Gold World News Flash |

- As Always, New Claims For Unemployment Claim the Economy Still Sucks

- The Million Dollar Drop

- “Face it, former Goldman Sachs CEO Hank Paulson, who served as US Treasury Secretary just long enough to loot taxpayers is never going to jail.”

- 14 Years Of Silver Reserves Left In This World

- The Perfect Storm in Gold

- Gold Seeker Closing Report: Gold and Silver Gain Over 1% and 3%

- Goldman Moves To Underweight On Commodities

- GoldSeek Radio interviews GATA Chairman Bill Murphy

- Did Goldman Sachs Lie?

- The End of the Road

- Chinese demand for gold ramping up as Beijing restricts Investment in Housing

- In The News Today

- SILVER STRETCH

- PREPARATION FOR THE DECLINE

- Phil Angelides Discusses America's Dual Justice System: One For Wall Street And One For Everyone Else

- Gold Standard Institute's letter focuses on infinite debt

- Fed Balance Sheet Holdings, Excess Reserves Hit New Record; Agency Prepayments Plunge

- J.S. Kim: GATA proved gold market manipulation long ago

- Is Marc Faber's Gold Valuation Rationally Optimistic Or Just Insane

- Gold Price Will Move Higher Tomorrow

- Capital Context Update: Little Ado About Something

- The 2011 Gold Quiz

- Low Hanging Fruit

- Gold finds support in China & India

- Awaiting the “Zero Hour” of Available Credit

- Citi Issues USD Warning: "Significant Downside Risk For USD And JPY If Market Begins To Price In Unsustainable Debt Risk"

- Gold futures rise as U.S. dollar weakens

- Gold Daily and Silver Weekly Charts - Gold, Silver and Stocks in a Financial Panic

- Goodbye $42...

- BRICS push for end of dollar dominance

| As Always, New Claims For Unemployment Claim the Economy Still Sucks Posted: 14 Apr 2011 06:42 PM PDT The market rallied a bit in the afternoon as rising new claims for unemployment missed analyst guesses by somewhere near a fuckton (give or take an asshair or ten), Portugal and Greece saw bond yields rocket up more than applications to LaSalle's MBA program and even more than Kate Upton on the awesomeness scale, and the US government got even closer to banging up against their fictitious debt ceiling (and it is more fictitious than the Easter Bunny, Hanukkah Harry, and Goldman Sachs' congressional testimony) that in the past 25 years has been lifted more times than Joan Rivers' face or Lisa Sparxxx's gunt. So as always, rally on Money McBags' friends because the solution to a weak (or non-existent) real recovery, to global turmoil so uncertain that it has even caused Heisenberg to roll over in his grave, and to long-term unemployment more structurally fucked than a Sarah Palin sentence, is to simply buy the dip and thank the great Bernanke in the sky for making QE a permanent part of the lexicon (and for making the US government closer to insolvency than Lenny Dykstra is, though unfortunately with fewer hookers and tobacco stains).

In macro news, new claims for unemployment rose by 27k to 412k which was just a rounding error away from analyst guesses of 380k (and a rounding error in the same way that Kathy Bates is a rounding error away from Kathy Gardiner) and signals the economic recovery may be losing steam faster than John Tyler's 1844 re-election campaign (because pissing off both parties is a worse election strategy than telling the truth, or at least more of the truth than others) or Hosni Mubarak's heart (though who knew he had one). And what Money McBags loves most about the number isn't just that it was likely the result of someone at the B(L)S forgetting to hit the goal seek function, but that the (No) Labor Department chalked it up to unusually large layoffs that happen at the end of quarters, but umm, while Money McBags is no econometrician (heck he couldn't even tell Daniel McFadden from Darren McFadden if he were given a discrete choice, and yes that was the first econometrics joke in the history of the award winning When Genius Prevailed) he is pretty sure analyst regression models should fucking account for seasonality since that is kind of the entire fucking point of a regression model. So either all of the analyst regression models suffer from some kind of spurious correlation (and correlation more spurious than thinking people buy Playboy for the articles) or the data is more made up than the Fed's mandate, so its hard to have any real confidence in the numbers.

And it's not just that the data is likely completely bogus, but in the continual "hold the shock and hope for no awe" government strategy, last week's numbers were revised up for the infinityillionth time from 382k to 385k which made last week's beat, now a miss. But of course the market cares about details about as much as the Brits now care about the Royal Bride's virginity (and Money McBags will take the over on that), so it is what it is.

In other macro news PPI was up .7%, though mostly because R Kelly was seen chugging bottles of Gatorade while telling his lady friends not to blink. Excluding food and energy, the core index rose only 0.3% which is great news for rocks who as far as Money McBags can tell are the only things that don't use food or energy to survive. Also, foreclosures dropped 27% from a year ago to their lowest level in 3 years mainly due to lenders' inability to keep foreclosing on the same homes. Actually, the drop was mostly caused by the the mortgage documentation scandal delaying many foreclosures as borrowers chant "if the documents are bogus, you can't foreclose us."

And finally, the budget remained in the news as on Wednesday night President Obama released his deficit reduction plan which was so well received by critics that it has already been nominated for a Pen/Faulkner award. Obama's plan aims to cut the deficit by $4T in 12 years through overhauling the tax code, cutting defense spending, and collecting underpants. Of course Republicans hate Obama's plan with the main differences being a lack of an overhaul of medicare and the fact that they didn't write it.

Look, Money McBags hates getting political (unless it is to support the Femen Movement, the Slut Walk, or the right to bare arms and barer breasts) but why do people give a fuck about this theater of the absurd which is more farcical than a Marx Brothers movie (where time flies like and arrow and fruit flies like a banana) or the notion of efficient markets? Seriously, it is a 12 year plan. Do you know who will be president in 12 years? Exactly. Shit, do you know who will be President in 2 years?

So this plan is completely irrelevant because it will change next year or the year after as whoever is in charge will continue to make short-term trade-offs for long-term pain because that is how you win fucking elections. Sure eventually someone will get caught holding the bag, but delaying the inevitable is more American than apple pie, pick-up trucks, and Carrie Prejean so why get so worked up about which plan is less full of shit when they both will accomplish less than Heather Mills in an ass kicking contest. And just to prove that point, the spending bill that was so fucking important last week that it threatened to shut down the government was finally passed by the House and the $38B in cuts were really only $350MM (or a year's supply of botox for Nancy Pelosi), so wake Money McBags up when either party gets serious about anything (though if you are going to wake him up, please make sure you are appropriately dressed).

Internationally, Greece's borrowing costs soared almost as high as Icarus as they rose to 18.3% which to put in perspective is the same as the rate on Stephen Baldwin's credit cards (though without the opportunity for cash back). The reason for the jump was that Germany said for the first time that Greece may need to restructure its debt and after last year's $140B bail out, any shenanigans with Greece's balance sheet could be more catastrophic to Europe than the bubonic plague or a black jean shortage. So keep an eye on Europe here, and also keep an eye on this.

The only other global news was that computer shipments fell 3.2% worldwide as earthquakes in Japan, uprisings in the Middle East, and no one having any fucking money, hindered sales. Computer shipments in Japan fell 15.9% as something called "not going outside to avoid radiation" took precedence over buying discretionary products while shipments in the US fell 10% as consumers either switched to tablets or decided not to upgrade due to the hassle of having to transfer all of their porn to a new machine.

In the market, RIMM was down after its tablet received worse reviews than "Our American Cousin" did from Mary Todd Lincoln (apparently she liked it as much as a hole in the head). Money McBags has been crapping all over RIMM for months now as like YHOO, EK, and Kourtney Kardashian, you never invest in the the second tier player when there is a clear market leader.

Also, GS was down today as Senator Carl Levin released the findings of a 2 year investigation that showed GS acted like a bunch of assshats by misleading clients and lying to congress. While Lloyd Blankfein tried to slip Levin some iocane powder and some more BS before the report came out, it doesn't really matter because the government has no interest in actually trying their own. The fact that no one at GS has been jailed for being complicit in the biggest financial meltdown of our time is more cockposterous than Taco Bell testing a taco shell made of Doritos or the Waterfall TALF Opportunity, but it's good to be King.

Money McBags has plenty more on the award winning When Genius Prevailed where he was busy today following the fall and then rise of one of his favorite small cap names which caused almost as much excitement as a Kate Upton sighting. |

| Posted: 14 Apr 2011 06:09 PM PDT |

| Posted: 14 Apr 2011 05:18 PM PDT |

| 14 Years Of Silver Reserves Left In This World Posted: 14 Apr 2011 05:12 PM PDT The Facts The following is a list of facts and reasons to switch all your Gold investments into Physical Silver: 1) Due to the tiny size of the Silver market and the lack of physical Silver available to the manipulators, the Silver battle is much easier to win than Gold. Ted Butler's discovery of massive Silver market manipulation should highlight the size, scope and importance of Silver to the current financial crisis. 2) Central banks have NO physical Silver to assist in the manipulation of the Silver market but they still have a lot of physical Gold (although much less than they claim). 3) The majority of Silver mined every year is consumed as an industrial metal in very small amounts and will never return to the market whereas the amount of above ground Gold grows year after year. 4) Silver has developed, due to its low price and superior physical properties, into a vital and necessary industrial commodity that makes it mandatory for modern life. If we woke up tomorrow and gold vanished from the face of the earth, life would continue pretty much as it was the day before. Without silver, modern life would change. 5) Due to the relative very low price of silver and very high price of gold, the man in the street, around the world, is in a position to buy silver in much greater quantities than gold. 6) In various forms there is an estimated 5B oz of above ground Gold and 5B oz of above ground Silver but Gold trades at $1400/oz and Silver trades for about $35/oz. Both metal prices are obviously manipulated but Silver appears to be manipulated more. As for Silver bullion that is "in play" for the manipulators, I estimate that less than 200M oz remain with a current market value less than $7B. 7) Silver has been in a supply deficit for over 50 years! Governments held approximately 10B oz of silver in 1950 and have been supplying that physical stock steadily into the market. Today there is no more of that surplus silver left to sell. 8) At current Silver consumption rates there are only 14 years of known Silver reserves remaining in the world. AFTER THAT SILVER WILL BE GONE FOREVER! Think about it. This posting includes an audio/video/photo media file: Download Now |

| Posted: 14 Apr 2011 04:42 PM PDT [If video is not supported by your browser, you can view with iTunes by downloading the raw file here: 20110411rt.m4v] (April 11th discussion) -- Numerous geopolitical and financial factors have converged over the past several weeks, pushing gold to all time highs and silver to 31 year highs. The debate over fiscal responsibility has begun to heat up in Washington, coming on the heels of a near government shutdown over the past weekend. Given the political headwinds to implementing the difficult policies required to make any substantive impact on budget deficits, it remains unknown if any meaningful action will be taken, or if a continuation of existing monetary policies will prove more palatable. With a government stuck squarely between "a rock and a hard place", the dollar index has fallen precipitously to within 4% of its all time low. Simultaneously, instability in the Middle East and North Africa continues to place push the price of oil higher, placing upward pressure on all co... |

| Gold Seeker Closing Report: Gold and Silver Gain Over 1% and 3% Posted: 14 Apr 2011 04:00 PM PDT Gold climbed almost $10 to $1463.79 in Asia before it fell back off in London and saw a slight loss at $1452.40 at about 7AM EST, but it then rose to a new session high of $1473.90 by early afternoon in New York and ended with a gain of 1.18%. Silver climbed to $41.38 in Asia before it fell back to $40.50 in London, but it then rose to a new session high of $41.743 by early afternoon in New York and ended with a gain of 3.45% at a new 31-year closing high. |

| Goldman Moves To Underweight On Commodities Posted: 14 Apr 2011 03:58 PM PDT Nobody could have seen this one coming: "Mounting downside risks to current exceptionally high crude oil prices are leading us to recommend an underweight allocation to commodities on a 3 to 6-month horizon, but we maintain an overweight on a 12-month horizon on tightening fundamentals over the next year....Not only are there now nascent signs of demand destruction in the United States, but also elections in Nigeria, a potential ceasefire in Libya and record market length on contagion fears. Further, softening near-term base metals balances suggest that a stock-out in copper inventories and associated price spikes has now been deferred beyond 2011, and recent gold price strength has pushed us close to our near-term price targets. As a result, we now recommend an underweight allocation to commodities on a 3 to 6-month horizon." Translation: please line up and convert your hard assets for dilutable fiat courtesy of the good folks doing god's work. GS Commodity watch |

| GoldSeek Radio interviews GATA Chairman Bill Murphy Posted: 14 Apr 2011 03:44 PM PDT 11:43p ET Thursday, April 14, 2011 Dear Friend of GATA and Gold (and Silver): As gold and silver blasted off today, GoldSeek Radio's Chris Waltzek interviewed GATA Chairman Bill Murphy for 10 minutes and you can listen to it here: http://radio.goldseek.com/nuggets/murphy04.13.11.mp3 CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Sona Drills 85.4g Gold/Ton Over 4 Metres at Elizabeth Gold Deposit, Company Press Release, October 27, 2010 VANCOUVER, British Columbia -- Sona Resources Corp. reports on five drillling holes in the third round of assay results from the recently completed drill program at its 100 percent-owned Elizabeth Gold Deposit Property in the Lillooet Mining District of southern British Columbia. Highlights from the diamond drilling include: -- Hole E10-66 intersected 17.4g gold/ton over 1.54 metres. -- Hole E10-67 intersected 96.4g gold/ton over 2.5 metres, including one assay interval of 383g of gold/ton over 0.5 metres. -- Hole E10-69 intersected 85.4g gold/ton over 4.03 metres, including one assay interval of 230g gold/ton over 1 metre. Four drill holes, E10-66 to E10-69, targeted the southwestern end of the Southwest Vein, and three of the holes have expanded the mineralized zone in that direction. The Southwest Vein gold mineralization has now been intersected over a strike length of 325 metres, with the deepest hole drilled less than 200 metres from surface. "The assay results from the Southwest Zone quartz vein continue to be extremely positive," says John P. Thompson, Sona's president and CEO. "We are expanding the Southwest Vein, and this high-grade gold mineralization remains wide open down dip and along strike to the southwest." For the company's full press release, please visit: http://sonaresources.com/_resources/news/SONA_NR19_2010.pdf Join GATA here: An Evening with Bill Murphy and James Turk Gold Rush 2011 Support GATA by purchasing gold and silver commemorative coins: https://www.amsterdamgold.eu/gata/index.asp?BiD=12 Or a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT The Gold Standard Now: It Can Work Today a dollar is worth 80 percent less than it was 40 years ago, and less than 5 percent of its value a hundred years ago. We deserve a dollar that is as good as gold, a dollar that will hold its value from year to year so we can be financially secure and our economy can generate more and better jobs. For most of America's history, our dollar was literally as good as gold. But on August 15, 1971, our politicians destroyed the link between gold and the dollar. They destroyed the foundations of our economic system. A new Internet site, TheGoldStandardNow.org, provides news and cutting-edge analysis about this most important issue and explains how the gold standard worked in the past and how it can work in the future. Visit us today: http://www.thegoldstandardnow.org/about/137-welcome-newsmax |

| Posted: 14 Apr 2011 03:44 PM PDT If you missed CNN's In The Arena on Thursday evening, then you missed the fireworks. Eliot Spitzer challenged investment banker Goldman Sachs: "Sue me. You lied to the public. You should be prosecuted" during an interview with Sen. Carl Levin, chairman of the Senate subcommittee charged with investigating the causes of the financial crisis (see interview below).

|

| Posted: 14 Apr 2011 02:52 PM PDT |

| Chinese demand for gold ramping up as Beijing restricts Investment in Housing Posted: 14 Apr 2011 02:41 PM PDT [url]http://www.traderdannorcini.blogspot.com/[/url] [url]http://www.fortwealth.com/[/url] The following report from Dow Jones is a very interesting read and provides a keen insight into another reason why Gold demand from China remains so robust. China Property Softening Fuels Gold Demand-JPMorgan Thu Apr 14 21:47:54 2011 EDT 0147 GMT [Dow Jones] The slowdown in China's property market, being directed by Beijing to rein in housing affordability issues, is driving gold demand by the country's "mass affluent", argues JP Morgan's China equities and commodities MD Jing Ulrich. This group "has seen its investment options sharply affected by restrictive housing measures" such as property taxes, increases in down-payment requirements, and raised interest rates, "since these households possess sufficient capital to purchase investment property, but do not have the same degree of access to investment vehicles such as private equity funds and retail property" as the super-rich, she says, ad... |

| Posted: 14 Apr 2011 02:36 PM PDT Dear CIGAs, Gold is going ballistic. We are on the threshold of the phenomena of 1979. Gold is getting ready to go ballistic. $1650 will fall like it did not even exist.

Jim Sinclair's Commentary Every day the fundamental reasons behind the price of gold firm up. It has become almost boring to report the new problems the dollar faces each day. $1650 is coming fast. Alf and Martin are looking quite right in their gold price objectives. Thanks for the heads up from CIGA Ursel. Dollar Status News out this morning from China shouldn't surprise any of our FutureMoneyTrends.com subscribers. The BRICS (Brazil, Russia, India, China, & South Africa) came out with a statement calling for a revamped global monetary system that relies less on the U.S. dollar. Meeting on the Chinese island of Hainan, the group agreed to establish mutual credit lines denominated in their local currencies, NOT in U.S. dollars. They also stated that the current financial crisis had exposed the inadequacies of the current monetary order (code word for dollar). The BRICS are very concerned right now about the inevitable dollar devaluation due to out of control spending and deficits in Washington. They also were frustrated with the advantages and privileges that the U.S. has controlling the reserve currency, calling for a new "broad-based international reserve currency system providing stability and certainty" in an official statement. These statements all come out just after congress and the President agreed to spend and borrow more for fiscal year 2011 then they did in 2010. If congress is to follow through on what they passed to avert a government shutdown (shutdown in name only), then the U.S. will need to borrow at least another trillion in order to get us to October. Of course the debt ceiling is currently by law set at 14.3 trillion which it's at now, so we are headed to at least 15.3 trillion within the next 6 months. Amazing isn't it, the first trillion took 204 years and the next one is projected to take 6 months. So the BRICS are starting to do transactions in their own currencies, pushing for a new reserve currency, and importing record amounts of gold and silver. Yet, more than likely we will have to suffer through more gold bubble talk from the main stream media, when in reality they should be talking about the mother of all bubbles, the dollar bubble. Mandatory Spending Doing a comparison of the year 2000 Vs. 2010, we can see that the national narrative and assessment of our current fiscal condition is fatally flawed. Lets look at the changes we have seen in the last 10 years. In the year 2000, 49.3% of Americans had jobs, we also had about the same number of non-working adults as we did children. In 2010, 45.4% of Americans had jobs, 66.8% of men had jobs (the lowest on RECORD), and the non-working adult population grew 27 million, while children under 18 grew by just 3 million. Why note non-working adults and children? Because with 77 million baby boomers, this change in demographics matters big time! Public school education costs tax payers around $10,000 a year, however a baby boomer entering their retirement years (social security & medicare) costs around $25,000 a year. Now it is important to note that the Federal Government picks up the tab for the retirees and educating a child is shared. What we are trying to point out is that when it comes to how much we are going to have to spend and borrow in order to keep up with entitlements, we have barely scratched the surface. In the year 2000, our fiscal budget was 1.8 trillion, with 197 billion going towards medicare and 232 billion going towards entitlements. By 2010, our budget nearly doubled to 3.4 trillion, medicare spending went up 128% to 451 billion, and entitlement spending went up 140% to 558 billion. Now, the first baby boomer didn't turn 65 until this year, so all of these spending increases were done before this huge wave of baby boomers began to enroll in these programs. In the last 2 years, our government has already been spending so much that just 2 years ago when President Obama took office, Medicaid spending has gone up by 50%, and as a percentage of the economy, government has gone from 35% to 44%. The advocates for taxing the rich simply don't understand economics nor our demographics. FutureMoneyTrends.com believes we will see significant changes either to our currency status or our entitlement programs in the next 5 years. If it's a currency crisis first, then by default the entitlement changes will happen. So which one will happen first? Well, let's just say at this point changes to the largest voting blocks retiree benefits is politically impossible. |

| Posted: 14 Apr 2011 02:36 PM PDT I'm starting to get the feeling that many people have now come to the conclusion that silver is bullet proof. First off let me warn you that we still haven't seen anything that looks like a daily cycle correction yet, and gold is now moving into the latter part of the timing band for that short term correction. When gold dips down into that trough silver is going to follow. Next let me show you a couple of longer term charts so you can get some idea of just how overbought this market is and how dangerous this is becoming especially this late in the cycle. In the first chart I've noted that silver has now rallied 100% above the last C-wave peak. That's much larger than any other C-wave rally. It's pretty rare to ever see an asset rally 100% above a prior peak. That alone warrants caution. I also noted that silver is currently stretched 60% above the 200 DMA, also a new all time high. I suggested in a nightly report that we could easily see a $3-$6 correction in silver once the move down into the daily cycle trough begins. I have a feeling most people at this point think that's virtually impossible. But is it really? Look at a $6 correction on that long term chart. A $6 correction is almost insignificant. It wouldn't even take silver back to the 50 DMA. A $6 correction would just be a normal pullback to test the March pivot and ease the extremely stretched conditions. I'll tell you what else a $6 correction would do. It would destroy all the over leveraged players. It would convince everyone that the silver rally is finished. And more importantly it would set silver up for the final spike higher to my expected target of $50 during the final daily cycle. Ask yourself, are you so heavily leveraged that a move back to $36-$37 would completely freak you out and knock you out of your positions? If so then maybe you need to focus on these long term charts and ease back on your leverage until gold moves down into it's cycle bottom. This late in a daily cycle and this stretched above the mean it is becoming increasingly dangerous to keep your foot to the metal (pun intended). This posting includes an audio/video/photo media file: Download Now |

| Posted: 14 Apr 2011 02:30 PM PDT Jesse with practical advice on how to be positioned for the coming decline. 14 April 2011 Gold Daily and Silver Weekly Charts – Gold, Silver and Stocks in a Financial Panic Gold is resilient, bouncing off its tentative right shoulder support. Silver is just awesome, taking no prisoners. The commodity commentary on the Bloomberg network [...] |

| Posted: 14 Apr 2011 01:56 PM PDT Lisa Murphy of Bloomberg interviewed the chairman of the now defunct FCIC, Phil Angelides to discuss the findings presented yesterday by Carl Levin. The topic was the "greased pig" that is Wall Street. The conclusion is that America now has a dual justice system: "One for ordinary people and then one for people with money and enormous wealth and power." As for crime deterrents, considering that to this day not one person has gone to prison, even an idiot can foresee what Angelides has to say on this issue: "To the extent laws were broken, we need deterrents. If someone robs a 7-11, they took $500 and they were able to settle the next day for $50 and no admission of wrongdoing, they'd knock over that 7-11 again. And we've seen time after time where people and firms have made tens, one hundreds, billions of dollars. They've settled charges for pennies on the dollar. At Citigroup for example they represented that they had $13 billion of subprime mortgage exposure when they really had $55 billion. The penalty to the chief financial officer who made $19 million that year, 2007, was $100,000. Goldman was fined $500 million but the date they settled their stock moved up $2 billion. There's been no real consequence." Too bad there is no acknowledgment that it is people like Angelides who through their corrupt behavior over the years allowed Wall Street to singlehandedly usurp the democratic process and replace it with that of a fascist corporatocracy. But that's irrelevant: at some point, sooner or later, the American peasantry will snap. Maybe not tomorrow, maybe not the day after the Apple borg hypnosis ends, and the fascination with American Idol expires, but at some point thereafter, absolutely. And the primary reason will be the glaring trampling of the tenets contained in both the Declaration of Independence and Constitution, by the kleptocratic "superclass." Then what happens when the billions of ones and zeros held in some bank vault and imparting some ephemeral monetary greatness to these people, finally is exposed for the sham it is, and they have nothing to protect them from the hordes of hungry, angry and very well armed? We can only hope they will be able to bribe their way to the top in that world order as well as they can in the current one. Somehow we doubt it.

Highlights from the Angelides interview:

|

| Gold Standard Institute's letter focuses on infinite debt Posted: 14 Apr 2011 01:40 PM PDT 9:35p ET Thursday, April 14, 2011 Dear Friend of GATA and Gold: Leading the April issue of the Gold Standard Institute's newsletter is an essay by Louis Boulanger, "False Belief No. 3: There Is a Debt Ceiling." As the U.S. debt ceiling is about to be raised for the 93rd time, Boulanger writes, it's more than a little leaky. Boulanger quotes the British economist Peter Warburton's landmark study, "Debt and Delusion," to argue that the world financial system has been built on the illusion of infinite debt. You can find the Gold Standard Institute's April letter here: http://www.goldstandardinstitute.net/GSI/wp-content/uploads/2010/06/TheG... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Sona Drills 85.4g Gold/Ton Over 4 Metres at Elizabeth Gold Deposit, Company Press Release, October 27, 2010 VANCOUVER, British Columbia -- Sona Resources Corp. reports on five drillling holes in the third round of assay results from the recently completed drill program at its 100 percent-owned Elizabeth Gold Deposit Property in the Lillooet Mining District of southern British Columbia. Highlights from the diamond drilling include: -- Hole E10-66 intersected 17.4g gold/ton over 1.54 metres. -- Hole E10-67 intersected 96.4g gold/ton over 2.5 metres, including one assay interval of 383g of gold/ton over 0.5 metres. -- Hole E10-69 intersected 85.4g gold/ton over 4.03 metres, including one assay interval of 230g gold/ton over 1 metre. Four drill holes, E10-66 to E10-69, targeted the southwestern end of the Southwest Vein, and three of the holes have expanded the mineralized zone in that direction. The Southwest Vein gold mineralization has now been intersected over a strike length of 325 metres, with the deepest hole drilled less than 200 metres from surface. "The assay results from the Southwest Zone quartz vein continue to be extremely positive," says John P. Thompson, Sona's president and CEO. "We are expanding the Southwest Vein, and this high-grade gold mineralization remains wide open down dip and along strike to the southwest." For the company's full press release, please visit: http://sonaresources.com/_resources/news/SONA_NR19_2010.pdf Join GATA here: An Evening with Bill Murphy and James Turk Gold Rush 2011 Support GATA by purchasing gold and silver commemorative coins: https://www.amsterdamgold.eu/gata/index.asp?BiD=12 Or a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT The Gold Standard Now: It Can Work Today a dollar is worth 80 percent less than it was 40 years ago, and less than 5 percent of its value a hundred years ago. We deserve a dollar that is as good as gold, a dollar that will hold its value from year to year so we can be financially secure and our economy can generate more and better jobs. For most of America's history, our dollar was literally as good as gold. But on August 15, 1971, our politicians destroyed the link between gold and the dollar. They destroyed the foundations of our economic system. A new Internet site, TheGoldStandardNow.org, provides news and cutting-edge analysis about this most important issue and explains how the gold standard worked in the past and how it can work in the future. Visit us today: http://www.thegoldstandardnow.org/about/137-welcome-newsmax |

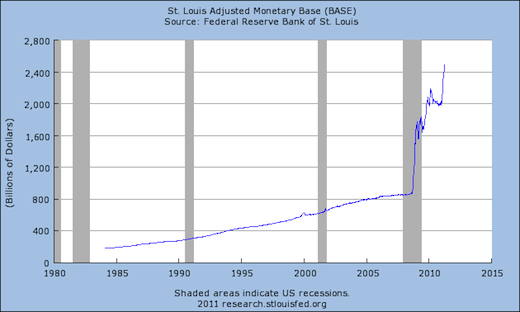

| Fed Balance Sheet Holdings, Excess Reserves Hit New Record; Agency Prepayments Plunge Posted: 14 Apr 2011 01:23 PM PDT For those confused why gold just hit a new all time high of $1,480, it may have something to with this. In the week ended April 13, the Fed's balance sheet hit a new all time record of $2.65 trillion, primarily due to an increase of $15 billion in Treasury holdings by the Fed (chart 1). Not surprising to those who have read our previous post on the matter, prepayments to the Fed have all but dried out, and for the third time in a row there were no MBS prepayments, which at $937.2 billion have declined by just $12 billion since the beginning of March: so much for magnetization demand arising from QE Lite (chart 2). Excess reserves continue to surge increasing by $29 billion in the last week. The increase at this point is more than just one accounting for the $195 billion SFP program unwind (which finished last month): should the economy really improve and banks start lending, all hell may well break loose. At this point the surge in excess reserves (liabilities) is rapidly overtaking the increase in Fed assets since the beginning of QE2 (chart 3). "Other Fed Assets" hit a fresh new ridiculous total: $125 billion, an increase of $2.5 billion over the prior week (chart 4). If this number is indeed a form of capitalized POMO commission to the PDs, then America likely has a right to know. Lastly for those still curious, the Fed's asset maturing within 1 year are $143 billion (chart 5). Putting this all together, presents the following picture: in a period during which the Fed's assets increased by $203 billion, GDP increased by about 1.5%, once all revisions are in the books. QE2 ends when Q2 ends. And so far, the economic in this quarter is without doubt starting to turn down. What will happen when there is no incremental monetization once Q3 kicks off, and GDP is about to go negative? Chart 1: total Fed balance sheet Chart 2 : weekly MBS/Agency putbacks to the Fed Chart 3: excess reserves compared to total Fed assets Chart 4: "Other Fed Assets" Chart 5: maturity distribution And a bonus chart, for the monetary purists: the money multiplier has dropped to what is probably the lowest ever.

|

| J.S. Kim: GATA proved gold market manipulation long ago Posted: 14 Apr 2011 12:39 PM PDT 8:33p ET Thursday, April 14, 2011 Dear Friend of GATA and Gold: J.S. Kim, creator of the SmartKnowledgeU investment system and publisher of The Underground Investor letter, today writes contemptuously of people who change their minds about investment issues just because of what a single prominent person says -- even if that person is as brilliant as Eric Sprott. Kim writes: "I concluded a decade ago -- after my own research and the research of industry pioneers such as GATA that contradicted the commercial investment industry stance -- that the price of gold was undeniably manipulated." Kim's commentary is headlined "One of the Dumbest Things I Have Ever Read" and you can find it at The Underground Investor here: http://www.theundergroundinvestor.com/2011/04/one-of-the-dumbest-things-... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Sona Drills 85.4g Gold/Ton Over 4 Metres at Elizabeth Gold Deposit, Company Press Release, October 27, 2010 VANCOUVER, British Columbia -- Sona Resources Corp. reports on five drillling holes in the third round of assay results from the recently completed drill program at its 100 percent-owned Elizabeth Gold Deposit Property in the Lillooet Mining District of southern British Columbia. Highlights from the diamond drilling include: -- Hole E10-66 intersected 17.4g gold/ton over 1.54 metres. -- Hole E10-67 intersected 96.4g gold/ton over 2.5 metres, including one assay interval of 383g of gold/ton over 0.5 metres. -- Hole E10-69 intersected 85.4g gold/ton over 4.03 metres, including one assay interval of 230g gold/ton over 1 metre. Four drill holes, E10-66 to E10-69, targeted the southwestern end of the Southwest Vein, and three of the holes have expanded the mineralized zone in that direction. The Southwest Vein gold mineralization has now been intersected over a strike length of 325 metres, with the deepest hole drilled less than 200 metres from surface. "The assay results from the Southwest Zone quartz vein continue to be extremely positive," says John P. Thompson, Sona's president and CEO. "We are expanding the Southwest Vein, and this high-grade gold mineralization remains wide open down dip and along strike to the southwest." For the company's full press release, please visit: http://sonaresources.com/_resources/news/SONA_NR19_2010.pdf Join GATA here: An Evening with Bill Murphy and James Turk Gold Rush 2011 Support GATA by purchasing gold and silver commemorative coins: https://www.amsterdamgold.eu/gata/index.asp?BiD=12 Or a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT The Gold Standard Now: It Can Work Today a dollar is worth 80 percent less than it was 40 years ago, and less than 5 percent of its value a hundred years ago. We deserve a dollar that is as good as gold, a dollar that will hold its value from year to year so we can be financially secure and our economy can generate more and better jobs. For most of America's history, our dollar was literally as good as gold. But on August 15, 1971, our politicians destroyed the link between gold and the dollar. They destroyed the foundations of our economic system. A new Internet site, TheGoldStandardNow.org, provides news and cutting-edge analysis about this most important issue and explains how the gold standard worked in the past and how it can work in the future. Visit us today: http://www.thegoldstandardnow.org/about/137-welcome-newsmax |

| Is Marc Faber's Gold Valuation Rationally Optimistic Or Just Insane Posted: 14 Apr 2011 12:25 PM PDT Tweet Reading time: 9 – 14 minutes The precious metals have been on a tremendous upleg as I predicted. But for the past few years I have maintained that gold and silver are about average value and sometimes a little expensive. In other words, they are no where near as cheap as they were at the beginning of this secular bull market in 1999. Then my ears perked up when I heard Marc Faber on CNBC say, "I think maybe gold is cheaper today than it was in 1999 when it was $252." Is Mr. Faber's subjective valuation of gold rationally optimistic, delusional or just plain insane?

When I am looking to buy or sell an asset, whether real estate, stock, bonds or precious metals, I generally use the 200 day moving average to determine its relative price and give a quick determination of whether it is cheap, average or expensive. On RunToGold I even have key ratios where one can easily view the DOW:gold or DOW:silver ratios based on the spot price or 200 day moving averages. I find these extremely helpful to get a quick assessment of current market ratios. Despite being extremely bullish about silver and understanding the silver backwardation implications on the silver price I have nevertheless been extremely cautious because of the overstretched 200 day moving average; based purely on technicals silver looks very expensive and due for a correction to around $30. But these are just techniques and do not get to the fundamental issues. They are only as good as their underlying premises.

Many financial professionals struggle with valuing gold. This is because traditional valuation techniques and strategies focus on discounted future cash flows, discount rates, interest rates, risk-free rates, real returns, ROI, IRR, WACCs, etc. Distilled simply they base all of their premises and conclusions on a faulty premise: The 10 year US Treasury is the risk-free rate. As a result, most people including almost all the gold bugs I know keep their balance sheets, income statements and cash flow statements using the FRN$ or Euro as the numeraire. Even among gold bugs I know it is only myself and Anthem Blanchard who seem to keep regular financial statements denominated in gold as the numeraire. The truth of the matter is that the benchmark for 'risk-free' is subjective and a decision every investor should make for themselves. What one uses for a numeraire is a completely different issue from what one should buy, sell or hold, etc. Plus, one should be acutely aware of return-free risk. Here are a few of the factors that persuaded me to use gold as my prime numeraire: 1. Gold, an element in the periodic table, is a tangible physical asset with a constant definition. 2. There are large above ground stockpiles of gold which results in low relative changes in size and those changes are largely predictable. 3. Gold is a current asset with significant financial liquidity properties. It belongs in the cash portion of the balance sheet. 4. Gold has value in itself, is not subject to counter-party risk and can never become worthless. 5. Gold has a long-term relationship with other commodities. Professor Jastram in The Golden Constant explained on page 130, As we have said, the purchasing power of gold depends on the relation of commodity prices to gold prices. A close scrutiny of this relationship over time discloses an affinity of a curiously responsive character. It could be called the 'Retrieval Phenomenon', meaning that the commodity price level may move away higher or lower, but it tends to return repeatedly to the level of gold. 6. When feeling insecure about the financial and economic conditions one can always pet their gold. Go ahead, pet your platypus.

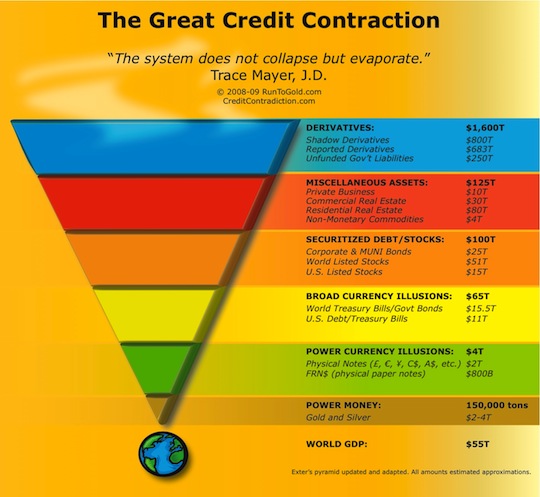

Viewing the financial and economic world through the prism of the FRN$, Euro, Yen, Pound, etc. leads to gross distortions. Due to the gold price suppression scheme one's vision is only slightly improved, and definitely not to 20/20, by viewing through the lens of gold as numeraire. But the one-eyed man is the dodgeball God when playing among the blind. To be honest, I do not really care if people disagree with how I assess value; I just kick their bum in the market and am rewarded with the purchasing power. It reminds me of what one of my banker's said about 10 months after we had closed on an acquisition, "You sure underpaid for that business." My response was, "We were buying, right?" Duh. Plus, the seller named his price so he got exactly what he wanted! In nature, atrophy is the natural order of things. The fiat currency and fractional reserve banking system has resulted in a concave financial prism that results in a financial inversion. The natural order of things would have a negative, not positive, interest rate. Perhaps most shocking when one begins to perform this initial paradigm change is to see what I like to call the inversion of interest income; store of capital expense. For example, if you have a batch of bananas or wheat you would not expect there to be more of higher quality tomorrow merely by the fact of putting them in a pile. In most cases, wealth does not just magically create and organize itself. In fact, most rational people would assume there would be less wealth because the bananas or wheat would spoil. So likewise with gold; there is a storage expense and insurance instead of earning interest. Most people forget that interest is supposed to compensate for risk which has largely been cartelized and resulted in tremendous moral hazard that will be meted out under economic law with systemic collapse. If you had 3,800 gold ounces, about $1,000,000 of value, in 2001 and wanted to store the capital until 2007 you could choose among many different tools. Let's assume you chose an interest bearing checking account and GoldMoney. The monthly store of capital expense for the bank account is about $1,500 while about $500 using GoldMoney. I should probably run the numbers to see if the fiat currency and fractional reserve banking system has gotten more expensive since 2007 but this is what Mr. Faber is asserting. CONFISCATING CERTIFICATES OF CONFISCATION THE CURRENT VALUE OF GOLD Over the past 40 years, the world economy has attempted to leave gold's orbit through the world reserve currency rocket of the FRN$ but it has ran out of fuel before reaching escape velocity and therefore been unsuccessful which has resulted in The Great Credit Contraction that has only just begun a few years ago with capital burrowing down the liquidity pyramid. The regression theorem reversed.

A tremendous portion of the liquidity pyramid, particularly with derivatives, has been created since 1999. Looking just at high-powered currency, the adjusted monetary base, relative to gold gives an interesting valuation metric. Supposedly the United States government has 261.5 million ounces of gold in Fort Knox. Despite the gold having not been audited in over 50 years and rampant corruption, inefficiency, misstatements, lies and omissions by the United States and other governments on countless topics we will assume for the sake of argument that they really do have the approximately 8,000 tons of gold.

Reasoned analysis for Mr. Faber's valuation comes into focus. As Mr. Robert Landis asserted at GATA's 2005 event, "Any rational person who continues to dispute the existence of the rig after exposure to the evidence is either in denial or is complicit." GATA asserts that central banks have only 1/2 to 1/3 of the gold they claim which would yield a ratio of $28,434. After all of the worldwide quantitative easing and competitive devaluation of the last few years what are the adjusted monetary base ratios of the ECB, Bank of England, Korea, China, Japan, etc. relative to their minuscule gold holdings? As Alan Greenspan said to the Council of Foreign Relations, "Fiat money has no place to go but gold."

For the last several years I have thought that gold and silver were about average valued based on the current market conditions and their liquidity. But after hearing Mr. Faber's assertions that gold may be cheaper now than in 1999 and analyzing the changed market conditions such as the rise of the digital gold currency GoldMoney, increased gold hypothecation via JP Morgan, tremendous increase in the adjusted monetary bases of central banks around the world, failed quantitative easing policies, the exacerbation of the Greater Depression , lack of access to knowledge and facts concerning the true state of affairs which is exemplified by Bloomberg taking the Federal Reserve to the Supreme Court and negative business and entrepreneurial environment due to increased government regulation and taxation therefore I may be changing my view on the underlying valuation of the precious metals. Despite the massive secular bull market they may actually be getting cheaper! The current metals prices may seem high in nominal terms but what is unseen is the change in fundamental value of the FRN$. I hate owning the precious metals because of the store of capital expense. I would much prefer to own a wealth generating business or real estate. But for now I will continue to buy gold, silver, platinum and palladium only because I do not see any other better alternatives and the difficulty in discerning the financial and economic landscape because of the twilight zone induced effects from quantitative easing. In other words, when the crystal ball is clouded just hunker down at the liquidity pyramid's tip. DISCLOSURES: Long physical gold, silver, platinum and palladium. Copyright © 2008. This article was published on http://www.RunToGold.com by Trace Mayer, J.D. on April 14, 2011. This feed is for personal and non-commercial use only. Applicable legal information and disclosures are available. The use of this feed on other websites may breach copyright. If this content is not in your news reader then it may make the page you are viewing an infringement of the copyright. Please inform us at legal@runtogold.com so we can determine what action, if any, to take. If you are interested in how to buy gold or silver then you may consider GoldMoney.(Digital Fingerprint: 1122aabbLittleBrotherIsWatching3344ccdd) Copyright © 2011 RunToGold.com. This Feed is for personal non-commercial use only. If you are not reading this material in your news aggregator then the site you are looking at may be guilty of copyright infringement. Please contact legal@runtogold.com so we can take legal action immediately. Plugin by Taragana Tweet RELATED POSTS: |

| Gold Price Will Move Higher Tomorrow Posted: 14 Apr 2011 11:04 AM PDT Gold Price Close Today : 1471.70 Change : 16.80 or 1.2% Silver Price Close Today : 41.661 Change : 1.426 cents or 3.5% Gold Silver Ratio Today : 35.33 Change : -0.834 or -2.3% Silver Gold Ratio Today : 0.02831 Change : 0.000653 or 2.4% Platinum Price Close Today : 1795.60 Change : 23.10 or 1.3% Palladium Price Close Today : 773.05 Change : 9.95 or 1.3% S&P 500 : 1,314.52 Change : 0.11 or 0.0% Dow In GOLD$ : $172.56 Change : $ (1.77) or -1.0% Dow in GOLD oz : 8.348 Change : -0.086 or -1.0% Dow in SILVER oz : 294.88 Change : 0.24 or 0.1% Dow Industrial : 12,285.15 Change : 14.16 or 0.1% US Dollar Index : 74.69 Change : -0.291 or -0.4% I don't get paid to worry, but I worry anyway. The GOLD PRICE performed splendidly today. By the time Comex locked the door gold had added $16.80 to close at $1,471.70. So what am I worrying about? That is a fine first step to resuming a rally, but reached only the last high close at $1,473.40. What if it's a double top, made specially to confound and mislead me? If the rally is resuming, gold tomorrow will jump through $1,475.00, and must not fall below $1,455. I will commit myself: gold will move higher tomorrow. There's too much steam under this move, BICBW. The SILVER PRICE rose a jaw-dropping 3.4% today, up 142.6c to 4166.1. High came at 4219c. This makes a new high close for silver and a new low for the gold/silver ratio at 35.326. Okay, I confess this is wilder than I can handle, stronger than a garlic milkshake, and I haven't the least clue how long it will run or where it will reach. Clearly gold should clear $1,500 and rise further. Silver might reach 4400c or 4600c, there simply are no yardsticks to measure this move. Sorry. However, the peak season is upon us and surely they will both have peaked and slowed down by mid or end May. Surely, BICBW. Underlying all my thoughts is the conviction (there's a dangerous word) that this rally will power ahead substantially, and that today's closes do not constitute a double top in gold. Tomorrow will immediately and directly inform us, because if that gold drops below $1,455, the buying panic will become a selling panic. Ain't this fun? Watching the US DOLLAR today was like watching racing snails darting around the track. It keeps on creeping lower. Ladies and Gentlemen, 'tis not force majeure of the market driving it lower, 'tis the rotten Fed and the administration letting it fall lower. At 74.689 (down 29.1 basis points this day) the dollar stands smack on its last low. Once again today it tried to rally, actually reached higher than yesterday, (75.15 against 75.10), but again collapsed as yesterday. Time to fish or cut bait: dollar holds here or sinks to 74, then 70.70. Face it: the administration and the Fed are depreciating your wealth and your currency to solve problems they created. Clever idea, balancing their mistakes on your back, Mushrooms. Euro has struck a roadblock at 1,450. Uptrend is unbroken. Stands now at 1.4489. Yen penetrated its 200 DMA heading upward and now stands at Y83.44/$ (118.94c/Y100). Looks like the Nice Government Men in Japan drove it down a bit too far. And if you tire of the snail race in the US dollar, move on over to the STOCK track. The mighty Dow rose 14.16 points to 12,285.15. The S&P500 -- that's the one with the lightning bolts painted on its shell -- gained 0.11 to 1,314.52. Basically that's about as much as a rounding error. Stocks traded below the waterline all day, and only jumped up at day's end. Whoa! Whose fingerprints are those? Could they belong to the NGM? On this day in 1912 the passenger liner Titanic, on its maiden voyage, hit an iceberg and began to sink. Widely advertised as unsinkable thanks to its advanced engineering, it sank anyway, taking 1,517 lives to the bottom. 700 survived. So much for trusting technology. On this day in 1995 Burl Ives died. Y'all are probably too young to remember him, but he acted in hundreds of movies, usually with his guitar in hand. He was almost always fun. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com Phone: (888) 218-9226 or (931) 766-6066 © 2011, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate in a bubble, primary trend way down. Whenever I write "Stay out of stocks" readers inevitably ask, "Do you mean precious metals mining stocks, too?" No, I don't. |

| Capital Context Update: Little Ado About Something Posted: 14 Apr 2011 11:03 AM PDT From Capital Context  Volume rose dramatically Another interesting day where headline performance comments will mask what was really going on under the covers. The S&P 500 managed a small gain on the day as did IG (investment grade) and HY (high yield) credit spreads at the index level as VIX reached its lowest since 2/18 - all good right? We hate to burst this bubble of ebulience, and we do note that what positives there were at the index level were minute anyway, but bottom-up painted a very different picture in credit and vol land and as the chart opposite shows, equity volume dried up as we rallied back to the green line. An 'orrible morning in Europe (discussed in the Midday Movers ) combined with a decent miss on jobless claims and hotter than expected core PPI sent us on a path lower pre-open today in S&P futures and both IG and HY credit was gapping up to two-week wides. Within an hour of the open, there was a bid to the market and while credit was not playing the game out of the gate (like stocks were), it too got caught up and indices slipped tighter - ending very modestly tighter on the day as S&P futures closed with a late day languish into the red. We have discussed how secondary bonds have been showing less systemic buying recently and have noted that the major liquid credit derivative indices have been underperforming suggesting macro overlays being laid out (protecting gains on considerably less liquid underlying bond/credit portfolios with a more generic liquid hedge). Today saw considerable underperformance among individual credits relative to the indices and we suspect the unwind of idiosyncratic longs and systemic short hedges (taking off the macro hedge piece by piece as you cover your underlying longs) has started to occur. There were seven wideners to every tightener today in credit markets and while moves in general were not large (aside from the idiosyncratic names we discuss below), they were under pressure all day - not compressing from the open like the indices did. Dispersion rose once again and the up-in-quality theme continues. We find it fascinating that the pop in PPI which caused TSY yields (caused or was coincident with) to increase helped the 2s10s30s butterfly, that we have been keeping an eye on, to increase. This increase seemed to provide the juice for the rise in equities today and as you can see in the chart opposite - the tick-for-tick moves in the last few days (a new regime from the previous few months) is very notable. We also note that GC repo popped 10bps today from very low levels in overnight - did anyone hear the Fed doing reverse repos? Anyway, TSY yields were all higher today 2s10s steepening and 10s30s flattening (as auction fever hit once again at the long end). Silver made new highs (above $42) and gold egded close as the Dollar (in it all its guises vs Majors, Asian FX and Trade-weighted) lost ground and DXY is getting very close now to the 2009 lows.  A mixed picture contextually Contextually , credit and vol were much clearer about their directional view today (deteriorating) than stocks (mixed) . Financials saw modest vol compression but the rest saw vol increase on average at the sector level. Tech, Energy, and Media were the worst (risk-adjusted) performers in credit while Financials and Media were worst on average in stock land (risk-adjusted). Interestingly equity outperformed credit (divergently - as in equity rose and credit widened on average) in Basic Materials, Consumer Noncyclicals, Energy, Healthcare, Tech, Telecoms, and Utilities and the fact that Utes and noncyclicals were the best risk-adjusted performers in stock land suggest less rotation out of stocks and more rotation across sectors today. Similar to our midday update, implied vol followed credit topday witgh the better quality names (rated A and above) seeing modest spread compression and vol decreases while lower quality (rated BB- and below) saw vol increases and spread decompression. The picture in stocks was mixed though lower quality names did underperform. DYN, EK, HOV, HON, and THC saw the largest (risk-adjusted) deterioration in credit today and SVU, TE, MCD, DTE, and SO were the best risk-adjusted performers. DYN, SVU, and EK were once again at the top of the list of divergences (credit considerably underperforming equity on a risk-adjusted basis) while Shaw Communications, HAS, DELL, and HSP were the most divergent witth compression in spreads and drops in stock prices (basis adjusted). The divergences in that direction (credit favorable, equity unfavorable) were dominated by releveraging names (or event risk prone names) - LBO/M&A premium coming out? The Bottom Line for us is that we feel an escalation of some derisking is occuring in credit and we would remain comfortably hedged in any long equity position (in fact our TAA model has started to drop the weighting to equities recently). Many of the themes and suggested trades of recent weeks are starting to gather pace - though nothing startling yet - but under-currents in credit (and vol surfaces) suggest more than the simple close-to-close unches in equity markets is underway. Index/Intrinsics Changes Spreads were mixed in the US with IG tighter, HVOL wider, ExHVOL better, and HY rallying. IG trades 3.5bps wide (cheap) to its 50d moving average, which is a Z-Score of 1.1s.d.. At 94.52bps, IG has closed tighter on 141 days in the last 589 trading days (JAN09). The last five days have seen IG flat to its 50d moving average. HY trades 17.7bps wide (cheap) to its 50d moving average, which is a Z-Score of 1.1s.d. and at 442.74bps, HY has closed tighter on 60 days in the last 589 trading days (JAN09). Indices generally outperformed intrinsics with skews mostly narrower. Comparing the relative HY and IG moves to their 50-day rolling beta, we see that HY outperformed by around 0.4bps. Interestingly, based on short-run empirical betas between IG, HY, and the S&P, stocks underperformed HY by an equivalent 1bps, and stocks underperformed IG by an equivalent 0.1bps - (implying IG outperformed HY (on an equity-adjusted basis)). Among the HY names in the US , the worst performing names (on a DV01-adjusted basis) were PMI Group Inc/The (+64.47bps) [+0.53bps], Radian Group Inc (+39.74bps) [+0.36bps], and Eastman Kodak Co. (+34.52bps) [+0.28bps], and the best performing names were Energy Future Holdings Corp. (-108.34bps) [-0.73bps], Supervalu Inc. (-52.84bps) [-0.49bps], and Alcatel-Lucent USA Inc. (-15bps) [-0.15bps] // (absolute spread chg) [HY index impact]. Among the IG names in the US , the worst performing names (on a DV01-adjusted basis) were SLM Corp (+6.96bps) [+0.05bps], Expedia, Inc. (+3.79bps) [+0.03bps], and RR Donnelley & Sons Company (+3.71bps) [+0.03bps], and the best performing names were CA, Inc. (-1.5bps) [-0.01bps], Sara Lee Corp. (-1.02bps) [-0.01bps], and General Mills Inc. (-0.75bps) [-0.01bps] // (absolute spread chg) [HY index impact]. |

| Posted: 14 Apr 2011 10:13 AM PDT syndicate: 1 Author: Vedran Vuk Synopsis: How much do you know about gold? Jeff Clark challenges you to test your knowledge. Also in this edition: Gold – the performing commodity; and, three ideas killed in the 2008 crash. Dear Reader, Even as the dust was settling from the 2008 crash, innumerable commentators were already proclaiming the death of capitalism. Well, nearly three years later, capitalism is still around in one form, and socialism's resurgence failed to produce the growth it promised. The trillion-dollar bailouts and stimulus plans have still not resurrected the economy. Yet, far fewer articles proclaim the death of government intervention. Such is life… But that doesn't mean some lines of thought haven't completely changed. So, I made a list of three ideas killed or severely wounded in the crash.... |

| Posted: 14 Apr 2011 10:13 AM PDT The 5 min. Forecast April 14, 2011 12:11 PM by Addison Wiggin – April 14, 2011 [LIST] [*]Hysteria, a host of sarcasm and gold forecasts… $1,550 inside a month and $1,600 before year-end… mild by comparison… [*]"Low-hanging fruit" for gold miners in Colombia: Frank Holmes identifies what makes the country so attractive, and Chris Mayer sorts out 40 miners working the country [*]"Margin squeeze" shows up big in latest wholesale price numbers… [*]Last week's budget deal? Turns out MORE than meets the eye… Plus, an amusing letter we had forgotten we'd received from the president… [/LIST] "Are you guys asleep at the wheel?!" writes a reader. "The main thing you seem to want to write about is 'Is gold in a bubble?' Who gives a hoot? [We don't usually start the 5 this way, but today it seems appropriate.] "Hezbollah (read Iran) in alliance with the Mexican drug cartels is on America's doo... |

| Gold finds support in China & India Posted: 14 Apr 2011 10:01 AM PDT by Shivom Seth … Zhou Ming, deputy head of ICBC's precious metals department was quoted as saying that China's largest bank had sold nearly 250,000 ounces of physical gold in January 2011, which was equivalent of 50% of all the bullion ICBC [the world's largest bank by market value] sold last year. … That is not to say that India is lagging behind. … Paul Walker, chief executive officer of GFMS reportedly said that in India, a huge amount of demand is a cultural and social imperative. In China, on the other hand, the imperative around weddings is not that strong, he said. India's total demand exceeded China's by 383.5 tonnes last year, narrowing from 496.5 tonnes in 2001, the GMFS data has shown. The report has also noted a growing shift toward physical gold by small investors, all of which will ensure that investment in the precious metal will be more solid in the coming months and less prone to short-term selloffs. [source] |

| Awaiting the “Zero Hour” of Available Credit Posted: 14 Apr 2011 10:00 AM PDT I watch expectantly as the national debt again nears the debt limit, and Zero Hour is just a few weeks away, a term I cleverly used to indicate that available credit will be zero. Maxed out. I let it go at that, as I am not inebriated enough to get up on my high horse to loudly and rudely note that nobody in the corrupt government (including the Federal Reserve) apparently needs any stinking permission from anybody to do anything anymore, including any number or frauds and corruptions, to keep the government wallowing in the oceans of cash it so desperately, desperately needs to keep, you know, wallowing. Of course, my own Zero Hour is fast approaching, too, as the pitifully few dollars that I was able to extricate from my wife's purse without her catching me are almost gone, which turned out to be too few to get me drunk enough to do any serious pontificating about the horrors of the Federal Reserve creating so much money, so that the government can spend so much money, that creates so much inflation in prices everywhere and so much corruption everywhere, too. I have perhaps struck a chord in Peter Schiff of Euro Pacific Capital, who notes that "Very few people have either the time or patience to sift through the data released by the Treasury Department in the wake of its bond auctions. But the numbers do provide direct evidence of the country's current financial condition that in many ways mirror a financial shell game that typifies our entire economy." And the reason is, I figure, because of the bloated, malignant nature of the economy itself, as Grandfather-Economic-Report.com notes, with ill-concealed horror, that "51% of the economy now depends on government spending," while another chart, labeled, "Relative Share of Economy Prior to 1930," shows the government's share of the economy back then was only 12%. In 1947, a mere two years after the gigantic wartime command-economy of WWII, it was 22%. Noticing that many of you are drifting off out of boredom, I decide to add a little drama to my presentation by using the eye-catching cinematic technique of dropping the pages of a calendar, one by one, letting them fall into a disgusting, dirty toilet, now stuffed to overflowing with old calendar pages, both as a way of indicating the passage of time and as a rude commentary on the stinking life that you have to lead, day after day, year after year, because you always need more and more money to always pay the higher and higher prices for the things you buy, thanks to the evil Federal Reserve creating so much money that price inflation is ever-present and ever-irksome, to say the least. Fortunately, there is a point to this "falling of the calendar pages" thing other than, for some reason, a stinking, dirty toilet that is very childish of me. Then you realize that the last page of the calendar to fall was the page for yesterday, meaning that today is today, where the government's share of the economy is a massive 51%! And I don't know if the Grandfather Report shows it somewhere on its massive site, but another Mogambo Economic Horror (MEH) is that 5 out of 10 – half! – of the employees in America work either for a local, state or federal government, or for the education system, or for a tax-supported private agency, or work for a non-profit organization. Half! "So," you may be asking yourself as I continually ask myself, "who in the hell is left to pay taxes to the government out of profits, when half of all employees in the Whole Freaking Country (WFC) make no profit at all, and who must get it from those who do earn a profit, and/or solicit charitable donations, which is, in essence, asking people to tax themselves?" Unfortunately, I have no answer that does not involve screaming obscenities at the Federal Reserve and summarizing the horror as, "We're Freaking Doomed (WFD)!" Fortunately, there is an easy answer to the question, "What in the hell can we do to save our butts from the horrible inflation that is guaranteed by the massive over-creation of money by the evil Federal Reserve to feed a fat, bloated, corrupt Congress and their myriad social engineering programs that are half the economy?" And the answer is, obviously, "Buy gold and silver under those circumstances," as the entire history of mankind shows that they do Very, Very Well (VVW) when the morons in control of the government and/or the banks are creating excessive amounts of fiat money to attempt to bail themselves out of bankruptcy. Since nothing can be easier than simply buying gold and silver when the money is being abused, perhaps that is why I say, "Whee! This investing stuff is easy!" The Mogambo Guru Awaiting the "Zero Hour" of Available Credit originally appeared in the Daily Reckoning. The Daily Reckoning recently featured articles on stagflation, best libertarian books, and QE2 . |

| Posted: 14 Apr 2011 09:49 AM PDT As anyone who has been following the VIX, US CDS (which is quite interesting as the US catastrophe trade appears to have become selling CDS to fund gold purchases in euros: more on that eventually), or stock markets in general has grown to appreciate all too well, no matter the amount of perceived risks, the market continues to shrug off any bad news: after all, the Bernanke put means that the greater the systemic shock, the higher the likelihood that the Fed will get involved yet again and push up all risk assets. However, the same can not be said about the dollar. The currency which in 2011 has traded like anything but the world's reserve currency is less than 1 point away from 2009 lows. But that could be just the beginning. Citi's head of FX has released a not warning about the potential coming avalanche to the greenback should debt ceiling negotiations hit a snag: "what we are looking at here is very much the tail risk event that the debt ceiling negotiations unexpectedly hit an impasse. The question is what the impact would be on USD." Englander's summary observations: 1) The USD will be in big trouble if investors get the sense that the debt ceiling negotiations have gone beyond the expected choreography into a zone where there is perceived risk to US credit; 2) More broadly, we think FX markets are increasing the attention they pay to fiscal sustainability relative to monetary policy; 3) The FX response may be non-linear so G10 countries may have a false sense of security in seeing little FX response to deterioration so far. Then again, perhaps a major step down in the dollar is precisely what the Fed wants... Englander's summary view:

Full note: The USD dodged the 2011 budget bullet last weekend and is now facing the debt ceiling cannonball. Although the debt ceiling is not normally considered a tool by which fiscal consolidation is achieved, it seems likely that there will be a fair amount of brinkmanship before the debt ceiling is raised. Investors and most economists expect political posturing as the debt ceiling debate drags on through late May and June, but no event that affects perceptions of US credit quality. So far US yields are showing no pressure and US CDS is trading well within the range of the last 15 months. So what we are looking at here is very much the tail risk event that the debt ceiling negotiations unexpectedly hit an impasse. The question is what the impact would be on USD. Below we present a cross-section analysis across more than 30 major currencies on what impact a deterioration in credit has on the currency. The analysis covers the period September 2009 to the present – September 2009 was the trough in spreads between financial crisis related sovereign credit concerns and the European sovereign credit blow-up, so it gives us a good base for comparison. We find a surprisingly strong impact of credit deterioration on currencies. A 100bps increase in CDS has been associated with 8% currency weakness over this period, but we also find that countries that started the episode with higher CDS tended to fall more or appreciate less than others. Having a September 2009 CDS level 100bps higher in the cross-section is associated with 7% less subsequent appreciation, given no further CDS deterioration. Hence poor credit seems to represent a headwind to appreciation beyond any additional deterioration. We have three takeaways from this. 1) The USD will be in big trouble if investors get the sense that the debt ceiling negotiations have gone beyond the expected choreography into a zone where there is perceived risk to US credit; 2) More broadly, we think FX markets are increasing the attention they pay to fiscal sustainability relative to monetary policy; 3) The FX response may be non-linear so G10 countries may have a false sense of security in seeing little FX response to deterioration so far. The debt ceiling negotiations We have little to add on the debt ceiling negotiations except to reiterate that there is very little evident concern in either FX or FI markets. Both 10- and 30-year yields are in the year’s range, the 30-year Treasury auction on April 14 was very well received and there is no stress evident on CDS. Last weeks budget negotiations probably had a small negative impact on USD, and the concern about the process is a lingering negative, but the impact of any concrete debt ceiling risks would be much higher. Impact of credit deterioration We regress the Sep 2009 to April 2011 change in the value of 33 currencies against the beginning level of their sovereign CDS and the change in the sovereign CDS, the correlation of the currency with the S&P and a dummy to distinguish between G10 and non-G10 currencies. The strongest association by far is with the CDS variables. The results imply that a currency with a 100bp higher CDS in Sep 2009 tended to appreciate about 8% less through Apr 2011, even if the CDS did not move, while a currency with its sovereign CDS rising by 100bps tended to appreciate about 9% less. (We ran our regressions using USD as a base but in a cross-section regression the base currency does not matter.) The measure of riskiness that we used, the correlation with the S&P, was marginally significant, indicating that over this long period, the CDS coefficient did not reflect the appetite for risk to any great degree. Being in the G10 had a modest negative effect and being heavily correlated with risk had a marginally significant positive effect but they did not affect the coefficients or results greatly. Figure 1 presents the actual currency changes as well the changes predicted by the model specified above. For such a simple equation it explains a fair amount of the currency variation. Most importantly for the USD it seems to have quite a bit of explanatory power for the currencies that have performed the poorest versus those that have performed the best. In some regressions we included levels and changes in swap spreads, but these did not seem to provide significant additional explanatory power. We did not include the EUR in our regression since the combination of national sovereign risks was not necessarily linear. However, we did calculate a debt weighted average of CDS and CDS changes and used the estimated coefficients to get an estimated EUR impact. Interestingly the actual change in the EUR very much matched the predicted and the 96bp increase in debt-weighted CDS suggests that the EUR would be about 8% (11 big figures) higher had the EUR sovereign CDS retained their September 2009 level. That would explain much of the deterioration in EURXXX crosses against commodity and other risk-correlated currencies. Visually we observe that the currency effect seems to become significantly larger when the CDS level was above about 90bp. Moreover the currency impact seems to kick in as soon as there is any deterioration. We do not want to emphasize this, but it comes back to the risk that there is a false security in having seen no effects till now. Conclusion This provides preliminary indication that FX markets have come to focus on debt and creditworthiness in addition to the standard macro variables. It suggests both potential upside for the EUR and other currencies that get their sovereign debt situation under control and significant downside for USD and JPY if markets ever begin to price in concrete risk that debt will become unsustainable.

|

| Gold futures rise as U.S. dollar weakens Posted: 14 Apr 2011 09:01 AM PDT By Myra P. Saefong and Claudia Assis Gold for June delivery added $16.80, or 1.2%, to $1,472.40 an ounce on the Comex division of the New York Mercantile Exchange, less than $2 from its April 8 settlement record. "For the time being, the traditional inverse relationship between the dollar and bullion is back in play with the prospect of wider [U.S./European Union] rate differentials set to provide further upside momentum to gold and silver," analysts at TheBullionDesk.com said in a note to clients. … A weaker dollar is beneficial for commodities in general, but greenback weakness plays an even more significant part in gold trading, as the metal often trades on concerns about currency debasement. [source] |

| Gold Daily and Silver Weekly Charts - Gold, Silver and Stocks in a Financial Panic Posted: 14 Apr 2011 08:14 AM PDT |

| Posted: 14 Apr 2011 08:10 AM PDT |

| BRICS push for end of dollar dominance Posted: 14 Apr 2011 07:53 AM PDT 4/15/2011 (Reuters) SANYA, CHINA — The BRICS group of emerging-market powers kept up the pressure on Thursday for a revamped global monetary system that relies less on the dollar and for a louder voice in international financial institutions. The leaders of Brazil, Russia, India, China and South Africa also called for stronger regulation of commodity derivatives to dampen excessive volatility in food and energy prices, which they said posed new risks for the recovery of the world economy. Meeting on the southern Chinese island of Hainan, they said the recent financial crisis had exposed the inadequacies of the current monetary order, which has the dollar as its linchpin.