saveyourassetsfirst3 |

- The Slumping 'IC' in BRIC

- Silver vs. Tech Stocks

- Aftershocks: Looking for Safety

- The Great Gold Bait-and-Switch

- What's Next for Europe?

- Freeport McMoran Copper & Gold: Miner With Major Upside

- Little Guys Buying Gold

- What's the Difference Between 1 Gold Karat, 1 Diamond Carat and 1 Troy Ounce?

- Prepare for Bargain Hunting

- In the Silver Pit No One Can Hear You Screaming

- The Sprotts Expect Silver to Keep on Sizzling

- Risk of Nuclear Catastrophe after Explosion and Contamination Found 60 Miles from Reactor

- Crude Oil, Gold, and Silver - Important Timing Connection?

- Resource guru Sprott: "Three-digit price" for silver coming soon

- Richard Russell: Gold is the only safe currency left

- Analyst: It's time to get out of stocks

- View From the Turret: Aftershocks

- Australian Gold Sector Dynamics

- Trader Dan Norcini doesnt believe silver COT report anymore

- Its Do or Die Week for Equities and Gold

- The Greenback - 1860 to 1880 - The United States of America

- Offering Kid Dynamite a chance to explain why SLV is better than PSLV

- Silver – Buy or Sell?

| Posted: 14 Mar 2011 06:20 AM PDT Sold At The Top submits: Looking deeper into today's OECD Leading Indicator release, one notable trend, namely the near simultaneous slowing of India and China, sticks out as very important development when considering macro-economic conditions going forward. One theme that has been spun numerous times since the lows of March of 2009 is that outsized growth in the BRIC (Brazil, Russia, India and China) emerging economies would provide the global economy the boost it needed to shake off the malaise of the collapse and maintain an ongoing expansion. It could easily be argued that investor enthusiasm for the speculative potential in these hot economies (along with the suspension of mark-to-market accounting and a few trillion here and there from the Feds) did, in fact, help to turn the trend during the dire days of early 2009 but many have taken the idea of these emerging economies actually driving the global economy with a "grain-of-salt" especially Complete Story » | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 14 Mar 2011 05:36 AM PDT It's now been over a decade since the great tech bubble burst in the year 2000, but even today technology stocks are still popular among most investors and the financial media. There are good reasons for the continued popularity of technology stocks. Not only do tech companies deliver us cool new products each year, but many tech companies have delivered great stock returns as well. This creates an opportunity for investors to follow one of Peter Lynch's famous principals, which is "invest in what you know". Most investors have used one or more of the products these companies produce, and naturally they want to invest in the growth of the technology products that they enjoy. When gold and silver moved from a bear market into a bull market way back in 2001, they started competing for the attention of investors. And as the gold and silver bull markets have progressed over the last ten years, they have steadily gained more attention from the media and from investors. New products like exchange traded funds have even been created to allow investors more access to precious metals investments. Even with the increased exposure precious metals have gotten though, they are always going to be competing with other asset classes for investors' capital, which includes tech stocks. Since the 2009 stock market bottom the overall market has rebounded strongly and some favorites in the tech space have provided exceptional returns. The table below shows the returns of some of these stocks from March 9th, 2009 to March 11th, 2011. Included in the list are Priceline.com (PCLN), SanDisk (SNDK), Netflix (NFLX), Apple (AAPL), Salesforce.com (CRM), Juniper (JNPR), and Amazon.com (AMZN). Also included in the table is SLV, the most popular silver ETF. Notice how these seven tech stocks have outperformed SLV since the stock market bottom in 2009. Three of the stocks have more than doubled the performance of silver.

In order for silver to take investors' attention away from popular investments like tech stocks and into silver, silver is going to need to do one or both of the following things going forward: 1. Outperform other popular investments like tech stocks A recent example of the second item above occurred when oil continued higher in 2008 while most other asset classes had already started trending lower. The advance in oil ended up accelerating before it topped because it attracted capital away from asset classes that were not only underperforming oil but also were trending lower. When SLV broke out of a multi-year consolidation in August 2010 into a strong advance it also started outperforming other asset classes, including many of the tech stocks mentioned above. The next table shows that since August 1st, 2010 only PCLN has outperformed SLV.

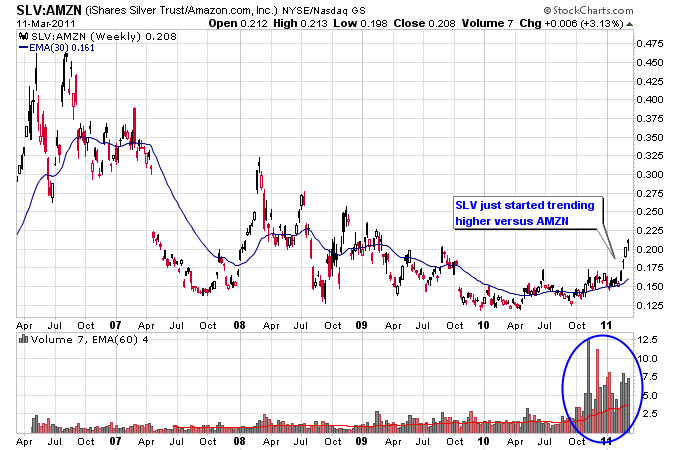

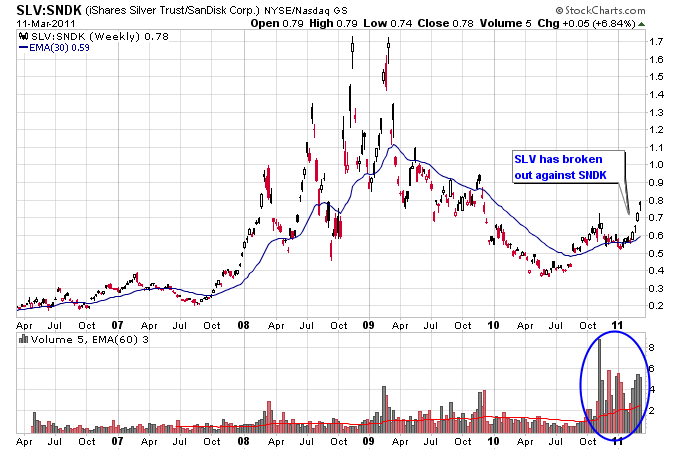

The chart below shows the ratio of SLV to AAPL, which graphically presents a performance comparison between the two. Notice that since the March 2009 bottom the ratio of silver to Apple has trended lower, meaning that silver has underperformed Apple during that time period. Since the fall 2010 breakout in silver though the trend has started to reverse back to the upside as shown on the chart. Note the big increase in volume on the chart as well. On a ratio chart the volume of SLV is divided by the volume of AAPL, so seeing a big increase in volume on this chart means more volume was coming into SLV than AAPL. This is the biggest increase in volume into SLV compared to AAPL since the SLV ETF has been in existence. Often a big increase in volume helps confirm a change in trend since a considerable amount of buying or selling pressure is required to create trend reversals. The next two charts show the ratio of SLV to AMZN and SNDK. The same thing has occurred on these two charts where the trend in silver versus Amazon.com and Sandisk has reversed to the upside on a big increase in volume.

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Aftershocks: Looking for Safety Posted: 14 Mar 2011 05:35 AM PDT Mercenary Trader submits: By Mike McDermott

It's been a sobering weekend as we begin to understand the magnitude of devastation caused by the earthquake and tsunami in Japan. From entire cities being wiped out, to nuclear power plants on the verge of meltdown, the human toll is difficult to comprehend. On the economic side, the picture is also quite concerning. Even before the quake's devastation, we discussed the churning action – an intense battle between momentum bulls and newly energized bears. This past week, the Nasdaq (QQQQ) and the S&P 500 (SPY) fell below their 50 day moving averages, a technical support line that has held up for more than three months for both the major indices. Bespoke Investment Group notes that this was the first time in history that both of these indices have broken this kind of streak on the same day. The statistical probability of further weakness is high as Complete Story » | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Great Gold Bait-and-Switch Posted: 14 Mar 2011 05:31 AM PDT The early decades of the 20th century was a time almost incessantly dominated by one catastrophe after another, subject only to a period of manic economic euphoria, sandwiched between two "World Wars". Sadly, one will gain little understanding of this tragic period from our "history books". The shocking revisionism which is shamefully on display in our modern textbooks and tomes on "history" comes in many forms. Nowhere is this re-writing of events more obvious than with respect to the cause of the Great Depression, and the subsequent response to this deliberately-created crisis. Much of this history (the real "history") centers on the efforts by the the ultra-wealthy to destroy and discredit silver-as-money, and is covered in great detail in Charles Savoie's seminal research on "The Pilgrims", which he has entitled "The Silver Stealers". While I intend to spend a considerable amount of time and effort in the future discussing Savoie's work, this piece is instead dedicated to the gold-stealing which occurred during this same period of time. Obviously, the particular event to which I refer was the traitorous decision by Franklin Roosevelt to confiscate most of the gold of U.S. citizens, and to do so in the most duplicitous manner possible. Again, one will gain absolutely no understanding of this betrayal by the U.S. government from our "history books". Fortunately, a superb essay by Garet Garrett provides us with not only a detailed account of events, but his own superb analysis on the hijacking of U.S. democracy which took place at this same time. Garrett was an American journalist who passed away in 1954, but who (prior to that time) published many contemporaneous works on the events of the "Roosevelt Era". While his analysis of that entire episode of American history is a "must read" for anyone seeking a better understanding of the Great Depression, for today I will focus on one small part of that essay: concerning U.S. gold-confiscation. Some readers will question the relevance of this discussion, noting that in the 1930's the U.S. had a "gold standard" while today it does not. However, in fact it was U.S. gold-confiscation which denoted the real end-point of the global gold-standard, with the subsequent "Bretton-Woods Agreement" of 1944 merely substituting a grossly-inferior, quasi-gold standard as a replacement for a monetary system previously based upon "sound money". More specifically, first the U.S. confiscated the gold of its citizens, and then the Roosevelt government announced it was abandoning a gold "standard", through ending the "convertibility" of the paper currency of the Federal Reserve into "real money" (i.e. gold). Then to complete its betrayal of its own people, it was only after Roosevelt stole the gold of his own people, and after Roosevelt ended convertibility of banker-paper back to gold that Roosevelt cynically announced his "revaluation" of the price of gold – i.e. the devaluation of the U.S. dollar by roughly 50%. Effectively, after Roosevelt had stolen the gold of his citizens, he retroactively cut their "compensation" in half. The sequence of events proves this was an intentional betrayal by the Roosevelt government: first he took the gold of U.S. citizens, and gave them (worthless) banker-paper in return. It was only after the gold has been confiscated for paper that Roosevelt informed Americans that they would never be able to get their gold back, and only after that he devalued their banker-paper by roughly 50%. This was history's greatest "bait-and-switch". When Americans were first told to "turn in their gold" as a matter of (what else?) "national security", their response was to simply shrug their shoulders and say "why not?" Because (at that time) Federal Reserve paper was directly convertible to gold, in the eyes of Americans they could always convert that paper back to gold should they ever have the desire to do so. It was only after Roosevelt subsequently ended "convertibility" and then also devalued their paper that Americans (some of them, at least) finally understood they had been robbed. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 14 Mar 2011 05:24 AM PDT Marc Chandler submits: European officials have reached an agreement in principle that falls well shy of the "comprehensive plan" officials had promised and is unlikely to provide investors with a sense of closure to the debt crisis that began in late 2009. Yet progress was sufficient that the debt crisis is unlikely to override the divergence of U.S. and European interest rate policy as the main driver in the euro-dollar exchange rate. Ironically, Greece, which had acknowledged just as the summit was beginning that its budget deficit was about 9% wider in the Jan-Feb period compared with year ago levels, was the biggest winner from the agreement in principle that requires an EU vote at the March 24-25 summit. Officials agreed to increase the efficiency and flexibility of the European Financial Stabilization Facility (EFSF). In order to maintain a triple-A rating, the EFSF had to have greater guarantees than loans and had to Complete Story » | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Freeport McMoran Copper & Gold: Miner With Major Upside Posted: 14 Mar 2011 05:12 AM PDT Money Morning submits: By Jack Barnes Sometimes the market offers investors a rare chance to buy shares of a great company on a dip. That's precisely the opportunity we're getting right now with Freeport-McMoRan Copper & Gold Inc. (FCX). The current market volatility is giving investors with an eye toward long-term investments a great chance to buy shares in a world-class company. FCX is one of the best-run global mining companies and a great way to gain exposure to gold and copper. So it's time to "Buy" Freeport-McMoRan Copper & Gold Inc. And if scooping up a top-notch commodities play on a pullback isn't reason enough, here are six other reasons to buy FCX.

Complete Story » | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 14 Mar 2011 05:10 AM PDT Hard Assets Investor submits: By Brad Zigler Real-time Monetary Inflation (last 12 months): 1.4% Small speculators are big gold buyers now. Well, in truth, they have been big buyers for the past three weeks. Net long positions held by small specs have notched new highs in the last three weekly Commitments of Traders reports published by the Commodity Futures Trading Commission. Now, some traders would look at this and figure it's time to sell. It seems that money managers took to that notion last week. While small specs were buying, money managers were liquidating their long positions. Not aggressively, mind you, but enough to drop gold's net speculative length by 20 basis points (0.2 percent). So, whose lead do you follow if you're a gold investor? Well, if you correlate the week-by-week changes in gold's price and investor bullishness, you've got to give the nod to the money managers. Money Managers' Gold Bullishness Over Complete Story » | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| What's the Difference Between 1 Gold Karat, 1 Diamond Carat and 1 Troy Ounce? Posted: 14 Mar 2011 04:51 AM PDT You have no doubt read countless articles on the price of gold costing "x dollars per ounce", own a gold ring or some other piece of gold jewellery and/or wear or have bought/plan to buy a diamond ring but do you really understand what exactly what you are buying? What's the difference between 1 troy ounce of gold and 1 (regular) ounce? What's the difference between 18 and 10 karat gold? What's the difference between a .75 and a 1.0 carat diamond? Let me explain. Words: 1102 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 14 Mar 2011 02:56 AM PDT Got Gold Report | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| In the Silver Pit No One Can Hear You Screaming Posted: 14 Mar 2011 02:42 AM PDT Jesse's Cafe | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Sprotts Expect Silver to Keep on Sizzling Posted: 14 Mar 2011 02:40 AM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Risk of Nuclear Catastrophe after Explosion and Contamination Found 60 Miles from Reactor Posted: 14 Mar 2011 02:25 AM PDT gold.ie | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Crude Oil, Gold, and Silver - Important Timing Connection? Posted: 14 Mar 2011 02:00 AM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Resource guru Sprott: "Three-digit price" for silver coming soon Posted: 14 Mar 2011 01:28 AM PDT From an interview in The Gold Report: The Gold Report: Your Markets at a Glance commentary last November said it seemed unlikely that silver would stay under $30 for long. Four months later, the spot price is about $35. Are you surprised by how quickly your prediction came true? Eric Sprott: Not really. Based on fundamental evidence, technical evidence and other things going on in the markets, I thought silver would be explosive this year. I've probably fallen a little short of my targets, but I think it's going higher. Silver doesn't have to hit $50 for everyone who's involved with it to make outsized returns, but I thought it could reach $50 within the first half of this year. All the data supports the thesis that silver is undervalued. TGR: Are you seeing $50 as a top price, or a new baseline? ES: Lots of things may happen in the short term that have no bearing on the long term. Silver now trades at a price ratio of about 40:1 to gold. In other words, it takes 40 ounces of silver price to equal one ounce of gold. The historical ratio is more like 16:1. My view is that we will go back to 16:1 within two to five years. To put that in perspective, a $1,600 gold price would imply $100 for silver. I happen to believe that gold will go much higher than $1,600; therefore, given time and letting this ratio play out, I think we'll certainly see a three-digit price for silver. TGR: So $50 may even become the floor. ES: It's a step on the way. It may come faster or it may take a little longer; but when it happens, silver will outperform gold 3:1. That's a shockingly large difference and good reason to get a little more involved in silver. TGR: You've said that silver will be this decade's gold... Read full article... More on silver: This silver miner could be starting a monumental rally Top precious metals CEO confirms: We don't have enough silver Resource guru Sprott:Eight reasons silver is the investment of the decade | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Richard Russell: Gold is the only safe currency left Posted: 14 Mar 2011 01:15 AM PDT From Casey Research: Speaking at the Casey Research Gold and Resource Summit, Richard Russell told the audience, "I’d feel much better holding everything I own in gold. Holding dollars means holding a depreciating asset and I feel much more confident holding gold." He went on to say, "The good part about gold is it can’t go bankrupt and it’s very hard to manipulate gold because it’s international. I know the Fed would love to manipulate gold, but it can’t control it because it’s traded all over the world, every hour of the day and night." Read full article (with video)... More from Richard Russell: Richard Russell on a surprising bullish sign for gold The great Richard Russell on how anyone can become rich Richard Russell: The most profitable gold rally is yet to come | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Analyst: It's time to get out of stocks Posted: 14 Mar 2011 01:08 AM PDT From Gold Scents: This is for all you folks out there with retirement accounts in the general stock market. I've been warning for many months that the cyclical bull market we've been in for almost two years is still just a counter trend rally in an ongoing secular bear market. I made that same warning about the last cyclical bull market from '02 to '07. Many people ignored me in November '07 when I said the second leg down in the secular bear market had begun. I suspect many people wish they hadn't. There are now warning signs that this counter trend rally may have topped. And even if it hasn't, the potential upside is so small it's not worth the risk of getting caught in the next bear leg to catch a few more percentage points... Read full article... More on stocks: Get ready for a "rout" in stocks, bonds, and commodities The world's greatest silver stock could soon be even better This could be the most important stock chart in the world today | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| View From the Turret: Aftershocks Posted: 13 Mar 2011 11:02 PM PDT

On the economic side, the picture is also quite concerning. Even before the quake's devastation, we discussed the churning action – an intense battle between momentum bulls and newly energized bears. This past week, the Nasdaq and the S&P 500 fell below their 50 day moving averages, a technical support line that has held up for more than three months for both the major indices. Bespoke Investment Group notes that this was the first time in history that both of these indices have broken this kind of streak on the same day. The statistical probability of further weakness is high as momentum traders are now becoming discouraged and emboldened bears are beginning to accumulate profits. Despite Friday's optimistic rebound, we're still cautiously positioned alongside the bears, expecting more weakness in the weeks ahead. As Jack noted over the weekend, the US consumer is still unlikely to be able to support an economic rebound, and improving personal debt figures are more a function of write-offs than healthy balance sheet repair. For the trillions of liquidity pumped into the system, all we got was a mild economic recovery with plenty of caveats to worry about. So as the indices begin to roll over and individual stock charts develop negative patterns, we're positioning our book to take advantage of a flight to quality and a broad evacuation from more speculative areas. ~~~~~~~~~~~~~~~ Stability Attracts Capital As the risk-off trade began to evolve in the last few weeks, we began looking for areas where managers would feel comfortable parking capital in a higher-risk environment. On 2/24, the Mercenary Live Feed noted an opportunity setting up in the S&P Utilities Fund (XLU):

XLU actually trigged our long entry on 2/28 and quickly began accumulating positive returns. This past week, the ETF hit our half profit target (HPT), giving subscribers to the Live Feed an opportunity to take some gains off the table. We continue to tighten the risk point on our remaining shares, with an eye towards protecting existing profit while also giving the position room to fluctuate on its way towards building stronger profits. If the broad market continues to roll over, areas of perceived safety and stability will likely capture a larger share of institutional capital, and we could see more bullish moves in areas typically perceived as "stodgy" and "boring." Dollar Rebound in Play? Despite its many flaws, the US dollar is still perceived as a safe place to park capital in times of elevated risk. Last week, Winston Wolfe outlined the potential for a US dollar short squeeze as traders appear to be caught with overly bearish positioning in the USD. Renewed debt concerns in Europe (the risk seemingly cannot be swept under the rug) will likely be supportive of the greenback, and the US dollar index is sitting right on a significant area of support. We've taken a long position in the dollar at what appears to be an important support area, and any strength this week could give us an opportunity to pyramid our exposure, adding to a profitable position.  Split Tape for Retail Retail stocks have been trading in somewhat of a bi-polar fashion, with high-end luxury shops holding up well, and chains that cater to mid to lower income clients experiencing weakness. This makes sense, considering the fact that consumers in these two groups are experiencing a very different flavor of economic recovery. High-end consumers are much more likely to have been able to preserve their employment, and since many of these workers are being asked to shoulder a heavier load of responsibility, they may feel more entitled to splurge on spending. The lower-income tier has an entirely different story. Jobs have been cut while higher food and gas prices cut into discretionary spending levels. For many, there simply isn't enough income to cover all of the necessary expenses – not to mention the cost of eating out or adding to the spring wardrobe. On Thursday, Lululemon Athletica (LULU) announces fourth quarter (fiscal year end Jan 31) earnings. Since LULU is one of the ultimate "luxury apparel" names – and also a speculative growth vehicle – it will be interesting to see how traders react to the report. If recent history is any indication, investors could be treated to yet another gap higher as the firm executes on its growth strategy. But if management offers any disappointing guidance or negative profit metrics, the speculative price multiple could get knocked for a loop. We'll be keeping our eye on this report as it has the potential to change the trading perception for a number of other speculative growth names. On the other side of the continuum, Target Corp. (TGT) caters to a less-affluent customer base and has been trading significantly lower this year. If the bears win the battle for the broader retail sector (see XRT chart in Jack's Weekender piece) retail names that have already established bearish trends could be great trading vehicles. While Target is not particularly expensive – the PE ratio is near 13 – analyst expectations have been revised lower and very little growth is in the forecast for the next two years. Compared to LULU, this chart shows a disappointing picture for retailers serving consumers with less discretionary income. Technology Leadership in Question For the majority of the last year, broad technology firms – and niche providers as well – have been attracting capital. This makes sense because the economic recovery has been largely built on efficiency gains. Productivity has continued to increase while hiring has been lackluster at best. Investments in tech upgrades have allowed a number of corporations to grow operations with very little investment in human resources. Today, a number of favorite tech companies appear to be weakening and could get hit by a broader "risk-off" move in the markets. Since many of these names carry a high multiple and robust growth expectations, they are particularly vulnerable to a significant decline. Of course, investor perceptions would have to shift dramatically to cause these multiples to contract – but we're already beginning to see the momentum shift and some topping formations in place. F 5 Networks Inc. (FFIV) has experienced a tremendous run over the past two years. The company managed to generate earnings growth even during the challenging financial crisis periods and investors have rewarded good performance with a PE multiple approaching 40. But over the last few months, the networking stock has begun to roll over and investors appear to be losing interest. If we are entering a more sustained "risk-off" environment, then high-growth, high-multiple names like FFIV could face much more pressure and significantly lower prices. Ninety minutes before the open, S&P futures are 9 handles lower. This only represents a portion of Friday's rebound, but given the elevated levels of risk, we are comfortable with our bearish posturing. Quake damage reports continue to be revised with nuclear reactor meltdown threats a significant concern. We also have a fed meeting and various economic reports to analyze this week, so expect plenty of volatility. We're locked and loaded and ready for another important week. Trade 'em well! | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Australian Gold Sector Dynamics Posted: 13 Mar 2011 10:00 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Trader Dan Norcini doesnt believe silver COT report anymore Posted: 13 Mar 2011 07:46 PM PDT GATA | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Its Do or Die Week for Equities and Gold Posted: 13 Mar 2011 05:50 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Greenback - 1860 to 1880 - The United States of America Posted: 13 Mar 2011 05:45 PM PDT Bullion Vault | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Offering Kid Dynamite a chance to explain why SLV is better than PSLV Posted: 13 Mar 2011 03:03 PM PDT Would like a thorough reasoning behind your SLV to PSLV dissertation. I'll just wait till he shows up. Shouldn't be long. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 13 Mar 2011 11:22 AM PDT -- Last week the silver price hit a 30-year record. Does that make it a buy or a sell? -- Dr Alex Cowie of Diggers and Drillers firmly believes it's a buy. He lays out a case here, alongside his latest silver stock recommendation. -- Certainly, a mixture of inflationary and geopolitical jitters might be viewed as sound reasons to be a silver buyer right now. But you can also be rightly dubious about an asset that's risen 790% in 10 years. Examination of the gold/silver ratio might shed some light where silver is heading. Dan Denning wrote about the subject back in 2008, the last time silver prices were heating up... -- "Before the modern era of floating currency exchange rates – where the relationship between currencies varies based on their respective strengths and weaknesses – the world was on a gold and silver standard. Precious metals were money, and the ratio between the gold price and silver price historically was around 15:1." -- "Gold has always been more valuable than silver, at least as money. Gold is harder to find and mine. Silver is relatively more abundant and can be consumed in industrial processes. Gold is more durable." -- "But in the last thirty years, the gold silver ratio has exhibited quite a bit of volatility. A higher ratio shows both gold strength and silver weakness. When the ratio declines – as it appears to be doing right now – it means silver is getting stronger. It should be noted that a declining ratio doesn't mean the gold price is falling. It could mean that both metals are rising, but that silver is rising faster than gold." -- Three years on, that seems to be exactly what's happening now, only at a much more aggressive pace...

- As you can see, the gold/silver ratio has been declining rapidly over the last six weeks. Back in late 2008, when silver hit its last low, it took nearly 90 ounces of silver to buy one gold ounce. On this Labor Day it takes just 40. The last time the ratio hit this level was February 1998. Silver had just soared 33% in five weeks. Gold only went up just 4% over the same period...

-- In previous years when silver started to gain strength against gold, the ratio would near the 40 level, then retreat backwards. Last Monday it breached this point for the first time in 13 years. Certainly the technical analyst would say this is a very bullish signal for silver. -- But, as mentioned, silver is already in the middle of a very mature bull market. Just how much more can possibly be left in the tank? -- There are a few reasons why silver is – and may well keep on – outperforming gold in 2011. -- One is that there is a thriving industrial demand for silver that is just not there for gold. 45% of the demand for silver comes from the electronics industry alone. -- But the main reason silver is outstripping gold at the moment is the fact that retail investors – particularly the Chinese – want silver like never before. -- Geopolitical issues will ensure precious metals remain an attractive option for the rest of the year. But the relatively smaller unit cost of silver compared to gold means smaller-scale investors looking for some kind of crisis hedge to inflationary worries or more unrest in the Middle East can get some peace of mind. Industrial demand for silver is pretty much the same level as it was back in 1998, the last time the ratio was this low. This time its retail demand that's the real difference. -- You can't find a silver bullion bar for love or money in China right now. Sustained retail demand for silver is soaring there. China used to be a net exporter of silver. Last year it gobbled 14% of the global silver market. Says Chris Berry, founder of Mountain House Partners: "I know that the Chinese are buying huge blocks of the SLV silver ETF and then selling it to try and get their hands on the physical metal. You have the Chinese sitting on a store of $2.5 trillion US of which they know is completely useless, so I think they are looking at gold, but also at silver as a store of value and a way to hedge against the decline of the US dollar." -- What you're getting with silver is cut-price wealth insurance in comparison to gold. That's an attractive proposition for nervy investors in the current environment. And that's why the gold/silver ratio is trading at a 13 year low. -- Now it's broken the key resistance level of 40, it's very possible you could see a gold/silver ratio edging closer to where it should be historically – around the 15 to 20 mark. It might not happen next week or next month...but could it happen this year? -- You can find out what our resource stock specialist Dr. Alex Cowie thinks in a new silver research report he's written by clicking here. Greg Canavan |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

It's been a sobering weekend as we begin to understand the magnitude of devastation caused by the earthquake and tsunami in Japan. From entire cities being wiped out, to nuclear power plants on the verge of meltdown, the human toll is difficult to comprehend.

It's been a sobering weekend as we begin to understand the magnitude of devastation caused by the earthquake and tsunami in Japan. From entire cities being wiped out, to nuclear power plants on the verge of meltdown, the human toll is difficult to comprehend.

No comments:

Post a Comment