Gold World News Flash |

- Gold Seeker Closing Report: Gold and Silver Fall About 1%

- Bargains on the Horizon for the Patient Vulture

- Terminal debt velocity approaching

- In The News Today

- Gold Price Must Close Higher Tomorrow and Step Out Smartly to a New High to Contradict that Key Reversal

- Living Well on Gold and Silver

- Goldman Goes For The Trifecta: Lowers 2011 Copper Price Target From $11,000 To $9,800/mt; Gold, Silver Next?

- Capital Context Update: Natural Normalization

- Gold seen safer than govt. bonds in survey of central bank reserve managers

- Here is Why Zero Hedge is Wrong!

- Gold Nears Former Resistance at 1441

- Is the US Housing Market Making a Comeback?

- Bullish or bearish on precious metals…

- The War on Money

- Hourly Action In Gold From Trader Dan

- Unrest in the Middle East: Oil Hits 32-Month High

- Gold and the CCCP Trade

- Gold to average $1,500 in 2011

- Why the World’s Largest Bond Fund is Now Shorting Treasuries

- Van Hoisington Eviscerates QE2: Full Q1 Review And Outlook

- Gold falls 1% as oil drops sharply

- “Since you have become the undisputed silver guru – thought you might find this interesting – a quick blast on my take on the silver market action over the past couple of days.”

- Gold Daily and Silver Weekly Charts

- Is The Budget Deal On The Verge Of Collapsing?

- More Anectdotal Evidence That The Fed Printing Will Not End With QE2

- Gallup Economic Confidence Index Plummets To August 2010 Level As Poverty Effect Laps Wealth Effect

- Keep Buying the Precious Metals Bull Market

- What Does a Breakout in Euro Mean for Gold Investors?

- Wives Of Morgan Stanley Receives 200 Million Dollars From Federal Reserve!

- Global Growth Questioned as Japan Raises Nuclear Severity

| Gold Seeker Closing Report: Gold and Silver Fall About 1% Posted: 12 Apr 2011 04:00 PM PDT Gold reversed overnight losses and rose to see a $0.59 gain at $1467.29 by about 9AM EST before it dropped back down to as low as $1444.08 by midmorning in New York, but it then bounced back higher in late trade and ended with a loss of just 0.93%. Silver climbed to as high as $40.878 before it dropped to as low as $39.72 and then also bounced back higher in late trade, but it still ended with a loss of 1.33%. |

| Bargains on the Horizon for the Patient Vulture Posted: 12 Apr 2011 03:04 PM PDT HOUSTON – We have received a fair bit of mail since we Vultures began building our Bargain War Chest (BWC - raising cash by reducing size in the small resource companies we have accumulated, getting to Free Shares wherever possible or selling down to Trophy Shares where possible). We began building that BWC late in 2010, stepped up the pace in January and completed the BWC in March. ... |

| Terminal debt velocity approaching Posted: 12 Apr 2011 02:41 PM PDT |

| Posted: 12 Apr 2011 01:58 PM PDT My Dear Friends, How many times have we seen days like today before? The gold banks play their games on the back of the Fed Hawk Talk which is just that, talk. Gold is going to take out $1521 after a lot of drama. The die is cast. QE has done its job. Currency induced cost push inflation is already here. Keep your eye on the ball, stop resisting and let the future play out. Regards,

Jim Sinclair's Commentary Here is John Williams' update for today. If you haven't already, subscribe to his essential service. - Near-Term Hyperinflation Risk Continues to Progress "No. 362: Trade, Liquidity, Hyperinflation Watch"

Jim Sinclair's Commentary The dawn of democracy? What are you smoking? Egyptian soldiers attack Tahrir Square protesters Egypt's deepening political crisis following the ousting of President Hosni Mubarak has taken a dangerous new turn after soldiers armed with clubs and rifles stormed protesters occupying Cairo's Tahrir Square in a pre-dawn raid, killing at least two. The demonstrators, angry at the slow progress of reform since the country's 18-day revolution earlier this year, had been demanding the trial of Mubarak, his son Gamal and close associates, and an immediate transition from military to civilian rule. The rally revealed the increasing impatience and mistrust that many Egyptians feel towards the military, which took over when Mubarak was forced out of office on 11 February. Some protesters accuse the top brass of protecting the former leader. Eyewitnesses who spoke to the Observer – accounts confirmed by graphic video footage – described hundreds of troops charging into the square firing rubber bullets at 3am on Saturday to clear it. The assault appears to have been triggered by the decision of several dozen Egyptian soldiers on Friday to defy orders and join a protest in the square to call for the removal of Field Marshal Mohammed Hussein Tantawi, who is titular head of the country. |

| Posted: 12 Apr 2011 01:19 PM PDT Gold Price Close Today : 1242.00 Change : 3.80 or 0.3% Silver Price Close Today : 18.594 Change : (0.084) cents or -0.4% Gold Silver Ratio Today : 66.80 Change : 0.504 or 0.8% Silver Gold Ratio Today : 0.01497 Change : -0.000114 or -0.8% Platinum Price Close Today : 1541.50 Change : -240.00 or -13.5% Palladium Price Close Today : 452.00 Change : -321.75 or -41.6% S&P 500 : 1,041.24 Change : -33.33 or -3.1% Dow In GOLD$ : $164.28 Change : $ (4.97) or -2.9% Dow in GOLD oz : 7.947 Change : -0.240 or -2.9% Dow in SILVER oz : 530.83 Change : -14.40 or -2.6% Dow Industrial : 9,870.30 Change : -268.22 or -2.6% US Dollar Index : 86.13 Change : 0.479 or 0.6% Today is Miss Susan's birthday, so I'll have to make this quick. She wanted to cook her own birthday supper for the whole family, but a daughter and daughter-in-law vetoed that. Coincidentally, on this day 150 years ago began the First War for Southern Independence. 'Twas an odd day, and you'll wear out your fingers and your patience scrabbling around for invisible reasons behind baffling contradictions. The DOLLAR INDEX remains in its wallow, but is clearly studying wallowing lower. After an overnight high at 75.20, the dollar wallowed deeper and deeper into the mud. Today's 74.704 low was lower still than Friday's. Both the failure to breach 75.20 and the edgey lower low forecast more wallowing to come, and a lot lower dollar. Meanwhile wrap -- nay, TRY to wrap -- your understanding around this little paradox. Bond values vary inversely with bond yields. A $1,000 bond due in a year that pays 10% interest is worth less than the same bond that pays 5% interest. Yet today the dollar sinks, reflecting a shrinking value and, one might conclude, a shrinking BOND value, since the 30 year US treasury bond is denominated in US dollars. Conclude again: today the 30 yr bond rose 0.71%, gapping up, while the yield fell. That also implies the market is expecting interest rates to fall and the US dollar to rise. Gives me a headache merely to look upon these charts. Meanwhile the euro, scrofulous jury-rigged currency of the cobbled-up European Union whose members boast 3 bankrupt countries and another 3 or four bankruptcy candidates, ROSE today to a new high for the move, 1.4474. And the yen jumped to 83.561Y/$ (119.67c/100Y). Some say that central banking is the best practical argument for the necessity of hell. I remain neutral on that point. STOCKS took a bad whipping with a big stick. Dow lost nearly 1% or 117.53 points to 12,263.58 and the S&P500 followed right along, losing 10.3 points to close at 1,314.16. Now I'm just a natural born fool from Tennessee, and not slick and smart like them Wall Street fellows with the shiny, pointy shoes (New York Fence Climbers, we call 'em), but if I were painting a chart that had made a double top and rolled over, it would strongly resemble the Dow chart. Today's plunge fractured support above 12,300, and dropped toward the 20 day moving average (12,198), first warning of a trend change. 50 DMA lieth not far removed, a close 12,170. Another drunken day like today sends the Dow slicing through both of them and leaves Wall Street investing geniuses with a tolerable lot of explaining to do. Stocks remain the Lucretia Borgia 2008 merlot at the Great Wine Bar of Investing. The GOLD PRICE followed through on the downside today, losing 14.50 to end at $1,452.90 on Comex. Behold, this is good, and this is bad! Good, in that it fell not through $1,445 but made a low at only $1,446.30 and closed above $1,450. Bad, in that it could not close through $1,455 resistance. Break the rules only at the risk of breaking your own neck. The four words an investor is most likely to hear shortly before he loses copious sums are, "It's different this time." It rarely is, hence why although gold "feels" much stronger, I confess that today's close contributes the second and final nail of a key reversal. Yesterday the break into new high territory with a lower close for the day, followed by a lower close today. Unless gainsaid by higher, much higher, closes, gold will trade earthward for a time. Yet recall that the upward trading channel will contain gold all the way down to $1,430, so without a close below that level 'twill not seriously cheapen gold. Up above the gold price would have to close higher tomorrow and step out smartly to a new high to contradict that key reversal. Friends, looks like the market's handing y'all a wonderful buying opportunity. SILVER, like gold, attempted a rally to 4085c but failed. Today's low came about where yesterday's appeared, 3966c, and Comex closed above 4000c at 4005.8c, but that still meant losing 54.6c. Here's one possibility: silver made its first corrective wave yesterday, rallied in the B-wave today, and tomorrow will complete the last down wave. However, it cannot fall below 3900c. If it does, then more downside lies in its future. Notice that the gold/silver ratio barely rose today, to 36.270. I am neither bold enough nor foolhardy enough to call Monday the high for this move in silver and gold. If that is true, few witnesses have yet come forward. Difficulty is that silver is working in what appears to be a wild third wave up, in territory not traversed since 1981. Tricky to discern whether silver will yet reach for 4400c or 4600c, or a stout correction has begun. It goes without saying that if silver rises above 4200c then we can back-burner the correction worries for a while. On this day in 1861 Abraham "Genocide" Lincoln maneuvered the Confederate States into firing on Fort Sumter so that he would have an excuse to invade the South. Confederate peace commissioners had already been to Washington to negotiate the transfer of forts and magazines on their territory peacefully. Lincoln dallied, delayed, mumbled out of both sides of his mouth, but refused to come to terms. After promising he would not re-supply Sumter, he sent a naval expedition to do so. Let's see: he sends a foreign navy to invade a sovereign nation's soil, after he promised not to and his own cabinet opposed the move. Clever move, though, since the misunderstood APPEARANCE of the CSA firing "first" shots at Sumter would give him an excuse to invade the South. And that's how it was done. On this day in 1864 Confederate Genl. N. Bedford Forrest captured Fort Pillow, Tennessee. Yankee war propaganda ran lurid reports that Forrest had "slaughtered" the black troops there. This lie is still repeated today, but is easily refuted. In 1871 or 1872, shortly after the war ended and when one can surmise Forrest found few friends in the US congress, he was summoned to testify before a congressional committee about Fort Pillow. After that testimony congress dropped the issue. Is it likely that Forrest's virulent enemies would have dropped the issue if there were even a mouse-burp of truth to the charges that he shot troops -- black or white -- seeking to surrender? AMERICAN CULTURAL MILESTONES: On this day in 1954 Joe Turner released "Shake, Rattle, and Roll." Argentums et aurum comparanda sunt -- -- Silver and gold must be bought. - Franklin Sanders, The Moneychanger © 2011, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2011, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate in a bubble, primary trend way down. Whenever I write "Stay out of stocks" readers inevitably ask, "Do you mean precious metals mining stocks, too?" No, I don't. |

| Living Well on Gold and Silver Posted: 12 Apr 2011 01:12 PM PDT Naturally, I bristle at people ignoring me except to say hurtful things, like, "Eww! Gross! Eat with your mouth closed!" and who then turn right around and say, "Shut up about buying gold and silver!" But how do I not eat and talk? Man, it has been said, cannot live on bread alone! Unless, of course, it is made into a nice, big sandwich with all the fixins, maybe with a tall, cool beverage and a fresh bag of potato chips, you're bent over the plate like some kind of starving Neanderthal, noisily shoveling it in your mouth with both hands, perhaps while you are watching TV, necessitating changing channels by hitting the remote control with your elbow. In polite deference to the easily offended, I swallow the last of a sandwich, whereupon I take up my one-sided conversation to say that buying gold and silver is the smartest thing you can do when the Federal Reserve is creating So Freaking Much Money (SFFM), as it creates horrific inflation in prices, with the historical evidence stro... |

| Posted: 12 Apr 2011 01:05 PM PDT Following two consecutive commodity downgrades which killed crude and all commodities, which led many to wonder just how many pictures of Lloyd Blankfein at Scores does Bill Dudley have locked up in his office, the bank, whose primary M.O. is to push inflation, has just released one more deflationary report, this time cutting the last man, er doctor, standing: copper. From Goldman: "We are pushing out our $11,000/mt target to 2Q2012 and lowering our 2011 year-end copper price target to $9,800/mt from $11,000/mt. Accordingly, we recently closed our long December 2011 copper trade recommendation – first opened on October 4, 2010 – for a gain of $1,872/mt. We are also raising our 3-month forecast to $9,300/mt, and 6-month forecast to $9,600/mt." And with this we can now scratch Scores, and move on to The Bunny Ranch. Incidentally, this means gold and silver are next. You have been warned. From Goldman's Joshua Crumb: We have updated our copper balance and price forecasts for 2011 and 2012. We now believe that prices will likely remain rangebound in 2011 and that risk has become more symmetric given our view that inventories are unlikely to draw down to critically low levels before 2012. However, we believe that a price spike has been deferred, not avoided, and maintain our 12-month forecast of $11,000/mt. Draw in inventories to critically low levels has likely been deferred Copper prices rallied sharply in the past week, heading back toward the top of the recent trading range between $9,300/mt - $10,000/mt that has held for much of the year. While we had expected prices to move decisively out of this range to the upside heading into late 2011, we now believe that prices will most likely remain rangebound and that copper price risk has become more symmetric as opposed to skewed to the upside. Underpinning this shift is our view that modestly slower-than-expected copper demand growth owing largely to Chinese consumer destocking, tighter inventory management and the negative supply shock resulting from the earthquake in Japan will likely delay the drawdown in copper exchange inventories to critically low levels. However, as we expect demand to continue to outpace supply, we now forecast a drawdown to critically low levels during 2Q2012. Price spikes likely no longer needed to balance the market in 2011 The avoidance of stockout suggests that price spikes will no longer be required to ration demand and balance the market this year. However, we maintain that Chinese end-use demand remains healthy, that consumers have been eager to step into the market on price dips and that the market will most likely remain in a meaningful deficit over the course of the year – all suggesting that prices are unlikely to fall significantly below the recent range on any sustainable basis. Price spike likely deferred, but not avoided We are pushing out our $11,000/mt target to 2Q2012 and lowering our 2011 year-end copper price target to $9,800/mt from $11,000/mt. Accordingly, we recently closed our long December 2011 copper trade recommendation – first opened on October 4, 2010 – for a gain of $1,872/mt (see Commodities Update: Target in sight, closing CCCP trade, April 11). We are also raising our 3-month forecast to $9,300/mt, and 6-month forecast to $9,600/mt. Full report Document1 |

| Capital Context Update: Natural Normalization Posted: 12 Apr 2011 12:55 PM PDT From Capital Context Spreads widened the most close-to-close since 3/25 with HY notably underperforming IG today as stocks continued the streak of eight of the last nine days Spreads were broadly wider in the US as all the major indices deteriorated. IG trades 4.1bps wide (cheap) to its 50d moving average, which is a Z-Score of 1.4s.d.. At 95bps, IG has closed tighter on 142 days in the last 587 trading days (JAN09). The last five days have seen IG flat to its 50d moving average. HY trades 17.1bps wide (cheap) to its 50d moving average, which is a Z-Score of 1.1s.d. and at 441.22bps, HY has closed tighter on only 57 days in the last 587 trading days (JAN09). Indices typically underperformed single-names with skews widening in general. Comparing the relative HY and IG moves to their 50-day rolling beta, we see that HY underperformed by around 0.7bps (or 10%). Interestingly, based on short-run empirical betas between IG, HY, and the S&P, stocks underperformed HY by an equivalent 6.3bps (~ 84%), and stocks underperformed IG by an equivalent 1.7bps (~ 134%) – (implying IG outperformed HY (on an equity-adjusted basis)). Among the IG names in the US, the worst performing names (on a DV01-adjusted basis) were Alcoa Inc. (+7.5bps) [+0.06bps], Expedia, Inc. (+6bps) [+0.05bps], and RR Donnelley & Sons Company (+5.5bps) [+0.04bps], and the best performing names were Loews Corporation (-4.5bps) [-0.04bps], Southwest Airlines Co. (-3.58bps) [-0.03bps], and DirecTV Holdings LLC (-3.5bps) [-0.03bps] // (absolute spread chg) [HY index impact]. Among the HY names in the US, the worst performing names (on a DV01-adjusted basis) were PMI Group Inc/The (+54.84bps) [+0.46bps], Radian Group Inc (+42.72bps) [+0.39bps], and McClatchy Co./The (+39.96bps) [+0.35bps], and the best performing names were Aramark Corporation (-25bps) [-0.25bps], Liz Claiborne Inc. (-10.76bps) [-0.1bps], and Universal Health Services Inc (-7bps) [-0.08bps] // (absolute spread chg) [HY index impact]. |

| Gold seen safer than govt. bonds in survey of central bank reserve managers Posted: 12 Apr 2011 12:26 PM PDT Central Banks Turn Net Gold Buyers, Cut Euro-Zone Debt: Survey By Sebastian Tong http://www.reuters.com/article/2011/04/12/businesspro-us-centralbank-idU... LONDON -- Central banks turned net buyers of gold last year and cut exposure to debt issued by euro-zone members Greece, Ireland, and Portugal, an annual survey of the world's reserve managers showed. A quarter of managers polled said they had upped their exposure to "non-traditional" reserve currencies such as the Australian and Canadian dollars in the last two years, and a majority said debt issued by the euro-zone rescue fund, the EFSF, had the makings of a sound reserve asset. "Traditionally, government bonds have been termed 'risk-free' assets but the euro-zone situation has made some of us change our understanding of that," said one of the 39 reserve managers that responded to the poll conducted by Central Banking Publications over the winter of 2010-2011. ... Dispatch continues below ... ADVERTISEMENT The Gold Standard Now: It Can Work Today a dollar is worth 80 percent less than it was 40 years ago, and less than 5 percent of its value a hundred years ago. We deserve a dollar that is as good as gold, a dollar that will hold its value from year to year so we can be financially secure and our economy can generate more and better jobs. For most of America's history, our dollar was literally as good as gold. But on August 15, 1971, our politicians destroyed the link between gold and the dollar. They destroyed the foundations of our economic system. A new Internet site, TheGoldStandardNow.org, provides news and cutting-edge analysis about this most important issue and explains how the gold standard worked in the past and how it can work in the future. Visit us today: http://www.thegoldstandardnow.org/about/137-welcome-newsmax Concerns over sovereign default fueled demand for gold, turning central banks into net buyers in 2010 after 20 continuous years of selling the metal. "Gold's quality as a store of value and fears over reserve currencies are the main reasons that central banks turned net buyers of bullion in 2010," wrote survey author Nick Carver. The survey's respondents, who manage central bank reserves worth $3.5 trillion in total or 35 percent of total world reserves, identified gold as a "safe" reserve asset at a time when rising sovereign debt levels and super-loose monetary policy from the world's major central banks sapped confidence in more traditional reserve currencies. "Both the euro zone and the U.S. are confronted by large deficits with simultaneously modest growth, which has influenced the value of their currencies and raised questions about debt sustainability," said one respondent. Gold, investment-grade corporate bonds, and AAA-rated bonds were the three assets that reserve managers saw as more attractive than the year before. Over 70 percent of the managers surveyed said central banks were likely to remain net buyers of gold given the level of uncertainty about sovereign debt. The survey also found 69 percent of respondents had not changed their reserve management strategies as a result of the Federal Reserve's expansion of its bond purchase program. Instead, the second round of quantitative easing had prompted a tactical reaction with some central banks shortening the duration of the U.S. debt they held. U.S. Treasuries remained the safest liquid asset "in the absence of a credible alternative," said a reserve manager from the Middle East. There was, however, growing interest among reserve managers in non-traditional reserve currencies. Over a 20 percent of respondents said they held more than 5 percent of their reserves in currencies such as the Australian dollar, the Swedish crown and the Singapore dollar. A European reserve manager said shifts to these currencies had come at the expense of further euro allocation. Diversification into these currencies, however, remained constrained by their lack of liquidity. Several reserve managers highlighted the Chinese yuan as an attractive alternative reserve currency but acknowledged that its share in foreign-currency reserves remained constrained by poor liquidity as well as investment hurdles. Some 81 percent of those surveyed viewed the new bonds issued by the European Financial Stability Facility (EFSF) as attractive reserve assets. Two of the respondents said they were considering investing in the AAA-rated bonds issued by the Facility, set up last May as a temporary rescue fund for weaker euro zone economies. Though the credit quality of the EFSF assets was acknowledged, reserve managers were unsure about the secondary market liquidity of the bonds. Some also predicted that the instruments could compete with debt issued by embattled euro zone economies. Join GATA here: An Evening with Bill Murphy and James Turk Gold Rush 2011 https://www.amsterdamgold.eu/gata/index.asp?BiD=12 Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: http://www.gata.org/node/16 ADVERTISEMENT Prophecy Resource Spins Off Platinum/Palladium Venture: Company Press Release, January 18, 2011 VANCOUVER, British Columbia -- Prophecy Resource Corp. (TSX-V:PCY)and Pacific Coast Nickel Corp. announce that they have agreed that PCNC will acquire Prophecy's Nickel PGM projects by issuing common shares to Prophecy. PCNC will acquire the Wellgreen PGM Ni-Cu and Lynn Lake nickel projects in the Yukon Territory and Manitoba respectively by issuing up to 550 million common shares of PCNC to Prophecy. PCNC has 55.7 million shares outstanding. Following the transaction: -- Prophecy will own approximately 90 percent of PCNC. -- PCNC will consolidate its share capital on a 10 old for one new basis. -- Prophecy will change its name to Prophecy Coal Corp. and PCNC will be renamed Prophecy Platinum Corp. -- Prophecy intends to distribute half of its PCNC shares to shareholders pro-rata in accordance with their holdings. Based on the closing price of the common shares of PCNC on January 17, $0.195 per share, the gross value of the transaction is $107,250,000. For the complete announcement, please visit: http://prophecyresource.com/news_2011_jan18.php |

| Here is Why Zero Hedge is Wrong! Posted: 12 Apr 2011 10:41 AM PDT What does a politician telling the truth, the federal reserve pausing from money-printing, and Tyler Durden being wrong have in common? Although rare, they do happen. Recently, Zero Hedge has been frothily arguing that, upon the conclusion of QE2 POMOs, appetite for U.S. Treasurys will abrubtly plunge and send yields sky-rocketing. Unfortunately, such a hypothesis fails to take into account forward-looking expectations and is therefore wrong. This is not to say that Treasury prices will continue fall, which may or may not occur and depends upon a myriad of variables. But it will not happen because QE2 stops. Here are the three main reasons as to why:

1. Markets are forward-looking and are not impacted by known variables (also known as market efficiency) Although market efficiency as a theory is not widely accepted by any means, any reasonable person would agree that upcoming and certain events should have no material effect upon market prices. Given that the termination date of QE2 has been sufficiently telegraphed to the market, there is little doubt that it is already priced in.

2. The maturity profile of the Federal Reserve`s assets is irrelevant. What matters is the extent to which the market believes that they will roll over their holdings in the future. Even if there are 0 prepays and most of the Fed`s asset run-off is concentrated 2, 3 or 5 years from now, the market understands that the Fed will have the option of reloading at that time. Further, if the economy begins to deteriorate and succumbs to deflation, the Fed could even signal to the market that they will be rolling a portion of their assets in the future.

3. Don`t Fight the Fed. The Fed will find a way to maintain inflation and debase the currency and its weapon of choice will be to stimulate artificial demand for Treasurys. This has always been the modus operandi of the Fed and there is no reason to believe that the end of QE2 will mean the end of propping up the Treasury market when necessary.

To conclude, the end of QE2 will not and can not result in the demand for Treasurys immediately falling off the cliff. Of course, Treasury yields are likely to slowly rise as horizon inflation comes to the fore and as investors lose faith in the U.S. government and the U.S. dollar. Yields may even spike as investors panic and flee out of the dollar. But yields will not rise simply because the pre-announced QE2 date arrives. |

| Gold Nears Former Resistance at 1441 Posted: 12 Apr 2011 10:31 AM PDT courtesy of DailyFX.com April 12, 2011 07:35 AM Weekly Bars Prepared by Jamie Saettele A break of long term trendline support in gold is needed in order to suggest that an important top has formed. The trendline is at 1371 this week. Continue to favor the upside towards long term channel resistance, which intersects with 1600 in the next several months. The 161.8% extension of the 1381.80-1449.70 rally is an objective at 1521. Short term support is 1441 and a drop below 1413.50 (April low) would be a sign that a top may be in place.... |

| Is the US Housing Market Making a Comeback? Posted: 12 Apr 2011 10:30 AM PDT Buenos Aires is beautiful. We have been blessed with good weather. The city is booming, too. Strong agricultural prices have done what they always do in Argentina – they've set off a boom. "Property prices are up about 30% over the last 3 years," says our BA-based colleague, Rob Marstrand. "But this is such a funny place. I love living here, because you see everything. If not in the present, certainly in the past…or the future. Booms, busts, corruption, inflation – everything. "Only about 6% of properties are sold with mortgages. So this is a real boom – where people are paying cash. But, where does this cash come from? Much of it comes from the bull market in farm products. Argentina is one of the world's top producers of cereals, for example. But there is probably a lot of money coming from the government too. The inflation rate is about 25%. "Now, you'd think that a country with a 25% inflation rate would have a currency that is falling through the floorboards. But no. The authorities have been supporting the peso; it actually went up 4% against the dollar. Put the dollar's drop and Argentine inflation together, and you get a loss of dollar purchasing power of 30%. "People want to protect themselves. And here, they do it by buying real estate. "Americans might want to think about it too." Prices are down 30% nationwide in the US. In Florida, Nevada, and most of California, they're half off. Even if they might go down a bit more, there are some very good deals available now. A friend of ours is able to buy apartment buildings for little more than 5 times rent income. If upkeep and taxes take half of that, that still gives him a 10% return. But it could be much better. Suppose he takes out a 30-year, fixed rate mortgage. Now, suppose inflation goes up. Every percentage point that consumer prices rise is another percentage point of yield for a fully-mortgaged investor. Rob also is in charge of our Family Office investments. "I don't see any way that they can unwind all this debt and spending without causing even more problems," he says. Investors might get some protection from real estate or stocks. But the best protection is gold. "But we're still in a correction," Rob continued. "It wouldn't be surprising to see gold fall when this round of quantitative easing ends. Take away the money-printing and gold could sell off along with everything else. But people are now catching on. When the economy worsens, they expect the feds to add more stimulus…or lower rates…or more QE. So, they know that over the long run, the effect will probably be to undermine the dollar. I wouldn't be at all surprised to see gold down 15% in the next sell-off. "But when the feds step in with more spending, gold will be the clear winner. We already own a lot of gold. I feel like I want to buy more of it…" Regards, Bill Bonner, Is the US Housing Market Making a Comeback? originally appeared in the Daily Reckoning. The Daily Reckoning recently featured articles on stagflation, best libertarian books, and QE2 . |

| Bullish or bearish on precious metals… Posted: 12 Apr 2011 09:48 AM PDT by Kerri Shannon Gold is up 5% so far this year after a 30% rise in 2010, and hit a record high of $1,476.21 an ounce Monday. While gold was the popular topic of 2010, silver has been the star this year, getting more investor interest as a cheaper alternative to the yellow metal. "People are quick to take profit when gold reaches a record," Matthew Zeman, a strategist at Kingsview Financial, told Bloomberg News. "The silver market is the one everyone is in love with and afraid of missing the boat. People fully expect silver to get to $50." [source] |

| Posted: 12 Apr 2011 09:37 AM PDT If you keep your money or savings in US dollars inside of the United States, you are a risk taker of epic proportions. Have you not been paying attention to what is going on? To begin with, the US Government now employs cash-sniffing dogs at most international airports. If you are carrying more than $10,000 in cash and don't declare it to the Government when coming in or out of the US, your cash will be seized. Thanks to these cash-sniffing canines, US customs officials seized $3.2 million at Boston's Logan Airport last year. Some government apologists might say, "If you aren't doing anything wrong, why would you mind being x-rayed, sniffed, patted down, detained and questioned?" Besides the obvious absurdity of that question, the main reason this is of concern is because in every case in history when a government has inflated its currency into worthlessness they always institute capital controls. Just ask anyone from Argentina or Italy. And it won't take much to change the rules from having to "declare" $10,000 to "not being allowed" to take $10,000 out of the country. Not to mention that if you do declare you are taking $10,000 out of the country, who knows what kind of database you will end up on. You are obviously highly suspicious if you have more than a few hundred bucks! Only Wall Street bankers and others associated with the government are supposed to have more than a couple dollars! The most ludicrous example of the War on Money came across the newswire today, "Feds Seek $7 million in Privately Made Liberty Dollars." The news story is only about 10 paragraphs long yet it has dozens of logical absurdities. Even in the Headline is one. According to the headline, part of the reason they want to seize these dollars is because they are "privately made"? Yes, we wouldn't want to compete with the private Federal Reserve banking cartel! And I know the Constitution is passé in the US, nowadays, but how in the world can this man be in trouble for making silver coins? The constitution states: No state shall enter into any treaty, alliance, or confederation; grant letters of marque and reprisal; coin money; emit bills of credit; make anything but gold and silver coin a tender in payment of debts. He is in trouble because he is making currency out of gold or silver yet, the Federal Reserve, another private organization, is not doing anything wrong by making paper currency NOT backed by gold and silver coin? Apparently, the thing they "got him on" was the following: Federal prosecutors successfully argued that von NotHaus was, in fact, trying to pass off the silver coins as US currency. Coming in denominations of 5, 10, 20, and 50, the Liberty Dollars also featured a dollar sign, the word "dollar" and the motto "Trust in God," similar to the "In God We Trust" that appears on US coins. Ignoring the fact that the dollar sign was originally used for Spanish and Mexican pesos and was stolen by the US to use for its dollars and the fact that the word dollar actually comes from the word thaler which was a silver coin minted in Bohemia, according to the Feds, he was trying to pass off coins, made of silver, worth more than $35/ounce, as quarters, which are now made from 92% copper and 8% nickel, and worth $0.06 in metal value. Boy, that's quite the racket! Passing off highly valuable silver to people who were expecting to receive near-worthless copper and nickel tokens! It's a good thing they stopped him before it was too late! Anne Tompkins, the US Attorney who was put on this important case, stated: "Attempts to undermine the legitimate currency of this country are simply a unique form of domestic terrorism." Anne, if attempting to undermine the currency of the US is a form of terrorism, why has Ben Bernanke not been tracked down and sent off to the Guantanamo concentration camp? This "news" story finished by quoting an unbiased source: a group named the Southern Poverty Law Center, a group that tracks political extremism which has apparently been tracking Bernard von NotHaus, the proprietor of the silver coin making terror enterprise. According to the story, long before the government began its investigation into von NotHaus, the group was raising concerns about the popularity of Liberty Dollars among fringe groups on the far right. "He's playing on a core idea of the radical right, that evil bankers in the Federal Reserve are ripping you off by controlling the money supply," said Mark Potok, spokesman for the group. "He very much exists in the world of the anti-government patriot movement, whatever he may say. That's who his customers are." The US has started another war. The war on money. Anyone with any amount of cash more that will buy them a couple NFL tickets and beers for the game is suspect. And if you are one of those deluded people who thinks the Federal Reserve is evil and is ripping you off and you buy gold or silver to protect yourself, you are a domestic terrorist. It's going to be a fun few years ahead in the US. Regards, Jeff Berwick The War on Money originally appeared in the Daily Reckoning. The Daily Reckoning recently featured articles on stagflation, best libertarian books, and QE2 . |

| Hourly Action In Gold From Trader Dan Posted: 12 Apr 2011 09:23 AM PDT Dear CIGAs, Click chart to enlarge in PDF format with commentary from Trader Dan Norcini For further market analysis and commentary, please see Trader Dan's website at www.traderdan.net |

| Unrest in the Middle East: Oil Hits 32-Month High Posted: 12 Apr 2011 09:11 AM PDT syndicate: 0 Author: Vedran Vuk Synopsis: Libya and Yemen grab the headlines, but Syria poses the biggest threat to stability, says the Casey Energy team. Also in this edition: The dollar has weakened… is this a good opportunity for a currency play? And, a Gallup poll on who has too much power. Dear Reader, As the dollar weakened over the $1.40/€ line, I was mildly concerned, but it made sense. European Central Bank President Trichet was talking a big game on raising rates – and he did raise them. However, Europe is still in rough shape. Could the euro really gain much ground with the Portugal bailout already here? I didn't think so, but the dollar continues to slide with no significant rallies. This morning, the euro briefly reached $1.45/€, and things could get worse from here. Countless ... |

| Posted: 12 Apr 2011 09:11 AM PDT The 5 min. Forecast April 12, 2011 12:03 PM April 12, 2011 [LIST] [*] Swiss celebrate daylight… European Gold Forum opens… and the rally in metals takes a breather… [*] Oil tumbles $5 as Goldman calls a pause to the “CCCP trade” [*] “Invictus” warns of a commodities sell-off at the end of QE2… while Richard Russell advises ignoring the “top callers”… [*] Stocks sell off, too… Greg Guenthner identifies a few stalwarts bucking the trend… [*] Readers, meanwhile, get “far-out“ on philosophy and hold a private conversation about capitalism… on cue, Atlas gets ready to Shrug… more questions about Strategic Currency Trader resolved… and more… [/LIST] After seeing the ashes of the Boogg yesterday, it wasn’t clear to us exactly how many weeks of spring the Swiss expect to enjoy this year. Nor did anyone we asked seem to care… The festival ... |

| Gold to average $1,500 in 2011 Posted: 12 Apr 2011 09:09 AM PDT by Heather Struck How high or low this hurdle may be depends on the state of the recovering U.S. economy after the Fed's bond-buying program ends. Investors may continue to seek safety in gold over looking for returns in equities or fixed income. With these options on the horizon, Tully said, gold will continue to rally, and $1,500 won't be far off. Hurdle cleared. … Investors are also showing a broader interest in gold as a portfolio component beyond the "safe-haven" nature that most are familiar with, which came into play during the financial crisis. International factors also exist, as central banks outside the U.S. have been adding gold to their reserves, making 2010 the first year in two decades that reserves were net buyers, rather than sellers, of gold. Central banks are continuing to buy gold into 2011, according to UBS. [source] |

| Why the World’s Largest Bond Fund is Now Shorting Treasuries Posted: 12 Apr 2011 08:50 AM PDT As we go to the cyber presses this morning, the global equity markets are wobbling a bit. The Dow Jones Industrial Average is down 130 points – its biggest drop in three weeks. Commodities, likewise, are adding to yesterday's losses. The CRB Index of commodity prices is down more than 3% during the last 24 hours, led by a steep 7% drop in the price of crude oil. The bond market, on the other hand, is enjoying the fleeting popularity of "flight to safety" buying. This array of counter-trend market moves might be signaling the beginning of new trends – i.e. commodity prices down, bond prices up – but we doubt it. For as long as Ben Bernanke's money machine keeps churning out the dollar bills that the Fed uses to buy Treasury securities, owning commodities and avoiding bonds seems like the appropriate course of action.

Bill Gross, founder of Pimco, the $1.2 trillion investment management firm that used to buy bonds, has stated very publicly that he considers US Treasury securities to be high risk, low reward investments. "If I were sitting before Congress," Gross recently remarked, "and giving testimony on our current debt crisis, I would pithily say something like this: 'I sit before you as a representative of a $1.2 trillion money manager, historically bond oriented, that has been selling Treasuries because they have little value within the context of a $75 trillion total debt burden. Unless entitlements are substantially reformed, I am confident that this country will default on its debt; not in conventional ways, but by picking the pocket of savers via a combination of less observable, yet historically verifiable policies – inflation, currency devaluation and low to negative real interest rates.'" Gross is not merely selling Treasuries, he is selling them short. His flagship, $235 billion Pimco Total Return Fund (PTTAX), now holds a net short position in "government-related" debt securities, while also sitting atop an enormous $73 billion pile of cash.

As such, Zero Hedge's Tyler Durden points out, "The world's largest 'bond' fund now has cash, at a stunning $73 billion, or 31% of all assets, as its largest asset class on both a relative and absolute basis. We repeat: cash is more than PIMCO's holdings of Treasurys and Mortgage securities ($66 billion) combined…US debt is no longer the safe haven it once was. Which begs the question: when will the Total Return Fund break out a 'gold' asset holdings line item." Whether or not Gross begins adding precious metals to the Total Return Fund, he is clearly erecting defenses against Ben Bernanke's "War on the Dollar." Yes, it is a war, even though the Fed never officially declared it. And history demonstrates that undeclared wars can inflict casualties just as well as the officially declared kind. In fact, wars on money always begin as "covert ops" and usually proceed as "classified" campaigns, far removed from public scrutiny. As long as these wars inflict limited damage, as measured by published inflation rates, the money-holders rarely complain. But if/as/when inflation starts inflicting painful wounds, the money-holders scream. By that point, often, the money-holders have already lost the battle. Ben Bernanke does not mean any harm, of course. He doesn't really want to prosecute a war against the dollar. That thought has probably never occurred to him. But so what? That's exactly what he's doing…and the free-spending members of Congress are his conscripts. Together, they wage war against the dollar with their trillion-dollar deficits and money-printing schemes. So far this year, the US Treasury has raised $293 billion in net cash by selling Treasury securities. And so far this year, the Federal Reserve has purchased a net $330 billion of Treasury notes and bonds. We'll do the math for you: the Fed has provided 100% of the net new cash the Treasury has "raised" this year, along with another $37 billion of what we'll call "old cash." This blatant Ponzi scheme seems to be working so far…and we predict it will continue working…until it doesn't. Anticipating that day, Bill Gross, the "Bond King," is selling bonds and asking himself, "Who will buy Treasuries when the Fed doesn't?" "If the USA were a corporation," Gross concludes, "then it would probably have a negative net worth of $35-$40 trillion once our 'assets' were properly accounted for, as pointed out by Mary Meeker and endorsed by luminaries such as Paul Volcker and Michael Bloomberg in a recent piece titled 'USA Inc.' However approximate and subjective that number is, no lender would lend to such a corporation. Because if that company had a printing press much like the US with an official 'reserve currency' seal of approval affixed to every dollar bill, that lender/saver would have to know that the only way out of the dilemma, absent very large entitlement cuts, is to default in one (or a combination) of four ways: 1) outright via contractual abrogation – surely unthinkable, 2) surreptitiously via accelerating and unexpectedly higher inflation – likely but not significant in its impact, 3) deceptively via a declining dollar– currently taking place right in front of our noses, and 4) stealthily via policy rates and Treasury yields far below historical levels – paying savers less on their money and hoping they won't complain." Gross is fortifying his defenses and manning the ramparts for a long, bloody campaign. Eric Fry Why the World's Largest Bond Fund is Now Shorting Treasuries originally appeared in the Daily Reckoning. The Daily Reckoning recently featured articles on stagflation, best libertarian books, and QE2 . |

| Van Hoisington Eviscerates QE2: Full Q1 Review And Outlook Posted: 12 Apr 2011 08:47 AM PDT Van Hoisington shares a good analysis at the reverse psychology that the prevailing crowd grasped, and yet was completely lost on the Ivy League educated Academics at the Marriner Eccles building.

According to Van Hoisignton this is what needs to happen:

We agree. Which is why this outlook will never be realized. The Fed will simply never accept the risk of another bout of deflation. Period. Full letter: Hoisington 1Q11 Updateh/t Adam

|

| Gold falls 1% as oil drops sharply Posted: 12 Apr 2011 08:45 AM PDT By Claudia Assis , MarketWatch Gold for June delivery declined $14.50, or 1%, to $1,453.60 an ounce on the Comex division of the New York Mercantile Exchange. It had traded as low as $1,445 an ounce. … Gold had pared its decline in early floor trading, but the attempt at a comeback evaporated as losses mounted for oil and U.S. equities Crude futures stumbled after weak U.S. trade data led to a rash of pessimistic views on U.S. economic growth and renewed doubts about oil demand. "The pullback in oil has helped undermine precious metals," said Jim Steel, a commodities analyst with HSBC in New York. A 3% drop for oil muted inflation concerns, he said. In addition, several economists have slashed their forecasts for U.S. growth, which diminishes appetite for commodities as a whole, Steel said. … Gold's correction is likely to continue in the short term, analysts at Commerzbank said in a note to clients. "The medium- to long-term positive outlook is still intact, especially for gold," they added. "Gold should remain in demand as a safe haven in any case and the price should be well supported. [source] |

| Posted: 12 Apr 2011 08:42 AM PDT |

| Gold Daily and Silver Weekly Charts Posted: 12 Apr 2011 08:24 AM PDT |

| Is The Budget Deal On The Verge Of Collapsing? Posted: 12 Apr 2011 07:46 AM PDT Something rather troubling for the "kick the bankrupt (and only modestly radioactive, still way below the unrevised legal threshold though) can down the street crowd"- Commentary Magazine reports that the "Budget Deal", won after so much theatrics, soap opera, and Razzie nominations, may in fact collapse shortly. "The big news today is that the $38.5 billion in budget cuts announced with such fanfare on Friday night mostly aren’t real. A good deal of it involves money from previous years and previous budgets that hasn’t actually been spent." Commentary refers to an AP article in which it is made clear that the proposed legislation is one 'financed with a lot of one-time savings and cuts that officially "score" as savings to pay for spending elsewhere, but that often have little to no actual impact on the deficit...cuts to earmarks, unspent census money, leftover federal construction funding, and $2.5 billion from the most recent renewal of highway programs that can't be spent because of restrictions set by other legislation. Another $3.5 billion comes from unused spending authority from a program providing health care to children of lower-income families." And once the more vocal fringers realize they have been cheated once again by both parties, it is possible that the whole thing could just as easily fall apart, and just in time for the US debt ceiling to be breached within 1-2 weeks tops. The bottom line is that even the woefully inadequate number of cuts previously cited, as great success for the GOP, is big fat lie:

Those who wish to replicate the math can do so using the GOP Summary of the Continuing Resolution. Republican Budget Deal Summary |

| More Anectdotal Evidence That The Fed Printing Will Not End With QE2 Posted: 12 Apr 2011 07:30 AM PDT Again, I get back to my thesis that the Treausury will not be able to fund the inexorable spending appetite of the Obama Administration (the $38 billion in cuts is a complete joke and all it does is ever-so-slightly reduce the growth trajectory of the spending). I've been waiting for someone to step up to the plate and show me the mathematices on how the Treasury will fund its spending needs if the Fed stops printing more money after June 30. Jim Rickards is all over the blogosphere like famine in Africa explaining that the Fed can fund Treasury auctions without increasing its balance sheet. I would like him to show me the math on that. HERE is the math on my view, as clearly and articularly elucidated by zerohedge: So putting it all together: assuming no QE3, and just continued rolling and transforming MBS in UST purchases, means that the Fed will have about $12 billion in average UST purchases per month from maturity extension, and about $20 billion from MBS prepays. This is at best one quarter of the amount the Fed monetizes per month currently and is largely inadequate to continue funding the US deficit.Here's the link to the article with links to the reference sites so you can check their math if you so desire: TO QE3 or NOT TO QE3 So if the Fed does not step up to the plate and print more money to fund Obama's Government, then who will? The Japanese? LOL. I think they have their hands full right now and probably need any excess liquidity to fund their own current problems. Capisci? How about the Chinese? Read this article which had almost no real media exposure: A former adviser to China's central bank said on Monday that China should have retreated from the U.S. government-bond market and instead allowed the yuan to appreciate more freely, warning that U.S. sovereign debt was akin to a giant Ponzi schemeHere's the link for that news item, which actually came out yesterday: LINK I think it's safe to say that the Chinese probably won't increase their Treasury holdings, have been systematically hedging them out with gold and silver and the real risk is that they start dumping them, like Pimpco's Bill Gross. Oh ya, the world's largest bond investment fund is not a likely candidate to fund Obama since he's now net short the Treasury market. And if you still want to suspend your disbelief and buy into the garbage coming from many Fed officials plus Rickards, please take the time to read this extraordinarily well-written analysis from Alisdair Macloed: One of the stark alternatives is to end quantitative easing and permit far higher interest rates, plunging the Obama administration into bankruptcy and the US economy into deep economic cleansing. The other is more ZIRP plus QE3 resulting in accelerating stagflation, made worse by a rapidly depreciating dollar. LINKHe argues that the Fed will pay lip service to being inflation-vigilant by delivering a gratuitous 1/4 point hike in the Fed funds rate, but will be forced to continue printing money or else Obama's spending dreams die and the Govt goes insolvent. I have made that same argument, in terms of the Fed justifying more printing by patronizing the M2 critics with a tiny, useless hike in interest rates. So there you have it. I suggest everyone ignore the flatulence coming from NYC and DC and start looking at their own finances and move some assets into gold and silver. Silver supplies are starting to dry up and the mining supply is not coming close to covering the demand globally. And if you really want to be irritated, check out the nice gift that Geithner, Hank Paulson (and de facto Bush and Obama) gave to their good friends on Wall Street using your money: The Real Housewives Of Wall Street |

| Gallup Economic Confidence Index Plummets To August 2010 Level As Poverty Effect Laps Wealth Effect Posted: 12 Apr 2011 07:10 AM PDT For anyone wondering why a hypothetical situation in which Bill Dudley met with former colleague Jan Hatzius and told him "ok, we bailed you guys out, now it's your time to kill oil" seems all too possible in our day and age, the latest news on the economy from Gallup should make it all too clear. As of April 11, the polling agency's Economic Confidence Index has dropped to -37: the lowest reading since August of 2010. It appears that disgust with $4+ gas (Poverty Effect for all) is more than offsetting Brian Sack's attempt reclaim the Russell 36,000 (Wealth Effect for some). Gallup's conclusion is absolutely spot on: 'Global events, continued political battles about the budget in the nation's capital, and a weak, if modestly improving job market add to consumer uncertainties. As a result, it is not surprising that consumer confidence plummets even as Wall Street continues to do well. However, if consumers continue to lack confidence and spending doesn't increase, it is hard to see how the U.S. economy can continue its modest improvement. In turn, it would seem Wall Street and Main Street will have to align at some point going forward. Either Wall Street will prove right and economic conditions on Main Street will improve or the reverse will prove to be the case." (source: Gallup) Some views from Goldman on the collapse in consumer sentiment (which unlike the Conference Board and UMichigan actually polls people instead of Fortune 500 CEOs):

Gallup's self-evident conclusion:

|

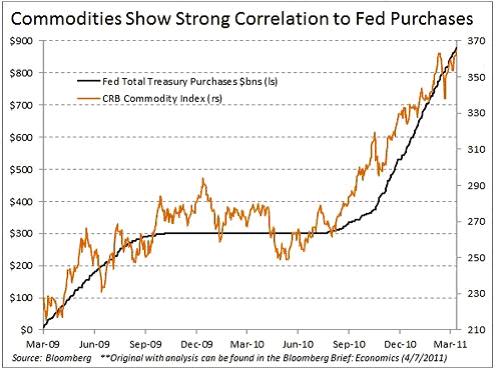

| Keep Buying the Precious Metals Bull Market Posted: 12 Apr 2011 07:03 AM PDT The European Gold Forum opens in Zurich today. The forum, hosted by the Denver Gold Group, is a private forum "designed to showcase institutional-quality precious metals companies to major global fund and portfolio managers, institutional investors and analysts." Our friend Bill Baker, whom you may recall from the last Apogee episode, is here as well as Matterhorn Asset Management's Egon von Grayerz. Vancouver favorite Frank Holmes is the keynote for tomorrow's session. They'll have plenty to talk about when the forum gets underway. Gold tumbled $20 this morning to $1,446, and silver plummeted nearly 80 cents. And as we write, silver just broke below $40 an ounce. With gold pulling back to $1,450, Richard Russell says "buy again", if you've been holding off. "Because the precious metals are in a massive bull market," writes the dean of newsletter men, "many eager amateur analysts are now trying their hand on calling 'the top.' This is a hopeless and ridiculous endeavor during a powerful bull market. "Much of this top-calling is done by an anti-gold element: Those who dislike gold or those who have missed the entire gold bull market. My advice all along has been to 'ride the bull' and to ignore the 'top callers.'" "Stay invested in the metals until they exhaust themselves in panic buying." The precious metals tumbled as soon as US trade deficit numbers came out at 8:30 a.m. EDT. It narrowed 2.6% in February to $45.8 billion, after reaching a seven-month high in January. Demand for imports fell for the first time in four months. Coincidentally, oil has pulled back more than $5 in the last 24 hours. It's now a few pennies below $107. In 2008, oil crashed from $147 in July to $33 in December. The CRB, a broad commodity index, crashed 58% between July and March 2009. Not a forecast per se, for this time around, but some food for thought. "Invictus," the pseudonymous blogger who keeps company with Vancouver favorite Barry Ritholtz provides a chart tracking the CRB since its March 2009 low…along with the Federal Reserve's purchases of US Treasuries.

Federal Reserve Treasury purchases started picking up pace in August of last year – at the very moment Ben Bernanke signaled in his annual Jackson Hole address that more quantitative easing (QE2) was on the way. Commodity prices have barely looked back since. But QE2 ends on June 30. And there's no guarantee QE3 will follow immediately. Should Fed purchases of Treasuries level off as they did between Sept. 2009-Aug. 2010, commodities might well head into "consolidation mode". Addison Wiggin Keep Buying the Precious Metals Bull Market originally appeared in the Daily Reckoning. The Daily Reckoning recently featured articles on stagflation, best libertarian books, and QE2 . |

| What Does a Breakout in Euro Mean for Gold Investors? Posted: 12 Apr 2011 07:00 AM PDT |

| Wives Of Morgan Stanley Receives 200 Million Dollars From Federal Reserve! Posted: 12 Apr 2011 06:40 AM PDT America has two national budgets, one official, one unofficial. The official budget is public record and hotly debated: Money comes in as taxes and goes out as jet fighters, DEA agents, wheat subsidies and Medicare, plus pensions and bennies for that great untamed socialist menace called a unionized public-sector workforce that Republicans are always complaining about. According to popular legend, we're broke and in so much debt that 40 years from now our granddaughters will still be hooking on weekends to pay the medical bills of this year's retirees from the IRS, the SEC and the Department of Energy. Most Americans know about that budget. What they don't know is that there is another budget of roughly equal heft, traditionally maintained in complete secrecy. After the financial crash of 2008, it grew to monstrous dimensions, as the government attempted to unfreeze the credit markets by handing out trillions to banks and hedge funds. And thanks to a whole galaxy of obscure, acronym-laden bailout programs, it eventually rivaled the "official" budget in size — a huge roaring river of cash flowing out of the Federal Reserve to destinations neither chosen by the president nor reviewed by Congress, but instead handed out by fiat by unelected Fed officials using a seemingly nonsensical and apparently unknowable methodology. |

| Global Growth Questioned as Japan Raises Nuclear Severity Posted: 12 Apr 2011 06:13 AM PDT The lofty all-time record figures of the Aussie dollar (AUD), got a taste of the other side of the coin last night, and has backed off those lofty figures of the past few days. I don't think profit taking was the key here; instead, it was probably the news that Japan had raised the severity rating for their nuclear power plant that was damaged in the Tsunami… The Japanese have raised the severity level to 7… The same as Chernobyl! The markets' participants believe that this time, global growth will get hurt… Of course we've seen earthquakes, floods, cyclones…and global growth didn't flinch… But the "experts" believe that this will be the straw to break the global growth's back. Hmmm… What if they're wrong again? Then these weaker levels could be bargains, eh? But who knows? Only the Shadow knows! And… As I always say… Australia is the proxy for global growth… If global growth fails or succeeds, you'll see it first in Australia! I told you last week that it was about time that something happened, or was made up to happen, to stop the dollar's fall, because in the past, that's exactly what we would see… I call them "circuit breakers"… The problem with them is that it gets the dollar bugs all lathered up, and they begin waving the long-term trend strong dollar flag… And people that don't know about trends, or deficit financing go along with the flag wavers, and the dollar rally lasts for a few months… Then you see the youngsters new to currencies begin to make calls that they'll have to eat later… So, anyway… Maybe this is the "circuit breaker"… And then…maybe not! The reason I say "maybe not" is that the Swiss franc (CHF) is still on the warpath against the dollar, as is the Canadian dollar/loonie (CAD)… The Bank of Canada (BOC) meets this morning to discuss rates… As I said yesterday, I don't expect the BOC to hike rates this month, but in June… So, the statement following the unchanged rate announcement will be key for the loonie this morning, especially with the price of oil falling $2 overnight. I saw a blurb by the researchers over at Morgan Stanley the other day, talking about the Brazilian real (BRL)… Those researchers say that because of considerable portfolio inflows the real could approach 1.40 in the "near-term"… WOW! Talk about going out on a limb! I sure hope these guys picked out a big fat limb, like I always have to do! For reference, the real is now trading around 1.58, so a trip to 1.40 would represent an 11% increase! Then add that to the 5% gain the real has garnered this year, and the 6% interest… Now, we're talking about something, eh? Oh, but wait! The key to the Morgan Stanley's call is that they said "could approach"… So, they're not convinced it will happen, and I'm not either! The real still is considered as an "emerging markets" currency, so be careful out there… This morning over in Germany… German inflation accelerated at its fastest pace in 2 ½ years during March! I bet the European Central Bank (ECB) is breathing a sigh of relief right now, given the rate hike they made a couple of weeks ago! So… ECB President, Trichet, had better get the "boys" together, and begin discussing another rate hike… I'm still not on board with the thought that the ECB could go back-to-back, instead, thinking that June would be the next hike… But, this latest report from the Eurozone's largest economy (Germany) will turn some heads, folks… And begin to turn the burners up on the ECB ministers… The co-chief euro-area economist, Klaus Baader said that the inflation rate for Germany could reach 2.8% by summer! Yesterday morning silver was trading above $41, and looked like a moon shot! But then the profit taking and chart trading began to knock it down, and by the end of my day, silver was down about $1… Was this the "sell off" that Sean Hyman talked about last week? Hmmm… It doesn't look like it yet, as silver is rallying this morning. At this point, I find it important to see what the "silver man" Ted Butler (no relation that I know of), has to say… Here's Ted… I know we are over-bought in silver and in a normal market the price should correct sharply. But this is as far from a normal market as you can get. This is a manipulated market where the manipulation is in the process of ending and in which the manipulators appear to be in trouble. That means the charts and previous price patterns may not matter. It is very easy to imagine some important shorts throwing in the towel in their weakened financial state. In fact, it may be what we are witnessing now. But keep in mind something that hangs over gold and silver like the Sword of Damocles… And that is that summer is usually not a good time for these two metals… The old stock saying of "sell in May and go away" tends to lend itself to the metals… Not always, though… For instance in 2010, gold lost ground in July, only to make it up and more in August and September… Same for silver, with it taking off in mid-August… So, it's not always the case, but keep it in mind if we begin to see the metals slip as we head into summer… One of the best performers in the past week (not last night though, UGH!) had been the Norwegian krone (NOK)… As one would expect it to be, when the keys for krone strength were all in alignment, those keys being: dollar weakness, euro strength, oil price… There was some good news in the oil exploration from Norway last week, and brother did they need that, as they had seen three recent drills come up dry… The latest drill was successful for Statoil… So, the Norwegian oil business is still strong. Well… The big news over the weekend was about the government averting a shutdown here in the US… Now the fight goes to the debt limit… So, let me set it all up for you… The current debt ceiling is $14.3 trillion (as if that's not enough!) and our current debt is $14.223 trillion… So, we're getting close, and… With the way we deficit spend, that won't take long to reach… OK… So the Republicans are telling the White House that they will not raise the ceiling unless the president agrees to trillions of dollars of spending cuts… And now the White House is saying that it will be Armageddon-like for the economy if the ceiling isn't raised before reaching its limit… I look at it like this… The debt ceiling isn't really a ceiling, if we just keep raising it every time we hit the top… I also believe that spending cuts have to be made, and real spending cuts, not the kind that were done to reach a budget agreement… Oh? Didn't hear about this? Many of the $38 billion in spending cuts agreed upon by Republicans and Democrats are nothing more than accounting tricks that have no impact on spending, officials said. The budget compromise that headed off a US government shutdown includes cutting $4.9 billion from the Justice Department Crime Victims Fund, which won't be spent this year anyway. For many programs, money cut could be restored by Congress next year with no impact on spending. Then there was this… From The LA Times… Two Federal Reserve governors said the US economy faces no serious threat from inflation and that it isn't time to tighten monetary policy. Janet Yellen, the central bank's vice chairwoman, said surging commodity prices are temporary and won't have a prolonged effect. William Dudley, president of the Federal Reserve Bank of New York, said he isn't enthusiastic about tightening because the labor market is expected to have "excess slack" through the end of 2012. Remember last week, when I told you to keep a scorecard on the Fed Heads who called for an end to quantitative easing, versus the Fed Heads who call for continuing the stimulus? Well… That's 3 for, and 3 against, so far… But, as I've said before, just like in the days of Big Al Greenspan… Whatever is on Big Ben Bernanke's mind is what we'll see for Fed Policy… Yes, the Fed Heads have a vote, but they don't dare go against the Fed Chairman… To recap… The Japanese have raised to 7, the severity level of their nuclear plant that was damaged in the Tsunami…the same level as Chernobyl. This has caused traders to think that global growth is going to take a hit, and therefore the proxy for global growth, the Aussie dollar, got sold overnight. That kind of news benefits the Swiss franc, and the franc is $1.11 this morning… Morgan Stanley waves the flag of currency rallies for the Brazilian real, and silver backed off $41 yesterday… Is this the selloff we talked about last week? Probably not yet… Chuck Butler Global Growth Questioned as Japan Raises Nuclear Severity originally appeared in the Daily Reckoning. The Daily Reckoning recently featured articles on stagflation, best libertarian books, and QE2 . |

| You are subscribed to email updates from Save Your ASSets First To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

April 12, 2011 (Forbes) — A poll of UBS clients found that 58% expect the Federal Reserve's Treasury buying program to wrap up at the end of June as intended. While the impact of the end of QE2 may already be priced into some asset classes, UBS precious metals strategist Edel Tully says it presents a "hurdle" to gold prices.

April 12, 2011 (Forbes) — A poll of UBS clients found that 58% expect the Federal Reserve's Treasury buying program to wrap up at the end of June as intended. While the impact of the end of QE2 may already be priced into some asset classes, UBS precious metals strategist Edel Tully says it presents a "hurdle" to gold prices.

Optimism in March essentially matches last year's low points: 32% in July, 33% in August, and 32% in September. However, it remains higher than it was throughout 2008 and early 2009.

Optimism in March essentially matches last year's low points: 32% in July, 33% in August, and 32% in September. However, it remains higher than it was throughout 2008 and early 2009. Optimism about the future of the economy declined across all political parties during the first quarter. Democrats remain the most optimistic, with 45% saying things are getting better, but this is down from 55% in January and 52% a year ago. Independents' economic optimism is at 31% and Republicans' at 21% -- both down from January.

Optimism about the future of the economy declined across all political parties during the first quarter. Democrats remain the most optimistic, with 45% saying things are getting better, but this is down from 55% in January and 52% a year ago. Independents' economic optimism is at 31% and Republicans' at 21% -- both down from January.

No comments:

Post a Comment