Gold World News Flash |

- Crude Oil Will Look Toward U.S. Payrolls for Guidance, Gold May Continue to Take Cues

- The Stench of US Economic Decay Grows Stronger: Paul Craig Roberts

- Guest Post: Lies Across America

- Euro Sells Off Following Comments By Banque De France Governor Noyer

- China, Russia, Iran Dumping Dollar For Gold

- Play China’s Yuan From the Long Side

- [Audio] King World News Interview: John Embry

- Guest Post: Ireland, Please Do the World a Favor and Default

- For week ending November 26, 2010

- Silver money for China

- How the U.S. Government Guaranteed the Coming Food Crisis

- Graham Summers’ Weekly Market Forecast (Dollar Rally vs. Bernanke Put Edition)

- "You Cannot Find a Bank Safe Deposit Box in Germany"

- Silver: The Sleeping Giant

- Collapsing Europe

- The Euro Has Become Schrodinger's Money: Goldman Sees European Currency As Both Alive And Dead

- LISTEN: $5,000 Gold

- Copper: the NEW ‘Poor Man’s Gold’

- Why the Government Hates Deflation

- GoldSeek Radio's Waltzek interviews Murphy, Austin Fitts, and Turk

- Trace Mayer interviews Dave Morgan on silver market manipulation

- Embry and McEwen interviews posted at King World News

- European Turmoil: Boon for Silver, Gold, and the Australian Dollar

- Head and Shoulders Pattern in Gold?

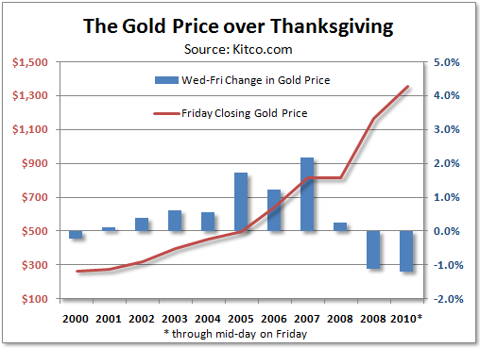

- The Gold Price Over Thanksgiving

- Higher demand helps gold to shine

- Canadian Zodiac coins ‘ideal gifts for winter’

- In The News Today

- PHYSICAL SILVER – THE ANTHEM FOR 2011

- Do you even know about the Shanghai Cooperation Organization?

- It's Not Just the "Peripheral" European Countries ... Financial Contagion Could Spread to "Core" Eurozone Countries and the U.S.

- Crash JP Morgan supporter – but dude, you are completely wrong about Silver – its uses industrially are many

- First transgender Crash JP Morgan Buy Silver vid.

- Is US Foreign Policy Crippled Following Latest Wikileaks Dump?

- Of Fake "Bogeymen" And Artificial "Security"

- For all seasons. . . . .

- Gold Hump Shifting from Diwali to Xin Nian

- Dear Len, don't bother suing JPM. Buy Silver with the 900 mn. you have left and help bankrupt them

- In fact, since the U.S. went off Gold standard and “Friedmanism” was adopted; global poverty rates have doubled

- Technically Precious with Merv For Week Ending 26 November 2010

- Technically Precious with Merv

- Remonetization of Silver: At What Price?

| Crude Oil Will Look Toward U.S. Payrolls for Guidance, Gold May Continue to Take Cues Posted: 28 Nov 2010 04:13 PM PST courtesy of DailyFX.com November 28, 2010 09:51 PM Though Europe sovereign debt worries still linger, there will be a number of releases this week that may shake things up a bit. Commodities – Energy Crude Oil Will Look Toward U.S. Payrolls for Guidance Crude Oil (WTI) - $85.35 // $0.59 // 0.70% Commentary: Crude oil will look to build upon gains established in last week’s holiday-shortened week. Recall that prices added about $2 after successfully testing $80 support four times. Though European sovereign debt concerns still linger, traders are beginning to focus on the recovery in the United States, and that should remain a bullish driver for oil prices. The big data point in the new week will be Friday’s U.S. nonfarm payrolls report which is expected to show a 145K increase for the month of November after having risen 151K in October. Private payrolls may show a similar 155K increase after advancing 159K in October. While this rate of gro... |

| The Stench of US Economic Decay Grows Stronger: Paul Craig Roberts Posted: 28 Nov 2010 02:48 PM PST Meanwhile in America the sheeple remain content with, or blind to, their role as sheep to be slaughtered to feed the rich. The Obama administration has managed to come up with a Deficit Commission whose members want to pay for the multi-trillion dollar wars that are enriching the military/security complex and the multi-trillion dollar bailouts of the financial system by reducing annual cost-of-living increases for Social Security, raising the retirement age to 69, ending the mortgage interest deduction, ending the tax deduction for employer-provided health insurance, imposing a 6.5% federal sales tax, while cutting the top tax rate for the rich. |

| Guest Post: Lies Across America Posted: 28 Nov 2010 02:47 PM PST Submitted by Jim Quinn of The Burning Platform Lies Across America “Every single empire, in its official discourse, has said that it is not like all the others, that its circumstances are special, that it has a mission to enlighten, civilize, bring order and democracy, and that it has a mission to enlighten, civilize, bring order and democracy, and that it uses force only as a last resort.” – Edward Said The increasingly fragile American Empire has been built on a foundation of lies. Lies we tell ourselves and Big lies spread by our government. The shit is so deep you can stir it with a stick. As we enter another holiday season the mainstream corporate mass media will relegate you to the status of consumer. This is a disgusting term that dehumanizes all Americans. You are nothing but a blot to corporations and advertisers selling you electronic doohickeys that they convince you that you must have. Propaganda about consumer spending being essential to an economic recovery is spewed from 52 inch HDTVs across the land, 24 hours per day, by CNBC, Fox, CBS and the other corporate owned media that generate billions in profits from selling advertising to corporations schilling material goods to thoughtless American consumers. Aldous Huxley had it figured out decades ago: “Thanks to compulsory education and the rotary press, the propagandist has been able, for many years past, to convey his messages to virtually every adult in every civilized country.” Americans were given the mental capacity to critically think. Sadly, a vast swath of Americans has chosen ignorance over knowledge. Make no mistake about it, ignorance is a choice. It doesn’t matter whether you are poor or rich. Books are available to everyone in this country. Sob stories about the disadvantaged poor having no access to education are nothing but liberal spin to keep the masses controlled. There are 122,500 libraries in this country. If you want to read a book, you can read a book. The internet puts knowledge at the fingertips of every citizen. Becoming educated requires hard work, sacrifice, curiosity, and a desire to learn. Aldous Huxley describes the American choice to be ignorant: “Most ignorance is vincible ignorance. We don’t know because we don’t want to know.” It is a choice to play Call of Duty on your PS3 rather than reading Shakespeare. It is a choice to stand on a street corner looking for trouble rather than reading Hemingway. It is a choice to spend Black Friday in malls fighting other robotic consumers for iSomethings, the latest innovative, advanced TVs, flashy Rolexes, and ostentatious Coach bags rather than spending the day reading Guns of August by Barbara Tuchman, a brilliant Pulitzer Prize winning history of the outset of World War I, which would provide insight into what could happen on the Korean Peninsula. It is a choice to watch 6 hours per day of Dancing With the Stars, American Idol, Brainless Housewives of Everywhere, or CSI of Anywhere rather than reading Orwell or Huxley and discovering that their dystopian warnings have come true. Conspicuous Consumption ConquistadorsAmericans have chosen to lie to themselves. They have persuaded themselves that buying stuff with plastic cards while paying 19% interest for eternity, driving BMWs while locked into never ending indecipherable lease schemes, and living in permanently underwater McMansions bought with 0% down on an interest only liar loan, is the new American Dream. They think watching the boob tube will make them smart. They soak in the mass media hype, misinformation and lies like lemmings walking off a cliff. Depending on their political predisposition, they watch Fox or MSNBC and unthinkingly believe the propaganda that pours from the mouths of the multi-millionaire talking heads who read Teleprompters with words written by corporate media hacks. They tell themselves that buying stuff on credit, giving them the appearance of success as measured by the media elite, is actually success. This is a bastardized, manipulated, delusional version of accomplishment. Americans have chosen to believe the lies because the truth is too hard to accept. Becoming educated, thinking critically, working hard, saving money to buy what you need (as opposed to what you want), developing human relationships, and questioning the motivations of government, corporate and religious leaders is hard. It is easy to coast through school and never read a book for the rest of your life. It is easy to not think about the future, your retirement, or the future of unborn generations. It is easy to coast through life at a job (until you lose it) that is unchallenging, with no desire or motivation for advancement. It is easy to make your everyday troubles disappear by whipping out your piece of plastic and acquiring everything you desire today. If your brother-in-law buys a 7,000 sq ft, 7 bedroom, 4 bath, 3 car garage, monolith to decadence for his family of 3, thirty miles from civilization, with no money down and a no doc Option ARM providing the funds, why shouldn’t you get in on the fun. It’s easy. Why sit around the kitchen table and talk with your kids, when you can easily cruise the internet downloading free porn or recording every trivial detail of your shallow life on Facebook so others can waste their time reading about your life. It is easiest to believe your elected leaders, glorified mega-corporation CEOs, and millionaire pastors preaching the word of God for a “small” contribution to their mega-churches. Americans love authority figures who act as if they have all the answers. It matters not that these egotistical monuments to folly and hubris (Bush, Obama, Paulson, Geithner, Greenspan, Bernanke) have committed the worst atrocities in the history of our Republic, leaving economic carnage and the slaughter of thousands in their wake. The most dangerous man on this earth is an Ivy League educated, arrogant ideologue who believes they are smarter than everyone else. When these men achieve power, they are capable of producing catastrophic consequences. Once they seize the reigns of authority these amoral psychopaths have no problem lying to the American public in order to achieve their objectives. They know that Americans love to be lied to, so the bigger the lie, the more likely it is to be believed. The current lie proliferating across the land of the free financing and home of the debtor is that austerity has broken out across the land. The mainstream media and the government, aided by various “think tanks” and Federal Reserve propagandists insist that Americans have buckled down, reduced spending, increased savings, and have embraced austerity. Austerity – Circa 1932

Austerity – Circa 2010

They now proclaim that it is time to spend again. It is the patriotic thing to do, just like defeating terrorists by buying an SUV with 0% down from GM was the patriotic thing to do after 9/11. Defeating terrorists by going further into debt was the brilliant idea of those Ivy League geniuses Bush & Greenspan. Let’s critically examine the facts to determine how austere Americans have become:

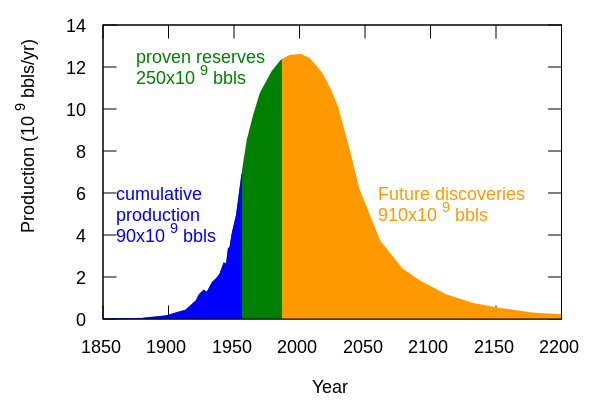

Does This Look Like Austerity? Really? This data clearly proves that austerity has not broken out across the land of delusion. The billions in consumer loan write-offs by the Wall Street banks that run this country have masked the fact that Americans have not cut back on their spending habits at all. GMAC (taxpayer owned) and Ford Credit continue to dish out car loans to anyone with a pulse and a 600 credit score. The Federal Reserve and the FASB have encouraged, if not insisted, that banks fraudulently value the commercial real estate loans on their books. The Federal Reserve has bought $1.5 trillion of toxic mortgage loans from the criminal Wall Street banks at 100 cents on the dollar. The government’s corporate fascist public relations firms then spread the big lie that the economy is recovering and consumers should join the party and spend, spend, spend. If Americans were capable or willing to do some critical thinking, they would realize that those in power have created the illusion of a recovery by handing $700 billion of your money to the banks that created the financial meltdown, spending $800 billion on worthless pork barrel projects borrowed from future generations, dropping interest rates to 0% so that the mega-Wall Street banks can earn billions risk free while your grandmother who depended on interest income from her CDs edges closer to eating cat food to get by, and lastly Ben Bernanke’s blatant attempt to enrich Wall Street by buying US Treasury bonds in an effort to make the stock market go up, while the middle and lower classes are crushed under the weight of soaring fuel and food price increases that exceed 30% on an annual basis. The illusion of recovery is not a recovery. With a true unemployment rate of 22%, a true inflation rate of 8% and a real GDP of -1.5% (Shadowstats), we are in the midst of the Greater Depression. You are being lied to, but most of you prefer it. The Little Lies We Tell Ourselves“Our ignorance is not so vast as our failure to use what we know.” – M King Hubbert When Jimmy Carter gave his malaise speech in 1979, Americans were in no mood to listen. Carter’s solutions were too painful, required sacrifice, and sought to benefit future generations. The leading edge of the Baby Boom generation had reached their 30s by 1979, and the most spoiled, pampered, egocentric generation in history could care less about future generations, long term thinking, or sacrifice for the greater good. They were the ME GENERATION. The 1970s had proven to be tumultuous episode in US history. M King Hubbert’s calculation in 1956 that U.S. oil production would peak in the early 1970s proved to be 100% correct. The Arab oil embargo resulted in gas shortages and economic chaos in the U.S. Hubbert used the same method to determine that worldwide oil production would peak in the early 2000s. If long term planning had been initiated in the early 1980s, combining exploration of untapped reserves, greater utilization of natural gas, development of nuclear plants, more stringent fuel efficiency standards, increased taxes on gasoline, and more thoughtful development of housing communities, we would not now face a looming oil crisis within the next few years. Instead of dealing with reality, adapting our behavior and preparing for a more localized society, we put our blinders on, chose ignorance over reason and pushed the pedal to the medal by moving farther away from our jobs, building bigger energy intensive mansions, and insisting on driving tank-like SUVs, Hummers, and good ole boy pickups. Kevin Phillips in American Theocracy explained that hyper-consumerism, fear, and inability to use logic have left our suburban oasis lives in danger of implosion when the reality of peak cheap oil strikes: Besides the innate thirst of SUVs, some of the last quarter century’s surge in U.S. oil consumption has come from Americans driving more – some twelve thousand miles per motorist per year, up almost one – third from 1980 – because they as a whole live farther from work. In consumption terms, exurbia is the physical result of the latest population redistribution enabled by car culture and the electorate that upholds it. Family values are central – if by this we mean having families and accepting lengthy commutes to install them in reasonably safe and well churched places. In the 1970’s such households might have been fleeing school busing or central city crime; in the post – September 11 era, many sought distance from “godless” school systems or the random violence and terrorist attacks expected to occur in metropolitan areas. We willingly believe the lies espoused by the badly informed pundits on CNBC and Fox that if we just drill in Alaska and off our coasts, we’ll be fine. The ignorant peak cheap oil deniers insist there are billions of barrels of oil to be harvested from the Bakken Shale, even though there is absolutely no method of accessing this supply without expending more energy than we can access. Environmentalists lie about the dangers of nuclear power, while shamelessly promoting the ridiculous notion that solar, wind and ethanol can make a visible impact on our future energy needs. Ideologues on the right and left conveniently ignore the facts and the truth is lost in a blizzard of their lies. Here is an explanation so clear, even a CNBC “drill baby drill” dimwit could understand: When oil production first began in the mid-nineteenth century, the largest oil fields recovered fifty barrels of oil for every barrel used in the extraction, transportation and refining. This ratio is often referred to as the Energy Return on Energy Investment (EROEI). Currently, between one and five barrels of oil are recovered for each barrel-equivalent of energy used in the recovery process. As the EROEI drops to one, or equivalently the Net Energy Gain falls to zero, the oil production is no longer a net energy source. This happens long before the resource is physically exhausted. After the briefest of lulls when oil reached $145 per barrel, Americans have resumed buying SUVs, pickup trucks, and gas guzzling muscle cars. They have chosen to ignore the imminence of peak cheap oil because driving a leased BMW makes your neighbors think you are a success, while driving a hybrid would make your neighbors think you are a liberal tree hugger. It boggles my mind that so many Americans are so shallow and shortsighted. According to Automotive News, at the start of 2008 leasing comprised 31.2% of luxury vehicle sales and 18.7% of non-luxury sales. This proves that hundreds of thousands of wannabes are driving leased BMWs and Mercedes to fill some void in their superficial lives. I bought a Honda Insight Hybrid six months ago. It gets 44 mpg and will save me $1,500 per year in gasoline costs. I put 20% down and financed the remainder at 0.9% for three years. My payment is $450 per month. I will own it outright in 2 ½ years. I could have leased a 2010 BMW 328i with moonroof, bluetooth, power seats with driver seat memory, lumbar support, leather interior, iPod adapter, 17″ alloy wheels, heated seats, wood trim, 3.0 Liter 6 Cylinder engine with 230 horsepower for 3 years at $389 per month. At the end of 3 years I’d own nothing. In 2 ½ years I’ll be able to put $450 per month away for my kids’ college education and I’ll be saving more on fuel as gasoline approaches $5 per gallon. The self important egotistical BMW leaser pretending to be successful will need to hand over their sweet ride and move on to the next lease, never saving a dime for the future. I’m sure they’ll make a killing in the market or their McMansion will surely double in price, providing a fantastic retirement. Delusional Practical The delusion that cheap oil is a God given right of all Americans can be seen in the YTD data on vehicle sales. Pickups and SUVs account for 48.5% of all sales, while small fuel efficient cars account for only 16.5% of all sales. Americans will continue to lie to themselves until it is too late, again.

Americans are so committed to their automobiles, hyper-consumerism, oversized McMansions, and suburban sprawl existence that they will never willingly prepare in advance for a future by scaling back, downsizing, or thinking. Our culture is built upon consumption, debt, cheap oil and illusion. Kevin Phillips in American Theocracy concludes that there are so many Americans tied to our unsustainable economic model that they will choose to lie to themselves and be lied to by their leaders rather than think and adapt: A large number of voters work in or depend on the energy and automobile industries, and still more are invested in them, not just financially but emotionally and culturally. These secondary cadres included racing fans, hobbyists, collectors, and dedicated readers of automotive magazines, as well as the tens of millions of automobile commuters from suburbs and distant exurbs, plus the high number of drivers whose strong self-identification with vehicle types and models serve as thinly disguised political statements. In the United States more than elsewhere, a preference for conspicuous consumption over energy efficiency and conservation is a signal of a much deeper, central divide. M King Hubbert was a geophysicist and a practical man. He observed data, made realistic assumptions, and came to logical conclusions. He didn’t deal in unrealistic hope and unwarranted optimism. He knew that our culture had become so dependent upon lies and an unsustainable growth model based on depleting oil and debt based “prosperity”. He knew decades ago that we were incapable of dealing with the truth: “Our principal constraints are cultural. During the last two centuries we have |

| Euro Sells Off Following Comments By Banque De France Governor Noyer Posted: 28 Nov 2010 02:27 PM PST ...But did traders pick the wrong currency to sell? Tonight's prompt sell off in the Euro is now being attributed to comments by Banque de France Governor Christian Noyer who said monetary easing creates the potential for global imbalances. While it is true that Noyer stated that The European Central Bank will keep its emergency measures as long as needed, this is not news. Obviously all of Europe is now reliant solely on the ECB's bidding of last resort for each and every failed bond auction and to prevent bond routs in the secondary market. Again: this is not news. Yet what is interesting is that instead of selling off the EUR, traders may have picked the wrong currency. To wit: Noyer was actually blasting the pegged CNY, which means that the CNY-derivative currencies, the AUD and the NZD should have taken the brunt of tonight's action, and in the wrong direction at that. And, ultimately, the target was the USD. The moment this became clear (9pm Eastern) is when gold took off. Confirmatory headlines: *NOYER: MORE FLEXIBLE YUAN WILL HELP IT PLAY BIGGER WORLD ROLE In other words, Noyer indirectly attempted to push the EURUSD. And failed... Was that the extent of Europe's intervention for the evening? |

| China, Russia, Iran Dumping Dollar For Gold Posted: 28 Nov 2010 02:23 PM PST The Fed's promises are not worth the paper they are written on. Ben Bernanke will print money until he cannot anymore and we have hyperinflation. That is because he has no other choice. He has no way out and he knows it won't work. Tragically, this is where we are headed and there is no way to stop what the elitists have put deliberately in motion. As long as quantitative easing is official Fed and Wall Street policy, gold is going to continue to rise with silver, and the stronger the case is that gold is the real world reserve currency. That means all currencies will eventually have to be backed by gold. We believe that elitists have accepted this fact and that was borne out recently by World Bank President, CFR, Trilateralist and Bilderberger Robert Zoellick. We can assure you that was no slip of the tongue. That was a cleverly planted trial balloon to get public reaction. |

| Play China’s Yuan From the Long Side Posted: 28 Nov 2010 01:46 PM PST Any doubts that China’s Yuan is a huge screaming buy should have been dispelled when news came out that it had displaced Germany as the world’s largest exporter. |

| [Audio] King World News Interview: John Embry Posted: 28 Nov 2010 01:28 PM PST |

| Guest Post: Ireland, Please Do the World a Favor and Default Posted: 28 Nov 2010 12:57 PM PST Submitted by Charles Hugh Smith from Of Two Minds Ireland, Please Do the World a Favor and Default Ireland would save the world from much misery by defaulting now and driving the vampire banks into liquidation. It's rather straightforward: as asset bubbles rise, they enable vast leveraging of credit and debt. Once mal-invested assets collapse in value, then the debt remains, unsupported by equity or capital. |

| For week ending November 26, 2010 Posted: 28 Nov 2010 12:40 PM PST Gold continues to act as one would expect when tracing out a bearish head and shoulder pattern. It's not finished yet and may not but it does require careful attention over the next week or so. GOLD It's the U.S. Thanksgiving week-end and most people are in holiday mode. Having lived over a dozen years in the U.S. I'll go along with that. This week is just the facts, little commentary. LONG TERM The long term P&F chart continues in a bullish mode. A drop to $1320, however, would break below two previous lows but would need a little more downside to break below the up trend line, which is at about the $1300 level requiring a move to $1285 to cause a bear signal. As for the normal indicators, gold remains comfortably above its positive sloping long term moving average line. The long term momentum indicator remains in its positive zone although it is heading lower and is below its negative trigger line. The volume indicator continues to move in new high ... |

| Posted: 28 Nov 2010 12:35 PM PST We have been proposing the monetization of a silver coin in Mexico since 2001. According to our proposal a one-ounce coin of pure silver, with no engraved value, would be given a monetary value by the Mexican Central Bank. This coin would exist and circulate as money, in parallel with the paper money system of Mexico. The monetary value would be superior to the bullion value of the silver ounce by about 15%. This margin would allow a profit, called “seigniorage”, for the Central Bank. Since the coin would not have an engraved value, rises in the price of silver (which would tend to eliminate the seigniorage of the Central Bank) would be met with new, higher, Central Bank quotes for the monetary value of the coin. The rises in the value of silver in the silver markets of the world would no longer cause the disappearance of the monetized silver ounce. As soon as a rise in the price of silver would begin to affect the seigniorage of the Central Bank, it wo... |

| How the U.S. Government Guaranteed the Coming Food Crisis Posted: 28 Nov 2010 12:17 PM PST By Porter Stansberry with Braden Copeland Saturday, November 27, 2010 Over the last several years, I've written constantly on the growing likelihood of a global currency collapse. The governments of Europe and the United States have accumulated debts so large they can't ever hope to repay them, except with currencies whose value will be inflated away by money-printing. That's led me to recommend inflation hedges like railroads, gold, silver, and various forms of energy. Owning these "real assets" is the single best way to protect yourself from the inflationary crisis. But make sure you don't forget the most important inflation hedge of all: food. If you've been reading the financial press for the past few months, you know the prices of vital food commodities are soaring. The price of corn is up 47% since this summer. Soybeans are up 30%. Wheat is up 43%. I expect this trend of higher food prices to continue for years as the U.S government intentionally deba... |

| Graham Summers’ Weekly Market Forecast (Dollar Rally vs. Bernanke Put Edition) Posted: 28 Nov 2010 11:53 AM PST Graham Summers' Weekly Market Forecast (Dollar Rally vs. Bernanke Put Edition)

From mid-August to early November the markets have operated based on the "Bernanke put": the idea that our esteemed Fed Chairman will do everything in his power to keep stock levels up. Indeed, with QE lite going in full force and QE2 on the horizon, the markets became dominated by the "inflation trade" in which the US Dollar fell and every other asset (specifically stocks and commodities) rallied on a near tick-for-tick basis.

However, once the Fed finally DID announced QE 2 in early November stocks began to sell off. Part of this was "selling the fact," but most of it had to do with a seismic shift occurring in the geo-political/ financial arena. With several major countries now raising interest rates (Australia and China) or planning to halt their own QE/ Bailout efforts in the near future (the UK and EU), the Fed's QE 2 program signaled that going forward, the Fed would be on its own regarding its re-flation efforts. This, combined with increasing political pressure hitting the Fed at home and abroad (China has made it clear it will not tolerate US Dollar debasement), has resulted in a seismic shift taking place in the markets. It's almost as though investors finally figured out that the Fed's "free lunch" liquidity schemes will eventually come at a cost, whether it be a US Dollar collapse, trade wars with China, or more. As a result of this, stocks began a sell off almost to the day that QE 2 was announced. They've since begun to trade in a wide range between 1,200 and 1,180 on the S&P 500.

As I write this, the market hasn't been able to break below support at 1,180 convincingly, largely due to the fact that the Fed is juicing the market almost every day via QE lite and QE 2. On top of this, the majority of traders remain convinced that the Fed can prop this thing up no matter what. By the same token, stocks can't seem to break above 1,200 on the S&P 500 because the whole world knows that QE 2 is the equivalent of a "Hail Mary" pass and that the odds are high it will be end very badly (inflation, trade war with China, US Dollar collapse, etc). Consequently, traders are not able to rally enough enthusiasm to push the market higher even during the extremely light volume of Thanksgiving week. One thing that COULD potentially override the "Bernanke Put" would be a major US Dollar rally. On that note I want to alert you to the fact the US Dollar looks to have broken out of its 6-month downward trading channel.

This move is of HUGE import as it could very easily kick the "inflation trade" off a cliff. As I've noted in previously essays, the US Dollar has been the carry trade of choice for many traders since the June '10 top. And with US Dollar bearishness at record highs, ANY upward momentum in the greenback could accelerate rapidly as the shorts are forced to cover. Can a US Dollar rally overcome the Bernanke put? We'll find out this week. We have a total of six POMOs this week (two today and one every other day). So the Fed will literally be juicing the market by $6-9 billion EVERY day this week. If stocks can't remain afloat in the environment and the US Dollar strength continues, then the markets are heading into some VERY DARK times in the near future. Indeed, I'm already preparing subscribers of my paid newsletter Private Wealth Advisory for this outcome. A few weeks ago I published a Special Report on QE2 outlining in intense detail what would come as a result of the Fed's mis-guided policies. Since that time, the three trades I suggested in that report have rallied 13%, 8%, and 4% respectively. And we've got one new trade "on deck" that we will be buying as soon as our "Buy trigger" hits.

I'm giving this report away FREE of charge to anyone who takes out a "trial" subscription to my Private Wealth Advisory newsletter.

|

| "You Cannot Find a Bank Safe Deposit Box in Germany" Posted: 28 Nov 2010 11:41 AM PST "U.S. silver eagles sales at 3,935,000... will the U.S. Mint break the 4 million mark next week? SLV ETF has a huge withdrawal. Silver money for China. EU rescue starts to threaten Germany itself. Three terrific King World News interviews... and much more. " Yesterday in Gold and Silver Despite how bad the gold chart looks... all is not as it seems. With most gold traders at the bullion banks officially M.I.A. yesterday and Thursday, the volume associated with the price moves shown below were the smallest in memory. Over both trading days, the actual net volume [with all roll-overs removed] was well under 10,000 contracts total. As I mentioned in my column yesterday, Thanksgiving day volume [with New York closed] was vapour. So was Friday's volume. Don't read a thing into this price action. And no matter how bad the chart looks, exactly the same thing can be said about silver... although silver's net volume on both days was around 12,000 contracts. Th... |

| Posted: 28 Nov 2010 10:45 AM PST (snippet) According to the U.S. Geological Survey (minerals.usgs.gov/ds/2005/140/silver.pdf), silver mine production has not increased much over this decade, although Jon Nadler recently reported that mine production was higher by 3% from 2009 over 2008 levels. Total silver "production"- which includes other sources besides mining- has been increasing over the past several years, but this production still represents about 25 billion dollars (26,000 tonnes or so). I hate to sound cavalier, but 25 billion dollars is NOTHING in our present debt-based, derivative saturated global economy. I might also point out that both Ted Butler and Michael Maloney interpret U.S. Geological Survey material to mean that silver mine production will begin DECREASING, not increasing over the next ten and twenty years. So the ability to ramp up mine production in order to help knock down the price (as was the case in the 1980s), may not be in the cards this time around. The two metals we will run out of first in the earth's crust are silver and then gold, and for anyone familiar with the numerous industrial uses for silver, it may not be the case that the industrial need of a certain amount of silver (as in some electronics) will decline by as much this time as thirty years ago in response to higher prices. And so, ladies and gentlemen, boys and girls, it looks like we are on the cusp of a new investment mania brought about by people younger than the usual gold or silver bug (with all due respect to my elders) and who live outside the traditional sources of economic power in the West. But we've seen this kind of thing before: human beings don't like to buy things that are cheap and undervalued. People like to buy things that are expensive, hot, and "all the rage." That is just the way the human investing herd operates. Jim Puplava, nearly ten years ago, began advocating that people buy silver by the 1000 ounce bar, I believe. I don't need to tell you what a great idea this was. Mr. Puplava referred to silver as a sleeping giant, and this is of course true. But the real reason silver is a sleeping giant is because the PEOPLE are a sleeping giant. And a case can be made that this sleeping giant is waking up to rediscover exactly what constitutes its money. More Here.. |

| Posted: 28 Nov 2010 10:23 AM PST Online version is here Collapsing Europe They must be keeping their fingers firmly crossed in Brussels, even praying that the Irish rescue package will do more, much more than buy a little breathing space. Relying on divine intervention will not be good enough, because there are three separate problems that will now make the financial collapse of the euro area a racing certainty. These problems are the large amounts of cross-border lending, misguided economic responses, and creditor-debtor politics. The scale of the Irish financial threat is considerably greater than commonly realised and presented, because the relative size of the Irish economy is being confused with the size of its external banking obligations which are significantly larger than those of Spain or Italy. Cross-border loans to Ireland by BIS-reporting banks amount to the equivalent of $715bn, and the comparable figures for Spain are $534bn and for Italy $467bn.[i] Of course these are not the only cross-border financial flows, because they do not include outward banking deposits and securitised debt issued by the Irish government and large companies. But they are the figures that matter. So we must focus on the banks, because they are at the heart of the real crisis. The cross-border loans by BIS-reporting banks for all the PIIGS amounts to $1,982bn at mid-year, which is 32% of the euro area total and disproportionate relative to the size of the economies involved. So if the largest of these debtors, which is Ireland, is allowed to fail there would probably be a full-blown banking crisis even before markets turn their attention to either Spain or Italy. These same statistics show that between September 2008 and June this year the PIIGS between them have also suffered loan withdrawals of $611bn, which indicates how hard their economies are being squeezed by the withdrawal of credit. For Ireland alone the figure is $165bn, about the same as one year’s GDP, and more withdrawals will have taken place since June, putting the proposed rescue package of only $113bn into context. This acute deflation is being conducted at the same time as taxes are being increased, which brings us to the serious mistakes being made in the management of the economy. The Irish government has got one thing right: the importance of keeping corporation tax low. Brussels views things differently, partly because Germany and France see Ireland as unfair competition with respect to corporate location. So between Brussels and Dublin an ugly camel is born, and their attempts to close the budget deficit by a mixture of tax rises and public sector wage cuts while robbing state pension funds betrays a lack of resolve to tackle banking solvency properly. It is madness to punish the Irish people for the current banking crisis, because Brussels is shooting at the wrong target: rescuing the European banking system does not require the Irish economy to be driven into the ground, it requires Brussels to recognise it has a full-scale banking problem on its hands. Both lender and borrower must bear responsibility for such wrong-headedness. It amounts to a protection of jobs in the public sector, while taxes are raised from the private sector and pensions are robbed. Taxing individuals and the private sector to reduce budget deficits prevents vital capital formation and so condemns Ireland’s economy to a prolonged period without recovery. This socially-driven approach is counterproductive, a point which will not be lost on the markets, when they work out that Ireland will be less able to repay its creditors because economic recovery, upon which government finances rely, is effectively cancelled. So markets are now faced with a bail-out too small to reverse the run on the Irish banks, and by an Irish economy that has no chance of economic recovery in the foreseeable future. A bail-out of $113bn amounts to an injection of only half of the money withdrawn from Ireland by the banks in the last two years. It is simply not enough. The crisis is not helped by the understandable reluctance of the German people to commit more good money after bad. It was difficult enough for Angela Merkel to come up with the funding for Greece, which was sold to the German electorate as a one-off. Six months later it’s Ireland, presumably then Portugal, then Spain. It is no surprise that she wanted someone else, like senior bondholders to share the pain. But talk of bondholder haircuts merely creates a new bond market crisis to add to the banking crisis and will drive up Irish bond yields even further; and back-peddling on this issue is unlikely to undo the damage. The importance of Ireland is that is the biggest cross-border banking debtor of all the PIIGS. If the Irish banks are not saved, the European banking system will probably go under, and soon, without waiting for the pressure to mount on Portugal Spain and Italy. The politicians and bureaucrats of Euroland have not demonstrated a sufficient sense of urgency and understanding of the true crisis to resolve it: rather they have made it worse. It is now becoming impossible to see a way out of the euro-banking problem without the ECB giving in on its anti-inflation stance and implementing aggressive quantitative easing. However, the ECB was set up to survive attempts to get it to inflate, so if it backs down from its sound-money stance in the middle of this crisis, the euro itself will suffer a loss of confidence. It looks like divine intervention is the best hope after all. 28 November 2010 Alasdair Macleod FinanceAndEconomics.Org Somerled Newton Poppleford Sidmouth Devon EX10 0BX Tel: +447790 419403 +441935 568393 |

| The Euro Has Become Schrodinger's Money: Goldman Sees European Currency As Both Alive And Dead Posted: 28 Nov 2010 10:16 AM PST It's time for a shirt: "Irish bondholders got a bailout and all the EURUSD managed was a measly 35 pips higher." It seems the currency vigilantes are calling the bluff in JC Trichet, and tomorrow Portuguese bonds will be next on the bidless brigade, further validating that the IMF's, just like the Fed's, primary mandate is to rescue insolvent bankers everywhere there is a taxpayer population that can be raped. But back to the EUR: at last check the currency was trading well inside 1.33, and only about 2.2k pips from Thomas Stolper's 12 month target of 1.55. Not to begrudge anything to Tom: after all, post QE4 he will certainly be spot on (the only question is how long it take Blackhawk Ben to get us there), but we wonder if another Goldman luminary got the memo. To wit: in an interview with the Telegraph, Jim "BRIC" O'Neill told Kamal Ahmad that "the eurozone must embark on a significant round of fiscal and political harmonisation if the euro is to survive...there are elements of the black swan concept that seem rather applicable to the EMU story" and if that wasn't clear enough, he added that the "euro should carry a "risk premium" and that it was over-valued by at least 10pc." Bottom line, according to O'Neill the "fair value for the euro is €1.20 against the dollar and anyone buying it 10pc above that is not very sensible." Uh.... What? Did Wikileaks intercept the memo from Thomas Stolper sent out just this November 25, in which the chief currency strategist said: "Overall, we believe the EUR/$ remains very much on track for the projected trajectory of 1.40 in 3mths as well as 1.50 and 1.55 in 6 and 12 months." And like that, Goldman has all bases covered. Of course, seeing how the outcome is binary, Goldman has just discovered the Schrodinger currency: per the bank that rules the world, the euro is now both alive and dead at the same time. As a reminder, here is what Stolper said 3 days ago:

And some more:

So how come Jim O'Neill can hit the press circuit less than 48 hours later and say that the Euro is virtually doomed:

Is there a power struggle within Goldman? That is the only one to explain such a dramatic divergence in opinions on the future of the common European currency:

Of course, it wouldn't be Jim O'Neill if he didn't infuse half a metric ton of his own personal unfounded hopium in the mssage:

Odd. We on the other hand anticipate that the complete collapse of the sovereign debt house of cards may actually result in upward pressure in the price of gold. But who are we to say anything: after all our opinions are, gasp, consistent, with what we say at least two days earlier. Full O'Neill clip.

|

| Posted: 28 Nov 2010 09:32 AM PST Rob McEwen Saturday, November 27, 2010 Rob McEwen: CEO & Chairman of the Board (BA, MBA) US Gold, Executive Chairman, Director, President & CEO Minera Andes – Rob is the original founder of Goldcorp Inc. (NYSE:GG TSX:G), where he took the… Listen Share this: This posting includes an audio/video/photo media file: Download Now |

| Copper: the NEW ‘Poor Man’s Gold’ Posted: 28 Nov 2010 09:10 AM PST By Jeff Nielson, Bullion Bulls Canada Silver bulls are very familiar with the somewhat facetious label attached to silver: that it is a "poor man's gold". However, as investors to the silver sector have increasingly come to realize, with silver inventories plummeting while silver's importance to our modern economy continues to grow, silver doesn't have to take a "back seat" to any other metal. Meanwhile, the price for a different, semi-precious metal is surging higher, while inventories for it are in steady decline: copper. Since the commodities Crash of '08, I have generally avoided all base metals miners in my portfolio – focusing exclusively on precious metals miners, as it was clear that this sector was going to bounce-back well ahead of any other. However, I certainly never abandoned my general enthusiasm for commodities. We are currently in the early stages of the largest growth-boom in the history of our species. Previously, the next greatest, protracted episode of economic growth was the rebuilding of Europe following World War II. That economic expansion fueled the global economy for decades, before these mature economies began to substitute credit-induced "bubbles" for real economic growth. This is not the situation in Asia, nor in many other emerging/developing economies. Here we see a similar episode of rapid, concentrated expansion – except that it is involving ten times as many people as the post-World War II economic boom. As billions of people in (previously) poorer economies begin to urbanize, their standard of living is quickly moving toward the middle-class affluence which Western economies used to take for granted. There is every reason to believe that a growth-boom fueled by ten times as many people is going to lead to ten times as much total economic growth – meaning that this boom will be ten times as large, ten times as long, or (more likely) some combination of the two. To fuel this unprecedented growth means expanding resource production at the greatest rate in history. Here we immediately see problems. With "peak oil" already a reality for our global economy, we are seeing supply constraints popping-up for many essential raw materials. In this respect, I remain heavily influenced by the superb research and analysis conducted by Chris Martenson. While his video presentation, "The Crash Course" is now several years old, Martenson was so far ahead of his time that the analysis remains "cutting edge". Among the most notable of Martenson's conclusions is that it isn't necessary to be facing absolute limits on the quantities of various minerals in the Earth's crust in order for us to begin facing "peak production" scenarios. Instead, Martenson focuses on two related points. First of all, most of the high-grade/easily accessible mineral deposits for many key minerals have already been found and developed. Thus, we must now dig much deeper, or do much more processing of lower-grade ore in order to simply replace the existing deposits which are drying up. It is an open (and as yet unanswered) question as to whether we are even capable of significantly expanding supply, given the increasing difficulty (and cost) in extracting these resources from the Earth. Secondly, this increased "effort" to mine these minerals directly translates into much greater energy requirements. In other words, it will take many more barrels of oil to produce a ton of refined copper than even a single decade earlier. Thus, as resource production becomes more difficult, it also becomes even more energy-intensive. Even today, in most mines energy is the #2 production cost, behind only labour. This leaves us in a scenario where as oil becomes rapidly more scarce, we will need much more of it to produce every unit of raw materials for this massive, global expansion. More articles from Bullion Bulls Canada…. |

| Why the Government Hates Deflation Posted: 28 Nov 2010 09:09 AM PST Being the naturally cynical type of guy that you would expect from someone so angry, so depressed, so outraged, so paranoid and so "Howard Beale" ("I'm as mad as hell, and I'm not going to take this anymore!") as I am, people want to know "what is with" all of this "deflation" stuff that the Fed is worried about. Some of them write to me, some beginning, "Dear Mogambo" or, "Dear Moron." These are the ones I immediately delete without reading, as they did not have the proper opening salutation. On the other hand, if the email is properly addressed, I will immediately read it, such as this latest one here that correctly begins, "Dear Handsome And Wise Mogambo (HAWM), What is with all of this fear of deflation? It is being portrayed as a dread so fearful that the treacherous, foul Federal Reserve feels somehow justified in using monstrous monetary policy to target inflation in prices to be at least 2% per year, which is the most horrifically terrible thing that the treacherous, foul Fed could do except target 3% inflation in prices, which is the most horrifically terrible thing that the treacherous, foul Fed could so except target 4% inflation in prices, which is the most horrifically terrible thing that the treacherous, foul Fed could do except target 5% inflation in prices, a point at which I assume it is unnecessary to continue along this obvious and tedious continuum because you get the point by virtue of your being as smart as you are handsome and wise! (signed) A Fan Of The Mogambo (AFOTM)." Firstly, let me say that I am pleased to see that fawning and groveling has not gone completely out of style, and let me say that that obvious, sniveling, servile and undeserved flattery is always appreciated. My pervasive bad mood got the better of me, however, and my answer was, "Dear AFOTM, Deflation is a fall in the money supply. Thanks for asking me instead of looking it up, you moron! –Mogambo" Well, AFOTM immediately wrote back, using our sudden familiarity to eliminate the use of an unctuous salutation, saying, "Screw you moron! (signed) Former Fan (FF)." Former fan! I viciously think to myself, "Two can play at this game!" and replied, "Dear FF, you treacherous little backstabbing moron, Deflation is a fall in the money supply, but it is always associated with falling asset prices, which is why that is also called deflation, too, which is when a lesser total money has to be spread among the same (in the short run) amount of actual assets, which means that the pro-rata money available for each asset goes down, which makes some prices go down, which hands losses to the owners of the assets, which they don't like, which are thankfully netted against gains when paying taxes, which means less tax revenue to the government, which the government doesn't like!" Helpfully, I did not expand into bogus mathematical terms, which is that the ratio of Money Supply to Actual Assets (MS/AA) obviously goes down when the Money Supply goes down, which it can do for a variety of reasons, one of which is when any creditor has to take a loss, because fiat money is created by a bank at the instant that someone borrows money from a bank. Therefore, then, money also literally disappears when the debt, underlying the fiat money, disappears when being defaulted upon because the guy who owes the money to the bank decided to default, jumped into his snazzy new car in the middle of the night and headed out of town and across state lines to start a new life, in a new place, with a new name, and an even snazzier, newer car. Of course, unless you are a dealer of snazzy new cars, it is worse than this, as the losses are not constrained to being one-to-one with the number of dollars created! Oh, no! Losses are in huge multiples of the original money created, thanks to the outrageously out-of-control fractional-reserves insanity in the banks that the Federal Reserve, under the horrid Alan Greenspan, was allowing and abetting, and the huge financial spider web of derivatives so that we could have a gigantic stock market bubble, and a bond bubble, and a derivatives bubble, and a housing bubble, and huge, cancerous bubble in the growth of government, which is not to even mention a whole asset-management/retirement-account industry of such greed and corrupted ethics that it makes 40% of all the profits of America, and for doing very, very little except enriching itself, its friends and Congressional lapdogs. It got so bad around the end of the housing bubble that that changes in bank reserves were, literally, zero, as nothing was held against the banks literally lending out as much new money as they wanted, whether they had additional deposits or not! Infinite leverage! It's not quite that way now, although bank reserves are still a piddly $68 billion, while the M2 money supply is up over $400 billion, to $8.76 trillion, from this time last year, which is an increase of about 4%. And the Fed is already launching QE2 to create another $600 billion ($1.2 trillion annualized) so that the federal government can deficit-spend it in the next six months! I howl – Ahhooooohhh! – in outrage! Hooper and Bandit, two animated characters at thewallstreetshuffle.com who do a very good job of discussing Austrian economics, note that "When the Fed finishes buying the $600 billion of US Treasuries and other debt, that they will be the largest single holder of US treasury debt in the world." Wow! Wow and yikes! They sum it up as, "This is just plain and simple gross monetization of our federal debt," and that "the result will be a 'financial Chernobyl' with dollars spreading like radiation around the world." Dollars as radioactive death is an interesting metaphor, and should be alarming to those who hold dollars, but not to those buying gold, silver and oil as ways to save themselves against the predations of the Federal Reserve and the government. To the buyers of gold, silver and oil, "dollars as radioactive death" means, "Whee! This investing stuff is easy!" The Mogambo Guru Why the Government Hates Deflation originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day."

|

| GoldSeek Radio's Waltzek interviews Murphy, Austin Fitts, and Turk Posted: 28 Nov 2010 09:08 AM PST 12:13p ET Saturday, November 27, 2010 Dear Friend of GATA and Gold (and Silver): Gatans Bill Murphy, Catherine Austin Fitts, and James Turk are interviewed today during the weekly precious metals market review by GoldSeek Radio's Chris Waltzek. Their part begins at about 1:25 of the program here: CHRIS POWELL, Secretary/Treasurer * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit:http://www.gata.org/node/16 |

| Trace Mayer interviews Dave Morgan on silver market manipulation Posted: 28 Nov 2010 09:08 AM PST 11:24a ET Sunday, November 28, 2010 Dear Friend of GATA and Gold (and Silver): Trace Mayer of RunToGold.com talks with Silver-Investor.com's Dave Morgan about silver market manipulation and the prospects for ending it in a 15-minute video interview at RunToGold.com. The work of silver market analyst Ted Butler and GATA is mentioned. You can find the interview here: http://www.runtogold.com/2010/11/david-morgan-silver-manipulation/ CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Prophecy Receives Permit To Mine at Ulaan Ovoo in Mongolia VANCOUVER, British Columbia — Prophecy Resource Corp. (TSX-V:PCY, OTCQX: PRPCF, Frankfurt: 1P2) announces that on November 9, 2010, it received the final permit to commence mining operations at its Ulaan Ovoo coal project in Mongolia. Prophecy is one of few international mining companies to achieve such a milestone. The mine is production-ready, with a mine opening ceremony scheduled for November 20. Prophecy CEO John Lee said: "I thank the government of Mongolia for the expeditious way this permit was issued. The opening of Ulaan Ovoo is a testament to the industrious and skilled workforce in Mongolia. Prophecy directly and indirectly (through Leighton Asia) employs more than 65 competent Mongolian nationals and four expatriots. The company also reaffirms its commitment to deliver coal to the local Edernet and Darkhan power plants in Mongolia." The Ulaan Ovoo open pit mine is 10 kilometers from the Russian border and within 120km of the Nauski TransSiberian railway station, enabling transportation of coal to Russia and its eastern seaports. Thermal coal prices are trading at two-year highs at Russian seaports due to strong demand from Asian economies. For the complete press release, please visit: http://prophecyresource.com/news_2010_nov11.php Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit:

ADVERTISEMENT Sona Drills 85.4g Gold/Ton Over 4 Metres at Elizabeth Gold Deposit, Company Press Release, October 27, 2010 VANCOUVER, British Columbia — Sona Resources Corp. reports on five drillling holes in the third round of assay results from the recently completed drill program at its 100 percent-owned Elizabeth Gold Deposit Property in the Lillooet Mining District of southern British Columbia. Highlights from the diamond drilling include: – Hole E10-66 intersected 17.4g gold/ton over 1.54 metres. – Hole E10-67 intersected 96.4g gold/ton over 2.5 metres, including one assay interval of 383g of gold/ton over 0.5 metres. – Hole E10-69 intersected 85.4g gold/ton over 4.03 metres, including one assay interval of 230g gold/ton over 1 metre. Four drill holes, E10-66 to E10-69, targeted the southwestern end of the Southwest Vein, and three of the holes have expanded the mineralized zone in that direction. The Southwest Vein gold mineralization has now been intersected over a strike length of 325 metres, with the deepest hole drilled less than 200 metres from surface. "The assay results from the Southwest Zone quartz vein continue to be extremely positive," says John P. Thompson, Sona's president and CEO. "We are expanding the Southwest Vein, and this high-grade gold mineralization remains wide open down dip and along strike to the southwest." For the company's full press release, please visit: http://sonaresources.com/_resources/news/SONA_NR19_2010.pdf |

| Embry and McEwen interviews posted at King World News Posted: 28 Nov 2010 09:06 AM PST 12:01p ET Saturday, November 27, 2010 Dear Friend of GATA and Gold (and Silver): This week's King World News interviews with Sprott Asset Management's John Embry and mining entrepreneur Rob McEwen have been posted. You can listen to the Embry interview here: http://kingworldnews.com/kingworldnews/Broadcast/Entries/2010/11/27_John… Or try this abbreviated link: The McEwen interview can be found here: http://kingworldnews.com/kingworldnews/Broadcast/Entries/2010/11/27_Rob_… Or try this abbreviated link: CHRIS POWELL, Secretary/Treasurer * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| European Turmoil: Boon for Silver, Gold, and the Australian Dollar Posted: 28 Nov 2010 09:06 AM PST Ananthan Thangavel submits: The past week has had financial markets focus on the impending Irish bailout. Starting in April of this year, Eurozone countries such as Greece, Ireland, Portugal, Spain, and Italy have all been under scrutiny for their heavy government debt burdens while economic growth languishes. The huge amount of sovereign debt is worrisome, as it threatens to derail the global economic recovery. However, in our view, the debt will cause even more money printing by developed economies, which will be bullish for precious metals and emerging market currencies going forward. Markets are worried about the threat of default by these debt-ridden European countries. While this is a possible outcome, it is a highly improbable one. Throughout the history of time, governments who have faced huge debt problems inflate their way out of the debt. In such a manner, governments print money to pay down their debt, thereby reducing the nominal value of the debt. Since the debt is measured in nominal terms (i.e. $10,000) and not the value of what that debt could purchase, governments often resort to money printing in order to ease the burden of debt repayment. |

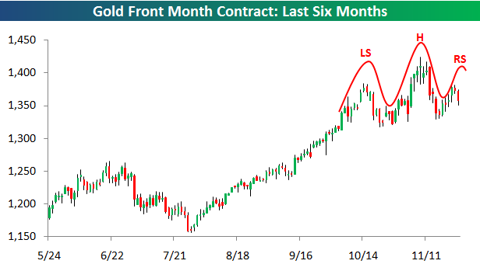

| Head and Shoulders Pattern in Gold? Posted: 28 Nov 2010 09:06 AM PST

While anyone doubting the ascent of gold over the last ten years has gotten their heads handed to them, the commodity's recent pattern is beginning to resemble a head and shoulders topping pattern. While the utility of trading on head and shoulders formations is questionable, look for increased chatter over this developing pattern in the coming days and weeks (click to enlarge). |

| The Gold Price Over Thanksgiving Posted: 28 Nov 2010 09:06 AM PST Well, so much for the theory that the gold price tends to go up over the Thanksgiving holiday, when traders in the US are away from their desks and the rest of the world is more likely to do more buying of the metal than selling. |

| Higher demand helps gold to shine Posted: 28 Nov 2010 09:06 AM PST Higher demand for gold is helping the precious metal to shine in the Indian market, reports Business Standard. |

| Canadian Zodiac coins ‘ideal gifts for winter’ Posted: 28 Nov 2010 09:06 AM PST Numismatic enthusiasts looking for the perfect gifts to give this holiday season could find Zodiac patterns from the Royal Canadian Mint to be ideal. |

| Posted: 28 Nov 2010 07:15 AM PST Jim Sinclair's Commentary QE to infinity goes for the EU too. Next will be Portugal, Spain and Italy getting bailed out. This will happen all at once or in series. Currency wars will continue, resulting in currency induced cost push inflation. EU backs Irish bailout BRUSSELS — The European Union approved an 85 billion euro ($115 billion) rescue for Ireland Sunday and outlined a permanent system to resolve Europe's debt crisis, in which investors could share the cost of any future default. Finance ministers from the 16-nation euro zone, anxious to prevent market contagion engulfing Portugal and Spain, unanimously endorsed an emergency loan package to help Dublin cover bad bank debts and bridge a huge budget deficit. "Ministers concur with the (European) Commission and the European Central Bank that providing a loan to Ireland is warranted to safeguard financial stability in the Euro area and in the European Union as a whole," Jean-Claude Juncker, chairman of the euro area ministers, announced at a news conference. The Irish government said 35 billion euros was earmarked to help restructure its shattered banks, of which 10 billion would be an immediate capital injection and the rest a contingency fund. Ireland will contribute 17.5 billion euros of its own cash and pension reserves toward the bank rescue. The rest of the emergency loans, which Dublin said were granted at an average interest rate of 5.8 percent, will help cover the giant hole the banks have blown in public finances. The IMF will contribute 22.5 billion euros.

Jim Sinclair's Commentary Only 3 weeks ago these people were blasting Bernanke for his mad venture into QE. Now the trillion dollar Euroland bailout fund is too small. That means one trillion in QE in Euroland is too small and must be expanded. Spain and Portugal are next, either one after another or both together. QE is going to infinity. Ireland bailout: fears mount that eurozone fund is too small The European Union is expected to announce a bailout of about €85bn (£72bn) for Ireland on Sunday, senior EU officials disclosed tonight amid worries that Europe's €750bn safety net for the single currency might not be enough to cope with the spreading emergency. Brian Lenihan, the beleaguered Irish finance minister, is to travel to Brussels or Luxembourg, sources said, to make the bailout statement with Jean-Claude Juncker, Luxembourg's prime minister and head of the Eurogroup of 16 single currency countries, and Olli Rehn, EU commissioner for economic and financial affairs. The announcement is to be preceded by a meeting of eurozone finance ministers to rubber-stamp the bailout, probably by video conference. With Ireland the first EU country to tap into the emergency fund – Greece's €110bn rescue in the spring was done separately – there was intense speculation today that the fund was not big enough to secure the euro against the bond markets after Axel Weber, head of Germany's central bank, said it may need to be increased. German media reports today claimed that the commission was lobbying for the largest part of the fund – the €440bn European Financial Stability Facility (EFSF) – to be doubled. Berlin promptly said there was no chance of increasing the fund, to which it is the biggest contributor, and Brussels dismissed the reports. Speaking in Paris , Weber, a contentious figure who has been critical of the Greek bailout, said €750bn "should be more than enough to counter attacks on the eurozone. If it's not enough, then one will have to increase this commitment."

Jim Sinclair's Commentary This all started as country building but all it built was a new mafia. When Afghanistan's vice president visited the UAE last year, he was carrying $52 million in cash. Cables Obtained by WikiLeaks Shine Light Into Secret Diplomatic Channels WASHINGTON — A cache of a quarter-million confidential American diplomatic cables, most of them from the past three years, provides an unprecedented look at backroom bargaining by embassies around the world, brutally candid views of foreign leaders and frank assessments of nuclear and terrorist threats. Some of the cables, made available to The New York Times and several other news organizations, were written as recently as late February, revealing the Obama administration's exchanges over crises and conflicts. The material was originally obtained by WikiLeaks, an organization devoted to revealing secret documents. WikiLeaks intends to make the archive public on its Web site in batches, beginning Sunday. The anticipated disclosure of the cables is already sending shudders through the diplomatic establishment, and could conceivably strain relations with some countries, influencing international affairs in ways that are impossible to predict. Secretary of State Hillary Rodham Clinton and American ambassadors around the world have been contacting foreign officials in recent days to alert them to the expected disclosures. A statement from the White House on Sunday said: "We condemn in the strongest terms the unauthorized disclosure of classified documents and sensitive national security information." "President Obama supports responsible, accountable, and open government at home and around the world, but this reckless and dangerous action runs counter to that goal," the statement said. "By releasing stolen and classified documents, WikiLeaks has put at risk not only the cause of human rights but also the lives and work of these individuals." |

| PHYSICAL SILVER – THE ANTHEM FOR 2011 Posted: 28 Nov 2010 07:07 AM PST |

| Do you even know about the Shanghai Cooperation Organization? Posted: 28 Nov 2010 07:04 AM PST |

| Posted: 28 Nov 2010 06:59 AM PST It's not just the "peripheral" European countries which are in trouble. As Ambrose Evans-Pritchard reported yesterday:

(While future demographic trends for the U.S. are not good, for example, Germany's population is even older.) As I wrote in May:

As the Washington Post points out today, the U.S. is not immune:

CNN notes:

Niall Ferguson, Marc Faber, and SocGen's Edwards and Grice predicted 9 months ago that the European debt crisis would eventually spread to America. But the question of what country the "contagion" might spread to next is the really wrong question altogether. The real question is whether the wealth of the people around the world will continue to be shoveled into the bottomless pit of debts held by the big banks, or whether the people will prevail and the giant banks and bondholders will be forced to take a haircut. See this, this and this. |

| Posted: 28 Nov 2010 06:51 AM PST |

| First transgender Crash JP Morgan Buy Silver vid. Posted: 28 Nov 2010 06:48 AM PST |

| Is US Foreign Policy Crippled Following Latest Wikileaks Dump? Posted: 28 Nov 2010 06:36 AM PST

Here is more on Der Spiegel's early take of the wikileaks release:

A brief overview of the content by the NYT:

And cable specifics:

The Guardian has done a great cliff notes summary of some of the key cables after the jump: |