saveyourassetsfirst3 |

- Weekly Economic and Market Review: Bullish Outlook Not Supported by Numbers

- Gold/Oil Ratio Pointing to Recovery

- A Review of 'The Billion Dollar Mistake'

- Gold: Correction Or Consolidation?

- ETF Investing: Five Overlooked Nuances

- Local Dealer Buying Prices for .999 silver?

- Silver Bar Shortages to Lead to Price “Tipping Point”?

- View From the Turret: A Crowded Theater

- Another essential metal is surging to all-time highs

- A huge turning point in stocks could be coming

- Top analyst Rosenberg: Buy muni bonds!

- 2011 Financial Meltdown Fast Approaching

- Dollar system is 'product of the past,' Chinese president says

- Not Only Commodities are Signaling Hyperinflation

- Sell Gold, Buy Silver

- Adrian Douglas: Strong indications of gold and silver shortages

- Watch Out For Bond Markets

- Trading Comments, 18 January 2011 (posted 10h45 CET):

- Reserve Bank of Australia Gold Sale

- Gold Stocks: Stick with Juniors and Avoid Large Caps

- 2011: What's going on with gold?

- Gold Update

- Panic Before the Herd and Win-Win with Silver!

- 2011: Another Banner Year for Gold

- Gold Speculation Hits Multi-Month Lows, "Correction May Last Longer" Says Faber

- Austerity In America: 22 Signs That It Is Already Here And That It Is Going To Be Very Painful

- Ten years ago today, Ag was born.

- Precious Metals Default Scenarios

- The Gold Wave Patterns remain Bearish and SP 500 near the top

- Get Rich, Get Terminated

- The US Deficit Recovery Program and Other Fallacies

- Goldrunner: Has Gold Topped Out? Nope, You Ain’t Seen Nothing, Yet!

- Strong Indications of Gold & Silver Shortages

- Private Buyers Defy Fund-Manager Sales with ‘Massive Demand’

- Gentlemen, Start Your...Houses!

- All That is Gold Does Not Glitter

- US Dollar, Gold & Silver Are Down – Really?

- Tracking a Silver ETF’s Impact

- Silver Wheaton: A Double in Waiting?

- Working For Profit to Prop Up the Economy

- The Gold Market Is ‘Tight’

- UK Inflation Forecast 2011, Imminent Spike to Above CPI 4%, RPI 6%

- An Interpretation of the China Silver Short Theory

| Weekly Economic and Market Review: Bullish Outlook Not Supported by Numbers Posted: 18 Jan 2011 05:23 AM PST Joseph Y. Calhoun III submits: Did you know that:

If all you’ve been watching is the U.S. stock market, you might think all is right with the world, but as the above short list -- not comprehensive by any means -- demonstrates, there are some nasty undercurrents in the world’s financial markets. Ignore them at great risk. Complete Story » |

| Gold/Oil Ratio Pointing to Recovery Posted: 18 Jan 2011 05:19 AM PST Hard Assets Investor submits: By Brad Zigler You might have noticed that the price trajectory for gold and oil have been diverging recently. The disparity has grown so large, in fact, that momentum in the gold/oil ratio has turned down. The ratio's 50-day moving average crossed to the downside of its 200-day moving average—a signal that lower daily values may lay ahead. Complete Story » |

| A Review of 'The Billion Dollar Mistake' Posted: 18 Jan 2011 05:18 AM PST Bruce Schrader submits:

The book details the billion dollar mistakes made by the following 10 famous investors: Complete Story » |

| Gold: Correction Or Consolidation? Posted: 18 Jan 2011 05:06 AM PST |

| ETF Investing: Five Overlooked Nuances Posted: 18 Jan 2011 04:29 AM PST Michael Johnston submits: Last week we highlighted several often-overlooked nuances of popular exchange-traded products, detailing the surprisingly large impact that seemingly minor distinctions can have on a portfolio’s risk/return profile. From the weighting methodology employed by the underlying index to the choice between large caps and small caps for international equity exposure, many details that are often the subject of little consideration can play a big role in determining how an ETF portfolio performs. Below, we highlight five more easy-to-overlook nuances of ETF investing that are often felt in the bottom line: 1. Futures-Based vs. Physically-BackedThe introduction of commodity ETFs in recent years serves as an example of the impressive innovation that has become common in the ETF industry. Previously, exposure to natural resource prices was hard to come by for many investors. But the proliferation of exchange-traded commodity products has made achieving exposure to everything from corn to sugar relatively simple. Complete Story » |

| Local Dealer Buying Prices for .999 silver? Posted: 18 Jan 2011 03:46 AM PST What would you estimate your local dealer(s) buying prices are for .999 silver (in terms like spot, $.50 per ounce below spot, $1.25 per ounce above spot...)? 1. American silver eagle 2. Canadian maple 3. One ounce generic round 4. 10 ounce generic bar 5. Any others you care to comment on. Thank you. |

| Silver Bar Shortages to Lead to Price “Tipping Point”? Posted: 18 Jan 2011 01:37 AM PST |

| View From the Turret: A Crowded Theater Posted: 18 Jan 2011 01:09 AM PST

As traders, we know this can be a dangerous situation. Whether the crowded trade is short or long, bearish or bullish, inflationary or deflationary, even right or wrong, the mere fact that so many people are committed to one side of a trade can lead to sharp, contrary movements. To quote the illustrious Agent Kay from Men In Black: "A person is smart…People are dumb, panicky dangerous animals and you know it!" Of course, most traders recognize this issue and even the most novice participant understands the wisdom in taking a contrarian approach. But the key is in figuring out just when to take action and fade the herd. Today's trading environment resembles the kind of crowded theater that any self-respecting fire marshal would shut down in a heartbeat. According to Bespoke Investment Group, bullish sentiment is near the highest level seen since before the financial crisis, and Barron's noted that the market has not experienced a 1% down day since before Thanksgiving. But the bullish side of the market has been crowded for some time now. Step in too quickly as a contrarian, and you're likely to get trampled by the herd. The key in taking advantage of crowded trades (and reversals of sentiment) is two-fold.

This week, we are looking at a few sectors that are not only crowded, but also beginning to show signs of reversal. This sets up some excellent opportunities that have potential for attractive profits in a very short amount of time. So let's shake off the holiday weekend and take a look at these setups: Precious Metals It took some time to happen, but the precious metal trade has become decidedly crowded. Quarter after quarter, academic types viewed gold as an ancient relic with little relevancy in today's financial markets. But with most developed (and emerging) nations seeking to pressure the value of their currency, it became necessary to find better ways to store value. Even the IMF got in on the action, laying the groundwork for a new reserve currency – which was partially supported by precious metal pricing. The net result is that a wide body of traders and investors are now long gold, silver, and platinum. Many of these positions have been taken recently – and grudgingly – by investors who are late to the party. As precious metals took on water last week, these new "fair-weather-fans" are trapped in new positions that are under water. At the same time, traders who have been involved in this trend for months are not watching profits begin to turn south, and have itchy trigger fingers for taking profits. Last week, Live Feed beta testers trading alongside the Mercenary portfolios took a short position in the ProShares Ultra Silver (AGQ) as it broke down from its topping process. If traders are quick to exit silver (which experienced a significantly higher percentage gain than gold), AGQ could easily test $100 over a few weeks time – a level it traded at as recently as November. In addition to the ultra-silver, we also took a short position in the Market Vectors Junior Gold Miners (GDXJ) which has also shown signs of breaking down. Junior gold miners rallied roughly 70% from mid-summer through the end of the year – quite an incredible move for a broad basket of stocks. GDXJ is more speculative than the large-cap sister Market Vectors Gold Miners (GDX) which was part of the appeal on the way up. The speculative miners had more to gain from a rise in the price of gold, and traders were quick to capture this leverage. But the negative side to that coin is that GDXJ should be more loosely held than the large cap ETF. GDXJ is perceived as more of a trading vehicle and now that the trend is being called into question, the junior ETF should have farther to fall. As a quick aside, we are not necessarily calling a "long-term top" in precious metals. The debasement of the world's currencies should eventually help support the price of precious metals. But it's very sobering to see how the US dollar was weaker late last week (which should have pushed the price of precious metals higher) and yet the topping process is still underway. As Mercenaries, we are never wed to one side of the market – or one side of a particular trend. Our goal is to capture profit from whatever opportunities the market gives us on a day to day basis.  Retail Rollover Another previously strong area that has captured our attention is the broad US retail sector. The US consumer has been surprisingly resilient even in the face of stubbornly high unemployment. Investors have taken their cue and pushed the entire sector sharply higher since the beginning of September – creating what is increasingly becoming another crowded trade. But over the last few weeks, crack have developed in the chart patterns – first with chains that cater to the more budget-conscious consumer – and next, middle-class and luxury brands. In recent weeks, we have begun building short positions in quick-service restaurant chains that are deteriorating, and this week we are looking to add a few more traditional retail operations. Considering the extent to which some of these names have become overbought and investors have become complacent, there is plenty of opportunity for a mass exodus and a sharp price correction. Target Corp. (TGT) had a rough start to the year, gapping sharply lower when the company missed expectations for December same-store-sales. Since that time, the stock has made a feeble recovery attempt with little progress. As investors begin to trim their retail holdings, TGT is likely to continue its slide being perceived as "damaged goods" with low growth potential and headline liability. Considering higher-end retailers, Nordstrom, Inc. (JWN) also looks vulnerable after a 50% ramp from the September low. While the department store chain is expected to report 38% earnings growth this year (fiscal year end is Jan 31), growth is expected to contract to just 14% in the coming year – an expectation that could turn out to be too optimistic should the employment numbers fail to improve. The stock has spent the last six weeks trading sideways, despite the fact that the broad market has been steadily rising. A break below the low end of the consolidation would likely trigger the fire alarm, sending weak holders for the exits. With the key 50 day average just below and plenty of room before major support areas, JWN looks like a good return to risk proposition. The Bullish Side While our intuition has us leaning towards the bearish side in today's environment, our method includes keeping a relatively balanced set of trades. We want to add bullish positions that stand on their own two feed and have merit from an absolute value standpoint – and also provide balance to the overall portfolio. With this in mind, we've got an eye on the alternative energy area with a couple of solar positions already in place with half-profits booked, and some additional names coming on line. Denison Mines Corp. (DNN) was one of our uranium opportunities outlined in our Strategic Intelligence Report #XX. As a flood of new nuclear reactors come online, supplies of uranium will quickly be taken off the market. Current uranium production is not sufficient to keep up with the expected demand, and so prices are expected to rise significantly. This is good news for the few companies with access to the needed resource, and DNN is one of the key players in this area. The stock rallied sharply this fall, and has spent the last several weeks consolidating its gains. A week ago, the price slipped briefly below $3.00 which is just the sort of action that would shake out weak holders. Now that the stock has survived this test, a breakout should lead to another strong run. Finally, Yingli Energy Holdings Co. (YGE) is another solar name we are interested in picking up. The stock is trading for less than 10 times expected earnings, and with Europe apparently kicking the can farther down the road, and China solar demand picking up – YGE should participate in a broad rebound for solar energy companies. Last week, the stock briefly crossed above the 50 EMA, creating a strong support area near $10.00. If this level turns out to be a launch pad for the stock, it's not difficult to see how YGE could test – and even break through – the $14.00 print from mid-October. Earnings season is now in full swing, and we've got a number of key reports due up this week. So stay nimble and on top of the action – and make sure you check in throughout the week. Trade 'em well! |

| Another essential metal is surging to all-time highs Posted: 17 Jan 2011 11:43 PM PST From MetalMiner: If you're in the electronic solder or food packaging business, or if you buy tin for plating (among other applications), prepare to pay more for the metal in 2011. If recent supply-side issues are any indication, worldwide exports might be very constricted in the first half of this year. Sure, Indonesia has said it will get back in the producing game, and as the world's No. 1 exporter, intends to roll out 90,000 tons of tin in 2011 after quite a shortfall. The country reported a 12.3 percent drop in production in 2010, to nearly 79,000 tons, according to Reuters. As of this writing, tin's LME cash price sits at... Read full article... More on commodities: This is the cheapest place in the world to buy gold coins Marc Faber: The three commodity investments you must buy now JPMorgan: This industrial metal is beginning to trade like gold and silver |

| A huge turning point in stocks could be coming Posted: 17 Jan 2011 11:42 PM PST From Gold Scents: Humans, for whatever reason, tend to project the past into the future. It is an emotional flaw in our genetic makeup. It is also the reason why so many otherwise intelligent people miss the big turning points in the economy and stock market. A classic example occurred in the summer of '07. The sub-prime market was just starting to implode. With the benefit of hindsight, we now know that was the beginning of the end for not only the stock market but the global economy. Unfortunately, because we couldn't read the writing on the wall, we trusted that the Fed would "fix" this minor blip by cutting rates aggressively and spewing out an avalanche of freshly counterfeited dollar bills. It did not fix the credit markets and instead spiked the price of oil to $147 a barrel. That turned out to be the final straw that broke the camel's back and sent the global economy spiraling down into the worst recession since the Great Depression. The stock market rolled over into the second worst bear market in history. Amazingly enough, we are ready to repeat this process all over again... Read full article... More on stocks: This chart says the bear market will return in 2011 A significant stock market top could be forming now When this alarm goes off, it's time to get out of stocks |

| Top analyst Rosenberg: Buy muni bonds! Posted: 17 Jan 2011 11:34 PM PST From Pragmatic Capitalism: David Rosenberg isn’t buying Meredith Whitney’s dire analysis of the municipal bond market in the USA. He's calling it a "huge long-term buying opportunity": "There is a clear buyers’ strike in the market for state and local government debt that is largely based on fear and misperception. The mass selling of muni’s, which represent the bedrock of the U.S. economy, is incredible – nine consecutive weeks of net redemptions totalling $16.5 billion ($1.5 billion in the January 15 week). Talk about fertile ground for a huge long-term buying opportunity. First, even if you buy into the default talk, look at the yield protection you get now. There are some long-term muni’s trading north of eight percent – even higher than junk bonds (a premium of over 100bps!). Long-term triple-A-rated muni’s are now trading well north of five percent or 116% vis-a-vis Treasury bonds (typically, muni bond yields are equivalent to 82% of Treasury yields given their tax advantage). California off-the-run 30-year 6% bonds are now being quoted at a yield premium to dollar-denominated debts offered by the likes of Mexico and Columbia. Give me a giant break. Even in California, only... Read full article... More on muni bonds: Pimco's Gross: Meredith Whitney is dead wrong about a muni crisis Wall Street catfight: Columnist attacks Meredith Whitney's muni bond call Must watch 60 Minutes story: This looming financial crisis rivals the subprime debacle |

| 2011 Financial Meltdown Fast Approaching Posted: 17 Jan 2011 09:00 PM PST |

| Dollar system is 'product of the past,' Chinese president says Posted: 17 Jan 2011 08:27 PM PST Image:  Here's an interesting Bloomberg story that the 'thought police' have given the once-over. The original headline read "Hu Highlights Need for U.S.-China Cooperation, Questions Dollar". Now it reads "Obama Gives Hu First State Dinner Showing Dual Views of China". But I prefer the headline that Chris Powell gave it...and that reads "Dollar system is 'product of the past,' Chinese president says". The link to the story is here. |

| Not Only Commodities are Signaling Hyperinflation Posted: 17 Jan 2011 08:27 PM PST Image:  Here's a short offering from James Turk over at the Free Gold Money Report. It's only a couple of paragraphs...and an excellent graph...and it's worth running through. The headline reads "Not Only Commodities are Signaling Hyperinflation". It's posted over at the fgmr.com website...and the link is here. |

| Posted: 17 Jan 2011 08:27 PM PST Link: Image:  My last offering for you today is courtesy of silver analyst Ted Butler...and is a story that was posted over at finance.yahoo.com last Friday. The topic is near and dear to my heart...as it is to Ted's...which is probably the reason why he sent it to me. The headline reads "Sell Gold, Buy Silver". As you know dear reader, I take my own advice...and that's exactly what I have done with my own portfolio. This piece is more than worth your time...and the link is read more |

| Adrian Douglas: Strong indications of gold and silver shortages Posted: 17 Jan 2011 08:27 PM PST Image:  Here's another GATA release that's a must read. As I have already spoken of many times in this column...the last time being on Saturday...the bullion banks have been covering short positions on rising prices since last August. As a matter of fact, it's partly their short covering that has led to the rise in the silver price leading up to year end. Ted Butler pointed this out when the December bank participation report was issued. |

| Posted: 17 Jan 2011 08:25 PM PST Treasury Notes Advance as Investors Question Pace of Economic Recovery. "Two-year Treasury notes rose, snapping three days of losses, as investors and economists said the recovery in the U.S. job market hasn't gone far enough for the Federal Reserve to consider raising interest rates." "Treasury 10-year note yields fell from a three-week high reached yesterday after data showed private employers added 297,000 jobs, ADP Employer Services reported, versus a forecast of 100,000 in a Bloomberg survey. The rise in yields is "extreme" and investors should use it as an opportunity to buy five-year notes, Citigroup Inc., one of the 18 primary dealers that trade directly with the central bank, recommended today in a note to clients." "We're getting a correction," said John Spinello, chief technical strategist in New York at primary dealer Jefferies Group Inc. "We got blasted yesterday. You have to try and sort out the truth of the ADP number. The Fed will continue with their purchases." "Two-year note yields declined three basis points to 0.69% at 7:59 a.m. in New York, according to data compiled by Bloomberg. The price of the 0.625% security maturing in December 2012 rose 1/16, or 63 cents per $1,000 face amount, to 99 28/32. Ten-year yields fell three basis points to 3.43%. They rose by 14 basis points yesterday. Two-year yields are 45 basis points more than the upper end of the Fed's target range of zero to 0.25%. The difference has widened from 2010's low of eight basis points in November. A basis point is 0.01% point." "Ten-year yields will drop to 3.17% and two-year rates will slide to 0.65% by March 31, a Bloomberg survey of banks and securities companies shows, with the most recent forecasts given the heaviest weightings. Treasuries tumbled yesterday after the ADP report showed private employers added jobs in December, almost three times the amount that economists expected." "The rise in yields after the report provides "an attractive tactical entry point," Brett Rose, strategist at Citigroup, wrote in a research note today. A "fairly strong" increase in payrolls in a report expected tomorrow could lead to a reversal of yield gains, he said. Labor Department data tomorrow will show the nation added jobs for a third month in December, a Bloomberg News survey of economists' shows. The jobless rate will be more than 9%for a 20th month, according to the survey." (Editor: USA jobless rate is now 23% and rising). "The difference between yields on 10-year notes and Treasury Inflation Protected Securities, a gauge of trader expectations for consumer prices, widened to 2.42% points yesterday, the most since April. 'The way ADP compiles its data tends to skew the figures for December, Andrew Tilton, an economist at Goldman Sachs Group Inc. in New York, wrote in his report yesterday. "We view the dramatic improvement shown in the report with skepticism," he wrote. "Markets may be overly optimistic about the extent this will show up in Friday's report." "The Fed is scheduled to buy $6 billion to $8 billion of notes due from January, 2015 to June, 2016 today as part of its effort to spur the economy. The Treasury plans to announce the sizes of three-, 10- and 30-year auctions set for next week. Signs of growth outside the job market will push Treasury yields higher, Satoshi Okumoto, a general manager at Fukoku Mutual Life Insurance Co. in Tokyo, which has the equivalent of $67.1 billion in assets.'' "Ten-year yields will advance to 3.75% by the end of March, he said. President Barack Obama has increased the U.S. publicly traded debt to a record $8.75 trillion. Okumoto said he's trying to buy dollar-denominated corporate bonds being sold this week, betting they will outperform (Japan's) government debt as the economy improves. The limited amount of the securities makes them tough to get, he said. Toyota Motor Corp., the world's largest automaker, and Warren Buffett's Berkshire Hathaway Inc. are among the companies that have issued debt this week." -Susanne Walker & Anchalee Worrachate Bloomberg.net 1-6-11 We strongly recommend traders and investors avoid everything in the bond markets for the longer term except perhaps for some select short trading positions. Be careful on those. This market is broadly manipulated by central banks and big traders world-wide. This posting includes an audio/video/photo media file: Download Now |

| Trading Comments, 18 January 2011 (posted 10h45 CET): Posted: 17 Jan 2011 07:45 PM PST Yesterday's test of important support at $1360 and $28 was successful, judging from the strength in both gold and silver this morning. Good for you if you bought yesterday because it |

| Reserve Bank of Australia Gold Sale Posted: 17 Jan 2011 06:20 PM PST Further to The Australian's 11 January article "Reserve Bank's gold sale cost us $5bn", I thought my readers may be interested in the then Perth Mint CEO's response to the 1997 sale. Consider these quotes: "It is important to remember that we are evaluating gold now in a low-inflation environment, in which other financial assets are currently performing extremely well, the most important of which is the stockmarket. However, current conditions are not going to last forever. In my experience, in the long term, politicians cannot help themselves. When they are faced with a really tough decision, such as the one creeping up on them now - that of how to create jobs - they will take the easy option and let inflation go." and "When the crunch comes, governments will want to be re-elected. Rather than take the tough decisions, they will turn the inflationary tap back on. For that reason, I believe that gold will again have its day. I have not lost faith in gold." The foresight of these statements come from the fact that Mr Mackay-Coghill worked for International Gold Corporation (Intergold) from 1971 to 1986. Intergold represented South African miners in the production and selling of Krugerrands and Mr Mackay-Coghill was responsible for the introduction of the Krugerrand to world markets in his role as CEO of Intergold. |

| Gold Stocks: Stick with Juniors and Avoid Large Caps Posted: 17 Jan 2011 06:15 PM PST In covering the gold sector for my premium subscribers, I have noticed something lately. The large-caps really suck! Ok, that is harsh but it is the truth. In the chart below I show the large-cap indices. What do you see? The Dow Jones Precious Metals Index hasn't gone anywhere for five years, while Gold has more than doubled. The next two (the XAU and GDX) are trading right at their 2008 peaks. Since then, I quickly calculate that Gold and Silver are higher by about 33%. We all know that GDXJ outperformed GDX in 2010. It wasn't close and even during this correction GDXJ is holding up better. Yet, GDXJ is weighted heavily in some companies that are above $1 Billion in market cap. Where is the "junior" in that? I created my own index of 25 gold stocks, which are equally weighted and range mostly from $200-$700 million in market cap. My junior index against the HUI (GDX follows the HUI) is moving higher after an 8-year breakout. This chart tells us that the juniors should outperform strongly in 2011 and likely 2012. We've written about this before but it bears hearing again. Too often we hear about how gold stocks are cheap and how they are priced for $1000 Gold or $800 Gold. Just because the HUI/Gold or XAU/Gold ratio is low doesn't mean the sector is at a bottom. The reality is that large gold stocks have consistently underperformed Gold over time. Take a look at this piece from Steve Saville and his chart which goes back to 1960. Steve attributes the poor performance to rising costs, management errors, environmental and political factors but most importantly, depletion. Just to stay in business gold companies have to consistently find new deposits, mine those deposits and add to reserves. The larger a company is, the more difficult it is to do these things. A junior company can grow by building a few small mines. A large-cap needs to find huge deposits that can become huge mines. It is simply a more difficult business for the larger sized companies. It is critical that investors and speculators take note of all these factors before partaking in the sector. I fear that the new entrants in the sector will think they are safe by buying Newmont or Barrick. They may be less volatile, but history argues you are better off holding Gold or Silver. Sure the juniors have already had a fantastic run, but our chart argues that it may be even better in the next few years. As the bull market rages on, the herd will naturally become more speculative. The large players have begun to resort to takeovers and acquisitions. This will continue and further catalyze the junior sector. If you want to be involved in the bull market then you have to have a presence in the junior market. Our service offers professional guidance and focus on uncovering the best opportunities in the juniors. We are soon starting a separate portfolio just for trading the GDXJ ETF. We invite you to consider a free 14-day trial. Good Luck! Jordan Roy-Byrne, CMT |

| 2011: What's going on with gold? Posted: 17 Jan 2011 06:02 PM PST In the first half of January 2011, the gold price declined from $1,405 to $1,360 (&ound;900 to &ound;855; €1,049 to €1,023). This 3% slip is well within gold's usual price swings. |

| Posted: 17 Jan 2011 05:08 PM PST |

| Panic Before the Herd and Win-Win with Silver! Posted: 17 Jan 2011 05:00 PM PST |

| 2011: Another Banner Year for Gold Posted: 17 Jan 2011 04:55 PM PST |

| Gold Speculation Hits Multi-Month Lows, "Correction May Last Longer" Says Faber Posted: 17 Jan 2011 04:44 PM PST |

| Austerity In America: 22 Signs That It Is Already Here And That It Is Going To Be Very Painful Posted: 17 Jan 2011 03:11 PM PST

Most Americans tend to think of "government debt" as only a problem of the federal government. But that is simply not accurate. The truth is that there are thousands of "government debt problems" from coast to coast. Today, state and local government debt has reached at an all-time high of 22 percent of U.S. GDP. It is a crisis of catastrophic proportions that is not going away any time soon. A recent article in the New York Times did a good job of summarizing the financial pain that many state governments are feeling right now. Unfortunately, as bad as the budget shortfalls are for this year, they are projected to be even worse in 2012....

So what is the solution? Well, for state and local politicians from coast to coast, the answer to these financial problems is to impose austerity measures. Of course they never, ever use the term "austerity measures", but that is exactly what they are. The following are 22 signs that austerity has already arrived in America and that it is going to be very, very painful.... #1 The financial manager of the Detroit Public Schools, Robert Bobb, has submitted a proposal to close half of all the schools in the city. His plan envisions class sizes of up to 62 students in the remaining schools. #2 Detroit Mayor Dave Bing wants to cut off 20 percent of the entire city from police and trash services in order to save money. #3 Things are so tight in California that Governor Jerry Brown is requiring approximately 48,000 state workers to turn in their government-paid cell phones by June 1st. #4 New York Governor Andrew Cuomo is proposing to completely eliminate 20 percent of state agencies. #5 New York City Mayor Michael Bloomberg has closed 20 fire departments at night and is proposing layoffs in every single city agency. #6 In the state of Illinois, lawmakers recently pushed through a 66 percent increase in the personal income tax rate. #7 The town of Prichard, Alabama came up with a unique way to battle their budget woes recently. They simply stopped sending out pension checks to retired workers. Of course this is a violation of state law, but town officials insist that they just do not have the money. #8 New Jersey Governor Chris Christie recently purposely skipped a scheduled 3.1 billion dollar payment to that state's pension system. #9 The state of New Jersey is in such bad shape that they still are facing a $10 billion budget deficit for this year even after cutting a billion dollars from the education budget and laying off thousands of teachers. #10 Due to a very serious budget shortfall, the city of Newark, New Jersey recently made very significant cuts to the police force. Subsequently, there has been a very substantial spike in the crime rate. #11 The city of Camden, New Jersey is "the second most dangerous city in America", but because of a huge budget shortfall they recently felt forced to lay off half of the city police force. #12 Philadelphia, Baltimore and Sacramento have all instituted "rolling brownouts" during which various city fire stations are shut down on a rotating basis. #13 In Georgia, the county of Clayton recently eliminated its entire public bus system in order to save 8 million dollars. #14 Oakland, California Police Chief Anthony Batts has announced that due to severe budget cuts there are a number of crimes that his department will simply not be able to respond to any longer. The crimes that the Oakland police will no longer be responding to include grand theft, burglary, car wrecks, identity theft and vandalism. #15 In Connecticut, the governor is asking state legislators to approve the biggest tax increase that the state has seen in two decades. #16 All across the United States, conditions at many state parks, recreation areas and historic sites are deplorable at best. Some states have backlogs of repair projects that are now over a billion dollars long. The following is a quote from a recent MSNBC article about these project backlogs....

#17 The state of Arizona recently announced that it has decided to stop paying for many types of organ transplants for people enrolled in its Medicaid program. #18 Not only that, but Arizona is do desperate for money that they have even sold off the state capitol building, the state supreme court building and the legislative chambers. #19 All over the nation, asphalt roads are actually being ground up and are being replaced with gravel because it is cheaper to maintain. The state of South Dakota has transformed over 100 miles of asphalt road into gravel over the past year, and 38 out of the 83 counties in the state of Michigan have transformed at least some of their asphalt roads into gravel roads. #20 The state of Illinois is such a financial disaster zone that it is hard to even describe. According to 60 Minutes, the state of Illinois is six months behind on their bill payments. 60 Minutes correspondent Steve Croft asked Illinois state Comptroller Dan Hynes how many people and organizations are waiting to be paid by the state, and this is how Hynes responded....

#21 The city of Chicago is in such dire straits financially that officials there are actually toying with the idea of setting up a city-owned casino as a way to raise cash. #22 Michigan Governor Rick Snyder is desperately looking for ways to cut the budget and he says that "hundreds of jurisdictions" in his state could go bankrupt over the next few years. But everything that you have just read is only the beginning. Budget shortfalls for our state and local governments are projected to be much worse in the years ahead. So what is the answer? Well, our state and local governments are going to have to spend less money. That means that we are likely to see even more savage budget cutting. In addition, our state and local politicians are going to feel intense pressure to find ways to "raise revenue". In fact, we are already starting to see this happen. According to the National Association of State Budget Officers, over the past couple of years a total of 36 out of the 50 U.S. states have raised taxes or fees of some sort. So hold on to your wallets, because the politicians are going to be coming after them. We are entering a time of extreme financial stress in America. The federal government is broke. Most of our state and local governments are broke. Record numbers of Americans are going bankrupt. Record numbers of Americans are being kicked out of their homes. Record numbers of Americans are now living in poverty. The debt-fueled prosperity of the last several decades came at a cost. We literally mortgaged the future. Now nothing will ever be the same again. |

| Ten years ago today, Ag was born. Posted: 17 Jan 2011 02:58 PM PST Silver is a big girl now, and our little baby looks like she's taking steroids! |

| Precious Metals Default Scenarios Posted: 17 Jan 2011 02:26 PM PST Precious Metals Default Scenarios Jeff Nielson 16 January 2011 For obvious reasons, there has been a great deal of discussion about actual, formal "defaults" in the gold and silver markets. Among those "obvious reasons" is that informal defaults are apparently already taking place in both markets. Beginning in the London gold market over a year ago, and now rumored to be occurring in New York's "COMEX" silver futures market, buyers who have legally contracted to take "physical delivery" of the metals they have purchased are said to be accepting large, paper bribes to accept a "cash settlement" instead. There are many reasons for investors to take such "rumors" seriously. Empirically, we see the premiums being charged for physical bullion (even from large, established dealers) rising to levels never before seen (Around the world). This strongly suggests a very tight market for bullion. This is confirmed through the anecdotal reports of both industrial users and large institutional investors (such as Sprott Asset Management) that they are having a great deal of difficulty locating any large quantities of bullion available for sale. In theoretical terms, we are merely seeing the culmination of arrogant bankers attempting to defy the elementary laws of supply and demand for over a quarter of a century. Even those with no training in economics know the basic rule (since it is merely an expression of common sense): when prices rise, demand falls; when prices fall, demand rises. There are many derivative principles which flow from this one basic law. Among the most salient (and the one apparently beyond the comprehension of bankers) is that if you under-price any good it will be over-consumed. I have demonstrated the unequivocal truth of this principle previously, and so will not do so again. Suffice it to say that in deliberately under-pricing gold and silver for well over a quarter of a century (through their relentless manipulation of these markets), the bankers have caused more than 25 years of excessive demand - where previous surpluses in these markets have been transformed into huge supply-deficits. In the gold market, where virtually all of the bullion ever produced has been conserved, this distortion of markets has merely resulted in a massive transfer of bullion: out of the vaults of the West and into the vaults of the East. The situation in the silver market is entirely different. Being both much cheaper than gold, and possessing even more superior chemical and metallurgical properties, silver was written off by those with no understanding of precious metals as merely an "industrial" commodity. As a matter of common sense, the rapid increase in industrial demand for silver must make it more "precious" rather than less so. Illustrating this elementary logic, the combination of gross under-pricing and surging industrial demand has served to decimate global silver stockpiles and inventories. Noted silver researcher Ted Butler has estimated that global stockpiles of silver plummeted from over 6 billion ounces (fifty years ago) to approximately 1 billion ounces today. Silver is literally six times "more precious" today than it was a half-century earlier. In terms of "inventories" (the amount of silver actually available for sale today), the destruction caused by the bankers is even more apparent. Between 1990 and 2005, global silver inventories plummeted by roughly 90%: from over 2 billion ounces to little more than 200,000 ounces. Since 2005, there has been a massive inventory-sham perpetrated by the bankers and the quasi-official "keeper of records" for the gold and silver sector: GFMS and the CPM Group. Through the farcical practice of adding the paper-bullion of silver "bullion-ETF's" to inventories and pretending this represents "new silver", inventories have magically "risen" by roughly 400% since then - despite the seemingly incongruous facts that silver demand has increased dramatically, while supply has remained flat. In fact, any bullion actually held in a bullion-ETF cannot be an "inventory", since it fails to satisfy the basic definition: it is not for sale, but rather is privately held by the unit-holders of these funds. How can the holders of such funds sleep at night, knowing that the legal "custodian" of their bullion is telling the world that their silver is "for sale"? Secondly, these holdings of bullion-ETF's are not "new silver" in any possible sense of those words. The bullion-ETF's didn't mine their own silver. They didn't discover "secret stockpiles", all they have done is to buy 100's of millions of ounces of silver out of existing inventories. For the record-keepers of the silver sector to pretend that these funds are "new silver inventories" is nothing but a shell-game of the clumsiest nature. It is because of the enormous differences between gold and silver inventories that a "default event" is likely to be much different between gold and silver. With gold bullion being principally a financial asset in global markets, it is much easier to forestall a true "failure to deliver" from occurring at the official bullion exchanges (i.e. London or New York) through the unofficial default-mechanism of "cash settlements". Indeed, the bankers consider this mechanism to be a "perfect solution" for the parameters of having very finite amounts of (extremely leveraged) bullion, while having access to infinite amounts of banker-paper from central bank printing presses. In reality, as the "cash settlements" continue to get larger and more frequent, at some point one or more large holders in this banker Ponzi-scheme are going to lose their nerve, and insist on real bullion rather than paper bribes. Such an event does not need to result in an official default. It merely needs to "spook the herd". As word gets out of some prominent investor refusing any quantity of banker-paper in favor of physical bullion (i.e. real "money"), this will cause the holders of $100's of billions of dollars of "paper bullion" products to ask themselves a very pointed question: "am I holding 'bullion' or am I holding 'paper'?" More importantly will be their response to such a question. The two obvious responses are either to demand delivery or to sell their paper bullion. At that point, it won't matter which path is taken, since both roads will lead to the obliteration of the bankers' 100:1-leveraged, paper gold Ponzi-scheme. If large numbers of bullion-holders demand delivery, there will either be a formal default in London or New York, or a formal default of the bullion-ETF's - since their "custodians" (the world's largest bullion "shorts") will simply walk-away from their commitment to unit-holders in order to cover their own, massive short positions. If large numbers of paper bullion-holders choose to sell their paper-bullion, this will create a massive decoupling between real "physical" bullion, and the vast quantities of paper-bullion products, where vendors are unable to conclusively prove these funds/accounts are fully-backed. While the default scenario in the gold market is necessarily complicated, the silver market offers a much clearer picture. The billions of ounces of silver which have been "consumed" industrially are now buried (in tiny quantities) in land-fills all over the Western world. Meanwhile, a large and obvious supply-deficit remains (for any observer not duped by the clumsy inventory-fraud). This can only end one way. Irrespective of whether the bankers can continue to mollify silver investors with their cash-bribes - and delay a formal default through investor demand alone, obviously this same mechanism cannot possibly work with the vast number of industrial users for silver - who need silver, or many/most of their businesses will cease to operate. You can't use banker-paper to make solar cells, lap-top computers, hybrid cars, anti-bacterial textiles, high-precision bearings, or satisfy any of the other myriad industrial applications for silver. Note that the bankers caused all of this incremental industrial demand through their decades of under-pricing silver - and now they have no possible means of meeting that demand. The only question which cannot be answered for investors (the question which they would like answered the most) is "when will default occur?" My own answer to this question is simple: the one aspect of "control" which the bankers still exert over the gold and silver markets is the timing of their own funerals. Allow these manipulated, grossly over-leveraged markets to implode today, and prices will soar higher (to multiples of current prices). Attempt to prolong their inevitable demise for several more months (years?), and all that happens is the implosion of these markets is even more catastrophic, with an even greater exponential effect on prices. Investors should not be troubled by this relatively minor level of uncertainty, as their strategy should be obvious: continue to accumulate precious metals until the bankers self-destruct. The longer we are forced to wait for our final pay-off/validation, the greater the reward for our patience. Meanwhile, the big-buyers who now rule this market can be expected to march precious metals prices higher - subject to occasional banker-orchestrated pull-backs, since these big-buyers will joyfully accept any "sales" on bullion provided to them by the bankers. The "obituaries" can already be written with respect to the era of banker-manipulation of precious metals markets. We merely have to wait to fill-in the date. Jeff Nielson http://www.bullionbullscanada.com/in...ary&Itemid=131 |

| The Gold Wave Patterns remain Bearish and SP 500 near the top Posted: 17 Jan 2011 01:19 PM PST My most recent forecasts for the SP 500 and Gold have been calling for interim peaks in both around Mid- January. Gold, I told my subscribers a few weeks ago, was definitely topping and likely to drop now to $1270-$1280 per ounce before resuming the Bull Market advance. The SP 500 I have forecasted a 1285-1315 topping area since the 1175 pivot lows on that index, and we are very close as well in that regard. |

| Posted: 17 Jan 2011 12:12 PM PST --Remember Ben Ali, the Tunisian President who was forced to flee his country this week as rising food prices drove people into the streets? Well, France's Le Monde is reporting that he didn't leave Tunis empty handed. According to Le Monde, Ben Ali and has family absconded with 1.5 tonnes of gold in their luggage (very strong luggage). That's about €45 million in gold. --Please note that they did not depart with Tunisian government bonds...or Spanish government bonds...or French government bonds. Or any government bonds at all, according to reports. Trust a thief to know best: gold is money. --You know it's an upside down world when the best way to a big-pay day is to flee/get deposed/retire. For example, AXA Asia Pacific chief Andrew Penn will receive a $17 million payout as part of his termination payment when his firm merges with AMP. The Age reports the termination payout is a combination of $8 million in options and $9 million in payout. --The obvious advice: get terminated! Of course that will only work if you're a highly-paid executive at a financial services corporation. If you're not, you had better keep getting wealth the old fashion way through hard work and good work. --We don't have anything against highly-paid executives, by the way. Who wouldn't want to be one of them? They often work many years under a lot of pressure. And running any kind of big, complex, multinational organisation these days requires a certain amount of talent. --But Mr. Penn' payout is an example of how good times have been for the financial services industry lately. In an economy that's been "financialised" by huge credit growth, the money shufflers of the world are going to make a killing. When they start jumping ship (as many CEOs did in 2007), you should take note. --The wider Australian market continues to take its cues from events abroad. Yesterday, the fear is that China did too much to slow down inflation and as its economy slows, so will Australia's. China, for its part, is ploughing ahead with efforts to prick its various credit bubbles before they pop in everyone's face. --For example, The People's Daily Online reports that Shanghai Mayor will announce new measures to make local housing more affordable to young professionals (it sounds so familiar). "We will step up macro-control measures, prioritize the supply of non-luxury residential units to be owned and occupied by ordinary citizens, and prepare for the trial reform on property tax as required by the central government," Han said, according to Bloomberg. --The trouble with bubbles is not that they are difficult (impossible) to manage. It's that once an economy has misallocated credit and real resources to speculative activity, the losses have to be written off before you can move on to a new investment frontier. -- Governments try to soften the blow of a bursting bubble by drawing out the consequences. But this usually turns what would be a sharp but short-lived adjustment into a long, drawn-out affair that ties up capital in old, non-productive investments. Sort of like all that bad housing debt that still sits on the balance sheets of American banks like a big fat stink bomb. --But good luck with that property bubble Shanghai! Home prices were up 26.1% in Shanghai last year and nearly 30% in Chongqing, according to Soufun Holdings, Ltd. That makes Melbourne, with its 10% gains in 2010, look miserly. --The trouble for the People's Bank of China (PBOC) is that banks have exceeded its loan quotas routinely in the last two years. This is why the PBOC is now trying reserve ratios to reign in the asset bubble. Thus the state of a global fiat dollar standard, where Chinese banks are just as capable of irresponsible lending as banks in Australia, Europe, and America. --Bad news for the Australian housing market could come in the form or rising interest rates. HSBC economist Paul Bloxham says interest rates will have to go up soon. He told clients that, "Food prices will rise due to the floods . . . against the backdrop of food markets which were already pretty tight." --"The more important issue," he added, "is that, with the labour market already around full employment, additional expenditure on reconstruction and repair will put further upward pressure on wages and thus inflation." He reckons rates will go up by 75 basis points this year and a full point by this time next year, to 5.75%. Similar Posts: |

| The US Deficit Recovery Program and Other Fallacies Posted: 17 Jan 2011 12:03 PM PST Products of the past...doomed... Chinese President Hu Jintao: the US dollar-based monetary system is a "product of the past." He is right about that. And last week two major US credit agencies – Moody's and Standard and Poor's – underlined the point. They said America's triple A credit rating would be lost if the nation continues to borrow so much money. Amen to that, brother... But how can the US borrow less? Ben Bernanke says the US economy will probably grow between 3% and 4% this year. Pretty good, huh? We can stop worrying, huh? Wait a minute. We don't know if the US economy will grow this year...and neither does Ben Bernanke. But even if it were to grow at 3% to 4%...would that mean we were enjoying a genuine recovery? Could the US dollar-based monetary system hold up after all? Could it surprise the Chinese and be a product of the future as well as of the past? Let's see how the present economic model works. You spend $10 trillion on bailouts and stimulus. This puts the whole country on course for bankruptcy...where the Chinese are telling you that your money is history...and the rating agencies are threatening to take you down a notch or two. But for your trouble you get, say, 4% growth. Hmmmm...4% growth is equal to about $560 billion more GDP. But don't look too closely. Much of this extra GDP is debt-fueled government boondoggling which adds nothing real to the nation's wealth. But in order to keep this "growth" going, you have to continue to run deficits – of about a trillion dollars a year. Hold on...what kind of business is Ben Bernanke running? It costs more in deficit spending than you get in positive GDP growth. Well, maybe you lose money every year...but you can make it up in the long run! Hold on... The deficits are expected to run 5% to 10% of GDP for years. Maybe forever. If the growth rate is only in the 3%-4% range, it will mean that debt always outgrows growth. In fact, that is exactly what almost every economist projects. Then, what's the point? Well, maybe deficits can be cut...and the growth rate will pick up? Hey, anything is possible. And since we're starting out in 2011 with a positive attitude...we're ready to believe anything. And maybe that's what gold speculators were thinking on Friday. They sold gold – taking the price down $26 an ounce. Gold rises as confidence in the financial system falls. If gold is falling, it must mean the confidence in the Bernanke, Geithner team is increasing. Based on the evidence so far, we'd have to take the other side of that bet. If Bernanke & Co. have any idea what they are doing it is not apparent from the public record. Even now, in the 5th year of the Great Correction, they still seem unable to see what is going on. Bernanke:

It may be that, in private, Bernanke has a clearer view of things. But we cannot tap his phone or channel his dreams. All we have to go on is what he says...and does. So far, he has said or done nothing that gives us confidence in the man. He's right: we got into trouble by making too many bad loans. But why did "we" do that? Because the Fed lent money too cheaply! It encouraged speculation and risk taking – especially by the banks, who must have known that they would be bailed out if they got into trouble. And how could the Fed remedy the situation? Easy. It could raise rates – just as Paul Volcker did. It could put the squeeze on speculators. It could raise reserve requirements. It could allow the banks to go bust...send them a message they wouldn't forget. But what has Bernanke done? Just the opposite. He has rewarded the reckless speculators by buying up their bad bets (adding $1.7 trillion in trashy mortgage backed securities to the Fed's core holdings). He has cut rates even more...bringing the effective rate down to zero for privileged borrowers. And he has created the illusion of "recovery" – by goosing up prices of stocks and commodities. Bad policies. Bad in the short run. Worse in the long run. Regards, Bill Bonner, |

| Goldrunner: Has Gold Topped Out? Nope, You Ain’t Seen Nothing, Yet! Posted: 17 Jan 2011 11:45 AM PST

A Gold Bull Market is much like a bucking bronco in the Old West – constantly trying to buck investors out of the saddle – as many in the Precious Metals universe are calling an intermediate-term top for Gold. Some are even suggesting that we have seen the final top in this Historic Gold Bull. We have a completely different view maintaining that we are very close to the juncture where Gold starts another rip higher into May or June. Let me explain. We believe such a significant move will just be one more step up for the developing Gold parabola that we have been following via the 1970's Gold Fractal Chart and will usher in a more parabolic rise on the chart. A Look At The Arithmetic $Gold Chart Gold Observation #1 Gold Observation #2 Observation #3 Short-Term Projection For Price of Gold – $1,975 by May/June Jesse Livermore is quoted as having said the following about a Gold Bull Market: "Get right, and sit tight." It seems that even the best of the best have struggled to stay in the saddle of historic gold bulls – so hang in there! Goldrunner has posted the above editorial on GoldrunnerFractalAnalysis.com which is his soon to be subscription website. Anyone wishing to receive information about when the site will be active can send an e-mail to GOLDRUNNER44@AOL.COM. Disclaimer Please understand that the above is just the opinion of a small fish in a large sea. None of the above is intended as investment advice, but merely an opinion of the potential of what might be. Simply put: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Comments within the text should not be construed as specific recommendations to buy or sell securities. Individuals should consult with their broker and personal financial advisors before engaging in any trading activities. Do your own due diligence regarding personal investment decisions. Goldrunner currently holds investments in the Precious Metals and Precious Metals stocks. |

| Strong Indications of Gold & Silver Shortages Posted: 17 Jan 2011 11:35 AM PST You need to go to the link to see the charts, I don't know much about cross plot charts, but Douglases interpretation is interesting. http://www.24hgold.com/english/contr...Adrian+Douglas Strong Indications of Gold & Silver Shortages by Adrian Douglas - Market Force Analysis Published : January 17th, 2011 Since reaching new highs at the end of 2010 gold and silver have been sold off, and the selling has been particularly intense in the last few days. The news on the economy is almost exclusively bullish for the precious metals. From the price action one might be falsely led to believe that investment demand for the precious metals is waning. On the contrary the data analysis I will show in this article reveals strong indications of growing shortages and furthermore that the gold and silver markets are approaching "tipping points" that will lead to an acceleration of price appreciation. We will first consider silver because the data for silver is the most dramatic. Figure 1 Figure 1 shows a cross plot of Comex silver futures open interest against the silver price since 2001. By looking at the data in this way the time element is removed and the relationship between open interest and price is revealed. On the left side of the chart the data falls within the green dotted ellipse. The long axis of the ellipse is slanted upwards which means that generally the data within the ellipse display a relationship wherein the price of silver increases as open interest increases and it falls as open interest declines. Within the green ellipse there are tightly packed clusters of data that have been enclosed in pink ellipses and are numbered from 1 through 4. Ellipse #1 is almost vertical; this data cluster is from the start of the bull market when silver was trading around $5/oz. Because this data cluster is almost vertical it means that at that time expansion of open interest did not result in an increase in price. In other words, there was sufficient supply of silver in the market that the commercials were ready to keep selling as many contracts short as speculators demanded. If all demand for contracts on the long side was met with eager short selling the price could never rise and it didn't. The data within ellipse #1 demonstrate that whether the open interest was 60,000 contracts or 120,000 contracts the price remained around $5/oz. It can be seen, however, that this situation gradually changed. The data clusters 2, 3 and 4 are enclosed by ellipses whose long axes tip progressively more toward the horizontal as one goes toward the right of the chart. As the ellipse leans over it means that the price is becoming much more sensitive to the open interest. As open interest increases the sellers are only prepared to meet increasing demand from the speculators at ever increasing prices. The progressively decreasing slope of the long axes of the ellipses 1 through 4 is indicative of a tightening supply of physical silver. As the supply becomes tighter there are less willing sellers so there are only minimal increases in open interest for quite large increases in price. The exciting revelation comes from ellipse #5 which is shown in red. This encompasses the open interest versus price data since silver went above $22/oz. The long axis of this ellipse is downward dipping. This means that as the price increases the open interest contracts! This means that in general existing shorts are covering their positions as the price rises. This is indicative of a looming chronic shortage. The owners of a commodity should be happy to sell at higher prices but that is not the case in silver. This shows that those who have committed to sell and don't have the silver are buying back their commitments and those that have silver no longer want to sell it. There is no other way to interpret this change in relationship between open interest and price that has been developing over the last ten years. We have reached the tipping point where physical shortages are going to become more and more apparent. John Embry in a recent interview with KWN explained how difficult it was to source physical silver for the Sprott Physical Silver Fund. In daily updates in the Midas column of www.lemetropolecafe.com I have shown how Comex silver inventories are shrinking and are not far from ten year lows. The Financial Times just reported on acute shortages of gold bars for investment in Asia. Let's now look at gold. Figure 2 shows a cross plot of Comex gold futures open interest against the gold price since 2001. There is a similar pattern to what was seen in silver except the lower volatility of gold results in the clusters being more tightly packed. Figure 2 There are five ellipses shown in pink and numbered 1 through 5. The long axes of the ellipses tip toward the horizontal as one goes from left to right on the chart. Ellipse #1 encompasses data from very early in the bull market. The ellipse is almost vertical which means that at that time increased demand for gold futures was met willingly by the sellers such that increasing open interest resulted in only minor increases in price. It can be seen from ellipse #1 that an expansion of open interest from 100,000 contracts to 375,000 contracts resulted in the gold price increasing from $260/oz to $425/oz, an increase of $165/oz. The ellipse #5 shows that an increase of around 50,000 contracts (600,000 to 650,000) resulted in an increase in the gold price of almost $200/oz ($1200/oz to $1400/oz). Just as we saw with silver the tendency of the long axes of the ellipses to tilt over as we go from left to right on the chart is an indication of a growing shortage. Ellipse #6 has been marked in red. It is horizontal. That is not yet quite as dramatic as in the case of silver where the ellipse is downward sloping but nonetheless it is indicating a looming chronic physical shortage. This horizontal data cluster means that even as the price rises the sellers, considered overall as a group, can not be persuaded to sell more commitments to deliver gold in the future despite a rising price. The clear trend in the data clusters that has developed over the last ten years indicates that the gold open interest will soon be declining with a rising price as is the case for silver. Taken together the data shows that in both gold and silver there is a growing reluctance of the traditional short sellers to meet rising demand even at elevated prices. This is strongly indicative of looming physical shortages. This conclusion is corroborated by many other market observations and anecdotal evidence. We are likely very close to the "tipping point" where shortages become exposed and a stampede of investors into precious metals to benefit from the accelerating prices will give rise to a feeding frenzy that will exacerbate the shortages. Perversely the more the market becomes close to the tipping point the more we can expect the cartel of bullion banks to make bear raids as we have seen this last week because they desperately need to cover their short positions. However, in the case of silver and soon to be the case with gold a negatively correlated open interest to price relationship means that lower prices lead to higher open interest; in other words there is no way to cover at lower prices; the only way to cover is at higher prices. As this becomes increasingly obvious to the cartel the severity of the bear raids will decrease, particularly when the premiums in the physical market are showing that the bear raids are stimulating massive physical offtake making the predicament of the cartel ever more precarious. This makes the brouhaha about the CFTC imposing position limits on the Comex a complete joke because, as always, the regulators are going to be too late. Just like all the other nefarious financial engineering schemes that are falling like houses of cards, the scam of selling precious metals that do not exist is fast approaching a rendezvous with its day of reckoning. Adrian Douglas Marketforceanalys.com |

| Private Buyers Defy Fund-Manager Sales with ‘Massive Demand’ Posted: 17 Jan 2011 10:00 AM PST Gold and silver bullion prices rose together with all major currencies on Tuesday morning vs. the dollar, erasing last week's losses for US investors as European stock markets gained more than 1%. |

| Gentlemen, Start Your...Houses! Posted: 17 Jan 2011 10:00 AM PST Trading action resumed on Tuesday with gains across the precious metals boards. A sizeable drop in the US dollar on the trade-weighted index prompted by early concerns about US housing starts data gave buyers the impetus to lift prices. |

| All That is Gold Does Not Glitter Posted: 17 Jan 2011 10:00 AM PST In the wake of gold's panic-inducing $30, one day sell off on Friday, players across the hedge fund universe are reassessing their relationship with the barbarous relic. |

| US Dollar, Gold & Silver Are Down – Really? Posted: 17 Jan 2011 10:00 AM PST US Dollar Index futures have been sold heavily and interestingly enough, gold and silver have not rallied. In fact, gold and silver have sold off while the dollar experienced downward price action as well. How does that whole scenario make any sense? |

| Tracking a Silver ETF’s Impact Posted: 17 Jan 2011 10:00 AM PST Silver's massive autumn rally has utterly captivated speculators and investors, their appetite for all things silver is insatiable. Interestingly a major driver of this metal's recent surge was stock-market buying of the flagship silver ETF, SLV. |

| Silver Wheaton: A Double in Waiting? Posted: 17 Jan 2011 09:11 AM PST

Silver Wheaton (SLW) has one of the best business models I have ever seen… It could make a billion dollars in profits in 2013… yet it has less than two-dozen employees and basically no operations. Its "business" is driving to the bank and cashing royalty checks. When your business is depositing big checks payable to you, it's near impossible to lose money. The biggest expense for a royalty company is income taxes… but Silver Wheaton has found a way to pay no income tax. It's based in the Cayman Islands. Silver Wheaton cashes royalty checks on silver – gold's redheaded stepchild. And if silver simply stays where it is, Silver Wheaton shares should nearly double by 2013. Here's how it works… Silver Wheaton approaches gold mining companies about buying their "pesky" silver byproduct. You see, gold companies want to be primarily gold producers, not gold-and-silver producers. But because silver deposits often occur alongside gold deposits, silver is often a byproduct of gold mining. Silver Wheaton approaches mining companies with cash in hand when the miners are the most vulnerable… when it's time to build a mine. A new mine is incredibly expensive, and "free" cash from Silver Wheaton up-front to help build a mine is irresistible… It's too attractive NOT to take. Then the good stuff starts for Silver Wheaton… It gets all the silver that comes out of the mine for just $4 per ounce. With silver at $29 right now, Silver Wheaton nets $25 per ounce of silver. Silver Wheaton's pile of silver keeps growing. It's on track to sell 40 million ounces of silver in 2013. If the company nets $25 per ounce… times 40 million ounces… it'll make a profit of $1 billion dollars in 2013. Economist-turned-Gold Stock Analyst-editor John Doody says a fair value for precious metal royalty "streaming" companies like Silver Wheaton is 20 times the royalties. Twenty times $1 billion is $20 billion. Yet as I write, Silver Wheaton is valued around $10.8 billion. Silver Wheaton shares would have to nearly double to get that kind of market value. What's our downside here? Primarily the price of silver… If silver tanks, Silver Wheaton will tank even harder. Since Silver Wheaton is so highly leveraged to the price of silver, it can fall dramatically – and it has in the past. If the price of silver goes up (which it should in the long run) or the ounces it earns royalties on go up (which they should in the long run), Silver Wheaton will double or more from here. Months ago in my True Wealth newsletter, I recommended buying shares of Silver Wheaton. I told my readers to use a 50% trailing stop and sell half once they were up 100%. From there, the sky is the limit. Currently in True Wealth, Silver Wheaton is a "hold." I moved these shares to a hold in mid-December. Corrections in silver are often violent. So I will wait for this correction to pass – I will wait for the uptrend to resume – before buying back in again. But Silver Wheaton is a story you should follow… It's a double in waiting. Good investing, Steve |

| Working For Profit to Prop Up the Economy Posted: 17 Jan 2011 08:46 AM PST Everybody seems to be complaining about the unemployment rate, mostly (I suspect) those who are unemployed. Being but a heartbeat away from that dismal fate myself, due to my crippling handicap of Lazy Bum Syndrome (LBS), I empathize with their plight. Naturally I am also laughing scornfully at anybody who thinks that, perhaps as a result of a miracle, the cycle will slowly turn around, things are going to get better, albeit slowly and surely, and jobs are going to gradually begin to appear sometime soon, flowers will again bloom, the sun will again shine, and over time unemployment will fall until, one day, jobs paying The Big Bucks (TBB) are everywhere, and everything will be fine – better than fine! – again. Hahahaha! Of course, there are those who are so drug-addled, drunk or mentally ill that they cannot properly interpret my Mogambo Laugh Of Scorn (MLOS), ringing loud and clear, as it does, across the fruitful fields and bustling cities of this great country, echoing from the rugged mountains, bouncing off buttes and mesas, caroming through canyons and valleys, flying across the flats – literally defying the very laws of physics the entire time! – to decry what abject, ridiculous stupidity this is! The fact is that our economic system, ostensibly geared towards profit-making capitalism in a free market, is now so grotesquely distorted and bizarre that 1 out of every 5 workers (mostly government and school systems) gets paid by taxes, and earns no profit on which to pay taxes! And another 1 out of 10 workers works for a non-profit organization, again making no profit! Together, this means that that 3 of every 10 workers in the Whole Freaking Country – a freaking third of the entire workforce! – relies, like parasites and leeches, on the other 7 in 10 workers to work and thus make enough profit to pay taxes and/or contribute with donations! This is insane! It's beyond insane! We're Freaking Doomed (WFD)! And, worse, since government workers now ludicrously make about twice as much as the private-sector workers, this makes it the equivalent of 5 of every 12 workers – almost half! – making no profit, paying no taxes on profits, paying no capital gains taxes, and relying on the other 7 workers to support them all! Did I say this is insane? I should have, because This Is Insane (TII), so I will, and say, "This Is Insane (TII)!" Agora Financial's Dave Gonigam, in his essay "BLS Unemployment Report Doesn't Add Up" obviously doesn't want to get into this whole "who is insane and who isn't" with a guy who is obviously insane, or at least acts like it, and they stick to the facts, one of which is "the percentage of working-age population in the labor force. It fell to 64.3% last month," which is a level that hasn't been seen since the early '70s. So if everything is so bad, then you want to know, "How come the official, governmental statistics show that unemployment is down, albeit by some mere fraction of a percent? Or is this, as we all suspect, just another case of the Great Mogambo Idiot (GMI) shooting his stupid mouth off, trying to impress people in a pathetic cry for attention that makes us despise you all the more and spit in your food when you are not looking?" Well, thanks for asking, but Dave says, "Herein lies one of the Bureau of Labor Statistics' favorite tricks. If you gave up looking for work more than a year ago, you're no longer counted as part of the labor force. Thus, employers added only 103,000 jobs in December…but incredibly, we have 556,000 fewer unemployed people!" Thus, as intended, headline unemployment, expressed as a percentage of the work force, "fell to its lowest in 20 months because more people gave up looking for work"! Hahaha! Showing that Mr. Gonigam is a true economist in the sense of Hazlitt's famous Economics in One Lesson, he continues on to think of the ramifications, one of which is a "big problem for Uncle Sam, because that means more people with no income to tax." And so, you can be sure, by looking deep, deep, deep into my clear blue eyes to see my Utter, Utter Sincerity (UUS), that the federal government is going to attempt to buy the nation's way out of this mess with even more government deficit-spending (as astonishing as that is to say), that the Federal Reserve will create the money that they will need (as astonishing as that is to say), that hellish inflation in prices is guaranteed from all of this new money (as terrifying as that is to say), and that gold and silver will soar in price (as wonderful as that is to say, if you own gold and silver). And it is more wonderful than that, in that buying them is so easy, too! "Here's my money, so give me my metal!" Whee! This investing stuff is easy! The Mogambo Guru Working For Profit to Prop Up the Economy originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." |

| Posted: 17 Jan 2011 08:46 AM PST Controlled markets in which price does not equilibrate supply and demand are often characterized by shortages. When this happens in gold market, it's called "tightness" rather than shortages. It sounds better. The tightness in gold is revealed by the growing spread between physical and paper gold. This is revealed in the chart below. The tightness becomes statistically significant when spread exceeds two deviations. The spread currently stands at 1.73. Physical relentless push since October 2010 and the spread's stickiness during the paper operation have to be raising some eyebrows. Gold London PM Fixed and Gold ETF (GLD) Ratio: Headline: PRECIOUS METALS: Gold Rises In Asia; Physical Market Tight

Source: online.wsj.com Source: The Gold Market Is 'Tight' |

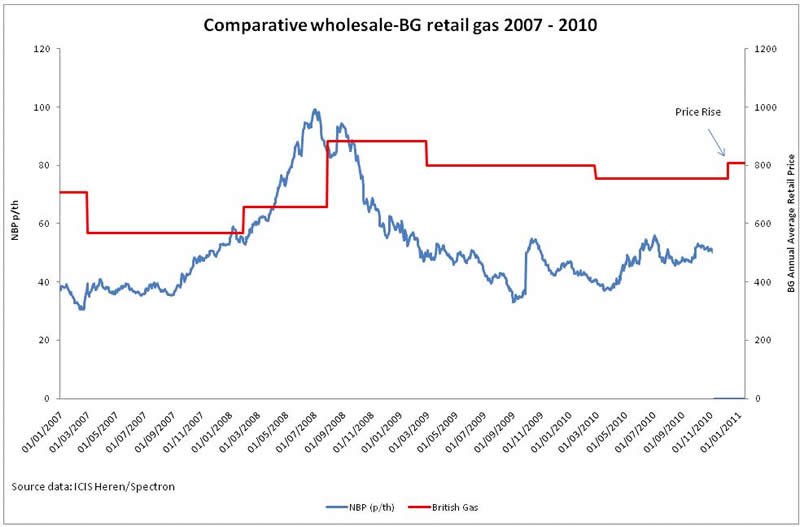

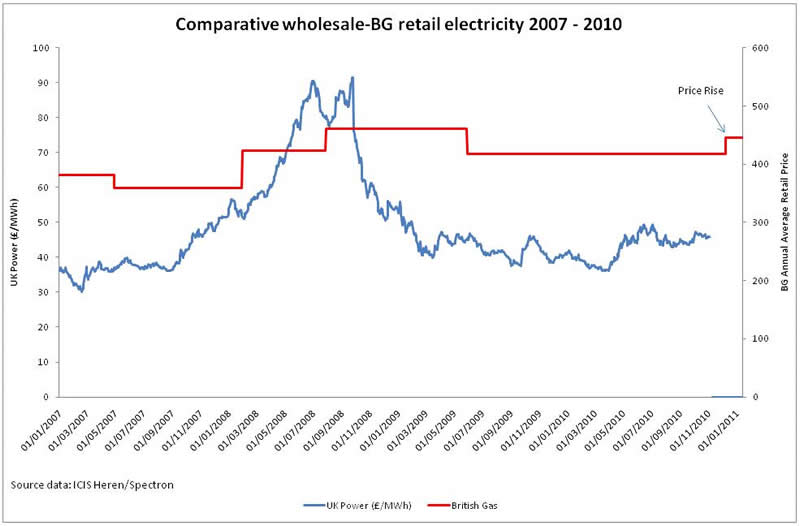

| UK Inflation Forecast 2011, Imminent Spike to Above CPI 4%, RPI 6% Posted: 17 Jan 2011 08:04 AM PST The last UK inflation data came in at CPI 3.3% and RPI 4.7% for November 2010, with real inflation at just above 6%, this is set against a continuous mantra in the mainstream press by pseudo economists / journalists that high inflation of above 3% was always just temporary and that it would resolve in a sub 2% rate by the end of the year (2010). Now a year on the same people that had misguided their readerships for virtually the whole of 2010 into avoiding inflation protection strategies that the coalition government has proceeded to strip away during 2010 such as scrapping of the RPI linked Index Linked National Savings certificates in June 2010, and are only now warning their readership's of the consequences of persistently high inflation that looks set to continue during 2011. This is set against my in depth analysis and concluding inflation forecast of December 2009, that UK inflation would spike to above 3% early 2010 and remain above 3% for virtually the whole year as illustrated by the below forecast graph (27th December 2009 UK CPI Inflation Forecast 2010, Imminent and Sustained Spike Above 3%).

The implications of high inflation for the economy and financial markets were further elaborated at length in January 2010′s 100 page The Inflation Mega-trend ebook (FREE DOWNLOAD) that contained 50 pages of analysis and 50 pages of wealth protection strategies to protect and grow ones wealth during a sustained period of high inflation which would be used by the UK Government as the primary mechanism to stealth tax and erode the value of UK debt. One year on the Inflation mega-trend continues to gather momentum which means that the wealth protection strategies are just as valid today as they were in January 2010, that I will continue to update the status of during 2011. Bank of England Inflation Propaganda Reports 2010 High UK Inflation that has apparently surprised everyone to the upside for virtually the whole of 2010, by spiking and remaining above 3% from early in the year illustrates the tendency of the mainstream press to basically regurgitate the views of vested interests that beat the drum of always imminent DEFLATION for the whole of the year as High inflation was always just temporary and should be ignored by the general population. To look at the reason why high inflation has been ignored during 2010 we have to look beyond journalists, we have to look beyond academic economists that are paid to follow a school of thought that their pay masters want to push in the media. The place to look for the reason why high Inflation was ignored throughout 2010 is to the very top of the financial pyramid, to the Bank of England. The connection that the mainstream press has never been able to make is that the Bank of England does NOT make Forecasts. Instead the Bank of England quarterly inflation forecast reports are nothing more than ECONOMIC PROPGANDA, that virtually always converge towards the Bank of England achieving its 2% Inflation target in 2 years time, despite the fact that historical analysis shows that the Bank of England FAILS in achieving its 2% target 96% of the time. The following are the four quarterly Inflation forecast reports by the Bank of England issued during 2010 that were instrumental in academic economists and journalists in the mainstream press regurgitating the always temporarily high inflation mantra during 2010. Bank of England February 2010 Inflation Report