Gold World News Flash |

- Is the U.S. Selling Gold Reserves?

- 2010-09-02 Wellington West gold price forecast $1,400 in 2011 and 2012

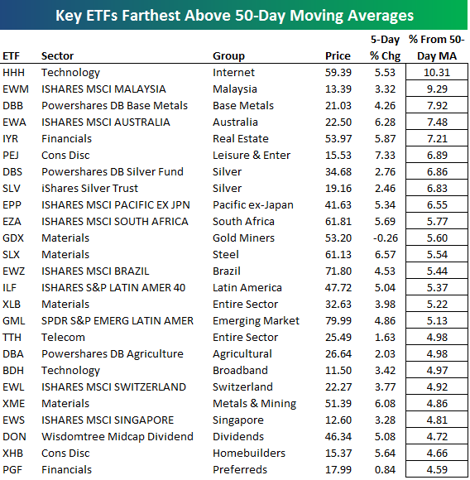

- Key ETFs Farthest Above 50-Day Moving Averages

- Friday Options Brief: TSN, PSS, XRT, BX

- Gold-Mining Margins

- My Friend the Bear

- Speculating in Gold

- Goldman Exposes The "Lend To Play" Conflict Scheme Involved In IPO Underwriter Allocation

- Nuts and Bolts of COMEX Silver Manipulation

- 10 Reasons This Is Not a Sustainable Rally

- DryShips: Come Aboard, Just Make Sure You Have Your Sea Legs

- How Will Census Workers Affect the Jobs Report?

- Another economic morsel from our friend, political cartoonist extraordinaire — Ed Stein

- Guest Post: Peak Denial About Peak Oil

- Gold Speculation During the Great Correction

- Member Contest: Free Bullion

- Bargain-Hunting in Gold?

- Speculating In Gold…?

- Schizophrenic Silver

- Bull Signal for Gold from Its Miners

- Confessions of a Gold Bug

- Signs of an Evil Economy

- 2011 Koala Silver Coins

- Jim O'Neill Is Back To Pitching The Great Consumption Potential Of Turkey, Bangladesh And Iran... Next Up - Uranus

- One of These Days

- Merchant Bank Becomes Gold Producer

- ECRI Declines, Passes Below "Double Dip" -10% Threshold Again

- How Japan and Switzerland Could Reshape the Currency Markets

- Stocks rally, treasuries, gold retreat on employment report

- Meanwhile, In Broken Correlation Land...

- Gold futures drop after better-than-expected jobs data

- Moving into Bonds: From Frying Pan to Fire

- Big Miss In ISM Non-Manufacturing Index, Employment Component Comes In Below 50, Lowest Since January

- Gold/Bonds Ratio Chart From Trader Dan

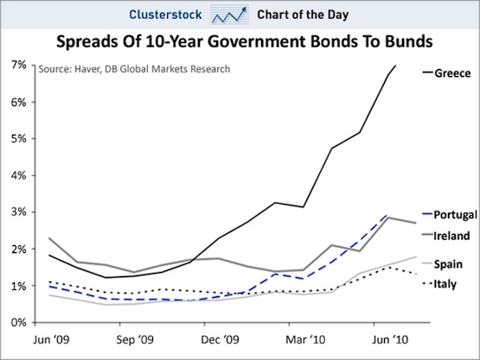

- Is a Default by Greece Inevitable?

- Gold Prices to Challenge All Time High

- "Dr. Doom" Roubini: The U.S. can't prevent a double-dip recession

- This could be the best time of the year to own gold and mining stocks

- Seven stocks returning more cash to shareholders

- Gold and Silver's Daily Review

- Gold & Silver Fall on US Jobs Data, But "Wealth Insurance" Needed as "Double-Dip Recession" More Likely

- Artist's Rendering Of Larry Summers' LinkedIn Profile

- Goldman On NPF: "Better Than Expected But Below Rate Needed To Keep Jobless Rate Stable"

- Why Can’t We Be More Like Chile?

| Is the U.S. Selling Gold Reserves? Posted: 03 Sep 2010 01:00 PM PDT We always have to remember that the Chinese are inscrutable. The Chinese government is very careful not to say any more than is necessary on anything. It's also very useful to have people, supposedly close to government makes statements that may appear to be government policy. Many of the statements come from people helping to lay a smokescreen for the true picture, or to get a reaction, like tossing a stone into a bush to see what flies out. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2010-09-02 Wellington West gold price forecast $1,400 in 2011 and 2012 Posted: 03 Sep 2010 10:42 AM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Key ETFs Farthest Above 50-Day Moving Averages Posted: 03 Sep 2010 05:57 AM PDT  Hickey and Walters (Bespoke) submit: Hickey and Walters (Bespoke) submit: Below we highlight the key ETFs that we follow that are currently trading the farthest above their 50-day moving averages. As shown, the Internet stock ETF (HHH) is currently on top of the list at 10.31% above its 50-day. Malaysia (EWM) ranks second at 9.29%, followed by Base Metals (DBB), Australia (EWA), and then REITs (IYR). A lot of times we'll see ETFs from one asset class clustered at the top of the most overbought list, but it is currently pretty diverse. Complete Story » | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Friday Options Brief: TSN, PSS, XRT, BX Posted: 03 Sep 2010 05:18 AM PDT Andrew Wilkinson submits: Tyson Foods, Inc. (TSN) – Call options on the food products company are a hot commodity this morning for bullish players positioning for a near-term rally in the price of the underlying shares. Tyson Foods’ shares rallied as much as 1.7% at the start of the session to an intraday high of $16.31. Shares of the producer and distributor of chicken, beef, pork, prepared foods and other products are perhaps higher following an upgrade to Ba2 from Ba3 by ratings agency, Moody’s Investors Service, on Thursday. Moody’s also lifted Tyson’s outlook to ‘positive’ from ‘stable’, citing continuing debt reduction for the food firm. Optimistic options investors breakfasted on call options, buying up roughly 5,600 calls at the September $17 strike for an average premium of $0.16 each. Call buyers at this strike are prepared to make money should Tyson’s shares surge 5.2% over today’s high of $16.31 to surpass the average breakeven price of $17.16 by September expiration. Bullish sentiment spread to the October $17.5 strike where traders purchased some 2,100 calls at an average premium of $0.33 apiece. These traders are poised to profit if TSN shares jump 9.3% to trade above the breakeven point to the upside at $17.83 ahead of expiration day in October. Increased investor demand for calls helped fuel a 20.4% hike in the stock’s overall reading of options implied volatility to 37.73% as of 11:00 am ET. Collective Brands, Inc. (PSS) – Long-term bullish action in Collective Brands’ LEAPs inspired a sense of déj` vu this morning as the same strategy observed today was also implemented on the holding company for Payless and Stride Rite during afternoon trading on Thursday. Collective Brands’ shares are currently up 1.75% to stand at $12.73 as of 11:20 am ET. The stock hit a new 52-week low of $12.41 yesterday after posting disappointing second-quarter results after the closing bell on Wednesday. A bullish risk reversal enacted by a contrarian strategist in the October contract in the previous trading session appears to be the same tactic utilized in the longer-dated January 2012 contract by optimistic players in the first 30 minutes of today’s session. Traders hoping Collective Brands’ shares continue to rally sold 5,000 puts at the January 2012 $10 strike for premium of $1.75 apiece and purchased the same number of calls at the higher January 2012 $12.5 strike at a premium of $3.30 each. The net cost of the bullish risk reversal amounts to $1.55 per contract. Thus, investors stand ready to profit should PSS shares jump 10.4% over the current price of $12.73 to surpass the effective breakeven price of $14.05 by expiration day in January 2012. Collective Brands was downgraded to ‘neutral’ from ‘positive’ with a target share price of $23.00 by analysts at Susquehanna this morning. Complete Story » | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 03 Sep 2010 05:17 AM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 03 Sep 2010 05:14 AM PDT A have come to know a fellow who does fixed income for a living. He can't write about it. He works for a name firm and moonlighting is "frowned upon". The reason for this policy is that one man's opinion may not be the published opinion of the firm. So my friend is kept in the dark. Sort of. His interesting thoughts on the NFP today. Also a strong recommendation on how to play it. A quick look at the data this morning, and an attempt to quantify the Labor Force Participation Rate: This is one of the first KEY data above expectations in quite a while, so it’s a good start, but 33 months after the recession started, we’re still LOSING jobs… so take the number into context. Overall though, the data is good – note the revisions to prior month: Bonds should / will read into potential inflation on the MoM Hourly Earnings data at 3x expectations… Two key factors I look at in this monthly report are Avg Weekly Hours Worked (as a clue to direction of future hiring) and Labor Force Participation (to make sense of the Headline UE number). …hours worked was steady after an upward trend since late 2009 – not too much to read into; will reserve judgment til next month… Labor Force Participation bounced up to 64.7% from 64.6%.... though on its own it has a negative effect on the Headline UE, it’s a good sign overall… To put this Labor Force Participation drop into perspective, let’s look at the raw numbers in UE Rate (all numbers SA)…. The fact of the matter is that we have more folks working this month than last: July: 138.96mil Aug: 139.25mil Change: +290k …but we also have more people unemployed (‘counted’ as unemployed, that is): July: 14.60mil Aug: 14.86mil Change: +260k …and let’s look at that in the context of the Labor Force: July: 153.56mil Aug: 154.11mil Change: +450k UE July: 14.6/153.56 = 9.50% UE Aug: 14.86/154.11= 9.64% so, obviously, jobs are “better”, but the UE is “worse” due to more participation in job searching… what to believe? I’ve mentioned many times in the past that the UE Rate is a faulty data point to consider in a debt deflationary cycle as the participation rate skews the data too much. (Actually, a case could be made that it is a contrary indicator at the turns) What’s been happening is that while the Civilian Population has been growing, the declining Labor Force Participation has not captured that in the UE Rate. Both the Labor Force and the number ‘counted’ as unemployed has leveled off to participation. Since Aug 2009, from the BLS Report: Civilian Population: +2.01mil Civilian Labor Force: -316k Number Employed: -183k Number Unemployed: -133k While that bottom line looks ok, it is also precisely the problem: there exist many more people who are out of a job but have given up looking, so they are not counted as part of the Labor Force. As a result, it looks like we’re improving in the numbers of unemployed. And as a result, we’ve seen headline UE in the 9.5-10% range since mid-2009: Aug 2009: 9.6% July 2010: 9.5% June 2010: 9.5% May 2010: 9.7% April 2010: 9.9% Aug 2009: 9.7% That looks steady, perhaps a base to build upon, but notice that this is exactly when Labor Force Participation Rate dropped off: To give better perspective, let’s quickly look at what would the jobs picture look like this month without the drop-out rate in Labor Force Participation: As seen in the chart above, current Labor Force Participation is at 64.7% having fallen off in the last 18months or so, from a baseline of 66.0% in 2008. Assuming that baseline held, we’d have a Labor Force of 157.145mil today (from current 154.11mil). Said differently, using this math around 3mil people left the Labor Force in the last year (reported BLS numbers are around 2.3mil). Using the Aug number of Total Employment (139.25mil), we calculate that the number counted as Unemployed would be 17.9mil today (up from the ’official’ 14.86mil). Hypothetical Aug UE at 66% Labor Force participation: 17.9mil / 157.145mil = 11.4% Here is that same exercise, using a hypothetical 66% Labor Force Participation Rate, and the real BLS data for Population and Number Employed, for the last few months and last year: Aug 2010: 11.4% July 2010: 11.5% June 2010: 11.3% May 2010: 11.1% April 2010: 10.9% Aug 2009: 10.5% So the August data really was better, but adjusted for drop in Labor Force Participation, the past year has been brutal; in stark contrast to the Headline UE Rate. Again, I’m going to put off concluding a trend for this month. At some point we will begin to run out of jobs to lose, so perhaps we’re getting there… I will say a “V”-shaped recovery this is not. From here I’ll let you draw your own conclusions on where we’ve been and where we’re going. While most of you know what I think, if you do not, I’ll just say I think it’s a great day to buy long duration, positively convex hi-grade paper. 8-15yr Agency bullets and even USTs are particularly out of favor at the moment….

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 03 Sep 2010 05:09 AM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Goldman Exposes The "Lend To Play" Conflict Scheme Involved In IPO Underwriter Allocation Posted: 03 Sep 2010 04:51 AM PDT Recently, the FASB opened up its "Accounting for Financial Instruments and Revisions to the Accounting for Derivative Instruments and Hedging Activities—Financial Instruments (Topic 825) and Derivatives and Hedging (Topic 815)" to public comment: a process which seeks to establish and develop "standards that generally require the increased use of fair value in financial reporting" when it comes to accounting for loss provision on financial assets and trading liabilities "not held for trading" (i.e. as part of the "banking book"). In other words, this is a direct attempt at providing some much needed transparency when it comes to the maze of liabilities that are "held to maturity" and thus, according to current FASB regulations, exempt from Fair Value, and Mark To Market adjustments. It is precisely this toxic hodge podge of bad loans that currently makes up the bulk of bank books, as firms like JPM and Wells Fargo are not required to make these to anything resembling reality, assuming fair value is equivalent to par throughout the life of the loans, and which as a result are materially mispriced. It is this "weakest link" that will inevitably serve as the next financial crisis focal point, once price discovery is forced upon all these "assets." One of the firms providing their input on this critical topic is none other than Goldman Sachs. Since Goldman, unlike the other TBTFs is merely a hedge fund, and is not reliant on warehousing loans (although it sure was good at originating CDOs), the bank sees to gain (but more importantly its competitors have lots to lose), should fair value of of such banking book assets be market to market. Which explains why Goldman's Matthew Schroeder says that: "the current model does not provide investors in large, complex financial institutions with an accurate picture of a company’s financial position and does not foster sound risk management. This latter point is crucial, as poor risk management was at the heart of the financial crisis. The consequences of such decisions can have a significant effect on financial stability." It is not surprising that on this one aspect, Goldman will be all for enhanced transparency: after all, Goldman is the Wall Street firm that has the least reliance on the traditional Wall Street model, as the bulk of its revenues come in the form of daily trading profits, with any risky holding promptly sold off to other more gullible investors. Yet where the letter gets interesting, is the very detailed explanation by Schroeder, of the "Lend To Play" practice, better known as "relationship loans" involved as part of IPO underwriting management syndicate allocation. In simple terms, according to Goldman, Wall Street IPO managers are only allowed on the IPO team if they commit to providing a loan to the same company, typically on far less than advantageous terms to the underwriter (a process Goldman explains as equivalent to writing a credit default swap on the issuer for the difference between the NPV of the full value of a revolver or a term loan and the periodic commitment fee). And since it is the bank's money that effectively is part of the firm's capital structure, it makes it all too clear that banks have a definitive bias to be extremely bullish in their sell side research on firms which they IPO, as it is their money, albeit higher in the capital structure, that could be impaired should the IPO candidate not trade up as expected. This was most recently exhibited by GM, which demanded that all firms who are part of its IPO syndicate provide the firm with credit facilities, if not direct debt investments. This is a glaring conflict of interest, yet the fact that a Wall Street firm has no problem describing this process as a daily occurence makes one wonder just how much fear of regulatory retribution or, heaven forbid, enforcement there is (hint: none at all). Here is the process described in Goldman's own words:

Goldman also makes it clear, that as a result of ancillary kickbacks in the form of other transaction fees, the banks are "incenivzed", despite their will, to price such "relationship loans" not at fair value, but at a price that is disadvantageous to the primary issuer. Of course, once it is out in the open market, secondary trading takes a cue from the primary issuance price, and end buyers result in overpaying for loans that have substantially more endogenous risks. And unlike the primary issuer of the loan, these secondary purchasers do not have the hedge of secondary revenue streams to cover losses associated with a "relationship loan" gone bad.

While, Goldman admits, this is not a brand new phenomenon, it has gotten substantially more acute in recent years:

Where it gets even more interesting is that Goldman acknowledges that the lender is fully aware of the explicit mispriced risks in the "contract" or issuance price of the loan.

In the following Appendix, Goldman present a real life example of precisely this phenomenon in action, and derives the precise impairment associated with the misrepresentation of the fair value of the loan on the books of the holders. In other words, in a perfect world, lenders of "relationship loans" would be forced to immediately write down their investment materially, with the loss amortizing to par over the life of the note. This makes a lot of intuitive sense, as this impairment is effectively the counterparty risk associated with agreeing to a long-term credit instrument with an entity that may very likely not survive through the duration of the original loan. Yet this is something that never happens in the banking community, and in fact, the opposite is prevalent, where banks misprice loans far to the upside in order to pad their underwater capitalization ratios (see Repo 105-like scams committed by virtually every single bank with a loan book). Setting aside the fact that loans, both those held on books, and traded in the secondary market, are by implication largely mispriced (although one could make the argument that sophisticated investors should be able to adjust for this syndicator arbitrage... of course one could also make that claim of CDO purchasers in 2006 and 2007), the bigger question is just how major the conflict of interest is to the firms that serve as both lender and IPO underwriter: does one realistically see the possibility of a bank issuing anything less than a Buy or a Strong Buy in a name in which it was forced off the bat to put in debt capital, and whose equity buffer could be largely impaired if the same firm's Sell rating were to decimate the equity market cap? Perhaps, once the SEC is done dismantling HFT, it can take a look at the practice of "Lend to Play" which could promptly become the biggest threat to investor wealth, as more and more companies are going public in anticipation of a market peak. And going back to the original topic of transparency, Goldman takes the following stab at those firms who will fight tooth and nail to block increased transparency into the banking book model:

We, for one, are not holding our breath on the FASB doing anything that forces banks to disclose the sorry state of their "held to maturity" books. Any inkling of that occuring would result in an immediate hit to the tune of at least $250 billion and possibly far more: this is an amount which with the recent weakness in the XLF, banks would simply not be able to sustain, endless blatherings to the contrary by Dick Bove aside. We are far more concerned by the implications of the just disclosed "cast study" by Goldman, which exposes yet another perspective in the endless conflict of interest game, so shrewdly played by Wall Street each and every day. For those curious, here is a real world example of the Lend To Play phenomenon presented by Goldman: Appendix: Real World Examples of the “Lend to Play” Phenomenon Example #1: Banks Required to Commit to Credit Facility to Participate in Underwriting and IPO Background The following is a typical example of a transaction involving an IPO where the company going public required the banks competing for the IPO business to commit to a credit facility in order to participate as an underwriter in the IPO. We have not used actual names in this example, have simplified some facts and rounded off some of the figures in order to avoid disclosing any non-public information. Company X is a private company owned by a group of financial sponsors (“Sponsors”). Company X solicited a number of large banks to serve as underwriters in its IPO. The solicitation process included a formal “request for proposal” (RFP) which included a number of specific questions and requirements that the banks had to address during their “pitch.” One of the requirements in the RFP was for each bank had to commit to a 3 year extension of an existing revolving credit facility (“Revolver”) that was set to mature in 2.5 years time in order to have a significant role in the IPO. There were minimum commitment sizes based on the title awarded to each bank, and a bank that did not make this minimum commitment would not be considered a candidate for a significant role in the IPO regardless of its qualification. The expected size of the IPO was $5 billion, although the actual size could have been larger or smaller depending upon a variety of factors, including market conditions at the time of the offering. The total fees payable to the underwriters in the IPO was estimated to be approximately $175 million (or 3.5% of deal size). In addition, the underwriters in the IPO would be in an advantageous position to serve as the underwriters for any future follow-on equity offerings as the Sponsors sell down their retained stake in Company X. These underwriters would also be likely to lead future bond offerings for Company X and would be well positioned to earn other advisory fees (e.g., for merger transactions). Thus, the total fee potential for the underwriters is significant, but they can only participate in earning those fees if they also commit to the Revolver. The total size of the extended Revolver is $2 billion and substantially all of this commitment will be sourced from banks that are underwriters in the IPO. Key Terms of the Extended Revolver The key terms of the Revolver are as follows:

Fair Value of the Revolver In this situation, there is reliable evidence that the fair value of the Revolver is significantly less than the contract price (i.e., the Revolver commitment represents a net liability at the contract date). However, the banks participating in the Revolver are willing to participate because of “other factors,” specifically the other fees they expect to earn in connection with the IPO and subsequent underwriting and advisory transactions. (As discussed above, under current accounting rules, participants that hold the Revolver in their “banking book” would not properly record the pricing discount thereby overstating their investment banking revenues.) There are several forms of reliable evidence to calculate the fair value of the Revolver at the contract date. Method One: Comparing Undrawn Fee to Credit Spread on Funded Loan One method to estimate the fair value of the Revolver involves comparing the interest rate charged by the lenders on amounts borrowed under the Revolver relative to the annual fee on undrawn amounts. A lender under the Revolver is exposed to Company X’s credit risk even if the Revolver is undrawn because an undrawn commitment represents an obligation to lend to Company X through the maturity day of the Revolver. In other words, the undrawn Revolver is similar to a bank writing a credit default swap on Company X’s credit since the bank has been exposed to Company X’s credit risk without actually funding a loan. Method Two: Comparing Undrawn Fee to Cost of Credit Default Swaps A second method that can be used to calculate the fair value of the Revolver is to look at the cost of purchasing insurance against a default by Company X. Given that an unfunded Revolver is akin to writing credit default protection, a lender can hedge its exposure by purchasing insurance in the form of loan credit default swaps (LCDS). This would put the lender in a “neutral” position since any loss incurred by the bank on the Revolver as a result of a default (relating to amounts drawn prior to default) would be offset by the “gain” on the LCDS that it purchased. At the time the Revolver was entered into, Company X had senior secured LCDS contracts that provided holders with protection on debt obligations with the same level of seniority as the Revolver. The cost of purchasing a 5-year LCDS was approximately 2.6% per year. Accordingly, a bank participating in the Revolver that wanted to hedge its risk could purchase LCDS protection in an amount equal to its Revolver commitment. The cost of purchasing this protection for 5.5 years (on a present value basis) would be approximately 10.2% of the Revolver commitment whereas the upfront and ongoing fees associated with the Revolver commitment total 2.0% on a PV basis. Accordingly, under this hedging approach, the fair value of a Revolver commitment illustrates an upfront cost of approximately 8.2% of the notional commitment. Conclusion Based on the above methodologies, the fair value of the Revolver is approximately 91-92% of the notional commitment amount. This would imply an upfront loss of approximately $8-9 million for a bank that agrees to a $100mm commitment. Under current accounting rules, banks that hold their Revolver commitments in their “banking book” would not properly record the pricing discount even though the Revolver commitment was made on these borrower-friendly terms with the expectation that such lending would create other opportunities to generate fees for the lending bank. Full Goldman Sachs response. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Nuts and Bolts of COMEX Silver Manipulation Posted: 03 Sep 2010 04:04 AM PDT By Bix Weir, SilverSeek The silver market is one of those puzzles that continues to challenge our understanding of free market concepts because it is MASSIVELY volatile for such a stable supply/demand dynamic. When was the last time you heard of a gigantic silver discovery that would drastically increase the supply of silver? Or a new manufacturing technology that will replace the ever increasing demand for industrial silver? Let me save you some time…you have never heard of any drastic changes in the supply/demand equation. So why are silver prices so volatile when everything else related to physical silver isn't? Taking a deep look at the details of COMEX silver trading can be very illuminating as to why but when you understand what is really going on… it is downright infuriating! I've put together a rare glimpse into what REALLY happens when buyers and sellers get together to make a market in silver on the COMEX. I hope you are sitting down because this covers just 5 MINUTES of a ordinary trading day… September 1, 2010: COMEX silver traded sideways almost all day. This is predictable as there was no earth shattering news of a huge discovery or massive industrial purchase coming out of the mainstream media. Other than a brief spike up to 19.535 at 8:38:07 (likely people were trying to make a run at the highs in both gold and silver) the market was drifting down a bit, and traded in a tight range between 19.35 and 19.40. Ho hum. Suddenly, the trading action changed dramatically. Starting at 13:20:00 (5 minutes before the COMEX floor close in silver), someone started to press the market down, and they in fact got a print at the low of the day at 19.32. To accomplish this they had to sell 215 contracts. Did someone panic OR was this a manipulation of the price lower (which is illegal)? Then, turning on a dime at 13:22:30 (2.5 minutes before the COMEX floor closed), they started buying all available liquidity. At this time of day (final two minutes), the market participants and market makers are the most active. It's the highest liquidity in the day. So, they started buying all they could, and drove the price quickly back up to 19.40. They didn't go above that price. They just bought all they could for the final 2.5 minutes, gingerly, not wanting to rally above 19.40. In the end they had bought 853 contracts. When the dust settled they basically were able to buy a net 638 contracts in the final 5 minutes of COMEX silver trading, without causing a price rise. They were able to do this, since they knew when the potential liquidity would be the largest of the day, and they started with a head-fake down move, to get extra sellers. If they had simply started buying, they would have created a much larger price rally. This "play by play" account really shows the nuts and bolts of manipulation as it happens. When you equate this to physical silver the numbers are staggering. This was basically a paper dump of 1,075,000 oz of silver to rig the price lower hitting stop losses and the clueless panickers only to buy back 4,265,000 oz of silver within minutes. The net effect… 3,190,000 oz of silver bought ALL IN 5 MINUTES WITHOUT EFFECTING THE PRICE OF THE METAL! They are clever crooks but they are crooks none the less. Read more…. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 10 Reasons This Is Not a Sustainable Rally Posted: 03 Sep 2010 03:56 AM PDT Bret Jensen submits: We continue to have a nice start to the month of September as the market continues to rally after a better than expected jobs report. Despite the nice start to the month, here are ten reasons that we believe this is just a move up to the top end of the trading range we have been in for months and not a sustainable rally. 1. Although the jobs report beat expectations, job growth is nowhere near the level we need to maintain employment; let alone fuel real job growth. 2. Furthermore, the U6 unemployment is 16.7%; the highest since April. In addition, the direction of job growth is down. July had private sector jobs added was 107,000; August had only 67,000 jobs added. 3. The direction of GDP is also down from over 5% in Q42009 to 3.7% in Q12010 to 1.6% in Q42010 4. The projected job growth in 2011 keeps coming down as well. Latest consensus is 1.8% from 2.3% 5. Health care premiums charged to workers are going up as result of Obamacare, and will start to be deducted out of worker’s paychecks. This is hardly a good thing for consumer spending or confidence 6. The capital of Pennsylvania just missed a bond payment and is considering bankruptcy. The last thing the economy needs is turmoil in the municipal bond market 7. The Mariner rig fire will likely prevent any quick end to the administration’s job killing drilling moratorium in the Gulf. Having highly paid oil workers sit idle is hardly what the Gulf economy needs right now 8. Retailers continue to have to resort to discounting to move merchandise according to the recent retail sales report. This is not good for margins, and a poor indicator of consumer confidence 9. The peak of Federal stimulus spending has now passed and its contribution to anemic GDP growth will lessen in the quarters ahead 10. Potential crises overseas continue to roil just below the surface a. The overheated property sector bubble in China could very well pop by the end of the year b. Ireland is a disaster and could be next European country to need help from the ECB c. The financial system in Afghanistan is on verge of collapse due to a massive fraud and a run on its third largest bank. Given this, enjoy the rally while it lasts and stay careful out there.

Complete Story » | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| DryShips: Come Aboard, Just Make Sure You Have Your Sea Legs Posted: 03 Sep 2010 03:47 AM PDT Daniel Long submits: When the rumor mill gets going about a potential buyout target, investors can generally become interested for one of two main reasons. The first is when the potential target has a strong foothold on technology, staff or demographics that the potential suitor perceives as essential to its future earnings growth or even survival. When this is the case, shares for the firm being bought will often have high multiples due to big R&D and other costs relative to current earnings. The buyer in this case will likely be overlooking the value concerns just to get their hands on what they so desperately need, and a bidding war can easily ensue. Because of this, however, the stock tends to rise quickly, well before any buyout is announced, and can often trade higher than what is ultimately paid. The other less exotic scenario occurs when a company has great long term fundamentals, but has been beaten down by short term forces. The buyer of these types of companies is generally looking for a solid investment to add to their balance sheet, something that will generate income right away. When this happens, the stock will likely see less action leading up to a deal, and a premium is often paid. This is because traders believe that the potential suitors will be more likely to low-ball any offers, and will have plenty of time to wait. The financial condition of the prey in this case is often the determining factor as to what price is paid. As different as the results can be for investors of these two scenarios when the sitting ducks are eventually acquired, a further divergence in results can occur if the companies are in fact not bought out. When something that was in dire need suddenly is not, chances are it will be left on the curb. Investors holding a value play, on the other hand, may benefit from the strong fundamentals that kept them from being overtaken in the first place. Complete Story » | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| How Will Census Workers Affect the Jobs Report? Posted: 03 Sep 2010 03:45 AM PDT It was a ping-pong day for the currencies, back and forth over the net… The net being the "level of the day"… For instance, the Aussie dollar (AUD) played over the 91-cent net all day, and the euro played over the 1.2820 level all day. The data on Thursday was all over the board, which may have acted as the paddles for the ping-pong day… The big news was that the European Central Bank (ECB) kept their stimulus in place and did not even mention any "exit plans" for that stimulus. You may recall that the last time the ECB began to remove stimulus, it just happened to run into the exposure of the deficit dilemma in the Eurozone… Obviously, that stimulus removal was stopped at that time. The ECB did revise upwards their growth forecasts for the second half of the year… That's kind of cheating don't you think? I mean, two of the six months in the second half have already posted their growth figures! But, they did revise them upwards, which is more than I can say for… Oh, never mind, I'm not going to open that wound on a Friday! So… I've been in the saddle at my desk for about 40 minutes right now, and from what I've seen in the currencies is that the game of ping-pong will continue to be played today… That is, of course, unless we get a Big Surprise in the Jobs Jamboree this morning… Yes, it's a Jobs Jamboree Friday, and here's the skinny on what I see happening today… First of all, you've just gotta love the way the Bureau of Labor Statistics (BLS) now breaks out the "private payrolls" from the overall figure, so that people can see the census workers getting cut… Just think back when all those census workers were being added, there was no "breaking out" of those numbers… No way! The BLS, government and media happily talked about all the "jobs that were being created"… Disgusting I know, but it's a Friday before a Holiday Weekend, so I'm going to leave that laying right there. So… Here's what I see… The overall number of jobs lost in August will total -100,000… But when the "private payrolls" are broken out, we see that the US probably created around 40,000 jobs… And the unemployment rate will probably tick up 0.1 to 9.6%… Let's accentuate the positive here… And say, YAHOO for the 40,000 jobs created, right? Yes, we should… However, 40,000 isn't anywhere close to the number of jobs that need to be created to sustain a strong or recovering economy… So… How will the markets view this report? That, my friends is the rubber hitting the road, this morning. All I keep seeing on the TV this morning are rumors that the White House is thinking about new ways to stimulate the economy… Can you say Japan circa 1997? I can, because I was there, trading currencies and remember it very clearly… Japan suffered a bubble popping in the early '90s, their stock market basically crashed, and their economy stumbled, fumbled, and ended up on its face… The Japanese government tried everything… They did multiple stimulus packages… They cut interest rates to the bone… They implemented quantitative easing… This went on for a decade, and still no gains in their economic growth, deflation had settled in all around them, and as the Japanese turned the calendar on a new millennium, all they had to show for all they tried to implement was a national debt to beat all national debts, ever! Now… Hopefully, you see why I've said for almost eight years now that the US was turning Japanese… Yes, I really think so! Just want to be perfectly clear on that, for someone told me yesterday that the Pfennig was "totally incomprehensible" … I had a good laugh at that one! So… Don't be surprised if in the next couple of weeks you hear about a "new and improved" stimulus package… Of course, if the stimulus money that's already been spent had been put to work properly, and not on pork projects, we might have seen some results, but even then I doubt it, for the government has to get its hands out of the cookie jar! The government needs to cut spending, stop manipulating the markets, and shrink… Now, those would be worthy things to do to help the economy… That, and taking the governor off small businesses. OK… Of course that's what I would do if I were "king for a day"… Along with many other things… Gold has had a good week overall, but the last two days have been very choppy… Up $5 one minute, and down $3 the next… I would have to think that today's Jobs Jamboree outcome will give gold a boost… That is, unless there is a surprise. But as soon as the jobs data is printed, I can see the NY trading desks clearing out, with the boys and girls heading to the Hamptons… And then the volume in markets gets thinned out, and by early this afternoon, the activity in the markets will be null and void of anything! So… Any follow-through on the morning's trading will not happen today… So be careful out there today, when you have thin markets, the volatility can be wild and crazy. Like I said at the top… The Aussie dollar went back and forth over the 91-cent net yesterday, and that's all I've seen it do this morning, since I came in. Notice how all the talk about the election outcome that filled the news from Australia a couple of weeks ago – and weighed on the Aussie dollar – has faded, and allowed it to recover… This is what I was talking about last week when I said that the markets lose their focus too quickly these days… But in the case of the Aussie dollar and the elections, this was a good thing! The Canadian dollar/loonie (CAD) has lost its mojo for now, but it might find it next week when the Bank of Canada (BOC) meets on September 8th… Recall that the markets have given up on a rate hike from the BOC, while I went out on the fat limb and said I was keeping the light on for a rate hike from the BOC at their 9/8 meeting. Should the BOC go ahead and hike rates, as I expect them to do, and not see the BOC talk down the rate hike, then the loonie could very well get is mojo back… Yeah, baby! (In my best Austin Powers voice) The Brazilian real (BRL) took off yesterday, and never looked back! The real began to rally in the morning with the other currencies, but as the other currencies began to back off and play ping-pong, the real continued to gain ground versus the dollar. Now… The question is this… Can the real hold onto these gains and not give them up, like they've done all year… Have a good month, and then sell off… Have a good month, and then sell off… Overall, year-to-date, the real is only up 1%, but then add in their high interest rate, and the overall return isn't anything to throw out with the bathwater. The Japanese yen (JPY), has gained 10% year-to-date, but has no yield, but again… Not to be thrown out with the bathwater! Then there was this… The Economist ran a story that caught my eye… The magazine notes that "a return to recession is possible for the US, especially if Congress won't act to prevent reduced government spending and the Federal Reserve can't bring itself to offset contractionary forces in the economy. Another way of putting this is… That the risk of a double dip is entirely political in nature." Hmmm… This is one of those times that I'm going to disagree with The Economist… The cards have already been played, so anything the government does now, is too little too late… And… The government needs to get out of the markets and stay out! Oh! And what's up with The Economist not wanting the government to cut spending? Makes no sense to me… But, now you see that even The Economist can be on the other side of the fence from me! To recap… It was a day of tight ranges for the currencies ahead of the Jobs Jamboree this morning. Chuck thinks that 40,000 jobs will have been created but overall 100,000 jobs will have been lost, when taking in the Census workers. This is not the kind of jobs report that a recovering economy wants to see… And it's up in the air as to how the markets will react to this report… There was a day, long ago, when I could say without a doubt, that job creation would be good for the dollar, and job losses would be bad for the dollar… Not any longer… The mental giants in the markets have seen to that! Chuck Butler How Will Census Workers Affect the Jobs Report? originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Another economic morsel from our friend, political cartoonist extraordinaire — Ed Stein Posted: 03 Sep 2010 03:44 AM PDT "With a wave of the hand, the Federal reserve has institutionalized printing money (monetizing the debt) as part of public policy. At this juncture the projected monetization is small compared to the overall additions to the national debt, but whatever the amount, it sets a bad precedent. … … For those of us who remember the Jimmy Carter years, Federal reserve policy under Ben Bernanke looks like the Arthur Burns' chairmanship on steroids. In all the years I have tracked Federal reserve policy, I cannot remember a time when printing money was presented to the public as the economy's saving grace and brought front and center as a national policy. Even when it was done in the past, it was done discreetly with the hope that no one would notice. Helicopter Ben is certainly living up to his reputation." … as featured in the latest newsletter, USAGOLD News, Commentary and Analysis, by Michael J. Kosares. Sign-up for our NewsGroup or request our FREE Introductory Information Packet to ensure that you don't miss out on a single issue! | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Guest Post: Peak Denial About Peak Oil Posted: 03 Sep 2010 03:34 AM PDT Submitted by Jim Quinn of The Burning Platform Peak Denial About Peak Oil It is par for the course that with oil hovering between $70 and $80 per barrel Americans have continued to buy SUVs and Trucks at a rapid pace. Politicians don’t have constituents screaming at them because gas is $4.00 per gallon, so it is no longer an issue for them. They need to focus on the November elections. It is no time to discuss a difficult issue that requires foresight and honesty. It is no time to tell the American public that oil will be over $200 a barrel within the next 5 years. Anyone who would go on CNBC today and declare that oil will be over $200 a barrel would be eviscerated by bubble head Bartiromo or clueless Kudlow. Bartiromo filled up her Escalade this morning for $2.60 a gallon, so there is no looming crisis on the horizon. The myopic view of the world by politicians, the mainstream media and the American public in general is breathtaking to behold. Despite the facts slapping them across the face, Americans believe cheap oil is here to stay. It is their right to have an endless supply of cheap oil. The American way of life has been granted by God. We are the chosen people.

A funny thing happened on our way to permanent prosperity and unlimited cheap oil. The right to prosperity was yanked out from underneath us by the current Greater Depression. The worldwide economic downturn has masked the onset of peak cheap oil. Therefore, when it hits America with its full fury, it will be a complete surprise to the ignorant masses and the ignorant politicians who run this country. A Gallup Poll in August asked Americans about our most important problems. Where is the concern about future energy supplies? It isn’t on the radar screens of Americans. They are probably more worried about whether The Situation will hook up with Snookie on the Jersey Shore reality show.

It is not surprising that the American public, American politicians, and the American media don’t see the impending crisis. The organizations that have an interest in looking farther than next week into the future have all concluded that the downside of peak oil will cause chaos throughout the world. The US Military, the German Military, and the UK Department of Energy have all done detailed studies of the situation and come to the same conclusions. Social chaos, economic confusion, trade barriers, conflict, food shortages, riots, and war are in our future.

http://www.acus.org/docs/051007-Hirsch_World_Oil_Production.pdf The U.S. was warned in 2005. Its own Department of Energy commissioned a report by Robert Hirsch to examine peak oil and its potential consequences to the US. The introduction stated: “The peaking of world oil production presents the U.S. and the world with an unprecedented risk management problem. As peaking is approached, liquid fuel prices and price volatility will increase dramatically, and, without timely mitigation, the economic, social, and political costs will be unprecedented. Viable mitigation options exist on both the supply and demand sides, but to have substantial impact, they must be initiated more than a decade in advance of peaking.” The main conclusions reached by the experts who worked on this report were:

The Hirsch Report clearly laid out the problem. It urged immediate action on multiple fronts. It is now 5 years later and absolutely nothing has been done. In the meantime, it has become abundantly clear that worldwide oil production peaked between 2005 and 2010. The Hirsch Report concluded we needed to begin preparing 20 years before peak oil in order to avoid chaos. We are now faced with the worst case scenario.

http://www.fas.org/man/eprint/joe2010.pdf The US Military issued a Joint Operating Environment report earlier this year. They have no political motivation to sugarcoat or present a dire picture. This passage is particularly disturbing:

A severe energy crunch is inevitable without a massive expansion of production and refining capacity. While it is difficult to predict precisely what economic, political, and strategic effects such a shortfall might produce, it surely would reduce the prospects for growth in both the developing and developed worlds. Such an economic slowdown would exacerbate other unresolved tensions, push fragile and failing states further down the path toward collapse, and perhaps have serious economic impact on both China and India. At best, it would lead to periods of harsh economic adjustment. To what extent conservation measures, investments in alternative energy production, and efforts to expand petroleum production from tar sands and shale would mitigate such a period of adjustment is difficult to predict. One should not forget that the Great Depression spawned a number of totalitarian regimes that sought economic prosperity for their nations by ruthless conquest. Here is the summary of their analysis:

To generate the energy required worldwide by the 2030s would require us to find an additional 1.4 MBD every year until then. During the next twenty-five years, coal, oil, and natural gas will remain indispensable to meet energy requirements. The discovery rate for new petroleum and gas fields over the past two decades (with the possible exception of Brazil) provides little reason for optimism that future efforts will find major new fields. At present, investment in oil production is only beginning to pick up, with the result that production could reach a prolonged plateau. By 2030, the world will require production of 118 MBD, but energy producers may only be producing 100 MBD unless there are major changes in current investment and drilling capacity. By 2012, surplus oil production capacity could entirely disappear, and as early as 2015, the shortfall in output could reach nearly 10 MBD. Energy production and distribution infrastructure must see significant new investment if energy demand is to be satisfied at a cost compatible with economic growth and prosperity. Efficient hybrid, electric, and flex-fuel vehicles will likely dominate light-duty vehicle sales by 2035 and much of the growth in gasoline demand may be met through increases in biofuels production. Renewed interest in nuclear power and green energy sources such as solar power, wind, or geothermal may blunt rising prices for fossil fuels should business interest become actual investment. However, capital costs in some power-generation and distribution sectors are also rising, reflecting global demand for alternative energy sources and hindering their ability to compete effectively with relatively cheap fossil fuels. Fossil fuels will very likely remain the predominant energy source going forward.

Just this week, the German magazine Der Spiegel obtained a confidential study about peak oil that was done by the German military. According to the German report, there is “some probability that peak oil will occur around the year 2010 and that the impact on security is expected to be felt 15 to 30 years later.” The major conclusions of the study as detailed in Der Spiegel are as follows:

Even the International Energy Agency, which has always painted a rosy picture of the future, has even been warning about future shortages due to lack of investment and planning. http://www.worldenergyoutlook.org/docs/weo2009/WEO2009_es_english.pdf Americans think that the discovery of oil on our soil in 1859 has entitled us to an endless supply. It is not so. We account for 4.3% of the world’s population but consume 26% of the world’s oil. As China, India and the rest of the developing world become economic powerhouses, they will consume more and more of the dwindling supply of easily accessible oil. As the consumption curve continues upwards, the production curve will be flat. The result will be huge spikes in prices. It will not be a straight line, but prices will become progressively higher. As the studies referenced above have concluded, the result will be economic pain, social chaos, supply wars, food shortages, and a drastic reduction in lifestyles of Americans. They won’t see it coming, just like they didn’t see the housing collapse coming or the financial system collapse coming. They’ll just keep filling up those Escalades until the pump runs dry.

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Speculation During the Great Correction Posted: 03 Sep 2010 03:28 AM PDT Yesterday was a good day for stock market investors. Prices went up. The Dow rose 254 points, leaving us uncertain about its near-term intentions. Of course, we're always uncertain. But sometimes we're more uncertain than others. What seems certain to us is that stocks are a bad bet. You might find this interesting, dear reader: Guess who was better off at this stage following the beginning of the crisis. The investor in the Great Depression? Or, the investor today? Well, we haven't done the calculation ourselves, but we've heard from two different sources that if you take inflation and re-invested dividends into account, investors during the Great Depression were actually ahead. The difference is in the dividends. In the 1930s, companies paid substantial dividends; today, they don't. But yesterday a report came out that told investors that manufacturing activity was picking up. After so much bad news for so long, that was all they needed. They switched back to "risk on" mode. Back and forth…to and fro… Mr. Market is making us wait. But for what? We expect stocks to go down until they finally reach their rendezvous with the bottom. We saw one estimate that put the final bottom seven years into the future. But who knows? All we know is that it hasn't happened yet. And since we believe it must come sooner or later, we conclude that it must be ahead of us…because it is not behind us. Since a lower low lies ahead, we see no reason to invest in stocks at all. The odds are against us. Besides, what's the hurry? The good companies will still be around seven years from now. And the bad companies? Well, we wouldn't want to invest in them anyway… But where…how…are we going to make some money in the next seven years? That is a good question, dear reader. We're so glad you asked. Do you have a good answer? Hope so, because we don't. The only reliable bull market of the last ten years has been in gold. The yellow metal lost $2 yesterday, closing at $1,248. That is only $14 below its all-time high. Which means, while we've been watching Bernanke, Jackson Hole, and stocks – gold has been quietly creeping up… …stocks go down; stocks go up – and gold keeps moving up… …fiscal stimulus, monetary stimulus, quantitative easing – and gold keeps moving up… …recovery…no recovery – gold keeps moving up… …inflation…deflation – and gold keeps moving up… Are you beginning to see a pattern? Yes, gold is in a bull market. It moves up on bad news. It moves up on good news. It moves up on no news at all. And if we're right about how this period of Great Correction ends, the price of gold in dollar terms should go up much, much more. But here's the important thing. Gold is money. You can use it to buy things. In terms of what gold will buy, it does not seem undervalued to us. Much has been written on the subject. But as near as we can tell, gold is now fairly priced. Go ahead; buy all you want. It is a good way to maintain your wealth and protect it against the monetary and economic calamities that are doubtless coming. And if you expect to make a lot of money on it, you'll probably succeed. When the Bernanke Fed loses its grip – which it will – and when the public gets on board the gold bull market – which it will – gold speculators will probably make a lot of money. We've been a gold bug for the last 30 years. Two thirds of that time was miserable, punishing and humiliating. Only the last 10 years have been rewarding. We expect the next 10 years to be even more rewarding. But the reward now is different. It is speculative…not inherent. When we bought gold in '99, we were buying an undervalued asset. We were buying real money, cheap. We made our money when we bought. Now, gold is fully priced. It is a still a good way to save money. But we cannot expect to make money by waiting for the metal to revert to the mean. It's already at the mean. Gold is now a speculation. A warning: we still have not had the sell-off in the financial markets that we expect. The Dow has still not sunk down to 5,000. The lights are still on at banks that should have been put out of business months ago. The public still believes another "stimulus" effort might do the trick. Leading economists still believe they can manage the economy back to growth and prosperity. We have not hit bottom yet. Far from it. When we do, the price of gold could be substantially lower. Which is okay with us. We bought years ago. We're happy with our gold holdings and don't really care if the price drops. Heck, we'd be happy to see the price back below $1,000; we'd buy more. But speculating on a rising gold price is a different thing. Most likely, speculators will be wiped out once or twice before gold hits its final top. Bill Bonner Gold Speculation During the Great Correction originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." More articles from The Daily Reckoning…. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 03 Sep 2010 03:28 AM PDT By Jeff Nielson, Bullion Bulls Canada As promised, we are pleased to announce two contests for our members, with free bullion being awarded to contest winners.

The first contest is the best kind of contest, in that members only need to continue to do what they are already doing. Prizes will be awarded each month, with the winner(s) chosen based upon their level of activity on our site. The more "active" you are, the better your chance of winning, but any member who participates even slightly on our site is a potential winner.

Make comments on our commentaries, do your own "post" on our blogs or bulletin board, or just send "friendship" invitations to other members. At the end of each month, we will select three winners.

First prize: Three, 1-oz silver coins + Bullion Bulls T-shirt Second prize: One, 1-oz silver "round" + Bullion Bulls T-shirt Third prize: One, 1-oz silver "round"

To be more specific, the "first prize" will be three government-minted coins: one ASE, one Canadian "Maple", and one Philharmonic. The "second prize" will be one "Buffalo round", while the "third prize" will be a "Liberty Bell round". In addition two of the winners will receive a "crappy T-shirt", but with our very stylish Bullion Bulls Canada logo on them. Who knows: these T-shirts could become "collector's items" – and end up being worth more than the silver? (I'm sure that line won't fool any of the silver-bulls on our site…)

Our second contest is a little more serious: the Bullion Bulls Miners' Challenge.

Starting from October 1st, and running through March 31st of 2011, we will have a contest to see which member's "top pick" performs the best over the contest period (i.e. experiences the greatest percentage gain over this period of time). Between today and October 1st , just send a personal message to either me, or our webmaster Chad McNamara, or our Mining Coordinator, Brian Boutilier – providing us with your "pick".

To make it easy to track these companies, the contest will be limited to North American-listed precious metals miners (i.e. miners which have gold or silver as the primary metal in their deposits (by dollar-value) and/or as their principal source of revenue). Only one pick per member is allowed, and naturally we can't have more than one contestant choose the same mining company, so in case of "duplicates", only the first entrant will be credited with that pick (we'll let you know if you have selected a duplicate).

Contest closes September 30th, 2010. We will post a "leaders' board" at least once a month, to let members know whose "horse" is leading this derby. We are not able to announce the grand prize as of yet, but we are definitely working on something more special for this contest…

These contests have only been made possible through the generous donations of SilverGoldBull.com, and are meant to commemorate our new relationship with SilverGoldBull.com – and their sponsorship of our site.

We did not enter into this relationship lightly. After long discussions with the management of this company, we have been very impressed with their commitment to provide the best prices, the best service, and (most importantly) a safe and reliable source for your bullion purchases. Those members who aren't willing to wait for their free bullion can always go directly to SilverGoldBull.com – and discover the many convenient options they have introduced to stream-line purchases, and reduce costs for you, their client(s).

The contest is not open to any individuals associated with either Bullion Bulls Canada, SilverGoldBull.com, or their family members.

More articles from Bullion Bulls Canada…. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 03 Sep 2010 03:27 AM PDT Bullion Vault You're forgiven for being frustrated. Gold simply refuses to drop back…

Gold is one of the world's most volatile assets. It is impossible to accurately value. You can't say "I'll pay 10 times earnings" for gold like you would with a stock. You can't say "I'll pay eight times annual rent" like you would with a property. Gold tends to trade on wild swings in investor fear. That's why many seasoned investors expected gold to endure a substantial correction after its massive 2009 rally…or after its similar rally this year. They expected to add to their gold holdings well off the short-term high…at short-term bargain prices. But as you can see from this chart, there's no gold bargains to be had this year. Gold is not suffering natural sell-offs after rallies. Instead, small price declines now trigger huge buying interest from Asia, the Middle East, and giant institutional investors…folks who want to diversify assets out of paper and into "real money". For those people looking to buy gold, we here at Daily Wealth say don't worry much about the current price… just keep accumulating ounces. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 03 Sep 2010 03:27 AM PDT Bullion Vault WEDNESDAY was a good day for stock market investors, writes Bill Bonner in his Daily Reckoning. Prices went up. The Dow rose 254 points, leaving us uncertain about its near-term intentions. Of course, we're always uncertain here at The Daily Reckoning. But sometimes we're more uncertain than others. What seems certain to us is that stocks are a bad bet. You might find this interesting, dear reader:

Well, we haven't done the calculation ourselves, but we've heard from two different sources that if you take inflation and re-invested dividends into account, investors during the Great Depression were actually ahead. The difference is in the dividends. In the 1930s, companies paid substantial dividends; today, they don't. But yesterday a report came out that told investors that manufacturing activity was picking up. After so much bad news for so long, that was all they needed. They switched back to "risk on" mode. Back and forth…to and fro…Mr. Market is making us wait. But for what? We expect stocks to go down until they finally reach their rendezvous with the bottom. We saw one estimate that put the final bottom seven years into the future. But who knows? All we know is that it hasn't happened yet. And since we believe it must come sooner or later, we conclude that it must be ahead of us…because it is not behind us. Since a lower low lies ahead, we see no reason to invest in stocks at all. The odds are against us. Besides, what's the hurry? The good companies will still be around seven years from now. And the bad companies? Well, we wouldn't want to invest in them anyway… But where…how…are we going to make some money in the next seven years? That is a good question, dear reader. We're so glad you asked. Do you have a good answer? Hope so, because we don't. The only reliable bull market of the last ten years has been in gold. The yellow metal lost $2 yesterday, closing at $1,248. That is only $14 below its all-time high. Which means, while we've been watching Bernanke, Jackson Hole, and stocks – gold has been quietly creeping up…

Are you beginning to see a pattern? Yes, gold is in a bull market. It moves up on bad news. It moves up on good news. It moves up on no news at all. And if we're right about how this period of Great Correction ends, the price of gold in dollar terms should go up much, much more. But here's the important thing. Gold is money. You can use it to buy things. In terms of what gold will buy, it does not seem undervalued to us. Much has been written on the subject. But as near as we can tell, gold is now fairly priced. Go ahead; buy all you want. It is a good way to maintain your wealth and protect it against the monetary and economic calamities that are doubtless coming. And if you expect to make a lot of money on it, you'll probably succeed. When the Bernanke Fed loses its grip – which it will – and when the public gets on board the gold bull market – which it will – gold speculators will probably make a lot of money. We've been a gold bug for the last 30 years. Two thirds of that time was miserable, punishing and humiliating. Only the last 10 years have been rewarding. We expect the next 10 years to be even more rewarding. But the reward now is different. It is speculative…not inherent. When we bought gold in '99, we were buying an undervalued asset. We were buying real money, cheap. We made our money when we bought. Now, gold is fully priced. It is a still a good way to save money. But we cannot expect to make money by waiting for the metal to revert to the mean. It's already at the mean. Gold is now a speculation. A warning: we still have not had the sell-off in the financial markets that we expect. The Dow has still not sunk down to 5,000. The lights are still on at banks that should have been put out of business months ago. The public still believes another "stimulus" effort might do the trick. Leading economists still believe they can manage the economy back to growth and prosperity. We have not hit bottom yet. Far from it. When we do, the price of gold could be substantially lower. Which is okay with us. We bought years ago. We're happy with our gold holdings and don't really care if the price drops. Heck, we'd be happy to see the price back below $1,000; we'd buy more. But speculating on a rising Gold Price is a different thing. Most likely, speculators will be wiped out once or twice before gold hits its final top. Buying Gold today? Slash your costs and enjoy maximum security at BullionVault… | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 03 Sep 2010 03:27 AM PDT Bullion Vault Industrial commodity or monetary asset? It doesn't matter according to this chart… The price of gold has displayed major reluctance to decline over the past year. There is simply too much interest from Asia and huge institutional investors, so that budding declines are overpowered by waves of buyers. This brings us to a recent buying wave for gold's precious-metal cousin, silver. Silver is a schizophrenic asset. It is viewed by some folks as a "real money" safe haven like gold. But it's also used in industrial production. So it tends to trade in line with economically sensitive commodities like copper and crude oil. Here's where it gets interesting…

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Bull Signal for Gold from Its Miners Posted: 03 Sep 2010 03:27 AM PDT Bullion Vault We've touched on the different volatility of bullion and mining stocks before here at HAI, previously comparing Gold Bullion (or rather, the SPDR Gold Trust proxy) with the Market Vector Gold Miners ETF (NYSE Arca: GDX). There's more than one way to obtain broad exposure to the gold mining sector, though. Since its November 2009 launch, the Market Vectors Junior Gold Miners ETF (NYSE Arca: GDXJ) has outperformed GDX by a 3.5-to-1 margin, albeit with a dollop of extra volatility. Some of GDXJ's components overlap into the GDX portfolio, but the newer fund weights smaller capitalization (read: development and exploration) companies more heavily than producers. The excess variance can be seen readily when you plot the price ratio of the two ETF portfolios. The GDX/GDXJ ratio started life around 2.0 (that is, GDX's price was roughly twice that of the nascent GDXJ fund's), but has generally drifted lower since then. I say "generally" because there have been significant gyrations along the ratio's downward course. At times, the ratio sinks, meaning GDX's senior producers lose value relative to the exploration companies. That's when investors' risk appetites sharpen. At other times, when investors rein in their risk-taking, the ratio tends to rise in favor of GDX. Presently, the GDX multiple is 1.72 times – not its lowest value, but well off its most recent top at 1.92x. If the ratio breaks through the 1.72x level, a test of its old low at 1.69x is likely to follow. But here's the thing: A falling ratio means a bigger market appetite for risk. More specifically, a bigger appetite for Gold Mining stock risk. That, in turn, is an expression of investor confidence in bullion's price strength. So if you're bullish on Gold Prices, then, you want the ratio between the broad gold-mining sector and the juniors miners to fall. Which it is doing. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 03 Sep 2010 03:27 AM PDT Bullion Vault SINCE I am known as something of a gold bug, a lot of people write to me about gold, says the Mogambo Guru in The Daily Reckoning. But since I am a paranoid lunatic, I don't read their letters, mostly because I now call myself Marvelous Macho Grande (MMG), figuring that an established alias could potentially come in handy when the prices of gold, silver and oil shoot higher and higher as inflation in consumer prices starts going parabolic as a result of the despicable Federal Reserve creating so, so, so much money, especially so that the despicable federal government can borrow and spend that selfsame so, so, so much money. So, you can see how a dramatic, romantic new name like Marvelous Macho Grande (MMG) would perfectly suit a guy like me, which is a guy with a theoretical massive coming increase in wealth from investing according to The Mogambo Perfect Portfolio (TMPP), which uses the Austrian school of economics (see Mises.org) and the last few thousands of years of history as Absolutely Compelling Reasons (ACR) to invest in gold, silver and oil when the government is acting so insanely bizarre, as does ours now, blithely deficit-spending a monstrous 11% of GDP, now with a national debt nearing a heart-stopping 100% of GDP, and allowing the Federal Reserve to continue to create So Freaking Much (SFM) money that, like creating too much money always does, it creates booms and bubbles that predictably, inevitably, unstoppably, disastrously go bust, leaving you, sadly, worse off than before. So, you can see how I am not in the mood to answer emails from people who, deep down in their hearts, are pleading, "Oh, please help me, Masterful Mogambo Guru, or Marvelous Macho Grande (MMG), or whatever in the hell your name is this week: Sadly, I have not been following your terrific advice to Buy Gold, silver and oil as the One True Way (OTW) to end up with a lot of money without working for it, and now I need one of your famous Secret Investment Plans (SIP) to make up for lost time, else I am reduced to being the widow of a rich Nigerian banker who needs to sneak $100 million out of Nigeria and into your country. In that case, I will give you $50 million after you give me your bank account number and $5,000 in cash to pay various fees, expenses and bribes." Alas, I don't have $5,000 to invest in this terrific opportunity to make a quick $50 million, as likewise there are no Secret Investment Plans (SIP), although I have spent a lifetime looking for one. Fortunately, constantly Buying Gold, silver and oil is always the smart thing to do when your stupid, desperate, half-witted, corrupt, clutching-at-straws government is acting like all the other stupid, desperate, half-witted, corrupt, clutching-at-straws governments that created too much money and destroyed themselves over the last 4,500 years. And if you don't believe me, then maybe you will listen to the famous Richard Russell of the Dow Theory Letters, who writes:

And "just accumulate" sounds so easy because it is so easy, which is why I say, as I always say until you are tired of hearing me say it, "Whee! This investing stuff is easy!" | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||