saveyourassetsfirst3 |

- Vulture Bargain Roundup for January/February

- Gold Seeker Closing Report: Gold and Silver End Higher After Late Rally

- The Fed, the Fear Index, and the Dollar

- If Metals Decline Even With Rising Stocks, What Would Happen If Stocks Declined?

- Re: Silver - going down for the count?

- China Plays Europe Card

- update 26/10/2010

- Largest Ever Gold Outflow From GLD

- Anyonee else getting dizzy from the ride?

- Case for Gold "Strong" as IMF Urges Loose Money, But Exchange-Traded Positions

- It's About to Happen - April Gold

- "Dr. Doom" Roubini: Four huge risks could destroy the recovery

- Mexicos Newest Emerging Silver Resource

- Why this is a great time to buy "insurance" on your stocks

- Five reasons Obama's State of the Union address was completely wrong on the economy

- Gold to Benefit as Currency Woes Continue

- Richard Russell - Get Out of Your Dollar Assets Now!

- Gold and Silver should be following China’s moves into US Banking Industry

- Gold Hits 3-Month Low, "Discouraged" by Strong Euro-Debt…

- TheDailyGold Podcast 1/25/2011

- Gold, Oil, and the Contrarian Mindset

- Silver - going down for the count?

- Gold Stocks a Buy, Declares Dan Amoss

- Stagflation in UK a Risk to US and Western Economies

- Beware the Coming Collapse of Gold

- The Price of Gold Breaks Key Support Point

- Spec Funds Exit Gold & Silver, Stay in Others

- Coming Soon: House of the Seven Hawks?

- US Panel Blames Banks for '08 Meltdown, but not Central Banks

- New World Order: Food Price Inflation; House Price Deflation

- Huge Drop in comex gold open interest, huge deliveries on silver/

- Gold Seeker Closing Report: Gold and Silver Fall About 1% and 2%

- Upcoming COMEX Silver COT Report Possibly Key

- Obamas State of the Union Address - Gold Bar Shortage in Hong Kong

- Bank of Russia Says It's Buying Only Domestic Gold

- Spec Money Exits Gold & Silver but Remains Heavily Long Other Markets

| Vulture Bargain Roundup for January/February Posted: 26 Jan 2011 07:23 AM PST Most people who are not familiar with the underlying fundamentals for silver metal, and therefore probably thought that the price jump last year from $18 to $31 was crazy; most people who haven't heard or have heard but don't believe that a shortage of commercial sized physical bars of silver has developed; most people who witnessed their friends buying into silver at $24, $26 or $28 probably shook their heads and mumbled to themselves something along the lines of: "There is a word for crazy people who get caught up in popular fads and bubbles…" And in their mind would be an image of something like this… | ||

| Gold Seeker Closing Report: Gold and Silver End Higher After Late Rally Posted: 26 Jan 2011 07:12 AM PST Gold rose $5.35 to $1338.15 in Asia before it fell back off in London and early New York trade to see a loss of $7.90 at as low as $1324.90 by a little after 11AM EST, but it then rallied back higher in late trade and ended with a gain of 0.06%. Silver climbed 34 cents to $27.16 in London before it fell to see a $0.159 loss at $26.661 by late morning in New York, but it then surged back higher in afternoon trade and ended near its new last minute session high of $27.22 with a gain of 1.12%. Both metals have also risen to new highs in after hours access trade at the time of writing in reaction to the fed's statement. | ||

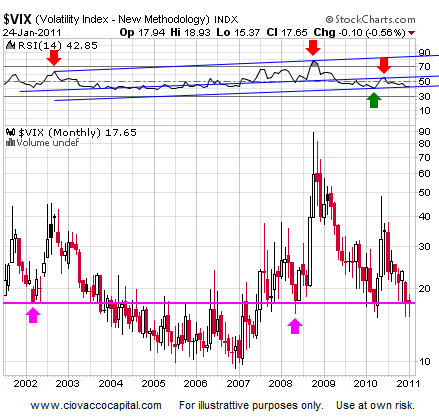

| The Fed, the Fear Index, and the Dollar Posted: 26 Jan 2011 05:10 AM PST Bloomberg provides some insight into the current two-day Fed meeting:

With the markets not having experienced a correction for some time and the Fed due to release a statement tomorrow, it is prudent to review some big picture issues. The VIX, or the "Fear Index", falls when investors are less concerned about volatility or pullbacks. Conversely, the VIX rises when concerns about volatility and possible corrective activity begin to mount. The chart below is a monthly chart of the VIX going back to 2002. The VIX is at a level where it could logically reverse and begin to move higher, which would most likely coincide with a pullback of some kind in risk assets. Two things we are monitoring relative to the VIX are highlighted in the chart. The parallel blue trendlines in the Relative Strength Index (RSI) have acted as both resistance (red arrows) and support (green arrows) – notice the blue line is at a point where it could provide support for the VIX. A break below the lower blue RSI trendline would open the door for another push higher in risk assets.

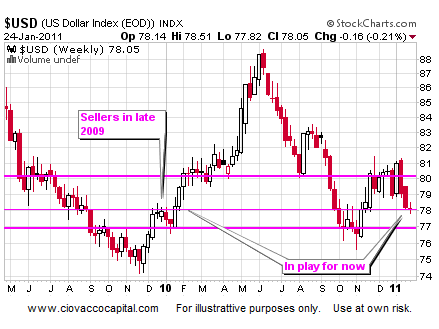

The pink line (above) and arrows show areas where interest in the VIX picked up in 2002, 2008, and in 2010. The VIX is currently holding near the pink support line. Tomorrow's Fed statement will be analyzed closely by the currency markets. The monthly chart of the U.S. Dollar below leans toward the greenback making a move toward 76, although it may not occur until after a move higher.

Like the VIX, the weekly chart of the U.S. Dollar sits at a point where a short-term reversal would be logical. Notice how the candlestick is hanging on the thin pink line.

The daily chart of the U.S. Dollar Index, shown below, also indicates a move higher bouncing off the green support line is one logical outcome over the short-term. Even if the buck moves higher in the short-to-intermediate-term, the negative slope of the green parallel trendlines remains an ally of the bears.

As outlined in late October 2010, the Fed's quantitative easing program (QE2) is more about asset prices and balance sheets than interest rates and the economy. In this context, it appears unlikely the Fed will scale back QE2. CCM Clients: I have been in Tampa since Sunday – I return to Atlanta today. It may take me a day or so to catch up on emails. This entry was posted on Tuesday, January 25th, 2011 at 10:01 am and is filed under Fed Policy. You can follow any responses to this entry through the RSS 2.0 feed. Responses are currently closed, but you can trackback from your own site. | ||

| If Metals Decline Even With Rising Stocks, What Would Happen If Stocks Declined? Posted: 26 Jan 2011 05:08 AM PST

With gold prices showing no signs of a breakout in 2011 so far, many investors have started unwinding long positions in anticipation of no further upside. The situation warrants a close scrutiny of the state of affairs. In the following part of this essay we analyze indications from the correlation matrix and technical indicators from silver and mining stocks to gauge the extent of this concern. However, first, we would like to draw your attention to the fact that the London Bullion Market Association conducted its annual survey of leading analysts to ask them where the price for gold will go in 2011. A total of 24 contributors gave their estimates for the high, low and average price for 2011 for gold, silver, platinum and palladium. In 2011, Forecast contributors predict rises for all precious metals. Their average gold forecast is US$1,457, a 19.0% increase on the 2010 average price, similar to the forecast of $1,450 made by delegates at the 2010 LBMA Precious Metals Conference in Berlin last September. Analysts predict that the average silver price will be $29.88, a 48.0% rise on the 2010 average price. The average 2011 Platinum price is forecast to rise 12.6% from the average 2010 price, to $1,813 and palladium shows no sign of slowing down with an average 2011 price prediction of $814.65, a 54.8% increase on last year's bumper average price. Generally, when everyone gets bullish it's time to sell, and when everyone is bearish it's time to buy, so perhaps the situation is not really as bullish as it might appear at the first sight. Let's begin this week's analysis by taking a look at the recent readings from our correlation matrix. The correlation matrix shows that the short-term coefficients are not as significant as in weeks past. There appears to be a slight negative correlation between metals and stocks but this does not hold true for silver. It seems that the medium-term coefficients (90-day and 250-day columns) are of more value at this time. Recent breakdowns have been seen in many of the markets this week but in most cases have not yet been verified. The situation is such that if these breakdowns are verified in the days ahead, the impact will likely be felt for weeks and therefore the medium-term columns will provide valuable insight. Only the general stock market appears to have a significant influence on the precious metals for this time-frame. Therefore, if stocks decline from here, the same will likely be seen across the precious metals sector for they will be dragged down as well by the declining stock prices. Although the relationship is not clearly seen on a day-to-day basis (short-term correlation is weak), a bigger move in stocks is still likely to have influence one the precious metals sector. Consequently, the most important influence upon precious metals this week seems to be the general stock market and the outlook for stocks appears bearish. An additional indirect influence comes from the USD Index and the sentiment here is bearish as well. Because of its multiple industrial uses, any serious weakness in the main stock indices is likely to affect silver more than gold (charts courtesy by http://stockcharts.com). Still, for now, silver's long-term chart for silver shows price action similar to that seen for gold. There has been a breakdown below the long-term support level which has not yet been verified. This is a slightly bearish signal and, if verified and seen in other precious metals markets, will likely result in silver prices declining quickly as well. As we have often mentioned in past updates, silver is the least predictable of the precious metals and often follows the trends set by gold and mining stocks. Today, it may also follow a quick decline in stocks, which we have yet to see. Moving on to the mining stocks, the breakdown below 2008 highs is clearly visible on the XAU Index chart. The XAU Index of gold and silver mining stocks saw a decline in excess of 10% since the beginning of the year. The previous increases have failed to hold the breakout above the 2008 highs, and at this moment the price is below this particular level. A move back to the 2008 highs will verify this recent breakdown. If this does indeed happen (mining stocks fail to move quickly above this level), further declines will be likely and perhaps a bet on lower mining stock prices would be in order. If the big decline does come to pass, the XAU Index levels will likely move down close to 180 and nearly to the lower border of the rising trend channel. Overall, if we see higher prices for mining stocks, which appears likely, and this increase is stopped by the level of the 2008 highs, this would be a strong indication that lower prices for the whole precious metals sector could soon be realized. Summing up, given the size of the potential move in the precious metals market in either direction from here, one should focus on factors influencing precious metals in the medium term – and at this point it is the general stock market. Meanwhile, we have just posted a special mid-week update with our next trade and explanation of a change concerning the long-term investment. In order to read it simply sign up today for our mailing list and you'll also get free, 7-day access to the Premium Sections on our website, including valuable tools and charts dedicated to serious Gold & Silver Investors and Speculators. Mailing list is free and you may unsubscribe at any time. Thank you for reading. Have a great and profitable week! P. Radomski Sunshine Profits provides professional support for precious metals Investors and Traders. All essays, research and information found above represent analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mr. Radomski and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above belong to Mr. Radomski or respective associates and are neither an offer nor a recommendation to purchase or sell securities. Mr. Radomski is not a Registered Securities Advisor. Mr. Radomski does not recommend services, products, business or investment in any company mentioned in any of his essays or reports. Materials published above have been prepared for your private use and their sole purpose is to educate readers about various investments. By reading Mr. Radomski's essays or reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these essays or reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise that you consult a certified investment advisor and we encourage you to do your own research before making any investment decision. Mr. Radomski, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice. | ||

| Re: Silver - going down for the count? Posted: 26 Jan 2011 04:56 AM PST | ||

| Posted: 26 Jan 2011 04:47 AM PST Whether Americans and Westerners in general like it or not, the Chinese have become and will remain the key drivers to many economic and financial market developments, progress, and averted wreckage. The intrepid lapdog US press, loyal to the syndicate, is a critical element to maintain distractions. Of course, China must adapt and react to their own stumbles and accidents, assured since for years they have maintained a tight link in monetary policy. Doing so has linked their asset bubble expansion and bust cycle to the deadly one in the United States, and filled their coffers with US$-denominated toxic debt securities. However, China has three advantages over the US that stand out. They have $2.65 trillion in savings, rainy day money in a war chest. They have a vast industrial base, courtesy of the US, the West, and Japan, which donated the technology for the fabled disastrous low-cost solution. They have an expanding middle class. Neither the US, the UK, nor Western Europe has anything remotely similar to these three benefit allowances. It is slowly becoming clear that the US granted the Most Favored Nation status to China in return for massive gold & silver swaps to the USGovt. The Wall Street fraud kings illicitly sold the leased bullion into the market, to sustain the American fiat paper congame, and thus a betrayal to the Chinese. The Beijing leaders are highly motivated to unseat the Anglo bankers from their perched throne, emboldened by vengeance. The betrayal was to the American people also, since waves of jobs went to China from US shores, since the US sold not only its own Fort Knox gold inventory, but Western Europe's also, then China's to boot. Those who believe the USGovt has any gold reserves at all should donate their cerebrums to science while still alive, a euthanized suicide. The USGovt in all likelihood is in possession of less than zero gold, owing both Europe and China massive amounts. It is the American ticket to the Third World, paved by lost industry, locked by vast debt, assured by broken economic principles blessed by high priest heresy. The US banking leaders still believe the US can revive itself by the flood of more debt and stronger consumer spending, without a clue of what legitimate income means or where it comes from. Before delving deeper into this important thesis topic, a comment is in order regarding President Obama's State of the Union address and his plan. As forecasted by the Jackass on repeated past occasions, the entirety of the sacrifice to reduce the USGovt budget will come from the domestic, non-defense, non-security side. Aid to businesses and households and dedication to infrastructure will be removed. The higher priority war machine will be preserved. He called it non-security measures, implying the sacred nature of the security of the nation. Ironically, the security of the nation has been put in peril from unspeakable banker fraud, abandonment of industry, and neglect of infrastructure, not to mention the continued ignorance toward capital formation and dutiful embrace of a consumption mindset. The Obama Admin will remain committed to gutting America, undercutting the middle class, and feeding the deterioration of the USEconomy. He will assure a reduced domestic blood supply and food intake. Expect more empty talk of clean energy and jobs. The greatest potential for spending cuts are from the defense budget, for which the USGovt spends more than the rest of the world combined. A vast array of military bases, embassies place on foreign soil, and weapons projects will be preserved. The maintenance of the foreign threat will be steadfastly maintained. The ethics of drone weapons, regeneration of enemies, destabilization of governments, and the absent economic multiplier effect from defense/offense spending will all conspire to weaken the United States in ways that our leaders seem incapable of understanding. They promote the Fascist Business Model, the very same that has contributed to the wreckage of the nation. The victims are economic growth, rule of contract law, sanctity of private property, and truth. The legitimate threat to the nation comes from its internal situation and the impunity of large scale financial crimes. When reference is made to a Sputnik moment for the United States, try not to laugh. A deeply indebted nation with spiraling deficits latched at the hip to a currency besieged by monetary inflation cannot afford any grand initiative, especially when its highest national priority is war. Survival will soon escalate to a higher priority. OVERVIEW OF THE CHINA-EUROPE CARD The Chinese are well along a full court press to secure Gold bullion and dominate in the next phase of the global chess game that will span the next decade or more. With the expansion in the European Dollar Swap Window by the Chinese, the Euro currency has risen impressively. No benefit to Gold has been realized despite the USDollar slide in the last month. One must suspect the Chinese are busy as yellow jacket bees dumping USTreasury Bonds. But also, the Chinese might have suspended some of their Gold & Silver purchases. They might have actually drained for a time the COMEX gold inventory, and await its replenishment. Enter the BIS after midnight from the loading dock. Beijing leaders might be anticipating a high volume Gold bullion purchase flow from the back door in Europe. Refer to EuroBonds bought at discount using the Dollar Swap Window, converted eventually to Gold. My guess is the harlot Intl Monetary Fund will facilitate the Gold conversion, from the EU member nation central banks associated with PIGS nations. If inadequate supply of Gold is a problem with PIGS nations, perhaps some gold swap contracts can be enabled with the help of the Bank For Intl Settlements in Switzerland. But those swaps would seal the PIGS nation fates, since they would hand over industrial, commercial, and other collateral, assuring banker elite ownership of whatever keys to the kingdom are left. Therefore, Gold is vulnerable to hits during the time China takes its foot off the accelerator pedal. China has found a way to purchase high volumes of Gold bullion at a discount. The discount is essentially the EuroBond sovereign debt discount under distress, which might be in the 10% to 20% range. So the PIGS debt will be rescued for a while, but with forfeit of their central bank gold, or borrowed gold. TRADE AS GEOPOLITICAL LEVER The last several decades have revealed some sordid bilateral contracts, critical deals like what was made with the Saudis. The USGovt pledged to protect the House of Saud and their kingdom, helped along by massive USMilitary weapon sales. The Saudis in turn would demand payment for crude oil in USDollar terms exclusively. The entire Persian Gulf has toed the line on US$ oil sales ever since, even other OPEC players like Nigeria and Indonesia. A difficult balancing act has been required, and still is required, to keep the peace and minimize the friction between Arab nations and the headquarters of the multi-faceted syndicate helm that has controlled the USGovt with tight reins for nine years and four months. The USGovt prefers to enforce and sustain its global domination with heavy handed banker tactics, financial market rigging games, export of crippling acidic debt, usage of the World Bank and IMF tools, and numerous clever devious nasty methods in the shadows best not described. Lately, a chief US export has been price inflation, most evident in food prices, courtesy of the QE2 program by the USFed. In the last decade, the chief export was toxic debt securities. The Chinese have a different approach, one that might have been more prevalent in the United States half a century ago. They have made 180 trade deals across the world, the exact number exaggerated. They do not place military personnel on foreign soil. They do not lace foreign banking systems with toxic debt. They establish multi-faceted contracts that involve the build-out of port facilities, railroad lines, schools, hospitals, and community living centers. They ignore ugly government facts of life like what exist in West Africa. They operate a sophisticated guerrilla economic warfare in sharp contrast to what the US does. The Chinese build partnerships, not without some friction, while the Americans ignite violent conflicts and demand that allies take sides, while extorting bank ruin, living above their means. The source of the ignition events is kept well under wraps. The ultimate motives of the Chinese is likewise kept rather quiet. DOLLAR SWAP WINDOW The most important factor to bear upon the financial markets globally in the last several months, the greatest change agent, in my view, is the creation of the Dollar Swap Windows by China. They are being erected in Europe. Their focus is on the PIGS nation sovereign debt. The debt of Greece, then Portugal, finally Spain very recently, and later inexorably Italy have found and will find a major buyer in China. They will buy PIGS debt at discount. They will win favor across the continent. They will gain advantages not well publicly mentioned. They will cut off geopolitical opposition in extremely subtle manner. They will open up the pathways for greater technology transfer. They will offer a semblance of stability to the currency markets in turmoil. They will spread their global presence, if not dominance. They will work some backdoor deals with motives to secure large volumes of gold bullion at discount. They will solicit more cooperation from previously devoted Anglo tools like the Intl Monetary Fund, and perhaps turn the IMF itself into a Chinese agent. They will possibly pave the way to a mild colonization movement, perhaps having already chosen Southern Spain over Southern California. The Mexican Civil War might have frightened them off any plan to send a million Chinese to North America, equal in intensity to the realization of rising hostility and trade war with the USGovt. Somehow friction with Basque Separatists and detente with Andora versus Spain seems tame compared to roving gangs of Mexican drug lord lieutenants ready to dole out violence on US soil, whose battle lines are drawn by tribal history far more than the US press reports. The systemic failure of Mexico was forecasted in the Hat Trick Letter in the summer 2007, with timing expected for some climax events and recognition in mid-2010, a correct forecast. The USGovt has gone from assisting China in economic and industrial development to blaming them for the depleted US condition. The bigger problem is obviously the deeply entrenched domestic devotion to asset bubbles and colossal bank fraud, run in parallel with the absurd destructive consumption mindset. HIDDEN EURO IMPACT So the Dollar Swap Window has been constructed, with expansion a certainty. The Chinese will have an opportunity to dump a big batch of USTreasury Bonds on a regular basis. My full expectation is that the Chinese will sell far more USTBonds than they purchase PIGS nation sovereign debt. In other words, they are building a dumping ground. Key parts of the equation are that the Europeans have been promised a willing buyer (although with ulterior motive) in the Chinese for PIGS sovereign debt. The Germans are sick & tired, fed up to the gills, in supporting the Southern Europe welfare system which identifies the broken element of the faulty European Union. Its foundation had cracks from the start, more than the Jackass recognized admittedly in past years. The Europeans have been promised some important support for the embattled Euro currency. Every time the Greek crisis made the news in past months, the Euro currency sold off with gusto. No more! A strong broad plank of support for the Euro has been provided by China. They are selling their USTBonds and buying EuroBonds with PIGS brand markers. The Euro currency has risen from a January 10th low of 129 all the way to almost 137 in this month alone. The rise has occurred despite the ongoing saga of PIGS debt distress. The Portuguese sovereign debt has been shored up by Chinese promises of purchase. The Irish Govt debt is a totally different animal. They accepted and swallowed the lethal IMF poison pill, cut their budget, and seen enormous deficits spiral out of control as their economy craters. They have resorted to monetary inflation approaching Weimar style as proof of the disastrous error in decisions. Translated to US size difference terms, Ireland has expanded their Euro money supply the equivalent of the US doing so by $12 trillion, all in the space of three months on the Emerald Isle centered in Dublin. They are not keeping Dublin tidy! The financial news reports fail to mention the China card. They fail to mention that China is exchanging USTBonds for Euros in order to purchase EuroBonds with PIGS skin labels. They fail to mention that large Chinese hands are supporting the Euro currency. My belief is that the news media does not wish to stress the expansion of Chinese influence. For a century, or perhaps three centuries, the cultural and heritage linkage between Europe and the United States has been firm and solid. A grand Chinese wedge has been inserted, not so much between Central Europe and Southern Europe as between Europe and the United States. China will be crucial in casting the Southern nations aside from the European core. They will become wards of China, even for exploit. The Dollar Swap Window constructed by China has actually isolated the USGovt in serious ways. Relief to PIGS EuroBonds is obvious. The numerous other effects are not, and those effects are not in the news. They are main elements of the Hat Trick Gold & Currency Report, and have been for several months. The expansion to Spain was a forecast made in November and December, with confirmation coming by denials in Madrid. Something unique and unusual has happened in the last three weeks. The Euro currency has risen noticeably from 129 to 137, but the Gold price has fallen from $1385 to $1335 per ounce. For almost a full decade, the correlation between the US$ DX index and the Gold price has been in the minus 70% neighborhood. What has happened in the last month has been a gigantic outlier. It is not just significant with umpteen standard deviations above the norm. It is in the wrong direction. My best guess is that the Chinese have temporarily halted their usage of the COMEX avenue for gold acquisition. They have permitted the corrupted COMEX to push down the gold price, using its fraudulent paper mechanisms. They have given free rein for the Wall Street maestros to lower the gold price for any IMF deal to secure European gold bullion in exchange for EuroBonds. Most gold & silver contracts are settled in cash anyway these days, since the COMEX does not have much precious metal in its possession. Imagine the day coming before too many months when gold & silver can be traded in contracts at the COMEX with no gold or silver metal exchanging hands. That day is coming, along with ruin of the GLD and SLV defaults, ruin, deep discounts in share price versus the metal price, and investor lawsuits. As for the Gold & Silver price, they will rise when the Chinese decide to resume buying. Right now, their attention is diverted to EU gold bought at deep discount, and in volume. As usual, they are thinking at least 20 years ahead. The Gold & Silver price will rise soon enough for the patient minded. The physical market wrests control always, as the mid-term forces take over. OBTAINING GERMAN TECHNOLOGY Germany is grateful that a new benefactor has come to Southern Europe. No longer does the German Govt feel burdened by the welfare enforced by the European Union dictum. The Germans are exhausted from $300 billion in annual welfare support of a deadbeat set of children in Portugal, Italy, Greece, and Spain. Over the last ten years, the drain of German wealth has been $3 trillion in total. A German banker has kept me up to date on the details. He frequently mentions that it is not a matter of willingness for the Germans to continue to support the broken nations of Southern Europe, complete with their grand deficits and inefficient economies, and greatly different work ethic, and their preference for song and dance and wine. The Germans are NOT CAPABLE of the continued drain of $300 billion per year, since the cost has turned into a nightmare burden. In return for the outsized Chinese relief of PIGS debt, the Germans have offered key exports in technology. The main items are machine tools, telecommunications, construction equipment, and cars. Germany is the technology leader in Europe, with no close second competitor. France is a distant second. The German Economy is not a war economy, as they possess world class technology for domestic purposes. In the early part of the last 2000 decade, the technology transfer was significant from Japan to China. It enabled a great leap for Chinese industry. In many instances, the installed Japanese technology, like with machine tools and sophisticated manufacturing floor control systems, the Chinese leapfrogged the US easily. Enter the current phase, where the Germans are working with the Chinese in major deals. My view is that the Eastern Alliance, whose participants are Germany, Russia, China, and the Persian Gulf states, has many components not easily seen. They are working on the New Nordic Euro currency, complete with a gold component, in order to establish a replacement for global banking and commerce. It could become a new global reserve currency, all in time. Expect the alliance to include commitments for vast Russian resources, vast German technology, vast Chinese bank reserves, and guarantees of vast Arab oil supply. The Dollar Swap Window is an important component to the advancement of the Eastern Alliance, in which the US and UK are not players. They are shut out. ISOLATE USGOVT IN TRADE WAR A significant hidden effect for the Dollar Swap Window has been the interruption of the trade war alliance encouraged and solicited by the USGovt. Evidence was clear at the most recent G-20 Meeting of finance ministers. The USGovt attempted to find wider support for hostility against China. They all fell of deaf ears. The American delegation was embarrassed, isolated, and stunned. With the Chinese acting as chief debt benefactor in Europe, with the Chinese forging Asian, Arab, South American alliances, nobody joined the adolescent US chatter to confront and combat China. The USGovt is increasingly isolated in its trade war against Beijing. The great trade war will be bilateral, with perhaps no other allies at the side of either nation. Witness the battle for global control and leadership. A great transition is in progress, as the global leader mantle passes from West to East, from the US hands to Chinese hands. The US is expert at creating enemies. As the Islamics fade in perceived threat, enter the Chinese who "stole" the US jobs and "sit on" vast hoard of money from "ill-gotten trade surpluses" in great ongoing accumulation. The ugly truth is that 60% to 65% of Chinese trade surplus from 2004 to 2008 was derived from US and Western corporations having expanded on Chinese soil with factories, fully endorsed by USGovt and Western Govts, often with direct support of ministries. The Europeans are courting the Chinese, and that is big news. China is playing the Europe card at the geopolitical table. Maybe the numerous NATO military bases will eventually fly Chinese flags and be converted to commercial supply transport usage. The hypocrisy is thick. However, the incessant annoying shallow charges of currency manipulation ring hollow when the US Federal Reserve announced the Quantitative Easing #2. They hypocrisy was extra thick, since the USFed had heralded an end to the 0% monetary policy. The Exit Strategy was followed by monetary inflation, US style, mimicking as best they could the Weimar program 70 years ago. The hypocrisy was doubly thick since the first QE round was promised to be the only round. It was followed by QE2, as forecasted by the Jackass all last year. Expect a QE3 later this year, to rescue states and muni bonds, but only after government pension obligations are abandoned and smashed. In the process, the United States has become isolated. Numerous trade deals exclude the USGovt and USEconomy. The new perverse grand trade partners for the United States are war continuation, war expansion, and a deep embrace of the Printing Pre$$, the monetary inflation machinery. As USTreasury Bond creditors have stepped away, the USFed has entered with powerful demand from printed USDollars, all done electronically, boasted at zero cost. In my view, the cost is infinite, with broad capital destruction and economic disintegration. BACKDOOR GOLD PURCHASE Word is gradually leaking out that the Chinese have a powerful ulterior motive to purchase EuroBonds, not so much out of altruism, not even so much out of global expansion of influence. THE CHINESE WISH TO CONVERT DISCOUNTED EUROBONDS TO SECURE HUGE VOLUMES OF EUROPEAN GOLD. The Beijing leaders must for instance have a plan to convert a fixed percentage of EuroBonds to gold bullion, even a cut deal with European leaders and bankers, arranged carefully in advance. They wish to replace the gold bullion possibly swindled by the USGovt. Any USGovt gold leases to European nations from past years might be repaid directly to the Chinese, to close out the lease contracts. The acquisition will NOT be front page news, will NOT be discussed by European leaders, and will NOT be publicly debated. The choice for PIGS nations has been and will continue to be default on sovereign debt or to cut deals with China that buy time. Since Germany has let it be known that their credit line is cut off, China has filled the void. But Beijing leaders are crafty. They have very likely secured deals whereby the IMF harlot will facilitate huge gold bullion sales to China with the EuroBond securities. The IMF has run past cover in lease close-outs from the USGovt, complete with grand deceptions. The key to unmask the lease close-out deals is that the IMF never identified buyers. There were none often. A sale without a buyer is an end to a short trade after the passage of years in time. Without some promised conversion to gold, China would not have cut the deals. It is the quiet underpin. The common denominator in the great majority of Chinese deals forged worldwide in the last decade is the secured supply line of hard assets, like commodities. They also have a preference for port facilities. Energy supplies, mineral wealth, and foodstuffs are the main objective of the numerous Chinese trade deals, which increasingly involve establishment of currency swap facilities and conversion systems. See Brazil and Russia, which do not bother to use the USDollar in trade settlement. In the future, look for commodity deals that supply China with fresh water. Expect this trend to increase to the point that eventually the Chinese Yuan (renminbi) is a global currency with full convertibility. Later, it might serve as global reserve currency. What gives it the edge in such a role is its rise, compared to the USDollar's decline. The next decade will see the Redback (Yuan) more and the Greenback (US$) less in banks worldwide, and in trade settlement. The extreme wild card in the entire equation is eventually colonization by the Chinese elite. If they aid in government debt purchase, then hold title to property, while providing supply lines to a wide range of consumer products (someday cars too), what would prevent them from sending 100 thousand people per year to occupy abandoned homes and empty apartment buildings held under proper title? Nothing! home: Golden Jackass website THE HAT TRICK LETTER PROFITS IN THE CURRENT CRISIS. From subscribers and readers: At least 30 recently on correct forecasts regarding the | ||

| Posted: 26 Jan 2011 04:12 AM PST Thank you Alexander, your dollar is appreciated ! :-) This posting includes an audio/video/photo media file: Download Now | ||

| Largest Ever Gold Outflow From GLD Posted: 26 Jan 2011 03:55 AM PST | ||

| Anyonee else getting dizzy from the ride? Posted: 26 Jan 2011 03:03 AM PST Decided to take a look at the 90 day chart and felt a bit woozy...It will be interesting to see how the next 90 play out.  It reminds me a bit of this:  | ||

| Case for Gold "Strong" as IMF Urges Loose Money, But Exchange-Traded Positions Posted: 26 Jan 2011 03:02 AM PST | ||

| It's About to Happen - April Gold Posted: 26 Jan 2011 02:59 AM PST It's About to Happen - April Gold Wednesday, January 26, 2011 by Jim Prince of US Charts April 2011 Gold has developed a trading range (channel). Prices are on the verge of breaking out to the downside of the range, which coincides nicely with the current Trend SeekerTM(TS) Trend Rating of Down. http://insidefutures.com/article/211...il%20Gold.html  | ||

| "Dr. Doom" Roubini: Four huge risks could destroy the recovery Posted: 26 Jan 2011 12:00 AM PST From Forbes: ... In the U.S., Roubini is keeping his eye on four main downside risks: * Continuing high unemployment rates. * A double-dip in the housing and real estate markets. * State and local governments at risk of bankruptcy. * Inaction with regards to federal deficit. In particular, the third point on that list could have us in for a wild ride... Read full article... More from Nouriel Roubini: "Dr. Doom" Roubini: The U.S. dollar will beat gold now "Dr. Doom" Roubini: Euro debt crisis will spread to the U.S. Nouriel "Dr. Doom" Roubini: Nightmare scenario ahead for Europe | ||

| Mexicos Newest Emerging Silver Resource Posted: 26 Jan 2011 12:00 AM PST | ||

| Why this is a great time to buy "insurance" on your stocks Posted: 25 Jan 2011 11:58 PM PST From OilPrice.com: I am one of those demented people who buys flood insurance when the sun is shining and sun tan lotion by the gallon from Costco in the dead of winter. I am such an inveterate bargain hunter that I even buy Christmas ornaments during the January sales when retailers are unloading inventories for pennies on the dollar. It is such instincts that drive me to take a look at the CBOE Volatility Index (VIX), a measure of the implied volatility of the S&P 500 stock index, which has been in a death spiral since it peaked nearly three years ago at the $80 level. You may know of this from the talking heads and beginners who call this the “Fear Index.” For those of you who have a Ph.D. in higher mathematics from MIT, the (VIX) is a weighted blend of prices for a range of options on the S&P 500 index. ... For the rest of you who do not possess a Ph.D. in higher mathematics from MIT, and maybe scored a 450 on your math SAT test, or who don’t know what an SAT test is, this is what you need to know... Read full article... More on stocks: Get ready for some big moves in stocks Read this before you blindly sell all your stocks Chinese stocks are about to make a HUGE move | ||

| Five reasons Obama's State of the Union address was completely wrong on the economy Posted: 25 Jan 2011 11:55 PM PST From The Economic Collapse: Barack Obama's State of the Union address sure sounded good, didn't it? There were lots of solemn promises, lots of stuff about America's "bright future," and a line about how we are now facing this generation's "Sputnik moment" that will surely make headlines all over the globe. But we all knew that Barack Obama could give a good speech. That has never been the issue. What the American people really need are some very real answers to some very real problems. So were there any real answers in Barack Obama's State of the Union address? Well, Obama promised that America will "out-innovate, out-educate, and out-build" the rest of the world. He also pledged that America will become "the best place in the world to do business" and that the government must "take responsibility" for our deficit spending. But does all this rhetoric mean anything? Or is all this just another batch of empty promises to add to the long list of empty promises that Barack Obama has already made and broken? Read full article... More on the economy: Porter Stansberry: You must prepare for a crisis NOW Must-see video reveals the real costs of U.S. central planning Shocking admission from Tim Geithner: U.S. on the brink of catastrophic collapse | ||

| Gold to Benefit as Currency Woes Continue Posted: 25 Jan 2011 08:40 PM PST GLD ETF has 1.0 million ounce withdrawal...SLV down 977,000 ounces. A decade of gaining 18% a year...some 'relic' - John Embry, Sprott Asset Management...and much more. ¤ Yesterday in Gold and SilverGold made an attempt to move higher the moment that trading began on the Globex system on Tuesday morning. But, as you can see from the graph, the rally ran into opposition shortly after it developed some legs...and the outcome from that point on was not in doubt. The low of the day came at the London a.m. gold fix, which occurred shortly after 10:30 a.m. local time. From there, gold made many rally attempts, only to get sold off before any one of them could get far. Gold closed down a couple of bucks from Monday's close but, without doubt, if left to its own devices its closing price would have been substantially higher.

And you'd be hard pressed to notice many significant differences between yesterday's gold graph...and its silver counterpart. The low was also at the London a.m. gold fix. Silver closed down about a dime from Monday...but would have also closed higher if it hadn't been for the New York bullion banks.

The dollar didn't do much until precisely 3:00 a.m. Eastern time. The dollar's zenith was at precisely 8:00 a.m. Eastern time...a rise of 50 basis points from its 3:00 a.m. low. From there, it was all down hill into the New York close.

The gold stocks trading in a tight one percent range yesterday...and the HUI closed almost on it's high of the day...down only 0.52%.

The CME Delivery Report showed that 9 gold and 46 silver contracts were posted for delivery on Thursday. In silver, it was JPMorgan as issuer in both its client and house accounts...and Prudential was the stopper in both of its accounts as well. What little action there was, is linked here. There was a whopping withdrawal from the GLD ETF yesterday...a cool 1,005,095 troy ounces to be exact...31.26 tonnes! That has got to be pretty close to a one-day record drop in that ETF. The SLV ETF also dropped a bunch as well...976,820 troy ounces. And, for the third day in a row, there was no report from the U.S Mint. There was smallish activity in all four Comex-approved depositories on Monday. By quitting time, they had shipped out a net 132,044 ounces of silver. The action, such as it was, is here. When I was at the Vancouver Resource Investment Conference the last couple of days, I was delighted to see that the Northwest Territorial Mint had a booth for the first time that I could remember since I started attending these conferences many years ago. I spent a fair amount of time talking to the owner of the firm, Ross Hansen. He seemed like a straight-up guy to me. One of things that both he and his staff mentioned was that they sold 51,000,000 ounces of silver last year. That's about 16 million ounces more than the U.S. Mint...and over 6% of total world silver production. They were running pedal-to-the-metal all year long. I was impressed. Before proceeding to my stories of the day, I thought I'd post this graph that Australian reader Wesley Legrand sent me on Monday. It's the 3-year graph of the HUI. The comment he posted with the graph reads as follow: The HUI is continuing its correction after its topping pattern in December. It may bounce off the 200-day moving average at 490...but the trend line at 475 would be a better bet. Since the gold price is a bullion bank-contrived number, the HUI will end up being the same thing when all is said and done. But note the fact that the RSI is plunging into deeply oversold territory...and once at the bottom, has a tendency to reverse quickly.

¤ Critical ReadsSubscribeIreland's Voters Ready to Confront Rest of Euro ZoneWith the fall of the Irish government last week, the upcoming elections are crucial to which direction Ireland takes. They can continue the way they are...or pull an Iceland, by renouncing the euro...and going back to the punt. The title from the story that's posted in yesterday's edition of The Wall Street Journal pretty much says it all "Ireland's Voters Ready to Confront Rest of Euro Zone". Whenever it happens, Ireland's general election will mark the first clash between the desires of voters in a euro-zone nation that is in receipt of help from its brethren...and the declared interests of the currency area as a whole. At the heart of that conflict will be a blanket guarantee made by the outgoing government to pay back international holders of all bonds issued by Irish banks should they fail. Everything is riding on this...and the world will be watching. I stole this story from yesterday's King Report...and the link is here.  E-mails Suggest Bear Stearns Cheated Clients Out of BillionsThis next story, posted over at theatlantic.com, is courtesy of reader U.D...and is headlined "E-mails Suggest Bear Stearns Cheated Clients Out of Billions". The lawsuit alleges the bank took extreme measures to defraud investors, and now JPMorgan may be on the hook...as former Bear Stearns mortgage executives who now run mortgage divisions of Goldman Sachs, Bank of America, and Ally Financial have been accused of cheating and defrauding investors through the mortgage securities they created and sold while at Bear. [No!!! Really??? Who would have thunk that??? - Ed] The link is here.  IMF chides US for fiscal follyThe IMF issued a couple of reports the other day...one that dumped on the USA...and the other on Europe. Since the IMF runs a pretty big currency-printing operation itself, this is definitely the pot calling the kettles 'black'. The first story on this is courtesy of reader Roy Stephens...and is from yesterday's edition of The Telegraph. The headline reads "IMF chides US for fiscal folly". The International Monetary Fund (IMF) has issued its clearest warning to date that the latest US fiscal stimulus is ill-judged, unlikely to do much for growth and raises the risk of a bond crisis over the medium term. The link to the story is here.  IMF Sees Europe's Debt as Top Recovery ThreatThe IMF report on Europe is touched on in this story in yesterday's edition of The Wall Street Journal. It's courtesy of reader Scott Pluschau...and is headlined "IMF Sees Europe's Debt as Top Recovery Threat". It's more the same 'do as we say, not as we do'...and the link is here.  Asian investors lead massive demand for first Euro bail-out bondHere's another Roy Stephens offering. This one, too, is from The Telegraph...and is headlined "Asian investors lead massive demand for first Euro bail-out bond". Asian and Middle-East investors have thronged to buy the first issue of AAA-rated bonds by the eurozone's new bail-out fund, marking a key moment in the evolution of Europe's monetary union. With Japan and China already committed to buying worthless European bonds with their equally worthless bonds, the success of this tiny auction of European debt was a foregone conclusion...and the link to this very short Ambrose Evans-Pritchard offering is here.  Rioting Breaks Out In EgyptLast week it was Tunisia...and this week it's Egypt. There's chaos in Cairo. The first is this zerohedge.com piece courtesy of Washington state reader S.A. that's headlined "Rioting Breaks Out In Egypt". Tyler Durden states the following..."When we reported three days ago that 59 outbound shipments of gold were intercepted at the Egypt airport, we predicted that the country's oligarchs were proactively preparing precisely for what they knew is coming imminently. It has arrived." This is worth the read...and the link is here.  Egypt Riots Update: First Casualties Reported As Police Use Live Ammo Against ProtestersHere's another zerohedge.com article that followed hard on the heels of the last one. This one is courtesy of 'David in California'. The headline reads "Egypt Riots Update: First Casualties Reported As Police Use Live Ammo Against Protesters". The most notable update is that according to reports, Jamal Mubarak has left Cairo to London. It's a one-paragraph story with a youtube.com video imbedded...and the link is here.  Tunisia's Worrying Precedent: Arab Rulers Fear Spread of Democracy FeverThe last word on this issue comes courtesy of reader Roy Stephen | ||

| Richard Russell - Get Out of Your Dollar Assets Now! Posted: 25 Jan 2011 08:40 PM PST Image:  Here's part of a Richard Russell blog that's posted over at King World News. The 'R' man is up on this soap box telling his subscribers for the umpteenth time to sell their dollar-based assets and buy gold in all its forms. The link to the blog, headlined "Richard Russell - Get Out of Your Dollar Assets Now!"...is here. | ||

| Gold and Silver should be following China’s moves into US Banking Industry Posted: 25 Jan 2011 04:58 PM PST | ||

| Gold Hits 3-Month Low, "Discouraged" by Strong Euro-Debt… Posted: 25 Jan 2011 04:50 PM PST | ||

| TheDailyGold Podcast 1/25/2011 Posted: 25 Jan 2011 04:43 PM PST Dave Skarica joined me to discuss Gold and the gold stocks and the possibility of a bottom in the coming days. This was recorded Monday evening. David Skarica is the founder and Editor of the newsletter Addicted to Profits and is the editor of a Gold service published by Newsmax. Skarica entered the financial markets at a young age. At the age of 18 he became the youngest person on record to pass the Canadian Securities Course. In January of 1999 Dave's first book "Stock Market Panic! How to Prosper in the Coming Bear Market" was published. Dave has also been a contributing editor to Canadian MoneySaver and Investors Digest of Canada.His newsletter, Addicted to Profits, is known for its stellar performance in up and down markets. In 2008, at the depths of the financial panic, Addicted to Profits published a letter with stock picks that are up 100 to 200%. 2009 saw his picks climb, on average, over 130% in value where as the S&P 500 climbed 50% over the same time period. David Skarica is a regular speaker at Trade and Investment Shows in Canada and is a regular guest on The Business News Network (BNN) the flagship Canadian business broadcasting network. He has also appeared on the Vicky Gabereau show and featured in The Globe and Mail. His work has appeared in publications such as The Bull and Bear Financial Digest, Barron's, Investor's Digest of Canada and Canadian Moneysaver. David's new book is available on Amazon. | ||

| Gold, Oil, and the Contrarian Mindset Posted: 25 Jan 2011 04:30 PM PST | ||

| Silver - going down for the count? Posted: 25 Jan 2011 10:49 AM PST I've mentioned before I'm no trader, not in anything anymore, not for quite a few years because I lost faith in the integrity of markets. So, I just watch, for entertainment as I don't have a tv. It's sorta like Nightmare on Wall Street, a long drawn out reality horror show ... and who knows where it will all end? Anyways, that's just to provide context to my suggestion that maybe silver has done its dash for this spike and it could be two years plus before we see it back above USD30 again. Consider:  Note four surges on the chart? Note how they have all occurred in the early months of the year? Note their regular periodicity? Note how long it took to surpass the point of the previous peak? Just sayin' --------------------------------------------------------------------------------------------------- Don't confuse me with facts. My mind's made up | ||

| Gold Stocks a Buy, Declares Dan Amoss Posted: 25 Jan 2011 10:36 AM PST 01/24/11 Baltimore, Maryland – Gold begins a new week up a touch from where it ended last week. The spot price as we write is $1,348. Silver is off a few pennies, to $27.45. While the markets tread water, the Russians and Chinese are snapping up metal…

"It's time to buy gold stocks," declares Strategic Short Report editor Dan Amoss. "Top-down 'macro' analysis indicates that the bull market in gold stocks still has a long way to go. And bottom-up analysis tells me that gold stocks are cheap. "I see the most likely macro scenario as follows: a steady rally in gold, a sideways stock market (some sectors up, some down) and falling Treasury bonds (rising yields) as more bond investors look ahead to a future of endless US budget deficits and decide to hit the Fed's 'QE2' bid. "The Fed's balance sheet will probably double in size again over the next few years, filling up with even more Treasuries. The central banks in China, India and elsewhere are woefully short of gold – and stuffed to the brim with less-desirable US dollar assets – so they should continue to trade paper for gold and other real assets at a steady pace. "More than an inflation hedge, gold is a hedge against chaos in the monetary system; people flee to gold when confidence in paper money crashes." Meanwhile, gold stocks remain cheap relative to gold, Dan says. Check out a chart of the HUI – a major gold stock index – divided by the price of gold. Leave aside the Panic of 2008 and gold stocks haven't been as cheap by this measure since 2003:

"This fact is even more compelling," Dan continues, "when you consider that the gold miners are far more profitable today. Profit margins are much higher. "More importantly, these margins are likely to stay higher, since the cost of mining – diesel, steel, equipment, chemicals, labor, electricity, etc. – is not likely to rise at anywhere close to the rate at which gold bullion should rise. There is little chance we'll see the same intensity of industrial activity worldwide over the next seven years as we saw over the past seven." Buying opportunities like this will be rare, Dan concludes, because many institutional investor portfolios remain underweight in gold. "These investors will keep looking to add exposure to gold because of the state of the private credit markets, government debts and central banks." Dave Gonigam Dave GonigamTreading a fine line between contrarian thinking and conspiracy theory, Dave Gonigam explores the nexus of finance, politics, and the media for Agora Financial's 5 Minute Forecast. He joined kindred spirits at Agora Financial in 2007 after a 20-year career as an Emmy award-winning writer, producer, and manager in local TV newsrooms nationwide. Special Report: Hyperinflation in the USA! If you think hyperinflation can't happen here in the USA, you're dead wrong. It's already happened before! Now Obama is setting the stage for another inflationary holocaust by letting the Federal Reserve kick their money printing presses into overdrive – everyday living for average Americans could simply become too expensive! Imagine not being able to afford filling up your car, or even a single loaf of bread. This threat is very real… Click here to watch the presentation now | ||

| Stagflation in UK a Risk to US and Western Economies Posted: 25 Jan 2011 10:00 AM PST What were termed "shock" United Kingdom GDP figures led to falls in the FTSE and the pound sterling, which fell against the dollar and gold. Sterling's fall saw sterling gold prices rise from £833 per ounce to over £842 per ounce after the news. | ||

| Beware the Coming Collapse of Gold Posted: 25 Jan 2011 10:00 AM PST The triple top on the charts that set up over the last three months could not be more clear. What is giving traders ulcers now is the prospect of a much more serious sell off in the yellow metal in coming weeks and months. | ||

| The Price of Gold Breaks Key Support Point Posted: 25 Jan 2011 10:00 AM PST January futures are set to expire on Thursday. At the same time, the value of the US dollar has climbed and the euro fell against the dollar. Those things may have put a lot of downward pressure on the price of gold. | ||

| Spec Funds Exit Gold & Silver, Stay in Others Posted: 25 Jan 2011 10:00 AM PST There are many ways to measure market sentiment. We use surveys, put-call ratios, fund flows data and for commodities especially, the commitment of traders reports (COT). Lately, we've noted the improving sentiment picture for gold. | ||

| Coming Soon: House of the Seven Hawks? Posted: 25 Jan 2011 10:00 AM PST Difficulties continued to confront the gold and silver markets overnight and even more so early this morning, as recent and growing fund liquidations appeared not to be easing up a whole lot (read: at all). | ||

| US Panel Blames Banks for '08 Meltdown, but not Central Banks Posted: 25 Jan 2011 10:00 AM PST The draft report says "dramatic failures of corporate governance and risk management at many systemically important financial institutions were a key cause of this crisis." It also points to "stunning instances of governance breakdowns and irresponsibility," including at American International Group Inc., which made giant bets on the mortgage market, and Fannie Mae. | ||

| New World Order: Food Price Inflation; House Price Deflation Posted: 25 Jan 2011 09:00 AM PST You can tell by my bleary, bloodshot eyes, my rumpled appearance, my musky aromas and my overtly hostile attitude that I have been holed up in the Mogambo Armageddon Bunker (MAB), scared out of my mind about the inflation in prices that is surely going to consume us, thanks to the unholy Federal Reserve creating so incredibly much, so stupendously much, so astoundingly much, So Freaking Much Money (SFMM). Naturally, as a lunatic-fringe Austrian Business Cycle Theory kind of guy, and one who has also seen the terrifying 4,500-year historical record of fiat currencies, and being an ordinary guy who is also paranoid and scared enough as it is without the added terror of this inflation thing, I am furiously buying gold, silver and guns, the latter item to protect the two former items, which will be so valuable in the collapse that I can buy anything I want, any time I want, anywhere I want, which you have to agree is a really nice way to get through a hyperinflationary collapse! Of course, it won't be inflation in the prices of all things, but more inflation in things that foreigners want, too (food, energy, pornography), but deflation in things that foreigners do not want (your house, your car, your job). Since there is no word for that, we turn to George Ure at UrbanSurvival.com, who calls it LifeFlation, and defines it as when, "Things you need – like food – go through the roof. Things you don't need, like a fourth car, an airplane, a motor home, and so on, collapse." And so with a smug look of self-satisfaction on my face to finally have someone on my side instead of the usual "me against everyone," I now point to the roaring inflation in the cost of food around the world (which people need), as evidenced when Ed Steer's Gold & Silver Daily gleaned that "Food inflation is alive and well in India," which he learned from the Times of India headline "Inflation up to 18.32% on veggie prices", which seems bad enough without continuing on that "Among the individual items, onions became dearer by 82.47 per cent on annual basis, while eggs, meat and fish became costlier by 20.83 per cent, fruits by 19.99 per cent and milk by 19.59 per cent." This is a dismal list that, thankfully, did not mention any price rises for yummy pizza, or delicious tacos, or any price rises for those crispy little Spring rolls that taste so good with that gooey red sauce, so that is at least something to be thankful for, I guess! Anyway, contrast this harrowing inflation in the prices of food with actual deflation in assets, as Zillow.com reports that home prices went down for the 53rd month in a row, which is (if my math is correct) more than four years, which is the worst slump since the 25% fall in housing prices during the Great Depression! And yet the Federal Reserve, which created all the money necessary to finance this insane bubble in housing that has been deflating for 53 months in a row and has caused almost 3 million foreclosure actions in 2010 with 1 million actual foreclosures, is still there, operating business-as-usual! A total, catastrophic failure, and yet the Federal Reserve remains totally untouched! "Outrage and a call to action" is one thing, but it was just too cold and snowy to consider rising up in open rebellion, marching upon the Federal Reserve as an angry mob, with photogenic flaming torches and pitchforks being brandished in a menacing manner, intent upon casting out an evil and re-installing the gold standard to the USA So, since I was snowed in, I had a lot of time on my hands to think about, you know, things. One of them was the realization that this is the year I turn 64, which reminded me of the Beatles tune that had the line "Will you still need me, will you still feed me, when I'm 64?" For a moment, everything seeming so warm and cozy, and the thought crossed my mind to do some of that touchy-feely "bonding" crap that families "do" these days, based on, as far as I can tell, some whacko academic theorists and self-promoting hucksters I never heard of, based loosely on statistics that actually prove my point: Mean-spirited, hateful children are obviously spawn of the devil who deliberately make their fathers so crazy that the continual familial dysfunction finally results in barely-controlled rage and a secret thirst for revenge. QED, damn it! QED! I mean, it's always something with kids! Always wanting me to go bankrupt by giving them money, instead of my using all of our money to buy as much gold, silver and oil as we can, as protection against the inevitable roaring inflation in prices that is guaranteed by the Federal Reserve creating so much excess money so that the federal government can borrow it and spend it to sustain an idiotic, bankrupted, suicidally-dysfunctional, cancerous, government-centric economy financed by the triple evils of a massively over-produced fiat currency, insane levels of fractional-reserve banking, and a federal government continually deficit-spending. And if it is not "the money thing" with these kids, then it is them whining for me to drive them somewhere so that they can visit their stupid friends, or take them to some stupid after-school function, or to the mall, or go to some expensive emergency room complaining of some ailment that probably would have gone away in a few days or weeks by itself anyway, or maybe they would have just gotten used to it after a few months. I say to them, in my defense, "I mean, consider that our incomes as not going up, but prices are, so something has to give!" In practical experience, this means that it is no wonder that so few people buy gold and silver, although they know they should, and would if they could, but if they did, they would find it so easy that they would, too, spontaneously shout, "Whee! This investing stuff is easy!" The Mogambo Guru New World Order: Food Price Inflation; House Price Deflation originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." | ||

| Huge Drop in comex gold open interest, huge deliveries on silver/ Posted: 25 Jan 2011 08:51 AM PST | ||

| Gold Seeker Closing Report: Gold and Silver Fall About 1% and 2% Posted: 25 Jan 2011 07:14 AM PST Gold fell as much as $22.55 to $1322.65 by about 6AM EST before it rebounded in New York and saw a nice rally in the last couple of hours of trade, but it still ended with a loss of 0.92%. Silver fell to as low as $26.556 by a little after 8AM EST before it also rebounded in New York, but it still ended with a loss of 2.01%. | ||

| Upcoming COMEX Silver COT Report Possibly Key Posted: 25 Jan 2011 06:24 AM PST | ||

| Obamas State of the Union Address - Gold Bar Shortage in Hong Kong Posted: 25 Jan 2011 01:29 AM PST | ||

| Bank of Russia Says It's Buying Only Domestic Gold Posted: 24 Jan 2011 08:39 PM PST SLV ETF rose 2.7 million ounces. Russia Imposes Inflation-Drive Price Controls. The Fed can no longer go bankrupt. Interviews with John Embry and David Franklin of Sprott Asset Management...and much more. ¤ Yesterday in Gold and SilverEverything was coming up roses when I went to bed on Sunday night, so I was hoping for big things on Monday morning. I suppose I should have known better, as gold saw its high of the day shortly before lunch in Hong Kong. From there, the selling pressure was relentless...and every time that gold showed any signs of rising, there was some not-for-profit seller waiting in the wings to take it down. This pattern continued all through London and New York trading. That pattern ended at the 1:30 p.m. Eastern time, which was the close of Comex trading...and the beginning of the electronic market. From that point, the New York bullion dealers really went to work...pulling their bids in thin electronic trading...and down went the price. Gold closed almost on its low of the day, which was reported as $1,331.60 spot. The high for the day occurred around 11:30 a.m. in Hong Kong at $1,153 spot. I'm having issues with the hotel's computer...and Monday's price action is the blue and red traces.

The shenanigans in the silver market were just as obvious. There was a spike high in late afternoon trading in Hong Kong...where silver tried to blast above $28...but ran into an immediate wall of selling. There were three attempts at rallies during London and New York trading, but all got sold off...especially the last one, where the bullion banks pulled their bids in ultra-thin electronic trading after the Comex had closed for the day. Blue and red traces in silver apply to Monday's trading as well.

None of the precious metals were spared yesterday...as both platinum and palladium got sold down as well. From Friday's close...gold was sold down 0.59%...silver 2.11%...platinum 0.71%...and palladium was down 1.34%. Of course they were all down more than that from their intraday highs. As the precious metals rose in early Far East trading on Monday morning, the dollar was pretty flat. But a smallish rally began as the metal prices began to head south. The dollar's top was around 6:40 a.m. Eastern time...and then fell 70 basis points during the next five hours of trading...before recovering a bit into the New York close. Needless to say, there was absolutely no sign of this big dollar drop anywhere to be found in the precious metals price charts yesterday.

Because gold was in positive territory for virtually all of the Comex trading session, the HUI was in the black most of the day. But the very second that the U.S. bullion banks pulled the pin on gold and silver in the electronic market around 2:45 p.m. Eastern..the precious metals stocks got sold off hard...and the HUI got sold down for a loss of 0.82%...but did not close on its low.

The CME Delivery Report on Monday showed that 2 gold, along with 126 silver contracts were posted for delivery on Wednesday. The issuer in silver was all JPMorgan out of its client account...and the stopper was Prudential in both their client and proprietary trading accounts. After a big jump on Friday, the GLD ETF continued in its usual direction by shedding 351,301 ounces. And, after a monstrous withdrawal on Friday, the SLV ETF showed a huge increase yesterday. This time it was to the tune of 2,686,349 ounces. The U.S. Mint had nothing to say for itself on Monday. But over at the Comex-approved depositories, they reported taking in 952,800 troy ounces of silver on Friday.

¤ Critical ReadsSubscribeJPMorgan, UBS Seek to Bring Florence to the Thames in lawsuits over swapsToday's first story is courtesy of Wesley Legrand. This is a Bloomberg piece from last Friday that's headlined "JPMorgan, UBS Seek to Bring Florence to the Thames in lawsuits over swaps". These two banks, amongst others, are bringing more than a half dozen Italian municipalities to London's courts over swaps that are turning sour for both sides. Local governments threaten to stop making payments on contracts...and others seek to recover fees they alleged were hidden. Where have we heard all this before? The link to the story is here.  Accounting Tweak Could Save Fed From LossesHere's an item from cnbc.com that was sent to me by reader Martin Arnest from California. The headline reads "Accounting Tweak Could Save Fed From Losses". It appears that the Fed has changed its accounting methodology that will allow it to incur losses, even substantial losses, without eroding its capital. This means that it can't go bankrupt. This story also falls into the "you can't make this stuff up category"...and the link is here.  Mortgage Giants Leave Legal Bills to the TaxpayersFrom reader 'David in California' comes this story from yesterday's edition of The New York Times that's headlined "Mortgage Giants Leave Legal Bills to the Taxpayers". Since the government took over Fannie and Freddie, taxpayers have spent more than $160 million defending them...and their former executives in civil lawsuits accusing them of fraud. Why am I not surprised...and the link is here.  Tens of thousands rally to demand politicians form a governmentThere's more trouble in Belgium these days. Here's a Roy Stephens offering from the france24.com website. The headline reads "Tens of thousands rally to demand politicians form a government". More than seven months after their last election, there is still no government...and the country is at the mercy of the financial markets. The link to this story is here.  The Manila Model: Plan Would Place Burden for Euro Rescue on CreditorsToday's next overseas story come from the German website spiegel.de...and was sent to me by reader Roy Stephens. The headline reads "The Manila Model: Plan Would Place Burden for Euro Rescue on Creditors". Despite public denials, euro zone governments are currently working on a proposal to relieve Greek bond debt. The proposal has a number of advantages for all countries involved, but it also entails risks that may prove insurmountable. Some believe regulatory pressure will be required to force banks to take voluntary losses on their loans to Athens. It probably won't be long before large portions of other European countries debt will be written off as well. The link is here.  Russia Imposes Inflation-Drive Price Controls: Will Use Price Caps on "Socially Important" CommoditiesThe next story is a zerohedge.com piece that's courtesy of Washington state reader S.A. The headline reads "Russia Imposes Inflation-Drive Price Controls: Will Use Price Caps on "Socially Important" Commodities. Price controls have never worked in the past...and when they're finally lifted, prices normally rocket higher than they would have, had they been left alone in the first place. We in Canada and the U.S. have been down this road before...and it has ended in disaster. Sooner or later, this will, too. The link is here.  Spain tempts fate with minimalist bank rescueHere's a piece that was filed late yesterday evening in The Telegraph. It's an Ambrose Evans-Pritchard offering headlined "Spain tempts fate with minimalist bank rescue". Spain has set in motion a partial nationalisation of its crippled savings banks, or cajas, but stopped short of the giant rescue deemed necessary by some experts to contain the country's festering crisis. I thank reader Roy Stephens for sharing it with us...and the link is here.  Interview with Agnico-Eagle's Sean BoydToday's first gold-related story is an interview by Eric King of King World News. Agnico-Eagle CEO Sean Boyd remarks that confidence in the world economy is misplaced...and more spectacular debt creation won't fix anything. Boyd sees gold rising to $2,000 this year. The "Interview with Agnico-Eagle's Sean Boyd" is linked here.  Bank of Russia says it's buying only domestic goldThe next gold-related story comes from Russia...and ended up as a GATA release later in the day. The GATA headline reads "Bank of Russia says it's buying only domestic gold". Russian reader Alex Lvov was the first one through the door with this story...and it's worth your time. The link is here. Spec Money Exits Gold & Silver but Remains Heavily Long Other Markets Posted: 24 Jan 2011 08:35 PM PST |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment