Gold World News Flash |

- Crude Oil Sinks as WTI Disconnects from Other Benchmarks, Gold Grinds Lower as Econom

- Ira Epstein's Weekly Metal Report

- The Goldsmiths, Part CLXXV

- Asian Metals Market Update

- Will The Tea Party Congress Bring Recovery?

- Gold Seeker Closing Report: Gold and Silver Fall Slightly

- PROPHETS OF DOOM

- Printing a Recovery

- Precious Metals and Stocks converging to top together in January

- Keeping You on the Right Side of the Market

- Peak Civilization

- Guest Post: A Brief History Of Silver Manipulation

- In The News Today

- SuperMarket Chain Exchanges Gold For Groceries

- Reminiscences Of An American Industrial Nation - How In A Few Short Years America Lost Its Manufacturing Sector

- The Gold Price Spiked Down Again, Could This be a Double Bottom?

- Gold Rally a Correction

- THURSDAY Market Excerpts

- Treat Me Like a Fool

- Trillions, Not Billions

- Bernanke: After the Maestro, the Magician

- Hoenig: Monetary Policy and the Role of Dissent

- There’s Still Time for the Korean Won

- Hourly Action In Gold From Trader Dan

- Investing in Facebook…Goldman-Style

- Heaven Knows

- New Budget Committee Chairman Will Push For One-Mandate Fed, Bernanke Couldn't Care Less

- New Year’s Resolutions and Predictions

- Thrilling Thursday – Comedy or Tragedy?

- Not Just "Inflation Versus Deflation" ... We've Got "MixedFlation" and "ExportFlation"

- Why Rising Rates are Super-Bullish for Gold and Silver

- Gold Daily and Silver Weekly Charts

- Real money. Great Vid. Support Indie Media. “Silver is best opportunty available”"

- New Year’s Resolutions and Predictions

- CDS Markets: The Ultimate Ponzi-Scheme

- Watch How Product Downsizing Happens at Your Grocery Store

- Gold Bullion Holdings Information Is Dubious

- Gold: Long-term outlook bullish…

- How to Skew Bad Economic Data to Inspire Investor Confidence

- Irish default risk soars

- Money & Markets Charts ~ 1.06.11

- World scrambles to contain food inflation

- Last Minute Surge In Financials Puts Paulson's Key Funds In The Green For The Year, Gold Fund Is Best Performer

- On the Brink of Catastrophic Economic Collapse

- Global Macro Notes: Whither Commodities

- The Better Commodity Investment: Gold vs. Barrick Gold

- A Day in the Life of the National Debt

- US Economic Decline a Believable Scenario

- Holiday Spending Was Up--So What

- How to Play the Current Silver, Gold and Dollar Reversal

| Crude Oil Sinks as WTI Disconnects from Other Benchmarks, Gold Grinds Lower as Econom Posted: 06 Jan 2011 06:40 PM PST courtesy of DailyFX.com January 06, 2011 08:41 PM WTI fell on Thursday partly due to profit taking and partly as the differential between it and other crude oils increased further. Gold continues to struggle as economic fundamentals improve. Commodities – Energy Crude Oil Sinks as WTI Disconnects from Other Benchmarks Crude Oil (WTI) - $88.87 // $0.49 // 0.55% Commentary: Crude oil fell $1.92, or 2.13%, to settle at $88.38. The WTI discount to other crudes grew even wider as Brent only fell $0.98, or 1.03%, to $94.52, while LLS fell $1.17, or 1.2%, to $96.13. At $6.14, WTI’s discount to Brent is the widest since late 2008/early 2009, when it got as large as -10.67 (a record). In terms of crude oil generally, we can attribute the latest move to a small amount of profit taking as traders wait for more clarity on fundamentals before a potential test of $100 later this year. WTI has to deal with the added burden of a glut at Cushing. There is limited... | ||||

| Ira Epstein's Weekly Metal Report Posted: 06 Jan 2011 06:09 PM PST Gold bulls continue to say that the current pullback is merely a buying opportunity. I think they're right in terms of the long term picture, but as a futures market analyst my current position is that a shorter term trade top has been made. How long the top stays in place remains to be seen. But I see it as being in place. | ||||

| Posted: 06 Jan 2011 06:03 PM PST There is much talk and concern presently in the gold and silver businesses over the fact that the big bank manipulators have been selling huge quantities of both gold and silver futures and call option contracts short (actually naked shorts). Certainly, there are more silver short contracts held by the big Cabal banks than there is available silver in the world. Rothschild linked JP Morgan Chase in particular has captured the attention of many people with its huge short position in silver. It even prompted much publicity from a London newspaper with a story entitled—Want to crash JP Morgan Chase? Buy Silver. | ||||

| Posted: 06 Jan 2011 06:00 PM PST Gains in the US dollar have resulted in commodities falling. However silver and copper are still over the mid December 2010 prices so the fall is not that much. The US dollar has gained on expectations that US December payrolls and its future outlook will be positive. Any bad news on US jobs prospects today can result in another round of weakness for the greenback. We need to be a bit careful on short US dollar trades today. | ||||

| Will The Tea Party Congress Bring Recovery? Posted: 06 Jan 2011 05:38 PM PST [FONT=Arial,Helvetica,sans-serif] [FONT=Arial,Helvetica,sans-serif][COLOR=#000000][FONT=Arial]John Browne, Senior Market Strategist at Euro Pacific Capital [/COLOR][/FONT] While the markets have known for almost three months that the 2010 election delivered the House of Representatives to the tea-infused Republican Party, I did expect a greater reaction on Wall Street to the formalities of the opening sessions of Congress yesterday. If the Republicans make good on their campaign promises, we will see cuts in government spending and an end to fiscal stimulus. Given that short-term stock market performance is very much dependent on such government assistance, the current rally is hard to fathom. Meanwhile, gold and silver have experienced a counterintuitive correction (although to be honest, pundits are making much more of this 4% pullback than the size of the move merits). Could it be that the markets now believe that fiscal restraint in Washington is the best pathway to ... | ||||

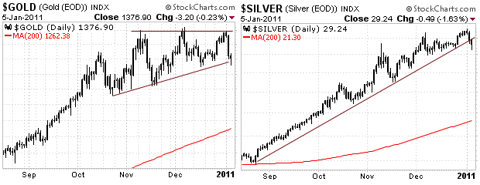

| Gold Seeker Closing Report: Gold and Silver Fall Slightly Posted: 06 Jan 2011 04:00 PM PST Gold saw a $5.65 gain at $1379.75 in Asia before it fell to see a $9.55 loss at $1364.55 by late morning in New York, but it then bounced back higher in the last couple of hours of trade and ended with a loss of just 0.19%. Silver rose to $29.42 and fell to $28.78 before it also rallied back higher in late trade, but it still with a loss of 0.14%. | ||||

| Posted: 06 Jan 2011 03:40 PM PST Did anyone else watch Prophets of Doom last night on the History Channel? I thought it was well done. Theybroke it into categories with an expert per category. One guy each on economic collapse, water depletion, peak oil, nuclear bomb proliferation and artificial intelligence gone amuck. Kunstler did an excellent job on peak oil. I [...] | ||||

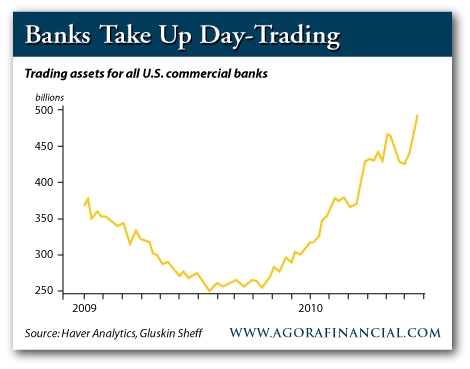

| Posted: 06 Jan 2011 01:15 PM PST Printing a RecoveryCourtesy of MIKE WHITNEY

Counterfeiting is an effective way to stimulate the economy, but the costs can be quite high. For example, if trillions of dollars in fake cash was injected into the financial system (undetected), we'd probably see the same type of thing that we see when a credit bubble is inflating; asset prices would rise, unemployment would fall, economic activity would increase, and GDP would soar. But when people figured out what was going on, investors would panic, the markets would crash, and the economy would go into a deflationary nosedive. So here's the point: Deregulation allows the banks to create as much bogus money as they want in the form of credit. When a bank issues a loan to someone who can't repay the debt, it's counterfeiting, which is the same as stealing. This is what the banks did in the lead-up to the Market Meltdown of '08; they issued trillions of dollars of mortgages to people who had no job, no income, no collateral, and a bad credit history. The banks abandoned all the standard criteria for issuing loans, so they could increase the quantity of loans they produced. Why? Because bankers get paid on the front-end of the transaction, which means that when they make a loan, they mark it as a credit on their books so they can draw a hefty salary and a fat bonus at the end of the year. In other words, there are powerful incentives for bankers to do the wrong thing, which is why they act the way they do. Now that the economy has begun to stabilize, there are signs that the whole process is starting over again and another bubble is already emerging. Check out this clip from an article in The Tennessean titled "Auto lenders approve more subprime borrowers":

Can you believe it? Auto finance companies are lending up to "140 percent of value" of the loan to "credit-challenged" consumers? And this is going on just two years after the biggest meltdown since the Great Depression. Keep in mind, that the housing/credit bubble cost ordinary working people $12 trillion in lost retirement savings and home equity while the perpetrators on Wall Street have seen their profits skyrocket. Bubblenomics is not "innovation" and it certainly does not increase productivity. It merely transfers wealth from one class to another via credit manipulation. Consider the recent reports about improvements in the economy. While it's true the data is looking better (retail sales, personal consumption, manufacturing, car sales etc) it's also true that the credit cancer is spreading again. Consumer demand is still weak because unemployment is nearly 10 percent and wages remain flat. So the only reason spending is up, is because credit is expanding. But that means more lending to people who are incapable of repaying their loans which will inevitably lead to another bust. Here's an excerpt from an article titled "Zero-down mortgages endure in rural areas" from bankrate.com which proves my point:

So a mortgage applicant can purchase a home with no down payment, no mortgage insurance, and no minimum credit score from the USDA? What the heck is the USDA even doing in the real estate business? This is just a sneaky way of creating another asset bubble. It's just more counterfeiting. Now take a look at this from torquenews.com. Same thing. It shows that the big auto manufacturers are jumping on board the credit bandwagon, too. Here's a clip:

"Zero down"; Weeee! "No monthly payment until spring", Weeeee! "$1,500 total allowance if the shopper finances" with us; Weeeee! Free money, never pay, borrow your way to prosperity; Weeeeeeeeeeee! Haven't we seen this movie before? Is Congress really so lazy and corrupt that they're willing to let the economy drop back into the shi**er just so some shifty bankster can buy a few more baubles at Tiffanys? Then there's this from yesterday's news: Allstate vs. Bank of America. Allstate wants to get its money back from B of A on toxic mortgage-backed securities. Here's the drift from the LA Times:

The "sophisticated investor" defense is an excuse that fraudsters use when they've just ripped you off. They say, "I thought you were smarter than that. I thought you were a "sophisticated investor."...which just dumps a little salt in the wound. The truth is, Countrywide clipped Allstate for $700 million in garbage loans and now claims that it procured the money "fair and square". Right. But they do have a point. In a system where there are no rules, anything goes. Allstate might lose their suit simply because the laws now mainly protect the interests of the predators rather than the victims. The banks are free to whip-up their junk debt-instruments (comprised of liar's loans etc) and peddle them to anyone who is gullible enough to invest their money. It's a con-game. One last example. Many people have noticed that there was a slight uptick in credit in the Fed's latest report. That's good, right? But, as it turns out, the only area where credit really improved was student loans which grew about 80% year-over-year, or roughly $120 billion. So why the sudden and explosive growth in student loans? The answer appeared on an economics blog called benzinga.com via firedoglake. Here's an excerpt:

So, there is no improvement in credit. Not really. It's just more backdoor bailouts that are dolled up to look like things are getting better. But things aren't getting better; we've simply restored the same crisis-prone wholesale credit system ("shadow banking") with trillions of dollars of government subsidies, bailouts, stimulus and guarantees, and now we are speeding towards the next big collision. That's not what I'd call "economic recovery". I'd call it stupidity. Pic credit: William Banzai7 | ||||

| Precious Metals and Stocks converging to top together in January Posted: 06 Jan 2011 12:58 PM PST In recent articles and forecast updates for my subscribers, I have been preparing them for a top in Precious Metals and US Markets around Mid January. We may have already seen the intermediate top in Gold and Silver recently, and the SP 500 and US markets are not far behind. There are a few factors I look at to forecast pivot tops and bottoms consistently and a little ahead of the curve when my crystal ball is clear. I look at Sentiment readings, Elliott Wave patterns (As I view them), and Fibonacci relationships and time. If all of these are lining up to give me enough evidence of a convergence and a bottom or top, then I go ahead and make the call or begin to forewarn. In the case of Gold, we see a really muddy chart pattern over the last several weeks that to me can only be read as toppy after a near $390 rally off the February lows this year. There are no clear Elliott Wave patterns anymore over the past few weeks, and the recent drop from $1422 to the $1360 ra... | ||||

| Keeping You on the Right Side of the Market Posted: 06 Jan 2011 12:43 PM PST | ||||

| Posted: 06 Jan 2011 12:00 PM PST | ||||

| Guest Post: A Brief History Of Silver Manipulation Posted: 06 Jan 2011 11:59 AM PST Submitted by Sudden Debt A Brief History of Silver Manipulation The silver fairy tale of the brothers Hunt And when a broker demanded $100 million dollars as payment, the largest margin call until then, and the Hunt couldn’t pay up it was the end for them. In a last attempt to turn the tide, the Hunt brothers tried fabricate paper obligations backed by their 200 million ounces of silver. But in reality they tried to create a international curreny that would have a silver standard. The plan failed and even pushed down the silver price even more because silver by then was linked with the failure of the Hunts and their unstable situation. The price got to a all time low on march 27 1980, a date still known as Bloody Thursday. But like any other casino game : You need to quit while you’re still ahead. For them 2007 should have been a warning light but by then it was already to late to unload their silver derivatives. | ||||

| Posted: 06 Jan 2011 11:36 AM PST Fed's Hoenig Says Gold Standard "Legitimate" System KANSAS CITY, Missouri (Reuters) – A gold standard that forces countries to back their currency reserves with bullion is a "legitimate" monetary system, though it would not prevent financial crises, Kansas City Federal Reserve President Thomas Hoenig said on Wednesday. "The gold standard is a very legitimate monetary system," Hoenig said, adding: "We're not going to have fewer crises necessarily. You will have a longer of period of price stability or price level stability, but I don't know that you'll have lower unemployment, I don't know that you'll have fewer bank failures."

Jim Sinclair's Commentary This problem is far from over. Foreclosures May Be Undone by State Ruling on Mortgage Transfer Massachusetts's highest court is poised to rule on whether foreclosures in the state should be undone because securitization-industry practices violate real- estate law governing how mortgages may be transferred. The fight between homeowners and banks before the Supreme Judicial Court in Boston turns on whether a mortgage can be transferred without naming the recipient, a common securitization practice. Also at issue is whether the right to a mortgage follows the promissory note it secures when the note is sold, as the industry argues. A victory for the homeowners may invalidate some foreclosures and force loan originators to buy back mortgages wrongly transferred into loan pools. Such a ruling may also be cited in other state courts handling litigation related to the foreclosure crisis. "This is the first time the securitization paradigm is squarely before a high court," said Marie McDonnell, a mortgage-fraud analyst in Orleans, Massachusetts, who wrote a friend-of-the-court brief in favor of borrowers. The state court, under its practices, is likely to rule by next month. Claims of wrongdoing by banks and loan servicers triggered a 50-state investigation last year into whether hundreds of thousands of foreclosures were properly documented as the housing market collapsed. The probe came after JPMorgan Chase & Co. and Ally Financial Inc. said they would stop repossessions in 23 states where courts supervise home seizures and Bank of America Corp. froze U.S. foreclosures. Massachusetts is one of 27 states where court supervision of foreclosures generally isn't required.

Jim Sinclair's Commentary This is so wrong while the Banksters now are mostly billionaires, reaching for trillionaire status. Census: Number of poor may be millions higher WASHINGTON — The number of poor people in the U.S. is millions higher than previously known, with 1 in 6 Americans — many of them 65 and older — struggling in poverty due to rising medical care and other costs, according to preliminary census figures released Wednesday. At the same time, government aid programs such as tax credits and food stamps kept many people out of poverty, helping to ensure the poverty rate did not balloon even higher during the recession in 2009, President Barack Obama's first year in office. Under a new revised census formula, overall poverty in 2009 stood at 15.7 percent, or 47.8 million people. That's compared to the official 2009 rate of 14.3 percent, or 43.6 million, that was reported by the Census Bureau last September. Across all demographic groups, Americans 65 and older sustained the largest increases in poverty under the revised formula — nearly doubling to 16.1 percent. As a whole, working-age adults 18-64 also saw increases in poverty, as well as whites and Hispanics. Children, blacks and unmarried couples were less likely to be considered poor under the new measure. Due to new adjustments for geographical variations in costs of living, people residing in the suburbs, the Northeast and West were the regions mostly likely to have poor people — nearly 1 in 5 in the West.

Jim Sinclair's Commentary CIGA BJS says "Mr. Gross sounds concerned."

Jim Sinclair's Commentary The Banksters Rule. Goldman's $1M fine closes door on Conn. ARS obligation Goldman Sachs & Co. will pay Connecticut more than $1 million to settle charges of unethical practices related to the Wall Street leviathan's auction-rate securities business prior to February 2008. On Wednesday, the Connecticut Banking Department posted a consent order signed on Dec. 17 between the state and Goldman's managing director, Michael C. Keats. The company admitted no wrongdoing and declined to comment on the order. This is Connecticut's share of a $22.5 million multi-state settlement of allegations that the New York firm hid knowledge of a troubled market for auction-rate securities, which got their name from the weekly, bank-run sales where the interest rate they pay investors is determined. Goldman continued to market the securities and allegedly filled the void with its own cover bids. The market, which once stood at $330 billion, according to Bloomberg News, collapsed in 2008 as banks stopped using their own cash to prop up the auctions. That left investors with bonds they couldn't sell and forced borrowers such as municipalities to pay a premium. Shares of Goldman Sachs rose 92 cents to $174 on Wednesday. UBS, Citibank and Deutsche have all reached similar settlements with the U.S. Securities and Exchange Commission to payback billions of dollars to investors who lost money as a result of the financial firms' actions. | ||||

| SuperMarket Chain Exchanges Gold For Groceries Posted: 06 Jan 2011 11:28 AM PST For those worried about food price inflation, we bring you the news that some supermarkets might be making contingencies (already). Specifically, this is the story of Tesco, which according to the Telegraph quietly entered the Cash for Gold market last year with the launch of its 'Tesco gold exchange'. So, when the household cash runs out, fear not! Soon enough you too will be able to swap your family jewelery for a loaf of Hovis or some fresh eggs. Well, it's not quite like that. You have to send your jewelery off to Tesco first who will then credit your account accordingly. But still. You get the idea. Mark O'Byrne, director at bullion dealer Goldcore told us what the phenomenon actually shows is that, contrary to popular belief, the public are still gold sellers at large, not gold buyers. Tesco, it would seem, is simply tapping into the opportunity. Or as he explained directly: More Here.. | ||||

| Posted: 06 Jan 2011 11:17 AM PST Some time ago, there was a lengthy debate as to why anyone even cares about the manufacturing ISM number. After all America is now by and far a service economy. Obviously, that debate ended in a stalemate. Nonetheless, the sad truth is that with each passing year America is losing ever more of its once dominant industrial advantage, and with the chief export being "financial innovation", should the world experience another risk flare up it is very likely that the world will enforce an embargo on any future US "imports" and the country's current account deficit will drop to a level from which there is no recovery. So for those who are still not convinced of just how serious the deterioration is, The Economic Collapse blog has compiled this handy list of 19 fact that demonstrate the deindustrialization of America in all its glory. #1 The United States has lost approximately 42,400 factories since 2001. #2 Dell Inc., one of America’s largest manufacturers of computers, has announced plans to dramatically expand its operations in China with an investment of over $100 billion over the next decade. #3 Dell has announced that it will be closing its last large U.S. manufacturing facility in Winston-Salem, North Carolina in November. Approximately 900 jobs will be lost. #4 In 2008, 1.2 billion cellphones were sold worldwide. So how many of them were manufactured inside the United States? Zero. #5 According to a new study conducted by the Economic Policy Institute, if the U.S. trade deficit with China continues to increase at its current rate, the U.S. economy will lose over half a million jobs this year alone. #6 As of the end of July, the U.S. trade deficit with China had risen 18 percent compared to the same time period a year ago. #7 The United States has lost a total of about 5.5 million manufacturing jobs since October 2000. #8 According to Tax Notes, between 1999 and 2008 employment at the foreign affiliates of U.S. parent companies increased an astounding 30 percent to 10.1 million. During that exact same time period, U.S. employment at American multinational corporations declined 8 percent to 21.1 million. #9 In 1959, manufacturing represented 28 percent of U.S. economic output. In 2008, it represented 11.5 percent. #10 Ford Motor Company recently announced the closure of a factory that produces the Ford Ranger in St. Paul, Minnesota. Approximately 750 good paying middle class jobs are going to be lost because making Ford Rangers in Minnesota does not fit in with Ford's new "global" manufacturing strategy. #11 As of the end of 2009, less than 12 million Americans worked in manufacturing. The last time less than 12 million Americans were employed in manufacturing was in 1941. #12 In the United States today, consumption accounts for 70 percent of GDP. Of this 70 percent, over half is spent on services. #13 The United States has lost a whopping 32 percent of its manufacturing jobs since the year 2000. #14 In 2001, the United States ranked fourth in the world in per capita broadband Internet use. Today it ranks 15th. #15 Manufacturing employment in the U.S. computer industry is actually lower in 2010 than it was in 1975. #16 Printed circuit boards are used in tens of thousands of different products. Asia now produces 84 percent of them worldwide. #17 The United States spends approximately $3.90 on Chinese goods for every $1 that the Chinese spend on goods from the United States. #18 One prominent economist is projecting that the Chinese economy will be three times larger than the U.S. economy by the year 2040. #19 The U.S. Census Bureau says that 43.6 million Americans are now living in poverty and according to them that is the highest number of poor Americans in the 51 years that records have been kept. The conclusion: So how many tens of thousands more factories do we need to lose before we do something about it? How many millions more Americans are going to become unemployed before we all admit that we have a very, very serious problem on our hands? How many more trillions of dollars are going to leave the country before we realize that we are losing wealth at a pace that is killing our economy? How many once great manufacturing cities are going to become rotting war zones like Detroit before we understand that we are committing national economic suicide? The deindustrialization of America is a national crisis. It needs to be treated like one. If you disagree with this article, I have a direct challenge for you. If anyone can explain how a deindustrialized America has any kind of viable economic future, please do so below in the comments section. America is in deep, deep trouble folks. It is time to wake up.

This posting includes an audio/video/photo media file: Download Now | ||||

| The Gold Price Spiked Down Again, Could This be a Double Bottom? Posted: 06 Jan 2011 10:54 AM PST Gold Price Close Today : 1371.40 Change : (2.00) or -0.1% Silver Price Close Today : 29.110 Change : (0.063) cents or -0.2% Gold Silver Ratio Today : 47.11 Change : 0.033 or 0.1% Silver Gold Ratio Today : 0.02123 Change : -0.000015 or -0.1% Platinum Price Close Today : 1728.60 Change : -1.90 or -0.1% Palladium Price Close Today : 761.10 Change : -13.30 or -1.7% S&P 500 : 1,273.85 Change : -2.71 or -0.2% Dow In GOLD$ : $176.32 Change : $ (0.20) or -0.1% Dow in GOLD oz : 8.529 Change : -0.010 or -0.1% Dow in SILVER oz : 401.83 Change : -1.08 or -0.3% Dow Industrial : 11,697.31 Change : -31.71 or -0.3% US Dollar Index : 80.88 Change : 0.625 or 0.8% The GOLD PRICE traded mostly sideways today, with another spike down to $1,364.50. That could be a double bottom, or it could be "Two strikes and the next one calls you out." Can't tell yet. Comex took $2.00 away form gold for a $1,371.40 close. The SILVER PRICE painted the same picture as gold, but with a slightly higher V-spike. Low came at 2884c. Comex closed down 6.3c at 2911c. GOLD/SILVER RATIO is what bothers me. Once it dips under its 20 day moving average, it doesn't arise again until its plunge has ceased. Today it crossed, just barely, above 100% of its 20 DMA at 100.1%. Now, it is also just barely possible that the ratio might make one last low, but not likely. My stroll down Mem'ry Lane yesterday overlooked a little item I needed to share with y'all. When the Dow last was at 11,722.98 on 14 January 2000, gold was not at $1,373.40 as 'twas yesterday, but at $283.90. So while the Dow in Gold Dollars yesterday stood at G$175.80 (8.504 oz), back then the DiG$ stood at G$853.59 or 41.292 oz. For stocks that's a loss of 79.4% against gold. DOLLAR INDEX stole center stage today as it gobbled up another 62.5 basis points to close at 80.883, up 0.8%. Thus it has o'erleapt the 80.50 resistance and run slap to the next ceiling at 80.83, and cracked that. If the dollar can break free tomorrow of that 80.83, it will at least hit its 200 DMA (81.67 now). Euro is free-falling. Stocks wavered and stumbled, dropping briskly about 11:00 and staying down most of the day. Dow gave up 245.58 points to close 11,697.31 while the S&P lost 2.71 and ended 1,273.85. Stay away, a bad surprise awaits those who put their trust in stocks. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com Phone: (888) 218-9226 or (931) 766-6066 © 2010, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate in a bubble, primary trend way down. Whenever I write "Stay out of stocks" readers inevitably ask, "Do you mean precious metals mining stocks, too?" No, I don't. | ||||

| Posted: 06 Jan 2011 10:40 AM PST courtesy of DailyFX.com January 06, 2011 07:44 AM 60 Minute Bars Prepared by Jamie Saettele The gold decline from the high is an impulse (5 waves), therefore the odds are high that an important top is in place. A pullback has materialized and the correction is shallow. The rally is corrective so the secondary top could be in place. A larger correction would see a move closer to 1385.... | ||||

| Posted: 06 Jan 2011 10:22 AM PST Gold trades sideways, weathers stronger dollar The COMEX February gold futures contract closed down $2.00 Thursday at $1371.70, trading between $1364.30 and $1380.00 January 6, p.m. excerpts: | ||||

| Posted: 06 Jan 2011 09:43 AM PST | ||||

| Posted: 06 Jan 2011 09:34 AM PST The 5 min. Forecast January 06, 2011 12:47 PM by Addison Wiggin - January 6, 2011 [LIST] [*] Breaking News: The “biggest announcement in the history of modern medicine”... Patrick Cox explains what it means for you... [*] The silver bullet for heart disease and autoimmune disorders… why scientists can finally take aim [*] Goldman Sachs adopts techniques of Nigerian email scammers to gin up interest in Facebook... [*] Gold down, again… two reasons to take heart [*] Readers stuff The 5’s inbox on eBooks… shrinking food packages… the Dow-gold ratio… and we (reluctantly) accommodate a female reader’s very special request for “equal time”... [/LIST] “I suspect that this is the biggest announcement in the history of modern medicine,” says Patrick Cox, “if not medicine itself.” It’s hard to capture Patrick’s zeal in mere words. A company he’s been following for... | ||||

| Bernanke: After the Maestro, the Magician Posted: 06 Jan 2011 09:33 AM PST | ||||

| Hoenig: Monetary Policy and the Role of Dissent Posted: 06 Jan 2011 09:29 AM PST excerpts of a speech by Kansas City Federal Reserve Bank president, Thomas Hoenig … because of my outlook for the economy during this past year that I have found myself in the minority view among my colleagues at the Federal Reserve… … the risk of further disinflation or outright deflation is small and, with an improving economy, should only decline further in the coming months. It is also noteworthy that long-run inflation expectations even now remain above 2 percent and should exert upward pressure on inflation during the course of the recovery. There are, of course, risks to the outlook. First, I am concerned about what might happen to the economy if we fail to deal successfully with our long-run fiscal challenges. The budget deficit is the largest we have seen, as a share of GDP, since World War II. With these large budget deficits, total federal debt outstanding is almost $14 trillion, or about 94 percent of GDP. Moreover, projections of deficits and debt show the federal debt will continue to increase, suggesting that fiscal policy is unsustainable and must be changed soon. As we have seen elsewhere, the reaction of interest rates and exchange rates to unsustainable fiscal policy can be sharp and disruptive…. A second concern I have is the consequences that will follow when we combine our current fiscal projections with a highly accommodative monetary policy. In essence, the Federal Open Market Committee (FOMC) has maintained an emergency monetary policy stance in a recovering economy and has continued to ease into the recovery. I believe these actions risk creating a new set of imbalances, or bubbles. Importantly, such actions as they continue are demanding the saving public and those on fixed incomes subsidize the borrowing public.

My view of the economy's prospects and the appropriate stance of monetary policy differ from the majority view among my Federal Reserve colleagues. Last year, I was a voting member of the Federal Open Market Committee. Reserve Bank presidents vote in rotation, so I will be a participant rather than a voting member this year. It is a matter of public record that I dissented, or cast a "no" vote in all eight meetings in 2010. … In my remaining time today, I will discuss why dissenting views at the FOMC are critical to the success of the Federal Reserve System and that public debate was the intent of its congressional founders. When the Congress created the Federal Reserve nearly a century ago, it believed very strongly that the best policy is not made in isolation, but encompasses a wide range of views from all affected interests. A Federal Reserve Bank was established in Kansas City, as well as 11 other major cities across the United States, to make sure the views of communities nationwide had a voice in Federal Reserve policy. The founders knew that such broad-based participation would lead to better decision making. This structure is replicated on the Federal Open Market Committee, which is the body that makes decisions about our nation's monetary policy through changes in an interest rate known as the federal funds rate, and, over the last couple of years, changes in the size of the Federal Reserve's balance sheet and the interest rate it pays on excess reserves. … The regional Bank presidents fill a critical role at the Fed's policy table. They have the responsibility of representing their respective Federal Reserve Districts in providing their unique perspective on national policy issues. … last year some suggested that dissenting votes confuse the market and that public disagreement among members reduced the effectiveness of Fed policy, including the second round of quantitative easing, known as QE2. As an economist, I cannot be certain that my views are correct. Certainly, a majority of my counterparts on the FOMC last year did not agree with my views. But it is important to recognize that in the face of uncertainty, arriving at the best policy decision is built on divergent opinions and vigorous debate. Because of this, the role of open dissent is at least as critical to FOMC monetary policy decisions as it is to deliberations by the Supreme Court, the United States Congress or any other body with important public responsibilities from the local through the federal level. If you find it unusual to consider the FOMC as being similar to these other deliberative bodies, it is perhaps because many — including some former Federal Reserve officials — tend to speak of Fed policy as being done by a single actor. … Credibility Some would suggest, of course, that monetary policy is not like a Supreme Court ruling. This line of reasoning comes from an idea that a unanimous FOMC is more likely to foster the confidence that is so critical to the functioning of our economy and financial system. To this line of thinking, dissent becomes even more dangerous in periods of high uncertainty. A deliberative body does not gain credibility by concealing dissent when decision making is most difficult. In fact, credibility is sacrificed as those on the outside realize that unanimity – difficult in any environment – simply may not be a reasonable expectation when the path ahead is the most confounding. The question then becomes: Should the debate that is happening privately remain hidden from the public eye until the meeting minutes or transcripts are later released? And in the interim, is the nation somehow better served by giving the public the impression that the entire body is in agreement to the prescribed approach even when that is not the case? … To suggest that public support is somehow encouraged by unanimous decisions suggests little appreciation for the public and their understanding about the challenges we face. To me, that fosters a loss of confidence that can be difficult to recover. As a result, the body becomes less able to respond to a crisis and is left more vulnerable to its critics. The Federal Reserve's founders recognized this a century ago. I hope we continue to recognize its critical importance in the years to come. As for me, I recognize that the committee's majority might be correct. In fact, I hope that it is. However, I have come to my policy position based on my experience, current data and economic history. If I had failed to express my views with my vote, I would have failed in my duty to you and to the committee. [source] RS View: As an individual, the most effective way to voice your own dissent is to vote with your wallet — put your money where your mouth is, so to speak. If you think the official monetary authorities are off course with their management and going from wrong to worse, then "vote" for hard assets as a means to insulate your savings from the failure of the national currency. ALSO… Fed's Hoenig says gold standard "legitimate" system "The gold standard is a very legitimate monetary system," Hoenig said, adding: "We're not going to have fewer crises necessarily. You will have a longer of period of price stability or price level stability, but I don't know that you'll have lower unemployment, I don't know that you'll have fewer bank failures." [source] | ||||

| There’s Still Time for the Korean Won Posted: 06 Jan 2011 09:26 AM PST On Dec. 19, South Korea announced plans for a new fee on bank transactions. The goal was to reduce speculation that was pushing its currency, the won, up in value. But Korean officials are wasting their time. These measures won't be enough to stop the won from appreciating even more. After all, we continue to see similar policies fail across the globe. World currencies are spiking as low interest rates and the widening money supply in the United States and Japan force investors to search for higher yields elsewhere. Increasing foreign taxes or introducing new fees is a standard way for a country to deal with a strongly appreciating currency. The idea is to make it more costly for investors to buy and hold its cash. Yet in country after country, attempts to apply these currency brakes have failed miserably. Consider Brazil. Portfolio managers love Brazil's 10.75% interest rates. By purchasing Brazilian bonds, the managers are essentially going long the Brazilian currency. And as a result, the Brazilian real has strengthened against the US dollar, rising by 10% in 2010. By October, Brazilian officials had had enough. They decided to deter further gains in the country's currency by raising taxes on foreign investments in fixed-income instruments. The core rate tripled from 2% to 6%. Despite this, the Brazilian currency has continued to strengthen against the US dollar. It currently sits at an exchange rate of 1.6973 – 2.1% stronger since the decision. And Brazil isn't alone. Other countries in Latin America and Asia have tried to restrict gains in their own currencies. You probably know about China's measures to keep its yuan stable, but do you know about Thailand's currency woes? Thailand's exports have soared to their highest level in almost two decades, accelerating to 28.5% in November 2010. Overall the country is expected to see a 7.5% economic expansion for all of 2010. Of course, record expansion spurs rapid currency appreciation. So in October, Thai officials removed a 15% tax exemption on income made from the country's bonds for foreigners. Shortly after the announcement, the Thai baht actually appreciated by another 1.3%. In fact, for 2010, the baht was one of the strongest performers for the Asian region – strengthening by a little over 10% against the US dollar – second only to the Japanese yen. Furthermore, the exchange rate continues to remain near the strongest levels since just before 1997's Asian financial crisis. So, if history has told us anything, it's that foreign tax policy matters very little when it comes to speculation in a currency. Solid growth prospects and higher yields will always attract investors and outweigh any temporary tax policy that a government can enact. For the South Korean won, this means that further appreciation is inevitable as long as regional strength continues to churn and the economy expands. South Korean manufacturing activity expanded at the fastest rate in seven months in December. At the same time, exports rose by 23% compared to activity in December 2009 – a value of a little over $44 billion. Overall the South Korean economy expanded by 6.1% in 2010. Seoul's central bankers are trying to slow the pace of growth – raising rates twice last year. Now, the 2.5% benchmark interest rate doesn't compare to higher rates offered in Brazil, but it's still higher than anything you'll see in the United States. So don't be surprised that the won has already jumped 8% against the US dollar since May 2010. And with the country's great growth and attractive interest rates, don't expect Korean intervention to slow the won's rise for very long, either. Richard Lee There's Still Time for the Korean Won originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." | ||||

| Hourly Action In Gold From Trader Dan Posted: 06 Jan 2011 09:21 AM PST | ||||

| Investing in Facebook…Goldman-Style Posted: 06 Jan 2011 09:16 AM PST Gee, we couldn't possibly have seen this coming: Goldman Sachs says they'll stop taking orders from its "high net worth" clients for shares of Facebook. And some of those clients have been told they'll have to settle for far fewer shares than they want, so intense is the demand. This is according to The Wall Street Journal, citing "people familiar with the situation" – as if Goldman doesn't really want this information put out there to further gin up demand for the inevitable IPO. "When you have a chance," reads the Goldman solicitation to its clients, "I wanted to find a time to discuss a highly confidential and time-sensitive investment opportunity in a private company that is considering a transaction to raise additional capital. "For confidentiality reasons, I am unable to tell you the name of the company unless you agree not to use such information other than in connection with your evaluation of the investment opportunity and to keep all information that we reveal to you strictly confidential." Any resemblance between this and a Nigerian email scam is purely coincidental. At least it wasn't in all caps. "It looks to me like that's typical of what the investment banks have been doing for the past decade, which is trading paper for profits, instead of investing in revenue streams," we told Tech News World this week. Unfortunately, in the process of editing the article, our central point got lost: How the whole thing smacks of a Ponzi scheme. Goldman's clients get the big gains, while the IPO investors will be left holding the bag. Plus, it looks like the deal as it's structured with Digital Sky Technologies gives Goldman's clients a built-in out…even before the IPO. Good position, if you can land it. But the question remains: If Goldman writes to its best clients in language that treats them like everyday marks in a wire-transfer scheme, imagine what it thinks of the schlubs who'd buy publicly traded shares. Investing in Facebook…Goldman-Style originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." | ||||

| Posted: 06 Jan 2011 08:58 AM PST By Captain Hook, Treasure Chests Heaven knows there are a myriad of good reasons for Western stock markets and other equity prices to be falling, and of course for the most part they are in real terms when measured against gold as the ultimate benchmark. We have Europe under increasing fiscal stress and rioting because of this (coming soon to a theatre near you); Chinese stocks looking very toppy; along with what looks to be a trend change from top to bottom in the debt markets that promises to turn into a global contagion likely sooner than later with all the money printing going on today. Of course all the problems listed above can be attributed to the global fiat currency economy that has been running loose since Nixon officially went off the gold standard back in 1971, where now fully matured, we are witnessing it's death spiral, and what will probably amount to an end to the Fed within the full measure of process. (i.e. this is the ultimate reason you want physical gold and silver.) Because print as they might, the money is not making it down to the masses, being horded by elite banking interests. Enough however is getting through to drive commodity prices and the cost of living up for everyone, which is increasingly impoverishing the middle classes in developed countries, that being the precondition for radical political / economic revolution. That's what happened in France all those years ago, and this was of course the driving force behind the American Revolution as well. So when you see rioting in US cities you will know what is happening. It's process unfolding as the oligarchs are no longer able to hold abloated bureaucracy together with increasing numbers beginning to feel the pain, whether it be via forced austerity or the dollar ($) being debased to the point it collapses. (See Figure 1 below showing a possible Fibonacci resonance related projection extending all the way down to 33.) Impossible? Perhaps the $ falling to 33, or even falling period, is a bit of a stretch right at the moment, however again, from our last commentary, if States and local governments start getting bailed out en masse next year, this, with some degree of austerity in Europe perceived, then you better believe the $ will fall, and it could fall hard given the potential size of such a tab. Yes, but won't rates rise as foreigners increasingly shun US bonds? Ah, there's the rub – the fly in the ointment if you will. Certainly this is the message we are currently getting in the market, where the US long bond is on the verge of breaching channel support on a 30-year trend that would mark the end of an era – that being the bond bubble of the increasingly cheap credit that has essential fuelled all other serial bubbles along with it in corporate credit, stocks, commodities, and just about everything else that moves. (See Figure 1) Figure 1 The question then begs, would a popping of the bond bubble in turn pop the other resultant bubbles in equities? Answer: One thing is for sure in this regard, if like a junkie, equities stop getting their now almost daily injection of POMO residual liquidity from bond market monetizations, it's difficult envisioning an alternate outcome. And of course the thing about rising rates and declining revenues into government coffers is austerity will be forced on America sooner or later, which would necessitate the abandonment of the liquidity feed, just when baby boomers will increasingly need more of their savings to retire. This is why I have no problem envisioning the S&P 500 (SPX) trading at 500 some day, likely when the ratio below (SPX / USB Ratio) is hitting channel bottom. (See Figure 2) Figure 2 As you can see above, and a view consistent with how we envision things tracing out in the new year, while small absolute gains in equities during the first quarter of next year are possible, once US long bonds fall off their apple cart due to the reckless monetization practices of the Fed, not long afterwards stocks should follow, where rising rates create a self-reinforcing negative feed loop of falling equity prices and deleveraging. Here, the very existence of our global fiat currency economy(s) would come into question, and disarray, likely resulting in more localized reorganizations as collapsing trade relations necessitate change. Sound radical? Well, that's what revolutions are all about – radical change at the highest levels. And this what we are undoubtedly facing at some point in the future, where if it's not for this reason, then peak oil will surely cause such change as global trade patterns are altered / curtailed. Again, like a junkie, the global fiat currency economy that has been constructed by Western central bankers and their politicians throughout the years depends on an ever-increasing and accelerating expansion of credit, and in the latter stages of the larger credit bubble they have been able to fill that need via expansion into emerging markets and money printing at home, exporting inflation to these areas. Unfortunately we cannot carry on past this point, as the remainder of this analysis is reserved for our subscribers. Of course if the above is the kind of analysis you are looking for this is easily remedied by visiting our web site to discover more about how our service can help you in not only this regard, but also in achieving your financial goals. As you will find, our recently reconstructed site includes such improvements as automated subscriptions, improvements to trend identifying / professionally annotated charts, to the more detailed quote pages exclusively designed for independent investors who like to stay on top of things. Here, in addition to improving our advisory service, our aim is to also provide a resource center, one where you have access to well presented 'key' information concerning the markets we cover. And if you are interested in finding out more about how our advisory service would have kept you on the right side of the equity and precious metals markets these past years, please take some time to review a publicly available and extensive archive, where you will find our track record speaks for itself. Naturally if you have any questions, comments, or criticisms regarding the above, please feel free to drop us a line. We very much enjoy hearing from you on these matters. Good investing and best of the season all. Captain Hook Copyright © 2011 treasurechests.info Inc. All rights reserved. The above was commentary that originally appeared at Treasure Chests for the benefit of subscribers on Friday, December 17th, 2010. Treasure Chests is a market timing service specializing in value-based position trading in the precious metals and equity markets with an orientation geared to identifying intermediate-term swing trading opportunities. Specific opportunities are identified utilizing a combination of fundamental, technical, and inter-market analysis. This style of investing has proven very successful for wealthy and sophisticated investors, as it reduces risk and enhances returns when the methodology is applied effectively. Those interested in discovering more about how the strategies described above can enhance your wealth should visit our web site at Treasure Chests. Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Comments within the text should not be construed as specific recommendations to buy or sell securities. Individuals should consult with their broker and personal financial advisors before engaging in any trading activities. We are not registered brokers or advisors. Certain statements included herein may constitute "forward-looking statements" with the meaning of certain securities legislative measures. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of the above mentioned companies, and / or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Do your own due diligence. | ||||

| New Budget Committee Chairman Will Push For One-Mandate Fed, Bernanke Couldn't Care Less Posted: 06 Jan 2011 08:58 AM PST Either the republicans have fully adopted a role as the "charade" party, or they are actually serious about believing that by limiting Bernanke to controlling just inflation, the Chairman will actually start acting on behalf of the peasants (note: he won't - he will just ignore the fact that food prices are at an all time record, and focus instead on the ongoing collapse in home prices, which simply means that middle class has less equity and is paying more for staples). Either way, they are not wasting any time. Reuters reports that representative Paul Ryan, the new chairman of the House of Representatives' budget committee, said he will push for legislation paring back the Federal Reserve's mandate to focus solely on controlling inflation, not ensuring full employment. Well, the problem there is that Bernanke will say that instead of doing QE in perpetuity, or until the unemployment rate goes back to 5% (whichever comes first), he will simply print money (pardon, feed primary dealers with infinite 1s and 0s, which in no was have an impact on cotton prices now trading at unheard of levels). More from Reuters: "Republicans have made no secret of their desire to impose more limits on the U.S. central bank and have been critical of it on a number of scores, including its plan to buy an additional $600 billion in government bonds to try to speed up a sluggish economic recovery." As if the same republicans don't realize that the only reason the Fed is buying said additional $600 billion is to monetize their own damn deficit created when they passed the tax cut extension for the rich, now that China's holding of Treasuries have basically not budged in the past year. Well, someone has to monetize all that debt. And as Zero Hedge has been screaming since September, the only reason for QE2 (and QE3 next) is to fund the $3 trillion in budget deficits over the next two years, as nobody else wants it any more. More trom Reuters:

So much for the Kool Aid - all who think that a dodecatuple (or zero mandate) will stop the private and very much unaccountable bank that is the Fed, from running the world, should consider lowering their recommended daily allowance of hopium. | ||||

| New Year’s Resolutions and Predictions Posted: 06 Jan 2011 08:51 AM PST The New Year invites guesses about the year ahead. I thought I wouldn't bother this year, but then I found myself scribbling out some investment resolutions and predictions on a napkin over breakfast. Here are some of them: 1. Ignore the "gold is in a bubble crowd." The mainstream press doesn't understand gold. They look at the price and think it's expensive. Instead, they should turn it around and question the value of the dollar. Gold is best thought of as a play on the creditworthiness of paper money. When people worry about the printing presses, gold does well. As most governments have huge deficits to finance, gold shouldn't collapse. Besides, on an inflation-adjusted basis, gold is still below its all-time high in 1980. It would have to trade north of $2,000 an ounce to break it. Gold stocks are the best way to play gold because they are going to put up a stellar year of earnings in 2011. Many will mint money at $1,400 an ounce. Stay long gold stocks. 2. Stick with the fu... | ||||

| Thrilling Thursday – Comedy or Tragedy? Posted: 06 Jan 2011 08:33 AM PST Thrilling Thursday – Comedy or Tragedy?Courtesy of Phil of Phil's Stock World

Russell 8-0-0, Russell 8-0-0! Wherefore art thou Russell8-0-0? Deny thy dollar and refuse to fall, or, if thou spike not, be but consolidating at resistance and I’ll happily Capitulate…. If it's good enough for fair Juliet, it's going to have to be good enough for us as the Russell finally makes it over our 800 target - the last barrier that was keeping us on the bearish side. Above these lines - it's time to stop worrying and love the rally as we romanticize the deadly combination of QE2 the Obama tax cuts as: "A pair of star-crossed lovers take their life, whose misadventured piteous overthrows doth with their death bury their parents’ strife." Of course Willie Shakespeare has nothing on Jimmy Cramer, who's pearls of wisdom are also sure to be repeated centuries from now. Last night the Bard of Wall Street sang a veritable sonnet in praise of the stock market and foretold a tale of woe for anyone dumb enough to take profits into this rally:

Note the old-time revival feeling as Cramer preaches to the retail investors. You almost want to jump out of your seat and yell "Hellelujah - I see the light and it is carried on fiber-optic cables from GLW with CSCO routers!" But Cramer isn't telling you to buy sensible companies like GLW ($18.98, forward p/e 10, way more cash than debt) or CSCO ($20.77, forward p/e 11, another great balance sheet) that we like to focus on, even in a runaway market. Cramer is selling the snake oil, he is selling the hair tonic and he is selling the religion of "Buy High and Sell Higher," which makes him one of the most dangerous men in America.

Wait, I'm sorry, I forgot the other time such bad advice was given to the American people. It was, in fact, just 2 years ago when CNBC in general and Jim Cramer in very particular used the same line of BS reasoning to stampede the poor, innocent sheeple in for the slaughter, right at the top of the market. As Jon Stewart famously pointed out: "If I had only followed CNBC's advice I would have a Million Dollars today --- providing I had started with $100 Million Dollars." Really, take 10 minutes and watch the above two videos - it's the same nonsense we're hearing today: "Ignore the naysayers, don't ignore the momentum, be afraid to miss out, ignore pockets of bad news, things are great in China...." CNBC, like much of the Mainstream Media is there to get you to BUY things. They want you to spend money and buy stocks from their advertisers - what do you expect them to say? Jon Stewart gave Jim Cramer an entire show to make his case so I will let them retort and you can decide but this is the reason I often say - Be careful out there.

This kind of advice doesn't even make sense. If we're having the kind of rally where NFLX ($179.73, p/e 46, net tangible assets of $199M, market cap $10Bn) or AMZN ($187.42, p/e 53, NTA $4Bn, market cap $84Bn) are "cheap" then we are not missing any kind of bus by cashing in our profits here. Yesterday I warned Members to do just that on plays from our October 23rd Dividend plays and our Dec 11th Breakout Defense plays (but not our longer-term Dec 25th Secret Santa's Inflation Hedges) that are up ahead of schedule if we now fail ANY of our Breakout II levels (see Stock World Weekly for summary of levels). I know this makes me seem like a big stick in the mud but I am forced to be the voice of reason when the markets become unreasonable - even though voicing concerns during a rally costs me "ratings." I have said this before, people love the cheerleaders, they want affirmation of their buying decisions, they want to feel good about their investments so they gravitate towards those who tell them what they want to hear. It's human nature - and CNBC et al play off it to get ratings. They don't care if the advice is good or bad - it makes the sponsors happy and it makes the viewers happy and, as 2008-9 has proven - there is no downside - no one except me seems to remember what a tragedy their last round of pom-pom waving caused.

Perhaps you can see why we don't fear a bull market - as long as we PRESERVE our cash - a monkey with a dartboard, even Cramer, can pick winners in an inflation-driven upside market. Our other play was bullish on oil and commodities (I'll bet you can already guess how that went!) using DBC with a longer play. There were two plays there. One was very simply buying the Apr $27 calls for $1. No margin is required and we were quite sure that inflation was taking commodities higher so we liked the rare (for us) naked position. Those calls are already $1.55, up a nice 55% in their first month but that's the kind of play we kill if they fall back to 45%, despite Cramer's "advice" to HOLDHOLDHOLD. The other trade idea for DBC was the Jan 2012 $26/30 bull call spread at $1.40, selling the 2012 Jan $22 puts for $1.10 for net .30 on the $4 spread. The $26/30 spread is just $1.60 but the $22 puts have fallen to .75 so a not so bad net gain on cash of 283% out of a potential 1,233% max gain so a bit ahead of schedule in our first month. This is an example of a play we're more likely to let ride as we can ride out a correction buy why on earth would we let the 2,033% gain get away from us or the 55% gain on the straight call that has no hedges? We're not afraid of a rally - we simply aren't convinced enough that the forces that are driving stocks higher have the fundamental underpinnings to be sustained and we are almost POSITIVE that the market will in no way be able to stand up to any serious bad news (sovereign default, municipal default, bank default, terrorism) - none of which even Cramer can pretend are really off the table. So we will continue to take our money and run and, frankly, this week we've been "Selling the F'ing Pops" as the Cramericans throw their cash into overpriced stocks that we think have an excellent chance of giving us big money on downside moves where we also will be taking the money and running. We're not bullish or bearish - we're rangeish and, until proven otherwise (Russell 800 would be a start), we will continue to play this as the top of our range. | ||||

| Not Just "Inflation Versus Deflation" ... We've Got "MixedFlation" and "ExportFlation" Posted: 06 Jan 2011 08:31 AM PST Many people have made persuasive arguments for inflation. See, for example, my roundup from 2009, and Gonzolo Lira's recent essay arguing that there is no political will to raise interest rates, and so commodities have become the safe haven investment (replacing bonds). Many others have made persuasive arguments for deflation. See, for example, my post from 2009, and Charles Hugh Smith's recent essay arguing that mild deflation is good for the powers-that-be, and so they will make it happen (part II). But perhaps debates about inflation and deflation paint with too broad a brush, or too narrow a focus ... Too broad a brush because the economy is not a monolith ... different asset classes can move in different directions at the same time. Too narrow a focus because you can't analyze what's happening in the U.S. in a vacuum in a highly global economy. MixedFlation As I noted in 2008:

I wrote in July 2009:

I reported in September 2010:

I have seen many reports of rising food, commodity, energy and healthcare costs. But housing is double-dipping, and wages are declining.

And see this. ExportFlation The Fed's easy money policies (including, but not limited to quantitative easing), asset purchases and other policies are sending a lot of hot money flows abroad. In fact, America has been massively exporting inflation. As Bloomberg noted last October:

So not only some asset classes rising and some declining in America, but a portion of the effects from American monetary policies are felt abroad, instead of within the U.S. The BRIC governments, apparently, are not very happy about America's exported inflation. As Phoenix Capital Research wrote in December:

Andy Xie agrees, arguing that 2011 will be a show-down between China's efforts to curb it's inflation and America's efforts to export it's inflation. Indeed, a prominent Chinese pro-democracy activist says that inflation will cause the collapse of the current Chinese regime unless it is put in check. | ||||

| Why Rising Rates are Super-Bullish for Gold and Silver Posted: 06 Jan 2011 08:30 AM PST By Jordan Roy-Byrne, CMT, The Daily Gold Heading into 2011, the consensus outlook on precious metals is slightly positive but the consensus believes that higher interest rates will ultimately support the US currency and in turn engender a move out of Gold. The Gold naysayers are using "rising rates" as a way to dismiss Gold. Let me explain why this belief is not only false but utterly dangerous. First and foremost, the parameters have changed in just a few short years. Government debt has increased substantially in the last few years. This debt and the debt of the last 10 years has been serviced at very low interest rates. In fact, its been serviced at historically low interest rates. When interest rates were higher in the 1990s, the overall debt load was significantly lower. John Hussman explains: Moreover, in order to adequately evaluate the existing deficit, it is essential to recognize that this figure reflects interest costs that are dramatically less than we can expect as a long-term norm. Consider the chart below. The blue line represents interest on the gross Federal debt at the average of prevailing 10-year Treasury yields and 3-month Treasury yields. Presently, this figure is comfortably low, thanks to the depressed level of interest rates. In contrast, the red line shows what the interest service would be at a 5.2% interest rate, which is the post-war norm. For debt service costs to skyrocket, interest rates only need to rise marginally. Think about it like this. There is $14 Trillion in debt. In theory, every 1% rise in interest rates could equate to an extra $140 Billion in interest service costs. Tax revenue in FY 2010 was $2.38 Trillion. Clearly, a continued rise in rates will have a highly inflationary impact. As we've said before, the Fed will have to monetize more as a result of higher rates and the Fed will have to monetize to keep rates low. Furthermore, rising rates will certainly have an impact on an economy that is only three years into a de-leveraging cycle. When rates started to rise in the early 1940s, consumers and businesses already endured more than a decade of de-leveraging. Rising rates in 2003-2007 didn't hurt the expansion because consumers were euphoric about housing and willing to borrow. Yet, this time around we are only a few years into the de-leveraging cycle and tons of mortgage rate resets are dead ahead. Simply put, rising rates are a death sentence for an over-indebted nation. It cripples the economy's ability to grow out of its debt burden. Moreover, it leads to default or hyperinflation, which basically means a doomed currency. Now, we do have a massively huge bond market so I am not suggesting rates are going to spike over a few weeks or a few months. This is something that will happen slowly but the market is already taking notice. After rising over $200 in sustained fashion, Gold corrected via a "running" correction. This type of correction occurs when a market is very strong and it precedes another impulsive advance. Because of the recent correction, Gold isn't so overbought. Also the COT data shows a reduction in both open interest and speculative long positions. Gold is in position to accelerate to new highs and then higher highs during the first half of 2011. Gold and Silver have already had a great run, but the best may be straight ahead. In our premium service, we are constantly working to find our subscribers the best stocks to profit the trends that lie ahead of us. If this interests you then we suggest you consider a free 14-day trial to our premium service. Good Luck! Jordan Roy-Byrne, CMT | ||||

| Gold Daily and Silver Weekly Charts Posted: 06 Jan 2011 08:15 AM PST | ||||

| Real money. Great Vid. Support Indie Media. “Silver is best opportunty available”" Posted: 06 Jan 2011 07:57 AM PST | ||||

| New Year’s Resolutions and Predictions Posted: 06 Jan 2011 07:38 AM PST The New Year invites guesses about the year ahead. I thought I wouldn't bother this year, but then I found myself scribbling out some investment resolutions and predictions on a napkin over breakfast. Here are some of them: 1. Ignore the "gold is in a bubble crowd." The mainstream press doesn't understand gold. They look at the price and think it's expensive. Instead, they should turn it around and question the value of the dollar. Gold is best thought of as a play on the creditworthiness of paper money. When people worry about the printing presses, gold does well. As most governments have huge deficits to finance, gold shouldn't collapse. Besides, on an inflation-adjusted basis, gold is still below its all-time high in 1980. It would have to trade north of $2,000 an ounce to break it. Gold stocks are the best way to play gold because they are going to put up a stellar year of earnings in 2011. Many will mint money at $1,400 an ounce. Stay long gold stocks. 2. Stick with the fundamentals. People come up with all kinds of crazy indicators to try to predict what the market is going to do. The year 2010 had a couple of really silly ones that got a lot of press. Anyone remember the "Hindenburg Omen?" That people gave any credence to this idea at all makes me wonder about the survivability of our species. But it wasn't the only one. I clipped out and saved a column from Barron's dated July 5, 2010, giving serious ink to the idea of the "Death Cross" – another indicator that cropped up in 2010 and predicted the market would crash. Of course, the market is 25% higher since. Ignore these contrivances. The future is unpredictable. You're better off studying businesses and trying to buy only cheap stocks. Move to cash when you can't find anything to buy and wait. It's worked for me anyway. 3. Question the "US blue chips are cheap" argument. This one is controversial because you couldn't find a money manager today who doesn't think US blue chips – Microsoft, Johnson & Johnson, Kraft and the like – are cheap. Nearly everyone does. That's the problem. Something is wrong here. Microsoft trades at only 12 times earnings, but perhaps deserves that multiple. Yes, it generates a lot of cash, but it has done little with it for shareholders' benefit. The problem is that a lot of these big firms hoard cash, earning nothing, or spend it on value-destroying acquisitions. All that great cash flow these firms generate never gets into shareholders' pockets. Microsoft, Hewlett-Packard, Cisco and Intel are examples of companies that throw off lots of cash and carry excess cash…yet pay hardly anything to shareholders. As Bill Miller, manager of the Legg Mason Value Trust, points out: "[These companies] all could EASILY pay out 70% of their free cash flows as dividends and still build cash on the balance sheet. If they did so, it is hard (nay, impossible) to believe their stocks would not move dramatically higher. My guess is that at worst they would trade at between a 4% and a 5% dividend yield, about where much-slower-growing utilities trade, providing an immediate gain of over 30% to their owners." I agree. If big blue chips were smart allocators, they'd be great investments. Look at what McDonald's has done. Or even IBM, which trades at a higher price-to-earnings ratio than Microsoft, a notoriously poor allocator of capital. Until these big blue chips start thinking about shareholders, I don't think they are especially cheap. They probably trade where they should trade. Meanwhile, I still find better bargains among smaller-cap stocks, in which the people running the show have skin in the game. I'd rather invest in these names than some giant corporation that hands its executives lush option packages. Over the long haul, I prefer "owners" versus "renters." 4. Stay with commodities where supply is tight and there is no immediate cure. I think 2011 will be more difficult for commodity investors. Mining companies are pouring record amounts of cash toward new projects. That's like turning on the shot clock in basketball. There is a window to score here, but it is closing. Some commodities, though, ought to do better than others. There is an old market saying that says, "Good things happen to cheap stocks." Even though we can't predict when things will happen, a cheap stock usually doesn't need much help to produce a sizeable gain. In the commodity world, a similar saying might be "Good things happen to commodities where supply is tight and finding more is not easy." Coking coal is a good example. Quality deposits are hard to find. Steelmakers are looking all over the world for new sources of supply. But then, in recent days, the sky opened up in Australia. The rain was so torrential, it's halted exports of about 40% of the world's coking coal. A whole bunch of companies declared force majeure, saying they would not be able to meet supply contracts. No one could've predicted that, but good things tend to happen to such commodities. Coking coal prices will surely spike upward in the second quarter. Already, coking coal contracts for January-March are $225 a tonne, the second highest on record. For 2011, I'd say uranium has the most upside potential, outside of the precious metals. Even though prices rose in 2010, they still don't compensate miners for the risk of building new mines. It's also a very concentrated industry, like coking coal. More than 60% of all uranium comes from just 10 mines. Stay long those uranium stocks. What about the biggest potential correction on the downside? I'd say agricultural commodities. We're going to see record planting all over the world. My guess is that these plantings will be enough to dent to the run of commodities such as wheat and corn. Good for stocks such as Pilgrim's Pride (NYSE:PPC), though, which should enjoy a fall in feed costs. 5. Keep traveling. I always learn something new when I travel and often uncover new investment ideas as well. All of which is to say it's a good thing to leave your desk and step out into the world. This year, I have a number of places and people I'd like see and meet. For instance, in March, I plan to check out Colombia. And in May, I hope to visit South Africa. 6. Keep a sense of humility. The most important resolution is one I make to myself every year: It is to keep a sense of humility about the markets. Unpredictable things happen all the time. There is some element of luck involved, for good or ill. And everyone – no exceptions – gets his head handed to him at some point or other in his investing life. If you play long enough, you will have your share of losses and disappointments. As Roy Neuberger wrote in his memoir, So Far, So Good: The First 94 Years: "Always-right investors don't exist, except among liars." So there is no room for overconfidence, stubbornness or arrogance. Take your gains and losses with cheerfulness and a light touch. Don't be afraid to say, "I don't know." Keep an open mind. Keep learning. And enjoy the ride. Here's to 2011! Regards, Chris Mayer New Year's Resolutions and Predictions originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." | ||||