Gold World News Flash |

- ” When $1,400 falls we will really begin to see the next leg higher in gold. At that point $2,000 is very much in the cards within the next twelve months”

- How Gold Became Politically Correct

- A Three-Minute Lesson in Gold Investing

- The Day After The Dollar Crashes - A Survival Guide, Rise of New World Order

- In The News Today

- Jim?s Mailbox

- Mexico’s Newest Emerging Silver Resource

- Inflationary Tuesday: Record Earnings Based on Record BS

- Gold Seeker Closing Report: Gold and Silver End Mixed and Near Unchanged

- Government To Pretend It Will Prosecute Wall Street

- Guest Post: The Opposite Of Apocalypse

- Spec Money Exits Gold & Silver but Remains Heavily Long Other Markets

- More spectacular debt won't fix anything, Agnico CEO tells King World News

- Mike Kosares: How gold became politically correct

- Russia Imposes Inflation-Driven Price Controls: Will Use Price Caps On "Socially Important" Commodities

- Bank of Russia says it's buying only domestic gold

- USAGOLD News, Commentary and Analysis — How gold became politically correct

- Scotia-Mocatta Sells Out Of 1 Kilo Silver Bars

- Graham Summers’ Free Weekly Market Forecast (Gold and Silver: Buy With Both Hands Edition)

- Silver and Gold Price Correction Continues, Ultimate Peak of Bull Market Still Years Away

- Euro's Reversal of Fortune & Outlook

- Monday Market Movement – Do or Dive!

- Question: What Happens When QE2 Ends?

- Insurance Companies Sue Bank Of America Over "Massive Mortgage Fraud", Find 91% Of Securitized Loans Are Misrepresented

- The Most Predictable Financial Calamity in History

- Food Crisis II

- Goldman Goes Gaga Over Cyclical Commodities, Says Gold Run Is Ending As QE2 Comes To A Close (Full Commodity Update)

- MONDAY Market Excerpts

- Spec Money Exits Gold and Silver but Remains Heavily Long Other Markets

- Gold: Not an Investment

- Speculative Money Exits Gold and Silver but Remains Heavily Long Other Markets

- Gold Price: "Correction Will Be Short-Lived"

- Gold Price: "Correction Will Be Short-Lived"

- Big Drop in Gold Prices

- What the "Global Yuan" Means for Gold

- What the "Global Yuan" Means for Gold

- Michael and Chris Berry: Berrys, Batteries and Burgeoning Demand for Vanadium

- Gold Investments: Why I Jumped in and Bought Twice this Week

- Gold Daily and Silver Weekly Charts

- Spec Money Exits Gold & Silver but Remains Heavily Long Other Markets

- How Central Bankers Will Save Us from Rising Food Prices

- Budget Cuts in the Irrational Financial System

- Gold Consolidates

- Gold stocks look cheap

- Long term effects on the gold price could be spectacular

- “The recent slide in gold and silver prices – more than the usual correction and profit taking.”

- Here It Comes - The Big Lie - We Need GMO To Feed The World

- Paper Silver getting crushed

- Jim's Mailbox

- Gold Market Update - Jan 23, 2011

| Posted: 24 Jan 2011 06:45 PM PST | ||

| How Gold Became Politically Correct Posted: 24 Jan 2011 06:26 PM PST | ||

| A Three-Minute Lesson in Gold Investing Posted: 24 Jan 2011 06:02 PM PST TheEconomicCollapseBlog.com had an article titled "10 Things That Would Be Different If the Federal Reserve Had Never Been Created." This is like my list of "10 Things That Would Be Different If I Was Rich" instead of being a weird little penniless paranoid recluse whose expensive family and expensive greens fees cruelly devour all my income, preventing me from buying lots and lots of gold, silver and oil as vital protection against the catastrophic inflation that will afflict us, thanks to the horrid Federal Reserve creating excessive amounts of money. | ||

| The Day After The Dollar Crashes - A Survival Guide, Rise of New World Order Posted: 24 Jan 2011 05:06 PM PST | ||

| Posted: 24 Jan 2011 04:41 PM PST View the original post at jsmineset.com... January 24, 2011 11:21 AM Jim Sinclair's Commentary Trader Dan sends us this intriguing article. Russia Central Bank Plans To Buy 100 Tons Of Gold A Year Mon Jan 24 09:10:31 2011 EST MOSCOW (Dow Jones)–The Central Bank of Russia plans to buy from domestic banks 100 metric tons of gold a year in order to replenish the country’s gold reserves, Deputy Head of the bank Georgy Luntovsky said Monday, according to the bank’s press service. In 2010 Russia’s gold reserve increased 23.9% to 790 tons, or 25.4 million Troy ounces. -By Grigori Gerenstein, contributing to Dow Jones Newswires; [EMAIL="gerenstein@hotmail.com"]gerenstein@hotmail.com[/EMAIL]... | ||

| Posted: 24 Jan 2011 04:41 PM PST View the original post at jsmineset.com... January 24, 2011 11:19 AM Jim Sinclair's Commentary Alf called for a low in gold last week. That is what is meant by the start of an up move. Erik McCurdy seems to be of the same mindset. We shall see. Greetings Jim, In early January, the Gold Currency Index (GCI) broke below long-term uptrend support, negatively diverging from gold in US dollar terms and suggesting the start of a correction or extended period of consolidation. Last week, gold broke below long-term uptrend support as well, confirming the development of a short-term downtrend from the beginning of the year. As longtime readers know, the GCI has an excellent track record when it comes to predicting the future direction of the gold market, and it has anticipated every major breakout and correction since it was created in 2005. The reason the GCI has been so successful during the past six years is also the reason that it was created in the first place: gold has taken on... | ||

| Mexico’s Newest Emerging Silver Resource Posted: 24 Jan 2011 04:34 PM PST Richard (Rick) Mills Ahead of the Herd As a general rule, the most successful man in life is the man who has the best information If you believe in the adage ‘mines are made, not discovered’ then the time has come to turn your attention to Kootenay Gold Inc. TSX.V – KTN. Drawing from the experience of its management team, led by Company CEO and Chief Geologist James McDonald, Kootenay is applying the same pragmatic approach to its flagship Promontorio Silver Project in Sonora Mexico, that has helped companies McDonald has been associated with, such as Alamos Gold Inc., turn into accomplished producers. Since first acquiring the historic past producer in 2005, Kootenay has taken no shortcuts in its quest to systematically exploit the vast silver resources believed to exist within Promontorio’s 79,000 hectare borders. Based on its success to date and the projects maturing status, the Company’s comprehensive approach appears to be paying off. To su... | ||

| Inflationary Tuesday: Record Earnings Based on Record BS Posted: 24 Jan 2011 04:02 PM PST Inflationary Tuesday: Record Earnings Based on Record BS This week, rather than focusing on inflation in the form of prices rising around the globe, I thought we'd focus a specific form of inflation, namely, that of inflated earnings. Indeed, with earnings season fully underway we've already seen some stellar results from the likes of General Electric, JP Morgan, and Citigroup. -JP Morgan: All time record earnings of $17.4 billion, earnings growth of 48% from 2009's results. -Citigroup: Annual earnings of $10.6 billion. First full year of positive earnings since 2007. -GE: Total earnings of $13.2 billion, an increase of 15% from 2009's results. These three companies, despite their supposed differences all have a common theme in their results. That theme is: Making money by lowering loan loss reserves. I realize this sounds like mumbo-jumbo. It is. In plain terms, what this means is that these companies are writing off the money they've kept in the proverbial rainy day jar to cover any losses that might occur from the loan's in their lending portfolios (yes, GE continues to lend money via its financial arm, GE Capital… the same arm that nearly took the company under in 2008). Let me give you an example. Let's say that my rainy day jar contains $10,000 to cover any unforeseen problems. Now let's say that one day I decide that I only need $5,000 to cover unforeseen expenses. Does this random mental calculation mean I've made more money and need to report $5,000 more on my tax return that year? NOPE. However, this is exactly how GE, JP Morgan, and Citigroup generated their "stellar" earnings. In JP Morgan's case, the bank did this with $2 billion, roughly 11% of its 2010 earnings. This was on par with GE's gimmicky at $1.4 billion or 10% of annual profits. In contrast, Citigroup pulled out all the accounting gimmicky stops, lowering loan loss reserves by $2.2 billion or 20% of 2010 earnings. Put another way, $1 out of every $5 that Citigroup reported in earnings was non-existent. And $1 out of every $10 GE and JP Morgan reported was non-existent. Thus, the message Big Business is sending to the world right now is clear: If you can't actually MAKE the money, just MAKE IT UP. I continually hear arguments that stocks are somehow cheap at today's levels. Just skimming over the results for JPM, C, and GE, I don't see how anyone can claim to have an accurate valuation of ANY of these companies. To value a company you need some clue as to its earnings potential. All of these companies are black boxes. This is just another layer of the great financial Ponzi scheme that is the US stock market. Bogus earnings, fictitious accounting, outright fraud, insider trading, backroom deals… the whole thing is just one huge house of cards propped up by one thing and one thing only… The Fed's liquidity. Take this away and the whole thing comes crashing down. Some commentators see this situation and claim that the market will never collapse. I couldn't disagree more. Liquidity has a price. And that price will ultimately be the US Dollar. Remember, the US's Federal debt is now at $13+ trillion. And if you include unfunded liabilities like social security and Medicare, you're talking about $70+ TRILLION in total debt on the US's balance sheet. After all, Gold and Silver are the most obvious inflation hedges out there. And to be blunt, anyone who invests in these two assets will likely do very well in the coming months as inflation erupts in the US (see their 2010 performance). However, to make truly ENORMOUS gains from inflation you need to find the investments that are off the radar... investments that the rest of the investment world hasn't discovered yet. I'm talking about investments that own assets of TREMENDOUS value that are currently priced at absurdly low valuations: the sorts of assets that larger companies will pay obscene premiums to acquire. Investments like three inflation hedges detailed in my Inflationary Storm special report. Case in point, since recommending them on December 15, they've OUTPERFORMED Gold and Silver by 2%, 7%, and 14%, respectively. And they're just getting started. You see, because these three investments are currently unknown to 99.9% of the investment world. It is literally impossible for them to become less popular. Which means that they have only one direction to go and that's to become more and more known to the investment world. After all, how many inflation hedges can you name that CRUSH Gold and Silver, rallying even when those precious metals FALL (yes, my three investments have done this). If you haven't already taken steps to prepare your portfolio for the inflationary storm that is coming, don't wait another day. You can reserve a copy of my Inflationary Storm Special Report today, receive the names, symbols, and how to buy the three investments it details... and get in on these investments before the rest of the investment world does, simply by taking out a "trial" subscription to my paid newsletter Private Wealth Advisory. In fact, you can keep my Inflationary Storm Special Report even if you choose to cancel your trial subscription and receive a full refund during the first 30 days of your subscription. How's that for a low risk offer? To take out a trial subscription to Private Wealth Advisory and receive a copy of my Inflationary Storm Special Report today…

An annual subscription to Private Wealth Advisory costs just $180. However, I realize my analysis and investment style are not for everyone.

| ||

| Gold Seeker Closing Report: Gold and Silver End Mixed and Near Unchanged Posted: 24 Jan 2011 04:00 PM PST Gold climbed $10.25 to as high as $1352.95 in Asia before it fell back off to see a $1.25 loss at $1341.45 by about 10AM EST, but it then bounced back higher in late morning trade and ended with a gain of 0.19%. Silver rose nearly 2% to $27.97 in Asia before it fell to see an almost 1% loss at $27.167 by about 10AM EST, but it then bounced back higher and ended with a loss of just 0.22%. | ||

| Government To Pretend It Will Prosecute Wall Street Posted: 24 Jan 2011 01:37 PM PST In what is merely the latest act in the neverending play of fraud and corruption, the bipartisan panel appointed by Congress to investigate the financial crisis has concluded that several financial industry figures appear to have broken the law and has referred multiple cases to state or federal authorities for potential prosecution reports the Huffington Post. "The sources, who spoke on condition they not be named, declined to identify the people implicated or the names of their institutions. But they characterized the panel's decision to make referrals to prosecutors as a significant escalation in the government's response to the financial crisis." Well, it would be so easy to believe that this is not merely the latest political attempt at cowardly subterfuge before their Wall Street overlords by the corrupt Congressional puppets if this same ploy had worked out a little better the last time, oh, precisely zero bankers were thrown in jail. That said, the semi-informed public who sees massive fraud and endless lies now on a daily basis will get more disclosure on Thursday when the "final report" is expected to be released. Said semi-informed people will be shortly disappointed when nothing at all comes out of this. As for the 99% of the less than semi-informed US population, well, they couldn't care less. From HuffPo:

Surely, Lloyd, Vic and Jamie are shaking in their boots. And just to extend the subreality distraction show by a few more days, while something far more criminal is likely taking place behind the scenes, the general public has two more days in which to imagine that one day someone may go to jail for the biggest legal heist in US history.

| ||

| Guest Post: The Opposite Of Apocalypse Posted: 24 Jan 2011 01:08 PM PST Submitted by JM Fear is where the Power Is November 2008: the situation was dire. But was it ever really an apocalypse? We were all conditioned to think that without government intervention a waking hellscape of crappiness awaited. And it continues. Over and over, we are told of being just a step away from US government default if someone dares fiscal sensibility. Or some variation of bank implosion catastrophe, or everyone going into foreclosure immediately, or something else equally horrible. These outcomes are debatable, and they deserve to be debated. Everything that happens in the future is debatable. What is not debatable is that we continue to be threatened with imminent doom if politicos don’t get what they want. I’m not a believer in global conspiracy theories, much less a perpetual ruling class, but I am a believer that democracies are absolutely awash with propaganda, veiled threats, and fear-mongering. Why? Fear is where the power is. Anybody who knew what was going on in November 2008 was afraid. I know I was. Being afraid of the unknown is exhausting and defeating. The only way to defeat this fear is to make it known, to see the beast in the clarity of thought-light. Being willing to communicate and engage is the step forward. No matter how big, ugly, or evil it is, one can stand up to it, fight it, and break it. It’s time to break the spell of fear that makes this whole planet reek like week-old gym socks. Breaking the spell means only this: to be unafraid to communicate, to be open and receptive to ideas, to weigh them on their merits. It doesn’t mean “find some guru and accept their crap ideology at face value.” No one is totally, unambiguously, right. Ideas may be challenging and unpleasant, but ones based on facts don’t wither under scrutiny. Here goes. Can a Company be “Shorted to Death?” I’ve heard many reasonable, intelligent people say that AIG was shorted to death by Goldman Sachs among others. On the face of it, sure looks like it. After all, Goldman Sachs took out protection on AIG exactly when it was most vulnerable. They profited from the demise of the largest insurance firm in the world. The question is not if Goldman Sachs did it. The question is why. The reason why they did it is because AIG was the insurer of a large chunk of the equity tranche securitizations they held. These securities were risky, and Goldman Sachs bought protection on them in the case of default. This protection was desirable not just as default protection. The price of protection goes up in times of stress, meaning profit, so it was a way to manage daily marks. So Goldman knew there was a housing bubble that would pop and they would lose when it did because of these securities on book. They also knew that AIG insured more than just their paper, but most of the world’s paper. Before the crisis even started, AIG was having trouble posting needed collateral to cover their losses associated with the securitizations for which Goldman paid insurance. This means Goldman would effectively pay insurance premiums for nothing, because AIG was at risk of not being around when they needed to pay out. So they bought CDS on AIG as a company. At least they would be able to recover a portion of their losses in the event that AIG went under. This is the naked shorting that has been talked about so much. It isn’t really naked at all, because it was insurance on the insurer of their book assets. This is a good business decision. It didn’t bankrupt AIG, because the swap counterparties, not AIG paid out if AIG went under. What bankrupted AIG were bad business decisions by AIG. They had to mitigate risk exposure, which they did. So did this “shorting AIG” actually bankrupt AIG? Could the situation be repeated for other companies? No and no. AIG didn’t pay out CDS upon default, the CDS counterparty paid out. Now it is true that a blow out CDS curve can affect a company’s funding costs and this is especially bad for financial companies. But insurance policy holders aren’t to blame for the spread blow-outs. A company that makes bad business decisions that take them to bankruptcy is to blame for spread blow-outs. And this isn’t a Goldman Sachs issue. Just about everybody with securitizations on book that knew what was going on did the same thing. In a sense, Goldman Sachs gets singled out because they weren’t a sucker holding the bag. Why should anyone weep for some suckers on Wall Street? Nobody weeps when the hammer comes down on retail. Am I saying all the bailouts and effectively free money was the right thing to do? No. I am saying that free money and political cronyism is a separate issue. No hedge fund I know of got a bailout. Is it Goldman’s fault that Uncle Sugar and the Fed screwed the taxpayers for generations to come? I don’t know the answer to that and remain open to evidence to know either way. I pass over it in silence until I know more. The Opposite of the Black Swan: Did Margining Mitigate the Apocalypse? CDS were designed to manage credit risk: one leg gets a payout given a triggering event and the other leg receives a premium up to that event—sort of like an insurance premium. To do this there has to be a buyer as well as a seller. Market makers are flat credit risk. Prop desks, hedge funds, and institutional books buy protection. Net sellers are the monoclines and insurers—beat-up companies like AIG. Credit default swaps are transacted in terms of notional amounts, but the notional amount isn’t paid at the outset… it is funded, meaning it is paid in some series of installments. Because they are paid in this way, and because the price of a credit default swap fluctuates in price based on supply and demand, the market value of the credit default swap position is monitored, mostly on a daily basis. To cover adverse swings in price, the party affected must post collateral. So we come to times of crisis. What do you think happens to CDS in these times? That’s right, the spreads blow out and more collateral has to be posted. More collateral is very beneficial to dealing with a crisis because a chunk of the crisis is paid for as spreads widen, before the default actually happens. This means that the losses were less sudden and more manageable than they would have been otherwise. Losses accumulated on a daily basis instead of all at once. CDS helped because the problem was insolvency. CDS procedurally expedite the insolvency process. The problem was inordinate concentration of risk, meaning that one side of the risk was taken on by too few parties, or equivalently, the parties that paid in the event of default didn’t charge enough premium (because more premium reduces risk). Has Nothing Been Learned? Well, this is an open question which is in some ways a legal issue that others should address. What I do know is that the industry is moving towards exchange traded derivatives, where there are a few central counterparties. This isn’t just some cosmetic hogwash. It can be clearly seen in the fact that non-OTC CDS contracts are being standardized. Standardization means that contracts are more like homogenous transaction units where the differences in circumstance are dealt with via an upfront payment by buyer or seller. The events that trigger CDS payouts are simpler and straightforward to manage than OTC, so a clearing house can settle up a contract easily. Counterparty exposures will be known, so you won’t have entities like AIGs effectively taking on risk that make no economic sense. Far before crisis happens, entities won’t buy protection from counterparties with insane exposures. Exchange cleared CDS is huge because it means multiple layers of protection for transaction settlement. More importantly, it means that dealers which make the market are responsible for each other’s failures. The clearinghouse is a business that survives or fails on the basis of its risk management. How? That’s how. All this still does not mean that the system is unbreakable. Things are simply better in an imperfect world. But consider this… when was the last time that the CME busted on an options meltdown, or oil price spikes? The answer is never. OTC (meaning non-clearinghouse for this purpose) CDS will continue to exist, at least until bank regulations catch up to how the market is evolving. This is because some parties need to have trigger events that are contingent on restructuring events, not just defaults. The motive is no speculation. It is pure insurance need. The Sun Also Rises All the fear-mongering facilitates a symbiotic victimhood simply because it is so paralyzing. It makes it easy to believe that never before has a society had to endure the trouble seen by those unfortunates living right now—because of the abomination unleashed by those whom voters legitimately brought into power. The great depression needs its capital letters removed. Chairman Mao was a benevolent breeze of fresh air compared to Bush. Cambodian genocide victims should heave a tremendous sigh of relief that they never saw the like of Ben Bernanke’s blasphemous money printing. This socioemotional hypocrisy is an obscenity. Take comfort in knowing that Joseph Fourier showed (Riemann proved) that everything can come in cycles, just like the sun coming up day after day on what is usually nothing new. And the sun will come up just like it always has independent of anything that happens on Wall Street. The last thing fear spreaders want is calm acceptance of truth; they want control. It is truly debatable whether anything alive and feral like a financial market can be controlled. But this is precisely what one is supposed to believe: a pretence that everything is under control. Accept that the experts have it all worked out, simply because they say so. Give in to public servant demands, or risk that hellscape scenario again and again. And when the endgame finally vaporizes what is regardless of any action or reaction, the ruse just starts again with the hideously stupid formula: “We can get things back under control. Oh yes, we can!” At their core, time-honored religious texts like Dao Te Ching and Ecclesiastes contain the vision of an intrinsic moral logic in the universe that makes things right. Even if the universe rolls like that (debatable), convergence is slow and unpredictable. The support for anybody having anything completely under control is pretty flimsy. Ben Bernanke could scarcely control himself on a “60 minutes” interview. Break on through to the Other Side So what to do? Let go of fear of the unknown and try to make it known. Let go of easy comfortable ideas that just can’t stand up to news flow. Holding on to shimmering BS is a sham unworthy of the intellect. That is to say: communicate and engage. There’s no going back as memory ensures that ideas aren’t reversible. There never was a Golden Age when everything was clean and easy anyway, because nothing has ever been easy or clean. So what if the 1950s didn’t have derivatives. They had Jim Crow laws and H-bomb tests that literally annihilated pristine South Pacific islands instead. They had to put up with this awful crap too. Everybody needs containers to hold their insecurities, including the author of this joint. But I know enough to know I haven’t figured it all out. And I never will. I will keep trying to figure out the nature of things, use the knowledge to make things better and adapt when it all changes in an instant. This is the spice of life. Living things don’t stay still unless they are dead, so don’t let your thinking stall out. Break on through to the other side.

| ||

| Spec Money Exits Gold & Silver but Remains Heavily Long Other Markets Posted: 24 Jan 2011 01:08 PM PST There are many ways to measure market sentiment. We use surveys, put-call ratios, fund flows data and for commodities especially, the commitment of traders reports (COT). Lately, we’ve noted the improving sentiment picture for Gold. As a market weakens sentiment will naturally become less bullish. In this case, sentiment has weakened considerably yet Gold is only 6% off its high. Most interesting in particular is the divergence between the COT data for Gold and Silver and the rest of the commodities. The speculators (non-commercials) according to the COT data are positioned more bullishly in Copper, Oil, Corn and Wheat while they’ve cut back long positions in Gold and Silver. First we see the chart of Gold and the commercial traders’ net short position at the bottom. The commercials’ short position is down 32% in the last several months. In other words, the speculative long position in Gold is down 32% and is at its lowest point si... | ||

| More spectacular debt won't fix anything, Agnico CEO tells King World News Posted: 24 Jan 2011 12:09 PM PST 5:05p PT Monday, January 24, 2011 Dear Friend of GATA and Gold (and Silver): Interviewed today by Eric King of King World News, Agnico-Eagle CEO Sean Boyd remarks that confidence in the world economy is misplaced and more spectacular debt creation won't fix anything. Boyd sees gold rising to $2,000 this year. You can find excerpts from the interview at the King World News blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2011/1/24_Ag... Or try this abbreviated link: CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Prophecy Resource Spins Off Platinum/Palladium Venture: Company Press Release, January 18, 2011 VANCOUVER, British Columbia -- Prophecy Resource Corp. (TSX-V:PCY)and Pacific Coast Nickel Corp. announce that they have agreed that PCNC will acquire Prophecy's Nickel PGM projects by issuing common shares to Prophecy. PCNC will acquire the Wellgreen PGM Ni-Cu and Lynn Lake nickel projects in the Yukon Territory and Manitoba respectively by issuing up to 550 million common shares of PCNC to Prophecy. PCNC has 55.7 million shares outstanding. Following the transaction: -- Prophecy will own approximately 90 percent of PCNC. -- PCNC will consolidate its share capital on a 10 old for one new basis. -- Prophecy will change its name to Prophecy Coal Corp. and PCNC will be renamed Prophecy Platinum Corp. -- Prophecy intends to distribute half of its PCNC shares to shareholders pro-rata in accordance with their holdings. Based on the closing price of the common shares of PCNC on January 17, $0.195 per share, the gross value of the transaction is $107,250,000. For the complete announcement, please visit: http://prophecyresource.com/news_2011_jan18.php Join GATA here: Cheviot Asset Management Sound Money Conference Phoenix Investment Conference and Silver Summit Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: http://www.gata.org/node/16 ADVERTISEMENT Sona Drills 85.4g Gold/Ton Over 4 Metres at Elizabeth Gold Deposit, Extending the Mineralization of the Southwest Vein on the Property Company Press Release, October 27, 2010 VANCOUVER, British Columbia -- Sona Resources Corp. reports on five drillling holes in the third round of assay results from the recently completed drill program at its 100 percent-owned Elizabeth Gold Deposit Property in the Lillooet Mining District of southern British Columbia. Highlights from the diamond drilling include: -- Hole E10-66 intersected 17.4g gold/ton over 1.54 metres. -- Hole E10-67 intersected 96.4g gold/ton over 2.5 metres, including one assay interval of 383g of gold/ton over 0.5 metres. -- Hole E10-69 intersected 85.4g gold/ton over 4.03 metres, including one assay interval of 230g gold/ton over 1 metre. Four drill holes, E10-66 to E10-69, targeted the southwestern end of the Southwest Vein, and three of the holes have expanded the mineralized zone in that direction. The Southwest Vein gold mineralization has now been intersected over a strike length of 325 metres, with the deepest hole drilled less than 200 metres from surface. "The assay results from the Southwest Zone quartz vein continue to be extremely positive," says John P. Thompson, Sona's president and CEO. "We are expanding the Southwest Vein, and this high-grade gold mineralization remains wide open down dip and along strike to the southwest." For the company's full press release, please visit: http://sonaresources.com/_resources/news/SONA_NR19_2010.pdf | ||

| Mike Kosares: How gold became politically correct Posted: 24 Jan 2011 11:59 AM PST 4:55p PT Saturday, January 21, 2011 Dear Friend of GATA and Gold: In commentary published today Mike Kosares of Centennial Precious Metals in Denver reviews the growing favor bestowed on returning gold to a central place in the world financial system. Kosares' essay is headlined "How Gold Became Politically Correct" and you can find it at Centennial's Internet site, USAGold, here: http://www.usagold.com/amk/newsletter0211.html CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Sona Drills 85.4g Gold/Ton Over 4 Metres at Elizabeth Gold Deposit, Extending the Mineralization of the Southwest Vein on the Property Company Press Release, October 27, 2010 VANCOUVER, British Columbia -- Sona Resources Corp. reports on five drillling holes in the third round of assay results from the recently completed drill program at its 100 percent-owned Elizabeth Gold Deposit Property in the Lillooet Mining District of southern British Columbia. Highlights from the diamond drilling include: -- Hole E10-66 intersected 17.4g gold/ton over 1.54 metres. -- Hole E10-67 intersected 96.4g gold/ton over 2.5 metres, including one assay interval of 383g of gold/ton over 0.5 metres. -- Hole E10-69 intersected 85.4g gold/ton over 4.03 metres, including one assay interval of 230g gold/ton over 1 metre. Four drill holes, E10-66 to E10-69, targeted the southwestern end of the Southwest Vein, and three of the holes have expanded the mineralized zone in that direction. The Southwest Vein gold mineralization has now been intersected over a strike length of 325 metres, with the deepest hole drilled less than 200 metres from surface. "The assay results from the Southwest Zone quartz vein continue to be extremely positive," says John P. Thompson, Sona's president and CEO. "We are expanding the Southwest Vein, and this high-grade gold mineralization remains wide open down dip and along strike to the southwest." For the company's full press release, please visit: http://sonaresources.com/_resources/news/SONA_NR19_2010.pdf Join GATA here: Cheviot Asset Management Sound Money Conference Phoenix Investment Conference and Silver Summit Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: http://www.gata.org/node/16 ADVERTISEMENT Prophecy Resource Spins Off Platinum/Palladium Venture: Company Press Release, January 18, 2011 VANCOUVER, British Columbia -- Prophecy Resource Corp. (TSX-V:PCY)and Pacific Coast Nickel Corp. announce that they have agreed that PCNC will acquire Prophecy's Nickel PGM projects by issuing common shares to Prophecy. PCNC will acquire the Wellgreen PGM Ni-Cu and Lynn Lake nickel projects in the Yukon Territory and Manitoba respectively by issuing up to 550 million common shares of PCNC to Prophecy. PCNC has 55.7 million shares outstanding. Following the transaction: -- Prophecy will own approximately 90 percent of PCNC. -- PCNC will consolidate its share capital on a 10 old for one new basis. -- Prophecy will change its name to Prophecy Coal Corp. and PCNC will be renamed Prophecy Platinum Corp. -- Prophecy intends to distribute half of its PCNC shares to shareholders pro-rata in accordance with their holdings. Based on the closing price of the common shares of PCNC on January 17, $0.195 per share, the gross value of the transaction is $107,250,000. For the complete announcement, please visit: http://prophecyresource.com/news_2011_jan18.php | ||

| Posted: 24 Jan 2011 11:51 AM PST Russia has just announced it would proceed with price caps on a variety of foodstuffs, from buckwheat, to potatoes, assorted fruits and vegetables and all other commodities it deems "socially important" accoding to Russian newspaper gazeta.ru. And so the big margin crunch goes up several orders of magnitude, as companies, desperate to pass through surging input costs, but prohibited from raising selling prices, are forced to eliminate any and all overhead, most certainly including such trivialities as labor, in order to stay in business. More importantly, experts now predict that full year inflation in Russia will hit double digits. Just in the first 17 days of January, inflation hit 1.4%, or 9% annualized (according to gazeta... our calculation indicates a notably higher number but readers get the idea). Luckily, Russia does realize just how futile this task of price controls is: "as soon as we introduce price controls, once a deficit, the product disappears from the market, followed by an even higher rise in prices on the shadow, not covered by official supervision, market." And so a vicious circle in which high prices beget even higher prices begins. But don't worry - this could never happen in the US: see Americans only eat gold and their iPods. There is therefore massive slack in the food vertical, and, furthermore, as Steve Liesman explains so well today, a 100% rise in the price of wheat would only translate to a 10% hike in the price of bread. What happens to the other 90% (which incidentally annihilates the producer's margin but Steve didn't get to page two in that particular Inflation for Dummies book), is apparently unclear to the CNBC head economist. From Gazeta.ru, google translated:

| ||

| Bank of Russia says it's buying only domestic gold Posted: 24 Jan 2011 11:46 AM PST 4:43p PT Monday, January 24, 2011 Dear Friend of GATA and Gold: The report from the ITAR-TASS news agency in Russia appended here seems notable for quoting the Bank of Russia as saying that it is buying gold only on the domestic market, and from Russian bullion banks, rather than on international markets as well, a change of the position articulated in 2005 by Russia's then-president, Vladimir Putin, now Russia's prime minister, who said then that the bank would be buying gold on all markets. Of course this policy of buying only domestic production rather than messing up the Western paper gold markets seems to be China's policy as well. CHRIS POWELL, Secretary/Treasurer * * * Central Bank Plans to Buy Over 100 Tons of Gold Every Year From ITAR-TASS, Moscow http://www.itar-tass.com/eng/level2.html?NewsID=15884581&PageNum=0 MOSCOW -- The Central Bank of Russia plans to buy more than 100 tonnes of gold to renew the country's gold and foreign exchange reserves (or international reserve assets) every year, the bank's first deputy chairman, Georgy Luntovsky, told reporters on Monday, giving no details pertaining to the terms. Earlier, in an interview to the Prime Tass economic news agency, the first Deputy chairman of the bank, Alexei Ulyukayev, said the central bank would increase the share of gold in the national reserves. In the middle of October 2010, the bank's director of the financial operations, Sergei Shvetsov, said the bank did not import gold in 2010. The bank buys gold on the domestic market, in Russian banks. According to the central bank, the reserves of gold in the Russian international reserve assets increased by 23.9 percent (152.4 tonnes) in 2010 to reach 25.4 million net troy ounces (790 tonnes) as of January 1, 2011, Prime Tass said. As of January 1, 2009, the amount of monetary gold in Russia's international reserves was at 16.4 million ounces (510.1 tonnes), the economic news agency said. In 2009, the central bank's gold reserves increased by 4.1 million ounces (127.5 tonnes) to reach 20.5 million ounces (637.6 tonnes) as of January 1, 2010, Prime Tass said. ADVERTISEMENT Prophecy Resource Spins Off Platinum/Palladium Venture: Company Press Release, January 18, 2011 VANCOUVER, British Columbia -- Prophecy Resource Corp. (TSX-V:PCY)and Pacific Coast Nickel Corp. announce that they have agreed that PCNC will acquire Prophecy's Nickel PGM projects by issuing common shares to Prophecy. PCNC will acquire the Wellgreen PGM Ni-Cu and Lynn Lake nickel projects in the Yukon Territory and Manitoba respectively by issuing up to 550 million common shares of PCNC to Prophecy. PCNC has 55.7 million shares outstanding. Following the transaction: -- Prophecy will own approximately 90 percent of PCNC. -- PCNC will consolidate its share capital on a 10 old for one new basis. -- Prophecy will change its name to Prophecy Coal Corp. and PCNC will be renamed Prophecy Platinum Corp. -- Prophecy intends to distribute half of its PCNC shares to shareholders pro-rata in accordance with their holdings. Based on the closing price of the common shares of PCNC on January 17, $0.195 per share, the gross value of the transaction is $107,250,000. For the complete announcement, please visit: http://prophecyresource.com/news_2011_jan18.php Join GATA here: Cheviot Asset Management Sound Money Conference Phoenix Investment Conference and Silver Summit Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: http://www.gata.org/node/16 ADVERTISEMENT Sona Drills 85.4g Gold/Ton Over 4 Metres at Elizabeth Gold Deposit, Extending the Mineralization of the Southwest Vein on the Property Company Press Release, October 27, 2010 VANCOUVER, British Columbia -- Sona Resources Corp. reports on five drillling holes in the third round of assay results from the recently completed drill program at its 100 percent-owned Elizabeth Gold Deposit Property in the Lillooet Mining District of southern British Columbia. Highlights from the diamond drilling include: -- Hole E10-66 intersected 17.4g gold/ton over 1.54 metres. -- Hole E10-67 intersected 96.4g gold/ton over 2.5 metres, including one assay interval of 383g of gold/ton over 0.5 metres. -- Hole E10-69 intersected 85.4g gold/ton over 4.03 metres, including one assay interval of 230g gold/ton over 1 metre. Four drill holes, E10-66 to E10-69, targeted the southwestern end of the Southwest Vein, and three of the holes have expanded the mineralized zone in that direction. The Southwest Vein gold mineralization has now been intersected over a strike length of 325 metres, with the deepest hole drilled less than 200 metres from surface. "The assay results from the Southwest Zone quartz vein continue to be extremely positive," says John P. Thompson, Sona's president and CEO. "We are expanding the Southwest Vein, and this high-grade gold mineralization remains wide open down dip and along strike to the southwest." For the company's full press release, please visit: http://sonaresources.com/_resources/news/SONA_NR19_2010.pdf | ||

| USAGOLD News, Commentary and Analysis — How gold became politically correct Posted: 24 Jan 2011 11:09 AM PST Clients & Friends, This issue of our newsletter explores what might be the most important development in the gold market in the past decade. Read the February-March issue of USAGOLD News, Commentary and Analysis here. Take advantage of our FREE Introductory Information Packet, and while you're there, consider signing up to ensure that you don't miss out on a single issue! | ||

| Scotia-Mocatta Sells Out Of 1 Kilo Silver Bars Posted: 24 Jan 2011 10:58 AM PST It seems that not a day passes by without some major dealer running out of a precious metal in inventory. Last Thursday when we presented the most recent inventory at Scotia Mocatta (alongside the ongoing firesale at the US Mint where incidentally total silver sales in January are now at a fresh all time record 4,724,000 ounces), one of the ten market-making members of the London Bullion Market Association and one of only 5 banks to participate in the London gold fixing, we indicated that of all silver bar related products, the bank only had the 1kg Valcambi silver bar, that was listed 3 weeks ago, in stock. As of today, this object is no longer in inventory even at the unit price of CAD$980.11. Reader S. presents the two logical alternative for what is happening: "This can only conclude two things: 1. They purchased a limited amount (due to low supplies) and was sold off quickly. 2. They purchased a large amount and was sold off due to major purchases." Alternatively, the bank now has the 100 oz silver bar back in stock. We will keep tabs on how long before this also becomes "sold out." Our question is whether the ongoing shortage at most dealers, despite the so-called drubbing in PM prices, is nothing but definitive evidence that just like in stocks, precious metal investors are merely using every drop in prices as nothing more than a chance to "buy the fucking (fisical) dip"? Compare Scotia-Mocatta eStore inventory as of January 18... | ||

| Graham Summers’ Free Weekly Market Forecast (Gold and Silver: Buy With Both Hands Edition) Posted: 24 Jan 2011 10:58 AM PST

Rather than discussing every asset class under the sun, this week I want to focus on a MAJOR buying opportunity that is developing in the precious metals space.

With that in mind, this week’s edition of my Free Weekly Market Forecast is titled Buy With Both Hands.

Gold has formed very ugly technical patterns both in the long-term and the short-term. In the short-term we have what looks like a dome top forming.

This is one of the cleanest dome top patterns I’ve ever seen. The downside target for it is around $1,250… which coincidentally lines up the Gold’s long-term chart pattern target as well.

In the long-term we have a rising bearish wedge forming since the 2008 Crash. As I write this, Gold is right on the lower trendline of this massive pattern. A break here would likely see the precious metal falling to $1,250 before putting in a base for another leg up.

Silver is posted similarly bearish looking patterns.

As you can see, Silver has broken the trendline that supported it during this latest rally. It has since failed to reclaim this line AND broken through initial support at $28. The next real line of support is $26 or so, though we could easily go as low as the $24-25 range if things pick up steam to the downside. Given the steepness of Silver rally from August to December, this is quite possible.

Let me be blunt here. If Gold falls to $1,250 per ounce and Silver falls $25 per ounce it’s time to BUY WITH BOTH HANDS.

I want to be clear here. I am SUPER bullish on both precious metals in the long-term. But right now, both are posting extremely ugly, bearish technical patterns. However, rather than seeing this as something to worry about, I view it as phenomenal buying opportunity for both assets.

One of the oddest things about investment psychology is that people only want to load up on an asset class when it’s soaring. Rarely do they view a collapse as a good thing. In some cases, this mentality is beneficial (buying Tech stocks in 2001 when they began to collapse after soaring would have been a HORRENDOUS move).

However, in the case of Gold and Silver today, a collapse right now would be absolutely FANTASTIC for investors.

For one thing it would shake out some of the hot money that recently flowed into the sector. And it would also give both precious metals a chance to form a sound base before beginning their next leg up.

Indeed, I expect both assets to be MUCH higher from where they are today this time next year. Why? Because the Fed and the world’s central banks have pumped trillions of Dollars into the financial system and have no means of getting back out again.

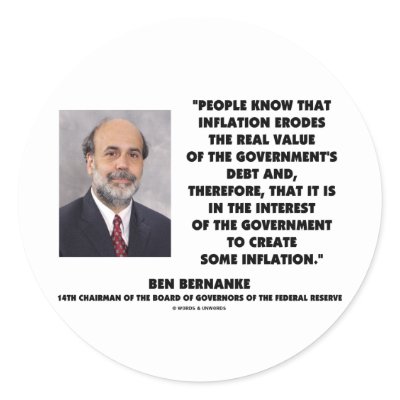

So, in the near-term, deflation remains the primary risk. In fact, I would venture that Ben Bernanke would LOVE another round of deflation to occur as it would serve as support for his money printing policies and his goal of pumping even more money into the system.

When this happens, Gold and Silver will begin the REAL explosion upward. So with that in mind, let Gold and Silver drop now and then BUY WITH BOTH HANDS. After all, the first wave of inflation has already hit the US (the initial stage of rising prices pushed by speculation).

After this comes the REAL stage of inflation: the CURRENCY COLLAPSE.

Remember, the US's Federal debt is now at $13+ trillion. And if you include unfunded liabilities like social security and medicare, you're talking about $70+ TRILLION in total debt on the US's balance sheet.

Graham Summers

PS. If you’re getting worried about the future of the stock market and have yet to take steps to prepare for the Second Round of the Financial Crisis… I highly suggest you download my FREE Special Report specifying exactly how to prepare for what’s to come.

I call it The Financial Crisis “Round Two” Survival Kit. And its 17 pages contain a wealth of information about portfolio protection, which investments to own and how to take out Catastrophe Insurance on the stock market (this “insurance” paid out triple digit gains in the Autumn of 2008).

Again, this is all 100% FREE. To pick up your copy today, got to http://www.gainspainscapital.com and click on FREE REPORTS.

PPS. We ALSO publish a FREE Special Report on Inflation detailing three investments that have all already SOARED as a result of the Fed’s monetary policy. You can access this Report at the link above.

| ||

| Silver and Gold Price Correction Continues, Ultimate Peak of Bull Market Still Years Away Posted: 24 Jan 2011 10:58 AM PST Gold Price Close Today : 1344.50 Change : 3.50 or 0.3% Silver Price Close Today : 27.416 Change : (0.098) cents or -0.4% Gold Silver Ratio Today : 49.04 Change : 0.302 or 0.6% Silver Gold Ratio Today : 0.02039 Change : -0.000126 or -0.6% Platinum Price Close Today : 1811.20 Change : -15.30 or -0.8% Palladium Price Close Today : 812.70 Change : -5.35 or -0.7% S&P 500 : 1,290.84 Change : 7.49 or 0.6% Dow In GOLD$ : $184.20 Change : $ 1.21 or 0.7% Dow in GOLD oz : 8.911 Change : 0.059 or 0.7% Dow in SILVER oz : 436.99 Change : 3.98 or 0.9% Dow Industrial : 11,980.52 Change : 108.68 or 0.9% US Dollar Index : 78..033 Change : -0.200 or #VALUE! The GOLD PRICE and SILVER PRICE are confused. After the long fall last week, gold bounced at least a little today, up 3.50 by Comex close to end at $1,344.50. Silver, though, pulled in the opposite direction, dropping 9.8c to finish its day on Comex at 2731.8c. 'Twas the aftermarket that unsettled me. Gold dropped $11 and silver 40c after Comex closed. That speaketh not strength in my ear. In my little mind, at least, it's clear that gold is targeting $1,330 before this correction ends. Beyond that, the 200 day moving average comes in about $1,277, while one of my correction targets generated by ratio history is $1280. Yet suspicion begins to build in my mind that the GOLD PRICE might well cut short this reaction. Peeking below that 2700c line did not leave the SILVER PRICE looking resolute. It fell to 2731.8c at Comex close, but that further drop afterward hurt, and leave the next target at 2650c. The unexpected right now would be for silver and gold to turn round and rally to new highs. This is NOT what I expect after studying behavior after earlier GOLD/SILVER RATIO lows, but because that last move up was so lethargic, it remains a possibility. We keep on getting calls from people inquiring whether they ought to sell their silver and gold now to protect their profits. Answer? Not unless you want to see all your pioneering work of the last 10 years go up in smoke while you watch silver and gold correct for a short time, then blast out of sight. Y'all must understand that you NEVER sell a bull market position, no matter how "certain" you are that the market will correct and you will be able to buy back lower. You never make the big money in trading, but in getting right and WAITING. Ultimate peak of this bull market lies three to ten (3 to 10) years away. Hold on. Wait. People with suspicious minds -- me -- would wonder if there were any connection between Bernard O'Bama's State of the Onion address tomorrow and a new high for the move in the Dow today. Am I hinting that the Nice Government Men, who (we all know) are above reproach, would manipulate the stock market or the economy for base political reasons? Yes, I suppose I am, since they've been doing that for the last 77 years or longer. Anyway, twas an eye-catching coincidence. Dow Jones Industrials moved further into the green zone of Over-bought-ness on the RSI today. Dow rose a large 108.68 to close at 11,980.52. S&P500, not quite as optimistic, rose 7.49 (the S&P's rise ought to be about equal to the Dow if you multiply it by 10). Dow is as overbought as gold was back in October or Silver in early November. Behold, friends! No market, not even stocks bloated by the NGM, is immune to gravity forever, except under that school of technical analysis dominated by the Brothers Grimm. Face the facts: the US DOLLAR makes it difficult for anyone to befriend it. Dollar index today closed down 19.6 basis points (0.25%) and made a new low for the move at 77.81. Barely held on above 78, and won't hold on there tomorrow unless something changes. Of course, currency exchange rates are all manipulated ultimately and reveal policy decisions. Seems that Bernanke and Bernard have taken a decision to let the dollar seek its natural level. Or maybe the market is doing that work for them, based on their promises of generous inflation to depreciate the dollar. Either way, the dollar index has passed almost all support areas and appears to be headed for 76.70 or even 75.60. Seems the currency markets don't expect much from the State of the Onion address. Yen fell 0.3% today and euro rose 0.38%. Since Friday my wife Susan's heart has been racing. Cardiologist today said it is atrial flutter, and tomorrow Susan will undergo a procedure to try to right her heartbeat. I would be deeply grateful for your prayers on her behalf, that this procedure would succeed in regulating her heartbeat. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com Phone: (888) 218-9226 or (931) 766-6066 © 2010, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate in a bubble, primary trend way down. Whenever I write "Stay out of stocks" readers inevitably ask, "Do you mean precious metals mining stocks, too?" No, I don't. | ||

| Euro's Reversal of Fortune & Outlook Posted: 24 Jan 2011 10:40 AM PST By Dian L. Chu, EconForecast The Euro closed up Friday`s session at 136.13, and looks poised to make a run up to test the 140 level in February. I, among many, was thinking the Euro would next test the 125 level, and things started heading well in that direction with the Euro moving down to 129, and appearing on a downward slope.

??? So, it appears that a common eurozone bond will finally occur sometime in the next few months, probably by March of 2011 at the latest, as the final terms are being worked out and negotiated behind the scenes, as well as the financing benefits that this accord will bring to the European Union.

| ||

| Monday Market Movement – Do or Dive! Posted: 24 Jan 2011 10:03 AM PST Monday Market Movement – Do or Dive!Courtesy of Phil at Phil's Stock World

Big week ahead! $30Bn in POMO from the Fed runs headlong into earnings reports from 15 of the 30 Dow components along with MoMo darlings like VMW (tonight), BLK (tomorrow morning), POT (Thursday morning) and AMZN (Thursday night). I already sent out an Alert to Members this morning outlining our strategy and Stock World Weekly did it's usual amazing job of wrapping up last week's action and laying out the week ahead so I won't be too redundant here. The key driver for the markets continues to be the dollar, which is making more sense now as it saved the Dow and the S&P last week (50% of revenues come from overseas) but not the Russell (only 10% of revs from overseas) or the Nasdaq (30%). The Dollar was relentlessly driven down last week, bottoming out at 78 on Friday evening, back to November lows, where they ditched the Dollar all the way down to 75.63 in early November before it broke back up and ran to 81.44 on the last day of the month. Now we're back down 4.2% from the Thanksgiving highs for the Dollar and the Dow and S&P are up 8%, which is our usual 2:1 correlation yet Uncle Rupert's Journal would have you believe that the Dollar no longer matters and that this rally is about (please sit down, PSW cannot be responsible for any beverages you are about to spit on your keyboad) - wait for it - Fundamentals!

We will be putting our virtual money where our mouth is this week as we begin our brand new $25,000 Portfolio. Except for our DIA shorts, we have wrapped up the $10,000 Portfolio with over $30,000 virtual dollars (as noted last Friday) and this weekend Option Sage and I updated our primer series on "Smart Portfolio Management - The $25,000 Portfolio" with tip on managing a portfolio of that size. We will NOT be following "smart" portfolio management in the $25KP - that's going to be an aggressive attempt to get us to $100,000 by the year's end but it will be a fun thing to do with a small portion of a larger portfolio! Since we started with $10K last year, getting to $100K in 18 months would be very nice... Meanwhile, we are still very cautious and mainly in cash as we navigate the busier weeks of earnings season and, of course, it's crunch time for the Alpha 2 pattern we've been tracking since January 3rd and, after two weeks, it is SCARY how on track we are. Elliott over at Stock World Weekly fixed the alignment to match the expiration days and also to match our 11,850 projected top with last year's 10,700 top to give you a better idea of how we're lining up and it is, as I just said, SCARY:

Do we open flat today and get some bad news mid-day and plunge 200 points? If so - I don't think I'd be buying that dip! Surely the Fed can break this patten as we have as much as $9Bn worth of POMO today, $8Bn tomorrow, $6Bn on Thursday and $9Bn on Friday (see SWW for chart) for a whopping $32Bn of fresh money created by the Fed in just 5 days. As I said to Members this morning - that is like handing everyone in America $100 to spend - you would think that would boost the markets just a little, right?

As long as you are willing to mindlessly wallow in debt and continue to consume mass quantities without, as ordinary consumers used to do, complaining about prices or altering your spending habits - then this system can continue to extract your wealth at an ever-increasing rate and The Bernank has already strongly affirmed his commitment to keeping the pedal to the metal until either the economy improves or the entire Global economy is plunged into the Abyss - either way his place in history is secured. John Mauldin tells us we are reaching the end game as "the unsustainability of the federal government’s fiscal trajectory becomes increasingly clear" and clearly, The Bernank has become a one-trick pony, who can no longer lower rates (are you going to pay people to borrow money?) and is all gas and no brakes in increasing the money supply on a weekly basis. We can expect the same old, same old this Wednesday, when the Fed issues their first policy statement of 2011 but before that we'll have Case-Shiller Housing Numbers, Consumer Confidence (or lack thereof), FHFA Housing Prices, MBA Mortgages, and December New Home Sales - along with earnings reports from roughly 100 US Corporations including MCD, AXP, TXN, VMW, JNJ, VZ, MMM, DDD, ERICK, BLK, GILD, COP, OXY, ABT and BA - all that before Wednesday afternoon - and you wonder why we have our cash on the sidelines!

America may not care about food shortages but we sure do like to drive and gas prices rose another 1% over the weekend to $3.11 according to the latest Lundberg Survey. This is truly amazing as gasoline storage is up 15% from last year and gasoline consumption is down 10% which, of course (as we all know from basic economics) leads to a 9.1% INCREASE in prices. If you were able to keep your breakfast down earlier as we looked at the BS being spouted by the WSJ - you may be strong enough to take a peek at the World Economic Forum's "Global Risk Report" but I don't recommend it as I had trouble sleeping after I read it. Da Boyz will meet in Davos this week and they like to get that report out early so they can ignore it and concentrate on the more positive sound-bytes for the assembled Global Press because, after all - why would they want to tell you what they are worried about? Trichet is trying to keep a lid on EU inflation and that strengthens the Euro relative to the Dollar, which drives up the price of the commodities we buy and that is now evidenced by our record yield curve, which some bond analysts believe will force a downgrade of US Debt (has NEVER happened before) by the ratings agencies, who are now being held accountable for lying about the credit-worthiness of the bonds they rate. The S&P has already issued a downgrade warning on Muni Bonds and, last I heard, municipalities were and extension of the National Government so this is kind of like saying "oh YOU'RE fine, it's just your body that has cancer." There are 25 nations identified by Business Insider and Nomura as already being in critical condition - generally net importers of food with high percentages of household consumption going towards food consumption like Venezuela (32.6% of the household budget is food), Vietnam (50.7%), India (49.5%), Pakistan (47.6%), Philippines (45.6%), of course Nigeria (already screwed with 73%) and even China (39.8% and a net importer of food). Have I mentioned what a nice hedge EDZ is? Ireland couldn't wait and their Government, along with Tunisia and Algeria, fell apart over the weekend. Don't worry though, JP Morgan is fighting inflation by giving their top 15 executives a $72M bonus - that should just about cover my Super Bowl order from Whole Foods! Morgan Stanley gave CEO Jim Gorman $7.4M to tide him over but the award for generosity for the month (so far) goes to Google, who gave outgoing CEO Eric Schmidt $100M in gas money AND he gets to keep his current salary even after giving up half his job! Nice work if you can get it... Let's make sure we get ours this week and let's be careful out there! | ||

| Question: What Happens When QE2 Ends? Posted: 24 Jan 2011 10:01 AM PST (snippet) "What happens when QE2 ends?"World renowned gold expert Jim Sinclair said, "States and Municipalities can and will go broke. The economic impact will act to foil QE. That will result in QE to Infinity regardless of MOPE. (Management of Perception Economics) Therefore, Washington and the Fed will backdoor rescues by buying State & Municipal debt, a form of QE." Next is prolific writer and author James Howard Kunstler. He specializes in novels about fictional depictions of the post-oil American future. Here's what Kunstler says about the end of QE2, "My guess is the Fed will find some other way to buy distressed securities or "investment-like" things. The models for that are the Maiden Lane portfolios (there's more than one) which are stuffed with crap like bankrupt hotels. Yes, the Fed owns bankrupt hotels! If they don't buy up what are essentially loans gone bad, the system sucks itself into a black hole of compressive deflation. That outcome is likely anyway, because the Fed won't be able to keep up with loans gone bad." Rick Ackerman, professional trader and founder of the website and newsletter called "Ricks Picks," says, "I don't think there's a snowball's chance in hell that promiscuous easing will end, regardless of what the fraudulent successor to QE2 is called. The commentary running right now at Rick's Picks says that easing in the form of a U.S. bailout of cities and states could become politically necessary as early as this year, although a decision to do so would trigger the worst run on the dollar in history. Look for the bailout to happen anyway, but in a way that tries to obscure the fact that it is being done with funny money. The subterfuge won't work for long, since public workers will figure out quickly that unless their retirement benefits are indexed to inflation, they're going to get paid in confetti." James Rickards is a heavyweight in the world of finance. He is an expert in Threat Finance & Market Intelligence. "What happens when QE2 ends?" Rickards says, "The Fed never said that QE2 would end; that's a popular misconception but they never said it. What they said was that they would buy $600 billion of intermediate term Treasury securities by June 2011. They never said that was all they would buy. They never said they would stop. The comments were carefully worded so that $600 billion by June was a targeted minimum but they never said anything about a maximum; technically there is no maximum. The first QE program ended in 2010 and the economy immediately began to fall into a double dip. In summary, all the experts I polled think QE Will Not End. That will surely mean an imploding U.S. dollar and exploding inflation. This is scheduled to happen by the end of June, making this the most predictable financial calamity in history. More Here.. | ||

| Posted: 24 Jan 2011 09:50 AM PST The benchmark for documented mortgage originators' lies is getting higher and higher. First it was the Allstate lawsuit, finding massive fraud in most Countrywide/Bank of America loans, then it was quantified at 70% after Wells Fargo sued JPM's EMC division, now it is all the way up to 91% after a just released lawsuit by the bulk of the world's biggest insurance companies has been made public, in a fresh lawsuit again Bank of America/Countrywide over "Massive mortgage fraud." To wit, from the lawsuit: "In carrying out its review of the approximately 19,000 Countrywide loan files, MBIA found that 91% of the defaulted or delinquent loans in those securitizations contained material deviations from Countrywide’s underwriting guidelines. MBIA’s report showed that the loan applications frequently “(i) lack key documentation, such as verification of borrower assets or income; (ii) include an invalid or incomplete appraisal; (iii) demonstrate fraud by the borrower on the face of the application; or (iv) reflect that any of borrower income, FICO score, debt, DTI [debt-to-income,] or CLTV [combined loan-to-value] ratios, fails to meet stated Countrywide guidelines (without any permissible exception)." The plaintiff counsel is Bernstein Litowitz, which was made famous from the WorldCom litigation. We doubt they will settle for a few measily pennies on the dollar. As for the list of litigants, it is a veritable who's who of the insurance industry: Dexia Holdings, FSA Asset Management, New York Life iInsurance Company, The Mainstay Funds, Teachers Insurance & Annuity, TIAA-CREF Life Insurance, and College Retirement Equities Fund. And here is why even the recent recent hike to BofA's Representation legal reserve, which Zero Hedge predicted in October, will be woefully insufficient to cover the tens of billions in incremental damages, monetary and punitive.

Full filing:

| ||

| The Most Predictable Financial Calamity in History Posted: 24 Jan 2011 09:42 AM PST By Greg Hunter's USAWatchdog.com Dear CIGAs In November 2010, the Federal Reserve announced a second round of economic stimulus commonly referred to as Quantitative Easing (QE2). The reason, according to the Fed, was "progress toward its objectives has been disappointingly slow." So, to try and turn the economy around, the Fed said, ". . . the Committee intends to purchase a further $600 billion of longer-term Treasury securities by the end of the second quarter (June) of 2011, a pace of about $75 billion per month."(Click here to read the complete announcement from the Fed.) QE means the Fed basically creates money out of thin air to buy debt. The current money printing orgy is financing more than half of U.S. government right now. The first round of QE bought toxic mortgage debt and bailed out the bankers. What was not said in the press release was much more important and may go down as one of the biggest turning points in the history of America. Bringing on QE2 meant QE1 ($1.75 trillion) failed to provide a sustained recovery. It also exposed the $12.3 trillion total spent or loaned by the Fed since the meltdown of 2008 failed to give the economy a lasting boost. The Fed did save some businesses and all the big Wall Street Banks from bankruptcy, but we now know nothing has really been fixed. This brings me to one really important question. I put this question to a group of well-known market experts, economists, investment bankers and big thinkers. The five guys you are about to hear from have at least one major thing in common. They all predicted tough times for America when most didn't see it coming. So, I asked them all last week to peer into the not-so-distant future for their take on "What happens when QE2 ends?" | ||

| Posted: 24 Jan 2011 09:30 AM PST A story I've been warning about for years is making sensational headlines right now. It's a story most people don't realize could make a huge impact on all of our portfolios in a number of ways. "US Crop Stock Forecasts Deepen Fears of Food Crisis" read a recent Financial Times headline. The US government cut its estimate for key crops. This came only a week after the UN warned the world faces "food price shock." Corn and soybean prices jumped and now sit at 30-month highs. Inventories are very tight. Corn is up 94% since June! And the world worries about a repeat of 2008, when food riots erupted in poor countries around the world. This has been in the works for a long time. It was there for all to see. The ratio of arable land to people has been falling for decades. Gains in crop yields have slowed. Population has expanded and income levels have grown. Diets have shifted. More people are eating more meat, which is much more grain-intensive to produce. And the love affair with biofuels puts food production in direct competition with energy. Plus, there are water scarcity issues affecting food supply. My readers have made tremendous gains from this trend by owning shares of agricultural fertilizer producers Potash (POT) and Mosaic (MOS). I should also make the point that this fits in with another topic I'm concerned about: inflation. Now, the man on the street uses the term "inflation" to mean when prices for everything seem to go up. Or put another way, inflation is when the dollars in his pocket buy less. In truth, this is the effect of inflation. The root cause is simply money printing. When you print more money, that money has less value than if you didn't print any new money at all. So what we are seeing with rising commodity prices is not only the supply and demand story I led off with. It's also the effect of paper money losing its purchasing power in the real world of things. This, too, was easy enough to see. Finally, all that money printing – the "quantitative easing" baloney you've heard about – is coming home to roost. Still, it's disconcerting to see it all playing out. For the sake of our world, I'd rather have gotten this one wrong. But we have to deal with the market we are in. So what might "Food Crisis II" mean from an investment point of view? Food prices will have to rise: There is no way around this. We are all going to pay more for food. Wells Fargo predicts US retail food prices will rise about 4% this year. Some things will go up much more. Pork and beef could rise more than 10%. This won't necessarily mean that meat producer stocks are good buys, because they may not get to raise prices to fully offset the rise in feed costs. Anecdotally, for instance, The Wall Street Journal cited a Minnesota 300-cow operation that reported feed costs had doubled. Plus, I've listened in to the conference calls of a number of food producers – Tyson, Hormel, and Sanderson Farms. They all talk about getting squeezed by rising feed costs. I do think these companies will be good buys sometime this year, because people will adapt and farmers will respond. Producers won't produce meat at a loss for long. And farmers will bring every resource they have to bear. It's been slow getting the crops in the ground so far in many places. But ultimately, there is a lot of potential supply from Brazil and the US. Still, weather is the big wild card here. If we have a drought in the US or in Brazil, this could really get ugly. Emerging markets are vulnerable: This follows from the above. It doesn't really faze the typical American to have to pay 4% more at the grocery store. Food is still such a small part of the typical American's budget. I think Michael Pollan in The Omnivore's Dilemma points out that the US spends 9% of its income on food, which is among the lowest percentage of any people anywhere at any time in history. The same is not true in India or China or many emerging markets. In China, people spend 50% of every incremental dollar on food. And in India, it's more like 70%. So the rising price of food is felt more keenly in these markets. The price of food is rising faster in emerging markets, too. In India, food prices are up 18% and at their highest level in a year. China has the same problem. Prices rose 5% in November alone. All around the world, emerging markets have a big problem with rising food prices. Indonesia's president is trying to get people to grow their own chili peppers. And the South Korean government recently released emergency stores of cabbage, pork, mackerel, radish, and other staples. I could go on and on. The point is that the emerging markets boom is not going to go far when it faces a food crisis. Already, the markets are starting to reflect this. India's Sensex was down three straight days and off 6% to start the year. Other markets also started badly. And if China and India and the rest slow down, it's going to have a huge impact on all those stocks and commodities most sensitive to emerging market growth. I'm keeping a close eye on these developments. There will be opportunities in this crisis, as with all others. For instance, though rising grain prices are not good for meat producers or emerging markets right now, it's a boon for fertilizer stocks. As the old golf saying goes, "Every putt makes somebody happy." Regards, Chris Mayer Food Crisis II originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." | ||

| Posted: 24 Jan 2011 09:22 AM PST The key catalyst for Goldman's suddenly cautious view on gold (which still has a $1,690 price target): the end of QE2 in June 2011. So, presumably, when QE 3 is announced in May in order to allow the continued monetization of $4 trillion in debt issuance over the next 2 years, that should be very bullish for gold, yes? Irrelevant: Goldman has become just one more glorified Jim Cramer: pumping anything that is green, and dumping anything in which there is even a modest (CME margin hike driven) correction. From Jeffrey Currie's just released report, "The cyclical commodities join the rally as gold falters."

That said, the firm is still recommending a long gold (and platinum) trading recommendation:

And here is the summary outlook/key issues on key commodities: WTI (target $105.50/bbl):

Brent (target $103.50/bbl):

Incidentally, this should make for a great compression arbitrage. If Goldman is even remotely correct, going long WTI and short Brent should generate a substantial IRR. RBOB (target $2.62)

NYMEX Nat Gas (PT $4.50/mmBtu)

LME Copper (PT:$11,000/mt) - better hope the "Cold Fusion" story is a hoax here..

Gold (PT: $1,690)

Silver (PT: $28.2)

Cocoa (PT: $2,4000/mt)

Much more in the full report:

| ||

| Posted: 24 Jan 2011 09:16 AM PST Inflation worries, softer dollar help gold futures close higher The COMEX February gold futures contract closed up $3.50 Monday at $1344.50, trading between $1340.70 and $1352.40 January 24, p.m. excerpts: | ||

| Spec Money Exits Gold and Silver but Remains Heavily Long Other Markets Posted: 24 Jan 2011 09:13 AM PST | ||

| Posted: 24 Jan 2011 08:57 AM PST | ||

| Speculative Money Exits Gold and Silver but Remains Heavily Long Other Markets Posted: 24 Jan 2011 08:53 AM PST There are many ways to measure market sentiment. We use surveys, put-call ratios, fund flows data and for commodities especially, the commitment of traders reports (COT). Lately, we’ve noted the improving sentiment picture for Gold. As a market weakens sentiment will naturally become less bullish. In this case, sentiment has weakened considerably yet Gold is only 6% off its high. | ||

| Gold Price: "Correction Will Be Short-Lived" Posted: 24 Jan 2011 08:50 AM PST | ||

| Gold Price: "Correction Will Be Short-Lived" Posted: 24 Jan 2011 08:50 AM PST | ||

| Posted: 24 Jan 2011 08:45 AM PST | ||

| What the "Global Yuan" Means for Gold Posted: 24 Jan 2011 08:42 AM PST | ||

| What the "Global Yuan" Means for Gold Posted: 24 Jan 2011 08:42 AM PST | ||

| Michael and Chris Berry: Berrys, Batteries and Burgeoning Demand for Vanadium Posted: 24 Jan 2011 08:40 AM PST Source: Brian Sylvester of The Gold Report 01/24/2011 In this exclusive interview with The Gold Report, Chris Berry, the founder of House Mountain Partners, and Michael Berry, publisher of Morning Notes and Discoveryinvesting.com, drop by to discuss some promising vanadium plays in North and South America. Vanadium is mostly used to strengthen steel, but as the Berry's suggest, the metal is poised to become "the next big thing," as its properties are ideal for use in mass energy storage devices and the lithium-ion batteries now being used in electric cars. Several companies are already aboard the vanadium train—and the Berrys divulge their favorites. The Gold Report: You both follow emerging micro-cap or small-cap stories in the metals and precious metals spaces. Chris, in a recent edition of Morning Notes you speculated that vanadium could be the next big thing. You compared vanadium to metals like lithium and rare earth elements (REEs) and discussed the three ... | ||

| Gold Investments: Why I Jumped in and Bought Twice this Week Posted: 24 Jan 2011 08:29 AM PST The way I look at the market and the way the majority of other analysts and economists look at the market are two different things. Yesterday, any news site you went to was telling the story of how higher than expected GDP growth in China would cause interest rates to rise there, slowing down the economy and pushing commodity prices down. | ||

| Gold Daily and Silver Weekly Charts Posted: 24 Jan 2011 08:23 AM PST | ||

| Spec Money Exits Gold & Silver but Remains Heavily Long Other Markets Posted: 24 Jan 2011 08:18 AM PST There are many ways to measure market sentiment. We use surveys, put-call ratios, fund flows data and for commodities especially, the commitment of traders reports (COT). Lately, we've noted the improving sentiment picture for Gold. As a market weakens sentiment will naturally become less bullish. In this case, sentiment has weakened considerably yet Gold is only 6% off its high. | ||