saveyourassetsfirst3 |

- China says stronger yuan does not hurt forex reserves

- Central Bank Buying and the sudden fall in the Gold price

- Freefall in Silver, What’s Next?

- Massive Drain of Silver from Comex Vaults/Open interest in Silver Remains High

- Derby Day

- Gold and Silver Prices Will Explode Again: John Hathaway

- CFTC's Chilton cites manipulation, high-frequency trading concerns

- New York Sun: Debates on gold captivate Manhattan

- The Gold Standard is About Creating Jobs

- Lars Schall: The war on gold [and silver]

- Silver corrects

- Silver Takes it on the Chin

- US Dollar Bear Rallies 2

- Predictions of the Gold-Silver Ratio

- Guest Post: Overruled

- Fear, Mr. Bond, takes Gold out of circulation…

- Understanding the Short-Term Top in Silver

- The Greek Debt Crisis Escalates: Is Greece Threatening To Leave The Euro?

- Catching Osama Without a Stop Loss

- How The CBOT, Comex And CFTC Coordinated To Break The Last Silver Price Surge

- Mexico, Russia, Thailand Add $6 Billion of Gold to Reserves

- By Using False and Incomplete Information, You Will Make Bad Decisions About Gold and

- Friday ETF Roundup: EWZ Up on Inflation Report, VXX Reverses on Jobs Report

- Rumors swirling that Greece will leave the Eurozone

- Mass Hysteria over Minor Drop in Commodities

- Paging Blythe, SLV call volume still outpacing puts, paging Blythe

- Euro Whacked by Reports that Greece May Leave the Eurozone?

- Jim Sinclair says ‘relax, dont do it - dont sell your gold!

| China says stronger yuan does not hurt forex reserves Posted: 07 May 2011 03:37 AM PDT A rising yuan will not cause heavy losses to China's $3 trillion foreign exchange reserves, the nation's forex regulator said on Friday, refuting some media reports that a stronger yuan against the US dollar had led to heavy losses of the huge forex reserves. Investment returns of China's forex reserves have maintained steady for years, the State Administration of Foreign Exchange (SAFE) said in a statement on its website, in response to some experts' view that a stronger yuan against the US dollar had caused a loss of $271.1 billion since 2003... Read |

| Central Bank Buying and the sudden fall in the Gold price Posted: 07 May 2011 01:23 AM PDT |

| Freefall in Silver, What’s Next? Posted: 07 May 2011 01:00 AM PDT |

| Massive Drain of Silver from Comex Vaults/Open interest in Silver Remains High Posted: 07 May 2011 12:01 AM PDT |

| Posted: 06 May 2011 11:40 PM PDT After an historic week, I'm very much looking forward to relaxing with a mint julep while watching The Kentucky Derby. Instead of hourly and daily charts, I'm spending the day today with The Daily Racing Form. If I get time later, I promise to give you my Derby pick. Can't promise the same general accuracy of my PM picks but ole Turd has certainly been known to play the ponies from time to time. For now, here's your reading list for this weekend: First, my South American buddy, Gonzalo, has penned a great new missive: http://gonzalolira.blogspot.com/2011/05/fiscal-spendingthe-steroids-of-gdp.html Gonzo also links a very interesting interview of the great Bill Black: http://gonzalolira.blogspot.com/2011/05/best-description-of-mortgage-mess-ever.html Mark Steyn wrote this great piece a couple of weeks ago. He's just great. I wonder if he's a Turdite? http://www.steynonline.com/content/blogcategory/13/99/ Silver was obviously the big story this week. First, here's a take from Santa: http://jsmineset.com/2011/05/04/silver-being-silver/ Next, Jeff Nielson chimes in and he's pissed off: http://www.bullionbullscanada.com/index.php?option=com_content&view=article&id=18630:the-new-operation-in-the-silver-market&catid=49:silver-commentary&Itemid=130 Trader Dan has a great chart on the gold:silver ratio: https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjvSSAYQvsOlZs_sOuBcec-4sYjTJCL818OmqG2hWjEIjGDoTpBiFrGxFGfW9eBsoCQwvjRkI9bncLRTgVM7dbzM7eEzZ9GHqpAcj-9p4sSQg6HB0QHAAwdcemhIZ83odxiKK0O_uXkAyE/s1600/Gold-Silver.PNG He also has a great gold chart: http://traderdannorcini.blogspot.com/2011/05/gold-weekly-chart-analysis.html Ole John Browne wrote a good piece yesterday: http://www.europac.net/commentaries/silver_takes_it_chin We're always talking about fundos here and this article sums them up quite well: http://www.commodityonline.com/news/Silver-Strong-fundamentals-to-beat-transient-speculation-38740-3-1.html I thought that this was kind of interesting: http://www.resourceinvestor.com/News/2011/5/Pages/Silver-Clobbered-on-Multiple-Fronts-.aspx And, hey, it may not matter anyway. The end is near: http://beforeitsnews.com/story/602/771/Edgar_Cayce_Predicted_WW3_In_2011.html I've received a lot of positive feedback regarding the WebBotForum interview I gave a few weeks ago. If you need some background noise today, you might check it out: http://tfmetalsreport.blogspot.com/2011/04/hours-of-easy-listening.html Finally, in the interview, I mention that I'd nearly chosen the pseudonym "Colonel Angus" instead of "Turd Ferguson". Many have inquired from where the Colonel Angus name originated. The link is below. Personally, I find this and the infamous "Cowbell" sketch to be the funniest SNL skits from the last 10 years. http://www.hulu.com/watch/4109/saturday-night-live-colonel-angus-comes-home For laughs, here's "Cowbell", too: http://www.funnyordie.com/videos/80a71ef8cb/more-cowbell OK, that's it. If I can come up with a Derby pick I'll let you know. Have a great Saturday! TF |

| Gold and Silver Prices Will Explode Again: John Hathaway Posted: 06 May 2011 10:50 PM PDT ¤ Yesterday in Gold and SilverThe gold price jumped about fifteen dollars to around $1,490 spot in early Far East trading. The price then spent the rest of the Friday trading day wandering around without much conviction within ten bucks of that price...and closed the day up about twenty three dollars from Thursday's close. Nothing much to see here folks, although the volume was pretty heavy.

Silver traded within a dollar of $35 up until shortly before noon in London. Then the price dropped down to its low of the day and this move down...$33.05 spot...which conveniently happened to occur right at the Comex open in New York at 8:20 a.m. Eastern time. From that low, silver caught a bid...and it's high price of the day [$36.61 spot] occurred shortly after 11:00 a.m...before giving up about some of those gains as Friday trading wound down for the weekend. I'll stick my neck out and guess that the $33.05 price print was silver's low for this move...and that the worst is now behind us.

The dollar opened around 74.10 in early Far East trading...and spent the next nineteen hours bouncing off of the 74.00 level. Then, at 12:00 noon in New York, the dollar caught a bid of sorts...and finished the Friday trading session up about 70 basis points. A cursory glance at the gold chart above shows that the dollars activity [or its lack thereof] had no bearing whatsoever on Friday's gold price action.

The gold shares gapped up at the open, but were not overly responsive to the gold price gains after that, which I must admit that I was a bit surprised at. Friday's HUI looked more like yesterday's Dow chart, than the chart of the gold price action. The HUI finished up a meager 0.34%. Here's the HUI chart for the week that was...and it's not very pretty. However, no matter what happens with the gold price next week, if we didn't set an important low in gold on Thursday around 3:00 p.m. Eastern time...the bottom in the gold price can't be far off, as the worst of this move is certainly already behind us.

The silver stocks had a much better time of it than their golden cousins yesterday...as there were decent percentage gains in most silver stocks. Here's Nick Laird's "Silver Sentiment Indicator" updated with Friday's change.

The CME Daily Delivery Report yesterday showed that 67 gold, along with a chunky 243 silver contracts, were posted for delivery on Tuesday. In silver, the big issuer was Barclays [241 contracts]...with the Bank of Nova Scotia [114 contracts] and Merrill [95 contracts] being the two biggest stoppers by far. The link to that action is here. The GLD ETF had another decline yesterday...but this one was rather small, as 97,477 ounces were reported withdrawn. The SLV ETF had a smallish decline as well...down 487,772 troy ounces. Ted feels that some, if not most, of the withdrawals of the last few days from SLV were 'plain vanilla' fund liquidation. The U.S. Mint had another sales report on Friday. They sold another 37,500 troy ounces of gold eagles, along with 1,500 one-ounce 24K gold buffaloes...but no silver eagles were reported sold. Month-to-date, gold eagle sales are 62,000 ounces [which is a lot for just five business days!]...4,500 one-ounce 24K gold buffaloes...along with 701,000 silver eagles. There was decent action at two of the Comex-approved depositories on Thursday...as no silver was reported being received, but 562,401 troy ounces were shipped out the door. The link to that action is here. The eagerly awaited Commitment of Traders Report [for positions held at the close of trading on Tuesday, May 3rd] was a surprise...at least in silver. Both Ted and I were expecting a huge drop in open interest...because of the 2-day $7.50 waterfall decline in the silver price that occurred on Monday and Tuesday of this past week. What we got in this report was no change at all in the Commercial net short position. Actually it did improve by a whole 74 contracts...but in the grand scheme of things, that's not even a rounding error. Ted and I agree that the bullion banks did not report all of Monday and Tuesday's action in a 'timely manner'...as I am wont to say from time to time. In other words, they fixed this report by withholding data so that curious eyes couldn't see what they were doing. One thing that did change, which I never talk about in this column, is the status of the Non-Commercial category. This is where the brain-dead technical funds trade...the large traders that hold over 150 silver contracts either long or short. Their net long position is now down to a tiny 23,354 contracts. The lowest number I've ever seen in that category is around 13,000 contracts held net long...and that was many many years ago. I'm only guessing, but after Friday's trading action, I'd say we're either back to that number...or below it. That means that there is virtually no tech fund long blood left in this stone to be squeezed out...and I would also guess that the tech funds have gone massively short as well. That's the principle reason why I think that the bottom is in for the silver price. It was a different story in gold...as the bullion banks reduced their net short position by 8,892 contracts...which is 889,200 ounces of gold. The Commercial net short position in gold is now down to 24.0 million ounces. The '4 or less' bullion banks are short 15.5 million ounces of that...and the '8 or less' bullion banks [which includes the '4 or less' bullion banks] are short 22.9 million ounces. Without doubt, the bullion banks' short position in both metals has declined dramatically since the Tuesday cut-off and, along with the data they withheld from this last COT report, next Friday's report should be a sight to see...unless we get a massive rally on Monday and Tuesday of this coming week that negates all that. Time will tell. Here's Ted Butler's "Days to Cover Short Positions" graph...courtesy of Nick Laird over at sharelynx.com.

Yesterday in 'The Wrap' section of this column I reported what I thought was the May Bank Participation Report numbers for silver...and what I ended up doing was repeating the BPR silver numbers from April's report, which I'd posted last month. Ted was kind enough to wake me out of a sound sleep at 8:00 a.m. Friday morning to tell me that, in hopes that I could change this data in my column...as it was wrong. I told him..."no, I'll just eat humble pie in my Saturday column...and move on"...which is just what I'm doing. Here are the figures for silver from the May Bank Participation report which was issued yesterday. All the data from that is extracted from yesterday's COT report for positions held of as this past Tuesday...so we can compare apples to apples. The report shows that 4 U.S. Banks [probably only 2 that matter...JPMorgan and HSBC] decreased their net short position by a whopping 5,757 Comex futures contracts...and are now down to 18,830 contracts held short. Ted says that this is the lowest Comex futures short position that JPMorgan has had in silver since they took over Bear Stearns' short position back in 2008. The 12 non-U.S. banks reduced their net short position in silver by 1,157 Comex contracts...and are now down 3,608 contracts held short. I'm speculating here, by I would bet money that the bulk of these short contracts are held by just one foreign bank...and that is Canada's Bank of Nova Scotia. Using Grade 3 arithmetic, this report shows that JPMorgan's short position [18,830 contracts] is almost five times the size of the entire short position of the 12 non-U.S. banks combined...which is 3,608 contracts. How's that for concentration? In gold, the May Bank Participation report shows that 4 U.S. banks are net short 92,940 Comex futures contracts...which is an increase of 5,225 contracts from the April report. The 14 non-U.S. banks are short 33,832 Comex futures contracts...which is a decline of 3,446 contracts from the April report. In a nutshell, the BPR shows that the world's bullion banks decreased their Comex short positions in silver by almost 7,000 contracts up until the close of trading on Tuesday...and increased their net short position in gold by a smallish 1,800 Comex contracts. And, without doubt, if JPMorgan et al had provided all the data from Monday and Tuesday's trading days, not only would the COT numbers be hugely different, but the BPR report would have been much better still. And it nearly goes without saying that if you could factor in the last three days of this past week into these numbers, May's BPR would be almost unrecognizable from the numbers I just reported. This has been a down-side clean-out of biblical proportions in both silver and gold...and I would suspect the same for platinum and palladium. Here's Nick Laird's graphic illustration of yesterday's Bank Participation Report...along with all the ones that have gone before it, so you can see the magnitude of the change in silver. The graph is a little on the busy side, but if you invest the time, the story it conveys will be clear.

My bullion dealer had his biggest sales day of 2010 yesterday. And it would have been an even bigger sales day, but he had to turn down several huge orders late in the day because, with the Comex closed, his suppliers would not lock in a silver price that late on a Friday afternoon. This has been a down-side clean-out of biblical proportions in both silver and gold...and I would suspect the same for platinum and palladium. Should Portugal and Greece be told to sell their gold? Debates on gold captivate Manhattan. CFTC's Chilton cites manipulation, high-frequency trading concerns. ¤ Critical ReadsSubscribeVolcker warns of danger from U.S. deficitsSpeaking before the World Affairs Council of Oregon, Volcker said that "prolonging trillion dollar deficits can't be a reality" and that the United States is on course to have its public debt exceed the size of its gross domestic product. "One way or another, we do have to return to a balanced budget," he said in prepared remarks. I thank reader Al Conle for providing this Reuters story...and the link is here.

CEO Pay Now Exceeds Pre-Recession LevelsHere's a story from yesterday's Huffington Post that was provided by reader Roy Stephens. In the boardroom, it's as if the Great Recession never happened. CEOs at the nation's largest companies were paid better last year than they were in 2007, when the economy was booming, the stock market set a record high and unemployment was roughly half what it is today. As Roy said in his e-mail..."the party goes on in Fantasy Land." It does indeed...and the link is here.

U.S. Regulators Face Budget Pinch as Mandates WidenHere's a piece out of The New York Times that 'Mike from Southern California' sent me earlier this week. It's a very worthwhile read...but it is on the longish side...which is why I've saved it for my Saturday column. Government regulators on the Wall Street beat have long been outnumbered and outspent by the companies they are supposed to police. But even after receiving budget increases from Congress last month, regulators are still falling behind. But critics contend that the agencies don't deserve extra money, given that they missed warning signs and failed to catch serious wrongdoing in the years leading up to the crisis. The S.E.C., too, has been accused of mismanaging its finances. The Government Accountability Office has faulted the agency's accounting almost every year since it began producing financial statements in 2004. As I mentioned, this piece is worth your time...and the link is here.

CFTC's Chilton cites manipulation, high-frequency trading concernsInterviewed by CNBC yesterday, Commodity Futures Trading Commission member Bart Chilton again expressed concern about manipulation in the commodity markets as well as high-frequency and algorithmic trading. This HFT is pretty much what's been driving the silver market lately. I stole the story...plus most of the above preamble...from a GATA release yesterday. A text account as well as the video are linked here. I would think that this piece is worth your time.

'The UK Will Need a Bailout Soon': Jim RogersBritain isn't cutting its structural deficit by enough or doing it quickly enough and may need a bailout from its European partners, investor Jim Rogers told CNBC. Rogers said the UK coalition government needed to go further in order to avoid financial catastrophe. I thank reader 'David in California' for providing this cnbc.com story...and the link is CFTC's Chilton cites manipulation, high-frequency trading concerns Posted: 06 May 2011 10:50 PM PDT Interviewed by CNBC yesterday, Commodity Futures Trading Commission member Bart Chilton again expressed concern about manipulation in the commodity markets as well as high-frequency and algorithmic trading. This HFT is pretty much what's been driving the silver market lately. I stole the story...plus most of the above preamble...from a GATA release yesterday. A text account as well as the video are linked here. I would think that this piece is worth your time. |

| New York Sun: Debates on gold captivate Manhattan Posted: 06 May 2011 10:50 PM PDT  Two debates about gold, held in New York City, were reported yesterday by the New York Sun's David Pietrusza, including comments by the Tocqueville Gold Fund's John Hathaway and billionaire investor Thomas Kaplan. The Sun's report is headlined "With Dollar in Turmoil, Two Debates on Gold Captivate Manhattan". I stole the story...and Chris Powell's preamble...from a GATA release yesterday...and the link to this absolute must read story is here.

|

| The Gold Standard is About Creating Jobs Posted: 06 May 2011 10:50 PM PDT  I ran a piece by author Ralph Benko in my Wednesday column. Here's another piece he wrote as a companion to that. The essay starts out with this paragraph..."The Roosevelt Institute, a leading Progressive policy institute, is preparing a reprise of William Jennings Bryan's famous 1896 critique of gold: "you shall not press down upon the brow of labor this crown of thorns." This short essay is posted over at thegoldstandardnow.org...and the link is here.

|

| Lars Schall: The war on gold [and silver] Posted: 06 May 2011 10:50 PM PDT  Here's a longish gold-related story that had to wait until today. It's a GATA release regarding a GoldMoney conference in Munich last week. It contains an interview with GATA chairman Bill Murphy, GoldMoney founder James Turk...and Egon von Greyerz of Matterhorn Asset Management in Zurich. You can read the rest of the preamble...plus the link to the interview here...and it's well worth your time.

|

| Posted: 06 May 2011 09:00 PM PDT Over the last two weeks silver has fallen from just under $50 to under $40, following a meteoric rise. Much of the fall has been engineered by the big commercial dealers triggering stop-losses, giving ... |

| Posted: 06 May 2011 05:35 PM PDT Euro Pacific Capital |

| Posted: 06 May 2011 05:28 PM PDT |

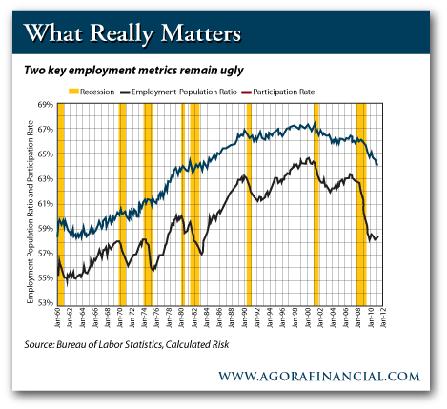

| Predictions of the Gold-Silver Ratio Posted: 06 May 2011 05:06 PM PDT 05/06/11 Baltimore, Maryland – Today, traders are celebrating that the U.S. economy added the most jobs in nearly a year. Or so they're led to believe. Let's examine the payroll data first:

In other words, nearly three-quarters of these new jobs are a statistical invention. And most of the rest are the 62,000 people McDonald's hired in a one-day job fair publicity stunt. The separate household survey is nothing to write home about, however:

As always in these situations, we turn to the two figures the statisticians can't game:

The red line is the percentage of the working-age population in the labor force. The black line is the employment rate of the overall population. Both lines are stuck at the same level they were when Hollywood inflicted the first Police Academy movie on an unsuspecting populace and Paul Volcker was getting kudos for "slaying inflation." But as long as the narrative is that job growth is on track – whew, what a turnaround in just 24 hours – we will get results like this…

After this correction, the gold-silver ratio – very simply, the dollar price of gold divided by the dollar price of silver – is back to 41 this morning. One week ago today, when the metals were at record highs, the ratio was 32. This number is important in terms of the long-term trend. A few years ago, Tennessee bullion dealer Franklin Sanders assembled this chart going back to the Coinage Act of 1792. We've updated it to the present day:

In the century since the creation of the Federal Reserve, the ratio's been all over the place. The key is that it's bottomed at or around 16 three times in the last century – 1919, 1968 and 1980. Sanders is among many who believe long term, it's headed back toward 16. Canadian fund genius Eric Sprott is another. Sixteen was the ratio for centuries before massive silver discoveries in the Americas in the 1800s. With gold at $1,500 today, a 16:1 gold-silver ratio implies $94 silver. That's a compelling case for silver… and with the ratio reverting for the moment above 40, silver's on sale. Read more: Predictions of the Gold-Silver Ratio http://dailyreckoning.com/predictions-of-the-gold-silver-ratio/#ixzz1LdzA7a00 |

| Posted: 06 May 2011 04:29 PM PDT Cross posted from MacroBusiness Ok, we all know that anyone who says "this time it is different" is to be treated at best as misinformed, at worst as a fool. "They are the five most dangerous words in the English language" etc. etc. But, to repeat my question: "Are things always the same?" Mostly, yes. Modern housing bubbles are not unlike 17th century Holland's Tulipmania, government debt crises have not changed all that much since Henry VIII reduced the gold in coinage, greed, profligacy, irresponsible plutocracies are always with us. But in global finance there are some things happening that are genuinely different. Dangerously so. It is becoming a hall of mirrors, money referring to itself in an infinite regress. Little wonder that people are attracted to gold, because gold seems to be a tangible, solid measure of value, something we can rest on in an environment where everything seems relative. Yet this, too, is an illusion. The yellow metal only has value because it has a history of being deemed to have value. It is no more an objective measure of value than the pieces of coloured plastic, notes, that make up legal tender. To explain what I mean, let's start with a definition of what money is. It is rules. Rules about value and obligation. Those rules are usually based on legally enforced structures, although that need not be the case. In the case of cross border capital markets, the enforcement is informal because there is no supranational government to impose penalties. Disputes are resolved by a handful of law firms, the main penalty is to be prevented from participating for a period. Now if money is rules, then what does it mean to "de-regulate financial markets" as was claimed in the 1990s? Can you de-regulate rules? Obviously not. So what happened? The place where rules were set shifted. Instead of government for the most part making the rules, the traders started making the rules. The logic was, as Alan Greenspan argued, that because everyone was acting in their self interest then nothing could possibly go wrong. Pricing would be accurate, the less formal self organisation of the market would be superior to the formal oversight of governments (what would governments, which are always bad, know?) and everyone would win. Free lunches as far as the eye can see. So the rules proliferated, especially after the advent of the Black and Scholes pricing of risk, a clever piece of maths based on what is probably circular argument, but one that is sufficiently concealed to give traders the impression that they are handing off risk accurately. This led to the explosion of derivatives and securities markets, including such instruments as collateralised debt obligations, credit default swaps and endless hedging games (my personl favourite is a derivative on "volatility"). Now the point about rules is that they are based on agreement, and their creation can be without any limit provided traders are prepared to agree, to trust each other enough to transact. They are not finite in the way that, say, gold is. And so the rule making exploded. The global stock of derivatives is $US600 trillion, about twice the capital stock of the world (all the shares, property, equities, bonds and bank deposits). Far from deregulation making the rules of finance more more streamlined and more efficient — as if the efficiency of money could be measured anyway, given that it would mean measuring money with itself — the rule making expanded wildly. And we all know what happened when the trust that underlies those rules collapsed. The Global Financial Crisis. We are lucky to have a financial system left. This era of meta-money, I submit, is different. It is "different this time". Some versions of it have appeared on the margin before. Hedging has a long history, for instance. But meta-money has never been the centre of the action before. In the past it has always been, for want of a better phrase, "normal" money: bank debt, equities, bonds, property and so on. The massive volume of meta money, the ever expanding hall of mirrors, now dominates and distorts more conventional forms of money. For instance, the $3.8 trillion that is transacted every day in the US dollar makes the annual budget deficit of over $1 trillion look like chump change. About 8 hours trading. There will not be a crisis in demand for US debt, causing an economic collapse, while there is such intense demand for US dollars in the foreign exchange markets. What is happening instead is that the logics of "normal" money are being used by the meta traders as a game (a game mainly of signs, semiotics) to try to make profits out of their exploitation of the rules of meta money. If the US government looks like it will reduce its government debt, then traders can make a play in the foreign exchange markets that the US dollar will rise. So the US dollar rises. Not because an imbalance is being corrected, changing the dynamics of supply and demand, but because a signal has been sent that an imbalance has been corrected, giving the traders something they can exploit. The rules of normal money are being overridden by the rules of meta money. That is the world we are now in. It is why such huge distortions are appearing in areas like quantitative easing, extremely low interest rates, an ailing cost of capital, the hankering after something solid in precious metals like gold and silver, equity markets whose pricing seems strange. Governments have given up oversight of the financial markets, handing it over to the traders. We must now suffer the consequences as the traders try to outdo each other in an infinite game of pass the parcel. Or, more accurately, taking out bets on who will pass the parcel to whom. Eventually, I suspect, GFC version 2 will come along, and the rules will finally collapse. Governments will have to come in and re-set them. There will be a huge re-regulation backlash. But how is it that governments allowed it to get to this stage? What ever happened to governing? |

| Fear, Mr. Bond, takes Gold out of circulation… Posted: 06 May 2011 04:00 PM PDT Goldfinger |

| Understanding the Short-Term Top in Silver Posted: 06 May 2011 01:01 PM PDT

Yesterday, silver experienced its biggest one-day dollar drop in 3 decades. In recent weeks, I've been warning that the downside risks in silver were huge, that silver rose too far, too fast, and that there was a frenzy developing in silver. I publicly stated I was lightening up above $46 dollars and that a minimum of a 30% decline in silver shares was very possible. I think enough of these things have come to pass that I can now speak from a position of strength about this recent craze in silver. I don't claim to have all the answers; I'm just trying to nudge you all to be objective and learn from your mistakes. If you unloaded silver near $50, great. If you went long instead, brush it off and try to figure out what you did wrong. Did you believe "this time is different"? Did you get caught up in the hoopla that there's some kind of shortage in silver? Did you believe that the collapse of the dollar was imminent even though I noted that objective metrics like debt servicing costs as a percent of revenue were suggesting otherwise? If so, don't continue believing in a flawed premise. That's what the rookies do. That's what the "professional" analysts do. We're just trying to make smart decisions without any personal allegiance to any asset. Everyone Has Two Choices When I first started investing, I too got caught up in the hoopla surrounding whatever the popular asset was at the time. I suffered the hard way from not putting enough thought into my investments. In response to these errors, I did something absolutely shocking in this day and age: I learned from my mistakes. I actually got angry that I screwed up. I spent hours in the bookstore learning and honing in on what I did wrong. Perhaps this reflects my nerd-like nature, but this is honestly what I did. And guess what? I've become a far better investor because of it. If I didn't learn from my mistakes, I believe I would have a small fraction of the profits I do now. How many people out there can honestly reflect on their mistakes without justifying their every action? I'm sure you all know someone who never admits fault. These are the type of people you just roll your eyes at; their mental maturation stalled at about the age of 12. Even at my age (27), most people I know are just set in their ways. Even now, people listen to what I say not necessarily because they are open-minded, but because my investing track record has been so good over the years. They may do well in investing, but in every other aspect of life, they are as close-minded as everyone else. While investing in general is hard, investing at extremes is pretty easy. I'm slightly overgeneralizing here, but if over 90% of people think something is going to happen, the opposite is likely to occur- at least in the short run. Now understand that this doesn't necessarily have anything to do with the validity of an investment thesis; it basically comes down to a question of who is buying. When 90% of people are on one side of a trade, then a significant percentage of those people are just lemmings who chased the popular investment. The smarter speculators who bought in the middle of a trend take profits, which forces the latecomers to panic and sell. Next thing you know, you have a trend reversal. Simple. The reason it is hard for most people to invest in extremes is that it is human nature to mimic the action of others, especially when it is a strong majority. In most aspects of life, this is the proper course of action; in investing, it is dead wrong. Now back to silver. I believe the bare minimum requirements for a correction have been met. If I had to hazard a guess, I would say this correction has more room to run. I'm just taking this one day at a time and adjusting to whatever the market gives me. Stay nimble and get ready to pounce when the opportunity comes. Source: Understanding the Short-Term Top in Silver |

| The Greek Debt Crisis Escalates: Is Greece Threatening To Leave The Euro? Posted: 06 May 2011 11:18 AM PDT

It was a new article in Der Spiegel that brought these rumors to the forefront again. Der Spiegel says that it possesses secret Greek government documents that discuss plans to leave the euro. Der Spiegel also claims that a secret crisis meeting was held in Luxembourg on Friday night to discuss this crisis. The following is a brief excerpt from the Der Spiegel article that caused the financial community in Europe to be in such an uproar today....

So was there such a meeting in Luxembourg on Friday night? Well, it turns out that there was a meeting of a small group of European finance ministers. But according to German government spokesman Steffen Seibert, this meeting was planned well in advance and had nothing to do with Greece leaving the euro....

So is Greece actually thinking about leaving the euro? All over Europe this notion is being denied. Perhaps the strongest denial was issued by the Greek Finance Ministry....

What was probably being discussed at this meeting of European finance ministers is a restructuring of Greek debt. This is something that Germany has apparently wanted for quite some time according to a recent article posted on Business Insider....

So what would a restructuring of this debt look like? A recent article on CNBC gives us some clues....

What Germany does not want is for Greece to even think about leaving the euro. According to the article on Der Spiegel, German Finance Minister Wolfgang Schäuble is ready to play hardball with the Greeks. Der Spiegel says that a report has been prepared that would lay out for the Greeks the severe consequences of leaving the euro....

Greece is really in a tough position. They are going to go bankrupt if they stay with the euro and they are going to go bankrupt if they leave the euro. Meanwhile, the anti-government protests continue. The Greek people are not happy. The Greek economy is coming apart like a 20 dollar suit. Greece could end up being the spark that sets off a massive financial panic in Europe. As I have written about previously, the European debt crisis is on the verge of spinning wildly out of control. It is not just Greece that is facing a horrific debt crisis. The financial problems in Europe literally span the entire continent. A lot of Americans are obsessed with the death of the U.S. dollar, but the truth is that there is a strong possibility that the euro could end up collapsing before the dollar does. Keep an eye on Europe. The European debt crisis could plunge the entire global financial system into chaos at any time. Things are not nearly as stable as they seem. |

| Catching Osama Without a Stop Loss Posted: 06 May 2011 10:45 AM PDT Your editor spent much of Tuesday trying to work out whether the Osama Bin Laden chase had been justified by his killing. And we came up empty. Here is what we wrote at the time:

We then proceeded to work on all sorts of cost-benefit analyses, profit calculations and the like. And none of them made any sense. How can the loss from 11 September 2001, including the government-generated dollar value for the loss of life, be justified by more cost and more killing in the hunt for Osama Bin Laden? How do you do a cost-benefit analysis with no dollar benefits? Put differently, how do you value Bin Laden's death? The last time we mentioned this sort of government-generated morbid accounting, the Daily Reckoning inbox overflowed with feedback. So we've decided to outsource the problem of calculating whether the endeavour of killing Bin Laden was a profitable one or not (to you). Here are some figures to help: 'The Environmental Protection Agency set the value of a life at $9.1 million last year.' (NY Times) Lives lost on 11 September 2001: 2819 ($25.65 billion) This website details some of the other costs of 11 September, although it seems to confuse millions and billions. Lives lost in the war on terror: 2,340 coalition deaths in Afghanistan ($21.3 billion) If you take the Afghanistan war as the proxy for the War on Terror, that gives $444 billion in cost. If your definition of the War on Terror is a little wider, consider http://costofwar.com/ Anyway, let us know at dr@dailyreckoning.com.au how you go tallying it all up. Most likely, you'll find the hunt for Osama was a losing escapade that should have been abandoned long ago. Maybe that's the point though. Revenge might feel good, but moving on is usually more constructive. Traders use stop losses to define the point where they should take their losses and move on. We don't get the impression the Pentagon has an understanding of the concept. If you do manage to come up with some sort of cost-benefit analysis for the War on Terror (might that name be a paradox?) and by your calculation it was a success, the Americans still won't be able to outperform the investor of the century. Agora publication The 5 Minute Forecast calls it the 'Most Successful Speculation Ever'. 'Al-Qaida pulled off the Sept. 11 attacks for somewhere in the vicinity of $500,000, according to the final report of the 9/11 Commission.' Plug that into the figures above and you get one hell of a return on investment for the Jihad hedge fund! But surely success shouldn't be measured in such ways?

Check the news and you can't help thinking that Osama may have lost the battle, but continues to win the war. He might even get his 10-year timeframe right! Instead of being a success, the whole 'we got him' parade is turning very embarrassing for the politicians. While former Pakistani President Musharraf claimed the US violated Pakistani sovereignty with the attack, Western media reported Pakistani and US forces worked together at the site of the killing. Wikileaks files claim Pakistani security forces previously protected Bin Laden and supposedly his hideout was a town populated by high ranked retired Pakistani military personnel. Other bungles so far include releasing the photo evidence of Osama's death, but then not doing it, stating the kill team was made up of Navy Seals, but then denying it, Kevin Rudd almost giving the game away, etc. Worst of all, the news of Bin Laden's death interrupted Donald Trump's TV show. Conspiracy! Things are back to normal outside the War on Terror. European nations agreeing to bailouts, governments handing out money to parents for putting up with their own children and growing opposition to the latest tax to pop out of a Labor leader's imagination. What's left to report on? The whispers of a European sovereign default are becoming louder. Of course they will call it something else when it happens. Two contributors at The Guardian reckon that 'repudiation' will be the buzz word. Simply declare some of the debts to be invalid on legal technicalities. It's what Ecuador did in 2007. The process goes like this. You have a 'debt audit', where you work out what debt is a little on the shady side. Then you declare parts of that debt to be illegal based on issues that come up during your investigations. It's actually quite similar to what US homeowners are doing when the bank stuffs up their paperwork. They simply stop paying their mortgage and challenge the bank to prove they own the debt, which it often can't. The big difference is that with the PIIGS the borrower writes the laws that determine what is a valid debt. So if the PIIGS tell their creditors 'sue me', that's going to be hard to do. The Greeks are well into the process and fruits so far have been a TV documentary and analysis of Goldman Sachs' rather dodgy dealings in Greek debt. The Irish are close behind. The notable point in all this is that nobody seems to keep track of these things in the first place. As the authors of the Guardian article point out, 'Public debt seems to operate like a mask behind which lies a shadowy world of creditors to whose upkeep entire economies are mortgaged.' You'd think this sort of information should be kept as transparent as possible. Here in Victoria, some serious budget fudging, as the sport is known, has now been exposed, leaving unexpected shortfalls. The federal government is little different. You have to worry that European debts may end up being exposed in the same way - much worse than first thought. When the repudiations begin, who will be the emperor with no clothes? Who will be the one without a seat when the music stops? It will be banks holding PIIGS debt, most likely. To a great extent, that's German banks. So the Germans should think carefully about the bailout terms. You don't want the bonds you own to be the ones repudiated. Once again, it all becomes a political game, not an economic one. And that is the sentence that sums up much of our malaise. How do markets regulate themselves? They allow success and failure. Profit and loss. If you take those away by having GSEs, deposit insurance, too big to fail, bailouts, taxes and the like, why is it a surprise that the free market does a poor job of regulating itself? You have stopped it from doing so. But when Australia's bursting housing bubble hits the media, don't expect government policy to take the blame. No, the evil banks will, just like in the UK and US. You have to admit though, their PR teams aren't doing too well even before the bubble bursting gets truly underway. At the mention of billions of dollars of bank profit, Aussies shake their head in disgust. Never mind that after adjusting for size, the profit is far less dramatic. So why have the figures been so glowing lately? Falling bad debts apparently. Or perhaps it's just a computer glitch, which are all too frequent at Australian banks these days. The air conditioning drops out at Westpac and about a quarter of the Aussie economy stands still. Sound like a good basis for a cashless society? Here's what has us confused on the matter. NAB may have had less bad debts this time around, but The Australian is reporting on how 'it's now clear that a rise in distressed home and consumer loans will be one of the main themes in the major banks' profit reporting season.' ANZ: 'Across the Australian mortgage portfolio, we are now at the highest levels of arrears experienced before, during or after the financial crisis.' Westpac: 'Overall health of the mortgage book was "exceptional"...' Surely you can't have it both ways and every other way? The ANZ CEO seems to think so. According to him, a fall in house prices is 'not a bad thing'. Tell that to people where your editor went to school. 'Analysts estimate Noosa's property values have fallen by 40 per cent since the peak of the market.' If it can happen there, it can happen anywhere. There is of course one bank that should take much of the blame for the housing bubble and its demise. The Central Bank. 'Housing is the primary mechanism of monetary policy,' is what you're taught at school. If the economy is overheating, the RBA puts up interest rates and suddenly we can afford less and people are less likely to build houses. What a coincidence that housing is where the bubbles formed all across the world! The latest way central bankers have decided to delude themselves into denial is quite amusing. If inflation is running too high, compromising your reputation as an all-knowing economic genius, just reframe the question: 'should the target be higher' is the correct one. The Economist hosted the debate on the matter. If economists can't even agree on the optimal level of inflation, how on Earth can you believe they know how to control it? They can't even measure it in the first place anyway. But that doesn't stop the results of their escapades being evident. Apart from blowing bubbles, '... the Fed seems very clearly to have achieved more in the Arab world in six months than the Pentagon achieved in decades' says Andrew Lilico at The Telegraph. How? By pushing up food prices, which are of course outside their preferred measure of inflation. So there you have it. Even revolutions don't wake up central bankers. Nick Hubble |

| How The CBOT, Comex And CFTC Coordinated To Break The Last Silver Price Surge Posted: 06 May 2011 10:32 AM PDT |

| Mexico, Russia, Thailand Add $6 Billion of Gold to Reserves Posted: 06 May 2011 10:31 AM PDT |

| By Using False and Incomplete Information, You Will Make Bad Decisions About Gold and Posted: 06 May 2011 10:28 AM PDT |

| Friday ETF Roundup: EWZ Up on Inflation Report, VXX Reverses on Jobs Report Posted: 06 May 2011 09:46 AM PDT ETF Database submits: U.S. equity markets, which started the day on a high note thanks to a solid jobs report, finished the day markedly below their highs as concerns over the situation in Europe once again were at the forefront. The Dow and S&P 500 finished ahead by 0.4% while the Nasdaq managed to post a gain of 0.5% in comparison. Commodity markets were more mixed as gold managed to rebound from its fall earlier in the week, gaining $13/oz., while oil continued to show weakness, falling by just over 2% in Friday trading. In currencies, the euro was especially weak against the dollar as rumors of Greece exiting the euro and reintroducing its own currency surfaced, potentially suggesting that some of the peripheral members may not be in as good of shape as initially thought. Thanks to this, investors continued to flow into U.S. Treasurys as the 10 and two year notes Complete Story » |

| Rumors swirling that Greece will leave the Eurozone Posted: 06 May 2011 09:17 AM PDT From Bloomberg: The euro tumbled the most in a year against the dollar on speculation Greece may stop using the currency, bolstering concern the nation’s debt crisis will spread through the region. Europe’s shared currency fell against all of its 16 most- traded peers even after Greece denied a report in Der Spiegel magazine that the European Commission called a meeting to discuss the situation. Futures traders raised bets as of May 3 to an almost four-year high that the euro would gain against the dollar. The greenback rose versus the yen after U.S. employers added more jobs than forecast. “It does bring to the forefront the existential concerns about the euro,” said Samarjit Shankar, a managing director for the foreign-exchange group in Boston at Bank of New York Mellon. “It underscores the risks that have never really gone away but had gone to the back burner.” The euro dropped 1.4 percent to $1.4340 at 4:40 p.m. in New York, from $1.4539 yesterday. It touched $1.4316, the lowest level since April 19, and has dropped as much as 3.5 percent since May 4, the biggest two-day decline since May 2010. The common currency fell 0.8 percent to 115.49 yen, from 116.44. The dollar gained 0.6 percent to 80.54 yen, from 80.07. The euro rose 8.6 percent this year through yesterday as the European Central Bank last month raised its benchmark interest rate for the first time since the financial crisis amid speculation U.S. and Japanese policy makers will lag behind. Net Longs The difference in the number of wagers by hedge funds and other large speculators on an advance in the euro compared with those on a drop -- so-called net longs -- was 99,516 on May 3, the highest level since July 2007, figures from the Washington- based Commodity Futures Trading Commission show. The total compared with net longs of 68,279 on April 26. Greece is lobbying for easier terms on the 110 billion euros ($164 billion) of bailout loans as speculation of a default mounts a year after European leaders set up an unprecedented emergency fund. European finance officials are gathering in Luxembourg today for an unscheduled meeting that may discuss proposals for restructuring Greek debt, said two European officials familiar with the situation. A German official said the discussions would include a German paper on options for confronting Greece’s growing debt load, which has spurred speculation by investors that a restructuring was a likely outcome. Greece isn’t considering abandoning use of the euro, the Athens-based Finance Ministry said in an e-mailed statement today on the Der Spiegel article. A spokesman for Luxembourg’s Jean-Claude Juncker, who leads euro-region finance ministers, denied the magazine report. Capital Flight “A restructuring is at some point likely to happen, but it’s not in anyone’s interest to have that happen now,” Axel Merk, president of Merk Investments LLC in Palo Alto, California, said in an interview on Bloomberg Television’s “Street Smart” with Carol Massar and Matt Miller. “If they were to leave, it would be a flight of capital out of Greece; there would be a concern of that spreading to other countries.” The dollar strengthened yesterday versus the euro as the ECB signaled it may not raise interest rates next month. The central bank boosted its key rate in April by a quarter- percentage point to 1.25 percent to curb inflation. It kept the rate unchanged yesterday. Trichet, at a news conference in Helsinki, refrained from using the phrase “strong vigilance,” which might have signaled a June boost. He instead said inflation risks will be watched “very closely.” Fed Versus ECB The Federal Reserve has held its benchmark rate at zero to 0.25 percent since December 2008 to spur the U.S. economy. Currencies of commodity exporters, which slumped yesterday, were the top performers against the greenback today after the U.S. payrolls report. Gains were capped as raw materials including crude oil erased early advances after Der Spiegel’s report on Greece. The Thomson Reuters/Jefferies CRB Index of raw materials fell 1.1 percent after rising as much as 1.5 percent. Australia’s dollar gained for the first time in five days, strengthening 1.1 percent to $1.0703. New Zealand’s dollar rose 0.9 percent to 79.10 U.S. cents in its first increase in five days, while the Brazilian real appreciated 0.4 percent to 1.6155 per dollar. Write-Off Concern Greek bond yields and the cost of insuring the country’s securities against default rose to records last week, rekindling concern that a debt write-off or extension of repayment terms may be needed to ease the nation’s fiscal crisis. Greece’s refinancing needs of 58 billion euros are covered this year by the loan package it received in 2010 from the European Union and International Monetary Fund. Next year, the nation is supposed to regain market access and refinance at least three-quarters of its maturing medium- and long-term debt, and then fully fund debt rollovers beginning in mid-2013. “The saga continues to unfold,” said Richard Franulovich, a senior currency strategist at Westpac Banking Corp. in New York. “If you can get rid of debts and clean up the balance sheet, it’s long-term positive for the euro.” U.S. payrolls increased by 244,000 workers last month, the biggest gain since May 2010, the Labor Department said today in Washington. Economists in a Bloomberg News survey projected an April rise of 185,000. The jobless rate rose to 9 percent, the first increase since November. To contact the reporter on this story: Catarina Saraiva in New York at asaraiva5@bloomberg.net. To contact the editor responsible for this story: Dave Liedtka at dliedtka@bloomberg.net. More on the euro: This country is the No. 1 threat to the euro today Whatever you do, don't forget about the euro crisis Euro CRISIS: The Irish government has collapsed |

| Mass Hysteria over Minor Drop in Commodities Posted: 06 May 2011 07:58 AM PDT If you had followed the news in the past few days you would have noticed the obsession with equating a normal drop in Commodities with a crash or a major market top. Here is just a sample of what I'm talking about. GaveKal's Five Reasons Commodities are Suddenly Tanking Demand's Not Killing Commodities, the Dollar is On top is the Continuous Commodity Index, which as we have argued, is a far better representation of the commodities complex than the CRB, which is extremely overweighted in the energy commodities. Does that look like a crash? Does that appear to be a major market top? Tanking? It is likely a correction or an interim top. Meanwhile, the greenback had one up day and its suddenly "killing" Commodities. This is extremely short-sighted analysis as the US Dollar has yet to even test its 2008 low while Commodities already surpassed their 2008 high. The greenback does have an impact but since early 2010, Commodities have been less affected by a strong or stable US Dollar. When the greenback fell from 83 to 81, the CCI surged from about 485 to 630. Since that time, the greenback fell from 81 to now 74. The CCI is up only 1% in that time frame. Commodities have been leading the greenback. Their failure to make a new high was a hint that trouble was coming. We've actually been cautious for weeks. We warned about excess bearishness in the greenback and the negative divergence with Treasuries which made a higher low. We've been cautious on Commodities and bullish on Bonds. We try to look beyond the day by day action and false headlines. The problem with today's financial media is that they focus only on the short-term. By short-term, I'm referring to not even weeks but days. Online print, newspapers, online shows and television take things day by day. One day Silver is ripping and the greenback is falling. The next day Silver's bubble is popping and so is the anti-dollar trade. Watch the shows and you'll hear phrases like "make money now," "crowded trade," "bubble," "crash." Rarely if ever do you hear "bull market." Trading commentary is entertaining but it does not amount to much if you want to make big money. The big money is made by finding trends early and riding them for years. Fortunately he bull market in Commodities has at least five more years to go. Soon we will see an accelerating trend and some type of bubble. That is still years away and that is why you should turn your focus to this correction and identify low risk entry points. Consider trying our service (free for 14 days) and getting the help of a professional. Good Luck! Jordan Roy-Byrne, CMT |

| Paging Blythe, SLV call volume still outpacing puts, paging Blythe Posted: 06 May 2011 06:28 AM PDT June 18th strike. Good thing is the the sane world still thinks silver is going higher. I have put my short term bets on for next week, straight up gambling the May 13th $38 strike on SLV at .68 cents, thus far I'm getting tuned (buy could wake to monday at 100% profit IMT who knows). I also bought a SMALL amount of phyzz today. You should have to just in case. I like this $35 here. My |

| Euro Whacked by Reports that Greece May Leave the Eurozone? Posted: 06 May 2011 06:16 AM PDT The Euro has fallen from roughly 1.49 to the dollar to 1.43 in a mere two days, which is a huge move. Many pundits have argued that the ECB's newly accommodative stance is the trigger, but there may be additional forces at work. Most experts have deemed the idea that any eurozone member would exit the currency to be simply inconceivable, that it would be too costly and disruptive. But with the hair shirt that Greece is being asked to wear, all bets may be off. As of this juncture, this reports in Der Spiegel does not appear to have gotten traction among the Usual Suspects in the MSM. Headline: "Greece Considers Exit from Euro Zone" (hat tip readers John M and Illya F).

Yves here. So what will they do if Greece refuses to observe niceties and bolts anyhow? Send in tanks? I'm curious as to what punishments might be visited on Greece if it chooses to exit. Iceland had a very rocky six months when its banking system failed but it is now on track for a solid recovery. This example cannot have been lost on Greece. Back to the story:

Yves here. This "you'll never borrow again" threat is greatly exaggerated. In fact, investors like borrowers who have cleaned up their balance sheets. That's why Chapter 11 works. Argentina's default and end of dollarization proved salutary, with the country now performing better on virtually every economic indicator than its Latin American peers. The big difference is that it did not have to recreate a stand-alone currency, which would be a huge operational hurdle for Greece. Back to the article:

The problem with some of this logic is that the Greek debt should already be written down severely. Most experts estimate losses in the range of 50% to 70%. So large losses exist but have not been recognized. The interesting question is whether this threat by Greece is serious or mere posturing. We may find out sooner than many expect. |

| Jim Sinclair says ‘relax, dont do it - dont sell your gold! Posted: 06 May 2011 03:37 AM PDT Mineweb |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment