Gold World News Flash |

- Daily Dispatch: Gold Confiscation: Straws in the Wind

- Kindergarten Double Dip Economics

- Don't Lose Sleep over Deflation

- U.S. Dollar Stress Next?

- A Crude Display of How to Invest in Oil

- Gold Technicals for July 28th

- Victor Gonçalves: Putting Money on the Juniors

- In The News Today

- Hourly Action In Gold From Trader Dan

- JPMorgan et al Pull the Pin

- Is It a Deflationary Depression?.. Comes a Blond Stranger ...

- Protecting Your IRA – Part 1: The Danger

- Avino Silver Prepares For Production In Mexico

- LGMR: Gold Stuck at 3-Month Low After "Weak Long Liquidation" & "Technical Sell-Off"

- GoldSeek.com Radio Gold Nugget: Jim Rogers & Chris Waltzek

- Is the Future of U.S. Oil Really Secure?

- Paradigm Shifts And Gold Rocket Launches

- Commodities, Equities, Bonds or Cash?

- Use This Correction to “Rethink” Gold

- For the Fed, Inflation is a Positive

- Looking for a Turn in Gold from $1140

- Look What Surprises They Snuck Into The Financial Reform Bill

- Asian Metals Market Update

- Government Admits We Are Finished: Taxes Cannot Pay Off Debt

- SP 500 September Futures; Gold Daily; Gold 200 DMA

- Financials, Oil & Gold on the Move

- Hooray for the Economic Recovery!…of 2016

- U.S. “Home Equity” Loans Revealing

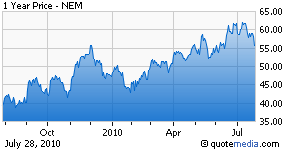

- Inside Newmont Mining’s Earnings Miss

- Inside Newmont Mining's Earnings Miss

- Some Mining Investors Are Already Witnessing Hyperinflation

- Capital Gold Group Report: Physical Demand for Gold "Very Visible" as Market Dip Attracts Buyers

- Is the Worst Over?

- Gold Seeker Closing Report: Gold and Silver End Mixed

- GoldMoney's Turk interviewed by GoldSeek Radio on the death of money

- GoldMoney's Turk interviewed by GoldSeek Radio on the death of money

- False Recovery in Commercial Real Estate?

- SEC says new financial regulation law lets it keep everything secret

- Hooray for the Economic Recovery!…of 2016

- Reducing Spending Not in the Feds' Plans

- Unrepentant Gold Bull and Stock Bear

- Jim Rickards Compares The Collapse Of The Roman Empire To The US, Concludes That We Are Far Worse Off

- WEDNESDAY Market Excerpts

- Zero Hedge: Dave Rosenberg’s Thoughts on End of Bond Bull

- Glenn Beck-endorsed gold company busted for shady practices

- Upside S&P Targets: Where Do You Short?

- A list of the greatest magazine articles of all-time

- What George Soros really meant when he called gold a "bubble"

| Daily Dispatch: Gold Confiscation: Straws in the Wind Posted: 28 Jul 2010 07:07 PM PDT July 28, 2010 | www.CaseyResearch.com Gold Confiscation: Straws in the Wind Dear Readers, In the emails that you send our way, questions and concerns about the possibility of gold confiscation rank high. My somewhat standard response is that, yes, it’s possible, but that we should see straws in the wind well before it happened… allowing us to take measures to protect ourselves. While I don’t want to make too big a deal about it, there have been clear signs of late that the U.S. government is taking an unhealthy interest in your gold. My article of July 8, 2010, titled I Smell a VAT, which you can read here, touched on one such straw. The relevant point being that, thanks to a regulation slipped into the healthcare legislation, coin dealers – and all businesses, for that matter – will have to begin reporting any purchases of $600 or more from anyone, including clients selling back their gold. ... |

| Kindergarten Double Dip Economics Posted: 28 Jul 2010 07:07 PM PDT by Jim Willie CB July 28, 2010 home: Golden Jackass website subscribe: Hat Trick Letter Jim Willie CB, editor of the “HAT TRICK LETTER” Use the above link to subscribe to the paid research reports, which include coverage of several smallcap companies positioned to rise during the ongoing panicky attempt to sustain an unsustainable system burdened by numerous imbalances aggravated by global village forces. An historically unprecedented mess has been created by compromised central bankers and inept economic advisors, whose interference has irreversibly altered and damaged the world financial system, urgently pushed after the removed anchor of money to gold. Analysis features Gold, Crude Oil, USDollar, Treasury bonds, and inter-market dynamics with the US Economy and US Federal Reserve monetary policy. Double Dip used to pertain to ice cream cones, but now to dreaded return to economic recession. Green Shoots used to refer to gardening proje... |

| Don't Lose Sleep over Deflation Posted: 28 Jul 2010 07:07 PM PDT [COLOR=#000000][FONT=Arial][COLOR=#000000]Below please find the latest commentary from Michael Pento who just joined Euro Pacific Captial as the Senior Economist and Vice President of Managed Products. [/COLOR][/COLOR][/FONT] After hearing the dire warnings of deflation that have become the standard talking points of most economists, American investors may be reaching for a bottle of Prozac. I believe that their anxiety is misplaced. Unfortunately, modern economists don't understand what deflation is or why, in reality, we have much more to fear from inflation. Moderate deflation is actually the natural trend of a productive economy. If a producer can increase his output per unit of input, then he can afford to expand his market by lowering prices while still increasing profits. In that way, deflation allows consumers to buy items that they may not have previously afforded. It also promotes savings, which is essential for investment and capital development. (For a si... |

| Posted: 28 Jul 2010 07:07 PM PDT The crisis is dead! Long live the crisis! In an attempt to address the debt crises swirling around the globe, policy makers have responded with a mishmash of somewhat questionable approaches: [LIST] [*]The U.S. has passed a financial reform bill not worthy of its name; [*]The U.S. & Europe have engaged in stress tests that aren’t all too stressful; and [*]China, in an effort to contribute to a more balanced global economy, has allowed its currency, the yuan, to appreciate by a whopping 0.7% in recent weeks (year-to-date as of July 25, 2010). [/LIST] In the meantime, the markets have been subsidized with fiscal and monetary stimuli: [LIST] [*]The Federal Reserve (Fed) has printed more than $1.5 trillion to jump start the economy; [*]Congress is engineering trillion dollar deficits. [/LIST] Policy makers say these subsidies are temporary and will be withdrawn as the economy recovers. In our assessment, that’s the “exit s... |

| A Crude Display of How to Invest in Oil Posted: 28 Jul 2010 07:07 PM PDT I get a lot of mail concerning my single-minded fanaticism about how gold, silver and oil are the best investments to buy when your stupid government is deficit-spending and allowing excess amounts of money to be created, in our case by the Federal Reserve, and particularly that part about buying oil, meaning, of course, oil company stocks. I throw up my hands in exasperation, especially now that China has surpassed the USA in terms of energy usage, ahead of all forecasts! Therefore, with a guaranteed rise in demand for oil, for as far as the eye can see, you would think that my Stupid Mogambo Advice (SMA) to buy gold, silver and oil is the famous-yet-elusive "no-brainer investment" that stupid guys like me are always looking for, since it does not involve any thinking at all at this point, except to remember to buy them, and thus we can save our thinking for thinking about getting a new set of golf clubs and how happy we think we will be. Instead, I get complaints. For example, I re... |

| Posted: 28 Jul 2010 07:07 PM PDT courtesy of DailyFX.com July 28, 2010 06:49 AM Gold has topped. Please see the latest special report for details. Gold is making its way lower and in an impulsive fashion. I wrote yesterday that “after bouncing to 1204, gold is testing its low so a secondary top may be in place at 1204.” Gold has plunged and the metal is probably headed much lower in a 3rd wave. The next important support area is 1045/67 (former 4th wave extreme and 161.8% extension). Jamie Saettele publishes Daily Technicals every weekday morning, COT analysis (published Friday evenings), technical analysis of currency crosses on Monday, Wednesday, and Friday (Euro and Yen crosses), and intraday trading strategy as market action dictates at the DailyFX Forum. He is the author of Sentiment in the Forex Market. Follow his intraday market commentary and trades at DailyFX Forex Stream. Send requests to receive his reports via email to [EMAIL="jsaettele@dailyfx.com"]jsaettele@dailyfx.com[/EMAIL].... |

| Victor Gonçalves: Putting Money on the Juniors Posted: 28 Jul 2010 07:07 PM PDT Source: The Gold Report 07/28/2010 Equities and Economics Report writer Victor Gonçalves, in this exclusive interview with The Gold Report, says the yellow metal is in its typical summer lull and will generally see more strength than weakness this year. He's enthusiastic about some undervalued juniors, saying good management is what makes or breaks these companies. The Gold Report: The price of gold has dipped to below $1,175 this morning; do you see this as a sign that the general economy is improving and that inflation is not on the horizon? Or perhaps it's just a summer lull? Victor Gonçalves: This is basically the traditional summer lull, so I'm not overly concerned. In fact, I talked about this very thing in one of our previous interviews. There are certainly other factors involved. Typically when we have mid-term elections with a democratic president and what could be a republican house, this will be good for gold and the markets, but until that happens, the m... |

| Posted: 28 Jul 2010 07:07 PM PDT View the original post at jsmineset.com... July 28, 2010 09:49 AM My Dear Friends, The following note preceding the excellent article written by Ambrose Evans-Pritchard is from the man who I consider the "Dean of Gold," Harry Schultz. This is what the Goldmans of the world are in the process of positioning themselves for at your expense. At the same time many in the gold community are in the bathtub with their razor blade kit. Please, no cutting yet. Regards, Jim Dear CIGAs, Hyperinflation will come overnight as Jim predicts. Forget gradual. How do you protect assets and food? Hide stuff. Avoid medium profile. The following article describes how bad it got in German hyperinflation and how dangerous it was to even own a painting. Read it all, then plan appropriately. Harry Schultz The Death of Paper Money As they prepare for holiday reading in Tuscany, City bankers are buying up rare copies of an obscure book on the mechanics of Weimar inflation published in 1974. ... |

| Hourly Action In Gold From Trader Dan Posted: 28 Jul 2010 07:07 PM PDT |

| Posted: 28 Jul 2010 07:07 PM PDT Tuesday's high price of around $1,187 spot was set early in the London trading session... and by the time that JPMorgan et al began to trade on the Comex in New York, gold was only down a couple of dollars from that high. But from that point, the bullion banks began to sell... and then began pulling their bids shortly after 9:00 a.m. in New York... and the rest, as they say, is history. The absolute low of the day [$1,156.80 spot] came shortly after 1:00 p.m. Eastern time... about 20 minutes before floor trading ended and electronic trading began. Once this new low price for gold's move down was set, the sellers disappeared and gold gained back about five dollars of its losses before trading ended in New York at 5:15 p.m. But, as usual, the metal that 'da boyz' were really after was silver... and it got the "Full Monty" yesterday. Silver's high of the day in New York was set moments after the Comex open. From that high, the selling began... and the... |

| Is It a Deflationary Depression?.. Comes a Blond Stranger ... Posted: 28 Jul 2010 07:07 PM PDT Is It a Deflationary Depression? Wednesday, July 28, 2010 – by Staff Report Drip after drip of deflation data ... Today's release on manufacturing activity by the Richmond Fed is pretty ghastly, as you would expect given that the effects of fiscal stimulus are now wearing off at an accelerating pace – before the happy handover to the private sector is safely consummated – and given that the structural East-West imbalances that lay behind the global crisis are getting worse again ... This follows yesterday's horrendous fall in the Texas business activity index from the Dallas Fed, which fell from -4 in June to -21 in July. "Thirty-one percent of firms reported a worsening of activity, up from 22 percent in June," said the bank. Texas New Orders were -9.6 in July, -8.2 in June, and +15.8 in May. Capacity Utilization was -0.6 in July, +2.7 in June, and +18.7 in May. This of course is why Fed chair Ben Bernanke has been giving strong hints o... |

| Protecting Your IRA – Part 1: The Danger Posted: 28 Jul 2010 07:07 PM PDT Wednesday, July 28, 2010 – by Terry Coxon Terry Coxon There is a worry that nags at many of the millions of American investors who look to their Individual Retirement Account as a source of retirement security. It keeps nagging because, while the worry is well founded, there is nothing obvious to do about it. An IRA is a tax-free zone for accumulating wealth. Whether it is a traditional IRA (fed by deductible contributions) or a Roth IRA (withdrawals can be tax free), an IRA offers a big growth advantage -- earnings compound at a before-tax rate of return, so the value of your IRA grows faster. The result can be far more spendable cash waiting for you at retirement time. There is now a robust political constituency supporting the generous tax treatment given to IRAs. One element is the 40 million people who have an IRA. A second element is the retail financial industry – banks, brokerage houses, mutual funds and insurance companies –... |

| Avino Silver Prepares For Production In Mexico Posted: 28 Jul 2010 07:07 PM PDT By Claire O'Connor and James West MidasLetter.com Wednesday, July 28, 2010 Avino Silver and Gold Mines Ltd. (TSX.V: ASM) recently started milling stockpiled ore on the Avino property in Durango State, Mexico. The ore is being milled in preparation for a 10,000 tonne bulk sampling program, leading up to the company's goal of full production by Fall 2010. With no debt, high-grade discoveries on the San Gonzalo vein and strong market demand for concentrates, Avino is well on its way to bigger and better things. The Avino Story Once described by Spaniards as "a mountain of silver", the Avino mine first opened in the 1500s and reportedly supplied considerable wealth to Spain for hundreds of years. Operating intermittently [URL]http://www.midasletter.com/news100728_Avino_silver-prepares-to-go-into-productionthroughout[/URL] the years, Avino began mi... |

| Posted: 28 Jul 2010 07:07 PM PDT London Gold Market Report from Adrian Ash BullionVault 08:25 ET, Weds 28 July Gold Stuck at 3-Month Low After "Weak Long Liquidation" & "Technical Sell-Off" THE PRICE OF GOLD held near 3-month lows against all the world's major currencies on Wednesday in London, recovering little of yesterday's 2.2% drop. Soft commodities and base metals rallied from their sell-off, but silver prices held at a 3-session low almost 4% beneath Tuesday's start, while an early gain faded in European stock markets. The Euro currency flipped either side of $1.30 to the Dollar. Gold priced in Euros held near €28,800 per kilo – some 15% off its record top of last month. "Gold was driven down through its long-term bullish trendline as liquidation swept the commodities markets," says Mitsui's London dealing desk in its precious-metals note today. "Physical demand should support here, but with the third quarter largely absent of major gold buying holidays and festivals in physica... |

| GoldSeek.com Radio Gold Nugget: Jim Rogers & Chris Waltzek Posted: 28 Jul 2010 07:00 PM PDT |

| Is the Future of U.S. Oil Really Secure? Posted: 28 Jul 2010 06:33 PM PDT |

| Paradigm Shifts And Gold Rocket Launches Posted: 28 Jul 2010 06:09 PM PDT Economic shocks come from nowhere. One day the global economy is humming along; the next day it collapses. Crashes don't occur because the fundamentals suddenly change; they occur because the public at large recognizes the fundamentals and heads for the exit at the same time. What's crashing next is the public's confidence in governments across the Western world. You can guess how that will affect the price of gold. |

| Commodities, Equities, Bonds or Cash? Posted: 28 Jul 2010 06:07 PM PDT Scott's Investments submits: At the end of May I reviewed a very simple ETF rotation system using the free tools available at ETF Replay involving GLD, SPY, and SHY (low duration Bond ETF, used as a proxy for cash). Using the average of the 3 month return (weighted 40%), 20 day return (weighted 30%), and 20 day volatility (30%), SHY is currently ranked highest among the three. If we lengthen the time frame to average the 6 month return (weighted 40%), 3 month return (weighted 30%), and 3 month volatility (weighted 30%), GLD is surprisingly still ranked highest. Complete Story » |

| Use This Correction to “Rethink” Gold Posted: 28 Jul 2010 06:06 PM PDT |

| For the Fed, Inflation is a Positive Posted: 28 Jul 2010 06:04 PM PDT The Federal Reserve is down on its luck. It struck out with near-zero interest rates, gargantuan monetary policy measures, and particularly quantitative easing programs – which all have failed to fire. Now the public is wondering why the Reserve did anything at all. The state of the nation, it seems, is just as poor as it was some many months ago. |

| Looking for a Turn in Gold from $1140 Posted: 28 Jul 2010 05:58 PM PDT |

| Look What Surprises They Snuck Into The Financial Reform Bill Posted: 28 Jul 2010 05:23 PM PDT

So just what are those surprises? Well, first let's talk about what the financial reform law does not do. The financial reform bill was supposed to "fix" Wall Street and the financial system, but it did not do much of anything.... -It does nothing to address the problems with Fannie Mae and Freddie Mac. -It does not eliminate "too big to fail". -It does absolutely nothing to eliminate the horrific bubble in the derivatives market. -It does nothing to reform the organization most responsible for the recent financial crisis - the Federal Reserve. In fact, this new law actually gives the Federal Reserve even more power. But it does create a ton of new paperwork and a bunch of new government organizations. Oh goody! But was there any major law that Congress has passed over the last several years that did not increase the size and scope of government? That is a good question. In any event, let's get to some of the nasty surprises contained in the new financial reform law.... *Barack Obama has been running around touting how this new law will "increase transparency" in the financial world, but it turns out that a little-noticed provision of the new law exempts the Securities and Exchange Commission from virtually all requests for information by the public, including those filed under the Freedom of Information Act. Not that the SEC was doing much good anyway. But now the SEC's incompetence and the nefarious actions of those they are investigating will be hidden from public view. So what makes the SEC so special that they get to block the public from seeing their records while other government agencies still have to comply with FOIA? Talk about ridiculous. But there is actually another little surprise contained in the new law that is even more nasty.... *Another little-noticed section deeply embedded in the financial reform law actually gives the federal government the authority to terminate government contracts with any "financial firm" that fails to ensure the "fair inclusion" of women and minorities in its workforce. This section of the law, written by U.S. Representative Maxine Waters, is 1,261 words long and it establishes "Offices of Minority and Women Inclusion" in the Treasury Department, the Federal Reserve, the Securities and Exchange Commission and more than a dozen other finance-related agencies. The directors of these new departments are tasked with developing standards that "ensure, to the maximum extent possible, the fair inclusion and utilization of minorities, women, and minority-owned and women-owned businesses in all business and activities of the agency at all levels, including in procurement, insurance, and all types of contracts." The maximum extent possible? That sounds pretty strong. So what kind of firms does this section apply to? Well, according to Politico, this section is going to apply to just about anyone who has anything to do with the financial industry.... This applies to "services of any kind," including investment firms, mortgage banking firms, asset management firms, brokers, dealers, underwriters, accountants, consultants and law firms, the legislation states. Every contractor and subcontractor must now certify that their workforces reflect a "fair inclusion" of women and minorities. The truth is that this small section of the law represents a fundamental change in employment law in the United States. And it is written so vaguely that firms are going to be tempted to go above and beyond in complying with it just so they are safe. In fact, many analysts are already saying that it could lead to an unofficial quota system. In any event, hundreds of new federal government bureaucrats will be watching to make certain that these vague new regulations are fully implemented. *It also looks like the new financial reform law is going to end the era of free checking accounts. Why? Well, it turns out that the new law really limits the amount of fees that banks can charge and the way that they charge them. So banks have got to make their money somewhere. Wells Fargo and Bank of America have already announced new fees on checking accounts, and other banks are expected to follow their lead shortly. What a mess. Can't Congress do anything right these days? At this point Congress is so incompetent that if they would just sit there and do nothing that would be a vast improvement. But that isn't going to happen. So what do you all think about this new financial reform law? Feel free to leave a comment with your opinion below.... |

| Posted: 28 Jul 2010 05:04 PM PDT |

| Government Admits We Are Finished: Taxes Cannot Pay Off Debt Posted: 28 Jul 2010 03:58 PM PDT Over the past few years, U.S. government debt held by the public has grown rapidly—to the point that, compared with the total output of the economy, it is now higher than it has ever been except during the period around World War II. The recent increase in debt has been the result of three sets of factors: an imbalance between federal revenues and spending that predates the recession and the recent turmoil in financial markets, sharply lower revenues and elevated spending that derive directly from those economic conditions, and the costs of various federal policies implemented in response to the conditions. Further increases in federal debt relative to the nation's output (gross domestic product, or GDP) almost certainly lie ahead if current policies remain in place. The aging of the population and rising costs for health care will push federal spending, measured as a percentage of GDP, well above the levels experienced in recent decades. Unless policymakers restrain the growth of spending, increase revenues significantly as a share of GDP, or adopt some combination of those two approaches, growing budget deficits will cause debt to rise to unsupportable levels. Although deficits during or shortly after a recession generally hasten economic recovery, persistent deficits and continually mounting debt would have several negative economic consequences for the United States. Some of those consequences would arise gradually: A growing portion of people's savings would go to purchase government debt rather than toward investments in productive capital goods such as factories and computers; that "crowding out" of investment would lead to lower output and incomes than would otherwise occur.More Here.. |

| SP 500 September Futures; Gold Daily; Gold 200 DMA Posted: 28 Jul 2010 03:43 PM PDT |

| Financials, Oil & Gold on the Move Posted: 28 Jul 2010 03:06 PM PDT By Chris Vermeulen, TheGoldAndOilGuy Most traders I have been talking with are feeling the same thing. Something big is brewing for the equities market but most do not want to get heavily involved until there is a clear direction. The broad market has been consolidating for almost 3 months and it's important to remember that the larger the consolidation the bigger the move. Also the biggest and best moves come from failed patterns. So is the big head & shoulders pattern on the SP500 which everyone is yelling about (the sky is falling) really going to happen or is this the BIG fake out? Only time will tell, either way no matter which way it goes I will be sure to catch some of it. Below area few charts pointing out patterns and trends which could provide some opportunity in the coming days or weeks. XLF – Financial Sector ETF USO – Crude Oil Fund GLD – Gold Bullion ETF Mid-Week Financial, Oil and Gold Trading Conclusion: Receive my Trading Analysis and ETF Alerts try my subscription service which has a 30 day money back guarantee: http://www.thegoldandoilguy.com/specialoffer/signup.html Chris Vermeulen Get My Free Trading Charts Newsletter |

| Hooray for the Economic Recovery!…of 2016 Posted: 28 Jul 2010 03:02 PM PDT Last week, the price of gold again broke below its new base at $1,200, and the US stock market was again under strong pressure, due to a confluence of fears, most of which point to a deflationary double-dip. The fears were fanned by disappointing second quarter results, by the latest CPI reports that show inflation continuing to moderate, and by yet another poll revealing faltering consumer confidence. The market is also spooked, no doubt, by notes from the latest Fed Beige Book that make it clear that the Fed is (finally) beginning to understand the entrenched and endemic nature of this crisis. While the notes are written in shamanic double-speak, the point is clear: members of the Fed don't expect the economy to get back on track until 2015 or 2016. "Participants generally anticipated that, in light of the severity of the economic downturn, it would take some time for the economy to converge fully to its longer-run path as characterized by sustainable rates of output growth, unemployment, and inflation consistent with participants' interpretation of the Federal Reserve's dual objectives; most expected the convergence process to take no more than five to six years." The simple reality the Fed is waking up to is that the structural underpinnings of the economy are damaged beyond any quick or easy fix. That's because until the excess and/or bad debts are wrung out of the system – either through default or raging inflation – there's no chance of any sustainable economic recovery. Each new government initiative – the latest being financial reform – that doesn't decisively address the debt, but rather tightens the government's around private enterprise, only serves to delay or prevent economic revival. And so each new day will bring more distress and bankruptcy to homeowners, businesses, and banks. Pundits are fond of saying that things are never really "different this time around"… yet there is something truly unusual now going on. See if you can spot the disconnect in the following descriptions of the current economy.

Anything strike you as out of place? The current setup with massive debts and low, low interest rates is like making an uncollateralized loan to a mere acquaintance at a very friendly, low interest rate. Then he comes back again for more, and more, and more. Because you live in a small town, you know he's putting the touch on a bunch of other people too. And because you know his loose-lipped accountant, you also know what his income is, and even what his total debts are – and it is blatantly obvious that he won't be able to repay his debts in a dozen lifetimes. So would you keep lending him money? And, if you did, would you do it at the same friendly interest rates? Not hardly. And therein lies the Twilight Zone-caliber disconnect in the world as we know it. In a recent conversation with my dear partner and friend of several decades, Doug Casey, he made the point that the situation today should only exist if the fundamental laws of economics had been suspended. Interest rates should be going up, but they aren't. Rather, they are bumping along at the very bottom of the possible range. In my view, this is testimony to the truly extraordinary lengths – involving trillions of dollars – that the US Treasury and the Fed have gone to in recent years. But they can only suspend the laws of economics for so long before the fundamentals again rule. And when that happens, the entire system could literally collapse. Not to sound dramatic, but it could happen almost overnight. As frustrating as it may be to all of us, the world is still locked firmly in the jaws of a powerful bear market. While the bear may loosen its bite now and again, it's really only temporary…to get a better grip. That being the case, it's worth remembering the single most important thing about bear market investing: it's very difficult. Or, put another way, it's hard to make a decent return without taking extraordinary risk. As Doug points out, in the current environment, everything – including commodities – is overvalued. And they are going to remain that way until they aren't. Maybe the Fed actually has it right this time, and the bottom won't be reached until 2015 or 2016? I wouldn't argue with that assessment. But what of the inflation we see as inevitable? And gold, in the interim? Let me quickly tackle the second question first. In any debt crisis, the foremost concern of creditors is to get paid back. Compared to that, returns on investment come in a weak second. In a sovereign debt crisis, the question of repayment is complicated by the fact that the debtors control the creation of the currency units that will ultimately be used for payments. Individual and institutional holders of US Treasuries, along with other assets amounting to trillions of US currency units, can see with their own eyes what's going on. To continue holding such large quantities of instruments denominated in these unbacked currency units – or those labeled "euros" or "yen" – is to risk being left with a lot of worthless paper as the governments try to repay debtors by creating the stuff, literally, out of thin air. And so these holders diversify their portfolios into alternative, and far more tangible, assets – gold and silver included. That is the fuel that has sent gold higher over the last ten years and that will keep it high – short-term corrections notwithstanding. It is, however, when the inflation from all the money creation starts to appear that we'll begin to see the shift into gold begin in earnest, and the price will really take off. When might that occur? Rather than trying to answer that question myself, I'll refer you to the latest, excellent edition of, Conversations with Casey, in which Louis James interviews Casey Report co-editor Terry Coxon on the outlook for inflation. Here's an excerpt… Coxon: All of the runaway deficit spending [by the US government] is not, in and of itself, inflationary. By spending borrowed money, the government does not increase the money supply… L: Ah. You're saying that out-of-control government spending isn't inflationary, but sets the stage for future inflation, when money has to be created to pay the government's debts? Coxon: What it does is create a political motive and economic need for inflation. These huge deficits may have slowed the recession that began in 2008, but to keep the recession from worsening, the Federal Reserve will have to prevent interest rates from rising for months or years to come. And to do that, it will have to start printing money to buy up debt instruments whenever the economy starts recovering, to keep interest rates down to levels that will not choke off the recovery. L: So more money creation will be necessary to keep interest rates low, but at some point, the foreigners holding dollars, believing it to be a sound currency, will have to get worried about all this dilution of the dollar – and that would tend to force interest rates up, as it will take more and more to convince those people to keep buying T-bills and such. Coxon: The world outside the US has become like a giant capacitor for US inflation. The charge that's building up is the accumulation of dollars and dollar-denominated assets in the hands of foreigners. When the outside world wakes up to the threat of inflation in the US, they will start unloading US dollars, which will suppress the dollar's value in foreign exchange markets, which will make prices of imports (including oil) go up, and that will be a separate vector feeding price inflation in the US. For now, the key is to get through this period in the best possible shape. That means watching your debt levels, keeping well cashed up, buying gold on dips, and, when you venture into investment markets, it's never been more important to understand what you are investing in and why. There's no need to chase anything – which means you have the luxury of building your portfolio over time, on exactly the terms you want. While it may sound contradictory, I think this is also a good time to learn more about speculating. In the simplest terms, a speculator risks just 10% of his/her portfolio in the hopes of receiving a 100% return. By comparison, most investors put 100% of their portfolio at risk in the hopes of getting a 10% return (actually, these days, most people would be happy with just 5%). In the case of the speculator, 90% of the portfolio can be largely kept in cash and gold. So, who's more at risk – the investor or the speculator? And where are the best speculations found today? Personally, I like energy, and I very much like bottom fishing in the junior gold sector. That's because there are some terrific Canadian junior exploration and mining companies sitting on large known deposits. But their share prices periodically fall back based on nothing more than investor emotion. That's called a buying opportunity. David Galland Hooray for the Economic Recovery!…of 2016 originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." More articles from The Daily Reckoning…. |

| U.S. “Home Equity” Loans Revealing Posted: 28 Jul 2010 03:01 PM PDT By Jeff Nielson, Bullion Bulls Canada A Bloomberg headline today read "Americans Tap $8.3 Billion in Home Equity, Least in a Decade". This is indeed a very news-worthy figure. Sadly, you won't learn anything about this issue from reading Bloomberg's ridiculous "spin" of this news.

At the peak of the U.S. housing-bubble, Americans were initiating more than $800 billion/year of such loans. They are now on a pace to take-out loans amounting to less than 5% of that gargantuan figure…and yet this same, propaganda-machine talks about a "recovery" in the housing market.

"It'll put consumers on firmer ground going forward. It'll give them more confidence," quotes Bloomberg, from an "economist" named Michael Bratus. Note the use of contractions to make his statement sound like a "cheer". The only thing he forgot to add was "Rah! Rah! Rah!"

If only Americans were getting on "firmer ground", and thus had any reason to be more "confident". Here's what is happening in the real world. After going on the most insane borrowing-binge in the history of our species, based upon all the "home equity" which Americans thought they had, that "equity" has all evaporated – but the trillions in debt remain.

The result: Americans hold less "equity" in their homes than at any time in history: not during the Great Depression, nor at any other time. Indeed, for the first time in history U.S. banks hold more equity in U.S. residential real estate than American "homeowners" themselves. U.S. "home equity" loans have collapsed not because Americans are "repairing their balance sheets" (as the Bloomberg propaganda suggests).

Instead, U.S. homeowners (except for the small minority with full-ownership of their homes) are leveraged-to-the-hilt with debt – and can't afford to borrow one more penny. Secondly, the banks won't lend these over-leveraged consumers any more money. And third, there is no "equity" to borrow against. You can call this process "repairing balance sheets" – as long as you include the observation that it will take a full generation to "repair" the damage of the Wall Street-induced credit-stampede (for those homeowners who survive the process).

Then Bloomberg gets plain silly. "This a rate-and-refinance boom as opposed to a cash-out boom," quotes Bloomberg, this time citing a suit-stuffer named Michael Larson (identified as a "housing analyst").

"Hello" Mr. Larson! Home-equity loans collapsed to less than 5% of their peak, which at least 95% of English-users would describe as a "crash". One can only wonder what numbers it would take to cause this "housing analyst" to use the word "crash" instead of "boom". One might even suspect that this "housing analyst" makes more money in a strong real estate market – and so his characterization might be a tiny bit biased.

The only truth in Larson's statement was his observation that the only activity taking place this in this market is respect to the (small number of) credit-worthy borrowers who are able to take advantage of the zero-percent-panic-interest-rates to refinance a minute piece of this mountain of debt (no more than 1%). Other than that, this market is dead. More articles from Bullion Bulls Canada…. |

| Inside Newmont Mining’s Earnings Miss Posted: 28 Jul 2010 02:58 PM PDT Zacks.com submits:

Including one-time charges, the company earned $382 million or 78 cents per share. Robust earnings were helped by higher gold prices, which reached a two-month high in June this year. Newmont realized gold prices of $1,200 per ounce, while copper prices were $2.33 per pound. |

| Inside Newmont Mining's Earnings Miss Posted: 28 Jul 2010 02:58 PM PDT Zacks.com submits:

Including one-time charges, the company earned $382 million or 78 cents per share. Robust earnings were helped by higher gold prices, which reached a two-month high in June this year. Newmont realized gold prices of $1,200 per ounce, while copper prices were $2.33 per pound. |

| Some Mining Investors Are Already Witnessing Hyperinflation Posted: 28 Jul 2010 02:56 PM PDT Chris Mack submits: Over the last decade, investors seeking protection from inflation have been accumulating gold and silver mining shares. Gold and silver have appreciated by more than 300 percent from their lows, so it would be logical to assume that mining shares have performed even better given their inherent leverage in earnings potential. Ironically, some of these investments have already suffered from their own hyperinflation in the form of share dilution. Just as governments have mismanaged their budgets and printed too much money; some mining companies have done the same to the detriment of their shareholders. Coeur d' Alene (CDE), an American silver miner, is one such company. It has diluted its shares so much that on May 27, 2009 it had a reverse 10 for 1 stock split. This article will use post split adjusted figures. Governments often do the same thing with their failed fiat currencies. In the wake of Germany's Weimar Republic hyperinflation, a new Rentenmark was created that was equal to 1,000,000,000,000 of the old German Marks. While not as bad, CDE's shares outstanding have risen from 2.4 million in 1999 to over 80 million in 2009 – a factor of more than 33. |

| Posted: 28 Jul 2010 02:56 PM PDT

Gold, Little Changed, May Rise as Price Slump Attracts Buyers by Nicholas Larkin and Pham-Duy Nguyen July 28 (Bloomberg) — Gold, little changed in New York, may gain as the lowest prices in almost three months spur demand. Futures yesterday fell the most in more than "From a risk-reward perspective, this level Yesterday and July 26 were the UBS sales desk's "The current decline in the gold price is

Capital Gold Group, gold group, gold, gold prices, gold news, gold coins, gold bullion, gold IRA, IRA |

| Posted: 28 Jul 2010 02:55 PM PDT Or have our financial woes only just begun? 7.28.10 By Craig R Smith, Chairman, Swiss America — The average person on the street believes the worst of this financial crisis is behind us and the economy and the country are now on the mend. Let's say all is well and we are miles away from the edge of the abyss… |

| Gold Seeker Closing Report: Gold and Silver End Mixed Posted: 28 Jul 2010 02:55 PM PDT Gold rose as much as $7.08 to $1165.93 in late Asian trade before it fell in London to as low as $1156.85 by about 10AM EST and then bounced back to $1165.15 in late morning New York trade, but it ultimately fell back off into the close and ended with a gain of just 0.11%. Silver rose to $17.73 in Asia and fell to $17.305 by about 9AM EST before it also bounced back higher in late morning New York trade, but it still ended with a loss of 0.8%. |

| GoldMoney's Turk interviewed by GoldSeek Radio on the death of money Posted: 28 Jul 2010 02:54 PM PDT 10:55p ET Wednesday, July 28, 2010 Dear Friend of GATA and Gold: GoldSeek Radio's Chris Waltzek this week interviewed GoldMoney founder and GATA consultant James Turk about the death of government currencies, with emphasis on the experience of Weimar Germany. The interview is about 20 minutes long and you can listen to it here: http://radio.goldseek.com/nuggets/turk07.27.10.mp3 CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Sona Resources Expects Positive Cash Flow from Blackdome, On May 18, 2010, Sona Resources Corp. (TSXV: SYS, Frankfurt: QS7) announced the release of a preliminary economic assessment for gold production at its flagship Blackdome and Elizabeth properties in British Columbia. Sona Executive Chairman Nick Ferris says: "We view this as a baseline scenario for gold production. The project is highly sensitive to the price of gold. A conservative valuation of gold at $1,093 per ounce would result in a pre-tax cash flow of $54 million. The assessment indicates that underground mining at the two sites would recover 183,600 ounces of gold and 62,500 ounces of silver. Permitting and infrastructure are already in place for processing ore at the Blackdome mill, with a 200-tonne per day throughput over an eight-year mine life. Our near-term goal is to continue aggressive exploration at Elizabeth and develop a million-plus-ounce gold resource, commencing production in 2013." For complete information on Sona Resources Corp. please visit: www.SonaResources.com A Canadian gold opportunity ready for growth Join GATA here: New Orleans Investment Conference * * * Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Prophecy to Become Coal Producer This Year Prophecy Resource Corp. (TSX.V: PCY) announced on May 11 that it has entered into a mine services agreement with Leighton Asia Ltd. to begin coal production this year. Production will begin with a 250,000-tonne starter pit as planned in August, with production advancing to 2 million tonnes per year in 2011. Prophecy is fully funded to production and its management team includes John Morganti, Arnold Armstrong, and Rob McEwen. For Prophecy's complete press release about its production plans, please visit: http://www.prophecyresource.com/news_2010_may11.php |

| GoldMoney's Turk interviewed by GoldSeek Radio on the death of money Posted: 28 Jul 2010 02:54 PM PDT 10:55p ET Wednesday, July 28, 2010 Dear Friend of GATA and Gold: GoldSeek Radio's Chris Waltzek this week interviewed GoldMoney founder and GATA consultant James Turk about the death of government currencies, with emphasis on the experience of Weimar Germany. The interview is about 20 minutes long and you can listen to it here: http://radio.goldseek.com/nuggets/turk07.27.10.mp3 CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Sona Resources Expects Positive Cash Flow from Blackdome, On May 18, 2010, Sona Resources Corp. (TSXV: SYS, Frankfurt: QS7) announced the release of a preliminary economic assessment for gold production at its flagship Blackdome and Elizabeth properties in British Columbia. Sona Executive Chairman Nick Ferris says: "We view this as a baseline scenario for gold production. The project is highly sensitive to the price of gold. A conservative valuation of gold at $1,093 per ounce would result in a pre-tax cash flow of $54 million. The assessment indicates that underground mining at the two sites would recover 183,600 ounces of gold and 62,500 ounces of silver. Permitting and infrastructure are already in place for processing ore at the Blackdome mill, with a 200-tonne per day throughput over an eight-year mine life. Our near-term goal is to continue aggressive exploration at Elizabeth and develop a million-plus-ounce gold resource, commencing production in 2013." For complete information on Sona Resources Corp. please visit: www.SonaResources.com A Canadian gold opportunity ready for growth Join GATA here: New Orleans Investment Conference * * * Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Prophecy to Become Coal Producer This Year Prophecy Resource Corp. (TSX.V: PCY) announced on May 11 that it has entered into a mine services agreement with Leighton Asia Ltd. to begin coal production this year. Production will begin with a 250,000-tonne starter pit as planned in August, with production advancing to 2 million tonnes per year in 2011. Prophecy is fully funded to production and its management team includes John Morganti, Arnold Armstrong, and Rob McEwen. For Prophecy's complete press release about its production plans, please visit: http://www.prophecyresource.com/news_2010_may11.php |

| False Recovery in Commercial Real Estate? Posted: 28 Jul 2010 02:49 PM PDT Daniel Thomas of the FT reports, CBRE upbeat on global recovery:

CBRE isn't the only one calling for a revival in real estate. Darren Currin of The Jounal Record recently reported that Prudential and Moody’s offer positive news for national market:

While this is encouraging, the reality is that commercial real estate activity remains weak. David M. Levitt of Bloomberg Businessweek reports, U.S. Commercial Property Sales Trail Six-Year Average:

There is tons of liquidity out there - and that's the problem. Prabha Natarajan of the Dow Jones Newswire reported earlier this month, commercial real estate bargain hunting is making bargains scarce:

Others are raising similar concerns. Jeff Harding of the Daily Capitalist recently asked, Is The Real Estate Market Turning Around?, and concluded:

|

| SEC says new financial regulation law lets it keep everything secret Posted: 28 Jul 2010 02:31 PM PDT SEC Says New Financial Regulation Law Exempts it From Public Disclosure By Dunstan Prial http://www.foxbusiness.com/markets/2010/07/28/sec-says-new-finreg-law-ex... So much for transparency. Under a little-noticed provision of the recently passed financial-reform legislation, the Securities and Exchange Commission no longer has to comply with virtually all requests for information releases from the public, including those filed under the Freedom of Information Act. The law, signed last week by President Obama, exempts the SEC from disclosing records or information derived from "surveillance, risk assessments, or other regulatory and oversight activities." Given that the SEC is a regulatory body, the provision covers almost every action by the agency, lawyers say. Congress and federal agencies can request information, but the public cannot. That argument comes despite the president saying that one of the cornerstones of the sweeping new legislation was more transparent financial markets. Indeed, in touting the new law, Obama specifically said it would "increase transparency in financial dealings." ... Dispatch continues below ... ADVERTISEMENT Prophecy to Become Coal Producer This Year Prophecy Resource Corp. (TSX.V: PCY) announced on May 11 that it has entered into a mine services agreement with Leighton Asia Ltd. to begin coal production this year. Production will begin with a 250,000-tonne starter pit as planned in August, with production advancing to 2 million tonnes per year in 2011. Prophecy is fully funded to production and its management team includes John Morganti, Arnold Armstrong, and Rob McEwen. For Prophecy's complete press release about its production plans, please visit: http://www.prophecyresource.com/news_2010_may11.php The SEC cited the new law Tuesday in a FOIA action brought by FOX Business Network. Steven Mintz, founding partner of law firm Mintz & Gold LLC in New York, lamented what he described as "the back-room deal that was cut between Congress and the SEC to keep the SEC's failures secret. The only losers here are the American public." If the SEC's interpretation stands, Mintz, who represents FOX Business Network, predicted "the next time there is a Bernie Madoff failure the American public will not be able to obtain the SEC documents that describe the failure," referring to the shamed broker whose Ponzi scheme cost investors billions. "The new provision applies to information obtained through examinations or derived from that information," said SEC spokesman John Nester. "We are expanding our examination program's surveillance and risk assessment efforts in order to provide more sophisticated and effective Wall Street oversight. The success of these efforts depends on our ability to obtain documents and other information from brokers, investment advisers, and other registrants. The new legislation makes certain that we can obtain documents from registrants for risk assessment and surveillance under similar conditions that already exist by law for our examinations. Because registrants insist on confidential treatment of their documents, this new provision also removes an opportunity for brokers, investment advisers, and other registrants to refuse to cooperate with our examination document requests." Criticism of the provision has been swift. "It allows the SEC to block the public's access to virtually all SEC records," said Gary Aguirre, a former SEC staff attorney-turned-whistleblower who had accused the agency of thwarting an investigation into hedge fund Pequot Asset Management in 2005. "It permits the SEC to promulgate its own rules and regulations regarding the disclosure of records without getting the approval of the Office of Management and Budget, which typically applies to all federal agencies." Aguirre used FOIA requests in his own lawsuit against the SEC, which the SEC settled this year by paying him $755,000. Aguirre, who was fired in September 2005, argued that supervisors at the SEC stymied an investigation of Pequot -- a charge that prompted an investigation by the Senate Judiciary and Finance committees. The SEC closed the case in 2006, but would re-open it three years later. This year, Pequot and its founder, Arthur Samberg, were forced to pay $28 million to settle insider-trading charges related to shares of Microsoft. The settlement with Aguirre came shortly later. "From November 2008 through January 2009, I relied heavily on records obtained from the SEC through FOIA in communications to the FBI, Senate investigators, and the SEC in arguing the SEC had botched its initial investigation of Pequot's trading in Microsoft securities and thus the SEC should reopen it, which it did," Aguirre said. "The new legislation closes access to such records, even when the investigation is closed. It is hard to imagine how the bill could be more counterproductive." FOX Business Network sued the SEC in March 2009 over its failure to produce documents related to its failed investigations into alleged investment frauds being perpetrated by Madoff and R. Allen Stanford. Following the Madoff and Stanford arrests it, was revealed that the SEC conducted investigations into both men prior to their arrests but failed to uncover their alleged frauds. FOX Business made its initial request to the SEC in February 2009 seeking any information related to the agency's response to complaints, tips and inquiries or any potential violations of the securities law or wrongdoing by Stanford. FOX Business has also filed lawsuits against the Treasury Department and Federal Reserve over their failure to respond to FOIA requests regarding use of the bailout funds and the Fed's extended loan facilities. In February, the federal court in New York sided with FOX Business and ordered the Treasury to comply with its requests. Last year the network won a legal victory to force the release of documents related to New York University's lawsuit against Madoff feeder Ezra Merkin. FOX Business' FOIA requests have so far led the SEC to release several important and damaging documents: -- FOX Business used the FOIA to obtain a 2005 survey that the SEC in Fort Worth was sending to Stanford investors. The survey showed that the SEC had suspicions about Stanford several years prior to the collapse of his $7 billion empire. -- FOX Business used the FOIA to obtain copies of emails between Federal Reserve lawyers, AIG, and staff at the Federal Reserve Bank of New York in which it was revealed the Fed staffers knew that bailing out AIG would result in bonuses being paid. Recently, TARP Congressional Oversight Panel chair Elizabeth Warren told FOX Business that the network's Freedom of Information Act efforts played a "very important part" of the panel's investigation into AIG. Warren told the network the government "crossed a line" with the AIG bailout. "FOX News and the congressional oversight panel has pushed, pushed, pushed, for transparency, give us the documents, let us look at everything. Your Freedom of Information Act suit, which ultimately produced 250,000 pages of documentation, was a very important part of our report. We were able to rely on the documents that you pried out for a significant part of our being able to put this report together," Warren said. The SEC first made its intention to block further FOIA requests known on Tuesday. FOX Business was preparing for another round of "skirmishes" with the SEC, according to Mintz, when the agency called and said it intended to use Section 929I of the 2000-page legislation to refuse FBN's ongoing requests for information. Mintz said the network will challenge the SEC's interpretation of the law. "I believe this is subject to challenge," he said. "The contours will have to be figured out by a court."

Join GATA here: New Orleans Investment Conference * * * Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Sona Resources Expects Positive Cash Flow from Blackdome, On May 18, 2010, Sona Resources Corp. (TSXV: SYS, Frankfurt: QS7) announced the release of a preliminary economic assessment for gold production at its flagship Blackdome and Elizabeth properties in British Columbia. Sona Executive Chairman Nick Ferris says: "We view this as a baseline scenario for gold production. The project is highly sensitive to the price of gold. A conservative valuation of gold at $1,093 per ounce would result in a pre-tax cash flow of $54 million. The assessment indicates that underground mining at the two sites would recover 183,600 ounces of gold and 62,500 ounces of silver. Permitting and infrastructure are already in place for processing ore at the Blackdome mill, with a 200-tonne per day throughput over an eight-year mine life. Our near-term goal is to continue aggressive exploration at Elizabeth and develop a million-plus-ounce gold resource, commencing production in 2013." For complete information on Sona Resources Corp. please visit: www.SonaResources.com A Canadian gold opportunity ready for growth |

| Hooray for the Economic Recovery!…of 2016 Posted: 28 Jul 2010 12:11 PM PDT Last week, the price of gold again broke below its new base at $1,200, and the US stock market was again under strong pressure, due to a confluence of fears, most of which point to a deflationary double-dip. The fears were fanned by disappointing second quarter results, by the latest CPI reports that show inflation continuing to moderate, and by yet another poll revealing faltering consumer confidence. The market is also spooked, no doubt, by notes from the latest Fed Beige Book that make it clear that the Fed is (finally) beginning to understand the entrenched and endemic nature of this crisis. While the notes are written in shamanic double-speak, the point is clear: members of the Fed don't expect the economy to get back on track until 2015 or 2016.

The simple reality the Fed is waking up to is that the structural underpinnings of the economy are damaged beyond any quick or easy fix. That's because until the excess and/or bad debts are wrung out of the system - either through default or raging inflation - there's no chance of any sustainable economic recovery. Each new government initiative - the latest being financial reform - that doesn't decisively address the debt, but rather tightens the government's around private enterprise, only serves to delay or prevent economic revival. And so each new day will bring more distress and bankruptcy to homeowners, businesses, and banks. Pundits are fond of saying that things are never really "different this time around"... yet there is something truly unusual now going on. See if you can spot the disconnect in the following descriptions of the current economy.

Anything strike you as out of place? The current setup with massive debts and low, low interest rates is like making an uncollateralized loan to a mere acquaintance at a very friendly, low interest rate. Then he comes back again for more, and more, and more. Because you live in a small town, you know he's putting the touch on a bunch of other people too. And because you know his loose-lipped accountant, you also know what his income is, and even what his total debts are - and it is blatantly obvious that he won't be able to repay his debts in a dozen lifetimes. So would you keep lending him money? And, if you did, would you do it at the same friendly interest rates? Not hardly. And therein lies the Twilight Zone-caliber disconnect in the world as we know it. In a recent conversation with my dear partner and friend of several decades, Doug Casey, he made the point that the situation today should only exist if the fundamental laws of economics had been suspended. Interest rates should be going up, but they aren't. Rather, they are bumping along at the very bottom of the possible range. In my view, this is testimony to the truly extraordinary lengths - involving trillions of dollars - that the US Treasury and the Fed have gone to in recent years. But they can only suspend the laws of economics for so long before the fundamentals again rule. And when that happens, the entire system could literally collapse. Not to sound dramatic, but it could happen almost overnight. As frustrating as it may be to all of us, the world is still locked firmly in the jaws of a powerful bear market. While the bear may loosen its bite now and again, it's really only temporary...to get a better grip. That being the case, it's worth remembering the single most important thing about bear market investing: it's very difficult. Or, put another way, it's hard to make a decent return without taking extraordinary risk. As Doug points out, in the current environment, everything - including commodities - is overvalued. And they are going to remain that way until they aren't. Maybe the Fed actually has it right this time, and the bottom won't be reached until 2015 or 2016? I wouldn't argue with that assessment. But what of the inflation we see as inevitable? And gold, in the interim? Let me quickly tackle the second question first. In any debt crisis, the foremost concern of creditors is to get paid back. Compared to that, returns on investment come in a weak second. In a sovereign debt crisis, the question of repayment is complicated by the fact that the debtors control the creation of the currency units that will ultimately be used for payments. Individual and institutional holders of US Treasuries, along with other assets amounting to trillions of US currency units, can see with their own eyes what's going on. To continue holding such large quantities of instruments denominated in these unbacked currency units - or those labeled "euros" or "yen" - is to risk being left with a lot of worthless paper as the governments try to repay debtors by creating the stuff, literally, out of thin air. And so these holders diversify their portfolios into alternative, and far more tangible, assets - gold and silver included. That is the fuel that has sent gold higher over the last ten years and that will keep it high - short-term corrections notwithstanding. It is, however, when the inflation from all the money creation starts to appear that we'll begin to see the shift into gold begin in earnest, and the price will really take off. When might that occur? Rather than trying to answer that question myself, I'll refer you to the latest, excellent edition of, Conversations with Casey, in which Louis James interviews Casey Report co-editor Terry Coxon on the outlook for inflation. Here's an excerpt...

For now, the key is to get through this period in the best possible shape. That means watching your debt levels, keeping well cashed up, buying gold on dips, and, when you venture into investment markets, it's never been more important to understand what you are investing in and why. There's no need to chase anything - which means you have the luxury of building your portfolio over time, on exactly the terms you want. While it may sound contradictory, I think this is also a good time to learn more about speculating. In the simplest terms, a speculator risks just 10% of his/her portfolio in the hopes of receiving a 100% return. By comparison, most investors put 100% of their portfolio at risk in the hopes of getting a 10% return (actually, these days, most people would be happy with just 5%). In the case of the speculator, 90% of the portfolio can be largely kept in cash and gold. So, who's more at risk - the investor or the speculator? And where are the best speculations found today? Personally, I like energy, and I very much like bottom fishing in the junior gold sector. That's because there are some terrific Canadian junior exploration and mining companies sitting on large known deposits. But their share prices periodically fall back based on nothing more than investor emotion. That's called a buying opportunity. David Galland |

| Reducing Spending Not in the Feds' Plans Posted: 28 Jul 2010 11:57 AM PDT Why the government hates it when people do the right thing Yesterday, the rally on Wall Street slowed down a bit. The Dow rose 12 points. Gold had a bad day - down $25. We had guessed that gold would be going down. But it is still too early to detect a real trend. For the moment, the financial markets and the economy are going in different directions. The stock market is signaling a boom. The economy and gold are signaling a bust. We'll have to wait and see which direction prevails... In the meantime, had a seer come to us a couple of years ago with a tale of back-to-back US deficits totaling $3 trillion over two years, his credibility would have been in doubt. Had he also foreseen US Treasury debt at record low yields - at the same time - he would have had no credibility at all. One of the surest things we thought we thought we knew back then was that the government could not simultaneously run huge deficits and borrow cheaply. It was one or the other; that was all there was to it. It turns out that Dick Cheney was right all along. Deficits don't matter. At least, they don't matter until they do matter. And they don't matter right now. Bloomberg:

Why have yields fallen so much? Because the economy is not recovering. Investors look for a safe place to put their money. Bloomberg continues: "Expectations of growth over the next couple of years have indeed come down," Alan Blinder, former Fed vice chairman, and economics professor at Princeton University, said in a telephone interview. "There is still plenty of fear out there in the world financial markets, which has investors all over the world scurrying into Treasuries, even though they get paid very little." We opined - without doing any research on the subject - that Harley Davidson had probably peaked out. Only old men ride Harleys. The young prefer a different style of bike. We guessed that it was time to sell the stock. Naturally, the company's earnings have soared since then. But not because of increased sales. Instead, like the rest of corporate America, Harley is learning to earn more money without selling more merchandise. The New York Times has the story:

Everyone is doing the right thing. Households are reducing spending. Business is reducing its costs. GDP growth is falling and investors are taking shelter in Treasury debt. So what's the problem? Well, the feds can't bear to see people doing the right thing. They want them to do the wrong thing - that is, they want them to spend money they don't have on things they don't need. Why? Because it makes the economy look good...and makes them look like they know what they are doing. It's all hokum and folderol, dear reader...all hokum and folderol...as guest columnist, David Galland, explains below... Paris is for lovers. We are sitting in a café in the 19th arrondissement, with a complete set of café furniture stuck upside down on the ceiling. In front of us, as we finish our Daily Reckoning, is a couple of young Japanese or Chinese. Good looking people. The man has a very distinctive look, with long hair and a chiseled face. Not knowing anything more about it, we would guess that he is a descendant of Mongol invaders who swept into China and set up a dynasty under Kublai Khan in the 13th century. He is a cross between Jackie Chan and Genghis Khan. She, on the other hand, has a prettier, softer, more civilized look, like the delicate court women found on Chinese paintings. What an ardent lover he is! He leans towards her. He kisses her. He strokes her shoulders and her leg. He is so full of life. So enthusiastic. It is hard not to like him. But she is being coy. It is not clear she really appreciates his attention. Maybe she is mad about something. Or, maybe she is thinking about something else...shopping...travel...or how she will pay her bills. Either he doesn't notice...doesn't care...or he is trying to win her over. Good luck to him! *** There are two kinds of people. There are the insiders and the outsiders. What makes the Vancouver conference particularly interesting and fun is that it is full of outsiders. Insiders are people who, literally, want to be inside. They are joiners. They are club members. They participate in community affairs and attend meetings. They know the right people and make easy conversation at dinner parties. They have the right ideas too, those that are socially acceptable. They get them from magazines and TV. If there were a crowd, the insiders would want to be in the middle of it. They are very alert to how to 'dress for success' and very careful to send their children to the right schools. Some are ambitious. Some are not. Some are leaders. Some are followers. But whatever they get in life they expect to get it by following paths laid out for them. But the people at the Vancouver conference are rarely insiders. They are often oddballs, eccentrics and free-thinkers. They tend to be original in their habits and in their dress. They went to universities no one ever heard of and followed career paths their parents warned them against. They can be excruciatingly bad company, because they tend to focus on narrow areas, noticing things that others miss...developing skills and interests that others avoid. They are always on the fringe...on the margins...on the edges of mainstream life. In short, they are Daily Reckoning readers! That is why it is a pleasure to meet them and hear their stories. One joined the army, learned radio communications, and went out on his own to build a technology company based on his own invention. Another bought up apartment buildings in Cleveland and sold them at the top of the bubble. One dropped out of high school. Another makes movies. "I went to college and studied engineering," said a man with a German accent. "Then, I came to the US. I didn't have any money. I didn't have any connections. So I looked for a job. This was many years ago, when you could still do things like this. After a couple of weeks, though, I was getting desperate. Because I was running out of money completely. So, I went into a bakery. The guy asked me if I knew anything about baking bread. I said 'sure.' All I knew was that I had lived above a bakery in Germany. I knew they started work early in the morning. But I figured I'd at least get a lot to eat before he realized I didn't know anything. He told me I could start tomorrow. "That afternoon, I went to the library and found a book on baking. I read it carefully. So, at least I knew what it was all about, in theory. But when I got to work, I didn't know how to operate the ovens or anything like that. And my boss saw I didn't know. So I told him... 'These are very different from the ovens we have in Germany.' "He pointed to the label on the machine - 'Made in Germany' - ha ha.... But we became good friends and we opened up a whole chain of bakeries." Outsiders often have strange ideas. But they always have good stories to tell. Regards, Bill Bonner |

| Unrepentant Gold Bull and Stock Bear Posted: 28 Jul 2010 11:27 AM PDT |

| Posted: 28 Jul 2010 10:19 AM PDT In the latest two-part interview with Jim Rickards by Eric King, the former LTCM General Counsel goes on a lengthy compare and contrast between the Roman Empire (and especially the critical part where it collapses) and the U.S. in it current form. And while we say contrast, there are few actual contrasts to observe: alas, the similarities are just far too many, starting with the debasement of the currencies, whereby Rome's silver dinarius started out pure and eventually barely had a 5% content, and the ever increasing taxation of the population, and especially the most productive segment - the farmers, by the emperors, to the point where the downfall of empire was actually greeted by the bulk of the people as the barbarians were welcomed at the gate with open arms. The one key difference highlighted by Rickards: that Rome was not as indebted to the gills as is the US. Accordingly, the US is in fact in a far worse shape than Rome, as the ever increasing cost of funding the debt can only come from further currency debasement, which in turn merely stimulates greater taxation, and more printing of debt, accelerating the downward loop of social disintegration. Furthermore, Rickards points out that unlike the Romans, we are way beyond the point of diminishing marginal utility, and the amount of money that must be printed, borrowed, taxed and spent for marginal improvements in the way of life, from a sociological standpoint, is exponentially greater than those during Roman times. As such, once the collapse begins it will feed on itself until America is no more. Rickards believes that this particular moment may not be too far off... In this context, Rickards presumes, it is not at all surprising that both individual Americans and domestic corporations have set off on a massive deleveraging and cash conservation wave: the subliminal sense that something very bad is coming, is becoming more palpable with each passing day. The bottom line is that the Fed, just as our founding fathers had warned, could very well end up being the catalyst to the downfall of American society as it cannibalizes all productive output and transfers the wealth to the oligarchy, while paying for this transfer in the form of unrepayable indebtedness. Ostensibly, had the army of Ancient Rome agreed to be paid in paper instead of (even diluted) precious metals, thus creating the first central bank in history, the collapse of that particular overstretched empire would have been far quicker. On the other hand, it would have prevented the disaster of Central banking in its current form, as civilization would have learned about its evils far sooner. Alas, that did not happened, and it now befalls upon the current generation to realize just how much of a destructive influence central banking truly is. If Jim Rickards is correct, however, the realization will be America's last, just before US society disintegrates. Must hear two part interview can be found here: |

| Posted: 28 Jul 2010 10:02 AM PDT Gold price edges higher again on physical demand The COMEX December gold futures contract closed up $0.60 Wednesday at $1162.40, trading between $1159.30 and $1168.80 July 28, p.m. excerpts: see full news, 24-hr newswire… July 28th's audio MarketMinute |