bernanke just made a terrible mistake New report reveals Federal Reserve president owns millions in gold and platinum Gov't OUTRAGE: Federal Reserve president denies inflation, but secretly owns millions in inflation hedges |

| Farms In Greater Depression I Wiped Out On Bad Farm Policy And No Safety Nets Posted: 03 Feb 2012 08:10 AM PST In Greater Depression II, the world is much different. Asia has taken-up the slack in buying world food supplies. With Seven Billion mouths to feed, prices can go down some but not much. Real shortages and a nasty-decades-long-weather-mess, will prop and propel grain and other foods. "Copper, Oil, Wheat Rally as Fed Commits to Low Interest Rates." "Commodities (SPGSCI) rose to the highest in two weeks as copper and oil jumped on speculation that Federal Reserve plans to keep U.S. interest rates near a record low will bolster investor demand for commodities. The Standard & Poor's GSCI Index of 24 commodities gained as much as 1.4% to 670.58, the highest level since January 12. It was at 669.69 at 1:37 p.m. in London. "Oil futures advanced as much as +1.6% after the Fed's announcement sent the dollar to its lowest in more than a month against the euro, making assets priced in the U.S. currency more attractive. The Federal Open Market Committee said yesterday it expects its benchmark interest rate to stay "exceptionally low" at least until late 2014. A halt of Iranian oil supplies may boost crude by as much as $30 a barrel the IMF said." "…Sintje Boie, an analyst at HSH Nordbank AG in Hamburg correctly predicted in November that oil prices would slide by year-end. 'For the markets, it's a liquidity thing. All this liquidity must go somewhere, and so we have some money also going into oil. Prices are higher because of this bubble of liquidity." "Wheat advanced for a sixth day to the highest price in more than three weeks as Russia may have to slow shipments of the grain as exportable supply declines. Corn and soybeans gained. Wheat stockpiles held by farmers in Russia's main exporting regions in the south have dropped below last year's levels, declining as much as 50% in some areas. Russia banned exports in August, 2010 after its worst drought in half a century. The ban was lifted in July. 'Russia could potentially put some export curbs in place, but nothing is for certain." -Marek Strzelecki 1-26-12 Bloomberg.net Current inflation is +11% and rising. USA money printing is now $100 Billion per month.

This posting includes an audio/video/photo media file: Download Now |

| Must-listen:Porter Stansberry interviews master speculator Doug Casey Posted: 03 Feb 2012 07:58 AM PST From The Daily Crux: We know many readers have already claimed their free subscriptions to Stansberry Radio -- our colleague Porter Stansberry's new weekly radio show -- but this week's episode is too good not to pass along. This week Porter and co-host Aaron Brabham welcome renowned speculator and free market guru, Doug Casey. Longtime readers know Doug's interviews are always worth a listen... and this one is no exception. Doug shares his thoughts on a huge range of topics, including: Why "income inequality" has become so extreme... The unbelievable way he made his personal fortune... His prediction for this year's U.S. presidential election... His take on the euro crisis and the "End of America"... What he's doing with his own money today... And the one thing every investor should do immediately. Listeners will also hear Porter's secret for using trailing stops with the world's best dividend-paying stocks, what Porter learned during his last vacation, and much, much more. You can access the episode immediately by clicking here. And if you'd like to get your own free subscription to Stansberry Radio, you can do so here. More from Porter Stansberry: Three terrible lies you need to know about gold Porter Stansberry: An update to my "End of America" warnings This could be Porter Stansberry's most outrageous interview ever |

| Posted: 03 Feb 2012 04:33 AM PST http://www.dailymail.co.uk/health/ar...#ixzz1lHgAfBIp Silver can kill some cancers as effectively as chemotherapy and with potentially fewer side effects, new research claims. Scientists say that old wives tales about the precious metal being a 'silver bullet' to beat the Big C could be true. |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

Economics and politics. Accretion and repletion. Mergers and acquisitions. Joe Mazumdar, senior mining analyst with Haywood Securities, sees all of these as catalysts for a rebound in the junior gold space in 2012. In this exclusive Gold Report interview, he reveals the names of companies he expects to take off.

Economics and politics. Accretion and repletion. Mergers and acquisitions. Joe Mazumdar, senior mining analyst with Haywood Securities, sees all of these as catalysts for a rebound in the junior gold space in 2012. In this exclusive Gold Report interview, he reveals the names of companies he expects to take off.

No comments:

Post a Comment