Gold World News Flash |

- Yamana Gold, Inc. Q2 2010 Earnings Call Transcript

- US Government Redefines “Fixing the Economy”

- In The News Today

- Consumer Credit - Watch The Revisions!

- Gold Perma Bears Never Learn

- Reducing Krugman (And All Like Him) To Size

- "War is Coming" -- Doug Casey

- Jobs Report and the Dollar: Comments

- Gold Resistance at 1220

- Quick Update

- Grandich Client Update – Silver Quest Resources Capoose Continues to Pleasantly Surpr

- Crude Oil Uptrend Intact, Gold Win Streak Ends

- Gold Seeker Weekly Wrap-Up: Gold and Silver Gain Roughly 2% on the Week

- Canada's Biggest MEPP in Dire Straits?

- The Rising Cost of Food

- If the U.S. Dollar were to fall how important is gold to the States?

- FRIDAY Market Excerpts

- US Government Redefines “Fixing the Economy”

- Gold Daily and Weekly, Miners, and Silver Charts at Week's End

- Forget wheat... buy gold

- Economy Heading for a Systemic Collapse into Hyperinflationary Great Depression

- Con-Way Inc. (NYSE:CNW) — Falls Short of Earnings Estimates

- Stop Waiting to Buy Gold - The Lows Have Been Posted

- Central bank gold sales minimal as IMF sales continue

- Federal Reserve could enact $1 trillion "rescue" as soon as next week

- Humiliation: Bank Of America Plunges From Trading Perfection To Just 81% Profitable Trading Days

- The Golden Decade

- Guest Post: Who's Scoffing Now

- Weekly Bull/Bear Recap

- Incredible Threat

- Gold Permabears Never Learn, Nearing Extinction

- Huh? No Inflation?

- White Swans into Black: Golden Antidotes

- Why Today's Deflation Won't Kill Gold

- Democratic Stocks (And Bonds) Surge On Confirmation Central Planning Works

- Australian Dollar’s Run May Hit a Short-Term Snag

- Consumers Confident… of US Debt Legacy

- Gold Rises for 7th Straight day

| Yamana Gold, Inc. Q2 2010 Earnings Call Transcript Posted: 06 Aug 2010 04:36 PM PDT Yamana Gold, Inc. (AUY) Q2 2010 Earnings Call Transcript August 05, 2010 11:00 am ET Complete Story » |

| US Government Redefines “Fixing the Economy” Posted: 06 Aug 2010 04:05 PM PDT The keen-eyed David Galland, Managing Director of Casey Research and regular contributor to The Daily Reckoning, notices something amiss. First he notes, staccato-style for emphasis, "Record total debt. Record government deficits. Record trade deficits. Massive additional government debt financing required to keep the doors open and avoid reneging on social contracts directly affecting the quality of lives of millions of people around the globe – the US, Japan, and Europe especially." Then, in a surprise move, he throws out, with the same punchy style, "Near record-low interest rates," whereupon he asks, with what I assume is a cynical and mocking tone to his voice, "Anything strike you as out of place?" Immediately, I instinctively blurt out, "Near record-low interest rates is an anomaly because a nation of deadbeats who can't pay their debts now should be charged higher interest rates to borrow money to offset the increased risk of non-repayment to the lender, at least, and a litt... |

| Posted: 06 Aug 2010 04:05 PM PDT View the original post at jsmineset.com... August 06, 2010 07:23 AM To Our Beloved Disbelievers: Are there any more questions about the dollar's ability to return and violate its low? Are there any more questions about whether gold will return to its traditional relationship with the dollar? If you have solid gold stocks in your portfolio then get ready for good times. I am so concerned about things that I, Little Buddy and Freddie are going fishing today. I will post because later because I care. Regards, Jim Jim Sinclair's Commentary There is no question it is coming. It will be done as I have outlined with a SDR gold ratio tied to a major indicator of world liquidity, and AFTER currency induced cost push inflation, it will work. Historically, currency induced cost push inflation results after the crisis. A commodity related currency has been the solution for a fix of sovereign paper. Replacing your defrocked currency with another country’s currency is no f... |

| Consumer Credit - Watch The Revisions! Posted: 06 Aug 2010 04:05 PM PDT Market Ticker - Karl Denninger View original article August 06, 2010 11:03 AM Gee, you don't think they're playing with the numbers, do you? [INDENT]Consumer credit decreased at an annual rate of 3-1/4 percent in the second quarter. Revolving credit decreased at an annual rate of 9-1/2 percent, and nonrevolving credit was about unchanged. In June, consumer credit decreased at an annual rate of 3/4 percent, revolving credit decreased at an annual rate of 6-1/2 percent, and nonrevolving credit increased at an annual rate of 2-1/2 percent. [/INDENT]Notice that there's no indication of the revisions here. Both Q1 and the first two months of Q2 numbers were revised. Sigh.... distortions galore. "Better than expected" eh? What did you expect? Non-revolving (autos, etc) are basically flat-lined at zero and revolving debt continues to decrease at a roughly 10% annualized rate. Improvement? Where? As you can see from the "outstanding" chart, there's no real... |

| Posted: 06 Aug 2010 04:05 PM PDT |

| Reducing Krugman (And All Like Him) To Size Posted: 06 Aug 2010 04:05 PM PDT Market Ticker - Karl Denninger View original article August 06, 2010 07:11 AM Krugman has "explained" why deflation is "bad". Well, he's tried. But in fact he's made the case for deflation, especially following insane bouts of INflation. His idiocy requires a response.... Ok, point-by-point: [INDENT]So first of all: when people expect falling prices, they become less willing to spend, and in particular less willing to borrow. [/INDENT]Why is this bad? Real capital formation comes from savings. Indeed, it is the essence of capital formation of all sorts. You can't lend except from excess capital (production ex required spending, that is, surplus) so being less willing to borrow or spend is a net public good over time. Yes, it makes the Madison Avenue people go nuts, and it particularly makes those people nuts who want to blow bubbles with borrowed money (which always ends in a bust with a huge number of people going bankrupt) but in terms of publ... |

| "War is Coming" -- Doug Casey Posted: 06 Aug 2010 04:05 PM PDT I wouldn't read a lot into Thursday's gold price action. However, having said that, shortly after New York trading began, gold broke through the $1,200 ceiling for the second day in a row and, for the second day in a row, it immediately got sold off to its low of the day [$1,189.20 spot]... as the usual not-for-profit sellers showed up to make sure that gold behaved itself. The low occurred minutes after London closed for the day... and from there, gold began recovering a bit. However, every tiny rally attempt during the New York session got sold off... and once Comex trading ended and electronic trading began, the 'volatility' disappeared as well. Here's the New York Spot Gold chart on its own. You can see that every little rally attempt got hit... as gold really wanted to go higher, but wasn't allowed to. It's obvious that some bullion bank is micro-managing the price and doesn't want it to break above $1,200 spot on a closing basis... at least... |

| Jobs Report and the Dollar: Comments Posted: 06 Aug 2010 04:05 PM PDT The following comments are from Peter Schiff, president of Euro Pacific Capital, Home | Euro Pacific Capital. Please feel free to excerpt for your reporting. Today's disappointing payroll report reveals that the U.S. economy has failed to respond to the massive fiscal and monetary stimuli that have flooded the nation over the past two years. Not only is the news bad for job seekers and political incumbents, but it's also a strong signal for traders to flee the U.S. dollar. The malaise in the U.S., where stimulus is still the word of the day, stands in contrast to active recoveries in Europe and Asia, where governments are actively removing stimulus. As a result, we are now headed for the eighth consecutive weekly decline in the Dollar Index. Inspired by comments this week from St. Louis Fed President James Bullard, it is now widely accepted that the continued domestic weakness will cause the Fed to significantly expand stimulus efforts through so called "quantitative easin... |

| Posted: 06 Aug 2010 04:05 PM PDT courtesy of DailyFX.com August 06, 2010 07:12 AM 240 Minute Bars Prepared by Jamie Saettele Gold has topped. Please see the latest special report for details. Gold is making its way lower in an impulsive fashion. The short term count has changed slightly. It seems as though the first 5 wave decline ended following a terminal thrust from a triangle. The 3 wave correction is nearing completion. Jamie Saettele publishes Daily Technicals every weekday morning, COT analysis (published Monday evenings), technical analysis of currency crosseson Wednesday and Friday (Euro and Yen crosses), and intraday trading strategy as market action dictates at the DailyFX Forum. He is the author of Sentiment in the Forex Market. Follow his intraday market commentary and trades at DailyFX Forex Stream. Send requests to receive his reports via email to [EMAIL="jsaettele@dailyfx.com"]jsaettele@dailyfx.com[/EMAIL].... |

| Posted: 06 Aug 2010 04:05 PM PDT The following is automatically syndicated from Grandich's blog. You can view the original post here. Stay up to date on his model portfolio! August 06, 2010 05:16 AM And I do mean quick! U.S. Stock Market – While those who have bet on a fall off the cliff continue to be disappointed, the "Don't Worry, Be Happy" crowd can't get no real satisfaction on the employment side. As hard as it seems to be for most, I continue to suggest a neutral position. I would consider some bearish spread plays if the DJIA somehow got up to 11,000 or so. Gold – When you think gold and Grandich, this is what should come to mind – "We're in the mother of all gold bull markets." And to all the crap about gold bubbles, tops, etc, I recommend this to the "Tokyo Roses" of the world. U.S. Dollar – There's a likely period of consolidation and even a little countertrend rally near as sentiment is extremely bearish and market deeply oversold. But while the 80+ area on the U.S. Dollar Index can hold for awhile, t... |

| Grandich Client Update – Silver Quest Resources Capoose Continues to Pleasantly Surpr Posted: 06 Aug 2010 04:05 PM PDT The following is automatically syndicated from Grandich's blog. You can view the original post here. Stay up to date on his model portfolio! August 06, 2010 04:17 AM Silver Quest announced good news, yet again, this morning.* They encountered 41 metres of 1.50 g/t of gold equivalent in D-10-116.* This represents one of the best intercepts on the property to date and also significantly expands the resource into the previously untested central portion of the deposit. Drill hole D-10-116 extends the eastern arm of the deposit by approximately 100 m to the west.* With a total of 26 drill holes completed this year, and only 4 released so far, this is a story that continues to evolve. D-10-116 and D-10-118, both released this morning have some excellent gold and silver intercepts.* D-10-118 was drilled further north and tested not only the boundary of the current mineralization but the depth extent of some of the historical drill holes.* Both of these holes released today, have great inte... |

| Crude Oil Uptrend Intact, Gold Win Streak Ends Posted: 06 Aug 2010 04:05 PM PDT courtesy of DailyFX.com August 05, 2010 10:51 PM Crude oil is holding onto this week’s solid gains ahead of Friday’s U.S. nonfarm payrolls numbers. The commodity remains close the top of an 11-month range. Gold’s win streak finally ended on Thursday, but the metal has been strong this week. Commodities – Energy Crude Oil Uptrend Intact Crude Oil (WTI) - $82.07 // +$0.06 // +0.07% Commentary: Crude oil fell $0.46, or 0.56%, on Thursday. The commodity has thus far held onto the bulk of gains registered earlier in the week. Were prices to end the week at current levels near $82, crude will have advanced nearly $3, or 3.8% in the period. Both oil and equities are maintaining an upward bias, as worse-than-expected economic data is not leading to sustained declines, while better-than-expected data is leading to large rallies. Keeping to this pattern, initial jobless claims were released on Thursday, and the sharp increase in claims only led to modest d... |

| Gold Seeker Weekly Wrap-Up: Gold and Silver Gain Roughly 2% on the Week Posted: 06 Aug 2010 04:00 PM PDT |

| Canada's Biggest MEPP in Dire Straits? Posted: 06 Aug 2010 03:37 PM PDT Tony Van Alphen of the Toronto Star reports, Workers in big pension plan could soon face cuts in benefits:

Let's leave aside those "questionable investments in Caribbean hotels and resorts" for now. I went over the CCWIPP's 2009 Annual Report. The results were impressive, especially in public markets and hedge funds:

Weakness in 2009 was concentrated in the private equity and private debt portfolio, which should recover in 2010. However, I'm not familiar with the funds they chose to invest in this space, and cannot comment further on their performance and track record. The outperformance in hedge funds could be due to the strategy selected. Remember, 2009 was the year of big beta, so I'm not surprised their hedge fund portfolio did well relative to the HFRI fund of funds index. The latter is not an appropriate benchmark if they're investing all the assets in L/S or global macro funds which did well last year. But the biggest concern remains the plan's funded status:

Hopefully none of the companies will be closing their doors anytime soon. One major governance concern I have is in regards to the trustees:

I happen to think you need some outside, independent experts (eg., an independent professor of finance with no industry ties whatsoever or a retired senior pension officer) to help them manage this fund. Trustees should be paid and they should be held accountable for the decisions they take on behalf of plan members. |

| Posted: 06 Aug 2010 01:54 PM PDT No Bees, No Bats, No Food for main street affordable, Phenomenal rise in Food Costs. Add that to a major point in the HOT/DRY cycle pending, and eatables have only one way to go, up. However food and energy does not count in the standard inflationary figures, because you and I do not use them. Jim Headline: Rising coffee prices spell a higher cost for that cuppa joe

Headline: Bacon Price Surge May Last Through August as Herd Cutbacks Tighten Supply

Headline: America's Most Common Bat Headed for Eastern Extinction

Headline: Wheat near 2-year high on Russia export ban

If the threat of deflation is real, why does it not manifest itself in the secular trends? Spot Commodity Prices: CRB Spot Index (1947 – Present); What is deflating other than the value of debt? The central planners, protecting the banking system and the currency that denominates its debt, print money to cushion debt implosion. They can do this because money is no longer anchored by gold. In other words, "Sound as a dollar" no longer means anything today. The commodity bull is largely currency related. This illustrated in the following chart. Spot Commodity Price Index (CRBSPOT) to Gold Ratio: Source: Eric De Groot Insights |

| If the U.S. Dollar were to fall how important is gold to the States? Posted: 06 Aug 2010 01:00 PM PDT Since the demise of the Gold Standard, monetary authorities have tried as many ways as possible out there to sideline gold as part of the monetary system. Since the early eighties they have succeeded to some extent, but this was by discrediting it and by emphasizing the benefits of paper currencies. |

| Posted: 06 Aug 2010 10:21 AM PDT Gold extends gains after jobs report, ends week up 1.8% The COMEX December gold futures contract closed up $6.00 Friday at $1205.30, trading between $1194.50 and $1213.30 August 6, p.m. excerpts: see full news, 24-hr newswire… August 6th's audio MarketMinute |

| US Government Redefines “Fixing the Economy” Posted: 06 Aug 2010 10:00 AM PDT The keen-eyed David Galland, Managing Director of Casey Research and regular contributor to The Daily Reckoning, notices something amiss. First he notes, staccato-style for emphasis, "Record total debt. Record government deficits. Record trade deficits. Massive additional government debt financing required to keep the doors open and avoid reneging on social contracts directly affecting the quality of lives of millions of people around the globe – the US, Japan, and Europe especially." Then, in a surprise move, he throws out, with the same punchy style, "Near record-low interest rates," whereupon he asks, with what I assume is a cynical and mocking tone to his voice, "Anything strike you as out of place?" Immediately, I instinctively blurt out, "Near record-low interest rates is an anomaly because a nation of deadbeats who can't pay their debts now should be charged higher interest rates to borrow money to offset the increased risk of non-repayment to the lender, at least, and a little something extra to offset the loss of buying power of the currency due to overproduction of money by the despicably foul and feeble-brained Federal Reserve!" In my excitement, I had forgotten that I was reading this at work, but was reminded when my officemates shouted out for me to shut up, shut up, shut up, which I, embarrassed, did. Then I went back to Mr. Galland's essay just in time to read that the Fed's "beige book" of economic conditions makes it "clear that the Fed is (finally) beginning to understand the entrenched and endemic nature of this crisis. While the notes are written in shamanic double-speak, the point is clear: members of the Fed don't expect the economy to get back on track until 2015 or 2016." Yow! Five or six more years of this no jobs, higher consumer prices, falling asset prices, higher taxes, lower income, and ruinous economic malaise crap before it gets better? Yikes! And that's, of course, assuming it doesn't get worse and collapse in the meantime, which is exactly what I think will happen, mostly because I am a paranoid, cynical little pipsqueak who doesn't believe that the horrifying problems caused by the long-term creation of too much money and too much government spending will be "fixed" by creating more money and more government spending. But maybe "that's just me," ya know what I mean? And it turns out that it might be just a matter of definition! I define "fixing the economy" as "People not living on the streets or in their cars or surviving by eating garbage, rodents, weeds and government handouts to keep from starving to death because there are no jobs, and won't be for a long time until after they are all dead." On the other hand, the Federal Reserve defines it with the incomprehensible and preposterous phrase "to converge fully to its longer-run path as characterized by sustainable rates of output growth, unemployment, and inflation consistent with participants' interpretation of the Federal Reserve's dual objectives" of low inflation and low unemployment, which means, with fuzzy criteria like these, "Inflation in the money supply until we die from inflation in prices, or until more people have jobs, whichever comes first, although it won't be more people having jobs." Mr. Galland is apparently not impressed with my gloomy interpretation, and notes that the "simple reality," as scary as it is, is that the Federal Reserve "is waking up" to, as I put it, the ugly fact that their ridiculous neo-Keynesian econometric idiocy coupled with a fiat currency has allowed disastrous booms to go to extremes so that the entire structure of the economy is so distorted and bloated with cancerous expansions of the money supply and size of government that, as he says, the "structural underpinnings of the economy are damaged beyond any quick or easy fix." I admire his optimism, but after a little judicious Mogambo Editing Magic (MEM), I instantly remove all sense of optimism, yielding the sad truth that "the structural underpinnings of the economy are damaged beyond any fix." The good news, in the face of all of this terrible calamity, is that you can still buy gold, silver and oil at bargain-basement prices, because at the rate that the terrifying Obama administration and the profoundly incompetent and corrupt Congress are spending money, and at the rate the Federal Reserve is creating the money to finance the spending, inflation in consumer prices is on its way, and these low prices won't last long! And then, because you bought at these low prices, it's, "Whee! That investing stuff was easy!" The Mogambo Guru US Government Redefines "Fixing the Economy" originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." |

| Gold Daily and Weekly, Miners, and Silver Charts at Week's End Posted: 06 Aug 2010 09:56 AM PDT |

| Posted: 06 Aug 2010 09:48 AM PDT From Hard Assets Investor: Adrian Day is one of the true pioneers of global investing. For years, the London native has run a boutique global investing firm (Adrian Day Asset Management) that combines complete independence, a global purview and a long-term value philosophy to bear on the markets. HardAssetsInvestor.com's editor in chief Matt Hougan caught up with Adrian recently to discuss his view on gold, platinum, wheat and the broader commodities landscape. HardAssetsInvestor.com (HAI): We've recently had a significant pullback in gold, and there are concerns about a gold bubble. What's your short-term outlook for the metal? Adrian Day, CEO, Adrian Day Asset Management (Day): I tend to be more focused on the long term, generally. I'm a long-term value investor who doesn't mind grinding out the volatility to realize the potential of an investment. But there is... Read full article... More on commodities: This could be the perfect time to buy gold and silver Tsunami of cash could send gold to unbelievable highs The huge source of power China has over America that no one talks about |

| Economy Heading for a Systemic Collapse into Hyperinflationary Great Depression Posted: 06 Aug 2010 09:47 AM PDT (snippet) A contraction greater than 25% peak-to-trough puts you in a great depression. That is what I envision, but we'll be taken there by hyperinflation and a resultant cessation of normal commerce. TER: Hyperinflation means different things to different people. How do you define it? JW: My definition has been and will remain very simple. When the largest-denomination note in circulation—the $100 bill in the case of the U.S. dollar—has the same value as toilet paper, you have a hyperinflation. You saw that in the Weimar Republic. People papered their walls with money. TER: I think you've said that the only reason that Zimbabwe's economy survived is because they started using dollars as black market currency. JW: But you don't have anything like that in the United States as a backup. We're going to have a much rougher time in the U.S., of all places, than they had in Zimbabwe. Zimbabwe was able to function because people could exchange the local currency into dollars, and then buy things with the dollars, so the economy continued to function. Without some kind of a backup system, as the currency becomes worthless you'll see disruptions to key supply chains. When people don't have food, you end up in very dangerous circumstances. TER: Do you see any real potential for precious metals or another currency as a backup? JW: Well, yes. I think they will become a backup fairly quickly, but we don't have any widely developed black market for another currency at this point because the dollar remains the world's reserve currency. All sorts of things may develop that we don't anticipate. What will be used to cover for the dollar? Gold and silver? The precious metals are limited in supply and not widely held by the population in general. Hard currency from Canada or Australia? That wouldn't be in wide circulation, at least not early on. I think a barter system is where it will go until the currency system is stabilized, but the currency system can't stabilize until the government's fiscal house is in order. There's no sense in setting up a currency on a gold standard if you can't live within your means, because you'd just end up going through successive devaluations against gold. So whatever's done to set up a new currency system will have to be in general conjunction with the overhaul of the government's fiscal condition. But in the interim, something of a barter system would evolve. Even that, though, is something that may take six months to get stabilized. TER: It's hard to imagine. JW: In the Weimar Republic, you could go into a fine restaurant one evening and enjoy its most expensive bottle of wine with a nice dinner. You'd probably negotiate the price before you sat down, because the price would be higher by the time you finished dinner. By the next morning the empty wine bottle would be worth more as scrap glass than it had been worth as an expensive bottle of wine the night before. That's how rapidly things change in a hyperinflation. But we have a circumstance that did not exist in the Weimar Republic. Our society is heavily dependent on electronic cash. Say you have a credit card with a $10,000 limit. In hyperinflation, that $10,000 might be enough to buy you a loaf of bread. TER: There's not even enough physical cash running around anywhere in the United States that actually represents what goes back and forth electronically. If you can't use your debit card, how do you pay for your coffee at Starbucks? And how will companies and banks adjust? JW: You're not going to have electronic payments that are in-barter equivalent that I can foresee. That would be a fairly sophisticated system and the needs are going to be immediate. When hyperinflation starts to break, it can unfold in a matter of weeks, months. You'll need to be able to handle things rapidly. Frankly I think the system will tend to break down. It's not a happy circumstance. How will a small company get its goods to people? There might be blackouts. Who's going to get the fuel to the power plants? TER: And to the gas stations for the cars for people who still have jobs? |

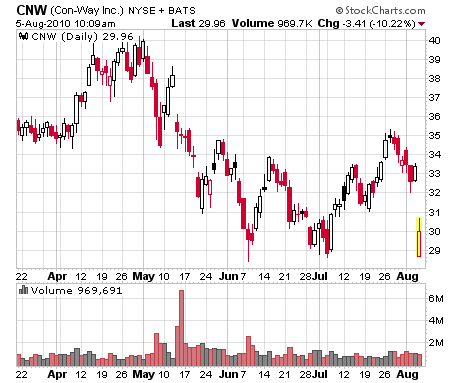

| Con-Way Inc. (NYSE:CNW) — Falls Short of Earnings Estimates Posted: 06 Aug 2010 09:45 AM PDT Con-way Inc. (NYSE:CNW), the San Mateo, California-based provider of transportation, logistics, and supply-chain management services, recently missed consensus earnings estimates. Dan Amoss, Agora Financial's editor of the Strategic Short Report, shows how the small miss could still be an important chink in the armor of CNW investor confidence. From Amoss' most recent reader update: "Con-way Inc. (NYSE:CNW) missed earnings estimates by a few pennies. More importantly, management's dour outlook finally spooked shareholders. 'Yield each month in the quarter improved sequentially,' says CEO Doug Stotlar. 'However, managing the balance between price and volume while bringing costs into alignment will take time, which restrains our expectations for near-term improvement.' Here is a chart of CNW since March 2010:

"On the conference call, a few analysts asked how the broad economy affects pricing and volumes. While management said pricing is a very company-specific issue, it admitted trucking demand might very well be slowing. Tonnage was down 3.3% sequentially from June to July. This compares to a 1%-3% sequential June/July decline in a typical year. "Based on management's views, it's likely that 2010 earnings estimates will come down substantially. Our thesis — that management is stuck with too much unprofitable freight, and customers will defect if prices are hiked too much — is playing out. CNW stock can go much lower from here in the coming months. "CNW shareholders are finally questioning why they own this stock at 30 times 2010 earnings, especially when odds of accelerating earnings growth are eroding. "Capacity in LTL trucking remains too loose to allow Con-way respectable profit margins. And now that the economy is off its April/May peak, pricing and volumes could keep softening." Dan Amoss sees the broader stock market as overbought, especially given today's rapidly slowing economy and the recent ugly initial jobless claims. If these data points manage to restore more rational expectations about future corporate earnings, then Amoss expects analysts to bring consensus numbers for CNW down from $1.10 for 2010 and $2.11 for 2011. To receive Amoss' specific trading recommendations for Con-way, you'll have to subscribe to the Strategic Short Report. It's available through the Agora Financial reports page, found here. Best, Rocky Vega, [Nothing in this post should be considered personalized investment advice. Agora Financial employees do not receive any type of compensation from companies covered. Investment decisions should be made in consultation with a financial advisor and only after reviewing relevant financial statements.] Con-Way Inc. (NYSE:CNW) — Falls Short of Earnings Estimates originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." |

| Stop Waiting to Buy Gold - The Lows Have Been Posted Posted: 06 Aug 2010 09:44 AM PDT Gold Price Close Today : 1,203.30Gold Price Close 30-Jul : 1,181.70Change : 21.60 or 1.8%Silver Price Close Today : 1845.9Silver Price Close 30-Jul : 1798.7Change : 47.20 or 2.6%Platinum Price Close... This is a summary only. Visit GOLDPRICE.ORG for the full article, gold price charts in ounces grams and kilos in 23 national currencies, and more! |

| Central bank gold sales minimal as IMF sales continue Posted: 06 Aug 2010 09:36 AM PDT 5:30p ET Friday, August 6, 2010 Dear Friend of GATA and Gold: MineWeb's Rhona O'Connell reports today that European central bank gold sales have declined to almost nothing, that the International Monetary Fund has been selling 14 to 19 tonnes per month since March, and that at its current rate the IMF could be done with its planned quota of dishoarding by the end of the year. Since nobody is allowed to see the central bank gold involved, it's not audited in any public sense, and financial journalists never ask any critical questions about it, it may be a little silly to pay much attention to these figures. But right or wrong what passes for the gold "market" still does, so you can find O'Connell's commentary, headlined "CBGA Gold Sales Minimal as IMF Sales Continue," at MineWeb here: http://www.mineweb.net/mineweb/view/mineweb/en/page33?oid=109370&sn=Deta... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Sona Resources Expects Positive Cash Flow from Blackdome, On May 18, 2010, Sona Resources Corp. (TSXV: SYS, Frankfurt: QS7) announced the release of a preliminary economic assessment for gold production at its flagship Blackdome and Elizabeth properties in British Columbia. Sona Executive Chairman Nick Ferris says: "We view this as a baseline scenario for gold production. The project is highly sensitive to the price of gold. A conservative valuation of gold at $1,093 per ounce would result in a pre-tax cash flow of $54 million. The assessment indicates that underground mining at the two sites would recover 183,600 ounces of gold and 62,500 ounces of silver. Permitting and infrastructure are already in place for processing ore at the Blackdome mill, with a 200-tonne per day throughput over an eight-year mine life. Our near-term goal is to continue aggressive exploration at Elizabeth and develop a million-plus-ounce gold resource, commencing production in 2013." For complete information on Sona Resources Corp. please visit: www.SonaResources.com A Canadian gold opportunity ready for growth Join GATA here: New Orleans Investment Conference * * * Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Prophecy to Become Coal Producer This Year Prophecy Resource Corp. (TSX.V: PCY) announced on May 11 that it has entered into a mine services agreement with Leighton Asia Ltd. to begin coal production this year. Production will begin with a 250,000-tonne starter pit as planned in August, with production advancing to 2 million tonnes per year in 2011. Prophecy is fully funded to production and its management team includes John Morganti, Arnold Armstrong, and Rob McEwen. For Prophecy's complete press release about its production plans, please visit: http://www.prophecyresource.com/news_2010_may11.php |

| Federal Reserve could enact $1 trillion "rescue" as soon as next week Posted: 06 Aug 2010 09:33 AM PDT From Bloomberg: A report U.S. companies hired fewer workers than forecast last month intensified a debate among economists over whether Federal Reserve policy makers will take an incremental step next week toward providing more stimulus. U.S. central bankers said in June that more monetary stimulus "might become appropriate" if the economic outlook "were to worsen appreciably." Chairman Ben S. Bernanke said last month the Fed may at some point maintain stimulus by investing the proceeds from maturing bonds into U.S. Treasuries. "I lean toward a result where the Fed talks about reinvesting mortgage-backed securities runoff at next week's meeting but decides to wait six weeks and see what the economic data bring," said Stephen Stanley, chief economist at Pierpont Securities LLC in Stamford, Connecticut. "The economic recovery downshifted in May but activity is absolutely not hurtling toward a double dip." Government figures showed today that private payrolls increased by 71,000 jobs last month, less than the 90,000 economists had forecast. While the data may not alone force the Fed's hand, other indicators including a slump in housing point to a slowing recovery and greater odds policy makers will move toward more easing at an Aug. 10 meeting, some economists said. Retailers in the U.S. reported July sales gains that missed analysts' estimates as consumers reduced spending before the back-to-school season. A manufacturing gauge tracked by the Institute for Supply Management fell, while a similar index tracking service industries rose. Reinvest Proceeds "The labor report increases the chance that they make the decision to reinvest the proceeds of maturing mortgage-backed securities in short-term U.S. Treasuries at this meeting," said Ward McCarthy, chief financial economist at Jefferies & Co. Inc. in New York. "They were heading in that direction anyway." Bernanke outlined three options for additional ease in response last month to questions from Senator Richard Shelby, an Alabama Republican. The Fed chairman said in semi-annual testimony to Congress that the central bank could strengthen its commitment to keep interest rates low, or lower the rate it pays on bank reserves. "The third class of things, though, has to do with changes in our balance sheet, and that would involve either not letting securities runoff as they are currently running off, or even making additional purchases," Bernanke said. The Standard and Poor's 500 Stock Index fell 0.8 percent to 1,116.71 at 2:53 p.m. in New York. Yields on U.S. 2-year notes fell below 0.5 percent for the first time as Treasuries rallied. 'Slow Drip' "It's a slow drip of quantitative easing medicine rather than a big shot," said Robert Dye, senior economist at PNC Financial Services Group Inc. in Pittsburgh. "That’s going to be a mostly symbolic move telling the public that the Fed remains watchful." Policy makers will probably "return to unconventional monetary easing by" late this year or early in 2011, Jan Hatzius, chief U.S. economist for Goldman Sachs Group Inc. in New York, said in a note to clients. Such steps may include "a more iron-clad commitment to low short-term policy rates" and more purchases of assets, probably Treasuries. The Fed would purchase at least $1 trillion in additional assets, he said. With 30-year mortgage rates trending around 4.5 percent to 4.75 percent, the Fed will have about $275 billion of its $1.1 trillion portfolio of mortgage-backed securities pay off over the course of this year, according to estimates by Barclays Capital Inc. That leaves about $23 billion a month for reinvestment if Fed officials choose that option. $1 Trillion Joseph Abate, Barclays' money market strategist in New York, said if the Fed chose to reinvest, that would signify they have a target for the level of excess bank reserves, currently at $1 trillion. "Is the Fed trying to target a specific level of bank reserves?" he said. "I don’t think they are." Barclays' economists don't expect the Fed to take more monetary policy steps at next week's meeting and for the remainder of 2010. The Fed may communicate next week more attentiveness to downside risks to growth, said Laurence Meyer, senior managing director of Macroeconomic Advisers LLC and a former Fed governor. "We expect the committee to offer a more pessimistic assessment of the outlook in its statement," he said. Meyer also said he hopes the Federal Open Market Committee will give consideration to the "risk management" strategy employed during the last deflation scare. "The risk management approach calls for an easier policy today," Meyer said. "It is better to err on the side of being too easy when the risks to growth are decidedly to the downside and the costs of slower growth are high and the risks of higher inflation are low." Still, Meyer said that, given the absence of any focus on the risk management approach so far, the threshold for taking action at the August meeting is high. "It is a big deal to take a step toward easing after you have spent a year talking about the exit strategy," he said. To contact the reporter on this story: Craig Torres in Washington at ctorres3@bloomberg.net. More on the Fed: Federal Reserve president begs Bernanke to raise rates to 1% The Fed's greatest nightmare: France calls for new reserve currency Ex-Federal Reserve governor: Fed's balance sheet is dangerously large |

| Humiliation: Bank Of America Plunges From Trading Perfection To Just 81% Profitable Trading Days Posted: 06 Aug 2010 09:28 AM PDT In an advance look at how the Q2 trading season turned out for Bank Holding Hedge Funds, some of which even accept your deposits to fund their 100x leveraged steepener trades, we have the first detailed 10-Q report out of Bank of America. Granted, the bank has a bunch of chimps running its trading operation and is thus not nearly indicative of the crack prop trading gurus at firms like Goldman and MS, due to not quite streamlining the whole prop-flow synergy bit while it had time (incidentally BofA is now looking for a seller for its prop operation) but the Fed and the government (or the Goved JV as it is known by those who suckle on its discount window teat) have made it so even a room full of chimps with Bloomberg terminals will pretty much generate trading perfection no matter what they do. So it comes as a shock that in the quarter following BofA's trading perfection days (which would be completely normal from a statistical point of view in a hyperbolic Universe, where superstrings don't need 10 dimensions, and where particle physicists are actually not superfluous), the bank has reported just 81% profitable trading days. Even scarier, the bank actually reported a day in which it lost $102 million, an event that has not occurred in over 60 days. Here is how the bank explains it:

So reality, an HFT-sponsored market collapse, a massive curve flattening, and the Fed's less than constant market intervention now has a name: "less favorable market conditions." We'll be sure to remember that for the quarter in which it reports first 19% winning trading days, then zero. |

| Posted: 06 Aug 2010 09:09 AM PDT |

| Guest Post: Who's Scoffing Now Posted: 06 Aug 2010 09:07 AM PDT Submitted by David Galland of Casey's Report Who's Scoffing Now A couple weeks ago, the family and I watched Dirty Jobs, an altogether entertaining show from the Discovery Channel. In the episode we watched the host, Mike Rowe, serve as a mechanic in the military. There were a couple of things that caught my eye.

For all the criticism of record budget deficits, President Barack Obama can take comfort knowing that for the first time in half a century, government bond yields are declining during an economic expansion and Treasury Secretary Timothy F. Geithner is selling two-year notes with the lowest interest rates ever.

|

| Posted: 06 Aug 2010 09:00 AM PDT Courtesy of RCS Investments Bullish + Manufacturing ISM shows a less than expected slowdown and refutes recent bear claims that manufacturing activity is falling off a cliff. The manufacturing recovery is also seen in the latest AAR weekly report. Meanwhile, the service sector is beginning to flex its muscle as the ISM Non-Manufacturing gauge rose to 54.3 which was better than expected (New Orders rose to 56.7 from 54.4). Let’s not forget that the service sector accounts for roughly 90% of the economy. + More signs that the labor market is improving as the job sub index of the Manufacturing ISM improves to +58.6%, ADP shows a better than expected gain of 42,000, and Non-Manufacturing ISM employment sub-index rose to expansion territory, @ 50.9. American Staffing Association continues to show growing demand. + Eurozone continues to print strong manufacturing and retail PMIs, pointing to growth in the region and offsetting fears of a sovereign debt crisis. The Euro continues to rally. This region is strengthening and is doing its part in the global recovery. (Links Courtesy of News-to Use) +We have a record 10-30 yield spread in Treasuries, which points to a steeper yield curve and is not signaling deflation. Inflation will win out at the end and this is a positive for risk assets, equities, commodities. (Link Courtesy of Calafia Beach Pundit) + Mortgage applications for purchase rose for a 3rd straight week, coming in at +1.5%. Demand has stabilized and now can begin building on this as jobs creation continues. +The Savings Rate has increased more than expected and shows that households have been deleveraging while consumption has been on a steady climb upward. At the same time, it also proves that the deleveraging cycle is further than most people think and balance sheets are being repaired quicker than expected.

Bearish - The recovery talk is a bunch of baloney. Gallup poll points to another month of weakening in consumer spending and declining confidence (confidence has plunged to the lowest this year). Other surveys point to the same thing. The reason for the decline in confidence? Firing continues in earnest and hiring remains tepid. Wake up people! (Link courtesy of Pragmatic Capitalism) - Manufacturing in China, the country to anchor the global economic recovery, is showing signs of a slowdown as PMI gauges come in weaker than expected. Meanwhile, just a test, but the parameters seem scary and if there really isn’t a bubble, why are they so severe?. - Small businesses, which account for most of the nations job creation, just voiced their verdict over the sustainability of the recovery. The Wells Fargo/Gallup Small business index hits a record low in July. Discover Small Business Watch falls for the 2nd month in a row. No jobs recovery if this sector can’t get off the ground. - Personal Consumption and Expenditures report shows a stalling in personal income and spending while previous month readings were weaker than previously thought. High joblessness will ensure that wages do not grow strong enough to support consumption growth penciled in by analysts. Meanwhile, the savings rate continues to rise as the deleveraging process continues, despite desperate attempts by the Fed to reverse the cycle. Structural challenges remain in the US economy, particularly the problem of debt. - Factory orders disappoint and points to a slowing in the sector that has carried the economy for the past 6+ months. - The housing debacle continues in earnest. Pending home sales fall to a record low down 2.6% after a 29.9% drop the month prior. A double dip in housing is all but certain. Banks will feel renewed pain and another liquidity crisis may ensue as trust evaporates along with any legitimacy offered by FASB 157. Observations/Thoughts >Here’s pretty much the main reason why I went Neutral on the US dollar in early July. Maybe that’s why it’s been going down since late June. People are anticipating the QE2 announcement soon. > A great synopsis of the baby boomers; stats, etc. >Equities have come a long way from just 1 month ago, however many red flags continue to wave. Treasury Bond yields not confirming the rise (see Bull/Bear Recap from two weeks ago in “Observations”). ISM Manufacturing report showed weakness developing in New Orders, and while we saw a higher Non-ISM Manufacturing report, breadth in the number of industries reporting expansion is deteriorating. Small business is not participating in the euphoria (see 3rd Bearish point) and job creation continues to be anemic. > Things are heating up in the Middle East once again. These “War Games” are what keep this issue on “The Market Radar”. VIPS Memo (Link Courtesy of Zero Hedge) http://www.msnbc.msn.com/id/37950730/ns/world_news-mideastn_africa/ http://noir.bloomberg.com/apps/news?pid=20601087&sid=a6D4GBFqhXRo&os=9 >This has to be the most ridiculous idea I’ve read in a long long time and ties into how a bigger trend of shafting the financially prudent/savers/renters and favoring risk takers/homeowners and morons who overspent and took on bigger debts that they could handle; Moral Hazard and socialism at the national level folks. I know I’m being general in the last statement as job losses turn an affordable mortgage into an unaffordable one; however, my point is that this sort of policy unequivocally shafts the taxpayer (to cover costs associated with the program, not to mention expose us to risk from covering a person with a lower credit score ` there’s a reason they have lower credit scores). Next on the docket QE2 is being discussed. “Savers, retirees, you are getting shafted as well. The Fed is trying to turn your cash into trash". Fed officials are trying everything in their power to debase our currency. …sure, go ahead, screw the savers even more; make it harder for the retirees to save. Get’em to spend; that’s gotta be the right prescription right? Spend Spend Spend!! Don’t save! Don’t mind oil and commodity prices going higher either…just keep spending. Finally, the final point in my rant, why do we need stimulus if we are in a “recovery”? (Link Courtesy of Zero Hedge) > So why has the market held up so well in the face of increasing bad news? We are seeing the good side of moral hazard now. Investors are expecting more funny money coming from the Fed and/or more stimulus goodies to keep fueling earnings growth, “the government’s got our back” is what they think. Growth need not be organic to investors, as long as it’s coming. I say that this is the good side of moral hazard because we aren't seeing a substantial crash on bad news at this point. So things remain mostly stabilized. As I stated in my Q2 outlook (See Gov’t Policy section), I think there’s enough political gas (fear) in the tank for another decent sized stimulus then that’ll be it. As far as the Fed goes, it gets a little trickier, but having such an anemic recovery and oil being above $80 dollars seems like a strong argument against QE. While not continuing QE would increase the chances of a deflationary outcome, initiating QE2 won’t have much of a positive effect either. Eventually we would head right into stagflation as commodity prices would skyrocket at any sign of growth and treasury yields would become VERY sensitive. If markets begin to sense that the Fed or the administration are beginning to waver in their support for the economy (due to excessive deficits or a scare on Treasury yields) then we may see the “moral hazard bubble” pop. Please visit RCS Investments for my expanded and detailed Outlooks (thesis), and my “Market Radar”, what I believe are the main factors affecting the economy and the financial markets. |

| Posted: 06 Aug 2010 09:00 AM PDT Last week, Mr. James Bullard was being both cagey and clairvoyant. The president of the St. Louis Federal Reserve Bank noticed what everyone else has seen for months; the US economic recovery is a flop. GDP growth was last measured pottering along at a 2.4% rate in the second quarter, less than half the speed of the last quarter of '09. At this stage in the typical post-war recovery, GDP growth should be over 5% with strong employment. Instead, the "Help Wanted" pages are largely empty. Homeowners are still underwater. And shoppers are still largely missing from the malls that once knew them. Whatever is going on, it is not the "V" shaped recovery that economists had expected. Many now worry that the recovery might have a "W" shape – a "double dip recession" form, with GDP growth dropping down below zero in this quarter or the next. Mr. Bullard told a telephone press conference he worries that the US economy may become "enmeshed in a Japanese-style deflationary outcome within the next several years." That is exactly what is likely to happen. But it is a little early for the Fed economists to throw in the towel. They still have some fight left in them. If they were really on the ropes, for example, they could throw their "widow maker" punch – dropping dollar bills from helicopters. This would make sure that the money supply increases, even if the normal distribution channel – bank lending – is broken. In a celebrated speech on Nov. 21, 202, Mr. Ben Bernanke, then a recent addition to the Federal Reserve Bank's board of governors, explained why deflation was not a problem: Like gold, US dollars have value only to the extent that they are strictly limited in supply. But the US government has a technology, called a printing press (or, today, its electronic equivalent), that allows it to produce as many US dollars as it wishes at essentially no cost. It was that technology to which Mr. Bullard referred when he ceased being prescient and began being cagey. He was not advocating dropping money from helicopters, not just yet. He was hoping he wouldn't have to. Instead, he was raising the menace of inflation, in the hopes that that would be enough. "By increasing the number of US dollars in circulation, or even by credibly threatening to do so," Mr. Bernanke had continued, "the US government can also reduce the value of a US dollar in terms of goods and services, which is equivalent to raising prices in dollars of those goods and services… We conclude that under a paper money system, a determined government can always generate higher spending and hence positive inflation." There's the problem right there. The threat must be credible. Ben Bernanke's speech title left no doubt about his intentions: "Deflation: Making sure it doesn't happen here." Back then, the reported consumer price measure stood at 1.7% – slightly below the 2% target. Perhaps it was that 0.3% undershoot that set Ben Bernanke to thinking about it. If so, we wonder what he must think now. Today, the Fed is off-target by 75%, which is to say, the measured inflation rate is just 0.5%. It is beginning to look as though Ben Bernanke's reputation as a deflation fighter is more boast than reality. The Fed's Open Market Committee meets on August 10th. On the agenda will be more direct purchases of US Treasury debt – bought with money that didn't exist previously. This is what economists call "quantitative easing." It is a way of increasing the money supply. But quantitative easing is not the same as dropping money from helicopters. If you drop money from helicopters there is no room for ambiguity, and no doubt about what happens next. In a matter of seconds, your currency will be sold off, your loans called, and your credibility ruined for at least a generation. Quantitative easing, on the other hand, is a much more subtle proposition. It allows the central banker to maintain his credibility, at least for a while, because it doesn't necessarily or immediately work. When the private sector is hunkering down, the money doesn't go far. Prices don't rise. Japan has done plenty of quantitative easing, with no loss to the value of the yen or to the credibility of its central bank. Europe has done it too. And so has America. The US Fed bought $1.25 trillion worth of Wall Street's castaway credits in the '08-'09 rescue effort. But instead of losing faith in America's central bank, investors bend their knees and bow their heads. Incredibly, the US now announces the heaviest borrowing in history while it enjoys some of the lowest interest rates in 55 years. A threat to undermine the currency, we conclude, is only credible when it is made by someone who has already lost his credibility. That is, someone with nothing more to lose. Bernanke, Bullard, et al, are not there yet. Regards, Bill Bonner Incredible Threat originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." |

| Gold Permabears Never Learn, Nearing Extinction Posted: 06 Aug 2010 08:59 AM PDT Source: Gold Permabears Never Learn, Nearing ExtinctionIt appears the gold rocket launch is underway, which of course means that gold permabears will soon go into hiding. Was it really only 10 days ago that weak hands were panicking; Dennis Gartman was saying he was no longer a gold bull; and deflationists took center stage? Intermediate term bottoms in gold always "feel" the same. Not only do you need a sleep-inducing period of consolidation followed by a steep sell-off, but you need sentiment to turn decidedly sour. You can always spot bearish sentiment through certain key words. These key words are: gold bubble; Robert Prechter; CNBC; gold bubble; deflation; gold bubble; shorting gold; gold bubble; "stupid" gold bugs; and of course, gold bubble. Come across these words enough times and you know a bottom is at hand. Get ready to back up the truck like I did when I said to embrace the sell-off in gold. At the time I said: To me, the current sell-off in gold is reminiscent of the sell-off in stocks 3 weeks ago. While bears were blindly and recklessly going short, the smart money was sitting patiently with their fingers hovering over the "buy" button. Based on the aforementioned, is it time to buy?

At the end of the day there are really only two kinds of investors: the smart money and the dumb money. The dumb money always hands over ownership of shares to the smart money at major bottoms. The dumb money is scared of adding in a correction. The dumb money always chases tops. The smart money understands the relationship between price and value. The smart money is patient. The smart money understands that the biggest profits in bull markets go to those who wait. This bull market has years to run. Skeptics will be shorting this market and losing money for the next 5 years just as they have the past 10 years. Don't complain, just thank them for giving you the opportunity to accumulate. These same investors will be buying from you at much higher levels. Eventually I will join the bears and short the gold market  with conviction, but it is not time yet. with conviction, but it is not time yet. |

| Posted: 06 Aug 2010 08:54 AM PDT |

| White Swans into Black: Golden Antidotes Posted: 06 Aug 2010 08:45 AM PDT |

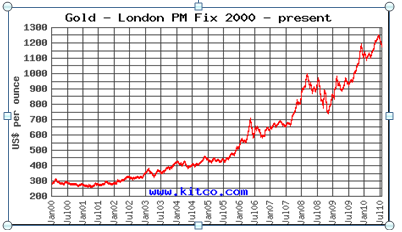

| Why Today's Deflation Won't Kill Gold Posted: 06 Aug 2010 08:33 AM PDT Aigail Doolittle submits: With all of the attention given to deflation recently, I thought it would be interesting to think about how this scenario might affect gold. After all, gold is thought to be the ultimate investment in a time of inflation. Does this mean that deflation could destroy the value of gold? More interesting than the question, in my view, is the road to the potential answer because there simply isn’t a clear one. However, based on everything I’ve read and researched, the outcome is closer to no: today’s deflation will not topple gold. 1. Gold’s Primary Trend Is Up – Gold’s decade-long chart tells us that if deflation is taking hold, it will not destroy the value of gold. We know this because this chart captures every fundamental possibility including that of deflation and in the face of this possibility, gold’s long-term and primary trend remains very clearly up.  However, we must define the word “destroy” because gold will not be immune to deflation or a general decline in prices. In fact, just as the chart above tells us that the primary trend is up, it suggests that gold may decline in value from current levels to about $900 per ounce or even lower. While this may seem like destroyed value to many, it will not be in relation to any other asset class in this period of deflation. It will be a good store of value in relative terms. 2. Today’s Deflation Will Bleed Into Hyperinflation – I believe the chart above is telling us the story of today’s variety of deflation or the sort that will twist into hyperinflation due to the world’s unsustainable 30-year borrowing binge that’s been transferred to the public sector, and thus sovereign debt and the underlying currencies, from the private sector. Under these circumstances, gold will be subject to the general decline in prices that will take hold under deflation as discussed above, but on a relative basis, gold will hold value due to the collective desire to hoard one of the oldest and most accepted transferrable stores of value. 3. Ultimate Hoarding Vehicle – Sam Hewitt of Sun Valley Gold Company makes the very strong point that in past U.S. deflations, individuals had the choice to hoard either in paper currencies or in gold. “The historical record,” according to Mr. Hewitt, “Demonstrates that loss of confidence in the issuer of paper currency is often a sufficient reason for individuals to choose gold over paper currency.” While the conversation about the coming collapse of fiat currencies has become rather popular in many circles more recently, the chart above is telling us that many more people have been having this conversation for at least ten years. It is not a coincidence that that the run-up in gold occurred as the world’s debt storm was completing its final phases. I also believe that the chart above is telling us that there have been many individuals who have been choosing to hoard gold due to a collective lack of confidence in a paper currency that may be pulverized by the U.S. deficit. 4. Untarnished Credit Quality – Another excellent point made by Mr. Hewitt is that when gold is compared to “widely available cash-substitutes, gold’s relative attractiveness boils down to relative credit quality.” Specifically, “Whenever deteriorating credit conditions negatively impact the issuers of paper currency, investors turn toward gold as the preferred hoarding vehicle. To predict the future behavior of gold under deflation, one must include the impact of deteriorating credit conditions on the issuers of competing cash-substitutes in today’s markets.” In the case of the current credit situation, the tremendous run-up in financial sector borrowing, and GSE borrowing in particular, that could not be sustained by the private sector, is now very squarely on the public shoulders of Uncle Sam. If this borrowing load proves to be unsustainable for the public sector as well, it will produce weakened Treasurys and a devalued dollar. Gold, however, is a store of intrinsic value that will not be tarnished by such a crisis. While such a possibility may render gold less valuable during the time of the crisis than it is today, it will retain value since it is independent of credit quality. I would like to point out that all of this is different than seeing gold as a currency which many consider to be the food of traders looking to profit on what had been gold’s run up. Rather, this is viewing gold as a store of value. This being said, I’ve read reports of areas in mid-Michigan which accept competing currencies including gold. Being a chartist first and foremost, however, I think the most compelling reason to believe that gold will hold value rather well under deflation is the chart above. Gold’s long-term and primary trend is up and strongly so. While it’s likely to decline from today’s levels, gold will not be toppled relative to where it was just 10 years ago as will most other asset classes and it may come out of this particular deflation (hyperinflation) dynamic as the one and only king. Disclosure: No positions Complete Story » |

| Democratic Stocks (And Bonds) Surge On Confirmation Central Planning Works Posted: 06 Aug 2010 08:16 AM PDT No longer in the twilight zone, the market is now democratic beyond reproach: of the idiots, for the idiots, by the idiots. The 10 Year is at 2.81% and refuses to budge as stocks explode. The catalyst - consumer credit, which came in slightly better than the expected trouncing even as the key source is revealed to be... entirely the Federal Government! In other words, forget Kremlin Joe: central planning works. Oh, and the Double DIP-ression is once again fully priced in. Note the 10 year-ES divergence. At this point this is a given. And below is the main change in consumer credit holders in Q2. The main one has been highlighted. (source: the Cave Of Ali Bernbaba and the 40 Wall Street Thieves) |

| Australian Dollar’s Run May Hit a Short-Term Snag Posted: 06 Aug 2010 08:15 AM PDT $3.2 billion. That's the record trade surplus Australia's Bureau of Statistics announced on August 3, thanks in part to Chinese demand for the country's rich iron ore and coal exports. And that's just the latest good news from the island continent that has speculators feeling bullish about the Australian dollar (AUD). But a closer look at the underlying fundamentals, including central banking mentality, reveals ample evidence that the currency may be in for a brief and wayward turn lower. Don't get me wrong – there are a lot of good things happening in Australia. Its annualized GDP is expected to grow at a 3.5-4% pace in 2010, led by strong manufacturing sector activity. And the Australian Industry Group and PriceWaterhouseCoopers recently released a joint survey that showed continued improvement in the sector. Its index rose by 1.5 points to 54.4 in July, up from 52.9 in June. (Anything above 50 indicates expansion.) The report's sub group assessments were also optimistic, with both production activity and order flow jumping higher as a result of increased business spending and demand. The rise in production and manufacturing activity has been a boon for the labor market. Australians are finding employment in every corner of the country, which is driving the national unemployment rate down. As of the latest release, unemployment in the "land down under" was a paltry 5.1%. Comparatively, US unemployment currently stands at double the rate. So, growth and employment prospects have added to bullish Australian dollar sentiment. Higher rates of economic expansion are expected to fuel consumption and more interest rate hikes by the nation's central bank. But not everything is as rosy as it seems. Yes, people are making money. However, with the fears of a global recession and higher interest rates at home, Australians aren't spending as much as they should. This is showing up in the bottom-line sales numbers for many of Australia's retailers. Retail consumption has been appalling in the last couple of months, rising only minimally since the beginning of the year. Even more disappointing is the fact that Aussie consumption has now dipped below the levels in the United States – where spending is about 2% and the savings rate has now crossed the 6% line. Granted, retail sales don't contribute a whole lot to the gross domestic product of the region – constituting about 23% of overall productivity. But it's never good when consumers aren't willing to spend in good economic times. Lower spending and consumption breeds lower prices as retailers discount merchandise to compensate for the drop in sales volume. The competition for consumer market share will bring prices down across the board – fostering lower inflationary pressures. And that puts Australia's central bank into standby. Governor Alan Bollard and members of the Reserve Bank of Australia rely on an inflationary target of 2-3%. The Bank began raising rates last year when it looked like the inflation rate would breach 3%. But consumer prices are now expected to trail off from their recent 2.7% reading – well below the 3% target. So the central bankers will contend that inflationary pressures remain contained, and the economy is growing at a moderate and controlled pace. The pause in rate hikes will leave some high-rate seekers in the Australian money markets disappointed, sparking a short-term exodus as investors prefer to take profits while they can. So while the Australian dollar is approaching four-month highs, the short-term sentiment is bearish. Australian assets are overbought. Stifled consumer spending threatens further Aussie economic expansion. And expectations are for no further moves in monetary policy until next year. Taken together, it leaves little impetus for another leg higher in the Australian dollar in the meantime. Richard Lee Australian Dollar's Run May Hit a Short-Term Snag originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." |

| Consumers Confident… of US Debt Legacy Posted: 06 Aug 2010 08:00 AM PDT This US shopper is confident, well, at least that the "recovery" Treasury Secretary Tim Geithner recently "welcomed" the nation to, via his New York Times op-ed, isn't real. Instead, he's preparing for the worst. To the extent the economy hasn't completely collapsed, as part of a needed a correction, it's "thanks" to taxpayer-funded bailouts and loans taken out against the nation's future fiscal integrity. Like this consumer's grandkids, generations of Americans will be on the hook for the accumulated debt.

Consumers Confident… of US Debt Legacy originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." |

| Gold Rises for 7th Straight day Posted: 06 Aug 2010 07:49 AM PDT |

| You are subscribed to email updates from Gold World News Flash To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

People were also buying gold on the longer-term view that the dollar may weaken further and inflation may rise if a stuttering economic recovery causes the U.S. to inject more money into the system, according to Ira Epstein, director of the Ira Epstein division of the Linn Group. Bob Haberkorn, senior market strategist with Lind-Waldock, also said that people are buying gold "anticipating some major inflation coming down the pike," although he said he believes this will come from previous liquidity injections rather than anything new…

People were also buying gold on the longer-term view that the dollar may weaken further and inflation may rise if a stuttering economic recovery causes the U.S. to inject more money into the system, according to Ira Epstein, director of the Ira Epstein division of the Linn Group. Bob Haberkorn, senior market strategist with Lind-Waldock, also said that people are buying gold "anticipating some major inflation coming down the pike," although he said he believes this will come from previous liquidity injections rather than anything new…

No comments:

Post a Comment