Gold World News Flash |

- If the U.S. Dollar were to fall how important is gold to the States?

- International Forecaster August 2010 (#1) - Gold, Silver, Economy + More

- Marc Faber Lectures Abu Dhabi on Asset Allocation and Tips Gold

- US Government Redefines “Fixing the Economy”

- To Infinity...And Beyond!

- Mr. Magoo - AGAIN (Tax Cuts)

- Gold Spikes Higher on Jobs Report

- Ready, Set, Gold: Best Months Are Just Ahead

- Ashley Lauren Foundation Gold Outing

- REAL GOLD SELLERS - NEEDED!

- Mainstreet Is Going To Get A Gigantic Bailout

- Japan Redux: A Video Case Study Of The Upcoming U.S. Lost Decade

- Senators introduce bill to keep SEC under open-government law

- Art Cashin: "The Fed Is Walking A Tightrope In A Hurricane" And Other Observations

- Bubblemania: Part IV, The Mythical "Gold Bubble"

- Bubblemania: Part IV, The Mythical "Gold Bubble"

- Silver Prices Mark First Week of August with Gains

- Bullion Prices and Business Weekly Update – August 7, 2010

- Pat Heller: Dollar plunges and commodities soar, but not gold and silver

- Gold council CEO helps The Economist put investors to sleep

- Morgan cuts gold and silver shorts, maybe permanently, Butler says

- Silver Spikes and Power Struggles

- Yamana Gold, Inc. Q2 2010 Earnings Call Transcript

- Goldman Made Between $11 And $16 Billion In 2009 Trading CDS And Other Derivatives

- [1157] The Truth About Markets – London – 07 August 2010

- What The Weak Employment Numbers Mean

- Au and Ag Languish, Dollar Plummets....Pat Heller

- Going Deep

- Silver Short: Days of World Production To Cover Certain Commodity Short Positions

- IMF Global Currency Master Plan Flies Under the Radar

| If the U.S. Dollar were to fall how important is gold to the States? Posted: 08 Aug 2010 01:00 PM PDT Since the demise of the Gold Standard, monetary authorities have tried as many ways as possible out there to sideline gold as part of the monetary system. Since the early eighties they have succeeded to some extent, but this was by discrediting it and by emphasizing the benefits of paper currencies. |

| International Forecaster August 2010 (#1) - Gold, Silver, Economy + More Posted: 08 Aug 2010 04:00 AM PDT It was only a month ago that the Dow closed at 9686. From there it started to move back up again as insiders learned of the Fed's plan to inject $5 trillion into the economy over the next two years. The result has been a run up to 10,674. We figured out what the Fed was up to, but most everyone else did not. |

| Marc Faber Lectures Abu Dhabi on Asset Allocation and Tips Gold Posted: 08 Aug 2010 01:00 AM PDT |

| US Government Redefines “Fixing the Economy” Posted: 07 Aug 2010 07:00 PM PDT The good news, in the face of all of this terrible calamity, is that you can still buy gold, silver and oil at bargain-basement prices, because at the rate that the terrifying Obama administration and the profoundly incompetent and corrupt Congress are spending money, and at the rate the Federal Reserve is creating the money to finance the spending, inflation in consumer prices is on its way, and these low prices won't last long! |

| Posted: 07 Aug 2010 06:00 PM PDT This coming week will be very important as the US Fed meets to discuss interest rates. Chances are near 100% that they will remain in the current range but what is important is that they are likely to announce some sort of second quantitative easing program, adopting Buzz's phrase, only applying it to money printing. |

| Posted: 07 Aug 2010 05:58 PM PDT Market Ticker - Karl Denninger View original article August 07, 2010 11:17 AM Here we go again..... [INDENT] Rather than keeping tax rates steady for all but the wealthiest Americans, as the White House wants, Mr. Greenspan is calling for the complete repeal of the 2001 and 2003 tax cuts, brushing aside the arguments of Republicans and even a few Democrats that doing so could threaten the already shaky economic recovery. "I'm in favor of tax cuts, but not with borrowed money," Mr. Greenspan, 84, said Friday in a telephone interview. "Our choices right now are not between good and better; they're between bad and worse. The problem we now face is the most extraordinary financial crisis that I have ever seen or read about." [/INDENT] Riiiiight.... A financial crisis Greedscam CAUSED with his insane monetary policy during the bubble years. And let's not forget - all these tax cuts - even then - were with borrowed money: Where's the surplus Alan? This is the tota... |

| Gold Spikes Higher on Jobs Report Posted: 07 Aug 2010 05:58 PM PDT Gold spent all of Far East and most of London trading hugging the $1,195 price level. Then there was the spike over $1,200 when the jobs numbers were released yesterday morning. Gold struggled mightily to break above $1,210 spot... but got sold off all three time that it tried to break through that price barrier... but still managed to finish the week over $1,200 spot. Volume was pretty heavy. Silver's price action was very similar to gold's... and every serious breakout attempt during the New York trading session ran into a not-for-profit seller. Volume was moderate. The dollar did a face plant at the release of the jobs numbers... and fell at least 75 basis points in less than two hours... hitting the 80.1 mark on the U.S. dollar index, before recouping some of its losses... but was still down 0.54% on the day. Here's the 5-day dollar chart for the week that was. Lot's of waterfall declines here. The 30-day chart is even uglier... as the ... |

| Ready, Set, Gold: Best Months Are Just Ahead Posted: 07 Aug 2010 05:58 PM PDT By Frank Holmes CEO and Chief Investment Officer Global economic conditions are now favorable for gold as a safe-haven investment. The U.S., Western Europe and Japan are close to buckling under the weight of their sovereign debt loads, government budget deficits remain large and persistent and, as a result, faith in major paper currencies is low. On top of this, China – the world’s No. 1 gold producer and No. 2 gold consumer – is encouraging gold investing by its rapidly growing middle class, and will likely have to increase imports to meet this new demand. If history is any guide, gold is about to get even more attractive because we are heading into the fall and winter gift-giving season. This is the time of year that gold jewelers typically do their biggest business. The kickoff is the Muslim holy month of Ramadan, which starts next week and ends with generous gift-giving in early September. After Ramadan comes India’s post-monsoon weddi... |

| Ashley Lauren Foundation Gold Outing Posted: 07 Aug 2010 05:58 PM PDT The following is automatically syndicated from Grandich's blog. You can view the original post here. Stay up to date on his model portfolio! August 07, 2010 04:06 AM SAVE THE DATE: October 4, 2010 Mark your calendar for Monday, October 4th for the 4th Annual Ashley Lauren Foundation Golf Outing at Bamm Hollow Country Club, Lincroft, NJ. I really need your help. Would you please consider playing/attending banquet/donating to a wonderful charity run by a true angel named Monica. No person I ever met inspires me more than her and what she accomplishes through this foundation. I can promise you that every dollar raised goes to great use to help kids with cancer and their families. I will consider it a personal favor by all who help. God Bless! P.S. Please note the invited celebrities and your ability to spend 4-5 hours on the course with them and your foursome. [url]http://www.grandich.com/[/url] grandich.com... |

| Posted: 07 Aug 2010 04:04 PM PDT Hello all. We are direct Buyers and we're seeking large quantites of AU Gold Bullion/Bars from real Gold Sellers/Mandate (no broker chains), any offers from Africa or Asia will be refussed, hope you understand me, because now are so many scamers. My name is Andrei, i'm partner with a man from Germany wich is is next to the Buyer Mandate of the World Bank. You just need two SKR number of any quantity, the Bank will check of the Gold really exist and then we can close the deal in 24H. The SKR number has just made for the Bank to check in their system the availability of the Gold. What form of gold do you want ? prefered - AU Bulion How many quantity will you purchase ? any big Quantity you have What is your payment term ? payment - BO to BO What is the possible proceed for the deal? it's a deal with a Bank Seller must provide the following: Full Corporate Offer (FCO) or Soft Corporate Offer (SCO) Table Top Meeting (TTM) Quantity : 500 MT with Rolls and Extensions (more quantity) Next to the seller or seller mandate Passport copy of the Seller Attractive discount Hallmark and certifications LOI will be provided to valid seller Bank to bank, L/C, POF, Buyer Mandate, doc's, etc. will be provided Acceptable procedures for transaction No gold sellers from Africa or Asia !!! Contact information: email: atopolnitchi@yahoo.com skype: andrei.topolnitchi y.mess: atopolnitchi Next to the Buyer Mandate, contact details: michelfouda@gmail.com skype: mickael2201 phone: +491633392425 Only real AU Gold Bulion sellers! Waiting for your offers Sincerely, Andrei Topolnitchi |

| Mainstreet Is Going To Get A Gigantic Bailout Posted: 07 Aug 2010 03:13 PM PDT (snippet) "Main Street may be about to get its own gigantic bailout. Rumors are running wild from Washington to Wall Street that the Obama administration is about to order government-controlled lenders Fannie Mae and Freddie Mac to forgive a portion of the mortgage debt of millions of Americans who owe more than what their homes are worth. An estimated 15 million U.S. mortgages - one in five - are underwater with negative equity of some $800 billion. Recall that on Christmas Eve 2009, the Treasury Department waived a $400 billion limit on financial assistance to Fannie and Freddie, pledging unlimited help. The actual vehicle for the bailout could be the Bush-era Home Affordable Refinance Program, or HARP, a sister program to Obama's loan-modification effort. HARP was just extended through June 30, 2011. "The move, if it happens, would be a stunning political and economic bombshell, less than 100 days before a midterm election in which Democrats are currently expected to suffer massive, if not historic losses. The key date to watch is August 17, when the Treasury Department holds a much-hyped meeting on the future of Fannie and Freddie." Normally I blow this type of stuff off. But Pethokoukis is a serious journalist with a solid pedigree and a long list of inside contacts, which you can see at the link below. I hope this is just a rumor. Seriously. You want to tax renters (about 35% of us) to help pay for mortgages for people who entered knowingly into a business transaction that sadly did not end well? I truly feel sorry for them. I have several very good (and responsible) friends who are in trouble, and I understand the issues. They just bought at the wrong time. But what about my investment in a start-up that failed? People who are behind on credit cards? If you bought a new car, you are underwater the moment you drive the car off the lot. Help for those? Where does it end? Hundreds of billions of debt that our children will have to pay? Say it ain't so, Joe. You can read the whole blog if you have adult beverages or blood-pressure medicine nearby. More Here.. |

| Japan Redux: A Video Case Study Of The Upcoming U.S. Lost Decade Posted: 07 Aug 2010 01:56 PM PDT Whether one believes in inflation or deflation, one thing is certain: in many ways the current US experience finds numerous parallels to what has been happening in Japan for not one but two decades. While major economic, sociological and financial differences do exist, the key issue remains each respective central bank's failed attempts to reflate its economy. While long a mainstay of Japan, if the first failed version of our own QE, which pumped $1.7 trillion of new liquidity into the system, is any indication, future comparable efforts by our own Fed will be met with the same outcome (and hopefully with the same political result: the half life of an average Japanese prime minister is 6 months - if only our career politicos knew their tenure in office could be capped at half a year...). There is of course the "tipping point" optionality discussed earlier by Ambrose Evans-Pritchard, when comparing the hyperinflationary timeline during the Weimar republic, which noted that it took just a few months for the economy to slide from a period of price stability to outright hyperinflation. Either way, for an ironic look at the Japanese deflation scenario, targeted more at novices although everyone will likely learning something from it, we present the following informative clip from, ironically, the National Inflation Association, which asks whether Japan is a blueprint for America's imminent lost decade(s).

|

| Senators introduce bill to keep SEC under open-government law Posted: 07 Aug 2010 09:44 AM PDT By Ken Sweet http://www.foxbusiness.com/markets/2010/08/05/senators-introduce-sec-foi... Four prominent members of the U.S. Senate introduced a bill Thursday that would strike the provision in the Dodd-Frank Act that potentially gives the Securities and Exchange Commission broad powers to deny Freedom of Information Act requests. The bill, introduced by a bipartisan group of senators on the Senate Judiciary Committee -- Sen. Patrick Leahy, D-Vt., Sen. John Cornyn, R-Texas, Sen. Ted Kaufman, D-Del., and Sen. Chuck Grassley, R-Iowa -- is similar to a House version introduced by Rep. Darrell Issa, R-Calif., that would strike the provision in the law. ... Dispatch continues below ... ADVERTISEMENT Sona Resources Expects Positive Cash Flow from Blackdome, On May 18, 2010, Sona Resources Corp. (TSXV: SYS, Frankfurt: QS7) announced the release of a preliminary economic assessment for gold production at its flagship Blackdome and Elizabeth properties in British Columbia. Sona Executive Chairman Nick Ferris says: "We view this as a baseline scenario for gold production. The project is highly sensitive to the price of gold. A conservative valuation of gold at $1,093 per ounce would result in a pre-tax cash flow of $54 million. The assessment indicates that underground mining at the two sites would recover 183,600 ounces of gold and 62,500 ounces of silver. Permitting and infrastructure are already in place for processing ore at the Blackdome mill, with a 200-tonne per day throughput over an eight-year mine life. Our near-term goal is to continue aggressive exploration at Elizabeth and develop a million-plus-ounce gold resource, commencing production in 2013." For complete information on Sona Resources Corp. please visit: www.SonaResources.com A Canadian gold opportunity ready for growth The drafting of a Senate bill to strike the SEC FOIA provision comes a day after House Financial Services Committee Chairman Rep. Barney Frank, D-Mass., said he would hold hearings next month regarding potential abuse of the bill. "When Congress enacted these exemptions, it sought to ensure that the SEC had access to the information that the commission needed to carry out its new enforcement powers and to protect American investors -- not to shield information from the public," said Leahy, who is also the chairman of Senate Judiciary Committee. "I have been troubled by the sweeping interpretation that the commission has expressed, to date, that these exemptions would shield all information provided to the commission in connection with its broad examination and surveillance activities." The SEC provision in the Dodd-Frank Act, known by its technical name 929I, was invoked by the SEC to deny an FOIA request by FOX Business last week. Since the news became public, several members of Congress have come out against the provision, saying it gives the SEC too much statutory power to deny FOIA requests. "If anything, the financial crisis and the wave of financial frauds we have seen over the past few years call for more transparency at the SEC, not less," Cornyn said in a statement. "I am alarmed that the financial regulatory reform bill appears to have excluded the SEC from the FOIA disclosure requirements." Journalism organizations have also come out publicly against the bill, citing the SEC's failures with the Bernie Madoff case and subprime mortgage crisis as reasons why the agency needs to be opened up to further scrutiny. The SEC has repeatedly denied that the 929I provision can be used to deny FOIA requests, saying that it will continue to honor them. Join GATA here: New Orleans Investment Conference * * * Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Prophecy to Become Coal Producer This Year Prophecy Resource Corp. (TSX.V: PCY) announced on May 11 that it has entered into a mine services agreement with Leighton Asia Ltd. to begin coal production this year. Production will begin with a 250,000-tonne starter pit as planned in August, with production advancing to 2 million tonnes per year in 2011. Prophecy is fully funded to production and its management team includes John Morganti, Arnold Armstrong, and Rob McEwen. For Prophecy's complete press release about its production plans, please visit: http://www.prophecyresource.com/news_2010_may11.php |

| Art Cashin: "The Fed Is Walking A Tightrope In A Hurricane" And Other Observations Posted: 07 Aug 2010 09:33 AM PDT The head of floor operations at UBS, who has followed the Dow since its triple digits days, and has been covering the market for the past 40 years, shares his ever amusing insights with Eric King. Art Cashin, whose daily comments on "napkin charting" and requisite market "nimbleness" are now legendary, and have appeared many times on the pages of Zero Hedge, discusses such matters as market topping, various levels of deterioration within the economy, the ongoing wage deflation, the shift of US society to a welfare state, the deflationary collapse of the economy, and the imminent response by the Fed: never one to mince words, Cashin observes with pinpoint accuracy "if you ask small businesses why aren't you borrowing, their answer is 'send me a customer, don't send me credit.'" and concludes "the Fed is walking a tightrope in a hurricane and it's going to be tough." We just found the understatement of the weekend. On the near-term market charting:

On the economic headlines:

On the headline improvements in Non-Farm Payrolls (well, one can scrap that after yesterday):

On the traditional dynamo of economic growth - small businesses:

On whether the stimulus is losing its ability to impact the economy:

On whether we are wallowing through what could be depressionary cycle:

On whether the Fed will raise rates and/or do Quantitative Easing, and on the leaderlessness at the Fed.

Link for full King World News interview.

|

| Bubblemania: Part IV, The Mythical "Gold Bubble" Posted: 07 Aug 2010 09:20 AM PDT By Jeff Nielson, Bullion Bulls Canada In Parts I, II, and III; I discussed the "epidemic of bubble-blindness" among American business writers and "analysts". This is a very peculiar condition in that not only are all U.S. asset-bubbles completely "invisible" to those afflicted (approximately 95% of all U.S. writers), but those suffering from this condition are prone to seeing non-U.S. asset "bubbles" virtually everywhere. The ultimate example of this phenomenon is the endless multitude of U.S. articles "warning" investors that there is a "gold bubble" which is about to burst. These bubble-blind boobs were totally unable to "see" the U.S. "dot.com bubble", the first and second U.S. housing bubbles, and the especially outrageous U.S. Treasuries bubble – despite the overwhelming evidence of absurdly excessive prices, and enormous amounts of leveraged-debt (the two components necessary for any bubble). Conversely, these pseudo-journalists regularly proclaim they can "see a gold bubble", despite there being absolutely zero evidence of such. To begin any analysis of asset-prices, the first step of such analysis is to strip-out inflation from the price of the asset in question. This is an obvious necessity, as if this is not done, then it is absolutely impossible to state how much of a "price rise" is an actual (absolute) gain in price, and how much of this "price rise" is merely tracking inflation. Virtually none of the American writers who "see" this supposed "gold bubble" ever even conduct this preliminary (and elementary) step in their analysis. Lest you think that I am "cherry-picking" among these dolts for the especially-clueless among the "gold bubble-spotters" (who failed to adjust the price of gold for inflation before concluding that there is a "gold bubble"), this list of incompetent analysts includes Nobel Prize winner (for economics), Nouriel Roubini (among many others). There is an obvious reason for the gold-bubble zealots to refuse to factor-in inflation in their facile attempts at "analysis": any attempt to strip-out inflation from the price of gold shows that rather being in a "bubble" that gold is one of the most under-priced assets on the planet. If we use the "official" inflation numbers of the U.S. government (i.e. ridiculously fraudulent numbers for inflation), even that partial-analysis shows that the price of gold would have to more-than-double (to nearly $2500/oz) from its current price just to equal its ("real dollar") all-time high from 1980. If we scan the world of commodities to look for any other major commodity which is currently priced at less-than-half its ("real dollar") price of 30 years ago, we find only one other commodity: silver. In fact, it is this remarkable "coincidence" that both of the most grossly-undervalued commodities on the planet are "precious metals" which is one of the myriad reasons why "gold bugs" are convinced of rampant manipulation in the gold market (with the confessions of many prominent officials being another reason). However, we can't truly understand the degree of U.S. gold-bubble idiocy until we use legitimate numbers for inflation (i.e. those from John Williams of Shadowstats.com). In other words, we need to look at the real, "real dollar price" of gold. As subscribers to Mr. Williams site already know (along with my own, regular readers), if we use actual numbers for inflation over the last 30 years, then the price of gold would have to rise to approximately $7,500/oz to equal the 1980-high (a more than six-fold increase from today's price). More articles from Bullion Bulls Canada…. |

| Bubblemania: Part IV, The Mythical "Gold Bubble" Posted: 07 Aug 2010 09:20 AM PDT By Jeff Nielson, Bullion Bulls Canada In Parts I, II, and III; I discussed the "epidemic of bubble-blindness" among American business writers and "analysts". This is a very peculiar condition in that not only are all U.S. asset-bubbles completely "invisible" to those afflicted (approximately 95% of all U.S. writers), but those suffering from this condition are prone to seeing non-U.S. asset "bubbles" virtually everywhere. The ultimate example of this phenomenon is the endless multitude of U.S. articles "warning" investors that there is a "gold bubble" which is about to burst. These bubble-blind boobs were totally unable to "see" the U.S. "dot.com bubble", the first and second U.S. housing bubbles, and the especially outrageous U.S. Treasuries bubble – despite the overwhelming evidence of absurdly excessive prices, and enormous amounts of leveraged-debt (the two components necessary for any bubble). Conversely, these pseudo-journalists regularly proclaim they can "see a gold bubble", despite there being absolutely zero evidence of such. To begin any analysis of asset-prices, the first step of such analysis is to strip-out inflation from the price of the asset in question. This is an obvious necessity, as if this is not done, then it is absolutely impossible to state how much of a "price rise" is an actual (absolute) gain in price, and how much of this "price rise" is merely tracking inflation. Virtually none of the American writers who "see" this supposed "gold bubble" ever even conduct this preliminary (and elementary) step in their analysis. Lest you think that I am "cherry-picking" among these dolts for the especially-clueless among the "gold bubble-spotters" (who failed to adjust the price of gold for inflation before concluding that there is a "gold bubble"), this list of incompetent analysts includes Nobel Prize winner (for economics), Nouriel Roubini (among many others). There is an obvious reason for the gold-bubble zealots to refuse to factor-in inflation in their facile attempts at "analysis": any attempt to strip-out inflation from the price of gold shows that rather being in a "bubble" that gold is one of the most under-priced assets on the planet. If we use the "official" inflation numbers of the U.S. government (i.e. ridiculously fraudulent numbers for inflation), even that partial-analysis shows that the price of gold would have to more-than-double (to nearly $2500/oz) from its current price just to equal its ("real dollar") all-time high from 1980. If we scan the world of commodities to look for any other major commodity which is currently priced at less-than-half its ("real dollar") price of 30 years ago, we find only one other commodity: silver. In fact, it is this remarkable "coincidence" that both of the most grossly-undervalued commodities on the planet are "precious metals" which is one of the myriad reasons why "gold bugs" are convinced of rampant manipulation in the gold market (with the confessions of many prominent officials being another reason). However, we can't truly understand the degree of U.S. gold-bubble idiocy until we use legitimate numbers for inflation (i.e. those from John Williams of Shadowstats.com). In other words, we need to look at the real, "real dollar price" of gold. As subscribers to Mr. Williams site already know (along with my own, regular readers), if we use actual numbers for inflation over the last 30 years, then the price of gold would have to rise to approximately $7,500/oz to equal the 1980-high (a more than six-fold increase from today's price). More articles from Bullion Bulls Canada…. |

| Silver Prices Mark First Week of August with Gains Posted: 07 Aug 2010 09:19 AM PDT U.S. silver tracked gold during the first week in August, registering a weekly gain of 46.9 cents after falling 3.8 percent in July. |

| Bullion Prices and Business Weekly Update – August 7, 2010 Posted: 07 Aug 2010 09:19 AM PDT

Silver tracked gold for the day and week, but platinum and palladium settled lower for both over concerns their industrial demand would weaken in a slowing economy. Crude oil and U.S. stocks were punched lower Friday by the jobs data, but still managed sizable weekly gains as the major indexes grew between 1.50 and 1.90 percent. European stocks were lower on Friday but higher for the week as well…. Read the rest of Bullion Prices and Business Weekly Update – August 7, 2010 (1,230 words) © 2010 CoinNews Media Group LLC |

| Pat Heller: Dollar plunges and commodities soar, but not gold and silver Posted: 07 Aug 2010 09:19 AM PDT 10:50a ET Saturday, August 7, 2010 Dear Friend of GATA and Gold (and Silver): Over the last five weeks, Patrick Heller reports at Coin Update, the U.S. dollar has fallen almost 6 percent and most commodity prices have risen sharply but gold and silver have fallen 4.3 and 1.4 percent, respectively. "This does not make sense," Heller writes, except in the context of surreptitious suppression of gold and silver prices by the U.S. government as part of a general scheme of currency market manipulation. Heller, proprietor of Liberty Coin Service in Lansing, Michigan, cites GATA's work. His commentary is headlined "While Gold and Silver Languish, U.S. Dollar Plummets and Other Commodity Prices Soar" and you can find it at Coin Update here: http://news.coinupdate.com/gold-and-silver-us-dollar-plummets-commodity-… CHRIS POWELL, Secretary/Treasurer * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Gold council CEO helps The Economist put investors to sleep Posted: 07 Aug 2010 09:19 AM PDT 11:20a ET Saturday, August 7, 2010 Dear Friend of GATA and Gold: The organ of financial establishment disinformation, The Economist magazine, this week did a most understated eight-minute interview with the chief executive officer of the World Gold Council, Aram Shishmanian, who remarked that Indian women hold twice as much gold as the tonnage reported held by the U.S. Treasury Department. Shishmanian added that Indian women don't sell their gold, though maybe the WGC will contrive a scheme through which they can lease it to the exchange-traded fund GLD. The Economist's interview with Shishmanian may be most remarkable for avoiding discussion of currency market issues even as the currency markets are cracking under the strains of national insolvency and central bank intervention. With industry leadership like this, gold's triumph over the crookedness of the central banking system is assured in about a thousand years. You can watch the interview with Shishmanian at The Economist's Internet site here: http://audiovideo.economist.com/?fr_story=64467a692b9a285a43a6dd99c7b598… CHRIS POWELL, Secretary/Treasurer * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Morgan cuts gold and silver shorts, maybe permanently, Butler says Posted: 07 Aug 2010 09:19 AM PDT 10:30a ET Saturday, August 7, 2010 Dear Friend of GATA and Gold (and Silver): In his weekly interview with Eric King of King World News, silver market analyst Ted Butler reports that JPMorganChase, the big short in silver, has brought its position to the lowest level since May 2009 and has been reducing its short position in gold as well. Because of pending changes in law and regulation in the United States, Butler doubts that MorganChase will ever be shorting again as much as it once did. The Comex situation for gold and silver, Butler says, is now about 85 percent bullish. You can listen to the King World News interview with Butler here: http://kingworldnews.com/kingworldnews/Broadcast_Gold+/Entries/2010/8/7_… CHRIS POWELL, Secretary/Treasurer * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Silver Spikes and Power Struggles Posted: 07 Aug 2010 09:19 AM PDT Chris Mack submits: Silver has a history of undergoing massive spikes that look more like a heart rate chart than a stock or commodity chart. Due to silver's conductive and reflective properties, it has been considered a strategic metal for industrial uses since the introduction of electronics. It is the only commodity that has a users' association lobbying for the organizations that consume it. Industrial use of silver has been relatively stable; however it is important to note that industrial use of silver has been greater than or near equal to production – which has thinned the market probably more than any other commodity. The reason for this is that both mining supply and industrial production have been near equal and stable. What is left at the margin are investors and speculators who are setting the price – not based upon 600-800 million ounces in global production or consumption, but 50-100 million that is the remaining marginal amount that buyers and sellers can get their hands on. |

| Yamana Gold, Inc. Q2 2010 Earnings Call Transcript Posted: 07 Aug 2010 09:19 AM PDT |

| Goldman Made Between $11 And $16 Billion In 2009 Trading CDS And Other Derivatives Posted: 07 Aug 2010 08:32 AM PDT As part of its most recent FCIC grilling, David Viniar left the political theater a month ago with a homework assignment to disclose all of the firm's derivative profits, as well as provide granular detail on its derivative trades. Today, courtesy of a memo from Goldman intercepted by the WSJ, we now know that derivative trades accounted for between 25% and 35% of 2009 revenue. "Based on the percentages provided by Goldman, such businesses generated $11.3 billion to $15.9 billion of the company's $45.17 billion in net revenue for 2009." As a reminder, the Office of the Currency Comptroller noted (table 2) Goldman had $49 trillion in total derivatives as of Q1. However, the bulk of the profit comes from trading credit derivatives where Goldman, post the assimilation of Bear and Lehman into the collective, is now virtually an undisputed trading powerhouse, and due to the OTC nature of the product allowing firms to set bids and asks as is, as long as liquidity in cash products continues to decline, Goldman will continue to dominate not only the most profitable vertical of derivative trading, but CDS will continue to generate roughly a third of the firm's profits, for both flow and prop. Post the recent shifts in prop trading across Wall Street, it will be interesting to see what the impact on the top line will be now that allegedly CDS trading at Goldman will be exclusively on a flow basis. The irony is that the Volcker Rule seems to focus almost exclusively on equity trading, while the bulk of the firm's questionable flow-prop "Chinese wall" transgressions may occur precisely in derivative trading, and should be the one area under much more scrutiny by regulators and legislators. More from the WSJ:

Keep in mind that Goldman's critical Trading and Principle revenue stream declined notably in Q2 as posted previously, which is a function of declining trade volumes, not so much in equity but across fixed income as well. Furthermore, following the decline in BofA's record daily trading profitability from perfection to 81%, we are waiting for Goldman's 10-Q with baited breath: we anticipate that Goldman will experience a comparable if not worse decline in Q2 trading prowess. In light of the firm's legal troubles in Q2, and its record low public perception, how much of this may have been on purpose is a different question.

|

| [1157] The Truth About Markets – London – 07 August 2010 Posted: 07 Aug 2010 06:34 AM PDT Stacy Summary: This week, Max and Stacy look at the possible future central banking monopolists of virtual currencies and compare the business models of Nollywood versus Hollywood. For more download & listening options, visit Archive dot org This posting includes an audio/video/photo media file: Download Now |

| What The Weak Employment Numbers Mean Posted: 07 Aug 2010 06:23 AM PDT From The Daily Capitalist A disappointing July jobs report came out Friday showing weak employment gains, further evidence that the economy is stalling out. While the headline was that the 9.5% unemployment rate didn't change, private job create was anemic at only 71,000 new jobs. That was not sufficient to overcome the longer-term effects of joblessness as the broader rate of unemployment, the "U-6" rate, stood unchanged at 16.5%. Roughly 6.6 million (45%) workers have been unemployed for more than 27 weeks. About 14.6 million workers are unemployed or underemployed. What was unsettling to the markets was the downward revision of June's numbers that increased unemployment by another 96,000 workers. An average of less than 100,000 new jobs per month is insufficient to offset job losses and show job growth. Many economists say we need at least 200,000 new jobs created every month to start chipping away at the unemployment level. Slight gains were seen in the average workweek and average pay. The big cuts were in government hiring as states and local government shed jobs and as Census workers jobs have come to an end. The 71,000 job increase in the private sector was seen as anemic and below economists' forecasts. Some of the highlights from the BLS report today:

The consumer credit report also came out Friday showing a continued decline. It was a negative $1.3 billion in June, down 4.5% annually. It slowed its contraction due to a good auto sales market (i.e., nonrevolving credit which was down by only 1.4%). But revolving credit, basically credit card debt, was down $4.5 billion in June or down 10.5% annually. Your political representatives continued to snipe. President Obama said words to the effect that it takes time to climb out of a big hole especially one that he didn't dig. Rahm Emmanuel, the President's Chief of Staff, said that that the business community just doesn't understand the Administration. The Democrats are trying to pass bills to aid small businesses and bailout state and local governments. “We need to do what’s right, not what’s political, and we need to do it right now,” the President said. Nancy Pelosi said that at least the Democrats were doing better than did George Bush. The Republicans claim that Obama's stimulus policies aren't working. McCain and others just released a report highlighting some wasteful spending from the Recovery Act. I am confident the Republicans have no idea what to do either. Yawn. What to watch for: the Fed's Tuesday meeting. As I reported in my article, "Is A Shift In Fed Policy Coming?," they are facing increasing pressure to thwart what they see as deflation, and right now inflation would look good to them. We'll see if the anti-deflationists ( President Bullard) or the anti-inflationists (President Hoenig) have it out. My guess is that they will vote to continue existing policy but will "stay vigilant against future weakness," which will be a sign that they are worried, but don't yet know what to do. I believe the economic data will continue to weaken and when unemployment ticks up, they will start increasing Open Market Operations in an attempt to create inflation. |

| Au and Ag Languish, Dollar Plummets....Pat Heller Posted: 07 Aug 2010 05:45 AM PDT article from Pat Heller http://news.coinupdate.com/gold-and-...ces-soar-0395/ While Gold and Silver Languish, US Dollar Plummets and Other Commodity Prices Soar By Patrick A. Heller on August 5th, 2010 Categories: Gold and Silver Commentary, Precious Metals In the five weeks from June 28 through August 3, the US Dollar Index fell 5.9%! This Index reports the relative value of the dollar against a basket of other major currencies. Over that time, the dollar has fallen 7.2% against the Euro, 5.3% versus the British pound, 4.4% to the Swiss franc, 4.4% compared to the Australian dollar, 4% versus the Japanese yen, 3.9% against the South Africa rand, and 3.8% to the Chile peso. The best result for the US dollar when compared to the 22 currencies I regularly track was no change to the India rupee. The dollar declined against the other 21, including 0.3% to the Chinese yuan, 1.1% to the Canadian dollar, and even 1.0% against the Mexican Peso. In normal markets, when the value of the US dollar plummets so quickly, gold and silver prices take off. Not this time. In the same time period, the price of gold was down a significant 4.3% and silver fell 1.4%! This does not make sense. After all, other commodity wholesale prices have soared in US dollar prices during these five weeks: Wheat 44.50% Eggs 28.60% Sorghum 22.60% Flour 22.10% Corn 15.90% Palladium 15.40% Cheddar cheese 14.70% Cottonseed meal 11.40% Zinc 11.30% Soybeans 11.30% Sugar 11.30% Crude oil 11.00% Aluminum 10.20% Copper 8.20% Hominy feed 8.10% Butter 7.00% Platinum 6.70% Nickel 6.40% Corn oil 5.10% Oats 5.10% Unleaded gasoline 3.40% Coffee 2.40% Chicken 0.30% Natural gas -0.40% Beef -0.50% Cocoa -1.90% Lard -9.10% Tallow -9.20% Cocoa -1.90% Lard -9.10% Tallow -9.20% Sources: The Wall Street Journal and London Metals Exchange These are the commodities I track on a regular basis to warn me about changes in price levels. I find this information far more accurate then the Consumer Price Index published by the US Bureau of Labor Statistics which shows virtually no rising prices. Why did the price of almost everything rise against the US dollar in the past month or so, except for gold and silver? I think I can explain. Two months ago, after observing that the Federal Reserve was flooding world markets with US dollars, I predicted an imminent reaction of significantly higher gold and silver prices by the end of July. While it happened for other currencies (versus the dollar) and commodities, it specifically did not occur for gold and silver. Gold and silver are special commodities. The price of gold effectively serves as a report card on the value of the US dollar, the US economy, and the US government. The US government has the largest budget of any nation. The US dollar pretty much serves as the world's reserve currency. The US economy is the world's largest—by far. Putting this all together indicates that the US government has a huge incentive to take actions to suppress the price of gold. The US government also has the largest total of outstanding debt of any country. By holding down gold prices and lulling creditors with a false sense of security, the US government derives substantial financial benefits from paying a lower interest rate on that debt. Silver generally trades in sympathy with gold. Therefore, in order to reinforce any manipulation of gold prices, the silver market would need similar attention. In addition to motive and opportunity, you also have to consider that the US government has actively manipulated the price of gold going all the way back to the end of World War I in 1918. As more federal documents are declassified every year, more information about past price suppression activities are confirmed. The most recent admissions of manipulation have to do with trading in the London gold pool in the 1970s. Kevin Warsh, a governor of the Federal Reserve Board, in a September 17, 2009 letter to the Gold Anti-Trust Action Committee, Inc. (GATA), admitted that the Fed has current gold swap arrangements with other central banks. So, it is possible for the prices of gold and silver to be held down while the dollar is falling and other commodity prices are mostly soaring. But gold and silver prices cannot be suppressed forever. In fact, it does not look like they can be held near current levels very much longer. With major trading partners of the US government, who almost certainly helped perpetrate the manipulations, now closing out their COMEX gold and silver short positions at a record pace, that indicates that those companies expect much higher prices soon. You can acquire your gold and silver today, or maybe have to pay a lot more for it in a month or two—if you will then be able to find any to buy! Patrick A. Heller owns Liberty Coin Service in Lansing, Michigan and writes "Liberty's Outlook," a monthly newsletter covering rare coins and precious metals. Past issues can be found online at http://www.libertycoinservice.com/ Pat Heller is also the gold market commentator for Numismatic News. Past columns online at http://numismaster.com/ under "News & Articles". His periodic radio interviews can be heard on WILS 1320 AM in Lansing, www.talkLansing.net, and on www.yourcontrarian.com XWe hope you enjoyed this article! Please subscribe to our RSS feed or sign up to receive future articles by email. Go to the subscriptions page. |

| Posted: 07 Aug 2010 05:16 AM PDT Recently, I had a long talk with Ali Moshiri, President of Chevron Africa and Latin America Exploration and Production Company. Mr. Moshiri has been working for Chevron for over 30 years. He's one busy man, whose responsibilities begin in the southern waters of the Gulf of Mexico and extend to the cold reaches of the southern Atlantic Ocean. In our talk, Mr. Moshiri and I looked at the future of offshore oil and gas exploration and development. Here's part of what we discussed… Byron W. King: Mr. Moshiri, you run a division of Chevron that includes Africa and Latin America. How much oil and gas do you pull out of the ground every day? Ali Moshiri: For Africa and Latin America, on a gross basis, Chevron is producing somewhere around 840,000 barrels per day. BWK: That's about 1% of all the oil that the world uses every day, at 85 million barrels per day. Can you say some more about what's happening in the areas with which you deal?

AM: (My area is ) the Atlantic Basin… If you look down at the southern part of the Americas and Africa, people are ignoring the contribution it's making worldwide. The basins in this area are different. It's not necessarily like the Middle East, that they are huge fields. But there are many accumulations. On the aggregate, they're significant. Not only to the Chevron portfolio, but overall to the supply of oil to the market. If you look at this area, they'll always be a net exporter. They'll always produce more than they can consume. My personal view is that if they continue their level of economic growth, that they assume is going to be above global, they'll still be an exporter. It creates an environment for industry to include them as part of the energy equation. The barrels can move to other locations where they don't have that balance. BWK: Are you only looking for oil? What's the larger hydrocarbon picture? AM: The (Atlantic) basins have similarity, but at the same time the basins have both oil and gas. It's not just oil. At the moment, the focus has been tremendously towards oil. I believe that both basins in West Africa as well as in Latin America have tremendous potential for gas for the future. But because of lack of infrastructure, they haven't got to the point similar to Asia Pacific of the Middle East yet. But if you look ahead 15 years, they'll get to the point of contributing natural gas, through LNG (liquefied natural gas) or pipeline… That's the next phase. Today it's very much focused on the oil side. BWK: In the Middle East, you're looking at a mature, 60-70 year old concept of exploration. Also, culturally, you've got similarities of climate, ethnicity to some extent, religion too. Not that everybody's the same. But by comparison, if you're moving from the Caribbean Basin to West Africa to Brazil to Angola, you're going to see a lot of different people and different governments and different cultures that you're going to have to work with. Can you comment? AM: Absolutely. If you look at the Chevron operations, we deal with ten different countries. Three of them are in OPEC. Two of them are observers in OPEC. Therefore five of them are very much within the framework of the OPEC community. That shows that each of them have (their) oil policy and different view compared to when you look at places like the US, Australia, UK and Europe. For that matter, you have to deal with each country separately. You have to understand, first of all, the geology, the technical aspects of it. And also the policies. The policies vary. I'm not saying it's good or bad, whether it's in the hands of the government or the private sector. That's what we deal with in this area. Not only do we have to worry about the technical side, but also about the fiscal, commercial aspects of it as well. BWK: Can you comment about what you've seen over the past 20 years, with the rise of the national oil companies (NOCs) in these regions, and how you've had to adapt from the way you used to do business to the way you have to do business now in the NOC environment? AM: The reality is that with the truly conventional aspects of oil and gas, the technology is there. The know-how is there. Whether or not we have it, or a service company has it. It's there. So the view of the NOC is that they have more than one option on just the conventional (development). For example, (what) if you discover an oil field on land, say light oil? Then building it, developing it, putting it into the market is relatively conventional. So what we would focus on is increasing the recovery factor. We focus on getting more out of the ground. The next phase is what I'd say depends on technology. You get into deepwater. The technology is different. The incremental cost is significant. Room for efficiency becomes a greater part of how we develop things. Yes, everybody (says that they) can develop deepwater. But how do you manage expensive wells that you've got to drill? How do you test the basin? How do you commit to the investment? Those are significant. As you see in the market today, it's almost becoming like there are a lot of people who can explore. But there are not a lot of people who can develop deep water.

BWK: I had a chance to visit a Chevron operation in the Gulf of Mexico (GOM) in March. Chevron had the Transocean vessel, Discoverer Inspiration, drilling in over 6,700 feet of water, about 200 miles off the Louisiana coastline. The target depth was over 30,000 feet. It was quite an operation. AM: I'm glad you took a visit to some of our operations. (You should see) some of the other remote places like offshore, deepwater off Nigeria. You can see how those places are highly technically driven. And for as much as we've gone so far into developing these (deepwater) fields, the technology is not there to work over the wells when there are problems. The technology is not there to create efficiency for working over some of these wells. For example, if a well goes off production in West Africa, and it's in the swamp, or in Block Zero, off Angola, in shallow water, we move a rig in and we know how to work over the well. But if a well goes off production and it comes to a work-over, if it's in deepwater, in say 8,000 feet of water, then you almost have to spend as much to work over a well as you spent to drill the well. Therefore, we are looking for the technology, and expanding our expertise, how to go back and do some of that work. To work those kinds of wells over. BWK: Can you describe how Chevron's relationships are changing over time, with the NOCs? AM: Yes, our relationship with the NOCs is changing, moving to a different direction. The next phase goes several years down the road and gets into the non-conventional hydrocarbons. Like tight sands and shale gas. I always use the US as the base, where we started. I've been in this business 32 years with Chevron. I remember when 500 feet of water was deep water. But now 500 feet of water is a conventional development, or work-over, with high recovery factor. And I think we need to expand that one all the way. In some of the other regions, especially my region, we are not to that point yet. Again, it's because some of these basins have not matured yet. BWK: Can you elaborate on that concept of maturity? How are things different between, say the US and further south in the Atlantic Basin? AM: (The US) Gulf of Mexico shelf is mature. But if you look at it south, from Mexico down to Argentina, or West Africa or sub Sahara or East Africa, we are still at the first phase of understanding the basins, understanding the potential, developing the technology around it, and being able to transport it. Some of the discoveries (that) some of the companies have, in sub Sahara Africa, the transportation is going to be the issue. That region is going through a different phase. The transportation is about one phase behind where we are in the US. According to Chevron's Mr. Moshiri, there's great potential for future energy development in the Atlantic Basin. The hydrocarbon resource is there – both oil and natural gas – and development is at an early stage. The future will see more exploration and development, moving from oil into gas. The local markets will doubtless expand, but there's still quite a bit available for export. But to accomplish this, the transportation infrastructure needs to expand. In short, there's much left to accomplish in an immense swath of the world. The Future Challenge of Energy Development There are great opportunities for future exploration and energy development in Latin America and Africa. This will require trillions of dollars of capital over many years. That, plus world-class technology, superb and skilled people, as well as close coordination between developers and the national host governments. Chevron, the subject of this article, is one of the world's best independent oil companies. From its roots in the California oil patch of more than a century past, Chevron has a solid record of successful exploration and development. Chevron has great financial strength, and a deep pool of technical competence. Chevron's success – certainly in deepwater development – is built upon its highly skilled and talented people such as Mr. Moshiri and the many members of his extensive team. That said, there are many other companies working on deepwater oil exploration and development projects across the world. They range from very big to not very big, from independent to nationally-owned and operated. Until we meet again, Byron W. King Going Deep originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." |

| Silver Short: Days of World Production To Cover Certain Commodity Short Positions Posted: 07 Aug 2010 05:08 AM PDT |

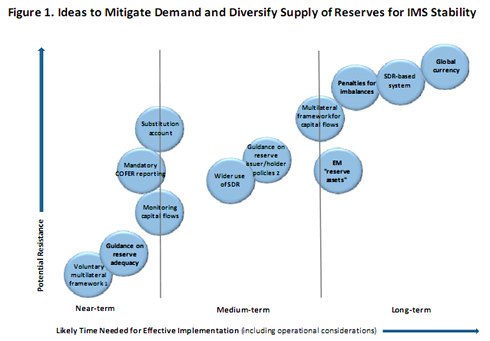

| IMF Global Currency Master Plan Flies Under the Radar Posted: 07 Aug 2010 05:00 AM PDT With the rather ho-hum title, "Reserve Accumulation and International Monetary Stability," one would hardly expect the dry-sounding April 13th IMF paper to essentially come to the conclusion that the final long-term idea to "mitigate demand and diversify supply of reserves for IMS stability" is to institute a global currency. Where'd that come from? A recent article mines the few months-old IMF paper… to understand how it could be interpreted as the IMF's blueprint for a global currency. From the Financial Times Alphaville:

"…in the eyes of the IMF at least, the best way to ensure the stability of the international monetary system (post crisis) is actually by launching a global currency. And that, the IMF says, is largely because sovereigns — as they stand — cannot be trusted to redistribute surplus reserves, or battle their deficits, themselves. "The ongoing buildup of such imbalances, meanwhile, only makes the system increasingly vulnerable to shocks. It's also a process that's ultimately unsustainable for all, says the IMF." And, from the IMF report: "From SDR [Special Drawing Rights] to bancor. A limitation of the SDR as discussed previously is that it is not a currency. Both the SDR and SDR-denominated instruments need to be converted eventually to a national currency for most payments or interventions in foreign exchange markets, which adds to cumbersome use in transactions. "And though an SDR-based system would move away from a dominant national currency, the SDR's value remains heavily linked to the conditions and performance of the major component countries. A more ambitious reform option would be to build on the previous ideas and develop, over time, a global currency. Called, for example, bancor in honor of Keynes, such a currency could be used as a medium of exchange — an 'outside money' in contrast to the SDR which remains an 'inside money'." Interestingly, "in honor of Keynes" isn't necessarily a good time… or a worthwhile honor. Yet, there it is, splayed out for all to see… the IMF busily at work on a global currency. You can read more details in Financial Times coverage of the IMF blueprint for a global currency. Best, Rocky Vega, IMF Global Currency Master Plan Flies Under the Radar originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." |

| You are subscribed to email updates from Gold World News Flash To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

Weaker-than-expected U.S. employment data set the direction of markets on Friday. The numbers rattled the dollar early and lifted gold which moved above $1200 an ounce and higher for an eighth straight session — its longest rally since November.

Weaker-than-expected U.S. employment data set the direction of markets on Friday. The numbers rattled the dollar early and lifted gold which moved above $1200 an ounce and higher for an eighth straight session — its longest rally since November.

No comments:

Post a Comment