Gold World News Flash |

- Gold Seeker Weekly Wrap-Up: Gold and Silver Fall Over 4% and 26% on the Week

- Greece denies may quit euro

- Volcker warns of danger from U.S. deficits

- Oil crash pits floor veterans versus computer algorithms

- Commodities' drop curbs risk appetite

- Oil falls again, gutted in record weekly drop

- $1764 Angel Starts To Shine

- In The News Today

- Market Commentary From Monty Guild

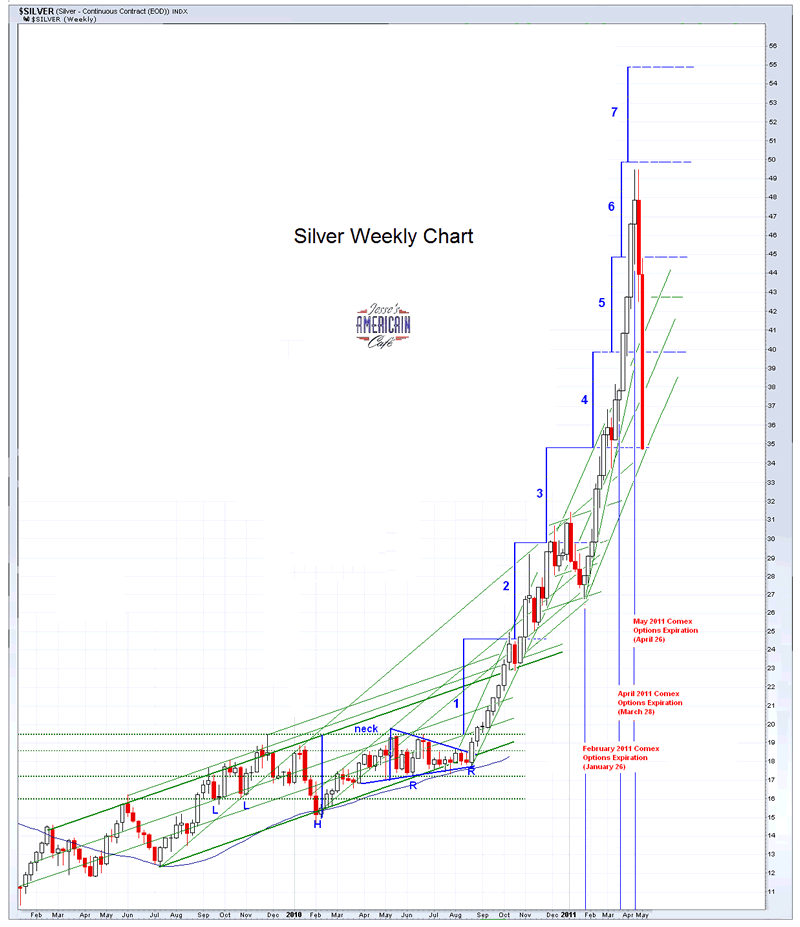

- Silver Takes it on the Chin

- How the COMEX Crashed the Silver Market

- Gold and silver will explode again, Hathaway tells King World News

- Central Bank Buying and the sudden fall in the Gold price

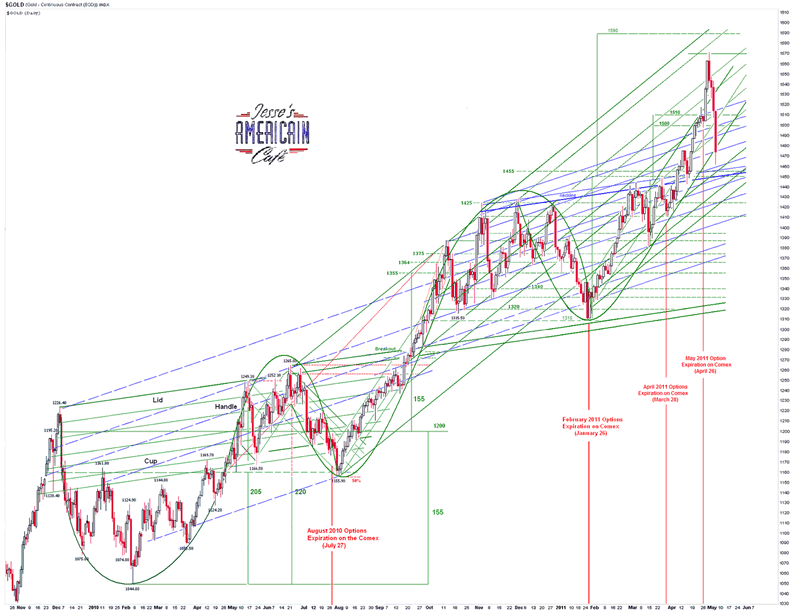

- Gold - weekly chart analysis

- Panic Volume: Gold & Silver Buy Signals!

- US Dollar Bear Rallies 2

- GLDX Gold Explorers ETF

- Gold, Silver and the Currency Wars

- Silver Price Lost 27.4% this Week the Gold Price Lost 4.2%

- Another Bullish Argument for Metals?

- Gold - 4 Hour chart update

- How The CBOT, Comex And CFTC Coordinated To Break The Last Silver Price Surge

- After the Commodities Rout

- Should the golden goose be plucked?

- Are Markets Selling Off in Anticipation of More QE?

- Gold Bounces from Trendline Support

- Hathaway - Gold & Silver to Explode Again After Consolidation

- Understanding The Yuan, U.S. Dollar Relationship To Gold, Silver And Commodities

- Closing Context Update: Protection Bid Across All Assets

- Silver in Freefall, What's Next?

| Gold Seeker Weekly Wrap-Up: Gold and Silver Fall Over 4% and 26% on the Week Posted: 06 May 2011 04:00 PM PDT Gold traded mostly slightly higher in Asia and London before it fell $5.70 to as low as $1475.70 by about 8:30AM EST, but it then rallied back higher in New York and ended near its late morning high of $1498.19 with a gain of 0.7%. Silver fell to $33.17 by a little after 8AM before it also rallied back higher and saw a slight gain at $36.43 by late morning, but it then fell back off in the last couple of hours of trade and ended with a loss of 2.34%. |

| Posted: 06 May 2011 03:00 PM PDT By Michele Sinner and Dina Kyriakidou

LUXEMBOURG/ATHENS (Reuters) – Top finance officials of the euro zone's biggest economies met to discuss Greece's debt crisis on Friday and Athens denied a media report that it was considering whether to leave the bloc. LUXEMBOURG/ATHENS (Reuters) – Top finance officials of the euro zone's biggest economies met to discuss Greece's debt crisis on Friday and Athens denied a media report that it was considering whether to leave the bloc. Jean-Claude Juncker, head of the group of euro zone finance ministers, said the meeting in Luxembourg was attended by ministers from Germany, France, Italy and Spain. He said there was a broad discussion of Greece and other international economic issues. Juncker denied a report in Germany's Spiegel Online magazine that the talks were held to discuss the possibility, raised by Athens, of Greece withdrawing from the 17-member euro zone, as well as the idea of restructuring Greece's 327 billion euro ($470 billion) sovereign debt. "We have not been discussing the exit of Greece from the euro area. This is a stupid idea. It is in no way — it is an avenue we would never take," he told reporters. "We don't want to have the euro area exploding without reason. We were excluding the restructuring option, which is discussed heavily in certain quarters of the financial markets…" But Juncker said a meeting of all euro zone finance ministers on May 16 would discuss whether Greece needed a further economic plan, beyond the 110 billion euro bailout which it obtained from the European Union and the International Monetary Fund in May last year. He did not elaborate. Greek Finance Minister George Papaconstantinou attended the Luxembourg talks, his finance ministry said. It added that Greece remained committed to repairing its finances and returning to economic growth. "The minister was invited to exchange views (on issues including) economic developments in Greece," the ministry said. "It is clear that during this meeting it was never discussed or posed as an issue whether Greece would remain in the euro zone." The Luxembourg talks were also attended by European Central Bank President Jean-Claude Trichet and Olli Rehn, the European commissioner for economic and monetary affairs, Juncker said. EURO FALL Earlier in the day, the euro fell nearly 1 percent against the dollar and the cost of insuring Greek debt against default was quoted at a record high in response to the Spiegel report. "The government has raised the possibility of leaving the euro zone and reintroducing its own currency," Spiegel said without citing its sources. Despite its international bailout Greece, which joined the euro zone in 2001, has been unable to cut its budget deficit as fast as planned amid a deep recession. It has been raising taxes and slashing spending but is still plagued by tax evasion, corruption and the economy's lack of competitiveness. Financial markets have been speculating for months that Athens will eventually have to restructure its debt and with the political will for more austerity starting to flag, some Greek politicians have been suggesting a "soft" restructuring which might involve lengthening maturities on the country's bonds. An exit from the euro zone could help the economy in the long term; Greece would be able to cut interest rates and having its own, weak currency would boost exports and tourism. But there is no legal procedure for leaving the zone, and the risks and immediate costs of the process — Greece could face bank runs, and banks around the region could be damaged — mean the government is likely to fight hard to avoid that option. Although taxpayers in rich euro zone states such as Germany are becoming increasingly reluctant to fund weak euro zone states, their governments prize the currency union as one of Europe's great political achievements. The EU is currently negotiating a bailout with Portugal, the third state it is rescuing after Greece and Ireland. A German government official told Reuters on Friday that a Greek exit from the euro zone "is not planned and was not planned," while a spokesman for the Austrian finance ministry said a breakup of the bloc would be "absolutely unthinkable." Spiegel quoted from what it said was an internal German finance ministry paper that German Finance Minister Wolfgang Schaeuble was taking with him to Luxembourg, which warned that a Greek exit "would lead to a significant depreciation of the domestic currency versus the euro" and increase Greece's debt levels to 200 percent of gross domestic product. Its debt is officially projected to climb to 153 percent of GDP this year. (Additional reporting by Jan Strupczewski and Luke Baker in Brussels, Andreas Rinke, Matthias Sobolewski and Noah Barkin in Berlin, Lefteris Papadimas in Athens and euro zone bureaux; Writing by Andrew Torchia; editing by Tim Pearce) |

| Volcker warns of danger from U.S. deficits Posted: 06 May 2011 03:00 PM PDT By Sarah N. Lynch

WASHINGTON (Reuters) – Former Federal Reserve Chairman Paul Volcker warned on Friday that trillion-dollar deficits posed a threat to the stability of the U.S. economy and the dollar, and said he is frustrated by the gridlock in Washington. WASHINGTON (Reuters) – Former Federal Reserve Chairman Paul Volcker warned on Friday that trillion-dollar deficits posed a threat to the stability of the U.S. economy and the dollar, and said he is frustrated by the gridlock in Washington. Speaking before the World Affairs Council of Oregon, Volcker said that "prolonging trillion dollar deficits can't be a reality" and that the United States is on course to have its public debt exceed the size of its gross domestic product. "One way or another, we do have to return to a balanced budget," he said in prepared remarks. Volcker's speech came on the same day that the Congressional Budget Office said the U.S. budget deficit had totaled $871 billion for the first seven months of the year, which is significantly above the previous year's pace. On Thursday, Vice President Joe Biden led a bipartisan meeting in an effort to strike a deal with Republicans on cutting the growing federal deficit and averting a default. They face an August 2 deadline to raise the country's $14.3 trillion debt limit. Volcker, who stepped down early this year as the chairman of President Barack Obama's Economic Recovery Advisory Board, said he was concerned about how the U.S. consumes and borrows "to the point that China, Japan and other foreign countries hold more than 5 trillion dollars of U.S. government obligations." "Consider that statistic in the light of prospects for continuing deficits, doubts about future inflation and the international stability of the dollar," he said, noting that the U.S. is running out of time to fix things. In order to address the deficit, Volcker said he agrees lawmakers need to tackle discretionary spending, an area that could help the U.S. save $300 billion from present projections by 2020. But that alone, he said, will not be enough to address the trillion dollar deficits. "I will put the point bluntly," he said. "It is simply unrealistic and irresponsible to believe budgetary balance can be achieved without higher revenues relative to GDP. We won't generate those higher revenues without tax reform. Separately, Volcker also discussed his views on the progress made so far on the Dodd-Frank Wall Street overhaul legislation and other efforts around the world to bolster regulation of the financial markets. Volcker was the driving force behind a pillar of the Dodd-Frank law known as the Volcker rule, which cracks down on proprietary trading by big banks. Although he no longer has a formal advisory role in the administration, he still visits the White House on occasion. In particular, he said he was concerned about a failure to properly address certain key areas including credit-rating agencies, accounting issues and money market funds — an issue the Securities and Exchange Commission plans to explore in a roundtable discussion next week. "Taken all together, my personal grade on financial reform is incomplete," he said, noting that it is even more lacking abroad than in the U.S. "I do not equate incomplete with out of time, but I fear that momentum in the reform effort is waning." (Reporting by Sarah N. Lynch; additional reporting by Caren Bohan, Alister Bull, and Richard Cowan; Editing by Bernard Orr) |

| Oil crash pits floor veterans versus computer algorithms Posted: 06 May 2011 03:00 PM PDT By David Sheppard, Emma Farge and Jonathan Spicer

NEW YORK (Reuters) – A day after oil prices plunged an unprecedented $12 a barrel, a New York trader sat on the steps of the dormant oil futures pit, playing a word game on his tablet computer. NEW YORK (Reuters) – A day after oil prices plunged an unprecedented $12 a barrel, a New York trader sat on the steps of the dormant oil futures pit, playing a word game on his tablet computer. Back to business as usual for floor traders, a vanishing breed in a market now dominated by machines and algorithms, a fact that some of them say worsened one of the most shocking — and baffling — trading sessions ever. On the waterfront of Manhattan's southern tip, veterans of the New York Mercantile Exchange's (NYMEX) pits recounted how the crash reminded them of the heyday of the trading floor. "Yesterday was organized chaos down on the floor, it was right back to the old days," said Chris Kenny, crude oil options trader at Lloyd Group. "The size of the move was almost unprecedented and you could see it all there. Greed and fear, that's what this job is all about." Action in the options pit was still lively, they said, reminding them of the jostling and jousting of days gone by. Miles away from the emotional rollercoaster that marked Thursday's puzzling rout, the new breed of computer traders counted their profits in anonymous offices across the country. High-frequency and algorithmic traders, comprising half the oil market, seem to have weathered Thursday's mayhem without breaking a sweat, unlike many of the new breed who took a beating in the stock market "flash crash" exactly a year ago. "We continued to trade normally and be involved in the market the whole time, no differently than the day before. We didn't change our risk parameters or our model parameters," an oil futures trader at an proprietary algorithmic trading firm told Reuters. Unlike with the stock market's "flash crash," few old-school traders blamed the algos for the fall, although some did blame them for the end of a way of life that aided both transparency and liquidity in an often opaque market. "When you get massive electronic long-liquidation like that the price just moves rapidly. It wouldn't have been the same on the floor," said Bob Penny, an individual trader of crude oil and sugar who has been in the business for 31 years. "You didn't get price vacuums there. Funds don't try and finesse it — when they decide to sell they just hit it." While conventional wisdom would have suggested buying on the dips in such a seemingly illogical and abrupt decline, computer programs said otherwise as the fall continued. "If you'd followed conventional wisdom… you would have got killed," said Jeffrey Grossman, President of BRG Brokerage. Analysts at investment bank Credit Suisse said automated trading probably did play a role in the fall. "We believe the magnitude of the correction appears in large part to have been exacerbated by algorithmic traders unwinding positioning." NOSTALGIA Many oil trading veterans returning to the NYMEX building on Friday swapped war stories of the previous day. Many still work out of booths and offices at the NYMEX, where open-outcry trading has withered due to the rise of electronic trading over the past decade. The open pit still exists, but only a few thousand lots ever trade there, a fraction of the million-plus that trade almost round-the-clock. Veteran traders at NYMEX, a unit of CME Group Inc (CME.O), recalled price swings linked to some of the biggest moments in recent U.S. history, including the 9/11 attack and Hurricane Katrina. The difference this time? Even a day later, most are unable to pinpoint exactly what set off the frenzy. The bout of panic selling jump-started trading in the oil options pit, which has resisted the migration of volumes to electronic screens. Traders and brokers still stand shoulder to shoulder, communicating complex deals through a series of shouts and hand gestures incomprehensible to outsiders. Brokers described near chaos in the pit as traders loaded up on $95 and $100 a barrel option contracts to protect against further price falls. "People were getting their faces ripped off yesterday, everyone was yelling and screaming all day," one crude oil options broker said, who asked not to be named. NEW GUARD The way prices move has changed with trading practices. Lightening-fast, algorithmic traders, known as "black box" players, have multiplied in recent years. Many used to trade open-outcry, yet they are viewed as the antithesis of the old-fashioned pit trader. Manoj Narang, CEO and chief investment strategist of Tradeworx, a hedge fund that also runs a high-frequency unit, called Thursday a "great day" for his fund, which trades commodity-linked Exchange Traded Funds (ETFs) and stocks. Narang said that unlike Wall Street's "flash crash" last May, automated trading was not behind oil's plunge. Instead, he cited traders who had gone long-commodities and short the dollar, but were caught out when the U.S. currency bounced up. "It was a very crowded trade," Narang added. Even as prices plummeted, oil brokers also stood to gain from the huge jump in trading volumes. On the sun-drenched plaza outside the exchange overlooking the Hudson River, long-term broker Dominick Caglioti was in good spirits. "It was great for business because there was a lot of action," he said, extinguishing a cigarette before heading back into the exchange. "It was still quieter than it used to be, but I guess screens don't yell." (Reporting by David Sheppard, Emma Farge and Jonathan Spicer; Editing by Jonathan Leff and David Gregorio) |

| Commodities' drop curbs risk appetite Posted: 06 May 2011 03:00 PM PDT

NEW YORK (Reuters) – Stock investors head into next week with added worries about the sustainability of the recent rally and a desire to reduce risk, as shown by the stampede out of commodities on Thursday. NEW YORK (Reuters) – Stock investors head into next week with added worries about the sustainability of the recent rally and a desire to reduce risk, as shown by the stampede out of commodities on Thursday. Stocks also will begin to lose the support they've enjoyed from stronger-than-expected earnings since the first-quarter reporting period is almost at an end. The drop in commodities this week spilled over into commodity-related stocks, which were among the top performers in the last two quarters. The Standard & Poor's energy index .GSPE ended the week down 7 percent, its biggest weekly drop in a year, and the iShares Silver Trust (SLV.P) suffered its worst week of outflows ever after heavy losses in the precious metal. While the commodities rout may be done for now, it has left many investors worried about the ramifications. "It's hard to pinpoint the time when the bubble bursts and hard to go against the current, but when it bursts it's precipitous usually," said Natalie Trunow, senior vice president and chief investment officer of equities at Calvert Asset Management Company in Bethesda, Maryland, which manages about $14.8 billion in assets and is underweight energy. With first-quarter earnings and also the Federal Reserve's QE2 purchasing program coming to an end, the stock market could be vulnerable to some weakness in the short term, she said. "I wouldn't be surprised if we had a somewhat softer summer or somewhat softer next couple of months," said Trunow, who said she is still positive on the U.S. market longer-term. The S&P 500 .SPX suffered its worst week since March, even with Friday's surprisingly strong jobs report that allowed the index to end a four-day losing streak. It is now just above critical support at 1,330. A close below that level could "turn the intermediate-term picture bearish," according to a note from Larry McMillan, president of McMillan Analysis Corp. SENTIMENT STILL UPBEAT Despite this week's skittishness, sentiment for the market is positive longer term, and technical indicators do not suggest the market is overbought. "Our view is still unchanged; we still like the market," said Jeff Rubin, market strategist at Birinyi Associates in Westport, Connecticut. Much of the fundamental picture remains bullish for stocks, said Hank Smith, chief investment officer at Haverford Trust Co. in Philadelphia. "The economy and valuations remain attractive," he said. "We remain bullish, but with any bull market, it's healthy to have pullbacks." Friday's Labor Department report, which showed U.S. employment increase more than expected in April and U.S. companies created jobs at the fastest pace in five years, gave evidence of the underlying strength in the economy, analysts said. But labor has been among the weakest areas, and next week's jobless benefits claims and retail sales data will be watched for further clues on the jobs picture and health of consumer spending. In earnings news, a number of retailers are expected to report next week, including Macy's (M.N), Nordstrom (JWN.N) and Kohl's (KSS.N). Earnings estimates have risen since the start of the reporting period. Profits for S&P 500 companies are now expected to have climbed 18 percent in the first quarter from the year before, up from an estimated 13 percent rise at the start of April, according to Thomson Reuters data. Of the 438 S&P 500 companies that have reported so far, 69 percent have beaten analyst earnings expectations. That's roughly in line with the high rate of beats seen in recent quarters. Adding to nervousness, a small group of European finance ministers were meeting to discuss the euro zone debt crisis, and Greece denied a media report speculating the country was considering leaving the euro zone. The speculation caused stocks to trim some of their gains on Friday. Friday marked the one-year anniversary of Wall Street's "flash crash" when prices suddenly plunged and nearly $1 trillion was wiped off U.S. stocks' value in a matter of minutes before the market bounced back. The crash shook many investors' confidence, but the market regained steam and has rallied since about the start of September. The S&P 500 is up about 28 percent since then. (Additional reporting by Doris Frankel, Editing by Kenneth Barry) |

| Oil falls again, gutted in record weekly drop Posted: 06 May 2011 03:00 PM PDT

NEW YORK (Reuters) – Oil prices steadied on Friday following a torrid 10 percent slide the previous session, as shellshocked traders mulled market fundamentals and the frenzy this week that wiped out half the year's gains. NEW YORK (Reuters) – Oil prices steadied on Friday following a torrid 10 percent slide the previous session, as shellshocked traders mulled market fundamentals and the frenzy this week that wiped out half the year's gains. Upbeat U.S. jobs data aided crude's early rise from Thursday's shock-inducing collapse, when Brent fell by as much as $12, a record, in a furious, high volume session that saw waves of selling as key techinical levels were broken. Crude eased off the early gains on Friday as the dollar rose. "I think it's just a little reaction to the way oversold conditions we got into yesterday, it was quite a bloodbath," Mike Zarembski, senior commodities analyst for optionsXpress in Chicago. "Traders are still a bit shellshocked from yesterday." Selling pressure on oil and other commodities came on several fronts this week, with investors weighing factors from the death of Osama bin Laden to the impact of higher fuel and commodity costs on the economies of consumer nations to monetary policy in major economies. Brent crude traded up 30 cents to $111.10 a barrel at 1:50 p.m. EDT in heavy trade, with volumes already 83 percent over the 30-day moving average. U.S. crude futures fell 57 cents to $99.23 a barrel. U.S. crude was off earlier highs of $102.38, pressured by the dollar's gains against the euro, which can support prices for dollar-denominated economies. A German news report, later denied, suggested Greece had raised the possibility of leaving the euro zone. The euro fell to its lowest in more than two weeks and headed for its biggest weekly decline against the dollar since January. Data from the Labor Department showed U.S. private employers added jobs at the fastest pace in five years in April, pointing to underlying strength in the economy, even as the jobless rate rose to 9.0 percent. "The jobs data wasn't so out of kilter that it justified the sell-off or a huge bounce, but investors will want to lighten their load ahead of the weekend if they are on the short side," said Richard Ilczyszyn senior market strategist at Lind-Waldock in Chicago. "The market got ahead of itself on the way up and now is bouncing after the sell-off." Thursday's sell off saw U.S. crude oil futures set a record high for open interest, while open positions also rose for Brent crude, and volatility surged as traders rushing to load up on $95 to $100 put options fearing further losses ahead. Chicago Board Option Exchange's oil volatility index fell nearly 5 percent on Friday, after briefly spiking to the highest levels in almost a year in the previous session. Oil prices have rocketed this year to levels not seen since the record spike in 2008, driven by supply disruptions in Libya and ongoing loose U.S. monetary policy, with Brent hitting a high of $127 a barrel and U.S. crude over $114. Goldman Sachs, which in April predicted this week's major correction in oil prices, on Friday said that oil could surpass its recent highs by 2012 as global oil supplies continue to tighten. "It is important to emphasize that even as oil prices are pulling back from their recent highs, we expect them to return to or surpass the recent highs by next year," Goldman Sachs' analysts said in a research note. "We continue to believe that the oil supply-demand fundamentals will tighten further over the course of this year, and likely reach critically tight levels by early next year should Libyan oil supplies remain off the market." (Reporting by Gene Ramos, Robert Gibbons, Matthew Robinson in New York; Jessica Donati-Bourne in London and Francis Kan in Singapore; Editing by David Gregorio) |

| Posted: 06 May 2011 02:11 PM PDT View the original post at jsmineset.com... May 06, 2011 10:50 AM Dear Friends, Today’s action totally eliminates all and any concern for the price of gold. Today's action lights up the $1764 Angel in gold. Technical damage always requires technical repair. That type of price action is a perfect set up for a major launch of the gold price in June. Relax and enjoy your protection and insurance positions. Regards, Jim... |

| Posted: 06 May 2011 02:11 PM PDT View the original post at jsmineset.com... May 06, 2011 10:47 AM Dear CIGAs, Here is Mope at spiritual levels. (Stocks are bouncing back nicely as a better than expected nonfarm payrolls report helps to support recovery outlooks) According to the Labor Department, nonfarm payrolls rose by 244,000 last month, as the private sector posted the strongest employment gain in over five years. However, the unemployment rate rose to 9.0% last month from 8.8% in March. Economists expected payrolls to rise 185,000 with the jobless rate steady at 8.8. Jim Sinclair's Commentary The latest from John Williams' ShadowStats.com. No. 367: April Labor Numbers, Money Supply, Dollar and Precious Metals - Increasingly Misleading Seasonal-Factors Continued to Pummel Accuracy of Jobs Data - April Household Survey Showed 190,000 Employment Drop - April Unemployment Rates: 9.0% (U.3), 15.9% (U.6),22.3% (SGS) - Broad Money Supply Gains in April - Underlying Inflation, Dollar ... |

| Market Commentary From Monty Guild Posted: 06 May 2011 02:11 PM PDT View the original post at jsmineset.com... May 06, 2011 10:45 AM Dear CIGAs, We see no reason to panic about the current price declines in stocks, gold and oil. Our long-term view gives us a different perspective. We have a plan and lots of cash, which we intend to use to purchase our favorite investment areas on dips. In summary, nothing has changed, except for the fact that some highly-levered speculators have been forced to sell by increases in margin requirements. After the panic has ended, buying opportunities at low prices will abound. We will write more next week. Please see the table below for our current and closed recommendation. Investment Date Date Appreciation/Depreciation Recommended Closed in U.S. Dollars Commodity Market Recommendations Corn 4/20/2011 Open -4.2% Gold 6/25/2002 Open +355.8% Oil 2/11/2009 Open +177.70% Corn 12/31/2008 3/3/2011 +81.0% Soybeans 12/31/2008 3/3/2011 +44.1% Wheat 12/31/2008 3/3/2011 +... |

| Posted: 06 May 2011 02:11 PM PDT By: John Browne Friday, May 6, 2011 This week saw the type of downside volatility in the precious metals market that will be remembered for years to come. For those of us who have been long gold, and silver in particular, the memories will not be pleasant. While many had been expecting a pullback in silver, when the violence did come it was nevertheless shocking. Silver shed one third of its value in less than one week. And while gold was pulled down by the general sell off in all commodities (oil, copper, coffee, etc.) the yellow metal shed only 6.5% during the carnage. Those mild losses should remind us that gold is not just another commodity, but has monetary qualities that tend to smooth out volatility. But will silver survive the vicious downturn? First, despite all the valid reasons that, in an era of perpetual quantitative easing, silver had become an attractive asset class, it had ... |

| How the COMEX Crashed the Silver Market Posted: 06 May 2011 01:08 PM PDT By the close of trading on Wednesday, May 4th, the silver market had experienced significant selling pressure that drove prices down by 17.3% from Thursday, April 28th. This sell off corresponded exactly to a series of increased margin requirements by the COMEX for trading silver futures contracts. Silver traders who may have been apprehensive about [...] |

| Gold and silver will explode again, Hathaway tells King World News Posted: 06 May 2011 01:01 PM PDT 9p ET Friday, May 6, 2011 Dear Friend of GATA and Gold (and Silver): Tocqueville Gold Fund manager John Hathaway tells King World News tonight that he expects gold and silver to consolidate for a while and then stage another breakout as big as their last. Of what happened this week, Hathaway says, "It's not a trend change. Just take a couple of weeks off and come back to it. The investment thesis is not at all in question here. It's just the dynamics of the market." An excerpt from the interview is headlined "Gold and Silver to Explode Again After Consolidation" and you can find it at the King World News blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2011/5/6_Hat... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Prophecy Resource Spins Off Platinum/Palladium Venture: Company Press Release, January 18, 2011 VANCOUVER, British Columbia -- Prophecy Resource Corp. (TSX-V:PCY)and Pacific Coast Nickel Corp. announce that they have agreed that PCNC will acquire Prophecy's Nickel PGM projects by issuing common shares to Prophecy. PCNC will acquire the Wellgreen PGM Ni-Cu and Lynn Lake nickel projects in the Yukon Territory and Manitoba respectively by issuing up to 550 million common shares of PCNC to Prophecy. PCNC has 55.7 million shares outstanding. Following the transaction: -- Prophecy will own approximately 90 percent of PCNC. -- PCNC will consolidate its share capital on a 10 old for one new basis. -- Prophecy will change its name to Prophecy Coal Corp. and PCNC will be renamed Prophecy Platinum Corp. -- Prophecy intends to distribute half of its PCNC shares to shareholders pro-rata in accordance with their holdings. Based on the closing price of the common shares of PCNC on January 17, $0.195 per share, the gross value of the transaction is $107,250,000. For the complete announcement, please visit: http://prophecyresource.com/news_2011_jan18.php Join GATA here: World Resource Investment Conference Gold Rush 2011 https://www.amsterdamgold.eu/gata/index.asp?BiD=12 Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: http://www.gata.org/node/16 ADVERTISEMENT Sona Drills 85.4g Gold/Ton Over 4 Metres at Elizabeth Gold Deposit, Company Press Release, October 27, 2010 VANCOUVER, British Columbia -- Sona Resources Corp. reports on five drillling holes in the third round of assay results from the recently completed drill program at its 100 percent-owned Elizabeth Gold Deposit Property in the Lillooet Mining District of southern British Columbia. Highlights from the diamond drilling include: -- Hole E10-66 intersected 17.4g gold/ton over 1.54 metres. -- Hole E10-67 intersected 96.4g gold/ton over 2.5 metres, including one assay interval of 383g of gold/ton over 0.5 metres. -- Hole E10-69 intersected 85.4g gold/ton over 4.03 metres, including one assay interval of 230g gold/ton over 1 metre. Four drill holes, E10-66 to E10-69, targeted the southwestern end of the Southwest Vein, and three of the holes have expanded the mineralized zone in that direction. The Southwest Vein gold mineralization has now been intersected over a strike length of 325 metres, with the deepest hole drilled less than 200 metres from surface. "The assay results from the Southwest Zone quartz vein continue to be extremely positive," says John P. Thompson, Sona's president and CEO. "We are expanding the Southwest Vein, and this high-grade gold mineralization remains wide open down dip and along strike to the southwest." For the company's full press release, please visit: http://sonaresources.com/_resources/news/SONA_NR19_2010.pdf |

| Central Bank Buying and the sudden fall in the Gold price Posted: 06 May 2011 01:00 PM PDT We have seen new surprising and strong demand from global central banks in the last week. This demand occurred over the last two months and had to compete with other strong demand from all sides of the gold market. As we move into the quiet season for gold and have experienced a short sharp correction so far how will central banks react? |

| Posted: 06 May 2011 12:23 PM PDT |

| Panic Volume: Gold & Silver Buy Signals! Posted: 06 May 2011 12:01 PM PDT Super Force Signals A Leading Market Timing Service We Take Every Trade Ourselves! Email: [EMAIL="trading@superforcesignals.com"]trading@superforcesignals.com[/EMAIL] [EMAIL="trading@superforce60.com"]trading@superforce60.com[/EMAIL] Weekly Market Update Excerpt May 06, 2011 Morris Hubbartt UUP (US Dollar Proxy) Chart UUP Analysis [LIST] [*]You are seeing the beginning of a counter trend move in the US dollar. I advise no purchases of the dollar, except for dedicated gamblers. I expect the US dollar dam to break this fall. The confirmation that a waterfall decline is coming is the gold price reaching $1575. [/LIST] [LIST] [*]Technically, I am issuing a has a “Fuel Cell” buy signal for UUP, and that could produce a rally to the $22 area I highlight on the chart. [/LIST] Gold Head and Shoulders Chart [LIST] [*]Three weeks ago stated, “Gold's Inverse H&S: Rocket Time” and issued a $1570 target for the move. My exact technical t... |

| Posted: 06 May 2011 11:57 AM PDT Adam Hamilton May 6, 2011 2740 Words The beleaguered US dollar has certainly challenged silver’s crown of being the most-one-sided trade lately. The bearishness and pessimism plaguing the world’s reserve currency is overwhelming and universal, with nearly everyone convinced the US dollar is ready to fall off a cliff. But it is psychological conditions just like today’s that birth mighty bear-market rallies, with widespread implications for traders. I certainly understand the bearishness permeating the US dollar today, as its fundamentals truly are rotten. On the supply side, Washington is spending like there is no tomorrow so Bernanke’s lapdog Fed is obsequiously creating vast amounts of new dollars out ... |

| Posted: 06 May 2011 11:55 AM PDT Scott Wright April 29, 2011 2819 Words Junior gold explorers represent a vital component of the global gold supply chain. These small companies take on the arduous task of discovering and developing many of the next-generation gold deposits. Without them, the gold markets would be in complete disarray and the large miners would be scrambling to backfill their project pipelines. But regardless of their significance, junior golds have long operated under the radar for most investors. While exploring for gold seems exotic and adventurous, the reality is it is an unglamorous and highly-risky business that only attracts the most hardcore entrepreneurs and rock-jocks. From an investme... |

| Gold, Silver and the Currency Wars Posted: 06 May 2011 11:49 AM PDT With five margin increases in ten days, one could suggest that the CME and their do-nothing friends in the CFTC are machine-gunning the lifeboats, and the refugees from the currency wars. There is no problem with the exchanges and regulators increasing margin requirements per se, and of course restraining leverage is a good thing. I would just like to see it done more transparently and in a 'rule-based' manner, as opposed to the ad hoc, cronyistic way in which it is done today, most often for the benefit of insiders who control the exchanges, and call for help and rule changes when they get in trouble. And they get into trouble through lax regulation and excessive leverage. People ask, why do not the sovereign silver and gold bulls, the BRICS, fight this? The answer is that they are long term bullion buyers, and this short term paper strategy benefits them greatly. I think the comparisons to the Hunt Brothers silver bubble might be a bit difficult to sustain, very big picture to the point of meaninglessness. The circumstances between then and now are very different, with the only thing in coincidence being the technical price action. But a concentrated effort by the government and the banks could write history and draw the graphs to suit themselves. I think there is more to this than meets the eye. It really centers around a major struggle with regard to international currency, and the methods by which countries denominate their trade, and store the liquid reserves portion of their wealth. This is a currency war. Certainly there are almost no bull calls for the precious metals here, and only a few neutrals. I am changing from short term bearish to neutral, and holding new light positions, most of them revolving around a few 'special situations.' I am neutral, which implies uncertainty. When in doubt, stay out. I have touched none of my long term positions. Let's see how the Non-Farm Payrolls number looks, and how it is received. If there is a liquidation panic in the weeks ahead, then all bets are off of course. This is going to pivot on the stock market and the Fed's short term liquidity actions. The market swings are being triggered by the opaque and irregular management of the markets and the money supply, and the fraud which still taints much of the financial system. Even the staid Economist magazine is questioning US government economic statistics. The American oligarchs may be having their own Mubarak moment in the not too distant future. What has been hidden will be revealed, and what has been whispered will be shouted from the rooftops. But one day at a time, so let's see what happens tomorrow.

By Jesse http://jessescrossroadscafe.blogspot.com Click Here for the original source. |

| Silver Price Lost 27.4% this Week the Gold Price Lost 4.2% Posted: 06 May 2011 11:45 AM PDT Gold Price Close Today : 1,491.20 Gold Price Close 29-Apr : 1,556.00 Change : -64.80 or -4.2% Silver Price Close Today : 3528.3 Silver Price Close 29-Apr : 4858.4 Change : -1330.10 or -27.4% Gold Silver Ratio Today : 42.264 Gold Silver Ratio 29-Apr : 32.027 Change : 10.24 or 32.0% Silver Gold Ratio : 0.02366 Silver Gold Ratio 29-Apr : 0.03122 Change : -0.00756 or -24.2% Dow in Gold Dollars : $ 175.21 Dow in Gold Dollars 29-Apr : $ 170.19 Change : $ 5.01 or 2.9% Dow in Gold Ounces : 8.476 Dow in Gold Ounces 29-Apr : 8.233 Change : 0.24 or 2.9% Dow in Silver Ounces : 358.21 Dow in Silver Ounces 29-Apr : 263.68 Change : 94.53 or 35.9% Dow Industrial : 12,638.74 Dow Industrial 29-Apr : 12,810.54 Change : -171.80 or -1.3% S&P 500 : 1,340.20 S&P 500 29-Apr : 1,363.61 Change : -23.41 or -1.7% US Dollar Index : 74.652 US Dollar Index 29-Apr : 73.050 Change : 1.602 or 2.2% Platinum Price Close Today : 1,777.00 Platinum Price Close 29-Apr : 1,874.90 Change : -97.90 or -5.2% Palladium Price Close Today : 706.10 Palladium Price Close 29-Apr : 794.45 Change : -88.35 or -11.1% This week the market taught everyone a lesson that must never be forgotten: markets fall faster than they rise. No exceptions. And markets also taught us a corollary lesson: the four words you are most likely to hear just before you lose copious amounts of money are, "It's different this time." Wherefore, the SILVER PRICE lost 27.4% this week, the GOLD PRICE lost 4.2%, the PLATINUM PRICE 5.2%, the PALLADIUM PRICE 11.1%, and stocks 1.3%. As you might have guessed, the US dollar index rose this week. What better time for the central bankers to spring their trap than when dollar sentiment was universally bearish and euro sentiment universally bullish? How better to punish those fleeing to silver, gold, and commodities from inflation? Let's look at the US DOLLAR first because that's the catalyst for these other markets. The US DOLLAR INDEX traced out an upside down head and shoulders with a neckline at 73.30. First target for a breakout over that neckline was 73.90. Sure enough, on Wednesday the dollar index jumped from 73.13 to 74.084. Today it made good its gains and confirmed its reversal by ending the day at 74.652, up 45.8 basis points or 0.59%. For its part the euro poured in a waterfall from its 1.4940 intraday high on Tuesday to 1.4339 today, sinking 1.39% today alone. This smasheth the 20 dma (1.4569) and neareth the 50 dma (1.4254). The Yen today reversed as well, closing at Y80.43/$ (124.33c/Y100). I told y'all that currencies are treacherous, and here you see it. You can trust fiat currencies and central banks exactly as you can trust a rattlesnake -- to bite you every time. STOCKS took sick most of the week. Today the Dow managed to lift its head off the pillow by 54.57 points to close at 12,638.74. S&P500 rose 5.1 to 1,340.20. More interesting is that for all gold has lost, stocks have gained little against gold. Dow in Gold Dollars this week rose by G$5.01 to G$175.21 (8.476 oz), remaining in the same range that has prevailed since February. No change there. I am so tried of this charade in stocks I can hardly work up enough energy to insult it. Well, I will try. Investing in stocks remains the Phrenology in the College of Investment Sciences. The GOLD PRICE lost $64.80 (4.2%) from its high on Monday at $1,475. Low yesterday fell on $1,460. Not surprising anybody much, gold rebounded today $10.30 to $1,491.20. Not surprising because the five day chart shows a completed down move. However, the SILVER PRICE fell 94.8c to 3528.3c, non-confirming gold's rise. Question is, which is non-confirming which? Is the silver gainsaying gold's rise, or is gold's rise contradicting silver's fall? I don't know, but I do remember a market proverb, "Never try to catch a falling knife." That means, don't pick a bottom too quickly. Give the market time to work itself out. Against that I have to balance the still-stinging memory of that January silver and gold price correction which refused to carry nearly as far as I thought (in my arrogance) that they ought. Yet for now, DOWN is the leading direction. The silver price has sliced with such speed and gravity through its 20 DMA and 50 DMA (38.88) that I begin to remember how often during this bull market the silver price has revisited its 200 DMA, now 2838c. Certainly possible. GOLD-SILVER RATIO today hit 42.264 at closing, up 10.2 points from its close on 29 April (32%). That correction falls nearly within the the range of 2004 - 2008 corrections, namely, from 33 to 38%. Yet don't forget 2008's terror, when the ratio rose 77% from its low. Silver's low today came at 3305c, so technically it has fulfilled my first target, and, yes, that might be the end of it. If not, watch for 3120c or even 2638c. Gold nearly fulfilled my first target at $1,445 by hitting $1,462 yesterday. That also nearly touched the 50 dma ($1,455.49), an often- witnessed reaction target. If gold doesn't stop there, it might find footing only at $1,382. Blusterers will bluster, and bubblers will bubble, but never mind all that. Keep your eyes fixed on the horizon, on the long term trend. Silver and gold's recent moves were NOTHING compared to their blow-off tops in 1980. More than that, ask yourself why you bought silver and gold, and what's driving the market: monetary demand born of central bank inflation. Ask yourself which of the fundamentals have changed: has the US government announced it will suddenly pull its troops home and cut spending? Has Ben Bernancubus appeared teary-eyed on TV, repenting of the evil he has done the country, begging forgiveness, and resigning his Fed-head-ship? Has congress abolished the Federal Reserve? Until some or all of this appears, you can relax and hold on to your silver and gold. No matter how the media terrorize you talking of silver and gold bubbles, calm yourself and fix your eyes on the horizon. And LO! A Reminder: a seasoned investor NEVER sells his bull market position during a correction. He knows that he can never make as much money trading as he can make WAITING. I understand that many of y'all call and want to talk to nobody but me. I don't recommend that, since you might wait two or three days to hear from me. Truth is, everybody here is kin, and we all sing the same tune. They're probably all smarter than I am anyway. I'm pretty sure they think that, at least. Please do not email me for personal trading advice. It would wholly inappropriate for me to advise you without knowing anything of your whole situation. Everything I have to say to the world is said here in public every day, so I will not answer these emails. If, however, you are interested in buying physical silver or gold from us, we will be glad to help you. Just don't ask me how to trade your precious metals stock or ETF or futures position. Y'all enjoy your weekend. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com (888)218-9226 © 2011, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate in a bubble, primary trend way down. Whenever I write "Stay out of stocks" readers inevitably ask, "Do you mean precious metals mining stocks, too?" No, I don't. |

| Another Bullish Argument for Metals? Posted: 06 May 2011 11:26 AM PDT |

| Posted: 06 May 2011 11:15 AM PDT |

| How The CBOT, Comex And CFTC Coordinated To Break The Last Silver Price Surge Posted: 06 May 2011 11:08 AM PDT Just like QE is nothing new in the monetary arena, and has seen some incarnation at least since the early 80's primarily in Japan, so parabolic commodity price surges have occurred periodically, most notably in 1980, when Bunker Hunt brought the price of silver to over $50. However, unlike any time before, never in the history of the world have we seen a coordinated worldwide monetary stimulus via relentless credit money "printing" courtesy of global central banks. In that regard, this time really is different, as there is no other remaining backstop to the world financial system: the global banking cartel has used up all its bullets and now can only double down in the most nightmarish Martingale system ever conceived, where each iteration means further fiat absolute value destruction (on a relative basis it simply means a race to the currency bottom, whereby definition only one can be in the lead at any given moment: usually the one with the biggest printing press, and greatest deflationary threat). And while many still believe that QE2 will be the last of domestic US monetary easing episodes, as Bill Gross noted earlier, it is very possible that the US may be headed into a triple-dip recession, for which the only prescription will be another QE round (with political gridlock in DC at unseen levels no fiscal stimulus is even remotely possible). If this happens, precious metals will once again surge. The only question is what will the exchanges do after the next gold and silver spike? Indeed, as we suggest, margin hikes are just the beginning. For a complete playbook of how the CME may proceed after the margin hike approach fails, we once again go back to the curious case of Bunker Hunt. Below, from the Playbook biopic of the Texas billionaire we posted yesterday, we present the walk through of how the CBOT, Comex and CFTC tried to break silver's back. Back in 1980 they succeeded. Have they, and will they succeed this time?

Ironically, while the paper holders of silver may be complaining to the CFTC now, the inverse is true about physical supply-demand dynamics. Indeed, instead of a scramble to convert physical silver to paper, we continue to see the inverse as a material amount of silver wholesale retailers continue to be out of actual silver. And, as was posted yesterday, those who wish to read the full story of Bunker Hunt and the still historic surge in silver, may do so here. |

| Posted: 06 May 2011 10:31 AM PDT The 5 min. Forecast May 06, 2011 01:52 PM Addison Wiggin – May 6, 2011 [LIST] [*]Flash Crash redux? Alan Knuckman on how yesterday's commodities sell-off is "good and healthy" [*]Three numbers to watch for signs the sell-off will reverse… or pick up pace [*]Markets recover on new employment numbers… The 5 finds less reason for cheer [*]Silver on sale… the chart that points to a long-term run-up that will outpace gold [*]"We've all learned to hate the banks"… more frontline tales of mortgages playing hard to get… Beijing, Shanghai, Vientiane, Phnom Penh and other exotic travels… [/LIST] Today is the one-year anniversary of the "Flash Crash" — in which the Dow fell 1,000 points by 2:45 p.m. and recovered 650 of those points by the close at 4:00. Yesterday, on the eve of that auspicious occasion, amid a flurry of news stories about the nationwide average gasoline price about to crack $4.00 a gallon, oil put in its wor... |

| Should the golden goose be plucked? Posted: 06 May 2011 10:20 AM PDT by David Cottle Prices, after all, are close to historic highs. Moreover, bullion is the ultimate hedge against an economic rainy day, and it's certainly pouring down in Greece, Portugal and Ireland. … Portugal's holding would be worth $18 billion at current market rates, which would be a handy offset to the €78 billion ($108 billion) bailout it has just accepted from the European Union. On the face of it, there is an absurdity here. How many of us would toss a dime to a beggar if we knew he had an ingot or two stashed under his sleeping dog? … Unfortunately for the pair, market economics are never quite as simple as they look, even when considering arguably the simplest asset of all. …… Moreover, as one gold dealer said: "Selling reserves has a finality about it; you never get them back. Governments can tell their people that there is some benefit at the end of austerity and reform, but not at the end of selling gold to plug a debt hole." … Monument Securities strategist Marc Ostwald is one analyst who doubts a straight gold sale is likely from either nation… But there is no reason, he said, why the gold of debtor states shouldn't be used as collateral in repurchase agreements, lent out and bought back later at a small premium, which would represent the interest on the cash paid. "I think some sort of repo deal using gold might make sense," he said, "although of course this would really be no more a long-term solution to these countries debt problems than the bailouts are." [source] RS View: For a better context, Ostwald's rough suggestion should be read in conjunction with today's news item (and following comment) regarding the use of gold as earmarked collateral. To the extent that Greece (or Portugal or Ireland) has gold with some remaining valuation headroom (that is to say, an excess of Mark-to-Market value of the gold reserves against which specific monetary liabilities (i.e. euros) of the Eurosystem have not been issued), then there is precious little standing in the way of a exploring the utility of properly secured gold-collateralized repos through an agent (specifically the Bank for International Settlements) that would be harmonious with the normal course of affairs in the pro-expansive forex market and equally harmonious (i.e., non-derivative, non-expansive in terms of supply) with the rational gold market. |

| Are Markets Selling Off in Anticipation of More QE? Posted: 06 May 2011 10:12 AM PDT Bill Bonner View the original article. May 06, 2011 09:07 AM We're finally getting some action on Wall Street! The Dow has lost more than 200 points in the last two days. Gold is down more than $50. And oil closed below $100 yesterday. Could this be the sell-off we've been waiting for? Maybe. Why do we expect a sell-off? Because we're still in a Great Correction. And in a correction, prices tend to go down. Deflation is the underlying trend…not inflation. Debt gets marked down…defaulted on…and written off. By our reckoning, the beginning of the correction actually began more than 10 years ago when the NASDAQ cracked wide open in January 2000. Since then, the US economy and stock markets have gone nowhere, in real terms. Who noticed? The feds poured on so much liquidity – beginning in '02…with a huge flood in '08-'09 – everything was swamped. Trash floated. But households drowned…they were shackled to sinking incomes, while the cost of living rose wit... |

| Gold Bounces from Trendline Support Posted: 06 May 2011 10:12 AM PDT courtesy of DailyFX.com May 06, 2011 01:52 PM Daily Bars Prepared by Jamie Saettele, CMT Gold’s decline is deep enough to suggest that a more important top is in place. Still, two way volatility is expected following such an extended move. Currently bouncing from a trendline, expect resistance from former daily lows at 1505.50 and 1540.30. Support/Resistance Index (M,W,D) – 0, (3), (3) Jamie Saettele publishes Daily Technicals every weekday morning, COT analysis (published Monday), technical analysis of currency crosseson Wednesday and Friday (Euro and Yen crosses), and intraday trading strategy as market action dictates at the DailyFX Forex Stream. A graduate of Bucknell University, he holds the Chartered Market Technician (CMT) designation from the Market Technician Association. He is the author of Sentiment in the Forex Market. Send requests to receive his reports via email to [EMAIL="jsaettele@dailyfx.com"]jsaettele@dailyfx.com[/EMAIL].... |

| Hathaway - Gold & Silver to Explode Again After Consolidation Posted: 06 May 2011 10:06 AM PDT  With fierce action in the gold and silver markets, today King World News interviewed John Hathaway of the Tocqueville Gold Fund. When asked about the smash in the metals Hathaway stated, "I think people go crazy over these price changes and I understand that. I understand how it affects the psyche and all that, but the idea is you have physical (metal), it's an asset. Whatever it's valued at one day to another in paper money is irrelevant, you don't price your house every day." With fierce action in the gold and silver markets, today King World News interviewed John Hathaway of the Tocqueville Gold Fund. When asked about the smash in the metals Hathaway stated, "I think people go crazy over these price changes and I understand that. I understand how it affects the psyche and all that, but the idea is you have physical (metal), it's an asset. Whatever it's valued at one day to another in paper money is irrelevant, you don't price your house every day." This posting includes an audio/video/photo media file: Download Now |

| Understanding The Yuan, U.S. Dollar Relationship To Gold, Silver And Commodities Posted: 06 May 2011 10:04 AM PDT In early January of 2011, a top secret candlelight dinner was held at the White House. There was no fanfare and meager publicity. Present were the industrial, military and governmental heads of both China and the United States. Our government had just digested the failures of Lehman Brothers, AIG and other corporate icons by creating massive bailouts and running up trillion dollar budgetary deficits. |

| Closing Context Update: Protection Bid Across All Assets Posted: 06 May 2011 10:01 AM PDT From Capital Context  S&P futures closed close to session lows and notably weaker open to close. After a solid open to the day session, thanks to the insta-pop headline-based algo triggers on a better-than-expected NFP print, the reality of participation rates and a continuing deleveraging in the commodities (and contagiously every other asset class) sector exaggerated a USD rally and derisking in general in stocks and credit. A late day rumor of crude margin hikes also didn't help things and while we closed off the lows/wides of the day in equity/debt, the drift all day was very weak. Credit narrowly avoided five days in a row of decompression in IG and HY spreads by pulling back to unch to very modestly tighter by the close and we want to point out some of the relative shifts in stocks today as job jubilence (and market reaction) seems a little overdone (judging by the news channels). S&P futures closed unchanged (well ok +0.5pts) which is 11pts below the level it traded at the open of the day session. S&P cash closed +5pts but unch from its opening level while SPY (the ETF) managed an equivalent 6pt gain close to close (+$0.59) but was down an equivalent 7pts (-$0.7) from open to close. We are using S&P futures as they are more liquid, accessible 24hrs, and are used by more professionals for hedging - so credit narrowly outperformed equity today (a continuance of the theme and in line with where we see fair-value shifts) but both equity and credit were very weak from open to close today, and more importantly we saw significant protection (derisking) across most asset classes today.

IG appeared to very slightly edge HY today as far as outperformance and low beta credits handily outperformed high beta with breadth actually better than we would imagine given index banality at around five-to-one wideners to tighteners. Intrinsics (the fair-value of the index based on the underlying components) notably outperformed today which is in the wrong direction from an index arb perspective (IG/HY are cheap/wide to fair-value - especially HY which suggests demand for 'blanket' protection remains relatively high) but given the lower liquidity this afternoon, we wonder if it is as simple as dealers not reracking so much into the close as index activity picked up post Greek rumors. Before we dive into the rest of the day's action, it is worth considering the posturing in Europe today. Europe was closed so sovereign bond and equity markets were unavailable but FX and credit markets were open for business and we saw the EUR tank and Greek spreads pop 75-100bps wider (depending on whether you trust the executable levels) to record wides around 1420bps offered. Plenty of acrinomy broke out over the Der Spiegel piece and its accuracy but the fact that there will be an emergency meeting this weekend stoked fears further.  The Cash-CDS basis curve for GGBs suggests restructing unlikely within two years. Our opinion of this is that it is highly unlikely that Greece will voluntarily leave the Euro (despite some appealing upside perspective to that deal) as the combination of major domestic holders of their sovereign debt and the fact that they have available funding for at least a year (if things are just terrible) and more like 2 two years. Greek spreads were well off their wides by the close of US trading in CDS land at around 1335bps mid (around 35bps wider on the day) even though the EUR close at its lows of the week/session - just above 1.43. The hit-job on the EUR as we heard it discussed as was timely and effective but from our angle the incentive for Greeks to leave the EUR anytime soon is low (unless they - meaning all retail and institutional holders are plenty hedged/covered) and this remains the carrot with which the ECB et al can keep them playing ball. What does worry us a little is the story today that naked sovereign bond shorts are banned and a further shift towards sovereign CDS bans. Of course we would say that - given our backgrounds - but the reality of the situation is that outside of basis traders (Cash-CDS arbitrageurs) there is very little active buying of mid-to-longer-term GGBs (especially now the ECB has stopped). The basis (see the chart above) remains fat and provides plenty of upside for those willing to step in (and funding does not seem to be a big issue for the basis books) and while there are plenty of technical drivers, the relationship suggests that there is considerably less likelihood of a restructuring event within two years than many believe (the oddness at the front-end reflects the cheapest-to-deliver option in CDS and not a real disagreement over probabilities of an event. There is plenty of speculation in here as to what is going on but it seems from after-hours comments that the Greeks are vehemently denying it (though didn't they all claim they didn't need a bailout?). Long the EUR is the obvious repercussion trade (even if Greece did exit) - lower aggregate debt and higher per capita GDP growth? but we shy away from calls on FX especially in this wild and waccy market. Its enough for us to remain underweight EU financials vs non-financials and look for more XOVer-Main decompression. Back to today's action and main themes. The main thing we note is a few themes just keep going and that there seemed a bid to more macro protection or overlays in general. In credit , CDS indices underperformed intrinsics significantly, HY underperformed IG (and our HYG-LQD position inched into the money from the open entry at $40.3), high beta underperformed low beta, duration was reduced in CDS, and long-dated cash was very definitely sold relative to mid-dated.  In vol , we saw skews steepen, VIX elevate (in line with the equity sell off intraday) but what was most evident was the flattening of the vol term structure. VIX/VXV (think 1 month/3month vol) rose from an open at 88% to as high as 95.5% before pulling back a little into the close. This is the flattest front-end since 3/28 and shows a demand for short-term protection (and necessarily foregoing the carry costs) that we havent seen in a while. It does seem that every time too many people pile into the sell short-dated vol to fund mid-dated vol trade (see chart around 80%) the fingers get caught under the steamroller. At the current levels though we are at another crossroads where we have tended to revert if the pending crisis does not evolve and given our views on Greece, we suspect this flattening is overdone - at least for a trade with very clear stops indicated. Towards the end of the day, it was indeed VIX (and not VXV) that compressed as we saw implied correlation drop very fast (after pushing higher for much of the day up to yesterday's highs) . We use this measure as a way to judge systemic versus idiosyncratic protection demand - when it rises it tends to mean traders are buying blanket protection (fast markets when liquidity is focused in indices or simply when macro fears are inflamed) and when it drops, one can think that demand for individual protection is relatively more bid. There are many moving pieces here but the significance of the drop towards the end of the day in implied correlation relative to the actual drop in index vol (which was not so great) is that we definitely saw demand shift to protecting individual positions and away from macro . This fits with our recent theme of high beta (well lower quality actually and these are not totally fungible) equity selling and lower beta (higher quality) protection demand (as opposed to outright selling).  TSYs recovered all the NFP print losses (ex 30Y) and then some as the curve steepened modestly on the day. In TSYs , we managed to retrace all the losses of the NFP print and then some in all but the long bond. The curve steepened (though modestly) for the first time since 4/27 but 2s10s remains 29bps below the April 8th swing steeps and for all but a bp or two back at DEC10 flats. 2s10s30s is as lows as it has been since early DEC10 (with the 3/16 spike down the only other print down here) and given the recent withdrawal of day to day liquidity whether by GC-IOER carry, FX vol too high for JPY carry, or even more simply the pending end of flip-that-bond QE2, we wonder what impact this will have on the US equity market as it has been a solid carry trade in the past. The clear preference for IG credit over HY credit today from TRACE data (in terms of relative size flows) and the positivity of TSYs suggests further protection being sought higher up in the capital structure both top-down and bottom-up - a theme we have been playing and liking for a while.

Index/Intrinsics Changes CDX16 IG -0.21bps to 90.29 ($0.01 to $100.36) (FV -0.67bps to 88.98) (26 wider - 92 tighter <> 54 steeper - 70 flatter) - No Trend. Spreads were mixed in the US with IG tighter, HVOL improving, ExHVOL weaker, and HY selling off. IG trades 1.8bps tight (rich) to its 50d moving average, which is a Z-Score of -0.7s.d.. At 90.29bps, IG has closed tighter on only 51 days in the last 604 trading days (JAN09). The last five days have seen IG flat to its 50d moving average. HY trades 12.5bps wide (cheap) to its 50d moving average, which is a Z-Score of 0.2s.d. and at 434.26bps, HY has closed tighter on only 51 days in the last 604 trading days (JAN09). Indices typically underperformed single-names with skews widening in general. Comparing the relative HY and IG moves to their 50-day rolling beta, we see that HY underperformed by around 0.9bps (or 9139%). Interestingly, based on short-run empirical betas between IG, HY, and the S&P, stocks underperformed HY by an equivalent 0.7bps, and stocks underperformed IG by an equivalent 0.4bps - (implying IG outperformed HY (on an equity-adjusted basis)). Among the IG16 names in the US, the worst performing names (on a DV01-adjusted basis) were Hewlett-Packard Company (+1.82bps) [+0.01bps], Johnson Controls Inc (+1.25bps) [+0.01bps], and Kroger Co (+1.17bps) [+0.01bps], and the best performing names were MDC Holdings Inc (-4.5bps) [-0.03bps], Toll Brothers, Inc. (-4.38bps) [-0.03bps], and Ryder System Inc. (-3.82bps) [-0.03bps] // (absolute spread chg) [HY index impact]. Among the HY16 names in the US, the worst performing names (on a DV01-adjusted basis) were K Hovnanian Enterprises, Inc. (+5.15bps) [+0.04bps], Eastman Kodak Co. (+4.39bps) [+0.03bps], and Cooper Tire & Rubber Company (+2.79bps) [+0.03bps], and the best performing names were MBIA Insurance Corporation (-40.44bps) [-0.28bps], Amkor Technology Inc. (-27.15bps) [-0.27bps], and Realogy Corporation (-28.42bps) [-0.24bps] // (absolute spread chg) [HY index impact]. |

| Silver in Freefall, What's Next? Posted: 06 May 2011 09:49 AM PDT Silver was one of the top priorities for many of precious metal traders until last week. However, silver market witnessed a dramatic turbulence in recent days. Let’s examine what has happened in silver market, in detail. Two weeks of gains for silver were erased in only 11 minutes this Monday as markets opened for electronic trading in Asia with prices falling as much as 12 per cent in the session. Spot gold fell 2.2% in 40 minutes. On Wednesday prices took another hit on a newspaper report that high-profile investors, including George Soros’ hedge fund, have sold precious metals. Silver for July delivery closed lower by 7.5%, at $39.39 an ounce on the Comex division of the New York |

| You are subscribed to email updates from Save Your ASSets First To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment