saveyourassetsfirst3 |

- Sanctions dodge: India to pay gold for Iran oil, China may follow

- Will the Mitt/Newt Slugfest Boost the Occupy Movement?

- Dollar’s Influence on Gold

- 6 Stocks Yielding Enough To Double Your Money Every 5 Years

- Interview with Bernard von NotHaus

- Much Higher Gold Prices Soon!

- 2012 Performance Challenges: Above-The-Money Strategy

- Market Events Few Are Watching

- Facts And Fiction Of Sovereign Debt Default

- “Absence of Far East Demand” sees Gold “Succumb to Profit Taking” as Markets “Fragile” on Greek Debt Uncertainty

- Clearwire: At Long Last, Positive EBITDA & LightSquared Collapse Confirm Deep Value

- Fear Index Shows That Gold is Undervalued

- Talk of Economic Recovery Not Rooted in Reality

- Sovereigns Declare War on US Dollar

- Northern Tiger’s Greg Hayes Heavy Insider Buying of NTR Continues

- Bering Sea Gold

- Japan Gold Buying on TOCOM Again Supports

- View From the Turret: A Day Late and a Dollar Short

- LISTEN: Schiff on This Week in Money

- Gold is Money?!

- Must-read take on Congress' outrageous new tax proposal

- World Gold Council – Record Central Bank Gold Buying in 2011

- Gold is money?! Indians to pay for Iranian oil with gold

- Gold & Silver Market Morning, January 24, 2012

- Marcus Grubb of the World Gold Council

- Intervention in Libya Was Largely About Gold: Jim Rickards

- Silver Update: “Interest Rates”

- Pan American Silver wishes to buy Minefinders for $1.5-billion

- Gold prices are driven by Asia, not inflation

| Sanctions dodge: India to pay gold for Iran oil, China may follow Posted: 24 Jan 2012 05:08 AM PST India has reportedly agreed to pay Tehran in gold for the oil it buys, in a move aimed at protecting Delhi from US-sanctions targeting countries who trade with Iran. China, another buyer of Iranian oil, may follow Delhi's lead. The report, by the Israeli-based news website DEBKAfile, states that Iran and India are negotiating backup alternatives with China and Russia, should the US and EU find a way to block the gold payment mechanism... Read |

| Will the Mitt/Newt Slugfest Boost the Occupy Movement? Posted: 24 Jan 2012 04:38 AM PST By Lynn Parramore. Cross posted from Alternet. Representing the twin evils of ruthless capitalism and government corruption, the GOP candidates are bringing core Occupy issues to the fore. The Occupy Movement brought key issues like economic inequality, Wall Street greed, and political corruption to the table. And we may have the GOP front runners to thank for keeping them there. Here's a look at how the Battle of Newt and Mitt can help keep the OWS flame alive… The Populist Platform Newt Gingrich's populist messages in South Carolina dealt Mitt Romney a body blow. Newt hit the multi-millionaire on his low tax rate and his role in the oft-reviled private equity industry to leave him stumbling through debate questions and looking generally ill at ease. Getting branded as a corporate raider who pays less in taxes than your housecleaner is not a great image, to say the least. Newt leveled three sets of charges at his rival on economic issues, all of which resonate with core Occupy Wall Street concerns. The first two were key in the South Carolina primary, and the third may be important in the next phase as Newt attempts to draw Ron Paul supporters into his camp. They are:

Each of these issues, of course, is viewed through somewhat different lenses by left and right-leaning populists. For Occupiers, questions about the Federal Reserve, for example, tend to call up issues of the banking industry's influence on government at the expense of the ordinary Americans. For many Tea Partiers, a greater concern is 1) the relationship between the Fed's activity and the government deficit and 2) the desire of some to abandon fiat money in favor of a return to the gold standard. Newt signaled his stance in Saturday night's victory speech: "Dr. Ron Paul, who on the issue of money and the Federal Reserve, has been right for 25 years. While I disagree with him on many other things, there's no doubt that a lot of his critique of inflation, of flat money into the federal reserve is absolutely right, in the right direction, and its something I can support strongly." However Newt spins them, all three issues are likely to produce robust discussions that highlight and educate the public on matters that OWS would like to have at the center of national economic debate. OWS and Tea Partiers often agree that the Fed should be more transparent and that it's structure is problematic, so even if Newt comes at the issue from the perspective of right-wing populism, there are enough intersections that OWS can celebrate the discussion. The tax and private equity issues have brought a flood of commentary throughout the media, such as a recent New York Times piece by Floyd Norris questioning the fact that investment income is now taxed at a lower rate than earned income—a debate driven by Mitt's admission that he pays a mere 15 percent in taxes. Norris demonstrated that this discrepancy has not historically been the case and also why it is unfair . Thanks to the attacks on Mitt, Americans have been talking about "vulture capitalism" (Newt's term for private equity) and the ruthless policies and game-rigging financial engineering it is known for. Of course, this produced an entirely predictable chorus of "Shame on Newt" from financiers and their apologists, succinctly captured by Steve Moore of the Wall Street Journal, who whined on Fox News: "This is what our capitalist system is about!" Truly, Occupiers could not have hoped for better media coverage of their grievances. Newt, Incorporated Having won in S.C. on a wave of populist discontent, Newt must now must do some fancy footwork in the ring. He has to figure out how to continue tapping into widespread resentment against elites while simultaneously bringing many of those same elites – particularly the financiers — on his side in the fall presidential battle. If Newt decides to go full force on populist economic issues, he will certainly garner enthusiasm from some elements on the right. But he's got a problem: If you keep hitting the Money Men, they tend to hit back. And they might just leave the show altogether and throw their weight behind Obama, who has served their interests well on many fronts. Another small problem: Just as Mitt became the face of the brutal and unfair aspects of our capitalist system in recent debates, Newt may find himself the poster boy for the corrupt influence of money in politics. In the final days of the S.C. showdown, Mitt began to signal that he was willing to hit on his opponent's big Achilles' heel in his demand that records of Newt's 1997 ethics violation be released. Here's a little history on why Newt's populist-champion narrative has more holes that a slice of Swiss cheese. As Speaker of the House, the number of ethics violations Newt racked up through unsavory money transactions is breathtaking, and resulted, as Mitt reminds us, in a $300,000 fine. But there's more. Oh, so much more. The worst thing about Newt is what political economist Thomas Ferguson pointed out in a paper for the Institute for New Economic Thinking – namely that Newt was the key architect of the current pay-to-play system in Congress. More than anyone else, he is responsible for building the system in which members of Congress who bring in the most cash get the plum and powerful committee appointments. It was not always thus. Before Newt and his buddy Tom Delay saw the potential for pay-to-play, committee appointments came through seniority. But after Newt & Co. came to power, influence in Congress was nakedly up for sale. Today, both parties actually post prices for key positions, as Ferguson noted in the Financial Times. This crass turn in American politics has undermined democracy and has done more to separate the will of the voters from the actions of the politicians they elect than perhaps anything else in the last fifty years. It's the shameless mentality that once prompted Newt's former buddy and fellow Georgia politician Ralph Reed to talk giddily about his aspiration to start "humping corporate accounts" following his turn in electoral politics. When Newt left Congress, he then went on to become a consultant for, oh, Everybody in the Universe. He cozied up to Big Oil and changed his stance on climate change. He hopped into bed with health care executives, selling access to lawmakers and collecting millions from the industry for his think tank. And he famously took $1.6 million from Fannie Mae and Freddie Mac for his services as a "historian." Know any real historians who rake in that kind of cash? Americans' deep anger about the degree to which Big Business buys the political system has been channeled through the Occupy Movement, and Newt's role not only as a key conduit in this system, but one of its engineers, may open up public discussion of this issue, much as Mitt's low tax rate and corporate raiding have helped keep the torch burning on income inequality and predatory capitalism. Mitt will certainly try to overwhelm Newt with money. But he can also call out Newt's particular affinity for channeling cash through the political system and expressing more enthusiasm for lobbying than anyone in recent memory. Calling him Mr. Anti-Free Market Capitalism is one tactic, branding him as Mr. Corruption is yet another. And the branding has begun. On Sunday, Mitt headed to Florida and challenged the former Speaker on his influence-peddling, criticizing him for "what's he been doing for fifteen years…working as a lobbyist and selling influence around Washington." Mitt asked Newt to release his records concerning his years working for Freddie Mac, emphasizing the GOP view that the government-backed lender played a key role in the housing bubble and subsequent collapse, which has been a major source of economic distress to Florida residents. Newt and Mitt will continue to duke it out, each trying to position himself as a Man of the People. As for the Occupiers, we'll be sending "thank you for your support" letters to both candidates. |

| Posted: 24 Jan 2012 04:35 AM PST

In our previous essays, we emphasized that the long- and short-term trends for gold are up. In today's article, we will feature the current situation in the USD and Euro Indices and in the general stock market. After analyzing each of them, we will move to implications for the precious metals investors. Let's start with the analysis of the USD Index (charts courtesy by http://stockcharts.com.) Our first chart this week is the very long-term USD Index chart. We see little change in the situation since last week. There has been no confirmed breakout above the late 2010- early 2011 highs and the long-term trend remains down. In the short-term Euro Index chart, there are some visible changes. Though not yet confirmed, there is a visible breakout above the short-term declining resistance line. This is positive news for the euro currency itself and bearish news for the dollar. We have an early indication here that the USD Index will finally begin to decline as the sluggish situation seen during this month seems to be reversing. It is too early to draw conclusions, however, since the breakout here is not yet confirmed. Consequently, the situation in the USD Index is a bit more bearish due to a sign of a possible breakout in the Euro Index. Since this move is not confirmed, the change is not extremely important yet, but the situation is more bearish for the dollar now as compared to recent weeks. Let's move to the stock market. In the long-term S&P 500 Index chart we see that stocks moved close to an important resistance line formed by the 2008 and 2011 tops. It appears likely that a period of consolidation could begin very soon and the recent rally will likely pause for a bit. In the short-term SPY ETF chart, a proxy for the general stock market, we have a signal from the RSI levels that a local top may be close. This is based upon comparisons to past patterns where similar RSI levels have coincided with local tops as seen last July. A pause here in the recent rally would not be a surprise and could, in fact, be a healthy development for the general stock market. In the Broker Dealer Index (proxy for the financial sector) chart this week, we see a breakout above the declining resistance line. This follows a strong move to the upside and although we could see a move back to the support line (and then likely a reversal), the financials do appear to be showing signs of strength. This is a bullish development for stocks in general, as the financials often lead the general stock market to higher (or lower) prices. Consequently, stocks are soon to encounter a major resistance line which will likely stall their recent rally. The strength seen in the financials, however, is often followed by moves to the upside for stocks in general. It seems probable that following a pause or small consolidation period, stocks could very well rally to new 2012 highs with the next resistance level around 1375. This is about 5% above Thursday's closing level for the S&P 500 Index. Let's take a look at the correlations between the above-mentioned markets and gold to estimate the possible moves in the latter. The Correlation Matrix is a tool which we have developed to analyze the impact of the currency markets and the general stock market upon the precious metals sector. A look at the short and medium-term columns for stocks in relation to precious metals shows that the expected pause in the general stock market does not seem to pose a serious threat to the precious metals market. The correlation with precious metals is weak in the short- and medium-term columns and it seems that gold and silver investors have little to worry about with respect to the general stock market outlook. The USD Index situation is likely to provide bullish news for the precious metals sector. The negative correlation between the dollar and the metals means that declines in the USD Index will likely coincide with higher precious metals prices. All-in-all, the situation has improved slightly this week for gold, silver, and gold and silver mining stocks based on the short-term (and so far not confirmed) breakout in Euro Index. Summing up, the situation in the currency markets is a bit more favorable for the precious metals this week. It appears that the USD Index could begin to move lower, which generally leads to higher precious metals prices. The euro appears to be strengthening and if its breakout is confirmed, will likely lead to good news for gold and silver investors. The general stock market situation is a bit more bearish this week as stocks have moved close to an important resistance line. A pause in the current rally is therefore likely but does not appear to impact the outlook in the precious metals sector. More details on precious metals (including price target for gold) are available to our subscribers in the full version of the above essay. To make sure that you are notified once the new features are implemented, and get immediate access to my free thoughts on the market, including information not available publicly, we urge you to sign up for our free e-mail list. Gold & Silver Investors should definitely join us today and additionally get free, 7-day access to the Premium Sections on our website, including valuable tools and unique charts. It's free and you may unsubscribe at any time. Thank you for reading. Have a great and profitable week! P. Radomski * * * * *

Sunshine Profits provides professional support for Gold & Silver Investors and Traders.

All essays, research and information found above represent analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mr. Radomski and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above belong to Mr. Radomski or respective associates and are neither an offer nor a recommendation to purchase or sell securities. Mr. Radomski is not a Registered Securities Advisor. Mr. Radomski does not recommend services, products, business or investment in any company mentioned in any of his essays or reports. Materials published above have been prepared for your private use and their sole purpose is to educate readers about various investments. By reading Mr. Radomski's essays or reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these essays or reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise that you consult a certified investment advisor and we encourage you to do your own research before making any investment decision. Mr. Radomski, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice. |

| 6 Stocks Yielding Enough To Double Your Money Every 5 Years Posted: 24 Jan 2012 04:27 AM PST By Hawkinvest: Both savers and investors have struggled to find stable investments that provide income for the past couple of years. The Federal Reserve has tried to prevent an economic collapse and is trying to revive the economy by setting and maintaining a very low interest rate policy. Certificates of deposits, money market accounts, and even most bonds pay so little that you might as well have the cash under your mattress or buried in the backyard. In the long-term, hiding money under the mattress or keeping it in a savings account that pays less than 1% could cost you plenty. If your money is in a certificate of deposit or other investment yielding 1% for five years, you will have only 5% more money. Plus, chances are high that the dollars you get back in five years will buy far less than they do today. There are much better alternatives for Complete Story » |

| Interview with Bernard von NotHaus Posted: 24 Jan 2012 03:48 AM PST Liberty Dollar Founder Fights for Financial Freedom from TheAlexJonesChannel: Alex talks with Bernard von NotHaus, founder of the Liberty Dollar, who will explain his current legal challenges and ongoing fight for financial freedom. North Carolina has characterized the Liberty Dollar as "a unique form of domestic terrorism." Part One Part Two ~TVR |

| Posted: 24 Jan 2012 03:46 AM PST Governments Will Allow Much, Much Higher Gold Prices Soon! A WINDFALL PROFITS TAX WILL LIKELY BE IMPOSED ON GOLD by Arnold Bock, Munknee.com:

That governments will want – and will NEED – much, much higher gold and silver prices in the future is counter intuitive, given that they have done everything within their power to throttle back and to keep a lid on bullion prices. Let me explain why. Although we have seen eleven consecutive years of gold bullion price rises, such increases have been incremental, measured and at levels which make the remainder of the commodities and equities markets look volatile – and anemic. Governments have used their preferred bullion banks as agents in the paper futures markets and their central banks, in conjunction with their respective Treasury bureaucracies, to limit the inexorable rise in precious metals prices as much as possible to keep gold – the only 'real money' – from drawing unfavorable attention to their own failing fiat currencies and uncontrolled sovereign debt. Recently central banks have become net purchasers of gold bullion after many years being net sellers. In 2011 central banks purchased 430 tonnes of gold, five times more than in 2010 and the highest since 1964. Much of this new demand has come from 'emerging markets' central banks like Mexico, Russia, Turkey, South Korea and of course China and India. Read More @ Munknee.com |

| 2012 Performance Challenges: Above-The-Money Strategy Posted: 24 Jan 2012 03:44 AM PST By Mark W. Bertolin: So far 2012 has been a mixed blessing. The market has delivered impressive results, but it's difficult to pin the performance to any reliable indicator or set of factors outside individual company earnings reports. In an earlier article I outlined changes I planned on making to a portfolio I manage for income. With options expiring last Friday, its time to review the strategy and adjust as necessary. In keeping with my 2012 strategy I sold the Cooper Companies (COO), a manufacturer of contact lenses and women's healthcare products. Shares were sold through covered calls with a strike price of $70 that were assigned. It is currently trading at $68.74. I did not see any compelling news that altered my assessment of 2012 revenue hurdles and decided to not roll over the covered call which yielded 3.14%. Holdings in the Vanguard S&P 500 VFINX were reduced as I continue to scale Complete Story » |

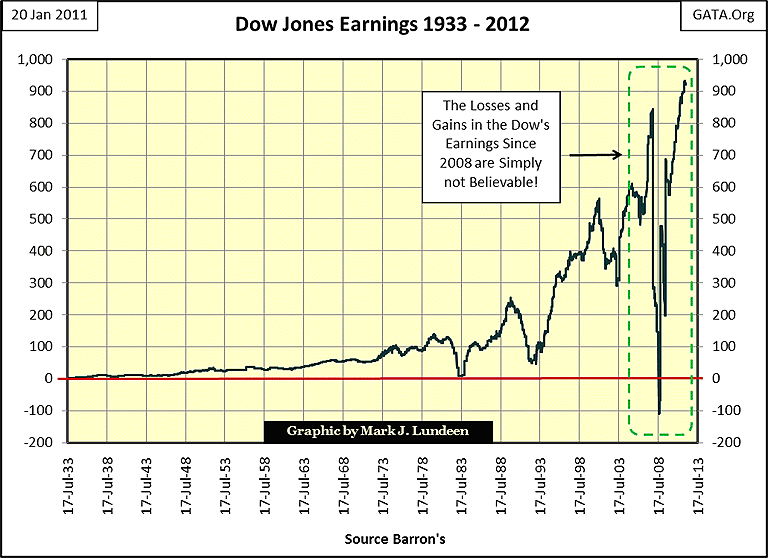

| Market Events Few Are Watching Posted: 24 Jan 2012 03:43 AM PST by Mark J. Lundeen, Gold-Eagle.com:

James Turk in a recent interview with Eric King gave one of the best definitions of a financial bubble, in human terms. "When there is a bubble in the markets, people are either not paying attention or accept as conventional wisdom, premises that do not stand up to logic or any kind of rational analysis." — James Turk Read More @ Gold-Eagle.com |

| Facts And Fiction Of Sovereign Debt Default Posted: 24 Jan 2012 03:38 AM PST By MA Managed Futures Fund: Since the S&P rating agency downgraded the U.S. sovereign debt in August 2011, it has sparked a firestorm among politicians, economists and investors alike. Warren Buffet has issued a challenge to the Republican Party to try to cut the deficit while doomsayers have said that the U.S. is the next Greece. In this continuing series on Soft Currency Economics, I would like to examine the facts and fiction behind sovereign debt default and the true meaning of the S&P downgrade. When a sovereign nation's money supply is determined by the amount of hard assets that country holds, like gold or silver, the country's currency is called a hard currency. The country has to hold a certain amount of gold or silver and be ready to convert its currency into gold or silver upon request. Therefore the country cannot issue more currency than its gold and silver holdings. Europe is similar. Complete Story » |

| Posted: 24 Jan 2012 03:28 AM PST London Gold Market Report from Ben Traynor BullionVault Tuesday 24 January 2012, 08:30 EST "Absence of Far East Demand" sees Gold "Succumb to Profit Taking" as Markets "Fragile" on Greek Debt Uncertainty WHOLESALE MARKET gold prices retreated to roughly where they started the week during Tuesday's morning session in London, making a 1% drop from yesterday's 6-week high to $1665 an ounce. Silver prices slipped to $31.91 an ounce – a 1% drop on Friday's close – as stocks and commodities also fell following news that Greek debt agreement remains elusive after yesterday's Brussels finance ministers meeting. "Key support [for gold prices] sits at the 200-day moving average, currently at $1643," says the latest report from Scotia Mocatta technical analyst Russell Browne. "Gold succumbed to profit-taking yesterday," adds Marc Ground, commodities strategist at Standard Bank. "The trend has continued into this morning, with the absence of Far East physical demand (due to Lunar New Year holidays) opening up the metal to further downside." European finance ministers have backed Greece in calling for private sector holders of Greek debt to take bigger losses. Private sector Greek bondholders agreed last October to accept 50% losses as part of a bailout deal aimed at reducing Greece's debt burden from 160% of annual gross domestic product to 120% by 2020. However, leaders now openly acknowledge that Greece's efforts to reduce its deficit look destined to fail. "It is obvious that the Greek program is off track," said Jean-Claude Juncker, chairman of the Eurogroup of single currency finance ministers, following their meeting yesterday. Greek finance minister Evangelos Venizelos has said he expects talks with private investors over Greek debt restructuring will be finished by February 1. His counterparts in other Eurozone governments meantime confirmed plans for a second Greek bailout of €130 billion should a deal be reached – without which Greece will be unable to repay €14.5 billion of bonds that mature on March 20. "It seems as if we are far from an agreement," reckons Yves Maillot, head of investments at French asset management firm Robeco Gestions , which oversees $6.8 billion. "The problem of solvency of countries remains, along with the question of Greece. The market situation is fragile." Euro finance ministers also discussed stricter budget rules for European Union governments as well as the introduction of the European Stability mechanism – the permanent bailout fund now due to replace the temporary European Financial Stability Facility in July, a year earlier than originally scheduled. Italy's prime minister Mario Monti, along with International Monetary Fund chief Christine Lagarde, have called for the ESM to have an effective lending ceiling of €1 trillion. Germany, however, insisted it be capped at €500 billion – a proposal with which the Eurogroup agreed yesterday. "I believe this is an important achievement," German finance minister Wolfgang Schaeuble said of the meeting's agreement. "It demonstrates that the Euro group and the European Union as a whole is capable of taking the necessary steps." Germany's manufacturing sector meantime has expanded this month for the first time since October, according to provisional purchasing managers index data released Tuesday. Here in the UK, public sector net debt breached £1 trillion for the first time last month – equivalent to 64.2% of GDP – according to the Office for National Statistics. The US on Monday imposed sanctions on Iran's third-largest bank, Bank Tejarat. Any firm that deals with it will be locked out of the US financial system. Also on Monday, the European Union banned Iranian oil imports and joined the US in imposing sanctions on Iran's central bank. Monday's actions "will deepen Iran's financial isolation, make its access to hard currency even more tenuous, and further impair Iran's ability to finance its illicit nuclear program," said US Treasury Undersecretary David Cohen. Earlier this month there were reports that sanctions imposed at the end of last year had led to Iranians buying gold as a currency hedge, and leading to concern among Iranian officials. Japan meantime is expected to announce its first trade deficit since 1980 on Wednesday, the Wall Street Journal reports. The Yen has risen over 5% against the Dollar since the start of 2011 – and is up around 40% over the last decade. Yen gold prices have risen by over 200% since January 2002 – compared to a rise in Dollar gold prices of over 450%. "Gold is negatively correlated with the US Dollar," says the gold investment statistics commentary from the World Gold Council. "In periods in which the US Dollar depreciates, gold prices tend to rise." The report (which can be downloaded here (free registration required here)) notes however that the relationship is not symmetric, with the negative correlation often weakening when the Dollar is buoyant. The report also comments that equity volatility rose faster than that of gold during periods of 2011 that saw extreme financial market stress. Ben Traynor Gold value calculator | Buy gold online at live prices Editor of Gold News, the analysis and investment research site from world-leading gold ownership service BullionVault, Ben Traynor was formerly editor of the Fleet Street Letter, the UK's longest-running investment letter. A Cambridge economics graduate, he is a professional writer and editor with a specialist interest in monetary economics. (c) BullionVault 2011 Please Note: This article is to inform your thinking, not lead it. Only you can decide the best place for your money, and any decision you make will put your money at risk. Information or data included here may have already been overtaken by events – and must be verified elsewhere – should you choose to act on it. |

| Clearwire: At Long Last, Positive EBITDA & LightSquared Collapse Confirm Deep Value Posted: 24 Jan 2012 03:22 AM PST By Helix Investment Management: Since soaring to a recent high in December, Clearwire (CLWR) shares have steadily fallen, recently trading at around $1.80. That is a fall of nearly 30% in just over a month's time. We have received a good deal of messages regarding this, and as such we would like to address the concerns about Clearwire. We have discussed Clearwire at length in several previous articles, including one about how deeply the company is undervalued, and about how its ownership structure presents a unique oppurtunity for retail investors. Recent News Clearwire shares have slowly but steadily drifted lower from their December highs, yet there has been no material negative news in the past month. The following 2 items have been the only operational announcements from Clearwire:

Complete Story » |

| Fear Index Shows That Gold is Undervalued Posted: 24 Jan 2012 02:27 AM PST by James Turk, GoldMoney.com:

They could not be more wrong. Neither a rising price, nor anecdotal reports of increased buying are in any way proper evidence of a bubble. If we ignore the chatter and actually look at empirical data, it is quite easy to recognise a speculative bubble or mania. That is to say, an irrational and unsustainable overvaluation of an asset regardless of fundamentals, reinforced by the belief that it will continue to rise indefinitely. We have a number of very vivid examples in living memory: the dotcom bubble, the housing bubble, and history provides many more examples, John Law's Mississippi Bubble being the classic example. A strict definition of a speculative bubble will therefore have two basic parts to it: Read More @ GoldMoney.com |

| Talk of Economic Recovery Not Rooted in Reality Posted: 24 Jan 2012 02:22 AM PST by Rick Ackerman:

Read More @ RickAckerman.com |

| Sovereigns Declare War on US Dollar Posted: 24 Jan 2012 02:20 AM PST Iranian Crisis Evolving into Dollar Hegemony and Western Power Challenge by Chris Blasi, GoldSeek.com:

Profoundly significant news came out of the Middle East on Monday January 23, 2012. The headline via DEBKAfile* reads: India to Pay Gold Instead of Dollars for Iranian Oil. Oil and Gold Markets Stunned Within the body of the report were gleaned these crucial items: 1. India has become the first buyer of Iranian oil to agree to settle purchases in gold. Read More @ GoldSeek.com |

| Northern Tiger’s Greg Hayes Heavy Insider Buying of NTR Continues Posted: 24 Jan 2012 02:00 AM PST Recall that we noted in an earlier notice in VultureInReview that Northern Tiger's CEO Greg Hayes bought at least 668,000 shares of his own company in the open market using his own after-tax money from December 20-22 at prices from $0.13 to $0.14. (See that notice here.) Well, Mr. Hayes is apparently not done adding shares of Northern Tiger (NTR.V or NTGSF), as the data below provided by Ink Research shows that from January 5 to 19 Mr. Hayes bought an additional 256,000 shares at prices between $0.17 and $0.175. Continued... So just since December 20 the CEO has acquired at least 924,000 shares. Mr. Hayes' confidence in his own company despite the harsh treatment of the shares by the market adds to our own confidence as we continue building our own position for this promising Yukon explorer. At the time of this writing shares of NTR were changing hands in Toronto at C $0.145 on light volume of 130,000 shares. For a full sized version of the image above please follow the link below. Januray 23, 2012 (Source: Ink Research) http://www.canadianinsider.com/node/7?menu_tickersearch=ntr Disclosure: Northern Tiger Resources is a Vulture Bargain Candidate of Interest (VBCI) and is our fully fledged Vulture Bargain #7. Members of the GGR team are actively accumulating and hold long positions in NTR.V or NTGSF. |

| Posted: 24 Jan 2012 01:35 AM PST The Discovery program Bering Sea Gold starts this Friday, after their other gold program Gold Rush (formerly Gold Rush Alaska). From the little previews I've seen it looks kind of interesting, kind of in as much as it's about four crews of dredgers, one crew looks pretty well 'professional' the other three.... slapped together home built rigs. Time will tell. Let's see, they have a placer show, a dredging show, now all they need is a hard rock mining program. |

| Japan Gold Buying on TOCOM Again Supports Posted: 24 Jan 2012 01:31 AM PST |

| View From the Turret: A Day Late and a Dollar Short Posted: 24 Jan 2012 01:19 AM PST

So far this year, the overall market has traded with a significant amount of resiliency. Despite ongoing uncertainty from Europe, weak manufacturing data from China, and growth concerns in India, equity prices have continued to advance. This is a welcome shift from last year's environment of constant shifting between "risk on" and "risk off" – with few trends, sector differentiation, or sustained trade opportunities. Today's Teflon market (bad news doesn't stick) makes sense as managers scramble to keep up with benchmarks, and its not surprising to see high beta names being accumulated. While two weeks ago we had the "official" start to earnings season, this week earnings reports are picking up momentum with dozens of names reporting each day. The information flow gives us a good chance to evaluate both fundamental and sentiment strength. The key in this environment is to look at not only the data being reported, but more importantly the reaction to individual company releases. Just because a company "beats expectations" doesn't mean the stock will shoot higher. Management guidance, whisper numbers, product commentary, and a myriad of company-specific items can affect the trading reaction. Our trading book is now almost exclusively bullish (with a short euro trade as our only bearish position), but we still have a material amount of cash and the ability to use leverage if the environment continues to strengthen. We can shift our exposure quickly if necessary, but for now the reward-to-risk is attractive for adding bullish exposure on pullbacks to support or breakouts from wedge patterns. Below are a few of the areas we are watching carefully this week…

Want to trade like a Global Macro pro? Learn the secrets of the Global Macro titans. Sign up for your FREE Report now! Biotech Benefits From New Technology The biotech area has been particularly strong over the past few months as advances in technology are creating new opportunities. This weekend, Investors Business Daily ran an interesting piece on "biosimilars" – biotech drugs that are similar to the "live" drugs that are currently in use, but more efficient and less costly to produce. The FDA has indicated that they will be evaluating this new class of drugs with rulings on particular situations expected early this year. Approvals for particular biosimilars would open both opportunity and risk as the potential for generic reproduction could cut profit margins for legacy drugmakers, while increasing profit for generic firms – or increasing volume due to lower-priced offerings. So far this year, the iShares Nasdaq Biotechnology (IBB) ETF has been a winner with the group breaking to a new high early and following through on the breakout. At this point, the broad sector is a bit extended and may pull back for a few sessions. But given the strength over the last several months, a pullback would be more likely to set up a strong buying opportunity barring a major negative announcement from the FDA. At the beginning of December, the Mercenary Live Feed took a bullish position in Biogen Idec (BIIB) as the stock broke out of a tight consolidation. The bullish action has been slow to develop for this position, but as the sector continues to move higher, we are able to tighten our risk point and have a meaningful unrealized profit at this time.  Precious Metals Rebound? As equities continue to rally, gold and silver prices are starting to come out of their slump as well. The fact that precious metals can rebound despite a relatively strong dollar is a healthy indicator of demand. Gold prices have recently been associated with a "safety bid" as retail investors and professionals alike have used the yellow metal to hedge against inflation. But silver prices can have significantly different characteristics. Silver has become much more of a speculative vehicle – rising when managers are willing to accept more risk, and falling during times of liquidation. Part of this price action stems from the fact that silver is both a precious metal AND an industrial metal. Silver has uses in circuitry, medicine, and other industrial sectors; so as expectations for an economic rebound increase, the perceived demand for silver also grows. Last week, silver prices rallied sharply and crossed above the key 50 day EMA (Exponential Moving Average). This after the commodity broke to a new low in December and immediately reversed higher. Today, we could see both short covering as well as organic buying driving prices higher – and a consolidation after last week's action could set up a nice buy point for later in the week. Building Materials – Following Housing Trend Over the last few weeks, we've talked several times about the positive homebuilder action. Sentiment is shifting in this area as housing starts pick up, prices stabilize, and shadow inventory begins to move.  While home construction stocks may be the logical "first step" to investing in this rebounding area, building suppliers also offer a unique opportunity. The building supply industry is benefiting not only from a strong housing market, but also from a positive farm environment. While home construction stocks may be the logical "first step" to investing in this rebounding area, building suppliers also offer a unique opportunity. The building supply industry is benefiting not only from a strong housing market, but also from a positive farm environment. Two weeks ago, Tractor Supply Co. (TSCO) gapped to a new high after pre-announcing strong fourth quarter numbers. The company will officially release earnings on February 1st, but the preliminary figures were strong and investors bid the stock sharply higher. TSCO caters to recreational farmers and ranchers – along with a number of small business clients. Overall rising sentiment for the broad economy has had a positive effect on TSCO's business, and the company is smaller and more nimble than heavyweights in its industry. This puts TSCO in a better growth position – making the company attractive to growth managers and institutional investors seeking "high beta" exposure to the construction / machinery industry. Options Spotlight Our screen from the Mercenary Options Dashboard turned up an interesting setup for this week. The ProShares Ultra Silver (AGQ) has a very attractive buy write opportunity that provides nearly 30% downside protection while still yielding more than a 20% annualized return. Obviously, silver prices have been more volatile lately (hence the attractive option premium). But with a bullish environment and silver breaking through resistance levels, the reward to risk looks extremely positive. According to the screen, traders can buy AGQ and sell the March 45 calls against the ETF for a nominal return above 3%. The expected breakeven point would be $43.22 – roughly allowing for a 30% drop in the ETF before the position turns negative. With our cash position relatively high, and our perspective turning more bullish, this looks like an attractive place to park some capital as we continue to scout for attractive swing trade opportunities. Once again, my apologies for the delay in posting the View From the Turret this week. There are a lot of moving parts to this market and we've got our hands full this earnings season. Trade 'em well this week!

|

| LISTEN: Schiff on This Week in Money Posted: 24 Jan 2012 01:05 AM PST In This Week in Money, Peter Schiff speaks about the surprising strength of the US dollar. ~TVR |

| Posted: 24 Jan 2012 12:40 AM PST Indians to Pay for Iranian Oil With Gold from GoldMoney.com:

Comex gold futures for February delivery gained 0.9% to settle at $1,678.30 per troy ounce. Silver for delivery in March gained 1.9% to settle at $32.27 per troy ounce – another solid day for the white metal, though it keeps banging up against selling resistance around $32.50. Read More @ GoldMoney.com |

| Must-read take on Congress' outrageous new tax proposal Posted: 24 Jan 2012 12:20 AM PST From Dan Ferris in the S&A Digest: We've written a lot about how new drilling technologies have led to a boom in U.S. natural gas supplies… and how the flood of resources is transforming the domestic energy and manufacturing sectors. This trend is at the heart of what I've termed the "American Industrial Renaissance." In short, the new technologies have allowed industry to extract gas from shale rock formations. And the U.S. has huge gas deposits in shales. The Marcellus shale alone is half the size of Spain. And it sits between two other large shale formations, the Utica shale and the Upper Devonian shale play – neither of which have been explored much. ... In addition to vast new natural gas deposits, massive new oil resources are also being exploited all over the North American continent. Thanks to the oil-rich Bakken shale within its borders, North Dakota is on pace to produce about as much oil as Ecuador, a member of the OPEC oil cartel. The Eagle Ford shale in south Texas is shaping to become the largest oil find in U.S. history. We already produce so much oil in the U.S. that we've started exporting the stuff. It's only a matter of time before big new supplies reduce the price of oil and gasoline. But Congress knows nothing of the marketplace. It deals in politics only, not economic fact. So six Democrats from the House of Representatives have proposed a new "Reasonable Profits Board," which would apply a windfall-profits tax as high as 100% on oil and gasoline profits. Naturally, the proposal contains no indication of what would constitute a "reasonable" profit. This issue has been in the air for most of my life. I was born in 1961 and vividly remember sitting in lines at the gas station in the morning on my way to school, when gasoline was rationed. You HAVE to be a politician to be this stupid. Selling gasoline is one of the crappiest, lowest-margin businesses around. If you don't attach a convenience store to it, it's generally not worth doing. And refining oil isn't much better… I just looked up a couple of refining stocks. Tesoro made losses three times in 10 years and reported net margins of less than 2% three times. Valero really knocked the cover off the ball with only two losing years out of 10 and three years of sub-2% net margins. And when they're firing on all cylinders, net margins rose to more than 5% once at Valero (in 2006) and more than 4% once at Tesoro (also 2006). I never recommend refiners in my newsletters for the same reason I don't recommend airlines. They're just not profitable on a consistent basis. But Congress says they're making too much money. If the legislators wanted to guarantee a reasonable profit from selling oil and gasoline, they wouldn't tax it. They'd subsidize it. Instead, they're running around trying to get votes by putting refineries and gasoline stations out of business, claiming they make too much money. What about people who lend out your bank deposits (10 times over) and forbid Wal-Mart from entering their business because the retailer's model would only benefit customers, not cronies? Are they making too much money? What about people who get protection and money from the government to keep the national price of sugar double the global price? Are they making too much money? What about people who get money from the government to grow corn so they can do the most expensive possible thing with it – turn it into ethanol? Are they making too much money? None of those people are making too much money because Komrade Obama and his ilk love them. But people who sell gasoline… one of the skinniest margins on Earth… a product without which life as we know it comes to a grinding halt… they're making too much money. The politicians are only doing what any rational person expects of them. They're trying to make good sound bites for the voting masses, as if the political process had all the depth and meaning of a Disney movie trailer. "Coming soon: Hope, Change, and Reasonable Profits!" More government stupidity: Unbelievable: Sen. Rand Paul detained today by TSA Top banking insider BLASTS Federal Reserve... Calls for new gold standard "Reasonable Profits Board": Congress is now pushing for another incredibly stupid law |

| World Gold Council – Record Central Bank Gold Buying in 2011 Posted: 24 Jan 2012 12:12 AM PST Our friends at Stephen Flood's GoldCore.com write in today's update: "The World Gold Council published its yearly report on gold's performance for 2011. They report, "During 2011, the US dollar price of gold rose by 9% ending the year at US$1,531/oz based on the London PM fix, marking the 11th consecutive year of price increases. During the first part of January 2012, the price of gold continued its upward trend above the US$1,600/oz level." Continued... Central bank gold purchases are expected to have hit another record in 2011, while demand for gold-backed exchange-traded products fell to less than half of that seen in 2010 last year, according to a report from the World Gold Council on Monday.The WGC, an industry-backed group, said in November it expected central banks to add some 450 tonnes of gold to their existing reserves in 2011, driven mainly by purchases from emerging economies that are seeking alternative investments to the U.S. dollar. Source: World Gold Council - Reuters graphic "Central bank net-buying is poised to have a record year, and many of these purchases happened during Q3 and Q4. Additionally, investment activity remained healthy as market participants continued to access the market whether through bars and coins or other vehicles," the council said in a report. "In fact, gold-backed ETFs, collectively, added 75 tonnes of gold between September and December alone (out of 153 tonnes during the full year)," it said. Demand for gold-backed ETFs in 2010, when the reach of the euro zone debt crisis first became apparent with the bailouts of Greece and Ireland, reached 367.7 tonnes, according to WGC data. Rising equity market volatility and a desire among safety-conscious investors for cash in the run-up to the end of the year knocked the gold price back from September's record highs to December's closing levels around $1,564.00. Since then, gold has risen by nearly 8 percent to trade around $1,670 an ounce in London at 1455 GMT. "Our analysis shows that there have only been six previous instances in which the price of gold has fallen by more than 10 percent over the past decade and once the price has stabilised to a certain (typically new) level, it resumed its upward trajectory," the World Gold Council said, but did not include any price forecasts for 2012. "Moreover, the price pullback experienced this last September was less pronounced than the pullback gold experienced during 2008. Even then, gold rose to finish the year with positive returns. Beyond the day-today market movements, the underlying gold price trajectory is based on its long-term supply and demand dynamics which remain robust," the council said." - GoldCore.com. Entire update at the link below. Source: GoldCore.com http://www.goldcore.com/goldcore_blog/japan-gold-buying-tocom-again-supports Comment: We have added the 8-page WGC summary to our "Special Reports Section" on the member pages. |

| Gold is money?! Indians to pay for Iranian oil with gold Posted: 23 Jan 2012 10:00 PM PST Markets enjoyed another "risk on" day yesterday, with stock markets and commodities all recording gains on the back of a weakening US dollar. The Dollar Index fell below 80, with the gold ... |

| Gold & Silver Market Morning, January 24, 2012 Posted: 23 Jan 2012 09:00 PM PST |

| Marcus Grubb of the World Gold Council Posted: 23 Jan 2012 08:51 PM PST from BullMarketThinking: I had the spectacular opportunity last week to speak with Marcus Grubb, Managing Director of Investment with the World Gold Council. It was an exciting interview to say the least, as the World Gold Council is the world's preeminent gold organization whose member companies represent nearly 70% of global gold production. Part One Part Two During the interview, Marcus shared his thoughts on the changing global perception of gold by investors, governments, and central banks, efforts by the World Gold Council to catalyze global gold demand and delivery systems, as well as the future of gold in the world's financial system. Beginnin A key role of the World Gold Council continued Marcus, is to "Effectively work with commercial partners to catalyze new channels and products–new access vehicles all around the world. Those access vehicles can either be for professional investors such as ETF's…but also they can be more in the retail initiatives…the Gold Accumulation Plan in China was signed roughly two years ago, and it was a deal I was involved in catalyzing for the World Gold Council and the ICBC(Industrial and Commercial Bank of China)…we assisted ICBC in launching a gold accumulation scheme in China through their branch network. Basically these are products where an investor can open an account at the branch bank and make a regular deposit of funds into that account thro Regarding the success of the ICBC Gold Accumulation Plan, Marcus commented, "The program in China has now reached something close to two million account holders and a very considerable amount of gold, something over a billion dollars of vaulted gold is now held in the ICBC gold accumulation scheme." With respect to the World Gold Council's efforts on the India Post Program, Marcus said, "The India Post Program…is a program where through the network of India Post we assisted them in launching a physical gold coin, which is effectively endorsed by India Post which is owned by the government of India, and this is sold in a special tamper proof pack, over the counters of the India Post network—which is as you might imagine a vast network across all the One of the more fascinating comments Marcus made regarding these gold delivery vehicles is that,"It's absolutely true that these products could well have applicability in other markets. I can't say too much more about it, but we are looking at a number of other countries where these kinds of…gold accumulation plans could well be very appropriate products for the needs of consumers in those markets." When asked about the perception of gold globally, and it's future, Marcus replied, "What you've seen is a trend recently for gold to become more and more a part of the fabric of the financial system, the most recent developments in that direction were last year with a number of major exchanges and clearinghouses behind major exchanges around the world, publically stating that they would accept gold as a c More at BullMarketThinking.com |

| Intervention in Libya Was Largely About Gold: Jim Rickards Posted: 23 Jan 2012 08:50 PM PST ¤ Yesterday in Gold and SilverThe gold price was up about ten bucks by the time lunchtime rolled around in London yesterday, but by 9:30 a.m. in New York, all that gain had disappeared. From that low, gold rallied about fifteen bucks to just above the $1,681 spot level, before selling off a hair into the close of electronic trading at 5:15 p.m. in New York. Gold closed at $1,676.30 spot...up $9.30 on the day. Net volume was a very light 91,000 contracts. Silver's price path was more 'volatile'...and traded within a 40 cent range of $32.30 spot. Maybe it was just me, but I got the impression that every time silver made a serious attempt to break out to the upside, it ran into a willing seller. The silver price closed at $32.35 spot...up 15 cents on the day. Net volume was pretty heavy at 39,000 contracts...a lot of which I would expect was the of the high frequency trading variety. The dollar index spiked up about 20 basis points right at the open on Sunday night...and then traded sideways until the London open at 8:00 a.m. GMT, which was 3:00 a.m. Eastern time. From there, the index shed about 70 basis points, with the absolute low of the day coming at 11:30 a.m. in New York. From there it rallied a bit into the closed. The precious metals certainly didn't follow the dollar move very well. Although both began to rally at the London open, both gold and silver got sold off pretty noticeably in the two and a half hour period between 7 and 9:30 a.m. New York time...despite the fact that the dollar was moving strongly lower. The gold stocks pretty much followed the gold price action during the New York trading session...with the high of the day coming at the 11:30 a.m. Eastern high in gold. From that high, the stocks got sold off a hair, but rallied a bit into the close...with the HUI finishing the day up 1.46%. Despite the fact that the silver price only closed up 15 cents, the silver stocks did pretty well for themselves...especially the junior producers. The big news of the day in the silver world yesterday was the $1.5 billion takeover of Minefinders by Pan American Silver. Pan Am's stock took a big hit...and because it makes up a very large chunk of Nick Laird's Silver Sentiment Index, the SSI only closed up 0.25% on the day. (Click on image to enlarge) The CME's Daily Delivery Report showed that 2 gold and 97 silver contracts were posted for delivery tomorrow. In silver it was, as usual, Jefferies once again as the only short/issuer of note....and the Bank of Nova Scotia and JPMorgan as the long/stoppers. As I mentioned before, this 3-ring delivery circus has been going on all of January between these companies. The link to the Issuers and Stoppers Report is here. Despite the rising gold price recently, there was a withdrawal of 165,246 troy ounces from GLD yesterday, but there were no reported changes in SLV. The U.S. Mint had a sales report yesterday. They sold 7,500 ounces of gold eagles...1,000 one-ounce 24K gold buffaloes...and 250,000 silver eagles. Month-to-date the mint has sold 113,500 ounces of gold eagles...10,500 one-ounce 24K gold buffaloes...and 5,547,000 silver eagles. Over at the Comex-approved depositories on Friday, they reported receiving 311,849 ounces of silver...and shipped 499,529 ounces out the door. Here are three free paragraphs from silver analyst Ted Butler's weekend commentary to his paying subscribers. "We've rallied around $120 in gold from late December on an increase of only 10,000 contracts or so in the commercial net short position. In silver, we've rallied a few dollars on about a 6000 contract increase in that commercial position. Considering that we were at historical lows in the commercial short position in each by many measures and still are, that's not too shabby. This doesn't mean we won't experience sell-offs and continued price volatility, but we are not close to bearish COT readings in gold or silver. In COT terms, there is plenty of room to run higher in price in both gold and silver. In percentage terms, of course, the biggest potential to run is in silver, in my opinion. "Considering the technical clean out we've just experienced in both gold and silver over the past few months and the proximity of some key moving averages above current prices in each that threaten to be penetrated, it is not hard to envision strong price rallies. Of course, we are still discussing markets that are manipulated in price, so we must be prepared for anything. The best preparation is not to borrow or deploy margin. "What next? Was the silver surge on Friday the breakout signaling much higher prices to come or a fake out designed to lead to lower prices and further disappointment? We can't predict the future with unquestioned accuracy; but we can prepare ourselves for it based upon the probabilities. Silver looks cheap based upon almost any measure except where it was priced 5 or 10 or 20 years ago. The COT set up looks better than I would have guessed several months ago. I never would have imagined in August and September that the commercials could reduce their net short position to the 20,000 contract level or lower. It took the most egregious manipulative sell-off for them to have accomplished that feat amid much damage and consternation to innocent silver investors. But perhaps it's true that what doesn't kill you makes you stronger." I'm up early in the morning to catch a plane back to Edmonton after the Vancouver conference, so I'm going to cheat once again and only post the linked headline to each story, as I don't want to be up all night doing this column. I apologize once again that I will not be able to give attributions to all the kind readers who sent me these stories. With the dollar down sharply during London and New York trading yesterday, I was more than disappointed that both gold and silver did not perform better. Gold breaking out, will hit new all-time highs: Egon Von Greyerz. Currency Wars: Iran Banned from trading gold and silver. Gold-market rigging has many whistleblowers; they're just always ignored. Gold's Happy New Year. ¤ Critical ReadsSubscribeBaltic Dry Index Plunging to Near Historic LowsI have a lot of stories, so I hope you have a lot of time. 1] Baltic Dry Index Plunging to Near Historic Lows - Silverdoctors.com 2] Appeals court dismisses suit over new CFTC rule - Yahoo.com 3] Top Justice officials connected to mortgage banks - Reuters 4] Thoughts on the Crisis of Capitalism - Doug Noland, Prudentbear.com 5] Fed would admit devaluation is policy, then keep underestimating it - Reuters 6] European banks prepare for worst, hoard cash - IFR/Yahoo 7] Portugal falls victim to Greece's debt swap ordeal - Reuters 8] Greek debt deal hits setback as talks suspended - The Telegraph 9] Eurozone finance ministers reject Greek debt offer - The Telegraph 10] 'Unprecedented Sanctions' - EU Agrees on Tough Oil Embargo Against Iran - spiegel.de 11] Oil prices rise over sanctions on Iran - The Telegraph 12] Iran oil sanctions spark war of words between Tehran and Washington - The Guardian 13] Sheikhs fall in love with renminbi - Asia Times 14] Currency Wars - Iran Banned From Trading Gold and Silver - Zerohedge.com 15] Gary North: Auditing the Fed's gold - GATA.org 16] Intervention in Libya was largely about gold: Jim Rickards - GATA.org 17] James Turk: Using vaults to store gold and silver - Goldmoney.com 18] HK$51m in gold and silver is grabbed - South China Morning Post 19] Gold-market rigging has many whistleblowers; they're just always ignored - GATA.org 20] 'Gold can't be faked,' Mr. Zhang? Ever hear of the LBMA, JPMorgan and the Fed? - FT 21] Gold to keep rising until real rates go positive: Sprott Asset Management - Mineweb.com 22] Back-door QE in Europe good for gold, Eveillard tells King World News - KWN 23] Commodities: gold equities could finally start to perform - The Telegraph 24] Gold Breaking Out, Will Hit New All-Time Highs: Egon Von Greyerz - KWN 25] Interview With GATA: No More Tinfoil Hats - Resource Investor 26] Gold's Happy New Year: Peter Brimelow - Marketwatch.com  ¤ The WrapWith the dollar down sharply during London and New York trading yesterday, I was more than disappointed that both gold and silver did not perform better...as both metals got sold off between 11:30 a.m. in London right up until the equity markets opened in New York at 9:30 a.m. Eastern time. I was quite happy with the preliminary open interest numbers from yesterday, but with delivery coming up on the February gold contract, there's lots of roll-overs and spread trades being removed, so I'm not about to read too much into them. However, we are now above the 50-day moving average in gold by a few dollars...and have been above silver's 50-day moving average since the big run-up last Friday. To add to that technical situation, the dollar index is hovering just above its 50-day moving average...and if/when it falls through that, things could get interesting in both gold and silver rather quickly. We'll find out soon enough, I would think. Here's one of the chart from my Vancouver presentations over the weekend...and they created a sensation in the audience when they went up on the big screens. This chart was no exception. It starts on January 1, 1970...and ends on December 31, 2011...which is 42 years. (Click on image to enlarge) The most amazing thing that it shows is that there hasn't been a positive year worth mentioning between the London a.m. and p.m. fixes since 1979...which is 32 years ago. And you'll also note that the price pressure between the fixes has been increasing just about every year of this 13-year bull market...and there's no chance that this is random market forces at work. The 'fix' is definitely in. As always, I thank Nick Laird over at sharelynx.com for his incredible efforts in making all the LBMA data come to life. Not much happened in either metal in Far East trading. Both were sold off a bit in the early hours in the Far East, but recovered back to unchanged by the London open at 8:00 a.m. GMT...which is 3:00 a.m. Eastern time. The dollar is flat as of 3:21 a.m. Eastern time...and volume in both metals is shockingly light. In gold, the volume is under 8,000 contracts...and in silver it's under 2,000 contracts. That's amazing for this time of month. And as I hit the 'send' button at 3:58 a.m. Eastern time, I note that gold and silver hit their respective highs shortly before London opened...and are now heading lower. However, on this amount of volume, I'm not prepared to read a lot into that. Volume's have jumped up a bit in both metals, but are still in the 'shockingly light' category, considering the fact that London has been open an hour. As I mentioned earlier, I have a plane to catch this morning...and I still have to pack and get some sleep, so I'll sign off here. See you on Wednesday.

|

| Posted: 23 Jan 2012 08:00 PM PST The markets are rising above moving averages. How long will it continue? A look at the markets by the numbers. Dow Jones Industrial Average: Closed at 12623.998 +45.03 breaking out and above serious resistance through a top line channel and out of the interior of a triangle apex. Volume was 110% of normal and momentum was mildly higher. Price is far above all moving averages. Next upper resistance is 12750-13,000. The Dow is free of five key resistance points with nothing above price but clear air. More buying on Friday and Monday and some clear sailing after this breakout for most stocks and their indexes. S&P 500 Index: Closed at 1314.50 +6.46 on 105% of volume and rising momentum. Price is still stuck inside its triangle but we can see the larger wave three up ready to give the S&P's a buying boost. The price of 1315 is current resistance at close; and 1325 is the next higher number. Price is above moving averages and support is 1300. Erin Swenlin at DecisionPoint said today, "We finally saw a sustained breakout above 1300. The market opened higher after a positive housing report was released and kept on climbing as good news arrived out of Greece regarding a temporary settlement with private debtors." She is correct but the news was all a fairy tale to pump markets; but it sure worked. On Friday-Monday expect more buying, from a triangle breakout with our next stop at 1325 and then 1350 resistance. Don't trade against rising trends. S&P 100 Index: Closed at 594.93 +2.41 with three closes above hard upper channel line resistance. Volume was +105% and momentum is up. With buying rising freely and no nearby resistance points, we can see the price going to 600 and 615 quite easily. Current resistance is mild at 595. Support is 585.00. I can see some profit-taking at the end of January with this rally continuing for nearly another month. Nasdaq 100 Index: Closed at 2441.70 +15.74 on faster, rising momentum and 105% of normal volume. Not only did this index jump-up and through top channel and price resistance at 2400, but it had a big up-day Wednesday and then gapped up even higher on Thursday. We are on or near the highest highs for the year for this index. Support is 2525 to 2530 and resistance is 2500. Google stumbled but IBM and most of the other techies did quite well. Look for more buying on Friday and Monday of next week. 30-Year Bonds: Closed at 142.81 -0.34 and were topping and selling against hard, upper resistance at 145.00. Improvement in the Euro currency and Euro-bond news put a cap on the 30's rise. Price still clings to the underside of the former bull supporting channel line. With stocks rising we can see the bond pattern going into a fade and sell. The Euro was back at 126.50 this past week and is now at 129.69. It is coming back up on being oversold. Close-by resistance is 143.00 and support is the 20-day at 142.76 and 142.11 on the 50-day. More selling pressure on Friday and Monday. In the middle of next week, bonds could be 140.00. XAU: Closed at 188.04 -3.16 selling down toward 180.00 on our previous forecasts. Momentum was up but is turning flat to down. Price is under all moving averages. Next lower nearby support is 185 then down to 180 and maybe even 175.00. The metal to shares ratio, which is 90% correct in forecasting has turned down. Do not despair on precious metals their related shares. We should bottom out on normal technicals next week followed by new and lower basing support. Then, we see a new six week rally with at least a 25 point jump in the XAU. After a mid-March correction, an even larger and stronger spring rally extends into the first 10 days of April. This will be driven by and higher precious metals prices. Gold: Closed at 1657.80 -2.90 on rising momentum and the price above all moving averages. January is usually a weaker or flat month for gold. However, pent-up demand from being oversold and the enormous amount of physical buying will firm this market. It provides a new floor for a major springboard rally toward $2,050 with a couple stops at 1708 and 1750-1923. Price of 2,000 is a major resistance point. However, with the strength we see in gold, we think an overshoot could be expected to 2,048.50 major resistance. Gold can go even higher this year but we see a top at the $1923-2050 trading range for the first and second quarters. If we touch $2,250-2,450 this year, it's probably going to be this fall in the 4th quarter. Silver: Closed at 30.62 +0.11 on rising momentum and a price above the 20-day average at 29.84. We have a great deal of resistance between the close and $34.48. There are probably at least 6-7 stop and go resistance points in that price range. This will slow silver to a crawl unless some real drama occurs in the news. Physical silver coin markets are setting new records. Foreign buyers especially in Asia and the Middle East are purchasing gold by the ton. Considering this, one would think the paper silver and gold should be fast track buyers. However, we must get past the settling-basing stage first. Have some patience and you will be rewarded. Expect a week of selling then we see the new rallies begin. US Dollar: Closed at 80.10 -0.42 as the dollar peaked at 81.80 with new selling underway. The momentum pattern made a bear double top and turned down to sell. First lower support is 80.00, which is very firm. When that is broken, a next lower price of significance is 78.50 support. We also have a 50-day moving average at 79.51 providing hard support. Last year from an early January peak above 81.00, the dollar sold back to 72.50 support. While it could do that again we think the dollar stops selling in mid-March after the next major Euro-land meetings. That could be a sinker for the Euro causing the dollar to rebound. From this coming Friday to following Friday, I expect the dollar to trade between 80.00 and 78.50. Crude Oil: Closed at 100.54 -0.41 with price in a trading channel between 98.50 and 102.50. Momentum is weaker and turning down like gold. Price remains above all the moving averages offering good support and a more bullish pattern. It is possible for oil to trade in chop for about one more month before moving-up faster in a strong spring rally. Before we really get moving up here, I think the price can sink back to $95-$96 first; then we begin a stronger move from $95 to $120-$125 by the end of April. Gasoline will be over $4 on refinery closings and inflation. Natural gas is bottoming at $2.20 to $2.40. These lows would then be followed by a mild rally on heavy, over-done natural gas reserves. Nat gas is smothering green energy. CRB: Closed at 311.96 +1.45 on toppy and flattening momentum. Price is trading in a choppy channel at 308 to 312. Resistance is the 200-day average at 319.99; say 320.00. Support is 310. We are sideways to lower through the end of January followed by three months of rallies. -Traderrog This posting includes an audio/video/photo media file: Download Now |

| Pan American Silver wishes to buy Minefinders for $1.5-billion Posted: 23 Jan 2012 07:46 PM PST |

| Gold prices are driven by Asia, not inflation Posted: 23 Jan 2012 07:44 PM PST |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

Markets are not nature's creation, whose movements and events are definable with mathematical precision. Markets are human creations, subject to the emotional swings of the buyers and sellers. This is true from market bottom to market top; and back to the bottom again. To understand markets, one must understand human psychology, and to understand human psychology, one only has to remember their high-school days where what was in or out, good or bad, smart or dumb was decided by whatever peer group they identified with. Those rare individuals who think for themselves, rejecting the opinion of the group, usually find themselves a lone-wolf in human society. This is especially so in the market place.

Markets are not nature's creation, whose movements and events are definable with mathematical precision. Markets are human creations, subject to the emotional swings of the buyers and sellers. This is true from market bottom to market top; and back to the bottom again. To understand markets, one must understand human psychology, and to understand human psychology, one only has to remember their high-school days where what was in or out, good or bad, smart or dumb was decided by whatever peer group they identified with. Those rare individuals who think for themselves, rejecting the opinion of the group, usually find themselves a lone-wolf in human society. This is especially so in the market place. The year 2011 ended on a very weak note for the price of gold, which tested support near the lowest levels since August as the precious metal slid below $1,550. This movement even drove the GoldMoney Fear Index below 3% as US M3 continued to rise, surpassing $14.4 Trillion. The downward path of gold since the September highs immediately prompted cries that the "bubble was bursting" from every corner of the financial press.

The year 2011 ended on a very weak note for the price of gold, which tested support near the lowest levels since August as the precious metal slid below $1,550. This movement even drove the GoldMoney Fear Index below 3% as US M3 continued to rise, surpassing $14.4 Trillion. The downward path of gold since the September highs immediately prompted cries that the "bubble was bursting" from every corner of the financial press. Talk of economic recovery is surfacing even in the Rick's Picksforum, and so it's probably a good time to consider why the very notion of a sustained recovery is factually unsupportable. It's not hard to fathom why sightings of supposed economic green shoots have returned like kudzu in recent weeks. For one, Europe's slow-motion collapse has been put on hold by an all-out effort by the central banks to suppress sovereign borrowing rates. This is being accomplished through "swaps" that allow the European Central Bank to exchange unlimited quantities of euros for Fed dollars for a nominal charge of 50 basis points. In effect, U.S.- style monetization is being surreptitiously applied to paper over Europe's debt problem. For two, with the Fed artificially holding mortgage rates near all-time lows, home sales – although, significantly, not home prices – are staging a dead-cat bounce. And for three, the endless election campaign has provided comic distraction for a nation terminally fatigued by real news. The news media are undoubtedly relieved to be able to report the meaningless details of an endless campaign because it frees reporters and editors from having to tackle more challenging subjects. (Full disclosure: Your editor was a newspaper editor and reporter for seven years.)

Talk of economic recovery is surfacing even in the Rick's Picksforum, and so it's probably a good time to consider why the very notion of a sustained recovery is factually unsupportable. It's not hard to fathom why sightings of supposed economic green shoots have returned like kudzu in recent weeks. For one, Europe's slow-motion collapse has been put on hold by an all-out effort by the central banks to suppress sovereign borrowing rates. This is being accomplished through "swaps" that allow the European Central Bank to exchange unlimited quantities of euros for Fed dollars for a nominal charge of 50 basis points. In effect, U.S.- style monetization is being surreptitiously applied to paper over Europe's debt problem. For two, with the Fed artificially holding mortgage rates near all-time lows, home sales – although, significantly, not home prices – are staging a dead-cat bounce. And for three, the endless election campaign has provided comic distraction for a nation terminally fatigued by real news. The news media are undoubtedly relieved to be able to report the meaningless details of an endless campaign because it frees reporters and editors from having to tackle more challenging subjects. (Full disclosure: Your editor was a newspaper editor and reporter for seven years.)

Apologies for the delay in this week's VFTT…

Apologies for the delay in this week's VFTT…

Markets enjoyed another "risk on" day yesterday, with stock markets and commodities all recording gains on the back of a weakening US dollar. The Dollar Index fell below 80, with the gold price also benefiting from increasing brinkmanship between Iran and western nations, with the European Union announcing the implementation of an embargo on Iranian crude oil.

Markets enjoyed another "risk on" day yesterday, with stock markets and commodities all recording gains on the back of a weakening US dollar. The Dollar Index fell below 80, with the gold price also benefiting from increasing brinkmanship between Iran and western nations, with the European Union announcing the implementation of an embargo on Iranian crude oil. g the discussion with the mandate of the World Gold Council, Marcus said,"The World Gold Council is the market development organization for the world gold industry. It represents the mining producers; something close to 70% of mine production is represented by members of the World Gold Council…We have programs to promote gold demand on a worldwide basis, we produce research on the gold market, and we also invest in developing and creating new channels and new products to make gold more accessible, whether it be in jewelry, investment, technology, and we also speak to and lobby on official use of gold and communicate regularly with the central banks."

g the discussion with the mandate of the World Gold Council, Marcus said,"The World Gold Council is the market development organization for the world gold industry. It represents the mining producers; something close to 70% of mine production is represented by members of the World Gold Council…We have programs to promote gold demand on a worldwide basis, we produce research on the gold market, and we also invest in developing and creating new channels and new products to make gold more accessible, whether it be in jewelry, investment, technology, and we also speak to and lobby on official use of gold and communicate regularly with the central banks." ugh a standing order or direct debit mechanism. Then the bank supplying the program buys gold on a daily cost average basis, so they take that monthly payment and use it to buy gold and accumulate metal in an account for the consumer."

ugh a standing order or direct debit mechanism. Then the bank supplying the program buys gold on a daily cost average basis, so they take that monthly payment and use it to buy gold and accumulate metal in an account for the consumer." twenty plus states of India…That program has also been very successful in making gold more accessible in cities, but also in more rural parts of India as well."

twenty plus states of India…That program has also been very successful in making gold more accessible in cities, but also in more rural parts of India as well." ollateral asset in financial transactions…therefore I think it's pretty clear that the trend is for the importance of gold to be increasingly appreciated by governments and central banks around the world."

ollateral asset in financial transactions…therefore I think it's pretty clear that the trend is for the importance of gold to be increasingly appreciated by governments and central banks around the world."

No comments:

Post a Comment