Gold World News Flash |

- California is barrelling towards "fiscal meltdown"

- Your employer could be stealing from your 401k

- Monetary Targets: A Fresh Take

- Wells Fargo chief admits who's really going to pay for the bank reforms

- "Barney Frank just lied straight to the faces of every American..."

- Why you should own the No. 1 natural gas producer in the U.S.

- The Fed Flashes the Nuclear QE Trump Card

- Fed's Bullard Throws Cold Water: Low Interest for 'Extended Period' Is a Sign of Failure

- Sign of Another Bubble: Swap Rates Lower Than Treasuries

- Daily Highlights: 7.30.10

- Spain Reports 20%+ Unemployment, a Structural Problem That May Persist For Some Time

- Here Is What To Watch Out For Today In Addition To GDP (Consensus At 2.6%, Range 1.0%-4.0%)

- Friday Morning Links

- Wall Street Breakfast: Must-Know News

- This Week in Financial Sarcasm: Goldman Sachs, Charles Schwab, Formula Capital & the SEC

- Is Now a Good Time to Buy Gold?

- Gold Pattern

- Is the Gold Trade “Crowded”?

- More Clueless Mainstream Commentary on Gold

- Time to Board the Gold Stocks Train?

- A Little Gold Trickles Out of the Trust at GLD

- Gold closes out Q2 on the plus side

- Central Banks Push Up the Gold Price

- Gold Selling Off Like Everything Else This Morning

- For the Last Time, Is Gold in a Bubble?

- Market Commentary From Monty Guild

- Crude Oil Rises on Bargain Buying, Gold’s Fate In the Hands of Investors

- Current Comments on the Companies I Cover: Q3 2010

- Daily Dispatch: Words from the Wise

- Grandich Client Update – Silver Quest Resources Continues to Grow The Capoose Resourc

- Gold Promises and Currency Lies

- Gold Technicals for July 29th

- Jim?s Mailbox

- Hourly Action In Gold From Trader Dan

- In The News Today

- Unorthodox Leverage Ideas for Physical Metals

- For the Fed, Inflation is a Positive

- 'Tis But a Scratch!

- Slicing the Salami

- UK Stagflation - Now It Begins... Inflation - India's Turn

- Is the Future of U.S. Oil Really Secure?

- The gold investment fund that doesn't invest in gold

- Housing Bubble will Not be Reblown; Foreclosures Increase…

- Understanding negative lease rates

- Deciphering the BIS Gold Swap

- Pre-Crime, Future Crime [Updated]

- Top Trader Warns Of Hyperinflation

- Inflation Scorecard: Currencies Extend Gains vs. Gold

- Gold - The Battle Is Already Won

- Three Reasons Silver Is Likely to Sparkle

| California is barrelling towards "fiscal meltdown" Posted: 30 Jul 2010 02:02 AM PDT From Bloomberg: California Governor Arnold Schwarzenegger ordered more than 150,000 state workers to take three days of mandatory unpaid time off to conserve cash. The executive order, effective Aug. 1, stipulates that the furloughs will end when a budget for the fiscal year that began July 1 is enacted, the governor's press secretary, Aaron McLear, said in an e-mail. It comes after government workers endured furloughs over almost 12 months that ended June 30. California began its fiscal year without a spending plan after Schwarzenegger and Democrats remained deadlocked over how to fill a $19.1 billion deficit. Controller John Chiang has warned he may again need to issue IOUs to pay bills if the impasse continues into September. "Every day of delay brings California closer to a fiscal meltdown," Schwarzenegger said in a statement today. "Our cash situation leaves me no choice but to once again furlough state workers until the Legislature produces a budget I can sign." About 37,000 state workers, including highway patrol officers, forest firefighters, and psychiatric technicians, are exempt from the furloughs because their unions struck labor contracts with Schwarzenegger that included cuts in pensions he sought. To contact the reporters on this story: Michael B. Marois in Sacramento, California, at mmarois@bloomberg.net. More on California: Why Texas is booming... while California is mired in socialist disaster California bond debacle: State forced to pay higher and higher yields to borrow Shocking figures show California gov't workers are making unbelievably high salaries | ||

| Your employer could be stealing from your 401k Posted: 30 Jul 2010 02:00 AM PDT From The Daily Crux: Lawsuits are popping up across the U.S. accusing employers of "improperly transferring, lending, or using plan assets." This month alone, over 150 million Americans received notice that their 401k contributions never actually went to their 401k. Many small- and mid-sized businesses have been hit hard by the recession and are using employees' money to pay bills. This article from MarketWatch explains the signs to look for if you think your 401k could be missing money. Read full article... More on saving money: The No. 1 strategy for getting out of debt fast More great ways to make money without a job You may be owed thousands... and have no idea | ||

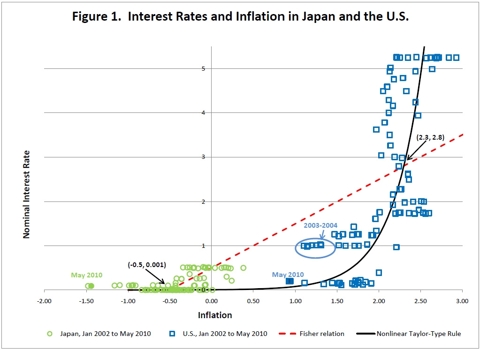

| Monetary Targets: A Fresh Take Posted: 30 Jul 2010 01:46 AM PDT John M. Mason submits: The morning papers contain articles on the newly released paper on monetary policy by James Bullard, the President of the Federal Reserve Bank of St. Louis. The basic thrust of the paper is that the Fed’s efforts to keep interest rates so low and for “an extended period” of time may eventually backfire and result in a Japan-like dilemma of stagnation and price deflation. Complete Story » | ||

| Wells Fargo chief admits who's really going to pay for the bank reforms Posted: 30 Jul 2010 01:46 AM PDT From Bloomberg: Wells Fargo & Co. Chief Executive Officer John Stumpf said customers, not just the bank, will bear the financial burden for U.S. regulations that cover services ranging from home loans to credit cards. "I can’t guarantee that we won’t pass on some of those costs," Stumpf, 56, said in an interview at his San Francisco office. "We'll try to tighten our belt and absorb some of the costs of compliance, but some costs may change and customers might pay for their financial services in new ways." Stumpf's comments add to evidence that new rules mean new expenses for consumers as banks make up for lost revenue and increased costs. JPMorgan Chase & Co. CEO Jamie Dimon said July 15 the legislation may translate into higher fees and credit-card rates, and Bank of America Corp.'s Brian T. Moynihan told shareholders a day later he's looking for ways to soften the impact on annual revenue, which the lender said could be $2.3 billion. Wells Fargo, with the biggest U.S. branch network, is already passing on costs by charging for checking accounts and raising interest rates on credit cards and loans, said Richard Bove, a banking analyst at Rochdale Securities LLC. The bank ended free checking last month by adding a $5 monthly fee for customers who don't meet certain conditions. "This bank does not intend to sit there and get nailed," said Bove, who recently upgraded Wells Fargo shares to a "buy." "Wells Fargo has moved well ahead of the crowd, and everyone will follow." New Rules President Barack Obama signed into law last week a 2,300- page overhaul of financial regulation that gives the government authority to unwind failing financial firms, imposes new rules on derivatives markets and creates a consumer-protection agency to monitor loans and services. Stumpf said it's too early to judge the costs for Wells Fargo, in part because the bank is looking for ways to offset expenses and lost revenue. Even with the bill's shortcomings, Congress got many parts of it right, Stumpf said in the July 22 interview. The creation of a systemic risk regulator will prevent another crisis from being sparked by the collapse of a large financial firm, he said. The Financial Stability Oversight Council, a super- regulator, will monitor Wall Street's largest firms and other market participants to spot emerging systemic risks. "Too-big-to-fail has been dealt with," said Stumpf, whose bank holds $1.2 trillion of assets. "Regulators needed a way to understand risk at the top of the house and opine on that risk. They did it in a way that makes a lot of sense." Not Enough Some of the new consumer protections don't go far enough because they contain too many exemptions, Stumpf said. Auto dealers and banks with less than $10 billion in assets may be exempt from some curbs. Consistent consumer protection rules are "good for Americans and it's good for us as providers because we know the playing field is level," Stumpf said. "Does it become less level because the consumer-protection agency has direct involvement with certain companies and not others, and will rely on other regulators to do it? I don’t know. That’s where the trickiness comes up." Wells Fargo, which ranks fourth by assets and third by deposits among U.S. banks, has dropped 20 percent since the middle of 2007 when credit markets began to falter, compared with 17 percent through yesterday for New York-based JPMorgan and 71 percent for Bank of America, based in Charlotte, North Carolina. New York’s Citigroup Inc. slid 92 percent. Wells Fargo rose 18 cents to $28.25 at 9:35 a.m. in New York Stock Exchange composite trading. The biggest stakeholder is Berkshire Hathaway Inc., the insurance and holding company controlled by billionaire Warren Buffett. Durbin Amendment Stumpf singled out new curbs on debit interchange fees for criticism. Under the so-called Durbin amendment, the Federal Reserve gets authority to limit interchange, or “swipe” fees, that merchants pay for each debit-card transaction. The measure pushed by Senator Richard Durbin lets retailers refuse credit cards for purchases of less than $10 and offer discounts based on the form of payment. "That is a dispute between banks and merchants and it somehow found its way into regulatory reform," Stumpf said. He told analysts on July 21, "I don't see how debit card fees between banks and merchants had anything to do with what happened in the last couple of years." Stumpf isn't the only financial leader voicing displeasure. Card industry executives say the legislation amounts to price controls, and American Express Co. Vice Chairman Ed Gilligan said June 15, before the language was finalized, that the Durbin amendment "provides no benefit to consumers." The largest payment networks, Visa Inc. and MasterCard Inc., also opposed the amendment. Derivatives New rules on derivatives will mandate that swaps between banks and major users like hedge funds and asset managers be backed by clearinghouses. Stumpf said moving those trades to clearinghouses would help show the true size of the derivatives market, but doesn't address what happens when a borrower doesn't pay or a member of the clearinghouse collapses, he said. "Somebody's got to take the credit risk," Stumpf said. His concern was echoed by Joel Telpner, a partner with the law firm Jones Day in New York, who spoke in a July 26 interview. "Maybe we are creating new entities that are too big to fail and setting up a scenario in the future where we're going to be arguing and anguishing about bailing out the clearinghouses," Telpner said. To contact the reporter on this story: Dakin Campbell in San Francisco at dcampbell27@bloomberg.net. More on banks: Star analyst Whitney: Avoid banks "at all costs" Bank analyst Bove: Financial reform bill is a "disaster" Ten things you must know about offshore bank accounts | ||

| "Barney Frank just lied straight to the faces of every American..." Posted: 30 Jul 2010 01:39 AM PDT From Green Faucet: I'm sitting here in amazement as I watch Barney Frank, THE chief architect of the housing bubble, lying through his teeth on virtually every economic subject known to man. I always say: I wish fiscal conservatives had someone as good at him with the gift of gab. In what must have been a 15-minute CNBC interview a few moments ago, Barney Frank said that the idea of a VAT tax is as "dead as a doornail." I'm sure he means that sincerely – for this year... Read full article... More on taxes: Tax horror: Healthcare bill to create an IRS "army" Tax horror: Congress could triple dividend tax rates Astonishing chart shows how high taxes could surge | ||

| Why you should own the No. 1 natural gas producer in the U.S. Posted: 30 Jul 2010 01:37 AM PDT From Dan Ferris in the S&A Digest: For the second quarter of 2010, Extreme Value World Dominator pick ExxonMobil reported a 91% increase in earnings over last year's second quarter. Everyone complains ExxonMobil bought back stock and piled up cash for years and years and didn't build reserves. I recently showed my Extreme Value subscribers why this viewpoint is incorrect. You don't have to be a genius to know that ExxonMobil using its stock to buy XTO Energy's 45 trillion cubic feet of reserves for less than $1 per thousand cubic feet was a great idea. Poof! Everyone who said ExxonMobil wasn't growing reserves, or wasn't growing them fast enough, is proved instantly wrong, due to a single transaction... a transaction that made ExxonMobil the "mac daddy," low-cost, largest producer of natural gas in the United States. What investors have failed to grasp is cash in ExxonMobil's hands is like cash in Warren Buffett's hands. Exxon is a brilliant capital allocator and a brilliant manager of its own capital structure. It knows what to do with the cash it generates. What's it doing now that the XTO deal is complete? Paying back XTO debt, of course. It just announced the repayment of another $2 billion in XTO bonds. ExxonMobil knows when to spend, when to refrain from spending, and how to keep itself in excellent financial condition. It refrained from spending during the boom years, buying back shares and building up cash. It bought XTO Energy with these shares after the crash. I understand if you're bored by big-cap stocks like ExxonMobil. But I promise you that's a foolish viewpoint, since you're unlikely to make much money anywhere else for the next five to seven years... Our World Dominator buy list, which includes ExxonMobil, is solely for subscribers to Extreme Value. Four World Dominators are selling below their maximum buy prices today. Crux Note: To access the full list of World Dominators along with weekly updates telling you which ones are in buying range, click here. More from Dan Ferris: Dan Ferris: The only investment you never have to worry about Dan Ferris: A one-of-a-kind farmland investment anyone can buy "This could be the safest, cheapest stock in the world right now..." | ||

| The Fed Flashes the Nuclear QE Trump Card Posted: 30 Jul 2010 01:11 AM PDT  Gary Dorsch (Global Money Trends) submits: Gary Dorsch (Global Money Trends) submits: Of ten people who hear the same story or speech, each one might understand it differently. Perhaps, only one of them will understand it correctly. On July 21st, Federal Reserve chief Ben Bernanke was speaking in riddles, as central bankers are apt to do, while delivering his testimony before Congress. Each word that’s uttered by the Fed chief is scrutinized by anxious speculators, who try to interpret the message correctly, before quickly placing bets in the marketplace. Bernanke is the captain of a ship that is sailing through some very stormy seas, and is desperately trying to steer the economy away from its worst downturn since the Great Depression. The US-housing market is under-water, and putting enormous financial stress on vast numbers of Americans. A record 270,000 US-homes were seized from delinquent owners in the second quarter, and bankers are on pace to claim more than 1-million properties by the end of 2010. Small businesses, the engine of job creation, - are largely cut-off from credit, and are sputtering. Complete Story » | ||

| Fed's Bullard Throws Cold Water: Low Interest for 'Extended Period' Is a Sign of Failure Posted: 30 Jul 2010 01:05 AM PDT Niklas Blanchard submits:

Complete Story » | ||

| Sign of Another Bubble: Swap Rates Lower Than Treasuries Posted: 30 Jul 2010 01:00 AM PDT As reported by FT, long-term dollar swap rates dropped below yields of treasuries with same maturity this week. The last time this happened was in March and it ended in April. We know what happened shortly afterward. In a nutshell, this is probably what happened. Some fund managers (no doubt the type who only care about relative performance, meaning their bonus/jobs are safe if they lose 10% when the market drops 10%) came to TBTF banks and begged them to sell some bonds. TBTFs said "heck, why not, as long as rates are low." So they sold over $7B of it last week, at very low rates, probably using it to roll over maturing debt sold in past years at much higher coupons. Since a bank's revenue is generally tied to short-term interest rates, it's standard practice for banks to swap a large portion of their fixed-rate liability (bonds) to floating rates. Large buying of the fixed leg of interest rate swaps drives down the swap rate. Complete Story » | ||

| Posted: 30 Jul 2010 12:21 AM PDT

Economic Calendar: Data on GDP, Employment Cost Index, Chicago PMI to be released. Earnings Calendar: ACI, AEP, ALU, AON, AXL, BWA, CVX, HMC, KT, MCK, MDC, MRK, PPC, TOT, TPL, WY. Data courtesy of Egan Jones Ratings and Analytics | ||

| Spain Reports 20%+ Unemployment, a Structural Problem That May Persist For Some Time Posted: 30 Jul 2010 12:19 AM PDT As I have warned ad nauseum, the problems in Europe are being signicantly underestimated. From CNBC: Spain Jobless Rate up to 20.09 Percent Spain’s unemployment rate rose to a 13-year high of 20.09 percent in the second quarter, the government said Friday, as the job market lagged behind an economy that has barely managed to break out of recession. Though the rate increased from 20.05 percent in the first three months of the year, the National Statistics Institute (external link) said the number of people working actually increased. Still, the overall unemployment rate rose to its highest level since 1997 because of a large increase in the work force. Spain crawled out of recession in the first quarter of this year after nearly two years of economic contraction and has been a focus of concern in recent months, as investors fretted that its bloated deficit and troubled banking sector could necessitate a Greek-style bailout. The statistics institute said in Friday’s report that there are now 4.645 million unemployed people in Spain, more than half a million higher than a year ago. Proposed austerity measures on top of a collapsed bubble in the real estate market and banks that are playing hide the sausage with NPAs are not going to help the unemployment rate any. From our proprietary report on Spain’s public finances, Spain public finances projections_033010 (click here to subscribe):

As a result, we feel that there is also over-optimism in regards to the health of the Spanish banks – particularly those with heavy exposure to the consumer and to real estate. We first sounded the alarm in January of 2009 with BBVA, and the alarm over here keeps ringing. Reference Reggie Middleton on the New Global Macro – the Forensic Analysis of a Spanish Bank, Tuesday, January 27th, 2009: In Spain, BBVA, the second largest domestic bank, could see a massive deterioration in its real estate and consumer loan portfolio. The Spanish real estate sector is making a high horsepower a U-turn after years of a massive housing bubble that has burst – culminating in an unemployment rate that has risen to an outrageous 13.4% level. The power skid is showing no signs of reaching an inflection point, and we believe is only in the beginning throes of a sharp downturn. In addition, the banks‘ other key growth areas including Mexico, the U.S and South America are witnessing a slowdown in economic activity, restricting BBVA’s growth prospectus amid the current turbulent environment. With increasingly challenging economic conditions in each of these economies, BBVA’s asset quality has deteriorated sharply with non-performing loans rising to 36% of its tangible equity without corresponding (equal) increase in provisions. As the bank deals with these tough times ahead, we expect BBVA’s bottom line growth to remain subdued due to a slower credit off-take and higher provisions in the coming quarters. Key Highlights Sharp slowdown seen in Europe - According to the European Commission forecasts, the European economy is expected to contract 1.9% in 2009 with a modest recovery in 2010. Spain, in particular, is expected to be one of the worst hit due to the humbling of its housing sector which had, for several years, been a significant contributor to the country’s economic growth. This will impact BBVA by slowing down its credit and loan growth in addition to significantly deteriorating the credit quality of its loan portfolio. BBVA’s asset quality is set to deteriorate rapidly as Spain enters recession - Problems in Spain are more pronounced than in most of its European counterparts. The Spain’s budgetary deficit has already crossed the 3% threshold limit set by the European Commission and is expected to cross 6% by 2009, only behind Ireland. The unemployment has reached a 12-year high of 13.4% in November 2008, the highest in the Euro zone, while the real estate sector bubble (particularly residential vacation homes purchased by foreigners), the pillar of economic growth engine, has burst. BBVA, with nearly 40% of its total loan exposure tied to real estate & construction loans and individual loans in Spain could see massive deterioration in its asset quality. Besides Spain the bank has to deal with other challenging economies including Mexico and the U.S - In 3Q2008, U.S and Mexico contributed nearly 29% and 16% of total revenues, respectively. The downturn in the U.S economy is showing no signs of stabilization, with an unabated fall in housing prices and frozen credit markets continuing to shatter consumer confidence. Recession in the U.S has also led to a sharp slowdown in Mexico which is highly dependent on US for exports and remittances. The slowdown in both of BBVA’s key markets will not only impact the pace of BBVA’s growth but also augment the risk profile for the bank as it now has to deal with vagaries of these economies to navigate itself in these turbulent times. I reiterated the warning again back in January of 2010 with “The Spanish Inquisition is About to Begin…“: Now, it is time to see if fundamentals return to the market. From Bloomberg: BBVA Fourth-Quarter Profit Plunges 94% to $44 Million on Asset Writedowns

Don’t be surprised if the contagion moves into the insurance sector as well: And, of course I am expecting financial and economic contagion to ensue, quite possibly before year end. See Introducing The BoomBustBlog Sovereign Contagion Model: Thus far, it has been right on the money for 5 months straight! Click here to look into subscribing to our research services! The entire Pan-European Sovereign Debt Crisis series is available for free by clicking here. I will attempt to push out a detailed preview of a retail short and an technology company stratey and business model report by the end of the day. Cheers! | ||

| Here Is What To Watch Out For Today In Addition To GDP (Consensus At 2.6%, Range 1.0%-4.0%) Posted: 30 Jul 2010 12:18 AM PDT With everyone focusing on today's GDP, it is easy to ignore the other relevant economic data to be released in the one and a half hour block before 10am. In order of appearance, they are: Q2 GDP,the employment cost index, the Chicago PMI, and the final UMichigan consumer sentiment. Below is a summary from a rather bearish Goldman Sachs (which expects a 2.0% GDP print in 15 minutes) on each of these data points.

| ||

| Posted: 30 Jul 2010 12:16 AM PDT MUST READS MARKETS/INVESTING ECONOMY/WORLD/HOUSING/BANKING | ||

| Wall Street Breakfast: Must-Know News Posted: 29 Jul 2010 11:09 PM PDT

Earnings: Friday Before Open

Earnings: Thursday After Close

Today's Markets

Friday's Economic Calendar

Seeking Alpha's Market Currents team contributed to this post. Goldman Sachs issued a new corporate policy banning the use of all swear words and even the use of bleeped swear words such as f***k and s**t from corporate emails and texts sent on corporate issued cell phones. The new policy comes on the heels of recent embarrassing leaks of profanity-laced emails that were made public in Congressional testimony including Goldman executive Tom Montag’s email that stated about a then current $600 million Goldman issuance of Timberwolf CDOs: “Boy, that Timberwolf was one shitty deal.” Within three weeks of selling Australian hedge fund Basis Capital $78 million of Timberwolf CDOs and assuring Basis Capital that the market for CDOs had stabilized, Goldman Sachs began making significant margin calls on these very securities. Next up for consideration, Goldman CEO Lloyd Blankfein stated that he will be considering banning lying, cheating and stealing from Goldman activities as well.

In other news, the Obama administration’s record of “yes” means “no” and “more transparency” really means “less transparency” continues. Upon its passing, President Obama lauded the Frank-Dodd Financial Reform Bill and stated that the bill would “increase transparency in financial dealings.” A closer look at the bill has revealed that the bill actually increases secrecy by exempting the SEC from disclosing records or information derived from "surveillance, risk assessments, or other regulatory and oversight activities”, including all requests filed through the Freedom of Information Act. This provision covers almost every action by the agency, lawyers have stated. As a result of the new financial reform bill, the SEC stated that the American public no longer has a right to know how many hours a day its employees are watching porn instead of performing their regulatory duties.

Charles Schwab’s Chief Investment Strategist Liz Ann Sonders stated that given the “pretty good” fundamentals of US markets, and “absolutely fantastic” earnings of US corporations this earnings season, investors need to take advantage of current volatility by buying into the market now and sticking to a “long term” strategy as any short-term activities like taking profits from short-term trades or placing puts on the S&P500 as a hedge against a likely imminent large fall would be at “their [investors’] peril”. Despite the fact that this last rally in the US markets has been obviously rigged and manufactured and non-existent trading volume has spawned 1%+ up and down days in recent months with frightening regularity, Sonders states that her personal CCI is at least three deviations above the rest of America's CCI because as an investment authority, it's quite easy to hypnotize the masses with b.s. propaganda.

Finally James Altucher, Managing Director of Formula Capital, also joined the “now is the best time ever to buy US stocks” bandwagon by warning investors not to buy gold despite the ongoing buying opportunity this dip presents, because, as he so wisely claims, gold is nothing but a “rock”. And of course, all Westerners already know that you can not eat a rock and a rock does not pay interest. Altucher claims investors should load up on US stocks because they are trading at the lowest point in five decades right now in terms of “earnings yield versus interest rates”.

In response to all this recent affliction of insanity among US investment strategists and advisers, the Barnum & Bailey Circus announced that they will be increasing annual salaries for their clowns to $250,000 with 5 weeks paid vacation in addition to allowing them to freely cuss anytime they want in emails and in texts (as long as the texts are not sent to children). A Barnum & Bailey spokesperson stated that the main reason for the significant salary increase was a direct response to the commercial investment industry's offering of high priced salaries for registered clowns and a renewed commitment of the circus to the retention of their most excellent and talented clowns.

P.S. We'll be back with a substantive, non-satirical piece soon regarding our current monetary crisis.

| ||

| Is Now a Good Time to Buy Gold? Posted: 29 Jul 2010 10:33 PM PDT | ||

| Posted: 29 Jul 2010 10:33 PM PDT | ||

| Posted: 29 Jul 2010 10:33 PM PDT | ||

| More Clueless Mainstream Commentary on Gold Posted: 29 Jul 2010 10:33 PM PDT By Jordan Roy-Byrne, CMT Once again we see another bearish piece on Gold in the WSJ. Rather than attack the author personally, we want to illustrate how the article is another example of the lack of any quality gold commentary both in general and in mainstream publications. First, its important to note why you won't [...] | ||

| Time to Board the Gold Stocks Train? Posted: 29 Jul 2010 10:33 PM PDT | ||

| A Little Gold Trickles Out of the Trust at GLD Posted: 29 Jul 2010 10:33 PM PDT | ||

| Gold closes out Q2 on the plus side Posted: 29 Jul 2010 10:33 PM PDT | ||

| Central Banks Push Up the Gold Price Posted: 29 Jul 2010 10:33 PM PDT | ||

| Gold Selling Off Like Everything Else This Morning Posted: 29 Jul 2010 10:33 PM PDT | ||

| For the Last Time, Is Gold in a Bubble? Posted: 29 Jul 2010 10:33 PM PDT | ||

| Market Commentary From Monty Guild Posted: 29 Jul 2010 10:30 PM PDT View the original post at jsmineset.com... July 29, 2010 03:05 PM Dear Monty, China knows the evil of over the counter derivatives. They handle substantial financial fraud as a capital crime. Going forward, listed derivatives with a clearinghouse function, margin requirements and standardized contract points can exist without endangering either China or the world. China has no significant backlog of the OTC type weapons of mass financial destruction. The Western World is overhung by $1.4 quadrillion dollars of notional value OTC derivatives before the BIS went to the cartoon value of "value to maturity," the ultimate Pollyanna computer fabrication. The size of the OTC weapons of mass financial destruction has grown during the crisis that they are in fact responsible for. China, who considers major white collar crimes as capital crimes ( punishable by death), will not screw up themselves and the world in their version of the credit default LISTED derivatives. Asia and Africa is... | ||

| Crude Oil Rises on Bargain Buying, Gold’s Fate In the Hands of Investors Posted: 29 Jul 2010 10:30 PM PDT courtesy of DailyFX.com July 29, 2010 08:02 PM A very interesting week with regard to commodities saw crude oil inventories surge to levels just shy of 10-year highs and gold ETF holdings plummet 500,000 troy ounces. Nevertheless, the near-term outlook for both commodities is highly uncertain. Commodities - Energy Crude Oil Rises on Bargain Buying Crude Oil (WTI) $78.12 -$0.24 -0.28% Commentary: Oil rose $1.37, or 1.78% on Thursday, as traders used the recent sell-off as an opportunity to buy. After the bearish inventory report on Wednesday, prices may find it hard to advance further. A bit of consolidation is possible under the recent double top resistance area. In the event next week’s report is bullish or at the very least neutral, prices should approach $80; but that remains to be seen. Technical Outlook: Prices found support at $75.81, the 23.6% Fibonacci retracement of the 5/20-6/28 upswing. Near-term resistance lines up in the $79.38-80.00... | ||

| Current Comments on the Companies I Cover: Q3 2010 Posted: 29 Jul 2010 10:30 PM PDT A Monday Morning Musing from Mickey the Mercenary Geologist [EMAIL="Contact@MercenaryGeologist.com"]Contact@MercenaryGeologist.com[/EMAIL] July 26, 2010 I provide many updates of the companies I cover in written, audio, and video interviews and in periodic workshops during various investment conferences called "Q and A on Junior Resource Stocks". However, until today I have not posted written updates in the Mercenary Musing format. The following is the first in what will be a periodic series of general musings that review recent progress, upcoming catalysts, share price history, and give an updated opinion of each sponsor company and one site affiliate. The junior resource speculation game is dynamic, markets go up and down, company fortunes ebb and flow, and my opinions change to reflect the current situation and future outlook. Before we examine individual companies, let's review my trading philosophy as recently explained in a musing called "The Power ... | ||

| Daily Dispatch: Words from the Wise Posted: 29 Jul 2010 10:29 PM PDT July 29, 2010 | www.CaseyResearch.com Words from the Wise Dear Reader, Today’s musings will be in staccato, as I am running late and don’t feel a windy exposé lurking in my psyche, waiting to pounce onto the page. Instead, I would like to share just a few snippets I think you’ll benefit from, starting with the latest posting from Ambrose Evans-Pritchard, which you can read in full here. Here’s an excerpt: [LIST] [*]Today’s release on manufacturing activity by the Richmond Fed is pretty ghastly, as you would expect given that the effects of fiscal stimulus are now wearing off at accelerating pace – before the happy handover to the private sector is safely consummated – and given that the structural East-West imbalances that lay behind the global crisis are getting worse again. [*] The expectations index for the US 5th District is crumbling: [*] [*] This follows yesterday’s ... | ||

| Grandich Client Update – Silver Quest Resources Continues to Grow The Capoose Resourc Posted: 29 Jul 2010 10:29 PM PDT The following is automatically syndicated from Grandich's blog. You can view the original post here. Stay up to date on his model portfolio! July 29, 2010 03:22 PM Silver Quest announced some much anticipated drill results this afternoon, that have lived up to expectations.* These are the first of many drill results from the growing Capoose Project. This season Silver Quest has completed 26 drill holes for a total of 7,400 metres of drill core or approximately 3,700 samples that have all been shipped to the assay lab for analysis. A new feature in this year's core is the appearance of massive sulphide stringers up to 25 centimetres wide.* This is a very interesting added feature. These types of features are generally associated with VMS (volcanogenic massive sulphide) deposits which usually contain elevated levels of copper, lead, zinc, silver and gold.* VMS deposits typically occur as lenses of polymetallic massive sulphides that form at or near the seafloor. Metals contained in ... | ||

| Gold Promises and Currency Lies Posted: 29 Jul 2010 10:29 PM PDT By James West MidasLetter.com Thursday, July 29, 2010 The signals emanating from the global economic matrix that can be considered realistic, unbiased and leading indicate strongly that we’re edging closer to another brink of some sort. Nobody can see over the edge, but if the last cataract shot by our collective connected market kayak is anything to go by, the Eskimo roll escape afforded by government counterfeiting (oops…I mean ‘stimulus’) is not likely to deliver us to any safe harbor. Here are my favorite indicators and what they’re doing: [*]Unemployment statistics from ShadowStats.com: The U.S. Department of Labor is shamelessly optimistic to a degree that would make George Orwell blush. Actually, optimistic is not the word…just plain misleading is the better descriptor. The official numbers in red versus the ShadowStats numbers as determined by that site’s John Williams, himself a professional consulting ec... | ||

| Posted: 29 Jul 2010 10:29 PM PDT courtesy of DailyFX.com July 29, 2010 08:33 AM Gold has topped. Please see the latest special report for details. Gold is making its way lower and in an impulsive fashion. I wrote yesterday that “after bouncing to 1204, gold is testing its low so a secondary top may be in place at 1204.” Gold has plunged and the metal is probably headed much lower in a 3rd wave. The next important support area is 1045/67 (former 4th wave extreme and 161.8% extension). Jamie Saettele publishes Daily Technicals every weekday morning, COT analysis (published Friday evenings), technical analysis of currency crosses on Monday, Wednesday, and Friday (Euro and Yen crosses), and intraday trading strategy as market action dictates at the DailyFX Forum. He is the author of Sentiment in the Forex Market. Follow his intraday market commentary and trades at DailyFX Forex Stream. Send requests to receive his reports via email to [EMAIL="jsaettele@dailyfx.com"]jsaettele@dailyfx.com[/EMAIL].... | ||

| Posted: 29 Jul 2010 10:29 PM PDT View the original post at jsmineset.com... July 29, 2010 08:51 AM The Dual Face of the Structural Trade Deficit CIGA Eric Eric, A big ship I would hate to try to avoid on the high seas while she was doing 30 knots. There will be three of the zapping back and forth across the Pacific 5 days each way! Wow! let’s hear it for Walmart! Jack Both pictures define the reality of structural deficits in which issuance debt at the expense of tomorrow’s production, consumption, and investment. Made in China: Made in China also manifests itself in the Formula depicted below. US Federal Budget (Surplus or Deficit As A % of GDP, 12 Month Moving Average) and Gold London P.M. Fixed: More…... | ||

| Hourly Action In Gold From Trader Dan Posted: 29 Jul 2010 10:29 PM PDT | ||

| Posted: 29 Jul 2010 10:29 PM PDT View the original post at jsmineset.com... July 29, 2010 10:55 AM Dear CIGAs, "Currency Induced Cost Push Inflation" cannot be avoided. It will happen overnight as confidence in currency breaks. All of this has happened before. There was a major dollar rally in 1931 as many European countries defaulted on their debt. The dollar looked outrageously bullish as a mirror image of the weak European currencies. The media spoke of the USA in the manner of a refuge currency in 1931. Then it all changed as it has here and now. The dollar returned to its previous bear market, plumbing new lows in 1932 and 1933. We are, here and now, continuing on QE to infinity. Here and now, the Fat Cat insiders of Wall Street know this and are NOW shifting to massive longs under cover of a paper gold game. The Fat Cat Wall Street demons will make the most money over the shortest period of time in gold just as they did in 1979-80 and in the 1930s. It is totally obvious to the objective observer of the hi... | ||

| Unorthodox Leverage Ideas for Physical Metals Posted: 29 Jul 2010 10:29 PM PDT Leverage is a very natural part of a great number of traditional investment options. Real estate investing is nearly dependent on leverage; stock traders have up to two times leverage through their brokerage accounts, futures traders are naturally highly leveraged, and currency traders use the most extreme leverage of any investor. So where does this leave the market for physical metals? Leverage and Physical Metals Unfortunately for physical metal investors, leverage is not as easily offered by your coin dealer as it is with stockbrokers. In fact, you'd be hard-pressed to find any company willing to sell gold and silver on leverage simply due to the fact that it is so hard to track – but so incredibly easy to sell. If we think about this in a roundabout way, there are a few ways to grab cheap leverage to double down on your precious metals and prepare for the long term. One choice that comes to mind first is also, in many cases, the scariest. Have a ... | ||

| For the Fed, Inflation is a Positive Posted: 29 Jul 2010 10:29 PM PDT The Federal Reserve is down on its luck. It struck out with near-zero interest rates, gargantuan monetary policy measures, and particularly quantitative easing programs – which all have failed to fire. Now the public is wondering why the Reserve did anything at all. The state of the nation, it seems, is just as poor as it was some many months ago. Bernanke's Poker Face Ben Bernanke knows, as a Keynesian, that his goal is to "boost aggregate demand." Simply put, his job is to make sure people want to buy more things today than they wanted to buy yesterday. To accomplish this goal, he has to convince people to spend their money now – either by giving them more money or persuading them to part with their cash. However, as we should already be well aware, giving people and banks more money or capital has not at all increased the rate at which consumers are demanding from the marketplace. His Next Move Since neither quantitative easing or near negativ... | ||

| Posted: 29 Jul 2010 10:29 PM PDT by Adrian Ash BullionVault Wednesday, 28 July 2010 The bull market in gold is a long way from losing both arms and legs just yet... WHATEVER FORCE you spy behind this week's swoon in gold prices to $1160 per ounce and lower, 'tis but a scratch – a flesh wound – so far. "I've had worse!" as Monty Python's Black Knight says. First, the current options contract on gold futures expired Wednesday, guaranteeing volatility. Because as bullish speculators moved to close and rollover their position in the derivatives market, those banks taking the other side of the trade were only too happy to oblige. Call that manipulation if you must (double-check your facts first), but more broadly, long-time investors and traders would always expect to see a seasonal lull – if not drop – in gold prices between July and Sept. India's gold-hungry millions don't buy over the summer, waiting instead until autumn's post-harvest Diwali festival. And after the... | ||

| Posted: 29 Jul 2010 10:29 PM PDT Compared to Tuesday, the gold action everywhere on Planet Earth yesterday was basically a non-event. However, it's important to note that the bullion banks were able to force a bit more tech long selling, as a slightly new low for this move down [$1,156.90 spot] was set going into the London p.m. gold fix at 10:00 a.m. in New York on Wednesday morning. Gold managed to finish up a buck or so on the day. Volume was gargantuan... but most of that was roll-overs and switches. Today's volume will be pretty chunky as well, as Thursday is the last day of trading in the July contract... and all traders in the gold market must either close out their July contracts, roll them over... or stand for August delivery on Friday. Silver, the center of the universe for JPMorgan, was down in price once again on Wednesday. But, up until the London open at 3:30 a.m. Eastern time, silver had been rising slowly but steadily. From the London open, silver fell slowly bu... | ||

| UK Stagflation - Now It Begins... Inflation - India's Turn Posted: 29 Jul 2010 10:29 PM PDT UK Stagflation - Now It Begins Thursday, July 29, 2010 – by Staff Report Mervyn King Bank of England's Mervyn King (left) warns over inflation ... Bank of England Governor Mervyn King has warned that high inflation will continue to erode earnings power through next year as the economy faces the threat of 'stagflation'. Prices rises have consistently defied the Bank's expectations of a slowdown, adding to pressure on households as wage growth remains weak and the Government introduces a strict austerity package. The Bank's rate-setters are charged with keeping inflation at 2% but the Consumer Prices Index benchmark has been above 3% throughout the year. However, addressing a committee of MPs, Mr. King suggested that they will be reluctant to try to curb the problem by raising borrowing costs from 0.5 per cent any time soon because of the weakness of the economy. "There will come a point when we will certainly need to ease off the accelerator and retur... | ||

| Is the Future of U.S. Oil Really Secure? Posted: 29 Jul 2010 10:29 PM PDT By Marin Katusa, Chief Energy Strategist, Casey Energy Report Two words that any oil company dreads to hear are "export duty." Especially if the word "increases" or "introduced" is floating around there too. So when Kazakhstan introduced an oil export duty to meet shortfalls in the national budget, the mood wasn't exactly jovial. On July 13, the Kazakh government brought back the tax that had been abolished during the financial crisis. A US$20 tariff will be levied on every ton of crude oil exported from the Central Asian nation. The hope: collect some US$406 million in additional revenue by the end of the year. The energy-rich, former Soviet republic has some of the largest oil and gas reserves in the Caspian Sea basin, producing 1.43 million barrels per day (bbl/day) in 2008. And as the giant Tengiz and Karachaganak fields are developed further, an additional 1.5 million bbl/day will be coming off the production line. With the country hol... | ||

| The gold investment fund that doesn't invest in gold Posted: 29 Jul 2010 10:22 PM PDT | ||

| Housing Bubble will Not be Reblown; Foreclosures Increase… Posted: 29 Jul 2010 10:00 PM PDT | ||

| Understanding negative lease rates Posted: 29 Jul 2010 09:15 PM PDT The reporting by LBMA of negative lease rates is often misunderstood, resulting in some commentators coming to incorrect conclusions. Given my recent discussions with FOFOA on backwardation, some explanation of negative lease rates would probably be useful. In the real world the cost of borrowing gold outright is never negative – no bullion bank will pay you to take gold. In fact, I am aware that some lenders have a minimum rate below which they will not lease. Makes sense, would you risk lending 1 tonne of gold worth $37 million on an unsecured basis at 0.1% for 3 months just to earn $9,400? So why does the LBMA report negative lease rates? Our starting point is how the lease rate is calculated: Lease Rate = LIBOR – GOFO (see the LBMA's Guide for why this is so) First point to note is that the lease rate is calculated from LIBOR and GOFO; the LBMA does not question its market making members for their actual lease rates. It is therefore based on the accuracy of LIBOR and GOFO. If we look at how these two rates are determined (see here and here) then we see a number of differences: 1. Set at different times – GOFO rate submitted at 10:30am and fixed at 11am, but LIBOR rates are requested between 11.00am and 11.20am and fixed shortly thereafter. 2. Set on different sides – LBMA's website GOFO is the rate "at which the Market Making Members will LEND gold on swap against US dollars", which involves using the USD interest bid rate. For LIBOR banks are asked "At what rate could you BORROW funds, were you to do so by asking for and then accepting inter-bank offers in a reasonable market size", that is the USD interest offer rate. 3. Set by different banks – LIBOR is set by 16 banks, GOFO by 8, with 6 common to both. LIBOR drops the top and bottom quartiles before averaging, GOFO drops the highest and lowest before averaging. It could therefore be possible that the 4 banks use to set LBMA's GOFO (which they would calculate/relate to their estimate of LIBOR) don't have their LIBOR rates included in BBA's LIBOR. Probably worth noting that within a bank LIBOR and GOFO would be set by different desks. Now these are minor differences as we would not expect rates to move too much between 10:30am and 11:00am, or much difference in the bid/offer spread, or too much divergence between banks on their rate so the dropping of high and low rates should not affect the average too much. However, I think when rates get close to zero, these differences could have a material impact. Consider also that questions have been raised about LIBOR's usefulness at these low rates, see here and here. The fact is that GOFO and LIBOR are not "in alignment". The resulting calculated lease rate is therefore just an approximation based on two averages. Caution should thus be exercised when trying to draw conclusions from it. GOFO, however, should be able to be relied on. It should relate to the basis, although not equate to the basis as the basis is calculated from futures prices whereas GOFO is a forward rate - the economics of those two are slightly different. | ||

| Posted: 29 Jul 2010 08:00 PM PDT | ||

| Pre-Crime, Future Crime [Updated] Posted: 29 Jul 2010 07:01 PM PDT Stacy Summary: Convergence of global police state following the sci-fi script to the word. Re: the second story, I included quotes that support my hypothesis that the intelligence services are looking for crowd-sourced analysis.

Choice quotes. First this one that could have come from Sumner "We're not going to kill him" Redstone:

And this:

**Update**: And if you can't even prove you don't owe zero cents, how can you prove you weren't going to commit that crime they 'predict' you were going to commit? Comcast threatens to cut off service unless customer pays the $0.00 he owes | ||

| Top Trader Warns Of Hyperinflation Posted: 29 Jul 2010 06:51 PM PDT "Trader Vic" Sperandeo is on CNBC describing the historical pattern for the onset of hyperinflation, and says the conditions for such a runaway inflation are now here in the US. We're getting more familiar with these types of extreme forecasts as our economy drifts into unchartered territory. It seems market watchers are almost growing accustomed to hearing predictions about a coming hyperinflation or a looming deflationary depression. Still, it should be noted that Sperandeo is a serious guy and a very serious researcher (my observations based on reading his work and listening to his interviews). His knowledge of economic history and the nature of money creation and business cycles is profound. So while the forecasted event is an extreme and rare event, don't dismiss Vic as "just another scaremonger". It is striking to note that while Vic is arguing his case for the likelihood of hyperinflation, in effect the spiralling collapse of a society and an economy, he is interrupted by the CNBC girl who wants to know "what the trade is" in this scenario. Cable TV never ceases to amaze. More Here.. | ||

| Inflation Scorecard: Currencies Extend Gains vs. Gold Posted: 29 Jul 2010 05:58 PM PDT Hard Assets Investor submits: by Brad Zigler Real-time Monetary Inflation (last 12 months): -1.6% Reserve currencies continued to take ground from gold this week. Sterling appreciated 4.1 percent against bullion while the euro rose 3.2 percent. Both the yen and the Swiss franc climbed 1.2 percent. Complete Story » | ||

| Gold - The Battle Is Already Won Posted: 29 Jul 2010 05:51 PM PDT | ||

| Three Reasons Silver Is Likely to Sparkle Posted: 29 Jul 2010 05:25 PM PDT Kevin Grewal submits: Although gold continues to grab most of the attention in the precious metal world, its less glamorous sister, silver, may be more appealing and for good reason. First off, silver has many more uses than gold does. It is used for numerous industrial purposes and nearly 55% of total silver fabrication is used for industrial purposes. Silver is commonly used in the electronics space and can be found in plasma display panels and printed circuit boards, as well as in the lining of refrigerators, for food storage containers and for water purification. Additionally, the metal can be used as an antimicrobial to fight bacteria and as an antiseptic to treat fungal infections. Silver’s industrial uses even span to the solar energy industry. As economies around the world continue to expand, the industrial demand for silver will likely follow. Complete Story » |

| You are subscribed to email updates from Gold World News Flash To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment