Gold World News Flash |

- International Forecaster October 2010 (#3) - Gold, Silver, Economy + More

- Is the Seesaw About to Tilt With the Dollar Up, Gold Down?

- The Mogambo Golden-Real Estate Project

- A Disappointing NFPs Encourages Gold and is Ignored by Oil Traders

- Gold, Get it While You Can

- Gold Bubbles

- Bank of Canada Sees Improving Business Confidence

- USDA Report a Game Changer for Corn

- Rick Santelli On The Fed's Upcoming "Nixonian" Price Controls

- Eric King: Food stamp nation with massive inflation

- World finance leaders fail to resolve currency dispute

- Your stash: details?

- Jim Sinclair: The Biggest Fraud Ever In Capital Markets

- The Biggest Fraud Ever In Capital Markets

- How High For Silver And Gold? Part I: Price-targets

- Crude Oil: Next Major Resistance $87 a Barrel

- Weekly Geopolitical Summary

- Ready? Food Prices Set To Explode This Winter

- Can You Spare 85,000 Tonnes Of Physical Gold

- [1176] The Truth About Markets London – 09 October 2010

- The SLV ETF Now Holds 10,000 Tonnes!

- Global Food Crisis: 6.8 Billion Served…and Counting

- Pat Heller: Metals suppressed again on eve of jobs report

| International Forecaster October 2010 (#3) - Gold, Silver, Economy + More Posted: 10 Oct 2010 04:00 AM PDT In spite of the disinformation, misdirection and outright propaganda the economy is faltering without the addition of stimulus and quantitative easing. The benefits of inventory accumulation over the past 17 months, which accounted for 60% of the strength in the economy is at an end. We either get more stimulus either governmental or from the privately owned Fed or growth is going to continue to drop. |

| Is the Seesaw About to Tilt With the Dollar Up, Gold Down? Posted: 10 Oct 2010 02:00 AM PDT The lines are drawn, the cannons are loaded - the currency war has begun. The opening shots have already been fired with the biggest battles still ahead. This is a superpower currency shoot-out with other counties trying to avoid getting caught in the cross-fire. Each nation is taking unilateral actions to defend its economy from the other in an escalating battle over the value of the world's key currencies. |

| The Mogambo Golden-Real Estate Project Posted: 09 Oct 2010 07:00 PM PDT Japan has taken an interesting approach to preventing people from accumulating so much debt that they default; The Wall Street Journal reports that Japan has a new law "restricting total loans from all lenders to one-third of a borrower's income." Hmmm! Criminal penalties for accumulating too much debt? Wow! |

| A Disappointing NFPs Encourages Gold and is Ignored by Oil Traders Posted: 09 Oct 2010 05:58 PM PDT courtesy of DailyFX.com October 08, 2010 04:44 PM Fundamental event risk was high Friday; but the commodity market was still trading on the high volatility from the previous session. A reversal effort would take precedence to a meaningful reaction to the frequently market-moving US NFP release. North American Commodity Update Commodities - Energy Despite Stable Risk Trends and Disappointing Data, Crude Manages a Sharp Rebound Crude Oil (LS Nymex) - $82.66 // $0.99 // 1.21% The sharp tumble from oil Thursday was a corrective effort following a particularly aggressive upswing. However, volatility begets volatility; and the drive to end the week would put the market back in tune with the past two week’s primary drive. Hovering just around $83, US oil is holding just off of five-month highs awaiting a catalyst (speculative or fundamental) to determine whether the bull trend will remain intact or a remarkable reversal is in the cards. Looking ahead to next week, t... |

| Posted: 09 Oct 2010 05:58 PM PDT By Jeff Clark, Casey's Gold & Resource Report We've got it easy right now. Click or call, and you can quickly and conveniently own a gold coin or bar. But if global concerns cause another panic or the dollar breaks down, you could find yourself standing in a line at the local coin shop or getting a busy signal. Simply, for reasons I’ll discuss here, you may find it very difficult to get your hands on physical gold when that time comes. It's happened before. Though there were no precious metal ETFs in 1980, the demand for physical gold was so great that you literally had to wait in line at a coin shop to buy, with plenty of occasions when you would have been turned away due to lack of inventory. And you'll recall we saw serious shortages, unexpected delays, and soaring premiums in late 2008. Given the fragile state of global affairs and the waiting-in-the-wings crisis for the U.S. dollar, I'll be surprised if we don't see another panic into physica... |

| Posted: 09 Oct 2010 05:10 PM PDT UK financial writer Dominic Frisby argues "that both metals [gold and silver] are still in a bull-market phase. Any mania is yet to come." In support, he notes that in 1980 gold bullion went from $400 to $873 an ounce in only 36 trading days, with silver trading from $16 to $50 in 37 days. The current market is not exhibiting those sort of price moves. He also proposes looking at the value of the US gold reserves compared to money on issue as an indicator of a bubble - "in 1980 … the market value of the 260 million ounces of gold held by the USA in Fort Knox came in at $221bn, yet only some $160bn of paper money was in issue" so if "the market value of the gold held in Fort Knox once again exceeds the number of US dollars the US authorities have issued, then gold will be in bubble territory once again, in that it will be trading at levels above its intrinsic value". Dominic closes his article with his definition of a bubble that I think may explain why a lot of financial commentators are consistently negative on gold: "A bubble is a bull market in which you don't have a position". However, I doubt we will see many of them change their view and buy gold, because these days the internet means all their previous statements are recorded and easily searchable and I can't see them admitting they were wrong. |

| Bank of Canada Sees Improving Business Confidence Posted: 09 Oct 2010 04:39 PM PDT The Bank of Canada released the results of its Autumn 2010 Business Outlook Survey, expecting business investment to increase to help assist with the country's lagging productivity. Despite their bullishness on the Canadian economy and investment, they expect "Global uncertainties [to] remain, although concerns have shifted from Europe back to the U.S. economy. A weaker outlook for U.S. economic growth is dampening sales expectations in a number of cases and reinforcing the general view that growth it likely to be moderate." Summarized from the report:

It will be interesting to see how negative housing data, removal of emergency fiscal and monetary stimulus, and a strong Canadian dollar will impact business investment over the next 12 months. While the bank acknowledges 'uncertainty' in regards to the US economy, they may have underestimated the impact of a weak US currency and economy. Canada's export economy is heavily reliant on the United States (77.7%), United Kingdom (2.7%) and Japan (2.3%). Ironically, all three of these countries have begun the race towards currency destruction in hopes of boosting exports. This will have an impact on the Canadian economy and business confidence within Canada.

|

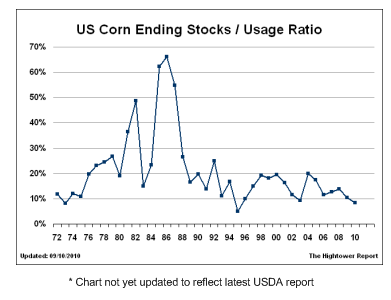

| USDA Report a Game Changer for Corn Posted: 09 Oct 2010 04:19 PM PDT James Cordier submits: There had been whispers all summer about dry weather across the US Midwest hampering corn yields this fall. But few expected the sharp reduction in yields and ending stocks reported by the USDA in Friday’s monthly supply/demand report. The USDA reports the average yield per acre for this year’s US corn crop will drop to 155.8 bushels of corn as compared to last month’s estimate of 162.5 bushels per acre. For those not familiar with corn futures, that’s a big, big number. It will result in US corn production dropping to 12.664 billion bushels down from 13.16 bushels last month – close to a 4% reduction. Most importantly, this takes projected 2011 ending stocks (the amount of corn left over at the end of the crop year on Sept 1. 2011), down to 902 million bushels of corn. The key figure of corn price discovery however is stocks to usage ratio. This is the amount of corn on hand at the end of the crop year vs. the expected demand for the upcoming year. A stocks to usage ratio of 10% would mean that if no corn were harvested in 2012, we would have enough left over from 2011 to meet 10% of the demand.  2011 stocks to usage ratio is now expected to drop to 6.7% - the 2nd lowest ever on record. This is the real figure that is driving corn bulls, especially given that last month’s estimate for 2011 stocks to usage was a more moderate 8.3%. Given the steadily rising global demand for corn, wheat and soybeans, continued dry weather concerns in global corn heavyweight Argentina, and they steadily eroding US dollar, today’s USDA report could lock corn into a bullish mode for months to come. The market’s job now will be to take corn to a price level that discourages demand, and preserves supply. At the very least, the chances of a sharp downtrend in corn prices seems remote at this point which should create a ripe environment for put sellers. Prices could be a little volatile next week as the market fully digests Friday’s USDA report. However, lower yields should secure somewhat of a floor beneath the market. Complete Story » |

| Rick Santelli On The Fed's Upcoming "Nixonian" Price Controls Posted: 09 Oct 2010 01:39 PM PDT Rick Santelli was on King World News today, discussing the distinction between deflation and deleveraging, or what some have dubbed the phenomenon of surging prices in things that one can buy without leverage (Friday's limit up open in various commodities being one example), and plunging prices in everything that requires debt (i.e., one's house). And while the Fed can game the CPI as much as it wants, once middle America see the cost of basic foodstuffs double (and it will once producers hit negative profit margins and are forced to pass input cost inflation to end consumers) they will realize just how serious this problem will be. Of course, the only way to offset this localized inflation is by returning to the time when America could use its houses as piggybanks in the form of taking out equity lines of credit. The problem with that, of course, is that the Fed will be forced to increase home prices at all costs, even as speculators take basic commodity prices up in anticipation of the coming hyperinflation. Which means that the Fed will be behind the ball, and will be forced to increasingly devalue the dollar as it is now obvious that no matter how cheap credit becomes, and how pervasive free money is, the last thing to go up are home prices which make up the bulk of US consumer "wealth." As such, today's collapse in the ceasefire in monetary talk is no surprise: every central bank is fully aware that with the monetary component to intervention, via cheap credit, now priced in, but priced in in terms of equities and commodities, the only way to create equity value in housing (of which per some estimates, 25% of all homes (and rapidly rising) are underwater to the underlying mortgage) is to broadly debase the currency. This is now a virtual certainty, and the higher gold (and soybeans, and corn, and what) goes, the faster the Fed will need to destroy the dollar, making the vicious loop of hyperinflation spin faster and faster... We dare the deflationists out there to look at the charts of coffee, barley, oranges, pork, cotton, rubber, iron ore, and tell us where is this much-hyped deflation...The right answer, of course, lies in one simple word - and as Santelli confirms what every Zero Hedge readers knows, it is "monetization." All that is well-known. What is more interesting is Rick's discussion of what will be the Fed's next step after another failed QE round: price target levels. This Santelli qualifies as a "Nixonian" approach of price, or specifically, yield controls, such as i.e., 2% on the 10 Year, and the Fed will keep bidding up securities until one after another target is achieved. Of course, for the abovementioned home equity values to reappear, the marginal cost of debt has to be as close to zero as possible, so that readers can refi into a new debt piece, which would make home prices essentially explode as consumer become price agnostic vis-a-vis taking one one dollar or one trillion in new loans: if the rate is zero, there is no cost. And this is what will ultimately happen, and be preceded by outright monetization and the collapse of the reserve currency system, and of monetarism as a result. That is, pure and simple, the end game. Naturally, all of Rick's logical objections to the Fed's launch on this road to dollar debasement will be ignored by the relevant people. Another amusing observation is the question by Jim Rickards addresed to Rick, and predicted by a Zero Hedge analysis on what is a statistically impossible perpetual upward revision in initial claims, as to whether "someone is finessing the data for the labor statistics." We agree and disagree with Rick that these adjustment are like noise in the grand scheme of things: agree in that indeed whether it is 450k or 455k is largely immaterial, when in both cases the economy is not generating jobs, yet when it comes to headline scanning robots, the difference can mean a world of difference to the marginal trader, who is being games by both the HFT system and the BLS bias. A last observation, on what will likely be the source of the next major rant by Santelli in the upcoming week, now that FX wars are the topic du jour, is Santelli's very correct highlighting of Geithner's hypocrisy in damning FX intervention by others, when the Fed is the biggest FX debaser courtesy of Bernanke's printing press, whose only purposes these days it appears is to end the dollar's status as a reserve currency. For all this and more, including Santelli's take on the upcoming mid-term elections, the link to listen to the always entertaining and informative Rick Santelli can be found here. |

| Eric King: Food stamp nation with massive inflation Posted: 09 Oct 2010 12:47 PM PDT 8:45p ET Saturday, October 9, 2010 Dear Friend of GATA and Gold: In a brief essay at the King World News blog, Eric King notes the commodity price inflation sweeping over the United States and wonders when the central planners and bankers who have brought the country low will be held accountable. King's essay is headlined "Food Stamp Nation with Massive Inflation" and you can read it here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2010/10/9_Fo... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Sona Resources Expects Positive Cash Flow from Blackdome, On May 18, 2010, Sona Resources Corp. (TSXV: SYS, Frankfurt: QS7) announced the release of a preliminary economic assessment for gold production at its flagship Blackdome and Elizabeth properties in British Columbia. Sona Executive Chairman Nick Ferris says: "We view this as a baseline scenario for gold production. The project is highly sensitive to the price of gold. A conservative valuation of gold at $1,093 per ounce would result in a pre-tax cash flow of $54 million. The assessment indicates that underground mining at the two sites would recover 183,600 ounces of gold and 62,500 ounces of silver. Permitting and infrastructure are already in place for processing ore at the Blackdome mill, with a 200-tonne per day throughput over an eight-year mine life. Our near-term goal is to continue aggressive exploration at Elizabeth and develop a million-plus-ounce gold resource, commencing production in 2013." For complete information on Sona Resources Corp. please visit: www.SonaResources.com A Canadian gold opportunity ready for growth Join GATA here: The Silver Summit New Orleans Investment Conference * * * Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Prophecy to Become Coal Producer This Year Prophecy Resource Corp. (TSX.V: PCY) announced on May 11 that it has entered into a mine services agreement with Leighton Asia Ltd. to begin coal production this year. Production will begin with a 250,000-tonne starter pit as planned in August, with production advancing to 2 million tonnes per year in 2011. Prophecy is fully funded to production and its management team includes John Morganti, Arnold Armstrong, and Rob McEwen. For Prophecy's complete press release about its production plans, please visit: http://www.prophecyresource.com/news_2010_may11.php |

| World finance leaders fail to resolve currency dispute Posted: 09 Oct 2010 12:42 PM PDT By Martin Crutsinger and Harry Dunphy http://news.yahoo.com/s/ap/20101009/ap_on_bi_ge/us_global_finance;_ylt=A... WASHINGTON -- Global finance leaders failed Saturday to resolve deep differences that threaten the outbreak of a full-blown currency war. Various nations are seeking to devalue their currencies as a way to boost exports and jobs during hard economic times. The concern is that such efforts could trigger a repeat of the trade wars that contributed to the Great Depression of the 1930s as country after country raises projectionist barriers to imported goods. The International Monetary Fund wrapped up two days of talks with a communique that pledged to "deepen" its work in the area of currency movements, including conducting studies on the issue. ... Dispatch continues below ... ADVERTISEMENT Prophecy to Become Coal Producer This Year Prophecy Resource Corp. (TSX.V: PCY) announced on May 11 that it has entered into a mine services agreement with Leighton Asia Ltd. to begin coal production this year. Production will begin with a 250,000-tonne starter pit as planned in August, with production advancing to 2 million tonnes per year in 2011. Prophecy is fully funded to production and its management team includes John Morganti, Arnold Armstrong, and Rob McEwen. For Prophecy's complete press release about its production plans, please visit: http://www.prophecyresource.com/news_2010_may11.php World Bank President Robert Zoellick said the rising economic tensions reflected a weak global recovery. "A lack of growth accompanied by high unemployment is having consequences," Zoellick told reporters at a news conference concluding the IMF-World Bank meetings. "There is a danger that countries will turn inward and, as a result, international cooperation falters. This could be dangerous." The communique essentially papered-over sharp differences on currency policies between China and the United States. The Obama administration, facing November elections where high U.S. unemployment will be a top issue, has been ratcheting up pressure on China to move more quickly to allow its currency to rise in value against the dollar. American manufacturers contend the Chinese yuan is undervalued by as much as 40 percent and this has cost millions of U.S. manufacturing jobs by making Chinese goods cheaper in the United States and U.S. products more expensive in China. China has allowed its currency, the yuan, to rise in value by about 2.3 percent since announcing in June that it would introduce a more flexible exchange rate. Most of that increase has come in recent weeks after the Obama administration began taking a more hardline approach and the U.S. House passed tough legislation to impose economic sanctions on countries found to be manipulating their currencies. Chinese officials continued to insist that their gradual approach to revaluing their currency was best, and that faster movements risked destabilizing the Chinese economy. Various other nations, including Japan, Brazil and South Korea, also have taken steps to keep their currencies weaker in an effort to increase their exports. And in the United States, expectations of further monetary easing by the Federal Reserve have driven the dollar down significantly against the euro and other major currencies. IMF Managing Director Dominique Strauss-Kahn said he did not view the outcome of the IMF discussions as a failure. He said they set the stage for further progress at the upcoming summit of leaders of the Group of 20 nations in November in Seoul and at future IMF meetings. The G-20 includes traditional economic powers such as the United States and Europe along with fast-growing economies such as China, Brazil and India. "I am not disappointed," Strauss-Kahn told reporters about the outcome of the two days of talks. Strauss-Kahn acknowledged that significant differences also remained on the question of reforming the IMF by giving China and other fast-growing economic powers greater voting rights and representation on the IMF board. The G-20 leaders are supposed to endorse a deal on IMF reform at their November summit. Treasury Secretary Timothy Geithner on Wednesday raised the possibility that awarding greater power to China in the IMF should be linked to an increased willingness of that country to reform its currency system. But Oxfam, an international aid group, criticized Geithner's comments. "The currency war cannot be used to hold IMF reform hostage," said Oxfam spokesperson Pamela Gomez. "The IMF can't do its job unless emerging economies are at the table." On Saturday, Geithner told the IMF's policy-setting panel that the organization must begin to speak more forcefully about how countries manage their currencies. The IMF's concluding statement did pledge to work for "stronger and evenhanded surveillance to uncover vulnerabilities in large advanced economies." Strauss-Kahn said he would personally participate in the annual economic reviews of the world's five or six largest economies, a group that would include the United States and China. But private economists were not impressed with the IMF's new commitments on surveillance. "The IMF ratcheted up the focus on exchange rate surveillance a few years ago and then eased off under pressure from China," said Eswar Prasad, a trade professor at Cornell University. French Finance Minister Christine Lagarde said Saturday that a successful resolution of the currency dispute with China would require a cooling of over-heated rhetoric about currency wars. "In a war, there is always a loser and in this situation there must not be a loser," she said. Join GATA here: The Silver Summit New Orleans Investment Conference * * * Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Sona Resources Expects Positive Cash Flow from Blackdome, On May 18, 2010, Sona Resources Corp. (TSXV: SYS, Frankfurt: QS7) announced the release of a preliminary economic assessment for gold production at its flagship Blackdome and Elizabeth properties in British Columbia. Sona Executive Chairman Nick Ferris says: "We view this as a baseline scenario for gold production. The project is highly sensitive to the price of gold. A conservative valuation of gold at $1,093 per ounce would result in a pre-tax cash flow of $54 million. The assessment indicates that underground mining at the two sites would recover 183,600 ounces of gold and 62,500 ounces of silver. Permitting and infrastructure are already in place for processing ore at the Blackdome mill, with a 200-tonne per day throughput over an eight-year mine life. Our near-term goal is to continue aggressive exploration at Elizabeth and develop a million-plus-ounce gold resource, commencing production in 2013." For complete information on Sona Resources Corp. please visit: www.SonaResources.com A Canadian gold opportunity ready for growth |

| Posted: 09 Oct 2010 12:09 PM PDT |

| Jim Sinclair: The Biggest Fraud Ever In Capital Markets Posted: 09 Oct 2010 10:24 AM PDT My Dear Friends, This is not an exaggeration. If anything, it might be an understatement. I told you about this last week as a class action with a RICO statute was filed against servicers acting for international investment banks foreclosing on loans that represented the collateral for securitized mortgage debt, a fraudulent OTC derivative. The banksters tried to sneak through a bill that would make their criminal actions legal. The screams were heard in the White House and before the bill passed all its requirements the President vetoed it. That occurred even before the bill had completed its required procedures. We are now in Crisis #2 which can eclipse anything you have seen yet because of the size of the creation of this pariah in the OTC derivative disaster. This will not pass quietly. It is going to tear the dickens out of what is left of the financial firms that brought the horror to the Western World. It will be orders of magnitude uglier than anything you have seen so far.Gold is headed to $1650 for starters. When it vaults, the price will move hundreds of dollars in a matter of days.When all this began, before others, I told you via JSMineset that "This is it! " Now I am telling you the final you know what has hit the fan. The geometric rise in gold and fall in the dollar are now at the doorstep. Are you ready? I am, everywhere and in every sense! 'This is the biggest fraud in the history of the capital markets' More Here..Jobless After 50? You May Be Out of Luck |

| The Biggest Fraud Ever In Capital Markets Posted: 09 Oct 2010 09:12 AM PDT My Dear Friends, This is not an exaggeration. If anything, it might be an understatement. I told you about this last week as a class action with a RICO statute was filed against servicers acting for international investment banks foreclosing on loans that represented the collateral for securitized mortgage debt, a fraudulent OTC derivative. The banksters tried to sneak through a bill that would make their criminal actions legal. The screams were heard in the White House and before the bill passed all its requirements the President vetoed it. That occurred even before the bill had completed its required procedures. We are now in Crisis #2 which can eclipse anything you have seen yet because of the size of the creation of this pariah in the OTC derivative disaster. This will not pass quietly. It is going to tear the dickens out of what is left of the financial firms that brought the horror to the Western World. It will be orders of magnitude uglier than anything you have seen so far. Gold is headed to $1650 for starters. When it vaults, the price will move hundreds of dollars in a matter of days. When all this began, before others, I told you via JSMineset that "This is it! " Now I am telling you the final you know what has hit the fan. The geometric rise in gold and fall in the dollar are now at the doorstep. Are you ready? I am, everywhere and in every sense! 'This is the biggest fraud in the history of the capital markets' Janet Tavakoli is the founder and president of Tavakoli Structured Finance Inc. She sounded some of the earliest warnings on the structured finance market, leading the University of Chicago to profile her as a "Structured Success," and Business Week to call her "The Cassandra of Credit Derivatives." We spoke this afternoon about the turmoil in the housing market, and an edited transcript of our conversation follows. Ezra Klein: What's happening here? Why are we suddenly faced with a crisis that wasn't apparent two weeks ago? Janet Tavakoli: This is the biggest fraud in the history of the capital markets. And it's not something that happened last week. It happened when these loans were originated, in some cases years ago. Loans have representations and warranties that have to be met. In the past, you had a certain period of time, 60 to 90 days, where you sort through these loans and, if they're bad, you kick them back. If the documentation wasn't correct, you'd kick it back. If you found the incomes of the buyers had been overstated, or the houses had been appraised at twice their worth, you'd kick it back. But that didn't happen here. And it turned out there were loan files that were missing required documentation. Part of putting the deal together is that the securitization professional, and in this case that's banks like Goldman Sachs and JP Morgan, has to watch for this stuff. It's called perfecting the security interest, and it's not optional. EK: And how much danger are the banks themselves in? JT: When we had the financial crisis, the first thing the banks did was run to Congress and ask for accounting relief. They asked to be able to avoid pricing this stuff at the price where people would buy them. So no one can tell you the size of the hole in these balance sheets. We've thrown a lot of money at it. TARP was just the tip of the iceberg. We've given them guarantees on debts, low-cost funding from the Fed. But a lot of these mortgages just cannot be saved. Had we acknowledged this problem in 2005, we could've cleaned it up for a few hundred billion dollars. But we didn't. Banks were lying and committing fraud, and our regulators were covering them and so a bad problem has become a hellacious one. EK: My understanding is that this now pits the banks against the investors they sold these products too. The investors are going to court to argue that the products were flawed and the banks need to take them back. JT: Many investors now are waking up to the fact that they were defrauded. Even sophisticated investors. If you did your due diligence but material information was withheld, you can recover. It'll be a case-by-by-case basis. |

| How High For Silver And Gold? Part I: Price-targets Posted: 09 Oct 2010 08:06 AM PDT For obvious reasons, there are few questions asked as regularly of precious metals commentators as "how high do you think the price of gold and/or silver can rise?" Before I look at what is implied when people ask that question, I will discuss the answers to that question – and what is implied by these estimates. The starting-point is to go back to when the bull market began for precious metals, at roughly the turn of the millenium. At that time, the small number of informed, precious metals commentators who occupied this niche were "estimating" that the price of gold could hit $1000/oz – with the more confident/bullish pundits suggesting that gold might even reach $2,000/oz. Skip-ahead to today, and now any experienced precious metals commentator who estimates $2,000/oz as a "ceiling" for the price of gold is seen as being extremely conservative. Veteran precious metals commentator, Lorimer Wilson, recently surveyed these analysts, to compile a list of such estimates – in order to set some parameters for these prices. He found five commentators currently suggesting that the price of gold could eventually exceed $10,000/oz, nearly two dozen who chose figures between $5,000 - $10,000/oz, and than another dozen who had specifically chosen $5,000/oz as their price target. He added more than two dozen other estimates of between $2,500 - $5,000/oz – and didn't include (or couldn't find) a significant number of informed commentators expecting anything less than that. What happened between then and now? Were those earlier commentators simply not as aware or astute with respect to the potential of precious metals? Hardly. As a commentator who was not one of the first to become an advocate for precious metals, I have great admiration for the "first generation" of commentators who were here before myself. Not only did they demonstrate superior insight in seeing what was happening before others, but they also demonstrated extraordinary courage and conviction in being ready to stand up and make their predictions for this sector – when it was literally the most-unloved asset-class among all Western investors. What has changed since $2,000/oz was originally seen as a long-term maximum for the price of gold is that our currency-debauching bankers keep "moving the goal-posts". Put another way, the bankers have accelerated the destruction of their cherished, paper currencies so rapidly that the earlier predictions were rendered obsolete. In short, while the original "gold bugs" were seen as extremists and alarmists, in fact their only 'sin' was to underestimate the monetary depravity of bankers. Thus, we have established the proposition that rather than being shrill "Chicken Littles", that precious metals commentators have been making sober, conservative appraisals of the economic harm caused by the extreme excesses of bankers – in the absence of a gold-standard. This leads us to a second proposition: given the reasonable, responsible efforts of precious metals commentators to apprise us of the relative appreciation of gold and silver versus banker-paper, the rate of change of such estimates provides a reasonable "proxy" for the speed at which the bankers are destroying these fiat-currencies – and most notably the U.S. dollar, the world's "reserve currency". It is extremely useful to identify such a proxy, living in a world where our governments use heavily-contrived statistical fictions as a means of deceiving rather than informing us. Listen to clueless, media talking-heads yammer on about a "gold bubble", listen to the same vacuous voices talk about "near-zero inflation", and you can rest assured that you will live in a state of perpetual ignorance regarding the rate of destruction of our paper currencies (and the paper wealth they represent). |

| Crude Oil: Next Major Resistance $87 a Barrel Posted: 09 Oct 2010 08:04 AM PDT By Dian L. Chu, Economic Forecasts & Opinions

The Euro appears to be gaining steam at the 1.39 level, and with QE2 starting in earnest could likely reach 1.45 by the end of the year as the inflation trade accelerates. This again would provide bullish support for Oil in the 4th quarter. (see euro chart)

|

| Posted: 09 Oct 2010 06:55 AM PDT Weekly Geopolitical Summary

Russia Makes Major Headway with South Stream Pipeline |

| Ready? Food Prices Set To Explode This Winter Posted: 09 Oct 2010 06:38 AM PDT Some recent headlines from the Financial Times: Soaring prices threaten new food crisis – Oct-08 Raw materials index soars to two-year high – Oct-08 Wheat and corn rise as Ukraine limits exports – Oct-07 Shortfall drives tin to record high – Oct-05 Food inflation is real, and it is here. A comment from a recent reader's post: "Just yesterday I compared my receipt from a grocery run to prices I have from the same exact store from September 15, 2009. Bacon? Up 52% to $13.69 from $8.99 for 4 lbs. Butter? Up 73% to $9.99 from $5.79 for 4 lbs. Pure vanilla extract up 14% to $6.79 from $5.95. Chopped dried onions up a mere 2% but minced garlic (wet) was up 32%." Defensive buying by investors worried about the inflationary effects of quantitative easing (QE) is behind the latest rise in gold, metals and food commodities to near record levels this week. Analysts have the usual litany of explanations: Chinese demand; plans for more QE from the Fed; a billion bushels of grain a year going to make ethanol….as Agricultural commodities prices exploded again on Friday, threatening higher global food prices, US forecasters slashed grains production estimates after adverse weather damaged crops worldwide. In Chicago, main agricultural commodities surged to daily fluctuation limits imposed by exchange rules, the FT reported. Traders, unable to use futures because of the daily limits, bid indicative corn prices to $5.60 a bushel in the options market, up 12.5 per cent. European wheat prices jumped by 10 per cent while the cost of other key commodities, including soyabean, sugar, cotton, barley and oats, also surged. More Here.. Global Leaders Fail To Resolve Differences That Threaten Full-Blown Currency War Read more: Here.. |

| Can You Spare 85,000 Tonnes Of Physical Gold Posted: 09 Oct 2010 06:17 AM PDT This is the amount that would be needed if same percentage of global financial assets would be switched from paper investments into gold assets (physical gold, gold stocks and ETFs) as they did in 1980 in last gold bubble. 85,000 tonnes of physical gold is equal to around 34 years of gold mining production!!! How [...] |

| [1176] The Truth About Markets London – 09 October 2010 Posted: 09 Oct 2010 05:18 AM PDT Stacy Summary: We're back with moral hazard, subsidizing bad behavior, devaluing currencies, gold vigilantes, banana republicanism, Tony Benn in Trafalgar Square, listeners' family selling their body in Camden Town, Eric Janszen, energy efficiency and wasted BTUs, when free energy used to mean 'communism' and it now means 'capitalism' and putting enough quantitative easing in front of the American people to inflate themselves to death. For more download & listening options, visit Archive dot org This posting includes an audio/video/photo media file: Download Now |

| The SLV ETF Now Holds 10,000 Tonnes! Posted: 09 Oct 2010 04:03 AM PDT We've arrived back in Bozeman, Montana and have mostly dug our way out from under a big pile of mail while assembling a big pile of dirty laundry and trying to put something together for the new issue of the Weekend Update at Iacono Research. In doing so, the run-up in the silver price and the SLV inventory are hard to ignore.

The nearly 30 percent rise in the price of silver over the last two or three months is quite impressive, but the almost 1,000 tonne increase in the the amount of metal held for the iShares Silver Trust ETF (NYSE:SLV) is even more so – if not in percentage terms, certainly in terms of weight to the tune of more than two million pounds or 35+ million ounces. Full Disclosure: Long silver bars, silver coins, and SLV at time of writing.

|

| Global Food Crisis: 6.8 Billion Served…and Counting Posted: 09 Oct 2010 04:00 AM PDT Paper is out; stuff is in. That's what the markets are telling us right now. The dollar, that esoteric, floating abstraction upon which the financial world erects its sandcastle economies, plumbed a new seasonal low this week, with the dollar index flirting dangerously with its support level of 77. "Stuff," as measured by the CRB Commodity Index, meanwhile, soared to within reach of the psychological 300-point milestone. Indeed, everywhere we look, stuff is on the march. Gold opened to another record above $1,365 on Thursday, then retraced a bit to around $1,345 as of this writing. Oil shot through $84 a barrel this week and copper busted the $3.75 mark, reaching ever closer to the 2008 high of $4.08. Not to be outdone, silver climbed to a fresh 30-year high, topping $23 per ounce by Friday morning. The message from Mr. Market, in anticipation of the Fed's QEII program (second round of quantitative easing – fancy jargon for "money printing") is clear: Increasingly, investors are coming to prefer the sober, welcoming embrace of physical materials to the unrelenting, drunken currency abuse perpetrated by the world's central bankers. In actual fact, there's not a whole lot that hasn't been rallying in dollar terms lately…except, of course, the reputation of those responsible for destroying its credibility. While the dollar index plummeted 12.4% from early June to the end of September – even as headlines persisted about a shaky euro – everything else has benefited. Our mates over at The 5 sketched up this neat little chart, which really puts the story in perspective:

One particularly notable – and worrying – component of the skyward global commodity trend can be found in the agricultural sector. The story here is part weak dollar and part supply-demand dynamic. Unlike metals or energy, however, the agricultural component of the commodity complex is not typically a "dollar diversification" tool for the emerging market's growing middle classes, or for the 1.2 billion (according to UN data) hungry souls around the world. For them, food is a necessity, not an investment strategy. The demand for dietary staples, therefore, does not enjoy the same price elasticity as does, say, an iPod or a spiffy new electric can opener. And, as the global population swells to 9 billion by mid-century, you can bet this is a trend with marathon legs. Partly due to this reality, farm commodities – or "ags" – have staged a remarkable rally this year. Wheat, for its part, is climbing back toward its 2008 crises levels. Prices have risen some 75% since June as the Black Sea region suffers through the most severe heat wave in nearly half a century. The affected area ordinarily produces roughly one quarter of the entire global output. Consequently, experts forecast Russia's harvest will come in around 60 million tonnes this year, well shy of the 75 million tonnes consumed domestically. Moscow has since implemented a ban on grain exports until late 2011. Chris Weafer, chief economist at Uralsib Financial, recently told The Financial Times that, even allowing for the country's emergency stockpile of 9.5 million tonnes, "We think Russia faces shortfall of 17 million tonnes and will have to import next year." Of course, supply shocks have been around as long as Mother Nature herself. Extreme weather patterns probably spawned the Biblical concept of the "seven fat years followed by seven lean years." Droughts in Australia, floods in Pakistan, heat waves around the Black Sea and cold snaps across the south all collude to hinder global production, and have done, in one form or another, for millennia. But now, more than ever, global population growth and the emergence of the middle classes in developing markets are trimming that critical margin for error. As Javier Blas reports in the FT, "…the most important underlying trend is the rise of emerging markets, where there are not only a growing number of mouths to feed, but where people with rising incomes want to eat higher-quality food – notably chicken, pork and beef. That in turn increases global demand for grain for animal feed." Corn, for example, is up more than 40% since June as global stock levels, with a "stock to usage ratio" of a paltry 12%, dipped to their lowest levels in almost four decades. Unfavorable weather patterns in the US kicked the rally off, but it was the revelation that China, feeding the fastest growing middle class on the planet, imported a record 432,000 tonnes in August that really kicked it into overdrive. This trend is all the more alarming, at least from a geopolitical perspective, when one considers that the US diverts a little over one third of its entire crop production to ethanol for fuel, a boondoggle that led one wry commentator to declare the program a blatant act of "unsustainable, government-sponsored food burning." To be sure, the hand of the state is always a dead weight on production, but when it comes to food, the matter quickly transforms from one of mere-to-moderate inconvenience to one of severe-to-apocalyptic life and death. Moreover, if analysts like John Clemmow of UBS are correct, what's on tap in the months to come could dwarf even the epic food crises of '08. "Clemmow maintains that despite riots and rationing at the time, there was no rice shortage in 2008," relayed The 5 earlier this week. "The shortage two years ago was the result of governments panicking over supplies." But "Unlike in 2008," says Clemmow, "there is now a possibility that with export bans in place, production problems in Pakistan and the strong suspicion that China and the Philippines will be importing in large quantities, we could be in for a fundamental squeeze." "Rice is the new iron ore," Clemmow concludes, "and corn the new gold." As the food crises of 2008 illustrated all-too-clearly, the world's dietary consumption habits seems to be approaching an important inflexion point, where a hungry emerging population literally eats into the market's ability to absorb supply shocks. It would be foolish, and immoral, to blame the hungry for demanding their daily bread…and equally blind to assume they'll ever be satisfied without it. Regards, Global Food Crisis: 6.8 Billion Served…and Counting originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." |

| Pat Heller: Metals suppressed again on eve of jobs report Posted: 09 Oct 2010 03:41 AM PDT 11:40a ET Saturday, October 9, 2010 Dear Friend of GATA and Gold: In commentary posted at Coin Update News, Pat Heller of Liberty Coin Service in Lansing, Michigan, remarks on the repeated clobbering of precious metals futures prices just before the release of the U.S. government's monthly jobs report. Heller's commentary is headlined "Once Again, Gold and Silver Prices Suppressed in Advance of Manipulated Jobs Report" and you can find it here: http://news.coinupdate.com/gold-and-silver-prices-suppressed-jobs-report... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Sona Resources Expects Positive Cash Flow from Blackdome, On May 18, 2010, Sona Resources Corp. (TSXV: SYS, Frankfurt: QS7) announced the release of a preliminary economic assessment for gold production at its flagship Blackdome and Elizabeth properties in British Columbia. Sona Executive Chairman Nick Ferris says: "We view this as a baseline scenario for gold production. The project is highly sensitive to the price of gold. A conservative valuation of gold at $1,093 per ounce would result in a pre-tax cash flow of $54 million. The assessment indicates that underground mining at the two sites would recover 183,600 ounces of gold and 62,500 ounces of silver. Permitting and infrastructure are already in place for processing ore at the Blackdome mill, with a 200-tonne per day throughput over an eight-year mine life. Our near-term goal is to continue aggressive exploration at Elizabeth and develop a million-plus-ounce gold resource, commencing production in 2013." For complete information on Sona Resources Corp. please visit: www.SonaResources.com A Canadian gold opportunity ready for growth Join GATA here: The Silver Summit New Orleans Investment Conference * * * Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Prophecy to Become Coal Producer This Year Prophecy Resource Corp. (TSX.V: PCY) announced on May 11 that it has entered into a mine services agreement with Leighton Asia Ltd. to begin coal production this year. Production will begin with a 250,000-tonne starter pit as planned in August, with production advancing to 2 million tonnes per year in 2011. Prophecy is fully funded to production and its management team includes John Morganti, Arnold Armstrong, and Rob McEwen. For Prophecy's complete press release about its production plans, please visit: http://www.prophecyresource.com/news_2010_may11.php |

| You are subscribed to email updates from Gold World News Flash To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

Here is the full report from the

Here is the full report from the

No comments:

Post a Comment