saveyourassetsfirst3 |

- 2010: Not Bad for the Dollar

- The next big Chinese investment trend is starting now

- Cotton Is King in Commodities, But Any Hike in Crude Could Be Game Changer

- Vulture Bargain Roundup for December

- New Video

- Premiums on British Gold Sovereigns and Eagle Demand Show Lack of "Irrational Exuberance"

- Weekly Market Review

- Gold Demand, Then and Now

- Watching Grass Grow... and Paint Dry

- If only Bloomberg believed in a transparent gold market too

- Silver analyst Ted Butler

- Dont "Trade" Gold And Silver, Advises John Embry

- Gold Flows to China Rise Sharply (and Early) Ahead of New Year…

- Bloomberg Counters Gold’s Run with Absurd, Baseless Hit-Piece

- Disappearing Boom Taxes

- CNBC interview: CFTC Commish Bartman Chilton on position limits

- The smart investment choice in 2011 will be Gold

- Teb Butler's important paper/IMF concludes gold sales/silver continues with high open interest

- Is Brazil For “Real?”

- Has The Financial Collapse Of Europe Now Become Inevitable?

- How to Double the Debt in 5 Years

- Gold Seeker Closing Report: Gold and Silver Close Near Unchanged

- Gold Rises as UK Finances Deteriorate and IMF Gold Sales Finish

| Posted: 23 Dec 2010 06:47 AM PST Hard Assets Investor submits: By Brad Zigler Traders and investors who believe the U.S. economy is in a death spiral shouldn't be in a rush to short the dollar. After all, better plays were there in 2010. Make that two better plays. Complete Story » | ||

| The next big Chinese investment trend is starting now Posted: 23 Dec 2010 05:43 AM PST From Frank Holmes of U.S. Global Investors: With home and auto purchases growing at an average 34% and 22% annual pace in the last decade, respectively, Chinese households have already acquired a significant number of material assets. Deutsche Bank thinks tourism could be the next major driver for overall consumption in China. In the next five years, in line with the government’s plan, tourism-oriented travel might undergo tremendous expansion, as Chinese consumers opt for more services-related expenditures instead of real estate and durable goods. ... This acceleration in tourism growth should benefit... Read full article... More on China: The real reason China is buying so much gold China is reawakening the bull market in this beaten-down commodity GOLD CRAZY: New wave of Chinese money is set to slam the gold market | ||

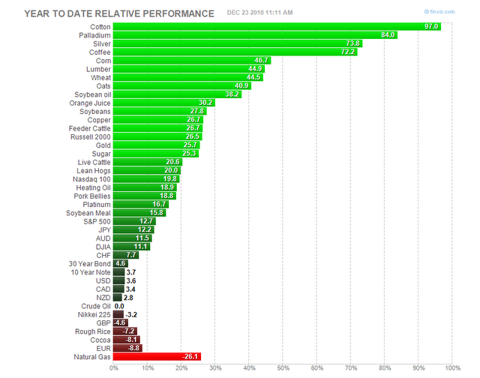

| Cotton Is King in Commodities, But Any Hike in Crude Could Be Game Changer Posted: 23 Dec 2010 05:13 AM PST Trader Mark submits: Via Finviz we see if you threw a dart in the commodity pit you made money in 2010 as long as you missed natural gas, cocoa, and rice. Cotton continues to be the star of the year along with silver, palladium, and coffee. Thankfully this chart means nothing to the Fed, so QE-infinity it is.  (Click to enlarge) Complete Story » | ||

| Vulture Bargain Roundup for December Posted: 23 Dec 2010 04:03 AM PST As we close the end of 2010, Barclays sees gold at $1,460 to $1,480 in 2011; the IMF is done selling its 403 tonnes of gold; coffee and cotton are very strong; sugar at new 29-year highs; the U.S. Federal Reserve is now the largest single holder of U.S. debt at more than $1 trillion (but Ben S. Bernanke says they aren't printing money); the Baltic Dry index is weaker; but the VXO volatility index is near its lows for the year; copper at or near record highs, with one trader holding 80% to 90% of the LME supplies, but shares in Shanghai are flagging; Iran, Nigeria and the PIIGS are rattling newswires and global nerves, but the Ted Spread canary is singing at just 17 bps; crude oil is flirting with a technical breakout above $90, but NatGas is still sucking wind near U.S. $4.00 (likely for not much longer); bitter cold in Europe and Asia – the next arctic blast is staging in Canada's Yukon – soon to be flying south; skepticism about gold and silver is rampant (and contrary bullish); uranium slightly stronger on supply concerns; economists upping targets for U.S. growth based on, uh, tax breaks?; gargantuan U.S. debt a giant concrete cloud hanging over everyone, everywhere; sovereign debt, credit card debt, student debt, mortgage rates rising, a bond exodus and now we have the EPA to the "rescue," cracking down on gold mining autoclaves and roasters over mercury emissions … Let's stop there, shall we? Friends and fellow Vultures, what we have here for Christmas is a WOLRD CLASS WALL OF WORRY with every fiat currency vying to devalue. | ||

| Posted: 23 Dec 2010 02:26 AM PST I will be releasing Part 2 of the JPM Silver Manipulation. Should be an instant hit. | ||

| Premiums on British Gold Sovereigns and Eagle Demand Show Lack of "Irrational Exuberance" Posted: 23 Dec 2010 01:33 AM PST | ||

| Posted: 22 Dec 2010 08:41 PM PST A review of the Markets as of the latest week ended. Dow Jones Industrial Average: Closed at 11491.91 -7.34 patterning a sloppy bear double top. Volume was normal for a pre-holiday rebalancing day with price clustered near 11500 resistance for the last four trading days. The tax cut extension approval came at the 11th hour preventing a major sell-off that we were anticipating. Momentum was up mildly and support is 11450. With price in this tighter trading range, we expect low volumes next week. Christmas is on Saturday so the 24th will be a holiday prior to that date. We have encouraged our traders and investors to do nothing but risk control until December 27th after the Christmas weekend. S&P 500 Index: Closed at 1243.90 +1.03 forming a five day cluster top on normal momentum and mildly up momentum. Resistance is 1250 and support is 1240-1222.84 on the 20-day moving average. While we expect little trading next week, there could be some mild rebalancing in this index. Usually, this occurs just after Christmas as traders get ready for the New Years' opener on Monday, January 3, 2011. The trend is up and we expect it to remain so until the middle of January when a normal cycle correction can sell stocks. S&P 100 Index: Closed at 559.49 +0.09 on normal volume and rising momentum. Support is the 20-day moving average at 549.74 and resistance is the price of 560. The chart pattern shows decisive resistance pressure at 560 having been touched by traders five days in a row but not broken through. We think 560 is the top for this index until selling begins in January followed by higher highs trading into April. Nasdaq 100 Index: Closed at 2218.29 +0.27 on normal volume but flat momentum. Since this is the leader index, that flat volume signals resistance pressures until the middle of next month. The Nasdaq can rise further but not much further. Oracle had positive reports today but this basically failed to rally the shares on this pre-holiday weekly closeout. We are seeing stronger resistance at 2220 but expect the Nasdaq to break up and through to resist at the price of 2250 in early January before profit-taking selling takes it back to 2150 support. 30-Year Treasury Bonds: Closed at 121.38 +1.84 as the waterfall selling of bonds continues. Price finally found support just under 119.00 with a danger of slipping beneath 118.00 and moving down to 115.50. Momentum hit the bottom of the PMO index and then reversed back up a tiny bit from -2 on the index. The low today on the March futures was 119.17. Price then did a rebound back above 120.00 main support. Major support was found matching a price from November, 2009 at 118.50. Watch for continued selling in bonds through at least the spring in choppy trading as Europe wrestles with credit disaster. Gold: Closed at 1375.80 +6.00 after some early morning touching of a low at 1365.40 on the February futures. We have just completed a full ABC normal correction and expect a tiny $50 rally from 1375 to 1424.50 by the end of the first week in January. Pressures are to the long side and silver has been even more powerful in regaining a comeback after matching gold's selling. Look for a small rally first and then a sell back to perhaps 1350-1360 followed an extended run for 90-120 days ending in May-June to 1450-1550. Silver: Closed at 29.15 +0.28 after the March futures retreated from a December high above $30 and pennies to a recent low of 28.68 on the futures. Daily trading ranges are moving heavily between 50 and 85 cents with one penny being $50 on the contracts. The ABC is done for silver too, but the difference is the last C wave did not sell as deeply, signaling the buy side pressures for silver are stronger than gold's. In the next rally starting after Christmas near the month's end, silver makes another try at $30.00+ in an effort to touch $32.48. The high should be at the end of January or in the first week of February before profit-taking. Gold & Silver Index XAU: Closed at 219.01 +0.72 after touching a high at 230 and then falling to support on the 20-day average at 219.14. Momentum is weaker and the metal to shares ratio has turned negative. Resistance is 230 and we forecast this index sells to 211.92 on the 50-day average followed by another rally to touch 230 producing a bear double top next month. The last three weeks of January are seasonal sellers. U.S. Dollar Index: Closed at 80.36 +0.18 on flat momentum and congested sideways trading. Price, three moving averages and a lower channel support line are all converging near 80.00 creating a choppy, narrow trading range. This narrow trading range should open up next month in a new and mild rally as Europe continues to have credit problems with a selling Euro. Both the dollar and the Euro are weak and going weaker. However, the dollar for now is temporarily the stronger one. This gives it an edge to rally to 80.00-82.50 over the next 4-8 weeks. Crude Oil: Closed at 88.60 +0.08 on flat momentum and choppy, sideways trading. Oil is now trading between 88.00 and 90.00 over the last 8 trading sessions. The current trading technically is 88.50 to 92.50. With new inflation and a temporarily repaired stock market, we forecast oil rallies back to 92.00 by the end of the first week in January. Price is bullish staying above all moving averages with strong support from the 20-day average at 87.21. Look for crude oil to be in a range of 108 to 112 by April with $4 unleaded gasoline prices. We can imagine $5 gas by the last quarter of 2011 on inflation. CRB: Closed at 320.62 +3.28 on resistance at the closing price and support of 317.50. Price is over all channel lines and moving averages. Since oil is the biggest driver and oil is expected to rally, we think the CRB will break through 320 moving to 340 by the end of the first week next month. After that, the price could drop back to 320 on profit-taking as commodities take a cycle-sell-rest. Expect big 2011 moves on higher inflation for the CRB and its market components in 2011. -Traderrog This posting includes an audio/video/photo media file: Download Now | ||

| Posted: 22 Dec 2010 08:35 PM PST Image:  Washington state reader, S.A. was kind enough to forward the following graph that was posted over at agorafinancial.com. The chart is titled "Gold Demand, Then and Now".

| ||

| Watching Grass Grow... and Paint Dry Posted: 22 Dec 2010 08:35 PM PST GLD ETF declines 302,000 ounces. Interviewed on CNBC, CFTC's Chilton defends position limits. 33rd week in a row for outflows from U.S. domestic equity mutual funds. The Christmas Truce... and much more. ¤ Yesterday in Gold and SilverWednesday's trading activity in gold was like watching paint dry... no price action on light volume. The chart says it all. The gold price made it above $1,390 spot a couple of times... and that was all the excitement there was.

Silver's price action was like watching grass grow. Volume was light as well.

From the Far East open at 6:00 p.m. on Tuesday evening... right up until precisely 5:00 a.m. Eastern time yesterday morning... the world's reserve currency fell 40 basis points. Then at that precise moment, the dollar began to rally, gaining about 45 basis points by around 1:30 p.m. Eastern time. Coincidentally, gold and silver's high ticks of the day were at precisely 5:00 a.m. Eastern time as well... and the prices of both metals slowly declined for the rest of the trading session.

The gold and silver stocks poked their heads into positive territory several times... the last time being around 12:15 p.m. From that point, they rolled over and finished down on the day, with the HUI declining 1.08%. A lot of the juniors [both gold and silver] fared far worse than that. Trading volume was pretty thin, so it's obvious that what sellers there were, were just hitting the bid and taking their money off the table in front of the holidays. There wouldn't be a lot of stock-loss selling in the gold and silver equities this year... as pretty much every precious metals stock was up substantially from a year ago.

The CME's Daily Delivery report showed that 40 gold and 50 silver contracts were posted for delivery on Monday. The GLD ETF had a rather large withdrawal yesterday. This time it was 302,561 troy ounces. There was no report from SLV. The U.S. Mint's sales report on Wednesday showed that they sold another 5,500 ounces of gold eagles... bringing month-to-date sales up to 57,000 ounces. Silver eagles sales for December currently sit at 1,772,000. There was a small decline in silver stocks reported over at the Comex-approved depositories on Tuesday. This time it was 64,644 ounces. The link to that activity is here. Before I start my stories for the day, I've got two more charts for you. Yesterday I ran the CRB chart, noting that the CRB was a long way away from taking out its highs of 2008. For those of you who have been around long enough, you may remember that the 'powers that be' re-engineered the CRB about five years ago [or more]... and reduced the oil and gold weighting... along with a few other things. They basically did a Greenspan Hedonistic Adjustment to the index... gutting the whole thing. If you look at the old CRB... which is now called the CCI... you'll note that we are back above the old highs of 2008 for the first time. Here's the 3-year CCI chart.

And, in case you've forgotten, here's the 'new and improved' 3-year CRB index... the one we use today. It's obvious why they changed it... it keeps inflation and the cost of living down. Any questions?

Here's another sharelynx.com chart that was sent to me late last evening by Australian reader, Wesley Legrand. With a zero base as of January 1, 1970... the graph needs no further comment from me. Don't forget to 'Click to Enlarge'... as this is a pretty busy chart when it's this small.

¤ Critical ReadsSubscribeNo End In Sight To Equity Outflows As Stock Boycott Persists Despite Largest Bond Outflow Since Lehman FailureToday's first story is zerohedge.com piece which is courtesy of 'David in California'. The headline reads "No End In Sight To Equity Outflows As Stock Boycott Persists Despite Largest Bond Outflow Since Lehman Failure". For the 33rd week in a row there has been an outflow from domestic equity mutual funds. It's a short read... and the two graphs are worth the trip all by themselves. The link is here.  Government liabilities rose $2 trillion in Fiscal Year 2010: TreasuryThe next item is a Reuters story that's courtesy of reader Scott Pluschau. The headline states that "Government liabilities rose $2 trillion in Fiscal Year 2010: Treasury". The United States is bankrupt. This isn't a long story, either... and the link is here.  If only Bloomberg believed in a transparent gold market tooHere's a Bloomberg story imbedded in a GATA release. The headline reads "Bloomberg Sues ECB to Force Disclosure of Greece Swaps". Chris Powell has his own headline, which reads "If only Bloomberg believed in a transparent gold market too"... and the link is here.  Interviewed on CNBC, CFTC's Chilton defends position limitsHere's another GATA release, with a preamble written by Chris Powell. There's no reason for me write a word about it, when Chris has already done the heavy lifting for me. The headline reads "Interviewed on CNBC, CFTC's Chilton defends position limits". This is worth the five minutes of your time that it takes to watch. The link to Powell's preamble... and Chilton's interview... is here.  Gold Demand, Then and NowWashington state reader, S.A. was kind enough to forward the following graph that was posted over at agorafinancial.com. The chart is titled "Gold Demand, Then and Now".

Silver analyst Ted ButlerSilver analyst Ted Butler provided another report to his clients yesterday... and I'm stealing one paragraph out of it in order to answer a question that a few of my readers had about JPMorgan's short positions being transferred to foreign banks. This is what Ted had to say about this issue... "Another story readers have questioned me about concerns a report suggesting JPMorgan is transferring its concentrated short position in Comex silver to foreign banks. I've studied the data closely... and do not come up with that conclusion. JPMorgan is clearly reducing its Comex silver short position... and that has contributed to the recent price rise, but there is no compelling evidence that it is merely a transfer of the short position to foreign banks. In the most recent Bank Participation Report, the US banks [JPMorgan] did reduce their net short position by around 4,000 contracts as previously reported, but the foreign banks only increased their net short position by 1,200 contracts. Besides, if there were such an arrangement in place, it would require overt false statements to the CFTC on large trader reporting requirements, something almost unimaginable for reporting financial institutions."  Gaddafi's Threats or TreatsSince this is my last column until next Tuesday, I thought I'd unload the rest of the stories that I've been saving in my in-box. There are only four of them, but all are fascinating reads. The first is a story that got posted late on Sunday evening in The Wall Street Journal. That's a wonderful time to post an important story that they don't want noticed. The headline reads "Gaddafi's Threats or Treats". Sean Connery, the actor and longtime Scottish nationalist, said that "I doubt we will ever know the full story" of why the Libyan agent who helped blow a Pan Am airliner out of the sky in 1988 was freed. Well, thanks to WikiLeaks... the world knows a lot more about it now. Nothing surprises me anymore... and this didn't either. I've also heard rumours that there was a big oil deal involving BP... and if they wanted Libyan leader Muammar Gaddafi to sign on the dotted line, it was conditional on the release of Abdel Baset Al-Megrahi. It's a very short read... and a lot of the unsavoury details are linked here.  Granting AnonymityThe next fascinating story is courtesy of reader G.G. This one was posted in the Friday edition of The New York Times. The short headline... "Granting Anonymity"... belies the intrigue in the story itself. I'd bet that "The Tor Project" doesn't mean much to you. It's a deliberately byzantine system of virtual tunnels that conceal the origins and destinations of data, and thus the identity of clients on the Internet. Tor has been around since 2001, when programmers from M.I.T. and the U.S. Naval Research Laboratory introduced it at a California security conference. Well, WikiLeaks knows all about it. This is a journey into the 'twilight zone' of the increasingly difficult art of keeping secrets online... and how it can be done. It's worth the read... and the link is here. | ||

| If only Bloomberg believed in a transparent gold market too Posted: 22 Dec 2010 08:35 PM PST Image:  Here's a Bloomberg story imbedded in a GATA release. The headline reads "Bloomberg Sues ECB to Force Disclosure of Greece Swaps". Chris Powell has his own headline, which reads "If only Bloomberg believed in a transparent gold market too"... and the link is here. | ||

| Posted: 22 Dec 2010 08:35 PM PST Image:  Silver analyst Ted Butler provided another report to his clients yesterday... and I'm stealing one paragraph out of it in order to answer a question that a few of my readers had about JPMorgan's short positions being transferred to foreign banks. This is what Ted had to say about this issue... "Another story readers have questioned me about concerns a report suggesting JPMorgan is transferring its concentrated short position in Comex silver to foreign banks. I've studied the data closely... | ||

| Dont "Trade" Gold And Silver, Advises John Embry Posted: 22 Dec 2010 05:59 PM PST | ||

| Gold Flows to China Rise Sharply (and Early) Ahead of New Year… Posted: 22 Dec 2010 04:32 PM PST | ||

| Bloomberg Counters Gold’s Run with Absurd, Baseless Hit-Piece Posted: 22 Dec 2010 04:05 PM PST Monday morning I was greeted via my inbox with a Bloomberg report on Gold. Bloomberg has a series called "The Dark Side of Gold." Its important to note this isn't the first time the news organization has attempted a hit-piece on Gold. I wrote about this exactly one year ago and identified the cases and examples of Bloomberg's gold bashing. The crux of the biased series (one that even makes CNBC blush) is how Gold ETF's are responsible for Gold's rise and contributing to a bubble. It is insinuated that because the ETF's are easily tradeable, a torrent of sell orders would cause Gold could to fall sharply, ala 1980. Gold's rise actually has very little to do with the GLD ETF. It really is a non-factor when you consider any of the following reasons: Threat of sovereign debt defaults, debt monetization in Europe, Japan and US, 0%-1% interest rates, commodity bull market, and falling gold production. The GLD ETF is an effect of the bull market, not a cause. The same is true with mutual funds during the bull market in the 1980s and 1990s. In the two minute preview video, Bloomberg's Carol Masser makes two ridiculous claims in a span of about four seconds. She claims that prior to the Gold ETF, only "conspiracy theorists" were buying Gold and that it cost a "fortune" because of holding costs and commissions. This is nothing other than failed hyperbole, seeking to demonize Gold and gold bulls. I'm not an expert on the exact ongoings of the physical market but I'm sure that it at that time it didn't "cost a fortune" to buy Gold. Meanwhile, any conspiracy theorists have clearly made a lot of money. Oh, I forgot to note at the very start of the video, the woman claims that even "college coeds" are buying Gold. Really Bloomberg? Where is the evidence of that? Google that and I bet you are more likely to find soft-core pornography than any hard-hitting evidence on such a ridiculous assertion. Speaking of "hard-hitting," Bloomberg interviewed Mark Williams of Boston University, who on camera made the case that Gold is in a bubble by providing zero evidence. A googling of the professor reveals he was perfect for this series, as he is a notorious hard-money hater. In November he wrote an editorial about how the gold-standard should be relegated to the dustbin of history. The only thing that will be relegated to the dustbin of history is our fiat currency system. It's happened before and will happen again. Finally, they trot out the Soros quote of Gold being "the ultimate bubble." There needs to be some clarification of this point. Soros is increasing his Gold position, which is already his largest position. In reality, he's not saying it is the ultimate bubble. Soros believes Gold will become the ultimate bubble and that is why Gold is his largest position. In reality making Gold the focus misses and obfuscates the real issues at hand. This is about the future of our monetary system and fiat currency. I can understand that Gold could fall $300 at anytime and the perception of it lacking utility but explain to us how the fiat system will survive? No fiat currency has ever survived the "dustbin of history." Fiat currencies have value based on the ability of government to meet its obligations. As others and we have picked up on, the USA's interest expense is now over $400 Billion and currently 17% of tax revenue. This is with interest rates at historical lows and a national debt of $14 Trillion. That doesn't include agency debt of $3 Trillion and an estimated $2.8 Trillion from the states. The situation is going to get worse. The states will likely need support in 2011 and perhaps a bailout by 2013. The continuation of the Bush tax cuts adds another $700 Billion to the deficit over the next two years. The most important variable of all, interest rates is now moving in the wrong direction. Two years from now, the US government would be dealing with over $17 Trillion in debt and at the least, a 50% rise in interest payments. Even if interest rates hold around 4%, you are still looking at an interest expense equivalent to 25% of tax revenue. And that accounts for growth in tax revenue. This speaks to why the Fed is monetizing the debt under the guise of economic stimulus and quantitative easing. They have to, and they are just getting started. In the coming months and years, the Fed will have to monetize more, as the debt burden grows larger. Moreover, the Fed will periodically have to buy bonds to try and keep rates down. As rates rise, so does the debt burden. The perception is that rising rates is bearish for Gold. While this can be true in the very short run, it is quite the opposite in the larger picture if you have a huge debt burden. We are in a new era. This isn't the 1980s and 1990s. The typical stockbroker, financial planner and mainstream publication don't get it. They've barely figured out this is a bull market for hard assets. Those who assume Gold is a bubble couldn't be more clueless about the state of affairs. They should do themselves a favor and study monetary history. Governments going broke, the restructuring of debts and monetary systems is nothing new. Certainly Gold is volatile and inherently risky. It can and will have small and large setbacks along the way. However, the greatest risk is being unprepared for the inflation tsunami that lies ahead. This is why we developed a service focusing on the best profit opportunities along the way. If you are looking for professional guidance in riding the Gold bull and leveraging your returns, then we invite you to a free 14-day trial to our premium service. Good Luck! Jordan Roy-Byrne, CMT | ||

| Posted: 22 Dec 2010 01:09 PM PST --How much money is left in this boom anyway? For company profits....for shareholders of the mining companies...for state governments...and, of course, for the nice people in Canberra running the Federal government. --Before we elaborate on the vanishing billions of the boom, a quick operational note. For the first time in our five-year history in Australia, the Daily Reckoning is going to take a proper holiday like everyone else. We won't be back live until Tuesday, January 4th, 2011. --Don't think that means you're off the hook for next week, though. Last week we asked the editors of each of our investment services to answer five questions. You'll read their answers next week, one publication per day. If, by the way, you're looking for your Bill Bonner fix, we assume Bill will be unable to keep himself away from a computer down in Nicaragua. You should be able to find his work over at www.dailyreckoning.com --Incidentally, the five questions we've asked Murray, Alex, Kris, and Greg are:

--Back to here and now, John Kehoe has the big scoop of the day in the Australian Financial Review. He writes that, "A senior government figure and officials told the Australian Financial Review the contentious minerals resource rent tax would raise far less than the government claims. Sources close to Treasury said a more realistic figure was less than $5 billion." --Ouch. --The issue? "Commodity price and volume assumptions used by the government and provided by the big miners to forecast the revenue were unrealistic and required downward revisions." This issue of elevated (unrealistic) expectations about the boom lasting forever (instead of being cyclical) is highlighted by the two charts below, both courtesy of the Reserve Bank of Australia.

--The last time Australia made this much money selling commodities to the rest of the world, it was riding high on the sheep's back in the 1950s. The Korean War was in full flight and agricultural commodities ruled the export roost. Today, of course, the economy is riding on the dirt's back, and the coal's back. --What you'll notice about both charts is how pointy and steep the recent rises look. They are far above trend. If they're mean reverting—as most things in life are—then they'll decline. --But that's too simple an explanation, isn't it? The counter argument is that is a structural revaluation of resources that shifts pricing power and long-term benefits to commodity producers. Commodity prices may decline a bit and the terms of trade might retreat, but it needn't be a collapse. --You can expect to see a lot more on this debate in next week's editorial interview series. --In the meantime, we're going to wish you and your family and Merry Christmas and Happy Holidays. Our own offices here in St. Kilda have already started to thin out as people make their way home. So we won't keep you any longer either! --Thank you from the whole crew here at Port Phillip Publishing for your attention, your patience, and your many kind (and even some not so kind) comments over the year. We wouldn't have a business without! In fact, we'll leave you today with the musings and thoughts of some of your fellow travellers. Hi, I am wondering when there will be an article about The Global Socialist Government we are heading into. There are signs all over the place, if one chooses to take note. I believe the financial system is slowly but surely being collapsed in order to bring in a one world currency, and eventually a one world government with a one world leader. Already we are seeing countries bound by the IMF. The amount of finance this Labour Government has borrowed, our turn is on the way. I don't know anything about finance, but there are those out there that are never satisfied and never seem able to get their hands on enough. The thing that really shocks me, is the lack of reporting by the media of this country. They could not see what a loser K Rudd was, until even the drovers dog was barking. So it's scarcely any wonder the massive con with global warming and carbon credit rackets, go as not noteworthy news. I think when the next part of the financial collapse comes marching along, there will be superannuation funds disappearing all over the place. I've had my little say, time reveals all. Kind regards , Ray C Hi Dan, Love your newsletter. Even though the NAB/Westpac story hasn't been a hit with the bigger newspapers, there are still lots of people aware of it. This is actually a concern for the banks, because they know if there is another financial crisis , there will be a run on the banks started by the "smart money". It is just one of these things, sure you wouldn't have 50000 cash in the bank the next time the cookie crumbles and neither will I. You are pretty spot on with your banking story anyway. Might want to dig into the CBA buying Bankwest. What did the government give CBA to take over a bankrupt bank at the time. Dirty deals I've been told anyway. Regards, Dear Dan, This is what is going on in the world. There are many bankrupts. Some are individuals. Some are Companies. Some are Nations. Each bankrupt has only one privilege. In the end that privilege is to choose who they pay before they actually go bankrupt. Those that trade honestly and pay all honest traders and leave the crooks to "Whistle Dixie" will keep their reputation and come out of bankruptcy. They will have learned their lesson and will recover much of their past fortunes and never go bust again. Those that cheat and lie will be hung out to dry. The next reality will be quite simple…"Honesty is the best policy" ... or ... "Thy word is thy bond". That was the way of our Fathers and strangely enough ... "The apple does not fall far from the tree". Kind regards,

| ||

| CNBC interview: CFTC Commish Bartman Chilton on position limits Posted: 22 Dec 2010 01:03 PM PST | ||

| The smart investment choice in 2011 will be Gold Posted: 22 Dec 2010 11:40 AM PST http://www.ibtimes.com/articles/94765/2 ... -gold.htm# Wednesday, December 22, 2010 4:13 PM The smart investment choice in 2011 will be Gold By Adrian Ash 2010 MARKED a step-change for the bull market in gold, says Adrian Ash, head of research at gold trading and ownership service BullionVault - a switch to steadier growth in investment demand, rather than short-term crisis buying, fed by a broadening awareness of just how deep and long-lived fiscal deficits have become. Most people rightly think of Gold Bullion as an inflation hedge. But it's only now, ten years into this bull market, that this "old normal" so clearly applies. After the interlude of the banking crisis - when debt-free gold, as an alternative to savings accounts, offered an immediate haven - gold has reverted to its more historic role: a refuge from excessive government debts, and from the currency crises they threaten to spawn. Below are the four ways this will impact fresh Gold Investment demand in 2011: #1. Risk Free' Means 'Guaranteed Loss' When the return on savings is less than the rate of inflation it doesn't matter that gold doesn't provide you with an income. Tightly supplied and indestructible, it offers a natural and obvious alternative to cash. Inflation expectations are rising as 2011 begins, but the Bank of England and US central bank look highly unlikely to raise rates this year, and not even the 'hawks' (Thomas Hoenig at the Federal Reserve, Andrew Sentance in London) are talking about raising rates anywhere near high enough to pay savers a decent real return on their cash. #2. Political Risk Hits the Euro In Europe, it's the Eurozone debt crisis driving strong growth in gold demand. The fear, especially in Germany, is that 2011 will see either inflation, debt default, the end of the Euro, or all three at once. This is also a growing worry for central-bank reserve managers, who tried to diversify away from the US Dollar over the last 10 years, only to find political risk added to the money-supply inflation they were suffering in the US currency. #3. The World's Fastest-Growing Gold Buyers After the 60% increase in gold reserves reported in early 2009, many analysts wonder when the People's Bank of China will next announce a further sharp increase. But the real gold story from China - the world's fastest-growing economy - remains private household demand. Chinese consumers bought more gold in the last two-and-a-half years than Beijing's central bank owns altogether. With cash deposit rates in China now barely half the official rate of consumer-price inflation (2.25% vs. 5.1%), demand for inflation-proof gold has risen by 14% year-on-year by volume since 2005, averaging 38% annual growth by value. Beijing is loathe to raise interest rates, fearing a flood of 'hot money' from Western markets desperate for a real return. The net result, with Chinese price-inflation already at 28-month highs, is continued erosion of cash values to domestic savers. #4. Supply - the Easy Gold's Gone It took Gold Mining output eight years to respond to rising prices, finally expanding by 6.4% in 2009 after a tripling of Dollar prices. Despite huge growth in exploration spending, it still lagged the peaks of 1998-2003, and major new discoveries remain absent. Scrap supplies from existing gold owners picked up the slack during the financial crisis, but just as Indian households (still the world's top buyers) have steadily adapted to rising prices to maintain their demand, so scrap sellers are starting to demand fresh record high prices. More urgently, the 'easy gold' from new gold-selling households in the West has already been tapped. So where former world No.1 mining nation South Africa is now digging 4 kilometres below ground to extract ore, more closely-held bracelets and earrings will demand much higher prices before returning to market. Looking ahead, the only serious challenge to continued growth in global gold demand remains sharply higher real rates of interest. But with Western governments desperate to keep rates low so they can finance their record peace-time deficits - and with emerging economies led by China desperate to avoid 'hot money' inflows as a result - a grinding loss of purchasing power for cash savers looks assured in 2011. Gold will remain the obvious, and increasingly popular, alternative. | ||

| Teb Butler's important paper/IMF concludes gold sales/silver continues with high open interest Posted: 22 Dec 2010 10:06 AM PST | ||

| Posted: 22 Dec 2010 10:01 AM PST "We were received with a hospitality hardly to be equaled...for [Brazil] asks neither who you are nor whence you come, but opens its doors to every wayfarer." - Louis Agassiz and Elizabeth Cabot Cary Agassiz, A Journey in Brazil (1879) I recently spent two weeks in Brazil on a four-city tour - in Campo Grande, Sao Paulo, Florianopolis and finally Rio de Janeiro. What can I say about the experience? I can say that the caipirinha - Brazil's national drink - is a potent cocktail; Brazilian meats are very salty; Brazilian desserts are very sweet. This taste for the extremes of the flavor spectrum extends to Brazil's monetary brand, as well. Today, the Brazilian real is strong (and the dollar is weak). The real is now at a 10-month high against the US dollar (having risen 40% from its lows in early 2009). This prompted the Brazilian finance minister to threaten weakening the real. You've probably heard of his comment about a "currency war." What he fears is that the strong real will hurt Brazil's exports by making Brazilian goods more expensive, hence weakening the Brazilian economy. It is a tired line of reasoning. This idea that a country gets rich by destroying the value of its currency is a weed that won't go away no matter how many times you pull it from the soil. What's curious about this notion cropping up in Brazil is that you'd think a Brazilian would appreciate the dangers of weakening a currency. Brazil has had a habit of blowing up its currency over the last 60 years. From 1942 to the present, Brazil went through eight different currencies:

The present-day real is but a teenager, a mere youth sprung from a bad family. Yet it is among the world's strongest currencies today, bolstered by the commodity wealth and strong growth rate of Brazil's economy. Say what you will about the US dollar, which has been a poor currency as far as retaining its purchasing power over time, it's never gotten so bad that we had to start over - at least not yet. Brazil's experience makes the dollar look like a gold standard. It was not that long ago that Brazil's inflation rate hit 2,700%. It happened in one 12-month period from 1989-1990. Even as late as 1999, Brazil was a financial basket case. In 1998 and 1999, its finances were such a mess that Brazil got the biggest IMF rescue package in history up to that point, $41.5 billion. During the 20th century as a whole, Brazil had a cumulative inflation rate of more than a quadrillion percent. If you were a net saver in Brazil and kept that money in Brazil's currency, you lost big. You might as well have set the money on fire. Today, Brazil is in a different position. The currency is so strong, its politicians fret. American travelers find no bargains in the shops of Sao Paulo or Rio. Brazil, too, has huge currency reserves and is now a net creditor, not a debtor. Brazil is even accumulating gold - the real thing. We met with an economist on our trip there who made a presentation that showed Brazil's central bank has 5% of its reserves in gold - and it's been buying more. Today, US investors go out of their way to buy products that give them exposure to Brazilian reais, instead of US dollars. It's incredible when you think how much things have changed in just the last 10 years. Of course, Brazil could screw it up again. There are some worrisome signs. The new president is Dilma Rousseff. She is a former Marxist guerrilla. Captured in 1970, she was beaten and tortured. Hers is a quite a tale. But she has since mellowed out, supposedly. Most see her as simply continuing the policies pursued under former President Lula. But we'll see... As with any emerging market, there are big problems, but also big opportunities. Still, Brazil's economic challenges seem less complicated and smaller than those in the US, where debt and deficits are much larger. And currency screwups are relative. Forced to make a choice, I'd rather bet on the Brazilian real than the US dollar. (But gold is the best currency of all.) Regards, Chris Mayer, | ||

| Has The Financial Collapse Of Europe Now Become Inevitable? Posted: 22 Dec 2010 09:39 AM PST

One would like to think that there is always hope, but each month things just seem to keep getting worse. Confidence in European government debt continues to plummet. The yield on 10-year Irish bonds is up to 8.97%. The yield on 10-year Greek bonds is up to an astounding 12.01%. The cost of insuring French debt hit a new record high on December 20th. Bond ratings all over Europe are being slashed or are being threatened with being slashed. For example, Moody's Investors Service recently cut Ireland's bond rating by five levels. Now there is talk that Spain, Belgium and even France could soon all have their debt significantly downgraded as well. But if the borrowing costs for these troubled nations keep going up, that is just going to add to their financial problems and swell their budget deficits. In turn, larger budget deficits will cause investors to lose even more confidence. So how far are we away from a major crisis point? Professor Willem Buiter, the chief economist at Citibank, is warning that quite a few EU nations could financially collapse in the next few months if they are not quickly bailed out....

Many analysts are even calling for some of these troubled nations to stop using the euro for a while so that they can recover. In fact, Andrew Bosomworth, the head of portfolio management for Pimco in Europe says that Greece, Ireland and Portugal must all quit the euro at least for a little while if they expect to survive....

Sadly, most Americans don't realize just how bad the situation in Europe is becoming. This is truly a historic crisis that is unfolding. German Chancellor Angela Merkel declared earlier this year that this is the biggest financial crisis that the EU has ever faced....

So what is the answer? Well, many are speculating that the EU could actually break up over this whole thing, but another possibility is that we could eventually see much greater integration. In fact, for the first time the idea that "euro bonds" could be issued is gaining some traction. This would spread the risk of European government debt throughout the European Union. At this point, Andrew Bosomworth says that things have gotten so bad that it now seems inevitable that we will soon see the creation of euro bonds....

So just how bad are things going to get in Europe? Well, earlier this year Anthony Fry, the senior managing director at Evercore Partners had the following to say about the emerging bond crisis in Europe....

So why should Americans care about all this? Well, what is happening to these troubled European states is eventually going to happen to us. If rates on U.S. government debt eventually hit 8 or 12 percent it will literally be financial armageddon in this country. The U.S. government has piled up the biggest mountain of debt in the history of the world, and if we continue piling up debt at the pace that we are, then it will only be a matter of time before the IMF is demanding that we implement our own "austerity measures". As I have written about previously, there are already numerous indications that confidence in U.S. Treasuries is dying. If that happens, we could literally see interest costs on the national debt double or even triple. But it is not just the U.S. government that is in trouble. A bloodbath in the municipal bond market has already started. Hundreds of state and local governments across the United States are on the verge of bankruptcy. So don't laugh at what is going on in Ireland or Greece. The next victims could be financially troubled states such as California and Illinois. In the history of global finance, we have never faced a sovereign debt crisis like we are seeing now. All over the globe governments are being suffocated by absolutely crushing debt loads. Once a couple of dominoes fall, it is going to be really hard to keep the rest of the dominoes from falling. This is the biggest crisis that the euro has ever faced. At some point Germany will either be unwilling or unable to continuing rescuing the rest of the EU countries from the unsustainable mountains of debt that they have accumulated. When that moment arrives, it is going to throw world financial markets into turmoil. But this is what happens when we allow long-term debt bubbles to be created. Eventually they always burst. So keep your eye on the euro, because if a financial collapse does happen in Europe it is going to have a dramatic impact on the United States as well. | ||

| How to Double the Debt in 5 Years Posted: 22 Dec 2010 09:00 AM PST As a paranoid and angry lunatic, I am always nervous and on the suspicious lookout for subtle signs of danger that I know are all around me because the foul Federal Reserve has created, and is still creating, So Freaking Much Money (SFFM), which means that the terror of ruinous inflation in prices is a dead-bang, take-it-to-the-bank, guaranteed certainty. And there is no telling what people will do when faced with both the ruinous deflation of the value of their assets and the unbelievable, catastrophic inflation in the prices of food and energy that seems so sadly certain, which is a nice phrase if I do say so myself, conveying, as it does, a sense of resigned melancholy instead of my more usual hyperbole of anger, hatred, betrayal, outrage and thirst for revenge against the treacherous Federal Reserve for creating so much excess money and against the corrupt Congress for allowing it! Unfortunately, this is not about how I have the lyrical soul of a poet, but about how these people are the same average idiotic Americans who have, for more than half of the last century, been electing and reelecting Congresses that have enacted huge, growing, cancerous budgets that deficit-spent a gigantic $14 trillion in new national debt – a sum equaling GDP! And these same disastrous weenies have borrowed and deficit-spent more than half of that $14 trillion national debt in just the last 10 years! And now they are on track to double the debt again in the next 5 years! Gaaah!! We're freaking doomed! Doug Noland in his PrudentBear.com commentary does not mention this kind of mental and fiscal insanity directly, much less leading to the Hysterical Mogambo Conclusion (HMC) that we should be frantically buying gold, silver and oil in a frenzied, single-minded panic. Instead, with the calm and dispassionate objectivity of the classic reporter, he notes that the latest Federal Reserve Z.1 "flow of funds" report shows that "This year will mark the second consecutive year where federal borrowings will have actually expanded more than the growth of total Non-financial borrowings. Nothing similar to this has happened in the post-WWII period." Yow! This is the kind of "danger signal" that I am talking about! The actual figures are that in just the last 9 quarters, which a little over 2 years, "total federal liabilities" exploded by a whopping $4.013 trillion, which increased the national debt by 60% in those aforementioned Two Freaking Years (TFY)! TFY! Even more astoundingly, "After doubling mortgage Credit in less than 7 years, our system is now on track to double federal debt in about four years." Gaaahhhh! I thought it was 5 years! I scream anew in outrage and fear! Gaaahhh! Suddenly, I am screaming in fear, but at the same time I am watching, as if in an out-of-body experience, little specks of spittle fly out of my mouth as I am screaming, and I am thinking to myself, "That's the problem with linear thinking! If I pursued a career of fame and fortune as The World's Fattest Man (TWFM) and weighed in at 1,500 pounds, can I actually double my weight in 4 years to 3,000 pounds? And then 4 years later double my weight again to 6,000 pounds? And then again to weigh 12,000 pounds?" The answer is, obviously, "Not without a lot of tasty grub! Hahahaha!" Fortunately, speaking of tasty grub calms me down enough so that I can read that the report also showed that combined local, state, and federal expenditures were up, and still totals about half of our $14 trillion GDP, even though the federal government borrowed and spent a whopping $1.8 trillion in the last 12 months, which may explain how Total Compensation increased 3.0% in the last year, rising to $8.03 trillion, which seems paradoxical since unemployment, at an "official" 9.8% and (according to John Williams at shadowstats.com) is unofficially 22%, is a Big, Big Problem (BBP). Even more surprising was that Household Assets increased $1.2 trillion to $68.8 trillion, while Household Liabilities were $13.9 trillion and did not increase much because, I assume, people did not spend a lot of borrowed money in the last quarter. The report handily subtracts liabilities from assets and concludes that that Household Net Worth increased $1.19 trillion during the third quarter, rising to a surprising $54.9 trillion, which is almost 4 times Liabilities, thus everything should be peachy keen and couldn't be better except for, you know, that pesky unemployment thing. If you believe that, then you will not be interested in the Mogambo Big Plan (MBP) to buy gold, silver and oil as protection against the roaring, catastrophic inflation caused by the Federal Reserve creating so much money, and the federal government borrowing it and spending it. And to tell you the truth, I don't know whether or not I believe any of it, and I only follow the Mogambo Big Plan (MBP) because it is fool-proof and so easy that I giggle with childish delight, "Whee! This investing stuff is easy!" The Mogambo Guru How to Double the Debt in 5 Years originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." | ||

| Gold Seeker Closing Report: Gold and Silver Close Near Unchanged Posted: 22 Dec 2010 07:11 AM PST Gold rose $3.13 to $1390.83 in early London trade before it fell to see a $2.42 loss at $1385.28 in midmorning New York trade, but it then bounced back higher in the last few hours of trade and ended with a loss of just 0.09%. Silver climbed to $29.475 and fell to $29.183 before it also rallied back higher and ended unchanged on the day. | ||

| Gold Rises as UK Finances Deteriorate and IMF Gold Sales Finish Posted: 22 Dec 2010 01:17 AM PST |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment