Gold World News Flash |

- Inflation: The Incredible Shrinking Dollar

- Gold Seeker Closing Report: Gold and Silver Gain With Stocks

- Crude Oil Rises on Demand Outlook, Gold Continues to Hold Support

- Thomas Kaplan: Brace for a 'perfect storm' in gold

- Bill Fleckenstein: The Race To the Bottom Will Be Won By the Dollar

- Eric King Interviews Rick Santelli

- Historical Silver: Gold Ratio Suggests Parabolic Top For Silver of Over $100 per Oz

- A Note From Alf Fields

- In The News Today

- Crude Fireworks

- US Mint Reports January Silver Sales Hit 26 Year High

- Great Basin Gold: Ready for Big Moves in 2011

- Gold Will Seize The Day

- 2011?s Wrecking Ball

- Guest Post: Tossing The Consumer Under The Bus...And Insanely Expecting An Economic Recovery

- Gold Price Looks to Continue Correction, What Would Change My Mind?

- JPM's Mortgage Unit Sued To Disclose Loan Quality Data, Following Allegations It Misrepresented Over 70% Of Loan Portfolio

- Defining Economics

- Are Mining Stocks a Sell at Their 2008 Highs?

- Better than Zero

- 2011′s Wrecking Ball

- Silver is higher in all currencies today, especially in the weaker US dollar.

- We Are In "The Great Depression II"

- A New ETF to Play Gold's Appeal

- Gold Daily and Silver Weekly Charts

- When Rising Food and Energy Prices Begin to Wreak Havoc

- TUESDAY Market Excerpts

- Ben Davies: He Scares fiat money addicts like Joe Weisenthal

- Good Time Charlie Gasbag needs a Seltzer enema

- Fed Spinning Gold

- Food Riots 2011

- Freedom Matters - Issue: January 18th 2011

- Long-Term Trends vs. Short-Term Corrections

- GoldCore Comments On Silver Shortages And A Possible Price "Tipping Point"

- Mining Stocks Decline to Their 2008 Highs - Should You Sell?

- Evidence the China Bubble is Edging Closer to a Pop

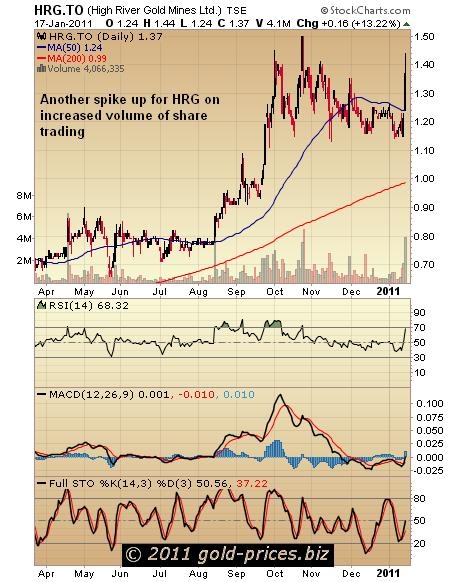

- Why We're Not Selling Into High River Gold Mines' Good News

- Cheaper Dollar Will Open Door For Chinese Investments In North American Natural Resource Companies

- Silver Consolidating, Yukon E-Conference Tomorrow

- Gold: Correction Or Consolidation?

- A Lighter Shade of Gray

- Gold Stocks: Stick with Juniors and Avoid Large Caps

- 2011 Financial Meltdown Fast Approaching

- He's Crushed the Stock Market for 13 Straight Years

- Ponzi Metal Paper Scheme To Collapse Soon

- Sell Gold, Buy Silver

- A Word of Advice to Financial Authorities

- Working For Profit to Prop Up the Economy

- Lawrence Williams: There's no substitute for gold as the world order changes

- Alasdair Macleod: The failure of derivatives regulation of precious metals

| Inflation: The Incredible Shrinking Dollar Posted: 18 Jan 2011 06:12 PM PST Guess what? Your pocket has been picked. I don't mean your wallet, or even its contents. What I am referring to is the buying power of the money it contains. The consumer price index (CPI) tells the story. As you know, it measures the change in prices of a fixed basket of goods and services that the typical household supposedly purchases every month. The recent trend of the CPI does not reveal much to worry about. In 2010, consumer prices rose a relatively benign 1.5%. However, there is more to this story. For one thing, prices in the month of December alone rose a whopping 0.5%. That was the biggest monthly rise since June 2009. Besides food and energy, other items in the consumer's basket went up as well, including health care, apparel and airline fares. Few items fell. Longer term, the buck's buying power has been shrinking for years — indeed, for decades. More Here.. |

| Gold Seeker Closing Report: Gold and Silver Gain With Stocks Posted: 18 Jan 2011 04:00 PM PST |

| Crude Oil Rises on Demand Outlook, Gold Continues to Hold Support Posted: 18 Jan 2011 03:40 PM PST courtesy of DailyFX.com January 18, 2011 08:51 PM Crude oil remains elevated as demand estimates move higher. Meanwhile, gold continues to hold a key technical level. Commodities – Energy Crude Oil Rises on Demand Outlook Crude Oil (WTI) - $91.51 // $0.13 // 0.14% Commentary: WTI fell $0.16, or 0.17%, on Monday to settle at $91.38, while Brent added $0.37, or 0.38%, to settle at $97.80. News that the Trans-Alaska pipeline led to modest selling initially, but prices rebounded to settle near 26-month highs. U.S. equity markets followed a similar pattern, selling off initially on profit taking and bad news related to tech giant Apple, but then finishing the session at 27-month highs. The IEA revised up its estimate of demand growth for 2011 by 0.32mmbbl/d to 1.4mmbbl/d due to robust economic growth and a colder-than-normal winter in the northern hemisphere. In turn, the call on OPEC was also upped to 29.9mmbbl/d versus current production near 29.6mmbbl/d. OPEC spare ca... |

| Thomas Kaplan: Brace for a 'perfect storm' in gold Posted: 18 Jan 2011 03:14 PM PST By Thomas Kaplan http://www.ft.com/cms/s/0/3b8b9f78-2312-11e0-ad0b-00144feab49a.html Investment implies moving some part of one's assets from financial safety to a position of acceptable risk with the hope of increasing wealth over time. What qualifies as "acceptable risk" may thus be seen to be the gating question for the investment criteria of a "prudent man." This has come to be known as the Prudent Man Rule to guide persons entrusted with the finances of others. Although the rule remains a guiding principle in the fund management industry to this day, at least one key element has changed. In 1971, our understanding of ultimate safety was transformed when President Nixon ended the US government's certification that each dollar in circulation was, in effect, worth exactly 1/35th of an ounce of gold. Since all major currencies had been linked to gold via the US dollar since 1945, when the US held the majority of monetary reserves, the announcement provoked a momentous change in the financial culture. Cash no longer meant gold: The amount of dollars the Federal Reserve could print would not be restricted to some degree by a stored metallic tangible asset with a finite supply. In a great leap of faith, paper dollars and traded US federal liabilities became "risk-free" assets, while gold, long regarded as money itself, was disdained as a "commodity," a volatile "risk asset." ...Dispatch continues below ... ADVERTISEMENT Sona Drills 85.4g Gold/Ton Over 4 Metres at Elizabeth Gold Deposit, Extending the Mineralization of the Southwest Vein on the Property Company Press Release, October 27, 2010 VANCOUVER, British Columbia -- Sona Resources Corp. reports on five drillling holes in the third round of assay results from the recently completed drill program at its 100 percent-owned Elizabeth Gold Deposit Property in the Lillooet Mining District of southern British Columbia. Highlights from the diamond drilling include: -- Hole E10-66 intersected 17.4g gold/ton over 1.54 metres. -- Hole E10-67 intersected 96.4g gold/ton over 2.5 metres, including one assay interval of 383g of gold/ton over 0.5 metres. -- Hole E10-69 intersected 85.4g gold/ton over 4.03 metres, including one assay interval of 230g gold/ton over 1 metre. Four drill holes, E10-66 to E10-69, targeted the southwestern end of the Southwest Vein, and three of the holes have expanded the mineralized zone in that direction. The Southwest Vein gold mineralization has now been intersected over a strike length of 325 metres, with the deepest hole drilled less than 200 metres from surface. "The assay results from the Southwest Zone quartz vein continue to be extremely positive," says John P. Thompson, Sona's president and CEO. "We are expanding the Southwest Vein, and this high-grade gold mineralization remains wide open down dip and along strike to the southwest." For the company's full press release, please visit: http://sonaresources.com/_resources/news/SONA_NR19_2010.pdf This historically radical new notion was validated by the arbiters of money themselves. Central bankers dumped gold, driving prices down sharply during the 1990s. They thereby reinforced the MBA textbook perceptions that the dollar and US Treasury bonds were "risk-free" assets and gold a "barbarous relic," as John Maynard Keynes famously called it. Even today, as the gold rally has reached the 10-year mark (following a 20-year bear market), the metal represents a mere 0.6 per cent of total global financial assets (stocks, bonds and cash). This is near the all-time low (0.3 per cent) reached in 2001, and significantly below the 3 per cent it accounted for in 1980 and the 4.8 per cent it was in 1968. However, there are changes afoot. After a lengthy absence, some asset managers and central bankers are readmitting gold back into the group of prudent asset classes. Assessing the devastation of financial industry and government balance sheets, fiduciaries have been reminded that one of the principal reasons to hold gold -- that it is the only major financial asset that does not represent someone else's obligation to repay -- is not the arcane concept it once appeared. I believe the renewed appreciation of risk management is in its infancy and that gold, like stocks and bonds, will recover its relatively small, but significant historical position in the world's investment funds. Considering the tiny size of the gold market, the implications of a potential return of gold into the world's largest portfolios are enormous. For, unlike stocks and bonds, whose supply can increase to meet demand, there is not enough gold to go around at today's prices. According to International Strategy and Investment Group (ISI), if gold ownership rose from 0.6 per cent of total financial assets to only 1.2 per cent, still less than half its 1980s level, this would equate to an additional 26,000 tonnes, or 16 per cent of aggregate gold worldwide. This represents 10 years' worth of current production. Is such a momentous development likely? I suggest it is more likely than not, as the metal is set up for a "perfect storm" from a supply/demand standpoint. At a time when mining companies can barely find enough gold to replace their reserves and production growth is anaemic, central banks have not only stopped selling their gold but are now aligning with investors to accumulate it. As it dawns on the wider market that the bull market in gold is real, the impact on gold mining equities will probably be dramatic. Until recently, in spite of their theoretical leverage, miners have lagged behind the metal's performance. This should not be so surprising. As most analysts haven't changed the long-term pricing of their cash-flow models to reflect a sustained bull market in gold, the shares have underperformed amid assumptions that are outmoded. This disconnect is similar to the experience of energy equities in the early 2000s. Even as oil surged, it was not until investors accepted that oil might not stay low forever and started to factor in higher prices that the equities were revalued. With the total market capitalisation of all gold mining companies only fractionally higher than that of Apple, any move by investors to capture the inherent leverage of these equities could drive stock prices substantially higher. Asset managers and central banks are just beginning to readmit gold back into the select group of prudent asset classes. That this is occurring at a time when what might be seen as the world's safest financial asset classes may also be its scarcest suggests interesting times ahead for those who own gold. ----- Thomas Kaplan is chairman of Tigris Financial Group. Join GATA here: Yukon Mining Investment e-Conference Vancouver Resource Investment Conference Cheviot Asset Management Sound Money Conference Phoenix Investment Conference and Silver Summit Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: http://www.gata.org/node/16 ADVERTISEMENT Prophecy Drills 71.17 Metres of 0.52% NiEq Prophecy Resource Corp. (TSX-V: PCY) reports that it has received additional assays results from its 100-percent-owned Wellgreen PGM Ni-Cu property in the Yukon, Canada. Diamond drill holes WS10-179 to WS10-182 were drilled during the summer of 2010 by Northern Platinum (which merged with Prophecy on September 23, 2010). WS10-183 was drilled by Prophecy in October 2010. Highlights from the newly received assays include 71.17 metres from surface of 0.52 percent NiEq (0.310 percent nickel, 0.466 g/t PGMs + Au, and 0.233 percent copper) and ended in mineralization. For more drill highlights, please visit: http://prophecyresource.com/news_2010_nov29.php |

| Bill Fleckenstein: The Race To the Bottom Will Be Won By the Dollar Posted: 18 Jan 2011 03:00 PM PST

Market commentator and money manager Bill Fleckenstein sat down for a recent interview with ChrisMartenson.com and opened fire with both barrels on the Fed and the monetary policy it's pursuing. He and Chris discuss the factors that enabled Bill to be one of the first to accurately identify and warn of the housing and credit bubbles - and how history is now repeating itself via the profligate printing of US dollars. The interview covers a wide range of topics meaningful to the investor trying to make sense of where things are headed from here - including central banking culture, bubble psychology, high-frequency trading, inflation/deflation, and the true relative value of the dollar vs the Euro. Click the play button below to listen to Chris' interview with Bill Fleckenstein: Download/Play the Podcast In this podcast, Bill sheds light on why:

|

| Eric King Interviews Rick Santelli Posted: 18 Jan 2011 02:43 PM PST After what seems another day of tireless brainwashing, it is always preferable to close, listening to the one man who continues to call it like it is. In today's feature interview, which touches on virtually every currently relevant topic, Eric King speaks to Rick Santelli discussing such items as European insolvency/austerity, try to get to the bottom of the quandary where Japan (itself massively in debt) is getting the money to fund the European rescue, deconstruct the once anathema and now mainstream topic of a global ponzi system (less than two years ago one would be branded a fringe idiot for calling the global financial realm one big ponz... now it is rare to find someone who doesn't), the Japanese demographic crunch, the US municipal collapse and its implications on the USD (judging by the blowtorching of the DXY tonight, nothing good), the food riots and their causes (surging demand due to monetary policy as well as supply constraints), on the inflationary aftermath of the CNY peg (and what it means for Chinese FX reserve investment strategy), the continued reckless issuance of debt by the Treasury, gold, and much more. |

| Historical Silver: Gold Ratio Suggests Parabolic Top For Silver of Over $100 per Oz Posted: 18 Jan 2011 02:36 PM PST By Lorimer Wilson MunKnee.com Approximately 70 respected economists, academics, gold analysts and market commentators (see list below) are of the firm opinion that gold is going to go to at least $2,500 if not as high as $10,000 per ounce (or more) before the parabolic top is reached. As such, just imagine what is in store for silver given its historical price relationship with gold. We're looking at an extreme case scenario of a future parabolic top of perhaps as much as $714 per ounce for silver, the 'poor man's gold'. Let me explain. The current price of gold and the price of silver – the silver:gold ratio - continues to hover around the 67:1 range which is way out of whack with the historical relationship between the two precious metals. It begs the question... |

| Posted: 18 Jan 2011 01:31 PM PST View the original post at jsmineset.com... January 18, 2011 05:14 PM Dear CIGAs, Firstly, to finish off on the ultra short term, here is the chart I showed a couple of days ago: Note the small a-b-c correction from $1420. The A leg was from $1420 to $1363, a decline of $57. If the C wave is the same size, a decline of $57 from $1412.50 takes us to $1355.50. Yesterday the PM fix was $1360.50 and the morning fix $1357.50. Conclusion: gold has either already finished the correction or requires one minor drop below yesterday's fixings to finish it. Turning to the longer term picture, I sent you the following weekly price chart in mid 2009. This is what has happened since then: I have numbered the minor waves and concluded that wave 5 is extending. This opinion is based on the size of the corrections since the wave 4 low at $1058. The following analysis of the minor waves and their relative proportions should make this quite clear: Wave 1 &#... |

| Posted: 18 Jan 2011 01:31 PM PST View the original post at jsmineset.com... January 18, 2011 12:53 PM Jim Sinclair's Commentary The coming of President Hu is being heralded by the media as if he was the Messiah. Having had the experience of negotiating with our Chinese brothers, I wish the Administration good luck! Jim Sinclair's Commentary It is the truth of the market, not an error. There is a living to be made here by the disciplined short. Tradeweb: Talk of bad Treasury trade on system “false” NEW YORK | Tue Jan 18, 2011 12:33pm EST NEW YORK (Reuters) – Electronic trading platform Tradeweb said on Tuesday that talk of a large erroneous trade of U.S. government securities on its system that sparked a sudden market sell-off is wrong. U.S. government bond prices dropped suddenly in early trading, which led to speculation of an erroneous trade on the Tradeweb system. “Reports of a multibillion dollar customer trade error on Tradeweb this morning are completely false. Indeed, Tradeweb... |

| Posted: 18 Jan 2011 12:51 PM PST Something is spooking the reflation trade. While both gold and silver have moved decidedly higher in the past hour, little compares to the fireworks in West Texas, where crude has just gapped up a solid dollar, in what briefly appeared to be an offerless market. Furthermore the move seems contained to WTI: the move in Brent is far more cool and collected, although will likely soon follow and pass the $100 barrier. And while the disconnected between the two (north of $5 recently) has been well noted, if not completely understood, the sudden move in WTI does not seem to have an immediate catalyst: the all critical Chinese CPI/GDP/retail data is not due until tomorrow, so either someone is trying to start a HFT algo melt up in various futures markets, or fat fingers (soon to be denied) are far more prevalent than previously expected. Incidentally the momentary move above has just wiped out another $100 billion of US GDP. While each individual $100 billion is pocket change, put 10 of these together, and soon they start to add up. Update: the major gap appears to be merely the on the run roll... |

| US Mint Reports January Silver Sales Hit 26 Year High Posted: 18 Jan 2011 11:40 AM PST When we had last checked on the total silver sales by the US Mint earlier today, the amount given was 3,407,000 ounces, a number which we had earlier speculated would be a monthly record if sales were maintained at the current pace. And as the number had not been updated we assumed that "either buying interest has ceased overnight (unlikely), that the mint is not updating its numbers (likely), or, worse, that the Mint has now stopped selling any form of silver for reasons unknown." Indeed, the result was the likely one, and following a quick check today on US Mint sales confirms that sales have once again surged following the Mint's delayed update. As of today they stood at a whopping 4,588,000, or nearly 1.2 million ounces sold in a few short days. This represents the biggest monthly total sold by the US Mint going back to 1986 when the Mint disclosed its first monthly sales record... And the month is not even over yet. In other words in just the first three weeks of January, the mint has sold more silver than in any month in its history according to its public records going back 26 years. So the bad news is that while the bulk of Scotia Mocatta's silver bars continue to be sold out (and just the Valcambi 1kg bar is shown as available), the good news is that the kind folks at BullionVault were good enough to advise us that their physical silver inventory is now back and is on line (and contrary to our previous notification, the firm's physical shortage was not in Germany but in England, where its vaults are located) so our England-based readers can go ahead and purchase at will from said location. |

| Great Basin Gold: Ready for Big Moves in 2011 Posted: 18 Jan 2011 11:37 AM PST Marco G. submits: Yes, 2010 was a very good year. This author was able to increase his portfolio value by double digits (nearing triple digits) by concentrating on the smaller mining stocks. The spectacular performance during the fall among the precious metals and miners accounted for almost all of the gains. Now looking forward to 2011, the author finds that his favorite gold mining Junior, Great Basin Gold (GBG) has finally got their two gold mines up and running. Complete Story » |

| Posted: 18 Jan 2011 11:08 AM PST www.theablespeculator.com [EMAIL="analyst@theablespeculator.com"]analyst@theablespeculator.com[/EMAIL] DAILY REPORT January 19, 2011 Yesterday was a holiday in the United States, Martin Luther King’s birthday, and I thought it would be appropriate to review some of what the man had to say. The first is an excerpt from his famous “I Have a Dream” speech: “Let us not wallow in the valley of despair, I say to you today, my friends. And so even though we face the difficulties of today and tomorrow, I still have a dream. It is a dream deeply rooted in the American dream. I have a dream that one day this nation will rise up and live out the true meaning of its creed: "We hold these truths to be self-evident, that all men are created equal." I have a dream that one day on the red hills of Georgia, the sons of former slaves and the sons of former slave owners will be able to sit down together at the table of brotherhood. I have a dream... |

| Posted: 18 Jan 2011 10:34 AM PST The 5 min. Forecast January 18, 2011 02:28 PM by Addison Wiggin - January 18, 2011 [LIST] [*] “Like a wrecking ball”... Chris Mayer on what inflation will do in 2011, and how to prepare [*] “Widespread complacency”... Dan Amoss’ on the biggest Black Swan looming this year [*] The sham behind the latest Goldman-Facebook announcement... [*] And an Internet IPO that could make a lot more sense, LOL [*] Readers wonder about gold’s future when the reserve currency vaporizes... come face-to-face with reality on the dealer lot... and tell us how to stick it to Starbucks... [/LIST] This morning, we see Britain’s consumer price index grew in December to an annualized 3.7%. Fuel prices are growing at their fastest pace since July, and food prices are zooming at a rate last seen in May 2009. Like the U.S. Federal Reserve, the Bank of England has an inflation “sweet spot” of 2%. But Britain’s CPI has been above 3% for 13... |

| Guest Post: Tossing The Consumer Under The Bus...And Insanely Expecting An Economic Recovery Posted: 18 Jan 2011 10:32 AM PST Submitted by D. Sherman Okst of Financial Sense Tossing the Consumer Under the Bus...And insanely expecting an economic recovery I’ve been pouring through the Fed Reserve’s recent release of circa 2005 FOMC meeting transcripts. The most striking observation that one can make is that the consumer - the very lifeblood that determines whether our economy will live or die - has been discarded. Discarded --- as in tossed under the bus. Ninety-nine percent of our “economists” today have it entirely ass backwards: They believe that the economy supports the consumer. In reality, it really is the other way around. Proof: You can put two or more consumers together and create an economy but remove the consumers from an economy and you are left with nothing. “Jobless recoveries” are Cable News media spin. The following excerpts will leave you thinking that you are watching some bizarro episode of the “Twilight Zone.” Toss the consumer under the housing wheel of the bus and laugh about it: "–I offer one more piece of evidence that I think almost surely suggests that the end is near in this sector. While channel surfing the other night, to the annoyance of my otherwise very patient wife, I came across a new television series on the Discovery Channel entitled “Flip That House.” [Laughter] As far as I could tell, the gist of the show was that with some spackling, a few strategically placed azaleas, and access to a bank, you too could tap into the great real estate wealth machine. It was enough to put even the most ardent believer in market efficiency into existential crisis. [Laughter]~David Stockton, Dec. 13, 2005, economist and Fed comedian. So while publicly denying the existence or even the possibility of a housing bubble --- the Fed was privately laughing about its imminent and apocalyptic end. Jokes on us. The result of this meltdown is 22% unemployment, 43 million people on Food Stamps, 1 in 5 kids going to bed hungry at night, millions of homeless people resulting from foreclosures, millions of Americans watching as their largest investment (their home) tanks, local governments who rely on property taxes left struggling and a few failed bond auctions away from shutting down or being “bailed out”. We are left holding the bag, as this past weeks Financial Sense News with G. Edward Griffin noted, WE - not the Fed - are the lenders of last resort. The other day I saw Alan Greenspan say ‘Prove it’ (that he created the housing meltdown). The reporter gave him a free pass, all he had to do is ask Greenspan who created the years of cheap money, who muzzled Brookley Born (the CFTC Commissioner who wanted to regulate Derivatives) and who helped get rid of the Glass Steagall Act with a 3-2 Fed vote, and who failed to regulate the banks. They knew, from the September 20, 2005 meeting: “I’ll close with one other thing, the central banker’s anxiety, which is: “Good times are bad because they could turn out to be bad. Bad times are bad for obvious reasons.” [Laughter] I think you’ve given us a lesson in why these extremely good times are unlikely to be good for us in the long run.~ Ferguson. Toss the consumer under the deficit wheel of the bus and laugh about it: “Tell me, Sam, is there really any difference between Republicans and Democrats when it comes to spending?” And Cohen said, “I want to think about it, do some research, and give you a serious answer.” He called back the next morning and said, “Yes, George, there is. Democrats enjoy it more.” [Laughter] “But otherwise there doesn’t appear to be any difference.”~Fisher. As ZeroHedge pointed out, “...that ratio is already roughly 1 to 2, meaning for every dollar in revenue the US government issues more than one dollar of debt just to fund the deficit.” While our public debt is about 14 trillion our unfunded liabilities are much larger. Unfunded (read: looted) Liabilities Social Security 14.6 trillion Prescription Drugs 19.2 trillion Medicare 76 trillion Total 109,800,000,000,000.00 109.8 trillion + 18 trillion (18 trillion includes GSE off balance sheet debt) = 127.8 trillion dollars. Perhaps the simplest way to look at it is this: 55%-65% of our income goes to taxes and fees, we work 8.5 months of the year to pay for this insane mess. The consumer has then 3.5 months of income with circa 1970s wages to consume. How anyone can joke about being the enabler, the debt pusher to a body of almost 535 fiscally insane debt binging lunatics when their kids are going to be going through debt detox hell is anything but something to laugh at. (Ron Paul, Rand Paul, Paul Ryan and a few fiscally responsible leaders excluded). If the Fed wasn’t monetizing debt the US would be where it should be - in bankruptcy reorganization. Overdosing the user only tosses the consumer under the bus, for it is the consumer who pays this tab 8.5 months of the year. Rob the consumer and then toss them under the currency tire and laugh about it: “Absent a dollar depreciation that’s now probably on the order of 8, 9, or 10 percent, the deficit is going to steadily worsen. If the dollar were to start depreciating, that would slow the rate of deterioration. If the dollar depreciation that we put into the forecast were to get as high as 8 or 9 percent, that might plateau the deficit”.~Johnson “One thing we can be sure of is that the value of the dollar will be worth 100 cents.” [Laughter]~Greenspan There was also discussion where Bernanke talks about a chart showing the dollar depreciating by 10% per year. All of this is insane robbery. Since the inception of the Fed our dollar has been robbed 96% of its purchasing power, 80% since Nixon declared force majeure in 1971 and took us off the quasi-gold standard. Wages have been flat since the 1970s, the consumer is saddled with 8.5 months of governmental debt, to steal 10% per year from the .04 cents he calls a dollar won’t make him/her a strong consumer. Think about that the next time you hand over a dollar, look at that dollar and picture .04 cents, next year it’ll be closer to .03 cents. Or worse. They can only toss people under the bus like this because most people don’t understand why prices go up. If money was grain they’d (consumers/people) would get this the first year they transitioned from a drought where their grain was in high demand to a year there was a bumper crop and no one wanted the stuff. Rob the consumer of good wages then toss them under the globalization tire and laugh about it: “Everyone I’ve talked to continues to try to figure out ways to exploit globalization. Each of them, from the IT [information technology] guys to the big box retailers to the specialty chemical firms to the service firms, wants to have offshore supply. One of the CEOs said, “We have a long way to go in exploiting China.” We’ve heard that forever. And one of my favorites was the comment, “China, India, and Indonesia can make Italian ceramics better than Italians can now or could 200 years ago.” [Laughter] Globalization was an unmitigated disaster. Low wages, high oil prices and trade deficits all resulted from Globalization. China runs a surplus because it sells more stuff it makes than it consumes. The year Globalization kicked into high gear was the last year we saw a surplus. Now we borrow. We can’t borrow our way to prosperity, we just borrowed our way to insolvency. We can’t compete against someone making 2 dollars a day. We can’t expect low oil prices when we just sent our best jobs to China so they can afford more cars. China now sells more cars than the US does, as a result, Asia now imports more oil than we do. The wheels are coming off the economic bus and the drivers are laughing at us as we get tossed under it and run down. Sad. The solution is simple, we are broke since we take in with taxes and borrowing less then we owe. Our deficit alone ensures default or Quantitative Easing from now until the wheels come entirely off. It is time we reissue the currency, tie it temporarily and loosely to gold, get our manufacturing jobs back and move on. |

| Gold Price Looks to Continue Correction, What Would Change My Mind? Posted: 18 Jan 2011 10:21 AM PST Gold Price Close Today : 1368.10 Change : 7.70 or 0.6% Silver Price Close Today : 28.910 Change : 0.592 cents or 2.1% Gold Silver Ratio Today : 47.32 Change : -0.717 or -1.5% Silver Gold Ratio Today : 0.02113 Change : 0.000316 or 1.5% Platinum Price Close Today : 1823.90 Change : 12.50 or 0.7% Palladium Price Close Today : 812.90 Change : 19.90 or 2.5% S&P 500 : 1,295.02 Change : 1.78 or 0.1% Dow In GOLD$ : $178.87 Change : $ (0.23) or -0.1% Dow in GOLD oz : 8.653 Change : -0.011 or -0.1% Dow in SILVER oz : 409.48 Change : 1.67 or 0.4% Dow Industrial : 11,837.93 Change : 50.55 or 0.4% US Dollar Index : 79.00 Change : -3.334 or -4.0% Right now, The GOLD PRICE and the SILVER PRICE both have today bounced off a touch of the lower Bollinger Band (I explain Bollinger Bands below) which hints but guaranteeth not that they will move higher. If you visit www.stockcharts.com, you can build these charts yourself, using "$gold" and "$silver" as symbols Today I want to introduce y'all to Bollinger Bands. This is a technical indicator which you statistics buffs will love and the rest of you will stare at like a calf looking at a new gate. Bollinger Bands measure volatility by comparing where the market presently stands to its recent volatility. As volatility increases, the bands automatically spread (and vice versa) because Bollinger bands are two standard deviations of the 20 DMA above or below the 20 DMA. There, I've said it. Never mind, just consider what they mean. When the market reaches the bottom or top Bollinger Band, is it highly likely (two out of three) to reverse. Readings outside the Bollinger Bands are very much overdone. Regardless of the Bollinger Bands I find myself a tad distrustful of silver and gold right now. Gold remains below its 50 DMA ($1,383), and silver only climbed above its 50 DMA (now 2849c) today. Aftermarket also lacks enthusiasm, falling off after Comex close. On the other hand, silver coin premiums have stiffened slightly. Today the GOLD PRICE gained $7.70 to close on Comex at $1,368.10. The $1,376 spike high that came around 9:00 showed how strong resistance up there is. Gold spent the balance of the day chastened and declining, to a low at $1,363.80 about 3:15 Eastern. Gold has trended up since Friday, but only barely. Gold's breach of that December $1,362 low leaves me nervous, but it hit $,1353 on 7 January, then on last Friday hit $1,355. That qualifies, at least until contradicted, as a double bottom. Yet given the size and duration of the preceding rise, two weeks hardly seems enough time spent correcting. What would change my mind? Gold above $1,392 would help. Above $1,406 I become warm and fuzzy, and above $1,425 I throw caution to the breeze and double up. But we aren't there yet. The SILVER PRICE hit the ceiling at 2906c today, but it bunched and clustered under 29 like a bull making up its mind to jump over a fence. Relative Strength Indicator (RSI) is neutral, while MACD points down. Once again, good as it looks I believe silver still needs to perform a bit more penance before it re-enters the limelight. I'd like to see a few more of those "experts" write articles explaining how the "silver bubble has burst." That will clinch the upside reversal. There were no tender feelings abounding in the Dollar Index today. It sank 33.4 more basis points (0.43%) to 79.003, on its way to 78.50. Be not surprised if the dollar rallies tomorrow, since it is pushing the envelop of its decline. I still expect the dollar to check its fall around 78.50. Low today was 78.635, not far off my mark. Euro on the other hand is pushing its upper envelope and its luck. It has slightly bested is 50 day moving average (1.3329) and closed today at 1.3380. Looks like a countertrend rally in an ongoing downtrend, although the MACD indicator is arguing with me about that. Lawsy, Miss Claudie, it sure looks good to me! Yes, yes, the Dow rose another 50.55 points to 11,837.93 and the S&P levitated 1.78 points to 1,295.02, and the fish are jumping and the cotton is high and Ben Bernanke is going to take care of all of us. I'm warning y'all, you take that poor, half-frostbit snake into your bosom to warm him up and he'll bite you. Keep clear of stocks, and maintain a watchful suspicion. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com Phone: (888) 218-9226 or (931) 766-6066 © 2010, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate in a bubble, primary trend way down. Whenever I write "Stay out of stocks" readers inevitably ask, "Do you mean precious metals mining stocks, too?" No, I don't. |

| Posted: 18 Jan 2011 10:03 AM PST The lawsuits over loan level detail continue to come fast and furious. After late last year Allstate sued Bank of America, providing proof that that the Too Big To Fail bank had repeatedly lied about the quality of its loans and broadly misrepresented its loan book to purchasers, today the Fed's favorite bank, JP Morgan, and specifically its EMC Mortgage division, were sued by Wells Fargo (the trustee) of a mortgage portfolio for refusing to turn over documents detailing the quality of loans bought by the trust. Bloomberg reports that Wells Fargo & Co., the trustee, is seeking access to files for more than 2,000 underlying mortgages in the Bear Stearns Mortgage Funding Trust 2007-AR2, according to the complaint filed today in Delaware Chancery Court in Wilmington. “The trustee has repeatedly requested that EMC provide access to the subject documents,” Wells Fargo said in the complaint. “EMC has played proverbial ‘rope a dope’ and otherwise continued to drag its feet, and has produced nothing.” Reading through the complaint, we find that the same rep fraud that Bank of America continues to be in hot water for (and that seemingly everyone involved, and on the defensive side, believes will eventually get swept under the rug) has been quite rampant at all other banks. Specifically, "on August 31, 2010, the Trustee sent a letter to EMC, notifying EMC that the Trustee had received a letter from the law firm of Grais & Ellsworth LLP (“Grais”), which represented an investor in the Trust owning 42% of the outstanding face amount of the Certificates in the Trust, dated August 3, 2010 (the “Grais Letter”). The Grais Letter gave notice to the Trustee that Grais had investigated the condition of 1,317 of the 2,049 Mortgage Loans held by the Trust, and determined that EMC appeared to have violated its representations and warranties in the MLPA with respect to 938 of those loans." That's roughly 70%: a number which any jury will find to be beyond statistically significant and will certainly impugn intent to defraud. Not surprisingly, neither JPM nor EMS has scrambled to provide the backup... or any required information. More from Bloomberg:

And while sooner or later justice will be served to those who blatantly lied to purchasers, one would at least hope that this practice may have ended. Wrong. In another article by Bloomberg written by Bob Ivry and Bradley Keoun we read that according to an internal Freddie Mac review obtained by Bloomberg, "three years after bad home loans helped trigger the recession and six weeks after the government cashed in the last of its $45 billion Citigroup investment, the New York-based bank is still selling mortgages that violate quality standards."

But don't expect Citi to give a mea culpa after being caught red handed:

Since Citi is for all intents and purposes still a very much bankrupt ward of the state, Das' assumption is certainly good enough... for government work. As for investors, they certainly seemed surprised, and the result was a broad 7% drop in Citi stock. And while investors may hope that the recent attempt by Bank of America to hush up the GSEs and settle hundreds of billions of misrepresented loans for pennies on the dollar, courtesy of the complicity of former BofA GC Tim Mayopoulos, who is far more concerned about preserving his millions in annual compensation than actually performing his fiduciary duty, which is protecting the interests of his superiors: American taxpayers (after all Fannie is insolvent and is nationalized), this will likely not end as clinically as desired. We are confident that as more disclosures, and allegations of fraud, such as those recently provided by Allstate and Wells Fargo appear, more investors who have lost money on the biggest housing crash in history will come out of the woodwork and will certainly demand at least a few ounces of flash, all of which will bite into assorted TBTF bottom lines. Full complaint filed by trustee Wells Fargo.

|

| Posted: 18 Jan 2011 10:00 AM PST I have grown to think that the definition of "economics" was the one found in the Mogambo Big Book Of Economic Stuff (MBBOES), which is, "The horrific inflation in prices caused by evil and/or stupid people creating excess money, perpetrators of which comprise a long, long list of evil people and/or stupid people, starting with the Federal Reserve, Congress, and the odious Supreme Court, whose particular idiocy is their traitorous decision to allow a fiat currency, instead of the dollar being defined as a specific weight of gold as required by the freaking Constitution of the United States, for crying out loud, a specific mandate purposely put there by the Founding Fathers to prevent inflation in the money supply, which causes inflation in prices, which is the Number One Killer Of Economies (NOKOE). See also Doomed, We're Freaking." You can see that this definition is a little bulky, which may be why it is seldom, if ever, referred to, and more usually "economics" is defined more like, as is found in the MIT Dictionary of Modern Economics, "The study of the way in which mankind organizes itself to tackle the basic problem of scarcity. All societies have more wants than resources (the factors of production), so that a system must be devised to allocate these resources between competing ends." Even that is a little unwieldy, which brings me to Robert Wenzel at economicpolicyjournal.com, who defines economics as "the science of exchange", which is a clever, and short, definition that I never heard before. And part of that "exchange" mechanism is the variable of, "How much money is being brought to the auction of the free market to bid on goods and services?" It's important because if a lot of money shows up, bidding goes up, and prices go up. And it is this, this inflation in prices, this Worst That Can Happen (WTCH), this destroyer of economies that makes me physically ill, my stomach constantly upset, no matter how much cheap, raw whiskey I drink to forget the horror of the inflation, or how many burritos and Snickers candy bars I eat before the prices of burritos and candy bars go up. No matter how much I wish it, and no matter how much gold and silver that I buy in fearful response, I cannot forget Ben Bernanke, chairman of the evil Federal Reserve, revealing everything we need to know to send us scurrying out to buy more and more gold and silver, buying them with a feverish intensity that borders on a scary, screaming mania that your friends and family have never seen before, but who still won't lend you any money to buy more gold and silver, which proves they are as stupid as I thought, and even when I tell them that they are stupid, they still won't lend me any money! Morons! This is not about my friends, family, neighbors or co-workers and their stupidity about gold, which is just scratching the surface of their collective failings, but about Ben Bernanke in his 2002 speech about deflation saying, and correctly so, that "The US government has a technology called a printing press (or today, its electronic equivalent), that allows it to produce as many US dollars as it wishes…" which is where I pause the playback to say that, up to now, this is exactly true. The Big Freaking Lie (BFL) is when he went on "…at no cost." "At no cost"? Hahaha! "At no cost"? Hahahaha! Suddenly, I am cheered to find myself laughing! Laughing at such preposterousness, even though it means doom for us all! And then my spirits were further buoyed at my surprising use of the word "preposterousness," having never used it before, or didn't remember it if I did, or why it popped into my head as I tried to think of a word that meant "so ridiculously absurd that it defies credulity to even imagine it," but not be too blustery or obscure a word to inadequately convey the "cost" of the suffering, and the "cost" of the ruination and the horror of high inflation in prices which is, literally, a cost, all caused by a high inflation in the money supply, caused by the high inflation in the amount of money created by the Federal Reserve, caused by the government's desperate need to borrow more and more money, caused by its insane attempt to attain a Utopia of equal outcomes, so that there are no more rich or poor, but everyone living in perfect harmony and equality via increasing taxation, increasing regulation and increasing the insane borrowing of staggering, insane amounts of money. Then the inflationary horror of it all, when combined with my lazy "Good enough, time to take a break!" attitude, took over, and so it stays "preposterousness," an indolent lassitude no doubt inspired by the guarantee – guarantee! – of gold and silver rising "to the moon", as a result of the horrid Ben Bernanke and his equally-horrid Federal Reserve, and I will be so richly rewarded by buying gold and silver now, when they are cheap, that one day, and perhaps one day sooner than even I dare hope, I can quit my stinking job and live a life of happy, and probably decadent, self-indulgence according to what suits my whim until my wife has finally "had enough" of my crap that she leaves and takes the kids with her, whereupon I move into Mogambo Plan Phase Two (MPPT) to, as chef Emeril says, "kick it up a notch." And the best part is that it is, except for the part about the wife deciding to leave and take the kids with her, so foolproof and mindlessly easy that I gotta say, with a huge, beaming smile and a boundless optimism born of certainty in my voice, "Whee! This investing stuff is easy!" The Mogambo Guru Defining Economics originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." |

| Are Mining Stocks a Sell at Their 2008 Highs? Posted: 18 Jan 2011 09:32 AM PST Przemyslaw Radomski submits: This essay is based on the Market Alert sent/posted on January 18th, 2011 Many gold and silver Investors are now confused and worried about their long-term holdings because many analysts are talking about this being a long and deep correction. Therefore, it's natural for one to wonder if it looks like the long-term gold and silver holdings are threatened. Complete Story » |

| Posted: 18 Jan 2011 09:30 AM PST Monetary worries are the order of the day. The dollar, the euro, the yen… Where are they all headed? Eventually, to zero. But there is a journey of some length between here and there. In the between, you'll be glad you own real assets like oil, natural gas and gold. These three are the subject of today's missive. We view them through the fog of currencies. You cannot say, for example, that since the price of oil rose in 2010 that means demand is strong and supply is tight. It may also mean the US dollar is weaker. Nonetheless, on oil, it seems as if the market tightened in the second half of 2010. But the key thing to watch is the marginal cost to produce a barrel of oil. This is an important analysis that many people overlook. What we want to know is how much it costs to produce the most expensive barrel. If the world's demand for oil is 85 million barrels a day, then what did it cost to produce the last barrels? This is the marginal cost. The reason it is important is tha... |

| Posted: 18 Jan 2011 09:28 AM PST by Addison Wiggin - January 18, 2011

This morning, we see Britain’s consumer price index grew in December to an annualized 3.7%. Fuel prices are growing at their fastest pace since July, and food prices are zooming at a rate last seen in May 2009. This morning, we see Britain’s consumer price index grew in December to an annualized 3.7%. Fuel prices are growing at their fastest pace since July, and food prices are zooming at a rate last seen in May 2009.Like the U.S. Federal Reserve, the Bank of England has an inflation “sweet spot” of 2%. But Britain’s CPI has been above 3% for 13 months now. Unlike in the United States, even the “core” rate of inflation in the U.K. is rising at an alarming 2.9%.  ”If history is any guide,” Chris Mayer contends, “inflation will likely get much worse. Everyone seems to know the U.S. inflationary story of the 1970s. The official inflation rate hit nearly 14% by 1980. ”If history is any guide,” Chris Mayer contends, “inflation will likely get much worse. Everyone seems to know the U.S. inflationary story of the 1970s. The official inflation rate hit nearly 14% by 1980.“In other countries, it was worse. In the U.K., inflation topped out at 27%; in Japan, 30%.”  “The year 2011 is the year when inflation will play the role of wrecking ball,” Chris declares. “The year 2011 is the year when inflation will play the role of wrecking ball,” Chris declares.“Emerging markets have been a vital part of the investment story of the last decade, for sure. Yet rising food and energy prices pose a big risk to them. “In India, food prices are at their highest levels in more than a year, rising 18%. The dabbawalla, when he is done delivering lunchboxes, trots off to the market and finds that the price of onions has doubled in only a few months. Even the basics, like potatoes, have become expensive to the average Indian. “In China, the typical Chinese also faces rising prices for nearly everything. The official inflation rate recently hit a 28-month high. But it’s the surging price of coal that may prove to be China’s Achilles’ heel, at least in the short term. Coal is what powers the great boom in China. And coal is at two-year highs. “The basics like food and energy are like brakes on these economies.”  But that’s not all they will put the brakes on... here’s an old video of Jim Rogers, Vancouver keynote, saying that given the current reckless spending and printing strategy in Washington, we’ll eventually experience “an inflationary holocaust.” In 4:33 or so is the mark that he gets into the holocaust theme. But that’s not all they will put the brakes on... here’s an old video of Jim Rogers, Vancouver keynote, saying that given the current reckless spending and printing strategy in Washington, we’ll eventually experience “an inflationary holocaust.” In 4:33 or so is the mark that he gets into the holocaust theme.Here’s another one from our friend Ron Paul laying into Ben Bernanke a while back. In the 3:43 mark he “goes off” on the Fed chairman explaining how money printing is already hurting retirees. And for good measure here’s video of another Vancouver veteran, Nassim Taleb, saying he feels more jittery about a currency crisis now than he did when he left his native Lebanon during a meltdown. Fact is, once it gets started, inflation is hard to stop. Not that Wall Street bankers or your friendly Washington representatives give a hoot. They’re not the ones who get walloped when money stops buying necessities... and interest rates spiral upward out of control. Our managing editor, Chris Mayer, has been investigating the harsh realities of the impending inflationary environment and the impact it will likely have on you... check out his report here.  On the trading floor today, the Dow is up, the S&P is flat and the Nasdaq is down. Among the nuggets traders are digesting… On the trading floor today, the Dow is up, the S&P is flat and the Nasdaq is down. Among the nuggets traders are digesting…

“I don’t recall such widespread complacency about risk assets in the face of obvious macroeconomic risks,” says our stock market vigilante Dan Amoss, “not even in spring 2008 when our research on Lehman Bros. pointed to massive insolvency in the U.S. financial system. “I don’t recall such widespread complacency about risk assets in the face of obvious macroeconomic risks,” says our stock market vigilante Dan Amoss, “not even in spring 2008 when our research on Lehman Bros. pointed to massive insolvency in the U.S. financial system.“In the wake of the March 2008 Bear Stearns bailout, an aggressive Federal Reserve was captivating the market (as it is now). Meanwhile, the stock market was ignoring both rising pressure on the CPI and intensifying pressure on asset values at banks (as it is now).” Just what could blow up this time? A sudden slowdown in China is a good candidate… or maybe a run-up in oil prices to $120 a barrel.  “The most likely catalyst for a return to stress in credit markets will be elections in Ireland,” Dan bets. “These elections, expected sometime in early 2011, could result in a government that repudiates the deal that the current government made with the EU for a bailout of Irish banks last December -- which was really a temporary bailout for the rest of the European banking system.” “The most likely catalyst for a return to stress in credit markets will be elections in Ireland,” Dan bets. “These elections, expected sometime in early 2011, could result in a government that repudiates the deal that the current government made with the EU for a bailout of Irish banks last December -- which was really a temporary bailout for the rest of the European banking system.”In short order, the government bonds of the PIIGS countries “could play the same role in the European banking system that toxic mortgages played in the 2008 U.S. banking crisis.” Into this volatile Irish stew, a new combustible ingredient just got thrown…  The Central Bank of Ireland is financing a fresh €51 billion bank bailout -- er, emergency loan program -- by “printing its own money,” according to the Irish Independent. The Central Bank of Ireland is financing a fresh €51 billion bank bailout -- er, emergency loan program -- by “printing its own money,” according to the Irish Independent.“A spokesman for the ECB said the Irish Central Bank is itself creating the money it is lending to banks,” the paper explains, “not borrowing cash from the ECB to fund the payments.” One of the underlying notions of the euro -- that its member states would outsource monetary policy to the European Central Bank -- just came undone. Hmmn... this will be fun to watch.  Dollar weakness is putting a little air back in gold’s sails today. The yellow metal has firmed to $1,369 as the dollar index has slipped below 79. Dollar weakness is putting a little air back in gold’s sails today. The yellow metal has firmed to $1,369 as the dollar index has slipped below 79.Silver’s move up today is even stronger, to $28.87.  China’s President Hu meets tomorrow with President Obama in Washington. “It is likely that this will be a positive dollar event,” says our currency trading expert Abe Cofnas, “as neither side wants to rock the markets with bad news.” China’s President Hu meets tomorrow with President Obama in Washington. “It is likely that this will be a positive dollar event,” says our currency trading expert Abe Cofnas, “as neither side wants to rock the markets with bad news.”With that in mind, Abe’s small circle of readers laid on a play just this morning that could deliver gains of 455% by Friday… trading a market followed by no other U.S.-based publisher. Similar recommendations last year delivered gains of 162%… 369%… even 1,329%… all in five days or less. For over six months now, access to Abe’s recommendations came only with membership in the Agora Financial Reserve. Watch this space for details on their general release.  And what’s this? Now U.S. investors are going to get shut out of the world’s greatest private placement ever? And what’s this? Now U.S. investors are going to get shut out of the world’s greatest private placement ever?All of a sudden, Goldman Sachs won’t allow its U.S. customers to take part in the $500 billion investment it’s making in Facebook. As the story goes, Goldman got skittish because the SEC says once you have more than 500 shareholders, U.S. companies have to start publishing more detailed financial information, which Facebook would rather not do. “The offer will still be open to investors elsewhere,” says the Financial Times, “but the bank said that the high level of publicity the plan had generated threatened to put it in breach of U.S. securities laws.” The scheme is as transparent as Facebook’s business model is opaque. Foreign investors, beware.  In the meantime, American money can be used wisely for ventures like this… In the meantime, American money can be used wisely for ventures like this…The Cheezburger Network, which started with two websites and has now exploded to 50, just snagged $30 million in venture capital to expand its staff and go international. Its business model is pretty ingenious: User-generated content that has the ability to “go viral,” so both content creation and distribution are darn near free. Founder Ben Huh says the sites have been profitable from the start, which is pretty remarkable for anything launched in the maw of the worst postwar recession. That or just plain stupid. Moar powr to yuh, Huh.  “What are the history lessons surrounding the gold (and other commodities) spot price when the reserve currency disappears? “What are the history lessons surrounding the gold (and other commodities) spot price when the reserve currency disappears?“If the U.S. currency is on a path of elimination (at least in terms of it being the reserve), it is obvious that the value of those commodities will rise in relation to that weakened piece of paper, but what happens (and how) to the ‘value’ of these commodities when a new globally accepted currency reserve is implemented? “Wouldn’t the ‘real’ value of these commodities be restored? And if so, the advantage of investing in physical gold is therefore ‘limited’ to maintaining a hedge against the devaluation of the current reserve currency (as opposed to real investment appreciation)?” The 5: We don’t have any real “history lessons” helping us understand what happens to the gold price when the reserve currency goes away. There are no precedents. As the Spanish, and later the Dutch and finally the British ceded their global economic primacy, the new top dog had a gold-backed currency to take its place. Today, there is no such thing. One thing we do know... the change doesn’t happen easily. War and political intrigue will play a role. In the meantime, check out this special report on the subject.  “I just had an interesting experience I thought I would share with you and your readers. I have had the misfortune of looking to buy a new car and going to various dealerships. On visits to dealers that were selling EU cars (Audi, BMW, VW, etc.), I noticed that there was almost no inventory and a wait of almost four months for any car that I would order. “I just had an interesting experience I thought I would share with you and your readers. I have had the misfortune of looking to buy a new car and going to various dealerships. On visits to dealers that were selling EU cars (Audi, BMW, VW, etc.), I noticed that there was almost no inventory and a wait of almost four months for any car that I would order.“I asked why and the response was stunning. I was told that the U.S. is no longer a decent percentage of the market for these carmakers. They get higher margins with significantly more volume in the Asian countries. “That is the first direct example I have seen from the reordering of the world economy. I used to be able to walk into any of the dealerships and have a choice among lots of cars. No longer.”  “Here’s how you beat Starbucks at their own game,” a reader writes in reply to our item about the new super-sized ice drinks for which you pay a whole lot more and get just a little more. “I love Starbucks’ large, iced lattes, and have for a long time, but I hated paying $4.50 for them. Now it looks like I’ll have to pay even more for their new super-size scam. “Here’s how you beat Starbucks at their own game,” a reader writes in reply to our item about the new super-sized ice drinks for which you pay a whole lot more and get just a little more. “I love Starbucks’ large, iced lattes, and have for a long time, but I hated paying $4.50 for them. Now it looks like I’ll have to pay even more for their new super-size scam.“To get around it, order two shots over ice in a large cup. This drink costs $1.95 (recently went up around here to $2.10). Next, take your drink over to the bar and add your sweetener, flavorings…vanilla powder, hazelnut, chocolate, etc. and the fill it up with half-and-half from the container on the bar. “Voila!...you now have a large, flavored iced latte for around $2.00... enjoy!... (and you save around $900/year too!)” The 5: Or... don’t go to Starbucks. Their coffee is bad at any price. Cheers, Addison Wiggin The 5 Min. Forecast P.S.: “I appreciate Chris Mayer’s commentary in Monday’s 5 on what to expect in food prices,” writes a Reserve member, “but he, obviously, doesn’t do the grocery shopping in his household. He may have cited Wells Fargo forecast of 4% increase in food prices, but between packaging size reductions and slight price increases, we’re currently running between a 10-15% increase on core grocery items. “Add that with the upward trend in energy prices, you’re slowly barking up a tree that’s 15-20% higher than what we started with a year ago. I realize the government knows more than me, but my checkbook balance is markedly lower at the end of the month than it was a year ago. So f...k the government. “We have much bigger problems than the hoi polloi imagines. This is just the beginning of the inflation onslaught, and we’re already at 15% on just two life necessity categories. Look out: When TSHTF here soon, it’ll be a mess that won’t be able to be cleaned up. “Thanks for keeping everyone on our toes.” What to do about it? Read The Great Retirement Holocaust, right here. |

| Silver is higher in all currencies today, especially in the weaker US dollar. Posted: 18 Jan 2011 09:14 AM PST |

| We Are In "The Great Depression II" Posted: 18 Jan 2011 09:00 AM PST (snippet) Today, just as then, almost one in four working-age Americans (or non-citizens, who also must be counted since they are part of the available work force) are unemployed. This 25% estimate includes those who previously were not in the workforce but who are looking now, presumably out of hardship. Tending to confirm this, a recent household survey found 22% unemployed. Conversely, the latest United States Bureau of Labor Statics (BLS) report puts the number at 9.9%. The disparity arises because the BLS number counts individuals receiving unemployment checks. No check? Not counted. From what I can tell, the total number of unemployed in America today is at least 37.5 million, rising to over 65 million if the underemployed are included. These numbers sound too big to be true but can be pieced together from a variety of sources, including the BLS. 37.5 million unemployed out of 150 million potential workers -- one in four. If this is correct, then where are the bread lines? First, Americans entered the current downturn far wealthier than ever before. Many survive today on fast-depleting retirement accounts and strained credit. Second, massive security nets -- welfare, extensive unemployment benefits, disability payments, and school loans -- have disguised or deferred the physical presence of otherwise visible hardship and deprivation. Government-backed programs, many themselves insolvent, are the "bread lines" of today. Persistent high unemployment will not soon resolve: job creation currently lags population growth. About 145,000 jobs must be created every month to reach parity -- not growth. 400,000 jobs would need to be created to replace by 2013 the jobs lost since 2007. Even with a sustained recovery starting immediately, it would take at least eight years to recover jobs lost during the last two. One reason the job picture is so grim is that investors are confounded by Federal monetary policy. Under Roosevelt, just as it is now and was during Carter, Fed policy was an explicitly Keynesian effort to correct unemployment -- not a stable-dollar course like Reagan pursued, or Thatcher for the British Pound. As Margaret Thatcher pointed out in her autobiography, The Downing Street Years, monetary policies must either "hitch their star" to a stable currency or pursue specific social outcomes, such as reducing unemployment. Never both, it must be one or the other. With trillions outlaid in "stimulus," America is committed to the latter course today. This posting includes an audio/video/photo media file: Download Now |

| A New ETF to Play Gold's Appeal Posted: 18 Jan 2011 08:56 AM PST Kevin Grewal submits: As the appeal for commodities - in particular gold - continues to rise, ETF Securities recently announced another first-to-market ETF, the ETFS Physical Asian Gold Shares (AGOL). It's the first U.S. precious metals product to be vaulted in Asia. Its custody will store all of its physical gold bars in secure London Bullion Market Association approved vaults in Singapore, as stated in its prospectus. From an investment perspective, the objective of AGOL is to reflect the price performance of physical gold, less trust expenses, while carrying an expense ratio of 0.39%. The launch of AGOL couldn’t come at a better time. Demand for gold and investment vehicles that enable one to gain access to gold continues to rise. The precious metal's safe haven characteristics during times of uncertainty, its ability to give investors the capability to hedge against inflation and its uses as a method to diversify assets are likely to keep it a “hot commodity”. Furthermore, as demand for gold continues to rise, from a consumer, investor and governmental standpoint, imbalances in supply and demand could further push up prices, since production and extraction of the metal is not easy. Complete Story » |

| Gold Daily and Silver Weekly Charts Posted: 18 Jan 2011 08:55 AM PST |

| When Rising Food and Energy Prices Begin to Wreak Havoc Posted: 18 Jan 2011 08:45 AM PST This morning, we see Britain's consumer price index grew in December to an annualized 3.7%. Fuel prices are growing at their fastest pace since July, and food prices are zooming at a rate last seen in May 2009. Like the US Federal Reserve, the Bank of England has an inflation "sweet spot" of 2%. But Britain's CPI has been above 3% for 13 months now. Unlike in the United States, even the "core" rate of inflation in the UK is rising at an alarming 2.9%. "If history is any guide," Chris Mayer contends, "inflation will likely get much worse. Everyone seems to know the US inflationary story of the 1970s. The official inflation rate hit nearly 14% by 1980. "In other countries, it was worse. In the UK, inflation topped out at 27%; in Japan, 30%. "The year 2011 is the year when inflation will play the role of wrecking ball," Chris declares. "Emerging markets have been a vital part of the investment story of the last decade, for sure. Yet rising food and energy prices pose a big risk to them. "In India, food prices are at their highest levels in more than a year, rising 18%. The dabbawalla, when he is done delivering lunchboxes, trots off to the market and finds that the price of onions has doubled in only a few months. Even the basics, like potatoes, have become expensive to the average Indian. "In China, the typical Chinese also faces rising prices for nearly everything. The official inflation rate recently hit a 28-month high. But it's the surging price of coal that may prove to be China's Achilles' heel, at least in the short term. Coal is what powers the great boom in China. And coal is at two-year highs. "The basics like food and energy are like brakes on these economies." But that's not all they will put the brakes on… Here's an old video of Jim Rogers, Vancouver keynote, saying that given the current reckless spending and printing strategy in Washington, we'll eventually experience "an inflationary holocaust." In 4:33 or so is the mark that he gets into the holocaust theme. Here's another one from our friend Ron Paul laying into Ben Bernanke a while back. In the 3:43 mark he "goes off" on the Fed chairman explaining how money printing is already hurting retirees. And for good measure, here's video of another Vancouver veteran, Nassim Taleb, saying he feels more jittery about a currency crisis now than he did when he left his native Lebanon during a meltdown. Fact is, once it gets started, inflation is hard to stop. Not that Wall Street bankers or your friendly Washington representatives give a hoot. They're not the ones who get walloped when money stops buying necessities…and interest rates spiral upward out of control. Addison Wiggin When Rising Food and Energy Prices Begin to Wreak Havoc originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." |

| Posted: 18 Jan 2011 08:35 AM PST Softer dollar, physical demand boost gold price The COMEX February gold futures contract closed up $7.70 Tuesday at $1368.20, trading between $1356.80 and $1376.00 January 18, p.m. excerpts: |

| Ben Davies: He Scares fiat money addicts like Joe Weisenthal Posted: 18 Jan 2011 08:23 AM PST |

| Good Time Charlie Gasbag needs a Seltzer enema Posted: 18 Jan 2011 08:17 AM PST Charlie Gasparino Rips Meredith Whitney, And Accuses Her Of Costing Taxpayer Millions MK: Meanwhile, let’s see – over the past year, “Keiser Report” has destroyed Cantor Exchange, Ripped Goldman a new one – resulting in SEC censoring them on their Facebook scam, and caused Silver shortages in cities around the world . . . Fuck [...] |

| Posted: 18 Jan 2011 08:04 AM PST The Fed is spinning gold. Deep in his subconscious, Ben Bernanke secretly yearns to return the country to the gold standard, but he knows that if this were to happen, he'd be out of job. And so would thousands on the government payroll who have perfected the art of printing money out of thin air. So, every day Chairman Bernanke issues the money printing quota to the cohorts, who print away, day after day, to the monotonous beat of the "deflation"drum. |

| Posted: 18 Jan 2011 07:57 AM PST Food Riots 2011Courtesy of Michael Snyder at Economic Collapse

Just as we saw during the food riots of 2008, when people get to the point where they can't even feed themselves anymore, they tend to lose it. In the video posted below, you can really feel the desperation of these young Algerians as they riot in the streets....

This next video is of the food riots in Tunisia. You will not want to let any young children watch this video. In fact, if watching police beat and smash protesters laying on the ground upsets you, then you might not want to watch this video either. The massive food riots that have erupted in Tunisia have left many city streets looking like war zones and at this point it is being reported that the violence has left over 100 people dead. The president of Tunisia has left the country because of the rioting, and an interim president has been sworn in. It is hoped that this will help restore order. This video is absolutely stunning....

You see, the truth is that it is not just in the United States that people are becoming angry at government. All over the world, frustration is boiling over. But unlike the United States, where food is still very plentiful, in many areas of the world it is the deteriorating economic conditions that are sparking many of these riots. According to the FAO, the global price of food hit a new record high in December. For most Americans and Europeans, a rise in the price of food is just an inconvenience. But in many areas of the world, even a relatively small rise in the price of food can mean that the survival of millions is suddenly threatened. Global authorities are concerned that these food riots might start spreading - especially if the extremely harsh weather all over the globe continues to damage crops. In fact, there are some signs that economic unrest is already beginning to spread.... *In the nation of Jordan, peaceful demonstrations were held in several locations around the country on Friday to protest rising food prices. *In Libya, protests about the late completion of government subsidized housing entered their third day on Sunday. Reportedly, hundreds of uncompleted units have been taken over by protesters and so far the police are not taking action to evict them. There is also growing concern that the food riots in neighboring Tunisia will soon pour over into Libya. *Economic protests also been reported recently in Mozambique, Morocco and Chile. Sadly, the desperate economic conditions that are sparking these food riots did not develop overnight. Rather, they have been building for decades. The truth is that the new "global economy" is designed to funnel more and more of the wealth of the world into the hands of the wealthiest 0.001% of the global population. Everyone else is left to fight with one another to divide up a pie that is increasingly shrinking. Just consider the following five facts.... #1 Approximately 1 billion people throughout the world go to bed hungry every single night. #2 Approximately 28 percent of all children in developing countries are considered to be underweight or have had their growth stunted as a result of malnutrition. #3 Every 3.6 seconds someone starves to death and three-quarters of them are children under the age of 5. #4 "Least developed countries" spent 9 billion dollars on food imports in 2002. By 2008, that number had risen to 23 billion dollars. #5 A study by the World Institute for Development Economics Research discovered that the bottom half of the world population owns approximately 1 percent of all global wealth. So if things are this bad already, what kind of food riots are we going to see if all of this weird weather continues and global harvests are much lower than anticipated in 2011? Most Americans have a really hard time even imagining such a thing, but the truth is that we are just one really bad harvest away from mass starvation in many areas of the world. We are not going to see mass starvation in the United States in 2011, but we could see food prices start to go up significantly. Keep in mind that more than 43 million Americans are already on food stamps. The incredible abundance of food that we have been enjoying for so many decades is not guaranteed to last indefinitely. Dennis Conley, an agricultural economist at the University of Nebraska, recently told MSNBC that food reserves in the United States are already disturbingly low....

So yes, there are legitimate reasons to be concerned. The world really is on the verge of a major food crisis, and if global harvests are not significantly better than most analysts are currently projecting, then we are likely to see a lot more food riots around the globe before 2011 is over. |

| Freedom Matters - Issue: January 18th 2011 Posted: 18 Jan 2011 07:38 AM PST Where is Galt's Gulch When You Need It? Welcome to 2011 and the establishment media is telling us happy days are here again. Expect economic growth, falling unemployment, more manipulated stock market gains, a stronger dollar, rising real estate values and the end of the recession. Come to think of it, I believe this was also their forecast for 2009 and 2010. Eventually they will get it right at least temporarily and - who knows? - it might be this year, given with trillions of additional stimulus and costs added to the national debt and future generations of taxpayers. Here at Freedom Matters, we don't care about the short term and we have no reason to be cheerleaders for Washington, Wall Street, the EU or the political establishment. Looking back at the last decade it would appear the euphoria and propaganda early in the decade was certainly misplaced. The Last Ten Years December 31, 2000 December 31, 2010 Gold $316 $1,400 plus Silver $5.00 $30.00 plus... |