Gold World News Flash |

- GoldSeek.com Radio Gold Nugget: Richard Daughty & Chris Waltzek

- China and the West: Opposite Approach to Inflation

- Sustainable Shortfalls on Unsustainable Debt

- Asian Metals Market Update

- Global Money Printing Is A Recipe For A Global Economic Nightmare

- Gold Seeker Closing Report: Gold and Silver Gain While Stocks Slump

- Lassonde sees EU collapse and $1,500 gold this year

- Time to Dump Stocks for Gold

- Why are Gold & Silver Breaking Out?

- Silver: When a Breakeven Isn't

- Why I’m Buying Silver at $30

- Which US Banks Are Managing Billions For The $32 Billion Libyan Sovereign Wealth Fund?

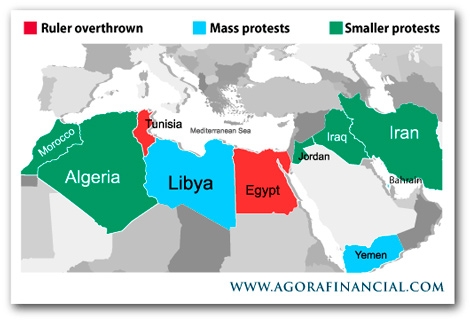

- Revolutionary Scorecard

- Jewelry Drives the Gold Trade

- Guest Post: Why I'm Buying Silver At $30

- Oil Price Spikes as Tensions in Libya Heat Up

- Why I'm Buying Silver at $30

- Gold Daily and Silver Weekly Charts - Empire Strikes Back

- Gold at 7-week high, silver at 31-year peak

- Ralph Benko: Gold, the states, and federal monetary policy

- Commodities Bloodbath Except Gold, Silver, Crude; Nasdaq Off 2.7%, SP 400 Off 2%; VIX Shows Little Fear; Will this be the Dip that Won't be Bought?

- Mine production can't avert silver squeeze, Embry tells King World News

- Why the Sun Is Setting on Gold

- Bailout Bubble Blues

- Jewelry Drives the Gold Love Trade

- Mohamed El-Erian Says We Can Not Assume The Dollar Will Retain Its Reserve Currency Status

- Why Are Gold and Silver Breaking Out?

- Excessive Bullish Sentiment Meets Inflationary Pressures

- The Best Investments of the Next 50 Years

- What a Difference 15 Basis Points Make

- Don't Hold Your Breath...

- Fractal Analysis Suggests Silver to Reach $52 - $56 by May

- With NYSE Short Interest At The Lowest Level In Years Following A Record Short Collapse... Who Will Be The Bid?

- The Role of US Debt in the Current Revolution

- Goldrunner: Fractal Analysis Suggests Silver to Reach $52 ? $56 by May ? June 2011

- The Daily Market Report

- This past week in gold - Feb 22, 2011

- Silver Train Is A Comin: Are You Onboard?

- Silver Train Is A Coming Are You Onboard

- Paper Silver and Gold markets Are "Nonsense" - John Hathaway

- Seabridge: My Best Trade Ever Is an Even Better Deal Today

- LGMR: Silver "Disconnected from Gold" as Middle East Turmoil Hits Equities

- Northern Gold Hits 58 Meters of 1.08 g/t Gold Including 2 Meters of 13.07 g/t, Plus 18 Meters of 2.08 g/t Including 1.0 Meter of 13.27 g/t, Plus 2 Meters of 7.13 g/t, and 1 Meter of 8.32 g/t

- The Box of Money

- 0% Interest Rate = Worthless Dollar

- The BIS Recognizes the Problems With the US Dollar…Finally

- Paper gold and silver markets are ‘nonsense,’ Hathaway tells King World News

- Goldcorp: Jump in Cash Flow and Earnings Expected in Q4 Report

- Unrest in Libya Boosts Gold and Silver Prices

- Will Gold Give In to Stock Market Rally?

| GoldSeek.com Radio Gold Nugget: Richard Daughty & Chris Waltzek Posted: 22 Feb 2011 07:02 PM PST |

| China and the West: Opposite Approach to Inflation Posted: 22 Feb 2011 06:06 PM PST Precious metals gained on Friday amid the G-20 weekend summit, geopolitical concerns, and inflationary pressures. Gold traded at $1390 per ounce while silver was at $32.65 per ounce. So far, February has been an interesting month for gold. The development in emerging markets, inflationary pressures in the United States and lingering geopolitical worries have all contributed to its rally. |

| Sustainable Shortfalls on Unsustainable Debt Posted: 22 Feb 2011 06:02 PM PST From the Economic Collapse Blog, an essay I found at LewRockwell.com, we learn the horrifying news that the United States Census Bureau has, for some reason, probably after spending millions and billions of dollars and countless man-hours, found out that there are approximately 1.5 billion credit cards in use in the United States, although what this has to do with the Census Bureau is beyond me, except that they are probably trying to justify their existence in light of looming budget cuts in light of a collapsing economy. |

| Posted: 22 Feb 2011 06:00 PM PST Gold and silver will fall if and when focus shifts away from the Middle East and North Africa region. Libya is trying to crush democratic moves, other rulers are also scared. Bahrain formula one grand prix has been postponed. This suggests that the situation can go out of hand in the middle east. Overall trend is bullish for gold and silver and corrections will be a part and parcel of a long term bull rally. |

| Global Money Printing Is A Recipe For A Global Economic Nightmare Posted: 22 Feb 2011 05:21 PM PST The Whole World is Going Crazy With Money Printing! If the U.S. dollar is being devalued so rapidly, then why does it sometimes increase in value against other global currencies?* It is because**there are times when one particular global currency will fall faster than the others but the reality is that they are all being rapidly devalued.**As the 6 charts below illustrate, the UK, the EU, Japan, China and India, as well as the U.S., have all*been printing money like there is no tomorrow.* Unfortunately, this is a recipe for a global economic nightmare. Words: 1102 So*says**theeconomiccollapseblog.com*in*an article* which Lorimer Wilson, editor of www.munKNEE.com, has reformatted*and edited* below for the sake of clarity and brevity to ensure a fast and easy read. (Please note that this paragraph must be included in any article re-posting to avoid copyright infringement.)*The article*goes*on to say: Right now you can almost smell the panic as it rises in global financial markets.*Pap... |

| Gold Seeker Closing Report: Gold and Silver Gain While Stocks Slump Posted: 22 Feb 2011 04:00 PM PST Gold climbed throughout most of trade on Monday and rose $23.25 to $1411.15 last night before it fell back to $1392.60 at around 5AM EST, but it then climbed back to as high as $1406.35 in New York today and ended with a gain of 0.87% from last Friday's close. Silver surged $1.93 to a new 30-year high of $34.32 last night before it fell back to $32.383 at around 5AM EST, but it also climbed back higher in London and New York and ended with a gain of 1.48% from last Friday's close. |

| Lassonde sees EU collapse and $1,500 gold this year Posted: 22 Feb 2011 02:38 PM PST 10:35p ET Tuesday, February 22, 2011 Dear Friend of GATA and Gold (and Silver): The European Union may collapse and gold well may reach $1,500 or more this year, mining entrepreneur Pierre Lassonde tells King World News, before discussing the prospects for some of the companies in which he is invested. The interview is about 19 minutes long and you can listen to it here: http://kingworldnews.com/kingworldnews/Broadcast/Entries/2011/2/23_Pierr... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Prophecy Resource Spins Off Platinum/Palladium Venture: Company Press Release, January 18, 2011 VANCOUVER, British Columbia -- Prophecy Resource Corp. (TSX-V:PCY)and Pacific Coast Nickel Corp. announce that they have agreed that PCNC will acquire Prophecy's Nickel PGM projects by issuing common shares to Prophecy. PCNC will acquire the Wellgreen PGM Ni-Cu and Lynn Lake nickel projects in the Yukon Territory and Manitoba respectively by issuing up to 550 million common shares of PCNC to Prophecy. PCNC has 55.7 million shares outstanding. Following the transaction: -- Prophecy will own approximately 90 percent of PCNC. -- PCNC will consolidate its share capital on a 10 old for one new basis. -- Prophecy will change its name to Prophecy Coal Corp. and PCNC will be renamed Prophecy Platinum Corp. -- Prophecy intends to distribute half of its PCNC shares to shareholders pro-rata in accordance with their holdings. Based on the closing price of the common shares of PCNC on January 17, $0.195 per share, the gross value of the transaction is $107,250,000. For the complete announcement, please visit: http://prophecyresource.com/news_2011_jan18.php Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: http://www.gata.org/node/16 ADVERTISEMENT Sona Drills 85.4g Gold/Ton Over 4 Metres at Elizabeth Gold Deposit, Extending the Mineralization of the Southwest Vein on the Property Company Press Release, October 27, 2010 VANCOUVER, British Columbia -- Sona Resources Corp. reports on five drillling holes in the third round of assay results from the recently completed drill program at its 100 percent-owned Elizabeth Gold Deposit Property in the Lillooet Mining District of southern British Columbia. Highlights from the diamond drilling include: -- Hole E10-66 intersected 17.4g gold/ton over 1.54 metres. -- Hole E10-67 intersected 96.4g gold/ton over 2.5 metres, including one assay interval of 383g of gold/ton over 0.5 metres. -- Hole E10-69 intersected 85.4g gold/ton over 4.03 metres, including one assay interval of 230g gold/ton over 1 metre. Four drill holes, E10-66 to E10-69, targeted the southwestern end of the Southwest Vein, and three of the holes have expanded the mineralized zone in that direction. The Southwest Vein gold mineralization has now been intersected over a strike length of 325 metres, with the deepest hole drilled less than 200 metres from surface. "The assay results from the Southwest Zone quartz vein continue to be extremely positive," says John P. Thompson, Sona's president and CEO. "We are expanding the Southwest Vein, and this high-grade gold mineralization remains wide open down dip and along strike to the southwest." For the company's full press release, please visit: http://sonaresources.com/_resources/news/SONA_NR19_2010.pdf |

| Posted: 22 Feb 2011 01:39 PM PST The S&P 500 has rebounded about 100% in 100 weeks. What crisis? What new normal? The economy is recovering and happy times are back again. Old normal is back. Stocks for the long run! Permabears be damned! The permabulls are back! Rates are low, core inflation is low, its Goldilocks time! US stocks are only following the same pattern they’ve followed in the last three bear markets. The midpoint crash (1907, 1937, 1974, 2008) gave way to a furious rebound in each case. Following 1937, the market retraced 62% of its losses. Following 1907 and 1974, the market peaked three and a half years later after retracing roughly 95% of the losses. Three and a half years and a 95% retracement equates to the S&P 500 peaking at 1500 in April of this year. Before you assume I’m a permabear gold-bug, take a look back to an article from February 2009. With the S&P 500 at 764, I called for a 15% decline before the market bottoms and rallies for months and signific... |

| Why are Gold & Silver Breaking Out? Posted: 22 Feb 2011 01:00 PM PST We have yet to complete two months of 2011 and so far we have already seen several attempted revolutions in Middle Eastern countries, with so far two of them successful. All of them have been unexpected and have caught the world by surprise. We are on the brink of the next successful revolution [Libya] disrupting the oil market and taking prices so high that we are likely to see them negatively impact growth in the developed world. The prospect of the dreaded, "double-dip" recession is now back on our screens. |

| Silver: When a Breakeven Isn't Posted: 22 Feb 2011 12:53 PM PST Hard Assets Investor submits: By aBrad Zigler Real-Time Monetary Inflation (Last 12 months): 0.9%. We get a lot of questions whenever we present option strategies in the Desktop. Options are arcane to many investors. No doubt, options can be complicated. Options can even seem inexplicable at times. Particularly baffling is this business about breakeven points. Case in point: our February 10 column ("Options For Silver Traders,") in which a bull call spread in the iShares Silver Trust (SLV) was presented. Back then, when spot silver and the SLV trust were dancing on either side of $30, the purchase of an April $32 call could be partially financed by the sale of a $34 call, leaving the spreader with a capital commitment of only 37 cents a share, or $37. On paper - meaning at the contracts' expiration date - the spread breaks even when SLV is at $32.37. In reality, though, the spread turned Complete Story » |

| Posted: 22 Feb 2011 12:41 PM PST http://www.caseyresearch.com/editorial/4083?ppref=TBP207ED0211A The silver price has bounced 27% since January 28, a huge advance for a measly 16 trading days. It's already soared past its 2010 high and was selling for less than $16 this time last year, a double in 12 months. So, is it pricy? Or should we ignore the run-up and keep buying? [...] |

| Which US Banks Are Managing Billions For The $32 Billion Libyan Sovereign Wealth Fund? Posted: 22 Feb 2011 10:28 AM PST Following the previous post taking a tangential if insightful peek into Gaddafi's personal eccentricities, we next look at something far more important, where once again courtesy of Wikileaks disclosure, we find that the Libyan Sovereign Wealth Fund (Libyan Investment Authority, or LIA), whose holdings were first dissected on Zero Hedge, and whose AUM is supposedly a massive $32 billion, has "several American banks each managing USD 300-500 million of the LIA's funds." Perhaps now that UniCredit has plunged by 12% in the past few days due to the recognition of Libya's involvement in the bank it is time for the US banks who manage billions in capital for the LIA, to step up. After all even most of the country's ambassadors have vocally recused themselves of any association with the government. Perhaps our banks can show a comparable level of objectivity and at the loss of a few million in management fees clean their conscience, before someone does it for them. Also curious is the fact that the LIA appears to have had its own direct involvement with a certified ponzi after having been approached by both Stanford (with a rumored investment by the LIA being the end result) as well as the one, the only, original (post-modern) ponzmaster, Bernie Madoff. From Wikileaks: C O N F I D E N T I A L SECTION 01 OF 02 TRIPOLI 000079 CRETZ0 01/28/2010 6969 CVIS,PREL,ECON,EFIN,ECIN,EINV,EIND,ETRD,ETTC,LY TECHNOLOGY TO TOURISM: HEAD OF INVESTMENT AUTHORITY DISCUSSES OPPORTUNITIES FOR U.S. BUSINESS IN LIBYA During a January 20 meeting with the Ambassador, Mohamed Layas, the Head of the Libyan Investment Authority (LIA, Libya's sovereign wealth fund), welcomed the February 20-23 Department of Commerce-led Trade Mission and highlighted ways that U.S. businesses could thrive in Libya, particularly in the tourism and health services sectors. The Ambassador underlined the need for the Libyan government to eliminate the "visa freeze" for official Americans and to improve the visa process for other Americans, including allowing American tourists to enter Libya. Layas asserted that the LIA has USD 32 billion in liquidity, and noted that several American banks are each managing USD 300-500 million of the LIA's funds. End Summary. |

| Posted: 22 Feb 2011 09:31 AM PST The 5 min. Forecast February 22, 2011 01:13 PM by Addison Wiggin - February 22, 2011 [LIST] [*] Why did Libya send oil up and stocks down? It's not all about the oil... [*] Byron King's firsthand recollections of another hot spot… "We had better batten down the hatches" [*] Rick Rule on the "Black Swan" factor behind gold and silver's latest moves [*] Tuesday data points: Housing down, consumer confidence up [*] Reader asks us to reply to our "narrow and somewhat feckless" view... We oblige [/LIST] Tunisia? Nah, not so much. Egypt? Meh. Bahrain? Almost. It took Libya to really get a rise out of the markets. Or a fall, depending on what asset class you’re looking at today. Only Libya ranks high enough on the list of the world's top oil exporters to register a reaction. The CIA Factbook ranks the desert nation No. 15 in exports: Bahrain, by contrast, ranks No. 49. But sitting, as it does, close to Iran, the island nation gets a f... |

| Posted: 22 Feb 2011 09:27 AM PST Frank Holmes submits: This week, the World Gold Council (WGC) confirmed something we'd already suspected: 2010 was a remarkable year for gold. Overall demand grew by 9 percent to reach a 10-year high on increased jewelry demand, strong momentum in key Asian markets and a paradigm shift in the official sector, the WGC says. Demand for jewelry was the biggest contributor to gold demand, accounting for 54 percent of the total. That's a 17 percent rise despite gold prices jumping 26 percent in many currencies. Gold demand for technology increased 12 percent. Surprisingly, investment demand declined 2 percent as investment in gold ETFs dropped 45 percent. Even with the drop, 2010 was the second-highest year on record in terms of investment demand. India led the world in gold jewelry demand with more than 745 tons. China was a distant second at just under 400 tons and the U.S. third at 128 tons. While Complete Story » |

| Guest Post: Why I'm Buying Silver At $30 Posted: 22 Feb 2011 09:13 AM PST Submitted by Jeff Clark of Casey Research Why I'm Buying Silver at $30 The silver price has bounced 27% since January 28, a huge advance for a measly 16 trading days. It's already soared past its 2010 high and was selling for less than $16 this time last year, a double in 12 months. So, is it pricy? Or should we ignore the run-up and keep buying?

|

| Oil Price Spikes as Tensions in Libya Heat Up Posted: 22 Feb 2011 08:56 AM PST Tunisia? Nah, not so much. Egypt? Meh. Bahrain? Almost. It took Libya to really get a rise out of the markets.

Or a fall, depending on what asset class you're looking at today. Only Libya ranks high enough on the list of the world's top oil exporters to register a reaction. The CIA Factbook ranks the desert nation No. 15 in exports:

Bahrain, by contrast, ranks No. 49. But sitting, as it does, close to Iran, the island nation gets a few extra brownie points for strategic importance. Shell, BP and Marathon are but a few of the international oil companies pulling their workers out of Libya and shutting down operations. ExxonMobil, ConocoPhillips and Occidental haven't said much more than "no comment." As a direct consequence, the price for a barrel of the black goo has reached a level last seen before the panic spike in 2008. Brent crude is up more than $1.50, to $107.33. West Texas Intermediate is up over $7, to $93.33. Other headlines from the region aren't helping. Iranian warships are passing through the Suez Canal, something the Israelis call a "provocation." And Somali pirates have killed four Americans aboard a yacht hijacked Friday off the coast of Oman. But the Libya story is more than that of a major oil exporter shutting down. It was one thing for Tunisians to rebel against a government with a weak army…or for Egyptians to rebel when the army largely refused to shoot at them. But it's another thing altogether when Col. Gaddafi sends in warplanes to strafe crowds of Libyan protesters…and the protesters keep showing up. Neither has it been a cakewalk in Bahrain. If you've got the stomach for it, there are a number of disturbing videos posted on YouTube detailing the level of violence being unleashed by the respective governments on their own citizens. "Back in the 1990s, I spent time a fair amount of time in Bahrain," said Outstanding Investments' Byron King in his essay "Investing Around the Chaos in the Arab World." "Bahrain is about 70% Shiite and 30% Sunni. The Sunnis run the government, industry, business, banking, commerce. The Shiites are consigned to the other side of the camel tracks. "I recall driving around Bahrain and encountering these surly-looking groups of underemployed young men — mostly Shiites — who were locked out of the economy. Nothing to do but smoke cigarettes, make a few dinar in the underground economy… and nurse grudges against the guys on top. "It struck me even then that Bahrain was a pot that would boil over, sooner or later." We're just about there. Addison Wiggin Oil Price Spikes as Tensions in Libya Heat Up originally appeared in the Daily Reckoning. The Daily Reckoning has published articles on the impact of quantitative easing, bakken oil, and hyperinflation. |

| Posted: 22 Feb 2011 08:33 AM PST |

| Gold Daily and Silver Weekly Charts - Empire Strikes Back Posted: 22 Feb 2011 08:24 AM PST |

| Gold at 7-week high, silver at 31-year peak Posted: 22 Feb 2011 08:20 AM PST SAN FRANCISCO (MarketWatch) — Gold futures settled at a seven-week high Tuesday as a jump in violence and protests in petroleum exporter Libya spurred safe-haven buying. Silver notched a fresh 31-year high, while metals more closely tied to industrial uses, such as copper and palladium, tracked the stock market lower and finished at multiweek lows on worries that surging oil prices could dent the economic recovery. [source] PG View: While spot is actually lower today for both gold and silver, yesterday's holiday means that the change in futures prices is basis Friday's close. |

| Ralph Benko: Gold, the states, and federal monetary policy Posted: 22 Feb 2011 08:17 AM PST 4:17p ET Tuesday, February 22, 2011 Dear Friend of GATA and Gold (and Silver): Ralph Benko of the American Principles Project recounts some fascinating history of the U.S. Constitutional Convention, whose members really didn't want anything but gold and silver to be money. Benko's commentary is headlined "Gold, the States, and Federal Monetary Policy" and you can find it at CNBC here: http://classic.cnbc.com/id/41665142 CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Prophecy Resource Spins Off Platinum/Palladium Venture: Company Press Release, January 18, 2011 VANCOUVER, British Columbia -- Prophecy Resource Corp. (TSX-V:PCY)and Pacific Coast Nickel Corp. announce that they have agreed that PCNC will acquire Prophecy's Nickel PGM projects by issuing common shares to Prophecy. PCNC will acquire the Wellgreen PGM Ni-Cu and Lynn Lake nickel projects in the Yukon Territory and Manitoba respectively by issuing up to 550 million common shares of PCNC to Prophecy. PCNC has 55.7 million shares outstanding. Following the transaction: -- Prophecy will own approximately 90 percent of PCNC. -- PCNC will consolidate its share capital on a 10 old for one new basis. -- Prophecy will change its name to Prophecy Coal Corp. and PCNC will be renamed Prophecy Platinum Corp. -- Prophecy intends to distribute half of its PCNC shares to shareholders pro-rata in accordance with their holdings. Based on the closing price of the common shares of PCNC on January 17, $0.195 per share, the gross value of the transaction is $107,250,000. For the complete announcement, please visit: http://prophecyresource.com/news_2011_jan18.php Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: http://www.gata.org/node/16 ADVERTISEMENT Sona Drills 85.4g Gold/Ton Over 4 Metres at Elizabeth Gold Deposit, Extending the Mineralization of the Southwest Vein on the Property Company Press Release, October 27, 2010 VANCOUVER, British Columbia -- Sona Resources Corp. reports on five drillling holes in the third round of assay results from the recently completed drill program at its 100 percent-owned Elizabeth Gold Deposit Property in the Lillooet Mining District of southern British Columbia. Highlights from the diamond drilling include: -- Hole E10-66 intersected 17.4g gold/ton over 1.54 metres. -- Hole E10-67 intersected 96.4g gold/ton over 2.5 metres, including one assay interval of 383g of gold/ton over 0.5 metres. -- Hole E10-69 intersected 85.4g gold/ton over 4.03 metres, including one assay interval of 230g gold/ton over 1 metre. Four drill holes, E10-66 to E10-69, targeted the southwestern end of the Southwest Vein, and three of the holes have expanded the mineralized zone in that direction. The Southwest Vein gold mineralization has now been intersected over a strike length of 325 metres, with the deepest hole drilled less than 200 metres from surface. "The assay results from the Southwest Zone quartz vein continue to be extremely positive," says John P. Thompson, Sona's president and CEO. "We are expanding the Southwest Vein, and this high-grade gold mineralization remains wide open down dip and along strike to the southwest." For the company's full press release, please visit: http://sonaresources.com/_resources/news/SONA_NR19_2010.pdf |

| Posted: 22 Feb 2011 08:15 AM PST |

| Mine production can't avert silver squeeze, Embry tells King World News Posted: 22 Feb 2011 08:02 AM PST 4p ET Tuesday, February 22, 2011 Dear Friend of GATA and Gold (and Silver): The short squeeze in silver can't be averted by mine production as the metal increasingly is targeted as a monetary asset, Sprott Asset Management's John Embry tells King World news today. Excerpts from the interview can be found at the King World News blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2011/2/22_Em... Or try this abbreviated link: CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Prophecy Resource Spins Off Platinum/Palladium Venture: Company Press Release, January 18, 2011 VANCOUVER, British Columbia -- Prophecy Resource Corp. (TSX-V:PCY)and Pacific Coast Nickel Corp. announce that they have agreed that PCNC will acquire Prophecy's Nickel PGM projects by issuing common shares to Prophecy. PCNC will acquire the Wellgreen PGM Ni-Cu and Lynn Lake nickel projects in the Yukon Territory and Manitoba respectively by issuing up to 550 million common shares of PCNC to Prophecy. PCNC has 55.7 million shares outstanding. Following the transaction: -- Prophecy will own approximately 90 percent of PCNC. -- PCNC will consolidate its share capital on a 10 old for one new basis. -- Prophecy will change its name to Prophecy Coal Corp. and PCNC will be renamed Prophecy Platinum Corp. -- Prophecy intends to distribute half of its PCNC shares to shareholders pro-rata in accordance with their holdings. Based on the closing price of the common shares of PCNC on January 17, $0.195 per share, the gross value of the transaction is $107,250,000. For the complete announcement, please visit: http://prophecyresource.com/news_2011_jan18.php Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: http://www.gata.org/node/16 ADVERTISEMENT Sona Drills 85.4g Gold/Ton Over 4 Metres at Elizabeth Gold Deposit, Extending the Mineralization of the Southwest Vein on the Property Company Press Release, October 27, 2010 VANCOUVER, British Columbia -- Sona Resources Corp. reports on five drillling holes in the third round of assay results from the recently completed drill program at its 100 percent-owned Elizabeth Gold Deposit Property in the Lillooet Mining District of southern British Columbia. Highlights from the diamond drilling include: -- Hole E10-66 intersected 17.4g gold/ton over 1.54 metres. -- Hole E10-67 intersected 96.4g gold/ton over 2.5 metres, including one assay interval of 383g of gold/ton over 0.5 metres. -- Hole E10-69 intersected 85.4g gold/ton over 4.03 metres, including one assay interval of 230g gold/ton over 1 metre. Four drill holes, E10-66 to E10-69, targeted the southwestern end of the Southwest Vein, and three of the holes have expanded the mineralized zone in that direction. The Southwest Vein gold mineralization has now been intersected over a strike length of 325 metres, with the deepest hole drilled less than 200 metres from surface. "The assay results from the Southwest Zone quartz vein continue to be extremely positive," says John P. Thompson, Sona's president and CEO. "We are expanding the Southwest Vein, and this high-grade gold mineralization remains wide open down dip and along strike to the southwest." For the company's full press release, please visit: http://sonaresources.com/_resources/news/SONA_NR19_2010.pdf |

| Why the Sun Is Setting on Gold Posted: 22 Feb 2011 08:01 AM PST Investment U submits: By Alexander Green Six weeks ago, I wrote a column advising short-term speculators to sell their gold. Since that time, the metal has drifted lower. But the brunt of the decline is likely still ahead. As I've said before, gold is difficult to value under the best of circumstances. It pays no interest, has no earnings, provides no rent. What gold will be worth next week or next month is whatever buyers will pay for it at the time. And that, in technical terms, is a guess. I've heard gold bugs make their case. Some are based on emotion. Others are based on political fantasies about the Federal Reserve turning us into the Weimar Republic circa 1923, or modern-day Zimbabwe. What I rarely hear them talking about is pedestrian stuff like supply and demand… When Buyers Become Sellers, Look Out Below Billions of dollars have been spent building gold mines Complete Story » |

| Posted: 22 Feb 2011 07:59 AM PST By Captain Hook, Treasure Chests They have to go further and further into forbidden territory all the time now to keep our bubble economies inflated. Increasingly, and like a junkie, because the establishment will not allow for a real correction (slow down) in our fiat currency economy(s), more and more artificial stimulus must be added into the equation every day now because the patient is a walking zombie, devoid of natural and sustainable life. Because if they didn't do this, the economy would collapse like an exhausted doper whose been too high for too long, never to be the same again, if not dead. That's the way the geniuses in charge of our financial institutions and their puppet politicians who have been bought and paid for manage the economy and financial markets today, hoping the party can last until the next guy is on the hook. The only problem is if our gambling government gangsters were ever in a poker game they would be easy to beat. This is because not only would they likely have a bad poker face, one that tells all to seasoned players, even worse they also have a tendency to show all their cards up front, which is a practice sure to doom even the surest of players. Therein, it's no secret the Fed is printing more money and the government is spending more, because again, our Ponzi economy needs this in order not to collapse. And the plutocrats are probably to allow an upcoming tax holiday for corporations in an effort to attract a great deal of money home that would keep the party going as well, which will have a stimulative but temporary effect in the end. The question arises however, 'after this, and aside from increasingly debasing the currency, what would be done to keep an exhausted economy going then, where hyperinflation would likely be necessary?' Of course they would blow the bond market up in the process (along with the death of fiat currencies), but as pointed out last week, this process is already likely underway with a buy signal (five-wave advance) now triggered in the TNX, meaning far higher interest rates are a real probability. (i.e. because of credit concerns.) So no matter how it comes down in the end now, the post housing bubble we call the bailout bubble (which is just another serial bubble) is already doomed, not to mention any hope of bringing real estate back to any large degree. What's more, and something likely not even contemplated by our price managing bureaucracy, is that pretty soon a consensus of speculators are going to come to the conclusion that QE will go on forever (it's amazing they haven't already) and stop buying puts on the market thinking that's the main variable. (i.e. QE is all that matters in keeping stocks rising.) And all this is happening as the markets are showing signs of increasing exhaustion if you know where to look. Of note, and so far during the present rally sequence, it should be noted tech stocks, as measured by the NASDAQ 100 (NDX) is underperforming the blue chips (Dow), meaning the NDX / Dow Ratio (seen here) is divergently below recent highs despite the fact stocks are vexing new highs. (i.e. this is forecasting the present advance is intermediate degree terminal.) And now that interest rates are rising, guess what, the big picture is beginning to look more and more like an '87 crash signature by the day, where understandably it won't take long for rising rates to do their magic. What is of course most scary about the present picture is our genius plutocracy has left itself no way of legitimately dealing with such an occurrence (debt too high, hollowed out economy, etc.) short of hyperinflation, which these idiots probably couldn't stop at this point even if they wanted. So, be sure and maintain your core positions in precious metals even if volatility picks up, as it surely will under such circumstances, because it's not surviving in the present economy you should be worried about, but how you will come out of this mess on the other side, where believe it or not, the same geniuses that are about to level the planet economically will also likely be in charge of reconstructing the new one as well – again – believe it or not. (i.e. new currency regimes could see old money traded in at ratios of 5 to 1, or higher, meaning you could possibly lose 50 % plus of your purchasing power overnight.) No denying it either, the world's stock markets are becoming increasingly unstable these days, however as usual in the smoke and mirrors environment spawned in fiat currency economies, you would never know it looking at developed country (Western) markets as capital flows out of increasingly suspect emerging markets to safety. Again however, such a trend will only delay the eventual day of reckoning, where like '87, when the trouble in stocks at home comes, it will come surprisingly fast, like the currency devaluation described above. Low volumes, rising margin debt, and rising interest rates are a potent cocktail for stock markets even when they are not as over extended as they are now, but again, they are very overbought, much like condition in both 2007 and 1987. So, when bearish speculators are finally exhausted and stop buying puts the declines should be severe, not the 5 to 10% most are expecting. In fact, it's because dip buyers will likely be active once stocks drop into this range that losses would continue as open interest put / call ratios on US indexes and ETF's fall, leaving the bureaucracy's price managers insufficient fools to feed on, meaning the short squeeze perpetuated since the lows in March of 2009 would be done on an extended basis. (i.e. the four-year cycle calls for a top in financials soon, matching seasonal timing in 2007 as well.) It should be noted that as can be seen here on a monthly chart of the BKX (bank index), that bank stocks are in fact running a negative divergence to new highs in the broads, which is what you would expect to see if the influence of the four-year cycle is taking hold. What's more, and again, this is also consistent with the observation interest rates are heading higher, possibly right across the entire curve. (See Figure 1) Figure 1 This is of course why we have been schooling debt is your enemy, because rates could rise far more than is currently viewed as likely by both a consensus of speculators, and unsuspecting debtors. So, pay your debt off if possible. Or hope for a Christian style jubilee eventually when the time is right (which will be either when it suits the plutocracy or as a result of revolution). Of course hoping for such an outcome could be a big mistake, as the bloodsucking parasites in the financial industry, government, etc. that depend on this usery will fight tooth and nail to keep the party going as long as possible, which could drain most before any relief is doled out. Moreover, if equities start to drop like the post bubble Japanese model (seen here in Figure 1) then those with unmanageable debt will get squeezed on both sides of the ledger, squeezed to the point of bankruptcy in far too many cases. (See Figure 2) And as you can see above, an important low could be witnessed quite soon once the CBOE Volatility Index (VIX) vexes the 14's, which looks to be only days away now, as options expiry approaches next week. As long time readers of these pages would know, the question then will be what are post expiry ratios to look like, where like the tops in stocks both in 2007 and 1987 (and all the significant tops in between), significant drops in US index open interest put / call ratios were witnessed once bearish speculators and hedgers had become exhausted, which meant these ratios were not run up again in subsequent months as these types continued to attempt picking a top. No, once this occurs what you have left are the dip buyers, as discussed above, which keep put / call ratios falling and contained, which in turn plays havoc with stocks that have few underpinnings past how much currency the moneychangers down at the bank will be printed today. Unfortunately we cannot carry on past this point, as the remainder of this analysis is reserved for our subscribers. Of course if the above is the kind of analysis you are looking for this is easily remedied by visiting our web site to discover more about how our service can help you in not only this regard, but also in achieving your financial goals. Along these lines, you should know your subscription to Treasure Chests would include daily commentary from either the myself or Dave Petch. As you may know, I cover macro-conditions, sector timing, and value oriented stock selection, while Dave covers the HUI, XOI, USD, SPX, and TNX technically each week. Mr. Petch is a world class Elliott Wave Theory technician. In addition to this, you would have access to all archived commentaries, the Chart Room, exhibiting 100 annotated charts of the precious metals and stock markets, along with stock selection and sector outlook pages. Here, in addition to improving our advisory service, our aim is to also provide a resource center, one where you have access to well presented 'key' information concerning the markets we cover. And if you are interested in finding out more about how our advisory service would have kept you on the right side of the equity and precious metals markets these past years, please take some time to review a publicly available and extensive archive located here, where you will find our track record speaks for itself. Naturally if you have any questions, comments, or criticisms regarding the above, please feel free to drop us a line. We very much enjoy hearing from you on these matters. Good investing and best of the season all. Captain Hook Copyright © 2011 treasurechests.info Inc. All rights reserved. Treasure Chests is a market timing service specializing in value-based position trading in the precious metals and equity markets with an orientation geared to identifying intermediate-term swing trading opportunities. Specific opportunities are identified utilizing a combination of fundamental, technical, and inter-market analysis. This style of investing has proven very successful for wealthy and sophisticated investors, as it reduces risk and enhances returns when the methodology is applied effectively. Those interested in discovering more about how the strategies described above can enhance your wealth should visit our web site at Treasure Chests. Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Comments within the text should not be construed as specific recommendations to buy or sell securities. Individuals should consult with their broker and personal financial advisors before engaging in any trading activities. We are not registered brokers or advisors. Certain statements included herein may constitute "forward-looking statements" with the meaning of certain securities legislative measures. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of the above mentioned companies, and / or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Do your own due diligence. |

| Jewelry Drives the Gold Love Trade Posted: 22 Feb 2011 07:04 AM PST This week, the World Gold Council (WGC) confirmed something we’d already suspected: 2010 was a remarkable year for gold. Overall demand grew by 9 percent to reach a 10-year high on increased jewelry demand, strong momentum in key Asian markets and a paradigm shift in the official sector, the WGC says. |

| Mohamed El-Erian Says We Can Not Assume The Dollar Will Retain Its Reserve Currency Status Posted: 22 Feb 2011 07:02 AM PST Mohamed El-Erian made one of his regular media appearances today (in addition to his almost daily Op-Ed, released earlier) appearing on Bloomberg Surveillance with Tom Keene and talking the developments in the Maghreb. While the full highlights are presented below, there are two items of note. El-Erian once again hits on what we believe will be the keyword of 2011: stagflation. To wit: "we have to appreciate that in the west, what is happening in Egypt and North Africa results in stagflation in the short term. So higher inflation and lower growth because of higher oil prices that take away purchasing power and transfer wealth somewhere else; because of higher geopolitical risk, which tends to diminish animal spirit and therefore impact investment; and let's not forget that the Middle East is a market, particularly for European exports. So from an economic perspective, it is important for the west to understand that these are stagflationary winds that have been added to the global economy." It is important, but not necessary: as long as the manipulated, liquidity glutted market continues to misrepresent the true state of the economy, nobody will care until it is too late. And speaking of "too late", validating our sarcastic observations over the past several weeks that the dollar is no longer the "flight to safety" currency (that would be the PM complex, and the swiss franc if anything), is the Pimco CIO's suddenly very dour outlook on the weakening US Dollar: "It is a warning shot to America that we cannot simply assume flight to quality, flight to safety. That people are starting to worry about the fiscal situation in the U.S., worrying about the level of debt and what they're hearing about states and municipalities. I would take this as a warning shot that we cannot assume that we will maintain the standing of the reserve currency as we have in the past." That's a given - the question however remains, which fiat currency, if any, is willing and ready to step in and replace the USD? With all eyes continuing to be look at the CNY, how long before China finally takes the plunge to find out just who is the real reserve currency in the world? From Bloomberg TV: On unrest in the Middle East: "I think that a common factor that's been driving all of that is a combination of youth unemployment, high food prices, and political repression. But as you say, Libya is different. The revolutions in Tunisia and Egypt were relatively peaceful. Libya is far from being relatively peaceful. There is a tremendous amount of human suffering and casualties there, making this protest more unpredictable and more dangerous. In addition, Libya is a major oil exporter, so suddenly developments in North Africa and the Middle East have a systemic impact on the economy." "Everyone in the Middle East and beyond understands that this is a movement that has to be taken seriously. That it is better to be ahead of the curve rather than behind the curve. The story of Egypt, Tunisia and Libya have been regimes that have been consistently behind the curve. The lesson that has gone out to not only other Middle Eastern countries but to the whole world, is take seriously these economic and political issues." "On the economic side, the data that you can confirm on the other side, particularly trade data where there is a trading partner and therefore you get another number, tends to be pretty good. It tells you that Libya is an export of about 1.5 million barrels per day, which is not insignificant. This is one of the top 10 or 11 oil exporters. When it comes to internal data--GDP numbers, inflation numbers--then it becomes more difficult. On the political aspects, what we have learned is that western intelligence has been behind the curve in terms of understanding the dynamics in those." "Three elements. One is the reality that in countries like Libya, the rest of the world cannot do very much other than condemn and try to put pressure, but ultimately that's not going to bear very much. Second, In countries that have gone to the first phase of revolution--Tunisia and Egypt--the west is able and willing to step in to help the process towards democracy. It is encouraging that the British prime minister went to Egypt yesterday. Thirdly, we have to appreciate that in the west, what is happening in Egypt and North Africa results in stagflation in the short term. So higher inflation and lower growth because of higher oil prices that take away purchasing power and transfer wealth somewhere else; because of higher geopolitical risk, which tends to diminish animal spirit and therefore impact investment; and let's not forget that the Middle East is a market, particularly for European exports. So for an economic perspective, it is important for the west to understand that these are stagflationary winds that have been added to the global economy." "The new normal is just a recognition that the western world is not going to grow as rapidly as before. That unemployment will be a persistent issue. That social safety nets will be very stretched. And that government intervention will continue in the economy. What we're getting on top of that now are headwinds from higher oil prices, higher geopolitical risk, and a concern that one of the reactions to higher commodity prices will be for consumers to stockpile. So I suspect that right now a lot of airlines are likely saying that with oil where it is now, should we be hedging now? What you get is an overshoot, just like we saw in 2008. That is a concern in terms of the stagflation headwinds." "Last week, Friday in particular, when the crisis started impacting countries like Bahrain, we recognize that things were morphing. That it would impact commodity prices and oil prices in particular. We identified a process of morphing that went on. When the crisis was focused on Egypt and Tunisia, when those countries were going to their peaceful revolution, they were not systemic in nature. The influence on the global economy was limited. They were not large economies. They were not major exporters of commodities. And they did not owe anyone lots of money. When the crisis and turmoil started to hit Libya and Bahrain, this whole phenomenon has morphed. And it has morphed into something that in the short term means higher oil prices, greater risk aversion, and a somewhat flight to quality. Although it's interesting to see that the dollar has not benefitted that much." "The global economies are going to have to live with these for a while. That is just a reality of the world we are living in today." "They have taken important steps. You've seen ministerial changes, you've seen a timeline announced. And most importantly, you've seen the protest movement saying that we will be the check and balance. We're going to make sure that this revolution that was started will end up with democracy and greater individual freedom. We're seeing progress. It's a bumpy road that does not happen overnight. But every day we are seeing progress." "It is a warning shot to America that we cannot simply assume flight to quality, flight to safety. That people are starting to worry about the fiscal situation in the U.S., worrying about the level of debt and what they're hearing about states and municipalities. I would take this as a warning shot that we cannot assume that we will maintain the standing of the reserve currency as we have in the past."

|

| Why Are Gold and Silver Breaking Out? Posted: 22 Feb 2011 06:57 AM PST We have yet to complete two months of 2011 and so far we have already seen several attempted revolutions in Middle Eastern countries, with so far two of them successful. All of them have been unexpected and have caught the world by surprise. We are on the brink of the next successful revolution [Libya] disrupting the oil market and taking prices so high that we are likely to see them negatively impact growth in the developed world. |

| Excessive Bullish Sentiment Meets Inflationary Pressures Posted: 22 Feb 2011 06:56 AM PST |

| The Best Investments of the Next 50 Years Posted: 22 Feb 2011 06:49 AM PST Some of the most successful companies of the last half-century all had one thing in common. And I am certain that the best investments of the next half-century will also share this trait. It's pretty simple and intuitive, yet I wonder why more investors don't focus on it. I'll use a simple analogy to reveal this idea. Let's say we have two houses. In one, the family that lives there also owns it. In the other, there is an absentee owner who rents it out. If you had to guess which house would be in better shape after 10 years, which would you guess? If you said the former, where the people who lived there owned it, odds are you'd be right. (There are always exceptions.) It's a truism in real estate that owners take better care of property than renters. The same kind of logic applies in the stock market. When the people running the show are also owners – what's known as the owner-operator model – those companies tend to deliver astonishing results over time. Steve Bregman, a portfolio manager at Horizon Asset Management, recently shared a little experiment. He looked at "the most successful, iconic constituents of the S&P 500 over the past half century." The impact of OOs was clear. These include Wal-Mart. "Think how well it did under the aegis of Sam Walton for 20 years," Bregman says. Wal-Mart delivered a return of 20.5% annually. But after him, Wal-Mart returned only about 9% per year. Then, there is also IBM. Under the Watson family, IBM returned 6.6% more than the stock market. After the Watsons, only 1.7% better than the market. "Good, but not great," Bregman says. The most recent example of an OO's impact is Apple. Without Steve Jobs for over a decade, Apple turned in a return of 3.1% per year worse than the market. With him, 28% per year better. For the whole list, give the following table a look.

Granted, this is not a scientific experiment, as Bregman notes. (There is scholarly research out there that backs the idea that stocks with owner-CEOs outperform.) But it does show you the importance of that OO. In only two instances did the company under the OO trail the market. Even then, there is a big qualifier. The table shows that during Jobs I, his first tenure as CEO, Apple trailed the market. But it was only a four-year stretch, which he more than made up for later. And in any event, the table shows results only since the company has been public. If you consider the wealth created by Apple's initial public offering, a different picture emerges. Apple's IPO created more millionaires than any company in history. The original venture capitalists that backed Jobs made billions. There is another advantage to OO-run companies that Bregman points to. The stocks have a low correlation to the S&P 500. In other words, returns were not as sensitive to the overall market as other stocks. Remember, a correlation of 1 means the stock matched the S&P 500 exactly. The lower the number, the less sensitive the stock to overall market movements. On average, the OOs had a correlation of only 0.52. By contrast, the average of the largest 50 companies excluding the OOs is about 0.70. That is a big difference and meaningful when building a portfolio. The OOs are your stalwarts. They tend not to mirror the broader market. In any case, this little experiment shows that there is something different about the decision-making process of an OO-run company and that of an ordinary company – and it shows up in returns. As Bregman points out, there are strategic and tactical advantages to being an OO. You can make decisions that are "at dramatic odds with the mainstream [whereas] most company managements are highly reactive to investor concerns." OOs focus on the business because they own it. They don't worry about the short-term stock price. Hired-gun CEOs think differently. For example, the typical company today has accumulated cash, preparing for known risks, waiting for the "all clear" sign before investing. It seems like a good idea, but it's not what creates great piles of wealth. As Bregman puts it, they are "reacting to a crisis that already happened." By contrast, look at the OOs. OOs accumulated cash before the downturn. So rather than continuing "to husband cash, they have been investing it assertively for the last two years." Bregman gives an example from his portfolio, AutoNation. There are 13% fewer dealerships than there were in 2008, which sounds very scary. Yet AutoNation repurchased 17% of its shares during this rough period. The stock today is at 52-week highs and that investment paid off handsomely. Our portfolio is full of such companies that continued to invest cash in dangerous times. Ironically, it is during such times when investing is safest, because the prices you get are the most attractive. And the assets so acquired become the foundations for great success later on. So that's the case for OOs in a nutshell. It doesn't mean there aren't great investments without OOs. But OOs do tip the odds in your favor. On behalf my subscribers to Capital & Crisis, I prefer to invest in owner-operators. Failing that, I seek managers who show an owner's mind-set. The main point is to think about who owns and controls what we are investing in. Regards, Chris Mayer The Best Investments of the Next 50 Years originally appeared in the Daily Reckoning. The Daily Reckoning has published articles on the impact of quantitative easing, bakken oil, and hyperinflation. |

| What a Difference 15 Basis Points Make Posted: 22 Feb 2011 06:46 AM PST Hard Assets Investor submits: By Lara Crigger Last week, I mentioned a curious fact gleaned from the most recent slew of 13-F filings: Billionaire investor and avowed gold aficionado George Soros increased his holdings of the SPDR Gold Trust (NYSE Arca: GLD) last quarter by 0.5%. Complete Story » |

| Posted: 22 Feb 2011 06:21 AM PST On housing, the economy or the dollar. Regarding the latter, I will sum my thoughts on this with a quote from James Turk from his interview with Eric King: But the lingering question in my mind is whether the strong hands who hold silver are unwilling to take a fiat currency. If that is the case, and this backwardation in silver eventually leads to a backwardation in gold, the implications for the US dollar, and indeed all of the fiat currencies in the world are ominous (Here's the LINK)While our policy-makers playing "kick the can down the road" with the catastrophically unmanageable financial problems in this country, the rest of the world is slowly transitioning away from the U.S. dollar and its use as a "reserve" currency. The evidence abounds. Suffice it to say that several countries now trade directly with each other in their local currencies. At some point the rest of the world will not accept dollars anymore and all the paper millionaires in this country will be paper paupers. This tragedy can be avoided by moving as much as you can, while you can, into physical gold and silver. And not CEF, GTU, GLD, SLV (or even PHYS and PSLV unless you buy enough shares to exchange for physical - about $500k for gold and I'm not sure with the silver but for sure 6-figures). Housing continues its acceleration into oblivion. To begin with, the Case-Shiller (leave off the "er" for "shill") monthly housing price index was published today and it showed a 2.4% year/year price decline for December. I did some research into how this index is put together and, first it's a statistical composite of 20 metro areas, and it looks like the numbers are skewed toward non-distressed sales. In other words, it understates the decline in prices being experienced in many areas and it overstates, on average, the price that has to be paid by buyers for homes. It would also not include seller-"soft" concessions, which can be substantial, because those are not factored into the sale price reported to local recording offices. What this means is that the true state of the housing market is much worse than is being reported even by independent data manipulators. Here's the press release for C/S: LINK To make matters worse, it now looks like the National Association of Realtors has overstated the number total home sales going back to 2006 by at least 20%. I actually had mentioned this report last week, I believe, but now it's been thrust into the mainstream media. Core-logic has done the work on this and you can read about it HERE The implications of this are quite ominous. To begin with, if this is true - and I would bet good money that it is - it means that the true inventory of unsold homes is much larger than is being reported by the industry and the census bureau. Oops. It also means that most people who bought a home in the last 5 years did so without good information about the true economic condition of the market and probably overpaid because their realtor hyped them on dwindling supply and a much higher level of sales activity than was actually occuring. Oh well it's only fiat money, right? But even more ominous is that not only is the inventory of unsold home much higher than is being reported right now, but the situation will get even worse as banks are forced to start unloading their inventory of foreclosed homes to make room for the avalanche of foreclosure activity that started in January. The bottom line here is the value of the entire housing market was bid up on a house of cards - so to speak - fueled by lack of credit standards, fraud and lots of printed fiat currency, and now this mess is unwinding and the snap-back in the other direction will be just as large in magnitude and it will be catastrophic in effect. Sorry, but I told anyone who was willing to listen back in 2004, when I unloaded my home, that the market was eventually going to collapse...now a lot of those same people want to know what I think is going to happen next and I refuse to even answer because they won't believe what I think will happen now any more than they did back then...history repeats the first time as a tragedy and the second time as a farce... And now the overall economy. If you want to read a great analysis as to why the retail sales numbers that are being reported completely overestimate the truth, go to http://www.shadowstats.com/ and get John Williams brilliant work. Here's the summary intro to his latest piece: Broad economic activity generally is viewed in real (inflation-adjusted) terms, as seen in headline Gross Domestic Product (GDP) reporting, for example. With sales numbers stripped of inflation gains, or of pricing effects from distortions in monetary policy, the residual growth is a measure of straight economic activity. Accordingly, when retail sales increase by the same amount as the underlying prices in those sales, underlying demand is flatWilliams' work aside, Walmart reported that its same-store-sales for the quarter ending Jan 28 fell 1.8%. This is a huge miss, given that the CEO in October said the sss would be positive. Oops. I did write a couple weeks ago about a report circulating that said insiders at Walmart were concerned about this quarter's revenues. Where there's smoke there's fire. Walmart represents something like 10% of all retail sales in this country. If sss sales declined 1.8% - and make no mistake, a negative sales result like this is HUGE for retail - imagine what the unit volumn is if you strip out the portion of revenues attributable to inflation. Bottom line here: the grass roots economy is in a downward tailspin net of the reporting mirage created by inflation, the Government and non-independent private entities (Nat'l Assoc of Realtors, Wall Street). Imagine how bad this will get if the Government actually tries to keep its spending levels constant with last year and eventually stops extending the duration of jobless benefits (aka Labor Force welfare)... The spike higher we are seeing in gold and silver these past few days is not the signal of blow-off top in a market that is in a bubble. Quite frankly most seasoned precious metals veterans are starting to conclude that we truly haven't even started Stage 2 of the bull market cycle for gold/silver. (To review: Stage 2 would be when big institutions pile heavily into a market sector - we have not seen that yet with the precious metals). The bubble stage occurs after Stage 3 (to review: everyone you know can't buy enough) is 50% over. The move in the metals right now is a warning shot being fired by the market that the financial and economic tsunami about to hit the United States is getting very close and it will be a lot bigger than the one that hit in 2008. I will wager any amount with anyone that I am right on this... |

| Fractal Analysis Suggests Silver to Reach $52 - $56 by May Posted: 22 Feb 2011 05:56 AM PST |

| Posted: 22 Feb 2011 05:36 AM PST One of the cute side-effects of the Fed's third mandate has been the successful elimination of all market shorts. A quick update of the NYSE short interest indicates not only the deplorable presence of shorts in the market (those entities who provide a natural bid when the market is plunging), but that the bulk of the market meltup over the past several months has been due exclusively to shorts covering existing positions. Well, with short interest now at a multi-year low of 12.4 billion shares (lowest since 2007), compared to 14.5 billion just after the Flash Crash, a 13.6 billion average over the period, and the lowest amount since the Lehman failure, our only question is when the market plunges, like it is doing today, who will be the natural short covering bid when stocks are in freefall? |

| The Role of US Debt in the Current Revolution Posted: 22 Feb 2011 05:18 AM PST Cereal Wars…and Zombie Wars… Hey, how 'bout that Ben Bernanke… He's a freedom fighter! Look what he's done to North Africa! Seems like every time we pick up the paper another dictator is toppling over. Where does it lead, we wonder? What would a world be like without dictators? Without them, who will the CIA and the State Department give our money to? On the run this morning (but not quite given up) is Muammar Gaddafi of Libya. Wait… Is this guy a friend or an enemy? We can't remember. Wasn't he a bad guy a few years ago? But recently we've heard that he is a good guy. He's helped with the War on Terror. And he sells oil. Friend or foe, we don't know…but whatever he is, he's beginning to look past tense. As of this morning, reports say he's lost control of Libya's second largest city. His troops are firing on protesters in the capital, where he and his loyal guards are holed up in a few government buildings. His son vows to fight back. He says there will be "rivers of blood" before he gives up. That "rivers of blood" image was used by Enoch Powell in Britain fifty years ago. It came from Virgil's Aeneid, in which a character foresees "wars, terrible wars, and the Tiber foaming with much blood." Powell was referring to the effects of immigration into Britain from Africa and elsewhere. He thought he saw race wars and power struggles coming as a result. But the younger Gaddafi uses the language as a threat, not a prophecy. Still, it didn't do Powell much good. Maybe Gaddafi will have better luck with it. Most likely, he'll high tail it out of the country before the blood is his own. That will bring to three the number of regime changes in the last few weeks. Which leads us to ask: what's up? The answer comes from our old friend, Jim Davidson. He pins the revolutions on Ben Bernanke. Behind the popular discontent is neither the desire for liberty nor the appeal of elections. It's food. And behind soaring food prices is Ben Bernanke. The Arab world is a model Malthusian disaster, says Davidson. Populations have ballooned. Food production has not. Which makes Arab countries the biggest importers of cereals in the world. And when the price of food goes up, the masses rise up too. From Jim's latest newsletter, Strategic Investment: Food prices hit an all-time high in January. According to the UN's Food and Agricultural Organization (FAO) "the FAO Food Price Index (FFPI) rose for the seventh consecutive month, averaging 231 points in January 2011, up 3.4 percent from December 2010 and the highest in both real and nominal terms" since records began. Note that prices have now exceeded the previously record levels of 2008 that sparked food riots in more than 30 countries. "Famine-style" prices for food and energy that prevailed early in 2008 may also have helped precipitate the credit crisis that Federal Reserve Chairman Ben Bernanke described in closed-door testimony "as the worst in financial history, even exceeding the Great Depression." This time around, the turmoil surrounding commodity inflation has taken center stage with more serious riots and even revolutions across the globe. Popular discontent is not just confined to "basket case" countries like Haiti and Bangladesh as in 2008. High food prices have roiled Arab kleptocracies with young populations and US backed dictators such as Tunisia, Egypt, Bahrain and Yemen. Even dynamic economies have been affected. Indeed, all of the BRIC countries, except Brazil, have witnessed food rioting. Well, how do you like that, Dear Reader? All those billions of dollars spent propping up dictators – $70 billion was the cost of supporting Hosni Mubarak in Egypt alone – and then the Fed comes along and knocks them down. The Fed lowers the cost of money so speculators can borrow below the rate of inflation. And then it prints up trillions more – just to top up the worlds' money supply. Is it any wonder food prices rise? Imagine you're a farmer…or a speculator. You can sell food. Or you can hold it in storage. You know the food is valuable. You know the world has more and more mouths to feed everyday. You know food production is limited. And you know Ben Bernanke can print up an unlimited number of dollars. What do you do? Do you sell immediately? Or drag your feet…holding onto your valuable grain as the price hits new highs? Davidson continues: While Mr. Bernanke modestly declines the credit for de-stabilizing much of the world, close analysis confirms that he played an informing role. His QE2 program of counterfeiting trillions out of thin air has helped ignite a raging bull market in raw materials with food and commodities – up 28% in the past six months. The fact that the US dollar has heretofore been the world's reserve currency means that almost all commodity prices are denominated in dollars. As a matter of simple math, when the dollar goes down, the prices of commodities tend to go up. Today, Libya. Tomorrow…Yemen? Or Saudi Arabia. In North Africa, Cereal Revolutions… In North America, Zombie Wars… Yes, the battle rages in the Dairy State. And yes, Nobel Prize winner Paul Krugman (Economics!) has no idea what is going on: It's "not about the budget. It's about power." He thinks it is a battle between the rich and powerful, whom he calls the "oligarchy," and the decent lumpenproletariat on the other. Wisconsin's governor is trying to bust the union, says Krugman, so that the elite can ride roughshod over poor government workers, cut their pay, and reduce their benefits (thereby downsizing the state's budget deficit). It's not about money, says the New York Times columnist. He's wrong, as usual. The Zombie Wars are always about money. There is less money available and more zombies who want it. In the present case, rather than hire honest people to work at market rates…Krugman wants the state to be forced to deal with a privileged union. Union zombies should bargain with government zombies, he says. Together, in cooperation, not in conflict, they should figure out how to rip off the taxpayer. Stay tuned…the Zombie Wars are just beginning. Regards, Bill Bonner The Role of US Debt in the Current Revolution originally appeared in the Daily Reckoning. The Daily Reckoning has published articles on the impact of quantitative easing, bakken oil, and hyperinflation. |

| Goldrunner: Fractal Analysis Suggests Silver to Reach $52 ? $56 by May ? June 2011 Posted: 22 Feb 2011 05:13 AM PST Silver to be Explosive into May-June*as in the 1979 Fractal Dollar Inflation remains the driver of the pricing environment for almost everything denominated in U.S. Dollars as long as the Fed continues to monetize debt.* The debt monetization creates Dollar Inflation that results in Dollar Devaluation.**By the time*the Fed has*ramped up the QE II that they have announced will end in June, I expect Gold, Silver, and the*HUI will have risen to $1860 – $1975, $52 – $56 and 940 – 970 respectively. Let me show you why. Words: 1301 So*says**Goldrunner (www.GoldrunnerFractalAnalysis.com)*in*an article* which Lorimer Wilson, editor of www.munKNEE.com, has reformatted*and edited* below for the sake of clarity and brevity to ensure a fast and easy read. (Please note that this paragraph must be included in any article re-posting to avoid copyright infringement.)*Goldrunner*goes*on to say: In previous articles I have shown that fractal analysis suggests that: [LIST] [*]Gold c... |

| Posted: 22 Feb 2011 04:52 AM PST Gold Turns Corrective After Monday's Gains Gold corrected in overseas trading on Tuesday after surging to new 7-week highs in thin holiday trading on Monday. The escalation of violence in Libya increased safe haven flows into the dollar overnight and an increasingly hawkish tone from the ECB has made the euro more attractive on rate hike speculation. Today Libyan strongman Muammar Qaddafi declared that he would not step down, vowing that the army and police would restore order tomorrow. The escalating situation in Libya, along with news that two Iranian naval vessels had traversed the Suez Canal and entered the Mediterranean Sea, have significantly ramped-up tensions in an already very tense region. Oil prices rose dramatically on Monday, corrected overseas and are now back on the rise, further stoking global inflation worries.

German support for various plans to create a permanent bailout facility for Europe have waned in the wake of the crushing defeat suffered by Chancellor Merkel's CDU party in Hamburg. Ms. Merkel, apparently in reaction to push-back from German taxpayers, has come out against both joint EU bond sales and bond purchases through the ESM. This position was largely reiterated by outgoing Bundesbank President Axel Weber in an FT op-ed today, where he said, "this means the principles of subsidiarity, responsibility of individual member countries and no-bail-out remain essential for the EU." Germany is the economic lynchpin of Europe and the Bundesbank is the lynchpin to the central banking system in Europe. If Germany is against expansion of the bailout fund, against bond purchases through the existing fund, against joint EU bond issuance and seemingly against further bailout, I'm not exactly sure what options that leaves the EU with to address the ongoing sovereign debt crisis. The situation strikes me as very reminiscent of post-bailout America. In the absence of political will for further bailouts, the Federal Reserve was forced into action, implementing their initial quantitative easing efforts. Might the ECB ultimately be forced to act similarly to prevent an EU collapse? And what might the implications be to the ECBs credibility, if rather than the rate hike that many now seem to be expecting, the ECB launches its own quantitative easing program? |

| This past week in gold - Feb 22, 2011 Posted: 22 Feb 2011 04:51 AM PST Jack Chan JACK CHAN's Simply Profits. Precision sector timing for gold, energy, and technology. GLD – on buy signal. *** SLV – on buy signal. The fact that silver is leading gold, is bullish. *** GDX – on buy signal. *** XGD.TO – on buy signal. Summary Long term – on major buy signal. Short term – on buy signals. We increased our exposure to the sector by adding to our core positions upon recent new buy signals and set ups. ### Disclosure We do not offer predictions or forecasts for the markets. What you see here is our simple trading model which provides us the signals and set ups to be either long, short, or in cash at any given time. Entry points and stops are provided in real time to subscribers, therefore, this update may not reflect our current positions ... |

| Silver Train Is A Comin: Are You Onboard? Posted: 22 Feb 2011 04:48 AM PST Stewart Thomson email: [EMAIL="stewart@gracelandupdates.com"]stewart@gracelandupdates.com[/EMAIL] email: [EMAIL="stewart@gracelandjuniors.com"]stewart@gracelandjuniors.com[/EMAIL] Feb 22, 2011 1. The Silver Train. Are you onboard? Just about six weeks ago, at the January highs for Silver, the average daily movement for Silver was about 50 cents a day. What is it now? It's 50 cents an hour! 2. I spoke yesterday about the new $30 to $40 Silver "Range Of Play". This morning you have approx. two dollars an ounce of visible weakness on the chart, in the range of play, to buy into. My suggestion: Do it now! 3. Here's a look at that visible weakness that I just bought into at 4am. That's a huge drop in price. A huge sale for you to buy. Early Morning Silver Chart Number One. 4. Here's a second chart that is speaking loudly about why this morning's weakness needs to be bought. Sometimes a chart al... |

| Silver Train Is A Coming Are You Onboard Posted: 22 Feb 2011 04:47 AM PST |

| Paper Silver and Gold markets Are "Nonsense" - John Hathaway Posted: 22 Feb 2011 04:43 AM PST "Mass withdrawals from South Korean banks continue. Blood runs in the street of Bahrain. Oil shock fears as Libya erupts...and much more. " Yesterday in Gold and Silver Well, it appeared that the precious metals markets were open for business in New York yesterday. And if not the Comex, then certainly the Globex system was up and running after the London close. Volume was very light, but that was almost beside the point after looking at some of the gains during Monday's trading day...especially in silver. The price of gold climbed slowly but unsteadily for most of the Far East and London trading day...with the high tick [around $1,408 spot] coming shortly after high noon in New York. It closed the Comex trading session less than two dollars below that high. The low of the day was at the open of Far East trading during their Monday morning. Except for the odd surge here and there, the silver price climbed slowly but steadily all during the Monday ... |

| Seabridge: My Best Trade Ever Is an Even Better Deal Today Posted: 22 Feb 2011 04:36 AM PST By Dr. Steve Sjuggerud Tuesday, February 22, 2011 In mid-2005, I recommended shares of Seabridge Gold (SA) to a few thousand subscribers. We sold a couple years later, up 995%. Today, it's a better deal than when I originally recommended it… Seabridge is one of the world's largest undeveloped gold deposits, with $90 billion worth of gold in the ground in Canada. When we bought it in 2005, it offered fantastic upside potential: If the price of gold went up, Seabridge would soar. But our downside risk was limited: Seabridge's stock was so cheap compared to the amount of gold it owned, it could hardly go lower. That's the way I want to invest. You want to buy Seabridge when you're getting a LOT of gold for a low price. After we made nearly 10 times our money on Seabridge, I never thought I'd get a chance like that again… But Seabridge is a better deal today than it was back then. Since 2005, shares of Seabridge have climbed from $2.64 when I original... |

| LGMR: Silver "Disconnected from Gold" as Middle East Turmoil Hits Equities Posted: 22 Feb 2011 04:34 AM PST London Gold Market Report from Adrian Ash BullionVault Tues 22 Feb., 08:55 EST Silver "Disconnected from Gold" as Middle East Turmoil Hits Equities, Oil Rises Again THE PRICE OF GOLD and physical silver whipped sharply in London trade on Tuesday, falling hard only to rally as New Zealand's second-biggest city Christchurch was struck by an earthquake and Libyan dictator Colonel Gaddafi's defiant appearance on state TV led to accusations of "genocide" and "the government killing its people" by his own diplomats in the Unitd States. Silver dropped nearly $2 per ounce, erasing Monday's 5.4% gain, in Asian and London dealing, rallying again near 31-year highs as world stock markets and commodity prices also hit massive volatility. Brent crude oil rose above $107 per barrel. US oil contracts were set to re-open New York trade with a near 8% jump after Presidents Day. "Problems in the Middle East are leading to a rise in the silver price," says Suresh Hundia, president o... |

| Posted: 22 Feb 2011 04:33 AM PST Northern Gold Mining Inc. (TSX VENTURE:NGM, NTGMF.PK; "Northern Gold" or "the Company") is pleased to announce assay results for seven more diamond drill holes totaling 1,496 meters of drill core in the Company's ongoing 30,000 meter drill program at the Garrcon Deposit on the Garrison Gold Property. A total of 25 holes (5,367 meters) have been reported to date for the drill program that began May, 2010. Assay results for the seven drill holes are listed in Table 1 and are available on the Company's website. |