Gold World News Flash |

- Louise Yamada - Gold & Silver Bulls to Continue Stampede

- Jan 9, 1933 : South Africa goes off the Gold Standard

- Numeraire

- Guest Post: The Making Of China's Epic Hard Landing

- Tebow Time

- Tick By Tick Research Email - The Austerity Story

- 50 Economic Numbers From 2011 That Are Almost Too Crazy To Believe

- Newt Gingrich: Bashes Pres. Obama as Hopeless

- Complex Systems, Dysfunctional Industries, and Catastrophic Collapse

- Non-Farm Payrolls: The TRUTH And The CON In Confidence

- Gold Market Update

- USD/CAD Could Rise to 1.08

- Reversal of Fortune: Soros Said to Buy Gold Again Late Last Year

- Russia, Iran Proceed With Bilateral Trade, Drop Dollar; Russian Warships Park In Syria; Iran Accelerates Nuclear Enrichment

- Sunday Stuff

- Empire Club Outlook 2012: Why Rising Debt Will Lead to $10,000 Gold

- Gene Arensberg: Silver, you ain't seen nothin' yet

- Got Gold Report – Silver, You Ain’t Seen Nothin’ Yet

- Economic System a Legal Ponzi Scheme on the Verge of Collapse!

- Silver Market Update

- Guest Post: 2012 - The Year Of Living Dangerously

- Rocks and Hard Places

- Silver Update: 1/8/12 Challenging Chilton

- In the News Today

- Silver Head and Shoulders Top Suggesting Price Crash

- Gold Strongly Bearish Price Patterns and COT Confusion Cleared

- Huh? When the Fed Balance Sheet Expands, it’s actually U.S. Dollar Bullish!?

- 8 tr. in Gold vs. 750 tr. in derivatives

- Warning Fake High Quality Gold, Silver Coins and Ignots

| Louise Yamada - Gold & Silver Bulls to Continue Stampede Posted: 08 Jan 2012 05:31 PM PST  With gold hanging around the $1,600 level and silver near $29, today King World News is pleased to share with KWN readers a piece of legendary technical analyst Louise Yamada's "Technical Perspectives" report. This information is not available to the public and we are grateful to Louise for sharing her incredible work with KWN readers globally. With gold hanging around the $1,600 level and silver near $29, today King World News is pleased to share with KWN readers a piece of legendary technical analyst Louise Yamada's "Technical Perspectives" report. This information is not available to the public and we are grateful to Louise for sharing her incredible work with KWN readers globally. This posting includes an audio/video/photo media file: Download Now |

| Jan 9, 1933 : South Africa goes off the Gold Standard Posted: 08 Jan 2012 05:30 PM PST |

| Posted: 08 Jan 2012 05:30 PM PST |

| Guest Post: The Making Of China's Epic Hard Landing Posted: 08 Jan 2012 04:28 PM PST Submitted by Dee Woo, The Making of China's epic hard landing 1. The unsavory episodes of China's economy For the better part of the past year, my concern about Chinese economy was constantly aggravated by the depressing stories of entrepreneurs who committed suicide, fleeted the country or emigrate to the western world in droves. Much of the media has blamed the credit crunch and monetary tightening for all these unsavory episodes. The public outcry for the deteriorating conditions for Chinese entrepreneurship climaxed with the seemly positive step the People's Bank of China(PBOC) took to alleviate the liquidity crisis: cut the reserve requirement ratio (RRR) to 21 percent from a record high 21.5 percent on Dec 5 2011. Right now the outlook for Chinese economy is looking rather confusing: should it continue the painful structural adjustment to burst the economic bubble built up after so many years of high growth? Alternatively, should it adopts the expansionary policy to reinvigorate the flagging economy? Either way China is approaching dangerously close to an epic hard landing. 2. It's the structural problems and not a liquidity crisis For one, it's easy to lay the blame on the tightening monetary policy. Nevertheless, nothing can be further from the truth. The main overseas markets for Chinese goods, Europe and the US, are both battling a possible recession, which greatly tightens their purse string. To make the matter worse, the cost push inflation, especially the wage inflation,is eating away the comparative advantage of China's manufacturing industry. All this has nothing to do with the tight monetary policy but the structural change of Chinese economy. (The manufacturing sector is bleeding. Purchasing Manager Index(PMI) has dropped to 49, lower than market expectation. This is the first time since Feb 2009 PMI contracted. The orders are declining, especially overseas orders, and the stocks are piling up.) In any case, the difficult access to credit for Chinese private small and medium businesses (SMBs), the driving force behind China's manufacturing industry, is a chronic problem long before the monetary tightening. More than 70% of the Chinese banking market is controlled by the "big four"--- Bank of China, the China Construction Bank, the Industrial and Commercial Bank of China and the Agricultural Bank of China. These state-owned commercial banks skew the monetary resource towards the state-owned enterprises or other privileged corporations. This allocation deficiency of Chinese banking system provides the breeding ground for China's huge and complicated shadow banking network, where most credit-starved private SMBs seek costly funding. The shadow banking system is awash with cash fleeting the negative real interest rate in the commercial banks, hardly regulated and monitored. In April 2011, 467.8 billion yuan of residential deposit left the commercial banks. We all can guess where the money ended up. Money is chasing positive yields into the wild wild west of shadow banks. Contrary to what many might like to assume, China now is not even close to suffering a liquidity crisis under the tightening monetary policy. There is more than enough liquidity to go around. China's M2 has surpassed that of the U.S. or Japan, as China's M2 is around US$ 11.55 trillion, exceeding the U.S.'s US$ 8.98 trillion and Japan's US$ 9.63 trillions. Regardless of all the hype of tight monetary policy, in 2010, Chinese banks issued 7.95 trillion yuan of loans, breaching the government's target ceiling of 7.5 trillion yuan. In 2011 the total new loan will stand comfortably close to 7.5 trillion. As of October 2011, the outstanding balance of RMB deposits totaled 79.21 trillion yuan,whose year on year growth rate is 13.6%. The PBOC's rate hike only removed 4.75 trillion yuan from circulation. According to Fitch rating, China's total social financing in 2011 may top 18 trillion yuan (US$2.8 trillion), a rise of 3.5 trillion yuan from the official target due to inflow of non-banking liquidity. Meanwhile, the PBOC claimed the total social financing of the first 3 quarters in 2011 is 9.8 trillion yuan, 1.26 trillion yuan less than that of last year. The PBOC's data suggests an effective tightening monetary policy while the Fitch report implies the opposite. The PBOC proves to be an inadequate central bank to rein in the liquidity binge Beijing have indulged itself in for so long during the boom time. Under such a gloomy context, China's credit expansion against all odds is still breath-taking. (Over the past decade, China's M2 surges past the US's by a wide margin from as low as nearly one third of the US's.) We obviously can't blame the tightening monetary policy for the sorry state of China's economy. We can't really pin our hopes on the loose monetary policy to turn around its fortune either. 3. The undoing of Beijing Consensus Monetary policy alone won't fix the structural deficiencies of Chinese economy. The well-being of Chinese economy is hugely leveraged on the consumption economy of the US and Europe. American and European economic turmoil together puts a massive strain on the demand for Chinese export. The substantial and increasing wealth gap in China has shackled the domestic demand so much that it fails to pick up the tab left over by the US and Europe markets. China is now saddled with a serious excess capacity problem, which forces down the marginal returns on the investment and makes investment more effective incurring inflation and bubbles than propelling GDP and employment ahead. This is the serious sign for over-investing and overheating. In 2010, China's export/GDP ratio is about 37% ,and Investment/GDP ratio is 45.8%. According to David M. Kotz and Andong Zhu's research, China's export plus fixed investment contributes almost 70% of GDP growth since 1999 while domestic consumption contributes roughly 30%. Using the export/investment combo to power economy ahead is what we know as Beijing consensus. It works beautifully for the past decade when the world is prospering in the globalization and free trade. However, now its good run is finished for good.

(According to Economist Intelligence Unit and US bureau of economics analysis, China will depend on an export-led economy late until 2030.) 4. The consumption-led economy is the only way out The dire situation in the US and Europe calls for another round of quantitative easing. With both Japan and UK firmly committed to QE and deteriorating market conditions, the embattled US and Europe will be more and more reduced to monetary aggressiveness. In the end, we will see a global competition of currency devaluation. China will lock horns more frequently with the US, Europe and other export nations over currency issues. The trade tension will flare up. The only way out for China is turning its economy into a consumption-led one. Or else fight for the overseas markets in vain and be prepared for trade wars. Or else try to reignite the economy with more wasteful investment and be prepared for a colossal asset bubble and epic hard landing. 5. The outlook for China's inflation and economic bubble And also, don't be too optimistic about China's inflation prospect. Indeed, China's CPI tumbled to 4.2%,the lowest level since September 2010. Nevertheless, the battle against inflation is far from over. China is the world's biggest importer of food and commodity. With the global competition of loose monetary policies, the food and commodity inflation will be persistent, to say volatile at least. China will face the serious threat of imported inflation and cost-push inflation regardless of whatever monetary policy it adopts. That combined with negative real interest rate and diminishing marginal return in industries will push more and more money into asset investment and speculation. The inflation will be lurking if these structural problems persist. Overall, there are both internal structural factors and external global factors, which contribute to the making of an epic hard landing in China. China will be really vulnerable when the US and Europe both unleash the quantitative easing. These are things China has no control of. Nevertheless, the best China can do to avoid the worst is to continue the painful structural adjustment: marketize the "big four"-dominated banking industry to allow for more efficient monetary allocation; Transform the labor intensive low value-added economy to the high value-added knowledge economy; reform the wealth redistribution system to empower the broad consumer base and honor its promise of a consumption-led economy.

While the US enjoys the luxury provided by the dollar's world currency status and diplomatic alliance with many major trade partners to export its liquidity and inflation, China enjoys none of that. They should look at the dollars in their hands with fear and doubt. So called Beijing consensus makes little sense, because the world is fast changing, pegging a country's growth to a certain set of policy tools or a certain reserve currency(the US dollar) is equally dangerous. The battle between Keynes and Friedman has long proven the only consensus is to adapt and change. Right now China needs to adapt and change fast. Or this will be the best time in history to short China. |

| Posted: 08 Jan 2012 04:20 PM PST from The Economic Collapse Blog:

As a result of the absolutely stunning 29-23 overtime victory by the Denver Broncos over the Pittsburgh Steelers, it seems inevitable that "Tebow Time" will become a household phrase all over America. The string of last second victories that we have seen Tim Tebow pull out this season is unprecedented and we will probably never see anything quite like it again. Unfortunately, miracles don't always happen in real life when we need them. Right now it is "Tebow Time" for the U.S. economy, the U.S. political system and the global financial system, and things look really bad. So will we see heroes rise up at this time to snatch victory from the jaws of defeat, or will we see the biggest debt bubble in the history of the world implode and plunge the entire planet into a devastating economic depression? Most people have no idea how fragile the global economic system has become at this point. Global leaders are currently engaged in a frantic juggling act in a desperate attempt to keep all the balls in the air. One wrong move could unleash a financial panic that could potentially be even worse than what we saw in 2008. It is Tebow Time for the global financial system. Lately I have been spending a lot of time writing about Europe. Many Americans have not really been too interested in these articles because they only want to hear about what is happening in the United States. |

| Tick By Tick Research Email - The Austerity Story Posted: 08 Jan 2012 04:18 PM PST

The Austerity Story

Dear All

Every year the folks over at Merriam-Webster's Dictionary award the coveted prize of "Word of the Year". Initially devised using a myriad of statistics, the award is now determined using an online poll devised by the popular internet dictionary and encyclopaedia company; which yields truly fascinating results. (Well to me anyway). Over the last four years, we have seen what I would refer to as intrinsically Finance related words take the crown (Pragmatic, Austerity, Admonish and Bailout) versus distinctly unrelated semantics from the preceding years. This includes the likes of the word "Blog" and "w00t". (for those wondering what exactly w00t is - it is the noise made when expressing joy - think whoop whoop!)

"All our work, our whole life is a matter of semantics, because words are the tools with which we work, the material out of which laws are made, out of which the Constitution was written. Everything depends on our understanding of them."

Felix Frankfurter

Anyway, I digress. This development towards a greater lay focus on the activities of the Finance world is hardly paradoxical. The actions of corporations, Governments and individuals alike have had, by the most part, lasting detrimental effects on the global population since the real-estate Ponzi exploded through the later half of the last decade. However, it is the winner of Merriam Webster's 2010 Word of the Year competition that brings me to the real point of this weeks first note. The word in question is: Austerity. Or, according to Wiki, the process of "deficit cutting, lower spending and a reduction in the amount of benefits and public services provided". A concept that the political powers of the US seem unable to get their head around.

The logic to austerity is very simple, cut your costs to reduce (or slow) the debt Burden. However, since its mass inception across various areas of the world, the economic skeptics among us have started to consider the validity of such measures. An excellent research report by Dr Tim Morgan initiated my skepticism over exactly how populations are expected to grow and cut concurrently. Is it possible? Well, Morgan argues that the fundamental growth assumptions built into the UK austerity plan are a little more than ambitious, and if this growth were to falter, we could experience a financially depressive state bought on through debt. Sound familiar? (A copy of the report is available HERE)

"There is no austerity equal to a balanced mind"

Chanakya

So does it work? Well, at this point I would like to introduce Hungary. The IMF austerity poster child. With a GDP half the size of California's, Hungary is a small European economy that has been indirectly crippled through profligacy of a vast quantity of other nations around the world. The story is actually fascinating. During November 2008, Hungary accepted the assistance of IMF, World Bank and Europeans (yes Europeans!) to help counter what can only be described as a run on the entire country. Since this point, the Hungarian government has successfully implemented a range of austerity measures to reduce their sovereign dependence on the global bond markets and, as the IMF puts it, "restore stability in the financial sector". In the period from January to November last year, Domestic borrowing fell by 8%. A truly staggering feat.

However, the story doesn't end here and im afraid that it doesn't end with "They all lived happily every after". Actually the result has been the polar opposite. Hungary, this week, was downgraded to junk by Fitch following what can only be described as a horrific bond auction. But why? The issue actually lies within Hungary's exposure to foreign denominated debt financing. Whilst Domestic Borrowing fell 8%, the repayments of Hungary's non Florint holdings increased by over 20% due to significant moves in the currency market from a weaker Hungarian economy and exposure to currencies such as the Swiss Franc. See, whilst the rest of the world was buying their 3rd, 4th or 5th house, the Hungarian population and Government were borrowing in Foreign currency denominations to avoid particularly high interest rates domestically. An activity that has vaporised the pertinence of any austerity measure in its entirety. The matter is made yet worse by evaluating the countries Monetary Policy. Any form of sovereign Florint printing would not result in a reduction of debt burden but would likely bring inflation.

Does austerity work? Can weak economies grow without reduced capital injections? I'll let you decide.

Before, I share my selection of the best articles from the last few days. I cannot go without mentioning the latest QE rumour that has emerged this week on the back of James Pethokoukis' article. Despite being better than a Jenna Jameson film to a certain bearded man over at the Fed, I see QE as the singularly most hopeless and dangerous policy that has re-emerged over the last decade. Supported by no credible or empirical evidence to suggest real long term growth, the policy is no different than the government lending the population their credit card for three months and expecting everything to be okay. Instead, the inflation that will result over the longer term will make the population as a whole poorer. Similar what they say for dogs, QE isn't just for Christmas it's for life. For those of you short EURUSD, I would urge you to look at the price change of the last two major interventions.

"Quantitative Easing is one of these PhD approved euphemisms that doesn't really convey the essential point..."money printing" would be so much a better step in the direction of intellectual hygiene. These people talk about quantitative easing as if they didn't mean to debase the currency over which they have temporary control"

Jim Grant

Without further ado, here are a number of articles well worth reading for the week ahead.

1. January Surprise: Is Obama preparing a trillion-dollar, mass refinancing of mortgages? - James Pethokoukis (Click HERE) The article noted above that started the most recent QE rumour

2. Things That Make You Go Hmmm... - Grant Williams (Click HERE) Grant takes another look at the Eurozone and Gold

3. Boom Time in the Middle East - Religare Research (Click HERE) Religare discuss the growing Middle Eastern tension

4. Towards the Paranormal - Bill Gross (Click HERE) Bill's welcome to the New Year

Best Regards George Adcock

Founder

If you would like to receive bi-weekly comment emails like this in the future, please send an email to team@tickbytick.co.uk with the words "add me" in the subject line.

All email addresses will be held with complete confidentiality and there is no profit motive in any piece of writing disseminated.

|

| 50 Economic Numbers From 2011 That Are Almost Too Crazy To Believe Posted: 08 Jan 2012 04:08 PM PST Even though most Americans have become very frustrated with this economy, the reality is that the vast majority of them still have no idea just how bad our economic decline has been or how much trouble we are going to be in if we don't make dramatic changes immediately. If we do not educate the American people about how deathly ill the U.S. economy has become, then they will just keep falling for the same old lies that our politicians keep telling them. Just "tweaking" things here and there is not going to fix this economy. We truly do need a fundamental change in direction. America is consuming far more wealth than it is producing and our debt is absolutely exploding. If we stay on this current path, an economic collapse is inevitable. Hopefully the crazy economic numbers from 2011 that I have included in this article will be shocking enough to wake some people up. At this time of the year, a lot of families get together, and in most homes the conversation usually gets around to politics at some point. Hopefully many of you will use the list below as a tool to help you share the reality of the U.S. economic crisis with your family and friends. If we all work together, hopefully we can get millions of people to wake up and realize that "business as usual" will result in a national economic apocalypse. The following are 50 economic numbers from 2011 that are almost too crazy to believe…. #1: A staggering 48 percent of all Americans are either considered to be "low income" or are living in poverty. Read more.... This posting includes an audio/video/photo media file: Download Now |

| Newt Gingrich: Bashes Pres. Obama as Hopeless Posted: 08 Jan 2012 04:00 PM PST Gingrich pointed out very well the game plan that Pres. Obama will run in the upcoming 2012 presidential election. Pres. Obama will have a billion-dollar campaign in which the vast majority will be extremely negative campaigning. Obama has no other choice but to run an extreme negative political campaign. The fact is Pres. Obama . . . . . .Know more........ This posting includes an audio/video/photo media file: Download Now |

| Complex Systems, Dysfunctional Industries, and Catastrophic Collapse Posted: 08 Jan 2012 02:19 PM PST |

| Non-Farm Payrolls: The TRUTH And The CON In Confidence Posted: 08 Jan 2012 01:56 PM PST As 2012 begins...so does the inglorious "race for the White House". Woe is the year of nonsense we are about to be forced to endure. And, why not begin the year with a VERY heavy dose of bullshit care of the monthly non-farm payrolls report! Before looking at the December "jobs report", let us do a little math with some of the recent "jobs data" that is being reported by the ever vigilant mainstream media as "good for the economy", and a "sign of growth". Every Thursday, the Employment and Training Administration of the Department of Labor reports "initial jobless claims" for the nation. An "initial jobless claim" is when somebody applies for unemployment benefits for the first time. Initial jobless claims measure the number of filings for state jobless benefits. This report provides a timely, but often misleading, indicator of the direction of the economy, with increases (decreases) in claims potential signalling slowing (accelerating) job growth. On a week-to-week basis, claims are quite volatile, and many analysts therefore track a four week moving average to get a better sense of the underlying trend. According to the Jan5, 2012 UNEMPLOYMENT INSURANCE WEEKLY CLAIMS REPORT, the 4-week moving average was 373,250. Using the back of a napkin and just this US Department of Labor reported 4-week moving average of "first time claims for unemployment", 1,493,000 Americans filed for unemployment benefits the past month. This sorry statistic was broadly portrayed by the news media as being hugely positive: US Initial Jobless Claims Fell 15000 to 372000 -Washington Post Initial jobless claims fall to lowest level since 2008 -Chicago Tribune Initial jobless claims lowest since April 2008 -MarketWatch Lowest level since 2008? What wonderful news! After almost four years, there has been virtually no improvement in first time claims for unemployment...not to mention the fact that 1.5 MILLION Americans filed a claim for unemployment in the last four weeks alone. Oh yes, what wonderful news! On the first Friday of every month, the U.S. Bureau of Labor Statistics releases the "non-farm payroll" report: A statistic researched, recorded and reportedly representing the total number of paid U.S. workers of any business, excluding the following employees: U.S. gains 200,000 jobs in DecemberUnemployment rate falls for fourth month in a row to 8.5% US Non-farm payrolls and private payrolls have sharply surpassed market expectations, with the US unemployment rate hitting its lowest level ... Wow! 200,000 "new" jobs! Joy, Joy, Joy for those looking for jobs... Hey wait a minute! 1.5 MILLION Americans filed first time unemployment claims in the past four weeks according to statistics released by the US Department of Labor on Thursday Jan 5. Sounds to me like 1.3 MILLION Americans got a rock in their Christmas stocking. Why all the joy in mainstream mediaville? Thankfully the reporting on the nonfarm payroll numbers from Zero Hedge was a bit more levelheaded and honest...because the TRUTH hurts: NFP Payrolls At 200K, Expected At 155K; Unemployment Rate Drops To 8.5%, Labor Force Participation At Lowest Since 1984The nonfarm payroll number prints at 200K on expectations of 155K. The Unemployment rate comes at 8.5% - lowest since February 2009, and down from an upward revised 8.7%. U-6 15.2% down from 15.6% in November. Average hourly earnings rose at 0.2%, in line with expectations, previous revised to -0.1% from unchanged. Private payrolls +212L vs Expectations of 178K. Manufacturing payrolls rose 23K vs Expectations of 155K. Yet the unemployment rate trickery still continues, with labor force participation (prior revised), now at a 27 year low of 64%, and the labor force itself declined by 50K from 153,937 to 153,887. In fact, persons not in the labor force have increased by 7.5 million since January 2007! Bottom line - dropping out of labor statistics is the new killing it. Average Duration Of Unemployment: Second Highest Ever At 40.8 Week The NFP report confirms the picture we have all known to grow and love - the people "entering" the labor force are temp workers, those with marginal job skills, and making the lowest wages. For everyone else: better luck elsewhere: the number of people not in the labor force has soared by 7.5 million since January 2007, and the average duration of unemployment is 40.8 weeks - essentially in line with last month's record 40.9. Bottom line - if you are out of a job, you are out of a job unless you are willing to trade down to an entry level "temp-like" position with virtually no benefits or job security. Massive Beat? Not So Fast - Morgan Stanley Warns 42,000 "Jobs" Bogus Due To Seasonal Quirk Enamored with the 200,000 number? Don't be - the reason why the market has basically yawned at this BLS data is that as Morgan Stanley's David Greenlaw reports, 42,000 of the 200,000 is basically a seasonal quirk, which will be given back next month, meaning the true adjusted number is 158,000, essentially right on top of the expectation. From David Greenlaw: "some of the strength in this report should be discounted because of an seasonal quirk in the courier category of payrolls (Fed-ex, UPS, etc). Jobs in this sector jumped 42,000 in December, repeating a pattern seen in 2009 and 2010 (see attached figure). We should see a payback in next month's report." Real Jobless Rate Is 11.4% With Realistic Labor Force Participation Rate One does not need to be a rocket scientist to grasp the fudging the BLS has been doing every month for years now in order to bring the unemployment rate lower: the BLS constantly lowers the labor force participation rate as more and more people "drop out" of the labor force for one reason or another. While there is some floating speculation that this is due to early retirement, this is completely counterfactual when one also considers the overall rise in the general civilian non institutional population. In order to back out this fudge we are redoing an analysis we did first back in August 2010, which shows what the real unemployment rate would be using a realistic labor force participation rate. To get that we used the average rate since 1980, or ever since the great moderation began. As it happens, this long-term average is 65.8% (chart 1). We then apply this participation rate to the civilian noninstitutional population to get what an "implied" labor force number is, and additionally calculate the implied unemployed using this more realistic labor force. We then show the difference between the reported and implied unemployed (chart 2). Finally, we calculate the jobless rate using this new implied data. It won't surprise anyone that as of December, the real implied unemployment rate was 11.4% (final chart) - basically where it has been ever since 2009 - and at 2.9% delta to reported, represents the widest divergence to reported data since the early 1980s. And because we know this will be the next question, extending this lunacy, America will officially have no unemployed, when the Labor Force Participation rate hits 58.5%, which should be just before the presidential election. ___________________________ WOW! Just like magic the unemployed will disappear just in time for a presidential election...amazing. What I find truly fascinating is that, in America, you can be unemployed, but not counted as unemployed because you are not looking for work OR collecting an unemployment check. Seriously...ONLY IN AMERICA! Labor participation rate? ___________________________ According to the U.S. Bureau of Labor Statistics, the labor force participation rate is the "share of the population 16 years and older working or seeking work." According to the site, the formula for determining the "labor force participation rate" is: (Civilian Labor Force / Total Non-institutionalized Civilian Population) x 100 Ok - this may be a bit confusing, so let's explain these terms a bit. First off, what is the "total non-institutionalized civilian population"? This is the total population minus a few key groups, including: -kids under the age of 16 -people in prisons or other institutions -military personnel Ok - now what is the "civilian labor force"? This group consists of people who are classified as being either employed or unemployed. A key item to note - you have to be actively looking for a job in order to be considered "unemployed". So, for instance, a woman who stays at home with her kids is not considered as being employed or unemployed. Or, students or people who have retired early are not considered to be employed or unemployed as well. So, again, in order to get the "labor force participation rate", we have to divide: The Civilian Labor Force by The Total Non-Institutionalized Population and then multiply by 100. The labor force participation rate has hovered around 65-67 over the past decade or so. It is currently sitting at 65.5. The rate has increased dramatically over the past 50 years or so due to more women entering the workforce. For comparison's sake, the labor force participation rate was around 58-59 in the late '40s. Source: Bureau of Labor Statistics ___________________________ So by not counting the unemployed who are not actively looking for work [maybe because there are no jobs to look for] the US Government can create the illusion that the unemployment rate is falling, and boost the "confidence" of those actually looking for work. Is this brilliant or what? ___________________________ Jim Sinclair's Commentary This is the real story behind today's job gains report. For additional details see: www.shadowstats.com - Seasonal-Adjustment Problems Spiked Jobs Growth, Seasonal- Adjustment Revisions Artificially Lowered Unemployment Rates - December Jobs Reading Remained Well Below Pre-2007 and Pre-2001 Recession Levels - December Unemployment: 8.5% (U.3), 15.2% (U.6), 22.4% (SGS) - Money Supply M3 Annual Growth Tops 3.0% for First Time in 28 Months ___________________________ Statistics can easily be manipulated and it is not unknown for political regimes to do so in order to hold on to power (and 2012 is an election year in the U.S.). After all, it is much easier to change a number than to fix the underlying problem the number represents. Fortunately, the BLS publishes a number of statistical tables with each monthly report that can be used to check its calculations. When the Great Recession began in December 2007, the civilian non-institutional population of the United States was 189,993,000. At that time, the number of people in the U.S. labor force was 125,588,000. As of December 2011, the BLS states that the employment population ratio for the U.S. is 58.5% (0.585). The non-institutional population of the U.S. was reported at 193,682,000 or 3,689,000 higher than it was in December 2007. The labor force in December 2007 was 125,334,000 and multiplying the increase in the U.S. population in the intervening four years by the employment population ratio indicates that the labor force should have increased by 2,158,000 to 127,492,000. However, the BLS reports the U.S. labor force last month was 124,114,000. More than three million people are missing from its figures. The smaller the labor force is, the better the headline unemployment rate becomes. The BLS claims these 3 million plus people left the labor force and this justifies purging them from the statistics. There is a problem with their line of reasoning, however. Large numbers of people only leave a labor force during periods of severe economic distress. It does not happen during economic recovery. It does not indicate an employment situation that is improving. Yet, the BLS produces numbers showing things are getting better when this happens. This violates the first rule of statistics - the results must reflect reality. The BLS numbers do not. Dividing the number of employed in December 2011 by the size of the labor force that should exist based on the population numbers produces an unemployment rate of 9.6%, not 8.5%. This is the headline number that should be reported. If the BLS wants to insist however that more than three million people have indeed left the labor force (and this has continued in the last year - the size of the labor force in December 2011 is smaller than it was in December 2010), it should also make it clear that this indicates that there has been an ongoing recession and no economic recovery has taken place. Both can't happen at the same time, except for a brief period. Either the economic recovery story is a lie or there hasn't been a shrinking labor force. While mainstream economists will insist that employment is a lagging indicator (more than two years is some lag), this has only been the case in the U.S. years after statistical "improvements" were introduced in the 1980s and 1990s in how government economic numbers were determined. Before that, employment recovered with improving GDP as should be the case. If you think about it, the term jobless recovery makes as much sense as tall midget or genius moron. The improvement in the weekly unemployment claims is also being cited as evidence of an improving jobs picture. It would be more accurate to say that it is evidence of a jobs picture that can't continue to get worse. As I have stated since at least mid-2010, the weekly claims number will regress toward the mean (move to its long-term average) because eventually there will be few workers who remain to be laid off. After being elevated for several years, the only way that weekly claims can now increase is with a big jump in bankruptcies. This will be avoided as long as the economy holds steady. What is keeping the U.S. economy from getting worse is the unprecedented budget deficits that the U.S. is running. If yo |

| Posted: 08 Jan 2012 01:10 PM PST We have in recent weeks been rather confused by the contradiction between the strongly bearish price patterns that are developing in gold and silver, which are indicative of a major top that portends a brutal deflationary downwave, and the seemingly bullish COTs and sentiment for the sector. Now we believe that we have come to a realization with regards to what is going on with the COTs, which will be set out lower down the page - first we will look at the price pattern development. |

| Posted: 08 Jan 2012 01:05 PM PST |

| Reversal of Fortune: Soros Said to Buy Gold Again Late Last Year Posted: 08 Jan 2012 11:45 AM PST by Forrest Jones, But the U.S. economy might not improve enough to make Federal Reserve officials fully comfortable, as the European situation could take a turn to the worse and threaten still-fragile economic output at home and keep unemployment rates elevated. ", "China, Russia Drop Dollar In Bilateral Trade", "China And Iran To Bypass Dollar, Plan Oil Barter System", "India and Japan sign new $15bn currency swap agreement", and now this: "Iran, Russia Replace Dollar With Rial, Ruble in Trade, Fars Says." And ironically, the proposal to dump the greenback did not come from Iran. Per Bloomberg: "Iran and Russia replaced the U.S. dollar with their national currencies in bilateral trade, Iran's state-run Fars news agency reported, citing Seyed Reza Sajjadi, the Iranian ambassador in Moscow. The proposal to switch to the ruble and the rial was raised by Russian President Dmitry Medvedev at a meeting with his Iranian counterpart, Mahmoud Ahmadinejad, in Astana, Kazakhstan, of the Shanghai Cooperation Organization, the ambassador said." Is Iran gradually becoming the poster child of an energy rich country that just says no to the dollar: "Iran has replaced the dollar in its oil trade with India, China and Japan, Fars reported." Next thing you know China, Russia and Japan will engage in bilateral trade agreements with the Eurozone in exchange for purchasing European or EFSF (which at last check are now forced to give 30% guaranatees) bonds, and bypassing dollars completely. But yes, aside from everyone else, virtually everyone (footnote 1) is still using the dollar as currency of global exchange. |

| Posted: 08 Jan 2012 11:27 AM PST from TFMetalsReport.com:

First up, the metals are, quite clearly, still being capped and contained by The Cartel. Though I am still of the mindset that there is an active movement by JPM et al to exit their perennial silver short position, that doesn't mean silver can't go down further before it rockets higher. This week's CoT data actually showed an increase in the commercial short position as well as an increase in the spec longs. This can sometimes be a precursor to a raid so be on the lookout. Additionally, having successfully kept silver below $30 last week, the EE has made the chart look a little precarious. Watch the $28.50 level very closely early this week. |

| Empire Club Outlook 2012: Why Rising Debt Will Lead to $10,000 Gold Posted: 08 Jan 2012 11:21 AM PST |

| Gene Arensberg: Silver, you ain't seen nothin' yet Posted: 08 Jan 2012 10:11 AM PST 6:10p ET Sunday, January 8, 2012 Dear Friend of GATA and Gold (and Silver): The Got Gold Report's Gene Arensberg gets out his charts tonight and sees an explosion building for silver. His commentary is headlined "Silver, You Ain't Seen Nothin' Yet" and it's posted in the clear at the Got Gold Report here: http://www.gotgoldreport.com/2012/01/got-gold-report-silver-you-aint-see... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Golden Phoenix Receives Inferred Gold Resource Estimate Company Press Release Golden Phoenix Minerals Inc. (OTC: GPXM) reports that on behalf of Golden Phoenix Panama S.A., the joint venture entity that owns and operates the Santa Rosa gold mine in Panama, it has received from SRK Consulting (U.S.) an initial resource estimate for Mina Santa Rosa. The Santa Rosa project is a volcanic-hosted epithermal gold-silver deposit previously operated as an open pit-heap leach operation. Production ceased in 1999 in part because of low gold prices. SRK Consulting reports an in-situ inferred resource at the former Santa Rosa and ADLM pits totaling 23.1 million metric tonnes at 0.90 grams/tonne gold, for a contained 669,000 ounces of gold at a 0.30 g/t gold cutoff. The resource also contains an average grade of 2.87 g/t silver for a contained 2.1 million ounces of silver. John Bolanos, Golden Phoenix's vice president of exploration, remarks: "In addition to SRK's inferred resource estimate of 669,000 contained ounces of For the company's full statement, including a table detailing the resources at Santa Rose, please visit: http://goldenphoenix.us/press-release/golden-phoenix-receives-initial-ni... Join GATA here: Vancouver Resource Investment Conference http://cambridgehouse.com/conference-details/vancouver-resource-investme... California Investment Conference http://cambridgehouse.com/conference-details/california-investment-confe... Support GATA by purchasing gold and silver commemorative coins: https://www.amsterdamgold.eu/gata/index.asp?BiD=12 Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Got Gold Report – Silver, You Ain’t Seen Nothin’ Yet Posted: 08 Jan 2012 09:26 AM PST HOUSTON -- On the day after Christmas last year we shared with Vultures (Got Gold Report Subscribers) our commentary on the Commodity Futures Trading Commission (CFTC) weekly report of the commitments of traders (COT) in COMEX silver futures for the period ending Tuesday, December 20. A few days later, on December 28, we shared that review with our entire readership in these pages as a holiday courtesy. In that review we said, as simply and clearly as our command of the vocabulary can convey, that "this COT setup is about as bullish as they come." Since that report there have been two subsequent COT reports and the changes which have occurred and have been reported are in keeping with our view then that the positioning of the large traders of silver futures in New York: "gives us cover to begin adding in our green target box for silver with reasonable confidence, for the first time in over a year, if only the Trading Gods will allow it." The green box on our tracking chart is visible in this reduced version of one of our silver tracking graphs we share with Vultures.

As Vultures already know, because they have constant access to all of our tracking and trading charts in the subscriber pages, we often use target boxes placed in advance on our charts to denote areas we intend to consider attempting a trade or to add to a position. In addition to those target boxes, we also often add commentary directly in the various charts to explain our thinking as the events and conditions change. It is a very effective way to convey how we are approaching the markets we track and game. Our "green box" for silver in our tracking chart has been in the same locale for quite some time – ever since we adopted the "Giant Flag" consolidation theory of the silver market. Silver Enters and Bounces in "The Green" On Thursday, December 29, having broken implied $28 technical support silver headed south in a hurry in nervous, thin trading early (in the U.S.), entering our green target box for the first time. As the trading neared the September panic spike low near $26.15 (actually the third test of $26 in 2011, having tested it in January and September prior) our instinct was then to set up a trade to fire the instant a bounce seemed to be in the making – so we did. As if on cue, bidding flowed in to support silver at almost the precise area the September panic spike was exhausted (about $26.15) (in the pre-market hours for the Big Markets). For the first time in over a year we initiated a new silver trade that day, securing a long position in our predetermined zone of potential support (filled at $26.41), as Vultures already know. What some new Vultures may not know, and longer-time Vultures may have forgotten, our last silver trade was stopped out about a year earlier in January of 2011, as we disclosed then on the blog. (We urge readers to review that linked post, if for no other reason than to review the January 20 2011 chart before continuing this offering.) Silver's 2011 Bounce at $26 Higher Than We Expected At the time, in late January of 2011, amid harsh profit taking for precious metals, including some of the heaviest negative money flow for silver ETFs we had seen up to that time, we had decided to target the area of a previous October 2010 flag consolidation for possible reentry (about $0.75 either side of $23 or so, as shown in the chart in the link above). In other words, in January of 2011 we expected more of a retrace by silver than actually occurred, as silver then fetched up just above the $26 level and just didn't provide us with a reentry we were comfortable with then. Consequently, except for our holdings of physical metal, we missed out on the run-up of silver from $26 to around $49 from January to April last year as far as our short-term trading was concerned. It was about that time that we adopted our current attitude with regard to silver – that since we already hold a meaningful position in physical silver, we had the luxury to wait for an extraordinary correction before taking another shot with our short term trading. It should be crystal clear by now, but in case it isn't, we believe that silver is in the midst of just the kind of extraordinary correction which allows us to put on a new short-term trading position – the first new trade in silver for us since August of 2010 (silver then below $19). We think that the fact that silver has come all the way back down from its near brush with an all time high in April to as low as $26.15 is a bona fide opportunity. Right or wrong, that is indeed how we have chosen to play it too. Bull Market Second Chances It is somehow fitting and proper, we think, that silver fetched up at precisely the same opportunity we did not take advantage of in January of 2011. We welcome this second-chance opportunity with open arms and a new trade. As always, however, we do so with a cautious eye and with our short-term trading stops always in play. Our Vulture members know exactly where our stops are placed at all times, because they have access to our trading and tracking charts 24/7. Silver, You Ain't Seen Nothin' Yet As we have said countless times, our short term trading has nothing at all to do with our holdings of physical metal, except as a vehicle to perhaps earn more resources so that we are able to add to our holdings of physical metal from time to time - opportunistically. For now and for the foreseeable future, our holdings of physical metal are just not for sale. (Except for emergencies, or for superb opportunities, when they arrive.) Just below is just one small hint of why that is especially true for silver. We are convinced, by a preponderance of all the available data to us, that even with the marginal increases in silver production over the past couple years, a structural imbalance between the combined overall global demand for physical silver and the quantity of available metal has been and is now developing. That applies most especially to the available quantity of commercial sized, average 1,000 ounce good delivery bars which form the basis of the market price everywhere. As a consequence of that imbalance we do indeed believe that over time the market will become more and more tuned in to it. We believe the market is in the process of re-valuing silver back to its historic relationship to gold metal because the forces which had artificially suppressed silver in the past have all receded to near zero. Nothing excites a market more than the notion that the commodity in question might be in shortage relative to demand. Perversely, the idea that a commodity might be becoming scarce has the tendency to encourage higher, not lower demand. It also encourages increased, not decreased speculation, hoarding, accumulation and, of course, it encourages higher prices as positive money flow takes hold (more capital flooding in to the market than flowing out of it). When a commodity is in real (or imagined) shortage, it takes higher prices in order to induce holders of that commodity to part with it at the same time that users and producers anticipate and expect to have to pay more for it in the future. Looking at the chart above, we have taken the view that silver is very likely involved in a giant flag consolidation. A pause, a waypoint in a great trend of silver to reclaim its role as a truly scarce and valuable monetary metal, alongside its more respected and much more available yellow cousin, gold. The process and the trajectory is choppy, for sure, but we think the trend is clear enough in the chart above. We cannot see the future and we do not know for sure what the price of the metal shall do just ahead, but if we are right about our view of the small, but vital silver market (we could be wrong, of course) … if we are right that the flag consolidation forming now is merely a correction … merely allowing the market to catch its collective breath and digest a new higher paradigm … to adjust to a new reality following the blow-off of the fourth parabolic advance of this Great Silver Bull Market (we call them definition moves) … if we are right Vultures and friends, then in the words of the Bachman Turner Overdrive, "You Ain't Seen Nothin' Yet." Mother of all Mid-Point Consolidations It is somewhat ironic that last year when we were stopped out of our silver trade in the $28 region (with our then largest-ever profit on a single silver trade, more than $8 the ounce) after it had tested $31, we said then that we thought silver was likely then in a mid-point consolidation (it was). But we had chosen a too-low reentry target then and missed the fulfillment of that call with our short term action. Well, friends and fellow Vultures, there we were again with a second shot at that $26 opportunity on December 29, so we were not about to let that second chance go by. And, once again, as we study the charts and all the available data, we are struck with the very same notion in an even bigger, more fundamental way. We have to say it now, in January of 2012, taking appropriate anti-jinx measures as we do – Look at the charts, friends, and look at it well. What we are seeing today very well may be the mother of all mid-point consolidations for silver metal. Indeed, as the chart above seems to suggest (at least it does to us in January of 2012), the silver market has advanced in a series of choppy parabolic surges, followed by long periods of "digestion" by the market, followed by a renewed surge of investor/speculator interest and money flow. Silver has advanced from a period of artificially low pricing in the 1990s below USD $5; the aftermath of decades-long government dishoarding over-supply, investor disdain and apathy, which resulted in super low, sub-economic pricing … artificial pricing so low it encouraged a supply/production deficit for many years, literally reducing the amount of physical silver metal in storage worldwide by a factor of at least half. Silver has advanced from those stark beginnings up to challenge its all time roughly $50 nominal high set in a wild, parabolic spike and only very briefly nearly 32 years ago at the very apex of the last bull market for precious metals (which by the way was also the result of a currency crisis then). We think there are huge and compelling differences in the silver market today versus that previous bull market peak in 1980. We have mentioned them on multiple occasions over the years, but the short version is that compared to then world population has increased by about 50% (from about 4.3 billion to more than 6.8 billion souls). The number of people that are able to participate in the silver metal bull market today is much, much higher today than in 1980 because so many of the people in Asia were prohibited from owning silver then. Not only can people in Asia own silver today, the government of China actually encourages its citizens to own precious metals and even makes it available to them via state-owned banks. We have not actually done the math, but intuitively the number of the world population which can own silver today is probably on the order of triple what it was in 1980. Perhaps more importantly, the number of people in the world that have accumulated wealth enough that they could actually use some of it to purchase silver has grown exponentially since the liberalization of the former Soviet Union and China (to mention the two most important formerly hard-line communist states) … their at least partial embrace of capitalism has created enormous new wealth, some of which will seek safe harbor in precious metals … a worldwide trend. In 2009 Merrill Lynch estimated that more than 10 million people worldwide had a net worth in excess of $1 million USD, about 0.15% of the global population, but for the first time since records have been compiled the number of millionaires in the Asia-Pacific region (3 million) exceeded the number in Europe (2.9 million). In the 32 years since 1980 world money supply has increased by a factor of at least 10 and probably more than that, depending on which measure of currency one uses (we prefer M1 and M2 averaged), meaning worldwide there is something like 1,000% more dollars, yen, euros, pesos, francs, yuan, etc. in existence today versus 1980. So, if we consider that in 1980 silver was still under the influence of artificial government dishoarding oversupply (that no longer exists today), and despite that it managed to touch $50 then, albeit for a instant in time, then consider that today, in 2012 we have about 50% more people in the world and maybe three times the number of people who are able to buy silver, using 1,000% more currency to chase half or less the available silver metal – in world where one can buy silver instantly using a mouse click from their home computer, or the touch screen of their iPad or smart phone while playing a round of golf or attending a soccer practice from anywhere in the world. No wonder Eric Sprott calls silver 'The Investment' for this decade, having correctly given gold that distinction in the past decade. Mr. Sprott can see and smell the same imbalance we are talking about and has moved into position for it in a very big way. Indeed, with his recent shelf offering, we think Mr. Sprott's next very large purchase of silver metal is more or less imminent. Mr. Sprott can see the same chart we do. We think that briefly describes the growing imbalance which is developing in silver metal; the imbalance which underpins our staunch confidence in the second most popular precious metal, thinking longer term. That is in part why we welcome these pullbacks and corrections for silver – because we know and believe they are opportunities for Vulture speculators like us.

Silver has been money almost as long as gold, if not even longer. We think it will be again, in the not too distant future, albeit in a ratio closer to its historic average of something between 15 and 20 ounces to one ounce of gold instead of its current 56:1 ratio. But that is a different story for another time. There is, of course, much more to the story than just this tip-of-the-iceberg look, but that's enough for one Sunday offering. Vultures kindly log in to review our newest commentary on the charts. We considered doing a full Got Gold Report one week early this week, but there were only insignificant changes to the data this week, most of it being skewed by the holiday, and we felt that this particular offering belonged in the public domain immediately. That is all for now but there is more to come. |

| Economic System a Legal Ponzi Scheme on the Verge of Collapse! Posted: 08 Jan 2012 08:50 AM PST Countries around the world, particularly in the West, are hopelessly in the red, with debt rising every day. Even worse, politicians seem paralyzed, unable — or unwilling — to do anything about it. It is a global disaster that threatens the immediate future… [Let me explain.] Words: 1132 So says Alexander Jung ([url]www.spiegel.de[/url]) in edited exerpts from*his original* article. [INDENT]Lorimer Wilson, editor of www.FinancialArticleSummariesToday.com (A site for sore eyes and inquisitive minds) and www.munKNEE.com (Your Key to Making Money!) has edited ([ ]), abridged (…) and reformatted (some sub-titles and bold/italics emphases) the article below for the sake of clarity and brevity to ensure a fast and easy read. The report’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Please note that this paragraph must be included in any article re-posting to avoid copyright infring... |

| Posted: 08 Jan 2012 08:41 AM PST |

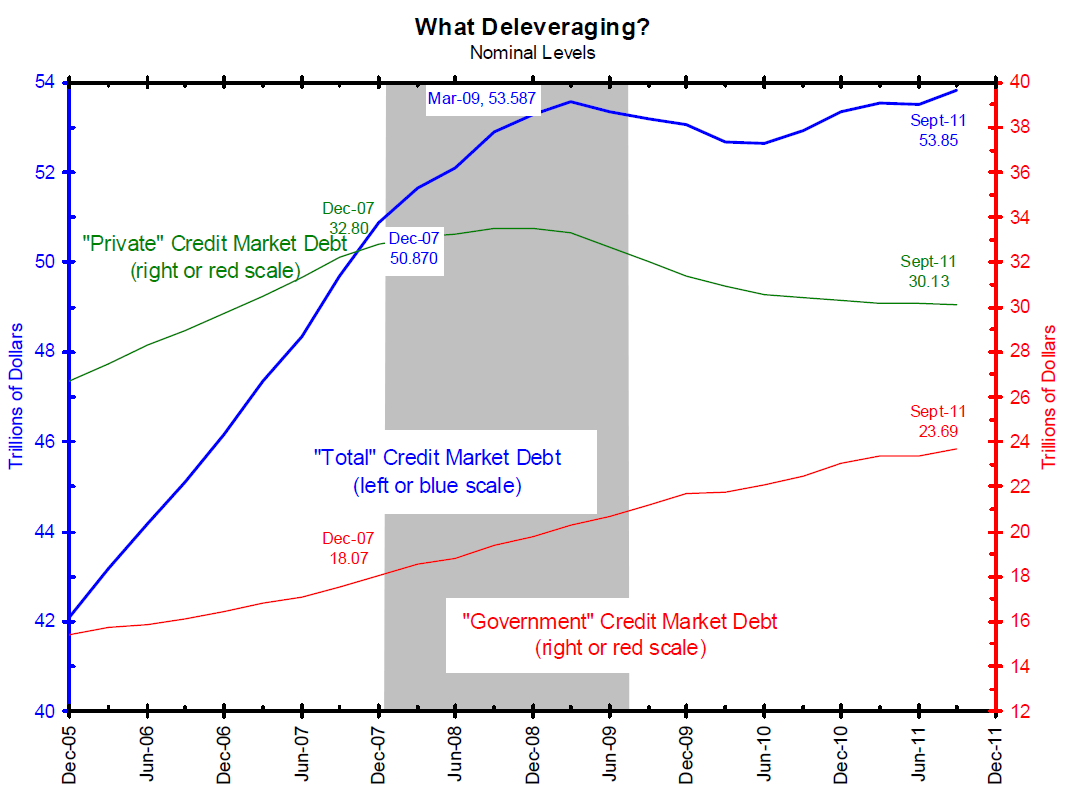

| Guest Post: 2012 - The Year Of Living Dangerously Posted: 08 Jan 2012 08:34 AM PST Submitted by Jim Quinn of The Burning Platform 2012 - The Year Of Living Dangerously "In retrospect, the spark might seem as ominous as a financial crash, as ordinary as a national election, or as trivial as a Tea Party. The catalyst will unfold according to a basic Crisis dynamic that underlies all of these scenarios: An initial spark will trigger a chain reaction of unyielding responses and further emergencies. The core elements of these scenarios (debt, civic decay, global disorder) will matter more than the details, which the catalyst will juxtapose and connect in some unknowable way. If foreign societies are also entering a Fourth Turning, this could accelerate the chain reaction. At home and abroad, these events will reflect the tearing of the civic fabric at points of extreme vulnerability – problem areas where America will have neglected, denied, or delayed needed action." – Strauss & Howe – The Fourth Turning - 1997 In December 2010 I wrote an article called Will 2012 Be as Critical as 1860?, that pondered what might happen with the 2012 presidential election and the possible scenarios that might play out based on that election. Well, 2012 has arrived and every blogger and mainstream media pundit is making their predictions for 2012. The benefit of delaying my predictions until the first week of 2012 is that I've been able to read the wise ponderings of Mike Shedlock, Jesse, Karl Denninger, and some other brilliant truth seeking analysts regarding what might happen during 2012. The passage above from Strauss & Howe was written fifteen years ago and captured the essence of what has happened since 2007 and what will drive all the events over the next decade. Predicting specific events is a futile human endeavor. The world is so complex and individual human beings so impulsive and driven by emotion, that the possible number of particular outcomes is almost infinite. But, as Strauss and Howe point out, the core elements that created this Crisis and the reaction of generational cohorts to the implications of debt, civic decay and global disorder will drive all the events that will occur in 2012 and for as far as the eye can see. Linear thinkers in mega-corporations, mainstream media and Washington D.C. focus on retaining the status quo, their power and their wealth. They believe an economic recovery can be manufactured through monetary manipulation and Keynesian borrowing and spending. They are blind to the fact that history is cyclical, not linear. In order to have an understanding of what could happen in the coming year, it is essential to keep the big picture in focus. As we enter the fifth year of this twenty year Crisis period, there is absolutely no chance that 2012 will see an improvement in our economy, political atmosphere or world situation. Fourth Turnings never de-intensify. They exhaust themselves after years of chaos, conflict and turmoil. I can guarantee you that 2012 will see increased mayhem, riots, violent protests, recessions, bear markets, and a presidential election that will confound the establishment. All the episodes which will occur in 2012 will have at their core one of the three elements described by Strauss & Howe in 1997: Debt, Civic Decay, or Global Disorder. Debt – On the Road to SerfdomThe world is awash in debt. Everyone is focused on the PIIGS with their debt to GDP ratios exceeding the Rogoff & Reinhart's 90% point of no return. But, the supposedly fiscally responsible countries like Germany, France, U.K., and the U.S. have already breached the 90% level. Japan is off the charts, with debt exceeding 200% of GDP. These figures are just for the official government debt. If countries were required to report their debt like a corporation, their unfunded entitlement promises to future generations are four to six times more than their official government debt. Any critical thinking person can look at the chart above and realize that creating more debt out of thin air to solve a debt problem is foolish, dangerous, and self serving to only bankers and politicians. The debt crisis took decades of terrible choices and bogus promises to produce. The world is now in the midst of a debt driven catastrophe. At best, the excessive levels of sovereign debt will slow economic growth to zero or below in 2012. At worst, interest rates will soar as counties attempt to rollover their debt and rolling defaults across Europe will plunge the continent into a depression. The largest banks in Europe are leveraged 40 to 1, therefore a 3% reduction in their capital will cause bankruptcy. Once you pass 90% debt to GDP, your fate is sealed. "Those who remain unconvinced that rising debt levels pose a risk to growth should ask themselves why, historically, levels of debt of more than 90 percent of GDP are relatively rare and those exceeding 120 percent are extremely rare. Is it because generations of politicians failed to realize that they could have kept spending without risk? Or, more likely, is it because at some point, even advanced economies hit a ceiling where the pressure of rising borrowing costs forces policy makers to increase tax rates and cut government spending, sometimes precipitously, and sometimes in conjunction with inflation and financial repression (which is also a tax)?" – Rogoff & Reinhart The ECB doubling their balance sheet and funneling trillions to European banks will not solve anything. The truth that no one wants to acknowledge is the standard of living for every person in Europe, the United States and Japan will decline. The choice is whether the decline happens rapidly by accepting debt default and restructuring or methodically through central bank created inflation that devours the wealth of the middle class. Debt default would result in rich bankers losing vast sums of wealth and politicians accepting the consequences of their phony promises. Bankers and politicians will choose inflation. They believe they can control the levers of inflation, but they have proven to be incompetent, hubristic, and myopic. The European Union will not survive 2012 in its current form. Countries are already preparing for the dissolution. Politicians and bankers will lie and print until the day they pull the plug on the doomed Euro experiment. The false storyline of debt being paid down in the United States continues to be propagated by the mainstream press and decried by Paul Krugman. The age of austerity storyline gets full play on a daily basis. Total credit market debt in 2000 was $27 trillion. It skyrocket to $42 trillion by 2005 as George Bush and Alan Greenspan encouraged delusional Americans to defeat terrorism by leasing SUVs and live the American dream by putting zero down on a $600,000 McMansion, financing it with a negative amortization no doc loan. Paul Krugman got his wish as a housing bubble replaced the dotcom bubble. Debt accumulation went into hyper-speed in 2006 and 2007 as Wall Street sharks conducted a fraudulent feeding frenzy by peddling their derivatives of mass destruction around the globe. By the end of 2007, total credit market debt reached $51 trillion. In a world inhabited by sincere sane leaders, willing to level with the citizens and disposed to allow financial institutions that took world crushing risks to fail through an orderly bankruptcy process, debt would have been written off and a sharp short contraction would have occurred. The stockholders, bondholders and executives of the Wall Street banks would have taken the losses they deserved. Instead Wall Street used their undue influence, wealth and power to force their politician puppets to funnel $5 trillion to the bankers that created the crisis while dumping the debt on taxpayers and unborn generations. The Wall Street controlled Federal Reserve provided risk free funding and took toxic mortgage assets off their balance sheets. The result is total credit market debt higher today than it was at the peak of the financial crisis in March 2009. Our leaders have done the exact opposite of what needed to be done to address this debt crisis. The country is adding $3.7 billion per day to the National Debt. With the debt at $15.2 trillion, we have now surpassed the 100% to GDP mark. The National Debt will be $16.5 trillion when the next president takes office in January 2013. Ben Bernanke has been able to keep short term interest rates near zero and the non-existent U.S. economic growth and European disaster has resulted in keeping long-term rates near record lows. Despite these historic low rates, interest on the National Debt totaled $454 billion in 2011, an all-time high. The effective interest rate was approximately 3%. If rates stay at current levels, interest will be between $400 and $500 billion in 2012. Each 1% increase in rates would cost American taxpayers an additional $150 billion. A rapid increase in rates to the 7% level would ratchet interest expense above $1 trillion and destroy the last remaining vestiges of Bernanke's credibility. It can't possibly happen in 2012. Right? The world has total confidence in pieces of paper being produced at a rate of $3.7 billion per day. Confidence in Ben Bernanke, Barack Obama and the U.S. Congress is all that stands between continued stability and complete chaos. What could go wrong?

Debt related issues that will likely rear their head in 2012 are as follows:

"Here's what ECRI's recession call really says: if you think this is a bad economy, you haven't seen anything yet. And that has profound implications for both Main Street and Wall Street." – ECRI At present, we observe agreement across a broad ensemble of models, even restricting data to indicators available since 1950 (broader data since 1970 imply virtual certainty of recession). The uniformity of recessionary evidence we observe today has never been seen except during or just prior to other historical recessions.- John Hussman Negative economic growth will probably be registered in the U.S. during the fourth quarter of 2011, and in subsequent quarters in 2012. Though partially caused by monetary and fiscal actions and excessive indebtedness, this contraction has been further aggravated by three current cyclical developments: a) declining productivity, b) elevated inventory investment, and c) contracting real wage income. In summary, the case for an impending recession rests not only on cyclical precursors evident in productivity, real wages, and inventory investment, but also on the disfunctionality of monetary and fiscal policy. – Van Hoisington

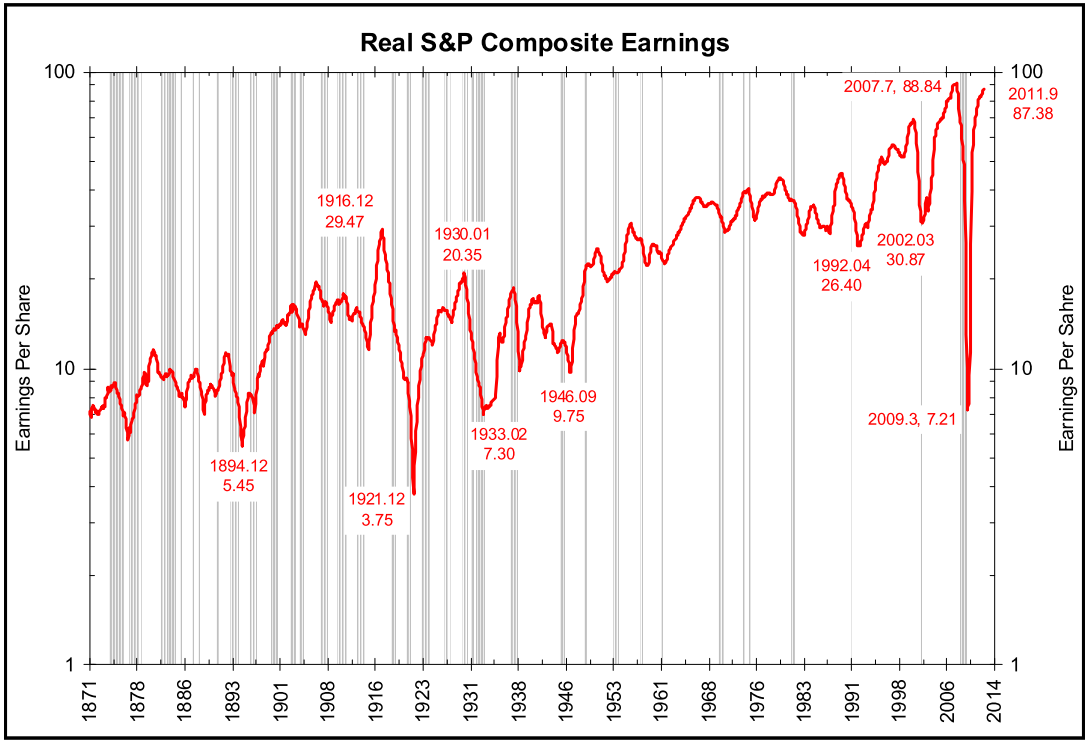

In a true free market excess profits will draw more competitors and profits will fall due to competition. When corporate profits exceed the mean by such a large amount, you can conclude that crony capitalism has replaced the free market. Government bureaucrats have been picking the winners (Wall Street, War Industry, Big Media, Big Healthcare) and the American people are the losers. Corporate oligarchs prefer no competition so they can reap obscene risk free profits and reward themselves with king-like compensation. Mean reversion will eventually be a bitch. Real S&P earnings have reached the 2007 historic peak. To believe they will soar higher as we enter a recession takes the same kind of faith shown by Americans buying a $600,000 McMansion in Stockton with no money down in 2005. The result will be the same. Do you ever wonder how corporations are doing so well while the average American sinks further into debt, despair and poverty?

The brilliant John Hussman captures the gist of an investor's dilemma in his latest article: "With 10-year Treasury yields below 2%, 30-year yields below 3%, corporate bond yields below 4%, and S&P 500 projected 10-year total returns below 5%, we presently have one of the worst menus of prospective return that long-term investors have ever faced. The outcome of this situation will not be surprisingly pleasant for any sustained period of time, but promises to be difficult, volatile, and unrewarding. The proper response is to accept risk in proportion to the compensation available for taking that risk. Presently, that compensation is very thin. This will change, and much better opportunities to accept risk will emerge. The key is for investors to avoid the allure of excessive short-term speculation in a market that promises – bends to its knees, stares straight into investors' eyes, and promises – to treat them terribly over the long-term." Ben Bernanke, Wall Street shysters and Barack Obama want you to be drawn in by the allure of short-term gains based on hopes of QE3. The stock market will be volatile in 2012 with stocks falling 20% when it becomes evident the country is going back into recession. Ben will try to ride to the rescue with QE3 as he buys up more toxic mortgage debt. Wall Street will do their usual touchdown dance celebration, but the bloom will fall off this rose fast, as quantitative easing has proven to be a failure in stimulating economic growth.Gridlock in Washington D.C., chaotic national conventions, and the implosion of Europe will contribute to the market finishing down by at least 15% for the year.

January 2009 $1.65 January 2010 $2.57 January 2011 $3.04 January 2012 $3.29 Gas prices are rising during the lowest usage time of the year. The average price of oil will exceed $100 during 2012 resulting in the highest average gas price in history for American drivers. These high prices, along with various weather related issues will keep food prices elevated, with 5% or higher increases likely. This should spur a few more peasant revolutions around the globe.

Civic Decay – Occupying, Plundering, CapturingCivic decay revealed itself dramatically in 2011 as millions of young people across the country occupied parks and town squares in a fruitless effort to correctly point out how the ruthless oligarchs inhabiting Wall Street bank executive suites, Mega-corporation boardrooms, the Marriner S. Eccles Federal Reserve Board Building, and the hallways of Congress had pillaged the wealth of the middle class through inflation, taxation, fraud and outright thievery. The majority of over-medicated, lethargic, uninterested, ignorant Americans yawned at this selfless display of courage and civil disobedience as they chose to occupy lines for hours to get the latest iPad or $3 waffle-maker at Wal-Mart. Delusional, non-thinking dolts across the land watched on their 60 inch HDTVs as young protestors got clubbed, beaten, tear gassed, tasered, maced, and brutalized by paid mercenaries for the ruling oligarchy. They treated the horrific scenes of brutality as if it was just one of their 30 favorite reality TV shows like I Didn't Know I Was Pregnant or Toddlers & Tiaras. They thought this was a new show called Mace A Millenial. Despite controlling the media, the money and the levers of power in Washington D.C., those in power cannot spin the reality of a middle class being systematically wiped out by the policies put in place by the corporate fascist oligarchs running th |