Gold World News Flash |

- Gold Takes Out 200DMA...The Other Way

- London Trader - There are Tremendous Silver Shortages

- Permanent Crisis: The First 5 Years

- Robust Demand For Bullion in Europe, Middle East and China Again - Very Little Selling

- Harvey Organ's Daily Gold & Silver Report

- Gold Seeker Closing Report: Gold and Silver Gain Over 1% and 2%

- Constitutional Expert: “President Obama … Says That He Can Kill You On His Own Discretion" Without Charge or Trial

- The Worst Steward of the Economy in American History

- Getting Worse: 40 Undeniable Pieces Of Evidence That Show That America Is In Decline

- The Reasons To Own Both Silver And Gold Continue To Accelerate

- Dennis Gartman Neutral on Gold

- The Previously Unthinkable Becomes A Planned Event

- Big buyers bypassing bullion banks, London trader tells King World News

- Are You Tempted to Sell, or Eager to Buy?

- The Gold Price and Silver Price had a Field Day, Gold up 1.3 Percent

- As US Decouples From World, Stocks Decouple From USD

- Robust Demand for Bullion in Europe, Middle East and China Again – Very Little Selling

- Ranting Andy: “I Am 100% in PHYSICAL And Will Never Return.”

- Carry, LTRO, Data, and VIX

- THE CORRUPTION OF AMERICA

- Gold $1000 Is Already Here

- The Importance of “Ground Truth”

- Are Torrid Tuesdays The New Merger Mondays?

- Euro Collapse Crisis Sledgehammer Pounds Into Stock Market Santa Rally

- Chris Whalen - Expect Bank Holidays in Europe & Higher Gold

- Investing vs. Speculating in Gold and Silver Stocks

- How Central Banks Attempt to Prop Up the Economy

| Gold Takes Out 200DMA...The Other Way Posted: 20 Dec 2011 07:42 PM PST | ||

| London Trader - There are Tremendous Silver Shortages Posted: 20 Dec 2011 06:07 PM PST  King World News is receiving reports of significant waits for delivery of silver. Today King World News interviewed the "London Trader" to get his take on the situation. The source stated, "It is so tight, the silver market is so tight that we've been waiting three weeks plus, before this takedown, for deliveries of size to arrive. I'm talking about tonnage orders. This is also key, most of the silver being delivered was refined after the orders had been placed, and again, that was before the takedown. You can just imagine how long the wait times will be going forward." King World News is receiving reports of significant waits for delivery of silver. Today King World News interviewed the "London Trader" to get his take on the situation. The source stated, "It is so tight, the silver market is so tight that we've been waiting three weeks plus, before this takedown, for deliveries of size to arrive. I'm talking about tonnage orders. This is also key, most of the silver being delivered was refined after the orders had been placed, and again, that was before the takedown. You can just imagine how long the wait times will be going forward." This posting includes an audio/video/photo media file: Download Now | ||

| Permanent Crisis: The First 5 Years Posted: 20 Dec 2011 05:35 PM PST | ||

| Robust Demand For Bullion in Europe, Middle East and China Again - Very Little Selling Posted: 20 Dec 2011 04:33 PM PST | ||

| Harvey Organ's Daily Gold & Silver Report Posted: 20 Dec 2011 04:12 PM PST | ||

| Gold Seeker Closing Report: Gold and Silver Gain Over 1% and 2% Posted: 20 Dec 2011 04:00 PM PST | ||

| Posted: 20 Dec 2011 03:41 PM PST OBAMA SAYS HE CAN ASSASSINATE OR INDEFINITELY DETAIN AMERICANS ON AMERICAN SOIL WITHOUT ANY DUE PROCESS OF LAW I've previously noted that Obama says that he can assassinate American citizens living on U.S. soil. This may sound over-the-top. But nationally-recognized constitutional law expert Jonathan Turley (the second most cited law professor in the country, one of the top 10 lawyers handling military cases, who has served as a consultant on homeland security and constitutional issues and is a frequent witness before the House and Senate on constitutional and statutory issues, who ranked 38th in the top 100 most cited 'public intellectuals' in a recent study by a well-known judge) said yesterday on C-Span (starting at 15:50):

THE GOVERNMENT HAS NEVER GIVEN A RATIONALE FOR ASSASSINATION

ALMOST ANY AMERICAN COULD BE ARBITRARILY LABELED A "TERRORIST" As I've previously noted, this is especially concerning when almost any American could be labeled a "terrorist" if the government doesn't happen to like them:

| ||

| The Worst Steward of the Economy in American History Posted: 20 Dec 2011 03:15 PM PST While the debt ceiling dance continues in Washington D.C. and the Republicans in the Senate are going wobbly, they need to understand they are dealing not only with an intransigent party in the White House but also someone that is the most incompetent president in modern history, and the worst steward of the American economy since the nation's founding. The Obama sycophants often resort to the White House pre-packaged line that Obama inherited the worst economy since the Great Depression, as a means of deflecting responsibility onto George Bush. Like so many of the emanations from this administration that too is a fabrication. As side-by-side comparison of circumstances inherited by Reagan and Obama is as follows: Among the factors that reflect the tale of the two presidencies is the price of gold. Recently the price of gold reached $1,609.00 per ounce. While this is an historic high in terms of raw dollars, it is not the high insofar as inflation-adjusted price. That came on January 21, 1980 when gold reached $850.00 per ounce; however adjusted to 2011 that price is the equivalent of $2,328.00. Gold prices often are a bellwether and commentary on the foibles and successes of those in power in the United States, as the dollar is the de facto global reserve currency and America has been the dominant economic and military power since World War II. In 1980, when gold prices set the record, the United States was in the throes of a recession with annual inflation running at 13.5%, the unemployment rate was 7.5%; the annual GDP growth was a minus 0.27%, and the bank prime interest rate was over 18.5%. The flight to gold was overwhelming as no one had any confidence in the policies of Carter and the Democrats in Congress. That was the landscape of the country when Ronald Reagan assumed office in January of 1981. The job facing Reagan was the most daunting since the Great Depression -- and far worse than what Barack Obama inherited in 2009 -- as the combination of extreme inflation (the highest annual rate in the nation's modern history), unemployment (which peaked at 10.8% in 1982), and virtually no one able to pay the exorbitant bank interest rates were major obstacles that had to be overcome in order to revitalize the economy. The price of gold reflected that dilemma. However markets react not only to the actual circumstances at hand but to confidence in leaders and what is perceived as future positive or negative factors. Because of Reagan's policy pronouncements and belief in the free markets combined with the passage of his economic growth agenda, by the end of his first 12 months in office the price of gold had declined to $377.50 per ounce (equivalent of $936.78 today). This remarkable drop of nearly 60% from the previous all-time peak just 24 months before came about despite the fact that America was still in the throes of excessive (but declining) inflation and extremely high unemployment. By August 1983 (28 months into President Reagan's first term) the price of gold was at $401.75 or $910.48 per ounce in 2011 dollars (down 61% from 1980 peak). Inflation had been reduced to 3.2% (from 13.5%); the unemployment rate was at 9.2% (down from a high of 10.8% in November of 1982); annual GDP growth in 1983 was 4.52%, the highest in the previous four years. In the final year of Reagan's first term GDP grew by an astounding 7.19% and the unemployment rate had been reduced to 7.6%). Yet the average annual federal government budget deficit over those years was kept at 4.2% of GDP despite the overwhelming debacle facing the country in 1980-81. The contrast between Ronald Reagan's first term and that of Barack Obama is stark and indicates a deliberate effort by the current president to destroy the American economy as he will have added over $5.5 trillion to the national debt in an effort to transform the United States into his vision of a socialist utopia. By comparison Reagan added $1.35 trillion (inflation adjusted to 2011) over his first term while saving the American economy. Yet many Republican Senators are willing to accede to political considerations in granting Obama his wishes regarding a massive increase in the debt ceiling and raising taxes coupled with vague promises of future spending cuts. Instead of listening to the American people many are allowing themselves to be intimidated by the president, the Democrats in Congress, and a media who view the current debt ceiling debate as a sporting event while openly cheerleading for their team. Rather than take the matches away from a pyromaniac, they are predisposed to hand him a flaming torch to complete the job. Twenty-eight months into the term of Barack Obama the scene is considerably different. Gold was priced at $849.00 per ounce on Inauguration Day (January 20, 2009); today it has nearly doubled (95%) to $1,609.00. The other Obama failures: Unemployment was at 7.6%, today 9.2% (if calculated as in the early 80's the rate today would be over 10.5%). Annual GDP growth will be between 1.5 and 1.75% in 2011. All current estimates conclude that the final year of Obama's term will show a GDP growth of less than 2.2% and unemployment still around 8.8 to 9.0%. But most devastating of all, the annual federal budget deficit has averaged nearly 10% of GDP (double the worst single year from 1947 to 2008). Additionally, the financial crisis of 2008 had been mitigated by the actions of George W. Bush (TARP et al) prior to Obama assuming office and the recession was declared over by June of 2006, just 5 months after inauguration. On the other hand the recession in play when Reagan became president was in its early stages and did not officially end until November 1982, 22 months after inauguration. It has been debated whether Jimmy Carter or Barack Obama is the epitome of incompetence in modern U.S. history. While Carter made myriad mistakes and was in over his head, he did not put the country in an untenable position regarding its future. Obama has. Post-Obama America has a questionable ability to financially overcome severe economic downturns; there is a very real possibility that the dollar will no longer be the world reserve currency -- a disaster for the American consumer. When Carter left office, the Gross Federal Debt as a percent of GDP was 33% (he never recorded an annual deficit higher than 2.65% of GDP). When George W. Bush left office the debt to GDP ratio was 69% (his highest annual deficit was 3.48% of GDP). On the other hand, by the end of the Obama term the debt will be nearly 100% of GDP (the annual budget deficit in 2011 is projected to be 11% of GDP). The United States as a nation is 222 years old, yet over one-third of the nation's debt will have been accumulated by Barack Obama in just four years. Read more: http://www.americanthinker.com/2011/07/the_worst_steward_of_the_economy_in_american_history.html#ixzz1h8jqsxyp | ||

| Getting Worse: 40 Undeniable Pieces Of Evidence That Show That America Is In Decline Posted: 20 Dec 2011 02:33 PM PST from The Economic Collapse Blog:

The following are 40 undeniable pieces of evidence that show that America is in decline…. | ||

| The Reasons To Own Both Silver And Gold Continue To Accelerate Posted: 20 Dec 2011 02:20 PM PST Morgan Stanley Deconstructs The Funding Crisis At The Heart Of The Recent Gold Sell Off, And Why The Gold Surge Can Resume From ZeroHedge A week ago, we touched upon the likelihood that the recent gold sell-off was driven primarily due to a quirk in liquidity provisioning in which gold plays a key role via its "forward lease rates", or the Libor-GOFO differential. Specifically, in "As Negative Gold Lease Rates Collapse, The Gold Sell Off Is Likely Coming To An End" we said, "In a nutshell, negative lease rates mean one has to pay for the "privilege" of lending out one's gold as collateral - a prima facie collateral crunch. The lower the lease rate, the greater the use of gold as a source of liquidity - and since the indicator is public - it is all too easy for entities that do have liquidity to game the spread and force sell offs by those who are telegraphing they are in dire straits and will sell their gold at any price if forced, to prevent a liquidity collapse." Said otherwise, the lower lease rates drop, and they recently hit a record low for the 3M varietal, the likelier it is that gold may see substantial moves lower. Today, Morgan Stanley's Peter Richardson recaps precisely what was said here, in a note titled "Recent fall in gold prices points to bank funding costs." Granted, MS only looks at the first part of the equation - the dropping lease rates, and ignores the re-normalization in gold, aka the tightening in lease rates. Well, with the 3M forward lease rate now almost back to unchanged, it appears our speculation that the gold sell off, with spot at $1575 on the 15th, is over were correct, and gold is now $40 higher, and just below the critical 200 DMA that everyone saw as the catalyst of gold going to $0. So what does MS have to add to our analysis? Well, much more optimism for one, because not only does the bank think we are right that the collapse in negative lease rates (i,e., the flattening to practically unchanged) mean the sell off is over, but such a normalization of the gold lease market has "the makings of a renewed upward assault on the recent all-time high.... Our current gold price forecast for 2012 of US$2,200/oz remains in place under these circumstances." Qed. The key highlight of Morgan Stanley's hypothesis of what negative gold lease rates imply for gold: Firstly, we think negative lease rates are highlighting a sharp increase in the demand for gold as collateral for US dollar loans at a time of reduced liquidity in the traditional US dollar interbank funding market. The more negative the lease rates the higher the cost of funding using gold as security. Secondly, access to this collateral on a scale indicated by the rise in GOFO can only emerge if the providers of liquidity to the leasing market are prepared to increase the stock of lent gold in circulation. This development points to the central banks, the largest custodians of above-ground stocks and the traditional providers of liquidity to the gold-leasing market. Aware of acute funding pressures in the traditional interbank market, it seems increasingly likely to us that central banks have increased the quantum of gold available for use in a non-traditional funding market, at least until the measures to alleviate bank-funding stress in the US dollar swaps market have been successful. The recent easing in the scale of negative gold lease rates, suggests that demand for this source of short-term funding might be easing, but has not disappeared, even after the raft of measures announced by the ECB and the earlier coordinated intervention by the six central banks.Said otherwise: we likely have smooth sailing for now, as banks will not proceed to cannibalize each other for a bit. But keep a very close eye on on that LIBOR-GOFO spread: the second it collapses, it may be time to step away from the market… more ___________________________ London Trader - We are Witnessing a Historic Bottom in Gold From Eric King With many investors worried the price of gold could head lower, today King World News interviewed the "London Trader" to get his take on the gold market. The source stated, "The Chinese have continued to take delivery of both physical gold and silver directly from the ETF's GLD and SLV. They are also going directly to producers. Entities are bypassing the COMEX altogether and going straight to gold mining companies. Every single month producers have a certain amount of gold and silver they sell. Normally they sell it to the bullion banks and the bullion banks, of course, leverage this gold and sell up to 100 times that in paper markets to control prices." The London Trader continues: "They (bullion banks) hold that little bit of physical gold and claim they are backed up on their position to the CFTC. I have all my large buyers now going to producers and saying to them, 'Look, don't sell it to the bullion banks, we'll buy it from you.' So we are buying directly from the producers and this includes some sovereign entities which are doing the same thing. We're struggling to get the physical out of these guys (producers) because they have so many people banging on their door, saying, 'Sell it to us direct.' What these buyers are doing is essentially taking gold out of the system, which means the bullion banks can't leverage that gold anymore. So this is a huge, dynamic shift that wasn't there before. Now we are working on one other thing. We're beginning to offer them forward contracts. If you are a sovereign entity, what you are saying to these producers, especially on new projects, is, 'Why don't you sell the gold to me in 12 months? Here's the cash, just provide it to me 12 months from now.' These buyers are now cutting off future gold supply from the bullion banks.... "This is a huge, tectonic shift in price dynamics going forward because it is taking price discovery away from the bullion banks. These large Chinese buyers and sovereign entities which are doing this are going to have a massive impact on the market. Interestingly, so many people are bearish on gold right now and looking for a collapse in the price of gold. They don't understand what is happening in the physical market. The bullish fundamentals I just described to you have enormous implications. We are making a historic bottom right now. The paper gold, or virtual gold market, has diverged so far from the physical market that it's no longer a credible marketplace. That's the key thing that came out of a very important meeting I was in yesterday where we had some serious players. The people I was meeting with are all on the buy side and have been since the lows last week. There are massive physical orders, sitting, waiting for any more discounts, and yet everyone else seems to be short. So you have huge fuel for a rally here. You have to keep in mind this recent plunge was orchestrated with borrowed gold and that borrowed gold is now gone. That's why gold can't go much lower. Any dips in price will be aggressively purchased. As I said earlier, right now we are witnessing a historic bottom." The London Trader previously told KWN on October 21st that China had purchased a massive amount of physical gold at the lows of the October 20th session. That marked the dead low for the price of gold in October and gold rallied roughly 10% in the following 8 trading sessions. ___________________________ THIS HEADLINE IS A BLATANT LIE: DJ US Nov Housing Starts Surge 9.3% Tue Dec 20 08:30:23 2011 EST WASHINGTON (Dow Jones)--U.S. home building surged to the highest level in 19 months during November and construction permits grew, encouraging signs for a part of the economy struggling to get back on its feet. Home construction last month increased 9.3% to a seasonally adjusted annual rate of 685,000 from October, the Commerce Department said Tuesday. The results were better than forecast. Economists surveyed by Dow Jones Newswires expected housing starts would rise by 0.3% to an annual rate of 630,000. The increase in November was driven by a 25.3% increase in multi-family homes with at least two units, a volatile part of the market. Construction of single-family homes, which made up about 65% percent of the market, rose only 2.3%. ___________________________ From Dave in Denver, The Golden Truth After an 8 month price correction that has been mistakenly taken to be a new bear market by those who are clueless, like Dennis Gartman, it appears that the gold bull is kicking at the gate: Interestingly, so many people are bearish on gold right now and looking for a collapse in the price of gold. They don't understand what is happening in the physical market. The bullish fundamentals I just described to you have enormous implications - London bullion traderHere's the short interview which is the source of that quote: LINK It is a must-read and the report of large "entities" going directly to gold producers in order to source large quantities of bullion is consistent with other industry insider accounts of this. I linked one a couple weeks ago. "Interesting" from my viewpoint because I have pointed to some indicators that likely signal that we are near or at a bottom and that the next extended move higher in gold will likely take us to a new record nominal high in gold. One of these signals as discussed yesterday is gold breaking its 200 dma to the downside. Currently the 200 dma is around $1618 using the Comex continuous futures contract (this would correlate to around $1615 on a spot price basis). Another signal would be the current long/short Commitment of Traders (COT) structure of the hedge funds (large specs) and the big banks (commercials). For the duration of the gold bull market, market bottoms have been associated with a low relative net long position being taken by the large specs and a low relative net short position being taken by the price manipulating bullion banks. That this is the case is indisputable. Currently the large specs have a very low net long position and the banks have low net short position. I rehypothecated Ted Butler's latest remark on the COT structure from Ed Steer's Gold & Silver Daily: I think the gold COT structure is back to a bullish set up, especially if the improvements after the cut-off are what I think them to be. As such, gold may also be at a price bottom, especially considering the bullish signals (or lack of bearish signals) coming from the gold physical market (ETF holdings, etc.). But to be fair, while gold is near bullish COT readings over the past year or so, on a much longer historical basis there may still be room for further liquidation. My personal sense is that we probably shouldn't see big further speculative long liquidation in gold and may, in fact, be good to go to the upside. But if the COT structure in gold is bullish (as I think), then silver's structure is screamingly, super-duper bullish.Combined, the 200 dma plus the COT signals are quite bullish for gold. One indicator that I have not seen commentary on is the COT set-up in the euro, and tautologically, the inverse set-up in the dollar. Currently, the large spec hedge funds are record short the euro, which means they also are very long the dollar vs. the euro. Conversely, the big banks are primarily the entities which would take the other side of the hedge fund bet, meaning the big banks are very long the euro and very short the dollar. This is very very bullish for gold. Take a look at this chart rehypothecated from http://www.barchart.com/ (click on chart to enlarge) The green line that goes below zero starting in May is the short position of the large specs. You can see how the hedge fund position has shifted from long to short this year. The red line is the long position of the big banks. Why would the euro begin to move higher again rather than collapse, like everyone seems to think will happen? Because I have said all along that I wouldn't be surprised if the EU figures out a way to save itself from extinction. Hell the U.S. is already printing money to bail out Europe via the up to $1 trillion currency swap facility arranged by the Fed. This is a de facto QE because it increases the size of the Fed balance sheet until the swap unwinds, if it ever does. This is printing and this dollar bearish. Just wait until the Fed has to start printing to fund 2012 Government spending programs...Don't forget, what's bearish for the dollar is bullish for gold... ___________________________ Will A Euro Short Squeeze Launch Gold And Silver Higher? ___________________________ From ZeroHedge ___________________________ Fed May Inject Over $1 Trillion To Bail Out Europe From ZeroHedge Bernanke yesterday told a closed-door gathering of Republican senators that the Fed won't provide more aid to European banks beyond the swap lines and the discount window -- another Fed program that provides emergency funds to U.S. banks, including U.S. branches of foreign banks." Well, between a trillion plus in FX swap lines, and a surge in discount window usage which only Zero Hedge has noted so far, there really is nothing else that the Fed can possibly do, as these actions along amount to a QE equivalent liquidity injection, only denominated in US Dollars. Aside of course to shower Europe with dollars from the ChairsatanCopter. Then again, before this is all over, we are certain that paradollardop will be part of the vernacular. Historical ECB swap line usage with the Fed, and projected assuming $1+ trillion in use. Just to put it all into perspective.  | ||

| Dennis Gartman Neutral on Gold Posted: 20 Dec 2011 01:19 PM PST Dennis Gartman : "People said I turned Bearish of... [[ This is a content summary only. Visit my website http://goldbasics.blogspot.com for full Content ]] This posting includes an audio/video/photo media file: Download Now | ||

| The Previously Unthinkable Becomes A Planned Event Posted: 20 Dec 2011 12:45 PM PST Wolf Richter www.testosteronepit.com Governments and companies around the world have been preparing for a collapse of the Eurozone—simple prudence requires them to do that. Theoretical exercises for a hypothetical scenario, they call it. But recently, these theoretical exercises have taken on practical overtones. In early December, Swiss Finance Minister Eveline Widmer-Schlumpf told parliament that the Swiss government was preparing concrete measures to defend Switzerland against a collapse of the euro. And then, just before the Brussels summit, Nicolas Sarkozy voiced his existential concerns about the Eurozone (for more on the Swiss and French debacle, read.... Sarkozy: "The Risk that the Euro Will Explode"). Large corporations are also preparing. "Our teams work on all possible scenarios, including an exit from the Eurozone," said Gilles Schnepp, CEO of Legrand, a French industrial company, during an interview with Les Echos on December 19. "We are doing simulations of what the exit of one or the other country would mean for our activities, balance sheet, and cash flow." Daimler is looking for a stabilizing force in ... China. Chairman Dieter Zetsche is offering Chinese investors, including state-owned China Investment Corporation, a 5% or 10% stake (Manager Magazin, December 20). Daimler is also building up its joint venture with Chinese partner Baic. Greater reliance on China could afford the company some protection from the travails of the Eurozone. Every major company must have some irons in the fire. But now the collapse of the Eurozone has entered public discussion via the front pages of the largest daily newspapers in France and Germany. And increasingly, regular people are comfortable debating an issue that not long ago was completely out of the question. "The Explosion of the Eurozone is now possible," said today's headline of Le Monde. The French daily, a staunch supporter of the euro, dove into details: French banks have steeped themselves in silence. "Not part of our scenarios," said Baudouin Prot, president of BNP Paribas. And Société Générale considered that issue something "that cannot be considered." The largest retailers Carrefour and Casino haven't made any announcements either, but they too will have to deal with these questions, "given the size of their supply chains in euros and dollars." According to Le Monde:

Le Monde got specific. "Those that have funds ask us into which bank they should deposit their money," said Nikan Firoozye, an economist at Nomura in London. He co-wrote a report that explored the subtleties of a Eurozone explosion. For example, a foreign professional bought assets in euros and hedged them against euro-dollar exchange risk. What would happen to that hedge if the investment were converted to pesetas? "I don't have an answer to everything," he admitted. And some traders bought German sovereign debt (Bunds) in order to profit from their conversion to Deutschmarks. The German Handelsblatt featured a long discussion today on what would happen if Germany reverted to the Deutschmark. And it advised its readers on how to prepare their finances for that event. "A share would remain a share," it started out comfortingly, and price would be determined by supply and demand, as before. The rest could be iffy, however. Stock exchanges could be closed for a while to implement the conversion. Once trading restarts, shares would plummet, and the crash would cascade around the world. It would be a challenge for Germany's export-dependent companies. Their customers in Southern Europe, whose currencies would be devalued, could no longer afford German products. Revenues would collapse. Recession and large-scale unemployment would follow. So what should German investors do? The Handelsblatt is clear: Don't load up on equities, and focus on German companies that do most of their business within Germany. Kabel Deutschland, for example. All of its revenues come from German subscribers, and presumably, they will still watch TV, even if they get their Mark back. And don't end up with stock in an Italian company at the moment when the euro converts to other currencies. Those shares would be valued in lira whose future devaluation would be immediately priced into the shares. German Bunds would likely be converted to Deutschmarks and would be guaranteed in Deutschmarks, a safe bet, presumably. Corporate bonds would be riskier. Contracts don't include language that would allow for them to be paid back in a different currency. Perhaps a voluntary conversion would be the solution. Fly in the ointment: if Germany by law converted all euro debt of German companies into Deutschmarks, it would replace debt denominated in a softer currency with debt denominated in a harder one, which might make it impossible for companies to pay it off, and bankruptcies might ensue. Investment in real estate, the Handelsblatt suggested, would be relatively safe because "a house will remain a house." But values could come under pressure if the euro collapse entails a long recession. And there is always gold, physical gold ... coins, actually. "For all those who have to deal with money in Frankfurt, the Deutsche Mark scenario is a horror." Breaking apart the ECB payment system would be tricky. And the logistics of reintroducing the various currencies would be a nightmare. From ticket vending machines to ATMs to banking computers, everything would have to be converted—a three-year process to get things to where they were before. The fact that major newspapers advise their readers on how to deal with a Eurozone collapse suggests that the people are coming to grips with the scenario. And once a certain comfort level sets in, popular support for the many financial, political, monetary, and democratic sacrifices required to save the euro will dwindle. Which would spell the end of the euro. Meanwhile, the European Union would go on as a free trade area, though perhaps in altered form. Sarkozy, the only French president since World War II with two recessions under his belt, faces a tough reelection campaign. And front runner François Hollande vows to oppose the German dictate on how to save the euro.... Political Realities Threaten To Split The Eurozone. | ||

| Big buyers bypassing bullion banks, London trader tells King World News Posted: 20 Dec 2011 12:36 PM PST 8:31p ET Tuesday, December 20, 2011 Dear Friend of GATA and Gold: Big gold and silver buyers increasingly are bypassing the rigged futures markets and the bullion banks that rig them and instead buying metal from the major gold and silver exchange-traded funds and from miners directly, the London trader source of King World News remarks today. These remarks echo those made two weeks ago by AngloGold Ashanti CEO Mark Cutifani to Takoa Da Silva of Bull Market Thinking: http://www.gata.org/node/10738 But the London trader tells King World News a lot more -- including that the new kind of buying is transforming the precious metals market, cutting off supply from the bullion banks and diminishing their ability to leverage their short positions in the futures market. "We're making an historic bottom right now" in the gold market, he says. An excerpt from the interview is posted at the King World News blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2011/12/20_L... Also at King World News, Tangent Capital's Chris Whalen sees the possibility of bank holidays as countries forced to break out of the euro zone need time to re-establish their own currencies. An excerpt from that interview is here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2011/12/20_C... And Fox Business News canceled its interview scheduled for this morning with gold advocate and GATA supporter Peter Grandich. Let's hope he is rescheduled soon. CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Sonora Aims to Follow First Majestic's Success Sonora Resources (OTCBB: SURE) is a silver mining exploration company focused on the development of prospective opportunities in Mexico. The company president and CEO is Juan Miguel Rios Gutierrez, who helped build First Majestic Silver Corp., which began trading for pennies and today is at more than $16 per share. Gutierrez was the fourth person to join First Majestic Silver, originally as general manager, then manager for new business initiatives and strategic planning. He left First Majestic Silver to work with Sonora Resources and yet maintains strong contacts with First Majestic. In fact, First Majestic is a large shareholder in Sonora and has a joint venture with the company. For more information about Sonora Resources, please visit: http://www.SonoraResources.com Join GATA here: Vancouver Resource Investment Conference http://cambridgehouse.com/conference-details/vancouver-resource-investme... California Investment Conference http://cambridgehouse.com/conference-details/california-investment-confe... Support GATA by purchasing gold and silver commemorative coins: https://www.amsterdamgold.eu/gata/index.asp?BiD=12 Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Golden Phoenix Signs Definitive Agreement Company Press Release SPARKS, Nevada -- Golden Phoenix Minerals Inc. (OTC Bulletin Board: GPXM) has signed a definitive agreement to acquire a 60 percent interest, with an option to buy an additional 20 percent interest, in the Santa Rosa gold mine in Panama, now owned by Silver Global S.A., a Panamanian corporation. Santa Rosa produced more than 100,000 ounces of gold from 1996 to 1998 before being closed in part to low gold prices, which are now more than five times higher. Golden Phoenix intends to acquire its initial 60 percent interest in Santa Rosa by acquiring 60 percent of the share capital of a recently created company under the name Golden Phoenix Panama S.A., formed to hold and operate the mine. Tom Klein, CEO of Golden Phoenix says: "The agreement establishes a solid framework from which we can advance Mina Santa Rosa to production-ready status." For Golden Phoenix's complete statement, please visit: http://goldenphoenix.us/press-release/golden-phoenix-signs-definitive-ac... | ||

| Are You Tempted to Sell, or Eager to Buy? Posted: 20 Dec 2011 12:30 PM PST | ||

| The Gold Price and Silver Price had a Field Day, Gold up 1.3 Percent Posted: 20 Dec 2011 12:11 PM PST Gold Price Close Today : 1615.60 Change : 21.20 or 1.3% Silver Price Close Today : 2949.60 Change : 67.40 cents or 2.3% Gold Silver Ratio Today : 54.774 Change : -0.545 or -1.0% Silver Gold Ratio Today : 0.01826 Change : 0.000180 or 1.0% Platinum Price Close Today : 1432.00 Change : 24.70 or 1.8% Palladium Price Close Today : 625.45 Change : 16.80 or 2.8% S&P 500 : 1,205.35 Change : -14.31 or -1.2% Dow In GOLD$ : $150.55 Change : $ (3.28) or -2.1% Dow in GOLD oz : 7.283 Change : -0.159 or -2.1% Dow in SILVER oz : 398.91 Change : -12.80 or -3.1% Dow Industrial : 11,766.26 Change : -100.13 or -0.8% US Dollar Index : 79.83 Change : -0.421 or -0.5% Mercy! The SILVER and GOLD PRICE had a field day. On Comex the GOLD PRICE rose $21.20 (1.3%), smashed through $1,605 resistance, and closed $1,615.60. Silver rose 67.4c (2.3%)to 2949.6. That's good, but it ain't exactly crossing over Jordan into the promised land just yet. Above lies resistance at $1,625, then $1,650, then $1,687. If this rally exceeds $1,675 it will command our attention and respect. Till then it earns only watching. And we'll find out something about that last low ($1,562.50) when this little rally-ette runs out of steam. The SILVER PRICE shone with a 2.3% rise, and Mondays trading looks like some sort of bottom -- permanent or interim is another question -- but now the rally meets real resistance at 2980. Must clear that barrier to maintain its reputation. To give y'all a nearer idea where today brings silver, think on this: the down trend line stands overhead at 3050c. Today's high reached only 2959c. All today's work was constructive, but settled nothing. Silver and gold remain in downtrends. They are only corrective downtrends, interrupting a primary bull market (uptrend), but down for the nonce still. Appears I got it exactly wrong at the exact bottom, facing yesterday's outlook to today's performance. Ahh, the obese female hath not yet sung her aria, so let me cover my embarrassment with patience. Euphoria's mother today was a pledge from Europe to pony up 150 bn euros ($196 bn), which they don't have, to the IMF to apply to the European debt crisis, where the questionable debt amounts to $3 trillion, 15 times the magnanimous contribution. ECB also widened its support for bond markets (NYT-speak for I don't know what), German economic confidence indicators rose, and the US Commerce Dep't said builders broke ground on 9.3% more new homes in November than in October, while building permits jumped 5.7%. This number is rock solid until the adjustments are published next month. Yeah, buddy! All that sounds like the world economy and the European crisis turning the corner to me. Right. Anyhow, that's how markets reacted as if "Happy Days Are Here Again." STOCK buyers fell into a frenzy like lemmings on their way to the coast. Dow jumped 337.32 points or 2.8% to 12,103.58. S&P 500 rose 2.98% (35.95) to 1,241.30. This positions stocks for a triple top just above 12,200. SOURPUSS! You might say, You never have any- thing good to say about stocks! And you'd be right, as I have nothing good to say about any market that is in a primary down trend (bear market) and technically looks as ratty as an old 1970s burnt orange polyester leisure suit. Technically that took stocks above the 200 day moving average (11,936). Since they are already above the 50 DMA (11,835), that does give them upward momentum. At least until the next piece of bad news out of Europe sends scuttles investor hopes. Dow will not pass 12,300; S&P500 won't rise above 1,280. I reckon time's come for me to get more accurate and precise about the US dollar index. Today it lost 42.1 basis points, down 0.54%, to 79.829. I've been saying it needs to hold 80. Have I changed my mind? Nope, I've just sharpened my pencil. The actual support line is 79.84 - 79.70, site of the last two peaks. today the dollar came back to that line, so today's action is not fatal. More than that, the uptrend line right now stands just a mite above 79. Long as dollar doesn't break that, it will still be rallying. Now I'm just a natural born fool, but if I were them Nice Government Men and I wanted to boost the euro and trim the dollar, I'd wait for some nested good news, or make some up, and then I'd buy them stock futures real heavy early in the day, to make it look like some mad buying panic was carrying away the public, just to sort of spark a rally like. But what do I know? Euro today rose 0.63% to close at 1.3080. Another few points and it'll hit my 1.3200 target where the trend line stands in its way, and stop like a wild steer running headfirst into a concrete block wall. Japanese Yen rose 0.18% to close 128.39c/Y100 (Y77.89/$1). Nothing happening there. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2011, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||

| As US Decouples From World, Stocks Decouple From USD Posted: 20 Dec 2011 11:49 AM PST from ZeroHedge:

UPDATE: ORCL missed. $8.8bn Rev vs $9.23bn exp., 54c EPS vs 57c exp. – Stock -9% AH With ES (the e-mini S&P futures contract) managing to pull over 40 points off overnight lows (bringing back memories of the 11/30 global bailout rampfest), we saw correlated risk assets disconnect one by one as the day proceeded. First to leave the party was FX carry (or more simply the USD) just before Europe closed. Then Gold stabilized and stopped accelerating and credit markets also went only gently higher/stable in the afternoon. Oil kept on lifting with stocks – helping Energy stocks lead the way (up over 4% on the day) – but even Oil went flat within an hour or so of the close. The only other asset that seemed to be correlating and self-reinforcing was the Treasury complex – most specifically the 10Y and the 2s10s30s butterfly but it was the former that had the highest correlation overall and kept going right to the end. Volume did die away towards the end but surged right at the close as average trade size picked up and ES started to roll over a little – pros selling into the close? Who knows but there was little else supporting ES up here on the day and with the 'news' ahead on LTRO take-up – maybe better safe than sorry. | ||

| Robust Demand for Bullion in Europe, Middle East and China Again – Very Little Selling Posted: 20 Dec 2011 11:44 AM PST from GoldCore:

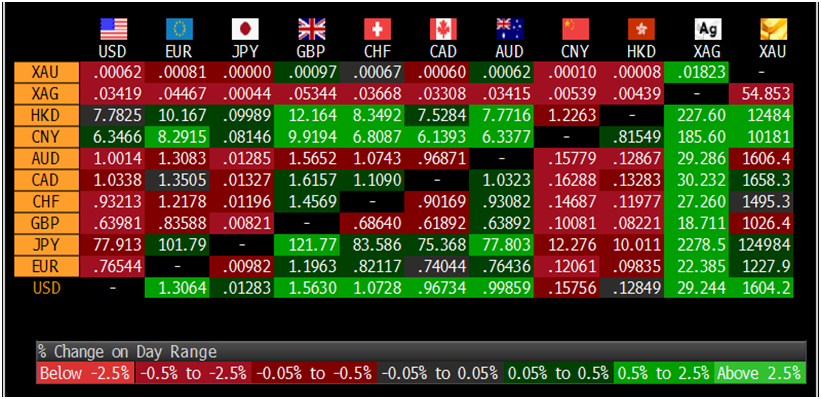

Gold is trading at USD 1,604.2, EUR 1,227.90, GBP 1,026.40, CHF 1,495.0, JPY 124,984 and AUD 1,606.40 per ounce. Gold's London AM fix this morning was USD 1,593.00, GBP 1,028.34, and EUR 1,222.94 per ounce. Yesterday's AM fix was USD 1,605.00, GBP 1,027.003 and EUR 1,227.91 per ounce. Gold is mixed and marginally higher in dollars and euros today despite European finance ministers pledging extra funding to the IMF. Concerns linger that politicians efforts to address the euro zone debt crisis are failing. Last week's price drop has stimulated demand from Europe and the Middle East and Asia with GoldCore and other dealers confirming still robust demand and little or no selling of bullion. | ||

| Ranting Andy: “I Am 100% in PHYSICAL And Will Never Return.” Posted: 20 Dec 2011 11:25 AM PST by SGT:

Hey friends. I'll be speaking with Andy Hoffman at the end of the week to get an in-depth rant about the absolutely criminal developments we are seeing; from the MF Global crossing-the-Rubicon event to the massive gutting we've seen of the paper silver and gold prices AND the mining shares. Today I e-mailed Andy the following: "It should be a good conversation given the recent annihilation of the metals prices & mining stocks by the cartel. I've been getting some e-mails from a few very concerned people who are wondering where the bottom is. Sadly, I don't think there is a "bottom" w/o regulators and rule of law." To which Andy responded:

If you have any specific questions that you'd like me to ask Andy in our interview, please leave them in the comments below. | ||

| Posted: 20 Dec 2011 10:33 AM PST From Peter Tchir of TF Market Advisors Carry, LTRO, Data, and VIX Once again we seem to have a discrepancy between what "credit" people think and what "equity" and "FX" people think. The broad market rallied strongly today, at least in part because of the LTRO. On one thing, everyone agrees, the take up rate will be high. There will be strong demand for the LTRO. What differs is the impact that will have on the market. At one end is a belief that banks will be borrowing this money so they can purchase new assets. The allure of carry will be too much to pass up, and with government encouragement, they will rush to purchase new sovereign debt and maybe even lend more. That will turn the tide in the European debt crisis since there will be buyers for every new issue, and the market can move on to "strong" economic data in the US. The other end of the spectrum is that the banks will use this facility to plug up existing holes in their borrowing. They won't have to rely on the wholesale market or repo market as much as they can tap this facility. It will take some pressure off of the "money market" as banks won't be scrambling for as much money every day, or over year end, but it won't lead to new asset purchases by the banks. Banks need to deleverage and that hasn't changed. The bonds can have a 0% risk weighting, but that doesn't mean anyone, including the banks, believe it. The road to hell is paved with carry. That is an old adage and likely applies here. High Yield did well today (with HY17 outperforming HYG and JNK). Investment Grade did okay as well (LQD tightened on a spread basis, though it shows up as a loss for most retail investors). IG17 also was tighter as no one wanted to be hedged. Away from that, more exotic trades, like curve trades didn't show a similar strength. These are the sorts of trades that would do well if everyone was looking for carry and thought the problems were solved. Little things like that further underscore how likely it is that banks will participate. Most banks are overexposed to these risks in the minds of investors anyways. Will buying more of something that is risky really help? Will loading up on a single position to the point that it can wipe you out be deemed as prudent? I think banks that have managed themselves well to this point will be very reluctant to add significantly to their exposure. You may get some token purchases so they can tell their regulators that they are playing nice, but beyond that, they will wait and see if the situation is really fixed. The reason banks are not buying more of these bonds has little to do with funding costs being too high. Risk and leverage are too high. That hasn't changed here, and most credit people believe that this new funding will encourage new asset purchases. Without that, it helps the banks by reducing some uncertainty on their existing debt rollover needs (let's not forget the hundreds of billions of bank issued debt that needs to be rolled this year), but doesn't encourage asset purchases or balance sheet expansion. Earlier today I had a bullish tone and did see 1300 and 1100 as being equally possible. With a 40 point move from overnight lows it seems like a lot, especially since to the extent I was right, it was for all the wrong reasons. I continue to believe that there may be an agenda behind the truth that is emanating out of Europe recently, but this LTRO plan doesn't do it for me. With our models showing seasonality being strongest from close of business tomorrow until the 27th, it is hard to be short, but without real news, we will be fading this. On the data front, I am a bit confused why housing starts going up is a good thing. The only industry that may be worse at predicting future demand than the airline industry, is the homebuilder industry. They build homes, it's what they do. Carefully managing inventory to demand is not their strong suit. A story about great demand and shortages of homes for sale would be much bigger news and may warrant a rally, I put this in a neutral category, at best. On the earnings front, it seems like as many companies are missing as beating. Oracle missed after the bell and is being punished. It is far from clear to me that the earnings story is that compelling, and the strength in the dollar is the last thing the nascent surge in manufacturing needs. We have a political system that couldn't agree that the sun comes up in the morning without holding special sessions. Their ability to provide any help to the economy is zilch and no matter how many times people say it, there is no strong evidence that "gridlock" and "a government that does nothing" is actually a good thing for stocks over the short term (even though it may be by far the best thing for the economy in the long run). VIX is back to levels last seen in August. The fact that those levels preceded a sell-off is largely being ignored on a day the DOW moved up 337 points, but as far as I can tell, VIX is as much a "risk on" / "risk off" asset as anything else and has limited predictive value (as in none). Somewhere out there, the quants are analyzing the skew of longer dated options as a better tool that may retain predictive value, but that is complex, and requires effort, but is probably the work that is required to make some sense of what the "vol" market is telling us. It is definitely the sort of work that serious tail risk hedge funds and quant funds are looking at and analyzing. Here is the "vol skew" graph function on the SPX on Bloomberg. As far as I can tell you would need to be either a rocket scientist or a Deadhead to understand it. I am neither, but am convinced that to the extent the vol market contains useful information, it is far more complex to figure out, than pulling up a VIX closing level. | ||

| Posted: 20 Dec 2011 10:01 AM PST Great read, long but great. Porter Stansberry doesn't pull any punches. The Corruption Of America 12/20/2011 Submitted by Porter Stansberry of Stansberry Research The Corruption of America The numbers tell us America is in decline… if not outright collapse. I say "the numbers tell us" because I've become very sensitive to the impact this kind [...] | ||

| Posted: 20 Dec 2011 09:36 AM PST | ||

| The Importance of “Ground Truth” Posted: 20 Dec 2011 09:30 AM PST GlobalPost is an online news organization dedicated to the idea of "ground truth." It's a simple concept. Say you have a satellite image. And then you send a person there to verify it. The latter is ground truth. It is a person on the ground, making a firsthand observation. GlobalPost has adopted this concept as its mission. GlobalPost expects its correspondents to live in the countries they write about. Co-founder Charles Sennott put together a correspondent's field guide with key points he expects his writers to live by. No. 1 on the list is simple: "Be there." I love this idea. I am also mindful of its wisdom in my own investing adventures. (This is why I rack up a lot of frequent-flier miles.) There is no substitute for being there. Today, I'm in Nicaragua. It's morning here as I write you from a palm-fringed house perched on a bluff overlooking a gorgeous stretch of beach at Rancho Santana. Before I visited Nicaragua for the first time, it was simply a place on a map. It was an abstraction. If anything, it was a set of received ideas — bits gleaned from other people, reflecting all the biases you'd expect. Now Nicaragua means something very specific. It is a house with a pool surrounded by coconut trees. It's green mountains and white surf and ocean breezes. It's a warm pile of rice and beans and fried plantains. It's friendly people and good times. I was here with a group of readers over the weekend. They were looking at possibly buying real estate here. That is an idea that many people back home in the US would think a bit nutty. Back home, Nicaragua often means something that has little to do with the substance of what it actually is. Nicaragua means Sandinistas. It means Ortega. It conveys a vague sense of menace. To invest here would seem insane. But the ground truth is different. On Saturday, Joel Bowman and I delivered the first presentations ever made at the brand-new clubhouse in Rancho Santana. It was a very low-key affair. (I gave my talk in bare feet.) My task was to provide some macro context for Nicaragua. Some of the ideas I included in my talk are below, based on my own ground truth. The big thing everyone thinks of first is el presidente, Daniel Ortega. Business people and investors in Nicaragua have no particular love for Ortega as far as I can tell. But they also believe he has been good for investors. He has provided tax breaks, carved out free-trade zones and boosted infrastructure investment. It's not an ideal free market, of course, but it's now functionally superior as such to many other markets investors might rank offhand as better. The proof is in the pudding. Hear it from Carlos Pellas Chamorro, the richest man in Nicaragua. He is the controlling shareholder of Grupo Pellas, which has an oar in seemingly every boat: sugar, rum, banking, media, insurance and more. A reporter once asked him if open and free markets really work in Nicaragua. He said: "Open and free markets work everywhere when you let them. Of course, there are many obstacles in Nicaragua, as in all emerging nations… Many sophisticated foreign investors like Citibank, GE, Grupo Roble, Cemex, America Movil, Telefonica, PriceSmart, Wal-Mart, Cargill and many others have invested large sums of money in Nicaragua, obtaining very attractive returns." Those of us who have been down here have known these things for years. Only recently, though, has the ground truth started to seep into the mainstream press. Still, most Americans would be surprised to learn Nicaragua is the second safest country in Central America, behind only Costa Rica. Or that the World Bank ranks it as the easiest country in Central America, Panama excepted, in which to start a new business. Or that in "ease of doing business," Nicaragua ranks well ahead of such perennial darlings as Brazil or India — or even neighboring Costa Rica. A recent IMF report said that Nicaragua was the Central American country that best protected investors' rights. There are always uncertainties. But sometimes I think people almost reflexively assume that a foreign place has greater risks than back home simply because they overlook — or have grown complacent — about the risks they've lived with for so long. Realities, too, can change. Places can go bad, like overripe fruit. But they can also re-emerge. In this way, the investor's chore (or pleasure) is clear: to stay informed, to always seek out and gather fresh insights, to revise opinions accordingly so they do not grow stale and cost you a lot of money. Great opportunities in markets often emerge simply because investors are relying on old assumptions or on ideas posed by people who have never checked things out up close. There is then an opportunity to get in at good prices and wait for the rest of the world to catch on. This is always important, but the idea of ground truth seems it will be more important in 2012, as a number of big questions linger unanswered in 2011: What is the fate of the EU? Who will be the US president after the 2012 elections? Will gold get back to $2,000 an ounce? Will the US Treasury bond bubble pop? Will the BRIC countries slow further in 2012 or reverse course? Can commodities rally in the face of tepid economic growth? It feels like 2012 will be an important year, maybe even a pivotal one, in the changes it could bring. Those who rely on ground truth have a better shot of ferreting out opportunities as the world changes than those who don't. So here's to finding more ground truth in 2012! Regards, Chris Mayer The Importance of "Ground Truth" originally appeared in the Daily Reckoning. The Daily Reckoning is published by Agora Financial and provides over 400,000 readers economic news, market analysis, and contrarian investment ideas. | ||

| Are Torrid Tuesdays The New Merger Mondays? Posted: 20 Dec 2011 09:16 AM PST While there is nothing quite like using correlation to imply causation, or predicting the future by observing self-fulfilling prophecies which work until they wipe everyone who blindly follows them, investors do enjoy observing technical patterns that lead to at least some incremental and tranistory beta. Especially in this day and age of centrally planned alpha disintegration. And while many have noted historical phenomena which used to work in the old days, such as the "Merger Monday" effect, this was before the Obama administration decided it would be the best and last arbiter of what transactions should and shouldn't work. As a result, Merger Monday were promptly forgotten. Also promptly forgotten were POMO days (at least for now), as every Fed bond purchase, has an equal and offsetting bond sale (inverse POMO). Granted once the Fed starts monetizing Italian bonds this will quickly change. But what about now? Well, as a trading desk advises us, using 2011 statistica data, "Torrid Tuesdays" just may be the new "Merger Monday." To wit:

Of course, now that it is public, using the old faithful precepts of the wave function collapse, this self-fulfilling anomaly will no longer work. Or maybe it will work that much better if even more momo chasers go after it. Who knows? Anyone crazy enough to want to put even a dollar of their money at risk in this joke of a market is welcome to try it. The rest of us will sternly contemplate the age old question: just how will the world grow when the marginal utility of debt is below 1, when capex is far lower than D&A, when asset bases do not generate enough cash flows to satisfy liabilities, and when the only solution is inflating our way out of every troublesome spot. | ||

| Euro Collapse Crisis Sledgehammer Pounds Into Stock Market Santa Rally Posted: 20 Dec 2011 09:13 AM PST Santa's Late! The stock market as measured by the DJIA closed the week down at 11,866, showing significant deviation from the santa rally script with barely a week remaining, the lack of progress to the upside has been as a consequences of the increasing mass of unserviceable debt out of the euro-zone where politicians repeatedly show themselves to be ignorant of the facts and what to do to get out of the hole that the euro-zone is sinking deeper into an economic depression each day. The euro-zone politicians appear single mindedly determined to do absolutely NOTHING to save the euro-zone, which is the reason why the bulk of my analysis and articles of the past 6 months has been centred around the risks coming out of the euro-zone, because just when you thought that they had succeeded at kicking the can a few months down the road, which was the conclusion of last weeks analysis that the risks of a collapse of the banking system had been delayed until at least Mid Jan 201... | ||

| Chris Whalen - Expect Bank Holidays in Europe & Higher Gold Posted: 20 Dec 2011 09:13 AM PST | ||

| Investing vs. Speculating in Gold and Silver Stocks Posted: 20 Dec 2011 09:05 AM PST | ||

| How Central Banks Attempt to Prop Up the Economy Posted: 20 Dec 2011 08:52 AM PST The Dow Jones Industrial Average tumbled about 100 points yesterday — probably not because anyone really wanted to sell stocks, but because no one could think of any really good reason to buy them. This morning, the Dow is soaring more than 300 points — probably not because anyone really wants to buy stocks, but because no one can think of any really good reason to sell them again. In short, the financial markets are reflecting what our friend, John Mauldin, calls a "muddle through" economy. Notwithstanding this morning's buoyant stock market action, the euro zone is still in crisis, the finances of most governments in the Western world are still in shambles… and Bank of America's share price is still hovering around five dollars — just like it was in March of 2009, when then-Treasury Secretary Paulson and Federal Reserve Chairman Ben Bernanke were busy patting each other on the back for "saving" the financial system. Toward the end of yesterday's trading session, Bank of America's share price actually slipped below five dollars per share for the first time since mid-March 2009. That event may or may not be significant, depending upon which rumors one chooses to believe. One of the juiciest rumors of the moment is that the Federal Reserve is desperately trying to prop up Bank of America, under the guise of helping to "save the euro." For example, the last time Bank of America's share price flirted with five dollars was November 29. The stock hit $5.03 during that trading session before closing at $5.08. The following morning, at the crack of dawn, the Federal Reserve announced its latest "coordinated intervention" with the European Central Bank and a bevy of other central banks. Stock markets around the world skyrocketed on the news. Distressed financial stocks like Bank of America's skyrocketed most of all. Therefore, as we noted in the December 5th edition of The Daily Reckoning, "[The King Report] speculates that problems here at home may have also spurred the cavalry into action. 'Fed concern about Bank of America was probably a prime factor in implementing the latest scheme,' says King. 'If BAC had fallen below $5, there could have been an avalanche of selling because some institutions cannot buy or hold a stock that is less than $5 per share. A cascading BAC could have generated an "Emperor has no clothes" moment for BAC. (Buffett would have been chagrined). So it was imperative that someone closed BAC above $5 on Tuesday and that some scheme had to be implemented to drive the price higher on Wednesday.' "So just as expected/hoped," the December 5th Daily Reckoning continued, "the markets rallied sharply on Wednesday, enabling BAC and a few other troubled financial institutions to live to fight another day. But the fight is far from over…and the troubled financial institutions are unlikely to emerge victorious, no matter how many times the central bank cavalry storms into battle." As predicted, the central bank intervention announcement on November 30 produced a very sharp, dramatic rally. Bank of America's shares rallied as much as 16%, while the shares of many other banks and finance companies rallied even more. Nevertheless, by the end of yesterday's trading session, those fleeting gains had more than disappeared… and there sat a forlorn Bank of America, priced at $4.98 a share

Then the cavalry charged in once again! Is it not somewhat curious, that today's 320 rally seemed to come out of nowhere, on no major news whatsoever? Is it not also somewhat curious that the stock market happened to the soar the very next morning after Bank of America fell below $5? These kinds of coincidences are almost enough to make me believe crazy rumors. Oh, wait a minute, there was some bullish news out of Europe this morning. The Spanish government managed to sell a few bonds to "the public." This announcement sparked a rally in Europe that continued into the New York trading session. But once again, if you believe some of the crazy rumors going around, the "successful" Spanish bond auction had the Fed's fingerprints all over it. According to the scuttlebutt, European banks snapped up the Spanish debt — these very same European banks that are already choking on life-threatening quantities of Spanish, Italian, Portuguese and Greek debt. So why would they buy even more of this stuff? Two reasons: 1) The banks have a large, vested interest in preventing the prices of the sovereign bonds they already hold from falling even more and; 2) Thanks to the Federal Reserve, these banks now have access to extremely cheap, unlimited funding through the swap lines the Fed announced on November 30th. (The banks also have access to very cheap 3-year credit lines from the ECB). Let's call this whole shebang, "Backdoor Quantitative Easing." Even if the details of this Backdoor QE theory are somewhat off base, the substance of the theory is certainly dead on. Somehow or other, you can be sure that the Fed and the ECB are busy "fixing things"…and utilizing clandestine tactics to do so. But so far, the troubled banks of America and Europe are still as troubled today as they were three weeks ago, and many of them are more troubled than they were three years ago, when the Fed moved full-time into the bank-rescue business. Of course, the Fed and the ECB have financial problems of their own. "No matter how you slice it," observes our friend Dan Denning, editor of the Australian Daily Reckoning, "many of the world's governments need money. If the private markets don't give it to them, their central banks will have to do the job. This will lead inevitably to money printing and currency devaluation. The amount of money these governments require is staggering. "Industrialized Welfare State governments will have to borrow some $10.4 trillion next year, according to the Paris-based Organisation for Economic Cooperation and Development (OECD)," Dan continue. "That's a lot of money. The countries doing the bulk of the borrowing are in Europe. Don't forget America. The chart below shows that nearly 60% of total US Treasury debt outstanding — or $5.6 trillion — must be refinanced in the next four years."

Where is that money going to come from? It's hard to say where the money will come from, but it's easy to say where it will not come from. It will not come from private citizens who are looking to park their cash in safe and secure investments. There aren't enough folks with actual money to invest who are willing to lend that money to a bankrupt government. So in order to fill this $10 trillion funding gap, we should expect a few more quantitative easing programs and other forms of money-printing. Meanwhile, we should also expect a lot more attempts by government powers to repel the forces of economic nature: More "coordinated central bank intervention," more "emergency landing facilities," and more ad-hoc, too-big-to-fail remedies. So at least we've got that going for us — a lot more of the stuff that hasn't worked… and never will. Buy gold…some more. Eric Fry How Central Banks Attempt to Prop Up the Economy originally appeared in the Daily Reckoning. The Daily Reckoning is published by Agora Financial and provides over 400,000 readers economic news, market analysis, and contrarian investment ideas. |

| You are subscribed to email updates from Save Your ASSets First To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

Is America in decline? That is a very provocative question. I have found that most people that hate the United States are very eager to agree that America is in decline, while a lot of those that love the United States are very hesitant to admit that America is in decline. Well, I am proud to be an American, but I cannot lie and tell you that America is doing just fine. The pieces of evidence compiled below are undeniable. Our economy is deathly ill and is rapidly getting worse. We were handed the keys to the greatest economic machine in the history of the world and we have wrecked it. But until we are willing to look in the mirror and admit how bad things have gotten, we won't be ready for the solutions that are necessary. The truth is that there are things that we can do to reverse the decline. It does not have to be permanent. We have gotten away from the things that made America great, and we need to admit that we are on the wrong path and start fixing this country. But if we choose to continue down the road that we are currently on, it will lead us into the darkest chapters in American history.

Is America in decline? That is a very provocative question. I have found that most people that hate the United States are very eager to agree that America is in decline, while a lot of those that love the United States are very hesitant to admit that America is in decline. Well, I am proud to be an American, but I cannot lie and tell you that America is doing just fine. The pieces of evidence compiled below are undeniable. Our economy is deathly ill and is rapidly getting worse. We were handed the keys to the greatest economic machine in the history of the world and we have wrecked it. But until we are willing to look in the mirror and admit how bad things have gotten, we won't be ready for the solutions that are necessary. The truth is that there are things that we can do to reverse the decline. It does not have to be permanent. We have gotten away from the things that made America great, and we need to admit that we are on the wrong path and start fixing this country. But if we choose to continue down the road that we are currently on, it will lead us into the darkest chapters in American history.

No comments:

Post a Comment