saveyourassetsfirst3 |

- Celebrating Independence With Boston Beer Company

- Those Damned Speculators!

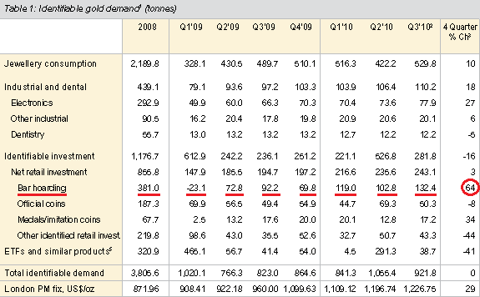

- Gold 'Bar Hoarding' vs. the ETFs

- gold gold gold.......

- Why silver could make another big move next month

- This could be the No. 1 investment of 2011

- How HIGH Could Silver Go in December?

- China Bubble?

- NeoLiberalism and the Cou...

- Frequently Asked Questions from Silver Buyers

- The Gold & Silver Play Has Gone To Greed?

- old and Silver Option Expiration in a Holiday Shortened Week in the US

- Is Gold Money?

- Europe Sacrifices Labour ...

- Full Spectrum Dominance: 8 Examples Of How The Government Is Attempting To Take Total Control Of Our Food, Our Health, Our Money And Even Our Dignity

- Are Russian Stocks a Buy?

- I Visit the Bilderbugs (Daily Bell Humor)

- Metals Trading 'Torn' as Ireland Takes Bail-Out

- Another Look at Gold Bull Seasonals

- S&P 500, Treasuries, Gold & Dollar are at Key Price Levels

- Gold Silver And Commodities Likely Safer

- Price suppression is no bargain once gold and silver are acquired

- ECB : sale of 3.030 oz of Gold last Week

- Hudson on Housing

- COT Flash November 21

- A Conservative Silver Forecast

- Schiff interview with GATAs Douglas covers sale of imaginary gold

| Celebrating Independence With Boston Beer Company Posted: 22 Nov 2010 04:44 AM PST Jefferson Starship submits: The Boston Beer Company (SAM) declares that a brewery must be small, independent, and traditional in order to be considered an American Craft Brewer, which basically leaves just them among publicly traded companies. Sure Anheuser-Busch InBev (BUD) and Molson Coors (TAP) have specialty beers but their money products are in cheap bulk beer, the types you’d find scattered around any college campus or professional football game. Samuel Adam’s does not have any offering similar to these, and almost all of their products are priced significantly higher, yet they recently had their best first quarter in a long time with 44 cents diluted earnings per share and are expected to have a monster of a second quarter at over a dollar. However the reasoning for all of this is a bit fuzzy. Over the course of the first quarter of 2010 Samuel Adam’s saw their stock price rise from $47 to $52 amongst generally peachy market conditions and has since shot up to a high of $74 during terrible conditions. On the last day of March they revised their expected annual earnings to between $2.65 and $2.95 (2009 year was only $2.17). They attributed their first quarter success to the launch of Samuel Adam’s Nobel Pils and a double digit increase in the shipping of Samuel Adam’s Boston Lager, Twisted Teas, and a range of their seasonal offerings. Complete Story » |

| Posted: 22 Nov 2010 04:17 AM PST Hard Assets Investor submits: By Brad Zigler Last week, we pondered the possibility of the oil market being led by bullion ("Is Oil Taking Lessons From Gold?"). Complete Story » |

| Gold 'Bar Hoarding' vs. the ETFs Posted: 22 Nov 2010 03:52 AM PST  Tim Iacono submits: Tim Iacono submits: In looking over the recently released Gold Demand Trends from the World Gold Council, it quickly becomes clear how the gold price could have risen so sharply in recent months with virtually no additions to the related ETFs that are now sitting at or below the levels seen during the summer while the gold price is more than $100 an ounce higher. Complete Story » |

| Posted: 22 Nov 2010 03:02 AM PST Russian, Chinese, seen any recent pics of US gold? |

| Why silver could make another big move next month Posted: 22 Nov 2010 12:03 AM PST From The TSI Trader: There is no other way to describe silver's price movement of the past 13 weeks other than to call it parabolic. With that in mind, I thought it would be interesting to do a little study of past silver parabolic moves and see if I could get a handle on just how high silver could travel into December before it implodes. For this study, I have chosen to examine the relative degree to which silver price can exceed its underlying 200-day moving average. This weekly chart of the World Silver Index (XSLV) uses the 40-week moving average as a proxy for the 200-day moving average. Silver is currently making its 5th parabolic appearance since the secular bull market for gold and silver began in late 2001. The range that silver has been able to soar above its 200-dma in previous parabolic moves, ranged from a modest 21% to a mind boggling 65%. The rule of thumb for these kind of things is... Read full article... More on silver: What you need to know about buying silver today Coin dealers are seeing unbelievable demand for silver bullion Three new reasons to buy silver that many investors aren't aware of |

| This could be the No. 1 investment of 2011 Posted: 21 Nov 2010 11:40 PM PST From Forbes: Don't let the People's Bank of China spook you with its anti-inflationary fifth hike in bank reserve requirements this year. China's economic growth will continue to be robust and so will its need for the world's natural resources. Some raw materials will be more in demand than others. The investment mantra for 2011 is called differentiation, meaning there will be relative differentials in performance among commodities, precious metals, energy, agricultural, and base metals. Unlike 2008 when the commodity bubble burst and the entire asset class went down with stocks, or the early part of 2010 when expectation of a cheaper dollar rallied stocks and commodities, 2011 will be starkly different. QE2 will "provide cyclical stimulus" to the most... Read full article... More on commodities: How the commodities bubble could burst Legendary investor Mark Mobius: Buy commodities... and buy 'em big T. Boone Pickens makes outrageous claim on America's natural gas supply |

| How HIGH Could Silver Go in December? Posted: 21 Nov 2010 10:56 PM PST TSI Trader |

| Posted: 21 Nov 2010 09:22 PM PST Chen's recent remarks from "What is Chen Buying? What is Chen Selling?" Last night the China stock market crashed on the fear of further rising interest rate in China. Gold and silver were hit very hard overnight, which is very unusual. I think it is due to Chinese traders who got margin calls and had to sell gold and silver. Remember China has limits on how much a stock can go down and over 150 stocks were "limited down" last night. Trader probably had to sell gold and silver to satisfy margin requirements. The China situation has been very complicated. Recently there were huge money rushing into hard assets and commodities due to the rising inflation concern. There were withdraws totaling 700 billion RMB from the personal bank accounts in October alone. Where did this money go? Likely to the stock market and commodities market. In the mean time, companies in the exporting business saw their margins cut big time because of the rising RMB and wages. The latest I heard is that they are starting to play the commodities and stock market as well since they core business is not making money anymore. These are dangerous combinations. It looks like they got hit hard last night. The question is, is this the beginning of a bigger correction or this is the only a small one move down to shake off weak hands? Frankly I am getting a little concerned here. I had long discussions with traders last night. It looks to me like everyone is having a great year with tons of profits to protect. Now I start to feel uncomfortable holding margin because of the market uncertainty. I will try to reduce margin and sell some high fliers of this year to lock in profits. There are quite a few funds that were shorting the market and shorting gold earlier this week. I think they are likely to lock in profits before the weekend. That could create a bounce which I intend to sell into. Regards, Chen EDITOR'S REMARKS – In my remarks on the CNBC Asia Squawk Box, I suggested that oil prices and other commodities are in a bubble that is enriching speculators and Wall Street but doing nothing to build economic growth in the U.S. and elsewhere. Chen's remarks above about how the real economy in China is getting squeezed and how people are using excess liquidity to speculate in stocks and commodities underpins the legitimacy of my remarks on CNBC Asia. Watch Video So while holding the Prudent Bear Fund has represented an "opportunity cost" while the system was expanding, we have it in place to help reduce the damage when the markets begin their fall. |

| Posted: 21 Nov 2010 08:21 PM PST |

| Frequently Asked Questions from Silver Buyers Posted: 21 Nov 2010 06:35 PM PST |

| The Gold & Silver Play Has Gone To Greed? Posted: 21 Nov 2010 05:43 PM PST The past few months it seems the gold and silver play has been getting a little crowed with everyone wanting to own gold. While I am a firm believer that these precious metals are a great hedge/investment long term, I can't help but notice the price action and volume for both metals which looks to me like they are getting exhausted. Silver – Daily Chart Gold – Daily Chart US Dollar – 60 Minute Chart The chart below shows the recent rally and breakout to the upside. Currently the dollar is pulling back to test the breakout level (support). It will be interesting to see how this week unfolds. If the dollar bounces then we just may see metals break below their necklines to make another heavy volume drop. Weekly Precious Metals Update: Don't get me wrong I'm not saying to sell of go short metals… not yet anyways. They are both still in an up trend but some interesting things are unfolding which could cause big action in the coming weeks. Join my trading newsletter and get my ETF trading signals, daily analysis and educational material: www.TheGoldAndOilGuy.comChris Vermeulen |

| old and Silver Option Expiration in a Holiday Shortened Week in the US Posted: 21 Nov 2010 05:00 PM PST Jesse's Cafe |

| Posted: 21 Nov 2010 04:30 PM PST |

| Posted: 21 Nov 2010 04:13 PM PST |

| Posted: 21 Nov 2010 01:37 PM PST

It isn't just in one particular area that all of this government intrusion into our lives is so offensive. What we are witnessing is the government slowly digging its fingers even deeper into our lives in a thousand different ways. Sadly, most Americans see the government as the one who is supposed to take care of them from the cradle to the grave, as the one who is supposed to fix all of the problems in society and as the one who is their ultimate authority. This is in direct contradiction to the concept of a "limited government" that our Founding Fathers tried so desperately to enshrine in our founding documents. The American people need a big-time wake up call. The following are 8 examples of how the U.S. government is attempting to take even more control over our lives.... #1 Taking Total Control Of Our Food - S. 510 "The Food Safety Modernization Act" S. 510, "The Food Safety Modernization Act", is another huge power grab by the FDA and the federal government over our food supply. The bill is written so broadly and so vaguely that nobody really knows what it means. The potential for abuse of these vague new powers would be staggering. So will the government abuse these powers? Those who are in favor of the bill say that of course the government will be reasonable, but those who are opposed to the bill point to all of the other abuses that are currently taking place as evidence that we simply cannot trust the feds with vague, undefined powers. Fortunately, the Tester Amendment has been attached to S. 510 at least for now, but big agriculture is not happy about this, and they will be doing everything they can to get it kicked out of the final version of the law. In any event, if this food safety law does get passed, tens of millions of Americans will be left wondering what they are allowed to grow in their back yards, what seeds they are allowed to save and what can and cannot be sold at farmer's markets. In case you think this is paranoid, just consider what is already happening. It has been documented that the feds recently raided an Amish farmer at 5 AM in the morning because they claimed that he was was engaged in the interstate sale of raw milk in violation of federal law. If the feds are willing to stoop so low as to raid Amish farmers, do you think they will have any hesitation when the time comes to raid your home? #2 Taking Total Control Of Air Travel - The Dehumanizing Full Body Scanners And "Enhanced Pat-Downs" Totalitarian governments throughout history have always sought to dehumanize their subjects. Sadly, that is exactly what is happening in America today. If you want to get on an airplane in the United States, you will now be forced to either let TSA agents gawk at your naked body or let TSA agents grope your entire body including your genitals. What these TSA agents are being instructed to do to ordinary Americans is so bizarre that it is hard to believe. It is being reported that in many instances TSA agents are actually reaching down the pants of male travelers and up the skirts of female travelers. One retired special education teacher was left humiliated, crying and covered with his own urine after an "enhanced pat-down" by TSA agents. Quite a number of women that have been through these "enhanced pat-downs" have used the phrase "sexual assault" to describe the experience. So is this what America has become? A place that is so "dangerous" that we all must be treated like prison inmates? Large numbers of Americans are swearing that they will simply not fly anymore, but what happens when these "enhanced pat-downs" start showing up at our schools, our shopping centers and our sporting events someday? #3 Taking Total Control Of Our Health Care - The Loss Of Our Health Freedom Once upon a time, Americans had control over their own health care decisions. That is no longer true today. Thanks to major changes in our health care laws, the health care landscape in America has been dramatically changed. Americans are now forced to participate in the officially-sanctioned health care system by purchasing health insurance. But Americans cannot just get any kind of health insurance policy that they want. Our health insurance choices are now tightly constrained by thousands of regulations. Not only that, but doctors in America no longer have the freedom to treat patients however they see fit. Only "approved" treatments are permissible, and now the federal government is going to be telling doctors which of those "approved" treatments are "cost-effective" enough. As the new health care laws are fully implemented over the next decade, the American people are going to become truly horrified not only about how much their health insurance premiums are going up, but also about how much health freedom they have actually lost. #4 Taking Control Of Our Money - Multiplying Taxes Whenever one tax goes down, it seems like several other taxes either go up or get invented. The truth is that Americans are being drained by the federal government, state governments and local governments in dozens upon dozens of different ways. To our various levels of government, our primary function is to serve as a revenue source. Each year it seems like they find more ways to stick it to us. In fact, it looks like 2011 is going to be a banner year for tax increases. If you doubt this, just see my previous article entitled "2011: The Year Of The Tax Increase". #5 Taking Control Of Our Businesses - Thousands Of Ridiculous Regulations Why would anyone in America even attempt to be an entrepreneur today? Most small businesses are literally being strangled by hordes of red tape. Just consider how things have changed in America. The Federal Register is the main source of regulations for U.S. government agencies. In 1936, the number of pages in the Federal Register was about 2,600. Today, the Federal Register is over 80,000 pages long. The following is just one example of how bizarre things have gotten in this country. The U.S. Food and Drug Administration is projecting that the food service industry will have to spend an additional 14 million hours every single year just to comply with new federal regulations that mandate that all vending machine operators and chain restaurants must label all products that they sell with a calorie count in a location visible to the consumer. Do we really need to spend 14 million more hours telling Americans that if they keep eating hamburgers and fries that they are likely to get fat? But it is not just the federal government that is the problem. One reader recently described how difficult it was to try to run a business in the state of California....

#6 Taking Control Of Our Environment - The Green Police The government is using the "green movement" as an excuse to take an unprecedented amount of control over our lives. From coast to coast, communities have been given government grants to track our trash with RFID microchips. The following are just some of the communities that will now be using microchips to track what we throw away.... *Cleveland, Ohio *Charlotte, North Carolina *Alexandria, Virginia *Boise, Idaho *Dayton, Ohio *Flint, Michigan Not only that, but some cities are now starting to fine citizens for not recycling properly. In Cleveland, Ohio if an RFID tracking chip signals that a recycle bin has not been brought out to the curb within a certain period of time, a "trash supervisor" will actually sort through the trash produced by that home for recyclables. According to Cleveland Waste Collection Commissioner Ronnie Owens, trash bins that contain over 10 percent recyclable material will be subject to a $100 fine. Does that sound like America to you? Now we don't even have the freedom to throw out trash the way we want to. #7 Taking Away Our Independence - The Exploding Welfare State You don't have much freedom if you can't take care of yourself. But in America today, tens of millions of Americans have literally become completely dependent on the government for survival. Over 42 million Americans are now on food stamps. Approximately one out of every six Americans is enrolled in a federal anti-poverty program. The number of Americans living in poverty has increased for three consecutive years, and the 43.6 million poor Americans in 2009 was the highest number that the U.S. Census Bureau has ever recorded in 51 years of record-keeping. The more Americans that are destitute and totally dependent on the government the easier it will be for the government to control them. Today a rapidly growing percentage of Americans fully expect the government to take care of them. But this is not what our founders intended. #8 Taking Away Our Patriotism - We Are Even Losing The Freedom To Be Proud Of America Do you ever think things will get so repressive in America that a group of high school students will be forbidden from singing the national anthem at the Lincoln Memorial? Well, that has already happened. Do you think that areas of our nation will ever become so anti-American that they will forbid students from riding to school with an American flag on their bikes? Well, that has already happened. Fortunately, there was such an uproar over what happened to 13-year-old Cody Alicea that it made national headlines and he ended up being escorted to school by hundreds of other motorcycles and bicycles - most of them displaying American flags as well. The school reversed its policy and now Cody can ride his bike to school every day proudly displaying the American flag. But what if nobody had decided to stand up? That school would have gotten away with banning the flag if the American people had allowed them to. Our liberties and our freedoms are under attack from a thousand different directions and they are being stripped away from us at a blinding pace. It has gotten to the point where most of us just sit in our homes and enjoy the "freedom" of digesting the "programming" that is constantly being hurled at us through our televisions. Of course the vast majority of that programming is produced by just 6 monolithic corporations that control almost everything that we watch, hear and read. Power and money have become more highly concentrated in America today than ever before, and yet most Americans don't even realize it. Most Americans are so busy just trying to survive from month to month that they don't even have time to think about the deeper issues. At the end of the night most of them are so exhausted from serving the system that all they can do is collapse on the sofa and turn on some programming. But the American people desperately need to wake up. Without liberty and freedom our country cannot work. But our freedoms and liberties are being stripped away a little bit more each and every day. The America that so many of us grew up adoring is dying right in front of our eyes. If you plan on saying something about it, you better do so before it is too late. |

| Posted: 21 Nov 2010 11:54 AM PST Pssst...wanna buy some cheap stocks? How about some shares in Russkie enterprises? They're the cheapest in the world...on a P/E of only 6.8 compared to a world average of about 12. Bloomberg has more details:

*** Those poor TSA agents. Just doing their jobs. Trying to protect the safety of travelers...by groping their private parts. And now everyone is getting on their case. One woman charged that her blouse had been pulled down, exposing her breasts to the whole airport...and that TSA agents laughed about it. One said he had missed the action. But no problem. He'll watch the video, he said. Another traveler said that an agent had put his hand down his pants. All right, so they occasionally go too far...embarrass and humiliate travelers. But think of all the good they do! Well...wait...we're thinking. When did TSA ever actually stop a bomber? Never, as far as we know. Did it ever discourage a bomber...so he had to take his rig and blow up a bus or a train or maybe even a golf cart instead? Not that we've ever heard about. We've never been mistreated by an agent of the TSA. Bullied, yes. Threatened, yes. They've been impolite on occasion. We've been patted down so vigorously we didn't know whether to leave a tip or lodge a complaint. But we try to maintain a sense of humor. "The trouble with you, is you just don't get it,"said a paranoid friend lately. "Can't you see? This TSA has nothing to do with keeping out bad guys. It's about keeping us in. They're not really there to make the airlines safer. Instead, it is just a preparation. They are getting Americans accustomed to following orders, standing in line, and acting like half-wits. They are also training up a whole class of goons. These guys don't ask whether it really makes sense to pat down girl scouts and look at old ladies naked. They just do whatever they're told to do. And they probably enjoy it. "There are always some people like that - ready to be concentration camp guards and exterminators. The TSA program helps the authorities identify these people." "Why" we asked. "Who knows...maybe they just want power. Maybe they just want a docile population so they can do what they want." |

| I Visit the Bilderbugs (Daily Bell Humor) Posted: 21 Nov 2010 10:00 AM PST So you wish to know how I visited the Bilderbugs, a young nome like me, only three years old and of very small, but disink size. My name is Farful and this is my story. It begins as we were taking a walk thru a magik nome tunnel on the way to Brussells, the folks and yers truly. We were moving fast, tho father was limping as he carried his many gold in coins in his pointy shoes, it being the way of our peeple. "Mummy," I ast brokenly, trying to keep up. "Are we there yet?" |

| Metals Trading 'Torn' as Ireland Takes Bail-Out Posted: 21 Nov 2010 10:00 AM PST Spot gold traded closely in line with the Euro currency on Monday morning, initially rising after Ireland agreed a €90 billion rescue package from its European partners and the International Monetary Fund. |

| Another Look at Gold Bull Seasonals Posted: 21 Nov 2010 10:00 AM PST Following gold's sharp retreat over the past week or so, traders are wondering how low it will go. Is this metal in a pullback or a correction? |

| S&P 500, Treasuries, Gold & Dollar are at Key Price Levels Posted: 21 Nov 2010 10:00 AM PST Some market prognosticators were noting short-term oversold conditions across the board while others discussed the potential for a strong reversal that could potentially take out recent highs. |

| Gold Silver And Commodities Likely Safer Posted: 21 Nov 2010 09:23 AM PST International Forecaster |

| Price suppression is no bargain once gold and silver are acquired Posted: 21 Nov 2010 09:22 AM PST |

| ECB : sale of 3.030 oz of Gold last Week Posted: 21 Nov 2010 09:20 AM PST |

| Posted: 21 Nov 2010 07:57 AM PST |

| Posted: 21 Nov 2010 07:56 AM PST Both gold and silver seemed to be probing support this week in U.S. dollar terms. We believe they may have already defined near-term support, but of course the jury is still out on that notion. Gold tested as low as $1,330 on COT reporting Tuesday, and silver as low as $25.02 on the cash market the same day. |

| A Conservative Silver Forecast Posted: 21 Nov 2010 05:28 AM PST About a month ago, I wrote a two-part commentary looking at the long-term "price targets" for gold and silver, and how those numbers tended to lose meaning because in the hyperinflation scenarios envisioned for the future (where paper currencies go to zero) the value of any hard asset correspondingly moves to infinity. The purpose of that piece was not so much to see how many "zeros" I could attach to gold and/or silver, but to remind people that since we can't "understand" hyperinflation that we were likely "under-preparing" for such a scenario. While we have very good reasons for looking at such the-sky-is-the-limit price-targets, as prudent investors it's also essential to engage in more conservative forecasting. It is only by looking at both upper and lower parameters that we can make optimal decisions as investors. The purpose of this commentary is to provide that "lower parameter", to guide us in answering two questions: how aggressively should we be buying (in particular) silver over the short-term, and (over the longer term) how much silver can we/should we accumulate? To answer those questions, I will attempt to provide readers with a realistic approximation of the rate of price-appreciation, rather than to simply assign some arbitrary, long-term number to the price of silver. In this respect, we must automatically look to the gold market. While silver has recently been "leading" gold higher, this is extremely atypical – due to the much larger size of the gold market. In any "conservative" long-term appraisal of the silver market, our base-assumption should be that gold will lead silver, not the other way around. Looking at the gold market, we see that over the last two years (the first time in decades that the bankers gold-manipulation scheme has been obviously unraveling) that the price of gold has advanced by roughly 30% each year - assuming that the current rally takes gold to somewhere around the $1500/oz mark by year end. More importantly, we have seen obvious indications that the price of gold is being steadily marched higher by the big-buyers who now control this market. Apart from the ever-shorter, ever more-trivial "ambushes" of these markets by the banking cartel, we are seeing a fairly stable progression. Let's assume that this 30% per year appreciation-rate is deemed "optimal" by these big-buyers. We can make a fairly persuasive argument that this is the case. Allowing the gold market to progress at a slower rate would not only impair supply, but would also allow the smaller, retail buyers to afford to purchase a bigger piece of the 'gold pie'. Conversely, pushing the price up faster than 30% per year pushes-up their own price for purchasing gold to a painful level. So we will consider the 30% annual appreciation rate to represent the "Goldilocks" scenario for the gold market. What does this imply for silver? The answer to that question depends totally on whether we want to make a "bullish" case for silver, or to answer more conservatively. Since I have already dedicated this analysis to "conservative" forecasting, this is the path I will currently pursue. Obviously, the most-conservative analysis of the price of silver (in relation to the price of gold) would be for the current price-ratio of 50:1 to persist. I do not, for the moment, believe this ratio to be sustainable over the longer-term. But (for the sake of argument), I will use this 50:1 ratio as our baseline assumption, and wait until the end of this piece to argue against my own scenario. If the price of gold continues advancing at roughly a 30% annual rate, this would also (roughly) translate into the price of gold increasing by an average of more than $500/ounce per year – even if we only extrapolate over only a five-year time horizon. A less-conservative appraisal would be that the price of gold will advance by at least $500 per year (and generally much more), but I'm happy for purposes of analysis to use the "round" and very conservative number of $500/year. Using that level of price appreciation for gold, and keeping our conservative 50:1 price ratio, we come up with our "conservative forecast" for the price of silver: that we can expect the price to advance by at least $10/ounce per year. While those new to the sector, or with very pessimistic appraisals of the silver market may disagree that this number represents a conservative forecast, certainly most of the silver-bulls who have looked at this market closely may consider this price-progression to be extremely conservative. Specifically, for the price of silver to be restrained to only an advance of $10 per year, we would have to make a number of pessimistic assumptions about the silver market: |

| Schiff interview with GATAs Douglas covers sale of imaginary gold Posted: 20 Nov 2010 09:48 AM PST |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment