Gold World News Flash |

- SIL (Silver Miners ETF) to Silver ratio

- Stock World Weekly: Inflation & the Great Beyond

- Long May Gold and Silver Run

- Selected Silver stocks to silver ratio by request

- US Currency in Circulation & Barron’s Gold Mining Index Part 3 of 3 (Continued)

- GDX (Majors) Versus GDXJ (Juniors) Ratio Chart

- Equities Don't Follow the Dollar Index So Hold On!

- Thanks to the folks who caught my stupid error

- Is the Gold price really rising?

- Shortage Threat Drives Texas Schools Hoarding Bullion at HSBC

- The SP 500, Oil, and Gold Will Respond To Price Action in the U.S. Dollar

- Will The Finnish Vote Dead End Europe's Bailout Bonanza?

- Guest Post: Years Of The Modern

- Global Key Economic Event And Bond Issuance Summary For The Upcoming Week

- GATA London conference and hotel registrations are open

- International Forecaster April 2011 (#5) - Gold, Silver, Economy + More

- Buying Gold on the Price Inflation Guarantee

- Mining shares priced for 2001 gold and silver prices, Norcini tells KWN

- Jim?s Mailbox

- “SANYA: Brazil, Russia, India, China and South Africa – the BRICS group of fastest growing economies – Thursday signed an agreement to use their own currencies instead of the predominant US dollar in issuing credit or grants to each other.”

- On The Upcoming Glencore IPO: Is The Juice Worth The Squeeze?

- S&P500, Crude Oil, and Gold Reliant on U.S. Dollar Price Action

- Jim's Mailbox

- Silver Continues to Outpace Gold

- Spitzer: If The Attorney General Does Not Sue Goldman Sachs, He Should Resign

- David Kostin's Latest Weekly Chartology: The S&P Downgrade Preparations Begin

- $5,000 Gold: Who?s Missing From This List of Peak Price Prognosticators?

- “With real estate no longer an attractive asset bubble, the “mass affluent” Chinese will be forced to invest in gold.”

- University of Texas buys $1 billion in gold bars, takes delivery

- China Hikes RRR For Fourth Time In 2011: As Real Estate Bubble Pops, JPM Sees "Mass Affluent" Rushing Into Gold

| SIL (Silver Miners ETF) to Silver ratio Posted: 17 Apr 2011 05:40 PM PDT [url]http://www.traderdannorcini.blogspot.com/[/url] [url]http://www.fortwealth.com/[/url] This one is very revealing as it contains silver miners. Its performance against silver since last year has been spectacular - if one can measure a poor showing in those terms (spectacularly poor). SIL Top Ten Holdings [*]Silver Wheaton Corporation (SLW): 12.74% [*]Industrias Penoles SAB de CV (PE&OLES): 11.10% [*]Fresnillo PLC (FRES): 10.44% [*]Pan American Silver Corporation (PAAS): 9.82% [*]First Majestic Silver Corp (AG): 6.86% [*]Coeur D'Alene Mines Corporation (CDE): 5.64% [*]Silvercorp Metals Inc. (SVM): 5.22% [*]Hochschild Mining PLC (HOC): 4.45% [*]Hecla Mining Company (HL): 4.40% [*]Silver Standard Resources, Inc. (SSRI): 4.32% ... |

| Stock World Weekly: Inflation & the Great Beyond Posted: 17 Apr 2011 05:34 PM PDT Here's the latest Stock World Weekly: Inflation & The Great Beyond In a classic retelling of the ancient “irresistible force meets immovable object” riddle, irresistible forces of rampant oil speculation, political and social instability in North Africa and the Middle East, and the Federal Reserve’s policy of quantitative easing (QE) are combining to support higher oil prices. Unfortunately, when the price gets high enough, it hits an immovable object called demand destruction every time. [...] As the American consumer copes with rising food prices, rising energy costs, stagnant wages, high unemployment, and declining real estate values, the premise of a “consumer led” recovery is difficult to fathom. High gasoline prices alone are costing U.S. consumers $360 million more a day compared to prices a year ago, according to petroleum industry analyst Bob van der Valk. Bob also expects the price of West Texas Intermediate Crude to drop sharply over the next few weeks, and points to the fact that inventories at the Cushing, Oklahoma hub are at all time highs, something we have been noting for months. Jan Hatzius is Goldman Sachs’ chief US economist, and is responsible for setting the firm’s US economic and interest rate outlook. Friday afternoon, Zero Hedge reported that Mr. Hatzius issued a major downgrade in his forecast for the “real GDP” for 2011, revising it down to 1.75% (annualized), from 2.5% previously (and from 3.5% not too long ago). He is very concerned about the downside risk to household real disposable income. In his view, the best chance for improvement in the forecasts is either “a substantial acceleration in the labor market and/or a large drop in gasoline prices.” (Jan Hatzius Friday Night Bomb: “We Are Downgrading Our Real GDP Growth Estimate”) With all the talk about real inflation rates, the impact of inflation on food and energy prices, and its resulting problems, popular opinion begins to embrace the inflationary premise and soon people begin talking openly about the possibility of not only inflation, but even hyperinflation. However, not everyone shares this opinion. Charles Hugh Smith, of the blog “Of Two Minds,” takes an opposing view of the future: “What the true believers of hyperinflation and the destruction of the dollar cannot accept is that debt is an asset to the owner of that debt. In focusing solely on the advantages of inflation to borrowers, they ignore the critical fact that inflation quickly destroys the value of the asset that debt represents to the owner. And debt is a primary asset to pension funds, insurance companies, banks, and indeed the entire financial sector." Archives #1e439a;">here > |

| Posted: 17 Apr 2011 04:46 PM PDT [U]www.preciousmetalstockreview.com April 15, 2011 [/U] It was another great week for gold and silver. Both hit new highs and soon we could see silver break into all-time highs. The S&P 500 has been consolidating with other markets after a strong bounce off the tsunami low. The S&P 500 is building what looks to be a reverse head and shoulders pattern here which should take it much higher after the pattern completes within a week or two. As always, I’m listening to some music while I write and as often happens some Neil Young came across the speakers so today’s title is for his great song “[ame="http://www.youtube.com/watch?v=nszR0tfp4Es"]Long May You Run[/ame]”. Unfortunately my reading and wiring computer is still down, apparently the part got lost in the mail! Hard to believe I know. And it’s getting very frustrating. We should be completely back to normal by next week I think, but I thought that last weekend ... |

| Selected Silver stocks to silver ratio by request Posted: 17 Apr 2011 04:31 PM PDT |

| US Currency in Circulation & Barron’s Gold Mining Index Part 3 of 3 (Continued) Posted: 17 Apr 2011 04:13 PM PDT Mark J. Lundeen [EMAIL="Mlundeen2@Comcast.net"]Mlundeen2@Comcast.net[/EMAIL] 15 April 2010 This is the continuation of my Part 3 of 3 on Currency in Circulation series. * * * What drives the Barron's Gold Mining Index (BGMI) up? The same force that drives it down: monetary inflation pumped in from the Federal Reserve, inflating a financial bubble somewhere in the economy. Initially, the Fed's inflation flows into their targeted market: the real estate and/or the stock markets. Eventually a public mania develops as the bubble inflates to epic proportions, inspiring the general public to believe that everyone investing in the bubble is going to get rich! At first precious metals mining shares might rise slightly in sympathy, or actually decline as our "monetary policy makers" feed their latest bubble. But inflationary bubbles don't last forever. At some point in the cycle, the Fed's "liquidity" stops flowing into the bubble, despite their best efforts to... |

| GDX (Majors) Versus GDXJ (Juniors) Ratio Chart Posted: 17 Apr 2011 03:15 PM PDT For further market analysis and commentary, please see Trader Dan's website at www.traderdan.net Dear CIGAs, At the suggestion of my good friend Jim Sinclair, I have prepared a chart detailing the ratio of the price of GDX compared to the price of GDXJ. The GDX does contain some smaller cap miners but it also mainly includes the large cap mining outfits. The GDXJ on the other hand, is comprised entirely of medium cap and small cap miners. Over 60% of the stocks that make up the GDXJ are Canadian firms. Nearly 14% are US headquartered with 13.31% being Australian. The remaining are from various countries around the globe. While not a perfect representation, it is a useful tool for charting the underperformance ( in general) of the small and medium cap miners compared to the larger cap miners. Note the steep decline in the line that began in the summer of last year which lasted throughout the remainder of 2010. Only towards the end of last year did the juniors recover a bit of ground but the best they could do was to retrace a small portion of their losses against the large cap miners by moving higher but since January they have gone nowhere against the large caps. It seems to me that the hedge funds are selectively targeting some of the small and mid tier mining firms to go after with their short side of the spread trade that they have been employing. Perhaps they feel that due to their sheer size and financial firepower, they can overwhelm any buying coming into the smaller firms and thus create an effective put option against their long metals positions. I am not sure but either way, the chart reveals the reason for the frustration among many who own quality junior and mid cap mining firms whose share prices seem stuck in the mud even as the gold and silver markets continue soaring higher. Let me take this opportunity to also clarify something in my earlier post about the HUI and XAU ratio charts. I did not mean to imply that the mining shares are trading at the same level as they were back in 2001 when silver was $4.00. That is of course preposterous as most have had strong gains over the last decade. The ratio charts' purpose is to show whether the shares are underperforming or outperforming physical gold and/or silver. What the charts do show however is that the mining shares in general have so seriously underperformed the gains in both gold and silver, that the ratio of the indices to the underlying metals is ridiculously skewed. In the case of silver, you have to go all the way back to 2001, a period in which very few people were calling for a major bull run in the metal. There was little if any excitement whatsoever in the mining sector back then. In regards to silver in particular, the ratio of the HUI and the XAU to it may not be as good of a gauge of how the silver stocks in particular are performing when compared to the price of the bullion, mainly because both indices are dominated by gold producers, particularly the HUI, but both indices do hold silver miners in their basket as well as some gold miners who produce both gold and silver. Since silver has been outperforming gold on a percentage basis, and both of these indices favor a larger number of gold producers than silver, it is reasonable to assume that both of the indices would be lagging silver when a ratio is constructed, but not to this extent. To see these indices trading at such extremely low levels when a ratio is created is indicative of the kind of short selling pressure that is active in the mining sector in many instances. It is just mindboggling to see how undervalued many of the shares are when compared to the metals. While many have moved strongly higher, a large number of them continue to lag and are not reflecting the kind of price movements that we would expect to normally see with the bullion making either all time highs in price or 30+ year highs. If you want to get a "fair" or reasonable level at which the indices should be trading, run some statistical analysis and see what the mean or average value should be then see what the standard deviation away from that mean is. I will leave that to my statistics friends but either way, the result is indicative of how cheap the stocks are compared to the metals in many cases. Here are a few of the silver stocks comparing them to the price of silver and creating a ratio chart. A rising line indicates the stock price is outperforming the price of silver. A falling line indicates the stock is underperforming. A pleasant exception: SLW |

| Equities Don't Follow the Dollar Index So Hold On! Posted: 17 Apr 2011 02:57 PM PDT |

| Thanks to the folks who caught my stupid error Posted: 17 Apr 2011 02:42 PM PDT [url]http://www.traderdannorcini.blogspot.com/[/url] [url]http://www.fortwealth.com/[/url] I appreciate the emails and notes from so many who took some time out to write and help me get my head on straight when it comes to interpreting my own chart. A falling GDX to GDXJ ratio does indeed note that GDX in UNDERPERFORMING the latter. That would mean the opposite is occuring from what I wrote! Maybe one of these days I will get some sleep and think clearly again. My apologies to the readers and my appreciation for your forebearance. What the falling ratio would indicate is that the large caps are underperforming against the smaller mid caps and juniors in general. I am going to leave the former post up as a monument to my denseness. Just flip the analysis around and you will have the right picture. You might also want to focus on some of the stocks I have detailed and compared to silver to get a view of actual company performances against the metal. I will probably be pressed fo... |

| Is the Gold price really rising? Posted: 17 Apr 2011 01:00 PM PDT |

| Shortage Threat Drives Texas Schools Hoarding Bullion at HSBC Posted: 17 Apr 2011 11:43 AM PDT Dallas hedge-fund manager J. Kyle Bass helped advise the University of Texas Investment Management Co. on taking delivery of 6,643 gold bars, worth $987 million on April 15, now stored in a bank warehouse in New York. Bass, who made $500 million with 2006 bets on a U.S. subprime-mortgage market collapse, said managers of the endowment, known as UTIMCO, sought board approval to convert its gold investments into bullion this year. A board member, Bass, 41, said he was asked to help with that process. While Bass, a managing partner at Hayman Capital Management LP, said in an April 16 e-mail that "the decision to purchase and take delivery of the physical gold" was made by endowment staff members, "I helped where I could." Gold futures touched a record $1,489.10 an ounce April 15 in New York before closing at $1,486. The Texas fund's $19.9 billion in assets ranked it behind only Harvard University's endowment as of August, according to the National Association of College and University Business Officers. Last year, UTIMCO added about $500 million in gold investments to an existing stake, said Bruce Zimmerman, the endowment's chief executive officer. The fund's managers sought to take delivery of bullion to protect against demand for the metal overwhelming supply, according to Bass. More Here.. |

| The SP 500, Oil, and Gold Will Respond To Price Action in the U.S. Dollar Posted: 17 Apr 2011 10:56 AM PDT |

| Will The Finnish Vote Dead End Europe's Bailout Bonanza? Posted: 17 Apr 2011 10:26 AM PDT The early Finnish votes are in and it does not look good for Portugal. As Reuters reports, Finland's anti-euro True Finns made huge gains in an election on Sunday, raising the risk of disruption to an EU bailout of Portugal. The right-leaning National Coalition topped the ballot, gaining just over a fifth of all votes. Party leaders will start talks soon on forming a new government. The problem is that as the anti-euro moniker indicates, the True Finns are pretty much hell bent on vetoing the Portugal bailout which means the ongoing annexation of Europe's periphery by Olli Rehn is about to finish (and yes there is a finish-Finnish joke in there somewhere). Per Marketwatch: "Early results Sunday from Finland’s parliamentary elections suggest the anti-EU bailout True Finns party will hold the second-most number of seats and could even be part of a coalition government. Such an outcome may mean the EU’s planned bailout of Portugal is vetoed by Finland, a move that would roil the euro-zone markets. With half the votes counted the True Finns were on 19% support, and on course for 41 seats, tied with the Social Democrats and one seat less than National Coalition Party’s predicted 42-seat haul, the BBC reported. Finland is the only euro-zone country that requires bailouts to be approved by its parliament. Strong gains by the True Finns could derail a planned rescue for Portugal." What this means is that Goldman Sachs' European analysts will be scrambling all night to come up with loophole to European law that will not result in an epic plunge for the European currency, as apparently not even that sage among sages, Thomas Stolper, whose 2010 batting average of 0.000 made his contrarian calls manna from heaven in the past year, could anticipate this Black Swan. We will keep you informed of all the sell-side spin as it starts trickling in. In the meantime, here is more from Marketwatch:

Well, when Europe is run by a man who tweets haikus and comes from a country that hasn't had a government for the longest amount of time in modern political history, logic probably is not the failing monetary union's strong suit. So just how real is the threat of a derailment of the encroaching bailout scheme:

But even if Finland is not the proverbial straw on the camel's back, one is certainly coming. At this point well over half of Europe has had it with the decade long failed EUR experiment.

So far the EURUSD is trading stead, even as silver just took out $43.20. Something tells us the next FX regime will not be one marked by continuing strength of a currency whose ever greater number of constituent countries continue to exist purely on the luck of the draw, or the ever angrier populist vote. |

| Guest Post: Years Of The Modern Posted: 17 Apr 2011 10:01 AM PDT Submitted by Jim Quinn of The Burning Platform Years Of The Modern Is humanity forming en-masse? for lo, tyrants tremble, crowns grow dim, Years prophetical! the space ahead as I walk, as I vainly try to Unborn deeds, things soon to be, project their shapes around me,

The great American poet Walt Whitman wrote these words in 1859. Whitman was trying to peer into a future of uncertainty. He was sure the future would be bleak. He had visions of phantoms. Maybe he saw the 600,000 souls who would lose their lives in the next six years. Whitman had captured the mood of a country entering the Fourth Turning. He didn’t know what would happen, but he felt the beat of war drums in the distance. Whitman did not have the benefit of historical perspective that we have today. There have been three Fourth Turnings in American History. The American Revolution Fourth Turning ended in 1794 with the Crisis mood easing with the presidency of George Washington. Whitman didn’t realize that, 64 years after the previous Fourth Turning, the mood of the country was ripe for revolution and the sweeping away of the old order. When the stock market crashed in 1929, 64 years after the exhausting conclusion to the Civil War Fourth Turning, Americans didn’t realize the generational constellation was propelling them toward a new social order and a horrific world war. It is now 66 years since the conclusion of the Depression/WWII Fourth Turning. All indications are that the current Fourth Turning began in the 2007 – 2009, with the collapse of the housing market and the ensuing financial system implosion. I find myself vainly trying to pierce the veil of events yet to be. The future is filled with haunting phantoms of unborn deeds which could lead to renewed glory, untold death and destruction, or the possibly the end of the great American experiment. Walt Whitman captured the change of mood in the country with his poem. History books are filled with dates and descriptions of events, battles, speeches and assassinations. What most people don’t understand is Fourth Turnings aren’t about events, but about the citizens’ reaction to the events. The Boston Massacre did not start the American Revolution Fourth Turning, but the Boston Tea Party did. John Brown’s attack on Harper’s Ferry did not start the Civil War Fourth Turning, but the election of Abraham Lincoln did. World War I did not start the Great Depression/World War II Fourth Turning, but the 1929 Stock Market Crash did. The 9/11 terrorist attack did not start latest Fourth Turning, but the Wall Street induced housing/financial system collapse did. In each instance, the generations were aligned in a manner that would lead to a sweeping away of the old civic order and a regeneracy with the institution of a new order. Old Artists disappear, Prophets enter elder hood, Nomads enter midlife, Heroes enter young adulthood—and a new generation of child Artists is born. One hundred and fifty years ago this week Fort Sumter was bombarded by upstart revolutionaries attempting to break away from an overbearing Federal government based in Washington D.C. Exactly four years later the butchery and death concluded dramatically with Robert E. Lee surrendering to Ulysses S. Grant at Appomattox and the assassination of Abraham Lincoln by John Wilkes Booth at Ford’s Theatre. For the next four years we will celebrate the 150th anniversary of various battles that marked the Civil War. What people will not consider are the similarities between that tumultuous period in our history and the period we are in today. Fourth Turnings are marked by different events but the same mood of upheaval, anger and fury. As Strauss & Howe note in their book, the morphology of a Fourth Turning follows a predictable pattern:

Strauss & Howe describe the normal sequence: This Crisis morphology occurs over the span of one turning, which (except for the U.S. Civil War) means that around fifteen to twenty-five years elapse between the catalyst and the resolution. The regeneracy usually occurs one to five years after the era begins, the climax one to five years before it ends. The catalysts are relatively easy to identify, but the point of regeneracy is more subtle and harder to grasp. Fiery Moment of Death & Discontinuity“Like nature, history is full of processes that cannot happen in reverse. Just as the laws of entropy do not allow a bird to fly backward, or droplets to regroup at the top of a waterfall, history has no rewind button. Like the seasons of nature, it moves only forward. Saecular entropy cannot be reversed. An Unraveling cannot lead back to an Awakening, or forward to a High, without a Crisis in between. The spirit of America comes once a saeculum, only through what the ancients called ekpyrosis, nature’s fiery moment of death and discontinuity. History’s periodic eras of Crisis combust the old social order and give birth to a new.” – Strauss & Howe – The Fourth Turning |

| Global Key Economic Event And Bond Issuance Summary For The Upcoming Week Posted: 17 Apr 2011 09:53 AM PDT Now that the global financial system is down to living literally auction to auction, with negligible available cash and deficits as far as the eye can see, not to mention a European continent living day to day on the whims of either political extreme, issuance of government paper, and particularly its proper uptake, takes takes on a especially significant role. Below we present not only Goldman's summary of the key events in the past week as well as those in the next 5 days, but a bond auction schedule, together with a POMO summary, for the next two weeks.With everyone selling as much paper as they can wet away it, not even the global central banking cartel selling unlimited long term puts on the worldwide treasury curve will do much to prevent the upcoming global yield tsunami.

Source: Morgan Stanley: Next, Goldman summarizes the past week, and forecast the next 4 business days (Friday is a holiday) What Matters in FX This Week : Business Surveys in Europe and Turkish Central Bank Meeting From a macro perspective, last week’s data offered a slightly more positive mix of growth vs. inflation. CPI data in the US showed a more moderate increase in core inflation, while consumer confidence in the US came in slightly better than expected and long-term inflation expectations eased.? In terms of our own market views, we re-emphasized our Dollar bearish bias in the FX Monthly but also highlighted that limited further upside in European rates together with slightly more volatile risk sentiment could temporarily hurt our long EUR/US $ exposure. Our commodities strategy team turned more neutral in the near term for oil, and as a result, we closed our long recommendation in Canadian equities. Week Ahead? The week ahead is reasonably light on data. The European PMIs and the German IFO will be the key releases to watch. So far, these forward-looking growth indicators have remained steady at remarkably high levels, and it will be interesting to watch whether it extends for another month.? As a result of our more neutral stance on oil, we are watching our RUB trade closely. If the CBR remains hawkish then there is room for RUB to continue to perform even if oil prices correct lower in the near term. Therefore, watching next week’s investment data is key for our view on the economy and the central bank’s next move.? Next week’s central bank meeting in Turkey is unlikely to provide a negative backdrop for our long EURTRY recommendation as we do not expect CBRT to raise reserve requirements again.? Monday 18 April? RBA Board Meeting Minutes.? Hungary Monetary Policy Meeting: We expect the National Bank of Hungary to keep rates unchanged at 6%.? Tuesday 19 April? Eurozone Flash PMIs (Apr): We expect the manufacturing PMI to print at 57.2, very close to last month’s print (of 57.5). Similarly for the services PMI we expect 57, which would be slightly below last month’s 57.2 print. Russia Investment Statistics (Mar): The strength of the rebound in domestic demand will be important to watch in order to assess the odds for further monetary tightening in the near term in Russia. Our long RUB basket recommendation is predicated on a hawkish CBR stance.? US Housing Starts (Mar): We expect a 5% increase in starts vs consensus forecasts of 9.6%.? Also of interest: Canada CPI (Mar), Japan trade balance (Mar), Hungary Wages (Feb), Poland IP (Mar).? Wednesday 20 April? Thailand Central Bank Meeting: We expect a 25bp hike of the policy rate to 2.75%, on the back of rising inflationary pressures.? Taiwan Export Orders (Mar): The March 11 earthquake in Japan is likely to distort export numbers across the region.? UK MPC Meeting Minutes: It would be a surprise if any committee member had switched votes between March and April.? US Existing Home Sales (Mar): We forecast a decline of 6% mom vs a 2.5%mom increase that consensus expects.? Also of interest: South Africa Retail Sales, Mexico INPC inflation.? Thursday 21 April? Germany IFO (Apr): We will be watching whether the IFO continues to point to substantial strength in the German manufacturing sector. The components will also be of interest in terms of assessing the course for business expectations and current trends in the retail and wholesale sectors.? Turkey Monetary Policy Meeting: We expect the Bank to leave rates unchanged at 6.25%. We do not expect the bank to hike reserve requirements (RRR).? Japanese Portfolio Flow data for the week ending April 15. The last data set showed large Japanese selling of foreign debt. In comparison to previous years, we think it is related to fiscal year end. If the trend continues, it may signal repatriation of foreign assets in response to last month’s earthquake.? US Philly Fed (Apr): We expect the Philly Fed indicator to decline to 33 from 43.4, consensus expects a decline to 36 only. Also of interest: US initial claims?, Canada retail sales. Friday 22 April? Good Friday? Of interest: Hungary Retail Sales |

| GATA London conference and hotel registrations are open Posted: 17 Apr 2011 08:56 AM PDT 5:16p ET Sunday, April 17, 2011 Dear Friend of GATA and Gold (and Silver): Registrations are now being taken for GATA's Gold Rush 2011 conference in London, to be held Thursday-Saturday, August 4-6, at the famous Savoy Hotel (http://www.fairmont.com/savoy/), and the hotel has begun taking reservations for GATA conference participants at a discounted rate. Admission to the conference will be US$800, $US1,500 for couples. This will cover not only all conference presentations but also a reception on Thursday night, coffee breaks and lunches on Friday and Saturday, and dinner Friday night. For couples with a member who wants to see a little more of London and a little less of monetary metals advocates, a ticket covering admission just to the reception, the two lunches, and the dinner will be available for US$250. We hope to offer some family outings in London as well, possibly on Sunday, August 7. More about that later. ... Dispatch continues below ... ADVERTISEMENT Canuc Resources Pursues Ecuador and Nova Scotia Gold Projects Canuc Resources Corp. (TSX: CDA) has confirmed high-grade gold and the potential for large-tonnage, low-grade copper and gold mineralization at its primary asset, property in the historic Nambija gold mining district in southeastern Ecuador. Last November Canuc took an option on the Mill Village gold property in southwestern Nova Scotia, which includes two past-producing mines. Canuc plans to begin surface and underground exploration at Mill Village in the next several weeks, financed by $2 million recently raised through a private placement. To generate immediate income, Canuc is acquiring MidTex Oil and Gas Co., owner of a producing gas well and a lease on 320 acres in Stephens County, Texas. Canuc's CEO, Gary Lohman, has more than 30 years of experience in the mining industry, primarily as a geologist, and the company's officers include similarly experienced people. For more information about Canuc, please visit http://www.canucresources.ca/. Among the speakers at Gold Rush 2011 in London: -- James G. Rickards, senior managing director for market intelligence at consulting firm Omnis Inc. in McLean, Virginia. -- London silver trader and whistleblower Andrew Maguire, whose complaint about silver market manipulation, presented by GATA to the public hearing of the U.S. Commodity Futures Trading Commission in Washington a year ago March, sent the price of silver soaring. -- Ben Davies, CEO of Hinde Capital, who has been making the case for gold and silver on financial news television programs throughout the world. -- Market Force Analysis editor and GATA Board of Directors member Adrian Douglas, whose research studies have documented gold and silver market manipulation. -- Cheviot Asset Management Investment Director Ned Naylor-Leyland. -- Economist and former banker Alasdair Macleod, whose commentaries on the markets are published at his Internet site, FinanceAndEconomics.org, and now at GoldMoney.com. -- GATA Board of Directors member Ed Steer, editor of Ed Steer's Gold and Silver Daily letter, published by Casey Research. Speakers returning from GATA's Gold Rush 21 conference in Dawson City, Yukon Territory, in 2005 will include: -- GATA Chairman Bill Murphy. -- South African gold mining industry expert Peter George. -- Sprott Asset Management Chairman Eric Sprott. -- Sprott Asset Management Chief Investment Strategist John Embry. -- GoldMoney founder James Turk. -- Hugo Salinas Price, president of the Mexican Civic Association for Silver. -- Gold price suppression litigator Reginald H. Howe. -- Kirkland Lake Gold CEO Brian A. Hinchcliffe. -- Gold market analyst John Brimelow. -- Samex Mining Corp. President Jeff Dahl. -- And your secretary/treasurer. Bringing the gold price suppression scheme to the attention of influential people around the world, the Gold Rush 21 conference in 2005 sent the gold price up sharply. With its conference in London, home of two major perpetrators of the gold price suppression scheme, the Bank of England and the London Bullion Market Association, GATA plans to increase understanding of the scheme and hasten its downfall. The conference will review where gold has gone amid GATA's hectoring and examine where it might go as it returns to its necessary place at the center of the world financial system. Gold Rush 21 conference organizer Janet Lee has returned to help organize GATA's London conference along with Howard Fitch of Market Edge Media in Vancouver. GATA soon will be posting an Internet site dedicated to the London conference but for the moment we've posted the conference invitation here -- http://www.gata.org/goldrush2011-london -- and you should not wait to register. Just send an e-mail to LondonConference@GATA.org with the names, postal addresses, telephone numbers, and e-mail addresses of all the people you're registering. Specify any registrations that are for just the reception and meals. We'll reply with information about payment and how to make your reservation at the Savoy at the conference rate. Of course it's not necessary for conference participants to stay at the Savoy but it sure will make things easier for the London police at closing time. We hope to see many of our old friends and to make many new friends in London -- so many, in fact, that we'd love to have to find out how many free gold market advocates it takes to fill the Albert Hall. CHRIS POWELL, Secretary/Treasurer Join GATA here: An Evening with Bill Murphy and James Turk World Resource Investment Conference Gold Rush 2011 https://www.amsterdamgold.eu/gata/index.asp?BiD=12 Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: http://www.gata.org/node/16 ADVERTISEMENT The Gold Standard Now: It Can Work Today a dollar is worth 80 percent less than it was 40 years ago, and less than 5 percent of its value a hundred years ago. We deserve a dollar that is as good as gold, a dollar that will hold its value from year to year so we can be financially secure and our economy can generate more and better jobs. For most of America's history, our dollar was literally as good as gold. But on August 15, 1971, our politicians destroyed the link between gold and the dollar. They destroyed the foundations of our economic system. A new Internet site, TheGoldStandardNow.org, provides news and cutting-edge analysis about this most important issue and explains how the gold standard worked in the past and how it can work in the future. Visit us today: http://www.thegoldstandardnow.org/about/137-welcome-newsmax |

| International Forecaster April 2011 (#5) - Gold, Silver, Economy + More Posted: 17 Apr 2011 08:19 AM PDT Europe continues to struggle from one problem to another. The euro has been strong only because the dollar has been weak. The governments of Greece, Ireland, Portugal and Spain continue their balancing acts on the edge of a financial precipice. All have Socialist governments, which have done terrible jobs, but the opposition is not much better. Each economy is in serious trouble and if Italy and Belgium follow it will take $4 trillion to bail them out. If the solvent EU members bail them out they'll fail as well. Americans and Brits can look down their noses, but their problems are just as bad if not worse. |

| Buying Gold on the Price Inflation Guarantee Posted: 17 Apr 2011 08:04 AM PDT At my age, I have pretty much figured out that people don't like me because they fear me. I don't know why, exactly, but perhaps they fear me because I am a cynical, paranoid, gold-bug old man who thinks that the Federal Reserve has turned into an evil institution by creating So Freaking Much Money (SFMM), now so that it can commit the sin of monetizing new government debt by the truckload, increasing the money supply and guaranteeing a roaring inflation that hurts the poor, and hurts the almost-poor, and hurts the not-quite-poor, and (now that I think about it) it hurts everybody, which hurts me personally because they come whining to me to give them some of MY money! |

| Mining shares priced for 2001 gold and silver prices, Norcini tells KWN Posted: 17 Apr 2011 07:55 AM PDT View the original post at jsmineset.com... April 17, 2011 09:28 AM Dear Friend of GATA and Gold: The weekly review of the precious metals markets at King World News finds Bill Haynes of CMI Gold & Silver reporting that retail demand remains strong, and futures market expert Dan Norcini reporting that gold and silver mining shares are priced as if the metals were still trading at their 2001 prices. You can listen to the interview here: [URL]http://kingworldnews.com/kingworldnews/Broadcast/Entries/2011/4/16_KWN_Weekly_Metals_Wrap.html[/URL] Audio of the recent King World News interview with James Grant of Grant’s Interest Rate Observer has been posted here: [URL]http://kingworldnews.com/kingworldnews/Broadcast/Entries/2011/4/16_James_Grant.html[/URL] And audio of the recent King World News interview with resource company broker Rick Rule has been posted here: [URL]http://kingworldnews.com/kingworldnews/Broadcast/Entries/2011/4/16_Rick_Rule.html[/URL] CHRIS POWELL, Se... |

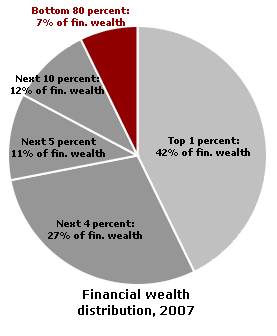

| Posted: 17 Apr 2011 07:55 AM PDT View the original post at jsmineset.com... April 17, 2011 09:24 AM Dear Jim, All this QE has devastating effects on the poor! Best, CIGA Big Tatanka CIGA Big Tanaka, You got that right with a little help from the weather long cycle, but what created the absolute need for the Central Bank tool, QE? The answer is the international collapse and false valuation of OTC derivatives scam. If karma exists the bankers are doomed for eternity. Regards, Jim World’s Poor 'One Shock' From Crisis as Food Prices Climb, Zoellick Says By Eric Martin – Apr 16, 2011 5:49 PM MT World Bank President Robert Zoellick said the global economy is "one shock away" from a crisis in food supplies and prices. Zoellick estimated 44 million people have fallen into poverty due to rising food prices in the past year, and a 10 percent increase in the food price index would send 10 million more people into poverty. The United Nations FAO Food Price index jumped 25 percent las... |

| Posted: 17 Apr 2011 06:09 AM PDT BRICS credit: Local currencies to replace dollar Palantír: following the headline with this: Max and Stacy, can you talk about the significant around what Chicago Mercantile Exchange (CME) will do tomorrow, April 18; offer six oil contracts (one for North Sea Oil and five for gasoline) that will be traded in Euros – not Dollars. [...] |

| On The Upcoming Glencore IPO: Is The Juice Worth The Squeeze? Posted: 17 Apr 2011 05:43 AM PDT This article is from Stone Street Advisors. Glencore is the most powerful, connected commodities trading firm on the planet. Since many valuable commodities are located in politically unstable parts of the world, earning, and more importantly retaining that honor necessitates that Glencore engage in some possibly questionable business practices, some (many?) of which might just happen to violate one or more international laws or sanctions. Running such operations as a private, closely-held firm based in a quiet corner of Switzerland is hard enough, but doing so as a soon-to-be publicly-traded company in both London and Hong Kong may provide near impossible given the much higher visibility and scrutiny that comes with a public listing.

For the uninitiated among you, I strongly suggest you read this Business Week article from 2005, entitled "The Rich Boys," not for the wealth accumulated by its employees, but in honor of the Man, the Myth, the Legend, Marc Rich, Glencore's founder and mentor extraordinaire. If allegations of his disregard for the law are even remotely true, then comparisons of Rich and his cronies to an evil empire of Bond Villain-esque proportions are not necessarily unfair. Under-the-table deals with despots and dictators, disregard for laws and according to some, a complete disregard for ethical practices, all in the quest for dominance of the global commodities trade. But now, as the legacy of Glencore, nee Marc Rich & Co AG, prepares its initial public offering, Wall Street anxiously awaits its chance to get a piece of the most successful commodities firm on the planet, and the riches that come with it. Seldom talked-about though is how those riches are procured. Mining, exploration, and extraction are not exactly pretty business, especially when said business is in some of the most hostile locations in the world, many rife with what amounts to little more than slave labor. One way or another, an incredibly wide swath of The Public is going to have some economic exposure to a piece Glencore (both pre and post IPO). I doubt many pensioners and endowment beneficiaries, to say nothing of the myriad mutual fund owners would be thrilled to know they're funding a firm described by some as the most evil on Earth. If people are outraged about Goldman Sachs' business practices, their heads would probably explode if they knew even the half of Glencore's dirt. Fund, pension, and endowment managers and trustees should be asking themselves whether they can in good faith support Glencore's IPO, not from a socially responsible investing perspective, but from an economic one. Do they want to be left holding the bag when, after the IPO, some of Glencore's less-proud tactics and practices result in potentially enormous economic liability while insiders cash-out? (Glencore's CEO has said no partners will be selling shares in the IPO, but that does not mean they won't at some point down the road) For their part, these insiders have to be asking themselves whether some liquidity (ok, $10 billion is ALOT of liquidity!) is worth the heightened exposure and criticism. Will the firm be able to deliver such stellar results when they have not just every regulator and politician in the world breathing down their neck, but the media, as well? Perhaps investors will view Glencore no-differently than any other publicly-traded energy/commodity firm, and the concerns about the Ways of Marc Rich are entirely overblown. But on the other hand, perhaps they are not. As an investor, legal liability and the uncertainties thereof should at the very-least give one pause before piling-into the trade. Glencore may be the best in the world at what it does, and buying best-of-breed may often be a winning strategy, but investors should be extremely wary of buying into a firm with such a colorful history. Given as-yet-"recovered" credit market conditions (at least to full pre-crisis levels), and a global commodity price boom, one cannot blame Glencore management for wanting to take advantage of the opportunity to raise a not-insignificant amount of capital in the equity markets. As an investor, do you really want to be on the other side of the trade from one of the most successful trading firms in this history? Caveat Emptor.

|

| S&P500, Crude Oil, and Gold Reliant on U.S. Dollar Price Action Posted: 17 Apr 2011 05:38 AM PDT “The week that was” left many investors running for the exits on Monday and Tuesday as prices in the equity, energy, and precious metals markets plunged. The U.S. Dollar index futures tried to work their way out of a descending channel, but came up unsuccessful. The U.S. Dollar index rallied in several morning sessions, but usually was met with heavy selling later in the day which either muted gains or pushed the dollar index lower. The other notable development this week was some Fed drivel which solidified the Central Bank’s continued efforts to devalue the U.S. currency and hold short term interest rates hostage. In addition, it seems more likely with every press release from a Fed Governor that Quantitative Easing II will expire in June and Quantitative Easing III will not be pursued unless economic conditions worsen. |

| Posted: 17 Apr 2011 05:24 AM PDT Dear Jim, All this QE has devastating effects on the poor! Best, CIGA Big Tanaka, You got that right with a little help from the weather long cycle, but what created the absolute need for the Central Bank tool, QE? The answer is the international collapse and false valuation of OTC derivatives scam. If karma exists the bankers are doomed for eternity. Regards, World's Poor 'One Shock' From Crisis as Food Prices Climb, Zoellick Says World Bank President Robert Zoellick said the global economy is "one shock away" from a crisis in food supplies and prices. Zoellick estimated 44 million people have fallen into poverty due to rising food prices in the past year, and a 10 percent increase in the food price index would send 10 million more people into poverty. The United Nations FAO Food Price index jumped 25 percent last year, the second-steepest increase since at least 1991, and surged to a record in February. Food price inflation is "the biggest threat today to the world's poor," Zoellick said at a press conference following meetings of the World Bank and the International Monetary Fund. "We are one shock away from a full-blown crisis." |

| Silver Continues to Outpace Gold Posted: 17 Apr 2011 05:14 AM PDT |

| Spitzer: If The Attorney General Does Not Sue Goldman Sachs, He Should Resign Posted: 17 Apr 2011 04:58 AM PDT Now that Goldman is back in the spotlight following Carl Levin's concluding report, referring Goldman Sachs to the same law enforcement authorities that are overeager to get a job at none other than Goldman (the most recent example of which came yesterday when Bank of America which hired Gary Lynch, a former director of enforcement at the SEC, to head its legal, compliance, and regulatory relations efforts) for misleading investors and perjury, the wave of indignation at the glaringly obvious is once again back in vogue. To wit: on Friday's Andreson Cooper, Matt Taibbi and Eliot Spitzer presented their views on the fact that several years into the biggest ponzi collapse in Wall Street history, stabilized only by the Fed's pledging of trillions in taxpayer capital and the Treasury issuing like amount in debt to prevent the insolvency of Wall Street's corner offices, nobody has still gone to jail. It was actually an oddly open and forthright show. Some of the notable soundbites from the transcript: "Eliot, do you believe Goldman broke the law and lied? - Yes, I do. And I know people are going to say how can you say that as a lawyer? I have read this report. It confirms our worst fears about double dealing, lying. Goldman Sachs has zero, none, nada credibility in my book"....."Tim Geithner, treasury secretary, apparently reported in today's "New York Times" was calling people saying don't bring cases, it will unsettle the markets, so they let these guys go free. Meanwhile, he signed off on $12.9 billion to Goldman to cover a bad bet they made."....."Goldman Sachs was the number one private campaign contributor to Barack Obama's presidential election campaign. It's one of the single biggest campaign contributors to both parties in Congress"..."Anderson, before I sued, went after Merrill Lynch, which was the first case we filed many years back, I was told by their lawyer -- this is a direct quote -- "Be careful, we have powerful friends"...and the kicker: "Do you think the Justice Department will prosecute? Spitzer: If they don't, shame on them. If they don't, the Attorney General should resign if he can't bring this case." And when Holder resigns, he can go work as Goldman's newest General Counsel, the end. Hopefully, unlike last time people got angry, only to promptly lose interest in Wall Street's crimes, this time it actually leads to something. Complete program transcript: Anderson Cooper Transcripth/t MM |

| David Kostin's Latest Weekly Chartology: The S&P Downgrade Preparations Begin Posted: 17 Apr 2011 04:16 AM PDT In his latest weekly kickstart, David Kostin says: "The core aspects of our positive outlook for US stocks remain in place. However, the distribution around our base case has widened since early December following a 9% rally in the S&P 500 and elevated risk to the US economic outlook from higher oil prices and inflation. Accordingly, we have shifted our recommended sector weights closer to benchmark and adjusted our thematic trade recommendations to gain more exposure to growth markets. We (1) maintain our S&P 500 year-end 2011 price target of 1500 (+14%); (2) lower our Financials weighting to Neutral from Overweight and reduce the size of our Health Care underweight; and (3) recommend buying stocks with high BRICs sales and close our Dividend Growth and Dual Beta trades. We believe these changes are consistent with portfolio risk reduction during periods of uncertainty." Considering that this came out before Hatzius' Friday night bomb skewering Q1 GDP from 2.5% to 1.75%, we are confident Kostin will have no choice but to lower his interim S&P target, following promptly by his full year 1,500 on the S&P. After all preparations for QE3 are now in full force., only this time the brent will have $125 as a baseline instead of $70. We won't even mention gold. Kostin Kickstart 4.15 |

| $5,000 Gold: Who?s Missing From This List of Peak Price Prognosticators? Posted: 17 Apr 2011 03:53 AM PDT [B]86*Analysts Believe Gold Will Go to $5,000 – or More![/B] 126 economists, academics, gold analysts and market commentators have been identified*as maintaining*that gold will reach a parabolic peak price of at least $2,500 a troy*ounce (ozt)*before the bubble finally pops! Of those 126 prognosticators 86 – yes, 86 – believe gold*will reach a high of $5,000 ozt; 52 of those maintain that a price in excess of $5,000 ozt is more likely. It would seem it is still not too late to buy into this gold (and silver) bull run. Words: 820 MunKNEE.com Editor-in-Chief Lorimer Wilson Holding a Gold Bar Lorimer Wilson, editor of www.FinancialArticleSummariesToday.com*and *www.munKNEE.com, identifies the 126 analysts below*by name with their price projections and time* frame. Please note that this complete paragraph, and a link back to the original article*,*must be included in any article posting or re-posting to avoid copyright infringement.* Editor’s Note: If you find a name or tw... |

| Posted: 17 Apr 2011 03:51 AM PDT |

| University of Texas buys $1 billion in gold bars, takes delivery Posted: 17 Apr 2011 02:41 AM PDT "The decision to turn the fund's investment into gold bars was influenced by Kyle Bass, a Dallas hedge fund manager and member of the endowment's board," Zimmerman said at its annual meeting on April 14. Bass made $500 million on the U.S. subprime-mortgage collapse. "Central banks are printing more money than they ever have, so what's the value of money in terms of purchases of goods and services," Bass said yesterday in a telephone interview. 'I look at gold as just another currency that they can't print any more of.'" USAGOLD: True believers led the first wave; big private money globally the second. Then came the third wave led by the hedge funds. Major institutions, of which the University of Texas is among the first, will lead the fourth wave. (There are likely others). Nation states, in my view, will constitute the fifth and final wave in this bull market. Even as each arrives on board, previous wave riders still add to their holdings. All the waves — all momentum — remain at sea yet to reach a beachhead. I recall the great quote from Mr. Churchill, "Now this is not the end. It is not even the beginning of the end. But it is, perhaps, the end of the beginning." MK |

| Posted: 17 Apr 2011 02:21 AM PDT Following leaked (and confirmed) news that in March Chinese inflation came at 5.4%, the PBoC has once again decided to intervene, enacting its fourth Reserve Requirement Ratio hike of 2011. From Bloomberg: "Reserve ratios will increase a half point from April 21, the People’s Bank of China said on its website today. The move, taking the requirement to 20.5 percent for the nation’s biggest lenders, came less than two weeks after the central bank boosted benchmark interest rates. “Tightening will continue until there are signs that inflation has been effectively brought under control,” Shen Jianguang, a Hong Kong-based economist at Mizuho Securities Asia Ltd., said before today’s announcement. A surge in foreign-exchange reserves to $3 trillion last month and rebounding lending and money-supply growth have highlighted overheating risks in the fastest-growing major economy. Gross domestic product rose 9.7 percent in the first quarter from a year earlier and inflation accelerated to 5.4 percent, the most since July 2008, the statistics bureau said April 15. Inflation has exceeded the government’s 2011 target of 4 percent each month so far this year. The increase in reserve requirements was the fourth this year." Naturally, this also means that the plunge in real estate ASPs, confirmed everywhere, but most pronounced in the capital, is set to continue. This, according to JPM's Jing Ulrich, means that with real estate no longer an attractive asset bubble, the "mass affluent" Chinese will be forced to invest in gold and alternative property investments. From Dow Jones: This group "has seen its investment options sharply affected by restrictive housing measures" such as property taxes, increases in down-payment requirements, and raised interest rates, "since these households possess sufficient capital to purchase investment property, but do not have the same degree of access to investment vehicles such as private equity funds and retail property" as the super-rich, she says, adding that equities, gold and alternative property investments are therefore the key beneficiaries." Below is Goldman's take on the RRR hike:

And the full Jing Ulrich note: Ulrich On Investment Behavior |

| You are subscribed to email updates from Save Your ASSets First To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

Joe Upsidetrader had a

Joe Upsidetrader had a

No comments:

Post a Comment