Gold World News Flash |

- GoldSeek.com Radio Gold Nugget: Steve Forbes & Chris Waltzek

- How to Spot the Top of the Gold Market

- Bloomberg Counters Gold’s Run with Absurd, Baseless Hit-Piece

- The Next Financial Meltdown, State Budgets Day of Reckoning

- Can Cities Legally Buy Silver or Gold?

- The re-printing of “Pieces of Eight”

- Gold Seeker Closing Report: Gold and Silver Close Near Unchanged

- Must Read Introspective: A Look Back At 2010 Events, Key Market Themes And The Circular Nature Of Everything

- Gold Price Floated Between $1,382.65 and $1,386.80, Must Not Close Below $1,380

- Interviewed on CNBC, CFTC's Chilton defends position limits

- Interviewed on CNBC, CFTC's Chilton defends position limits

- Soho Resources Corp

- How to Double the Debt in 5 Years

- Trader Dan Comments On Today's Commodity Market Action

- Guest Post: House Values Fall 30%, But Property Taxes Keep Rising

- WEDNESDAY Market Excerpts

- Behind the “Recovery”

- Behind the “Recovery”

- NYSE October Margin Debt Jumps To Highest Since Lehman Failure As Investor Net Worth Is At Lowest Since April Highs

- Is Brazil For “Real?”

- Las Vegas The Next Detroit

- Is Brazil For “Real?”

- GoldMoney Foundation assists new edition of Vieira's 'Pieces of Eight'

- GoldMoney Foundation assists new edition of Vieira's 'Pieces of Eight'

- Gold Daily and Silver Weekly Charts

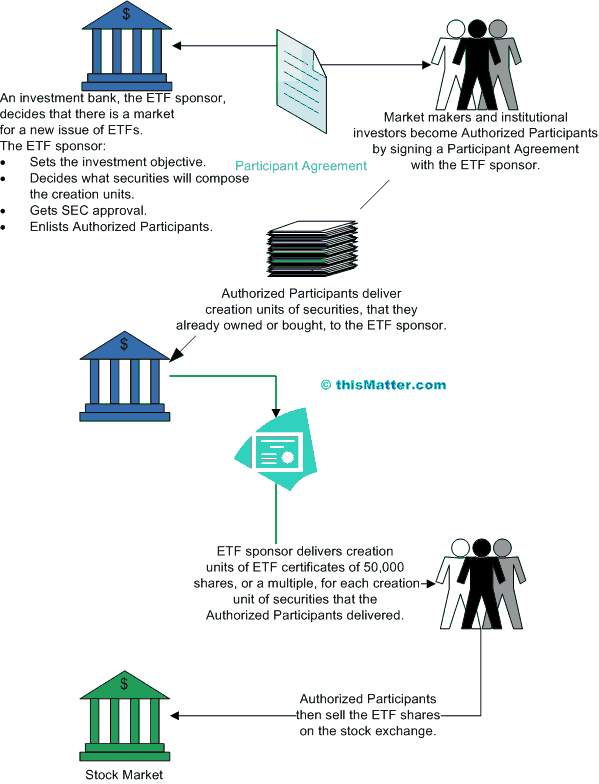

- Investor ETF Madness hits $1 Trillion

- The First Casualty Of An "Improving" Economy: The Fast Food Dollar Menu, As McDonalds Considers Hiking Prices

- Monitoring Takeover Targets In Gold and Silver Junior Mining Stocks

- Is A Police State Worth Fighting For?

- Wednesday’s Worry – ETF Madness hits $1,000,000,000,000

- IMF Completes 403.3 Tonne Gold Sales Program

- IMF gold sale completion – out with a whimper

- How to Spot the Top of the Gold Market

- Are We in a Gold Bubble?

- LGMR: Gold Flows to China Rise Sharply (and Early) Ahead of New Year

- Soaring With the Eagles

- The Details Of The CitiFX Contrary Call For A Watershed Bear-Market 2011

- Volatility Set to Pick Up in the New Year

- Is There Any SNB Out There? Eurostoxx' Head Deep In Koolaid

- If only Bloomberg believed in a transparent gold market too

- Is Your Gold Worth the Paper it's Printed on?

- We Are Now Paying for the Destruction of the US Dollar and Economy… Literally

- Oil breaks $90, copper prices surge

- In The News Today

- Just Print More Money: The Easy Way to Manage and Economy

- Precious Metals Propaganda Games

- CNBC - Gold and Standardisation

- US Data Releases Could Move the Markets

- Hinde Capital Sees Gold Breach $2,000 in 2011

- Jim's Mailbox

| GoldSeek.com Radio Gold Nugget: Steve Forbes & Chris Waltzek Posted: 22 Dec 2010 07:00 PM PST |

| How to Spot the Top of the Gold Market Posted: 22 Dec 2010 06:33 PM PST Chris Weber writes: I recently read an article about the famous Aden sisters in BusinessWeek. Something Mary Anne Aden said in it really struck a chord with me. In the midst of showing the generally fantastic track record of the Adens, they talk about their "biggest goof": how they stayed bullish on gold in the early 1980s. "We were new to the game," said Mary Anne. "We were feeling enormous pressure from our subscribers to stay bullish." |

| Bloomberg Counters Gold’s Run with Absurd, Baseless Hit-Piece Posted: 22 Dec 2010 06:16 PM PST Monday morning I was greeted via my inbox with a Bloomberg report on Gold. Bloomberg has a series called “The Dark Side of Gold.” Its important to note this isn’t the first time the news organization has attempted a hit-piece on Gold. Iwroteaboutthisexactlyoneyearagoand identified the cases and examples of Bloomberg’s gold bashing. |

| The Next Financial Meltdown, State Budgets Day of Reckoning Posted: 22 Dec 2010 05:59 PM PST |

| Can Cities Legally Buy Silver or Gold? Posted: 22 Dec 2010 05:11 PM PST (Legally, according to the CA code? What about other States?!) Silver Stock Report by Jason Hommel, December, 2010 The precious metals community of advocates may need legal assistance. Position letters, or even lobbying. Most of the money in this world, in the USA, sits in government pension plans. Some of those who direct such plans say they are not legally allowed to buy silver or gold. Is this true? Do we need to change the law? Can they buy certain ETF's? I need help to be able to answer these questions. Please read the following exchange: A Precious Metals Advocate writes to a City Manager: I have suggested to this council that they take a hard look at precious metals for investing the treasury funds of Culver City. I first asked the council to do this in Dec 2008. Gold was under $800, it currently is approaching $1400. In the CAFR from 2008-2009 the treasury reported a less then 4% return on investments. Not bad but had you invested in gold... |

| The re-printing of “Pieces of Eight” Posted: 22 Dec 2010 05:03 PM PST FGMR - Free Gold Money Report December 22, 2010 – I am pleased to announce the re-printing of Pieces of Eight: The Monetary Powers and Disabilities of the United States Constitution by Edwin Vieira. This is a special run of the 2002 revised edition of the two-volume, 1,700+ page study of American monetary law and history that has been out of print and virtually unavailable (except at scalpers’ prices) since 2006. This reprinting, which is being supported by the GoldMoney Foundation, is now underway at RR Donnelley & Sons Company, one of the premier printers in the United States. Books are only available directly from Edwin, who will arrange for delivery to each buyer when the books are ready around mid-January 2011. Those who have had an opportunity to peruse this book know that there is nothing equivalent on the market, and likely never will be again. And those who have not seen it will find it to be as comprehensive and complete a study of money and ban... |

| Gold Seeker Closing Report: Gold and Silver Close Near Unchanged Posted: 22 Dec 2010 04:00 PM PST Gold rose $3.13 to $1390.83 in early London trade before it fell to see a $2.42 loss at $1385.28 in midmorning New York trade, but it then bounced back higher in the last few hours of trade and ended with a loss of just 0.09%. Silver climbed to $29.475 and fell to $29.183 before it also rallied back higher and ended unchanged on the day. |

| Posted: 22 Dec 2010 03:38 PM PST Tonight's must read piece of introspection comes from the keyboard of Russ Certo over at Gleacher, who has compiled a fantastic look back at the key events that transpired and shaped 2010, and summarizes the key market themes that prevailed in the now past year. In summary: "the answer to the question of what were the main themes in the market is ...............valuations in equities, credit spreads, sovereign spreads, exchange rates, mortgage interest costs, bank earnings, net interest margin, accounting schemes, tax code, debt ceiling and more are all related. Related to the ebb and flow of monetary and fiscal policy aspiring to make adjustments to imbalances caused by earlier failed fiscal and monetary policies. How, circular indeed." In other words, not only does history not only rhyme, but chases its tail, and the more things change, the more absolutely nothing has changed. We are where we started, and in fact are in a far worse position, as increasingly fewer last resort levers to push and pull are available to the fiscal and monetary authorities. We jest when we suggest that a Martian bail out of plant Earth will soon be required, but pretty soon, in our Onion (or is that Douglas Adams?) reality, NASA may find itself with the prerogative to rapidly find semi-intelligent and very wealthy life on other located within a few parsecs. We can only hope that the restaurant at the edge of the universe is an In and Out Burger. It's A Wrap, by Russ Certo, Gleacher We await a supply announcement tomorrow of next week's 2yrs, 5yrs, and 7yrs. Further, there are two 3-4yr area buybacks next week as well to conclude the Fed buybacks/Tsy auction circular reality for the year. Treasury selling Fed buying. I recall in recent history that the Treasury market has suffered meaningful setbacks anticipating supply weeks during recent holiday shortened weeks/sessions in the last quarter. I believe limited street balance sheet and an opportunistic leveraged community are/were the main culprits. I'm guessing that by the end of the week, traders, trading accounts, and funds will likely be looking for a spot to push the market lower for a supply trade. One man's opinion. The above rate call is despite the fact that European bank funding is dysfunctional. And we can see this anecdotally in a variety of expressions but also in the Fed's explictly telegraphed renewal of FX swap lines with foreign central banks yesterday. Explicitly telegraphing a statement is policy action itself as the bank doesn't need to announce these measures. But the desire to semantically communicate can provide a policy function which serves gradualist preservation dry powder policy approaches to save the full arsenal of tools for some other time when capital markets sniffs out inbalances. What does it mean when the Fed still has to provide year end FX liquidity? What does it mean when the EU has to issue new paper as part of funding the new EU mechanism bail out fund? Will central banks buy? Will they sell sovereign or supra or agency paper to make room for purchases? With IMF and EFSF (European Financial Stability Mechanism), European Commission and ECB review and sponsorship along with triple A ratings from Moody's, Fitch and S&P it feels like central bank likely buyers are buying themselves. Hey, new concept: Try to figure the spread price talk of buying yourself? What spread to yourself are you willing to buy? All circular. We'll skip over the agency debenture market mainly, which is supposedly a liquid market, only other to say that callables, in particular, are nearly untradable. Although some may debate this conversations with traders that have yard+ books suggests otherwise. So does personal experience. The irony is that swaps have ratcheted in despite extreme illiquidity and low volumes in liquid markets and a lack of swappable new issue calendar and where large money center banks can't procure all their funding needs. Mind you, liquid Treasury market volumes at 50% of normal with most of the activity in year end window dressing bill space. Bills are half the volume today. Off the run Treasuries were performing horribly as of late, almost near LTCM type on the run/off the run "itis" which not only had the belly of the curve underperforming but also the off-the-runs in the belly (7yr) faring the worst. Go figure that when the Fed announced the newest rung of buybacks two weeks ago that they conveniently started with the 7yr sector and the off the runs. Further, the decision by the Fed 48 hours ago to "clarify" that they can acquire up to 70% of any issue, conveniently served as a "stability" lip service boon to off the runs. Recall, they recently relaxed the rule which limited purchases of any one issue to not exceed 35%. Again, communicated with explicit tongue and cheek for the desired effect during year end illiquidity and carnage in dealer sheets, balance sheets. I was asked earlier how to summerize trading themes of 2010. Well, after looking at some notes and a walk down memory lane, I am reminded of Tiger woods being cited for "careless driving" and I have the official photo post "accident". But as I look back to 12/09 is see headlines:

Given the rudimentary walk down memory lane above, I think themes have come full circle. So the answer to the question of what were the main themes in the market is ...............valuations in equities, credit spreads, sovereign spreads, exchange rates, mortgage interest costs, bank earnings, net interest margin, accounting schemes, tax code, debt ceiling and more are all related. Related to the ebb and flow of monetary and fiscal policy aspiring to make adjustments to imbalances caused by earlier failed fiscal and monetary policies. How, circular indeed. |

| Gold Price Floated Between $1,382.65 and $1,386.80, Must Not Close Below $1,380 Posted: 22 Dec 2010 03:00 PM PST Gold Price Close Today : 1386.80 Change : (1.40) or -0.1% Silver Price Close Today : 29.367 Change : (0.009) cents or 0.0% Gold Silver Ratio Today : 47.22 Change : -0.033 or -0.1% Silver Gold Ratio Today : 0.02118 Change : 0.000015 or 0.1% Platinum Price Close Today : 1723.65 Change : 12.75 or 0.7% Palladium Price Close Today : 750.20 Change : 8.20 or 1.1% S&P 500 : 1,258.84 Change : 4.24 or 0.3% Dow In GOLD$ : $172.31 Change : $ 0.58 or 0.3% Dow in GOLD oz : 8.335 Change : 0.028 or 0.3% Dow in SILVER oz : 393.62 Change : 0.90 or 0.2% Dow Industrial : 11,559.49 Change : 26.33 or 0.2% US Dollar Index : 80.63 Change : -0.088 or -0.1% The GOLD PRICE kept on treading water today, yea, with less bobbing than yesterday. Floated between $1,382.65 and $1,386.80. This narrowing range only promises that the eventual breakout will be violent. Gold must not close now below $1,380. Overhead $1,392 blocks the way. The SILVER PRICE didn't feel up to pioneering leadership today, so merely plodded along behind in gold's row, bounded by 2916c and 2945.3c. Comex closed down a laughable 9/10 of a cent at 2936.7. Nothing happening there. Accident vs. Substance. Folks keep on hounding me about the Internet campaign to break JP Morgan -- supposedly short tons of silver -- by buying silver. Theory is that buying will so press the market that JPM will go belly up, just punishment for shorting silver and suppressing the price, and silver will skyrocket. Now whether JP Morgan is as short as these folks claim I am not informed enough to judge. I doubt not that the US government beginning about 1995 acted through intermediary bullion banks to suppress gold and so lower the long term interest rate and attempt to create -- yawn! -- perpetual prosperity, like numerous other megalomanics in history. Of course, the veriest parvenu knows that gold cannot be suppressed without suppressing silver also, because a declining gold price against rising silver (a falling gold/ silver ratio) would give away their game. Thus I doubt not that the same bullion banks acted to suppress silver. Who was involved other than the Nice Government Men I leave to those more knowledgeable than I. It goes without saying (but of course I will say by apophasis) that after 2001 the price suppression scheme has been as notoriously incompetent as any other government scheme, suppressing gold from $252 to $1,400 and silver from 400c to 3000c. The "suppression" has only served to raise the price a little faster, it seems. Yet the true-believing fervor around this JPM business prompts me to point out the difference between accidents and substance, or, as the Germans might say, Schein und Sein, appearance and reality. Accidents are all those chance characteristics surrounding substance. In the 1970s silver bull market "the world was running out of silver" and "the Indian silver hoard was about to come onto the market/the Indians would soak up the excess." Today it's JPM. Every bull or bear market spawns dozens of meretricious reasons to explain why the market is trending up or down, but most of these are just the accidents of the day, the trappings that shroud the market. They never are the motor that drives it: that is the substance. What is the substance of a bull market in silver and gold, the motor that powers it? Monetary demand, arising from fear of fiat currencies. Why am I soaking up your valuable time with this discussion? Simply because every one of us who wants to think clearly must learn to distinguish between Schein and Sein, between accident and substance. Otherwise we will become the ready victims of every enthusiasm, fanaticism, and hysteria that comes along. It is enough to identify the primary trend, and to identify its motor. Regardless of accidents -- and there are always plenty of accidents, persuasive and urgent -- that bull or bear market will unfold in pretty much the same way, with its own peculiarities ("accidents") of course, as most other markets. It doesn't pay to let accidents distract your attention from the big picture. In other words, keep your eye on the motor, not what brand of oil filter is installed on it. Now, before you write me a steaming e-mail about how I am aiding and abetting the enemy and how stupid I am, go back and read what I wrote. I did not deny the price suppression, I only question its effectiveness, and deny that is the motive power of this bull market. Is it a crime? Sure, but a hilariously incompetent one. Evil is merely silly, never grand, never omnipotent, but it can kill you, like measles. TODAY nothing much happened at all. The US DOLLAR INDEX danced sideways again, between 80.281 and 80.781. Clearly, 80.80 blocks its road, but the stall probably arises from the looming Christmas holiday. Who wants to take a big position before a 3-day weekend, over which anything at all might happen? The DOW today scratched together 26.33 points and rose to 11,559.49. S&P picked up 4.24 and toted up the day at 1,258.84. No change here, no improvement: outlook grim, but "there are people who don't know and you can't tell 'em." MARKETS are sleeping ahead of the Christmas holiday. Expect no big action before St. John's Day, maybe Holy Innocents (28 Dec.). Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com Phone: (888) 218-9226 or (931) 766-6066 © 2010, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate in a bubble, primary trend way down. Whenever I write "Stay out of stocks" readers inevitably ask, "Do you mean precious metals mining stocks, too?" No, I don't. |

| Interviewed on CNBC, CFTC's Chilton defends position limits Posted: 22 Dec 2010 01:43 PM PST 9:38p ET Wednesday, December 22, 2010 Dear Friend of GATA and Gold (and Silver): Interviewed for five minutes on CNBC's "Fast Money" program today, CFTC Commissioner Bart Chilton derided the assertion of a commodity exchange operator that large market shares don't interfere with free markets. Chilton insisted that position limits are necessary to prevent market manipulation, even as he acknowledged that preventing manipulation is likely to require the cooperation of exchange regulators in many countries. You can watch the interview at the CNBC archive here: http://www.cnbc.com/id/15840232/?video=1706782569&lay=1 CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Sona Drills 85.4g Gold/Ton Over 4 Metres at Elizabeth Gold Deposit, Extending the Mineralization of the Southwest Vein on the Property Company Press Release, October 27, 2010 VANCOUVER, British Columbia -- Sona Resources Corp. reports on five drillling holes in the third round of assay results from the recently completed drill program at its 100 percent-owned Elizabeth Gold Deposit Property in the Lillooet Mining District of southern British Columbia. Highlights from the diamond drilling include: -- Hole E10-66 intersected 17.4g gold/ton over 1.54 metres. -- Hole E10-67 intersected 96.4g gold/ton over 2.5 metres, including one assay interval of 383g of gold/ton over 0.5 metres. -- Hole E10-69 intersected 85.4g gold/ton over 4.03 metres, including one assay interval of 230g gold/ton over 1 metre. Four drill holes, E10-66 to E10-69, targeted the southwestern end of the Southwest Vein, and three of the holes have expanded the mineralized zone in that direction. The Southwest Vein gold mineralization has now been intersected over a strike length of 325 metres, with the deepest hole drilled less than 200 metres from surface. "The assay results from the Southwest Zone quartz vein continue to be extremely positive," says John P. Thompson, Sona's president and CEO. "We are expanding the Southwest Vein, and this high-grade gold mineralization remains wide open down dip and along strike to the southwest." For the company's full press release, please visit: http://sonaresources.com/_resources/news/SONA_NR19_2010.pdf Join GATA here: Yukon Mining Investment e-Conference http://theyukonroom.com/yukon-eblast-static.html Vancouver Resource Investment Conference http://cambridgehouse3.com/conference-details/vancouver-resource-investment-conference-2011/15 Cheviot Asset Management Sound Money Conference Phoenix Investment Conference and Silver Summit Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: http://www.gata.org/node/16 ADVERTISEMENT Prophecy Drills 71.17 Metres of 0.52% NiEq Prophecy Resource Corp. (TSX-V: PCY) reports that it has received additional assays results from its 100-percent-owned Wellgreen PGM Ni-Cu property in the Yukon, Canada. Diamond drill holes WS10-179 to WS10-182 were drilled during the summer of 2010 by Northern Platinum (which merged with Prophecy on September 23, 2010). WS10-183 was drilled by Prophecy in October 2010. Highlights from the newly received assays include 71.17 metres from surface of 0.52 percent NiEq (0.310 percent nickel, 0.466 g/t PGMs + Au, and 0.233 percent copper) and ended in mineralization. For more drill highlights, please visit: http://prophecyresource.com/news_2010_nov29.php |

| Interviewed on CNBC, CFTC's Chilton defends position limits Posted: 22 Dec 2010 01:43 PM PST 9:38p ET Wednesday, December 22, 2010 Dear Friend of GATA and Gold (and Silver): Interviewed for five minutes on CNBC's "Fast Money" program today, CFTC Commissioner Bart Chilton derided the assertion of a commodity exchange operator that large market shares don't interfere with free markets. Chilton insisted that position limits are necessary to prevent market manipulation, even as he acknowledged that preventing manipulation is likely to require the cooperation of exchange regulators in many countries. You can watch the interview at the CNBC archive here: http://www.cnbc.com/id/15840232/?video=1706782569&lay=1 CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Sona Drills 85.4g Gold/Ton Over 4 Metres at Elizabeth Gold Deposit, Extending the Mineralization of the Southwest Vein on the Property Company Press Release, October 27, 2010 VANCOUVER, British Columbia -- Sona Resources Corp. reports on five drillling holes in the third round of assay results from the recently completed drill program at its 100 percent-owned Elizabeth Gold Deposit Property in the Lillooet Mining District of southern British Columbia. Highlights from the diamond drilling include: -- Hole E10-66 intersected 17.4g gold/ton over 1.54 metres. -- Hole E10-67 intersected 96.4g gold/ton over 2.5 metres, including one assay interval of 383g of gold/ton over 0.5 metres. -- Hole E10-69 intersected 85.4g gold/ton over 4.03 metres, including one assay interval of 230g gold/ton over 1 metre. Four drill holes, E10-66 to E10-69, targeted the southwestern end of the Southwest Vein, and three of the holes have expanded the mineralized zone in that direction. The Southwest Vein gold mineralization has now been intersected over a strike length of 325 metres, with the deepest hole drilled less than 200 metres from surface. "The assay results from the Southwest Zone quartz vein continue to be extremely positive," says John P. Thompson, Sona's president and CEO. "We are expanding the Southwest Vein, and this high-grade gold mineralization remains wide open down dip and along strike to the southwest." For the company's full press release, please visit: http://sonaresources.com/_resources/news/SONA_NR19_2010.pdf Join GATA here: Yukon Mining Investment e-Conference http://theyukonroom.com/yukon-eblast-static.html Vancouver Resource Investment Conference http://cambridgehouse3.com/conference-details/vancouver-resource-investment-conference-2011/15 Cheviot Asset Management Sound Money Conference Phoenix Investment Conference and Silver Summit Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: http://www.gata.org/node/16 ADVERTISEMENT Prophecy Drills 71.17 Metres of 0.52% NiEq Prophecy Resource Corp. (TSX-V: PCY) reports that it has received additional assays results from its 100-percent-owned Wellgreen PGM Ni-Cu property in the Yukon, Canada. Diamond drill holes WS10-179 to WS10-182 were drilled during the summer of 2010 by Northern Platinum (which merged with Prophecy on September 23, 2010). WS10-183 was drilled by Prophecy in October 2010. Highlights from the newly received assays include 71.17 metres from surface of 0.52 percent NiEq (0.310 percent nickel, 0.466 g/t PGMs + Au, and 0.233 percent copper) and ended in mineralization. For more drill highlights, please visit: http://prophecyresource.com/news_2010_nov29.php |

| Posted: 22 Dec 2010 12:53 PM PST |

| How to Double the Debt in 5 Years Posted: 22 Dec 2010 10:00 AM PST As a paranoid and angry lunatic, I am always nervous and on the suspicious lookout for subtle signs of danger that I know are all around me because the foul Federal Reserve has created, and is still creating, So Freaking Much Money (SFFM), which means that the terror of ruinous inflation in prices is a dead-bang, take-it-to-the-bank, guaranteed certainty. And there is no telling what people will do when faced with both the ruinous deflation of the value of their assets and the unbelievable, catastrophic inflation in the prices of food and energy that seems so sadly certain, which is a nice phrase if I do say so myself, conveying, as it does, a sense of resigned melancholy instead of my more usual hyperbole of anger, hatred, betrayal, outrage and thirst for revenge against the treacherous Federal Reserve for creating so much excess money and against the corrupt Congress for allowing it! Unfortunately, this is not about how I have the lyrical soul of a poet, but about how these people are the same average idiotic Americans who have, for more than half of the last century, been electing and reelecting Congresses that have enacted huge, growing, cancerous budgets that deficit-spent a gigantic $14 trillion in new national debt – a sum equaling GDP! And these same disastrous weenies have borrowed and deficit-spent more than half of that $14 trillion national debt in just the last 10 years! And now they are on track to double the debt again in the next 5 years! Gaaah!! We're freaking doomed! Doug Noland in his PrudentBear.com commentary does not mention this kind of mental and fiscal insanity directly, much less leading to the Hysterical Mogambo Conclusion (HMC) that we should be frantically buying gold, silver and oil in a frenzied, single-minded panic. Instead, with the calm and dispassionate objectivity of the classic reporter, he notes that the latest Federal Reserve Z.1 "flow of funds" report shows that "This year will mark the second consecutive year where federal borrowings will have actually expanded more than the growth of total Non-financial borrowings. Nothing similar to this has happened in the post-WWII period." Yow! This is the kind of "danger signal" that I am talking about! The actual figures are that in just the last 9 quarters, which a little over 2 years, "total federal liabilities" exploded by a whopping $4.013 trillion, which increased the national debt by 60% in those aforementioned Two Freaking Years (TFY)! TFY! Even more astoundingly, "After doubling mortgage Credit in less than 7 years, our system is now on track to double federal debt in about four years." Gaaahhhh! I thought it was 5 years! I scream anew in outrage and fear! Gaaahhh! Suddenly, I am screaming in fear, but at the same time I am watching, as if in an out-of-body experience, little specks of spittle fly out of my mouth as I am screaming, and I am thinking to myself, "That's the problem with linear thinking! If I pursued a career of fame and fortune as The World's Fattest Man (TWFM) and weighed in at 1,500 pounds, can I actually double my weight in 4 years to 3,000 pounds? And then 4 years later double my weight again to 6,000 pounds? And then again to weigh 12,000 pounds?" The answer is, obviously, "Not without a lot of tasty grub! Hahahaha!" Fortunately, speaking of tasty grub calms me down enough so that I can read that the report also showed that combined local, state, and federal expenditures were up, and still totals about half of our $14 trillion GDP, even though the federal government borrowed and spent a whopping $1.8 trillion in the last 12 months, which may explain how Total Compensation increased 3.0% in the last year, rising to $8.03 trillion, which seems paradoxical since unemployment, at an "official" 9.8% and (according to John Williams at shadowstats.com) is unofficially 22%, is a Big, Big Problem (BBP). Even more surprising was that Household Assets increased $1.2 trillion to $68.8 trillion, while Household Liabilities were $13.9 trillion and did not increase much because, I assume, people did not spend a lot of borrowed money in the last quarter. The report handily subtracts liabilities from assets and concludes that that Household Net Worth increased $1.19 trillion during the third quarter, rising to a surprising $54.9 trillion, which is almost 4 times Liabilities, thus everything should be peachy keen and couldn't be better except for, you know, that pesky unemployment thing. If you believe that, then you will not be interested in the Mogambo Big Plan (MBP) to buy gold, silver and oil as protection against the roaring, catastrophic inflation caused by the Federal Reserve creating so much money, and the federal government borrowing it and spending it. And to tell you the truth, I don't know whether or not I believe any of it, and I only follow the Mogambo Big Plan (MBP) because it is fool-proof and so easy that I giggle with childish delight, "Whee! This investing stuff is easy!" The Mogambo Guru How to Double the Debt in 5 Years originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." |

| Trader Dan Comments On Today's Commodity Market Action Posted: 22 Dec 2010 09:47 AM PST Dear Friends, Observing the price action in the commodity markets today has given me great reason for concern for that which I feared seems to have occurred, namely, the crude oil market has broken out to the upside. I suppose it was just a matter of time based on the orgy of fund buying across the commodity sector but I was secretly hoping that we might avoid such a close mainly to prevent what now seems to be a certain price rise for the cost of energy. Heretofore, the soaring CCI (Continuous Commodity Index) has been moving higher mainly based on food and metal costs. Now we have the trifecta where the three main segments of that index are moving higher in tandem. Actually, given the extent of the price run in the food and metals sector, the energy sector has a lot of ground to make up. Yesterday crude put in its best close in 26 months. Today it has closed above what has become both technical and psychological chart resistance at the $90 level. Should it end this trading week above $90, holiday trading conditions or no holiday trading conditions, it will put in its best weekly close since October 2008. Moving forward into the New Year, it looks most probable that it is going to make a run at $100. My fear mentioned above is that in addition to consumers soon to get walloped with sticker shock at the grocery stores within the space of a few months as the price rise works its way through the distribution channels, they were also going to get hit with rising gasoline and energy costs, a double whammy for their pocketbooks at the time that many can ill afford it. There are so many struggling families dealing with lost incomes and underemployment for those fortunate enough to have found work, that any further price pressures on the energy front would act to take some of them over the edge financially. Many are having to cut expenses drastically in an attempt to stay in their homes. How soaring food and energy costs are supposed to benefit the economy escapes me. The ivory tower types of the monetary realm are completely disconnected from the havoc and harm that they have caused so many with their incredibly short-sighted and foolhardy monetary policies. The Federal Reserve is presiding over the deliberate and planned unleashing of the inflation genie without the least bit of concern as to how that is going to affect the average middle class American. Words cannot express the contempt and disdain I have for this group of elitists. Keep in mind how this entire debacle began and the "medicine" that has been brought forth to supposedly cure it. If this is the cure, they are only succeeding in slowly killing the patient. There does not seem to be any end in sight to the continued money creation efforts of the Fed so all that we can do is attempt to protect ourselves and our loved ones from their depredations upon our life savings. The bond market, while currently being artificially propped up by these snake oil salesmen, looks heavy, even in spite of the massive buys it is seeing as the Fed makes the purchases that are part of its QE (money printing) program. Once that market breaks down in earnest, it will not take much to see a cascade of selling erupt as bond holders head to the exits. I suspect that the Chinese are more than seriously concerned about their national wealth, a large part of which still remains trapped in these worthless IOU's called Treasury Debt. Long term rates could then rise quite rapidly as bondholders experience a selling panic and feverishly attempt to avoid being the last man standing in what might well become a sort of perverse game of musical chairs. Their actions will create a cycle in which selling intensifies. The resulting rise in longer term interest rates will work to continue depress the Real estate sector not to mention hit thousands of homeowners trapped in adjustable rate mortgages which will then reset to a rate that may force even more of them out of their homes. Quite frankly, I see nothing on the horizon preventing this from occurring at this point because the Fed cannot create enough money to buy up all the outstanding Treasury debt that is going to be unloaded. Oh they conceivably could I suppose but at what cost to the Dollar! Jim has said it more than once over the last few years that these derivative creators and vile peddlers have destroyed us all in their greed. Many of you have not understood what he has been saying or perhaps felt that it was an overreaction. Rest assured, the fallout from this sordid mess is now rapidly descending upon us. The Fed created this travesty under the tenure of Mr. Greenspan who never saw a potential problem on the horizon without throwing money at it. For that, he was stupidly hailed as "The Maestro". His madness, of lowering interest rates to ridiculously low levels, gave rise to the hedge fund industry and its attempts to then find yield in any sector that it could. The wave of speculative frenzy unleashed then crashed into one sector after another only abating when the derivative market blew all to hell which was inevitable. Enter Mr. Bernanke, who then revitalized the beast of speculative frenzy by one upping his predecessor. Much like Beowolf's golden horn raised the dragon, Bernanke's QE idiocy fan the fires of leveraged insanity as he practically begged the hedge funds to buy commodities to induce inflation and ward of his ridiculous fear of deflation. The results are now obvious. Nice going guys – you can sit in your ivory tower and quietly study the effects of your brain child while Middle America slowly dies of price asphyxiation. A pox on your entire house. Click either chart to enlarge in PDF format with commentary from Trader Dan Norcini |

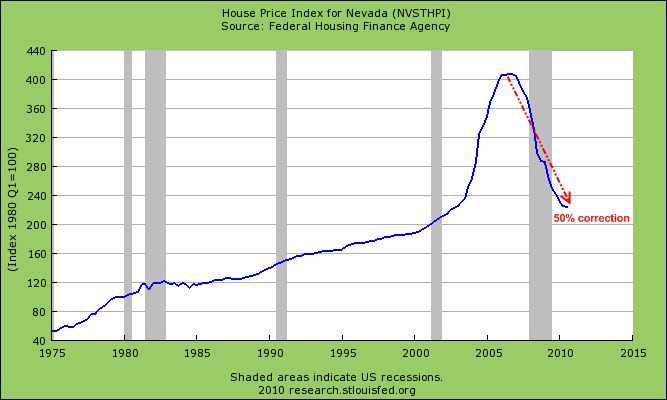

| Guest Post: House Values Fall 30%, But Property Taxes Keep Rising Posted: 22 Dec 2010 09:42 AM PST Submitted by Charles Hugh Smith from Of Two Minds House Values Fall 30%, But Property Taxes Keep Rising Even though home values have plummeted by a third, property taxes are increasing: welcome to the Great Middle Class Squeeze.

Local governments should go back to the revenues and budgets of pre-bubble years, but instead they are jacking up rates to maintain revenues, even as valuations have fallen off a cliff. Bubble-era prices and equity are gone, it seems, but bubble-era property taxes are here to stay. |

| Posted: 22 Dec 2010 09:34 AM PST Gold holds steady in narrow range-bound trading The COMEX February gold futures contract closed down $1.40 Wednesday at $1387.40, trading between $1385.60 and $1391.70 December 22, p.m. excerpts: |

| Posted: 22 Dec 2010 09:22 AM PST The 5 min. Forecast December 22, 2010 02:21 PM by Addison Wiggin - December 22, 2010 [LIST] [*] Third-quarter GDP still a surprise... what the numbers mean for your favorite S&P stocks [*] "Margin squeeze" and other 2011 trends worth paying attention to... plus two great shorts from our stock market vigilante [*] Euro near two-month low against the dollar… but euro woes reveal unique opportunity [*] Latest terror to U.S. citizens: 'the Prius is too quiet'... but at least federal regulators are there to save you... [*] Bloomberg ballyhoos gold bubble, tax evasion via Gold Eagles and your take on the “10 Outrageous Predictions” for 2011… all among our mailbag goodies [/LIST] Given what we were expecting, the third and final revision by the Commerce Department of third-quarter GDP figures in the U.S. is a pretty good number. Alas, the Street was looking for something higher. Despite their best efforts, the quants on L Street could onl... |

| Posted: 22 Dec 2010 09:21 AM PST by Addison Wiggin - December 22, 2010

Given what we were expecting, the third and final revision by the Commerce Department of third-quarter GDP figures in the U.S. is a pretty good number. Given what we were expecting, the third and final revision by the Commerce Department of third-quarter GDP figures in the U.S. is a pretty good number.Alas, the Street was looking for something higher. Despite their best efforts, the quants on L Street could only deliver an annualized growth rate of 2.6%, a scant improvement on last month’s guess of 2.5%. Traders were betting on 3%.  Looking under the hood, we see a curious optimism for holiday spending. The bulk of the increase can be traced to businesses building up their inventories to the tune of $121.4 billion. Take that away and the increase would be less than a percent, annualized. Looking under the hood, we see a curious optimism for holiday spending. The bulk of the increase can be traced to businesses building up their inventories to the tune of $121.4 billion. Take that away and the increase would be less than a percent, annualized.If holiday shoppers don’t swipe their plastic over the next eight-12 days at the rate supply managers across the country are anticipating, the third quarter won't look quite so rosy. For the record, we’re agnostic on whether consumers are opening their wallets for the holidays. The incessant media rah-rah appears to be based on either anecdotal evidence or statistics from the retail industry. Or just holiday good cheer. Or eggnog with the good stuff in it. In any case, corporate cash flow is slowing from a stream to a trickle. From the Commerce Department report: “Current-production cash flow (net cash flow with inventory valuation adjustment) -- the internal funds available to corporations for investment -- decreased $68.4 billion.”  And that's the real trend we've been following on for the better part of the post- autumnal equinox period: “margin squeeze.” Many firms’ costs are rising, but their ability to pass on those costs to customers is not. And that's the real trend we've been following on for the better part of the post- autumnal equinox period: “margin squeeze.” Many firms’ costs are rising, but their ability to pass on those costs to customers is not.The trend is especially noticeable in the food industry, rocked by rising commodity costs (wheat and corn will probably end the year up 50%). We’re hearing one earnings miss after another lately -- Kroger, General Mills, Chef Boyardee, ConAgra.  “Last week,” writes Strategic Short Report editor Dan Amoss, “an American icon, A&P, filed for Chapter 11 bankruptcy. It had too much debt, a unionized work force, too many unfavorable store leases and a toxic relationship with its key wholesaler. “Last week,” writes Strategic Short Report editor Dan Amoss, “an American icon, A&P, filed for Chapter 11 bankruptcy. It had too much debt, a unionized work force, too many unfavorable store leases and a toxic relationship with its key wholesaler.“Investors have yet to anticipate how bad conditions will get for grocers. Not only do wholesalers and mammoth packaged food companies have more negotiating leverage over pricing, negotiating leverage will be critical.” That’s because with food, like everything else, it’s no longer ‘all about us.’ “U.S. consumers no longer dominate the demand side of the process for determining food prices,” says Dan. “People in emerging market economies are getting richer, and one of the first things they do with this newfound wealth is improve the quality of their diets.” Further, “grocery chains have been assaulted by new, aggressive competition from Wal-Mart, Target and even drugstore and ‘dollar’ store chains.” Dan points to a recent UBS study on rising food prices. It concludes that grocers are the weak link in the chain of passing through food price increases to stretched consumers. “That puts grocers’ gross profit margins at risk,” says Dan. He sees one of two scenarios playing out during 2011 -- neither one good for grocers:

As our resident stock market vigilante, Dan has targeted two grocers as especially vulnerable during 2011. Apply his strategy and you could potentially double your money while they tank. How can you pull it off? Find the answer here.  The major stock indexes are flat after yesterday’s gains on thin pre-holiday volume. The major stock indexes are flat after yesterday’s gains on thin pre-holiday volume.Nothing else is moving much, either. Gold is about where it was 24 hours ago, at $1,388, silver at $29.29. The dollar index is also going nowhere fast, at 80.7.  The euro is steady against the dollar this morning at $1.31 -- near a two-month low against the dollar, and an all-time low against the Swiss franc. The euro is steady against the dollar this morning at $1.31 -- near a two-month low against the dollar, and an all-time low against the Swiss franc.“The Swiss franc has benefitted from a shift out of the euro,” says EverBank’s Chris Gaffney, “as the sovereign debt crisis in Europe continues. The Swiss currency is still a favorite ‘safe haven’ for investors, even when the risks are based on the European continent.”  "A falling currency and massive bailouts are actually helping Germany,” adds our income investing specialist Jim Nelson. "A falling currency and massive bailouts are actually helping Germany,” adds our income investing specialist Jim Nelson.“The majority of the supposedly at-risk PIIGS -- Portugal, Italy, Ireland, Greece, Spain -- bonds are held by foreign governments. Germany’s banking system holds a whopping $394 billion in PIIGS debt. That’s 9.3% of its total foreign debt exposure. So without these bailouts, the German banking system would take a serious hit. “Merkel may seem to be losing the debate on whether to let the PIIGS fail, but her country is all the better for it.” As the euro falls, eurozone exports should rise. “Germany, being the industrial powerhouse it is, will see even better growth,” Jim says. “With more orders comes higher demand for a number of industries, like shipping, telecommunications and energy.” With all that in mind, Jim revealed a German income opportunity delivering a 6.1% yield… with the potential for a 237% capital gain to boot. He has the full write-up in the current Lifetime Income Report. [Ed. Note: If you’re not yet a subscriber, you can get in today and learn about another outstanding European income opportunity. Jim likes it so much he calls it “the ‘other’ government-backed retirement program.”  In a further demonstration of Congress’ commitment to pursue extraordinary means to solve nonexistent problems, we have this: A bill to make “green” cars noisier. In a further demonstration of Congress’ commitment to pursue extraordinary means to solve nonexistent problems, we have this: A bill to make “green” cars noisier.When a Toyota Prius runs on its electric motor, it makes very little noise. Supposedly, this poses a mortal danger to blind pedestrians. Except that the government’s own accident data shows no increase in the deaths of blind people due to pedestrian accidents in the decade that hybrids have been around. In fact, the overall rate of pedestrian (and cyclist) deaths and injuries has fallen steadily since 1994. No matter, the Senate recently passed a bill requiring automakers to come up with some sort of noisemaking apparatus. Just imagine where this could go: “One opportunity for automotive marketers and startups,” according to the Green Car Reports website, “is the emerging business of supplying drivetones, the automotive equivalent of cell phone ringtones. Want your green car to rev like a Ferrari or BMW? Just buy the right drivetone and crank up the exterior volume.” Yeah, the sound of a 12-cylinder Maybach coming from a Nissan LEAF. We’re not sure which would be louder -- the noise generated by the drivetone or the laughter it would induce from passersby. But at least our roads would be safer. Ugh.  “Yesterday, Bloomberg did a segment on gold,” writes a reader who read our 2011 gold outlook. “Their slant was that gold is a massive bubble... “Yesterday, Bloomberg did a segment on gold,” writes a reader who read our 2011 gold outlook. “Their slant was that gold is a massive bubble...“Though I was amused by their picture of a skull cleverly overlaid onto a bar of gold and their 20-year-old expert rapping on how it would certainly tumble, I wonder if it was the big banks that paid the bill for the murky advertisement or the stockbrokers. When they have to resort to these kinds of advertisements, does that mean they are getting squeezed by the glittery metal? “I wish they'd go play in their paper world and leave us metal boys alone, because I do want my $50.00 an ounce silver... I do.”  “Silver Eagles and Gold Eagles are legal tender in the U.S.,” writes another. “Why not take a salary (or some part thereof) in the face value of those coins. Or conduct a sale in the face value? “Silver Eagles and Gold Eagles are legal tender in the U.S.,” writes another. “Why not take a salary (or some part thereof) in the face value of those coins. Or conduct a sale in the face value?“Your taxes would only be on the face value. You could even offer your counterparties a discount on the payment. Thoughts?” The 5: Someone beat you to the punch… and the Feds beat him to a pulp, figuratively at least. Nevada business owner Robert Kahre tried paying his employees in Eagles, thinking the same thing you are. He’s now doing 15 years. A jury took only a day and a half to find him guilty last year on all 57 counts he faced for charges ranging from tax evasion to failure to withhold, among other things. [Ed. Note: You can still buy them yourself, however. Despite our "window of exclusivity" having closed yesterday, First Federal still has X in stock and a good deal on the table. If you're interested, take a look here, and keep in mind we have an advertising relationship with the company.]  “Gold at $1,800 next year doesn’t seem that ‘outrageous’ to me,” a reader writes after seeing to our item on Saxo Bank’s “10 Outrageous Predictions” for 2011. “Gold at $1,800 next year doesn’t seem that ‘outrageous’ to me,” a reader writes after seeing to our item on Saxo Bank’s “10 Outrageous Predictions” for 2011.The 5: In a typical year, three or four of Saxo’s 10 potential black swans tend to show up… and we asked yesterday which ones you thought were most plausible. Our unscientific tally finds the highest number of readers coalescing around: #6. Crude oil tops $100 a barrel before correcting by one-third #7. Natural gas surges 50% #8. “Currency wars” drive gold to $1,800. Of course, a 50% boost in nat gas would simply bring prices back to year-ago levels. A vocal minority spoke up for No. 1 -- “Congress blocks a Fed attempt at QE3 to bail out banks and local governments.” Heh. That would be a black swan event, for sure.  “When QE2 doesn't work,” one of the vocal minority writes, “and as situations in state and local governments worsen, there will be pressure on the federal government to step in. “When QE2 doesn't work,” one of the vocal minority writes, “and as situations in state and local governments worsen, there will be pressure on the federal government to step in.“We're seeing the genesis of this here in Michigan, where there is a movement afoot to have the state assume all of the debts of, for example, the Detroit Public School District. A bailout, by the state, of the school district. And who will the state turn to?” “They say the s*** runs downhill; well, this just may be one of those examples where it flows up... up from local governments and entities to the states, and then from the states to the federal government. “If that happens, I do think the new Congress will be in quite a pickle! The absurdity of it all certainly should be entertaining. I am glad, however, that I exited all of my VKQ and NIO positions earlier this fall; yes, I missed the top, but avoided the mess that followed.”  “Meredith Whitney expects 50-100 major muni defaults,” adds another. “And there will no doubt be screaming by those in Congress for bailouts. Screw 'em. Let them eat what they have sown.” “Meredith Whitney expects 50-100 major muni defaults,” adds another. “And there will no doubt be screaming by those in Congress for bailouts. Screw 'em. Let them eat what they have sown.”The 5: Under current law, the only munis the Fed can buy are those of less than six months maturity. But it’s the longer-dated stuff that’s in trouble. Ben Bernanke could assert emergency powers to buy those bonds anyway… but would Congress let him get away with it? No matter the outcome, we don’t want to be hanging around the muni market right now, even if the yields are tax-free. Income investors looking around for better options in 2011 can find some good ones here. Program note: On Jan. 4, 2011, we will be releasing ALL of the Agora Financial 2011 Forecasts to AF Reserve members, along with the specific actions you'll need to take to play each forecast. If you're not a Reserve member, but would like to be, today would be a good time to inquire within. Next week, we'll be offering the Reserve at its current price, for the LAST time. We've added two new services this year and increased the "value" of the Reserve by nearly $1,000 dollars (published price). It's still a great deal and getting better all the time. Call John Wilkinson at (866) 361-7662 to inquire what discounts already apply to your account and to lock in at the premium rate before it goes up. If you call John today, you'll be sure to receive all our forecasts and picks for 2011 in time to kick off the new year! Cheers, Addison Wiggin The 5 Min. Forecast P.S.: In addition to his annual forecast, Breakthrough Technology Alert editor Patrick Cox is putting the final touches on his latest batch of special reports. It took months of feverish research, well-placed phone calls, extended plane trips... late nights and lots of coffee. But the results could make staggering amounts of money for early investors in his best new ideas. Watch your inbox this evening to learn about five “wealth quakes” Patrick sees coming in 2011. |

| Posted: 22 Dec 2010 09:11 AM PST It is not just the stock market that is at the highest levels since Lehman. Probably just as importantly, NYSE margin debt has surged to $269 billion, an increase of $13 billion from the prior month, and the highest since September 2008 when it was at $299 billion, and subsequently tumbled as investors rushed to get out of all margined positions. And this has happened even free cash credit accounts and credit balance in margin accounts remained relatively flat. In other words, net NYSE available cash decreased by $10 billion M/M to ($34) billion, the lowest since April 2010, just before the market tumbled, and net cash surged by almost $50 billion in two months. We are confident that NYSE cash in November will be at the lowest level of the year, not to mention December, as hedge funds leveraged everything they could, in some cases hitting as much as 3-4x gross leverage, in pursuit of beta, now that unleveraged alpha strategies have ceased to work. Which means that with retail stubbornly missing from the picture, the only beneficiaries of the HFT and Fed facilitated melt up are the 1000 or so hedge funds, where average net worth is in the 6 digits, that will be profitable this year. Everyone else can drown their sorrows in McDonalds fries which are about to surge in price. Of course, what this means should some unexpected credit event occur, is that the forced selling that will follow this two year high margin debt unwind will lead to a comparable results as those seen after the Lehman collapse. For the sake of America, we can only hope that the centrally planning Chairman can sustain the lie for a few more months before the house of cards on the camel's back, which in turn is suspended on a ladder as the eye of the hurricane passes over, finally topples. |

| Posted: 22 Dec 2010 09:06 AM PST "We were received with a hospitality hardly to be equaled…for [Brazil] asks neither who you are nor whence you come, but opens its doors to every wayfarer." – Louis Agassiz and Elizabeth Cabot Cary Agassiz, A Journey in Brazil (1879) I recently spent two weeks in Brazil on a four-city tour – in Campo Grande, Sao Paulo, Florianopolis and finally Rio de Janeiro. What can I say about the experience? I can say that the caipirinha – Brazil's national drink – is a potent cocktail; Brazilian meats are very salty; Brazilian desserts are very sweet. This taste for the extremes of the flavor spectrum extends to Brazil's monetary brand, as well. Today, the Brazilian real is strong (and the dollar is weak). The real is now at a 10-month high against the US dollar (having risen 40% from its lows in early 2009). This prompted the Brazilian finance minister to threaten weakening the real. You've probably heard of his comment about a "currency war." What he fears is that the strong real will... |

| Posted: 22 Dec 2010 09:04 AM PST If Wall Street is the hub of American finance then Las Vegas was the manifestation of credit dreams going viral. Las Vegas, the beating heart of Nevada had a tremendous boom with the real estate bubble because it played into the narrative of making it big. Where else can unknowns strike it big and have their name put up in lights? With Wall Street feeding the frenzy Las Vegas seemed to be an endless playground of free flowing capital. During the boom it was hard not to notice the high end Rodeo Drive like stores of Gucci, DKNY, and Prada covering the floors of many casinos. The stores were full and money seemed to flow like the exhaust of Maserati's cruising up and down Las Vegas Blvd. If heaven on Earth for kids is Disneyland Las Vegas was the heaven of debt. What once seemed as an endless dream has burst into a barren desert nightmare. Las Vegas once boasting some of the fastest growth rates now has largely led Nevada into having the highest unemployment rate of all states in the country. If Michigan was the result of the offshoring of American manufacturing and the demise of the US auto industry Nevada is the exclamation mark at the end of the credit bubble era. You only need to look at the drastic collapse in real estate prices to see how quickly the bubble burst in Nevada: What took from 1980 to 2000 in terms of price growth was achieved in four years from 2000 to 2004. The rapid rise in Las Vegas was largely due to the real estate bubble, both residential and commercial. The bust in commercial real estate values in Las Vegas was all but set in stone but the bubble grew to a point where many started believing that the mania would last forever: More Here.. |

| Posted: 22 Dec 2010 09:00 AM PST "We were received with a hospitality hardly to be equaled…for [Brazil] asks neither who you are nor whence you come, but opens its doors to every wayfarer." – Louis Agassiz and Elizabeth Cabot Cary Agassiz, A Journey in Brazil (1879) I recently spent two weeks in Brazil on a four-city tour – in Campo Grande, Sao Paulo, Florianopolis and finally Rio de Janeiro. What can I say about the experience? I can say that the caipirinha – Brazil's national drink – is a potent cocktail; Brazilian meats are very salty; Brazilian desserts are very sweet. This taste for the extremes of the flavor spectrum extends to Brazil's monetary brand, as well. Today, the Brazilian real is strong (and the dollar is weak). The real is now at a 10-month high against the US dollar (having risen 40% from its lows in early 2009). This prompted the Brazilian finance minister to threaten weakening the real. You've probably heard of his comment about a "currency war." What he fears is that the strong real will hurt Brazil's exports by making Brazilian goods more expensive, hence weakening the Brazilian economy. It is a tired line of reasoning. This idea that a country gets rich by destroying the value of its currency is a weed that won't go away no matter how many times you pull it from the soil. What's curious about this notion cropping up in Brazil is that you'd think a Brazilian would appreciate the dangers of weakening a currency. Brazil has had a habit of blowing up its currency over the last 60 years. From 1942 to the present, Brazil went through eight different currencies:

The present-day real is but a teenager, a mere youth sprung from a bad family. Yet it is among the world's strongest currencies today, bolstered by the commodity wealth and strong growth rate of Brazil's economy. Say what you will about the US dollar, which has been a poor currency as far as retaining its purchasing power over time, it's never gotten so bad that we had to start over – at least not yet. Brazil's experience makes the dollar look like a gold standard. It was not that long ago that Brazil's inflation rate hit 2,700%. It happened in one 12-month period from 1989-1990. Even as late as 1999, Brazil was a financial basket case. In 1998 and 1999, its finances were such a mess that Brazil got the biggest IMF rescue package in history up to that point, $41.5 billion. During the 20th century as a whole, Brazil had a cumulative inflation rate of more than a quadrillion percent. If you were a net saver in Brazil and kept that money in Brazil's currency, you lost big. You might as well have set the money on fire. Today, Brazil is in a different position. The currency is so strong, its politicians fret. American travelers find no bargains in the shops of Sao Paulo or Rio. Brazil, too, has huge currency reserves and is now a net creditor, not a debtor. Brazil is even accumulating gold – the real thing. We met with an economist on our trip there who made a presentation that showed Brazil's central bank has 5% of its reserves in gold – and it's been buying more. Today, US investors go out of their way to buy products that give them exposure to Brazilian reais, instead of US dollars. It's incredible when you think how much things have changed in just the last 10 years. Of course, Brazil could screw it up again. There are some worrisome signs. The new president is Dilma Rousseff. She is a former Marxist guerrilla. Captured in 1970, she was beaten and tortured. Hers is a quite a tale. But she has since mellowed out, supposedly. Most see her as simply continuing the policies pursued under former President Lula. But we'll see… As with any emerging market, there are big problems, but also big opportunities. Still, Brazil's economic challenges seem less complicated and smaller than those in the US, where debt and deficits are much larger. And currency screwups are relative. Forced to make a choice, I'd rather bet on the Brazilian real than the US dollar. (But gold is the best currency of all.) Regards, Chris Mayer Is Brazil For "Real?" originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." |

| GoldMoney Foundation assists new edition of Vieira's 'Pieces of Eight' Posted: 22 Dec 2010 08:24 AM PST 4:18p ET Wednesday, December 22, 2010 Dear Friend of GATA and Gold: With financial support from the GoldMoney Foundation, the magisterial work of lawyer, scholar, and historian Edwin Vieira, "Pieces of Eight: The Monetary Powers and Disabilities of the United States Constitution," is being reprinted and offered for sale, with delivery expected to begin in the middle of January. Details and ordering information were posted today at the Internet site of James Turk's Free Gold Money Report here: https://www.fgmr.com/reprinting-of-pieces-of-eight.html CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Prophecy Receives Permit To Mine at Ulaan Ovoo in Mongolia VANCOUVER, British Columbia -- Prophecy Resource Corp. (TSX-V:PCY, OTCQX: PRPCF, Frankfurt: 1P2) announces that on November 9, 2010, it received the final permit to commence mining operations at its Ulaan Ovoo coal project in Mongolia. Prophecy is one of few international mining companies to achieve such a milestone. The mine is production-ready, with a mine opening ceremony scheduled for November 20. Prophecy CEO John Lee said: "I thank the government of Mongolia for the expeditious way this permit was issued. The opening of Ulaan Ovoo is a testament to the industrious and skilled workforce in Mongolia. Prophecy directly and indirectly (through Leighton Asia) employs more than 65 competent Mongolian nationals and four expatriots. The company also reaffirms its commitment to deliver coal to the local Edernet and Darkhan power plants in Mongolia." The Ulaan Ovoo open pit mine is 10 kilometers from the Russian border and within 120km of the Nauski TransSiberian railway station, enabling transportation of coal to Russia and its eastern seaports. Thermal coal prices are trading at two-year highs at Russian seaports due to strong demand from Asian economies. For the complete press release, please visit: http://prophecyresource.com/news_2010_nov11.php Join GATA here: Yukon Mining Investment e-Conference http://theyukonroom.com/yukon-eblast-static.html Vancouver Resource Investment Conference http://cambridgehouse3.com/conference-details/vancouver-resource-investment-conference-2011/15 Cheviot Asset Management Sound Money Conference Phoenix Investment Conference and Silver Summit Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: http://www.gata.org/node/16 ADVERTISEMENT Sona Drills 85.4g Gold/Ton Over 4 Metres at Elizabeth Gold Deposit, Company Press Release, October 27, 2010 VANCOUVER, British Columbia -- Sona Resources Corp. reports on five drillling holes in the third round of assay results from the recently completed drill program at its 100 percent-owned Elizabeth Gold Deposit Property in the Lillooet Mining District of southern British Columbia. Highlights from the diamond drilling include: -- Hole E10-66 intersected 17.4g gold/ton over 1.54 metres. -- Hole E10-67 intersected 96.4g gold/ton over 2.5 metres, including one assay interval of 383g of gold/ton over 0.5 metres. -- Hole E10-69 intersected 85.4g gold/ton over 4.03 metres, including one assay interval of 230g gold/ton over 1 metre. Four drill holes, E10-66 to E10-69, targeted the southwestern end of the Southwest Vein, and three of the holes have expanded the mineralized zone in that direction. The Southwest Vein gold mineralization has now been intersected over a strike length of 325 metres, with the deepest hole drilled less than 200 metres from surface. "The assay results from the Southwest Zone quartz vein continue to be extremely positive," says John P. Thompson, Sona's president and CEO. "We are expanding the Southwest Vein, and this high-grade gold mineralization remains wide open down dip and along strike to the southwest." For the company's full press release, please visit: |

| GoldMoney Foundation assists new edition of Vieira's 'Pieces of Eight' Posted: 22 Dec 2010 08:24 AM PST 4:18p ET Wednesday, December 22, 2010 Dear Friend of GATA and Gold: With financial support from the GoldMoney Foundation, the magisterial work of lawyer, scholar, and historian Edwin Vieira, "Pieces of Eight: The Monetary Powers and Disabilities of the United States Constitution," is being reprinted and offered for sale, with delivery expected to begin in the middle of January. Details and ordering information were posted today at the Internet site of James Turk's Free Gold Money Report here: https://www.fgmr.com/reprinting-of-pieces-of-eight.html CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Prophecy Receives Permit To Mine at Ulaan Ovoo in Mongolia VANCOUVER, British Columbia -- Prophecy Resource Corp. (TSX-V:PCY, OTCQX: PRPCF, Frankfurt: 1P2) announces that on November 9, 2010, it received the final permit to commence mining operations at its Ulaan Ovoo coal project in Mongolia. Prophecy is one of few international mining companies to achieve such a milestone. The mine is production-ready, with a mine opening ceremony scheduled for November 20. Prophecy CEO John Lee said: "I thank the government of Mongolia for the expeditious way this permit was issued. The opening of Ulaan Ovoo is a testament to the industrious and skilled workforce in Mongolia. Prophecy directly and indirectly (through Leighton Asia) employs more than 65 competent Mongolian nationals and four expatriots. The company also reaffirms its commitment to deliver coal to the local Edernet and Darkhan power plants in Mongolia." The Ulaan Ovoo open pit mine is 10 kilometers from the Russian border and within 120km of the Nauski TransSiberian railway station, enabling transportation of coal to Russia and its eastern seaports. Thermal coal prices are trading at two-year highs at Russian seaports due to strong demand from Asian economies. For the complete press release, please visit: http://prophecyresource.com/news_2010_nov11.php Join GATA here: Yukon Mining Investment e-Conference http://theyukonroom.com/yukon-eblast-static.html Vancouver Resource Investment Conference http://cambridgehouse3.com/conference-details/vancouver-resource-investment-conference-2011/15 Cheviot Asset Management Sound Money Conference Phoenix Investment Conference and Silver Summit Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: http://www.gata.org/node/16 ADVERTISEMENT Sona Drills 85.4g Gold/Ton Over 4 Metres at Elizabeth Gold Deposit, Company Press Release, October 27, 2010 VANCOUVER, British Columbia -- Sona Resources Corp. reports on five drillling holes in the third round of assay results from the recently completed drill program at its 100 percent-owned Elizabeth Gold Deposit Property in the Lillooet Mining District of southern British Columbia. Highlights from the diamond drilling include: -- Hole E10-66 intersected 17.4g gold/ton over 1.54 metres. -- Hole E10-67 intersected 96.4g gold/ton over 2.5 metres, including one assay interval of 383g of gold/ton over 0.5 metres. -- Hole E10-69 intersected 85.4g gold/ton over 4.03 metres, including one assay interval of 230g gold/ton over 1 metre. Four drill holes, E10-66 to E10-69, targeted the southwestern end of the Southwest Vein, and three of the holes have expanded the mineralized zone in that direction. The Southwest Vein gold mineralization has now been intersected over a strike length of 325 metres, with the deepest hole drilled less than 200 metres from surface. "The assay results from the Southwest Zone quartz vein continue to be extremely positive," says John P. Thompson, Sona's president and CEO. "We are expanding the Southwest Vein, and this high-grade gold mineralization remains wide open down dip and along strike to the southwest." For the company's full press release, please visit: |

| Gold Daily and Silver Weekly Charts Posted: 22 Dec 2010 08:20 AM PST |

| Investor ETF Madness hits $1 Trillion Posted: 22 Dec 2010 08:13 AM PST After adding $209Bn (26.3%) in total assets so far this year, the US ETF industry has passed the Trillion Dollar mark led by $31Bn of inflows into fixed income ETFs, of all things as well as $29Bn of inflows into emerging markets, and $21Bn into domestic. Recent outflows have knocked commodity ETFs down to $11.4Bn, miles down from last year’s $32.6Bn inflow – rats leaving a sinking ship, perhaps? That would be very bad news for the firm that bought up 90% of the LME copper supply recently. Do ETF traders really know something or are they a lagging indicator? |

| Posted: 22 Dec 2010 08:11 AM PST As the fallacy that an economy is improving if the stock market is higher percolates, accompanied by the all too real surge in input costs (yes, oil really is on the verge of breaking $91 first, and then $100), the margin contraction we have been discussing for over 2 months is becoming increasingly acute: for a good recent example nowhere is it more evident than in the latest Philly Fed reading. Yet what is true for manufactured products, is far more applicable for food products, whose input costs are determined by the daily vagaries of millions of speculators. Which means that as the catch 22 of an "improvement" for some courtesy of 3 year highs in the Nasdaq is perceived by the speculators as an actual improvement for all (which would be the case if stocks were owned uniformly by every layer of society, which is certainly not the case), prices will eventually hit the tipping point where retailers will be forced to start passing on cost increases to consumers. Enter McDonalds whos executives according to AGWeb, were quoted as saying that "menu prices could rise if the economy improves." And since after listening to the endless barrage of brainwashing from the mainstream media, one can't not be left with the impression that the economy is doing anything but improving, conveniently ignoring the fact that the Fed is stimulating it coincidentally via QE2, the next step for the broad part of the US population for whom there is no improvement in anything, which would be the majority of America, is about to get its next whopper (pun intended) of a Bernanke side effect, namely inflation in the most affordable of food product categories: fast food. But since this is not caught by the core CPI, all shall be well, and the Fed will be able to proclaim, without losing any sleep, that inflation is truly contained, when the only thing that is contained is lending to those who most need it. As for that critical choice of when and how to pass on food costs, here are additional details of the dilemma gripping food retailers, per AG Web:

For those concerned that the recent resumption in limit up openings in various commodity classes is a worrying development, all we can say is "you are absolutely right to be concerned." Indeed, Bernanke's Gusher of Endless Liquidity gusher (GELTM) is starting to make its way to asset classes far beyond stocks.

And herein lies the rub: those very same surging S&P EPS that are supposed to form the bedrock of the number to which some multiple is applied to get a 1,550 year end estimate if one is David Bianco, are about to plunge as profit margins are hit, while fixed costs refuse to be reduced.

What this means specifically is that pretty soon America can kiss the various iterations of the dollar menu goodbye.

Elsewhere, fast food price hikes have already taken place.... even with 9.8% unemployment.

And so forth. Those interested in the full story can read it here. The bottom line is obvious. As the surge in the stock market continus to be equated, totally incorrectly, with an improving economy, prices will increase inevitably, immediately nullifying any benefit brought from the recent tax extension, and pushing all profits to commodity goods speculators, while taking away purchasing power from end consumers. Keep in mind this is the Fed's plan, which no longer fights disinflation, but is in the inflation creation business. Luckily, Bernanke is 100% certain he can contain this process. It is then too bad it has already started, and is about to get a whole lot worse. h/t Dan |

| Monitoring Takeover Targets In Gold and Silver Junior Mining Stocks Posted: 22 Dec 2010 08:03 AM PST There is a growing scarcity of available precious metal mines in the world. The old majors such Barrick(ABX:NYSE), Goldcorp(GG:NYSE), and Newmont(NEM:NYSE) are facing diminishing reserves in their existing mines. They are mature miners with pockets bulging with cheap dollars. Moreover these majors are competing with the Chinese, Russians, Japanese and Koreans who have all shown an interest in expanding their precious metals assets and diverting assets away from paper currencies into real assets. All of them know it is cheaper to buy growth rather than to find it. They are like the Red Queen in "Alice in Wonderland", who must take two steps forward just to stay in the same place. |