Gold World News Flash |

- Jim Rickards - This Will Send the Price of Gold to the Moon

- Trustee to Seize and Liquidate Even the Stored Customer Gold and Silver Bullion From MF Global

- By the Numbers for the Week Ending December 16

- About Gold: Don’t Panic!!!

- Why the Gold Price is Falling Far and Fast

- The Last Ponzi Game

- Saxo Bank's 10 "Outrageous Predictions" For "2012: The Perfect Storm"

- Saxo Bank's 10 "Outrageous Predictions" For "2012: The Perfect Storm"

- Is A Bearish Bet On Boeing The Cheapest Way To Hedge A Crude Oil Collapse?

- Gonzalo Lira: About Gold: Don’t Panic!!!

- Silver Update: Silver Optimism

- Richard Russell - I Will Stay with Gold & Gold Stocks to the End

- UBS' Top Ten Surprises For 2012

- UBS' Top Ten Surprises For 2012

- Accelerating money supply

- Harvey Organ's Daily Gold & Silver Report

- Egon von Greyerz Interview on Future QE, Hyperinflation and the Price of Gold

- New Analysis Suggests a Parabolic Rise in Price of Gold to $4,380/ozt.

- “For those not familiar with this skullduggery, the big “trusts” like SLV and GLD have a sort of “loophole” where the trustee can issue new shares even before they acquire the metal to back them.”

- Liquidation of Customer Stored Gold and Silver Bullion From MF Global

- Silver Update: 12/15/11 Silver Optimism

- Did The Fed Quietly Bail Out A Bank On Tuesday?

- MUST READ: Trustee to Seize and Liquidate the Customer Gold and Silver Bullion From MF Global

- This Past Week in Gold

- Gold for What its Worth!

- Will Moving Averages Deter Gold Investors?

- “In short order we are going to see a divergence of the paper price and the spot price.”

| Jim Rickards - This Will Send the Price of Gold to the Moon Posted: 17 Dec 2011 06:58 PM PST  With investors concerned about the recent plunge in gold and silver and continued uncertainty regarding the European situation, today King World News has released part II of the eagerly anticipated interview with KWN resident expert Jim Rickards. KWN expert, Rickards, has gained international recognition for his deadly accurate predictions regarding moves by central planners. Here is a small portion of what Rickards had to say about gold, QE3 and more: "Well, you see the Treasury shorting the dollar in the form of taking SDR notes. You see printing in order to get the dollar back down against the euro. You see more printing to break the peg if China chooses to repeg, which I believe they will. And, of course, the IMF has its own printing press to print SDRs." With investors concerned about the recent plunge in gold and silver and continued uncertainty regarding the European situation, today King World News has released part II of the eagerly anticipated interview with KWN resident expert Jim Rickards. KWN expert, Rickards, has gained international recognition for his deadly accurate predictions regarding moves by central planners. Here is a small portion of what Rickards had to say about gold, QE3 and more: "Well, you see the Treasury shorting the dollar in the form of taking SDR notes. You see printing in order to get the dollar back down against the euro. You see more printing to break the peg if China chooses to repeg, which I believe they will. And, of course, the IMF has its own printing press to print SDRs." This posting includes an audio/video/photo media file: Download Now |

| Trustee to Seize and Liquidate Even the Stored Customer Gold and Silver Bullion From MF Global Posted: 17 Dec 2011 04:24 PM PST Trustee to Seize and Liquidate Even the Stored Customer Gold and Silver Bullion From MF GlobalCourtesy of Jesse's Cafe Americain  The bottom line is that apparently some warehouses and bullion dealers are not a safe place to store your gold and silver, even if you hold a specific warehouse receipt. In an oligarchy, private ownership is merely a concept, subject to interpretation and confiscation. Although the details and the individual perpetrators are yet to be disclosed, what is now painfully clear is that the CFTC and CME regulated futures system is defaulting on its obligations. This did not even happen in the big failures like Lehman and Bear Sterns in which the customer accounts were kept whole and transferred before the liquidation process. Obviously holding unallocated gold and silver in a fractional reserve scheme is subject to much more counterparty risk than many might have previously admitted. If a major bullion bank were to declare bankruptcy or a major exchange a default, how would it affect you? Do you think your property claims would be protected based on what you have seen this year? You always have counter-party risk if you hold gold and silver through another party, even if they are a Primary Dealer of the Federal Reserve. As Ben said, the Fed offers no seal of approval. If a Bankruptcy Trustee can pool your bullion into the rest of the paper assets and then liquidate it at prices that are being front run by the Street, you will have to accept whatever paper settlement that they give you. The customer money and bullion assets are not lost, or rehypothecated or anything else. This is a pseudo-legal fig leaf, a convenient rationalization. The customer assets were stolen, and given to at least one major financial institution by MF Global to satisfy an 11th hour margin call in the week of their bankruptcy, even as MF Global was paying bonuses to its London employees. And in an absolutely classic Wall Street move, they are still charging the customers storage fees on the bullion which they have misappropriated from them. lol. And now that powerful financial institution does not want to give the customer money and metal back. And they are apparently so powerful that the Trustee and the Court are reluctant to try and force its return to the customers, which is customary in this type of preferential distribution of assets prior to a bankruptcy, much less assets that were stolen. And keep in mind that in those last days the firm sent checks instead of wire transfers to customers so they could bounce them, and in a few cases even reversed completed wire transfers! And so in the great Wall Street tradition they are trying to force the customers and the public to take the loss. The regulators and the exchange are aghast, and are trying to imagine how to resolve and spin this to preserve investor confidence and prevent a run on the system. 'Let them eat warehouse receipts.' For many this would have been unthinkable only a few months ago. They had been cautioned and warned repeatedly, but chose to trust the financial system. And now they are suffering loss and anxiety, frozen assets, and the misappropriation of their wealth. How more plainly can it be said? The US financial system as it now stands cannot be trusted to observe even the most basic property rights as it continues to unravel from a long standing culture of fraud. Get your money as far away from Wall Street as is possible. And if you want to own gold and silver, take delivery and store it in a secure private facility outside the fractional reserve system.

|

| By the Numbers for the Week Ending December 16 Posted: 17 Dec 2011 03:45 PM PST LAS VEGAS -- Just below is this week's closing table followed by the CFTC disaggregated commitments of traders (DCOT) recap table for the week ending December 16, 2011.

Gold and Silver Disaggregated COT Report (DCOT) In the DCOT table below a net short position shows as a negative figure in red. A net long position shows in black. In the Change column, a negative number indicates either an increase to an existing net short position or a reduction of a net long position. A black figure in the Change column indicates an increase to an existing long position or a reduction of an existing net short position. The way to think of it is that black figures in the Change column are traders getting "longer" and red figures are traders getting less long or shorter. All of the trader's positions are calculated net of spreading contracts as of the Tuesday disaggregated COT report.

*** More in the linked technical charts for Vultures by Sunday evening.*** |

| Posted: 17 Dec 2011 12:00 PM PST by Gonzalo Lira:

For those of us watching the gold markets—that is, those of us anticipating the collapse of the euro and the eventual collapse of the dollar—the last week has been a scary ride: Gold has fallen over 8.6%, from a high of $1,730 on December 7 to $1,580 on December 14. WTF???, I can practically hear everyone say. The fundamentals would point to gold being a safe haven play—it should not be falling: If anything, it ought to be rising. But a fall of 8.6%? In a week? The first thing that pops into my head is, Don't Panic!! The second thing that pops into my head is, This is to be expected—and is only a temporary pullback. |

| Why the Gold Price is Falling Far and Fast Posted: 17 Dec 2011 11:10 AM PST |

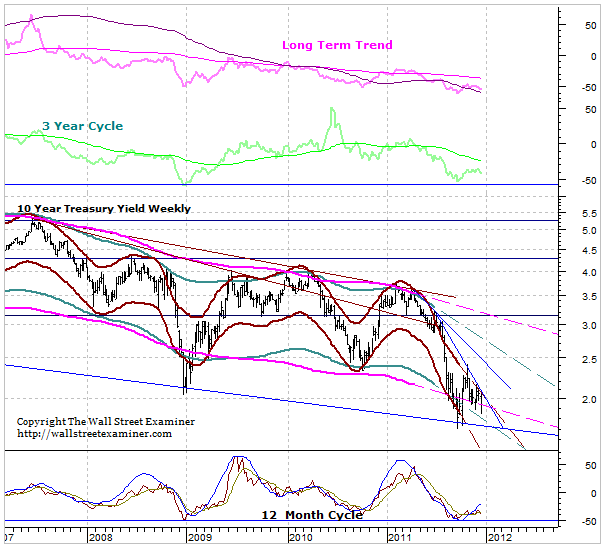

| Posted: 17 Dec 2011 10:37 AM PST The Last Ponzi GameCourtesy Lee Adler of the Wall Street Examiner

A heavy Treasury auction schedule with a big settlement on Thursday was enough to contribute to keeping stock prices (SPX) in check this week, but not to knock down Treasuries. Demand for US Government paper is so great it simply engulfs even heavier than expected levels of new supply. The massive capital flight out of Europe is now confined to the only game in town, the US Treasury market, the last great Ponzi game still operating. This won't end well, but it won't end until it ends, and the technical signals suggest that won't be in the short run. Yields appear to be still headed lower, and that's bad news for stocks given the recent correlation between lower yields and lower stock prices. As I've illustrated in the accompanying Fed Reports, there isn't enough liquidity to power both markets toward higher prices simultaneously. It's either one or the other. Eventually I expect a shortage of liquidity to negatively impact both markets, but we're not there yet. Withholding tax collections remain weak, and the government continues to need to raise substantially more cash than the TBAC had estimated it would need. That means that the economy is significantly weaker than government forecasters had foreseen just 6 weeks ago when these estimates were issued. The clues were available in the data at that time and I correctly guessed that the auctions would begin to balloon in size. Normally this would be problematic for the markets, but not in the current environment. At the same time, foreign central bank purchases of Treasures have fallen off a cliff. Again, that would normally be extremely problematic. But it just doesn't matter because panicked institutions fleeing Europe are like the Coneheads consuming mass quantities of all available US Treasury paper. In fact, the demand is overwhelming the massive supply. Tidal waves of panic capital flight have been flooding into the Treasury market in never before seen amounts, both in terms of the indirect bid and the bid by Primary Dealers, of whom 1/3 are European banks. The panic buying has been concentrated in the 4 week bill, but there was also a jump in the bid for longer term paper, particularly the 10 year note (TNX) this week. The 4 week bills are where the real panic is. This is short term cash looking for a safe place to park. At the same time, the increase in nervous buying is pushing out on the curve enough to continue to push yields down for a while longer. It's also pushing the dollar higher. The dollar (DXY) faces a critical test at 82. Get regular updates on the US housing market, and stay up to date with the machinations of the Fed, Treasury, Primary Dealers and foreign central banks in the US market…stay ahead of the herd. Click this link to try WSE's Professional Edition risk free for 30 days! Pic credit: Sox First |

| Saxo Bank's 10 "Outrageous Predictions" For "2012: The Perfect Storm" Posted: 17 Dec 2011 09:21 AM PST As we wind down 2011, the time for predictions for what is to come as nigh. Having posted what UBS believes their biggest list of surprises for 2012 will be earlier, we next proceed with out long-term favorite - Saxobank's list of "Outrageous Predictions" for what the bank has dubbed "2012: the Perfect Storm." Mostly proposed tongue in cheek (unlike predictions by other pundits who actually believe their own delusions), the list of 10 suggestions represents nothing less than an attempt to force people "out of the box" and look at the world with a set of "what if" eyes. Because if there is anything 2011 taught is, it is not to discount any one event from happening. As Saxo says: "Should one, two or three of our Outrageous Predictions come to pass, it would make 2012 a year of tremendous change. This may not necessarily be a negative thing either - and given the structure and uncertainties in the marketplace here at the end of 2011, we would suggest that even if none of our predictions come to pass, equally important and totally unanticipated events will. Sometimes we need to get to a new starting point before we can gain the right perspective. We hope 2012 will be the year where we start on the long march towards re-establishing jobs, growth and confidence." Naturally, the best outcome for 2012 would be the end of the broken status quo model, and a global fresh reset... but not even we are that deluded to believe that the quadrillions in credit money (real or synthetic) will allow such a revolutionary event to occur in such a brief period of time. At least not before everything is thrown at the intractable problem unfortunately has just one possible long-term outcome. In the meantime, here, to help readers expand their minds, is Saxo Bank's list of "Outrageous Predictions" for 2012. From Saxo's Chief Economist Steen Jakobsen 2012: THE PERFECT STORM Generating this year's Outrageous Predictions has been even more of a pleasure than usual, as it seems that never before have there been so many path uncertainties for the future, so we have had an infinite variety of scenarios to draw on. As usual, we try to keep at least a measure of consistency across the predictions by using a unifying theme. For this year, we settled on the theme for 2012: The Perfect Storm. Saxo Bank's yearly Outrageous Predictions report has always been one of our more popular publications, and understandably so, as it frees us and our readers from the constraints of the high probability events in the middle of the supposed bell curve of possibilities. But there are a few key points I need to underline about this publication: The first is that we always focus on "fat tail" predictions, i.e. events that are unlikely to happen, but are perhaps far more likely than the market appreciates. Saxo Bank first launched this publication 10 years ago as an exercise in looking at events which, should they happen, would change the outlook and performance of markets. This was before the concept of Black Swans was popularised. Our publication was rather inspired by option theory and looking at the tail-risk – an event which based on odds or logic has a very small chance of happening, but somehow still happens far more often than any model is able to predict. Consider volatility during the 2008 Financial Crisis which no model could even imagine. Or think about a natural disaster like the earthquake/tsunami that hit Fukushima. Disaster planning could supposedly handle a very substantial earthquake and Fukushima was supposedly located in a low risk zone. But instead, Japan suffered an earthquake of severity which seemed impossible in Japan's geology, and the resultant tsunami wiped out back-up power. The unimaginable happened once again. Saxo Bank's yearly Outrageous Predictions are not intended as real predictions and certainly not as "forecasts" in any way. Rather, the Outrageous Predictions are 10 important events with under-recognised probabilities in our view. Should any of them come to pass, they would change the way we need to analyse, trade and report the markets. It is also important to note that our Outrageous Predictions nearly always have a negative bias, which is in fact a natural antidote to how the market normally operates. Human beings have a tendency to think positively, which is a natural part of our motivation to get up and go to work every day and a vital part of our survival instinct. Day in and day out we think about building a better future based on a continuation of the present. This is good for morale but does a poor job of preparing us for reality. In that light, please do not let our Outrageous Predictions get you down. They have been prepared in the spirit of encouraging you to think outside the box and prepare for world-altering events. Thinking outside the box is rarely a comfortable exercise, but neither is dealing with an unpleasant surprise for which one has failed to prepare in any meaningful way. Should one, two or three of our Outrageous Predictions come to pass, it would make 2012 a year of tremendous change. This may not necessarily be a negative thing either - and given the structure and uncertainties in the marketplace here at the end of 2011, we would suggest that even if none of our predictions come to pass, equally important and totally unanticipated events will. Sometimes we need to get to a new starting point before we can gain the right perspective. We hope 2012 will be the year where we start on the long march towards re-establishing jobs, growth and confidence. Maybe, just maybe, our Outrageous Predictions can at least lead to a discussion on how we can prevent some of them from happening. We would like nothing more than to be proven wrong on negative views, but only if they are replaced with something better than the current central bank and government-manipulated paradigm.

OUTRAGEOUS PREDICTIONS 2012 1 - THE STOCK OF APPLE INC PLUMMETS 50 PERCENT FROM 2011 HIGH No sovereign or corporate empire has ever maintained its superior position for long because attacks mount and loyalty fades. Going into 2012 Apple will find itself faced with multiple competitors such as Google, Amazon, Microsoft/Nokia, and Samsung across its most innovative products, the iPhone and iPad. Apple will be unable to maintain its market share of 55 percent (three times as much as Android) and 66 percent on the iOS and iPad as Android will gain further momentum and Amazon's low priced Kindle Fire will cut deeply into Apple's tablet reign. In relation to current earnings Apple is not expensive but expectations about future profit growth will come down hard as competition reaches insane levels and crushes Apple's profit margins. 2 - EU DECLARES EXTENDED BANK HOLIDAY DURING 2012 The December EU Treaty changes prove insufficient to solve EU funding needs – particularly those in Italy – and the EU debt crisis returns with a vengeance by mid-year. In response, the stock market finally caves in and drops 25 percent in short order, prompting EU politicians to call an extended bank holiday – closing all European exchanges and banks for a week or more. EU leaders gather like Vatican cardinals at a conclave to hammer out a "New Europe". This could result in EU officials overstepping their mandate once again with new burdensome command and control measures that further violate the principles of the EU and free markets. Regardless, this "final" attempt leads straight to a popular overthrow of the old order and beginning of destruction of the sovereign debt time bomb. A period of pain is inevitable, but this will quickly allow a "new EU" to regroup with new membership and a new base from which its economies and markets can start planning for the future, rather than dealing with the mistakes of the past. 3 - A YET UNANNOUNCED CANDIDATE TAKES THE WHITE HOUSE In 1992, a savvy, yet highly erratic Texas billionaire named Ross Perot managed to take advantage of a recessionary economy and popular disgust with US politics and reap 18.9 percent of the popular vote. Step forward to 2008, and Obama promises "real change" from eight years of Republican rule as the economy is nose-diving. Now, three years of Obama has brought too little change and only additional widespread disillusionment with the entire US political system. Going into the election in 2012, the incumbent Democrats are in ideological disarray and will get the blame for continued economic malaise and the favour-the-rich Republicans will never win the popular vote with the US rich/poor gap at a record width and social tension rising. In short, conditions for a third party candidate have never been riper. Someone smart enough to sense this and with a strong programme for real change throws his hat in the ring early in 2012 and snatches the presidency in November in one of the most pivotal elections in US history, taking 38 percent of the popular vote. A new political order is born. 4 - AUSTRALIA GOES INTO RECESSION The Chinese locomotive has been losing steam throughout 2011 as investment and real estate led growth becomes harder and harder to come by due to diminishing marginal returns. The effects of the slowing of the up-and-coming Asian giant ripple through Asia Pacific and push other countries into recession. If there ever was a country dependent on the well-being of China it is Australia with its heavy dependence on mining and natural resources. And as China's demand for these goods weakens Australia is pushed into a recession, which is then exacerbated as the housing sector finally experiences its long overdue crash – a half decade after the rest of the developed world. 5 - BASEL III AND REGULATION FORCE 50 BANK NATIONALISATIONS IN EUROPE As 2012 begins, pressure will mount on the European banking system as new capital requirements and regulatory pressure force banks to deleverage in a great hurry. This creates a fire sale on financial assets as there are few takers in the market. Troubled sovereigns, structural funding gaps and massive trading books set the scene for the largest bank rescue operation in Europe's history. Politicians, eager to score points with the public, create a regulatory mob enforcing value destruction in the banking system "in the name of greater good". A total freeze of the European interbank market forces nervous savers to make bank-runs, as depositors distrust deposit guarantees from insolvent sovereigns. More than 50 banks end up on government balance sheets and several known commercial bank brands cease to exist. 6 - SWEDEN AND NORWAY REPLACE SWITZERLAND AS SAFE HAVENS Sweden and Norway are at risk of replacing Switzerland as the new safe havens – "risk" because, as we saw with Switzerland, becoming a safe haven in a world of devaluing central banks presents a number of risks to a country's economy. The capital markets of both countries are far smaller than Switzerland, (the combined FX volume in Sweden and Norway being a mere fraction of Switzerland's), but the Swiss are aggressively devaluing their currency and money managers are looking for new safe havens for capital. At the same time, Germany and its balance sheet are embroiled in the EU debt debacle and the classic safe haven appeal of 10-year Bunds is fading fast. Sweden and Norway sport excellent current account fundamentals, prudent social policies and skilled and flexible labour forces. Flows into the two countries' government bonds on safe haven appeal becomes popular enough to drive 10-year rates there to more than 100 basis points below the classic safe haven German Bunds. 7 - SWISS NATIONAL BANK WINS AND CATAPULTS EURCHF TO 1.50 Switzerland's persistency in fighting the appreciation of its currency will continue to pay off in 2012. After the dramatic failure of direct FX intervention in the market in 2009 and 2010 and after EURCHF threatened to destroy the Swiss economy with its death spiral towards parity in mid-2011, the Swiss National Bank and Swiss government finally joined forces to engineer an aggressive expansion of money supply and established a floor in EURCHF at 1.20. With Swiss fundamentals – particularly export related – continuing to suffer mightily in 2012 from past CHF strength, the SNB and government bear down further to prevent more collateral damage and introduce extensions to existing programmes and even negative interest rates to trigger sufficient capital flight from the traditional safe haven of Switzerland to engineer a move in EURCHF as high as 1.50 during the year, much to the chagrin of those who believe central banks can't intervene successfully. 8 - USDCNY RISES 10 PERCENT TO 7.00 The impressive growth rates in the world's second-largest economy, China, since the end of the Great Recession have been predicated on investment and exports. As marginal returns from building million-inhabitant ghost towns diminish and exporters struggle with razor-thin margins due to the advancing CNY China gets to the brink of a "recession", meaning 5-6 per cent GDP growth. Chinese policymakers come to the rescue of exporters by allowing the CNY to decline against a US Dollar - buoyed by its safe-haven status amid slowing global growth and an on-going Eurozone sovereign debt crisis - and send the pair up to 7.00 for a 10 percent increase. 9 - BALTIC DRY INDEX RISES 100 PERCENT Despite the dry bulk fleet being expected to outgrow demand in 2012, leading to further over capacity, several factors could surprise resulting in a price spike in the Baltic Dry Index. Lower oil prices in 2012 could lead to an increase in the Baltic Dry Index as operating expenses go down. Brazil and Australia are expected to expand iron ore supply, further leading to lower prices and therefore higher import demand from China to satisfy its insatiable industrial production. In combination with monetary easing this leads to a massive spike in iron ore demand. The last shock that could impact the dry bulk market is exceptional dry weather, due to El Nino, leading to a plunge in hydropower electricity generation and thereby fuelling demand for coal imports. 10 - WHEAT PRICES TO DOUBLE IN 2012 The price of CBOT wheat will double during 2012 after having been the worst performing crop in 2011. The drop was brought about due to a combination of farmers responding to high prices in 2010/11 and normalised weather in the Former Soviet Union. However with 7 billion people on the earth and money printing machines at full throttle bad weather across the world will unfortunately return and make it a tricky year for agricultural products. Wheat especially will rally strongly as speculative investors, who had built up one of the biggest short positions on record, will help drive the price back towards the record high last seen in 2008.

And for those curious, here are Saxo's "Outrageous Predictions" from a year earlier. US CONGRESS BLOCKS BERNANKE'S QE3 As we move into the second half of 2011, politicians and pundits increasingly succeed in putting the Fed in the hot seat for having been the critical enabler of the US housing debacle and resulting bank bailout and public debt catastrophe. Meanwhile, the too-big-to-fail banks are back in deep trouble again as their troubled mortgage portfolios once again threaten their solvency. The Fed's Bernanke rallies the FOMC to indicate a strong new expansion of monetary policy to once again bail out the troubled banks and/or local governments. Emboldened by the political and popular winds blowing, however, a Ron Paul led challenge of the Fed's authority sees the Congress blocking the Fed's authority to expand its balance sheet, and sets up an eventual challenge of the Fed's dual employment/inflation mandate. APPLE BUYS FACEBOOK What do you do when you want domination of the electronic and mobile device consumer market and have no significant presence in social networking? Oh, and a war chest of a mere USD 51 billion? You buy Facebook, the mother lode of (yet to be monetised) social networks. Facebook is worth USD 43 billion, according to sharespost.com. In interviews, Apple CEO Steve Jobs has explained that Apple was in talks with Facebook about partnership opportunities, but that the talks ultimately produced nothing. Facebook was after "onerous terms that we could not agree to", according to Jobs. At the Web 2.0 Summit Facebook founder Mark Zuckerberg called for Apple to ease its approach to connecting Ping with Facebook, and said that Apple had to "get on the bus". Steve Jobs might get on the bus indeed and buy Facebook outright. It makes perfect sense; Facebook doesn't compete against Apple and it 'faces up' to Google, which Jobs loves since Google has become his new number one enemy. It's a deal made in heaven… The gigantic 500+ million Facebook user base could be integrated across Apple's consumer products and services - every Facebook user automatically has an iTunes Store account and FaceTime chat is integrated into Facebook chat. That's a lot of iOS devices. US DOLLAR INDEX TOPS 100 The economic growth trajectory in most areas of the world appears healthy for a time in 2011 – at least outside of Europe and Japan. But then trouble occurs in China, where its new 12th five-year plan aimed at increasing consumption fails to function as hoped. With the Chinese industrial base growing more slowly or not at all as a result of the policy shift, the satellite countries dependent on Chinese demand see their economies facing a rough adjustment. This puts global risk appetite in a tail spin, and with the Japanese economy struggling and the Eurozone in disarray, the US dollar suddenly doesn't look as bad as it did previously. This is especially the case since the market was massively short of the currency at the beginning of the year. The unwinding of these positions pushes the USD index 25% higher to over 100 late in the third quarter of 2011. US 30-YEAR TREASURY YIELD SLIDES TO 3% The dollar devaluation policy, with its roots in the 'currency wars' of 2010, force emerging markets to use more of their spare dollars on Treasuries. Also, the US edges over the brink toward a 'Japanisation' of its economy with core inflation dropping. The Federal Reserve's quantitative easing did not have any positive effects, apart from easing the balance sheet woes of American banks. Main Street did not receive much except some benefits from slightly higher stock prices, and with a failure to clear out the system, borrowing returns only slowly and recovery does not gain traction. And then there's the Eurozone, where the ECB, EU and IMF fail to cure the ills of the peripheral PIIGS, pushing the flock of flustered investors to the safe haven of Uncle Sam. The feel-good factor may have been on the rise in the US in the latter part of 2010, but it vanishes in 2011 and the 30-year Treasury yield drops to 3%. AUSSIE-STERLING DIVES 25% The UK returns to the values of the old days; they work harder, they save more, and soon enough a surprisingly strong expansion in 2011 is underway as the austerity-stricken country defies the naysayers. The markets have it in for the UK, giving the wide expectation that the economy slows as Prime Minister Cameron's cuts work their way through the system. However, the large, narrow cuts will not hinder consumer sentiment and as real savings boost production the economy bounces back in the second half of 2011 to end the year as a growth frontrunner in Europe. CRUDE OIL GUSHES BEFORE CORRECTING BY ONE THIRD Crude oil, now driven by fundamental investor macro expectations, gets carried away, surging to over USD 100 a barrel in early 2011 on the wave of euphoria that the US economy has broken free of the shackles. Unlike 2008, there's no follow through to drive the spike higher and investors are left holding oil positions they cannot sustain. Crude succumbs to a violent one-third correction lower later in the year. NATURAL GAS SURGES 50 PERCENT Natural gas enters 2011 with a supply surplus as the global downturn has resulted in supply exceeding demand for two years – resulting in two years' of double digit losses. But heading into 2011 the fundamentals for Henry Hub improve dramatically. Increased industrial demand on a US recovery, historical cheapness relative to crude and coal, forward curve flattening and action on proposals to export more US natural gas reserves all combine to make passive investments in gas more profitable. And the icing – an unusually frigid cold snap leads to a rapid depletion of stocks. Henry Hub thus sees a one-in-25 year move up by 50% in 2011. GOLD POWERS TO USD 1800 AS CURRENCY WARS ESCALATE The 'currency wars' return with a vengeance in 2011, driven by improvement in the US economy rather than a need to help economic recovery. The US trade deficit widens as consumers and governments get their wallets out. As the deficit expands, President Obama's plan to 'double exports in five years' increasingly becomes a pipe dream and incites the 'man on the street' to twist the US Congress's arm to pursue a weaker dollar. Pressure piles on China and as investors flee to metals in search of some stability, gold shoots up to USD 1,800 an ounce. S&P500 REACHES AN ALL-TIME HIGH Dr. Bernanke, using his mandate of 'make sure the stock market keeps going up', continues to pump liquidity into the system in 2011. Even 'mom-and-pop' investors realise the only strategy worth following is to buy the dips. But the tactic actually works for the Fed, even though it's a house of cards, and the US consumers start to spend as their stock portfolios improve and they forgive their money managers. Corporate America doesn't buy the euphoria that a healthy share price is a good indicator of health, though, and continues the deleveraging process – margin improvements, a wary approach to spending and managing the balance sheet, refinancing debt at next to zero interest rates, and so on. Next thing you know, it's a proper recovery and the US benchmark index sees the 2007 peak in the rear-view mirror on its way to 1,600. RUSSIA'S RTS INDEX REACHES 2500 It's a perfect storm for Russia's RTS index in 2011. The next global economic bubble starts to inflate early in the year, sending crude oil above USD 100 a barrel again. The average US investor won't do anything with his money other than buy the dips on the US stock market, and fans of the Russian stock market realise value in their index at a 1-year forward P/E of 8.6 and price to book ratio of 1.26. The RTS nearly doubles to 2,500 in 2011. The options market says it has a one-in-twelve chance of happening – but the RTS was last up there in mid-2008. h/t Frode and Arnold |

| Saxo Bank's 10 "Outrageous Predictions" For "2012: The Perfect Storm" Posted: 17 Dec 2011 09:21 AM PST As we wind down 2011, the time for predictions for what is to come as nigh. Having posted what UBS believes their biggest list of surprises for 2012 will be earlier, we next proceed with out long-term favorite - Saxobank's list of "Outrageous Predictions" for what the bank has dubbed "2012: the Perfect Storm." Mostly proposed tongue in cheek (unlike predictions by other pundits who actually believe their own delusions), the list of 10 suggestions represents nothing less than an attempt to force people "out of the box" and look at the world with a set of "what if" eyes. Because if there is anything 2011 taught is, it is not to discount any one event from happening. As Saxo says: "Should one, two or three of our Outrageous Predictions come to pass, it would make 2012 a year of tremendous change. This may not necessarily be a negative thing either - and given the structure and uncertainties in the marketplace here at the end of 2011, we would suggest that even if none of our predictions come to pass, equally important and totally unanticipated events will. Sometimes we need to get to a new starting point before we can gain the right perspective. We hope 2012 will be the year where we start on the long march towards re-establishing jobs, growth and confidence." Naturally, the best outcome for 2012 would be the end of the broken status quo model, and a global fresh reset... but not even we are that deluded to believe that the quadrillions in credit money (real or synthetic) will allow such a revolutionary event to occur in such a brief period of time. At least not before everything is thrown at the intractable problem unfortunately has just one possible long-term outcome. In the meantime, here, to help readers expand their minds, is Saxo Bank's list of "Outrageous Predictions" for 2012. From Saxo's Chief Economist Steen Jakobsen 2012: THE PERFECT STORM Generating this year's Outrageous Predictions has been even more of a pleasure than usual, as it seems that never before have there been so many path uncertainties for the future, so we have had an infinite variety of scenarios to draw on. As usual, we try to keep at least a measure of consistency across the predictions by using a unifying theme. For this year, we settled on the theme for 2012: The Perfect Storm. Saxo Bank's yearly Outrageous Predictions report has always been one of our more popular publications, and understandably so, as it frees us and our readers from the constraints of the high probability events in the middle of the supposed bell curve of possibilities. But there are a few key points I need to underline about this publication: The first is that we always focus on "fat tail" predictions, i.e. events that are unlikely to happen, but are perhaps far more likely than the market appreciates. Saxo Bank first launched this publication 10 years ago as an exercise in looking at events which, should they happen, would change the outlook and performance of markets. This was before the concept of Black Swans was popularised. Our publication was rather inspired by option theory and looking at the tail-risk – an event which based on odds or logic has a very small chance of happening, but somehow still happens far more often than any model is able to predict. Consider volatility during the 2008 Financial Crisis which no model could even imagine. Or think about a natural disaster like the earthquake/tsunami that hit Fukushima. Disaster planning could supposedly handle a very substantial earthquake and Fukushima was supposedly located in a low risk zone. But instead, Japan suffered an earthquake of severity which seemed impossible in Japan's geology, and the resultant tsunami wiped out back-up power. The unimaginable happened once again. Saxo Bank's yearly Outrageous Predictions are not intended as real predictions and certainly not as "forecasts" in any way. Rather, the Outrageous Predictions are 10 important events with under-recognised probabilities in our view. Should any of them come to pass, they would change the way we need to analyse, trade and report the markets. It is also important to note that our Outrageous Predictions nearly always have a negative bias, which is in fact a natural antidote to how the market normally operates. Human beings have a tendency to think positively, which is a natural part of our motivation to get up and go to work every day and a vital part of our survival instinct. Day in and day out we think about building a better future based on a continuation of the present. This is good for morale but does a poor job of preparing us for reality. In that light, please do not let our Outrageous Predictions get you down. They have been prepared in the spirit of encouraging you to think outside the box and prepare for world-altering events. Thinking outside the box is rarely a comfortable exercise, but neither is dealing with an unpleasant surprise for which one has failed to prepare in any meaningful way. Should one, two or three of our Outrageous Predictions come to pass, it would make 2012 a year of tremendous change. This may not necessarily be a negative thing either - and given the structure and uncertainties in the marketplace here at the end of 2011, we would suggest that even if none of our predictions come to pass, equally important and totally unanticipated events will. Sometimes we need to get to a new starting point before we can gain the right perspective. We hope 2012 will be the year where we start on the long march towards re-establishing jobs, growth and confidence. Maybe, just maybe, our Outrageous Predictions can at least lead to a discussion on how we can prevent some of them from happening. We would like nothing more than to be proven wrong on negative views, but only if they are replaced with something better than the current central bank and government-manipulated paradigm.

OUTRAGEOUS PREDICTIONS 2012 1 - THE STOCK OF APPLE INC PLUMMETS 50 PERCENT FROM 2011 HIGH No sovereign or corporate empire has ever maintained its superior position for long because attacks mount and loyalty fades. Going into 2012 Apple will find itself faced with multiple competitors such as Google, Amazon, Microsoft/Nokia, and Samsung across its most innovative products, the iPhone and iPad. Apple will be unable to maintain its market share of 55 percent (three times as much as Android) and 66 percent on the iOS and iPad as Android will gain further momentum and Amazon's low priced Kindle Fire will cut deeply into Apple's tablet reign. In relation to current earnings Apple is not expensive but expectations about future profit growth will come down hard as competition reaches insane levels and crushes Apple's profit margins. 2 - EU DECLARES EXTENDED BANK HOLIDAY DURING 2012 The December EU Treaty changes prove insufficient to solve EU funding needs – particularly those in Italy – and the EU debt crisis returns with a vengeance by mid-year. In response, the stock market finally caves in and drops 25 percent in short order, prompting EU politicians to call an extended bank holiday – closing all European exchanges and banks for a week or more. EU leaders gather like Vatican cardinals at a conclave to hammer out a "New Europe". This could result in EU officials overstepping their mandate once again with new burdensome command and control measures that further violate the principles of the EU and free markets. Regardless, this "final" attempt leads straight to a popular overthrow of the old order and beginning of destruction of the sovereign debt time bomb. A period of pain is inevitable, but this will quickly allow a "new EU" to regroup with new membership and a new base from which its economies and markets can start planning for the future, rather than dealing with the mistakes of the past. 3 - A YET UNANNOUNCED CANDIDATE TAKES THE WHITE HOUSE In 1992, a savvy, yet highly erratic Texas billionaire named Ross Perot managed to take advantage of a recessionary economy and popular disgust with US politics and reap 18.9 percent of the popular vote. Step forward to 2008, and Obama promises "real change" from eight years of Republican rule as the economy is nose-diving. Now, three years of Obama has brought too little change and only additional widespread disillusionment with the entire US political system. Going into the election in 2012, the incumbent Democrats are in ideological disarray and will get the blame for continued economic malaise and the favour-the-rich Republicans will never win the popular vote with the US rich/poor gap at a record width and social tension rising. In short, conditions for a third party candidate have never been riper. Someone smart enough to sense this and with a strong programme for real change throws his hat in the ring early in 2012 and snatches the presidency in November in one of the most pivotal elections in US history, taking 38 percent of the popular vote. A new political order is born. 4 - AUSTRALIA GOES INTO RECESSION The Chinese locomotive has been losing steam throughout 2011 as investment and real estate led growth becomes harder and harder to come by due to diminishing marginal returns. The effects of the slowing of the up-and-coming Asian giant ripple through Asia Pacific and push other countries into recession. If there ever was a country dependent on the well-being of China it is Australia with its heavy dependence on mining and natural resources. And as China's demand for these goods weakens Australia is pushed into a recession, which is then exacerbated as the housing sector finally experiences its long overdue crash – a half decade after the rest of the developed world. 5 - BASEL III AND REGULATION FORCE 50 BANK NATIONALISATIONS IN EUROPE As 2012 begins, pressure will mount on the European banking system as new capital requirements and regulatory pressure force banks to deleverage in a great hurry. This creates a fire sale on financial assets as there are few takers in the market. Troubled sovereigns, structural funding gaps and massive trading books set the scene for the largest bank rescue operation in Europe's history. Politicians, eager to score points with the public, create a regulatory mob enforcing value destruction in the banking system "in the name of greater good". A total freeze of the European interbank market forces nervous savers to make bank-runs, as depositors distrust deposit guarantees from insolvent sovereigns. More than 50 banks end up on government balance sheets and several known commercial bank brands cease to exist. 6 - SWEDEN AND NORWAY REPLACE SWITZERLAND AS SAFE HAVENS Sweden and Norway are at risk of replacing Switzerland as the new safe havens – "risk" because, as we saw with Switzerland, becoming a safe haven in a world of devaluing central banks presents a number of risks to a country's economy. The capital markets of both countries are far smaller than Switzerland, (the combined FX volume in Sweden and Norway being a mere fraction of Switzerland's), but the Swiss are aggressively devaluing their currency and money managers are looking for new safe havens for capital. At the same time, Germany and its balance sheet are embroiled in the EU debt debacle and the classic safe haven appeal of 10-year Bunds is fading fast. Sweden and Norway sport excellent current account fundamentals, prudent social policies and skilled and flexible labour forces. Flows into the two countries' government bonds on safe haven appeal becomes popular enough to drive 10-year rates there to more than 100 basis points below the classic safe haven German Bunds. 7 - SWISS NATIONAL BANK WINS AND CATAPULTS EURCHF TO 1.50 Switzerland's persistency in fighting the appreciation of its currency will continue to pay off in 2012. After the dramatic failure of direct FX intervention in the market in 2009 and 2010 and after EURCHF threatened to destroy the Swiss economy with its death spiral towards parity in mid-2011, the Swiss National Bank and Swiss government finally joined forces to engineer an aggressive expansion of money supply and established a floor in EURCHF at 1.20. With Swiss fundamentals – particularly export related – continuing to suffer mightily in 2012 from past CHF strength, the SNB and government bear down further to prevent more collateral damage and introduce extensions to existing programmes and even negative interest rates to trigger sufficient capital flight from the traditional safe haven of Switzerland to engineer a move in EURCHF as high as 1.50 during the year, much to the chagrin of those who believe central banks can't intervene successfully. 8 - USDCNY RISES 10 PERCENT TO 7.00 The impressive growth rates in the world's second-largest economy, China, since the end of the Great Recession have been predicated on investment and exports. As marginal returns from building million-inhabitant ghost towns diminish and exporters struggle with razor-thin margins due to the advancing CNY China gets to the brink of a "recession", meaning 5-6 per cent GDP growth. Chinese policymakers come to the rescue of exporters by allowing the CNY to decline against a US Dollar - buoyed by its safe-haven status amid slowing global growth and an on-going Eurozone sovereign debt crisis - and send the pair up to 7.00 for a 10 percent increase. 9 - BALTIC DRY INDEX RISES 100 PERCENT Despite the dry bulk fleet being expected to outgrow demand in 2012, leading to further over capacity, several factors could surprise resulting in a price spike in the Baltic Dry Index. Lower oil prices in 2012 could lead to an increase in the Baltic Dry Index as operating expenses go down. Brazil and Australia are expected to expand iron ore supply, further leading to lower prices and therefore higher import demand from China to satisfy its insatiable industrial production. In combination with monetary easing this leads to a massive spike in iron ore demand. The last shock that could impact the dry bulk market is exceptional dry weather, due to El Nino, leading to a plunge in hydropower electricity generation and thereby fuelling demand for coal imports. 10 - WHEAT PRICES TO DOUBLE IN 2012 The price of CBOT wheat will double during 2012 after having been the worst performing crop in 2011. The drop was brought about due to a combination of farmers responding to high prices in 2010/11 and normalised weather in the Former Soviet Union. However with 7 billion people on the earth and money printing machines at full throttle bad weather across the world will unfortunately return and make it a tricky year for agricultural products. Wheat especially will rally strongly as speculative investors, who had built up one of the biggest short positions on record, will help drive the price back towards the record high last seen in 2008. h/t Frode |

| Is A Bearish Bet On Boeing The Cheapest Way To Hedge A Crude Oil Collapse? Posted: 17 Dec 2011 09:07 AM PST Traders in the market (what little is left of them) always seek out the investment thesis with the highest upside/downside ratio to a delta in any fundamental forecast. In other words, what derivative play to a secular trend generates the higher IRR? A good example is the ABX which allowed contrarians in 2006 and early 2007 to bet on a collapse in subprime and put on a "short" at next to now cost of carry, with practically no downside if the thesis ended up being wrong, and unlimited upside (just ask Paolo Pellegrini and Kyle Bass). Well, as we just learned, one of UBS "surprises" for 2012 is that oil could drop below $70/barrell. Is this possible? Absolutely - should the Eurozone collapse, and/or China experience the long-overdue hard landing, a deflationary shock (which will naturally only precipitate the central banks into an even more rapid devaluation of legacy paper currencies) can and likely will send crude tumbling (Iran geopolitical concerns aside) as happened back in early 2009 when crude collapsed to around $30/barrel however briefly. So is there a better option to play crude downside than merely shorting CL? Perhaps one idea with better "upside" in case of a deflationary collapse in crude is to get bearish on Boeing instead. As the following chart from Goldman shows, 3 of the 4 biggest widebody (and thus most profitable) aircraft orders are from Gulf airline companies - Emirates, Qatar and Etihad. Together, they amount to about 450 profitable future orders... which could well be cancelled if Gulf states revert to their panicked state last seen so vividly in the spring of 2009 when they were cancelling orders left and right. The thesis is quite simple - should crude collapse, and deflation reign, for however many brief months (remember: central banks only need to press a switch to add any number of zeroes to the global "monetary" reserve), it will be precisely these companies that will cancel any and all standing orders for delivery. Of course, in addition to Boeing, one may also extend this thesis to Airbus, but with the amount of subsidization by the broke European continent, it is quite possible that in a downside case Airbus actually does better than Boeing. Of course, if and when Europe blows up all bets are off. As for the other three of the top 6 carriers with widebodies on order, they are all China-related - Cathay, Singapore and Air China. So yes, a global deflationary collapse (once again, pre-central bank response) will force not only the Gulf companies, but those operating out of China to hunker down as well, to the detriment of shareholders of companies who believe that an order is an order, only to realize that orders all too often can be cancelled at any given moment. source: Goldman Sachs |

| Gonzalo Lira: About Gold: Don’t Panic!!! Posted: 17 Dec 2011 08:39 AM PST |

| Silver Update: Silver Optimism Posted: 17 Dec 2011 08:25 AM PST |

| Richard Russell - I Will Stay with Gold & Gold Stocks to the End Posted: 17 Dec 2011 08:21 AM PST |

| UBS' Top Ten Surprises For 2012 Posted: 17 Dec 2011 08:11 AM PST Unlike other, more humorous instances, such as Byron Wein and his 10 endlessly entertaining year end forecasts, some banks take the smarter approach not of predicting what will happen, because only idiots think they have any clue what tomorrow may bring with any sense of certainty, especially under global central planning - a regime that is by definition irrational, but instead of stating what would be a surprise to a base case forecast. And with "surprise" now the new normal, it would be prudent to anticipate what to the status quo may represent as fat tails in the coming year. Especially since even UBS now mocks the Wall Street consensus, and the traditional upside biad: "Let's face it: Bottom-up consensus earnings forecasts have a miserable track record. The traditional bias is well known. And even when analysts, as a group, rein in their enthusiasm, they are typically the last ones to anticipate swings in margins." Which is why, with that advance mea culpa in hand, we bring to readers the Ten Surprises for 2012 from UBS' Larry Hatheway: "At the end of each year, in our final strategy note, the global asset allocation and global equity strategy teams join up to consider possible surprises for investors in the year ahead. Inside, we briefly describe ten such outcomes, and also provide a review of how last year's surprise candidates fared." For those pressed for time, here is the full list: i) The consensus of bottom-up earnings estimates is right; ii) Financials outperform; iii) The euro rallies; iv) Oil prices fall below $70/barrel; v) Sovereign default outside the Eurozone; vi) Rising Treasury yields; vii) An Italian sovereign upgrade; viii) EU or EMU disintegration; ix) Fewer than five governments switch hands and, last but not least, x) Britain does Great at next summer's Olympics. Let's dig in. Ten for 2012 At the end of each year, in our final strategy note, the global asset allocation and global equity strategy teams join up to consider possible surprises for investors in the year ahead. In what follows, we briefly describe ten such outcomes, and also provide a review of how last year's surprise candidates fared. Our aim is not to second-guess our or our colleagues' baseline scenarios. Rather, we are all too aware of what can happen to forecasts, particularly when shocks arrive or when consensus-like positioning evaporates. Of course, in these turbulent economic times, with elevated levels of sovereign stress and market volatility, the bar for qualifying as a genuine surprise keeps moving higher. Ten surprises for 2012 Caveats aside, here are our ten surprise candidates for 2012: 1. The consensus is right (for once) Let's face it: Bottom-up consensus earnings forecasts have a miserable track record. The traditional bias is well known. And even when analysts, as a group, rein in their enthusiasm, they are typically the last ones to anticipate swings in margins. So it qualifies as surprise in any year if the bottom-up consensus is close. Maybe 2012 will be the year they get it right. Unsurprisingly, the collective wisdom of analysts anticipates another robust year of earnings growth in 2012, with global earnings expected to be up 11.7%. While this figure has moved lower in recent months, expectations remain overly optimistic. After all, global economic activity is slowing. Our economists forecast global GDP growth of just 2.7% in 2012. That figure is only slightly above levels normally associated with global recession and implies earnings growth in the low-to-mid single digits, at best. Furthermore, the current bottom-up earnings estimate is generated on forecast revenue growth of just 4.2%, which implies significant margin expansion in the coming year to arrive at a double-digit earnings forecast. The assumption of margin expansion appears heroic. Margins have flattened or shrunk in the last two quarters. It is unusual to see a further widening of profit margins at this stage of the cycle, particularly from current levels. So what needs to happen for the consensus of analysts to get it right? For one, global GDP growth would have to re-accelerate to drive up revenue estimates. Operating leverage remains high across the corporate sector generally, so any increase in final demand above current forecasts could be magnified to the bottom-line. That would particularly be the case if companies remain cautious about hiring and capital expenditures. In that case, higher turnover would lift productivity and capacity utilization, factors which typically push profit margins higher. Still, the conclusion is inescapable: Consensus estimates will only be right if everything goes right. 2. Financials outperform Perhaps, after five years of underperformance, financials will outperform in 2012. Readers will be forgiven if that sounds both a bit far-fetched and self-serving. After all, most of the conditions that have caused the sector to sharply underperform are still in place: Mounting regulatory hurdles (many of which are yet-to-be implemented), insufficient capitalization, deteriorating credit and funding conditions in Europe, fears of hard landings and property bubbles in China, weak turnover in capital markets, moribund primary businesses, a stagnant US housing market, etc. And then there are the new challenges: Shrinking balance sheets and sovereign stress in Europe coupled with woeful policy responses. Looming ahead are possible further regulatory changes, reflecting popular discontent with banks, as manifest for example in the 'occupy' movements. Maybe, therefore, we should just move on to surprise #3… The hope, however, is that much of the bad news about banks is known and discounted. According to our global banks team, for example, expectations for the sector are low and costs are being slashed. As a result, any unexpected revenue pick up could lead to nice bottom-line surprises. Furthermore, if some elements of the Dodd-Frank bill and Volcker rule could be eased, that would provide a further positive catalyst for the sector. Most important would be an early recapitalization of European banks, coupled with Of course, if sector performance depends on European policy makers getting it right, then arguably this surprise is the longest shot of them all. 3. The euro rallies The resilience of the euro in 2011 was one of the bigger surprises given the immense pressures seen in European equity and bond markets. After starting the year around 1.33, the currency rallied above 1.48 in April and only recently has started to fall more sharply. Yet it remains within a whisper of its 2011 starting value at the time of writing. In classic British understatement, all is not well in Europe. Europe's policy makers have shockingly mis-diagnosed the patient, administering pro-cyclical fiscal austerity just as a full-blown credit crunch and deep recession get underway. Meanwhile, the ECB had the temerity to hike rates earlier this year. It has belatedly undone its error, but still remains incapable of providing the monetary stimulus the Eurozone now clearly needs to offset fiscal austerity and tighter credit conditions. The ECB is more worried about moral than economic hazard. Predictably, the Euro area economy is forecasted to contract -0.7% next year (with the annualized pace of decline around -1.7% in the first half of 2012). In short, Germany and the ECB are conducting a majestic string quartet while Rome, Athens, Madrid, Lisbon and Dublin burn. And the sparks are beginning to fly in Paris as well. In less prosaic terms, the euro is sliding in the currency markets. So it would be a big surprise if, contrary to all evidence and reason, the euro were to rally in 2012. So why might it happen? Part of the answer is 'the pain trade'. As our currency strategy team points out, the consensus is already short of the euro. In addition, strategists are falling over themselves to see who can forecast euro/dollar parity soonest. Hence, short-covering euro rallies are surely possible in 2012. What else could help the single currency? Fundamentally, renewed US economic weakness and another round of Fed quantitative easing might do the trick. Even if unlikely, that scenario can't be ruled out, particularly if financial contagion from Europe spreads across the Atlantic. A second source of (temporary) euro support could come from aggressive asset repatriation by European financial institutions striving to shore up their domestic liquidity buffers and capital positions in the event the Eurozone crisis intensifies. Come to think of it, euro strength might not be all that far-fetched. 4. Oil prices drop below $70/barrel Brent crude oil prices began this year at $95/bbl and proceeded to rally in almost uninterrupted fashion up to $123/bbl by the end of April, as 'Arab spring' unfolded. Since then Brent prices have trended gently lower but have remained well supported above $100/bbl, apart from a dip in early October. The resilience of oil prices has been notable, particularly given the US 'soft patch' this summer, the advent of Eurozone recession in late 2011, and slowing growth across the emerging complex, including in China. Demand is likely to soften further and oil production may get a lift from some resumption of output in Libya. Accordingly, our oil team forecasts that the price of Brent crude will fall to $95/bbl by the end of 2012. But the idea of oil prices falling even further from current levels (say 25%-30% or more) is difficult to envision given still-present tensions in the Middle East. While a repeat of the protests and rebellion seen this year may be unlikely, uncertainty is likely to remain high, particularly as now regards Iran. So an unexpected sharper fall in oil prices would require some reduction in regional tensions. The other way oil prices could drop more than we expect is via global recession. We are sceptical that could originate in China (we don't fancy the hard landing scenario there) or from the US. Yet again, it seems all trails lead to Europe. 5. Sovereign default…outside the Eurozone We doubt anyone would be surprised by a Eurozone sovereign default in 2012. Greece, after all, is almost certain to default—only the form and precise timing remain in question. What would be a surprise is if an emerging economy defaulted first. As we have noted elsewhere, sovereign balance sheets and fiscal sustainability metrics look pretty robust across the emerging complex. But a few risk cases stand out. The following chart shows credit default swap pricing for selected emerging countries. The highest probability of default, according to investors, exists in Pakistan, the Ukraine, Hungary and Croatia. Among emerging countries, our strategy teams have highlighted that Hungary looks particularly worrisome, given its high sovereign debt-to-GDP ratio and weak growth prospects. Hungary also has the highest external public debt ratio in the emerging world. With significant foreign currency funding exposure Hungary is vulnerable to 'sudden stops and reversals' of capital flows, without the backstop of its central bank (which can only act as lender of last resort for local-currency bank financing). That situation is reminiscent of peripheral Eurozone countries. Any unexpected sovereign default would boost risk premiums across equity and debt markets, probably leading to an underperformance of emerging versus developed markets. Safe-haven assets such as US Treasuries, German Bunds, the Swiss franc, and Japanese yen would perform best. 6. US 10-year Treasury yields break out Despite large deficits, mounting debt levels and a downgrade, US Treasuries remain amongst the safest of all asset classes. Coupled with strong support from the Fed (in terms of quantitative easing), this has led to a period of dampened volatility for Treasury yields. Most investors expect more of the same in 2012. What could prove them wrong? The case for higher yields would be presented by a sustained improvement in US economic and financial conditions. That scenario would most likely be accompanied by a recovery in risk appetite and, ultimately, in shifting expectations for Fed policy normalisation. All of those factors would lead to a rise in yields. The other path to higher yields would be a significant worsening in US sovereign credit quality. To be sure, investors continue to assign a very low default probability to US government debt. Alternatively, the appeal of US Treasuries could be eroded by common bond issuance in the Eurozone, creating the potential for a larger homogenous market for European government debt that could rival US government debt hegemony. That, however, seems a remote possibility. In market terms, rising bond yields would obviously erode the value of Treasuries. A rise in US ten-year yields to, say, 4.5% next year would imply a negative -16% total return. Stocks would clearly outperform if the reason was stronger growth. A US sovereign crisis, on the other hand, would produce just the opposite result—a risk asset sell-off. 7. An Italian sovereign upgrade Yes, you read that right—an Italian sovereign upgrade. Here goes. The austerity package proposed by the Monti government has not yet persuaded the rating agencies' to lift their outlook on Italian sovereign debt from 'negative watch'. An Italian rating upgrade within a year appears highly unlikely—clearly it would be a big surprise to markets. But it isn't impossible. There have been two examples in the recent past where investment grade sovereign debt ratings have been upgraded within two years of the initiation of a negative outlook. The first comes from the Baltic region, namely Estonia and Latvia. They were among the most severely hit economies during the financial crisis, which resulted in Fitch announcing a negative outlook in April 2009. But both Estonia (July 2010) and Latvia (March 2011) were upgraded (to A and BBB, respectively) within two years of being put on negative watch. The second example is Turkey. In March 2003 Turkish sovereign debt was put on negative outlook, but the Turkish government responded by slashing the budget deficit from about 15% of GDP in 2002 to below 5% three years later. Fiscal tightening resulted in Fitch upgrading the debt first to B in September 2003 and again to B+ in February 2004, all within a one-year time frame. So, back to Italy—can it make the grade? As our European economists have noted, the reform package in Italy is credible. We suspect that the criteria for an upgrade are three: 1) Final political approval of the austerity package (our economists expect this to happen before year-end); 2) Efficient implementation of the austerity package; and finally 3) Restoration of 'normal' liquidity conditions in Italian sovereign debt markets. The second and third factors arguably pose the biggest challenge to an upgrade. They are also interrelated. For liquidity to return to the Italian bond market investors need to be convinced about implementation of austerity. Investors would also have to be re-assured that Italy can avoid a severe and/or prolonged recession. For that, Italy needs help from Germany or the ECB. So it seems Italy's sovereign rating, like so much else these days, will be made in Germany. 8. An E(M)U exit Over the past year, we've written extensively about the prospects for, and consequences of, Eurozone exit. The bottom line is that exit would be a dreadful mistake for the departing country, as well as for those remaining in the Euro area. That doesn't mean it couldn't happen. One clear lesson from history is that when populism and nationalism are in ascendency, rationality is usually in decline. And frustration with the mis-diagnosis of the Eurozone crisis—and hence the application of the wrong policy prescription (fiscal tightening without any offset)—could lead to a populist backlash and calls for exit. But, equally, the imperative for a closer fiscal union (with proper transfers and common debt issuance) implies the need for a closer political union. That's where matters also get tricky. Fiscal subordination and other forms of sovereignty transfer are unpopular in many parts of Europe. Look no further than to Cameron's veto of the proposed changes to the EU treaty last week for evidence of ambivalence to 'an ever closer European union'. Nor is the UK as isolated as some might think. Within Germany there is open hostility to the idea of a 'fiscal transfer union'. Nationalist and populist forms of discontent are already evident in Finland, the Netherlands and France. Moreover, any discussion of 'disintegration' in the old world is not limited to the EU—it is also evident within countries. The rise of Scottish nationalism or the linguistic and cultural splits in Belgium offer examples of fault lines within nations. To be sure, the political, legal and practical challenges of exit—whether from the Eurozone, the EU, or from national association are daunting. As a result, the probability of disintegration in Europe in the next twelve months remains very low. But it has happened—Czechoslovakia and the former Yugoslavia provide the most recent examples of disintegration in Europe. And if Europe's long history tells us anything, it is that political structures have a tendency not to last. So watch this space. Even a rising probability of disintegration—particularly within the Eurozone—is likely to greatly unnerve investors and send them scurrying for the safest assets they can find. 9. Fewer than five governments switch hands In 2012 a number of countries go to the polls. Incumbents are nervous, and rightly so as public opinion polls register mounting voter discontent. Already in 2011 turnover at the top has been in evidence, among others in Greece, Italy, Portugal, Belgium and Spain (not to mention in the Arab world, albeit under different circumstances). So it would not come as surprise to see many fresh faces in office at the end of 2012. Given the number of elections (and other ways political change could happen), the surprise would be if fewer than five heads of state are shown the door in 2012. Political change is already determined by process or law in China, Mexico and Russia—so we won't count those in our baseline of five. Otherwise, elections are scheduled next year in Taiwan, Finland, France, South Korea, Switzerland, India, The Ukraine, the US, and Venezuela. In addition, coalition governments are feeling strains in countries where elections are not otherwise scheduled for 2012—among them, Germany and the UK. 10. Britain does Great The summer Olympic Games will be held in London next year and provide a bevy of opportunities for surprise. Rather than think about individual events and the historical dominance of certain nations in certain disciplines, we choose to focus on the home nation's prospects. The following chart shows that until the last Olympics in 2008, Great Britain consistently achieved a number six rank in the summer Olympics. In 2008, 'Team GB' leapfrogged to fourth place, narrowly missing out on a top-three result. Next year, a 'team bronze' is within reach. Discouraged by Eurozone political ineptitude, we have recently turned our research focus to the academic literature of sports and have built a model to forecast the country medal count next summer. One well-known tenet of 'Olympic modeling' is accounting for host nation advantage. Host nations usually manage to boost their medal haul relative to previous Olympics (and also suffer 'hangover' in subsequent games). Whether the host advantage resides in 'home cooking' or more favorable treatment by judges, officials and referees we can't tell, but the tendency for the hosts to do well is clear. So what do our models suggest? The table below is our prediction of the medal results at the London Olympics, ranked by number of gold medals (rather than total medals). In short, we wouldn't be surprised by a top-three result for Great Britain. The real surprise would be for the Brits to finish ahead of either the Americans or the Chinese. Or to finish below the Australians—heaven forbid! |