saveyourassetsfirst3 |

- High Wages and Economic Prosperity, Part I

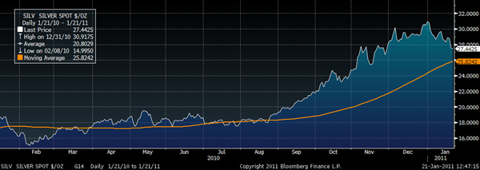

- Silver in Backwardation in London, silver OI refuses to fall/margin levels rise in silver/gold

- Unusual COT Action, Bullion Banks Cover Shorts, Swap Dealers Hammer Gold

- Gold Moves Lower as Stocks Reach Their Key Resistance Level - Whats Next?

- Gold Standard Fully Supported by Alan Greenspan

- Stunner: Gold Standard Fully Supported By... Alan Greenspan!?

- Interview With John Hathaway

- China buys gold and the world follows

- James Turk - Silver in backwardation, set to explode

- Unbacked Money, 40 Years On

- Monetary Aspects of the Gold Price

- 10 Dividend Champions: Lowest Yields, Highest Total Returns

- Bernanke the Alchemist

- Three Gold and Silver Stock Picks for 2011 and Beyond

- Friday ETF Roundup: GDX Sinks on Gold Pessimism, JJC Regains Lost Ground

- Huge Numbers Of Dead Animals, Dead Birds And Dead Fish – What In The World Is Happening Out There?

- State of the States

- Palladium's Perfect Storm for the Automakers

- China’s US Assets Fall With the Dollar

- Chinese Silver Demand Quadruples in One Year - A Lesson for the West?

- Jim Cramer Is Better Than You Think

- Gold Seeker Weekly Wrap-Up: Gold and Silver Fall Over 1% and 3%

- JPMorgan: Stay bullish... buy this dip

- Gold Moves Lower as Stocks Reach Their Key Resistance Level – What’s Next?

- COT Silver Report - January 21, 2011

- GGR Not Darth Vader, “Darth Vulture”

- Gold Hits Two-Month Low, "Pressured by ETF Selling"…

| High Wages and Economic Prosperity, Part I Posted: 22 Jan 2011 04:47 AM PST In my writing, I typically focus upon exposing the current economic myths and deceptive propaganda which continually emanate from the mainstream media. However, thanks to some recent questions and materials supplied by readers, I have found my gaze drawn back through time. In this look back, I have come across economic myths and propaganda which are nothing less than shocking. For more than four hundred years, Western economies (and the deluded theorists who have been allowed to guide those economies) have focused upon two extremely simplistic and somewhat opposite "models" for our economies. In this respect, I am indebted to John Maynard Keynes. While Keynes may have been utterly inept as an "economist", he is more than adequate as a "research assistant". Keynes tells us that the older of these too economic models (by far) is "mercantilism", while the more recent theoretical model is that of "free trade". For those readers who become phobic whenever exposed to economic jargon, relax. I have no intention of bombarding you with complex jargon. Indeed, as I alluded to earlier, these economic models are shocking for their simplicity (among other things). Both of these models centered on the need to have a "balance of payments" surplus for one's economy. There is nothing controversial here. A nation having a balance of payments surplus is like a corporation which makes a profit. No nation (or corporation) can survive over the long term as a money-losing enterprise. However this aspect of economic theory has obviously been totally (and conveniently) forgotten by all of our politicians and all of our modern "theorists" (i.e. banker apologists). For the benefit of the precious metals enthusiasts out there, the "surpluses" that these nations and economists coveted above all else were not surpluses accumulated in banker-paper, but rather surpluses of gold and silver. For more than four centuries, those who accumulated the gold and silver were considered history's winners, while those whose gold and silver was taken from them were the losers. We can see the obvious result of such thinking through the rampant corruption of modern, Western precious metals markets. Mercantilism is by far the older of these two economic models, and can be thought of as an "adversarial" system of economic management. In this law-of-the-jungle philosophy, nations aggressively sought to out-maneuver competing nations in creating their balance of payments surplus – in the simplistic belief that there could only be "winners" and "losers" in any economic system. If you didn't try to "screw the other guy" then they would certainly try to "screw" you. Conversely, free trade is a much more cooperative economic system, in that thanks to the wonders of "comparative advantage" it was theoretically possible that most (or even all) economies could simultaneously be "winners". To reiterate, this is all simple stuff. The doctrine of comparative advantage stipulates that if all nations focus on producing the goods/services which they can produce the best, then through the mechanisms of "free markets" and global commerce an optimal equilibrium can be achieved where (in theory) everyone is a winner. While free trade can immediately be seen as a more enlightened approach to global commerce, it should not be seen as some "theoretical breakthrough". Rather, all it did was to mirror the general change in attitude in Western cultures, which (for the first time in history) sought to use diplomacy and negotiation as the principal tools of "foreign policy" rather than war, and more war. Mercantilism was an economic model of "constant war", while free trade was a model (supposedly) based upon cooperation and mutual advantage (i.e. enlightened self-interest). Keynes characterizes mercantilism and free trade as being in many respects opposite to each other, yet notes that both schools of thought have some shared beliefs. Here is where this previous theoretical work becomes interesting. Any time more-or-less opposing views share a common belief, this is highly suggestive that such a belief is flawed (with respect to at least one of the competing theories). While it is possible for opposing systems to share valid, common beliefs/goals, such scenarios clearly represent the "exception" rather than the "rule". With respect to my own analysis, the shared belief in which I am most interested is the belief of both schools of theorists that minimizing wages (for the average worker) was a critical component of economic prosperity. Some will accuse me of twisting the meaning of the work of Keynes and others here, in that these renowned theorists typically talk about the virtues of a "stable wage-unit". I would argue that such double-talk is very transparent. Look into the work of these theorists in detail, and we will observe a remarkable 'coincidence'. All of these theorists warn of the "great danger" of rising wages (i.e. wages being too high), but none of these theorists have ever been able to see any harm in falling wages (i.e. wages being too low). Indeed, all that low wages have ever represented to these titans of economics are high profits for corporations (i.e. the very wealthy who own those corporations). Clearly, an economic system which possesses a large, permanent, extreme bias against "high wages" while having demonstrated a multi-century "love affair" with low wages is not a system which believes in keeping wages "stable", but rather in keeping them as low as possible. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver in Backwardation in London, silver OI refuses to fall/margin levels rise in silver/gold Posted: 22 Jan 2011 03:18 AM PST | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Unusual COT Action, Bullion Banks Cover Shorts, Swap Dealers Hammer Gold Posted: 22 Jan 2011 02:59 AM PST More unusual action in the positioning of the largest traders of gold futures in New York surfaced in the Commodity Futures Trading Commission (CFTC) Commitments of Traders (COT) Report released Friday, January 21. The report is for large trader positioning as of the close on Tuesday, January 18. Gold closed Tuesday at $1,367.91, down $13.27 the ounce from the previous Tuesday. From the disaggregated COT data, it is pretty clear who was behind this week's weakness in the gold bullion market, and it wasn't the big U.S. reporting banks – this time. ... | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Moves Lower as Stocks Reach Their Key Resistance Level - Whats Next? Posted: 22 Jan 2011 01:00 AM PST | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Standard Fully Supported by Alan Greenspan Posted: 21 Jan 2011 11:34 PM PST On Wednesday, the COMEX experienced an epic event in the silver spread market. GLD ETF adds 653,831 ounces. SLV ETF has withdrawal of 4,249,437 ounces. Interview with Jim Rickards and John Hathaway...and much more. ¤ Yesterday in Gold and SilverAs I mentioned in this column yesterday, I'm at the Vancouver Resource Conference...and this column is going to be as short as I can make it. The gold price didn't do much on Friday anywhere on Planet Earth...and the low price tick [$1,337.00 spot] occurred in New York minutes after 9:30 a.m. Eastern time. Gold then traded sideways for the rest of the day...and closed down $3.20 from Thursday's close.

Silver's trading pattern was similar, but it hit a new low for this move down when 'da boyz' pulled their bids shortly before the London open at 8:00 a.m. GMT...and the tech funds found themselves selling into a vacuum...and down went the price. The low was around $27.05 spot. From there, the silver price recovered about fifty cents...and actually closed the New York trading session up 6 cents on the day.

Despite how poorly gold and silver did in the face of a declining dollar, platinum finished up $17 on the day...and palladium rose $11... up 0.94% and 1.36% respectively. The dollar, which hit its high around l1:00 a.m. Eastern time on Thursday, continued to decline in fits and starts through the rest of Thursday's...and all of Friday's...trading day, closing on its absolute low of the day. From the top to the bottom, the dollar was down about 102 basis points...and down 70 basis points of that during Friday's trading session. There was, of course, no sign of that big dollar decline in either the gold or silver price action.

The gold stocks tried mightily to stay in positive territory on Friday but, in the end, the HUI finished down 1.01%...and I wouldn't read much into that. Here's the 5-day HUI chart...and as you can tell, most of the damage came on Thursday's smash-down.

The CME Delivery report showed that 10 gold and 27 silver contracts were posted for delivery on Tuesday. Much to my surprise, the GLD ETF showed a very large addition yesterday...up a whopping 653,831 troy ounces. But the SLV ETF headed in the other direction with another monstrous withdrawal. This time it was 4,249,437 ounces. That's the second withdrawal of 4+ million ounces this week. The first one was on Tuesday...and that one was 4.5 million ounces. Since the beginning of the year, 17.0 million ounces have been withdrawn from SLV...and very little of that would be because of the price action. It's obvious that, for whatever reason, large amounts of silver were urgently needed elsewhere. The U.S. Mint had a sales report yesterday. They sold another 7,500 ounces of gold eagles...along with another 136,000 silver eagles. Month-to-date...83,000 ounces of gold eagles have been reported sold, along with 4,724,000 silver eagles. That's a silver/gold sales ratio of 57 to 1. I hope you're getting your share. Over at the Comex-approved depositories, they reported a net withdrawal of 204,379 ounces of silver from their warehouses on Thursday. The Commitment of Traders report [for positions held at the close of trading on Tuesday, January 18th] was interesting. In silver, the Commercial open interest only fell 1,382 contracts...dropping the Commercial short position down to 226.8 million ounces. The '4 or less' bullion banks are short 202.8 million ounces...and the '8 or less' bullion banks are short 259.1 million ounces. Both Ted and I were expecting a somewhat bigger improvement. But it was gold that was the big surprise, as the Commercial open interest fell a very large 18,591 contracts, leaving the Commercial net short position at 20.65 million ounces. Ted says it's been a couple of years since the Commercial net short position has been this low. The '4 or less' bullion banks are short 16.9 million ounces...and the '8 or less' bullion banks are short 23.4 million ounces. The other thing to note about gold this week was that the technical funds went massively short to the tune of 12,379 contracts...or 1.24 million ounces. In both gold and silver, Ted noted that it was the raptors...all the traders not in the '8 or less' category...that covered a lot of short positions this past week. This is absolute proof that not only is JPMorgan heading for the exits...so is everyone else. Without doubt, there was further improvement in the bullion banks' short positions in both metals since Tuesday's cut-off...especially after the hammering they both took on Thursday. I'd give a day's pay to see what the open interest numbers are now, without having to wait until next Friday. Here's Ted's "Days to Cover Short Positions" graph that's courtesy of Nick Laird over at sharelynx.com.

Ted had a couple of things to say in a private note to clients early on Friday. The first was this..."The sole reason for this latest swoon in the price of silver is coordinated and collusive manipulation upon the part of the big commercial interests, including JPMorgan, on the CME Group's Comex market. I realize that I have to make this statement repeatedly whenever there is a significant sell-off in silver. I don't set out to be repetitive, nor do I have my mind made up in advance; it's just that commercial manipulative behavior always stands out as the sole cause of every silver sell-off. Certainly, one would think if it weren't so clear, that the commercials were engaged in collusive illegal behavior on what I call a criminal enterprise of a market [the CME], one of them would object to my characterization of them as crooks. I'll let you know when, and if, that occurs." "Collusion is a strong word. I don't use it loosely. It's easy for me to label the large Comex commercial trading entities as operating collusively on this sell-off, because they have operated collusively on every silver sell-off over the past 25 years. The proof is simple and clear...and contained in CFTC data...and both the COT and Bank Participation Reports. This sell-off...and every sell-off...have always been met with uniform commercial net buying. There has never been an exception to this pattern. How is it possible that the big commercials can always find themselves to be net buyers on every sell-off? Easy--they are acting collusively. In fact, considering their easily-documented history, it is not possible for them not to be acting collusively. How otherwise could one cohesive group always end up buying big on every decline?" Then there was this comment on what happened in the silver spread market earlier this week. This is only two of the many paragraphs that silver analyst Ted Butler used in his explanation...and I don't completely understand it myself... "On Wednesday, the Comex experience an epic event in the silver spread market. Let me state this clearly--the spread difference between the various trading months in Comex silver futures experienced the largest price changes in history. The price direction of the spreads was to relative price strength in the nearby months...and weakness in the more deferred months; a dramatic "tightening" of the spreads that may be a precursor to backwardation, or a premium developing on the nearby months. Let me by frank--I'm not sure what this monumental spread price move may mean at this point. There is no news from knowledgeable and trusted observers, just that the market changed." The spread tightening was unusual in that it didn't appear driven by delivery considerations. Generally, spread pricing is more gradual and trending than the sharp out-of-nowhere event that occurred on Wednesday. It appeared to be driven by spread traders for financial reasons. The tightening was completely at odds with the dramatic fall in the price of silver these past few days, as such spread tightening would normally be thought to result in sharply rising silver prices. Instead, the opposite occurred. I don't know how this is connected to the manipulation, but I have been conditioned to believe that there can be no coincidences in a market as crooked as silver. I don't mean to leave you with more questions than answers regarding the spread event, but I don't want to make things up. I'm sure we'll know more as time rolls on."

¤ Critical ReadsSubscribeIrish government falls and calls 11 March pollToday's first story is courtesy of reader "Nick in San Diego". It's from The Independent in Ireland and bears the headline "Irish government falls and calls 11 March poll". The Irish Government collapsed yesterday, with multiple ministerial resignations propelling Prime Minister Brian Cowen into setting 11 March as the date for a general election. His Fianna Fail party, which dominates the government, is widely expected to be largely wiped out in the contest, since under the Cowen leadership it has slumped to unprecedented depths in opinion polls. The Irish Government collapsed yesterday, with multiple ministerial resignations propelling Prime Minister Brian Cowen into setting 11 March as the date for a general election. His Fianna Fail party, which dominates the government, is widely expected to be largely wiped out in the contest, since under the Cowen leadership it has slumped to unprecedented depths in opinion polls. This is worth the read...and the link is here.  Spain to rescue its banksReader Roy Stephens provides the next story which is out of yesterday's edition of The Telegraph. The Spanish government is set to launch a sweeping restructuring of its troubled regional savings banks in an attempt to reassure the market it can sort out the problems of its financial system. The headline reads "Spain to rescue its banks"...and the link is here.  The World is sinking: Dubai islands 'falling into the sea'Here's a real cute story from reader U.D. out of Thursday's edition of The Telegraph. The headline falls into the "you can't make this stuff up" category...and reads The World is sinking: Dubai islands 'falling into the sea'. The islands were intended to be developed with tailor-made hotel complexes and luxury villas, and sold to millionaires. They are off the coast of Dubai and accessible by yacht or motor boat. Now their sands are eroding and the navigational channels between them are silting up. This is definitely worth your time...and the link is here.  China buys gold and the world followsThe rest of the stories are, more or less, all precious metal related in one form or another. This first is a piece from marketwatch.com that's headlined "China buys gold and the world follows". It's contained in this GATA release of the same title...and the link is here.  James Turk - Silver in backwardation, set to explodeThe next one is from King World News. Chris Powell's preamble reads GoldMoney's James Turk told King World News yesterday that silver is in backwardation a year out and the last time this happened, silver exploded 40 percent in a few weeks. May the excerpts of this interview find their way to the Great Market Manipulator's ears, and we don't mean Bernanke. The headline reads "James Turk - Silver in backwardation, set to explode"...and the link is here.  Stunner: Gold Standard Fully Supported By... Alan Greenspan!?Here's a shocker for you. Tyler Durden at zerohedge.com reports that former Fed Chairman Alan Greenspan, the chief of the bubble blowers, has just remarked to Fox Business that the gold standard m | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Stunner: Gold Standard Fully Supported By... Alan Greenspan!? Posted: 21 Jan 2011 11:34 PM PST Image:  Here's a shocker for you. Tyler Durden at zerohedge.com reports that former Fed Chairman Alan Greenspan, the chief of the bubble blowers, has just remarked to Fox Business that the gold standard might be a preferable monetary system. The last time he said that was back in 1966 when he wrote an essay entitled "Gold and Economic Freedom" to be included as a chapter in Ayn Rand's new book called Capitalism: The Unknown Ideal. The headline reads "Stunner: Gold Standard Fully Supported By... | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 21 Jan 2011 11:34 PM PST Image:  My last item is yet another interview that Eric King sent me a few moments ago. This is an Interview With John Hathaway, chief investment strategist with the Tocqueville Fund. This is another interview that I haven't listened to either...but he's also another person in the gold world that I have lots of time for. Eric says it's an 'outstanding interview'...and I have no reason to doubt him...and the link is here. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| China buys gold and the world follows Posted: 21 Jan 2011 11:34 PM PST Image:  The rest of the stories are, more or less, all precious metal related in one form or another. This first is a piece from marketwatch.com that's headlined "China buys gold and the world follows". It's contained in this GATA release of the same title...and the link is here. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| James Turk - Silver in backwardation, set to explode Posted: 21 Jan 2011 11:34 PM PST Image:  The next one is from King World News. Chris Powell's preamble reads GoldMoney's James Turk told King World News yesterday that silver is in backwardation a year out and the last time this happened, silver exploded 40 percent in a few weeks. May the excerpts of this interview find their way to the Great Market Manipulator's ears, and we don't mean Bernanke. The headline reads "James Turk - Silver in backwardation, set to explode"...and the link is here. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 21 Jan 2011 10:01 PM PST Soft Gold Prices without hard-money rates? Not for long... | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Monetary Aspects of the Gold Price Posted: 21 Jan 2011 04:45 PM PST | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 10 Dividend Champions: Lowest Yields, Highest Total Returns Posted: 21 Jan 2011 01:41 PM PST Chuck Carnevale submits: The importance of dividends cannot be disputed or denied. To paraphrase Will Rogers, dividends provide investors both a return of and a return on invested capital. Consequently, in addition to augmenting returns, dividends also simultaneously reduce risk. Each time a dividend is paid to an investor, the investor has less capital at risk equal to the amount of the dividend paid. As an aside, this important point is often left out when people are calculating yield on cost. Even though this return of capital is a great benefit, it also can require a new investment decision if the investor is not spending the dividends. One way to handle this is to only invest in dividend paying companies that offer a DRIP (dividend reinvestment program) program. This is a legitimate strategy that takes advantage of the benefits provided by the concept called “dollar cost averaging.” If the price of the stock you are reinvesting in is high, your dividend will buy fewer shares of expensive stock, and conversely, if the price of the stock you are reinvesting in is low, your dividend will buy more shares of the cheaper stock. This is a proven strategy that works in the long run. Complete Story » | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 21 Jan 2011 01:20 PM PST The modern financial system is based on the idea that central bankers can perform alchemy. More specifically, that American central bankers can do so. That is because the US Dollar is the world's reserve currency. And it can be created out of thin air. The idea that people are willing to trade real goods and services for a piece of paper because everyone believes that piece of paper is money is, of course, the most important idea in the world fractional reserve banking. Without that idea a lot less global trade and a slot slower or lower global economic growth. So how did the dollar come to be so central to the global system? Why is its status now in doubt? And if the dollar standard of the last 50 years falls, what will replace it and what will that mean to you as an Australian investor. First, let's clarify what a global dollar standard actually means. Currently, if the Chinese want to buy Middle Eastern oil, they have to buy US dollars and then buy the oil with those dollars. The same goes for other internationally traded goods. That creates an artificial and powerful demand for US dollars. If you want to buy things, you need dollars. But why, then, is this alchemy? Under a gold standard, where gold forms a nation's monetary reserves, any nation that prints too much money or consumes more than it produces (runs a trade deficit) will lose its gold to other nations. How exactly does that work? In the above example, let's say the the Chinese are trading for oil under a gold standard and not a U.S. dollar standard. To buy their oil, they would provide money backed by gold to their Middle Eastern trading partners instead of pure paper U.S. dollars. The key is that the paper money is backed by an redeemable for gold upon demand. Whomever accepts the paper can trade it for gold if they're worried about the value of the paper (or simply more paper). In China's theoretical case, if China bought oil and also ran up a huge trade deficit, it would probably see a net outflow of gold from its bank vaults. Why? Debtor countries tend to pay off debts the easy way, by inflating the paper currency. Holders of the paper currency under a gold standard can prevent this effective devaluation by simply asking for gold. In this way, during the first "golden age" of globalisation in the late 19th and early 20th century, the gold standard enforced sound fiscal and monetary policies over the world. It prevented large structural imbalances in the global economy because debtor countries always risked losing their gold if they accumulated too much debt and tried to inflate it away. By taking the world off the gold standard and making US dollars an unbacked global reserve currency, you have a new revelation. Nations other than the US need to buy US dollars to trade. They'd agree to this (or have so far) because everyone else used the dollar to. It was convenient (liquid) and with the largest economy in the world for many years, the U.S. currency was also the most stable and reliable store of value. The flaw in the design of the dollar standard system is that the US Federal Reserve can simply print more dollars to pay for its overseas spending sprees. This is convenient, as it costs nothing to create US dollars. The American economy cannot run out of what needs to be handed over when it runs trade deficits. It simply prints more dollars. Charles De Gaulle is said to have called this an "exorbitant privilege". Of course, other nations can simply create more of their currency too. But when they do, those currencies usually lose purchasing power. No one wants to own money that's declining in value as its supply increases. But dollars have been able to retain value despite the increasing supply because of the artificially high demand for them. They are used not just for trade in the US, but trade on international markets too. The US is not punished for printing too much money in the same way that other country's would be. However, that doesn't mean that price inflation from printing US dollars doesn't occur. All the dollars flooding the system can cause inflation of the internationally traded goods. That's exactly what is happening now. And it's why many commodities - especially food - are making new highs. Crucially, then, Americans can print money without necessarily experiencing the inflation themselves. Because export economies prefer weak currencies to spur their growth, many of them offset any decline in the value of the dollar by printing their own currency. The Chinese peg their currency and are forced to print money to maintain this peg. By doing so, they fuel inflation in their own nation. They import the US's inflation. That's why inflation in nations other than the US continues despite attempts to slow it. Of course, the artificial demand for US dollars as the reserve currency extends to dollar denominated assets for the same reasons. Many internationally traded goods can be paid for using US Treasuries, for example. That in turn creates an artificial demand for US Treasuries. This allows US politicians to run the deficits they do. If you think all of this is just theoretical rambling, consider the comments made by the Chinese President Hu, as printed in the Wall Street Journal:

The tendency for inflation to cause such tensions shows how powerful a force it is. It influences trade, fiscal balances and capital flows. That is why Austrian Economists base their explanation of the business cycle on inflation of the money supply. And it explains how poor monetary policy in the US can cause a global boom and bust. But what if America's control over currency reserves comes to an end, as President Hu suggests? What if the US dollar loses its reserve currency status and all this artificial demand for its money and debt disappears? Before looking at the consequences, is there any reason to believe it might happen? Certainly. As a matter of course, empires come and go. So do their currencies. The list of examples is long. The signs now are ominous for the US empire. The Congressional Budget Office's more realistic projections, according to economic historian Niall Ferguson, include interest payments at 85% of government revenue in 2050. The government will barely be able to repay interest, let alone any government services. The choices then are default, inflation or austerity. Austerity can probably be ruled out based on the projections of the CBO. Default is the best option according to Bill Bonner and Iceland's economy is forging ahead with proof. But inflation is the likely outcome. Hence the Daily Reckoning's regular mention of gold. Back to that in a moment. How do the all too regular episodes like this usually end? The British Pound held reserve currency status before the US dollar did, although with gold as the ultimate reserve. As the British discovered, losing this status is painful to say the least. Just Google "the winter of discontent". Inflation, shortages, picket lines around hospitals, even grave diggers packed up their work for strikes. Maybe the world will move from one reserve currency to another at some future political summit. More likely is that countries will turn around and demand a form of payment that cannot be printed, rather than US dollars, in their international dealings. Whoever does this first will suffer a smaller devaluation of US dollars currently held. Anyone who catches on late will be in for a surprise. So the incentive is to act. Except, of course, for the damage such a move might cause to the global economy. And you probably don't want to be on the wrong side of an angry US President with a furious mob of voters who demand action against those trashing the dollar. Still, at some point the dollar will have to crack and someone or some country will be the first to crack it. Empires tend to end with a military conquest, which features in many sane economists' predictions for the future. The investment atmosphere, then, looks bleak. But it's not all bad news. At least if you aren't American. If you are, consider changing your passport color. Apart from the tough times ahead for the world, things are already looking particularly troubling for those stuck in the States. You might recall the media reporting that international (read Swiss) banks were considering whether to cease serving US clients because of various new laws. Well, now Goldman Sachs has decided to make its offering of Facebook stock unavailable to Americans! An American investment bank, an American company, but no Americans allowed. Goldman blames it on securities law. The key point is that America is falling apart law by law. Not just dollar by dollar. Comments on you Reckoning Portfolio Gold has taken a hit. But relative to what? Paper, or digits on a screen that represent a quantity of paper? Fiat currency will remain what it is, as will gold. Fiat turns to dust (usually in a fireplace after being used as fuel), gold does not. Even you may [may? ☺] die in the long run, but your wealth needn't go with it. That's why gold will continue to feature in the Daily Reckoning's spotlight. But one man seems to have stolen the show when it comes to gold. Robert Griffiths, a technical strategist with investment firm Cazenove, recently outlined his view on the metal on CNBC: "Not owning gold is a form of insanity. It may even show unhealthy masochistic tendencies which might need medical attention." So there you have it. If you don't own gold you're crazy. And from a technical analyst! As for the "gold bubble" commentators, they can't even pick a bubble in their own asset classes, let alone ones they inherently don't understand. Anecdotal Analysis of Europe Despite the lack of riots, strikes and protests, your editor's trip to Europe was eventful. Let's not go down the path of reciting travel misadventures. Instead, here is the impression a few weeks in Europe gave a former resident: Firstly, austerity is accepted. Whether it's students, employees or grandparents, people aren't deluding themselves. They know the party is over and they know things will change. That doesn't mean some fun can't be had in the streets. The French in particular identify with strikes and riots, so that is what they will spend their time doing. But even they acknowledge that austerity is now a given. So despite what you may see on TV, Europe's citizens won't be shutting up shop because their government won't spend money on them. Then again, some will. But it won't be due to a lack of ambition. In fact, quite the opposite. The English in particular are eyeing off Australia as a place to escape to. The opportunities are simply so much better. Young people seem more concerned with opportunity than the cost of their education. Right now, they are getting a raw deal on both, and both thanks to the government. The country we missed on our travels was Ireland. Friends there say times are tough. But not to worry, the money printers have been at work. You will be surprised to know that the ECB wasn't involved. Apparently, "The Irish Independent learnt last night that the Central Bank of Ireland is financing €51bn of an emergency loan programme by printing its own money." About 51 billion Euros! So those economists who told you European governments gave up independent monetary policy were wrong. They kept the historically favoured tool to themselves - printing money. And the ECB isn't bothered, as long as it is notified of the printing. This changes the ball game dramatically, if it's accurate. Frankly, it seems rather suspicious and mindboggling. On Wednesday morning, if you googled "Irish 51 billion" you got a bunch of obscure websites or irrelevant results. By Wednesday afternoon, the story was everywhere. While we may be able to outline trends, and imbalances that will need correcting, the Daily Reckoning does not have eyes and ears amongst decision makers. Who knows what the likes of Ben Bernanke, Lloyd Blankfein and Silvio Belusconi are up to? Occasionally information will leak. None of the true stuff will be good. As an aside, can anyone tell me if this article is satirical or not? Similar Posts: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Three Gold and Silver Stock Picks for 2011 and Beyond Posted: 21 Jan 2011 12:54 PM PST Robert Kientz submits: I have been researching gold and silver miners for awhile now, but had not invested because there were just too many choices. I couldn't get a handle on them all, and I tend to examine the entire marketplace before plunging in. Hence, no positions. Each prospect takes time to research, compare financials, resource reports, compare to market fundamentals, and against their competitors. But using a couple of methods, I have finally narrowed my picks to three which I present here. These may be different from your top three, and that is fine because in this segment of the market there will be many winners as fundamentals of gold and silver are bullish. Complete Story » | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Friday ETF Roundup: GDX Sinks on Gold Pessimism, JJC Regains Lost Ground Posted: 21 Jan 2011 10:10 AM PST ETF Database submits: Markets failed to respond to solid earnings reports from key market bellwethers as any hope for a strong day was soon squashed by mid-day trading. Still, both the Dow and the S&P 500 managed to finished the day in the green as the Dow jumped by 0.4% while the S&P 500 rose by 0.2%. However, the Nasdaq was not as fortunate, tumbling by 0.6% on the day, a figure that pushed the tech-heavy index down more than 2% for the week. Commodity markets also continued their weakness as both gold and oil resumed their recent tumble with both falling modestly in the session. While most commodities failed to move higher on the day some did manage to surge on continued supply concerns; coffee was up 3.7%, and sugar and lumber both rose by 3.3% as well. In addition to concerns about supplies, a weaker dollar probably helped these soft commodities as the greenback experienced more weakness against the world’s major currencies and especially against its chief rival, the euro. The biggest stories for the market in Friday’s session came as GE (GE) reported robust earnings which helped to buoy a number of companies in the industrial sector. The Connecticut-based conglomerate said that its fourth-quarter earnings rose 31% to $3.9 billion, beating estimates by four cents a share. Investors were especially bullish on the company’s order book; overall orders jumped 12% year-over-year while the company’s total deal backlog increased by $3.1 billion to $175 billion. “It’s a pretty strong earnings season,” said Philip Orlando, the equity market strategist at Federated Investors Inc., “U.S. bellwethers reported profits that beat estimates. On top of that, the tone of the economy has changed significantly for the better. That’s a great backdrop for investors who want to take money out of bonds and put it into the stock market. I bet the trend is higher, with the S&P 500 at 1,450 by year-end.” Complete Story » | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 21 Jan 2011 10:05 AM PST

A couple good summaries of the mass bird and fish deaths that we witnessed during the first few weeks of this crisis can be found here and here. Unfortunately, large groups of animals, birds and fish continue to keep dying. The following is just a handful of the reports that have poured in from all over the globe during the past week or so.... -"10,000 Cattle Dead In Vietnam: Cows, Buffalo Part Of Mass Die-Off" -"Beijing reports mass bird deaths" -"Hundreds of dead seals in Labrador" -"55 buffalo die mysteriously on southern Cayuga County farm" -"Two Million Dead Fish Appear in Chesapeake Bay" -"Another Massive Bird Kill in the Tennessee Valley" -"Trapped in ice, 'thousands' of fish die in Detroit River" -"Dead birds from north Ala. being sent to Auburn for testing" -"40,000 Dead Crabs Wash Ashore in U.K." -"First Birds & Fish, Now Hundreds of Cows are Dying" It was easy enough to brush off one or two "mass death" news stories, but when they start coming in day after day after day it really starts to get your attention. So does anyone know why all of this is happening all of a sudden? Well, there certainly are a lot of theories being floated around out there. When things like this start happening people start coming up with all sorts of really wild ideas. Posted below is a list of some of the most common theories about these mass death. Some of the theories seem to have some substance to them, while others seem just downright bizarre. Theories That Have Been Put Forward To Explain The Huge Numbers Of Dead Animals, Dead Birds And Dead Fish Around The Globe *Changes In The Magnetic Field Of The Earth *Extreme Weather *A Pole Shift *Pesticides *HAARP *Other Secret Government Programs *Cold Weather *"Global Warming" *The Approach Of 2012 *Methane Gas *Loud Noises *Disease *UFOs Are Responsible *Effects Of The BP Oil Spill *The Second Coming Of Jesus *Birds Are Dying Because Of Indigestion *Increased Radiation From The Sun *Large Groups Of Animals Always Die And This Is All Normal Now, it must be noted that a couple of the recent "mass death episodes" can actually be explained. For example, the U.S. government has admitted being responsible for the deaths of several hundred birds in South Dakota. But what about the dozens of other "mass death" reports that have been pouring in from all around the earth? How do we explain all of those? That is something to think about. Hopefully all this will end up being nothing. Hopefully it will turn out that all of this can be easily explained. We certainly don't need any more problems right now. As I wrote about the other day, the entire world financial system is on the verge of collapse. At this point any kind of major event could be the "tipping point" that pushes the global economy into chaos. The world as we know it can literally change overnight. Today a reader emailed me the following video. It is entitled "The Day After The Dollar Crashes", and it takes the viewer through what a potential unraveling of the global financial system might look like. As you watch this, keep in mind that any type of "big event" could set off a panic like this.... | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 21 Jan 2011 09:54 AM PST

01-21 Friday

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Palladium's Perfect Storm for the Automakers Posted: 21 Jan 2011 09:26 AM PST Sean Daly submits:

Complete Story » | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| China’s US Assets Fall With the Dollar Posted: 21 Jan 2011 09:00 AM PST I laughed when I read a Bloomberg story that reported, "China said it would 'welcome' a positive statement from the US on the stability of Chinese-held dollar assets during next week's summit in Washington between President Hu Jintao and President Barack Obama." Apparently, that Bloomberg quote is probably taken from the actual remarks of Chinese Vice Foreign Minister Cui Tiankai, who is quoted to have said, "If the US makes a positive statement on this issue we surely will welcome that." I was chortling away as I thought to myself, "Okay, Chinese dude! We are positive! We are positive about the stability of your dollar assets! Hahaha! We are positive that the purchasing power of your US assets will fall along with the fall in the purchasing power of the dollar, you moron, as the Federal Reserve keeps creating more and more money, so that the government can borrow and spend more and more money, to support more and more people by, unbelievably, bailing out the greedy and the banks, as redundant as that is, with the growth in the national debt (the REAL spending deficit!) now amounting to an astounding 13% of GDP, with all of it adding to the money supply, which means much higher inflation in prices, a cruel misery inflicted on the people by the Federal Reserve because of the increase in tax revenues that, they are sure, will accrue to local, state and federal governments! Hahaha!" That paragraph is a good example of how rude and disrespectful I can be when there is nobody around to hear me, and thus nobody around to say to me, "Stop that delusional, paranoid, xenophobic crap, sir, or I am going to have to ask you to leave the store and stop harassing other customers about how they are stupid, stupid, stupid not to buy gold, silver and oil when the Federal Reserve is creating so insanely much excess money!" So, by not having to answer my critics by telling them, "Shut up!" I put the time to good use by examining the details, and was rewarded when my keen Mogambo Eye For Detail (MEFD) noticed that this Chinese guy is a lowly vice-minister! A vice-minister! This means to me that he doesn't have enough seniority to be a minister, see, or to have any opinion, about anything, that was not the exact same opinion as the minister's, or he is going to find himself selling egg rolls and souvenir T-shirts to tourists at the Great Wall of China. "So," I say triumphantly, "Obviously, his words must be a code of some kind! What nefarious information does it contain, one wonders?" This brings me to the point of all of this, which is that I wish to demonstrate, as the world-wide debut of a fabulous new offering from Mogambo Interstellar Enterprises (MIE), the remarkable Mogambo Translating And Decoding Service (MTADS). To provide an actual demonstration of this exciting, new Mogambo Translating And Decoding Service (MTADS), firstly, let me draw your attention to how we merely input the original statement, in this case the Chinese saying, "China follows very closely the economic health of the United States and vice versa." Watch, then, hopefully transfixed in rapt attention, as I read the input data and seemingly go into a trance-like state, and how, after just a few, short minutes of spinning the words through my head, I cleverly and definitively decode the message to mean, "My superiors told me to say that China is watching you weenies ruining yourselves with your ridiculous economic model of increasing government intrusion into the economy and un-payable debts to finance a lifestyle of grubby profligacy, and we know that you Americans are spying on us and plotting against us, just like you are spying on, and plotting against, The Wonderful Mogambo (TWM), whose fabulous advice to us Chinese dudes was to accumulate as much gold and silver as possible so that we could more easily have a gold standard yuan, which would automatically make the yuan the strongest currency in the world, making the price of our imports fall, fall, fall so low that we could inflate the yuan for years to stoke domestic growth, but without any inflation in the prices of imported food and energy, whose prices keep dropping! Hahaha! You Americans are morons!" A moment's reflection should convince you that the message was correctly decoded, and so, if you are in need of such wonderful decoding services when confronted with other remarks made by other people, remember our motto: "Decoding: Finding out what those sneaky bastards are up to!" If you don't need such powerful decoding services because you just don't care, or because you are stupid, or because you are too cheap to shell out thousands of dollars to some obvious Mogambo huckster running some stupid "decoding" scam that wouldn't fool a pre-schooler, but you just want to invest your money someplace where it is guaranteed to go up in price, then I suggest that you buy gold and silver, because that is what has always happened to their prices in the last 4,500 years whenever any of thousands and thousands of dirtbag governments got so far in debt. And, with a guarantee like that, investing doesn't get easier than that! Whee! The Mogambo Guru China's US Assets Fall With the Dollar originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Chinese Silver Demand Quadruples in One Year - A Lesson for the West? Posted: 21 Jan 2011 08:37 AM PST Mark O'Byrne submits: Gold is flat and silver marginally lower despite dollar weakness this morning. Some market participants are blaming the precious metal sell off on speculation that China may take more monetary action to curb surging inflation. This is unlikely to be the reason for the sharp selloff, rather it looks like another paper driven sell off in the futures market by leveraged players on Wall Street with various motives. Complete Story » | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Jim Cramer Is Better Than You Think Posted: 21 Jan 2011 08:06 AM PST Michael Anderson submits: I always hear and read how Jim Cramer does not know what he is talking about, that he's a fool and just about entertainment and that is it. I used to watch him a lot over a year ago, not to buy stocks he recommended, but to listen to his ideas on different sectors, the overall market, and how he does not have an issue going after poor management. A lot can be blocked out, and there is some that is not useful, but for the most part I believe Cramer does a good job. 2010 actually ended up being a good a year overall for the markets, with a good amount of volatility. In actuality, an individual can use Cramer as a strategy and have a chance to beat the market. Now, if one was to just take all of his recommendations blindly, that may not be the best idea. What an individual can do is take the stocks he goes about in-depth and add extra research. What I did to show the results of this "Cramer strategy" is to list 50 of his recommendations from January 5-February 8, 2010. Here is how I chose the stocks:

With those 50 stocks, making the buy date one day after the recommendation and the sell date up to today, the return was 16.79%. While many investors can beat that mark, that is huge diversification that beat the overall market during that timeframe as well. Just using a strategy to invest $1,000 on each of those, totaling $50,000, the end result would be a value of $58,395. Not so bad given that each holding is only 2% of the overall portfolio. The S&P 500, if an investor were to invest the same $50,000 evenly on January 5, 2010, January 20, 2010, and February 9, 2010, the would have seen a 12.89% return versus Cramer’s 16.79%. That is a difference of 3.9% or $1,950 using the example of $50,000. Of those stocks listed, he was right the large majority of the time, as 38 out of 50 were either even or positive, which makes 76%. While there would be some flaws in just following this idea, because it only shows a small time frame and does not emphasize research, it is another tool and idea that is at the very least interesting. If an individual were to follow this, but do additional research on top of it and add a larger position to the “better stocks,” there is a possibility for an even higher gain. This is not something I would utilize myself, but I thought that it was a valuable portfolio idea and something to think about. I also think Cramer deserves a little more respect for the knowledge that he does hold and share. I was always curious about his actual results on the stocks he went in-depth about; based on that data that I gathered, his results are pretty good. It would be interesting to go a little further and see his results throughout a longer timeframe using the same approach. Disclosure: I am long AAPL. Complete Story » | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Seeker Weekly Wrap-Up: Gold and Silver Fall Over 1% and 3% Posted: 21 Jan 2011 07:37 AM PST Gold climbed $3.10 to $1350.50 in Asia before it fell to as low as $1337.55 by about 9:30AM EST, but it then bounced back higher into the close and ended with a loss of just 0.35%. Silver fell over 1% to $27.095 in Asia before it jumped up to $27.61 in late morning New York trade, but it then fell back off into the close and ended with a loss of 0.15%. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| JPMorgan: Stay bullish... buy this dip Posted: 21 Jan 2011 07:29 AM PST From Bloomberg: U.S. equity strategists at JPMorgan Chase & Co. say this week's slump is a buying opportunity because monetary policy is supportive and the economy has positive momentum. The group led by Thomas J. Lee identified 19 stocks, which they forecast to gain at least 10%, including Citigroup Inc., Hewlett-Packard Co. and Newmont Mining Corp. The Standard & Poor's 500 Index declined 1% on Jan. 19, the biggest one-day drop since November, and has slipped 0.6% to 1,285.46 this week as of 11:27 a.m. New York time today. The measure closed at the highest level since August 2008 on Jan 18. "While we ultimately expect a correction in the March/April timeframe, we are buyers of this current dip," New York-based Lee said in a report today. Faster inflation in other countries means that the U.S. "fully capitalizes on economic growth surprise," because the Federal Reserve is unlikely to raise interest rates before 2013, the strategists said. In contrast to a year ago, indicators for the U.S. such as the Economic Cycle Research Institute's U.S. Weekly Leading Index have been gaining strength, the report said. Money supply also is growing at a faster rate than a year ago, JPMorgan said. The strategists favor financial and consumer cyclical companies, a view they said is widely held. Within the groups, they recommended 19 companies with out-of-favor characteristics including high market value, low price, low price-to-earnings ratios, low price momentum and high quality. The companies are: ACE Ltd. Aflac Inc. Allstate Corp. Bank of America Corp. Bank of New York Mellon Corp. Barrick Gold Corp. Citigroup Inc. Freeport-McMoRan Copper & Gold Inc. General Motors Co. Hewlett-Packard Co. Kohl's Corp. Magna International Inc. Newmont Mining Corp. Nexen Inc. PNC Financial Services Group Inc. Raytheon CO. Symantec Corp. Wells Fargo & Co. Western Union Co. To contact the reporter on this story: Elizabeth Stanton in New York at estanton@bloomberg.net. To contact the editor responsible for this story: Nick Baker at nbaker7@bloomberg.net. More on JPMorgan: JPMorgan: Dollar to become the world's weakest currency OUTRAGE: This megabank is raking in huge profits from food stamps Silver could bring down one of Wall Street's manipulative mega-banks | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Moves Lower as Stocks Reach Their Key Resistance Level – What’s Next? Posted: 21 Jan 2011 07:14 AM PST This essay is based on the Premium Update posted on January 21st, 2011 In our previous free essay we've mentioned that mining stocks are at a particularly important crossroad, and whichever they decide to move is likely to determine the way for the underlying metals as well. In the following article we will put another factor into the equation – the general stock market. In the very long-term S&P 500 Index chart this week, we see that an important resistance level has been reached. This is equal to the late 2008 high, which was followed by a quick and severe decline. The price action, which followed this high towards the end of 2008 and this 1,300 level itself are therefore important factors (from the psychological point of view) from which some possible 2011 projections can be made. According to the classic Dow Theory the signals from the industrial average should be confirmed by the ones seen in the transportation average. Without that a signal does not mean much. Here, we are using this divergence in a slightly different way. In the past few days we have seen a sharp decline in the Dow Jones Transportation Average, without a similar action in the Dow Jones Industrial Average. In order to isolate this relative phenomenon, we have included a transportation:industrial stocks ratio below the price chart. Here, we clearly see that the ratio moved quickly lower recently. Since this signal is quite clear, let's take a look what it meant in the past. The fact is that in the past it was an early warning about the coming decline. In the past, declines such as this were seen to continue for days or even weeks. The implication here further confirms the short-term bearish case for stocks. Speaking of implications, let's take a look below, at our correlation matrix. In this week's Correlation Matrix, the short-term coefficients are not as significant as in weeks past. There appears to be a slight negative correlation between metals and stocks but this does not hold true for silver. The very long-term chart for gold this week shows a key breakdown below the long-term support level. Price has declined below the 50-day moving average and slightly below the rising support line. This latter breakdown however has not been verified. Three days below this previous support level are generally required to verify such a breakdown. Thank you for reading. Have a great and profitable week! P. Radomski Sunshine Profits provides professional support for precious metals Investors and Traders. All essays, research and information found above represent analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mr. Radomski and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above belong to Mr. Radomski or respective associates and are neither an offer nor a recommendation to purchase or sell securities. Mr. Radomski is not a Registered Securities Advisor. Mr. Radomski does not recommend services, products, business or investment in any company mentioned in any of his essays or reports. Materials published above have been prepared for your private use and their sole purpose is to educate readers about various investments. By reading Mr. Radomski's essays or reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these essays or reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise that you consult a certified investment advisor and we encourage you to do your own research before making any investment decision. Mr. Radomski, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| COT Silver Report - January 21, 2011 Posted: 21 Jan 2011 06:45 AM PST | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| GGR Not Darth Vader, “Darth Vulture” Posted: 21 Jan 2011 06:39 AM PST Naturally it never fails that silver or gold tends to rise the day after we are stopped. Speaking tongue in cheek, the amount of the rise the day after our trades are stopped is usually inversely proportional to the vigor we expended in announcing the trade just exited. We hope that we seemed less than vigorous, while being, as Richard M. Nixon might have said, "perfectly clear" that our trading stops were indeed hit yesterday and we are indeed out with our short-term ammo – for now. As we write silver has turned "green" immediately following the close of the floor trading for the week in New York (USD $27.49). Let's call it "light green." | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Hits Two-Month Low, "Pressured by ETF Selling"… Posted: 20 Jan 2011 05:17 PM PST |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

Mercenary Links Roundup for Friday, Jan 21st (below the jump).

Mercenary Links Roundup for Friday, Jan 21st (below the jump).

No comments:

Post a Comment