saveyourassetsfirst3 |

- Investing vs. Speculating in Gold and Silver Stocks

- Despite Settlement Uncertainty Remains For WaMu Junior Debt

- Goldrunner: Gold on the Cusp of $3,000+: An Update

- Gold “Could Be Weak but Volatile” to End of Year, “Large Scale Liquidity” Required to Restore Confidence to Markets

- SILVER MINING / Making Doré Bars - Discovery Channel

- Gold Sector: Current Situation and Per-Ounce Valuations

- Robust Demand for Bullion in Europe, Middle East and China Again - Very Little Selling

- Delayed Santa Claus Rally

- How To Lose 25% Of Your Assets Instantly (The MF Global Gold and Silver Scam)

- Will European central banks sell their gold?

- Several top value investors are buying this country's hated stocks

- Obama Tax Cuts Will Push Investors Further to Gold

- The great Richard Russell issues a super-bearish warning

- Morning Outlook from the Trade Desk - 12/20/11

- Ted Butler: Don't Stop Complaining About Shorting of SLV

- The East Is Gold? Bugs Take Big Hit, but Asia Is Buying

- Jim Rickards - This Will Send the Price of Gold to the Moon

- John Williams - Gold to Prevail as System Falls into Disorder

- 'Bargain' gold spurs buying in Dubai

- Zero Hedge: Did GLD and other gold ETFs kill gold stocks?

- Lots of gold and silver went missing at MF Global

- Gold price forecast to drop

- Euro Woes May Prompt Return of Gold Standard

- James Turk: More deficits, more debt

- Gold & Silver Market Morning, December 20, 2011

- Silver Update: “S.P.A.R.C.”

- LISTEN: Jim Willie talks with SGT

- India gold demand weak amid inauspicious phase

- DMCC chairman sets date to switch Gold listing

- Global Savings Glut or Global Banking Glut?

| Investing vs. Speculating in Gold and Silver Stocks Posted: 20 Dec 2011 06:11 AM PST One thing that is intriguing about the precious metals sector is the vast composition of the companies in the sector. The entire equity sector can be divided in so many forms and ways. We can divide the gold and silver stocks, the producers and non producers, the explorers and the developers, the royalty companies and non-royalty companies as well as those making money and those not making money. To make money in this sector one really needs to have a plan and know what they are doing. Specifically, one needs to define an investment and a speculation. Though the sector itself is risky, there are still numerous companies that can be defined as an investment. An investment is something which you receive a return on your money and a return of your money. Therefore we are looking for companies that are making money and have the reasonable ability to grow cash flow and earnings. The royalty companies and large and senior producers fit this bill. An investment in GDX or a gold mutual fund fit this category. Mid-tier and smaller producers with experienced management, a track record and a strong financial position can be categorized as investments. Anything and everything else falls into the speculation category. How about a large developer with 10 M oz Au? It is a speculation. No one knows if the owner will ever be acquired, much less if the project will ever go into production. Even if a junior explorer or junior developer are trading at $10/oz in the ground, it still qualifies as a speculation. Why are we talking about this? Many gold bulls were hurt in 2007-2008 and again this year as they forgot that most of the companies in this sector as speculations. They forgot that shares can fall tremendously, even as the metals remain firm or even rise. You cannot just sit in your juniors and think they will be up 50-fold by the end of this bull market. After all, you should know by now that most juniors will fail and even fail in this historic bull market. This year provides a clear example of the difference between speculating and investing. GDX is down 14% while GDXJ is down 33% while the CDNX is down 38%. Going forward, one has to have a plan that distinguishes between investing and speculating. How much of your portfolio should be in Gold-related investments and how much should be in speculations? Obviously, we are coming out of a difficult year and those who held too many speculations will feel jaded. They will feel that the juniors will never gain or that gold stocks will always underperform the metal. The result of this year will cloud their thinking for 2012 and beyond. On the other hand, the real professionals were cautious this year. They held high cash positions and focused most of their risk-capital on investments and not speculations. Since the market is likely to make a major low within potentially days or weeks, it may be time to consider some of the speculations, rather than become really defensive and only sit in a few large cap stocks. Your job, Joe Investor is to figure out the right balance for your portfolio and then shift accordingly with market conditions. Your investments should earn you a return of your money and a return on your money. Whether that is 80% or 50% of your portfolio depends on your risk tolerance, time horizon and other factors. In our premium service, we look for both investments and speculations in this sector that can make you money. If you'd like professional guidance in navigating what lies ahead, while managing risk, consider learning more about our premium service. Good Luck! Jordan Roy-Byrne, CMT |

| Despite Settlement Uncertainty Remains For WaMu Junior Debt Posted: 20 Dec 2011 06:03 AM PST By Troy Racki: Last Monday, after six previous plans of reorganization and two failed confirmation attempts, Washington Mutual finally announced a long overdue settlement between its creditors and shareholders after weeks of intense mediation. While the settlement carves out a recovery for WaMu's preferred (WAMKQ.PK) and common stock classes (WAMUQ.PK) it also resulted in a doughnut hole for the holding company's junior most creditors. According to the seventh plan of reorganization's disclosure statement investors in WaMu's Trust Preferred Securities (WAHUQ.PK) have seen their recoveries plunge from a previous estimation of 32% to a paltry 9% or $3.20. These prices are a far cry from May 2010 when the trust preferreds traded at a high of $27 on expectations of a 75% recovery and ownership in the reorganized company. Since then copious legal fees and mounting interest has steadily eroded away at the class' recovery. But now even nine cents on the dollar is Complete Story » |

| Goldrunner: Gold on the Cusp of $3,000+: An Update Posted: 20 Dec 2011 04:35 AM PST

www.goldrunnerfractalanalysis.com

THE $GOLD ARITHMETIC CHART On the chart below you can see the lower channel in green that Gold traded within during the early part of the current Gold Bull running up the low channel base before busting out of the green channel with a huge move out of the top and into a more parabolic growth rate into the blue channel and then underwent parabolic growth as it busted upward into the blue channel. At this stage in the late 70's, $Gold made a similar sharp run higher and busted out of the top of the blue channel on the $Gold Chart, much like we saw as Gold busted out of the lower channel in 2005. This is how the Golden Parabola grows. We see a relatively constant acceleration in price per period of time – acceleration in price driven by the devaluation of the Dollar in response to more Dollars being printed in an accelerating way or Dollar Inflation. THE 2008 DEFLATION SCARE GOLD CHART PROJECTIONSAbove and below, are two of the Fractal Gold Charts I posted back in September of 2007 showing where we were in the Fractal Model off of the late 70's, using two of Dan Norcini's Gold charts. Note the sharp correction into late 2008 that was denoted on one of the two charts for 2008. Also note that there is no similar sharp correction further along in the late 70's Gold chart to match "a second deflation scare for today" as the parabola powered onward and upward.

We would like to extend our wishes for a very Merry Christmas to all of you. |

| Posted: 20 Dec 2011 04:31 AM PST Tuesday 20 December, 08:45 EST Gold "Could Be Weak but Volatile" to End of Year, "Large Scale Liquidity" Required to Restore Confidence to Markets SPOT MARKET gold prices climbed to $1608 an ounce Tuesday lunchtime in London – a 2.8% gain from last week's low – while stocks and commodities traded higher, with the exception of the FTSE in London which fell lower. Silver prices rose to $29.51 per ounce – still 0.9% down on last week's close – while major government bond prices fell and the Euro gained amid signs of progress on the Eurozone crisis. "Liquidity in the precious metals space remains light," warns Walter de Wet, commodities Strategist at Standard Bank. "Short-term the [precious metals] complex is likely to remain vulnerable to bouts of long liquidation amid concerns over funding levels," agree analysts at Swiss refiner MKS. Despite this morning's rally, gold remains around 8% down since the start of December. "Profit-taking and year-end book squaring by large investors, including mutual funds and macro hedge funds…help explain the recent drop in prices," says a note from HSBC. "Gold prices may stay weak but volatile for the rest of this year, we believe, as trading volume is likely to dry up in the run-up to the year-end holidays." Eurozone finance ministers agreed Monday to lend an additional €150 billion to the International Monetary Fund. Four other European countries outside the Eurozone – Czech Republic, Denmark, Poland and Sweden – also said they will contribute extra funds. Britain meantime did not offer additional funding, but added it will "define its contribution" early next year. "The UK has always been willing to consider further resources for the IMF, but for its global role and as part of a global agreement," said a statement from HM Treasury. Germany's Bundesbank pledged €41.5 billion – but on condition that these funds go to the IMF's general resources and are not earmarked for Europe, news agency Bloomberg reports. Boosting the IMF by €150 billion is "obviously a small-scale solution" says former UBS chairman Peter Kurer. "What really would be needed in the ideal world would be Eurobonds or a substitute which can bring large-scale liquidity and confidence into the markets." Tuesday saw the beginning of the European Central Bank's 3-Year Longer Term Refinancing Operation (LTRO), whereby banks will be able to borrow from the ECB for three years while posting distressed Eurozone government debt as collateral. "These measures address the risk that persistent financial markets tensions could affect the capacity of Euro area banks to obtain refinancing over longer horizons," ECB president Mario Draghi told the European parliament yesterday. Draghi also confirmed that the ECB has lowered the reserve ratio – the proportion of a bank's balance sheet it is required to hold with a central bank – from 2% to 1%, as well as expanding the list of collateral eligible for refinancing. Spain's government saw its borrowing costs fall Tuesday morning when it auctioned €5.64 billion of short-term Treasury bills. The average yields on 3-month T-bills fell to 1.735% – down from 5.11% last month – while 6-month yields were down from 5.227% to 2.435%. "The expectation is that a lot of banks have been buying [peripheral Eurozone government debt] into the LTRO," one trader told Reuters. "It's going to be an interesting battle in January when we start getting big chunks of supply, but at the moment people were probably underweight their benchmarks and short Italy and Spain, and this is an opportunity for them to square positions." Banks in the United States meantime are still vulnerable to the Eurozone crisis, despite selling most of their European government bonds, research published by the Federal Reserve Bank of San Francisco warns. "US banks have mostly shed their direct exposure to European sovereign debt," noted San Francisco Fed research advisor Sylvain Leduc earlier this month. "But they remain subject to the risk that European trading counterparties might not be able to meet their obligations." Over in India, gold demand remained subdued yesterday despite last week's fall in gold prices, newswire Reuters reports. "Consumers are not buying due to an inauspicious period," says Ashok Jain of Mumbai jeweler Chenaji Narsinghji. "Demand will improve only after January 14," he added, explaining that the Hindu calendar month of Khar Mass – considered an inauspicious time to buy gold – runs until then, having begun on December 16. Rupee gold prices have fallen from all-time highs hit in recent weeks, as the Rupee fell on currency markets to record lows against the Dollar. Ben Traynor Gold value calculator | Buy gold online at live prices Editor of Gold News, the analysis and investment research site from world-leading gold ownership service BullionVault, Ben Traynor was formerly editor of the Fleet Street Letter, the UK's longest-running investment letter. A Cambridge economics graduate, he is a professional writer and editor with a specialist interest in monetary economics. (c) BullionVault 2011 Please Note: This article is to inform your thinking, not lead it. Only you can decide the best place for your money, and any decision you make will put your money at risk. Information or data included here may have already been overtaken by events – and must be verified elsewhere – should you choose to act on it. |

| SILVER MINING / Making Doré Bars - Discovery Channel Posted: 20 Dec 2011 02:08 AM PST Nice quick vid |

| Gold Sector: Current Situation and Per-Ounce Valuations Posted: 20 Dec 2011 01:55 AM PST |

| Robust Demand for Bullion in Europe, Middle East and China Again - Very Little Selling Posted: 20 Dec 2011 01:48 AM PST |

| Posted: 20 Dec 2011 01:47 AM PST A delayed Santa rally will probably be small but should occur before Christmas according what we see in the charts as of the end of last week. We add comments as we see it from the technical charts. Dow Jones Industrial Average: Closed at 11866.39 -2.42 on 110% of normal volume, flat-to-down momentum and a closing price under the 20-day average at 11904.59. Support is the 50 day average at 11792.28 and the 200-day average at 11725.39. The chart pattern has a bear double top. However, the lower close and chart price remain above hard support at 11,750. We still have faith the belated Santa rally, curbed by European troubles, can provide some bounce on Monday next week. With so little trading time before Christmas, we suspect the monthly high could be a triple top at 12,250 by next Friday, 12-23-11. If this is true, Santa had better get busy next week on some good news to get this market moving. S&P 500 Index: Closed at 1219.66 +3.91 on 110% of normal volume and mildly falling momentum. The close and all moving averages are very close together between 1219 and 1233. The continuation triangle pattern is setting-up for a breakout either up or down next week. Our view is a new breakout rally in stocks. New support is 1200 with resistance on the 20-day average at 1228.48. Look for a new rally to 1250 followed by a pause to correct. Then, the rally could continue to 1275 and potentially to 1300-1325. S&P 100 Index: Closed at 553.61 +1.74 on 110% of volume and falling momentum. The close and all moving averages are bunched together in a continuation triangle. All the prices are between 555.28 and 553.61, today's close. With the chart pattern and tightly knit price congestion, we can yet receive a breakout rally. However, price may not get past 575 where it could be blocked by the upper channel line of the triangle. Technically, the price cycle is not deep enough into the triangle apex for a breakout until perhaps January. It could rise to the channel line if the move was faster and powerful enough. We would more conservatively expect a milder move to 575 for this month's next high pre-holiday. Nasdaq 100 Index: Closed at 2238.18 +11.47 on 120% of normal volume and mildly flat to down momentum. The close is just under the 200-day moving average. All averages and the close are between 2238 and 2280. Like the other stock indexes, this one is in a similar triangle and has advanced closer to the apex for a breakout. We expect a rally but we need some news and encouragement over this weekend and/or next week for a rally. The price of 2250 is hard support and resistance. We have attained a 50% retracement from the lows in August and may have another 10-12% upside remaining. This would take the price to 2250-2350 and a further out 2400 if the rally has some serious power. 30-Year Bonds: Closed at 145.28 +1.12 on rising momentum and a higher price reflecting new buying from those exiting Euro-land paper and currency. The bonds have now posted a quadruple top. We have basically, two double tops in September and in November-December. The dollar is over-bought and toppy. The Euro is oversold and in the green today. Despite the messes in Euro-land, we see a small recovery in the Euro currency with milder selling to 79.50-80.00 for the dollar. The long bonds will follow the dollar and should begin to sell-off to 142.50-143.50 for the balance of December. Normally, the bonds are in a choppy trading channel from mid-December to the end of January. We expect more of the same in this cycle. XAU: Closed at 183.33 +2.77 on a flat metal to shares ratio and falling momentum. Precious metals shares are negative but they have based this week on 180.00 support. There is resistance at 202.22 on the 200-day moving average. New support is the price of 180. Look for a mild rally this month followed by corrective selling on calendar cycles for January. Gold and silver should have rallies in February, March and April with one correction in mid-March, 2012. Gold: Closed at 1597.70 +28.90 in a recovery rally on this Friday. Momentum remains down but it should catch-up and turn-up next week. Price drove into a continuation triangle, hit the apex, and sold down and through a supporting channel bottom. All moving averages were broken as well as the lower channel line. New support is 1585-1592.50 with resistance at 1607. This weekend and next week gold will have to break-up and through the powerful 200-day moving average (now resistance) at 1617.32. We can see a new rally to 1685 but one top analyst mentioned this morning he sees 1790 by the end of the year. Based on the recent volatility, most anything is possible as precious metals and other markets gyrate faster than ever. Silver: Closed at 29.67 +0.61 on falling momentum and a price posted within a wider, selling, trading channel. Based upon the recent hard selling in this market of late, we forecast the snap-back rally to be mild, taking silver to a lower than expected December high of $34.00 on the 200-day moving average. We had earlier predicted both $36.00 and $38.85 but we are running out of trading days ahead of Christmas. There should be normal annual buying between 12-16-11 and 12-30-11 but not more than $1.00 to $2.00, in our view. US Dollar: Closed at 80.18 -0.14 after taking a run at 81.00 and trying to hold. The main support and resistance for the dollar is 80.00; very near the close. Price touched 80.00 and sold back in early October. The recent breakout above 80.00 was a direct result of European Euro currency problems. Sell the Euro and buy the Dollar. With the new shift in support and resistance on both currencies, they are moving toward a new balance. The cooling dollar is positive for precious metals and other commodities. We could dollar double top next month and then begin to sell mildly in a choppy channel. The dollar could remain stronger for the first quarter of 2012 on a weaker Euro. Expect weeks of trading between 79.50 and 81.50 for the dollar. Crude Oil: Closed at 93.53 +0.08 on falling momentum and support just above the 200-day moving average at 92.64. OPEC had a meeting to hold prices this week and agreed on the status quo. This means a strong base at 88.50 to 92.50 with flurries of buying between $92.50 and $102.50. Oil should stay in a choppy trading channel until near the end of February. Then, we forecast rising prices all the way to May on inflation, demand and a so-called recovering global economy, which is not true. A longer view double top for oil would be $115.00. We hold our first half 2012 higher oil price at $120. Two factors affect price: (a) Potential Middle Eastern conflict and media reports on recession-depression. The dollar should not do much on oil's price for about six weeks. Support is $92.50 and resistance is $96.50. Expect mild buying next week. CRB Index: Closed at 295.00 +0.55 on falling momentum. Price has double bottomed bullish in October and this week. Price fell under all moving averages. New support is 290.00 with resistance at 300.00. There is higher resistance at 320-322 on a channel line and 200-day moving average. Buying next week. -Traderrog This posting includes an audio/video/photo media file: Download Now |

| How To Lose 25% Of Your Assets Instantly (The MF Global Gold and Silver Scam) Posted: 20 Dec 2011 12:51 AM PST |

| Will European central banks sell their gold? Posted: 20 Dec 2011 12:47 AM PST |

| Several top value investors are buying this country's hated stocks Posted: 20 Dec 2011 12:42 AM PST From The Guru Investor: While Japanese stocks have for years yielded little for investors, some top value investors are keen on the country. In a column for SmartMoney, Brett Arends writes that Japan's "stock market is cheap. Possibly very cheap -- at a time when nearly everything else looks pricey. The Nikkei 225, Japan's major stock market index, trades at just 10 times forecast earnings. The dividend yield is up to 2.3 percent -- a hefty amount in a country with zero inflation. Japanese equities today trade for half of annual revenues, according to FactSet. (The figure for the U.S.: 1.2 times revenues.) And they trade for less than book value, while U.S. stocks trade for twice book." That, Arends says, has led some top value managers to load up on Japanese stocks. One is Charles de Vaulx of International Value Advisers. More than 40% of his... Read full article... More on Japan: Radiation experts: Tokyo may have to be evacuated Japanese investors are selling gold and buying this instead Jim Rogers: One country's stocks are a huge bargain right now |

| Obama Tax Cuts Will Push Investors Further to Gold Posted: 20 Dec 2011 12:34 AM PST |

| The great Richard Russell issues a super-bearish warning Posted: 20 Dec 2011 12:29 AM PST From Pragmatic Capitalism: Here are some deep thoughts from the great Richard Russell that will give the bears something to chew on for a while: "I talked with my good friend, Joe Granville, over the weekend, and Joe is as bearish as I've ever seen or heard him, based on his OBV volume figures. This checks with my own work and studies. While fundamentalists scour the news for indications of bullish news, the internals of the stock market continue to deteriorate. Even the action of the stock market is bearish as the market rallies on dull volume but declines on higher volume. Furthermore, rising breadth is narrow on rallies while declining breadth is broad when the market heads down. I don't know what more I can do or say to convinced subscribers that we are seeing the resumption of the bear market. This means that we should be OUT of all stocks. As for gold mining stocks, this is a personal choice. In due time, I expect gold to fully express itself with a huge upside blow-off. At that time, I expect gold mining stocks to follow. But between now and then, gold mining shares will probably be hit like every thing else by the fury of the bear market. I should add that I am expecting this bear market to be far worse than most people expect or are prepared for. The fact is... Read full article... More from Richard Russell: Richard Russell: This is a modern day Depression Richard Russell: Gold will be "the last man standing" Richard Russell: 12 tips for surviving the "End of America" |

| Morning Outlook from the Trade Desk - 12/20/11 Posted: 20 Dec 2011 12:22 AM PST Some better economic numbers out of Germany boosted European shares and creates some enthusiasm for the US open. Translation, stocks up metals along for the ride. Gold market is putting in a major effort to try and close above the $1,622 level by yearend. Thin markets can do strange things, but looking at the global issues and watching the metals move in tandem with "good" news, ie higher equities, its difficult to be bullish the metals complex at least for the 1st quarter of 2012. Events such as occurred in North Korea yesterday, where the new leader, we think he is 26 and appears to have control over the market share of Big Macs, may flex his muscle (fat) to show the world he is a real dictator to be, could be price supportive. The economics of the world stage appear gloomy at best, which at a minimum, should cap any equity enthusiasm and most probably will create equity value erosion. This should create a test of lower levels in the New Year and possibly much lower levels. Thin markets watching for headlines are dangerous. Two and one half days left. Traders stay safe. |

| Ted Butler: Don't Stop Complaining About Shorting of SLV Posted: 19 Dec 2011 09:10 PM PST ¤ Yesterday in Gold and SilverGold's rally over the $1,600 spot price at the open of trading in New York on Sunday night ran into a not-for-profit seller right out of the gate. Gold's low price tick on Monday came shortly before 1:00 p.m. Hong Kong time...and then the price rallied back to a few dollars below unchanged by half-past lunchtime in London. At that point, the gold price blasted back through the $1,600 mark...making it up to $1,608 before a willing seller sold it back down to around $1,590 spot. The subsequent rally attempt at half-past lunchtime in New York got sold off the instant it hit the $1,600 price mark. Gold closed at $1,539.90 spot...down $5.30 on the day. Volume was a fairly light 121,000 contracts. But it was obvious to anyone with two synapse to rub together that JPMorgan et al were after the silver price once again...as it got creamed almost the moment that trading began in New York on Sunday night. The low of the day came shortly after 2:00 p.m. Hong Kong time. From that point it regained a bit of ground going into the London open, before losing a bit going into the London silver fix, which occurred minutes after 12 o'clock noon in London. The silver price, like gold, took off to the upside from that point, but ran into the usual not-for-profit sellers the moment that Comex trading began in New York at 8:20 a.m. Eastern time. Every subsequent rally attempt after that, also got sold off...and silver closed almost on its low of the day. The New York low price tick was $28.61...just before the close of electronic trading. Silver had a trading range of $1.13 since Friday's close...3.8%. The silver price closed at $28.80 spot...down 94 cents on the day. Volume was monstrous at 50,000 contracts. I would guess a lot of that would be high-frequency trading. The dollar rose about 35 basis points from the open on Sunday night, right up until about 10:00 p.m...and by 9:00 a.m. Eastern time, had lost the entire gain...but then rallied a bit into the close. The dollar's antics were not a factor in yesterday's precious metal price action. The gold stocks were in the red all day long...and then got sold off even more...along with the rest of the equity market, starting about 3:00 p.m. Eastern time. The HUI finished below the 500-mark at 495.67...down 2.89%. With the silver price down 94 cents on the day, the silver stocks suffered as well. Nick Laird's Silver Sentiment Index closed down 2.92%. (Click on image to enlarge) The CME's Daily Delivery Report showed that 114 gold and 18 silver contracts were posted for delivery on Wednesday. It was pretty much 'all the usual suspects' as issuers and stoppers. The link to that report is here. There were no changes reported in the GLD ETF on Monday...however, SLV reported a withdrawal of 1,458,705 troy ounces. The U.S. Mint's sales report on Monday showed that they sold 2,000 one-ounce 24K gold buffaloes...and 350,000 silver eagles. Month-to-date the U.S. Mint has sold 65,000 ounces of gold eagles...15,500 one-ounce 24K gold buffaloes...and 1,909,000 silver eagles. The Comex-approved depositories reported receiving 1,225,662 troy ounces of silver on Friday...and only shipped a smallish 80,369 ounces out the door. The link to that action is here. Silver analyst Ted Butler posted his weekly review for clients on Saturday...and here are a couple of free paragraphs... "I think the gold COT structure is back to a bullish set up, especially if the improvements after the cut-off are what I think them to be. As such, gold may also be at a price bottom, especially considering the bullish signals (or lack of bearish signals) coming from the gold physical market (ETF holdings, etc.). But to be fair, while gold is near bullish COT readings over the past year or so, on a much longer historical basis there may still be room for further liquidation. My personal sense is that we probably shouldn't see big further speculative long liquidation in gold and may, in fact, be good to go to the upside. But if the COT structure in gold is bullish (as I think), then silver's structure is screamingly, super-duper bullish." "That doesn't mean, of course, that we can't go lower in price on a very short term basis. After all, silver is the most manipulated market in the world. And the crooks at the CME Group have armed the commercial manipulators with powerful anti-free market tools, such as High Frequency Trading. But the greater weight of the evidence suggests that we are at an important silver price bottom regardless of continued dirty market tricks from the commercials. In fact, we appear to be at an almost mirror-image opposite of where we were at the top in April, including price action, sentiment, technical readings, etc. I firmly believe that we had reached the breaking point back in April in terms of physical shortage and the commercials getting overrun on the short side. The crooks managed to save themselves at the very last minute with the blatant and desperate Sunday evening massacre of May 1st that led to these 8 months of downward price manipulation. Unfortunately, there are times when the criminals get what they want, especially when the regulators are negligent and timid. Hopefully, we are at the end of the criminals' holiday since there appears to be little left for them to steal." Here's another analysis of Friday's Commitment of Traders Report. This one is posted over at ewfresearch.com. Besides excellent analysis, the charts are first rate. Here's what he has to say about silver..."The silver COT for positions held on 12/13/2011 still shows extreme positions across all classes of traders. The commercials' bullish stance is currently extreme. The speculators' bearish stance is also extreme. This is exactly the COT configuration that contrarian investors look for." He also has six new charts on the undervaluation of the gold mining shares. The link to the gold and silver COT analysis...and the gold shares charts are here. It's worth a few minutes of your time. Here's a graph that Washington state reader S.A. sent me yesterday. The chart covers thirty-six years...and shows the gold price performance, the gold equities performance...and the performance of the ETFs during that period. The chart is self-explanatory. (Click on image to enlarge) Here's another little financial tidbit that's been making the rounds for the last little while...and this illustration certainly adds more clarity. Once again, no explanation is needed. I thank reader Dennis Miller for sending it along. There was a lot of news on just about every front over the weekend...and on Monday. I hope you have the time to give these stories the attention they deserve. The huge volume associated with the dollar plus sell-off in silver yesterday is proof positive that the short position in silver is still at the center of the '8 or less' Commercial trader's universe. 'Bargain' gold spurs buying in Dubai. John Williams - Gold to Prevail as System Falls into Disorder. Lots of gold and silver went missing at MF Global. ¤ Critical ReadsSubscribeSlapped Wrists at WaMuWhen Washington Mutual collapsed in 2008, it was the largest bank failure in American history. So the $64.7 million settlement struck last week by federal banking regulators and three former WaMu executives seems like small potatoes indeed. "Pretty soft," is how Senator Carl Levin, the Michigan Democrat who heads the Senate's permanent subcommittee on investigations, characterized the settlement in an interview on Friday. "Washington Mutual Bank epitomizes everything that went wrong with the banking industry and contributed to the financial crisis, so the F.D.I.C. was right to go after the bank's leadership," Mr. Levin said in a statement issued on Tuesday. "Former WaMu executives Killinger, Rotella and Schneider are truly the 1 percent: they got bonus upon bonus when the bank did well, but when they led the bank to collapse, insurance and indemnity clauses shielded them from paying any penalty for their wrongdoing." This short piece by Gretchen Morgenson came from the Saturday edition of The New York Times. I thank reader Phil Barlett for sending it along...and the link is here.  Here's One Big Thing MF and Jon Corzine Got Right: Jonathan WeilIf you were stranded on a desert island the past two months and upon your return to civilization tried to learn why MF Global Holdings Ltd.. had collapsed, you might find that some of the standard explanations don't make much sense. One scenario is that a catastrophic bet on some European government bonds killed the commodities and derivatives broker. Another story line has it that investors were slow to realize MF had made such a big leveraged wager, and their concerns evolved into fear, leading to a run on the firm. Neither version of events is satisfactory. What caused investors to lose confidence in MF in late October? There's a simple, sensible explanation. Six days before it filed for bankruptcy, MF reported a large quarterly loss, the details of which contained a message: Don't expect this company ever to be profitable again. The markets responded accordingly. This op-ed piece by Bloomberg columnist Jonathan Weil was posted over at bloomberg.com last Wednesday. It's well worth the read...and I thank reader Scott Pluschau for sending it to me on the weekend. The link is here.  Divisions in eurozone over ECB bond-buyingThe eurozone was facing fresh splits today after one of the European Central Bank's most senior figures said the bank should not be used to fund national debts and that if it was forced to, it would mean the end of the single currency. Executive board member Juergen Stark, who announced his surprise resignation from the ECB earlier this year, said disagreements over the central bank's bond-buying programme was behind his decision. In an interview with German weekly WirtschaftsWoche to be published on Tuesday, Mr. Stark said he did not agree with the way the euro crisis has been handled. He particularly criticised the use of monetary measures, or the wholesale purchase of sovereign bonds by the bank, to contain the crisis. The statement is in contrast to what the Bank said in September to explain his surprise resignation, which was put down to "personal reasons". This story appeared in the Saturday edition of The Telegraph...and is Roy Stephens first offering of the day. The link is here.  Psssst France: Here Is Why You May Want To Cool It With The Britain Bashing - The UK's 950% Debt To GDPThe truth is that France is actually 100% correct in telling the world to shift its attention from France and to Britain. So why is this bad. Because as the chart below shows, if there is anything the global financial system needs, is for the rating agencies, bond vigilantes, and lastly, general public itself, to realize that the UK's consolidated debt (non-financial, financial, government and household) to GDP is... just under 1000%. That's right: the UK debt, when one adds to its more tenable sovereign debt tranche all the other debt carried on UK books (and thus making the transfer of private debt to the public balance sheet impossible), is nearly ten times greater than the country's GDP. To call that "game over" is an insult to game overs everywhere. This story is certainly worth skimming...and the graph is worth the trip all by itself. I thank Matthew Nel for sending this zerohedge.com story along...and the link is here.  Resentments Reawaken: Britain's Mounting Distrust of GermanyIn Britain, distrust of Europe goes hand-in-hand with distrust of Germany. Relations between the two countries have cooled following the furore caused by the latest EU summit, and British euroskeptics are once again resorting to old stereotypes. The London-based Daily Telegraph newspaper has warned its readers against what it calls Berlin's blatant effort to dominate Europe and |

| The East Is Gold? Bugs Take Big Hit, but Asia Is Buying Posted: 19 Dec 2011 09:10 PM PST  There's wide agreement that gold's charts now do indeed look gruesome. The situation was well summarized on Friday by Pring.com's Weekly InfoMovie report: "Gold has now completed a massive head-and-shoulders top. The share ETF has also completed a smaller distribution pattern. ... Lower prices look likely in the next few weeks. For the record, the head-and-shoulder objective for the gold price calls for an eventual move to the $1,300 area." But could this be excessive panic? GCRU, the short-term gold-trading service started by gold veteran Harry Schultz and now operated by the Aden Forecast, thinks so. Very bravely, it issued a special alert on Thursday afternoon overriding its stops: "Our stop loss was triggered today on both gold and silver." |

| Jim Rickards - This Will Send the Price of Gold to the Moon Posted: 19 Dec 2011 09:10 PM PST  Eric King sent me a Jim Rickards interview yesterday. It's so long that he's had to post it in two parts. I haven't had time to listen to either one, but it will be on my 'to do' list when I get up later this morning. Their both posted over at the King World News website. I would think that they're both a must listen. The link to Part I is here...and Part 2 is here. |

| John Williams - Gold to Prevail as System Falls into Disorder Posted: 19 Dec 2011 09:10 PM PST  "My outlook has not changed a bit. The underlying fundamentals have not changed a bit. The domestic and global financial systems, however, appear to be on the brink of massive instabilities. This environment is one where prudent investors—in a U.S. dollar-denominated world—should be looking to preserve their wealth and assets, using assets that are liquid and that preserve the purchasing power of invested funds. Accordingly, gold, and related hedges such as silver; and stronger currencies such as the Swiss franc, Australian dollar and Canadian dollar; should be held for the long term. Irrespective of short-term market instabilities, such assets will prevail as the system falls into disorder. |

| 'Bargain' gold spurs buying in Dubai Posted: 19 Dec 2011 09:10 PM PST  Physical gold buying saw a significant upsurge last week after prices slumped in the wake of global concerns. "I was resigned to the fact that the physical buying in our market (Dubai and UAE in the wider sense) had finished for the year, and then came Thursday, 15th December. We saw excellent buying from customers which reminded us very strongly of the heydays in August/September," Gerhard Schubert, Head of Precious Metals at Dubai-based Emirates NBD, said in his weekly precious metals report. |

| Zero Hedge: Did GLD and other gold ETFs kill gold stocks? Posted: 19 Dec 2011 09:10 PM PST  Here's a GATA release where Chris Powell has written a preamble that I'm not about to cut and paste. The title is pretty much self-explanatory...and is a must read. The link is here. |

| Lots of gold and silver went missing at MF Global Posted: 19 Dec 2011 09:10 PM PST  It's one thing for $1.2 billion to vanish into thin air through a series of complex trades, the well-publicized phenomenon at bankrupt MF Global. It's something else for a bar of silver stashed in a vault to instantly shrink in size by more than 25%. That, in essence, is what's happening to investors whose bars of silver and gold were held through accounts with MF Global. |

| Posted: 19 Dec 2011 09:10 PM PST  This bear-type story is typical of the main steam media's coverage of this engineered price decline by the Commercial traders in the Comex futures market. This Reuters piece was posted over at iol.co.za website in South Africa on Saturday. This drivel is accompanied by a photo of a gold dragon the will knock your socks off. For that reason alone it's worth the trip. I thank Matthew Nel for digging it up on our behalf...and the link is here. |

| Euro Woes May Prompt Return of Gold Standard Posted: 19 Dec 2011 09:10 PM PST  Gordon Kerr, founder of consultancy firm Cobden Partners, talks about banking industry risks and the European sovereign-debt crisis. He speaks with Linzie Janis and Elliott Gotkine on Bloomberg Television's "First Look." Kerr sort of reminds me of a British version of Kyle Bass. This interview, courtesy of Elliot Simon, runs 6:22...and is posted over at youtube.com. This is worth watching...and the link is here. |

| James Turk: More deficits, more debt Posted: 19 Dec 2011 09:10 PM PST  GoldMoney founder, Free Gold Money Report editor, and GATA consultant James Turk writes that the U.S. government has long passed its "Havenstein moment," as it now spends 58 percent more than it takes in on a monthly basis, that 58 percent constituting debt monetization and a guarantee of hyperinflation. But we might add -- and Turk probably would agree -- that, in the United States, the imperial power and proprietor of the world reserve currency, the new Havenstein moment also guarantees, even before hyperinflation, more and more repressive interventions to subvert markets from manifesting hyperinflation. That is, for starters, what the gold price suppression scheme long has been about. |

| Gold & Silver Market Morning, December 20, 2011 Posted: 19 Dec 2011 09:00 PM PST |

| Silver Update: “S.P.A.R.C.” Posted: 19 Dec 2011 08:54 PM PST from BrotherJohnF:

~TVR |

| LISTEN: Jim Willie talks with SGT Posted: 19 Dec 2011 08:50 PM PST from SGT: Jim Willie of GoldenJackass joins SGT to talk in his uniquely no-bull style about a 20-Lehmans 'Flash Event', the Libyan gold, the Comex shortage, the MF Global farce & Global Quantitative Easing to infinity… Buckle up. Also, read Jim Willie's latest piece, Pathogenesis of Central Bank Ruin. Part 1: Part 2: Part 3: ~TVR |

| India gold demand weak amid inauspicious phase Posted: 19 Dec 2011 06:31 PM PST |

| DMCC chairman sets date to switch Gold listing Posted: 19 Dec 2011 06:21 PM PST |

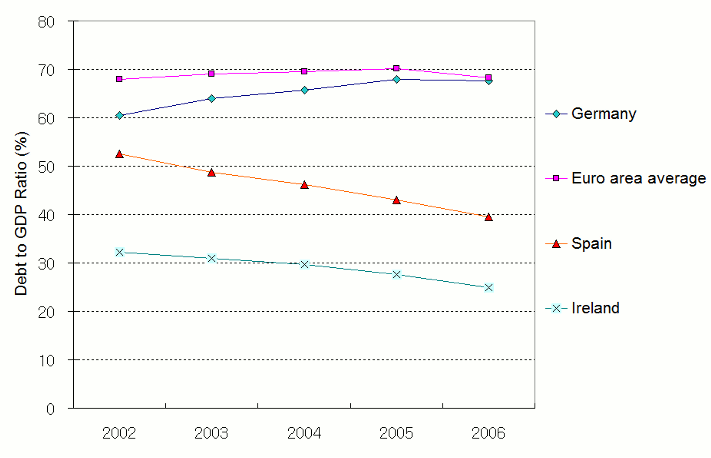

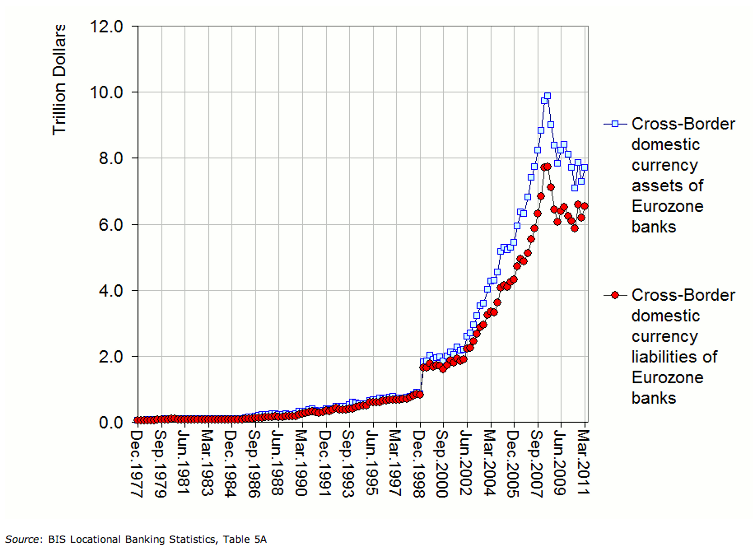

| Global Savings Glut or Global Banking Glut? Posted: 19 Dec 2011 05:58 PM PST Yves here. It has been striking how little commentary a BIS paper by Claudio Borio and Piti Disyatat, "Global imbalances and the financial crisis: Link or no link?" has gotten in the econoblogosphere, at least relative to its importance. As most readers probably know, Ben Bernanke has developed and promoted the thesis that the crisis was the result of a "global savings glut," which is shorthand for the Chinese are to blame for the US and other countries going on a primarily housing debt party. This theory has the convenient effect of exonerating the Fed. It has more than a few wee defects. As we noted in ECONNED:

Similarly, the global savings glut thesis cannot explain why banks created synthetic and hybrid CDOs (composed entirely or largely of credit default swaps, which means the AAA investors did not lay out cash for their position) which as we explained at some length, were the reason that supposedly dispersed risks in fact wound up concentrated in highly leveraged financial firms. By contrast, the Borio/Disyatat paper tidily dispatches the savings glut story, and develops a more persuasive argument, that the crisis was due to what they call excess financial elasticity, which means it was way too able to accommodate bubbles. From Andrew Dittmer's translation of the paper from economese to English:

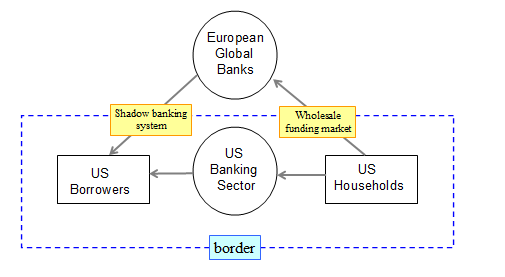

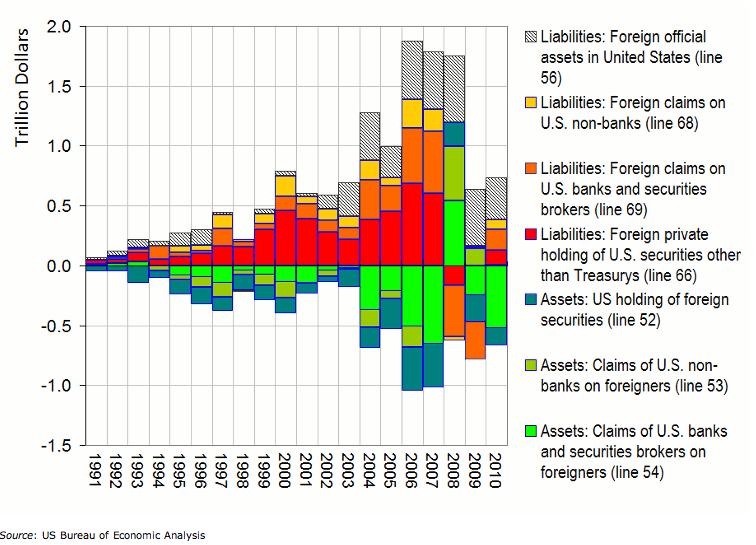

Keep in mind that this is not a mere aesthetic argument. If you believe the Bernanke argument, you'll argue that China needs to let the renminbi appreciate faster and provide more safety nets to its populace so they can shop almost as much as Americans do. If you accept the Borio/Disystat analysis, it means you need to regulate financial players and markets far more aggressively. This VoxEU article by Hyun Song Shin provides further support for the Borio/Disytat thesis, as well as providing the additional benefit of providing a clear and simple explanation of some of the issues it raises. By Hyun Song Shin, Professor of Economics at Princeton. Cross posted from VoxEU It has become commonplace to assert that current-account imbalances were a key factor in stoking subprime lending in the US. This column says the 'global banking glut', i.e. the rise in cross-border lending, may have been more culpable for the crisis than the 'global savings glut'. As the European banking crisis deepens, the deleveraging of the European global banks will have far-reaching implications not only for the Eurozone, but also for credit supply conditions in the US and capital flows to the emerging economies. The 'global savings glut' is what Ben Bernanke called it. This phrase provided a powerful linguistic focal point for thinking about the surge in net external claims on the US on the part of emerging economies. The biggest worries concern the financial stability implications of these large and persistent current-account imbalances. Since Bernanke's 2005 speech (Bernanke 2005), it has become commonplace to assert that current-account imbalances were a key factor in stoking the permissive financial conditions that led to subprime lending in the US. But maybe the finger is being pointed the wrong way. My recent research suggests that the 'global banking glut' may have been more culpable for the crisis than the 'global savings glut' (Shin 2011). What is the 'global banking glut'? To introduce the distinction, it is instructive to start with the financial crisis in Europe. What role did current-account imbalances play there? There are some superficial parallels with the US in the run-up to the crisis. Figure 1. Current account of Ireland and Spain (% of GDP) Figure 2. Government budget balance and debt-to-GDP ratios of Ireland, Spain and Germany To push the analogy with the US further, imagine for a moment that the Eurozone is a self-contained miniature model of the global financial system. In this miniature model, Germany plays the role of China, while Spain and Ireland play the US. According to the analogy, excess savings in Germany find their way to Spain and Ireland where they inflate the property bubbles there. The bubbles subsequently burst, resulting in the socialisation of private debt through bank bailouts and precipitating the sovereign-debt crisis. However, the further we push the analogy, the stranger it gets. According to the 'global savings glut' hypothesis, Chinese savers favour US Treasuries because China lacks deep financial markets that could cater to demands for safe assets. In the miniature model of the savings glut for the Eurozone, Spanish and Irish bank deposits play the role of US Treasuries, since current-account imbalances in the Eurozone were financed through capital flows in the banking sector. To sustain the analogy, we would need to argue somehow that German savers shunned bank deposits in Germany to favour bank deposits in Ireland and Spain. Why would German savers believe that deposits in Spain and Ireland are safer than those in Germany? At this point, the savings glut analogy strains credulity and breaks down. A more plausible narrative is a banking glut associated with the explosive growth of cross-border lending in Europe, as illustrated by Figure 3 which plots the cross-border domestic currency lending and borrowing by EZ banks. Figure 3. Cross-border domestic currency assets and liabilities of EZ banks There is a mechanical jump in the two series at the start of 1999 with the launch of the euro, as previously foreign-currency lending and borrowing are reclassified as being in domestic currency (i.e. euros). But from 2002, cross-border bank lending saw explosive growth as the property booms in Ireland and Spain took off and as European banks expanded their operations in central and Eastern Europe. What drove European banks to do this? By eliminating currency mismatch on banks' balance sheets, the introduction of the euro enabled banks to draw deposits from surplus countries in their headlong expansion. Meanwhile, the permissive bank-capital rules under Basel II removed any regulatory constraints that stood in the way of the rapid expansion. To be fair, the permissive bank risk-management practices epitomised by Basel II were already widely practised within Europe before the formal introduction, as banks became more adept at circumventing the spirit of the initial 1988 Basel Capital Accord. Compared to other dimensions of economic integration within the Eurozone, cross-border mergers in the European banking sector remained the exception rather than the rule. Herein lies one of the paradoxes of Eurozone integration. The introduction of the euro meant that "money" (i.e. bank liabilities) was free-flowing across borders, but the asset side remained stubbornly local and immobile. As bubbles were local but money was fluid, the European banking system was vulnerable to massive runs once banks started deleveraging. Europe's crisis: A banking crisis first, a sovereign-debt crisis second The banking glut hypothesis is a better perspective on the current European financial crisis than the savings glut hypothesis. The crisis in Europe is a banking crisis first, and a sovereign-debt crisis second. It carries all the hallmarks of a classic "twin crisis" that combines a banking crisis with an asset-market decline that amplifies banking distress. In the emerging-market twin crises of the 1990s, the banking crisis was intertwined with a currency crisis. In the European crisis of 2011, the twin crisis combines a banking crisis with a sovereign-debt crisis, where the mark-to-market amplification of financial distress worsens the banking crisis. The banking glut in Europe was part of a global phenomenon, as documented in a recent paper delivered as this year's Mundell-Fleming lecture at the IMF (Shin 2011). Effectively, European global banks sustained the "shadow banking system" in the US by drawing on dollar funding in the wholesale market to lend to US residents through the purchase of securitised claims on US borrowers, as depicted in Figure 4. Figure 4. European banks in the US shadow banking system Although European banks' presence in the domestic US commercial banking sector is small, their impact on overall credit conditions looms much larger through the shadow banking system. The role of European global banks in determining US financial conditions highlights the importance of tracking gross capital flows in influencing credit conditions, as emphasised recently by Borio and Disyatat (2011). In Figure 4, the large gross flows driven by European banks net out, and are not reflected in the current account that tracks only the net flows. Figure 5. Gross capital flows to/from the US The downward-pointing bars before 2008 indicate large outflows of capital from the US through the banking sector, which then re-enter the US through the purchases of non-Treasury securities. The schematic in Figure 4 is useful to make sense of the gross flows. European banks' US branches and subsidiaries drove the gross capital outflows through the banking sector by raising wholesale funding from US money-market funds and then shipping it to headquarters. Remember that foreign banks' branches and subsidiaries in the US are treated as US banks in the balance of payments, as the balance-of-payments accounts are based on residence, not nationality. European banks: Gross flows and US pre-crisis credit conditions The gross capital flows into the US in the form of lending by European banks via the shadow banking system will have played a pivotal role in influencing credit conditions in the US in the run-up to the subprime crisis. However, since the Eurozone has a roughly balanced current account while the UK is actually a deficit country, their collective net capital flows vis-à-vis the US do not reflect the influence of their banks in setting overall credit conditions in the US. The distinction between net and gross flows is a classic theme in international finance, but deserves renewed attention given the new patterns of international capital flows (see, e.g., Borio and Disyatat 2011). Focusing on the current account and the global savings glut obscures the role of gross capital flows and the global banking glut. Net capital flows are of concern to policymakers, and rightly so. Persistent current-account imbalances hinder the rebalancing of global demand. Current-account imbalances also hold implications for the long-run sustainability of the net external asset position. For the US, however, the current account may be of limited use in gauging overall credit conditions. Rather than the global savings glut, a more plausible culprit for subprime lending in the US is the global banking glut. As the European banking crisis deepens, the deleveraging of the European global banks will have far-reaching implications not only for the Eurozone, but also for credit supply conditions in the US and capital flows to the emerging economies. Just as the expansion stage of the global banking glut relaxed credit conditions in the US and elsewhere, its reversal will tighten US credit conditions. Its impact in the emerging economies (especially in emerging Europe) could be devastating. In this sense, there is a huge amount at stake in the successful resolution of the European crisis, not only for Europe but for the rest of the world. |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment