Gold World News Flash |

- SP500 & Gold At Crucial Pivot Points

- The Market Ticker - Fiscal Policy: The Fed, Romer, And A Path Forward

- Oil and Gold Advance in Tandem as Speculative Volatility Recedes Pre-NFP

- Signs of an Evil Economy

- Gold Bullion Likely To Pullback Then Rocket Higher

- Dear Billionaires of the World

- Hourly Action In Gold From Trader Dan

- Silver About To Break Out Big!

- Gold 1270 in Danger

- Jockeying For Position

- Ron Paul's Gold Audit Story Goes National

- LGMR: Gold Ignored by US Media as Good Harvest Points to Strong Indian Demand

- How to Make 50% in One Month Trading Gold Stocks

- Bank Run 2011?.. Mises Shakes the World?

- Crude Oil Weighed by Inventories, Gold Stalls as Equity Markets Rally

- An Exception in Equities - September 1, 2010

- Can Silver Break $20 in September?

- The Goldsmiths, Part CLVII

- Opening the mint to gold and silver - then and now

- Nuts and Bolts of COMEX Silver Manipulation

- Triangle Capital: Dividend Outlook Short Term and Long Term

- Four Strategies for September's Bad Reputation

- Prelude To Meltdown: An Interview With Bert Dohmen

- Gold Ignored & Dismissed by US Media as Good Harvest Points to Strong Indian Demand

- SSDD

- Important Manufacturing Indicators Look Weak

- Gold Seeker Closing Report: Gold and Silver Gain With Oil and Stocks

- Gold Prices to Challenge All Time High

- Papa John's: Still an Appetizing Stock

- Thursday ETF Roundup: XLY Surges, BLV Continues To Slide

- The Market Ticker - Fiscal Policy: The Fed, Romer, And A Path Forward

- Ireland: Great Example of Why the Eurozone Crisis Isn't Over

- James Turk: Big money quickly buying dips in gold and silver

- Pension Funds Looking at Potash Bid?

- Record Low Mortgage Rates, A Record Low Federal Funds Rate And Obscene Economic Stimulus Spending Have All Failed – Will Nothing Stimulate This Dead Horse Of An Economy?

- Nielson, Weir badger CFTC to act against silver market manipulation

- Fake Kangaroo

- Dialing for Dollars

- Interesting Gold Fact of the Day

- M2 Update

- Gold Speculation During the Great Correction

| SP500 & Gold At Crucial Pivot Points Posted: 02 Sep 2010 07:29 PM PDT Wednesday was a big session with better than expected manufacturing surging the market 3%. In this article I will do a quick technical take on the current situation for the SP500 and gold as they are both trading at a key resistance level. also its important to know what type of price action we will [...] | |||||||||

| The Market Ticker - Fiscal Policy: The Fed, Romer, And A Path Forward Posted: 02 Sep 2010 07:05 PM PDT | |||||||||

| Oil and Gold Advance in Tandem as Speculative Volatility Recedes Pre-NFP Posted: 02 Sep 2010 07:05 PM PDT courtesy of DailyFX.com September 02, 2010 12:01 PM It is a common phenomenon for the capital markets. With the approach of heavy event risk like US nonfarm payrolls, speculative liquidity sources will temper their turnover to avoid being caught on the wrong side of a fast moving market. North American Commodity Update Commodities - Energy Positive Momentum Carries Oil to the Boundary of Congestion, Leaving NFPs Responsible for Direction from Here Crude Oil (LS Nymex) - $75.02 // $1.11 // 1.50% Compared to the high correlation and definitive speculative momentum Wednesday; the capital markets were far more tame today. That being said, most of the growth and risk-dependent asset classes would nonetheless put in for a bullish follow up to the previous day’s remarkable performance. For crude, a second consecutive daily climb would mark the best back-to-back performance traders have seen in months. Furthermore, the push would put the active US futures contract into... | |||||||||

| Posted: 02 Sep 2010 07:05 PM PDT I am standing on the corner of the street, doing my duty to "give back" to society, in this case by yelling at morons passing by in the cars, "We're freaking doomed, you moron! Your own stupid government has destroyed you by letting the foul, fetid, festering Federal Reserve create too much money that they stupidly, stupidly, stupidly did as part of the stupid neo-Keynesian econometric theoretical lunacy that has mesmerized them, so that a shiny computer in front of a neo-Keynesian econometric economist is like a shiny toy in front of a monkey, and which has mesmerized the Fed and the government for similar reasons, and with similar results, in that the toy is now broken, the monkey cut its hand on the broken toy, the cut is infected, and there is a good chance that the monkey will die a horrible, painful death! Hahaha! How do you like them apples? Horrible, painful death! We're freaking doomed, including you and your hotshot car with the radio turned up real loud, trying to drown me o... | |||||||||

| Gold Bullion Likely To Pullback Then Rocket Higher Posted: 02 Sep 2010 07:05 PM PDT Gold Bullion Likely To Pullback Then Rocket Higher Back in latter June I forecasted a big top in Gold, mostly due to the 5 wave structures up from the October 2008 lows to June highs, and the 5 waves up from February lows to June highs converging. We then dropped from 1243 at the time of the forecast to $1155, which was one of my potential "A wave down" rally pivots. I expected a counter-trend rally or "B" wave up to 1212-1225. So, all of that worked out pretty well, until we hit $1238. Now, $1238 is a 78% Fibonacci re-tracement of the drop from $1265 to $1155. Normally, a re-tracement in a weaker market or sector is capped at 61.8% or 50%. The strength of that counter-trend move caused me to go back and review my patterns a few more times. Most of this is pure instinct and experience, but I think $1155 was the low of the correction. It also looks like that was an A B C correction to $1155, and with the strong rally it means we are likely beginning a new set of 5 waves ... | |||||||||

| Dear Billionaires of the World Posted: 02 Sep 2010 07:05 PM PDT (The Silver Market is a tiny $1.9 billion) Silver Stock Report by Jason Hommel, September 2nd, 2010 It is too late for any of you, personally, to buy much silver below $20 per ounce. While silver prices languished at about $5/oz. for almost two decades until about 2001, it's now too late for you to buy much, if any, silver below $20/oz. Did your personal wealth increase that much in the last decade like silver prices did? I don't think any billionaire in the world matched or exceeded that performance. The silver market is very tiny, and thus prices are still potentially very explosive--especially if one of the 1000 billionaires in the world tried to buy any. The potential for future gains far exceed what has happened in the last ten years. Only a tiny $1.9 billion dollars worth of silver per year is bought for investment; most of that is purchased in the USA, that's about 100 million troy ounces of silver, at $19/oz. Of that, nearly 40 million oun... | |||||||||

| Hourly Action In Gold From Trader Dan Posted: 02 Sep 2010 07:05 PM PDT | |||||||||

| Silver About To Break Out Big! Posted: 02 Sep 2010 07:05 PM PDT Silver is one asset class I do not cover very often, but have been largely bullish on since $6 an ounce many years ago. It can be considered “poor man’s Gold” as they say. I believe Silver is about to stage a pretty large advance based loosely on the Elliott Wave pattern I see unfolding after a 9 odd month consolidation. (Obviously, there are also fundamental fiat currency/debt events worldwide that give it the underlying bull chart pattern). Since the average person can’t run out and buy an ounce of Gold for $1,240 tomorrow, as the unfolding of the fiat crises continues to enter the public psyche, you will see a strong populace movement into buying silver, silver coins, etc. To wit, many silver stocks are moving up strongly of late, signally an imminent breakout of this precious and industrial metal. The triangle pattern has taken nearly 9 months so far, and a move over $19.50 could start a multi-month run targeting $26-$29 per oun... | |||||||||

| Posted: 02 Sep 2010 07:05 PM PDT | |||||||||

| Posted: 02 Sep 2010 07:05 PM PDT The following is automatically syndicated from Grandich's blog. You can view the original post here. Stay up to date on his model portfolio! September 02, 2010 06:15 AM The PGMs are almost always the forgotten child in the precious metals group despite many times outperforming gold and silver. The South African PGM players may be quite interesting for 2011 and beyond. Please note Anooraq Resources is a client of Grandich Publications. [url]http://www.grandich.com/[/url] grandich.com... | |||||||||

| Ron Paul's Gold Audit Story Goes National Posted: 02 Sep 2010 07:05 PM PDT The gold price began to rise about 1:00 p.m. Hong Kong time during their Wednesday afternoon... perhaps in sympathy with the US$ which had begun to head south about four hours before that. The gold price continued to rise quietly right up until 8:40 a.m. Eastern time in New York. Then a not-for-profit seller showed up and sold gold down ten dollars over the next two and a half hour time span. The selling came to an end shortly after London closed at 11:00 a.m. Eastern time... and basically did nothing for the rest of the New York trading session. Gold's high and low of the day were both set in New York. The high was $1,256.00 spot... and the low was $1,241.80 spot. Silver's price path was similar... with the exception of three price spikes that tested the $19.50 price level... two in London and one in New York. The middle spike was the London silver fix at noon local time... and the silver price was under light selling pressure from that point on. ... | |||||||||

| LGMR: Gold Ignored by US Media as Good Harvest Points to Strong Indian Demand Posted: 02 Sep 2010 07:05 PM PDT London Gold Market Report from Adrian Ash BullionVault 08:45 ET, Thurs 2 Sept. Gold Ignored & Dismissed by US Media as Good Harvest Points to Strong Indian Demand THE PRICE OF GOLD rose back above $1250 an ounce for the second time this week – and the sixth time since May – on Thursday morning in London, as government bonds ticked lower together with energy prices. Soft commodities rose, as did base metals and platinum. Silver prices touched a new 16-week high at $19.57 an ounce. In the US, an article from Forbes magazine highlighting "Six Ways Retirees Can Beat Inflation" today does not mention gold investing. "Gold has doubled since 2006," adds a personal-finance video at Yahoo.com, sponsored by the Fidelity fund group. "This train left the station a long time ago. "So before you pour your savings into gold, be careful...A lot of the money's already been made." Asian stock markets meantime closed Thursday 1.5% higher, but European shares stalled a... | |||||||||

| How to Make 50% in One Month Trading Gold Stocks Posted: 02 Sep 2010 07:05 PM PDT By Matt Badiali, editor, S&A Resource Report Thursday, September 2, 2010 While most investors are fretting about unemployment and weak manufacturing reports, a bonanza is happening in one tiny area of the market… It's an area that doesn't worry about manufacturing reports… and it hasn't been hampered at all by the 11% decline in stocks since May. It's an area that maybe one investor out of a thousand follows. That area is "junior" gold stocks… and the returns this sector is generating right now are extraordinary. These "junior golds" are the bloodhounds of the gold business. They are tiny companies (typically under $250 million market cap) that scour the world looking for the next big deposit of precious metals. When one of them finds a huge deposit, shares can absolutely skyrocket. For example, in 2005, Esperanza Silver made an amazing discovery called San Luis. And with each hole the company drilled, it found more gold. Here's what happened t... | |||||||||

| Bank Run 2011?.. Mises Shakes the World? Posted: 02 Sep 2010 07:05 PM PDT Bank Run 2011? Thursday, September 02, 2010 – by Staff Report Ben Bernanke Readers of my articles will recall that I have warned as far back as December 2006, that the global banks will collapse when the Financial Tsunami hits the global economy in 2007. And as they say, the rest is history. Quantitative Easing (QE I) spearheaded by the Chairman of Federal Reserve, Ben Bernanke (left) delayed the inevitable demise of the fiat shadow money banking system slightly over 18 months. That is why in November of 2009, I was so confident to warn my readers that by the end of the first quarter of 2010 at the earliest or by the second quarter of 2010 at the latest, the global economy will go into a tailspin. The recent alarm that the US economy has slowed down and in the words of Bernanke "the recent pace of growth is less vigorous than we expected" has all but vindicated my analysis. He warned that the outlook is uncertain and the economy "remains vulnerable... | |||||||||

| Crude Oil Weighed by Inventories, Gold Stalls as Equity Markets Rally Posted: 02 Sep 2010 07:05 PM PDT courtesy of DailyFX.com September 01, 2010 10:51 PM Multi-decade highs in crude oil inventories kept a lid on oil prices, as the commodity failed to recapture the previous day’s losses despite surging equity markets. Gold is holding up well on insatiable investor demand. Commodities – Energy Crude Oil Weighed by Inventories Crude Oil (WTI) - $73.70 // $0.21 // 0.28% Commentary: Crude oil reversed a large part of Tuesday’s losses on Wednesday, but the commodity remains notably below the recent $75.58 high registered on Monday. One would have expected more from crude oil given the enormous 3% rally in U.S. equity markets, but yet another bearish inventory report kept a lid on prices. U.S. oil inventories are going through the roof, and while a large part of the increase could perhaps be attributed to floating storage coming back onshore, other factors are contributing to the oversupply as well. U.S. crude oil production, for instance, has hit the highest le... | |||||||||

| An Exception in Equities - September 1, 2010 Posted: 02 Sep 2010 07:05 PM PDT Conversations With Casey September 1, 2010 | Visit Online Version | www.CaseyResearch.com • About Casey • Forward this email • New? Free sign up for Conversations With Casey • CaseyResearch.com (Doug Casey, interviewed by The Gold Report) Editor's Note: Just recently, our friends at The Gold Report interviewed Doug on his thoughts about the precious metals bull market, how high gold will go, his views on gold stocks, and much more. Some of what he says below is not new to longtime readers, but we think his comments on gold investments being a potential exception to the rule for what's coming are well worth bringing to your attention. * * * The Gold Report: Doug, at a recent conference you said that the U.S. ought to default on its national debt now. Why that rather than letting it play o... | |||||||||

| Can Silver Break $20 in September? Posted: 02 Sep 2010 06:45 PM PDT Matthew R. Green submits: It’s that time of year again, folks. Welcome to September. For all the commentary about gold entering its period of seasonal strength, within the realm of silver much of the attention has been focused on whether the white metal can break $20 on a sustained basis. While much of the recent media attention has been focused on gold setting new all-time highs, silver is nearing a showdown with the key $20 psychological and technical level. This echoes the debate that was taking place at this time last year regarding gold’s ability to break $1000. Complete Story » | |||||||||

| Posted: 02 Sep 2010 06:03 PM PDT The privately owned US Federal Reserve Banking system held its annual Monetary Symposium at the fat cat resort at Jackson Hole, Wyoming in late August 2010. Since that event, the financial news wires have been ablaze with statements, procrastinations, predictions and assessments from this conference attempting to evaluate what was said about the US economy and what the Fed would do about it (since the Fed's charter grants it a primary role and responsibility for stability and growth in the US economy). | |||||||||

| Opening the mint to gold and silver - then and now Posted: 02 Sep 2010 06:00 PM PDT | |||||||||

| Nuts and Bolts of COMEX Silver Manipulation Posted: 02 Sep 2010 06:00 PM PDT | |||||||||

| Triangle Capital: Dividend Outlook Short Term and Long Term Posted: 02 Sep 2010 05:48 PM PDT Nicholas Marshi submits: We’ve just reviewed Triangle Capital’s (TCAP) 10-Q filing for the period ended June 30, 2010, listened to the company’s first ever Conference Call on August 5th, and looked over the Earnings Report again. All of this with a view to providing readers with our outlook for TCAP’s dividend. WHY THE DIVIDEND IS IMPORTANT: For most investors in BDCs, the dividend level is a key element in the buy or sell decision. That’s because the dividend is a useful proxy for earnings, as BDCs are required to distribute essentially all their taxable earnings (not including Unrealized Gains or Losses) in the form of distributions. [Like everything else in the Business Development Company arena, though, nothing is black and white. BDCs have a variety of dividend strategies: some pay out a distribution higher than current earnings in the anticipation that profits will grow as capital is deployed. Others religiously pay out only what is earned, or projected to be earned, in the current tax year. Some BDCs pay out only a portion of earnings, squirreling away the rest for future periods.] Notwithstanding all the above, a company’s dividend is a very useful indicator of its financial health and prospects. Most investors seek BDCs that promise a steady, or increasing dividend level. Usually a reduction in the dividend results both in lower income and a reduced stock price. Complete Story » | |||||||||

| Four Strategies for September's Bad Reputation Posted: 02 Sep 2010 05:36 PM PDT AAII submits: A bubble may be forming in bearish indicators. A sign of just how much attention pessimistic prognosticators are getting occurred last week when my mother asked me about the Hindenburg Omen. This is an arcane indicator that uses technical analysis criteria to try to predict a forthcoming market crash. Complete Story » | |||||||||

| Prelude To Meltdown: An Interview With Bert Dohmen Posted: 02 Sep 2010 05:30 PM PDT | |||||||||

| Gold Ignored & Dismissed by US Media as Good Harvest Points to Strong Indian Demand Posted: 02 Sep 2010 05:26 PM PDT | |||||||||

| Posted: 02 Sep 2010 05:09 PM PDT It's the same story, different day (SSDD). That is, nothing much has been revealed overnight to cause us to change our view that you're investing in the midst of a long-term depression. Most of the positive GDP data coming out globally is backward looking. It doesn't tell you much about the future. It is worth noting that a story in yesterday's Financial Review showed that prices for coking coal have followed iron ore and coal prices down. Record high prices for all of those key exports drove a huge increase in the terms of trade and are behind bullish projections for stock prices, government revenues, and GDP expectations. But if Chinese demand for these steel-making ingredients falls, all those projections are pretty iffy. It all depends on if Chinese property prices are in a bubble. They are, according to Jiang Hui, the investment director at Star Rock Investment (not Rock Star investment). According to Bloomberg, Jiang told a conference in Shanghai that, "China's property market has a very big bubble, which may last for a while...Only higher interest rates and the introduction of a property tax can bring down real-estate prices." There are many other things that can prick a bubble. But since we've been hitting it pretty hard this week, we're going to leave those subjects alone. Instead, we've published a summary of some of the most interesting lists we got in response to our question a week ago of what to stock up on for the end of the world as you know it. You'll find the notes below. But first, and quickly, a mate asked us why we were being so overtly political and pro Liberal in an investment e-letter. We should clarify that we're against all politicians. Someone wrote to us that, "Comparing elected political representatives to criminals is offensive." Yes, it is, to the criminals. You have to keep your eye on politics these days since the government has rushed in to muck up the market even more than it was mucked up by the banksters. But there's no doubt, that stupidity and economic illiteracy are bi-partisan. If the Greens are basically against industrial society, then what does that make the independent Member for Kennedy, Bob Katter? Katter has submitted a list of 20 demands/suggestions/flights of fancy/acts of lunacy to Julia Gillard and Tony Abbott. His support can be obtained (not purchased, as in Andrew Wilkie's case) in exchange for agreeing to some of his demands/suggestions/flights of fancy/acts of lunacy. This is why Libertarians are generally not conservatives. Conservatives, some of them anyway, don't have any problem using State power to achieve their favoured ends. They're just after different favours and different ends. In Katter's case, he's especially ticked off that Coles and Woolworth's have managed to offer Australians thousands of items they'd not be able to get at the Corner Milk shop at a reasonable price. They must be stopped! He does have some provocative and entertaining ideas. We'll give him that. But he reminds us of the Rich Texan character on the Simpson's, also known as Senator Shady Bird Johnson. Do you see the resemblance?  More seriously, it's interesting to see how the interest of regional Australia - very real and legitimate ones which Katter represents - differ from the capital cities. Maybe a one-size-fits-all Federal government isn't going to work as Australia gets bigger. It's not exactly the Red State/Blue State divide you see in the States. Not yet anyway. Now, what's on your list of things to stock up on because they disappear from shelves when people lose confidence in paper money? Some replies below. We've published quite a few of them. So take your time over the weekend to review! Of utmost importance, toilet paper!!! Also, long term outlook, off the rack magnifier reading glasses of various strengths, thread, needles, safety pins, buttons, antibacterial ointments, hydrogen peroxide, rubbing alcohol, toothpaste & brushes, vitamins & supplements, OTC pain killers as it all must fit in a small home, chose small items Thanks for the daily reckoning! Really enjoy reading something amusing while learning Anne For us old fashioned book readin' stay at homes, old fashioned light bulbs, preferably bayonet mounts but screw ins if that's all and screw in fittings to replace the bayonet fittings. Serious...my local milk bar is selling them for $5 each (bloody screw ins) lots of cigarettes and vodka and proper beer. Crossbows and accessories? Quality dog food (for dog, if huntin' gets bit tough) bicycles and accessories...are getting very pricey. Old fashioned cameras, film, darkroom equipment-anything that doesn't need computers. Musical instruments. Good quality art materials and paper. And tools to fortify the joint. Now I'm getting carried away and romantic, this had better stop right here. Enjoy ya trip like I enjoy ya newsletters. Jill. I have a wife and four daughters - no matter how bad things are chocolate always seems to lift the mood!! At the top of my list!! Mind you after reading your columns I don't know whether to reach for the vodka or the pain killers - or both!! I have been following you for only 6 weeks now, is it just the current climate or is the glass always half empty?? Bruce W. [Ed. note: not always, just the last ten years or so] Among my list are sprout seeds, quick growing & nutritional (few days), matches/lighters, rice/pasta, tinned tomatoes/sauces. Anonymous. My plan.

Kind regards, J. Sounds like you have the survivalist bug. Some more reserved commentators call it the lifeboat scenario. After watching Tony Robbins inform people that they had best watch out for a collapse late this year and no later than early next year I have been buying extras of everything, kitting out the 4wd and pencilling in great camp sites to go to when the bank holiday starts. Do you want to be in a city when people cannot access money - ergo food and fuel? Not this little black duck. If you consider that Australia has no more than three weeks worth of fuel reserves and four weeks' worth of food reserves I think a recovery in the near to medium term is psychopathic optimism. Good luck. M. You have a good list. I would add: Heirloom seeds, matches and/or fire starters, first aid products, good boots, Swiss Army knife. Best regards, Charley Lots of toilet paper, the nice soft one. Think we may be using it or selling it. Graham I'd add a tin opener. It might be embarrassing to die on top of a pile of tins, maybe holding an empty weapon. V. My wife's Polish grandmother would always buy up huge stocks of salt when she thought a depression was coming. She lived through two world wars and died at a ripe old age of 93 about 10 years ago. Love your column, T. Smith -First up, I love your dailies and weeklies. Very insightful and must say I do agree with almost all posted. That said, I do find it incredibly curious that a group of smart guys like yourself (nor almost any other economists I might add), still do not mention the underlying cause of why the word is going through this GFC right now. It's called Demographics, guys. Wow, ever heard or studied that? The world economy pumps out around 58T per annum. Of that the US around 14-15T, the EU around 16T, China and Japan a piddly 5T. Germany rates bout 3.3T, then all of us just follow…Now assume the rest of the world is just like the US (I'm not sure, but a good bet I recon), the consumer is approximately 70% of the economy... Any problems so far? So. If you only knew when (demographically) the big spenders were on the sidelines or spending, s**t, we would all be rich! But wait, we do! Through National and international statistics from (IMF, CIA, World Bank), we are now armed with these facts! The big fact is that people in their late 40's to 50's scale down, with everything, from cars to Mc Mansions. The kids have left (or are leaving) home, me and you just wanna get all cuddly... And guess what? Whatever Obama or anyone says (or tries to pay for), I don't f**cking need a new SUV from Ford or whomever! All I want my little retirement condo and my 401K (or Super in AUS)... And that is the fact. The US and EU Consumers are now not spending. NO amount of FED spending will entice the Consumer to spend on that RV or the Mc Mansion they don't need. Please feel to comment, like the song, I'm just a guy. I agree, no Bonds. Well, make money while you can though. Eric Items necessary on the basis of the experience of my grandmother, who lived through three bankruptcies during her life (1920, 1930, 1948) in Europe:

Hope that I could be of any help. Although you did not ask for it, but I would like to add something else from my grandmother, here a list, what you should avoid in any case:

From the history of my grandmother (she is now dead): She and my grandfather have saved money during their whole life, they wanted to have a nice banking account for their retirement. They wanted to travel to several places in their old days. But the 2nd world war came. And the banks have eventually closed, but the paper money has lost all of its purchasing power anyway. She told me, if they had bought gold for their money, they could have been well off even during the hard times and thereafter. When I was a little girl my grandmother used to tell us these stories. I am happy, that I have listened. And do you know what? My father used to purchase gold bars during the 1960s. Unfortunately he died being 49, so he did not need it. With best wishes, Valéria Hello I am stocking up on: sterno canned heat or ecofuel canned heat as that is the only heat source I can find that is safe to burn indoors without dying of carbon monoxide poisoning. And some of those fold up sterno stoves. You can buy them all on eBay and they ship worldwide, a lot of the sellers Plus there is a company called sun jel that make indoor fireplaces that run of cans of fuel that is safe to burn indoors. Plus I found on eBay these cool headlamps- they are headbands with a torch light stuck to the front of them- like miners use in mines, and I also got off eBay some cap lights whish are lights that you clip not the rim of your cap. I got some for the whole family. How else are you going to see at night when you're cooking tins of spam ham on your sterno stove? Plus spam ham of course, you can cut it into slices and fry it on your sterno stove. Packets of seeds that reproduce year after year Dried mashed potato that you just have to add water to. Maybe even a camping fridge that runs on batteries Get the whole house converted to solar so you won't be subject to blackout or brownouts, and get a water tank for your backyard Buy a dingo bush camping kettle so you don't need a stove to boil water but be careful not to burn the house down as they don't look too safe Buy a 30 second tent in case you and your family need to flee And some thick mink blankets to put over your family when the power goes off in winter, while you light the sun jel indoor fireplace. Plus tinned food including tins of fruit cake and chocolate self saucing pudding so nobody rips each other's heads off from depression during all of this fiasco. Chocolate works well in any situation to cheer people up Plus powdered milk so you can have a tea or coffee at any time if you don't have a fridge Plus aero guard and rat and mouse poison as pests increase when nobody collects the rubbish in the streets for months, which I saw firsthand on a visit to Bali once And plastic plates, cups and spoons and cutlery in case there is not much water to wash dishes. Plus lots of garbage bags. Plus a radio that runs on batteries to hear the news on, and lots of batteries AND- you should store it in your house- buy a shed for the backyard or even 2 sheds because who's to say that the owner of your storage facility wont steal your stuff when the going gets tough (all he has to do is cut the padlock on your storage room or open the door himself with a key) (remember- desperate people do desperate things) and b) who's to say that the owner of the storage facility is going to let you in or even be open for business when everything collapses? What if he sleeps in? What if he broke and gives up? And how are you going to get to the storage facility if the roads are blocked with rioting people? And how will you pack the stuff into your car without being mobbed by other people at the storage facility who might be starving? As they used to say in the 1930's great depression: "If you don't hold it you don't own it" That doesn't just apply to gold and silver and cash, it applies to survival supplies as well. Good luck!! Thanks for your great newsletter; I love it a lot Kind Regards, from Christina Toilet Paper, seed, generator, drinking water, bleach, rolling papers, spices. Of course whiskey and gunpowder must play a prominent role if you have anything the hoards now living off the government may well try to take from you when the merde hits the fan. ALL THIS IS BEING HASTENED BY TRAITORS IN DC WHO CONTINUE TO OVERLOAD OUR SYSTEM WITH DEBT AND MONETIZATION. If we fail to vote enough of the bastards out in November to at least create a little gridlock, we are almost surely doomed, if we are not already doomed by the actions of these Marxists. If your predictions of doom and gloom come to pass then the things that will be in greatest demand will be comfort and succour to the devastated. Become an expert in human relations such as helping yourself and others cope with their losses and emotional turmoil would be a good start on a personal and family survival basis. But if it is not as bad as a total breakdown of the system and just a garden variety depression then the three essential assets of food, clothing and entertainment come into play. A small farm might be in order but you will need all those bullets you intend to get to keep the crows (of all sizes) off the vegies as they ripen. Maybe a soup kitchen or two wouldn't go astray. You could supply it from the vegies you grow and what's left of the government will be subsidising the place so you will at least get paid. Maybe the US will take in the China welcome mat and you can open the clothing factories again if you can find anyone who still has the knowledge on how to make sewing machines and clothes. Luckily Hollywood is still functioning so all you need there is a re-incarnation of likes of Bing Crosby and co along with Madison Ave who got the US out of the last depression. It was not the "Great Roosevelt" I can tell you that for free. As far as safe assets go I should buy a chain of medical practitioners and chemists (drug stores to you) and I would own the premises too. Pharmaceuticals will do well for a while pushing drugs and anti-depressants but as I am totally opposed to that industry in principle I would not be recommending it. I can't see hording gold being a lot of good as apart from filling teeth it doesn't do a lot to maintain life. Unless you can use it to buy the soup kitchens, if we really hit the fan who will want it? Will it even be valued in paper currency after all? As people get hungry and desperate and dump their gold and jewellery to keep alive the price of it should crash to next to nothing. I guess it's all a matter of degree. As the master of doom and gloom you tell me how bad it's going to get? I already admire (and envy) your skill as a wordsmith. I would love to read your assay on the subject. Regards, Merv. Until next week! Similar Posts: | |||||||||

| Important Manufacturing Indicators Look Weak Posted: 02 Sep 2010 05:06 PM PDT From The Daily Capitalist There are a lot of indicators that have been published recently that show continuing weakness in the economy which will lead to declines in output. The key indicators to me are the decline in factory orders and the build-up of inventories. I expect this trend to continue. The important indicators are:

Here is the money comment (Emphasis, mine):

What has not been encouraging is the slowdown at the wholesale level as June inventories rose 0.1%: We will have to wait until the week of the13th when the wholesale inventory numbers for July come out to see if this trend is continuing.

The market has been going gaga over these numbers, don't ask me why (ask DoctorX). On one side of the world, Europe's indices are weak. On the other side, China is flat, but Taiwan, South Korea are down. The market reacted very positively to the fact that China's version of an ISM report was up 0.5% (to 51.7 from 51.2). I don't see it myself. As fiscal stimulus is wearing off, and as the housing bubble is starting to burst, I wouldn't expect much growth out of China. Did the bulls check the consumer data in Europe and here?

Not good, not bad:

Personal Income and Consumption

Not a bad report, but I'm not certain it can be sustained. Without strong gains in disposable income or employment, and the above chart doesn't show that, it is doubtful that we'll see strong consumer spending. Especially when you consider that one reason for the little July bump in spending was that consumers drew down their savings to pay for it. Savings decreased from 6.2% to 5.9%: From The Wall Street Journal Note that the savings rate has been fairly steady since the beginning of the Crash, except for the Cash for [Whatever] spending spree in H1 2009. I doubt that we'll being seeing any significant increase in consumer spending as consumers continue to save at relatively high rates and continue to deleverage. Tomorrow (Friday) the jobs report will be coming out and everyone is holding their breath. I won't comment on it until I see the numbers. | |||||||||

| Gold Seeker Closing Report: Gold and Silver Gain With Oil and Stocks Posted: 02 Sep 2010 04:00 PM PDT Gold traded mostly slightly higher in Asia and London and rose to as high as $1253.05 by about 9:30AM EST in New York before it fell back off a bit in choppy trade into the close, but it still ended with a gain of 0.43%. Silver climbed to a new 3 month high at as high as $19.66 before it also fell back off slightly in the last 4 hours of trade, but it still ended with a gain of 0.83%. | |||||||||

| Gold Prices to Challenge All Time High Posted: 02 Sep 2010 03:55 PM PDT

So much for a lackluster summer and the summer doldrums as gold prices increased by around $100/oz in August 2010, to close at $1251.20/oz . As the chart shows, August has been a great month for gold prices setting the stage for a ‘Fall’ rally which we expect to be dramatically to the upside. The technical indicators are now in the overbought zone and we would normally expect gold to take a breather, however, these indicators have been known to stay high for prolonged periods of time. Complete Story » | |||||||||

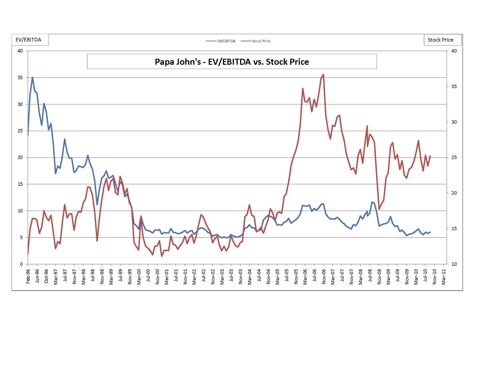

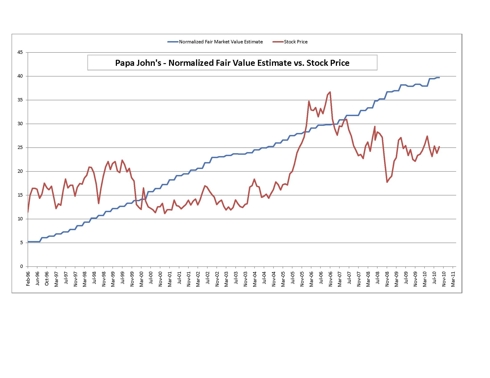

| Papa John's: Still an Appetizing Stock Posted: 02 Sep 2010 03:53 PM PDT Tony Abbate submits: On Thursday Burger King (BKC) sealed the deal and agreed to be acquired by 3G Capital Management, a private equity firm, for $24 a share. This $24 price equates to an Enterprise Value to EBITDA (EV/EBITDA) multiple of 8.8 and is in line with the historical acquisition valuations assigned to high quality restaurant companies. Restaurant stocks across the board rallied on the news. In particular, I think Papa John’s (PZZA) is undervalued and offers significant appreciation potential. Back on March 22 of this year Seeking Alpha asked me for my “High Conviction Stock Pick”. I indicated Papa John’s. My rationale at the time was Papa John’s is very well managed, has a good business model and is significantly undervalued. My opinion on this company and stock remains unchanged. I think investors can buy the stock at today’s price and still do well over time. In my interview on March 22, I indicated high quality restaurant stocks were generally acquired at EV/EBITDA multiple of nine. Interestingly, this is in line with what the multiple being applied to Burger King. While it is unlikely Papa John’s will be acquired, I think it is still significantly undervalued and has a high probability of delivering market beating returns. Below is a chart comparing Papa John’s stock price against its valuation (EV/EBITDA) since February 1996: You will notice in 2006 and 2008 the valuation of the company peaked at an EV/EBITDA multiple around 11.5. At the market bottoms in 2003 and 2009 the company traded towards an EV/EBITDA multiple of 5.0. (Prior to 2000, in my opinion Papa John’s was an overvalued growth stock. I stay away from these types of stocks. They can be hazardous to your wealth!) Using an EV/EBITDA multiple of 5.0 on the downside and 9.0 on the upside, I still think the upside appreciation for Papa John’s far exceeds the downside risk. Let us do the math. If we were to assign a 5.0 EV/EBITDA multiple, we get a stock price of $20.40. If we were to assign an EV/EBITDA multiple of 9.0 to the stock, we get a stock price of $38.85. My estimate of Papa John’s upside potential is about 2.9 times my estimate of its downside risk. In addition to a favorable valuation, a secondary factor associated with Papa John’s is the fact that over time its intrinsic value has grown. As I indicated in the March interview, much of this growth can attributed to well timed stock repurchases. I actually love to own companies where the actual business growth is low but management has the discipline to reduce the size of the business via stock purchases or debt repayments. It has been my experience that buying undervalued companies combined with management that understands how to allocate capital can create some wonderful investment results. To illustrate, below is a chart that displays Papa John’s Normalized Intrinsic Value versus its stock price since 1996. (Note: Normalized Intrinsic Value is calculated by normalizing EBITDA margins over the course of time and applying an EV/EBITDA multiple of 9.0 to Papa John’s stock.) You will notice in the chart above that the company’s normalized intrinsic value has grown steadily over time. You will also notice that over time Papa John’s stock price has followed its intrinsic value. What is interesting is that, as the table below illustrates, sales and EBITDA have grown much less than its stock price.

The appreciation in Papa John’s stock price and growth in Normalized Intrinsic Value over time has been aided by the reduction of shares outstanding.In an environment where I think the economy is going to exhibit anemic growth over the next decade, it is important to look for companies that are undervalued, have a good business model and are managed well. Papa John’s meets this ‘trifecta’ of criteria. Hence, I think it is highly likely investors in Papa John’s will make money over the next five years and it is unlikely they will suffer indigestion. Complete Story » | |||||||||

| Thursday ETF Roundup: XLY Surges, BLV Continues To Slide Posted: 02 Sep 2010 03:33 PM PDT ETF Database submits: Despite a rocky start, U.S. equity markets ended the day higher on Thursday ahead of tomorrow’s crucial jobs report. While the Dow only reported a modest gain of 0.5%, the S&P 500 and the Nasdaq soared higher by 0.9% and 1.0%, respectively. Today was also an eventful day for commodities, as gold continued its surge higher, pushing past the $1,250/oz. mark. Meanwhile oil jumped by 1.5% thanks to news of a fresh oil disaster in the Gulf, which spooked investors right before the end of trading. Today’s trading day featured relatively light volume as traders stood their ground and patiently waited for tomorrow’s report on August unemployment levels, which looks to set the tone for markets. Economists polled by Thomson Reuters predict that the unemployment rate will trend higher up to 9.6%, further demonstrating that the private sector is not yet confident in an economic recovery. “We’re treading water,” said Dan Genter, CEO of RNC Genter Capital. Traders are waiting to see if Friday’s jobs data “provides more of a rescue or a shark attack.” Complete Story » | |||||||||

| The Market Ticker - Fiscal Policy: The Fed, Romer, And A Path Forward Posted: 02 Sep 2010 03:31 PM PDT | |||||||||

| Ireland: Great Example of Why the Eurozone Crisis Isn't Over Posted: 02 Sep 2010 03:30 PM PDT Garrick Hileman submits: Wondering whether the world has put the spring eurozone sovereign debt crisis behind it? Check out this succinct summary of the massive issues confronting Ireland. The NY Times article written by Messrs. Simon Johnson (former IMF chief economist) and Peter Boone (research associate at the London School of Economics) clearly articulates the overwhelming obstacles faced by just one of the euro currency member countries. Complete Story » | |||||||||

| James Turk: Big money quickly buying dips in gold and silver Posted: 02 Sep 2010 02:46 PM PDT 10:34p ET Thursday, September 2, 2010 Dear Friend of GATA and Gold (and Silver): In a brief interview with King World News, GoldMoney founder James Turk says big money is buying gold and silver on the slightest pullbacks now, sometimes waiting only hours to get into the market. The interview is headlined "Big Money Buying Pullbacks in Gold and Silver" and you can find it at King World News here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2010/9/2_Jam... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Prophecy to Become Coal Producer This Year Prophecy Resource Corp. (TSX.V: PCY) announced on May 11 that it has entered into a mine services agreement with Leighton Asia Ltd. to begin coal production this year. Production will begin with a 250,000-tonne starter pit as planned in August, with production advancing to 2 million tonnes per year in 2011. Prophecy is fully funded to production and its management team includes John Morganti, Arnold Armstrong, and Rob McEwen. For Prophecy's complete press release about its production plans, please visit: http://www.prophecyresource.com/news_2010_may11.php Join GATA here: Toronto Resource Investment Conference The Silver Summit New Orleans Investment Conference * * * Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Sona Resources Expects Positive Cash Flow from Blackdome, On May 18, 2010, Sona Resources Corp. (TSXV: SYS, Frankfurt: QS7) announced the release of a preliminary economic assessment for gold production at its flagship Blackdome and Elizabeth properties in British Columbia. Sona Executive Chairman Nick Ferris says: "We view this as a baseline scenario for gold production. The project is highly sensitive to the price of gold. A conservative valuation of gold at $1,093 per ounce would result in a pre-tax cash flow of $54 million. The assessment indicates that underground mining at the two sites would recover 183,600 ounces of gold and 62,500 ounces of silver. Permitting and infrastructure are already in place for processing ore at the Blackdome mill, with a 200-tonne per day throughput over an eight-year mine life. Our near-term goal is to continue aggressive exploration at Elizabeth and develop a million-plus-ounce gold resource, commencing production in 2013." For complete information on Sona Resources Corp. please visit: www.SonaResources.com A Canadian gold opportunity ready for growth | |||||||||

| Pension Funds Looking at Potash Bid? Posted: 02 Sep 2010 02:34 PM PDT ABC News reports, Pension Fund Approached on Potash Bid:

It seems that AIMCo wasn't the only one approached to make a rival bid. CBC reports that PotashCorp takeover bid to get review: | |||||||||

| Posted: 02 Sep 2010 02:23 PM PDT

Once upon a time, a big drop in mortgage rates would get Americans running out to buy homes in big numbers. But that is just not happening this time. As you can see from the chart below, mortgage rates are at ridiculously low levels right now. The average rate for a 30-year fixed mortgage was 4.32 percent this week. That is the lowest it has ever been since Freddie Mac began tracking mortgage rates back in 1971. These low rates have motivated millions of Americans to refinance their existing home loans, but sales of new and existing loans remain at record low levels. In fact, the number of Americans refinancing their homes is now at its highest level since May 2009, but the U.S. housing crisis just continues to get worse. Despite these record low mortgage rates, existing home sales declined 27 percent during the month of July and new homes sales dropped to the lowest level ever recorded in July. So if Americans are not buying houses when mortgage rates are this ridiculously low, what in the world is going to cause a turnaround in the U.S. housing market? The Federal Reserve has sure been trying to do what it can to resuscitate the U.S. economy. For decades, a drop in the federal funds rate could always be counted on to give the economy a jump start. But the Fed has dropped the federal funds rate almost to zero for quite some time now and it has done next to nothing to get things moving again. So is the Federal Reserve out of ammunition? Well, let's just say that they have used up all of their "best" ammunition. The Fed has been telling us since March 2009 that the federal funds rate will remain between zero and 25 basis points "for an extended period" of time, but the U.S. economy doesn't seem to care. Of course Ben Bernanke insists that the Fed is not out of ammunition and that everything is going to be okay, but at this point there is just not a lot left of Bernanke's fading credibility. The U.S. government tried to do their best to help the economy by passing stimulus bill after stimulus bill, but it just has not helped much. The government spent hundreds and hundreds of billions of dollars on some of the most wasteful things imaginable, and while the massive injection of cash may have helped temporarily stabilize the economy, it has not brought about the "recovery" that our politicians were hoping for. Now the pendulum has swung the other way in Congress and there is very little appetite for more economic stimulus spending. But if the economy was not recovering when the government was throwing giant piles of money at it, what is going to happen as the economic stimulus totally dries up? Already there are signs that the U.S. economy is in big, big trouble. General Motors announced this week that U.S. sales in August fell 24.9% to 185,176 vehicles from 246,479 vehicles in August 2009. But don't let up and down sales reports fool you. One month they may be down and the next month they may be up a bit. The important thing is to keep your eyes on the truly disturbing long-term trends. Thanks to the nightmarish U.S. trade deficit, far more wealth leaves the United States each month than enters it. That means that the United States is getting significantly poorer each month. As I noted yesterday, the United States spends approximately $3.90 on Chinese goods for every $1 that the Chinese spend on goods from the United States. That is not sustainable and China is going to continue to bleed us dry for as long as we allow it to continue. In addition, the United States continues to go into more debt every single month. Each month the U.S. national debt gets bigger, state governments go into more debt and local governments go into more debt. So what we have is a nation that is getting poorer and that is going into more debt month after month after month. We are on the road to economic hell, and the American people don't even realize it because things are still relatively good - at least for now. But as the economy continues to unravel, is there anything that the folks over at the Federal Reserve can do? Well, yes there is. It is called "quantitative easing" and the Fed has already indicated that they are going to start doing it again. Essentially, quantitative easing is when the Federal Reserve creates money out of thin air and starts buying things like U.S. Treasuries, mortgage-backed securities and corporate debt. But isn't there a good chance that this could cause inflation? Well, yes. But "Helicopter Ben Bernanke" seems determined to live up to his nickname. Anyone who thinks that Bernanke is going to just sit there and do nothing is delusional. At some point he is going to fire up his helicopter and start showering the economy with money. And the reality is that feeding massive quantities into the economy will create more economic activity. However, it will also come with a price. Someday soon, you may wake up to newspaper headlines that declare that our economy is growing at a 10% annual rate, but what they won't tell you is that the real rate of inflation will be running about 15 or 20 percent at the same time. In fact, the U.S. government will probably try to convince us that the "official" rate of inflation is only about 5 or 6 percent. The cold, hard truth is that the U.S. economy is going to continue to get worse. Whether it will be a deflationary decline or an inflationary decline depends on the boys over at the Fed. But it is going to be a decline. Meanwhile, millions of American families are hanging on by their fingernails and are hoping in vain for the great economic recovery which is never going to come. | |||||||||

| Nielson, Weir badger CFTC to act against silver market manipulation Posted: 02 Sep 2010 01:54 PM PDT 9:45p ET Thursday, September 2, 2010 Dear Friend of GATA and Gold (and Silver): Jeff Nielson of Bullion Bulls Canada and Road to Roota letter writer Bix Weir this week gave a shove to the U.S. Commodity Futures Trading Commission to get it moving against the increasingly obvious manipulation of the silver market by the big shorts. Nielson's commentary is headlined "Commodities: Hoarding Vs. Shorting" and you can find it at Bullion Bulls Canada here: http://www.bullionbullscanada.com/index.php?option=com_content&view=arti... Or try this abbreviated link: Weir's commentary is headlined "Nuts and Bolts of Comex Silver Manipulation" and you can find it at GoldSeek's companion site, SilverSeek, here: http://news.silverseek.com/SilverSeek/1283447660.php CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Sona Resources Expects Positive Cash Flow from Blackdome, On May 18, 2010, Sona Resources Corp. (TSXV: SYS, Frankfurt: QS7) announced the release of a preliminary economic assessment for gold production at its flagship Blackdome and Elizabeth properties in British Columbia. Sona Executive Chairman Nick Ferris says: "We view this as a baseline scenario for gold production. The project is highly sensitive to the price of gold. A conservative valuation of gold at $1,093 per ounce would result in a pre-tax cash flow of $54 million. The assessment indicates that underground mining at the two sites would recover 183,600 ounces of gold and 62,500 ounces of silver. Permitting and infrastructure are already in place for processing ore at the Blackdome mill, with a 200-tonne per day throughput over an eight-year mine life. Our near-term goal is to continue aggressive exploration at Elizabeth and develop a million-plus-ounce gold resource, commencing production in 2013." For complete information on Sona Resources Corp. please visit: www.SonaResources.com A Canadian gold opportunity ready for growth Join GATA here: Toronto Resource Investment Conference The Silver Summit New Orleans Investment Conference * * * Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Prophecy to Become Coal Producer This Year Prophecy Resource Corp. (TSX.V: PCY) announced on May 11 that it has entered into a mine services agreement with Leighton Asia Ltd. to begin coal production this year. Production will begin with a 250,000-tonne starter pit as planned in August, with production advancing to 2 million tonnes per year in 2011. Prophecy is fully funded to production and its management team includes John Morganti, Arnold Armstrong, and Rob McEwen. For Prophecy's complete press release about its production plans, please visit: http://www.prophecyresource.com/news_2010_may11.php | |||||||||

| Posted: 02 Sep 2010 01:27 PM PDT | |||||||||

| Posted: 02 Sep 2010 01:01 PM PDT With the market volatility and poor economic data ruling the market in the last few months, it's no surprise that many investors see this part of 2010 as a time to flee the scariness of stocks for more stable assets. But they're dead wrong... Many industries are starting to become oversold once again, and opportunities abound for value investors in 2010. One of those industries is wireless communications... Cellular stocks have been getting a lot of good attention of late, and it's no surprise why. The hype over the next new cell phone models - like the iPhone 4 or HTC Evo - has had consumers shelling out big bucks in both acquisition costs and high-margin data contracts. At the same time, consumers are eschewing fixed-line alternatives for their cell phones, opting to keep connected to a single number whether they're at home or in the car.  In turn, that increasing reliance on cell phones has made them significantly more common in the US over the course of the last decade - where only around one in three Americans owned cellular phones in the year 2000, the number of cellular subscribers is quickly approaching a ratio of one-to-one! And the end isn't yet in sight... According to industry think tank IE Market Research, wireless subscribers are expected to grow another 27.5% in the next four years. For carriers, that accelerating subscriber growth has fundamentally changed their businesses. Where the income statements of telecom giants like AT&T and Verizon were once dominated by fixed-line services, wireless customers now make up the bulk of each company's revenues. But as the cellular market becomes increasingly saturated and wireless services become further commoditized, it's likely we'll see the margins of most carriers get squeezed. More attractive is the cellular infrastructure market - the companies that exist to build out and support the massive cellular networks that span the country. Increasing numbers of subscribers (particularly high- end, data-hungry subscribers) mean that older networks aren't keeping up with the speed and throughput requirements of US customers. To stay competitive, the carriers are forced to shell out massive amounts of cash. How much? In 2011 infrastructure spending is expected to hit $40.3 billion, a 6.7% rise over last year. And unlike the cellular carrier business, which is dominated by mega-cap blue chips like AT&T, many of the companies that service cell carriers are small, growth-oriented firms. A couple familiar names to small-cap investors would include Neustar (NYSE:NSR, $22.80), a wireless communications clearinghouse, and FibreTower (NASDAQ:FTWR, $3.63), which provides facilities-based backhaul services to wireless carriers. While I do think that all of the firms that operate in this business will see at least some benefits from organic cellular subscriber growth, I also believe that some are much better equipped to benefit from that growth than others... I recently recommended shares of a fascinating small cap telecommunications firm to my Penny Stock Fortunes subscribers...and I am actively monitoring opportunities in this rapidly growing sector. Remember, even in a slow-growth economy, a few select industries will still prosper. The cellular infrastructure industry is likely to be one of them. Sincerely, Jonas Elmerraji | |||||||||

| Interesting Gold Fact of the Day Posted: 02 Sep 2010 12:58 PM PDT While out and about today on a trip to Dillon, Montana to see if we could score any Patagonia gear at their Labor Day outlet sale (it was a mad house and a pair of ski pants alpine climbing pants were secured at a hefty discount), one of the lingering little gold mysteries that had popped into my head over the years was solved.

To wit, how can they sell these little bottles that are seemingly filled with gold (about two inches high) in the many Gold Country gift shops that dot the western U.S. for just six or eight dollars a pop? Surely, there has to be more than a couple dollars worth of gold in these little bottles that are marked "99.99 Percent Pure Gold" while, at the same time, the manufacturer and retailer can't be selling them at a loss. Well, malleability is the operative word here and a display in the mining section of the Dillon Museum is what prompted the writing of this post. According to one of the displays, a single ounce of gold can be hammered into a flat sheet that spreads out into something like a 100 foot square. (Note that I don't recall the exact number, but it was much, much bigger than you would believe when looking down at a one-ounce gold coin in the palm of your hand that is about an inch and a half in diameter). Apparently, gold leaf can made unbelievably thin, a post over at Zero Hedge today noting that it "is commonly 0.18 microns (seven millionths of an inch) thick. It's so thin that a stack of 7,055 sheets would be no thicker than a dime." The folks who make these little bottles filled with gold leaf are probably making a killing. | |||||||||

| Posted: 02 Sep 2010 12:34 PM PDT | |||||||||

| Gold Speculation During the Great Correction Posted: 02 Sep 2010 12:26 PM PDT Yesterday was a good day for stock market investors. Prices went up. The Dow rose 254 points, leaving us uncertain about its near-term intentions. Of course, we're always uncertain. But sometimes we're more uncertain than others. What seems certain to us is that stocks are a bad bet. You might find this interesting, dear reader: Guess who was better off at this stage following the beginning of the crisis. The investor in the Great Depression? Or, the investor today? Well, we haven't done the calculation ourselves, but we've heard from two different sources that if you take inflation and re-invested dividends into account, investors during the Great Depression were actually ahead. The difference is in the dividends. In the 1930s, companies paid substantial dividends; today, they don't. But yesterday a report came out that told investors that manufacturing activity was picking up. After so much bad news for so long, that was all they needed. They switched back to "risk on" mode. Back and forth...to and fro... Mr. Market is making us wait. But for what? We expect stocks to go down until they finally reach their rendezvous with the bottom. We saw one estimate that put the final bottom seven years into the future. But who knows? All we know is that it hasn't happened yet. And since we believe it must come sooner or later, we conclude that it must be ahead of us...because it is not behind us. Since a lower low lies ahead, we see no reason to invest in stocks at all. The odds are against us. Besides, what's the hurry? The good companies will still be around seven years from now. And the bad companies? Well, we wouldn't want to invest in them anyway... But where...how...are we going to make some money in the next seven years? That is a good question, dear reader. We're so glad you asked. Do you have a good answer? Hope so, because we don't. The only reliable bull market of the last ten years has been in gold. The yellow metal lost $2 yesterday, closing at $1,248. That is only $14 below its all-time high. Which means, while we've been watching Bernanke, Jackson Hole, and stocks - gold has been quietly creeping up... ..stocks go down; stocks go up - and gold keeps moving up... ..fiscal stimulus, monetary stimulus, quantitative easing - and gold keeps moving up... ..recovery...no recovery - gold keeps moving up... ..inflation...deflation - and gold keeps moving up... Are you beginning to see a pattern? Yes, gold is in a bull market. It moves up on bad news. It moves up on good news. It moves up on no news at all. And if we're right about how this period of Great Correction ends, the price of gold in dollar terms should go up much, much more. But here's the important thing. Gold is money. You can use it to buy things. In terms of what gold will buy, it does not seem undervalued to us. Much has been written on the subject. But as near as we can tell, gold is now fairly priced. Go ahead; buy all you want. It is a good way to maintain your wealth and protect it against the monetary and economic calamities that are doubtless coming. And if you expect to make a lot of money on it, you'll probably succeed. When the Bernanke Fed loses its grip - which it will - and when the public gets on board the gold bull market - which it will - gold speculators will probably make a lot of money. We've been a gold bug for the last 30 years. Two thirds of that time was miserable, punishing and humiliating. Only the last 10 years have been rewarding. We expect the next 10 years to be even more rewarding. But the reward now is different. It is speculative...not inherent. When we bought gold in '99, we were buying an undervalued asset. We were buying real money, cheap. We made our money when we bought. Now, gold is fully priced. It is a still a good way to save money. But we cannot expect to make money by waiting for the metal to revert to the mean. It's already at the mean. Gold is now a speculation. A warning: we still have not had the sell-off in the financial markets that we expect. The Dow has still not sunk down to 5,000. The lights are still on at banks that should have been put out of business months ago. The public still believes another "stimulus" effort might do the trick. Leading economists still believe they can manage the economy back to growth and prosperity. We have not hit bottom yet. Far from it. When we do, the price of gold could be substantially lower. Which is okay with us. We bought years ago. We're happy with our gold holdings and don't really care if the price drops. Heck, we'd be happy to see the price back below $1,000; we'd buy more. But speculating on a rising gold price is a different thing. Most likely, speculators will be wiped out once or twice before gold hits its final top. And more thoughts... Wolf, Stiglitz, Krugman - we love these guys! They pushed the world's governments to undertake huge "stimulus" programs. Of course, the stimulus programs didn't work. They couldn't work. All they could do was to disguise the facts and delay the necessary adjustments. But these fellows don't care about that. They are the technicians, scientists, and engineers of finance. They have measures of financial health - GDP, employment, inflation, etc. They may not be able to make anyone better off...but they can damned sure move those indicators. At least, they believe they can. Spend enough money and you can move the GDP up. Hire enough people and you can get unemployment down. It's not that complicated. So, the engineers went to work two years ago. You know the rest of the story. That is how we got where we are. They turned valves. They connected wires. They adjusted dials and switches. They put at risk nearly an entire year's worth of US GDP - on the idea that an economy can be controlled and managed, just as if it were a brewery. How many cans do you want? Just work backward to figure out what inputs you need - how much grain, how much sugar, how many cans, how much electricity... It's not rocket science, for Pete's sake. The trouble is...managing an economy is not science at all. And these guys are not scientists. They have no controlled experiments. They have no test panels nor test results. They have no peer reviews. They have no proper theories - none that can be disproven or confirmed. They just have crackpot ideas and quack treatments. And now, Paul Krugman is on television in the US calling for another $800 billion program of boondoggles, bailouts and bumph. "Stimulus," he calls it. Claptrap is what it is. Regards, Bill Bonner |

| You are subscribed to email updates from Gold World News Flash To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

It really didn't take much to solve this riddle – it was more a matter of it never rising to the level where any attention was ever focused on it.

It really didn't take much to solve this riddle – it was more a matter of it never rising to the level where any attention was ever focused on it.

No comments:

Post a Comment