saveyourassetsfirst3 |

- Gold Outlook 2011: Irreversible Upward Pressures and the China Effect

- Chinese Ag imports up 4x in 2010

- India Markets Friday Wrap-Up: No Respite From Selling Pressure

- Mike Burke: Be Patient; More Yukon Gold Will Be Found

- Gold Vs. the S&P 500

- The Better Commodity Investment: Gold Vs. Agnico-Eagle Mines

- Gold and Silvers Daily Review for January 21, 2011

- “Gold & Gold Stock: Major Buy Signals!”

- Monitoring the ‘Risk Trade’ with the Gold/Silver Ratio

- Gold Investments: Why I Jumped in and Bought Twice this Week

- Precious Metals Whacked By Grim Goldilocks

- Monitoring the Risk Trade with the Gold/Silver Ratio

- Chinese Silver Demand Surges Incredible Four Fold in Just One Year

- Suddenly, Gold Becomes a Pariah

- Jim Rogers: $200 oil is coming soon

- This surprising country could be a great escape from the "End of America"

- This emerging market's credit rating is about to get upgraded...

- Chinese stocks are about to make a HUGE move

- False Dawn Coming In First Half Of 2011 Entices Investors

- Russia to Raise Gold Share in Reserves, Ulyukayev Says

- Gold and Silver to Take Off Despite Weakness

- JPMorgan et al Cover More Silver Short Positions

- Inflationary Guerilla Tactics Resume As Comex, Nymex Hike Margins On Gold, Silver, Cracks, Spreads And Other Products

- Gold Hits Two-Month Low, "Pressured by ETF Selling"…

- The Value Case for Silver

- Gold : How High is High ?

- Which Of The Currencies Of The World Is Going To Crash First?

- Payday for our Silver Trade

- Oh - the recent drop makes sense now (ht ZeroHedge)

- 2011: When M0 Becomes M2

- Part 3- Silver Manipulation Explained

- Why Retirements Are Going Bust, Again

- Massive raid in gold and silver/options exercise on stocks tomorrow

- Der Optimist

- Chinese Silver Demand Surges Four Fold in Year

- Panic Selling Hit S&P 500 & Silver is Next

- The Surprising Price of Wheat

- Hard Landing?

- Gold Seeker Closing Report: Gold and Silver Fall Almost 2% and 5%

- Gold Mining Stocks Trendpower

| Gold Outlook 2011: Irreversible Upward Pressures and the China Effect Posted: 21 Jan 2011 07:07 AM PST As presented by Nick Barisheff, January 6, 2011 at the Empire Club 17th Annual Investment Outlook Luncheon | ||

| Chinese Ag imports up 4x in 2010 Posted: 21 Jan 2011 06:03 AM PST | ||

| India Markets Friday Wrap-Up: No Respite From Selling Pressure Posted: 21 Jan 2011 05:43 AM PST Equitymaster submits: Markets languished in the red throughout the trading session today. Although there were attempts to move into the positive these proved futile, as fresh bouts of selling activity pushed the indices lower. There was no respite in the final trading hour either as the indices closed below the dotted line. While the BSE-Sensex closed lower by around 39 points (down 0.2%), the Nse-Nifty closed lower by 15 points (down 0.3%). The BSE Midcap and the BSE Small cap, however, bucked the trend as they notched gains of 0.2% and 0.5% respectively. Losses were largely seen in IT, FMCG and metals stocks. As regards global markets, most Asian indices closed mixed today, while European indices have opened in the positive. The rupee was trading at Rs 45.68 to the dollar at the time of writing. Complete Story » | ||

| Mike Burke: Be Patient; More Yukon Gold Will Be Found Posted: 21 Jan 2011 05:20 AM PST | ||

| Posted: 21 Jan 2011 05:09 AM PST Eddy Elfenbein submits: In 1980, gold was going for more than 7.5 times the S&P 500. To hit that level today, gold would need to be close to $10,000 per ounce. By July 1999, the ratio had fallen to less than 0.18, which in today’s terms would place gold at $230 an ounce. The ratio then rebounded to 1.37 in March 2009. Since then, gold and the S&P 500 have followed each fairly closely. Since last May, gold has held the upper hand but now the two are starting to get much closer. Complete Story » | ||

| The Better Commodity Investment: Gold Vs. Agnico-Eagle Mines Posted: 21 Jan 2011 04:46 AM PST Peter Mycroft Psaras submits: A century-old debate is still raging in the markets (more so today, with the introduction of commodity ETFs like GLD and SLV), and it has to do with whether it is better to invest in a commodity or in the companies that produce the commodity. The main thrust of this analysis is concentrated in three parts. The first two parts are based on free cash flow (current and historical) and the third is based on historical price action as a gauge of investor sentiment. Complete Story » | ||

| Gold and Silvers Daily Review for January 21, 2011 Posted: 21 Jan 2011 04:31 AM PST | ||

| “Gold & Gold Stock: Major Buy Signals!” Posted: 21 Jan 2011 04:29 AM PST Gold and Precious Metals UUP (US Dollar Proxy) Chart.

SGOL (Gold Bullion Proxy) 6 Mth Chart

Gold Bullion 14 Month Price Chart

Gold Juniors – GDXJ Chart.

GDX 6 Month Chart

GDX. Massive Breakout On 3 Year Chart SIVR (Silver Proxy)6 Mth Chart:

The SuperForce Proprietary SURGE index SIGNALS: 25 Surge Index Buy or 25 Surge Index Sell: Solid Power. Stay alert for our surge signals, sent by email to subscribers, for both the daily charts on Super Force Signals at www.superforcesignals.com and for the 60 minute charts at www.superforce60.com About Super Force Signals: Frank Johnson: Executive Editor, Macro Risk Manager. Email: | ||

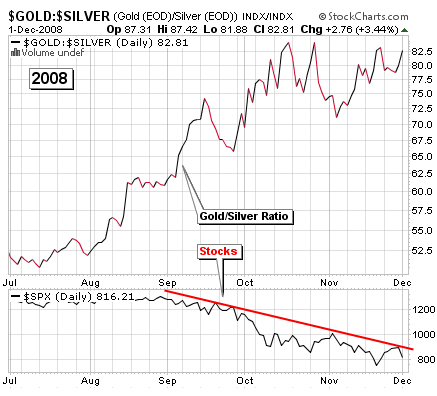

| Monitoring the ‘Risk Trade’ with the Gold/Silver Ratio Posted: 21 Jan 2011 04:17 AM PST The gold/silver ratio is not just for gold bugs; it can help us monitor the appeal of the 'risk on' trade relative to the 'risk off' trade in many markets, including global stocks (SPY) and commodities (DBC). While gold (GLD) and silver (SLV) are often grouped together in investment discussions, gold has more of an Armageddon appeal and silver has more of an industrial appeal. Generally, when the gold/silver ratio is rising, it signals higher levels of fear and concern about the economic outlook. Notice how gold was much more attractive in the minds of market participants during the 2008 portion of the last bear market (see below).

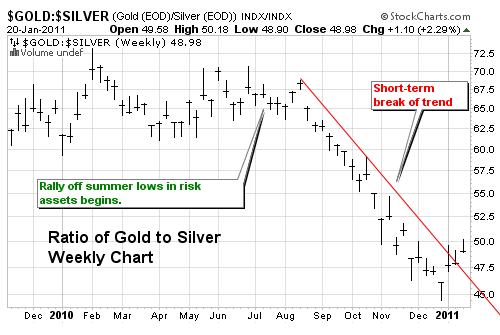

The current gold/silver ratio, shown below, recently broke through the downward sloping trendline that was formed as risk assets rallied off the July and September 2010 lows. While it is too early to read too much into the break of the red trendline shown below, it is worth keeping an eye on.

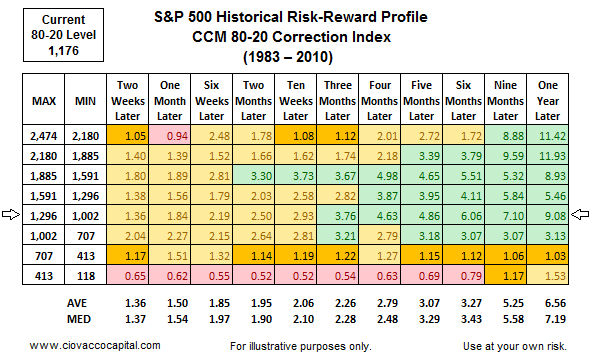

If the gold/silver ratio makes a higher low, followed by a higher high, then our concerns would be increased relative to a possible bout of risk aversion in all markets. As of Thursday's close, the risk-on trade still rules the day. Sentiment and possible overhead key S&P 500 levels are two other ways to keep an eye on the health of the current bullish trends in stocks and commodities. On Thursday, the CCM Bull Market Sustainability Index (BMSI) closed again at 3,745, a level that continues to favor bullish outcomes over bearish outcomes. The CCM 80-20 Correction Index dropped down to 1,176, which historically points to favorable risk-reward conditions for risk investors looking out one-to-twelve months (see table below).

Notice the risk-reward ratio of 3.76, looking out three months, is the most attractive three month ratio in the table. This aligns well with the positive fundamental and technical developments we identified in lateDecember 2010 This entry was posted on Friday, January 21st, 2011 at 9:18 am and is filed under Commodities. You can follow any responses to this entry through the RSS 2.0 feed. Responses are currently closed, but you can trackback from your own site. | ||

| Gold Investments: Why I Jumped in and Bought Twice this Week Posted: 21 Jan 2011 03:22 AM PST

The way I look at the market and the way the majority of other analysts and economists look at the market are two different things. Yesterday, any news site you went to was telling the story of how higher than expected GDP growth in China would cause interest rates to rise there, slowing down the economy and pushing commodity prices down. Rubbish. The prices of commodities are falling, because players are taking some chips off the table, plain and simple. How easily we forget—gold bullion started 2010 at a price of $1,092 per ounce. It ended 2010 at $1,422 an ounce for a one-year gain of 30%. What other investment returned 30% last year? Gold stocks, of course, did even better, with the Dow Jones Gold Mining Index up 34% in 2010. Sure, there are two camps on the gold debate: Those who say that gold bullion is in a bubble that is deflating and those who think that the debasing of the U.S. dollar will push gold much higher over the next two to five years. I'm obviously in the second camp. This morning, gold is at a new two-month low and I'm already hearing the cries that the bull market in gold is over. I heard the same rhetoric when gold bullion fell from $725.00 to $575.00 an ounce in mid-2006 (a 20% correction) and again in 2008, when gold bullion fell in price from $1,000 an ounce in March 2008 to $750.00 an ounce in October of that year (a 25% correction). My view on gold bullion is simple: The metal has been rising in price for almost a decade. The year 2010 was a year many novice investors got into gold stocks. They are getting their "Christening" right now. From its peak of about $1,422 U.S. an ounce, gold is only off about six percent, not much to panic about considering the 2006 correction was 20% and the 2008 correction was 25%. Seasonally, the worst months for gold bullion prices are the period from January to March. It is impossible for any forecaster to pinpoint the exact bottom of the current correction in the gold bullion bull market. Those who have faith in the metal, those who believe that foreigners will have trouble continuing to buy U.S. Treasuries as America continues it path to debt of $20.0 trillion by the end of this decade, and the true gold bugs who believe the status of the U.S. dollar as a world reserve currency will be jeopardy should see corrections in the gold bull market as opportunities. I bought more gold-related investments on Monday and will buy more today, making it twice this week I believe I took advantage of the softness in the gold market. Could I be wrong? Sure, we could all be wrong. But I'll likely be a buyer of more gold-related investments all the way down to a 20% correction. And, if that big of a correction doesn't happen, I believe I'll be happy with the additional investments in the metal I made on its price weakness. Michael's Personal Notes: Solid earnings continue to pile up from large American businesses: General Electric Company (NYSE/GE) reported this morning that its fourth-quarter profit (from continuing operations) jumped 31% to $3.93 billion, beating analyst expectations. GE hiked its dividend twice in 2010. Search-engine company Google Inc. (NYSE/GOOG) said last night that net income in its last quarter jumped 29% to $2.54 billion, beating analyst expectations. And let's not forget the banks: The biggest U.S. home lender, Wells Fargo & Company (NYSE/WFC), said that its net income grew 21% to $3.41 billion in the last quarter, beating analyst expectations. Morgan Stanley (NYSE/MS), which owns the world's biggest stock brokerage house, reported Thursday that its fourth-quarter profit rose 35% to $836 million, beating analyst expectations as well. Collectively, these companies added $10.0 billion to the coffers of shareholders in a single quarter—and they are only four companies. But what do all four have in common? All four saw their quarterly profits increase in the range of 20% to 30%. And all four beat analyst expectations. Who's not beating analyst expectations this year? It's almost like the analysts are keeping their earnings estimates low because the market loves when a stock beats earnings expectations. Finally, do we really expect large American companies to continue to post profits 20% to 30% higher in 2011? Where the Market Stands; Where it's Headed: The bear market rally in stocks that started in March 2009 could be getting tired. I've been writing about how I'm turning bearish on the stock market for 2011, given the sea of optimism I see developing among investors. Yes, in the immediate term, more profits can be squeezed out of this bear market rally, but it is obvious that the easy money in this market has already been made. Tread with caution. What He Said: "The year 2000 was a turning point of consumer confidence in high-tech stocks. The year 2006 will be remembered as the turning point of consumer confidence in the housing market. That means more for-sale signs going up, longer time periods to sell homes, bloated for-sale inventory and eventually lower prices for homes. But this time, the turnaround in consumer confidence will have a bigger impact on the economy. Hold onto your seats, this is going to be a nail biter." Michael Lombardi in PROFIT CONFIDENTIAL, August 24, 2006. Michael started talking about and predicting the financial catastrophe we started experiencing in 2008 long before anyone else. Sign Up for PROFIT CONFIDENTIAL and | ||

| Precious Metals Whacked By Grim Goldilocks Posted: 21 Jan 2011 01:45 AM PST

In last week's global macro notes we noted that precious metals were looking tired. That observation was followed up with an immediate decision to go short (via the four instruments in the chart above).

The following time-stamped commentary is reproduced verbatim from the Live Feed archives:

It took a few days, but the break came shortly after. On Thursday Jan 20th there were ugly downside gaps all across the complex. So what next for gold and silver? We are not long-term bears. But we do think the "Grim Goldilocks" scenario has good potential as a swing trade… In short (no pun intended), Grim Goldilocks is our offhand summation of the following observations, none of which are positive for precious metals:

To be clear, we are NOT long-term bearish on gold and silver. No need for die-hard bulls to lecture on all the reasons gold will soon surpass $2,000 per ounce, silver $50 per ounce, and so on. We know these arguments well. A recent Marketwatch piece, China buys gold and the world follows, also did a fair job of reiterating the bullish case. That is why we stress this idea is "good for a trade" — a confluence of near to medium term factors regarding fundamentals, technicals and sentiment that all augur poorly for the precious metals complex. As usual we employ strict risk management discipline — a standard practice — and at some point we will again become buyers of precious metals when the time is right. | ||

| Monitoring the Risk Trade with the Gold/Silver Ratio Posted: 21 Jan 2011 01:33 AM PST | ||

| Chinese Silver Demand Surges Incredible Four Fold in Just One Year Posted: 21 Jan 2011 01:30 AM PST | ||

| Suddenly, Gold Becomes a Pariah Posted: 21 Jan 2011 01:00 AM PST | ||

| Jim Rogers: $200 oil is coming soon Posted: 21 Jan 2011 12:00 AM PST From Investment Postcards from Cape Town: The price of oil could surge above $200 a barrel, more than doubling from present levels, according to Jim Rogers. As concerns about oil reserves running out heighten, he believes we will see another dramatic rise in price. "Maybe there is a lot of oil in the world. But if there is, we don't know where it is or how to get to it," he says... Read full article... More from Jim Rogers: Jim Rogers: The only assets you must own today Jim Rogers: Silver is one of the few safe refuges left Jim Rogers: Paul Krugman is an idiot... Obama barely knows anything about the world | ||

| This surprising country could be a great escape from the "End of America" Posted: 20 Jan 2011 11:58 PM PST From Sovereign Man: ... September 2004, a small force of separatist Ingush and Chechen militants took over a school in Beslan, North Ossetia, Russia… a small town of 35,000 in Russia's Caucasus region near Georgia and Azerbaijan. The militants held over 1,100 civilians captive, including 777 children. They demanded an end to Russia's counter-insurgency operations in Chechnya, though negotiations quickly broke down in the three-day crisis. Russian security forces ended the conflict by assaulting the school grounds with tanks, rocket launchers, and other heavy weapons, resulting in over 1,000 casualties and at least 156 children dead. ... [T]hese events are unfortunate, infamous examples of hostage situations… and I bring this up because of the numerous email questions we've received lately asking for more information about the 'hostage situation in Chile.' Thank you, Mainstream Media, for once again distorting reality. Fact: There is no hostage situation in Chile. There never was... Read full article... More Cruxallaneous: Porter Stansberry: You must prepare for a crisis NOW Shocking admission from Tim Geithner: U.S. on the brink of catastrophic collapse A huge threat to your freedom is gathering strength (WARNING: extremely controversial post) | ||

| This emerging market's credit rating is about to get upgraded... Posted: 20 Jan 2011 11:45 PM PST From Bloomberg: Fitch Ratings will probably upgrade Russia's credit score this year if the economy continues to expand and the budget deficit and inflation remain in check. Bonds gained the most in two weeks. "I think we will see all these trends and if they are in line with our positive expectations, then it is highly probable that there will be an upgrade this year," Vladimir Redkin, who oversees Russia's rating at Fitch, said in an interview in Moscow. Fitch last changed its score for Russia in February 2009, cutting it one step to BBB, the second-lowest investment grade. It put Russia on "watch positive," indicating optimism, last September and will probably issue a new rating this September, Redkin said. Standard & Poor's ranks Russia the same as Fitch, while Moody's Investors Service rates the country one level higher at Baa1, the same as Ireland. The country's sovereign dollar bonds maturing in 2020 climbed the most in two weeks, pushing the yield down 7 basis points to 5.039 percent. Dollar debt due 2015 rose the most since Jan. 4, lowering the yield 9 basis points to 3.600 percent. The ruble was little changed versus the dollar at 29.9873 by 1:15 p.m. in Moscow. Russia in 2009 ran its first budget deficit in a decade amid the global recession and had one again last year, when it reached 3.9 percent of gross domestic product. Finance Minister Alexei Kudrin has said the shortfall may shrink to as little as 3 percent of GDP this year, when the budget is based on an average oil price of $75 a barrel. Urals, Russia's main export blend of crude, closed yesterday at $92.65. Euro Turmoil In contrast to Russia, there is a continuing risk that euro-region nations will have their credit ratings downgraded because of episodes of market turmoil, David Riley, head of sovereign ratings at Fitch in London said in the slides of a presentation due to be given today. Russia's rating is at a "turning point," with upgrades likely within six months, Commerzbank AG said this week. Higher oil prices may allow the government this year to balance the budget and increase its stockpile of foreign currency by about $50 billion from $477.5 billion, said Barbara Nestor, an emerging-market specialist at the Frankfurt-based bank. "We expect them to narrow the deficit," Redkin said. "What is important is the downward trend." The budget gap narrowed to 3.9 percent of GDP last year from 5.9 percent in 2009 when the economy shrank 7.9 percent. The government forecasts the shortfall will decline to 3.6 percent this year, 3.1 percent in 2012, and 2.9 percent in 2013. Economic Expansion The economy of the world's biggest energy exporter expanded 3.7 percent in the first 11 months of last year and probably met the full-year target of 3.8 percent growth, Economy Minister Elvira Nabiullina said last month. GDP growth is set to reach an annual 4.2 percent this year, according to government forecasts. "If economic growth continues and exceeds growth in 2010, if authorities manage to curb inflation, then they are definitely factors to changing the outlook and upgrading Russia," Redkin said. The risk of accelerating inflation is higher than that of slowing economic growth, Bank Rossii First Deputy Chairman Alexei Ulyukayev said in London yesterday. "It will be very, very difficult" to reach the central bank's "ambitious" 6 percent to 7 percent inflation target, he said. Privatization Plan Another factor supporting an upgrade is the government's three-year plan to raise at least 1 trillion rubles ($33 billion) selling assets, Redkin said. "It means revenue into the budget and more competitiveness in the market," he said. The government plans to sell stakes in Russia's biggest companies, including OAO Sberbank and VTB Group, the nation's largest lenders, shipper OAO Sovcomflot, and OAO Novorossiysk Commercial Sea Port. The country's last major asset sale was in 2007, when VTB raised $8 billion in the biggest initial public offering that year. To contact the reporters on this story: Emma O’Brien in Moscow at eobrien6@bloomberg.net; Maria Levitov in London at mlevitov@bloomberg.net. To contact the editor responsible for this story: Gavin Serkin at gserkin@bloomberg.net. More on Russia: This emerging market is bucking the trend Russia gives the U.S. a lesson on capitalism Russia scraps capital gains tax for foreign investors | ||

| Chinese stocks are about to make a HUGE move Posted: 20 Jan 2011 11:33 PM PST From dshort.com: Chris Kimble calls our attention to a flag in the Shanghai Composite over the past three years. He sent the chart below before the Asian markets opened on Friday. As I post this, the Shanghai is up 1.85%. Chris comments: You have highlighted the Shanghai index on a regular basis. This key stock market has formed a key pattern that very well could influence the entire world... Read full article... More on China: Chinese stocks are getting KILLED The real reason China is buying so much gold GOLD CRAZY: New wave of Chinese money is set to slam the gold market | ||

| False Dawn Coming In First Half Of 2011 Entices Investors Posted: 20 Jan 2011 08:44 PM PST As reported last week in Trader Tracks, private equity funds holding so many beaten down post Lehman investments intend to sell them via new IPO's. The amount of new stock coming this first half of 2011 is enormous. This will-drive up stock markets until spring with the normal profit-taking cycles. Stock indexes might rally hard fooling the Sheeple herd to be "All in Shares." Later this year we see hard selling and a potential collapse of the broader markets as credit goes nasty and the funds bail out with their IPO profits. Meanwhile, dire credit problems go ballistic after May as states' counties, cities, towns, villages and other municipal entities go over the cliff. The Repubs have said they will NOT bail them out.

Illinois Governor Flees Capitol Through Basement After Disastrous Meeting On State Budget."-Greg White Business insider "Illinois Governor Pat Quinn fled the state's Capitol building through the basement after a lengthy day of debating a rescue plan for the troubled state, according to CBS Chicago. Illinois is considering raising the state's income tax by 75% as part of its financial reform package. The reform is key to Illinois balancing its budget and avoiding further debt market stress. The state's current government is attempting to rush through income tax reforms prior to the new assembly being sworn in later this week. The proposed tax increases from the Democrats from CBS Chicago: (1) An increase in the income tax from 3% to 5.25%, to decline in four years time and, (2) A dollar increase in the cigarette tax, doubling the current tax. Illinois' budget deficit may rise to $15 billion this year." Article (Editor: Pols suggest the passed +65% income tax declines in 4 years. We say not a chance). This Illinois reform is a final act of supreme futility. USA States' are sinking like Titanic.

States' and municipal debts are structured for failure. There is no way some of these bondo deals can ever be repaid and many must default. The spreads are widening faster for the worst of the lot and without huge federal investment in their local bonds they must go down. Best first candidates for bondo train wrecks are Illinois, California, New York and maybe Nevada. The GOP will fight to give them all nothing; and zero help. For now, Illinois and California appear first in line to crash and burn. California is receiving $44,000,000 per day from the federal government to stay alive. How ironic that Governor Moonbeam in Sacramento has to live with his prior excesses as new governor when he caved into state benefit plans, unions and too generous pay checks. Now the chickens come home to roost in California, as the 7th largest economy in the world is headed into the dumpster. Like Illinois, California businesses are fleeing the state in droves. My state of Washington just last year received over 27,000 new residents from California as reported in the Seattle Times by counting new driver's licenses. Meredith Whitney of Whitney Advisors told us some days ago she sees 50-100 major bond defaults this year. We agree and reported this several weeks before her latest missive set-off a New York analysts' firestorm. This posting includes an audio/video/photo media file: Download Now | ||

| Russia to Raise Gold Share in Reserves, Ulyukayev Says Posted: 20 Jan 2011 08:33 PM PST Image:  Russian reader Alex Lvov provides our first gold-related story of the day, which is a Bloomberg piece filed from Moscow. The headline reads "Russia to Raise Gold Share in Reserves, Ulyukayev Says". It's a short read...and worth skimming. The link is here. | ||

| Gold and Silver to Take Off Despite Weakness Posted: 20 Jan 2011 08:33 PM PST Image:  Interviewed today by Eric King of King World News, GoldMoney founder James Turk remarks that Europe's sovereign debt problems are being camouflaged and getting worse, not alleviated...and this will put a bid under the precious metals despite the usual bear raids. The headline reads "Gold and Silver to Take Off Despite Weakness"...and the link is here. | ||

| JPMorgan et al Cover More Silver Short Positions Posted: 20 Jan 2011 08:33 PM PST Russia to raise gold share in reserves. Gold and silver margins increased on the Comex. SLV ETF declines 1,563,046 ounces. China seizes rare earth mine areas...and much more. ¤ Yesterday in Gold and SilverGold was under pressure right from the open in Far East trading on Thursday...and by half past lunchtime in London, gold was down about eight bucks...or thereabouts. Then the bottom dropped out from underneath the gold price at the precise moment that the dollar began a big rally...a coincidence that's just too cute for words. Gold's low of the day occurred around 10:25 Eastern time at $1,342.50 spot. Two subsequent rallies in the gold price got sold off...and gold closed barely off its low of the day.

Since silver is at the centre of JPMorgan's universe, it was singled out for its usual 'special treatment'. Like gold, the silver price was in negative territory right from the open in Far East trading...and was down about two bits by 12:30 p.m. in London. From there, the price fell like a stone...with the low of the day [$27.37 spot] coming somewhere between 10:30 and 10:45 a.m. in New York. From it's high at 9:05 a.m. on Wednesday, to it's low yesterday...silver got hit for over two bucks. JPMorgan et al are obviously serious about covering their short positions...and they did lots of that during that time frame. Silver also tried to rally off its lows, but got sold off both times...the same as gold...and closed the Thursday trading session down $1.30.

Platinum and palladium both got hit yesterday as well...but their sell-offs began in Zurich at least half an hour before the out-of-the-blue dollar rally began...and 'da boyz' pulled the pin on silver and gold. Both of these metals also had very strong rallies off their respective lows...which also occurred at the same times as gold and silver made their lows...but they then they went on to recaptured most of their losses on the day. The bullion banks made sure that there was no recovery in either silver or gold. Here's the platinum chart as an example...but the recovery in palladium was even more dramatic.

For the day, gold finished down 1.82%...silver was down 4.52%...platinum down 1.31%...and palladium was down 0.25%. It's very obvious where the bullion banks' interests lay. As far as the world's reserve currency is concerned...it hovered around unchanged for most of Far East and early London trading. It's 'low' of the day, such as it was, came at 7:30 a.m. Eastern time...which was right in the middle of London's lunch hour. Starting at precisely that the time, the dollar began a 70 basis point rally...and hit its high of the day shortly before 11:00 a.m. in New York...which was about fifteen or twenty minutes after the precious metals hit their respective lows of the day. From its zenith, the dollar slid back to up only 20 basis point on the day by the time that New York trading ended.

As I said in my gold commentary, this dollar rally...along with the crucifixion in silver and gold...was just too must of a coincidence. This was a planned operation...and JPMorgan and the rest of the bullion banks pulled it off with almost military precision. Good job, guys! The gold shares gapped down at the open...and the low tick of the day came at 11:00 a.m. Eastern time. From there, the stocks recovered two percentage points of their loss...and the HUI only finished down 1.45%. However, almost all the silver producers...both large and small...got smoked once again. The CME Delivery Report showed that 5 gold and 17 silver contracts were posted for delivery on Monday. Nothing to so here, folks...as January is not a regular delivery month for either metal. Month-to-date, only 1,325 gold...along with 517 silver contracts...have been posted for delivery. The gold number is not significant...but the silver number is pretty high. For a change, there was no report from the GLD ETF...but over at the SLV ETF, they reported another large silver withdrawal. This time it was 1,563,046 ounces. The SLV ETF reached it's peak holdings on December 14, 2010...and has had 14.1 million ounces of silver withdrawn since that date. For the second day running, there was no sales report from the U.S. Mint. There wasn't a lot of activity over at the Comex-approved depositories on Wednesday...as they reported a smallish withdrawal of 55,131 ounces of silver...which isn't worth checking out. As I mentioned in this column yesterday...Thursday was the day that The Central Bank of the Russian Federation updated their gold reserves for December. They added a smallish 200,000 ounces...bringing them up to 25.4 million troy ounces. Here's Nick Laird's most excellent chart.

¤ Critical ReadsSubscribeVallejo Bankruptcy Plan Would Pay Creditors as Little as 5%Today's first story is one that I 'borrowed' from yesterday's King Report. It's a Bloomberg offering that bears the headline "Vallejo Bankruptcy Plan Would Pay Creditors as Little as 5%". General unsecured creditors would collect 5 percent to 20 percent of their claims under the plan of adjustment filed late yesterday in U.S. Bankruptcy Court in Sacramento, the state capital. The link is here.  Path Is Sought for States to Escape Debt BurdensOn a similar theme, here's a story that was sent to me by reader 'Charleston Voice'. It's a piece from yesterday's edition of The New York Times. The headline reads "Path Is Sought for States to Escape Debt Burdens". Policy makers are working behind the scenes to come up with a way to let states declare bankruptcy and get out from under crushing debts, including the pensions they have promised to retired public workers. Unlike cities, the states are barred from seeking protection in federal bankruptcy court. Any effort to change that status would have to clear high constitutional hurdles because the states are considered sovereign. I respectfully request that you find the time to read this...and the link is here.  The Specter of Inflation: Rising Prices Lurk in Europe's Immediate FutureOn the inflation front comes this story posted over at the German website spiegel.de. This one is courtesy of reader Roy Stephens...and the headline reads "The Specter of Inflation: Rising Prices Lurk in Europe's Immediate Future". Moderate inflation isn't a bad sign. But prices in Europe are threatening to spiral upward in the near future as commodity prices across the globe explode. What's more, there may be little the European Central Bank can do about it. There isn't...and the link to the story is here.  The Waiting Game: 'Communist Monopoly' Teaches Downside of Socialist LifeHere's another Roy Stephens offering...and this one is really quite interesting. It, too, is from the spiegel.de website. It's a new board game developed in Poland called 'Communist Monopoly'. It teaches young people about life under Communism. In the game, which is inspired by Monopoly, players must wait in endless lines at stores for scarce goods. For added realism, they have to put up with people cutting in line and products running out -- unless they have a "colleague in the government" card. There are no glamorous avenues for sale, nor can players erect hotels, charge rent or make pots of money. The headline states "The Waiting Game: 'Communist Monopoly' Teaches Downside of Socialist Life". It's a very short, fun read...and the link is here.  Société Générale crafts strategy for China hard-landingHere's a story from yesterday's edition of The Telegraph that's also courtesy of Roy Stephens. It's an Ambrose Evans-Pritchard offering that's headlined "Société Générale crafts strategy for China hard-landing". Société Générale fears China has lost control over its red-hot economy and risks lurching from boom to bust over the next year, with major ramifications for the rest of the world. It's worth the read...and the link is here.  China Seizes Rare Earth Mine AreasWhile we're talking about China...here's another story about that country that's courtesy of Australian reader Wesley Legrand. It was filed from Hong Kong...and was posted on The New York Times website yesterday...and is headlined "China Seizes Rare Earth Mine Areas". A Chinese government agency has taken steps to more tightly manage the production and export of rare earth minerals, crucial materials used in a wide range of technologies and products vital to the West. They did this by invoking a seldom-used mining law to take direct control of eleven rare earth mining districts in southern China. It's a bit of a read, but it's worth it...and the link is here.  GATA participates in Vancouver and London conferences this monthI'm off to Vancouver for a precious metals conference tomorrow morning...and I hope to see some of my readers there. GATA's Chris Powell has a few words on this conference...plus the Cheviot Sound Money Conference in London on Thursday, January 27. Both conferences are free...but reservations are required. The headline reads "GATA participates in Vancouver and London conferences this month"...and the link to all the pertinent details on both conferences is here.  Russia to Raise Gold Share in Reserves, Ulyukayev SaysRussian reader Alex Lvov provides our first gold-related story of the day, which is a Bloomberg piece filed from Moscow. The headline reads "Russia to Raise Gold Share in Reserves, Ulyukayev Says". It's a short read...and worth skimming. The link is here. Posted: 20 Jan 2011 08:33 PM PST Image:  Here's my last offering of the day...and it's a very important read. It was a zerohedge.com posting that Washington state reader S.A. sent me early yesterday evening that's headlined "Inflationary Guerilla Tactics Resume As Comex, Nymex Hike Margins On Gold, Silver, Cracks, Spreads And Other Products". Normally, margins are increased as prices rise...but not this time...and this is the second time that margin prices have been increased as the underlying asset has fallen steeply in value. | ||

| Gold Hits Two-Month Low, "Pressured by ETF Selling"… Posted: 20 Jan 2011 05:17 PM PST | ||

| Posted: 20 Jan 2011 05:00 PM PST The prices for commodities can change quickly and wildly, and in many cases, investors can hold commodities for years without any realization of profits. The wild cyclicality is what has kept many out of the commodities markets, and it is the reason why so many value investors choose to ignore commodities as a broad investment alternative. In respectful disagreement, making the case for a value investment in silver is a cakewalk at worst. | ||

| Posted: 20 Jan 2011 04:00 PM PST | ||

| Which Of The Currencies Of The World Is Going To Crash First? Posted: 20 Jan 2011 03:14 PM PST

So which of the currencies of the world is going to be the first to come crashing down? Well, let's take a quick look at the yen, the euro and the dollar.... The Yen Japan has the 3rd biggest economy in the world, but they are also deeply swamped in debt. At well over 200%, the Japanese government has the biggest debt to GDP ratio of all of the major industrialized nations. In fact, it is estimated that this massive pile of Japanese government debt amounts to approximately 7.5 million yen for every person living in the entire nation of Japan. So why hasn't Japan defaulted yet? Well, a big reason is because Japan has one of the highest personal savings rates on the entire globe, and Japanese citizens have been more than happy to gobble up huge amounts of Japanese government debt at very, very low interest rates. However, Standard & Poor's has warned that they may have to slash Japan's credit rating if the debt gets much bigger, and once confidence starts to falter Japan is going to have to start paying higher interest rates. At some point Japan is going to be facing a financial meltdown, but for the moment they are hanging in there. The Euro Several large European nations would have already defaulted on their debts if they had not been bailed out last year. Greece, Portugal, Ireland, Italy, Belgium and Spain are all on very shaky ground right now. Several of them have already had their credit ratings slashed. Bond yields all over Europe have been absolutely soaring in recent months. It is getting really expensive for many of these nations to take on new debt. Interest rates on 10-year Greek bonds went from 6 percent up to 13 percent in just a single month at one point in 2010. In fact, even some of the nations that aren't in the most danger are even feeling the pain. For example, the cost of insuring French debt hit a new record high on December 20th. Right now there are all kinds of rumblings that more European nations are going to need bailouts very soon. Professor Willem Buiter, the chief economist at Citibank, is warning that quite a few EU nations could financially collapse in the next few months if they are not rapidly bailed out....

So where is all of this bailout money coming from? Well, a lot of it is coming from Germany and a significant amount of it is actually coming from the United States. But will wealthy nations such as Germany be willing to pour hundreds of billions of euros into these financial black holes indefinitely? Are the Germans going to accept a situation where they are permanently bailing out the "weak sisters" all over the rest of the continent? Already some prominent politicians in Europe are calling for the European "bailout fund" to be doubled in size to about 2 trillion dollars. Other analysts believe that it is going to take at least 4 or 5 trillion dollars to properly bail out all of the European nations that need it. In any event, the truth is that the situation is really, really bad. If at some point the bailouts stop, the defaults are going to begin. The Dollar The United States has the biggest national debt of all. The 14 trillion dollar threshold has just been crossed, and the national debt is now less than 300 billion dollars away from the 14.294 trillion dollar debt ceiling. If the U.S. Congress does not raise the debt ceiling, the U.S. government will shortly begin to default on its debts. Of course everyone fully expects that the U.S. Congress will indeed raise the debt ceiling just like they have every time before. However, U.S. politicians are not going to be able to keep kicking the can down the road forever. Today the U.S. national debt is more than 14 times larger than it was just 30 years ago. Everyone around the world is beginning to realize that this debt is not even close to sustainable. Investors are beginning to become more hesitant about loaning the United States money. The Federal Reserve has been forced to step in and "buy" more and more of the debt the U.S. government is issuing. Yields on U.S. Treasuries have been moving up in recent months and this could eventually become a huge problem. Why? Well, the sad truth is that the U.S. government has been increasingly using short-term debt. At this point, the average maturity of U.S. government bonds has fallen to 4.4 years. The is the lowest figure of all the major industrialized nations. That means that the U.S. government must constantly roll over massive amounts of debt. As a point of comparison, UK government debt has an average maturity of approximately 13 years. That obviously gives them a lot more breathing room. For the United States, the situation could become incredibly dire if interest rates start to go up. If interest rates on U.S. government debt reach an average of 7 percent, interest payments on the debt would gobble up approximately 45 percent of the tax revenue that the U.S. government takes in each year. Yes, at that point the game would be over. But what the United States has going for it that the European nations do not is that the United States can just have the Federal Reserve keep printing currency. Unfortunately for the nations involved in the euro, they do not have that option. That is why an increasing number of analysts believe that it will be the euro that will crash and burn first. But only time will tell. There are even many that believe that authorities at the highest level actually want the dollar, euro and yen to fail. Why? Well, many of the same individuals and groups that brought us NAFTA, the WTO, the IMF, the OECD and the World Bank believe that it would be absolutely wonderful for humanity if we could all have a single, united global currency. The "chaos" produced by the fall of our existing global currencies could provide the perfect "opportunity" to provide the grand "solution" that they have been hoping to introduce all along. All over the world top politicians and financiers have been very open about the fact that a world currency is coming. In fact, men like George Soros are openly talking about these things. The United Nations has been publicly calling for the U.S. dollar to be replaced with a new global currency for some time now. Just this week Chinese President Hu Jintao stated that "the current international currency system is the product of the past." So will the American people just sit back and accept it when their dollars are replaced with a new global currency? Well, sadly, when things go badly most Americans seem to be willing to accept just about anything if it will mean that things will go back to "normal". When the global economy falls to pieces, and there already lots of signs that we are on the verge of such a collapse, will the American people be willing to say goodbye to the dollar if politicians from both major political parties tell them that the new global currency is the "answer" to our problems? Hopefully the American people will wake up and will realize that "globalism" is rapidly wiping away almost everything that it means to be an "American". Now even many of our children and teens are primarily identifying themselves as "citizens of the world" rather than "citizens of the United States". Even if the U.S. dollar does collapse, it is absolutely imperative that we continue to have our own national currency. The U.S. Constitution does not make any provision for any sort of "world currency". If we allow the globalists to push a truly global currency down our throats it will be another giant step towards the creation of a totalitarian one world system. So what do you think about all of this? Please feel free to leave a comment with your thoughts below.... | ||

| Posted: 20 Jan 2011 02:47 PM PST It will come as no surprise to Vultures that today, Thursday, January 20, 2011, silver took out our initial trading stops and then even before our one-hour "grace period" expired, the downward momentum was strong enough to hit our 20-cent lower "hard stops". Therefore we move to the sidelines with our short-term silver trade, which we have been in since August 25 of last year. It's Payday! ... | ||

| Oh - the recent drop makes sense now (ht ZeroHedge) Posted: 20 Jan 2011 01:29 PM PST Who knew? Seems the margin requirements were just "unexpectedly" increased for PMs . Wow. So, like all those short sellers who got out in the last few days were "totally good guessers" right? http://www.zerohedge.com/article/inf...ks-spreads-and | ||

| Posted: 20 Jan 2011 01:24 PM PST Silver investors who have been stockpiling physical silver on massive global changes in monetary policy have been a bit ahead of themselves. While the fear of inflation exists in very broad detail, the realizations of inflation have yet to show themselves. | ||

| Part 3- Silver Manipulation Explained Posted: 20 Jan 2011 12:12 PM PST | ||

| Why Retirements Are Going Bust, Again Posted: 20 Jan 2011 10:19 AM PST Forget 2008... We're seeing the worst hit to retirement accounts right now! Mutual funds, specifically tax-exempt funds, have long been favorites among near retirees. With the clock ticking, where would you go for an edge on retirement building? And if you could find tax-free, high- yielding, considerably safe income, wouldn't you take it? Unfortunately, those who bought into this line of thinking over the past several years have just rudely awoken to a major collapse. Many municipal bond funds offer investors a tax-exempt source of income that is backed by the full faith and credit of US cities and states. These, in turn, have an implied backing by the federal government. (After all, would Obama really let California break off into the ocean?) And with a gigantic slew of near-retirement-aged baby boomers, weak interest rates, and 2008's stock performance stuck in the back of investors' minds, the municipal market has looked as sexy as ever. Over the past two years, we've seen nothing but cash inflows into muni funds. But that trend has reversed with a vengeance. We've noted the recent outflow of bond funds in weeks past. But that was just headline stuff. A mere sampling of the pain funds in general have felt. Here's what the muni universe has looked like:

Quite a hit. And of course, when a panic like this starts, bottoms can be a tricky subject. The muni market isn't a clear one. We're not saying it has no transparency. We're saying that often, no one can really make heads or tails out of the figures. But here are the steps, as best as anyone can understand so far, that caused this two and a half month panic. First, we saw a QE2 build up. We discussed this program before. But quickly, it simply opened up a pile of $600 billion (plus another $300 billion potentially) to buy up medium-term Treasuries. In theory, this should push yields down, spitting more cash into the rest of the economy, nudge the inflation rate higher, stimulate job growth, and save the planet from a flesh-eating super robot. Okay, one of those things wasn't part of the deal. Nonetheless, what it did was virtually nothing...so far. But the anticipation of the program led investors out of the muni market and into Treasuries. After QE2, the new threat to city and state debt was the potential end of the Build America Bonds program. Then the actual end of BAB. And it certainly doesn't look like the new "deficit-conscious Congress" will inspire similar attitudes at the state government level any time soon. In this time period, we also had a number of rating downgrades and bad press, such as the rating cuts to San Francisco and Philadelphia. We saw threats to California and Illinois as well, even going so far as comparisons to Greece and Ireland. Sure, all of these factors, combined, led to some of the muni outflows. But all they really did was lightly nudge the giant calamity of muni investor losses down the giant figurative hill. Once investors started pulling out of muni mutual funds, the funds had to sell some of their muni bonds. That led to a decline in actual muni prices...which led more fund investors to sell. This circular pattern is actually still happening. Take a look at this:

Even if you know nothing about charts, you can tell this ain't pretty. This chart represents the past nine months of trading of the iShares municipal ETF. It tracks the most popular municipal bonds on the market. And since the first week in November - which corresponds to the first week of fund outflows - all bets have been off. All the technicals, all the support, all the buyers have turned away from the municipal market completely. And this pattern may continue for some time. Of course, as we noted above, no one can truly read the muni market 100% of the time... That is especially true now. So what does this say? We don't know. There seems to be two drastically different points of view in the press. That much we do know. Meredith Whitney, the "genius" that called the banking crash of 2008, went on 60 Minutes last month claiming that the muni market will see more defaults than anyone can imagine. She called for "hundreds of billions" in losses. As widespread as that show is - and her own newly-acquired following - it wouldn't surprise us if some of the recent selling came from that interview. And we're even less surprised by the backlash it caused in the rest of the media. Joe Weisenthal, a largely-followed and highly-syndicated author for Business Insider, struck back at Whitney, claiming the free fall in muni prices is 100% attributable to the downward selling spiral we summed up above, which he called "the feedback loop"... instead of actual risk of defaults. Charles Gasparino wrote on Huffington Post that Whitney needed to "finally come clean." He wants her to show her evidence of the "hundreds of billions" in losses prediction. Celebrity (kind of) economist David Rosenberg went so far as to claim that the muni market fall is "a huge long-term buying opportunity". And who knows? Maybe they are all right. We expect muni funds will find a bottom at some point. And then, just as quickly as they stabilize, they'll fall again on actual news of defaults. It won't take much in the way of a real scare to truly collapse these investments. Regardless of their future, the point is: we're entering into panic mode on some of the best performing and hottest assets for pension plans, 401(k)s and IRAs. Pensioners are no doubt beginning to reel again. We're keeping a critical eye on this whole situation. And, of course, we never stop looking for solutions. Regards, Jim Nelson, Editor's Notes: Jim Nelson is the managing editor of Lifetime Income Report. He has been playing the stock market since he was 14, always with a preference toward smaller companies. He has honed his stock picking skills at Agora Financial since 2004, effectively combining a growth and value approach. Similar Posts: | ||

| Massive raid in gold and silver/options exercise on stocks tomorrow Posted: 20 Jan 2011 10:13 AM PST | ||

| Posted: 20 Jan 2011 10:00 AM PST Gold and silver extended Thursday's deep losses early on Friday as leftover selling continued to be visible and the probability of margin call-related selling rose significantly. Gold fell to two-month lows at $1,340.00 basis spot bid values. | ||

| Chinese Silver Demand Surges Four Fold in Year Posted: 20 Jan 2011 10:00 AM PST Demand figures released by the General Administration of Customs in China overnight show the massive turnaround in China from large silver exporter to large silver importer. | ||

| Panic Selling Hit S&P 500 & Silver is Next Posted: 20 Jan 2011 10:00 AM PST Wednesday the stock market bled out with a river of red candles. All of the recent gains vanished in one session. Strong selling volume sessions like this are typically a warning sign that distribution selling is starting to enter the market. | ||

| Posted: 20 Jan 2011 09:00 AM PST I was intrigued by the title of the essay "The Cheapest Thing on Earth" by Nathan Lewis here at The Daily Reckoning. I was interested because I thought that such a tasty trivia tidbit could come in handy, like this morning when I could have used it as a distraction when my kids were calling me "cheap" because I wouldn't open up my wallet and give them another king's ransom for some new dumb reason; I forget what, but there was a lot of crying and wailing about it, whatever it was. This is where I could have said, to throw them off, "Cheap? What do you know about cheap? Do you know what is the cheapest thing on earth? Huh? Do ya? Huh? Do ya? Yes or no?!" Instead of providing me with the answer, he starts off with a pop quiz! Damn! And when I say "pop" quiz, I mean exactly that, as he says, "Quick: name an asset, publicly traded, that is the cheapest in a hundred years." Pop! I, of course, had no idea, and instead of admitting it, I quickly read ahead, hoping to immediately find the answer, only to be surprised when he taunted me. "Houses?" he asks. "Nope. Stocks? I don't think so. Commercial real estate? Bonds?" By this time I was pretty peeved, and getting bored, too, as I was sure that if it was, indeed, none-of-the-above, then this was going to devolve into something about investing in something obscure, the significance of which would elude me even if you explained it to me over and over again, in a company I never heard of, and, probably, in a country I never heard of, either. Just before I gave up reading in disgust, he dared to taunt me one more time, the bastard! "Not too many, are there?" he asks. At this final insult, my mind screamed, "Damn you! Damn you to hell! Tell me now, or I will fire off a flaming email that will be both highly insulting and vaguely threatening!" I could almost hear his cruel, mocking laughter as he rudely called my bluff, and further insulted me and my false bravado with, "Now here's a tougher one. Name an asset that is near the lowest price in all of human history." Arrgghhh! In all of human history? By this time I am angry and distraught, mostly angry, that somebody was exposing my stupidity and ignorance! Suddenly, I am gasping for air and screaming that if he doesn't tell me the answer pretty soon, I am going to start hearing those voices in my head again, and (now that you mention it) if I listen really closely, I can almost hear them already, way off in the distance, screaming to be heard and obeyed. And we all remember how it turned out the LAST time that happened. Obviously intimidated by the sudden revelation of the strange, powerful forces he is unleashing, he quickly announces, "The answer is: wheat"!! I admit that I personally put those two final exclamation points at the end of his sentence as an emphasis, both to indicate surprise and to remind you that there are surely significant ramifications of this "price of wheat" thing, the horrors of which I never allow myself to even think, except during sleep, and then hopefully only when I am dreaming of being with some beautiful young thing, and maybe with some of her friends, too, who are all naked and sweaty and grunting and heaving and writhing around in some surreal bacchanalia of some kind, where the only interruption is the masses of people outside wailing and crying that "The price of food is up so much that we are burning things and looting grocery stores in mindless anger and desperation, and we are looking for the Fabulous Mogambo Seer (FMS) to pledge our undying allegiance and love because he predicted that this inflationary hell is Exactly What Would Happen (EWWH) when the stupid Federal Reserve kept creating more and more fiat money, creating astonishing amounts of money, creating outrageous amounts of money, creating So Much Freaking Money (SMFM) for so, so long that We're Freaking Doomed (WFD)!" I can reliably report, thanks to these dreams, that the sound of people starving to death is a real "mood killer," perhaps on a par with the horror that wheat is now at the highest price ever, even going back to Biblical times, which is probably why those old Bible-era people were always "breaking bread," and eating unleavened wheat crackers, and consuming miscellaneous cheap wheat products instead of having, you know, a few tasty tacos or maybe a pizza once in awhile, which I figure must have been because they were very expensive or something, which is why you never hear of anybody eating them. Anyway, I immediately used this new information-as-icebreaker at the supermarket, and told the cashier, as she rang up my groceries, "I'll bet you don't know that wheat is at its lowest price in recorded history, but climbing fast because the horrid Federal Reserve is still creating So Freaking Much Money (SFMM) that the terrifying, heartbreaking misery and suffering of inflation in the prices of subsistence prices of items, like wheat, is guaranteed! Guaranteed, I tells ya!" She just dragged my frozen burrito across her laser scanner, the irritating "beep!" noise only underscoring her complete lack of interest. I went on, helpfully adding that they also said, "Actually, the entire agriculture complex, including corn, beef, pork and beans could fit this description." Again the lonely "beep!" as she listlessly ran my bag of Oreo Double Stuf cookies through the beam, her face never changing, not even to make the time pass with idle conversation about, for example, how much she adores cute old guys who buy such delicious cookies, or how my eyes twinkle so charmingly, or even to say how she noticed I kept looking at her boobs. You know; anything. Giving up, I took my groceries in hand and parted without giving anyone my usual advice, which is to "Buy gold and silver right now, using whatever money you can glean from your stupid little job, because inflation is going to eat us alive, and a weird, distorted economy will make it even more hellish, all thanks to the horrid Federal Reserve continuing to create so much excess money. And buying gold and silver is so easy that a bunch of bored, underpaid worker-bees in a low-margin business like you can do it! In fact, it's so easy that even morons say, 'Whee! This investing stuff is easy!'" The Mogambo Guru The Surprising Price of Wheat originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." | ||

| Posted: 20 Jan 2011 08:18 AM PST

01-20 Thursday

| ||

| Gold Seeker Closing Report: Gold and Silver Fall Almost 2% and 5% Posted: 20 Jan 2011 07:12 AM PST Gold fell to as low as $1343.24 by about 10:30AM EST before it rebounded in the last few hours of trade, but it still ended with a loss of 1.72%. Silver fell to as low as $27.39 before it also rebounded, but it still ended with a loss of 4.68%. | ||

| Posted: 20 Jan 2011 07:00 AM PST |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

Mercenary Links Roundup for Thursday, Jan 20 (below the jump).

Mercenary Links Roundup for Thursday, Jan 20 (below the jump).

No comments:

Post a Comment