saveyourassetsfirst3 |

- Bullish and Bearish: Forced Neutrality on the Dollar

- U.S. Dollar Gaining Fair-Weather Friends

- Consumer Price Inflation: The Wolf at the Door

- In A Disappointing Europe, Sweden Stands Out

- Monday Options Brief: BCS, XRT, FRX & HANS

- update 29/11/2010

- Gold/Silver - Controlling Your Trades, Money and Emotions

- Holiday Bargains – Northern Tiger

- Euro crash continues... clobbered overnight... breaching important levels

- Gold demand from this giant Asian nation is surging

- Super Imperialism: The Ec...

- Crude Up on Down Dollar

- Gold/Silver – Controlling Your Trades, Money & Emotions

- Crash JP Morgan, Buy Silver!

- Interview With David Morgan About The Silver Manipulation

- David Galland – What Could Trip Up Gold?

- Euro-Bankers Demand of Gr...

- 9 Shocking Examples Of Black Friday Violence – Is This A Foretaste Of The Economic Riots We Can Expect When The Financial System Collapses?

- Eurozone Breaking Up

- Double Dips, Dollar Declines and Disillusioned Doctors

- Yeah, Thanks A Lot!

- Interview With David Morgan About Silver Manipulation

- Gold Price: From Diwali to the Chinese New Year

- Why Gold? Here is the Scientific Explanation

- Metals Look for More Cues from Europe, Dollar

- The Gold Price Over Thanksgiving

| Bullish and Bearish: Forced Neutrality on the Dollar Posted: 29 Nov 2010 05:13 AM PST Douglas Borthwick submits: Last week's move lower in the EUR/USD stopped us out of our weaker USD story, as our trailing stop took us out on the Friday after Thanksgiving. On the whole we fundamentally remain of the view that the USD must weaken from here. It is not a popular view, yet one that we have been fighting and winning for much of the year. Last week’s price action allows us to look again at what moves the USD so that we may better define what to look for going forward. We look at the EUR/USD from the view of the Bull and the Bear; and we discuss specific actions and indicators. Charts are found at the end of the discussion. On the whole we fundamentally remain of the view that the USD must weaken from here. It is not a popular view, yet one that we have been fighting and winning for much of the year. Last week’s price action allows us to look again at what moves the USD so that we may better define what to look for going forward. We look at the EUR/USD from the view of the Bull and the Bear; and we discuss specific actions and indicators. Charts are found at the end of the discussion. Complete Story » |

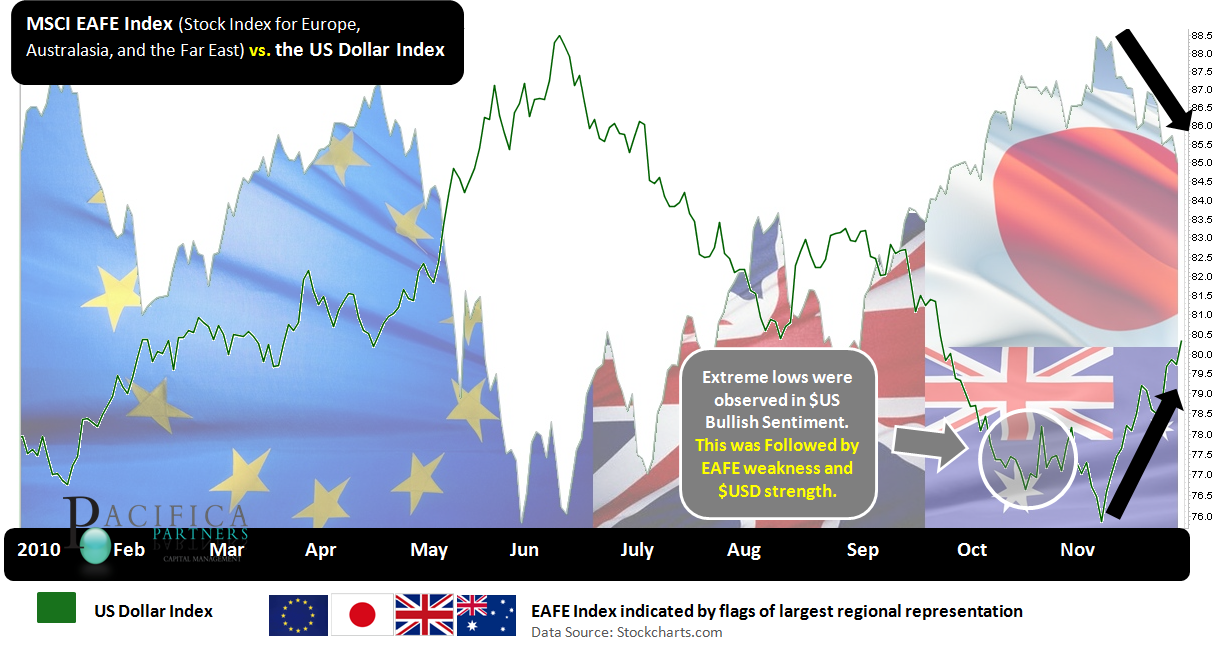

| U.S. Dollar Gaining Fair-Weather Friends Posted: 29 Nov 2010 05:08 AM PST Pacifica Partners submits: Several weeks ago, upon seeing an analysis of the data that details the speculative long and short positions in the U.S. dollar by currency traders, it put into perspective how one-sided the Long Commodities & Long Equities & Short the U.S. dollar trade had become. According to the data as compiled by Credit Suisse First Boston, net speculative positions were the most skewed they have been since October 2007 -- just before the financial crisis began to gain speed and unravel equity markets around the globe. (Data Source: StockCharts.com) Complete Story » |

| Consumer Price Inflation: The Wolf at the Door Posted: 29 Nov 2010 04:58 AM PST I knew I was pretty sloshed when I started giggling about the perverse idiocy in which bankrupted governments wallow, as The Wall Street Journal had a nice headline that said it all: "States Raise Payroll Taxes to Repay Loans." Hahaha! I mean, what kind of crazy crap is it when the government is so desperate for money that it is raising the cost of hiring people at the same time as 10% unemployment has, literally, decimated the workforce? This is crazy! And as bad as it is being unemployed, this is at the same time that inflation is rising from the central banks of the world continuing to create so much new money, such an avalanche of new money, such a tidal wave of new money, so that their respective governments can deficit-spend it and provide bailouts to their Various And Sundry (VAS). Oh, I've always had my fears about the inflation that comes from all this new money, and I knew that inflation would start showing up in real life as well as in my nightmares where prices are like ravenous wolves seeking to devour me, piece by piece, and while my neighbors are all around me being torn to pieces by the snarling rising price-wolves, I am whacking them on the head with a bar of gold, which gets bigger each time that a price-wolf takes a bite out of my leg, so that when I hit the wolf with it, I hit him so hard my leg grows back! Amazing! I am sure that this is some kind of metaphor because of what I know about wolves, and I am not sure that I could successfully defend myself with a bar of gold against a pack of them, a knowledge gleaned from watching TV and reading books, one of which was the story of a single big, bad wolf devouring some old woman, whom I assume had a kitchen full of knives and cleavers to no avail, and a girl named Little Red Riding Hood. Well, perhaps Little Red Riding Hood was British, as Britain seems to be leading the inflationary way. John Stepek of the Money Morning newsletter writes that their latest figures on inflation "came in at 3.2%." Junior Mogambo Rangers (JMRs) have doubtlessly noted the understated punctuation used by Mr. Stepek to announce 3.2% inflation, as those Truly Fearful Of Inflation (TFOI) would use at least one exclamation point! Thus, a re-write would be "the latest figures on inflation 'came in at 3.2%!'" followed by an explanatory, "We're freaking doomed!" And things must be heating up over here in the USA, too, as James Turk of The Free Gold Money Report notes that "since the date of its March 18, 2009 QE announcement, the CRB Continuing Commodity Index has risen 61.7%. Gold has risen 54.0%, while the US Dollar Index has dropped -7.2%." Predictably, I would immediately use this as a handy springboard to Go Freaking Berserk (GFB) that inflation in prices was over 3%, which is the historical dividing line between saving yourself from death by inflation in consumer prices and dying a horrible death from inflation in consumer prices, a fact of such importance that common sense says it should rate at least one exclamation point! But Mr. Stepek is made of sterner stuff, and calmly goes on to disguise the horror of "if you look at the breakdown of all the items included in the CPI, not a single item actually fell in price compared to this time last year." This inflation is, of course, at the worst possible time, as he explains, "commodity price inflation at a time when unemployment is relatively high is stagflationary," which is keenly felt in that "Your wages don't rise to accommodate your rising cost of living, which is a grim situation to be in." Again with the lack of an exclamation point! Perhaps he would not be so stingy with his exclamation points if I give him an example that he can relate to: Imagine the year 1965. If you were 20 years old in 1965 and worked for 45 years, you would now be 65 years old and ready for retirement. So how much retirement money did you put away in1965? Well, according to thepeoplehistory.com, the average income in 1965 was $6,500 a year, so you put away 10%, which is $650 a year. By comparison, a new car cost $2,650 in 1965, rent was $118 per month, and a loaf of bread cost 21 cents. Today, the average income in the private sector is around $40,000 a year, which is about right, since the Bureau of Labor Standards says that inflation since 1965 results in $1 of buying power in 1965 now requiring $6.94, which comes out to an annual inflation rate of 4.4% per year. If you saved a whopping 10% of your 1965 gross income, or $650 a year, it would have to grow by a whopping 4.4% a year to $4,510 just to keep up with inflation, which is, sad to say, about what 10% of your $40,000 income today would be ($4,000). And this is before paying taxes on the $3,860 gain, and not to mention all the fees and expenses paid along the way! In short, because of inflation, expenses and taxes, you have to invest a month's income to get a month's income at retirement, meaning that your money did not grow at all. And that is the absolute best-case scenario, in that investing is a zero-sum game, and with the government always taking money out, and the financial services industry always taking money out, there is less money for the investors to divide amongst themselves than was put in by the investors! Hahaha! "Investing for the long term!" Hahaha! And if you needed another reason to buy gold, as if you needed another reason to buy gold when then Federal Reserve is creating so much money, then the fact that gold has kept up with inflation, without all the hassle, is it! Whee! This investing stuff is easy! The Mogambo Guru Consumer Price Inflation: The Wolf at the Door originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." |

| In A Disappointing Europe, Sweden Stands Out Posted: 29 Nov 2010 04:35 AM PST Michael Shulman submits: With Europe engulfed in a financial crisis that is also becoming a political crisis, Sweden stands out as an exception, and we affirm our expectation of the krona's outperformance in the period ahead. Sweden's economy contracted 5.3% last year but has rebounded smartly this year. Q3 GDP was reportedly earlier today and, at 2.1% quarter-over-quarter, was nearly twice as strong as the consensus forecast, while Q2 figures were revised up a touch. From a year ago, the Swedish economy is 6.9% larger. Adding to the positive news stream was the October retail sales report. The 0.8% rise was twice the consensus. The point is that not only is Sweden reporting robust data, it is surprising the market to the upside. This is serving to shift expectations decidedly in favor of a rate hike by the Riksbank at its next meeting (Dec.15), likely to be followed by another rate hike in the middle of Q1. The Riksbank expects the repo rate to average 1.3% in Q1 of 2011. (Currently it is at 1 percent.) It expects the repo rate to average 2% in Q4 11. At this juncture, the main risk to a Riksbank hike next month is if there is a complete meltdown in the euro; the international variables might steady the Riksbank's hand. Since mid-September the euro had corrected higher against the krona. It repeatedly tried and was turned back from the SEK9.40-SEK9.42 area; today the euro is testing the SEK9.20 area. The multi-year lows were set in September just below SEK9.10. We suspect that the euro is headed back there and probably toward SEK9.0. International asset managers will be drawn to the Swedish bond market as an alternative to German bunds and the equity market is among the best performers in the G10. The dollar is trading at two-month highs against the krona. Technically the risk appears to be another 1% dollar gain toward SEK7.12. However, for those inclined to try picking a dollar top, the krona may be a more attractive candidate than the euro. Sweden is only tangentially involved with the European financial crisis. It has loaned money to Latvia, Iceland and now Ireland (€600 million), but there seems to be little will at this juncture to do any more. Complete Story » |

| Monday Options Brief: BCS, XRT, FRX & HANS Posted: 29 Nov 2010 04:14 AM PST Andrew Wilkinson submits: Barclays PLC (BCS) – More than 160,000 option contracts, nearly all of which are in-the-money put options, changed hands on Barclays by 12:20 pm in New York. Overall previously existing open interest represented by 102,738 contracts on the financial services firm pale in comparison to volume generated in the first half of the current trading session. It looks like the majority of the in-the-money puts exchanged on Barclays today were sold by investors expecting shares in the name to rise ahead of March 2011 expiration. Shares of the London-based bank are currently down 0.25% to stand at $16.27 just before 12:30 pm, but earlier rallied 1.95% to touch an intraday high of $16.63. Investors exchanged more than 40,000 puts at the March 2011 $17 strike, selling roughly 28,000 of the put options for an average premium of $1.75 each. Another 42,200 puts changed hands at the higher March 2011 $18 strike, with roughly 28,500 of those put contracts trading to the bid at an average premium of $2.33 apiece. Investors traded 40,500 puts at the March 2011 $19 strike, selling roughly 30,000 of the contracts for an average premium of $3.02 a-pop. Finally, it appears investors sold approximately 25,800 lots of the more than 34,000 puts exchanged at the March 2011 $20 strike for an average premium of $3.79 each. In-the-money put sellers are hoping to see shares in Barclays rally. But, it seems investors selling the deep in-the-money contracts are more than willing to have shares of the underlying stock put to them should the puts land in-the-money at expiration. Bulls selling the puts keep the premium received if shares in Barclays rise sufficiently and the put contracts expire worthless by expiration in March. SPDR S&P Retail ETF (XRT) – Put players flocked to the retail SPDR to initiate bearish positions on the fund right out of the gate this morning. Shares of the XRT, an exchange-traded fund designed to replicate the performance of the S&P Retail Select Industry Index, fell as much as 2.04% to touch down at an intraday low of $46.48. A sizeable ratio put spread drew our attention to the front month where one investor purchased 5,300 in-the-money puts at the December $47 strike for a premium of $1.45 each, and sold 10,600 puts at the lower December $45 strike at a premium of $0.69 apiece. The net cost to establish the ratio spread amounts to $0.07 per contract. Thus, the investor responsible for the trade is prepared to make money – or realize downside protection on a long position in the underlying shares – should the price of the underlying fund trade below the effective breakeven price of $46.93 through expiration day next month. Maximum available profits of $1.93 per contract are available to the trader if shares of the XRT slide 3.2% from the current intraday low of $46.48 to settle at $45.00 at expiration. The parameters of the transaction suggest that while the investor is wary of limited downside potential in shares of the XRT, he does not expect an all out collapse in the price of the underlying in the near-term. This is because the put-spreader faces losses should shares of the retail fund plunge 7.3% to trade below the lower breakeven price of $43.07 by expiration. Finally, pessimists picked up some 4,600 puts at the January 2011 $46 strike for an average premium of $1.70 apiece. Put buyers at this strike make money if shares of the fund fall 4.7% to breach the average breakeven price of $44.30 by expiration day in January. Options implied volatility on the XRT is higher by 6.8% to arrive at 28.38% just before 12:00 pm in New York trading. Complete Story » |

| Posted: 29 Nov 2010 03:25 AM PST With current level of the USDX, 1° POG = 1391 2° POG = 1350 A rise of the USX in the direction of 88 is in the current phase NOT Gold negative. Gold will rise slowly with a higher USDX and rise faster with a lower USDX.This posting includes an audio/video/photo media file: Download Now |

| Gold/Silver - Controlling Your Trades, Money and Emotions Posted: 29 Nov 2010 01:30 AM PST |

| Holiday Bargains – Northern Tiger Posted: 29 Nov 2010 12:33 AM PST "Analysts from GFMS and elsewhere are forecasting that "poor man's gold" silver will reach over $30/oz in 2011. Given the favourable supply and demand equation and the significant increase in investment demand this seems likely and may happen early in 2011." – GoldCore.com The road higher for silver almost certainly won't be a straight line. We think it will be a similar looking pattern to what we saw in the late 1970s. A rising bias, but interspaced with very harsh retracements, with some of those retracements spanning as much as 40% or even 50%, but most of them half or less. That is assuming that the world manages to avoid a complete collapse of confidence in its fiat currencies, or some other equally upsetting event. |

| Euro crash continues... clobbered overnight... breaching important levels Posted: 28 Nov 2010 11:22 PM PST From Bloomberg: The euro fell to the lowest level in more than two months against the dollar as Ireland's agreement to receive 85 billion euros ($112 billion) in aid failed to stem concern that Europe's sovereign-debt crisis will deepen. The shared European currency slipped versus the yen and erased an early advance versus the greenback. Finance chiefs ended crisis talks in Brussels yesterday, agreeing that a future crisis-management system won't automatically cut the value of bond holdings as the Irish package was secured. Irish opposition parties criticized the terms of the agreement, and the cost of insuring debt from Spain and Portugal soared to record highs. "We saw an attempt for the euro to trade higher earlier in the session, but even if the Irish problem is solved, and that's still debatable with the need to get the austerity budget passed, investors are very wary of seeing the reaction of the other peripheral members," said Jeremy Stretch, executive director of foreign-exchange strategy at Canadian Imperial Bank of Commerce in London. The 16-nation currency slid 0.7 percent to $1.3153 at 7:32 a.m. in New York, and depreciated earlier to $1.3136, the weakest since Sept. 21. The euro slid 0.6 percent against the yen to 110.73, from 111.37 on Nov. 26. Ireland said it will pay average annual interest of 5.8 percent on the package, which breaks down into 45 billion euros from European governments, 22.5 billion euros from the International Monetary Fund, and 17.5 billion euros from Ireland's cash reserves and national pension fund. Sovereign Bailouts European finance leaders also backed a Franco-German compromise on post-2013 sovereign bailouts that waters down calls by German Chancellor Angela Merkel for investors to assume losses and share the costs with taxpayers. Irish opposition politicians reacted angrily to the bailout package. Michael Noonan, finance spokesman for the largest opposition party Fine Gael, said the interest rate was "far too high" and that the "government was cleaned out in the negotiations." The deal for Ireland shifts attention to Portugal, which last week passed the deepest spending cuts in more than three decades with the goal of getting back under the EU's deficit limits by 2012. The cost of insuring debt of Spain and Portugal soared to record highs, according to CMA prices for credit-default swaps. The dollar is poised for its first monthly gain versus the yen since April as concern military action on the Korean peninsula will escalate underpinned demand for the relative safety of the U.S. currency. Korean Concern South Korea has doubled its artillery strength on the disputed island of Yeonpyeong, which was hit by shells fired from North Korea last week, and asked journalists to leave, Yonhap News reported. The North Koreans have installed surface-to-air missiles in the area, it said. "The dollar is going to be the currency of choice as risk appetite remains somewhat under pressure as issues with Korea remain front and center," said Stretch. The Dollar Index, which tracks the greenback against the currencies of 6 major U.S. trading partners including the euro and the yen, rose 0.4 percent to the highest since Sept. 21. The Swiss franc rose against 12 of the 16 most active currencies monitored by Bloomberg as investors sought a refuge amid lingering concern about the risk of contagion from the Irish debt crisis. The franc strengthened 0.7 percent to 1.3190 per euro from 1.3278 last week. It appreciated 0.1 percent against the U.S. currency to 1.0031 franc per dollar, from 1.0036 franc on Nov. 26. The currency has gained 7.8 percent against its major trading partners in the past six months, according to Bloomberg Correlation-Weighted Currency Indexes, making it the best-performing currency during that period. To contact the reporter on this story: Lucy Meakin in London at lmeakin1@bloomberg.net To contact the editor responsible for this story: Daniel Tilles at dtilles@bloomberg.net |

| Gold demand from this giant Asian nation is surging Posted: 28 Nov 2010 11:14 PM PST From Mineweb: Against all odds, and beating all market expectations, soaring gold prices in the international market which are reflected in the metal's price in India, have not daunted India's passion for the yellow metal. In the third quarter of this year, and given the onset of the festive season in India, gold imports crossed last year's total imports by almost 100 tonnes, to reach a new sizzling high – 624 tonnes. Traders and market analysts insist that Read full article... More on gold: Why gold will always be the best currency Three scenarios that could "put a stake through the heart" of gold If you think gold is rising just because the dollar is falling, you're way off |

| Posted: 28 Nov 2010 09:30 PM PST |

| Posted: 28 Nov 2010 08:49 PM PST Energy Rising Not On Demand But On Pure Inflation Of Sinking Dollars. "European October Inflation Accelerates on Surging Energy Costs. European inflation accelerated fastest in two years in October, led by surging energy." An Energy Inflation Price Breakout Is Coming In 2011. Weekly crude oil futures stuck in a trading channel. Soon we break $92.50 after a maybe $70 pullback; later over $100. "Euro-area consumer prices rose +1.9% from a year earlier after increasing +1.8% in September, the European Union statistics office in Luxembourg said today. That's the fastest since November, 2008 and in line with an estimate on October 29. Energy prices rose 8.5% in October from a year earlier, the biggest gain since May." "Crude-oil prices have jumped 12% over the past two months just as growth in the region's economy weakened. The European Central Bank, which has kept borrowing costs at a record low and provided banks' with emergency liquidity, forecast on November 4 that inflation will remain "moderate. It's purely oil-driven," said Christoph Weil, an economist at Commerzbank AG in Frankfurt. "Underlying inflation pressures will remain very subdued overall into 2011." (Editor: Disagree. Inflation will be horrendous). "The Euro was little changed against the dollar after the data, trading at $1.3602 at 10:03 a.m. in London, up In more recent news oil supplies were abruptly reported lower and inflation is going faster. This posting includes an audio/video/photo media file: Download Now |

| Gold/Silver – Controlling Your Trades, Money & Emotions Posted: 28 Nov 2010 05:47 PM PST Last week we had typical pre-holiday light volume trading going into US Thanksgiving. The previous week I warned every one to trade with extreme caution because of the light volume and the fact that the market is on the verge of a sizable drop for both stocks and commodities. Any price action could not be taken seriously because of the light volume. We will not know until later this coming week what the big money wants to do… Buy or Sell, also what the manipulators will do… Seems like there are a lot of wild cards out there with Europe issues and both unemployment and payroll numbers out on Friday morning. Below are a few charts showing my intermediate term outlook for gold and silver. Gold & Silver Futures – Daily Chart US Dollar Index – Weekly Chart As you can see, the past 3 weeks have been in a strong uptrend reaching the first resistance level. The point of this chart is to show you that if you step out to the next longer time frame you can get a solid feeling of where an investment will find major support and resistance levels. Any investment not matter if it's a stock, commodity or currency, if the price is trading in the middle of a large range like this chart you should not be taking large positions because it almost becomes a 50/50 bet on the market which is not a good winning strategy unless you are very experienced at managing your trades and money. If you are going to trade then you want to focus on the underlying trend and you do that by looking at the next larger time frame. For example: if you focus on trading the daily chart, then you must step back each week and review the weekly chart to be sure you are trading with the underlying trend which is up for the dollar right now. Weekend Trading Ideas: Trading in general is a very difficult task especially if you are doing it for a living and planning on using your monthly income to pay bills, salaries etc… We all know the stress which comes with trading and if do not have a solid trading strategy, rules and cannot properly manage yourself (emotions) then you are most likely running into problems like over-trading, getting shaken out of trades easily, and taking bigger risks than your account can handle. Each of these cause more traders to blow up their accounts and big up on trading. I am giving away my book on how you can control your trades, money and emotions. This short and to the point guide is full of my trading techniques, tips and thoughts which will help you get a handle of your emotions turning the market noise into music. Download Book: http://www.thegoldandoilguy.com/trade-money-emotions.php Chris Vermeulen |

| Posted: 28 Nov 2010 04:39 PM PST |

| Interview With David Morgan About The Silver Manipulation Posted: 28 Nov 2010 03:44 PM PST |

| David Galland – What Could Trip Up Gold? Posted: 28 Nov 2010 02:21 PM PST What Could Trip Gold Up? In a recent conference call with the research team of The Casey Report, we once again collectively tried to imagine what situation… what scheme… what government manipulation… might finally put a stake through the heart of gold. Setting the stage, I think it's safe to assume that in order for the gold bull to decisively reverse direction, the following general conditions would have to be precedent in the economy: 1. The financial crisis will have to have ended. Which is to say that… 1. Unemployment would have to begin falling by significant numbers – with 300,000 jobs or more being added month after month, instead of being lost. 2. The housing markets will be stabilizing. Foreclosure rates would have to fall to more normal levels (and not because banks are forced to postpone the process for legal reasons, which is the case now), and sales would have to accelerate in the right direction. 3. Government deficits would have to be sharply curtailed and heading lower. 4. All quantitative easing will have ended. 5. GDP will have to be on sound footing and rise based on sustainable, private-sector growth – not based on the activities of government, which loom so large today in the calculation. 2. Real interest rates – the yields you earn over the actual rate of inflation (not the fabricated numbers ginned up by the government) – will have to be solidly positive. Which, of course, is a big problem given the sheer magnitude of the outstanding debt. Rising rates will only beget more debt. 3. The monetary base of the country will have to be contracting, not soaring as it has been in recent years. The following chart from The Casey Report a few months ago tells the story of runaway printing, and of why gold is so strong by comparison. Inherent in the above are other conditions that will have to be precedent for gold's run to end. For example, politicians around the world will have to find the uncharacteristic courage to act in ways that are deeply unpopular with the very voters that brought them to office. Namely by slashing the scale and cost of government, with all the many cutbacks in subsidies and services that such a Great Downsizing must entail. And this rare new breed of politician would have to retain their jobs long enough to see through the reduction in government that must occur if stability is to be regained. Of course, for the politicians to retain their jobs despite voting in deeply unpopular cuts to government spending will require that the voting public adopts a long forgotten stoicism and becomes willing to take their licks without running to the government for relief. Very much not the case with the students in London who last week started tearing things up over a proposed reduction in tuition subsidies. Video here. In addition, the world's governments will have to step back from the brink of the full-scale currency wars now darkening the horizon and move to restore confidence by tossing their fiat monetary systems over the side in favor of something more limiting. Absent a return to some semblance of monetary sanity, the purchasing medium that gold has compared so favorably to in recent years will continue to weaken, and gold will continue to rise. Then there is the matter of energy. Civilization's ascent into relative prosperity is tightly related to the widespread availability of cheap energy. In the current context – as opposed to the perfect-world vision of a green energy future – we need the dirty stuff, and lots of it, if we are going to avoid serious economic pressure that in turn keeps the Treasury and the Fed throwing money into the furnace. Like them or not, there's no denying that coal, oil, and nuclear are the proven sources of base load power. Sure, implement the latest technologies to mitigate negative side effects, but don't let that stop us from fully embracing their development and production. Which means the government needs to stick the many new "green" regulations back on the shelf for a day in the future when we can actually afford them. With oil stubbornly pushing back toward $100 per bbl, now is not that time. Even that incomplete list of the hurdles to be climbed before the crisis can end, and before gold's run ends as well, begins to communicate the challenge in finding a scenario where the world's governments don't opt for currency debasement. Or, put another way, where governments turn their backs on the default practice of using counterfeit money to buy their way through the next day, the next month, and the next election. That's the "easy" way out… versus the really, really hard work required to essentially turn back the clock on decades of expanding government and the currency debasement that expansion has required. And so, as hard as we try – and we try very hard – we inevitably come back to the conclusion that the government is now tightly caught between a rock and a hard place. And that, as a result, the loss of confidence in government and its fiat money, which is now evident in gold's rise, is very likely to continue and grow even more extreme. Germany's hyperinflation, even after burning out, helped set the stage for Hitler's rise. In other words, anything is possible. So, What Could Make Gold Go Down? That scares me, because there is a similar – albeit not nearly so widespread – meme going around today. Let me share with you a couple of "out of the box" ideas for how the U.S. government might torpedo gold's further advance today, in the same way that Volcker did back then. (As for the rest of the world's governments – sorry, but it's everyone for themselves at this point.) Overt debt default. In this scenario, Uncle Sam rolls out of bed one morning and announces that Treasury debt will henceforth be redeemed at only pennies on the dollar. To lessen the domestic political blowback, perhaps he announces a process whereby domestic holders are redeemed at a higher rate than foreigners… or maybe he most disadvantages debt held by those foreigners labeled as currency manipulators. There is much historic precedent for this extreme action – and, other than some negative consequences over a relatively short initial period of time, countries that have defaulted have suffered no lasting effect. Case in point, both Russia and Argentina now have debt-to-GDP ratios well under 10% – among the lowest in the world. In concert with resolving the debt, the government could promise a new regime of austerity, as well as issue a new dollar with at least some limited backing. Change-o, presto, problems solved, and gold heads into the tank. Tired of dealing with the "gold vigilantes," Uncle Sam simply outlaws gold ownership. Hey, it's happened before. But what about the price of gold in this scenario? Terry Coxon comments… Still, who knows, maybe an international consortium of nations could agree to ban gold – kind of like how they all now ban heroin? Unlikely, but desperate times call for desperate measures. The U.S. adopts a gold standard. In this scenario, Uncle Sam, his back against the wall, agrees to henceforth link the dollar to gold at some fixed price. With concerns over unlimited government spending capped, gold might hold at the fixed price while awaiting further signals. Of course, what that fixed price might be is anyone's guess – although it would almost certainly be a lot higher than it is today. Our own Marin Katusa has identified one possible sleight of hand that could be deployed should the U.S. decide to return to a gold standard – and that would be to nationalize all the nation's gold deposits, then use the inferred resources in the ground as backing for the currency. An interesting thought, as it would greatly reduce the price of gold necessary to reach full backing of the dollar. While each of those three scenarios carries further implications, they may just pass the test of being politically feasible – which, in this government-dominated world of ours, is all-important. Unfortunately, only the first – overt default – would actually make a dent in solving the gargantuan overhang of debt that now torments the global economy. As such, only overt default mitigates the need for the government to continue its insane deficit spending or the debt monetization required to support that spending. In the end, it's hard to imagine that there's a way the government could get out of this situation without the country – and the world – going through a crash for the history books. ~David Galland of The Casey Report |

| Posted: 28 Nov 2010 01:12 PM PST |

| Posted: 28 Nov 2010 01:02 PM PST

All of us had better hope and pray that an economic collapse does not happen any time soon, because it is becoming increasingly apparent that the American people are not morally equipped to be able to handle one. Greed and selfishness have become so rampant in America that large segments of the population have totally forgotten how to be any other way. If the United States ever experiences a really, really bad economic downturn, this nation could very quickly start looking like New Orleans after Hurricane Katrina from coast to coast. Most Americans would simply not know how to handle it. The following are 9 shocking examples of Black Friday violence that should make all of us wonder what is happening to America.... #1 At a Target store in Buffalo, New York the crowds waiting impatiently outside suddenly became a chaotic mob once the doors opened at 4 AM on Friday morning. One man that was lying on the ground remembers thinking "I don't want to die here" while he was being trampled by crazed shoppers....

#2 Crowds were becoming so violent at a Wal-Mart in Sacramento, California that the police actually evacuated the store early Friday morning. #3 Three women from West Palm Beach, Florida said that $1,000 in presents that they had just purchased at Best Buy were stolen from their vehicle on Friday morning within minutes of being purchased. #4 One U.S. Marine reservist that was collecting toys for children was stabbed with a knife when he attempted to stop a shoplifter in eastern Georgia on Friday. #5 Blogger Lynne Elder-Blau has posted about overhearing police officers describe a huge brawl that erupted this year at one well-known store on Black Friday....

#6 A 21-year-old woman from Middleton, Wisconsin was arrested when she threatened to shoot other shoppers while waiting to get into a Toys R Us store for Black Friday. The other shoppers had objected when she attempted to move to the front of the line. #7 The following is video of customers literally tearing apart a store display at a Wal-Mart in Douglasville, Georgia as they pushed and shoved each other in an attempt to grab the best deals.... #8 The Los Angeles County Sheriff's Department actually "locked down" a section of a Cerritos, California shopping mall after a wild fight broke out in the food court. There were even reports that some people were flinging chairs at other customers. #9 At one Wal-Mart in Texas, a near-riot broke out right in the middle of the store as a huge crowd of customers pushed and shoved each other to get a handful of Black Friday deals that were being wheeled out to the floor.... If you want to see even more videos of Black Friday craziness, check out this and this. Remember, the products that these Americans are fighting over are not free. This is how crazy people are willing to go just to get a deep discount on an item. So what is going to happen someday when people are desperate for food or shelter? If this is how people act when the sun is shining, how are they going to behave once a really bad storm arrives? In America today, fewer and fewer people are treating others the way that they would like to be treated themselves. Instead of showing others kindness and respect, in 2010 most Americans would seemingly rather trample anyone who is in the way of getting what they want. So what do you think? Are Americans becoming more greedy and more selfish or are they basically "good" and "decent" people most of the time? Feel free to leave a comment with your opinion.... |

| Posted: 28 Nov 2010 12:40 PM PST It's been a busy weekend for finance officials in Europe. That's a sure sign that things are getting serious. Weekend meetings in the northern hemisphere are all about getting a soothing message out before markets open in Asia on the Monday. We saw plenty of Sunday press conferences in the US during the dark days of 2008. Last week was a shocker for Europe. The Irish bailout plan did nothing to assuage the markets' fears about the financial contagion spreading to Portugal and then Spain. Bond yields in those countries rose significantly last week, making it more expensive for their governments to borrow funds. So what went on over the weekend? Well, European Union Finance ministers signed off on a €85 billion 'rescue' package for Ireland. More on that in a moment. It was also proposed that Europe's current bailout fund, due to expire in 2013, be replaced with a permanent 'European stabilisation mechanism', and that rules relating to private creditors and possible (probable) future debt restructurings be brought into line with IMF regulations. According to a Bloomberg article, this means 'investors won't automatically take losses to share the cost with taxpayers as German Chancellor Angela Merkel initially proposed to the consternation of bond traders.' The aim, of course, is to inject a shot of confidence into the market. Banking is a confidence game. It relies on someone lending to someone who lends to someone else, and so on. Once the chain of lending is broken, usually because of a loss of confidence, that's when the game is up. This is what is happening - in slow motion - in Europe. The market is slowly but surely losing confidence in the current structure of the Eurozone and the European Union (EU). But the determination of EU officials is heroic. They wont let the euro experiment fail without an almighty fight. Hundreds of billions of euros that don't yet exist will be pledged to maintain the status quo. But it can't possibly work in the long term. Let's look at Ireland's bailout package to see why. According to the Financial Times, of the €85 billion total, approximately €50 billion will supplement the Irish government's finances (depleted because of their prior attempts to bail out their banks). Bank recapitalisations will absorb €10 billion while the remaining €25 will go to the banks if needed. (They'll need it). Now, in addition to being saddled with an extra €85 billion in loans, at roughly 6% interest, the Irish people will be subjected to a four year austerity package that aims to cut €15 billion in spending. How the economy will achieve sufficient growth to pay down its debts is anyone's guess. More importantly, will the Irish population actually allow the EU's plans to play out? This is where we come to the reason why the euro experiment, in its current form at least, is doomed. What is happening in the peripheral countries of Europe now is similar to what occurred on a global scale in the Great Depression. In the lead up to the 1930s depression, the global economy boomed on the back of massive credit expansion. The reasons behind the credit boom are complex but basically, the rules of the classical gold standard gave way to what became known as a gold exchange standard after WWI. This allowed both the Bank of England and the Federal Reserve to pursue very easy money policies, particularly in the second half of the 1920s. When the bubble burst, in 1929, the fact that currencies were still tied to gold meant that the adjustment had to be borne internally. That is, wages, prices, etc were required to fall to correct the imbalances built up during the boom. Democracies are not especially equipped to deal with 'internal adjustments', which is another name for deflating an economy's price structure to bring it back into balance. It can be done after minor booms (eg, 1921) but not after massive credit binges such as was experienced in the last 1920s. And in the 1930s there was no social safety net. So it's not surprising to note that Britain abandoned gold in 1931, the US in 1933, and France in 1936. By abandoning gold, these countries effectively devalued their currencies and tried to shift the necessary adjustment from an internal to an external one. But when everyone tries to do the same thing, it loses its effectiveness. This was one reason (amongst many) why the Depression lingered. Perhaps you can see the parallels in Europe today. Greece, Ireland, Portugal and Spain are all experiencing depression like conditions because they are tied to the euro. The euro allowed them all to party hard under low interest rates but its now its enforcing a long and painful hangover. Under the current system, these countries cannot default on their debt and devalue the currency. Sticking with the euro will tie them to a painful internal devaluation. But without debt restructuring as well, this is likely to fail. In a few years time, their debt-to-GDP ratios will still be sky high. This whole rescue business is about protecting the banks from defaults. The idea is to get the banks to build up their capital bases so they can begin to absorb some losses. But that will take years. In the meantime, do you think these countries' people will stand by and accept austerity measures while bankers and those who lent to the banks receive taxpayer-funded bailouts? Ireland has done so for a few years now but the political situation there is looking fragile. Last week, the markets lost faith in the ability of the EU, ECB and IMF to hold the eurozone together. This latest series of announcements may take some pressure off for another few weeks, or even months. But the euro and the eurozone cannot continue to exist in their present form. Similar Posts: |

| Double Dips, Dollar Declines and Disillusioned Doctors Posted: 28 Nov 2010 12:39 PM PST Oh...and here's something else to reckon with. New home sales took a dive in October. The FHFA has confirmed a "double dip" in the homing market. Prices are weak everywhere and falling in some areas. And if you leave a house vacant, squatters might move in. Talk about complications! The house next door has been foreclosed. But the paperwork was fraudulent. Who owns it? So who's got the right to expel the squatters? Don't worry about it. It will work its way out somehow. *** And on the other side of the globe, they've had enough too. "Russia and China Ditch the Dollar," says the headline. It was inevitable, wasn't it? The two said they didn't need no stinkin' greenbacks to do their bi-lateral trade. They can work it out perfectly well in yuan and rubles. Besides, with the Fed undermining the value of the dollar, who wants to hold it? You could have a few hundred billion one day. And then, the next day you discover that you've lost $200 million – just from holding the wrong currency at the wrong time. No thanks. The Russians and Chinese won't be the first. And not the last either. Gradually and suddenly, the world will drop the dollar. Eventually, Americans will drop it too. *** "I don't know if I want to be a doctor," said Henry, back from college for Thanksgiving. "I like the theory and the science of it. But now it's extremely regulated and controlled. And nobody seems to know what the new health care system will mean or where it will end up. I don't know if I could live with the paperwork. "I'm thinking about sticking with physics." Regards, Bill Bonner, |

| Posted: 28 Nov 2010 12:38 PM PST This week, Americans sit down in their sturdy chairs to enjoy a national feast. Businesses are shut down. Congress is adjourned. For one day at least, citizens can enjoy their peace. In every hamlet, urban ghetto and rank suburb they gather, sacrificing turkeys to their deities, whoever they might be. Before they tuck in, they bow their heads and give thanks. But for what? There have always been two parts to the Thanksgiving holiday – one sincere and personal, the other national, fraudulent and delusional. One of the first Thanksgivings took place in 1623. The colony at Plymouth Rock had barely survived. The supply ships from England had not brought enough food. Harvests were poor. People died of hunger, cold, disease and malnutrition. Like all central planners, Governor William Bradford blamed it on the weather. Then, when communal farming was abandoned, what luck, the weather improved: "The Lord sent them such seasonable showers, with interchange of fair warm weather as, through His blessing, caused a fruitful and liberal harvest...for which they blessed God. And the effect of their particular [private] planting was well seen, for all had...pretty well...so as any general want or famine had not been amongst them since to this day." Thanksgiving wasn't made a national holiday until 1863. Then, it celebrated not the success of the American experiment, but the end of it. Imagine a battle today in which 500,000 American soldiers died – almost as many as died in WWI and WWII combined. As a percentage of population that was the death toll at Gettysburg. That was what Lincoln chose to follow with a day of thanksgiving. Thanksgiving for what? "...peace has been preserved with all nations, order has been maintained, the laws have been respected and obeyed, and harmony has prevailed everywhere [EXCEPT IN THE THEATRE OF MILITARY CONFLICT]." Emphasis added.... [And we] "commend to his tender care all those who have become widows, orphans, mourners or sufferers in the lamentable civil strife in which we are unavoidably engaged." Lincoln should have proclaimed a day of mourning. The battle and the War Between the States were not glorious achievements. They were national disasters. The fondest hope of the founders – that people could decide for themselves what kind of government they would have – died on the battlefield. But the nation's course was set. America may be in the New World, but it has one of the oldest governments on the planet. France, Italy, Germany, India, China – all have newer, fresher governments, as much as 200 years younger. Newer economies bustle with more energy and money too. America appears near exhaustion by comparison. China and India eagerly court the future; America seems desperate to hold onto the past. Her armies are stretched over the globe, trying to prevent anything really new from coming about. At home, her politicians and economists try to prevent anything old from going away. At great cost, banks and businesses, as well as the old timers themselves, are propped up...supported...and sustained. Still, the typical American has much reason for gratitude. His house is bigger and gaudier than ever before. His car is a plush monster. He has more than enough to eat. He has gadgets and gizmos galore – including a machine that blows the autumn leaves off his asphalted driveway. And behind him is still the mightiest government the world has ever seen – ready to protect his vital interests in the Hindu Kush as well as Wall Street. Yet, all his blessings seem to come with fuses attached. If the winter is severe, he may not be able to heat his palace. If the price of gasoline rises, driving his land barge could ruin him. If he looks in the bathroom mirror, he might get depressed. Our own polling tells us that 1 in 10 households will give thanks for their government this week. They should reconsider. Didn't the federal government tempt them to buy a house by giving him tax breaks and subsidizing mortgage rates? Didn't it egg them on to spend money by reducing the value of the dollar by 97% over the last 97 years? Didn't the feds stymie every attempt to correct their over-consumption by cheapening credit and stimulating consumption even more? And isn't it the government that has run up a net national "finance gap" of more than $200 trillion...so that each newborn American faces a burden of $700,000 in debt even before his first diaper has been changed? And now, the government practically mocks him in an outrageous way. Ever since an amateur terrorist set his underwear on fire, the airport polizei are determined that a man should have his genitals checked before he boards an airplane. Thank god the would-be terrorist didn't tuck his explosives into a body cavity! It is fascinating from an ethnological point of view; the poor American has been led along, put upon and knocked around so much. Foreigners must look on in amazement, wondering how much abuse he'll take. And now, his head bent over...the "butterball" turkey waiting for him...the American must feel the weight of his blessings. He is broke. He may lose his job. His country is in decline, headed for bankruptcy and his leaders are incompetents and scoundrels. To make matters worse, his central bank is keen to commit a new act of sabotage – intentionally trying to undermine his savings...his labor...and his standard of living. Like Lincoln, he can say to himself...except for that...everything is okay... Regards, Bill Bonner, |

| Interview With David Morgan About Silver Manipulation Posted: 28 Nov 2010 11:17 AM PST |

| Gold Price: From Diwali to the Chinese New Year Posted: 28 Nov 2010 10:00 AM PST As gold demand moves from India to China, gold price peaks move from Diwali to Xīn Nián. |

| Why Gold? Here is the Scientific Explanation Posted: 28 Nov 2010 10:00 AM PST Why did our earliest ancestors choose gold over copper, neptunium or any other of the earth's elements as a form of currency? |

| Metals Look for More Cues from Europe, Dollar Posted: 28 Nov 2010 10:00 AM PST Gold shrugged off gains in the US dollar last week to rise, though the metal lost a bit of momentum at the week end. Silver fell notably on Friday and gold followed suit. |

| The Gold Price Over Thanksgiving Posted: 28 Nov 2010 01:59 AM PST |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment