saveyourassetsfirst3 |

- What Is Value, And How Is HFT Affecting Market Value?

- Is There a Direction for Precious Metals?

- Magnum's Recent Deals Provide Upside Going Forward

- Six Offshore Drilling Companies: A DuPont Analysis

- Does Gold Have a Fair Value?

- The End of America? Not Quite

- The Fed Won't Be Able to Combat Inflation by Raising Fed Funds Rate

- Find a Job Dating Wine Our Papers Feedback My Stories Sunday, Jan 23 2011 9AM 4°C 12PM 6°C 5-Day Forecast The end of The World: Dubai island development sinks back into sea after being scuppered by financial crisis

- January 7 : Demonetization of gold by the Jamaican agreement and the effect

- Jan 22, 1980 : The day the Gold Bull market stopped

- Monetary Aspects of the Gold Price

- Chinese Silver Demand Surges Incredible Four Fold in Just One Year

- Gold Hits Two-Month Low, "Pressured by ETF Selling"…

- Gold : How High is High ?

| What Is Value, And How Is HFT Affecting Market Value? Posted: 23 Jan 2011 05:04 AM PST Volatility Trader submits: My apologies to readers who’ve been requesting that I write more about options-selling strategies. I promise to get a series on that subject started with my next post. After the hail of fire I drew with my prior post, which dared to inform readers of research that suggested the price of gold might be in a bubble pattern, I decided to stay away from writing anything that implies “value” is nothing but a social construct. But then I heard two recent public-radio programs that featured refreshing takes on economics, trading, markets, and the meaning of money. Seasoned investors and veteran economists might find these programs trivial—but I humbly submit that it's important to look outside the bubble (no pun intended) to get some perspective. Cutting right to the chase, there's last week's This American Life program entitled, “The Invention of Money”. Prompted by reports that more than a trillion dollars “disappeared” when the housing bubble burst, contributors started to investigate what money really means. Planet Money correspondent Jacob Goldstein asked his aunt, a savvy, successful business-woman, “Where did all that money go?” and her reply was, “Money is fiction.” Indeed, whether it's represented by salt, stones, silver or, yes, gold, the value of everything is determined by social contract. As TAL host Ira Glass put it,

Complete Story » |

| Is There a Direction for Precious Metals? Posted: 23 Jan 2011 04:35 AM PST Clemens Kownatzki submits: The year 2011 hasn't started all that well for precious metals. Bearing the 3rd straight weekly loss in a row, Spot Gold closed the week at $1,343 per ounce. Silver is off almost 12% since it reached a 30-year high during the first week of this year. Taking nothing away from an incredible bull-run during the past decade, investors should keep in mind that precious metals are in essence commodities, even though gold and silver are often considered investment assets. As such, an investment in gold or silver provides no inherent yield other than price appreciation. The commodity aspect comes to light now and then when prices are on the run. From the perspective of the average investor therefore, an investment in precious metals is not to be taken lightly, particularly the slightly dubious sounding gold investments touted on TV ads. Complete Story » |

| Magnum's Recent Deals Provide Upside Going Forward Posted: 23 Jan 2011 02:40 AM PST Michael Filloon submits: The recent purchase of Nuloch Resources Inc. (NULCF.PK) and NGas Resources Inc. (NGAS) by Magnum Hunter Resources Corp. (MHR) could turn out to be a boon to share price. The NGAS purchase has resulted in possible litigation, which could affect the deal for Nuloch. But if everything goes as planned, these two deals could form a JV oil exploration and production company into a one billion dollar corporation. My first response to the NGAS purchase was negative. Oil has much better margins, and better profits. Chesapeake Energy Corp (CHK) CEO Aubrey McClendon was on CNBC being applauded for his hedging strategy, but in the same interview, he commented on some natural gas companies only breaking even on today's prices Oil margins are great and this is why CHK is wanting to become the 5th largest producer of oil in the United States. They currently are ranked 13th. Looking at the price paid for NGAS, this could be a steal if natural gas prices move up. The only hang up is the shareholders. Litigation filed by NGAS shareholders was not to stop the buyout, but to increase the purchase price. The lawsuit used two metrics for price. They cited NGAS stock price was as high as $1.11 in August of 2010 and an analyst recommended a price target of $1.00 as proof of not receiving fair value. The only problem is there is no value when you can't pay your creditors, only bankruptcy. Complete Story » |

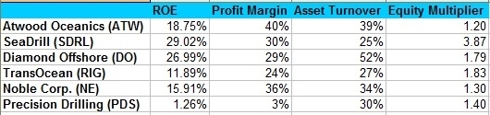

| Six Offshore Drilling Companies: A DuPont Analysis Posted: 23 Jan 2011 02:30 AM PST Power Hedge submits: It is understandable for investors to feel as though they are suffering from information overload. There are literally thousands of stocks and bonds trading on exchanges all over the world, thousands of mutual funds, and thousands more etfs. It can be very difficult to perform research on all the companies in an industry in a time-effective manner. Fortunately, there is a quick method to allow an investor to perform a comparables analysis on the return on equity. The DuPont formula is a formula that allows an investor to quickly break down a company’s return on equity into three parts to easily identify the source of the firm’s returns. This is an excellent way to do comparables analysis between competing companies to determine how each is earning most of its returns and profitability. The DuPont formula is named after the DuPont Corporation, which pioneered the use of this formula in the 1920s. The formula is: Return on Equity = (Net Margins)(Asset Turnover)(Leverage Ratio) The return on equity indicates how much return a company is generating for each dollar of shareowner’s equity that has been invested. High net margins indicate that a company has a superior ability to get customers to pay more for its products than it costs to produce them. Asset turnover is a measure of efficiency; a high asset turnover indicates that a company is more efficiently using its assets to generate revenues. A high leverage ratio indicates that a company is relying on debt to generate much of its profits – it is leveraging itself to juice its returns. As a general rule, higher numbers are better, but beware of high values in the leverage ratio. While leverage can indeed be used to generate returns, too much debt can prove problematic. If a company has a high leverage ratio, particularly in comparison to its peers, then it is a good idea to investigate further to determine if that debt is sustainable. I decided to use this formula to examine some of the offshore drilling companies (all figures are TTM): Source: ROE and Asset Turnover obtained from Fidelity. Net Margins are from Motley Fool CAPS. As should be immediately obvious, SeaDrill (SDRL) and Diamond Offshore (DO) have by far the best returns out of their competitors. However, they are generating these profits in different ways. As I have written about before (here and here), SeaDrill is an excellent offshore oil drilling company. This analysis provides further insight into how it is generating its best of breed returns. The net profit margin is a healthy 30% (CapitalIQ has the margin at 33.6%), which is largely comparable to the margins of the other offshore drillers. The asset turnover, a measure of efficiency, is the lowest of its peers. That tells us that at this time, SeaDrill is not using its great assets very efficiently. Once we see the leverage ratio however, we can see where SDRL is generating its profits. It is by far the most heavily leveraged company in this industry. As I described in my previous article, I do not believe this to be a problem at this time, but it is still something that potential investors will be well advised to keep in mind. Diamond Offshore provides an interesting contrast. Unlike SeaDrill, its returns are not juiced by leverage – but the DuPont analysis does provide some excellent insight into how it achieves returns nearly as good. Diamond Offshore’s net profit margin is a respectable 29%, about average for the industry. Their leverage is largely in line with its peers. DO’s competitive advantage is efficiency. Its asset turnover of 52% is significantly better than any of the other offshore drilling companies listed here. The DuPont formula is no substitute for proper, indepth due diligence but it is a handy tool that can be used by investors looking to compare a number of companies quickly. It can also help alert the investor to potential competitive advantages or problems with a given firm. In this case, it has alerted me to a possible opportunity – I intend to begin some research on Diamond Offshore to figure out how it is so much more efficient than its competitors. Disclosure: I am long SDRL. Complete Story » |

| Posted: 22 Jan 2011 11:58 PM PST Ben Comston submits: The debate between fiat currency and variations of the gold standard is intensely political as much as it is economic. My aim is not to discuss the virtues of either system or comment on policy; rather I would like to discuss the realities of present monetary policy in terms of its effect upon the price of gold in the context of value investing. Value investing can be a rather generic term. The core of value investing, though, is the assigning of value to assets, determining the precision of the assigned value and then inferring an appropriate margin of safety. Can this form of analysis be done with gold the same as it often is in regards to corporate bonds or equities? And if so, what does it say about the attractiveness of gold at its current price of $1,341? Before answering the question, first consider a brief review of gold's use as money in the United States. Complete Story » |

| Posted: 22 Jan 2011 10:42 PM PST I am sitting here shaking my head while reading yet another newsletter calling for the end of America due to massive money printing which will lead to massive inflation and blood in the streets. While I do agree that the government is currently meddling in the markets to lift asset prices the constant call for the end of America as we know it is getting tired. Complete Story » |

| The Fed Won't Be Able to Combat Inflation by Raising Fed Funds Rate Posted: 22 Jan 2011 10:41 PM PST Ed Zimmer submits: There are any number of ways to say it, but it all comes down to the same thing. The Federal Reserve has reached the rock and a hard place position when it comes to the Federal Reserve Rate. According to the US Treasury, the cost of paying the interest on the national debt was 413 billion dollars in 2010. Despite the fact that our national debt at the time reached 13.5 Trillion, that was not a record, it was barely an effective rate of 3.05%. Just 10 short years earlier, our effective rate on the national debt was 6.19% and the Federal Funds rate was 3.5%. So by lowering the Federal Funds rate, we cut a like amount off the effective rate of the interest on the national debt. In fact, since 2000, the effective rate of interest on the national debt has fallen from 6.38% to just 3.05%. During the same period, the national debt rose from 5.6 trillion to 13.5 trillion. (Figures based on Sept 30, end of the federal fiscal year). Chairman Bernanke has said that the Fed will raise rates to trim any inflation that exceeds their target rate of 2%. According to the Federal Government, inflation has not been a factor, just look at the rise in COLA for the senior citizens on Social Security. My contention is that the Federal Reserve will not be able to deal with inflation through raising the Federal Funds rate. As it sits now, the 0.25 rate can only be lowered to 0.1 or taken to zero. Moving it in the other direction would increase the already substantial weight of interest on the national economy. President Obama’s Budget anticipated a revenue stream of 2.5 trillion dollars in 2011. Anticipated to 14.8 trillion and at 3%, would cost the US 444 billion dollars in interest, a 31 billion increase. 444 billion dollars is 17.8% of the anticipated revenue stream, just to service the interest costs on the debt. Now, what if the effective rate were to rise because the Federal Funds rate is raised to combat inflation? According to the Government, there is no inflation, or very mild inflation, because the Government is calculating the inflation rate to minimize what every shopper who goes to the store to buy their own groceries already knows. Inflation is running over 4% (according to John Williams over at Shadowstats.com) which if the Federal Reserve was to raise the rate to combat this (by about 2%); the effect on the budget would be staggering. A 5% effective rate on the debt would cost the US 740 billion dollars or 29.6% of anticipated revenues. At that point, 30 cents of every dollar taken in by the Government would be devoured by the interest on the national debt. And that’s not the whole story. The President’s budget is based on very robust assumptions. Among them, an 18.5% increase in revenues from 2010. GDP is anticipated to be a very strong 4.6%. The increase in revenues assumes a 19.7% increase in Individual Income taxes, a 52.8% increase in Corporation Income taxes and a 6.1% increase in Social Security Payroll taxes (which were cut by 2% for employees, the employer rate remains at 6.2%). I don’t see individual income taxes rising by nearly 200 billion dollars this year, considering the tax breaks that Congress demanded. On the SS payroll side, if the revenue is being cut 2% (from a total of 12.4 to 10.4%) that would weaken their already rosy prediction of 674 billion to roughly 565 billion dollars, an income loss of more than 100 billion dollars. Given the declining options for income, the ability of the Fed to combat inflation through the increase in the Federal Funds rate is non-existent. If they increase it, they raise the cost of borrowing money, adding further deficits which in turn would cost more to service. If they can’t raise the rate, they have to manipulate the inflation figures for as long as possible to give the illusion that “all's well!” Oh, and that increase to a federal fund rate of 2%, which would give us an effective rate of 5% would also give us a service on the debt that would be the largest expenditure on the budget, eclipsing even Social Security. Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. Complete Story » |

| Posted: 22 Jan 2011 08:51 PM PST It exemplified the booming property market and ambition of Dubai's entrepreneurs. But after the global financial crisis led to the collapse of the emirate's home-building market, a unique development known as 'The World' is reportedly facing Armageddon... Read |

| January 7 : Demonetization of gold by the Jamaican agreement and the effect Posted: 22 Jan 2011 05:00 PM PST |

| Jan 22, 1980 : The day the Gold Bull market stopped Posted: 22 Jan 2011 04:45 PM PST |

| Monetary Aspects of the Gold Price Posted: 21 Jan 2011 04:45 PM PST |

| Chinese Silver Demand Surges Incredible Four Fold in Just One Year Posted: 21 Jan 2011 01:30 AM PST |

| Gold Hits Two-Month Low, "Pressured by ETF Selling"… Posted: 20 Jan 2011 05:17 PM PST |

| Posted: 20 Jan 2011 04:00 PM PST |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment