Gold World News Flash |

- Major Buying Opportunity Developing in Precious Metals

- Agnico-Eagle Mines Limited: Buy, Hold or Sell?

- China vs. JP Morgan and the Battle Over Gold and Silver

- What Every American Needs To Understand About The Economy

- Gold Market Update

- Silver and Gold Continue to Cool Off

- International Forecaster January 2011 (#7) - Gold, Silver, Economy + More

- China’s US Assets Fall With the Dollar

- In The News Today

- The Good, Not So Good, Bad & Ugly on the Indexes

- Long Term Investments for Continued Family Wealth

- Russia Plans to add More Gold, Eventually Yuan, to Reserves

- China is to Gold as the US is to Paper Currency

- High Wages and Economic Prosperity, Part I

- American Veterans Disabled for Life Silver Dollars History

- Inflation is the way the rich tax the poor, Rickards tells King World News

- Too much gold paper, not enough metal, Hathaway tells King World News

- Meet GATA's board at conclusion of Vancouver conference

- Graham Summers’ Free Weekly Market Forecast (Buy With Both Hands Edition)

- Silver: your first line of defense against fiscal and corporal illness

- Seven Men, Nine Days, One New Monetary Cartel, Pt. 2

- Crash JP Morgan Buy Silver – The Hosers!

- Silver Market Update

- In Praise of Anarchy

- What Is Value, And How Is HFT Affecting Market Value?

- Is There a Direction for Precious Metals?

- Gold Weakening Momentum Continues, Next Target $1320

- "Buy A Gun" Google Queries Hit All Time High, And Other Off The Grid Economic Indicators

- Great Depression, Debt and Economic Decline: Ireland, Portugal, Greece, US, UK

- Gold and Silver tocks Converging towards a Major Uptrend

- Silver Close to Reversing to the Upside

- How will they will prop up stocks after QE? An answer?

- Money & Markets - Week of 1.23.11

- Precious Metals - Week of 1.23.11

- The Only Stocks I'm Telling My Retired Friends to Buy Right Now

- Does Gold Have a Fair Value?

- Greenspan Advocates a Gold Standard: For Now, Expect Near-Term Declines

- Commodities Continued to Sizzle in 2010

- Will Platinum Prices Continue to Soar?

- Let's get this world party started: crash jp morgan buy silver

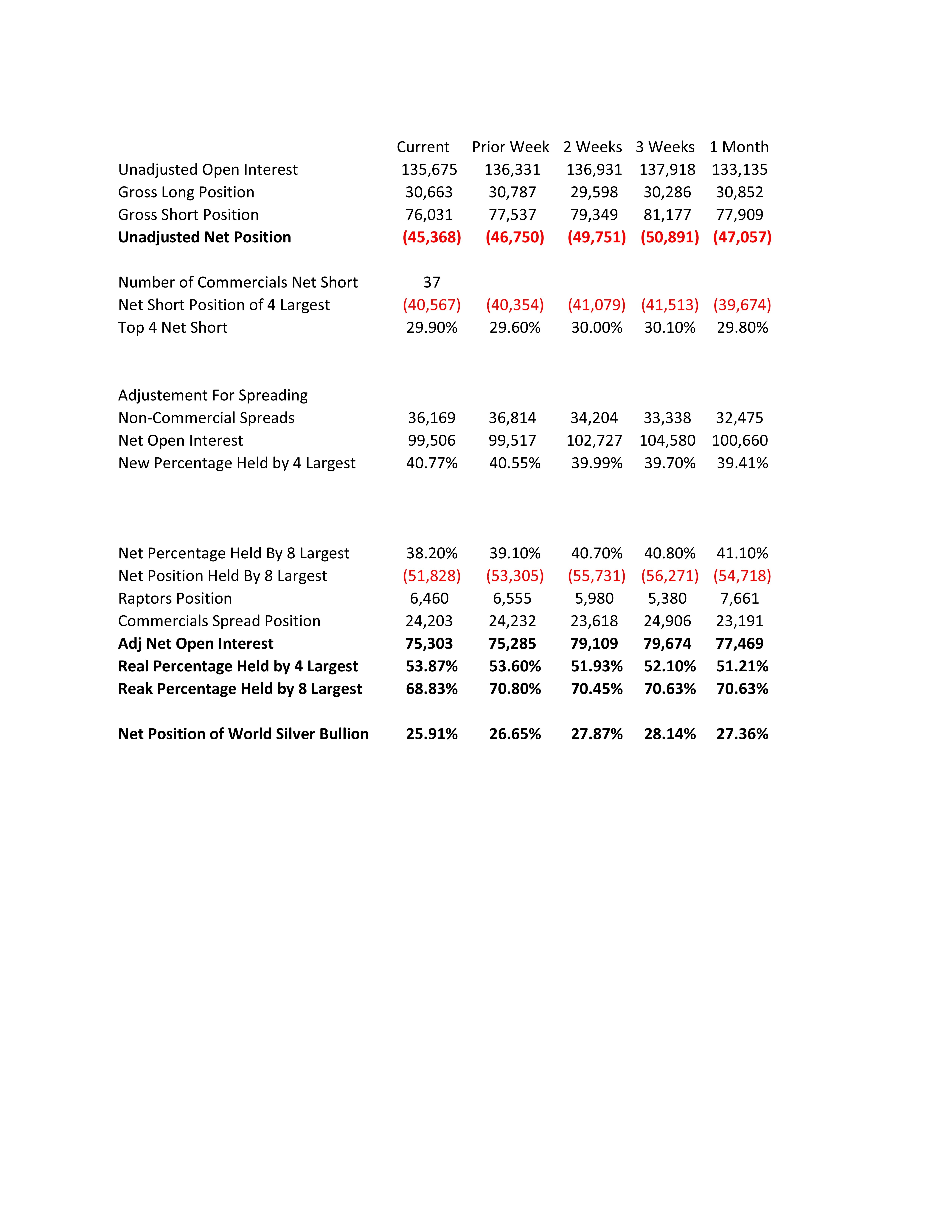

- Silver COT Update: Expect More Bearish Trend Next Week

- Silver IS The New Gold

| Major Buying Opportunity Developing in Precious Metals Posted: 23 Jan 2011 08:04 PM PST Graham Summers submits: Rather than discussing every asset class under the sun, this week I want to focus on a MAJOR buying opportunity that is developing in the precious metals space. With that in mind, this week’s edition of my weekly market forecast is titled "Buy With Both Hands". Complete Story » |

| Agnico-Eagle Mines Limited: Buy, Hold or Sell? Posted: 23 Jan 2011 08:00 PM PST Agnico-Eagle Mines (AEM) has dropped around $20.00/oz since December, and could be oversold at this point. The technical indicators suggest that AEM is now oversold, also note the widening gap between gold prices and the stock price. Let's take a quick look at it to try and ascertain whether this stock is a Buy, a Hold or a Sell. Complete Story » |

| China vs. JP Morgan and the Battle Over Gold and Silver Posted: 23 Jan 2011 07:56 PM PST Jason Hamlin submits:

Corrections are a healthy and normal part of any secular bull market, allowing the bull to rest its legs, shake out weak hands and prepare for the next phase up. Every correction in precious metals over the past decade has brought so-called “experts” out of the woodwork to proclaim an end to the gold bull market. They were wrong when gold hit $500, $800, $1,000 and will be wrong many times again before gold finally does peak somewhere above $5,000 per ounce. Complete Story » |

| What Every American Needs To Understand About The Economy Posted: 23 Jan 2011 07:37 PM PST As the United States debates its economic future in light of large government budget deficits, it is important that the public has a clear understanding of how the economy works. A good starting point for understanding how the economy works is to understand how it is measured. Economies are measured in terms of their Gross Domestic Product or GDP. GDP is made up of personal consumption expenditure, private investment, net trade (i.e. exports minus imports) and government spending at both the federal level and the state and local level. If the size of each of these components is known, it is only necessary to add them together to find the size of the whole economy. In 2009, the United States GDP was $14.1 trillion, according to the Bureau of Economic Analysis (BEA). Of that amount, spending on personal consumption accounted for 71% or $10 trillion; private investment 11% or $1.6 trillion; and government spending 21% or $2.9 trillion, with federal government spending of $1.1 trillion and state and local government spending of $1.8 trillion. Net trade deducted 3% or $390 billion from GDP because exports from the US were $390 billion less than imports into the US. So, what is the outlook for the US economy? The outlook for personal consumption is bad because the household sector is heavily indebted. Household debt increased from 64% of GDP in 1998 to 97% of GDP in 2008. At that point, millions of Americans became unable to repay their debt, defaulted, were cut off from additional credit and were forced to spend less. The drop in private spending threw the world into economic crisis and caused US unemployment to soar to 10%. Prospects remain discouraging because home prices have fallen by more than 30% on average, meaning that even the Americans with good credit ratings have much less collateral to borrow against. With limited access to credit, household spending will remain depressed. The outlook for private investment is also bad. Capacity utilization, which measures the extent to which factories are operating relative to their capacity, is roughly 75%. This is one of the lowest levels since records began in the 1960s. Businesses will not invest more at a time when they cannot utilize the capacity they have already put in place. Net trade has deducted from US GDP every year since 1975 because the United States imports so much more than it exports. There is no reason to expect this to change given current government policies. That leaves government spending. The figures for government spending mentioned above are actually misleading in the sense that they underestimates the true impact of government spending on the economy. For instance, as classified by the Congressional Budget Office, federal government outlays actually amounted to $3.5 trillion in 2009, three times the figure shown above. The explanation for this large difference is that the amount reported for the federal government in the GDP data provided by the BEA represents only the federal government's direct purchases of goods and services. It excludes normal transfer payments such as unemployment benefits, Social Security payments, Medicare, and assistance to state and local governments, as well as emergency assistance to the financial sector. In other words, federal government transfers provide significant support to other sectors of the economy, particularly personal consumption expenditure and state and local government. Therefore, the contribution to GDP of those sectors is actually overstated in the BEA data, while that of the federal government is understated. At a time when government spending is under fierce attack in the United States, every American needs to understand how much of the economy depends on that spending. This year the US budget deficit will be approximately $1.4 trillion. If the federal government were to attempt to balance its budget by spending US$1.4 trillion less in 2011, the reduction in government spending would not cause personal consumption or private investment to increase. To the contrary, both would decline. Personal consumption would decline because less government spending would cause unemployment to rise sharply; and private investment would decline because there would be much lower demand for goods and, consequently, much lower levels of capacity utilization than exist now. Moreover, as consumption and investment declined, tax revenues would also decline, making it necessary for the government to cut its spending even further to balance its budget. In the past, it was understood that if the government spent less and borrowed less then interest rates would fall since there would be less demand for loans. Lower interest rates would then boost the economy by allowing businesses and consumers to borrow at cheaper rates and to spend more. That is not the case now, however. Short-term interest rates in the United States are very near 0%. They will not go lower if the government spends less. What this means then is that the economy will contract by more than the amount that the government reduces its expenditure – and, perhaps, much more. Of course, the US government cannot continue to run trillion dollar budget deficits forever. Therefore, if the United States is to avoid eventual economic ruin, we must shift the national debate away from slashing government spending regardless of the consequences and instead discuss how the government could spend that money in a way that generates a high return on investment. In other words, the sensible approach is to shift the government spending away from areas that support consumption to areas that boost investment. A smart investment strategy would allow the United States to develop new, high-tech industries that would boost US exports, reduce US imports, create US jobs and generate significantly higher tax revenues. It is simple minded to dismiss this idea as "Un-American". Today, many of the United States most successful export industries, including agriculture and defense, are supported by US trade barriers, direct government subsidies, or both; while, historically, the United States industrialized during the 19th century behind a high wall of tariff protection. The United States is in crisis. Before we can reach the point where the government can spend less, the country must go through a period where the government spends much more wisely. To simply slash government spending now would result in a depression in the United States and around the world. Just do the math. Regards, Richard Duncan P.S. For more perspective from Richard Duncan you can visit his blog on economics in the age of paper money at www.richardduncaneconomics.com. What Every American Needs To Understand About The Economy originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." |

| Posted: 23 Jan 2011 07:05 PM PST We are now seeing a convergence of indications that a reversal in the Precious Metals sector is at hand that will lead to a major uptrend soon. The last Gold and Silver updates posted on 11th January were bearish over a short to medium-term time horizon and have been proven correct as gold and silver have since fallen substantially, and stocks have taken a real beating. However, in view of the current strongly bullish constellation of indications, it now looks like the downside targets for gold and silver were set too low, although our downside target for stocks has just been hit. |

| Silver and Gold Continue to Cool Off Posted: 23 Jan 2011 06:59 PM PST Dr. Duru submits: The “cooling off” of silver and gold has unfolded very slowly over several months. On Thursday, this process entered yet another phase. This time, silver made a clean and strong break below its 50-day moving average (DMA). Silver even made its first lower low since the latest rally began in late summer. Complete Story » |

| International Forecaster January 2011 (#7) - Gold, Silver, Economy + More Posted: 23 Jan 2011 06:09 PM PST Today's energy prices will reflect a loss in buying power of more than $60 billion in the US alone. Higher grain and meat prices will add $40 billion to total, a loss in buying power of $100 billion. By the looks of it costs and inflation will rise further causing further cuts in GDP consumption. These costs will affect 70% of the stimulus and QE2. That means very little consumption gains and stagnant unemployment. |

| China’s US Assets Fall With the Dollar Posted: 23 Jan 2011 06:02 PM PST I laughed when I read a Bloomberg story that reported, "China said it would 'welcome' a positive statement from the US on the stability of Chinese-held dollar assets during next week's summit in Washington between President Hu Jintao and President Barack Obama." Apparently, that Bloomberg quote is probably taken from the actual remarks of Chinese Vice Foreign Minister Cui Tiankai, who is quoted to have said, "If the US makes a positive statement on this issue we surely will welcome that." |

| Posted: 23 Jan 2011 04:24 PM PST View the original post at jsmineset.com... January 23, 2011 04:58 PM Dear CIGAs, Look, it is only natural to be concerned when markets react, but have no fear because the price of gold has significantly more than $1444 to go on the upside. We live in a market world run by algorithms which are mechanical sociopaths reflecting their conscious-less creators, owners and operators. Gold, as the saying goes, never promised us a rose garden, but it will insure you against the madness. Do not give up your insurance because of your emotions. Use your intellect to survive. What influenced the price of gold last week has none. Jim Sinclair's Commentary I have always enjoyed the outdoors. It might be one of the reasons that I live in Northwest Connecticut on a farm. Ever since I was a young man I read and thought about what it would be like to live in rural Alaska, especially in the winter. Well this year I found out. We had a 10 inch and a 24 inch snow storm with a few additional inc... |

| The Good, Not So Good, Bad & Ugly on the Indexes Posted: 23 Jan 2011 03:54 PM PST By Chris Vermeulen, TheGoldAndOilGuy Depending what type of trader you are and what you focus on the most for trading you could be either bullish or bearish on the stock market right now. The charts below show how the Dow Jones Industrial Average is bullish while the Small-Cap Russell 2K is bearish. Options expiration last week really mixed the market up as the market makers and the big money players manipulate stock prices in their favor. Let's take a look at the charts… DIA – Dow Jones Industrial Average Daily Chart Currently the price is trading above the 5 period moving average after briefly tagging it on Friday and then bouncing higher. Volume has picked up indicating more people are exchanging positions because of a shift in sentiment. Remember the Dow represents only 30 stocks so it does not provide a solid view of the overall market strength.

QQQQ – NASDAQ Daily Chart IWM – Russell 2K Small Cap Stock Index Small caps has broken key moving averages and are now nearing the 50 period moving average which I figure will provide a small bounce or pause before crashing through it. But with the amount of selling volume happening in the small caps it could just drop through that level and keep on going. Only time will tell and its best to wait for a low risk entry point before taking a position. Weekend Trading Conclusion: You can get my trading videos, analysis and trade alerts by subscribing to my newsletter: http://www.thegoldandoilguy.com/trade-money-emotions.php Chris Vermeulen |

| Long Term Investments for Continued Family Wealth Posted: 23 Jan 2011 03:53 PM PST Yesterday, we began telling you about our visits with our strategic advisors…that is, people who advise us about what to do with our family money. One of them runs a fund that focuses on India. The other runs a fund in Germany. Both are looking for bargain stocks – one in the Old World. The other in the New World. Yes, Asia is the New World now…America is part of the Old World. And both of our strategic partners told us the same thing: it's gotten a lot harder to find bargains. So what do you do, we asked. "Just keep looking…" was the answer. We were explaining the difference between investing for yourself and investing for your family. If you're investing for yourself you usually have fixed objectives – often retirement financing. Since you know when you will need the money, you need to focus on investments that will pay off in the allowable time. Trouble is, the trends that pay off most tend to be very long term. And very hard to time. Gold, for example, is probably going to pay off in a big way – some day. It has been in a bull market for a decade. It is hard to imagine such a powerful bull market ending in a whimper… Most likely, it will end in a Big Bang…as the price goes vertical. We've been saying for a long time that the Dow and gold will probably come to the same number, sooner or later. Maybe around 3,000. Maybe 5,000. Whatever it is, it will be a big payday for people who've stuck with gold. But what if you need money next year…or the year after? And what if you buy gold today and it drops 50% – as it did during the early '70s…in the middle of a huge bull market? Bummer, right? But if you're investing for the family, you can take the long view. You can buy gold, bury it…and forget it. Maybe the next generation will need it. Just don't forget to tell someone where you buried it! Regards, Bill Bonner Long Term Investments for Continued Family Wealth originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." More articles from The Daily Reckoning…. |

| Russia Plans to add More Gold, Eventually Yuan, to Reserves Posted: 23 Jan 2011 03:53 PM PST As further evidence that central bank interest in gold accumulation continues unabated, Russia's indicated that it's going to continue increasing the proportion of gold holdings in its already third largest in the world foreign exchange reserves. The statement is consistent with the plan Russia has had in place since at least June of last year, when president Medvedev announced Russia would reduce its use of the US dollar, despite its position as the world's reserve currency. According to Bloomberg: "'We've increased our investment in gold during the last several years and we will continue to move in the same direction in the future, ' he [First Deputy Central Bank Chairman Alexei Ulyukayev] said in an interview in London. 'Gold is a natural part of reserves.' "Russia, which aims to diversify its reserves, started adding the Canadian dollar and plans to invest in the Australian dollar. The central bank has almost doubled the share of gold in the past three or four years, according to Ulyukayev. The stockpile comprises 47 percent U.S. dollars, 41 percent euros, 9 percent British pounds, 2 percent Japanese yen and 1 percent Canadian dollars, according to the central bank. "The bank won't begin to add the Australian dollar until the middle of the year, Ulyukayev said on Dec. 1. Policy makers may also add new currencies to the reserves, with the Chinese yuan a potential target once it becomes fully convertible." Foreign central banks are wising up enough to slowly back away from paper currencies and especially the dollar, which for so long has been the majority holding of most nations. The tide of central banks turning away from the dollar is liable to continue throughout 2011. You can read more details in Bloomberg's coverage of Russia raising the share of gold in its reserves. Best, Rocky Vega, Russia Plans to add More Gold, Eventually Yuan, to Reserves originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." More articles from The Daily Reckoning…. |

| China is to Gold as the US is to Paper Currency Posted: 23 Jan 2011 03:50 PM PST Big drop in gold yesterday – down $23. Oil fell hard too. Otherwise not much action… We'd still like to see a deep decline in the gold price. Too many people are getting onto gold. Most of them have no idea of what they are doing. Like readers of MONEY magazine, they're buying the yellow metal as a speculation. Most likely they're going to lose money. Almost everyone who speculates on gold loses money. Don't ask us why. It's just one of those Iron Laws of investing. Gold goes up for 10 years straight. Speculators notice. They jump on board. And then the train runs off the tracks. That's just the way it works. Besides, remember that this Great Correction is not over yet…not by a long shot. It has barely begun to correct the excesses of the Bubble Era. A quarter of all homeowners are said to be underwater on their mortgages – that still needs to be sorted out. And the whole financial industry – with the collusion of the Fed – is sitting on trillions of dollars' worth of mortgage backed securities, pretending that they are good credits. There are still major bankruptcies ahead…and deflation of assets prices. And in all the sturm and drang of it, the price of gold could go down too. But if you're acquiring gold, you have some powerful competition. As nations become rich and powerful, they accumulate gold. Those that are getting weak and poor give it up. Here's The Financial Times with the latest news: Traders said that gold sales to China had jumped 30-50 per cent since Christmas, driving the cost of kilo bars in Hong Kong more than $3 per ounce above the market price of gold, the highest level since 2008 and an indication of the tightness in the physical market. "Physical demand has rocketed in China at the start of the year," said Walter de Wet, head of commodities research at Standard Bank. The wave of Asian buying has propped up gold prices at about $1,360 a Troy ounce, traders and analysts said. The metal's price has dropped 4.6 per cent from its December record price of $1,430.95, trading at $1,364.10 on Friday, as optimism about prospects for US growth has led western investors to turn their attention away from gold to other commodities and equities. "We have a balanced situation where one part of the world is buying and the other part is selling," said a senior trader in Hong Kong. Chinese and Indian investors are increasingly turning to gold to protect savings against sharply rising food prices. Investor buying of gold bars jumped 80 per cent to a record 144 tonnes last year in India, according to GFMS, the precious metals consultancy, while across east Asia bar hoarding was up 125 per cent at a 15-year high. Asians build their holdings of gold. Americans add to their supplies of paper money. The Fed is adding some $600 billion of it in the first half of the year. And it is already considering what to do next. How about this: stop. Admit that you've been a fool. Renounce QE, Keynes and the devil too. And all their works. But that's not going to happen. Because liquidity masks insolvency; and inflation disguises deflation. The feds are providing liquidity and inflating the money supply with the only thing they have left – paper money. And as long as the money flows…they can pretend that everything is okay. Things are quiet. Everybody is happy. Confident. "…experience suggests that quiet periods do not extend indefinitely," wrote Reinhart and Rogoff in their history of monetary crack-ups. Meanwhile, smart investors are buying gold…and hoping the price falls so they can buy more. Bill Bonner China is to Gold as the US is to Paper Currency originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." More articles from The Daily Reckoning…. |

| High Wages and Economic Prosperity, Part I Posted: 23 Jan 2011 03:24 PM PST By Jeff Nielson, Bullion Bulls Canada In my writing, I typically focus upon exposing the current economic myths and deceptive propaganda which continually emanate from the mainstream media. However, thanks to some recent questions and materials supplied by readers, I have found my gaze drawn back through time. In this look back, I have come across economic myths and propaganda which are nothing less than shocking. For more than four hundred years, Western economies (and the deluded theorists who have been allowed to guide those economies) have focused upon two extremely simplistic and somewhat opposite "models" for our economies. In this respect, I am indebted to John Maynard Keynes. While Keynes may have been utterly inept as an "economist", he is more than adequate as a "research assistant". Keynes tells us that the older of these too economic models (by far) is "mercantilism", while the more recent theoretical model is that of "free trade". For those readers who become phobic whenever exposed to economic jargon, relax. I have no intention of bombarding you with complex jargon. Indeed, as I alluded to earlier, these economic models are shocking for their simplicity (among other things). Both of these models centered on the need to have a "balance of payments" surplus for one's economy. There is nothing controversial here. A nation having a balance of payments surplus is like a corporation which makes a profit. No nation (or corporation) can survive over the long term as a money-losing enterprise. However this aspect of economic theory has obviously been totally (and conveniently) forgotten by all of our politicians and all of our modern "theorists" (i.e. banker apologists). For the benefit of the precious metals enthusiasts out there, the "surpluses" that these nations and economists coveted above all else were not surpluses accumulated in banker-paper, but rather surpluses of gold and silver. For more than four centuries, those who accumulated the gold and silver were considered history's winners, while those whose gold and silver was taken from them were the losers. We can see the obvious result of such thinking through the rampant corruption of modern, Western precious metals markets. Mercantilism is by far the older of these two economic models, and can be thought of as an "adversarial" system of economic management. In this law-of-the-jungle philosophy, nations aggressively sought to out-maneuver competing nations in creating their balance of payments surplus – in the simplistic belief that there could only be "winners" and "losers" in any economic system. If you didn't try to "screw the other guy" then they would certainly try to "screw" you. Conversely, free trade is a much more cooperative economic system, in that thanks to the wonders of "comparative advantage" it was theoretically possible that most (or even all) economies could simultaneously be "winners". To reiterate, this is all simple stuff. The doctrine of comparative advantage stipulates that if all nations focus on producing the goods/services which they can produce the best, then through the mechanisms of "free markets" and global commerce an optimal equilibrium can be achieved where (in theory) everyone is a winner. While free trade can immediately be seen as a more enlightened approach to global commerce, it should not be seen as some "theoretical breakthrough". Rather, all it did was to mirror the general change in attitude in Western cultures, which (for the first time in history) sought to use diplomacy and negotiation as the principal tools of "foreign policy" rather than war, and more war. Mercantilism was an economic model of "constant war", while free trade was a model (supposedly) based upon cooperation and mutual advantage (i.e. enlightened self-interest). Keynes characterizes mercantilism and free trade as being in many respects opposite to each other, yet notes that both schools of thought have some shared beliefs. Here is where this previous theoretical work becomes interesting. Any time more-or-less opposing views share a common belief, this is highly suggestive that such a belief is flawed (with respect to at least one of the competing theories). While it is possible for opposing systems to share valid, common beliefs/goals, such scenarios clearly represent the "exception" rather than the "rule". With respect to my own analysis, the shared belief in which I am most interested is the belief of both schools of theorists that minimizing wages (for the average worker) was a critical component of economic prosperity. Some will accuse me of twisting the meaning of the work of Keynes and others here, in that these renowned theorists typically talk about the virtues of a "stable wage-unit". I would argue that such double-talk is very transparent. Look into the work of these theorists in detail, and we will observe a remarkable 'coincidence'. All of these theorists warn of the "great danger" of rising wages (i.e. wages being too high), but none of these theorists have ever been able to see any harm in falling wages (i.e. wages being too low). Indeed, all that low wages have ever represented to these titans of economics are high profits for corporations (i.e. the very wealthy who own those corporations). Clearly, an economic system which possesses a large, permanent, extreme bias against "high wages" while having demonstrated a multi-century "love affair" with low wages is not a system which believes in keeping wages "stable", but rather in keeping them as low as possible. More articles from Bullion Bulls Canada…. |

| American Veterans Disabled for Life Silver Dollars History Posted: 23 Jan 2011 03:09 PM PST The 2010 American Veterans Disabled for Life Silver Dollars are officially no longer available from the United States Mint. They went off-sale on December 13, 2010, at 5PM ET to allow the US Mint a window of two weeks in order to fulfill any outstanding orders before the end of last year, which the Mint is required [...] |

| Inflation is the way the rich tax the poor, Rickards tells King World News Posted: 23 Jan 2011 03:08 PM PST 6:14p PT Saturday, January 21, 2011 Dear Friend of GATA and Gold: Inflation is the mechanism by which the rich tax the poor, market intelligence analyst Jim Rickards tells King World News. Rickards expects gold to be revalued well beyond $2,000 per ounce. The interview is 19 minutes long and you can listen to it here: http://kingworldnews.com/kingworldnews/Broadcast/Entries/2011/1/22_Jim_R… CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Sona Drills 85.4g Gold/Ton Over 4 Metres at Elizabeth Gold Deposit, Extending the Mineralization of the Southwest Vein on the Property Company Press Release, October 27, 2010 VANCOUVER, British Columbia — Sona Resources Corp. reports on five drillling holes in the third round of assay results from the recently completed drill program at its 100 percent-owned Elizabeth Gold Deposit Property in the Lillooet Mining District of southern British Columbia. Highlights from the diamond drilling include: – Hole E10-66 intersected 17.4g gold/ton over 1.54 metres. – Hole E10-67 intersected 96.4g gold/ton over 2.5 metres, including one assay interval of 383g of gold/ton over 0.5 metres. – Hole E10-69 intersected 85.4g gold/ton over 4.03 metres, including one assay interval of 230g gold/ton over 1 metre. Four drill holes, E10-66 to E10-69, targeted the southwestern end of the Southwest Vein, and three of the holes have expanded the mineralized zone in that direction. The Southwest Vein gold mineralization has now been intersected over a strike length of 325 metres, with the deepest hole drilled less than 200 metres from surface. "The assay results from the Southwest Zone quartz vein continue to be extremely positive," says John P. Thompson, Sona's president and CEO. "We are expanding the Southwest Vein, and this high-grade gold mineralization remains wide open down dip and along strike to the southwest." For the company's full press release, please visit: http://sonaresources.com/_resources/news/SONA_NR19_2010.pdf Join GATA here: Vancouver Resource Investment Conference Cheviot Asset Management Sound Money Conference Phoenix Investment Conference and Silver Summit Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: http://www.gata.org/node/16 ADVERTISEMENT Prophecy Resource Spins Off Platinum/Palladium Venture: Company Press Release, January 18, 2011 VANCOUVER, British Columbia — Prophecy Resource Corp. (TSX-V:PCY)and Pacific Coast Nickel Corp. announce that they have agreed that PCNC will acquire Prophecy's Nickel PGM projects by issuing common shares to Prophecy. PCNC will acquire the Wellgreen PGM Ni-Cu and Lynn Lake nickel projects in the Yukon Territory and Manitoba respectively by issuing up to 550 million common shares of PCNC to Prophecy. PCNC has 55.7 million shares outstanding. Following the transaction: – Prophecy will own approximately 90 percent of PCNC. – PCNC will consolidate its share capital on a 10 old for one new basis. – Prophecy will change its name to Prophecy Coal Corp. and PCNC will be renamed Prophecy Platinum Corp. – Prophecy intends to distribute half of its PCNC shares to shareholders pro-rata in accordance with their holdings. Based on the closing price of the common shares of PCNC on January 17, $0.195 per share, the gross value of the transaction is $107,250,000. For the complete announcement, please visit: http://prophecyresource.com/news_2011_jan18.php |

| Too much gold paper, not enough metal, Hathaway tells King World News Posted: 23 Jan 2011 03:08 PM PST 5:40p ET Sunday, January 23, 2011 Dear Friend of GATA and Gold (and Silver): Interviewed this weekend by Eric King of King World News, Tocqueville Gold Fund manager John Hathaway remarks that all the fundamentals for gold's rise remain in place, that there is hugely more paper gold than real gold, that only high real interest rates or gold backing for currencies can restore confidence in the financial system, and that any gold backing for currencies likely would put gold's value in four or even five digits. The interview is 13 minutes long and you can listen to it at King World News here: http://kingworldnews.com/kingworldnews/Broadcast/Entries/2011/1/22_John_… CHRIS POWELL, Secretary/Treasurer Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: http://www.gata.org/node/16 |

| Meet GATA's board at conclusion of Vancouver conference Posted: 23 Jan 2011 03:08 PM PST 5:16p PT Saturday, January 21, 2011 Dear Friend of GATA and Gold: Here's a reminder that GATA will be participating in the Vancouver Resource Investment conference, to be held Sunday and Monday at the new Vancouver Convention Centre West on Coal Harbor. Many GATA favorites will be speaking and many resource companies will be exhibiting. Admission is free if you register in advance. You can learn all about the conference here: http://cambridgehouse.com/conference-details/vancouver-resource-investme… At the conclusion of the conference, starting at about 5:30 p.m. Monday, GATA's Board of Directors plans to meet friends at the Lions Pub, 888 West Cordova St., just a couple of blocks away from the convention center. CHRIS POWELL, Secretary/Treasurer Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: http://www.gata.org/node/16 |

| Graham Summers’ Free Weekly Market Forecast (Buy With Both Hands Edition) Posted: 23 Jan 2011 02:06 PM PST Graham Summers' Free Weekly Market Forecast (Buy With Both Hands Edition)

Rather than discussing every asset class under the sun, this week I want to focus on a MAJOR buying opportunity that is developing in the precious metals space. With that in mind, this week's edition of my Free Weekly Market Forecast is titled Buy With Both Hands. Gold has formed very ugly technical patterns both in the long-term and the short-term. In the short-term we have what looks like a dome top forming.

This is one of the cleanest dome top patterns I've ever seen. The downside target for it is around $1,250… which coincidentally lines up the Gold's long-term chart pattern target as well. In the long-term we have a rising bearish wedge forming since the 2008 Crash. As I write this, Gold is right on the lower trendline of this massive pattern. A break here would likely see the precious metal falling to $1,250 before putting in a base for another leg up.

Silver is posting a similarly bearish looking pattern.

As you can see, Silver has broken the trendline that supported it during this latest rally. It has since failed to reclaim this line AND broken through initial support at $28. The next real line of support is $26 or so, though we could easily go as low as the $24-25 range if things pick up steam to the downside. Given the steepness of Silver rally from August to December, this is quite possible. Let me be blunt here. If Gold falls to $1,250 per ounce and Silver falls to $25 per ounce it's time to BUY WITH BOTH HANDS.

I want to be clear here. I am SUPER bullish on both precious metals in the long-term. But right now, both are posting extremely ugly, bearish technical patterns. However, rather than seeing this as something to worry about, I view it as phenomenal buying opportunity for both assets. One of the oddest things about investment psychology is that people only want to load up on an asset class when it's soaring. Rarely do they view a collapse as a good thing. In some cases, this mentality is beneficial (buying Tech stocks in 2001 when they began to collapse after soaring would have been a HORRENDOUS move). However, in the case of Gold and Silver today, a collapse right now would be absolutely FANTASTIC for investors. For one thing it would shake out some of the hot money that recently flowed into the sector. And it would also give both precious metals a chance to form a sound base before beginning their next leg up. Indeed, I expect both assets to be MUCH higher from where they are today this time next year. Why? Because the Fed and the world's central banks have pumped trillions of Dollars into the financial system and have no means of getting back out again. So, in the near-term, deflation remains the primary risk. In fact, I would venture that Ben Bernanke would LOVE another round of deflation to occur as it would serve as support for his money printing policies and his goal of pumping even more money into the system. When this happens, Gold and Silver will begin the REAL explosion upward. So with that in mind, let Gold and Silver drop now and then BUY WITH BOTH HANDS. After all, the first wave of inflation has already hit the US (the initial stage of rising prices pushed by speculation). After this comes the REAL stage of inflation: the CURRENCY COLLAPSE. Remember, the US's Federal debt is now at $13+ trillion. And if you include unfunded liabilities like social security and medicare, you're talking about $70+ TRILLION in total debt on the US's balance sheet. After all, Gold and Silver are the most obvious inflation hedges out there. And to be blunt, anyone who invests in these two assets will likely do very well in the coming months as inflation erupts in the US (see their 2010 performance). However, to make truly ENORMOUS gains from inflation you need to find the investments that are off the radar... investments that the rest of the investment world hasn't discovered yet. I'm talking about investments that own assets of TREMENDOUS value that are currently priced at absurdly low valuations: the sorts of assets that larger companies will pay obscene premiums to acquire. Investments like three inflation hedges detailed in my Inflationary Storm special report. Case in point, since recommending them on December 15, they've OUTPERFORMED Gold and Silver by 5%, 9%, and 11%, respectively. And they're just getting started. You see, because these three investments are currently unknown to 99.9% of the investment world. It is literally impossible for them to become less popular. Which means that they have only one direction to go and that's to become more and more known to the investment world. After all, how many inflation hedges can you name that CRUSH Gold and Silver, rallying even when those precious metals FALL (yes, my three investments have done this). If you haven't already taken steps to prepare your portfolio for the inflationary storm that is coming, don't wait another day. You can reserve a copy of my Inflationary Storm Special Report today, receive the names, symbols, and how to buy the three investments it details... and get in on these investments before the rest of the investment world does, simply by taking out a "trial" subscription to my paid newsletter Private Wealth Advisory. In fact, you can keep my Inflationary Storm Special Report even if you choose to cancel your trial subscription and receive a full refund during the first 30 days of your subscription. How's that for a low risk offer? To take out a trial subscription to Private Wealth Advisory and receive a copy of my Inflationary Storm Special Report today….

An annual subscription to Private Wealth Advisory costs just $180. However, I realize my analysis and investment style are not for everyone.

|

| Silver: your first line of defense against fiscal and corporal illness Posted: 23 Jan 2011 09:57 AM PST |

| Seven Men, Nine Days, One New Monetary Cartel, Pt. 2 Posted: 23 Jan 2011 09:15 AM PST

Thus, on a wintery day in November 1910, seven men retreated to JP Morgan’s private Jekyll Island resort to plan a system of banking that would address all of these problems, while simultaneously expanding their power and influence over the US banking system.

G. Edward Griffin, in The Creature From Jekyll Island, puts their primary goals as the following:

1) To stop the growing influence of smaller banks and increase the Anglo-American banking giants’ grip on the US financial system 2) To shift US banking to a more “loan heavy” structure thereby expanding the monetary base more dramatically (making money more “elastic”) 3) To pool all national banks reserves and set nation-wide standards for loans to reserves ratios, thereby minimizing the risks of bank runs and failure 4) To establish a means of shifting the losses from bank failures away from the banks and onto the public

And finally…

5) To develop a PR campaign that would result in the US populace accepting the implementation of a full-scale private banking cartel

I do not have time to detail the precise proceedings of the meetings these men held over their nine day stay at Jekyll Island, nor is there room to explain precisely how they infiltrated the US political system and managed to introduce a banking plan that was written by Frank Vanderlip and Benjamin Strong (who represented the Rockefeller and Morgan families, respectively) as if it were a bill produced by members of Congress.

However, a brief overview is as follows:

Initially Senator Aldrich proposed something quite similar to the Bank of England, in which there would be one single large bank. However, the Rockefeller interests (who had ample experience with the US populace’s reaction to monopolies) thought this would be too much for Americans to stomach. Instead, they proposed the creation of 12 regional banks largely to maintain the illusion that the Fed would be a union, not a single central bank.

This is where the expertise of Paul Warburg, who had the most experience with European-style central banking cartels, came in. Warburg proposed creating a banking structure that would be more conservative at first so that the general public would be more willing to accept it, then stripping away the conservative props once the system was in place.

For instance, Warburg proposed the Federal Reserve Board of Governors, a group of semi-elected officials who would meet and decide Fed policy on interest rates and the like. This created the illusion that the Fed would resemble a normal banking corporation with a board of directors. However, in point of fact the Fed Board was a means to keep all the key decision making centralized at one bank in Washington DC (close to New York where the Bank Oligarchs were headquartered).

Warburg also came up with the name “Federal Reserve” which evoked the sense that the organization was aligned with the Government and was secure. His view was that the words “central” and “bank” must be avoided at all costs.

However, the most daring and provocative of all Warburg’s proposals was that the Fed would take over the issuance of ALL money in the US. For the first time in US history, money would be produced by privately held banks, NOT the US Government.

From then on, US Federal Reserve notes would be legal tender for settling all debts public or private. Thus, if someone was owed money and refused to accept Federal Reserve Notes (Dollars) as payment, he or she could go to jail. The Dollar even says this in the top left corner of its face.

Obviously, getting the public to swallow this proposal wasn’t going to be easy. The bankers put together a special committee to investigate the plan. However, the Pujo Committee was largely a farce in which various members of Congress (all bought out by the banks) questioned the bankers on the more innocuous portions of the proposal.

As part of their PR campaign, the bankers also donated some $5 million to Harvard, Princeton, and the University of Chicago (the last of which was founded using contributions from John D Rockefeller) all of which began turning out studies and academic papers promoting the virtues of the proposed system.

However, the bill remained a tough pill to swallow especially given Senator Aldrich’s close affiliation with Wall Street (remember, he was an associate of JP Morgan). The “Aldrich Bill” as it was known never even made it to vote in the Senate.

Splitting the Vote… and Backing All Three Candidates

Bruised, but not defeated, the bankers knew that in order to get their plan put into action they needed support from the very TOP of the US Government: the President of the United States. Consequently, they engaged in one of the most sophisticated lobbying efforts in history, backing all THREE candidates (Taft, Wilson, and Roosevelt) in the 1912 election.

In fact, it was JP Morgan’s associates who pushed Roosevelt to run in the first place (giving him the monetary backing to do so) in order to pull voters from Taft who was publicly recognized as pro-Wall Street and so would not have been as effective at getting the bankers plan implemented without public outcry.

Thus the 1912 election consisted of three pro-Wall Street candidates, though only one of them (Taft) was publicly recognized as such. Roosevelt and Wilson were both backed by private banking money, though their backers urged them to sound out an “anti Wall Street” bank campaign (which they did with great success).

The results worked as hoped. Roosevelt served as the “anti-bank” foil to Taft’s pro-Wall Street/ Big Business status, splitting the vote and allowing Wilson to win with just 42% of votes (the other 58% were split between Taft and Roosevelt). The bankers now had a supporter in the White House, most importantly, one who was thought by the public to be against the banks and their “Aldrich Plan” plan as it had come to be known.

Officially Backed and Bailed Out By Uncle Sam

Ready to make a second attempt at implementing their plan, the bankers enlisted the Democratic Chairman of the House Banking and Currency Committee, Carter Glass, to draft a new banking bill. Glass, who by his own admission knew nothing about banking, was merely a front, a figurehead who denounced the Aldrich Plan, pointed out its biggest flaws to the public, and the proposed an identical plan with the very same flaws included.

The Glass-Owen bill (it was co-sponsored by Senator Robert Owen) moved along towards becoming law much more quickly than the Aldrich Plan, largely due to the fact that the Wall Street banks engaged in a massive PR campaign in whch they publicly decried it as wrong and evil and against their interests (despite the fact they themselves wrote it).

The final coup was accomplished when William Jennings Bryan, the most powerful Democrat in Congress, met with Glass and said he would pass the bill provided that the money issued by the Federal Reserve was backed by the US Government and that the Governor of the Federal Reserve would be appointed by the President and approved by the Senate: two clauses that the Wall Street bankers wanted but had intentionally left out of the draft so that they could be used as “bargaining chips” to make it appear as though compromises were made.

G. Edward Griffin, repeats a quote Fed mastermind Paul Warburg regarding their success:

While technically and legally the Federal Reserve note is an obligation of the United States Government, in reality it is an obligation, the sole responsibility for which rests on the reserve banks… The Government could only be called to take them up after the reserve banks failed.

Here lies the ultimate triumph of the cartel, not only would the Federal Reserve issue money (collecting interest on the loans since the money was technically being leant to the US), but should the system ever go bust, the US Government would be required to step in and bailout the Federal Reserve’s losses.

It had taken three years and countless strategies and deceptions, but on December 23 1913 the Federal Reserve Act was passed into law. From then on, the US monetary system would be controlled by private interests in a government-backed cartel.

The above account is a very condensed version of the history of the Federal Reserve’s creation. The actual story is even more rife with twists and power struggles. For those of you who are interested in knowing more about it, I highly recommend reading The Creature From Jekyll Island by G. Edward Griffin. It’s a stunning book and full of revelations that range from shocking to outright infuriating.

Best Regards,

Graham Summers

PS. If you’re getting worried about the future of the stock market and have yet to take steps to prepare for the Second Round of the Financial Crisis… I highly suggest you download my FREE Special Report specifying exactly how to prepare for what’s to come.

I call it The Financial Crisis “Round Two” Survival Kit. And its 17 pages contain a wealth of information about portfolio protection, which investments to own and how to take out Catastrophe Insurance on the stock market (this “insurance” paid out triple digit gains in the Autumn of 2008).

Again, this is all 100% FREE. To pick up your copy today, got to http://www.gainspainscapital.com and click on FREE REPORTS.

PPS. We ALSO publish a FREE Special Report on Inflation detailing three investments that have all already SOARED as a result of the Fed’s monetary policy. You can access this Report at the link above.

|

| Crash JP Morgan Buy Silver – The Hosers! Posted: 23 Jan 2011 09:03 AM PST |

| Posted: 23 Jan 2011 06:49 AM PST |

| Posted: 23 Jan 2011 06:29 AM PST Left alone, good people tend to do good things. And, when unobstructed by coercion, force, violence or any other tool employed by the state in order to foster and maintain a more "responsible," "socially conscious" citizenship, most people tend toward being good people…all on their very own. Nowhere was this sentiment better expressed during the past few weeks than in the flood-stricken state of Queensland, Australia (and, more lately, in the state of Victoria, to Queensland's south). The rains that inundated an area the size of France and Germany (combined!) across the Sunshine State wrought havoc and destruction upon its people. Lives were lost, property damaged and industry crippled. When the worst of Mother Nature's wrath had subsided, Queensland residents were left with a monumental clean up. To their credit, these individuals, in the face of near-immeasurable disaster, performed admirably. They did what came naturally. Contrary to the patriotic rally cries of politicians, they didn't do what Queenslanders do; they did what good people do. And it was beautiful. The general feeling was perhaps best summed up by Wally "The King" Lewis, a retired national football hero, who spent the last week of his holidays helping his fellow Brisbane residents prepare sandbags and to bail rising flood waters out of their homes. (It is worth pointing out here that, for many Australians, there is no higher office to be attained in the land than that of venerated sporting legend.) Speaking to National Nine News from the waterlogged front yard of a neighbor – whom he had never met – Wally said, "If someone's doing it tough, I think it's the right thing to do to put the hand up and ask them if they want any help." The interviewer then turned his microphone to another volunteer. "What was your reaction when Wally Lewis turned up?" Typifying the laid back disposition of the crowd, the young man casually replied, "[Laughs] Yeah, I was a little surprised but…you know…people help out. It's all good." The Australian people appeared to be perilously close to discovering something very important about themselves; something, perhaps, they've always known; an instinctual tendency toward human solidarity, the natural urge to help a neighbor in distress, to lend a hand; in short, to volunteer. Alas, barely had the first piece of debris been cleared away when the media, as it typically does, lost sight of the bigger picture. Alongside inspirational stories of non-violent, voluntary cooperation, the local papers turned their attention to the state's role in the cleanup. Should the state and federal governments remain focused on returning "their" budgets to surplus, or should they deploy funds to assist those in need of help? In other words, how "best" should the state spend its citizens' money…as if the only just, honest option had not already expired on point of expropriation in the first place? [The answer, in other words, is not to steal it.] While sifting through the news reports and reading comments about what the state "should" do, we wondered how people who are so ready to do what is natural, to cooperate freely with neighbors and "mates down the street," could so miss the overarching lesson in all this tragedy. Why do hostages of the state turn to their captor when it comes to arbitrating issues of freedom, issues they are, individually and through voluntary cooperation, demonstrably capable of resolving for themselves? Perhaps it has to do, at least in part, with the misrepresentation of the concept of anarchy itself; a misrepresentation that serves not the interests of individuals, but of the state itself. We are taught that "anarchy" means violence, looting and the aggressive form of chaos that all-too-often flourishes in the wake of natural disasters. We are told that this is what happens given the absence of state control. Nothing could be further from the truth. The state IS control. It is the very incarnation of force and violence from which it purports to protect us. As Murray Rothbard, the man credited with having coined the term anarcho-capitalism, expressed in Society and the State: "I define anarchist society as one where there is no legal possibility for coercive aggression against the person or property of any individual. Anarchists oppose the State because it has its very being in such aggression, namely, the expropriation of private property through taxation, the coercive exclusion of other providers of defense service from its territory, and all of the other depredations and coercions that are built upon these twin foci of invasions of individual rights." We can expect nothing more from an agent of force than that which is its primary, defining characteristic; namely, more force. A mule is no more capable of giving birth to a unicorn than the state is capable of "granting" freedom. Last night, with all this in mind, your editor telephoned his father. Dad lives about an hour south of Brisbane, where the post disaster clean up continues. In the aftermath of the flood, volunteer posts were set up around the city where groups of concerned individuals could assemble to donate their time and/or resources to help get the place back on its feet. "Sixteen thousand people turned up to help on the first day," Dad told us. "They came with their own equipment and made their own way there. In the end, they had to turn people away. "I put my name down to lend a hand," he continued, before adding, with sincere disappointment in his voice, "but I haven't been called up yet." Then, as a man who has spent his life helping people, he added, enthusiastically, "but I've still got two more days of holiday left, Sunday and Monday. Hopefully I'll have the chance to get up there and help out then." To those who would argue that coercion is necessary to foster freedom, that force is a prerequisite for peace and that the expropriation of individuals' property on threat of violence is compulsory to fund an agency that, alone, is capable of guaranteeing safety and prosperity, we say: you don't know the real meaning of anarchy, you don't know what voluntarism is and, until you do, you will never know what it means to be truly free. Thank you to all the people in Queensland – and around the world – who do understand these concepts and, through their fine example, prove statists everywhere and always wrong on a daily basis. Regards, Joel Bowman In Praise of Anarchy originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." |

| What Is Value, And How Is HFT Affecting Market Value? Posted: 23 Jan 2011 06:04 AM PST Volatility Trader submits: My apologies to readers who’ve been requesting that I write more about options-selling strategies. I promise to get a series on that subject started with my next post. After the hail of fire I drew with my prior post, which dared to inform readers of research that suggested the price of gold might be in a bubble pattern, I decided to stay away from writing anything that implies “value” is nothing but a social construct. But then I heard two recent public-radio programs that featured refreshing takes on economics, trading, markets, and the meaning of money. Seasoned investors and veteran economists might find these programs trivial—but I humbly submit that it's important to look outside the bubble (no pun intended) to get some perspective. Cutting right to the chase, there's last week's This American Life program entitled, “The Invention of Money”. Prompted by reports that more than a trillion dollars “disappeared” when the housing bubble burst, contributors started to investigate what money really means. Planet Money correspondent Jacob Goldstein asked his aunt, a savvy, successful business-woman, “Where did all that money go?” and her reply was, “Money is fiction.” Indeed, whether it's represented by salt, stones, silver or, yes, gold, the value of everything is determined by social contract. As TAL host Ira Glass put it,

Complete Story » |

| Is There a Direction for Precious Metals? Posted: 23 Jan 2011 05:35 AM PST Clemens Kownatzki submits: The year 2011 hasn't started all that well for precious metals. Bearing the 3rd straight weekly loss in a row, Spot Gold closed the week at $1,343 per ounce. Silver is off almost 12% since it reached a 30-year high during the first week of this year. Taking nothing away from an incredible bull-run during the past decade, investors should keep in mind that precious metals are in essence commodities, even though gold and silver are often considered investment assets. As such, an investment in gold or silver provides no inherent yield other than price appreciation. The commodity aspect comes to light now and then when prices are on the run. From the perspective of the average investor therefore, an investment in precious metals is not to be taken lightly, particularly the slightly dubious sounding gold investments touted on TV ads. Complete Story » |

| Gold Weakening Momentum Continues, Next Target $1320 Posted: 23 Jan 2011 05:14 AM PST |

| "Buy A Gun" Google Queries Hit All Time High, And Other Off The Grid Economic Indicators Posted: 23 Jan 2011 04:56 AM PST In lieu of a credible macroeconomic data reporting infrastructure in America, increasingly more people are forced to resort to secondary trend indicators, most of which have zero economic "credibility" within the mainstream, yet which provide just as good a perspective of what may be happening behind the scenes in this once great country. A good example was a recent Gallup poll, which contrary to all expectations based on a now completley irrelvant and thoroughly discredited ADP number, which led some br(j)okers such as the Barclays Insane Predictions Team to speculate a 580,000 NFP number was in the books, indicated that the jobless situation barely improved in December. Sure enough, this was promptly confirmed by the January 7 NFP number. And so, in looking for a variety of other "off the grid" economic indicators we read a recent report by Nicholas Colas, which proves to us that we are not the only 'nerdy' entity out there increasingly searching for metrics that have some rooting in reality, and not in the FASB-BLS-Census Bureau joint ventured never-never land. And while we recreate the key points from the report, the one item that should be highlighted is that, as we have suspected for a while, the social undertow of fear, skepticism and anger is coming to a boil, as Google queries of the "Buy A Gun" search querry have just hit an all time high. How much of this is due to the recent events from Tucson, AZ is unclear. What is clear is that the trend is most certainly not your friend (unless you are of course the CEO of Smith and Wesson). We'll leave the interpretation of this chart to our very erudite politicians. As for other must read observations on the topic of derivative economic indicators, we present Nicholas Colas' must read latest: "Off The Grid” Economic Indicators – Q410 Edition There are a lot of economic indicators out there, and we pay attention to all of them because government decision makers have told us they shape economic policy. But there’s a wealth of independently developed economic and statistical data available as well, and much of it provides much-needed color on the real state of the U.S. economy. Our collection of anecdotal datapoints, which we have dubbed the “Off The Grid” indicators, paint a more nuanced picture of a slow growth U.S. economy that is still struggling with the aftermath of the Financial Crisis. Bullish points include demand for pickup trucks, used cars and an increasing number of people who leave their jobs voluntarily instead of through layoff. Bearish points are headlined by still-rising food stamp participation, with gun sales and rampant buying of silver coins underpinning continued popular concerns over personal security and the soundness of the dollar. Food inflation also features on this list. Neutral points: mutual fund inflows (but potentially turning positive) and Gallup poll consumer spending. Ever wonder where the word “Nerd” came from? It’s a “nerdy” question, to be sure, but apparently it comes from a Dr. Seuss book entitled “If I Ran the Zoo.” I don’t remember the appearance of the word from my early exposure to the work, but I certainly remember the opening:

That’s pretty much the way I feel about the current state of economic indicators that we all pick apart, analyze, and try to cajole into some form of investable signal every day. We look at them because the Federal Reserve looks at them. And the Treasury. And the White House. And every other seat of economic power. But in reality they look at them because these datasets have been around long enough that someone, somewhere, has done a doctoral dissertation or other academic treatise validating their relevance. In the world of automated and computerized payrolls, for example, the Bureau of Labor Statistics still uses a telephone survey of a few thousand households to decide if employment is rising or falling. OK, this used to be a hard issue to tackle in the 1950s and 1960s. But the U.S. Treasury’s Internal Revenue Service tracks everyone’s contributions for payroll and tax withholding in real time now. If someone stops getting their paycheck, Treasury knows about it by the time of their next pay cycle. They can identify where the person works based on their zip code. The employment picture should be clear as day using this data. It used to be hard when paychecks doubled as computer punchcards (my Dad had those in the 1970s). The telephone survey approach is like using a horse and buggy to get around when there are the keys to a perfectly good Ferrari in your pocket. All good natured ranting aside, there’s no excuse for not casting a wider net when it comes to the never-ending search for useful economic data. And you don’t need to be a “nerd” (there’s that word again) to get it – we aren’t talking about advanced language algorithms working against a Twitter API feed. The data is out there and thanks to the Internet it is pretty easy to track. That’s the reason we have developed our “Off the Grid” economic indicators – our “eyes” into the real U.S. economy. And those “eyes,” we hope, are truly the windows into the soul of some form of lasting recovery. Our take away from this quarter’s indicators is that the recovery in the U.S. economy is slow and unevenly distributed, with several long-tailed effects that may take decades to fully understand.

The data, in short, supports the mainstream economic viewpoint that the U.S. economy is improving at a slow pace. The nuances that it highlights, however, are that the damage from the recent recession is as much cultural as economic. A consumer base – even one at the lower end of the economic ladder – with fundamental concerns over food security and affordability or personal safety is not the “dry tinder” of a strong economic bounce back. I don’t know whether to call that “New Normal,” “Old Abnormal” or whatever other rubric might fit this paradigm. But it is a picture of the landscape that you don’t see as much in the government-approved economic indicators, and it tells a separate and perhaps more accurate truth. The various indicators that inform this view are all included in the attachments to this note , and we’ll touch on a few of the important ones here: Food Stamps – This program, originally created to sell surplus produce to starving Americans in the Depression, has morphed over the decades into a foodpurchase grant to low income households. The growth rates for SNAP (the modern name for Food Stamps – Supplemental Nutrition Assistance Program) have been stratospheric for the last two years at +15% year-on-year growth. Part of this was a change to eligibility requirements in 2009, but a lot more was the impact on the recession among low income households. The program now helps over 43 million Americans feed themselves, about 14% of the U.S. population. The good news, if one can call it that, is that the growth rates are slowing. Last month one of our one strategy team members went to several public assistance offices outside New York to speak to people waiting for a consultation and those interviews shed some light on this trend. The bottom line is that such facilities were simply overwhelmed over the past two years. People who qualified for public assistance needed to visit such centers several times, as the paperwork needed to complete the application process is lengthy and convoluted. So growth rates rose steadily as these individuals finally cleared the hurdles required to receive benefits. One other data point that supports that the growth in the SNAP program may have peaked: Google searches for the term “Food Stamps” are no higher than mid-year 2010. The deeper question is what the widespread adoption of SNAP will do to the society over the coming years. This is actually not a budget discussion – SNAP is very efficient and costs less than $100 billion a year to help +40 million Americans. Rather, it is a question of the effects of long term reliance on government support to economic issues such as labor participation rates and employment levels. We are in uncharted waters here, to be sure. Durable Goods Purchases – The most upbeat news from our indicators is the degree to which consumers are snapping up used cars and pickups. Yes, the economic data focuses on all light vehicles, but the “Off the Grid” indicators dance to a different drummer. Used car prices are a great leading indicator for new car and truck demand, and the Manheim Auto Auction data keeps hitting new highs. Pickup trucks are work vehicles, primarily purchased by small businesses. After a steep selloff from the bursting of the housing bubble, pickup truck demand is now positive again, to the tune of +20% year on year for several months in a row. Guns, Ammunition, and Silver Coins – Whether you are “pro-“ or “anti-“ gun, the sale of firearms should be on your radar screen as a heuristic measurement of something I will call “consumer security.” There is a baseline of organic firearm demand in the U.S. – for years it was about 8 million units, as measured by the FBI’s instant background check request data. With the 2008 recession that number spiked to first 10 million and now 14 million background checks a year. At first observers chalked that up to a Democratic President, but it has been years since Obama’s inauguration and the numbers keep climbing. I attribute that to a deeper sense of unease in the population – perhaps about government controls, perhaps about crime. Hard to say how much of each. But it is easy to say that an unsure society is not one ready to resume a carefree spending profile. And keep in mind that guns are not cheap – a basic rifle or shotgun will run $300 or more. Much of the same point applies to the recent surge in demand for silver coins. From a monthly sales run rate of less than 1 million coins, the U.S. Mint now pushes out close to 3 million coins a month, and dealers would clearly like to have more. As with guns, silver coins are not cheap - +$30/piece, or +$600 for a roll of 20. I suspect much of this demand stems from gold’s steady price move higher and the fact that the Mint is not producing as many fractional ounce gold coins as it once did. That means people with less than $1,400 to spend on precious metals coins migrate to silver. That is born out in the decline in Google searches for “Gold Coins” as prices there spiked in 2010. Bottom line – there is a fundamental lack of confidence among enough people in the population as to the long term soundness of the dollar. We’ll close out on a few positive points and one real problem.

And all the non-government originating charts that's fit to print: Manheim Used Vehicle Value Index and Equity Mutual Fund Flows: Food stamp participation and gold coin sales Silver coin sales, Prices Received, and NCIS Background Checks Pickup truck sales and Consumer confidence Google Queries: "Buy a Gun", "Buy Ammunition", "Food Stamps", "Gold Coins", Gallup consumer spending. |

| Great Depression, Debt and Economic Decline: Ireland, Portugal, Greece, US, UK Posted: 23 Jan 2011 04:36 AM PST (snippet) We have two economic and financial Americas, one of poverty and advancing poverty and one of sumptuous wealth. The top 20% own 93% of financial assets, which could be the seeds of upheaval. The average family is one or two weeks away from starvation and debt collapse. How do you make up the difference working 34.3 hours a week as gasoline rises from $2.50 to $3.50 a gallon and the price of food advances 50%? If you do not own gold and silver related assets to offset these increases you are just plain screwed. If QE2 isn't translating into recovery then QE3 is fast on the way. It will be kicked off later this year or in 2012. It won't work either. Throwing money at a problem never has a positive desired result. Even though other nations have problems the dollar will remain under pressure. The gauge should not be the USDX. It should be every currency versus gold and silver, which are the only meaningful yardsticks. For two years gold and silver have been propelled by a flight to quality. A primary fight between gold and the dollar, which obviously gold has won hands down and will continue to do so. Inflation hasn't even entered the equation yet, but it will this year and next. That will cause gold and silver to roar to the upside along with gold and silver shares. The elitists who control government are about to lose another battle and in the end the war against gold and silver. Since 2000, when we began recommending gold and silver related assets after having exited the stock market in early April, the market is down about 80% versus gold. That means the only reliable guide to value is gold, not the dollar. The dollar has dropped from 13.80 Mexican pesos to 12.00 in a year. Mexico is considered a second world nation and its currency is appreciating versus the dollar. That is becoming typical and will continue to be so. The Mexican economy will grow 4% in 2011, and will have 4% inflation, far better results than in the US, and Mexico has not stimulated its economy. Not only do we have the dollar falling 20% versus gold annually, but also we have the dollar falling versus inferior currencies. That means creditors of US Treasuries are receiving a negative return of over 6%. What can they be thinking of? This is a form of default. Even with these conditions the stock market reflected by the Dow will probably trade between 10,000 and 13,500, while gold and silver again gain a real 20% plus, year after year, as long as budget deficits climb. More Here.. |

| Gold and Silver tocks Converging towards a Major Uptrend Posted: 23 Jan 2011 04:12 AM PST We are now seeing a convergence of indications that a reversal in the Precious Metals sector is at hand that will lead to a major uptrend soon. The last Gold and Silver updates posted on 11th January were bearish over a short to medium-term time horizon and have been proven correct as gold and silver have since fallen substantially, and stocks have taken a real beating. However, in view of the current strongly bullish constellation of indications, it now looks like the downside targets for gold and silver were set too low, although our downside target for stocks has just been hit. |

| Silver Close to Reversing to the Upside Posted: 23 Jan 2011 04:00 AM PST While silver has performed as predicted in the last update posted on 11th January and has broken to successive new lows as its correction has progressed, it does not now look like it will drop to the downside targets that we earlier projected. Instead it now looks like we are very close to a reversal to the upside. |

| How will they will prop up stocks after QE? An answer? Posted: 23 Jan 2011 03:59 AM PST Bernanke has told us at least a half-dozen times that the primary objective of QE is to jack up stock prices. Let’s give the man his due. It has worked. Rising equities and an improving economy are now synonymous. Daily doses of QE through POMO purchases are creating liquidity. Some of that loose money finds its way to equities.

The conclusion of the report regarding the 2004 tax holiday for US corporations: Estimates indicate that a $1 increase in repatriations was associated with a $0.60-$0.92 increase in payouts to shareholders.

|

| Money & Markets - Week of 1.23.11 Posted: 23 Jan 2011 03:00 AM PST |

| Precious Metals - Week of 1.23.11 Posted: 23 Jan 2011 02:45 AM PST |

| The Only Stocks I'm Telling My Retired Friends to Buy Right Now Posted: 23 Jan 2011 01:37 AM PST Dr. David Eifrig writes: "I'm worried, Dave... There's so much talk everywhere about collapse and the end of the world. What should I do?" Like many retirees, my mom is bombarded all day long on TV and radio with talk of financial collapse and how bad off America is. Many of these commentators expect a hyperinflation that will wipe out bonds and the value of the dollar. Their top recommendations are to stock up on bottled water, canned food, and gold bullion. |

| Posted: 23 Jan 2011 12:58 AM PST Ben Comston submits: The debate between fiat currency and variations of the gold standard is intensely political as much as it is economic. My aim is not to discuss the virtues of either system or comment on policy; rather I would like to discuss the realities of present monetary policy in terms of its effect upon the price of gold in the context of value investing. Value investing can be a rather generic term. The core of value investing, though, is the assigning of value to assets, determining the precision of the assigned value and then inferring an appropriate margin of safety. Can this form of analysis be done with gold the same as it often is in regards to corporate bonds or equities? And if so, what does it say about the attractiveness of gold at its current price of $1,341? Before answering the question, first consider a brief review of gold's use as money in the United States. Complete Story » |

| Greenspan Advocates a Gold Standard: For Now, Expect Near-Term Declines Posted: 22 Jan 2011 11:17 PM PST Garrick Hileman submits: Some choice comments on gold from the former Federal Reserve Chairman previously made on Fox Business News:

Complete Story » |

| Commodities Continued to Sizzle in 2010 Posted: 22 Jan 2011 10:34 PM PST Frank Holmes submits: If 2009 was a recovery year for commodities, 2010 was the year they regained their crown. The Reuters-Jeffries CRB Index jumped 17.44 percent in 2010. Combined with 2009’s 24 percent gain, the CRB has climbed nearly 45 percent off 2008 lows. Twelve of the 14 commodities we track were in positive territory in 2010 and nine of them saw gains exceeding 20 percent. That’s in stark contrast to the bloodshed of 2008 when gold was the only commodity not in the red. Complete Story » |