saveyourassetsfirst3 |

- Goldrunner: Has Gold Topped? Nope, You Ain't Seen Nothing, Yet!

- Trading Comments, 15 January 2011 (posted 19h45 CET):

- Massive Raid on silver and gold..shortages of silver..cftc hearings vote.

- HERE WE GO AGAIN

- Sensible Comments by MD

- Will Asian ETF help Morgan rig gold's most prospective market?

- Interview With Hinde Capital's Ben Davies

- Five reasons silver glitters more than gold

- JPMorgan Gets Its Wish

- BullionVault.com Runs Out Of Silver In Germany

- As West's gold paper price falls, metal gets scarce in Asia

- Upcoming TV of interest

- Gold and Silver Move Together

- Is It Time to Sell Australian Dollar?

- With Demand Rising Again, Crude Prices Could Have Floor in Place

- Gold Drops 5% for Week vs. Euro, Rising-Rate Fears Threaten "New Crises"

- Are Gold Pool Accounts Safe?

- Cycles and the price of Gold

- Silver Going Mainstream in 2011 - Sean Rakhimov

- Chris Waltzek interviews: Michael Ruppert & Dr. Greg Myers, CEO of Caza Gold Corp.

- Doom And Gloom

- Inflation and the Damage Done

- U.S. Dollar, Gold, & Silver Were Down on Thursday – Really?

- COMEX Commercials Short Covering for Gold

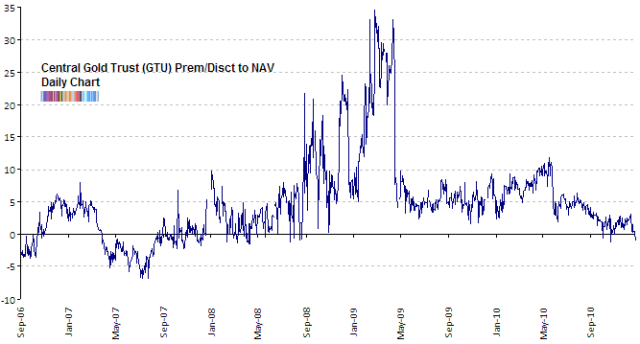

- GTU Premium

- Jim Rogers: Gold is "overdue" for a fall

- Jim Rogesr: Gold Prices Are Not In A Bubble

- Gold Seeker Weekly Wrap-Up: Gold and Silver Fall Less Than 1% on the Week

- These common supplements could be slowly killing you

- Mining’s Making Money as One of the Most Profitable Industries Out There

- Gold Versus Defective Economists and Delusional Leaders on Drugs

| Goldrunner: Has Gold Topped? Nope, You Ain't Seen Nothing, Yet! Posted: 15 Jan 2011 04:55 AM PST A Gold Bull Market is much like a bucking bronco in the Old West - constantly trying to buck investors out of the saddle - as many in the Precious Metals universe are calling an intermediate-term top for Gold. Some are even suggesting that we have seen the final top in the Historic Gold Bull. We have a completely different view maintaining that we are very close to the juncture where Gold starts another rip higher into May or June. Let me explain. Words: 908 | ||

| Trading Comments, 15 January 2011 (posted 19h45 CET): Posted: 15 Jan 2011 04:45 AM PST Last week gold fell -0.6%, while silver dropped -1.2%. Bullish sentiment for the precious metals is scraping the bottom, along with many people's emotions. They feel like they have | ||

| Massive Raid on silver and gold..shortages of silver..cftc hearings vote. Posted: 15 Jan 2011 03:52 AM PST | ||

| Posted: 15 Jan 2011 02:35 AM PST Humans, for whatever reason, tend to project the past into the future. It is an emotional flaw in our genetic makeup. It is also the reason why so many otherwise intelligent people miss the big turning points in the economy and stock market. A classic example occurred in the summer of `07. The sub-prime market was just starting to implode. With the benefit of hindsight we now know that was the beginning of the end for not only the stock market but the global economy. Unfortunately because we couldn't read the writing on the wall we trusted that the Fed would "fix" this minor blip but cutting rates aggressively and spewing out an avalanche of freshly counterfeited dollar bills. It did not fix the credit markets and instead spiked the price of oil to $147 a barrel. That turned out to be the final straw that broke the camels back and sent the global economy spiraling down into the worst recession since the Great Depression. The stock market rolled over into the second worst bear market in history. Amazingly enough we are ready to repeat this process all over again. The writing is on the wall and virtually no one can see it. I'm now going to lay out the the series of events that will ultimately lead to the next leg down in the secular bear market and the reaction by the Federal reserve that will end up pushing the economy over the edge into the next depression. It is going to start in the municipal and state bond markets. I should say it's already started. So far the stock market is ignoring the cancer growing in the city and state bond markets... just like it ignored the initial stages of the sub-prime implosion in the autumn of `07. At some point it is going to dawn on the market that there may be a serious problem developing. I expect that recognition to come as the market starts to drop down into the next intermediate cycle correction (which I expect to begin next week). If so, then what should start out as just a profit taking correction will turn into a much more serious decline, possibly even erasing all of the fall rally. We've already seen big warning signs that smart money has been exiting this market for a couple of months now, basically since the first signs of stress in the muni markets appeared in November. Big money has used the QE driven rally to unload stock on the clueless public over the last several months. It will begin as the first cities and states start to default. That will correspond with massive layoffs as cities and states will no longer be able to borrow to meet payrolls. Their only option will be to make drastic cuts any and everywhere they can. The Fed will panic and start running the printing presses in overdrive just like they did in `08 and just like in `08 that will spike the price of energy and food (it's already starting. Gasoline is back above $3.00 a gallon and a loaf of bread is pushing $4.50-$5.00). Spiking inflation in a very high unemployment environment will understandably destroy the fragile economy just like it did in `08. (I have no idea why Bernanke thinks rising prices along with 20% unemployment is a good thing.) This will be the period when gold will enter the final leg up in its ongoing C-wave advance and the dollar will collapse down into the 3 year cycle low unleashing the currency crisis we've been expecting. I fully expect by fall the economy will be heading back into recession/depression and the global stock markets will have rolled over into the next leg down in the secular bear market that began in 2000 with the bursting of the tech bubble. For the rest of January I am going to run a special trial $10 subscription rate for new subscribers only. The subscription will run for the duration of January and then convert to the regular rate of $25 a month unless you cancel before the trial period expires. To take advantage of the $10 offer click on the link below. This posting includes an audio/video/photo media file: Download Now | ||

| Posted: 15 Jan 2011 12:16 AM PST Received via email. Doctor signed email but I am not sure he wants his name released, so I have withheld it: Dear Mr. President: During my shift in the Emergency Room last night, I had the pleasure of evaluating a patient whose smile revealed an expensive shiny gold tooth, whose body was adorned with a [...] | ||

| Will Asian ETF help Morgan rig gold's most prospective market? Posted: 14 Jan 2011 11:35 PM PST Image:  The next item is a GATA release that Chris Powell has headlined "Will Asian ETF help Morgan rig gold's most prospective market?" It's a story that's posted over at TheStreet.com that they have headlined "New Gold ETF Set for Launch on NYSE"...and the link is here. | ||

| Interview With Hinde Capital's Ben Davies Posted: 14 Jan 2011 11:35 PM PST Image:  Next is an "Interview With Hinde Capital's Ben Davies" over at King World News. Ben gives an excellent interview on the recent troubles in Europe...and gives KWN listeners a sneak peak of what he expects for gold going forward. The interview runs about fifteen minutes...and the link is here. | ||

| Five reasons silver glitters more than gold Posted: 14 Jan 2011 11:35 PM PST Image:  The next story is also silver related...and it's courtesy of reader Scott Pluschau. It's a piece posted over at marketwatch.com that's headlined "Five reasons silver glitters more than gold". The story is a short read...and the link is here. | ||

| Posted: 14 Jan 2011 11:35 PM PST GLD declines another185,429 ounces. The U.S. Mint sells another 19,500 ounces of gold eagles. The Bullion Vault has no silver to sell for a second week in a row. Silver analyst Ted Butler talks about the 'new' position limits in silver...and much more. ¤ Yesterday in Gold and SilverThe gold price was up a couple of bucks by 2:00 p.m. Hong Kong time in their Friday afternoon trading session before rolling over and heading south, in a pattern very similar to what happened on Wednesday and Thursday during that time of day. But this time there was no price recovery worthy of the name in New York. The high [$1,369.70 spot] during Comex trading was at the London p.m. gold fix at 10:00 a.m. Eastern...before the price dropped a percent...with the New York low [$1,354.30 spot] coming shortly before 11:30 a.m. From that low, the price recovered a bit going into the close at 4:15 p.m. Volume was almost as heavy as it was on Thursday.

But, as I had predicted, the real action was in silver once again. Along with gold, silver rose gently in early trading in the Far East yesterday...and, like gold, the top came around 2:00 p.m. Hong Kong time. I knew that 'da boyz' were gunning for silver's 50-day moving average...and they made it a reality in New York yesterday. Silver managed a bit of a rally at the New York open, but that ended in tears shortly before 11:00 a.m...as the silver price got smacked for 60 cents in the next 60 minutes of trading...reaching its nadir around lunchtime on the East coast. Although the silver price recovered a bit, it closed below it's 50-day moving average. Volume was very heavy.

The dollar had a bit of a rollercoaster ride on Friday. The price dipped briefly below 79 cents at 8:30 a.m. in London...then gained about 60 basis point by shortly after lunch...and then slid quietly lower going into the New York open...and continued that slide for the rest of the day...closing a hair above 79 cents...at 79.066.

Here's the 1-year graph of the world's reserve currency...and it's not a pretty sight.

What was even more remarkable is how the bullion banks managed to engineer such a huge sell-off in both gold and silver in the teeth of this week's dollar collapse. The gold stocks gapped down at the open...and then bottomed half an hour after the gold price hit its low of the day...and right on the button of silver's low price tick instead. The shares finished off their lows, but just barely. Here's the 5-day HUI chart for the week that was...and it's not a pretty sight, either.

The CME Delivery Report showed that 113 gold and 28 silver contracts were posted for delivery on Tuesday. It was all JPMorgan and the Bank of Nova Scotia in gold...and JPMorgan and Prudential in silver. JPMorgan was the only issuer in both metals. Here's the link to the 'action'. The GLD ETF took another hit yesterday, with 185,429 ounces of gold being withdrawn. And, for the third day in a row, there were no changes reported in SLV. The U.S. Mint reported a big jump in gold eagle sales yesterday...19,500 ounces worth. There were no sales in silver eagles. For the month, there have been 63,000 ounces of gold eagles and 3,407,000 silver eagles sold. Over at the Comex-approved depositories on Thursday, they reported a net withdrawal of 250,241 ounces of silver. The link to that activity is here. Friday's Commitment of Traders report was just about everything that one could have hoped for. In silver, the bullion banks reduced their net short positions by 3,001 contracts, bringing the Commercial net short position down to 46,750 contracts, which is 233.8 million ounces. The '4 or less' bullion banks are short 201.8 million ounces...and the '8 or less' bullion banks are short 266.5 million ounces. What's amazing about these numbers is that since we know [from last week's Bank Participation Report] that JPM's short position is around 100 million ounces, it's easy to see that the three traders left in the '4 or less' category, must be holding around 134 million ounces between the three of them. I would say that HSBC is one of the three...and that the other two big shorts would be U.S.-based bank holding companies. Because their 'bank holding companies'...they are not required to report their short positions to the CFTC in the monthly BPR. But it's what's in the '8 or less' category that's real interesting. By straight subtraction, the four bullion banks left in the '8 or less' category must hold about 65 million ounces...16 million ounces apiece. A pittance compared to Morgan and the rest of the 'big 4'. I would guess that the four smaller bullion banks in the '8 or less' trader category would mostly be American-based bank holding companies as well. Now, to gold...where the bullion banks covered a huge pile of short positions...29,518 contracts [2.95 million ounces worth] to be exact. The Commercial net short position has now dropped down to 22.5 million ounces. The '4 or less' bullion banks are short 18.9 million ounces...and the '8 or less' bullion banks are short 25.5 million ounces. What applies to silver regarding bank holding companies, also applies equally to gold. Since Friday's COT report was for positions held at the end of trading on Tuesday, January 11th...there has been, without doubt, more improvement in the bullion banks' short positions since then. But, because of the criminal way they cover what they're doing, we won't have a clue as to how much improvement there was until next Friday's report. So, once again, we wait. Here's Ted Butler's "Days to Cover Short Positions" graph that's courtesy of Nick Laird over at sharelynx.com. The '4 or less' bullion banks are now down to 104 days...and the '8 or less' bullion banks are down to 137 days of world silver production to cover their short positions. These are big improvements from what they were about a year ago.

The CFTC/CME position limits meeting on Thursday was a bust of sorts. Here's silver analyst Ted Butler's take on it. "The CFTC meeting went pretty close to what I had handicapped on Wednesday. The proposal involves a formula based upon total open interest [10% of the first 25,000 contracts of open interest...and 2.5% of the remaining open interest]. In silver, this would amount to a position limit of around 5,300 contracts based upon current open interest. This is an economically stupid level for silver position limits and the staff should be ashamed for proposing it. It is three and a half times greater than the 1,500 contract level proposed by thousands of members of the public." "The sad truth is that the [staff's] proposal was only passed because it is a measure without substance and is only tentative at best. Given the current composition of the Commission, no meaningful reform on position limits is possible anytime soon. Nothing with teeth could garner a majority vote." [But] "there was one surprising and very encouraging development. There was palpable and genuine alarm and concern expressed by Commissioners O'Malia and Sommers, two staunch opponents of position limits, about the [CFTC's] staff looking into the details of JPMorgan's swap book which justifies its giant concentrated silver short position on the Comex. Heretofore, this function had been handled by the CME. Of course, neither silver nor JPMorgan was mentioned, but it was clear that any such inquiry was of great concern [to them]. As you may recall, this issue came up at the last hearing on December 16th...and it led to my speculation that JPM's swap book was [filled] mostly with Chinese counterparties. Whether interests from China are holding positions in the OTC market with JPM is of secondary importance. The real issue is that JPMorgan has to have some excuse for holding the concentrated silver short position and it appears that the CFTC surveillance staff is beginning the process of inquiry."

¤ Critical ReadsSubscribeBanks Poised to Pay Dividends After 3-Year GapToday's first story is from Thursday's edition of The New York Times...and is courtesy of reader Phil Barlett. The headline reads "Banks Poised to Pay Dividends After 3-Year Gap". Since all the major U.S. banks are insolvent...and are only on their feet because of "Mark to Fantasy" accounting, plus all the TARP money they need...it's the U.S. taxpayer [through the pockets of Uncle Sam] that will be paying all these dividends. It gives you a warm feeling all over...doesn't it? The link is here.  China Tops U.S. as Biggest Economy by Purchasing PowerThe next two stories are about China...and both are courtesy of reader Scott Pluschau. The first is from Bloomberg...and is headlined "China Tops U.S. as Biggest Economy by Purchasing Power". China overtook the U.S. last year as the world's biggest economy when measured in terms of purchasing power, according to Arvind Subramanian, senior fellow at the Peterson Institute for International Economics in Washington. The link to the story is here.  China Raises Bank Reserve Ratios to Fight InflationScott's next offering is another Bloomberg piece. This one's headlined "China Raises Bank Reserve Ratios to Fight Inflation". China told banks to set aside more deposits as reserves for the fourth time in just over two months, stepping up efforts to rein in liquidity after foreign- exchange holdings rose by a record and lending exceeded targets. The Chinese are serious about inflation this time...especially food inflation...and I suggest you run through this. The link is here.  Tunisia Leader Flees and Prime Minister Claims PowerYesterday I mentioned that there had been food riots in both Algeria and Tunisia this past week. Well, it turned out to be worse than that in Tunisia. Here's a story about it in yesterday's edition of The New York Times...and it's courtesy of reader Roy Stephens. The headline reads "Tunisia Leader Flees and Prime Minister Claims Power". Tunisia's president, Zine el-Abidine Ben Ali, fled his country on Friday night, capitulating after a month of mounting protests calling for an end to his 23 years of authoritarian rule. The official Saudi Arabian news agency said he arrived in the country early Saturday. The fall of Mr. Ben Ali marked the first time that widespread street demonstrations had overthrown an Arab leader. The Arab world had begun debating whether Tunisia's uprising could prove to be a model, threatening other autocratic rulers in the region. This story is definitely worth your time...and the link is here.  BullionVault.com Runs Out Of Silver In GermanyThe rest of my stories today are precious metals related in one form or another. The first one is from reader 'David in California'. It's a piece that's posted over at zerohedge.com...and has to do with the ongoing silver shortage at bullionvault.com. One of my readers from Scotland pointed this out to me last week...and I ran a paragraph on it. At the time, the Bullion Vault said they would have silver in their possession on January 11th. Well, this zerohedge.com piece updates that saying that the they now won't be getting any silver until Tuesday, January 18t | ||

| BullionVault.com Runs Out Of Silver In Germany Posted: 14 Jan 2011 11:35 PM PST Image:  The rest of my stories today are precious metals related in one form or another. The first one is from reader 'David in California'. It's a piece that's posted over at zerohedge.com...and has to do with the ongoing silver shortage at bullionvault.com. One of my readers from Scotland pointed this out to me last week...and I ran a paragraph on it. At the time, the Bullion Vault said they would have silver in their possession on January 11th. Well, this zerohedge.com piece updates that saying that the&n | ||

| As West's gold paper price falls, metal gets scarce in Asia Posted: 14 Jan 2011 11:35 PM PST Image:  Today's last gold-related story is a story that appeared in yesterday's edition of London's Financial Times. Chris Powell's headline reads "As West's gold paper price falls, metal gets scarce in Asia". The FT headline reads "Gold Prices Buoyed by China Demand". It's a short read, but worth your time...and the link is here. | ||

| Posted: 14 Jan 2011 11:15 PM PST How Do They Do It - Sunday 1:00am CDT - minting coins How Its Made - Sunday 3:00am CDT- silver mining | ||

| Posted: 14 Jan 2011 09:58 PM PST Silver And Gold Rally Or, Sell Together, But Not Always. Sometimes one metal will trade faster than the other; either up or down with trading speeds differing by as much as a full two week cycle. Eventually, however, the return to a ratio match-up. On this Wednesday of January 5, silver is selling faster than gold but that's to be expected considering wide valuations between the two metals. A primary market mover today is a falling weaker Euro with the inverse trade of a rising US Dollar. US Dollar futures opened this morning at 79.71 and the March most active contract is now 80.44. The high so far today in early trading on this Wednesday is 80.60. Magnet numbers for the dollar index are 80.50, and 81.50. Note Small box (right)-A full five waves up is complete. We're in wave A down in correction. Gold May Fall on Stronger Dollar And Concerns Investment Demand Will Slow Down. "Gold may decline in New York as the dollar strengthened and on concern investor demand for the metal will wane. The dollar gained against the Euro as a report showed U.S. companies added more jobs in December than economists forecast. Gold, which reached a record $1,432.50 an ounce on December 7, yesterday fell the most since July on speculation data showing recovering economies will curb investment demand. 'The stronger dollar is adding to the price pressure,' said Bayram Dincer, an analyst at LGT Capital Management in Pfaeffikon, Switzerland. 'Technically-oriented market participants will now try to test the low levels in December of about $1,360' after the metal failed to climb back above the record high, he said." Companies in the U.S. added 297,000 workers to payrolls in December, according to figures from ADP Employer Services. The median projection of 33 economists surveyed by Bloomberg News called for a 100,000 gain last month." -Nicholas Larkin Bloomberg.net 1-5-11 This posting includes an audio/video/photo media file: Download Now | ||

| Is It Time to Sell Australian Dollar? Posted: 14 Jan 2011 06:00 PM PST Ralph Shell submits: Since the double bottom late last spring in the A$ at around .81 versus the USD, the currency has made a spectacular move above parity to a high of 1.0253. During this period, the large specs have engorged themselves with a net long of 62,365 futures and delta adjusted option positions, according to the last COT report. Small specs have joined the festivities, and own another 20,618 contracts. Commodities and commodity related companies and currencies have been in vogue during the past year. Expansion of the money supply, combined with fears of inflation, and strength in the metals markets have supported the move. Complete Story » | ||

| With Demand Rising Again, Crude Prices Could Have Floor in Place Posted: 14 Jan 2011 05:53 PM PST James Cordier submits: Unlike gold or some of the "exotics" like coffee or sugar, crude oil prices remained relatively stable through the dollar related volatility that roiled markets in the second half of 2010. While a falling dollar and various weather issues caused supply worried bulls to bid up agriculture and metals, concerns over global demand kept a bullish reaction in crude prices largely in check. However, as we stated in our December client newsletter, crude oil appears to have all the right fundamentals alligning at the right time. This could make crude oil a leader in the commodities markets in 2011. It could also make the crude oil options market fertile ground for investors that make their living collecting premium. Complete Story » | ||

| Gold Drops 5% for Week vs. Euro, Rising-Rate Fears Threaten "New Crises" Posted: 14 Jan 2011 05:44 PM PST | ||

| Posted: 14 Jan 2011 05:19 PM PST One of the cheapest ways to buy and store physical gold and silver is with unallocated (or pool) storage. With unallocated storage, a dealer holds metal that is owned by its customers, but without identifying any particular piece of metal belonging to any particular customer. The advantages of this method are considerable: you avoid the risks inherent in storing the metal yourself (transport loss, fire, and theft); you can buy or sell just a few ounces of gold and silver at a time; you escape the big bid-ask spreads associated with coins and small bars; and perhaps best of all, storage is usually free. Complete Story » | ||

| Posted: 14 Jan 2011 04:30 PM PST | ||

| Silver Going Mainstream in 2011 - Sean Rakhimov Posted: 14 Jan 2011 03:56 PM PST The Gold Report submits: Never mind the correction in the price of silver, says Silver Strategies Editor Sean Rakhimov; better things are ahead. "It may be volatile; it may be steep; but it should be short-lived," he says, adding that he expects silver to rise well above its 2010 high at some point in 2011. Some of that price support could come from governments entering the silver market. Find out all the reasons for this and read about some of Sean's favorite silver plays in this exclusive interview with The Gold Report. The Gold Report: Sean, it seems that among commodities, silver is getting the biggest headlines. The price of silver hit a 30-year high in late December. Silver was up 83% in 2010. And a high-profile lawsuit was launched by a significant silver investor against JP Morgan (JPM) for allegedly manipulating the silver market. It seems that silver has, for the time being, wrested the spotlight away from gold. What sort of things do you expect for silver in 2011? Sean Rakhimov: Well, the short answer is that I expect silver to continue its run. In previous interviews with The Gold Report, I discussed how small and volatile the silver market is, and how explosive the moves can be. We're in the middle of one of those explosive moves now. A year ago, silver was going nowhere, having spent quite a bit of time in the $14–$16 range. A lot of people were questioning if it was for real, especially with gold reaching new all-time highs while silver languished. Speaking of these 30-year highs, these are all nominal numbers versus inflation-adjusted numbers. That should be kept in mind. You have to keep it in perspective. Complete Story » | ||

| Chris Waltzek interviews: Michael Ruppert & Dr. Greg Myers, CEO of Caza Gold Corp. Posted: 14 Jan 2011 01:48 PM PST Jan. 14, 2011 20,000 Global Listeners Toll Free Hotline - Q&A: 1-800-507-6531 Featured Guests: Michael Ruppert & Dr. Greg Myers, CEO of Caza Gold Corp. Host: Chris Waltzek GREATEST INVESTMENT INFO ON THE WEB!!! This posting includes an audio/video/photo media file: Download Now | ||

| Posted: 14 Jan 2011 09:57 AM PST

Most Americans may not care, but the food riots that are starting to erupt around the globe are actually very serious. Do you remember what happened back in the summer of 2008? That summer, the price of oil spiked to an all-time high of $147 a barrel and that caused a substantial increase in the price of food all over the globe. Suddenly millions of poor people couldn't afford to feed themselves anymore and food riots erupted all over the world. Well, here we are in 2011 and the price of oil hasn't even reached $100 a barrel, and yet the food riots are already beginning. Violent food riots are being reported in Tunisia, in Algeria, in Chile and in Mozambique. In Tunisia, the riots have been so intense that the President of Tunisia, Zine El Abidine Ben Ali, has been forced to step down and flee for his life. Yes, that is how serious things are getting already. Unfortunately, it looks like the global food situation is only going to get even worse. Australia is a major food producer and right now they are experiencing flooding of Biblical proportions. In fact, it has been reported that at one point the flooding covered an area greater than France and Germany combined. In Brazil, another major food producer, horrific flooding has killed more than 500 people so far. This flooding is being called the "worst-ever natural disaster" in the history of Brazil. Meanwhile, record cold temperatures and record snowfalls are playing havoc with winter crops all over the Northern Hemisphere. But even before all of these weather disasters struck the price of food had been going up significantly. The UN recently announced that the global price of food hit an all-time high during the month of December, and world leaders all over the globe are openly expressing concern about what 2011 is going to bring. Sadly, the truth is that there has been a trend of rising food prices for quite some time. According to Forbes, corn is up 94% since June, soybeans are up 51% since June, and wheat is up 80% since last June. As one of my readers recently pointed out to me, it usually takes about six months for the prices of agricultural futures to filter down into the supermarkets. So the very high prices for agricultural commodities that we are seeing right now should really start to be felt around the globe by the middle of 2011. In addition to everything else, reports continue to come in of thousands of birds and millions of fish suddenly dying all over the globe, and nobody seems to really know what is causing it. Do you want some more doom and gloom? *There are reports of "panic buying" of silver and other precious metals right now. *Investors are bailing out of municipal bonds at an absolutely staggering rate. *S&P and Moody's have both warned once again that the United States is in danger of having its credit rating slashed if it does not get government debt under control. *U.S. housing prices have now fallen further during this economic downturn than they did during the Great Depression of the 1930s. Meanwhile, America's economic infrastructure continues to be taken apart piece by piece. The United States is losing more jobs to China. In fact, the United States is losing more high technology "green jobs" to China. Evergreen Solar, a company that manufactures solar panels, is closing their factory in Devon, Massachusetts and they are moving their production facilities to China. This is going to result in the loss of 800 good American jobs. The following is what the company had to say in a statement about the move....

Is it any wonder that a recent survey found that 47 percent of Americans now believe that China is the world's leading economic power while only 31 percent still believe that the United States is the world's leading economic power? As America continues to lose good jobs, millions of Americans find themselves simply unable to pay the bills. In fact, at this point one out of every six Americans is now enrolled in at least one government-run anti-poverty program. As things have fallen apart in the United States, many private citizens have tried to step forward and do what they can to help people, but now in many areas of the country the government is actually stepping in and shutting down these private avenues of assistance. For example, in the city of Houston, Texas a couple named Bobby and Amanda Herring has been feeding homeless people for over a year. They never left behind any trash and no trouble was ever caused. But now the city of Houston is shutting them down. Why? Because they don't have a permit. So will they be able to get a permit? Well, it turns out that city officials are saying that this "Feed a Friend" effort most likely will be denied one. Apparently the city "officials" believe that the homeless "are the most vulnerable to foodborne illness" and that therefore the warm meals that the Herrings were providing for them were potentially dangerous. Can you believe this? This is what happens when political correctness and bureaucracy get wildly out of control. Now it is illegal to go out and feed homeless people? What is American turning into? As the economy continues to fall part, the iron grip of the government is likely only going to get tighter as it desperately tries to keep order. But do we really need to be giving tickets to 6-year-olds? Yes, you read that correctly. According to one recent report, police in Texas have given "1,000 tickets to elementary school children in 10 school districts" over the past six years. For more examples of how America is turning into a police state, please see my recent article entitled "Almost Everything Is A Crime In America Now: 14 Of The Most Ridiculous Things That Americans Are Being Arrested For". America is rapidly becoming a very dark place. The truth is that there is a reason why so many websites are now reporting so much "doom and gloom". Things really are getting bad out there. Sadly, most Americans have only known tremendous prosperity all of their lives, so they can't even conceive of what it would be like to go through difficult times. Most Americans have been conditioned to believe that while we may have brief "recessions" once in a while, in the end our economy will always get better and the good times will continue to roll. But the good news is that an increasing number of Americans are waking up and are trying to warn their family and friends about what is coming. So do you believe that the food shortages and the food riots are going to get even worse throughout the rest of 2011? Please feel free to leave a comment with your thoughts below.... | ||

| Posted: 14 Jan 2011 09:22 AM PST The Mogambo Stupidity Prize (MSP) is a not-so-rare honor bestowed to highlight the laughable kind of stupidity about inflation that is so prevalent these days that I find myself screaming at the radio, the newspaper and the TV, wildly ranting, arms akimbo like some kind of demented old man, about how inflation is the Worst Thing That Can Happen (WTTCH), working myself into a fit of uncontrolled anger that goes beyond "outrage" and into some dark, dangerous place in my heart where enemies, both real and imagined, are rounded up and thrown into a hellish prison, and I reign victorious in abolishing the Federal Reserve, reinstalling the gold standard for the US dollar, thus abolishing inflation forever and becoming a national hero whose courageous victory will live forever in the hearts of the people and in the history of the United States and the world, which quickly realized the beauty and simplicity of the gold standard in delivering stable prices and higher standards of living for everyone, instead of the grinding misery and suffering of inflation under a standard of expanding a fiat currency. Thus, I will be loved and revered by everyone, except possibly my kids, who will probably still be insisting that they will hate me forever unless I let them go to Disney World with a guy they know as Dave, and his girlfriend, Krystal, who is a professional-pole dancer. Naturally, I replied, "Disney World? Pole dancer? Sure! But only if I can come, too!" They rudely said, "No" and made disgusting gagging noises. So I, indignantly, said, "No!", too, but with an exclamation point to show them I was serious and my feelings were hurt. Ergo, the aforementioned "hate unto death" pour moi. But that is not important, if a cataclysm of inflationary horror that will destroy the USA is not important, because we were originally talking about the Mogambo Stupidity Prize (MSP), but somehow veered off into another of my rambling harangues about the Federal Reserve destroying the purchasing power of the dollar with their relentless, ruinous, catastrophic over-creation of money, which seems important to me in that "You are soon going to be killed. Do you want to know why?" way, which seems to satisfy a basic human hunger, as evidenced by a lot of movies showing a guy dying of a gunshot wound, and he says to his killer, "Before I die, I want to know your name!", which is pointless because he will be brain-dead in a few minutes and he will forget whatever name he hears. Moron. Abruptly, I now veer BACK to the subject, which is to announce that The Financial Times is this week's winner of the MSP in recognition of their winning entry in a January 8 editorial where they wrote, "Higher prices are not something to be scared of. Indeed, they are a necessary precondition to make supply catch up with demand." Hahaha! Higher prices are not something to be scared of? Hahaha! You know that this is stupid AND funny because of the way I laughed "hahaha!" each time I wrote it, which was, at last count, two! Well, as you knew I would, I have some Hot Mogambo News (HMN) for these Financial Times weenies: Higher prices ARE something to be "scared of" because it is exactly tantamount to saying, "Getting a bad, debilitating disease is not something to be scared of. Instead, it is a precondition to making advances in medicine catch up with demand." Hahaha! I wonder how these Financial Times morons would like to suffer from disease until production of curative medicine increases in response to the demand for cures, in the meantime suffering more and more, and then more and more suffering every month, suffering and suffering until, hopefully one day, the supply of medicine catches up with demand, and their disease is cured, although they will suffer a permanent decrease in health from the damage done. They surely must like it as much as they like inflation, paying higher and higher prices for food until production of food increases in response to the shortage causing the higher prices, paying higher prices, and then more higher prices, and then more and more, every month, higher and higher, and then the prices of everything else go up in price, too, higher and higher, month after month, businesses being pressured to raise the "wage" part of that important land, capital and labor triumvirate, as are sellers of land and credit, even though your income will surely not increase along with prices, meaning that you will have spent so much money on subsistence rather than investment that you will have suffered a permanent decrease in financial health from the damage done. As for me, I choose not to suffer inflation at all, and merely buy gold, silver and oil, which is so easy that I cannot help but exclaim in a giggly kind of rapturous glee, "Whee! This investing stuff is easy!" Inflation and the Damage Done originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." | ||

| U.S. Dollar, Gold, & Silver Were Down on Thursday – Really? Posted: 14 Jan 2011 09:15 AM PST U.S. Dollar, Gold, & Silver Were Down on Thursday – Really? The U.S. Dollar Index Futures have been sold heavily and interestingly enough, gold and silver have not rallied. In fact, gold and silver have sold off while the dollar experienced downward price action as well. How does that whole scenario make any sense? I do not fancy myself as an expert in the area of reasoning why a stock or commodity rises or falls. I firmly believe that the media is nearly always wrong as to the real reasons stocks and commodities are rallying or falling. I believe that the market is a giant discounting mechanism. The market discounts news, political variables, and the future supposedly. It is hard to know if the future is actually priced in, but the experts say that it is as do the academics, therefore we might as well consider it fact else be thrown to the proverbial wolves. The point in all of this is that I have no earthly idea why the U.S. Dollar, gold, and silver were all sold on Thursday. I would also point out that light sweet crude oil futures closed the day lower. I can't believe I am about to say this, but I believe the U.S. Dollar Index may be setting up to rally here. If we take a look at the daily chart of the U.S. Dollar Index Futures we can see that the dollar has been under serious selling pressure accompanied with high volume. However the price action represented on the chart below illustrates that support is located around its 50 period moving average. It might take several days before the U.S. Dollar forms a bottom, but should it start to rally it may attempt to break out over recent highs. Insert /DX Daily Chart Time will tell, but the U.S. Dollar has several support levels that should help support the price action and push prices higher. A rally in the U.S. Dollar would be somewhat contrarian as most people are expecting a pullback. I am not trying to imply that the U.S. Dollar is going to rally for the next 5 years. I am trying to point out a short term rally in the dollar is possible right now based on the daily chart. I would urge caution for those who are leaning heavily into shorting the dollar as it could backfire, particularly if gold, silver, and oil are unable to rally on dollar weakness. The U.S. Dollar Index futures (/DX) traded lower on heavy volume today yet gold futures (/GC) closed the trading session down around $11.70 / an ounce or (0.83%). We have all been conditioned to believe that the U.S. Dollar Index and gold move inversely with one another. For those of you that say this inverse relationship is constant I would love an explanation of how this happened. I have been ridiculed for discussing the possibility that gold and silver could go through a correction. When we look at the gold futures daily chart, the price action is ominous as it is currently trading below its 50 period moving average while it has put in a lower high. Insert /GC Daily Chart In addition to the selling pressure in gold, silver futures were unable to move higher on the lower dollar. In fact, silver futures closed trading down by nearly $0.42 an ounce, or (1.45%). Silver performed worse on a lower dollar than gold. The daily chart of silver futures (/SI) reveals that price is testing the 50 period moving average and at this point a rally is still possible. The daily silver futures chart is shown below: Insert /SI Daily Chart Another reason to be cautious of precious metals in the short run is the price action in the gold miners ETF GDX. The daily chart of GDX leaves little to the imagination as it was sold off heavily on Thursday. GDX traded lower by $1.85 / share or (3.20%) which is not exactly a great way to demonstrate relative strength in the marketplace. The action in GDX on Thursday was quite simply ugly and more selling could transpire in coming days. The daily chart of GDX is illustrated down below. Insert GDX Daily Chart It remains to be seen if the price action today in the U.S. Dollar, precious metals, and the miners really means much of anything. However, it would be foolish to ignore the price action in the metals and the U.S. Dollar Index. The divergence from the norm could be a warning that gold and silver are about to go through a correction. The price action in GDX would be supportive of that conclusion and the dollar trading down near a support level where a bounce higher is likely also point to potentially lower prices in the precious metals complex. In the short term I am very cautious with regards to precious metals and the miners, while I am cautiously bullish about the U.S. Dollar Index in the short run. For those trading precious metals, the U.S. Dollar, and the gold miners risk is excruciatingly high. If you would like to receive these reports please join my free newsletter: http://www.optionstradingsignals.com/profitable-options-solutions.php | ||

| COMEX Commercials Short Covering for Gold Posted: 14 Jan 2011 08:06 AM PST If the COMEX Big Sellers saw today's pullback for gold ahead of time, they sure didn't position as though they saw it coming. ... | ||

| Posted: 14 Jan 2011 07:48 AM PST This chart comes from Babak at TradersNarrative:

The premium in GTU has dipped into the red for the first time since October 2010 and prior to that, late 2008. This is positive as it shows optimism is now quite low, if there is any. | ||

| Jim Rogers: Gold is "overdue" for a fall Posted: 14 Jan 2011 07:21 AM PST From Bloomberg: Gold is "overdue for a rest" and probably will fall after a decade of gains that sent prices to a record, said Jim Rogers, the chairman of Rogers Holdings who predicted the start of the global commodities rally in 1999. While gold "may go down for awhile," the metal is "going to go over $2,000 in this decade," Rogers, who owns gold, silver and rice, said today during a presentation to business executives in Chicago. Gold touched a record $1,432.50 an ounce in New York on Dec. 7. The price closed today at $1,387. "I'd rather own rice," Rogers said. "I'd rather own something that's more depressed than gold." Agricultural commodities are "going to boom" as demand increases in developing markets, primarily in Asia, he said. All commodities will be supported by the weakening dollar, which is losing value because Federal Reserve Chairman Ben S. Bernanke is "printing money" by buying Treasuries in an effort to shore up the U.S. economy, Rogers said. "Paper money is made of cotton, and I'm long cotton, by the way," Rogers said. "One reason I'm long cotton is because Dr. Bernanke is out there running the printing presses as fast as he can." Rogers said he doesn't own shares in U.S. companies and is short U.S. long-term treasury bonds. The Chinese renminbi may provide "almost sure profits over the next five to 10 years," he said. "In the future, it's the stock broker who's going to be driving the cabs," Rogers said. "The smart stock brokers will learn to drive tractors, and drive them for the farmers, because the farmers will have the money." To contact the reporter on this story: Whitney McFerron in Chicago at wmcferron1@bloomberg.net. To contact the editor responsible for this story: Steve Stroth at sstroth@bloomberg.net. More from Jim Rogers: Jim Rogers: Inflation data is a lie Jim Rogers: The U.S. should be worried about this Jim Rogers: Now is the time to buy silver and natural gas | ||

| Jim Rogesr: Gold Prices Are Not In A Bubble Posted: 14 Jan 2011 07:14 AM PST Gold Prices Are Not In A Bubble – Jim Rogers 14 January 2010, 01:59 p.m. By Debbie Carlson Of Kitco News http://www.kitco.com/

| ||

| Gold Seeker Weekly Wrap-Up: Gold and Silver Fall Less Than 1% on the Week Posted: 14 Jan 2011 07:12 AM PST Gold steadily fell throughout most of world trade and ended near its late morning New York low of $1354.90 with a loss of 1.9%. Silver followed a similar pattern and ended near its noontime low of $28.097 with a loss of 3.38%. | ||

| These common supplements could be slowly killing you Posted: 14 Jan 2011 07:12 AM PST From Dr. David Eifrig in Retirement Millionaire: Over Thanksgiving, I opened my sister's cupboard to grab a vitamin C supplement from her stash. I was shocked to find a brand-name bottle of vitamin E and vitamin A combined in a single pill. The only study I know of that examined consumption of vitamin E showed an 18% jump in the instances of cancer among smokers who also took a supplement of beta-carotene alone or beta-carotene with vitamin E. So here was a bottle of known cancer-causing chemicals sold to her as some kind of health aid. (The bottle touted the vitamins as antioxidants that would protect every cell in her body.) The thing is, many people assume the herbs and supplements sold in "health" stores are proven safe... safer even than the prescription and over-the-counter (OTC) pills they get at the pharmacy. Research shows nearly 80% of people take supplements occasionally. No problem there. Many supplements are beneficial. I take some (notably vitamin C). But the research also shows close to 60% of people think supplements are safer than prescription or OTC medications. That's a dangerous - potentially fatal - assumption. Here's why: Congress passed the Dietary Supplement Health and Education Act in 1994. The act requires prescription and OTC medications to prove their safety and their efficacy. It takes pharmaceutical companies six to 10 years of trials and clinical studies to gather all the data required by the FDA's approval process (and there's no guarantee the agency will give the thumbs up). Meanwhile, the herb and "natural" supplement market is virtually unregulated... I could mix eye of newt into a powder and sell it as a health aid if I want. As long as it's "natural," you can sell it without needing to prove anything about it - so long as you don't "claim to treat, mitigate, or cure any disease." That's why bottles of things don't say they cure depression. Instead, they'll say they're "mood enhancers." Or they'll claim a tea helps you sleep (but not "cure" insomnia). Longtime readers know I'm not afraid to embrace natural and alternative means of healing. The key is to go on a case-by-case basis. If you're thinking of adding a supplement to your routine, make sure you read all the available research on it. You should know exactly what a chemical is going to do in your body before you ingest it. I read all the literature for proof of benefits. In many cases, these treatments are dangerous. In the case of my sister, the real danger of the vitamins in her cabinet is they are fat-soluble. Over time, vitamin E and A can build up in your fatty tissue. At high concentrations, these vitamins create serious health problems: headaches, hemorrhagic strokes... That's why I take fat-soluble supplements only a few times a month. My diet is varied and I eat nuts and green leafy vegetables regularly for natural doses of vitamin E. For my vitamin A, I eat carrots, sweet potatoes, and green leafy vegetables. When you consume these vitamins in your food, you're getting much lower doses, and you're getting them in a form your body can process better. Crux Note: Every month in Retirement Millionaire, Dr. David Eifrig debunks common myths and misinformation to help you save money and live a healthier, happier life. Doc Eifrig recently published a report that on the world's best way to buy silver today - detailing exactly what to buy, how to buy it, how much you should own, and the benefits versus other silver investments. Click here to learn more. More on health: The top five myths of aging The "calcium lie" every adult over 50 should know about This common habit could cause you to gain 15 pounds this year... | ||

| Mining’s Making Money as One of the Most Profitable Industries Out There Posted: 14 Jan 2011 06:51 AM PST

I continue to see a lot of good news hitting the wires and I hope this momentum lasts. We're getting positive results from big companies and small companies and across a range of industries. This is a strong signal that the economic recovery might be stronger than economists currently estimate. The one industry that continues to be a standout in my view is mining. I know it's an industry that very few people see as exciting, but as a business model, the cash tumbles in when conditions are right—and, you guessed it, conditions are exactly right now. At this time, the mining industry has almost perfect conditions in which to grow. Precious metal prices have been and should continue to be strong. The stock market is on solid footing, so there's lots of equity capital around to finance expansion. The cost of cash is also cheap, which is always helpful. And, we have a global economic recovery in mature economies, with continued high growth in large, emerging economies like Brazil, China and India. In my view, global events have somehow conspired to create the perfect environment in which to be in the mining business. It's no wonder that so many mining companies are overflowing with cash. What you want in a mining investment is a well-managed company that's run by known industry veterans. You want a company with the right assets (properties that are producing, along with exploration potential), growing production for the next several years and a rising commodity price environment. If you have the chance, pull up a list of recent press releases on a company called Yamana Gold Inc. (NYSE/AUY; TSX/YRI). This well-known, established producer just issued an operational update that I would say represents the "perfect world" for a mining business. The company announced increased gold production in the fourth quarter and a major reduction in cost per ounce. The company previously estimated that its cash costs would be $175.00 per gold equivalent ounce (GEO) in 2010, but now says that this number will be less than $125.00 per GEO. That's a big deal and should produce a major gain in earnings. The company also said that it expects 2012 total production to grow about 27% over 2010, to between 1.2 and 1.32 million ounces of gold. In addition, 2013 total production is expected to keep growing to between 1.46 and 1.68 million ounces, and 2014 is targeted at over 1.7 million ounces of gold, representing growth of about 65% over 2010. That's impressive, and the price of gold doesn't even have to go up for this company to grow its earnings. It's the kind of growth you might associate with a high-flying technology stock. I don't own Yamana Gold, but it's a great example of the outstanding business conditions that are now present in the mining industry. It is difficult to get excited about financing big holes in the ground, but this year and next, I think this industry will really pay off. Sign Up for PROFIT CONFIDENTIAL and | ||

| Gold Versus Defective Economists and Delusional Leaders on Drugs Posted: 13 Jan 2011 09:00 PM PST |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment