Gold World News Flash |

- Gold Producer Targeting $0 Mining Costs Reaches Commercial Production; Investors Preparing for Dividends and More!

- Meeting Minutes: The Fed Sees a Long Slog

- Financing Retirement: It's All About Income

- Financial Default Risk

- GoldSeek.com Radio Gold Nugget: Arch Crawford & Chris Waltzek

- Helicopter Drop Time: Paul Krugman Gets One Wrong

- Capital Treatment and Future Bank Blow Ups

- Illinois Overtakes Iceland: Will Other States Follow?

- Precious Metals In A Jobless Recovery

- Chris & Michael Berry: Berry Picking in Colombia, Yukon

- Monster Employment Index Europe at 16 Month High

- Summer stagnation

- Mid-Week US Dollar, Oil, Gold and SP500

- Crude Oil Back To Following Equities, Gold Volatility Declines to Lowest Since April

- What are the Differences between Investing Silver and Gold?

- Money Disillusion: 8 Ugly Facts About Inflation

- Chris & Michael Berry: Berry Picking in Colombia, Yukon

- Gold Technicals for July 14th

- When to Buy and Sell Gold

- July FOMC Minutes: Interesting Observations

- Jim?s Mailbox

- Hourly Action In Gold From Trader Dan

- Is Chapter 13 Reducing the Foreclosure Rate?

- The Bearish Bull

- Will the Dollar Crisis Spawn Chaos?.. Big Science Desperation Over God Particle

- Buy Gold, Buy silver... and Have Faith

- C&I Lending Remains Distressed

- LGMR: Gold & Silver Slip Back But "Long-Term Appeal Unthreatened"

- First BAC, Now Citibank: "Accidental" Repos

- How To Start An Economic Recovery

- Orion Marine Group: Massive Driver Could Propel the Stock

- Reg Howe: BIS swaps seem meant to stretch out paper gold

- The Silver Price Needs Not to Fall Below $17.90 nor the Gold Price Below $1,198 for Continuation of the Uptrend

- China Has Been Covertly Funding A Housing Bubble Five Times Larger Than That Of The US: 65 Million Vacant Homes Uncovered

- Gold Seeker Closing Report: Gold and Silver End Mixed In Volatile Trade

- Is Time to Sell Your Gold?

- Currencies Rally After Alcoa Profit Announcement

- U.S. Economy Crashes

- Money Disillusion: 8 Facts About UK Inflation

- The Money Supply Conspiracy

- Heritage Summer FUN US Coin Auction Tops $7.4 Million

- Gold Prices Rebound to Top $1210, Silver Gains 1.9%

- Gold, Silver, Metal Prices Commentary – July 14, 2010

- John Taylor: "Cash Is Now King, Worthless Or Not, So Buy Dollars."

- More protection

- Sprott plans physical silver trust

- Peter Grandich has a $50,000 bet for two gold perma-bears

- Roubini Says Obama Must Talk To Americans As Adults Even As He Advocates Treating Them As Children

- PSPIB in a $1.5B-Plus Secondary-Market Sale?

- Getting gold for China is world's top financial problem, Rickards tells KWN

| Posted: 15 Jul 2010 01:00 PM PDT Gold Resource Corporation (GORO) made a significant announcement on July 1st by reaching commercial production. 1st year production is forecasted to be 70,000 ounces at a $200 cash cost. By year 3, production is projected to ramp up to 200,000 ounces gold equivalent (gold and silver) at a $0 cash cost, as base metals offset costs. The company continues to have an impressive share structure, with just under 50 million shares outstanding. The company has no debt and just announced application to list on NYSE: AMEX, which should open the company further up to new sources of investment capital. With the company now starting to produce strong cash flow and intending to distribute 1/3 of cash flow to investors in a form of dividends, investors continue to revalue the share price. |

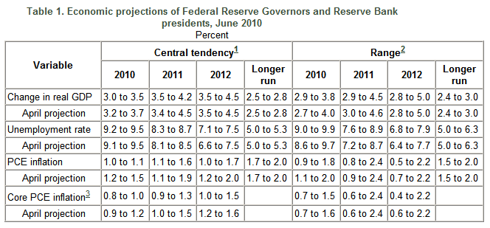

| Meeting Minutes: The Fed Sees a Long Slog Posted: 14 Jul 2010 07:43 PM PDT John Lounsbury submits: The minutes of the Federal Reserve Board meeting June 22-23 were released yesterday, July 14. The essential news is that the Fed's economic outlook was lowered slightly from the April meeting. A symmary of some of the changes are given in the following table from the Summary of Economic Projections: Complete Story » |

| Financing Retirement: It's All About Income Posted: 14 Jul 2010 07:31 PM PDT David Van Knapp submits: Many articles on Seeking Alpha involve retirement, express or implied. That’s the goal many readers are shooting for—a comfortable, secure retirement, with confidence that you can live at a lifestyle of your choosing without running out of money. I have been retired for nine years. I was fortunate to be able to retire early (age 55) and turn more of my attention to one of my passions, which is helping other people through my writing about stock investing. Other passions include my wife and activities with her, golf, gaming (poker and blackjack), and the Buffalo Bills (don’t ask). When I was planning to retire—or more correctly, exploring whether I would be able to retire—the first step was to learn more about financing retirement. One thing that I decided quickly was that in retirement, it’s all about income. I don’t refer here to “income investments”—dividend-paying stocks, bonds, or annuities—I’ll get to those later. I mean that when you are retired, you need income—money coming in—that covers your expenses. You will need that income for the rest of your life, which may be a long time, potentially longer than you worked at your principal career. So when you are exploring retirement, the first two questions become, how much will you need, and where will it come from? On the first question, I quickly decided that conventional rules of thumb, like “You will need 70% of your final year’s income,” are worthless. That particular canard fails on at least two levels. First, it presumes that you were spending all of your income in your last year of work. But more likely, you were saving a good portion of your income as you came into the home stretch prior to retirement. So the amount you were making in that final year probably bears little relationship to what you will actually need. Second, your expenses can change significantly on the day that you retire. I had a position that required formal business clothing. Since the day I retired, I have not worn a suit, and I only wear ties to weddings and funerals. That entire expense category disappeared. The “savings” category disappeared. On the other hand, I spend more now on golf equipment and greens fees. So instead of scaring yourself silly with the 70% rule, create a retirement budget. We like to travel, so that’s part of the budget. I don’t care about having a new car every few years, so that’s gone, along with the business clothing. We paid off our house, that expense is gone. Senior discounts make a little dent. You may be surprised that your retirement budget comes in at far less than the 70% rule would have led you to believe. The point is, everyone’s circumstances are different. You cannot rely on a crude rule of thumb to estimate your expenses. You’ve got to sit down and work them out yourself. The second question is, Where will it come from? Here, you need to list all the sources at your disposal:

I wrote an article in February, “Why I Love Dividends.” It spawned a lively discussion (over 110 comments to date), and one of the branches of the discussion is directly on point here. The debate was whether it is better to derive your retirement income from income-producing investments, or to create it by selling off part of your investments each year. We have to be careful with the definition of “income” here, because it has two meanings. It can refer to the money you receive from income-producing instruments (dividend stocks, bonds, etc.). But it also refers to the monthly money you need in your retirement budget. If you simply receive income from income-producing investments and put it directly toward your retirement budget, the two definitions merge. But if you re-invest the income from investments and sell part of those investments each year for retirement income, you are converting capital (your investments) into retirement “income” each time that you sell. The rule of thumb on selling part of your investments to finance retirement is that the “safe” thing to do is to calculate 4% of your investments when you retire, and that’s the amount you can sell each year with confidence that you will never run out of money. You are supposed to increment that amount each year to account for inflation—commonly by increasing it 3% each year. The rule of thumb presumes that you have a well-diversified portfolio under the standards of Modern Portfolio Theory, and I believe the 4% “safe” figure has been validated by millions of Monte Carlo tests to about a 95% confidence level that your money will never run out. Once again, I find the rule of thumb wanting. For one thing, you may not need 4% per year to round out your retirement budget. That doesn’t create a problem. But you may need more, in which case the experts I’ve read disagree on what you should do (delay retirement, lower your budget, get part-time work, withdraw 5% or 6% per year, etc.). A second disconnect for me is the 3%-per-year inflation adjustment. As discussed earlier, your retirement budget is unique to you. Your personal “basket of goods and services” probably bears little relationship to the government’s basket when they are figuring inflation. The costs of travel have gone down, not up, since I have been retired. Furthermore, the automatic adjustment ignores the performance of your investments. I think that’s a big flaw. What I have been doing is adjusting the 4% base amount not by inflation, but by how our investments have actually performed. I withdraw 1% per quarter of what’s actually there. If the total value of our investments has gone up, the withdrawal amount goes up a little. If the investments have declined, the withdrawal amount goes down. The change is at the margin and has been no trouble to absorb. But over time, I think it makes the 4% rule a lot safer to adjust it by how your investments are actually doing than to just automatically bump the withdrawal amount up each year and ignore what’s happening in the real world. Frequent readers who know my appreciation for dividend investing may be wondering why I just don’t take my dividend money directly. I see this article as the first of an occasional series on retirement realities, if there is sufficient interest in the topic. In a future article, I will explore my reasons for using a quarterly-withdrawal system. Hint: The dividends help fuel it. Disclosure: No positions mentioned. Complete Story » |

| Posted: 14 Jul 2010 07:29 PM PDT  Hickey and Walters (Bespoke) submit: Hickey and Walters (Bespoke) submit: Here at Bespoke, we track default risk in the financial sector through our Bank and Broker CDS Index. The index is cap-weighted and measures the collective default risk of a number of financial firms around the world. As shown in the chart of our CDS index below, financial default risk spiked to its highest levels since early 2009 at the start of June. The beginning of the spike coincided with the peak in financial stocks back in April. More recently, however, default risk has pulled back. Interestingly, when financial stocks made a lower low in the week before July 4th, default risk didn't make a higher high. click to enlarge Complete Story » |

| GoldSeek.com Radio Gold Nugget: Arch Crawford & Chris Waltzek Posted: 14 Jul 2010 07:00 PM PDT |

| Helicopter Drop Time: Paul Krugman Gets One Wrong Posted: 14 Jul 2010 06:58 PM PDT Brad DeLong submits: Paul Krugman writes (Nobody Understands The Liquidity Trap):

Complete Story » |

| Capital Treatment and Future Bank Blow Ups Posted: 14 Jul 2010 06:40 PM PDT Craig Pirrong submits: While doing her research at Heritage, Renee came across this 2000 article in Regulation by Thomas Oatley. It discusses the Basel capital standards, and is amazingly prescient:

Complete Story » |

| Illinois Overtakes Iceland: Will Other States Follow? Posted: 14 Jul 2010 06:27 PM PDT Dian L. Chu submits: Illinois made headlines a few weeks ago when it overtook California as the worst credit risk among American states. Now, the fifth most populous state in the U.S. has officially overtaken Iceland in the default risk category as well. (See screenshot below from CMA site) Click to enlarge Complete Story » |

| Precious Metals In A Jobless Recovery Posted: 14 Jul 2010 06:08 PM PDT Already months into a "recovery," we're hearing about how this will turn out to be a jobless recovery – that is, the economy will grow without adding any actual jobs or reducing at all the number of unemployed persons. While we would all like to embrace that idea, the theory that an economy can grow without anyone being employed simply isn't practical. However, precious metals investors should like it for one simple reason: higher prices. |

| Chris & Michael Berry: Berry Picking in Colombia, Yukon Posted: 14 Jul 2010 06:06 PM PDT |

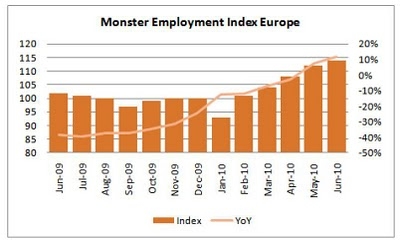

| Monster Employment Index Europe at 16 Month High Posted: 14 Jul 2010 06:03 PM PDT Mark J. Perry submits: European Online Recruitment Activity Reaches 16-month high, Reports Monster Employment Index June 2010 Index Highlights: Complete Story » |

| Posted: 14 Jul 2010 05:48 PM PDT The S&P has rallied almost 9% in seven session off the lows seen on the first day of this month. Volume has lagged, however, and as we come to test the 50DMA & 200DMA, downside risks are back into play. The head & shoulders "breakdown" through S&P 1040 was a bear trap, confirmed by the ridiculous 54% AAII bearish readings that week. A jump from mid-30s to mid-50s is unsustainable and showed that everyone had gone risk-off on a technical pattern. The true head & shoulders, however, is at the 1015 level, the Oct 2009 & July 2010 lows (as well as July 2009 highs). Flow data has confirmed short-covering and fast money has rallied the market, with no conviction as per volume data.

Meanwhile, the 10yr Tsy yield, as mentioned in the previous post, retraced back to its 310-315bps breakdown level (and subsequently sold off), suggesting the risk rally is over, at least implied by the bond market. This confluences with the moving average resistance in the equity indices, suggesting risk may find selling here. The recent divergence between Tsy yields & equity suggest equity is overpriced, if the bond market is taken to be the leading indicator that it has been since April when it failed its 400bps breakout and reversed course downward. The 10yr yield corrected back up to June lows but never got above those levels.

After the YoY 10.3% Q2/11.1% H1 GDP growth data from China, the AUD/USD went vertical, shooting up 50 pips in a matter of minutes. But since then it has retraced all of those gains and against the backdrop of overbought risk markets facing all kinds of resistance, its .8780-.8860 range seems at risk for breakdown and consequent resumption of downtrend.

Iron ore, copper, and coal prices are down significantly from their highs, while China is cooling itself down in an environment of global austerity (aka decreasing import demand). Global trade has all but halted, as judged by the Baltic Dry Index, which is on its 37840th consecutive day of decline. These factors do not bode well for the Aussie Dollar, and all it takes is a little risk aversion to send it underperforming and exposing the RBA's rate hikes as malconceived. The high rates will eventually pop the Aussie property bubble (one of only two remaining bubbles Jeremy Grantham observes), furthering the downside risk, and probably leading to a reversal in rate policy from the RBA, which would be an embarrassing turn of events that would be disastrous to Australia's currency & equities. The RBA effectively leveraged the entire Australian economy and growth story (via rate hikes) into the China export story. But that is one-time demand, from stimulus engaged at the depths of the financial crisis, and the global push for tightening and austerity will most likely send Australia into its first dose of true recession and skyrocket its employment (currently consisting of millions of miners supplying China's now-peaked demand for building commodities). The Shanghai Composite (in bear market territory) isn't making things look any better, either. Bank earnings are coming up for American stocks and the technical backdrop shows a low-volume rally that has brought financials back up to significant resistance & the 200DMA in the context of a major head & shoulders topping pattern. There's always a chance blowout earnings result in bank stocks breaking out, but at these levels even good results will probably result in selling the news. With recent market vol, trading volumes and leverage used by hedge funds has declined dramatically (even getting WSJ exposure), while hedgies have faced big redemptions in the face of poor May & June numbers (Paulson may single-handedly be catalyzing the selloff in gold with his big redemptions after an abysmal May & June). JPM is on deck tomorrow for earnings. Let's take a look at how the market has fared in the past few quarters following JPM earnings. Market loves to pump on low volume ahead of JPM results, only to dump on high volume subsequently. The technicals imply this pattern may continue this quarter, as well. On smaller timeframes like 30min/hourly charts, we still have higher highs & higher lows, suggesting risk is still bid. But with heavy resistance above, low volume behind the rally off July 1 lows, a poor macro backdrop, and slowing momentum, we could see some distribution resulting in a reversal of trend. My take is that this may be near the top of this move, judging strictly by technicals. JPM (and subsequent bank) earnings may provide catalyst for movement. |

| Mid-Week US Dollar, Oil, Gold and SP500 Posted: 14 Jul 2010 05:37 PM PDT |

| Crude Oil Back To Following Equities, Gold Volatility Declines to Lowest Since April Posted: 14 Jul 2010 05:24 PM PDT courtesy of DailyFX.com July 14, 2010 08:14 PM Crude oil is back to taking its cues from equity markets, as the easy gains from the low $70's have been registered. Gold's narrow range makes it easy to trade on a breakout. Commodities - Energy Crude Oil Back to Following Equities Crude Oil (WTI) $76.69 -$0.35 -0.45% Commentary: Crude oil is lower after falling 0.14% in the prior session. Oil initially bounced following surprising DOE inventory figures, but subsequently fell back into the red, as U.S. equities gave up their gains. The Department of Energy reported that in the week ending July 9, 2010, U.S. crude oil inventories decreased by 5.1 million barrels, gasoline inventories increased by 1.6 million barrels, distillate inventories increased by 2.9 million barrels, and total petroleum inventories increased 3.2 million barrels. This is the second week in a row that crude oil inventories fell by 5 million barrels; but while crude oil inventories h... |

| What are the Differences between Investing Silver and Gold? Posted: 14 Jul 2010 05:24 PM PDT The traditional rule that gold always trades within a range of 20 to 70 times the value of silver may quickly be tested as the financial markets lose their fear and again start investing in stocks, bonds and other investments. Silver and Gold Comparison When it comes to protecting your wealth against financial turbulence and inflation, both metals are strong. However, when we look at underlying fundamentals that drive consumption for both metals, we find they are very different. Silver and gold both have uses in manufacturing and electronics, where they are often used to coat cables and make better connections on circuit boards, electrical wiring, or virtually any product where a quality connection is important. Both perform well, but silver performs best and is more widely used than gold. Silver is the best conductor of electricity known to mankind, and at the current price of just $18 per ounce, the beauty of silver's uses have yet to shine. Why Bu... |

| Money Disillusion: 8 Ugly Facts About Inflation Posted: 14 Jul 2010 05:24 PM PDT Money Disillusion: 8 Ugly Facts About Inflation by Adrian Ash BullionVault Wednesday, 14 July 2010 Behold the sad case of the poor British worker and saver... PEOPLE BUY GOLD when they fear inflation ahead. But they also buy gold when inflation arrives and starts eating into their savings – which is just what it's done during the last decade. Take the poor UK cash saver, for instance. Oh sure – the London press pretty much agreed that "inflation eased off" when the latest data were released on Tuesday. But as BullionVault never tires of reminding people, it's worth putting such a "dip" into context, starting with its impact on real rates of interest... #1. On the old Retail Price Index, UK household deposit accounts have lost value – after inflation – in 57 of the 120 months since July 2000. Gold priced in Sterling has risen by 332%; #2. Since Mervyn King moved from deputy to governor of the Bank of England in June 2003,... |

| Chris & Michael Berry: Berry Picking in Colombia, Yukon Posted: 14 Jul 2010 05:24 PM PDT Source: Brian Sylvester of The Gold Report 07/14/2010 Newsletter Writer Michael Berry, PhD, is one of the most respected economic strategists in America and a frequent to contributor to The Gold Report. On this occasion, Michael's son, Chris, joins the discussion and shows he's clearly a chip off the Berry block. Among other things, the Berrys discuss the growing fears of deflation as well as several promising junior gold plays in Colombia and the Yukon. It's all part of their "three legs of the survival stool" approach to investing that you will learn about in this exclusive interview with The Gold Report. The Gold Report: People are hearing and reading about the potential for deflation. On its surface, paying less for everyday items seems like a good thing, but please paint us a picture illustrating why we should all fear deflation. Michael Berry: I want to point out that deflation isn't foreordained; it just looks likely. Given the history over the last two o... |

| Posted: 14 Jul 2010 05:24 PM PDT courtesy of DailyFX.com July 14, 2010 06:35 AM Gold has topped. Please see the latest special report for details. Near term, gold is making its way lower and most likely in an impulsive fashion. From a trading standpoint, the next opportunity will come from the short side on completion of wave iv of 3 (possibly complete at 1219). Jamie Saettele publishes Daily Technicals every weekday morning, COT analysis (published Friday evenings), technical analysis of currency crosses on Monday, Wednesday, and Friday (Euro and Yen crosses), and intraday trading strategy as market action dictates at the DailyFX Forum. He is the author of Sentiment in the Forex Market. Follow his intraday market commentary and trades at DailyFX Forex Stream. Send requests to receive his reports via email to [EMAIL="jsaettele@dailyfx.com"]jsaettele@dailyfx.com[/EMAIL].... |

| Posted: 14 Jul 2010 05:24 PM PDT The 5 min. Forecast July 14, 2010 11:24 AM by Addison Wiggin & Ian Mathias [LIST] [*] The importance of contrarianism: Stocks stage remarkable rally, despite lousy economy [*] Alan Knuckman offers new S&P resistance and support targets [*] Time to sell gold? Bill Bonner & Frank Holmes offer sober assessments [*] Chris Mayer unveils his latest BRIC investment opportunity [/LIST] Despite all economic indicators to the contrary, the Dow and S&P 500 are up nearly 7% so far in July. Last week, we were ready to leave the stock market on the side of the road, dead. But after yesterday’s rally, the Dow is just shy of break-even for the year… and the rally continues today. “Last week was the biggest weekly jump in the Dow since July 2009,” our resource trader, Alan Knuckman, wrote early this week. “The rise of more than 5% in four trading sessions sets up a recovery from extreme lows that was led by the base in commodities prices the we... |

| July FOMC Minutes: Interesting Observations Posted: 14 Jul 2010 05:24 PM PDT Market Ticker - Karl Denninger View original article July 14, 2010 10:34 AM Interesting comments in the so-called "Minutes" (which are really more filtered notes that only say what they want, intentionally omitting anything "contrary", as we now know) [INDENT]In his presentation to the Committee, the Manager noted that "fails to deliver" in the mortgage-backed securities (MBS) market had reached very high levels in recent months. Under these conditions, dealers had experienced difficulty in arranging delivery of a small amount--including about $9 billion of securities with 5.5 percent coupons issued by Fannie Mae--of the $1.25 trillion of MBS that the Desk at the Federal Reserve Bank of New York had purchased between January 2009 and March 2010 [/INDENT]Wait a second - two months later these securities that were "sold" were not really sold - that is, they were shorted NAKED by the seller to THE FED? Now is $9 billion material? It sure as hell is. It may be a small p... |

| Posted: 14 Jul 2010 05:24 PM PDT View the original post at jsmineset.com... July 14, 2010 09:28 AM Dim retail sales hurt economy but offer bargains CIGA Eric No spin to refute here. A second straight month of declining retail spending will likely keep unemployment high and help weaken the recovery. Trend line breaks mark deceleration in "real" retail sales. This is important to economy in which consumption accounts for more than 70% of national income. Either the economy is accelerating or decelerating. Deceleration with extremely high debt burdens will be met with further stimulus. Real or CPI-Adjusted Retail Sales (RRS) and YOY Change: Gold-Adjusted Retail Sales (RSGLDR) and YOY Change: Weakness in retail sales is confirmed by the ISM data. ISM Prices Paid Index (PP) to National Purchasing Manager’s Index (PMI) Ratio: Source: finance.yahoo.com More… Members of the US Union face major shortfalls CIGA Eric Austerity or government spending? As C, I, (X-I... |

| Hourly Action In Gold From Trader Dan Posted: 14 Jul 2010 05:24 PM PDT |

| Is Chapter 13 Reducing the Foreclosure Rate? Posted: 14 Jul 2010 05:24 PM PDT Chapter 13 of the bankruptcy code is known as adjustment of payments section. It is available to those with regular income who find themselves with a debt service burden that "busts their cash flow budget". Its official name is "Individual Debt Adjustment". Chapter 13 for individuals has some parallels to Chapter 11 reorganization for corporations and partnerships. Catherine Curran writes in The New York Post that underwater homeowners with second mortgages who are facing financial distress are increasingly seeking protection under Chapter 13. In order for the filing to work to the homeowner's advantage, the market value of the home must be less than the first mortgage outstanding principal. Curran writes about Chapter 13:[INDENT]If the home is appraised at less than the value of the first mortgage, the owner can apply for permission in bankruptcy court to reclassify the second mortgage debt. That changes it from a secured debt, which must be repaid, into an unsecur... |

| Posted: 14 Jul 2010 05:24 PM PDT By Neil Charnock goldoz.com.au I have taken some excerpts from our new GoldOz Newsletter service to construct this article. Even the hedge funds boys are reportedly dazed by market action after their worst performance in 18 months during May. Has it been difficult to assess the markets this year? No it has been extremely hard. This is firstly because of the political and regulatory changes that are clouding the picture. The second difficulty is that we are transitioning into a new financial world and I do not say this lightly. Take Greece for example where there are riots in the streets and default hangs directly overhead. They need strong growth to provide an economy that can pay back debt and thereby overcome chronic deficits. Yet SME's (Small to Medium Enterprises) have only been able to borrow €85M in the past 6 months to end June this year and at a whopping 22% average interest rate. In 2009 by contrast they borrowed €900M. Changes are part of ... |

| Will the Dollar Crisis Spawn Chaos?.. Big Science Desperation Over God Particle Posted: 14 Jul 2010 05:24 PM PDT Will the Dollar Crisis Spawn Chaos? Wednesday, July 14, 2010 – by Staff Report Western Powers in Decline, China To Rule: Economist ... Western powers are in decline and China will end up ruling the world economically, Stephen D. King, chief global economist at HSBC told CNBC Monday. "Western prosperity is slowing eroding," said King. "The U.S. is increasingly reliant on China's deep pockets (to pay its debt with China buying U.S. Treasurys) and China will end up dominating the world when it comes to economics." King also said that the euro crisis will turn into a crisis for the U.S. dollar. "It comes down to the U.S. deficits," King added. "The U.S is behaving like the debtor nations of the Mediterranean (Greece, Italy). China and other countries are asking themselves whether American taxpayers will pay their debt." – CNBC Dominant Social Theme: It gets worse and worse, and perhaps that's the plan! Free-Market Analysis: When is a report a do... |

| Buy Gold, Buy silver... and Have Faith Posted: 14 Jul 2010 05:24 PM PDT Gold's low for Tuesday [around $1,195 spot] occurred within the first fifteen minutes of trading in the Far East on Tuesday morning. After that, gold didn't do much until the London open when there was a little break-out to the upside... and from there, the gold price continued to work its way slowly higher. But the moment that New York opened, a serious buyer showed up and the gold price blasted up to its high of the day [$1,219.10 spot] by 9:00 a.m. Eastern time, before being hammered flat. After that, the price gently sold off into the close. Volume was around 90,000 contracts net of everything. Silver's low on Tuesday [around $17.85 spot] was at approximately 4:00 p.m. in Hong Kong... shortly before London opened. From that low, the silver price advanced in fits and starts until shortly after the London silver fix was in at noon local time. From that point, the silver price began to really move... and once the Comex opened, silver blasted to it... |

| C&I Lending Remains Distressed Posted: 14 Jul 2010 05:24 PM PDT A graph from David Rosenberg, Chief Economist for Gluskin Sheff (Toronto), shows one of the severe headwinds the recovery is battling. C&I (commercial and industrial) lending remains at historically depressed levels. May of 2010 is at levels 16% below May, 2009, which, in turn, was about 10% below May, 2008. Rosenberg points out the following:[INDENT]One-quarter of bank credit available for businesses has totally vanished during this intense debt deleveraging cycle (and nobody, including the Fed, knows why this credit contraction is ongoing — see Small-Business Lending is Down, But Reasons Still Elude the Experts on page B3 of the NYT; although in the article, Mr. Dunkelberg is quoted as saying: “Credit’s not the issue, customers are the issue” in reference to the view that with capex plans near a 35-year low, the demand for loans is unusually low. [/INDENT]The New York Times article referred to is by Sewell Chan and is available here. The c... |

| LGMR: Gold & Silver Slip Back But "Long-Term Appeal Unthreatened" Posted: 14 Jul 2010 05:24 PM PDT London Gold Market Report from Adrian Ash BullionVault 08:40 ET, Weds 14 July Gold & Silver Slip Back But "Long-Term Appeal Unthreatened" as Expanding Eurozone Faces "Either State or Banking" Insolvency THE PRICE OF GOLD and silver bullion edged 0.7% below yesterday's two-week highs in London on Wednesday morning, trading at $1207 and $18.17 per ounce respectively as European stock markets fell for the first session in seven. The US Dollar rallied from its lowest Euro level in nine weeks, but slipped from a near two-week high vs. the Japanese Yen at ¥89.10. Crude oil fell back through $77 per barrel after new data showed US stock-pile inventories rising sharply. US Treasury bonds rose, but German Bunds and UK gilts slipped, nudging 10-year British bond yields up to 3.40% – fully 160 basis points below the latest reading of retail-price inflation. "Yet again not much change for gold on Tuesday," says technical analyst Phil Smith for Reuters in Beijing," ... |

| First BAC, Now Citibank: "Accidental" Repos Posted: 14 Jul 2010 05:24 PM PDT Market Ticker - Karl Denninger View original article July 14, 2010 06:05 AM Yeah, ok... [INDENT]Corporate Counsel reports that Citigroup (C) temporarily took as much $10.7 billion in debt off its books just in time to make its quarterly filings by "mistakenly" classifying a kind of borrowing as a sale. A May 13 letter that Citigroup sent to the Securities and Exchange Commission admitted the faulting accounting occurred four times: March 31, 2007 ($4.5 billion in debt hidden), December 31, 2007 ($1.8 billion), September 30, 2008 ($10.7 billion) and March 31, 2009 ($573 million). In making the "mistaken" classification, Citi was not using the infamous Lehman Brothers Repo 105; instead, Citi's move is called a "dollar roll." [/INDENT]Just like Bank of America, right? [INDENT]July 10 (Bloomberg) -- Bank of America Corp., the largest U.S. bank by assets, said it wrongly classified as much as $10.7 billion of short-term repurchase and lending transactions as sales from 2007 to 2009 ... |

| How To Start An Economic Recovery Posted: 14 Jul 2010 05:06 PM PDT From The Daily Capitalist Regular readers of The Daily Capitalist know I think we are headed for a decline in economic growth in 2010 and that the data is starting to show this. Why isn't our economy recovering? I ask that question often and have written about it many times. Perhaps a better question is: what needs to happen in order to make our economy grow? I offer some solutions. There are many problems seen as hindering recovery. Here are the common ones I wish to examine:

There are a host of other issues that are also important but let me focus on these points and show what can be done to fuel a recovery. Numbers 1 and 2 (debt/demand) are related. Our economy is consumer driven and we are reminded over and over again that consumer consumption is 70% of our economy. To put this in perspective, for Germany it is about 57% of GDP. Our economy is built on consumption which is fine as long as it is supported by real savings, productivity growth, and wage growth. The data reveal that most of the consumption binge of the boom phase of this current cycle was financed directly or indirectly by debt related to rising home values. Personal savings declined to almost zero. Now savings are back up to 4%. Here is why this is seen as a problem for recovery: PCE will decline as consumers pay down debt and increase savings. Spending drives the economy and the economy will decline. Is this really a problem? Saving is a process necessary for a recovery. Consumers are acting rationally to uncertainty and they will give us the signal when they are ready to spend again. About $10 trillion in household net worth was wiped out during the bust. Until consumers see unemployment decrease, wages go up, and their debt go down, they aren't going to spend anyway. But savings is never bad for an economy. Economists often fail to look at the other side of savings which is an increase in capital necessary to fuel future growth. In a normal cycle, increased savings reduces interest rates, which sends a signal to producers of capital goods that consumers don't want to buy consumer goods right now, and that there is opportunity for them to increase production of durable goods such as machines, homes, and basic equipment. They use the loan funds to pay workers who will spend which, as this capital works its way through the economy, will create new and real economic activity. While manufacturers have been increasing production in response to normal business cycle activity (inventory recovery; weak dollar advantages), they are just utilizing current capacity. If they wanted to expand, unless they are a large company with access to money center capital, they now report they are having trouble getting a bank loan. What does this mean? It means they can't expand and hire new workers whose spending will take up the slack from consumers who save. The government and the Fed have confused our ability to make economic decisions because they are artificially lowering interest rates. What can we do to fix this? Savings is the fix. There is nothing that should be done to prevent this from occurring. In the longer term it will prepare the economy for new growth. See No. 4 for why flogging a dead horse is harmful to recovery. The question is: why can't we get loans? Number 3 is that banks have too many bad loans and, as a result, have too little capital. The Fed and the Administration's economic advisers are very concerned that banks aren't lending. On Monday, Chairman Bernanke in a speech said that getting credit to America's small businesses was crucial to a recovery because they hire half the workers in America and create 60% of new jobs. After he went through his reasons for the credit crunch he came to this startling conclusion:

Let me translate this for you: nothing we've done has worked and we don't have any ideas how to make it work. I have explained in great detail why banks aren't lending in previous articles (e.g., Will We Have Inflation, Deflation, or Hyperinflation?). That is, they made a ton of bad loans as the result of cheap Fed money which created fake wealth in the form of a housing boom. Most of the troubling loans encumbering regional and local banks are for commercial real estate and it is tying up their balance sheets. They are afraid to extend credit to middle America because they know their CRE loans will need to be written down as real estate prices continue to decline and they will need to come up with more capital to satisfy regulatory requirements. Also, it is apparent that when banks do wish to lend, they aren't finding quality borrowers to whom they would like to extend credit. What can we do to fix this? This one is easy. Until those bad CRE loans are written down, written off, banks liquidated, banks raise more Tier 1 capital, they will continue to be reluctant to lend and the credit crunch will continue. The government's programs of extend and pretend, delay and pray, mark-to-make-believe, only serve to delay the healing process. Meanwhile valuable capital is locked up in failing or failed banks and the economy can't get credit (unless you have access to the big money center banks or the Fed's discount window). Do away with these policies, get rid of failed or failing banks, let the economy heal itself, and credit will return. I urge you to read my above mentioned article on the inflation-deflation debate which goes into great detail on this topic. That gets us to point 4, the government's interference in the economy. Artificially stimulating spending is counter-productive to a recovery since such economic activity is not based on organic, market based consumer demand. In other words, since the spending is not being generated by increased business activity caused by consumer demand, no lasting economic activity is produced. Once the stimulus spending stop, the effect goes away and the economy resumes its decline. This is what is happening now. It makes no economic sense to encourage consumers to take on more debt after they have just suffered the results of the biggest debt binge in history. Today Mrs. Romer, Chief Shaman of the Obama Administration's Council of Economic Advisors, reported that such stimulus spending is working, that it has achieved a Keynesian multiplier of 3:1, that is, for every dollar spent by the government, three dollars of private economic activity. Further they claim that they have saved or created three million jobs. They also claim that they increased GDP by between 2.7% and 3.2%. The only problem with this report is that it is wrong, misleading, and, how shall I say it, politically motivated. Another way to say it is that they are lying to make the Administration look good. While Keynesians, such as Paul Krugman, argue for more government spending, there is no believable evidence that this is working now, that more spending will work, or that it has ever worked in the past. It's a fake science. If government could create economic growth by either printing money or taking your money and spending on government-favored projects, then we'd all be gloriously rich. Of course Japan is the poster child of the failure of Keynesian economics. Professor Krugman told them they ought to spend more too. They did and the results were debt and stagnation. Here is what Mrs. Romer and her staff are doing. They skew the numbers so that they represent the most favorable result under their faith-based assumptions, and then they claim that the results are caused by government spending. This is a logical fallacy known as post hoc, ergo propter hoc, or, because B event followed A event, then A caused B. I looked on Recovery.gov and they claim there that they have "funded" 682,370 jobs as of March 31. Is Mrs. Romer saying they added another 2.3 million jobs since March? These Keynesian seem to equate private sector jobs with government jobs. A "job" in the economic sense isn't just paying someone to do something. A private employer will hire a person only if he sees market opportunities that will make him more money. If he hires someone just to be nice, and there isn't enough revenue to support the wages of this employee, he could go broke. His payments would be considered to be charity. The government has never created a job, if you define a job as wages based on market productivity. If you define a job as the payments by the government to do something, it isn't work based on market forces. It's like welfare. Now before you jump on me, I will admit that some government workers who maintain the commercial infrastructure, such as our roads, water and power systems, and enforce laws that support private property, personal safety, and commerce (commercial, tort, and criminal natural law--I know this is a big topic but ignore it for this discussion), then you could argue that it is a productive activity. Any job they do could most likely be done by private industry better and more cost effective, but ... we are saddled with what we have. There is only one thing that the government can do to create jobs: get out of the way of businesses and entrepreneurs who create them. As I have argued, the only result of government stimulus will be a stagnating economy saddled with a large government debt. The greater the government's percentage of GDP, the less productive will be the private sector (the Rahn Curve). The less productive the private sector is, the fewer jobs they will create. Let me suggest my fixes for the economy:

Do these things, even just points 1 through 6, and I guarantee you that we will see an expanding economy and rising employment. If you want economic stagnation, high taxes, and a further rise in big government, stick with Obama, the Democrats and the Republicans. We know what we need to do. |

| Orion Marine Group: Massive Driver Could Propel the Stock Posted: 14 Jul 2010 04:54 PM PDT I first learned of Orion Marine Group (ORN) in late 2009, when it was featured in a Forbes cover story regarding the 200 best small companies. Complete Story » |

| Reg Howe: BIS swaps seem meant to stretch out paper gold Posted: 14 Jul 2010 04:28 PM PDT 12:25a ET Thursday, July 15, 2010 Dear Friend of GATA and Gold: Reginald H. Howe of GoldenSextant.com, plaintiff in the 2000 federal lawsuit against the Bank for International Settlements for gold market manipulation, analyzes the recent massive gold swaps undertaken by the BIS and figures that they are likely "the latest technique for giving official support to an increasingly shaky gold banking business," a way of "increasing the ratio of paper claims on gold to the underlying amount of available real metal." Howe concludes: "The growing reluctance of central banks to part with whatever gold they have left can only be a positive development for committed gold investors." Howe's analysis is headlined "Gold Derivatives Update: BIS Swaps" and you can find it at the Golden Sextant here: http://www.goldensextant.com/commentary37.html#anchor5208 CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Sona Resources Expects Positive Cash Flow from Blackdome, On May 18, 2010, Sona Resources Corp. (TSXV: SYS, Frankfurt: QS7) announced the release of a preliminary economic assessment for gold production at its flagship Blackdome and Elizabeth properties in British Columbia. Sona Executive Chairman Nick Ferris says: "We view this as a baseline scenario for gold production. The project is highly sensitive to the price of gold. A conservative valuation of gold at $1,093 per ounce would result in a pre-tax cash flow of $54 million. The assessment indicates that underground mining at the two sites would recover 183,600 ounces of gold and 62,500 ounces of silver. Permitting and infrastructure are already in place for processing ore at the Blackdome mill, with a 200-tonne per day throughput over an eight-year mine life. Our near-term goal is to continue aggressive exploration at Elizabeth and develop a million-plus-ounce gold resource, commencing production in 2013." For complete information on Sona Resources Corp. please visit: www.SonaResources.com A Canadian gold opportunity ready for growth Join GATA here: New Orleans Investment Conference * * * Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Prophecy to Become Coal Producer This Year Prophecy Resource Corp. (TSX.V: PCY) announced on May 11 that it has entered into a mine services agreement with Leighton Asia Ltd. to begin coal production this year. Production will begin with a 250,000-tonne starter pit as planned in August, with production advancing to 2 million tonnes per year in 2011. Prophecy is fully funded to production and its management team includes John Morganti, Arnold Armstrong, and Rob McEwen. For Prophecy's complete press release about its production plans, please visit: http://www.prophecyresource.com/news_2010_may11.php |

| Posted: 14 Jul 2010 04:09 PM PDT Gold Price Close Today : 1206.80Change : -6.50 or -0.5%Silver Price Close Today : 18.274Change : 0.037 cents or 0.2%Platinum Price Close Today : 1523.80Change : 10.80 or 0.7%Palladium Price... This is a summary only. Visit GOLDPRICE.ORG for the full article, gold price charts in ounces grams and kilos in 23 national currencies, and more! |

| Posted: 14 Jul 2010 04:07 PM PDT China just announced that its Q2 GDP came in at 10.3%, just below a consensus estimate of 10.5%. Surprisingly, for some odd reason the market seems to believe this "data." Although in retrospect, based on China's bottom up GDP goalseeking, the number, which we will show in a second is completely irrelevant, could very easily be true, based on two just announced stunners about the Chinese economy. The first comes from Fitch, which in a report released today titled Informal Securitisation Increasingly Distorting Credit Data, uncovers that China has in fact been massively underrepresenting the actual amount of new loans in the first half of 2010, courtesy of precisely the kinds of securitization deals that blew up half of our own banking system: "Adjusted for informal securitisation activity, Fitch estimates that the net amount of new CNY loans extended in H110 was closer to CNY5.9trn, or 28% above the official figure of CNY4.6trn...on a flow basis the volume of credit being shifted off balance sheets in recent times has been large and rising. Activity also is largely concentrated among just a few dozen banks, and institution?specific exposure is often much higher." And some are wondering why China's AgBank was scrambling to raise $20 billion via a hurried IPO... Yet this data pales in comparison with disclosure from a recent article in South China Morning Post, in which an economist at the Chinese Academy of Social Sciences noted estimates from electricity meter readings that there are about 64.5 million empty apartments and houses in urban areas of the country! This number is five times larger than the roughly 12 million in total US public (3.89 million) and shadow (8 million as estimated by Morgan Stanley) home inventory available currently. Forget Stephen Roach - China is covertly funding and creating a housing bubble that is at least 5 times as big as that of the United States. We leave it up to you to imagine the consequences of that particular bubble's bursting... The Fitch report is pretty self-explanatory (presented below) but here is a section that highlights that China's banks are increasingly becoming more opaque in data presentation, which one can assume is due to their unwillingness to reveal the true state of affairs. Of course the same tactic worked very well for our own subprime sector... until virtually every company in the space went bankrupt in the span of 3 weeks in 2007.

As for actual issuance metrics, as Fitch says, the "volume of credit being re?packaged on the rise."

There is much more in the full report, presented below. Yet the real shocker of the day comes from the following article in the South China Morning Post, presented below in its entirety, and without comments. None are needed.

Full Fitch report:

h/t Cheeky |

| Gold Seeker Closing Report: Gold and Silver End Mixed In Volatile Trade Posted: 14 Jul 2010 04:00 PM PDT Gold saw slight gains in late Asian trade and modest losses in London before it spiked higher in late morning New York action to as high as $1217.85 by about 11:30AM EST, but it then fell to a new session low of $1202.56 in the last couple of hours of trade and ended with a loss of 0.54%. Silver jumped to as high as $18.462 before it also dropped back off in late trade, but it still ended with a gain of 0.22%. |

| Posted: 14 Jul 2010 03:46 PM PDT If we were speculators, we might consider selling. But here at The Daily Reckoning, we're not gamblers. We hold gold because it represents real wealth, not because we think it will go up in price. We don't really know what direction it is going. But that's why we hold it. We don't know what direction anything is going. The nice thing about gold is that it doesn't matter. Gold doesn't go anywhere. It just sits there. If you buy a bond, for example, you have to worry about the credit quality of the issuer. If things get bad enough, he won't be able to pay up. Your bond could be worthless. Same for stocks. A stock is a share of a company. If the company goes out of business, your stock certificates (assuming you have them) are only good for decorations. Real estate is more reliable. But there are taxes and upkeep to pay. Gold is a better way to store wealth. You don't pay property taxes on it. And the roof never leaks. Besides, gold is especially valuable when other forms of money lose their appeal. The trend of debt destruction will probably not end soon. And the feds will probably sooner or later follow Paul Krugman's advice to "raise [the Fed's] long-term inflation target to help convince the private sector that borrowing is a good idea and hoarding cash is a mistake." In the meantime, gold may go down in dollar terms. Which will make a good time to buy it. Bill Bonner Is Time to Sell Your Gold? originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." More articles from The Daily Reckoning…. |

| Currencies Rally After Alcoa Profit Announcement Posted: 14 Jul 2010 03:46 PM PDT Another Big "WOW" goes to the currencies and metals yesterday! What a rally! The currencies, led by the Big Dog euro (EUR), left the porch and chased the dollar dog down the street all day! The euro returned to the 1.27 handle, moving through the 1.26 handle like a hot knife goes through butter! By the time I made it into work from the doctor's office yesterday morning, the damage to the dollar was a done deal… Last night, before I went to bed, I checked the currencies just to see if there had been profit taking in Asia… And what to my surprise did I see? But no profit taking, what glee! The guys and gals who write about currencies, and I must say that list has grown by leaps and bounds since I began my currency letter, all attributed the rally in the currencies to the strong rally in stocks after the Alcoa profit announcement yesterday. I'm not silly enough (although a few would question that!) to think that the stock rally didn't have something to do with the currency rally…but all of it? I think not! I think that Fed Head Rosengren had a bit to do with the rally… Oh! You didn't see or hear what he had to say yesterday on your cable news station? I'm shocked… NOT! So for how long have I been telling you all that we were following Japan down the slippery slope? I even brought out the old '80s song by the Vapors about Turning Japanese. Well… A Fed Head by the name of Rosengren is singing the same tune these days. Let's listen in to his comments to The Wall Street Journal yesterday… "We have plenty of tools to tighten up if it turns out the economy grows faster and inflation becomes more of a concern. But it is a little uncertain how effective our tools are once the economy gets into a deflationary environment. The experience of Japan is sobering. They've spent a decade and a half dealing with an economy that has had falling prices and despite a variety of monetary and fiscal actions taken are still facing a deflation problem. It just highlights that it is not straightforward for policy makers to break out of a deflationary environment. And so if you were to look at the balance of risks and what we could do about those risks, the risk from a downside shock I would view as more of a problem than the risk of an upside shock of inflation or to the economy overall." OK… I hear a lot of you also saying that I've said that the US would not follow Japan through a "decade"-long funk of deflation, and that inflation would be all around us once the deflation bug was squashed… Well… I stand by those comments, and will continue to do so. We are following Japan, but we don't have to go "down there" with them! We can stop the deflation thing at the border if we want to… and the more we attempt to stop it, the more the inflation waves will come crashing down on us in the future… Ask yourself this… Would you, as a consumer, prefer to have prices remain at current levels and even fall lower… Or… Would you prefer to have them rising so fast it makes your head spin? One is deflationary, and the other is inflationary… Choose your poison because this is what the government, the Fed and Treasury has led us to… I've always contended, well, I guess, not always, but since I was able to think about this stuff, that the Fed is the cause of all our problems… Think about this… If we didn't have a Fed, the markets would set the interest rates, and they would be bang on about what's happening in the economy. We would never see inflationary times or deflationary times! The Fed was created to even out the peaks and valleys of the economy… Yeah, that's what I say, "nice job"… NOT! And somewhere along the way, it was given the responsibility of employment… Now, if you had done your job so miserably for almost 100 years, wouldn't you expect to get fired? We should repeal 1913… That's the year that we had both the Fed and income taxes forced upon us… I've said it before, and I'll say it again many times… Woodrow Wilson was the worst president ever! Ok… I really went off on a tangent there, eh? Let's get back to the currencies and metals… The Aussie dollar (AUD) rallied 1-cent yesterday, and held onto the gains overnight after seeing the color of its latest Consumer Confidence report, which printed at a HUGE increase of 11.1% in July! There's a lot to be confident about in Australia these days… The labor market is cooking with gas, the mining tax is being resolved in a better way, a new Prime Minister, and even the RBA is holding steady with the rate hikes last month… And… The most important thing to me… Australian Treasurer announced that his 2012 Budget has a larger surplus in it than previously discussed! The rally wasn't confined to the currencies yesterday… Gold and silver got in the mix too! And for the first time in a while, gold and euros rallied versus the dollar on the same day! I find this whole ying and yang with euro and gold to be strange… For instance, yesterday gold rallied because of renewed Euro-debt problems after Moody's downgraded Portugal's debt rating… But the euro rallied! Strange days indeed, so peculiar momma! Today, though, gold is pretty much flat on the day… Remember a week or so ago I told you about the better times for the British pound sterling (GBP) in recent weeks? Well… I just saw a blurb go across the screen, catching it with my good eye, that said, "UBS ends trade recommendation to sell pound sterling." Again… I'm not saying we should go out and load up the truck with pound sterling, just pointing out that things are better there, and it all points to the U.K.'s willingness to cut deficit spending. The Norwegian krone (NOK), and the South African rand (ZAR), an odd couple in every stretch of the imagination, both rallied impressively versus the dollar yesterday… Here's the thing, folks… Rand is a high yielder, and krone is a "wanna' be high yielder" that has raised rates at least two times, which is two times more than any other European country! When the karma is flowing and the stars align, like they did yesterday for the currencies, these are two of the smaller dogs that run past the Big Dog euro, and chase the dollar dog down the street. And Brazilian real (BRL)… I haven't talked much about Brazil lately… I suspect the country was in mourning after their soccer team lost in the World Cup… But have come back strong taking the real along for the ride. This real strength must have put a lot of pressure on the Central Bank Governor who, along with the President, have on more than one occasion expressed their wishes for a weaker real… The markets will have nothing to do with those wishes though! When you have a currency that sports an interest rate differential so large you could drive a Mack truck through it, you've got investors getting into line to buy this market… OK… The data cupboard comes back strong today with Retail Sales for June, and the Fed Head minutes of their last meeting. Here's the skinny on how I see Retail Sales printing this morning: The BHI (Butler Household Index) tells me the report will be weak…. and will not reverse the -1.2% decline in May that printed last month. Remember the "cash for appliance" rebate program? Well, just like all the hair-brained ideas the government has had to stimulate growth, like Cash for Clunkers, this one has hurt future sales… Yes, you see this program ended in April, and May's report was horrible, and most likely June's will be very disappointing, and it can all be traced to the government program… UGH! Then there was this… The US Senate will probably vote on the financial regulation reform bill by the end of this week… The House already passed it, and the President can't wait to get his hands on it to sign… But let me ask you this… Will it really keep us from another meltdown? In a recent survey, people were asked that question… And it was overwhelmingly decided that the bill will NOT help us avoid another meltdown… In fact, only 15% of those surveyed thought it would! So… If it's not going to help us, why pass it as it is? To recap… The currencies & metals had strong rallies yesterday, with the euro going back over 1.27, and gold back over $1,210… There was little if no profit taking overnight. Fed Head Rosengren made a comparison of the US and Japan, and Aussie confidence soared! Chuck Butler Currencies Rally After Alcoa Profit Announcement originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." More articles from The Daily Reckoning…. |

| Posted: 14 Jul 2010 03:46 PM PDT By Jeff Nielson, Bullion Bulls Canada Yet once again, I feel like the fictional little girl who journeyed "through the Looking Glass". I see all these pieces of disastrous U.S. economic data being announced – with only the mildest concern being expressed by market "experts".

Let's review what has emerged on the U.S. economy in just the past few weeks. First we had the lowest reading for U.S. housing starts in history. That horrific announcement came along-side news that U.S. foreclosures had just hit (yet) another "all-time record" in May. Now today we hear that mortgage applications have fallen to their lowest level in 14 years – going all the way back to when the bubble-blowing began in the U.S. housing market back in 1996.

However, the total collapse in the U.S. construction industry will do nothing to heal the U.S. real estate market: the most-oversupplied market in history. Somewhere around 20 million homes stand empty or abandoned. On top of that, retiring U.S. baby-boomers will need to dump $1 to $2 trillion more in real estate – just to top-up their grossly underfunded retirements. A CNN article released today reports that 47% of baby-boomers aged 56 – 62 are destined to "run out of money". With 75% of the assets of these individuals being real estate, there is no mystery in what these "boomers" will do to raise money.

Meanwhile, the news is even worse in the retail sector: the "backbone" of the U.S. consumer-economy. May retail sales plummeted by 1.1%, and now that horrific number was followed-up by news that June retail sales fell by an additional 0.5%. Since the U.S. propaganda-machine never puts these numbers in context for readers, let me do so. First of all, since these are monthly numbers, we must multiply them by twelve to get the annual rate of decline. Doing that we see that the May number worked out to an annual rate of decline of 13.2%, while June was a less-extreme 6%. Since these are annual rates, they have to be averaged-out: to slightly above 9.5%.

That doesn't sound too bad, you say? Keep in mind that the U.S. propaganda-machine doesn't adjust these numbers for inflation. As John Williams of Shadowstats.com can tell you, U.S. inflation has been averaging well over 9% all year. Since we must subtract the effects of inflation to get a real year-over-year change in U.S. retail sales, let's do that. When we add the May/June average of more than a 9% annual drop in retail sales with the (real) rate of inflation, which is also above 9%, we find that U.S. retail sales have crashed by over 18.5% over the last year.

For those who want to distrust my numbers and believe the pie-in-the-sky, fantasy-numbers of the propaganda-machine, these numbers do nothing more than confirm the observations I just made five days ago in "U.S. Mall-Vacancy Nightmare". Readers will recall in that piece that I pointed to yet more, dire U.S. economic news: U.S. mall-vacancies are once again approaching a new, all-time record – and only a year after a wave of shopping mall bankruptcies already swept across the U.S.

What the combination of the terrible mall-vacancy numbers and the even more-horrific numbers for U.S. retail sales indicate is that the U.S. retail sector is about to suffer another savage round of store-closures, mass lay-offs, and bankruptcies. Forty percent of all employed Americans work in low-wage service-sector jobs – with the vast majority of those jobs being clerical, retail sector positions. More articles from Bullion Bulls Canada…. |

| Money Disillusion: 8 Facts About UK Inflation Posted: 14 Jul 2010 03:41 PM PDT Bullion Vault But as Bullion Vault never tires of reminding people, it's crucial to put such a "dip" into context, starting with its impact on real rates of interest…

Real returns to cash aside, however, this apparently "gentle" inflation isn't just hurting savers – those rentiers whom John Maynard Keynes longed to euthanize, and whom his self-declared reincarnation Paul Krugman thinks should be forced to spend! Spend! SPEND! New data today showed UK unemployment dipping slightly to 7.8% in May, but the drop was driven by a jump in self-employed and part-time workers. Naturally, they earn less than their permanent and full-time colleagues, but fact is, real wages have long been stagnant, and have begun falling, across the UK economy. Don't tell Westminster (let alone Fleet or Threadneedle Streets), but millions of workers have already suffered effective pay cuts and a fall in their standard of living.

Glancing back at the last decade today, the average UK worker might guess what the average gold buyer feared way back when. That the credit boom – with its lifetime mortgages, spiralling credit-card limits and plunging savings rate – was just a classic case of money illusion. |

| Posted: 14 Jul 2010 03:41 PM PDT Marin Katusa is Chief Energy Strategist for Casey Research, which probably made it easier for him to get his stuff into Casey's Daily Dispatch, whereas no matter what I write, they always say to me, "This is crap! Stop sending us your Stupid Mogambo Crap (SMC)! It's crap! It's always crap!" For a long time, I thought their behavior was, you know, just because they were like everybody else, actively thwarting my every move and stabbing me in the back at every opportunity to make my life miserable, like how my garbage cans always mysteriously end up at the end of the block on garbage day, like they get there by themselves, or they are caught in some weird forces of gravity, perhaps not unlike those said to be swirling around the Bermuda Triangle, sucking boats and planes into some weird inter-temporal time-space discontinuum or, in this case, at the end of the street. And when I walk down there to retrieve them, all my stupid neighbors just happen to be outside, and they say, "Hello, neighbor!" as I walk past, like I don't know that what they really, really mean is, "I hate you, Mogambo! And that is why we put your garbage cans at the end of the block so that you will have to go get them and drag them back, and maybe you will have a heart attack and then you'll die! That's how much we hate you! Just like your wife and kids! Hahaha!" So, naturally, I say to them, "Shut up! And why don't you show a little smarts by going out and buying gold, silver and oil since it doesn't take a real genius to see that our own government has destroyed the country by plunging us into un-payable debt in order to support whole populations of people, both domestic and foreign, and regulate everything via 'a multitude of new offices, sending hither swarms of officers to harass our people and eat out their substance,' all made possible by the despicable Federal Reserve creating So Freaking Much (SFM) money that was thusly borrowed and spent on new offices and officers, to name a few, money which must continue to be produced and which will, in turn, produce ruinous, cataclysmic inflation in consumer prices that will destroy us more thoroughly than did Godzilla when he was stumbling angrily around Tokyo, maliciously flattening some buildings, stomping on a few trains and taking out whole swaths of the electrical grid!" Well, I notice that my neighbors never really have a good reply to that, and as I can trudge back up the street with my garbage cans in tow, I shout "Moron!" at each neighbor as I pass them, just to remind them about how stupid they are not to buy gold, silver and oil to protect themselves against the predations of an expensive, expansive, deficit-spending, idiotic socialist government and a Federal Reserve that expands the money supply to an unbelievable size to accommodate such insane levels of governmental borrowing and spending, despite how Utterly, Utterly Bizarre (UUB) it all is even to contemplate – for even a nanosecond! – such economically-suicidal behavior in the face of its disastrous inflationary effects. Such fiscal and monetary stupidity, I maintain, can only be the result of a conspiracy of some kind, which is a whole other topic, even though I am reminded of the old saying "Never attribute to malice what can be explained by stupidity," although my comeback is "But it takes such a mass stupidity that it must involve some kind of thought-control beams from outer space, or government goon squads putting psychoactive substances in our food!" Well, it turns out that neither Mr. Katusa nor anybody at Casey Research wants to get into a discussion with me about juicy conspiracy theories and how there are murderous enemies galore out there, four of which are the Obama administration, the Congress, the Federal Reserve and the Supreme Court which continuously upholds that money does not have to be made of silver or gold like the Constitution requires, which it requires so that the supply of money will always be stable and thus easily prevent inflation in the money supply which produces inflation in stock prices, and prevent inflation in bond prices, and prevent inflation in house prices, and prevent inflation in the price of government, which is not to mention the sheer impossibility of a derivatives market that swamps everything else in terms of sheer size. Instead, the Supreme Court has consistently ruled, to its continual shame, that money can be made of paper and promises so that we will have inflation in stock prices, and inflation in bond prices, and inflation in house prices, and inflation in the price of government, which is not to mention allowing a derivatives market that swamps everything else in terms of sheer size. Nor do they want to get me started on a Loud Mogambo Rant (LMR) about the horrors of inflation in prices that follows inflations in money supplies, but they apparently want to keep it more topical, and thus they discuss the BP oil spill and the Obama administration over-reacting by outlawing off-shore oil drilling, which has lots of knock-on effects, and which is the reason that I am here in the first place. Firstly, he says, "Thousands upon thousands of rig workers were effectively laid off when the 33 rigs operating in the Gulf stopped drilling. The full economic impact of the ban is still unrealized, with the layoffs just starting, but estimates put the figure for lost wages as high as US$330 million per month. Given the potential economic losses, BP's US$100 million compensation fund for rig workers starts to look rather paltry." I don't bring this up only because of the ugly economic effects of $330 million per month being cut out of aggregate spending or the blighted circumstances of the people who suffer as a result, as bad as that it, but that "It doesn't end there either. There's a domino effect in play as well – each rig job supports up to four additional jobs for cooks, supply-ship operators, and those servicing the industry." Thus, the jobs multiplier is 4! This is important, because if the multiplier is 4, which it probably is because all economic multipliers like this seem to be between 4 and 7, and if all multipliers of this kind are likewise 4, then since there are 130.4 million jobs on all non-farm payrolls and 22.7 million of them are government jobs, but which may, or may not, but probably don't, count a couple of million teachers and support personnel, among others, who are paid by taxes but are not actually government employees. So, if the total is actually 25 million government and taxpayer paid jobs, and the multiplier is 4, then I can make the ridiculous statement that 100 million of the 130 million non-farm jobs are based on taxpayers! There are one hundred million taxpayer-paid "government" workers and only 30 million private sector-workers! Gaaaahhh! We're Freaking Doomed (WFD)! Fortunately, as you can tell by the serene look on my face and the way I am not vomiting up blood at the contemplation of imminent destruction that I know that the example is bogus, but 3 guys supporting 10 is the way it feels around here sometimes, and thus I am justified in citing it as a fact. It is also a fact that the noun "we" in the phrase "We're Freaking Doomed (WFD)" does not include those who buy gold, silver and oil, which is (at last count) you and me, in which case it is "They're Freaking Doomed (TFD) but We're Making Money Like It's Going Out Of Style (WMMLIGOOS)! Whee! This investing stuff is easy!" The Mogambo Guru The Money Supply Conspiracy originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day."

|

| Heritage Summer FUN US Coin Auction Tops $7.4 Million Posted: 14 Jul 2010 03:41 PM PDT DALLAS, TX – An original 1867 5C Rays PR65 Cameo NGC. Dannreuther-1A, State a/a, a highly desirable and celebrated rarity, brought $57,500 to lead Heritage's $7,387,384 July Orlando, FL Summer FUN Signature US Coin Auction.

Demand for high quality numismatic gold rarities continued in Orlando, with seven of the top 10 lots being gold rarities. All prices include 15% Buyer's Premium. (…) © Heritage Auctions for Coin News, 2010. | |

| Gold Prices Rebound to Top $1210, Silver Gains 1.9% Posted: 14 Jul 2010 03:41 PM PDT

Precious metals climbed as a group. Silver gained 1.9 percent, platinum climbed 1.3 percent and palladium jumped 3.3 percent. In other markets, crude oil futures rallied nearly 3 percent while U.S. stocks surged with major indexes advancing between 1.4 percent and 2.0 percent. (…) © CoinNews.net for Coin News, 2010. | |

| Gold, Silver, Metal Prices Commentary – July 14, 2010 Posted: 14 Jul 2010 03:41 PM PDT

Gold prices remained above the $1210 level overnight but the metal was as yet unable to add significant amounts to Tuesday's Portuguese downgrade-induced gains as rising overseas equities markets and a rebound in the euro capped advances. Indian buyers remained on the sidelines as shopkeepers reported no changes in pending orders for bullion purchases from would-be buyers under the $1190 value zone- the very price neighborhood from which the yellow metal rebounded recently. Should assaults on the $1220-$1235 region fail to be successful, such buyers may yet see their orders filled. (…) © Jon Nadler, Kitco Metals Inc. for Coin News, 2010. | |