Gold World News Flash |

- Bears Beware II

- Buying Gold, Silver and Oil: The Ultimate No-Brainer

- Client Update – Donner Metals

- The G20 and a Double Dip Recession

- ROFL: "It Wasn't Bush's Fault!"

- Gold Technicals for July 13th

- Jim?s Mailbox

- Hourly Action In Gold From Trader Dan

- JPMorgan et al Show Up at the London P.M. Gold Fix Again

- Gold: Rushing The Line!

- Why the "100 Minus Your Age" Rule is Wrong

- Inflation: The Runaway Train

- LGMR: Gold Jumps with Silver & Stocks as Chinese Agency Downgrades Western Debt

- The Engine Of Job Creation Is Full of Sand

- Grandich Client Silver Quest Resources Finds New Zones and Bulks Up Land Position

- Crude Oil to Take its Cues from U.S. Corporate Earnings, Gold May Be Ready to Fall Ag

- GoldSeek.com Radio Gold Nugget: Robert Kiyosaki & Chris Waltzek

- FICO Credit Scores Collapse - 25% of Americans Sink Below 600 vs. 15% Historically

- A Case Study on Cash

- Talk of a Bubble in Gold is Just Fear-Mongering, Nothing More

- The Euro Gold Standard

- The End Game and the Illusory Gold Bubble

- Re-visiting the “China Story”

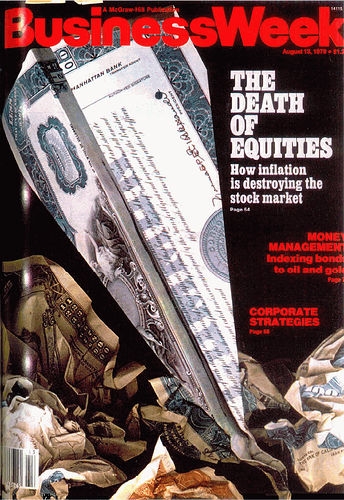

- Individual Investors Abandon Stocks; The Death of Equities Redux?

- When Animal Spirits Attack

- Asian Metals Market Update

- What Does The Financial Reform Bill Do Other Than Being Completely And Utterly Worthless?

- Gold Seeker Closing Report: Gold and Silver Gain With Stocks and Oil

- The Facts About This Depression Are Getting Extremely Grim

- US Corporate Pension Deficits Widen in June

- Best Gold Blogs

- Baltic Dry Index Collapse

- Gold Prices Rebound to Top $1210, Silver Gains 1.9%

- 2009 Jefferson Nickels and Roosevelt Dimes Values

- Patrick A. Heller: BIS swap mystery is likely bullish for gold

- John Lee: Focus on Junior Miners

- Gold steady as euro debt woes support

- BIS swap transactions show creative use of gold – GFMS

- A Glowing Recommendation

- How to Cure an Economic Depression

- In The News Today

- Gold Daily Chart

- June Deficit Fails To Account For $142 Billion In Excess June Borrowings; U.S. Has Issued $1.5 Trillion Excess Debt Over Budget In Past 4 Years

- Tomorrow the Gold Price Ought to Advance.

- Stores To Empty When Hyperinflation Arrives

- TUESDAY Market Excerpts

- Goldman Sachs On How To Navigate The Slowdown

- A Look at Empty Store Shelves in America

- Apple: Hedge Fund Slingshot Is Back

- Trader alert: Stocks have reached a key level... again

| Posted: 13 Jul 2010 07:46 PM PDT In my last article Bear's Beware I warned that shorts were running the risk of getting caught in an explosiverally as the intermediate cycle was due to bottom. Well, it did bottom and bears have watched their profits quickly evaporate as the market has surged out of the intermediate cycle low. The initial thrust out of one of these major cycle bottoms will usually gain 6-10% in the first 8-13 days. We are now 6 days in and up 6.9% so far. I expect we will see a test of the 200 day moving average before we see any significant pull back. These initial moves out of intermediate bottoms don't tend to wait around as smart money smelling blood in the street pile in quickly. It's only the little guy, who doesn't understand what has just happened, that continues to fight the trend change. This is usually about the time that I see the technicians start calling for this or that resistance level or trend line to put a halt to the rally. They are, of course, assuming this is a bea... |

| Buying Gold, Silver and Oil: The Ultimate No-Brainer Posted: 13 Jul 2010 07:46 PM PDT In my monthly report to Glabbnarxx, the new despotic Overlord for this sector of the galaxy (and who, I heard, is supposed to be a real pinhead of a dork), I included the news that as a result of oceans of money being created and spent, you would think that none of the sentient inhabitants of this planet called Earth would buy bonds to receive the paltry, miserable, fixed coupon stream from the already-overpriced bonds because of the horrifying, unstoppable inflation in consumer prices that will soon, and surely, result from all the insane amounts of money being created by the Federal Reserve, which was then borrowed and spent by the federal government, and thus the price of bonds will soon fall in response to such inflation in prices, handing a huge capital loss to any moron who bought bonds at today's extremely high, ludicrously high, insanely high prices (and thus interest rates at such extreme, ludicrous, insane lows). This report has surprisingly caused a stir at SubSector Centra... |

| Posted: 13 Jul 2010 07:46 PM PDT The following is automatically syndicated from Grandich's blog. You can view the original post here. Stay up to date on his model portfolio! July 13, 2010 01:35 PM Right on the heels of the mine development decision announced Friday are more drill results from Donner Metals (TSXV: DON) Matagami Project in Québec. Friday's news brought in volume over 3.3 million with the share price opening at $0.185 and closing at $0.28. In a news release from Xstrata's head office, Jean Desrosiers, VP of Mining Operations for Xstrata Zinc Canada commented: "We are delighted to be able to commence construction on the development of the Bracemac-McLeod Mine. The project is a low capital cost, high return project that will provide a continued feed of ore to Xstrata's Matagami concentrator once the Perseverance Mine comes to the end of its life. The new mine will use existing processing infrastructure and will provide ongoing employment opportunities for the existing workforce at Perseverance. The new ... |

| The G20 and a Double Dip Recession Posted: 13 Jul 2010 07:46 PM PDT [CENTER]Mark J. Lundeen[/CENTER] [CENTER][EMAIL="Mlundeen2@Comcast.net"]Mlundeen2@Comcast.net[/EMAIL][/CENTER] 13 July 2010 A global double dip is unavoidable. The problem is that we have massive global debt weighing down the world's economies that are woefully incapable of servicing the burdens of debt placed on them. Debt by itself is not necessarily bad, if used properly debt has many benefits. Debt financed the industry and commerce that lifted western civilization out of the dark ages. But debt has a dark side too. What it built, it can destroy. So what distinguished creative debt, from destructive debt? Simple, all debt finances economic activity of some nature. If in the creation of debt, economic activity is stimulated that pays off the debt, as it produces a profit for the lender and borrower; that is good debt. Valuable goods and services are produced, jobs are created, and taxes are paid, all thanks to debt. But this i... |

| ROFL: "It Wasn't Bush's Fault!" Posted: 13 Jul 2010 07:46 PM PDT Market Ticker - Karl Denninger View original article July 13, 2010 11:24 AM What a complete and utter load of crap: [INDENT]President Obama and congressional Democrats are blaming their trillion-dollar budget deficits on the Bush tax cuts of 2001 and 2003. Letting these tax cuts expire is their answer. Yet the data flatly contradict this "tax cuts caused the deficits" narrative. [/INDENT]Well, perhaps Obama is running that line of crap, but I'm not - and never have been. But let's look at what's being "identified" by the CBO: [INDENT]The bulk of the swing resulted from economic and technical revisions (33%) [We lied and the economy was being pumped with excessive debt], other new spending (32%) [Medicare Part D anyone?], net interest on the debt (12%) [What, you mean I have to pay that credit card?!], the 2009 stimulus (6%) and other tax cuts (3%). Specifically, the tax cuts for those earning more than $250,000 are responsible for just 4% of the swing. If there were no Bu... |

| Posted: 13 Jul 2010 07:46 PM PDT courtesy of DailyFX.com July 13, 2010 06:11 AM Gold has topped. Please see the latest special report for details. Near term, gold is making its way lower and most likely in an impulsive fashion. From a trading standpoint, the next opportunity will come from the short side on completion of wave iv of 3 (possibly complete now). Jamie Saettele publishes Daily Technicals every weekday morning, COT analysis (published Friday evenings), technical analysis of currency crosses on Monday, Wednesday, and Friday (Euro and Yen crosses), and intraday trading strategy as market action dictates at the DailyFX Forum. He is the author of Sentiment in the Forex Market. Follow his intraday market commentary and trades at DailyFX Forex Stream. Send requests to receive his reports via email to [EMAIL="jsaettele@dailyfx.com"]jsaettele@dailyfx.com[/EMAIL].... |

| Posted: 13 Jul 2010 07:46 PM PDT View the original post at jsmineset.com... July 13, 2010 06:52 AM Dear Lt, When your banker cuts your credit rating the end is near! People need to give their heads a shake if they wish to sell gold for bonds! Best, CIGA BT Dear BT, Now you don’t believe the West would ever have a bias in favor of the West, do you? We are the stars of xenophobia. Should we anticipate our Western credit agencies to downgrade the Yuan and Renminbi? I would say the chances are high! Regards, Jim Chinese rating agency strips Western nations of AAA status China’s leading credit rating agency has stripped America, Britain, Germany and France of their AAA ratings, accusing Anglo-Saxon competitors of ideological bias in favour of the West. More…... |

| Hourly Action In Gold From Trader Dan Posted: 13 Jul 2010 07:46 PM PDT |

| JPMorgan et al Show Up at the London P.M. Gold Fix Again Posted: 13 Jul 2010 07:46 PM PDT Gold's high of the day [around $1,213 spot] was moments after Far East trading began on Monday morning... which was shortly after 6:00 p.m. in New York on Sunday night. The price was down about $10 by the time the Comex opened for trading yesterday morning... and the smallish rally that developed at that moment only lasted until the London p.m. gold fix... before the bullion banks showed up and that was it for the day. Every attempt to break back over $1,200 the ounce got rebuffed... and gold closed at its low of the day... which, according to Kitco, was $1,195.40 spot. Volume was not overly heavy... which made 'da boyz' job of pushing the gold [and silver] price around real easy. Silver's high of the day [$18.15 spot] was at the open in Far East trading on Monday morning. Then the price declined until the London a.m. gold fix was in at 10:30 a.m. local time. From there. it rallied until the London p.m. gold fix... which was 10:00 a.m. in New York... |

| Posted: 13 Jul 2010 07:46 PM PDT Stewart Thomson email: [EMAIL="s2p3t4@sympatico.ca"]s2p3t4@sympatico.ca[/EMAIL] July 13, 2010 1. First, my subscribers are probably the largest group of GDXJ shareholders. If I told everyone last week that "it's gonna crash, it's 2008, sell everything!" I probably could have tanked the GDXJ down to the $15 area, maybe even to $10. Of course, I didn't say that. I said buy. 2. I termed July 1st 2010 "Black Thursday". Tuesday, July 6th was another black day. Those two days were marked by massive selling across the board, in both the gold and fund communities. I was inundated with various email "analysis" showing me why gold was going down and how wrong I was to buy as it fell. Question: How important does that analysis seem this morning, how wrong am I now? 3. This situation reminds me greatly of past bottoms in the market. Putting in a final low is a process, not an event. The level ... |

| Why the "100 Minus Your Age" Rule is Wrong Posted: 13 Jul 2010 07:46 PM PDT By Tom Dyson Monday, July 12, 2010 The other day, a millionaire asked me to construct a retirement portfolio for her Unfortunately, I don't have the right government certifications for this type of work, so I had to refuse the job. But it got me thinking Most financial planners would have recommended some ratio of stocks to bonds. The rule of thumb is, you subtract your age from 100. That's the percentage you put in stocks. The rest you put in bonds. My friend is in her fifties. A conventional financial planner would probably have her put 45% of her money in stocks and 55% in bonds. I'm 35. They'd have me put 65% in stocks and 35% in bonds. I can't stand this advice. For starters, it's based on the flawed economic theories they teach at business school. These theories suggest the best returns come from buying and holding a diversified basket of stocks. Buy and hold worked last century when the Fed was able to reinflate the economy every time it looked like ... |

| Posted: 13 Jul 2010 07:46 PM PDT Kieran Osborne, CFA, Merk Investments Inflationary risks have seemingly fallen out of the mindset of many investors recently, with the European debt crisis causing many to reevaluate their outlook for global economic growth in concert with record low headline CPI numbers being released. Despite this, gold, traditionally a hedge against inflation, continues to move up in price. Is this dynamic inconsistent? We don’t think so. Of course, some of gold’s price movement may reflect its safety aspect, given renewed concerns over the long-term health of the economy, but in our opinion, inflationary concerns are very much valid and should be front and center of any investment strategy going forward. We believe there may be considerable inflationary pressures built into the system, which may become apparent over the coming years. Importantly, we believe structural changes to the global economic landscape have raised the risk of inflation in the U.S. subs... |

| LGMR: Gold Jumps with Silver & Stocks as Chinese Agency Downgrades Western Debt Posted: 13 Jul 2010 07:46 PM PDT London Gold Market Report from Adrian Ash BullionVault 09:15 ET, Tues 13 July Gold Jumps with Silver & Stocks as Chinese Agency Downgrades Western Debt, Central Banks Switch Out of Dollars THE PRICE OF GOLD rose on Tuesday morning in London trade, recovering all of Monday's 2.1% drop as new US trade data drove the Dollar lower, and world stock markets extended their week-long rise. Gold priced in Euros also gained, hitting one-week highs above €31,000 per kilo and reversing an earlier drop after the single currency shrugged off a downgrade to Portugal's debt rating by the Moody's agency. China's Dagong Global Credit Rating Co. meantime downgraded US, German, UK and French government bonds from their "triple-A" status, highlighting instead the "wealth creating capacity" of emerging Asian economies. "The gold market [was] desperately looking for volumes and directions," said one Hong Kong dealer overnight. "Barring a major risk-off event," says Mitsui's... |

| The Engine Of Job Creation Is Full of Sand Posted: 13 Jul 2010 07:46 PM PDT Market Ticker - Karl Denninger View original article July 13, 2010 04:51 AM I give the NFIB credit for their analysis, but not for their "education" during the last bubble - and this collapse. Indeed, their newest report is rather interesting: [LIST] [*]The prime problem with small business is slow or declining sales, and is worse today (by six points) than last year, which was the so-called "formal" bottom of the recession. Access to credit is the prime problem in only 8% of small businesses. [*]38% of small businesses are using credit cards as a funding mechanism (!!!) At today's pricing this is suicidal. If this number indicates those small business who have effectively been forced into this use of credit (and I suspect it is) we're in deep kimchee - nearly 4 in 10 small businesses are likely to fail in the next two to three years as a consequence of this. [*]Far too many (11%) small business owners are collateralizing real estate as a means of fundin... |

| Grandich Client Silver Quest Resources Finds New Zones and Bulks Up Land Position Posted: 13 Jul 2010 07:46 PM PDT The following is automatically syndicated from Grandich's blog. You can view the original post here. Stay up to date on his model portfolio! July 13, 2010 04:58 AM I believe this is the beginning of lots of news flow on SQI. CEO Randy Turner tells me based on staking, SQI could now be the largest land holder in the Yukon Gold Rush area. We’re also eagerly waiting on news from Capoose. The share price has been in a vey long basing phase and with a significant bump up in volume in recent days, could be ready to challenge its highs made earlier in the year (I own 2 million shares as of this posting). [url]http://www.grandich.com/[/url] grandich.com... |

| Crude Oil to Take its Cues from U.S. Corporate Earnings, Gold May Be Ready to Fall Ag Posted: 13 Jul 2010 07:46 PM PDT courtesy of DailyFX.com July 12, 2010 08:02 PM Crude oil has established a clear uptrend in recent weeks, but will the rally continue with U.S. corporate earnings season set to kick off this week? Gold's recent price action is indicative of a potential move lower. Commodities - Energy Crude Oil to Take its Cues from U.S. Corporate Earnings Crude Oil (WTI) $74.61 -$0.35 -0.47% Commentary: Crude oil is slightly lower after falling 1.5% on Monday. The latest action seems to be a bit profit taking, as the commodity has risen briskly off the $71.50 lows put in just last Tuesday. This week marks the beginning of the U.S. corporate earnings season, which will undoubtedly have a significant impact on the direction of equity markets, and in turn, crude oil markets. Earnings announcements from bellwether corporations such as JP Morgan, will give markets an idea of the health of the U.S. economy and thus bear close watching. Notable economic releases this week inclu... |

| GoldSeek.com Radio Gold Nugget: Robert Kiyosaki & Chris Waltzek Posted: 13 Jul 2010 07:00 PM PDT |

| FICO Credit Scores Collapse - 25% of Americans Sink Below 600 vs. 15% Historically Posted: 13 Jul 2010 06:42 PM PDT |

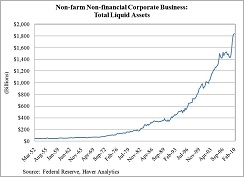

| Posted: 13 Jul 2010 06:37 PM PDT Annaly Salvos submits: There has been a lot of discussion recently about corporate cash levels, both in newspapers and blogs . Back in June, the Fed published the 1Q 2010 Flow of Funds report that shows corporations are sitting on $1.8 trillion of cash.  A recent article in the Washington Post suggests that this balance sheet cash is actually pent up capital expenditure waiting to happen, and blames the hoarding behavior on uncertainty over new regulation and the likelihood of higher taxes going forward. This seems like a reasonable assumption, when you consider the current low level of net domestic investment. This measure, gross domestic investment less consumption of fixed capital (or depreciation), is now at levels comparable to the mid-1980s. Complete Story » |

| Talk of a Bubble in Gold is Just Fear-Mongering, Nothing More Posted: 13 Jul 2010 06:36 PM PDT |

| Posted: 13 Jul 2010 06:25 PM PDT The Pragmatic Capitalist submits: Regular readers have often heard me compare the euro to the gold standard. In effect, the euro as a single currency system is restrictive in exactly the same ways that the gold standard was restrictive. I have referred to this as the “inefficient market irony behind the euro crisis“. I haven’t seen the comparison made too often elsewhere until reading the Financial Times the other day. Edward Chancellor of GMO beautifully describes the restrictions of single currency systems and why they ultimately fail:

Complete Story » |

| The End Game and the Illusory Gold Bubble Posted: 13 Jul 2010 06:22 PM PDT |

| Posted: 13 Jul 2010 06:09 PM PDT Great credit expansions prompt investment decisions that only make sense within the fantasy-world created by a relentless deluge of new money. When the flow of new money slows or when the true nature of the inflation-fueled boom becomes apparent to a critical mass of people, many of the investments prompted by the easy money fail and the economy enters a recession. |

| Individual Investors Abandon Stocks; The Death of Equities Redux? Posted: 13 Jul 2010 06:07 PM PDT Ravi Nagarajan submits: Throughout the 1990s, mutual funds were marketed to individual investors with stellar ten and fifteen year track records made possible by the record bull market of the 1980s and 1990s. While there were a few notable interruptions, with the 1987 crash being the most obvious, most individual investors learned to “buy the dips” throughout this period. Most large capitalization companies made significant advances in earnings during these years but the expansion in earnings multiples had the effect of turbo charging returns to investors. Of course, this all culminated in the bubble of the late 1990s, but small investors remained relatively optimistic for much of the past decade, having been trained to buy the dips for so long. However, optimism may now be turning to pessimism as small investors abandon stocks in disgust.

Complete Story » |

| Posted: 13 Jul 2010 05:43 PM PDT "Yes that's a gun in my hand. Yes it's pointed at your head. And no, I have no intention of pulling the trigger. Would you like some whiskey?" More on this hypothetical line of thought below. But first, all appears to be right with the world today. Stocks are up locally. Last night in New York investors got it in their pretty little heads that earnings for corporate America were better than expected. The catalyst for that notion came from a $136 million net profit from aluminium producer Alcoa. That's definitely good news for Alcoa. But how does it measure up against the big picture we laid out yesterday? Can you continue to have good corporate earnings performances in an economy that's in the middle of a structural deleveraging? Maybe. We doubt it. Most companies will see smaller profits and less growth if households deleverage. And of course, households are deleveraging partly because businesses are deleveraging too. And business spending, for the most part, drives growth in household incomes. But what are we talking about anyway? Australia is not America. And Australia isn't deleveraging at all. As Steve Keen pointed out awhile back, Australia was one of few countries where households actually RE-leveraged during the GFC. Household debt - mostly mortgage debt - is now 155% of GDP according to the Reserve Bank of Australia. It was either a very contrarian move...or a case of animal spirits gone wild! Of course you need to feel like tomorrow is going to be better than today in order to take a risk. This is fundamental not just to markets, but, we reckon, to life as well. Otherwise, why else would you get out of bed if you didn't things were going to be better? Why would you go out on a first date...or lean in for a first kiss...or sign your first pre-nuptial agreement? Growing economies...growing people...growing anything...it all requires the proper spirit of enterprise. But life is not a theory. How you feel about something is how you feel about it. It doesn't alter what the thing is. We realise this point is arguable if you're a physicist. And it might even be arguable if you're an economist. After all, what people are willing to pay for something is part of what prices communicate, and prices vary based on an aggregation of personal preferences (another miracle of the market). And what people are willing to pay is influenced by whether they think, economically, every day is getting better and better (in which case they buy a tall latte with extra caramel and emerging market bonds or commodity currencies) or whether they think things are not getting better (in which case they hoard cash and gold and drink tap water and read Foucault and Derrida while buying extra razor blades). But sentiment and confidence are not the ultimate factors, we'd argue, in deciding what a thing is worth. Or whether a thing is even a thing. Which brings us back to the subject of bank capital. Yes, you'd think it would be pretty straight forward deciding what a capital asset is and what it is not. Definitions shouldn't be that hard, unless you're deliberately trying to confuse people. A capital asset - an asset whose purpose is to make money - should be tangible, relatively easy to value, and thus form the foundation for a well-capitalised company. You'd think. If you think. But along comes this stunner of an article from Bloomberg yesterday. You know the world's banking system is well and truly stuffed when bankers can't even agree amongst each other on what capital is. The reason they're disagreeing, you'd suspect, is that depending on the definition, some firms are better capitalised than others. And some are not well capitalised at all. According to the article, "The 36-year-old Basel committee, a body of central bankers and regulators that sets capital standards for banks worldwide, was asked by the Group of 20 nations to draft new rules after the worst financial crisis in 70 years caused lenders to write off $1.8 trillion." By the way, we reckon that's roughly have of the total losses that will be realised by the time the global deleveraging is done. That argues for taking out the 2003 lows on stock markets...eventually. Why were the G-20 leaders so keen to redefine capital? "G-20 leaders urged the committee to improve the quantity and quality of bank capital, strengthen liquidity requirements and discourage excessive leverage. They set a deadline of December for making the rules and originally gave countries until the end of 2012 to implement them." The trouble is that if you have an exact definition of capital and you strengthen liquidity requirements and discourage excessive leverage, you probably get a huge reduction in loan growth from the banks to the real economy. That means less growth. And it also means contraction. The spirit is willing, but the balance sheet is weak. No one wants contraction, though. So they're going to redefine just what capital is. "Representatives from the U.S. and the U.K., who have sought to rein in risk-taking, are willing to compromise on how capital is defined to reach an agreement at a committee meeting that begins tomorrow, the people said...The committee is expected to decide on the definition of capital this week and defer issues such as capital ratios until its meetings in September and October, according to members." When in doubt - or when the existence of large financial institutions is at stake - change the rules! But changing the rules does not change the reality...it only delays the inevitability of what must happen. What must happen is that the bed debts accumulated during the excesses of the global credit boom must be liquidated. Until they are, there will just be more garbage money thrown by governments to prop up asset values....mostly of assets that aren't producing income. That's a massive amount of mal-investment...and it chokes off the flow of real credit to real enterprise, which is pretty discouraging if you think about it. If you think. And finally, what do you make of the story last week that China's State Administration of Foreign Exchange said it won't go nuclear on the free-spending Americans and dump their Treasury bonds, crash their dollar, and generally prosecute an unconventional and unrestricted economic war on Uncle Sam? The committee that manages China's $900 billion investment in Treasury bonds and its $2.45 trillion in foreign exchange reserves said that, "Any increase or decrease in our holdings of U.S. Treasuries is a normal investment operation." The acronym for the committee is, without any trace of irony, SAFE. SAFE says, "U.S. Treasury bonds deliver fair good security, liquidity and market depth with low transaction costs." SAFE says gold is not liquid enough to figure prominently in the diversification of China's big pot of reserves. SAFE says gold, "cannot become a main channel for investing our foreign exchange reserves." SAFE also says that dollar devaluation is bad for SAFE and everyone else. So SAFE says it's happy to buy U.S. bonds and not so happy to buy gold. Do as I say, not as I do. Of course the forex war chest is a problem of China's own creation. It's not a horrible problem to have, mind you. But when you've generated a giant trade surplus, what you do with that money becomes a pressing issue. Invest at home? Buy U.S. bonds? Sell the bonds and crash the dollar, damaging the value of your own asset but ruining your adversaries finances in the process? Hmmn. "No that's not a gun in my hand at all. It's my finger. Bang." Similar Posts: |

| Posted: 13 Jul 2010 05:04 PM PDT The Portugal debt rating downgrade by Moody resulted in gold and silver flaring up. But the euro also rose and the US dollar weakened. I do not understand the timing of the rating downgrade after the soccer world cup. There seems be vested interest and connivance with hedge funds and others and that the Portugal rating downgrade could have been leaked. |

| What Does The Financial Reform Bill Do Other Than Being Completely And Utterly Worthless? Posted: 13 Jul 2010 04:02 PM PDT

So will the financial reform bill do any good at all? Well, yes. A very, very small amount. Essentially, it is kind of like going over to the Pacific Ocean and scooping out a couple of cups of water. That is about how much good this bill is going to do. But U.S. Senate Majority Leader Harry Reid is making this sound like this is some kind of history-changing legislation.... "We're cleaning up Wall Street." Oh really? Charles Geisst, professor of finance at Manhattan College recently had the following to say about this absolutely toothless bill.... Like health-care reform, this bill is being drawn up to grab headlines but its details betray it as nothing more than a slap on the wrist for Wall Street. It is true that Wall Street can commit grand theft and apparently get off with nothing more than community service. The truth is that most of us never expected the U.S. government to truly take on Wall Street. The relationship between the two is just way too cozy for that to happen. So does the financial reform bill actually accomplish anything? Yes. Let's take a look at the "sweeping changes" contained in the bill.... *Federal regulators will receive more authority to monitor everything from mortgages to complex derivatives. (Oh goody! Just what we needed - more federal regulation! As if federal agencies have ever been very good at regulating the financial industry...) *Financial firms will be required to reduce the debt they take on and to hold more capital in reserve. (This will make financial firms marginally more stable, but the truth is that the big banks are so good at accounting tricks that this will not really make much of a difference. When a big firm is going to fail a few extra bucks in reserve is NOT going to make a difference.) *The U.S. government will be given extensive power to seize collapsing financial firms. Federal regulators would keep collapsing firms operating long enough to prevent a massive panic and would slowly sell off its pieces. (This does not eliminate "too big to fail" - instead it enshrines "too big to fail" into law permanently. The bill institutes "orderly procedures" for exactly how to proceed when the U.S. government steps in and takes over failing financial firms. Just what we need - more socialism!) *The financial reform bill creates a new Bureau of Consumer Financial Protection at the Federal Reserve that is supposed to help prevent abusive lending by mortgage and credit card companies. (Wait a second - this bill gives the Federal Reserve more power? Who came up with that grand idea? Yeah, let's give the fox more power to guard the hen house. The truth is that the Federal Reserve is one of the core problems with our economic system as we have written about previously.) *Some rather toothless regulations will be placed on the derivatives markets, hedge funds and credit rating agencies. (A big emphasis on "toothless".) So what does this legislation not do? -It does not eliminate "too big to fail". The truth is that the biggest banks and financial institutions have been systematically gobbling up a bigger and bigger share of the market and this legislation does nothing to change that. Anthony Sanders, a professor of finance in the School of Management at George Mason University, says that this bill essentially does nothing about the "too big to fail" problem.... "As far as I can see the 'too big to fail' problem is still in place." In fact, this legislation may cause even more consolidation in the financial industry, because small firms are going to have an especially difficult time complying with all of the new rules, regulations and paperwork created by this bill. -The financial reform bill does nothing about the horrific bubble in the derivatives market. Originally it was believed that some tough regulations were going to be imposed on derivatives trading, but the Wall Street lobbyists were all over those provisions like rabid dogs. So now there is loophole after loophole in the bill and the "derivatives problem" still ominously hangs over Wall Street. Not that there is any way to fix it. Nobody actually knows the true total value of all the derivatives in the world, but estimates place it at somewhere between 600 trillion dollars and 1.5 quadrillion dollars. When the derivatives bubble pops, and it will, there won't be enough money in the entire world to fix it. -The financial reform bill does nothing about mortgage giants Fannie Mae and Freddie Mac. They remain financial black holes that the U.S. government will be forced to pour hundreds of billions (if not trillions) of dollars into. -A proposal to conduct yearly comprehensive audits of the Federal Reserve was left out of the financial reform bill. Instead, a very, very, very limited one-time audit of a few of the transactions that the Federal Reserve conducted during the height of the financial crisis was included. What we really need is a true audit of the Fed. The Federal Reserve has never been the subject of a true, comprehensive audit since it was created in 1913. Considering the fact that the Federal Reserve issues our currency, controls our banking system, sets our interest rates and is basically the core of the U.S. economy, you would think that the American people should have the right to see what is going on over there. But Ben Bernanke and the rest of the folks over at the Fed fought against the comprehensive audit proposal with everything that they had. They seemed extremely alarmed that the American people might actually get to take a look inside their books. The truth is that unless something is done about the Federal Reserve, no true "financial reform" is really going to take place. But the U.S. Congress could have done at least some good with this bill. Instead, they have given us a 2,300 page mess that is pretty much completely and utterly worthless. So what do you think about the "financial reform" bill. Feel free to leave a comment with your opinion.... |

| Gold Seeker Closing Report: Gold and Silver Gain With Stocks and Oil Posted: 13 Jul 2010 04:00 PM PDT Gold rose in London to see an almost $20 gain at as high as $12.17.80 by about 9AM EST before it chopped its way back lower into the close, but it still ended with a gain of 1.26%. Silver climbed over 2% to as high as $18.325 by late morning in New York before it fell back off a bit in the last couple of hours of trade, but it still ended with a gain of 1.96%. |

| The Facts About This Depression Are Getting Extremely Grim Posted: 13 Jul 2010 03:13 PM PDT Many readers have been contacting me with reminders that the most important story in America right now - the shockingly high level of long-term unemployment - is about far more than the latest statistics. It's about people's lives. "I was laid off in August of 2008. I am worried about the future. I am the mother of three children," writes Simone Perry, an audio/visual producer. "I have no problem working or seeking employment. Many times I have not even received a response to the resume I submit. I have gone on interviews, only to get disappointed." She is not alone. "My husband and I are fortunate to be able to move in with my 81-year-old mother-in-law. But how sad is that? I apply for jobs and nothing happens," writes Gayle Hanson. "Who wants to hire a 59-year-old woman? My answer is nobody. [I] have years of experience, excellent references. And nothing to show for it." I get letters like that almost every day, and I assume a great many elected officials nationwide can say the same. The mystery is why so many lawmakers remain convinced that the government should do absolutely nothing to help fix the problem. So-called fiscal hawks in Washington recently voted down a proposal to extend unemployment benefits for these folks and millions more like them - people seeking work and in need of a little help until they find it. That's not just heartless, it's foolish. The current recession is not like any we've seen since World War II. An ocean of data refutes the myth that America's millions of jobless are maybe a touch lazy, and need the added incentive of losing their unemployment check - around $300 a week, on average - to persuade them to get back to work. A comment by Sharron Angle, the Republican candidate trying to unseat Sen. Harry Reid in Nevada, is typical. "They keep extending these unemployment benefits to the point where people are afraid to go out and get a job because the job doesn't pay as much as the unemployment benefit does," Angle said in a televised interview. She's wrong on two counts. First, there's no clear evidence that what Angle says is true: economists are, at best, divided over whether receiving unemployment benefits causes people to delay their jobseeking. Read more: Here. |

| US Corporate Pension Deficits Widen in June Posted: 13 Jul 2010 02:55 PM PDT Timothy Inklebarger of Pension & Investments reports, Funding ratio of corporate plans drops in June:

The WSJ also reports, Funded Status Of US Corporate Pension Plans At 16-Month Low:

There is no "quick fix" to pension deficits. I had lunch today with an experienced pension consultant who told me flat out that pension deficits are going to get a lot worse, and he fears that we're heading into a full blown crisis in less than 20 years. Think about it logically. Bond yields at a historic low, so liabilities are growing while expected returns on assets are dwindling. How are pensions responding? By diving into alternatives. In some respects, they're trying to match liabilities with long-duration assets like infrastructure, but they're also looking for diversification benefits to protect them from the next crisis. Problem is that so much money is flowing into alternatives that returns will get diluted and diversification won't be there when you need it the most. Is there a role for real estate, private equity and infrastructure in a pension portfolio? Of course there is, but let's not exaggerate the "diversification benefits" or "return enhancement" of these asset classes. The fact is that talented managers are scarce in alternatives. You're not going to find many who can compete with the likes of George Soros or David Bonderman. Nor should you be aiming to find the next Soros or Bonderman. Sometimes it's best to stick to nuts & bolts, finding experienced managers with a proven process. For example, the consultant I had lunch with today spoke highly of Dodge & Cox Funds. John Gunn, Chairman and CEO of Dodge & Cox, told him that back in 1997, they got out of technology, missing the big run-up, but also missing the big smash-up that ensued. They risked losing clients but because they explained why they thought tech shares were way overvalued, and because they invested their own money alongside their clients, they didn't lose anyone. I particularly like this passage from Dodge & Cox's long-term approach to investing:

Think about that simple question. How would you invest an all-cash portfolio today assuming you could not trade for the next three to five years? Pensions are shoving a good chunk of money into alternatives, taking a big gamble on the future. |

| Posted: 13 Jul 2010 02:27 PM PDT Continuing The Daily Reckoning's series on the Best Blogs, in this article we explore The Best Gold Blogs You Should Be Reading. After you review the list let us know if there are other Best Of Gold Blogs in the comment section below. The current economic difficulties have left most investors with a deep-seeded feeling of insecurity. And with good reason too… With the US dollar index plummeting around 25% since 2000, the need for secure investment opportunities is at an all time high. In fact, even today the average lifespan for paper currency is only 39 years. As Voltaire (1694-1778) famously said, "paper money eventually returns to its intrinsic value – zero." With the death of modern fiat currency quickly approaching, there's never been a more important time for you to hold the one resource that has existed as a stable store of value for generations – gold. Put simply, investing in gold and other precious metals is one of the best ways to protect yourself from currency debasement. Many financial analysts identify it as the most sensible option in the current economic situation and believe that precious metal bullion prices will only rise in the future. To help secure your non-paper currency future… Here are the Best Gold Blogs you should be reading right now: 1. Bill's Blog – With 37 years experience in the industry and as the current head of CMI Gold and Silver Inc, one of the nation's oldest gold and silver dealers, Bill Haynes is an expert when it comes to precious metal bullion trading. With articles intended to keep readers up to date on new information related to investing in gold and silver, his blog straightforwardly promotes the benefits of owning gold and silver. According to Bill, "with massive inflation by the Fed to finance our welfare sate and foreign wars, [there is] a greater need to own gold and silver now than any time in [my] 37 years as a bullion dealer." 2. Dollar Collapse – Run by financial author John Rubino, this site follows the current collapse of the US dollar and offers ways to profit from it. He advocates investing in gold in the face of what he believes is a fiat currency collapse. The site is frequently updated with new articles to keep readers on top of this "complex story…[with its] moving parts and a constant flow of new information." 3. Ed Steer's Gold and Silver Daily – A daily blog highlighting the important stories on gold and silver, Ed Steer uses thorough research of market trends to bring about his conclusions. He is a financial analyst and a correspondent for Casey Research working closely with gold, and each day he examines the 24-hour prices of gold and silver for any indicators or trends that might benefit his readers. 4. Gold and Silver Blog – This blog shares timely news and commentary on the gold and silver investing world. While it only updates with new articles about once a week, they are detailed and concise. With their own analysis and critique of the mainstream media's coverage, this is a great site to find an independent non-biased voice on precious metal trading. 5. Gold & Silver Forecast – From Bob Chapman, the writer of The International Forecaster, a subscription-based economics newsletter, comes this specialized blog with his ideas of the present and future of gold and silver trading. An extremely successful stockbroker – one of the world's largest in gold and silver from the 1960's-80's, the now-retired Chapman updates this site about twice a week with new articles (although they are not always specifically focused on gold and silver). 6. Assurance Trading Gold Industry Blog – This blog, run by the "experts in gold trading" from Assurance Trading, offers news updates and advice on the gold industry. They follow the trading price and status of gold, and strongly encourage the reader to buy gold 7. Whiskey and Gunpowder – Although not focused on gold investing, Whiskey and Gunpowder offers precise and unique advice on a range of topics from gold trading, commodities, politics, technology, and history. In addition to a rotating cast of excellent contributors, the regular contributors include "polymath oil man Byron King (economics, history and geology), financial and commodities expert Dan Denning, and renowned author and urban historian James Howard Kunstler." Through independent and non-biased study, Whiskey and Gunpowder delivers analysis you will never get from the mainstream media. With these helpful gold blogs, you will have the advice and analysis you need to weather the current economic uncertainties and perhaps try your hand at investing in precious metal bullion. Gold investments have historically been exceptionally stable, especially in times of economic crisis (any coming to mind?). As this is in no way a comprehensive list, if you know of or are fond of any gold/silver/precious metal investing blogs, please let us know in the comment section. Thanks for reading… Michael MacLeod Best Gold Blogs originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." More articles from The Daily Reckoning…. |

| Posted: 13 Jul 2010 02:19 PM PDT |

| Gold Prices Rebound to Top $1210, Silver Gains 1.9% Posted: 13 Jul 2010 02:18 PM PDT

Precious metals climbed as a group. Silver gained 1.9 percent, platinum climbed 1.3 percent and palladium jumped 3.3 percent. In other markets, crude oil futures rallied nearly 3 percent while U.S. stocks surged with major indexes advancing between 1.4 percent and 2.0 percent. (…) © CoinNews.net for Coin News, 2010. | |

| 2009 Jefferson Nickels and Roosevelt Dimes Values Posted: 13 Jul 2010 02:18 PM PDT

The sharp US Mint June coin production increases may further jog the memory, reminding collectors of the historically low mintage levels in 2009. For the entire year, just 3,548,000,000 circulating coins were produced. In comparison, 2008 had a production total of more than 10.1 billion and 2007 came in even higher over 14.4 billion. In fact, the last time the US Mint had circulating strikes at such a low level was forty-plus years ago. (…) © Darrin Lee Unser for Coin News, 2010. | |

| Patrick A. Heller: BIS swap mystery is likely bullish for gold Posted: 13 Jul 2010 02:18 PM PDT 9p ET Tuesday, July 13, 2010 Dear Friend of GATA and Gold: The latest informed speculation about the gold swaps undertaken by the Bank for International Settlements has been posted at Numismaster by Liberty Coin Service's Patrick A. Heller, who figures that whatever the details, the swaps are probably bullish for gold. For starters, Heller figures that much of the gold involved was delivered into the market even before the swaps were discovered. (We can't really say "announced.") Heller's commentary is headlined "Gold Price Swings on Swap News" and you can find it at Numismaster here: http://www.numismaster.com/ta/numis/Article.jsp?ad=article&ArticleId=122… CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Sona Resources Expects Positive Cash Flow from Blackdome, On May 18, 2010, Sona Resources Corp. (TSXV: SYS, Frankfurt: QS7) announced the release of a preliminary economic assessment for gold production at its flagship Blackdome and Elizabeth properties in British Columbia. Sona Executive Chairman Nick Ferris says: "We view this as a baseline scenario for gold production. The project is highly sensitive to the price of gold. A conservative valuation of gold at $1,093 per ounce would result in a pre-tax cash flow of $54 million. The assessment indicates that underground mining at the two sites would recover 183,600 ounces of gold and 62,500 ounces of silver. Permitting and infrastructure are already in place for processing ore at the Blackdome mill, with a 200-tonne per day throughput over an eight-year mine life. Our near-term goal is to continue aggressive exploration at Elizabeth and develop a million-plus-ounce gold resource, commencing production in 2013." For complete information on Sona Resources Corp. please visit: www.SonaResources.com

A Canadian gold opportunity ready for growth Join GATA here: New Orleans Investment Conference * * * Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Prophecy to Become Coal Producer This Year Prophecy Resource Corp. (TSX.V: PCY) announced on May 11 that it has entered into a mine services agreement with Leighton Asia Ltd. to begin coal production this year. Production will begin with a 250,000-tonne starter pit as planned in August, with production advancing to 2 million tonnes per year in 2011. Prophecy is fully funded to production and its management team includes John Morganti, Arnold Armstrong, and Rob McEwen. For Prophecy's complete press release about its production plans, please visit: http://www.prophecyresource.com/news_2010_may11.php |

| John Lee: Focus on Junior Miners Posted: 13 Jul 2010 02:18 PM PDT The Gold Report submits: The Gold Report: Everyone is concerned with the volatility in the markets. What's going on out there? |

| Gold steady as euro debt woes support Posted: 13 Jul 2010 02:17 PM PDT |

| BIS swap transactions show creative use of gold – GFMS Posted: 13 Jul 2010 02:17 PM PDT GFMS Chairman PhilipKlapwijk says the operations validate gold's centrality to the financial system |

| Posted: 13 Jul 2010 02:00 PM PDT One of the best investments we can make right now is to buy into supplies of relatively secure, low-cost uranium - the feedstock for nuclear reactors. The simple story is that the uranium supply trails far behind demand. The added wrinkle is that supply cannot easily increase. "In the world of commodities, demand is rarely the compelling reason to get long," observes Robert Mitchell, a general partner at Portal Capital, "Instead, you want to own a commodity where supply is incapable of responding to even a small bump in bids." In other words, you want to buy the commodities where it is very difficult to increase supply. Though hardly a new insight, it's one that investors sometimes forget. One commodity that aces this simple test is uranium. Just looking at the raw numbers, the annual mined supply of uranium provides little more than half the annual demand. Most of the balance comes from decommissioned warheads. Furthermore, uranium production is constrained, both geologically and politically. A few years ago, Cameco's enormous Cigar Lake project went "offline" due to massive flooding. This property will not come back online until 2013! A large, offline mine is a very big deal in the uranium world, as nearly 60% of the world's mined uranium comes from only ten mines. Cameco's MacArthur River mine alone provides 15% of the world's production. For comparison, the top ten mines in the gold sector produce only 19% of the world's supply. Politically, uranium production is also problematic. Let's take a look at just a pair of snapshots from around the world. Consider them postcards from the frontier of the uranium market. (Even if you don't care about uranium, this is an issue that affects many commodities, including oil.) First up, the blue men of the desert... The Tuaregs have been roaming the deserts of North Africa since at least the seventh century. For hundreds of years, they prospered from the lucrative trans-Sahara caravan trade. Tuaregs trafficked in gold, salt, ivory and slaves across the bazaars of North Africa and its trading hubs, such as Timbuktu. Because the indigo dyes they use in their veils and turbans rub off on their skin, people call them the "blue men of the desert." The rise of maritime trade in the 16th century led to the decline of the great overland trade routes of Africa, as it also contributed to the demise of the old Silk Roads across Asia. Today, the Tuaregs live in poverty - even though Tuareg lands in Niger and Mali sit on the third largest reserves of uranium on the planet. Mining interests have tried to push the Tuaregs off these lands. In response, Tuareg fighters have clashed with Niger troops and ambushed mining personnel. The Niger government, by the way, is not exactly a hallmark of stability, either. Niger just had another coup d'état. The mining contracts signed so far are about as good as Confederate money. Risks abound. So even though Niger has handed out over 130 prospecting licenses, mostly for uranium, only 10% are active, because of the Tuareg revolt and political uncertainty. Niger may hold some of the world's richest uranium reserves, but they aren't worth a pile of eggshells if you can't get them out of the ground. Another postcard comes from Kazakhstan - a great, big, empty country in Central Asia. It's the ninth largest country in the world by area, bigger than Western Europe. Yet it has only 16 million people - that's about 15 people per square mile. Kazakhstan, though, is one of the world's largest uranium producers. It has one-sixth of global reserves. Kazatomprom, the state uranium company, is the largest producer of uranium in the world. Kazakhstan is also a relatively risky place to do business. Recently, Kazakhstan arrested the head of Kazatomprom and seven other executives. The sale of some uranium assets is under scrutiny. Among these assets are Uranium One's mines. There is a possibility, though insiders say it is highly unlikely, that Kazakhstan nationalizes these assets. That would make Uranium One, a publicly traded stock, essentially a zero overnight. (Oil companies have also had issues in Kazakhstan.) In any event, the world is depending on Kazakh's plentiful uranium. It will not come cheaply. Current production is profitable under $50/lb. But the low-hanging fruit is always picked first. Getting Kazakhstan's other vast uranium resources on stream will require uranium prices north of $80/lb. to maintain similar profitability. Current spot prices - meaning for immediate delivery - are only about $42/lb. The long-term price is around $65/lb. Most uranium is sold at the long-term price under contracts. (The uranium spot price peaked in the summer of 2007 at $136/lb.) Kazakhstan and Niger are just two examples of why it's not going to be easy or cheap to increase uranium production. Yet we'll need lots more uranium. The demand for uranium is building in intensity like a heap of hot coals. The market has been in deficit for years, as it burns off Cold War stockpiles, which are finite and dwindling. Another way to look at it: Uranium demand is on its way to hitting 226 million pounds per year. Yet last year, the top dogs - which make up 90% of the market - produced only about 110 million pounds of uranium. There are already 436 reactors up and running today. And there is a surge in demand coming in the next decade from the hundred or so new reactors expected to come online. Yet the industry is about 400 million pounds short of meeting that demand. Jerry Grandey, president and CEO of the second largest uranium miner, says the challenge before the industry "will not be easy." New production has been hard to come by. Miners have generally been unable to keep up with production targets. As evidence, he cites the fact that world uranium production is up only 24% since 2003, even though the price of uranium is up more than fourfold over that timeframe. I've been canvassing people in the uranium business to get a sense for what it looks like on the ground. I had an interesting conversation with Chuck Melbye, who has been in the mining business for five decades. His resume is impressive and too extensive to recount here. (Mining also seems to run in the family. His son is president of Cameco Inc., the marketing arm of the big uranium producer.) Anyway, we talked about all things uranium. We talked about projects in the pipeline. We talked about uranium deals signed by China, Japan and Abu Dhabi and one in the works for India. We talked about the slow process to bring on new mines and how expensive and uncertain it all is. We talked about the diminishing stockpiles of uranium. In the end, Melbye's view echoed much of what I've been hearing. "The uranium price is depressed," he says. "It shouldn't be. It's going to take off one of these days. There is going to be a uranium shortage in three to four years." So let's see... strong demand, plus constrained supply, equals investment opportunity! Tune in tomorrow for a specific investment idea... Regards, Chris Mayer |

| How to Cure an Economic Depression Posted: 13 Jul 2010 01:37 PM PDT "As recently as two years ago, anyone predicting the current state of affairs (not only is unemployment disastrously high, but most forecasts say that it will stay very high for years) would have been dismissed as a crazy alarmist." That was Paul Krugman in today's newspaper. Thomas Friedman is fixing problems in the Middle East, so we'll have to make do with Krugman to entertain us on economic matters. It is amazing that anyone takes Krugman seriously. It is obvious now that he - and his fellow interventionists - had no idea what was going on two years ago. Now, at least he sees the drift of events more clearly; we are headed towards a Japan-style deflationary slump. "It's a good bet that by some measures we'll be seeing deflation by sometime next year," he writes. "Mr. Bernanke has thought long and hard about how to avoid a Japanese- style economic trap, and the Fed's researchers have been obsessed for years with the same question. But here we are, visibly sliding toward deflation..." So you see, dear reader, even a Nobel Prize-winning dog can learn a new trick. Now, he sees through a glass darkly... Soon, he will be face to face with deflation. Of course, the poor man still completely misunderstands what is really going on. But what do you expect? His career depends on not understanding it. Krugman would have to turn his back on his neo- Keynesian creed if he ever caught on to the plot. He would have to look for a new job if he were ever to tell his readers about it. Almost everyone wants the feds to "do something" to avoid the Japanese "trap." Imagine what would happen if The NY Times' leading economist were to say: "Forget it. The feds have already done too much. Following my advice, they were a major cause of the present crisis. Following my advice, they have made it worse. I was wrong. Now the best thing they can do is to withdraw as gracefully as possible." That's not what Times readers want to hear. It's not what anyone wants to hear, except us "crazy alarmists" here at The Daily Reckoning. We've been talking about the Japan trap for years. Economist Richard Koo calls it a "balance sheet recession." He's right about that. The private sector destroys excess capacity and excess debt. When it's over, the private sector balance sheet looks a lot better. Of course, it could happen faster. In Japan, it may still be going on. Why? Because the Japanese feds worked so hard to stop it. Monetary stimulus. Fiscal stimulus. Quantitative easing. They tried everything. And kept at it for nearly 20 years. But what they were really doing was preventing the one fix that really fixes. It is as if they were letting the air out of the market economy's tires...and then were amazed that it didn't roll. You know what cures a depression, dear reader? We'll tell you. A depression. A depression destroys excessive debt. Businesses with too much debt go broke. Bonds that can't be paid go into default. Households that have spent more than they could afford go broke. Problem solved. Debt disappears. Then, the economy can grow again. So what does Krugman suggest? You guessed it: stop the process of debt destruction at all costs! Do what the Japanese did, in other words, only do more of it. And more thoughts... What's really going on? No one knows. The world is much too complex a place to ever really know what is going on. At best, we can have a vague idea...and maybe see a couple broad trends developing. Our guess is that the broad trend developing leads towards more debt destruction...deflation...and a Japan-style on-again, off-again slump. US stocks still trade at 17-times earnings. Most likely, earnings are going down. P/E multiples are going down too. So, the Dow can be expected to shrink to half or less of today's level. It's harder to see the trend in the bond market. Bill Gross says the two-decade bull market in bonds is over. We're not so sure. The 10-year yield - at 3.05% - is just above the record low from November '09. The 30-year is at 4.04%. Both seem to be sinking toward record lows (meaning higher bond prices). Meanwhile, world trade appears to be slowing. The key shipping index has been down every day for a month. And the two biggest emerging markets both announced warning signs. China said yesterday that its property prices were declining. India said its rate of industrial production growth "sharply" declined to 11.5%. If this is so, expect higher bond prices...and perhaps lower gold prices...over the next few years. *** Does that mean you should sell your gold? Well, if we were speculators, we might consider selling. But here at The Daily Reckoning, we're not gamblers. We hold gold because it represents real wealth, not because we think it will go up in price. We don't really know what direction it is going. But that's why we hold it. We don't know what direction anything is going. The nice thing about gold is that it doesn't matter. Gold doesn't go anywhere. It just sits there. If you buy a bond, for example, you have to worry about the credit quality of the issuer. If things get bad enough, he won't be able to pay up. Your bond could be worthless. Same for stocks. A stock is a share of a company. If the company goes out of business, your stock certificates (assuming you have them) are only good for decorations. Real estate is more reliable. But there are taxes and upkeep to pay. Gold is a better way to store wealth. You don't pay property taxes on it. And the roof never leaks. Besides, gold is especially valuable when other forms of money lose their appeal. The trend of debt destruction will probably not end soon. And the feds will probably sooner or later follow Paul Krugman's advice to "raise [the Fed's] long-term inflation target to help convince the private sector that borrowing is a good idea and hoarding cash is a mistake." In the meantime, gold may go down in dollar terms. Which will make a good time to buy it. *** "Boy, those days were very different. It was before the war." An uncle, 93, was reminiscing. "I was so lucky. I had just gotten out of Polytechnic in Baltimore...which was what you'd call a high school...but I think it was much better than high schools today. And I had a girlfriend at the time whose father had bought her a little roadster. We'd drive around town and have a great time. "I'd pull into a gas station. In those days, someone would come right out and start washing your windshield. "I'd say 'fill 'er up' like I was a big shot. Gasoline was only 15 cents a gallon. But I only had 30 cents. Of course, no one had any money. And everybody knew that no one had any money. So I would say 'fill 'er up' to impress my girlfriend, but then I'd put my arm out the window and hold two fingers down so he knew I really only wanted two gallons. "Ha ha...what a ball we had back then... And then I was lucky again. I got a job at the Bethlehem steel plant. I made $18 a week. That was a lot of money back then...I was on top of the world. "Then, of course, along came the war. And we all knew what we had to do. So, we all went down to the armory and signed up. "We'd had such good training in math and geometry at Poly that they put us in the artillery. And they sent me to officer training... "And then, they sent me to the Pacific. And I was lucky again. I guess I've always been lucky. If I weren't so lucky I probably wouldn't still be here. They sent me to one of the islands. I was leading a platoon. My mission was to clean the enemy out of valley. We went in...and didn't encounter any resistance. And then we realized that it was a trap. We were surrounded. And they were shooting at us from every side. We radioed for help but there wasn't any help around. "The men were looking at me... And I was just a young lieutenant... Good God, I thought we were all finished. "I didn't know what to do. We were stuck. And if we stayed there, we were all going to be killed. So, I ran up a white flag. And when they stopped shooting, I got up and took a couple of men with me...and we advanced to where most of the shooting was coming from. Of course, we thought we were going to be gunned down at any minute. But they allowed us to come up to them... "And I still didn't know exactly what I was doing...but it was too late to think...I went right up to the fellow who was in command and asked him to surrender! "And he did! Ha...ha...I couldn't believe it. "Boy, you can't imagine what that felt like... I was so lucky. He thought he was surrounded...and he was short of supplies." Regards, Bill Bonner |

| Posted: 13 Jul 2010 01:26 PM PDT Thought For The Evening You pulled the rock over your hole in the ground when the BS was flying in gold and all the top callers were out of their cages. What you saw there was and will remain pleasing. Gold is going to $1650 on this move with all the outrageous drama common to this market. To our men out there, man up if you want to be in gold on pay day. The ladies seem never to whine.

Jim Sinclair's Commentary Survey data is the least reliable of data series, but for what it is worth… US consumer confidence falls in July vs June—IBD NEW YORK July 13 (Reuters) – U.S. consumer confidence fell 3.2 percent in July from June as Americans remained unconvinced by signs of a recovery, a report found on Tuesday. Investor's Business Daily and TechnoMetrica Market Intelligence said their IBD/TIPP Economic Optimism Index slipped to 44.7 in July from 46.2 in June. Readings above 50 indicate optimism, while those below 50 point to pessimism. The index is now 3.2 points below its 12-month average of 47.9, and 0.3 points above the 44.4 level IBD reported in December 2007 when the recession began. "Many Americans remain troubled at the failure of the economy to respond to more than $2 trillion in various stimulus, bailout and Fed programs," said Terry Jones, associate editor of Investor's Business Daily.

Jim Sinclair's Commentary Thinking of relaxing in your retirement? Can you imagine if the pension funds mark to market the paper they hold? Pension funds have been the wastepaper basket of Wall Street since they planted the Buttonwood Tree. Pension fund managers have legal fiduciary duties so do not expect any noise from them. Funding Status of U.S. Pensions Falls to 74.0 Percent in June, According to BNY Mellon Asset Management BOSTON, July 13 /PRNewswire-FirstCall/ — A combination of U.S. stock market declines and lower interest rates in June resulted in the lowest-funded status for the typical U.S. corporate pension plan since February 2009, according to monthly statistics published by BNY Mellon Asset Management. The funded status in June declined 6.0 percentage points to 74.0 percent. Through the end of June, the funded status of the typical U.S. corporate plan is down 9.5 percentage points for the year. The falling stock markets resulted in a decline of 2.3 percent in assets at the typical U.S. corporate plan, while liabilities sharply increased in June, rising 5.6 percent, as reported by the BNY Mellon Pension Summary Report for June 2010. Plan liabilities are calculated using the yields of long-term investment grade corporate bonds. Lower yields on these bonds result in higher liabilities. "Investors' fears sent U.S. stocks down 5.7 percent in June, which followed the 7.9 percent fall in May," said Peter Austin, executive director of BNY Mellon Pension Services, the pension services arm of BNY Mellon Asset Management. "The second quarter decline of 11.3 percent in U.S. stocks was the worst quarterly performance since the fourth quarter of 2008." The June rally in Treasuries led to a 39-basis-point drop in the Aa corporate discount rate to 5.34 percent, the lowest point since June 2005, according to BNY Mellon Asset Management.

Jim Sinclair's Commentary The gold swap is bullish for gold. Those that say otherwise haven't a clue what gold is all about. This speaks to the nonsense used by the gold banks via the media in an attempt to cover more of their short positions. You have a question about gold? Read us regularly. BIS swap operation signals wider use of gold-GFMS LONDON, July 13 (Reuters) – The 346 tonnes of gold swap operations conducted by the Bank of International Settlements (BIS) in recent months highlight gold's central role in the financial system and are unlikely to lead to dumping of the metal on the market, GFMS chairman Philip Klapwijk said. The operations, detailed in the bank's latest annual report, show the bank was holding 346 tonnes of gold as part of swap operations in exchange for currencies. "Here we have gold being used quite creatively," Klapwijk told Reuters Insider television. "That is in a sense a validation again of gold's centrality to the financial system."

Jim Sinclair's Commentary If you have faxed me in the last two weeks I have not received your message due to technical difficulties with my fax machine. Please resend your inquiries.

Jim Sinclair's Commentary Will the BP disaster be used as a cover for a Florida bailout of banks certain to be closed soon? Maybe, maybe not. The interesting point is they asked. Strapped Florida Banks Ask for Help Florida banks—already weakened by the real-estate bust and hit again by customers suffering from the BP PLC oil spill—are asking federal regulators for a reprieve from government-ordered capital raising as they struggle to stay alive. In a Monday letter to Federal Deposit Insurance Corp. Chairman Sheila Bair and Federal Reserve Chairman Ben Bernanke, Florida's top banking lobbyist requested all local banks be granted a 12-month break from higher capital requirements, loan appraisals and new regulatory sanctions.

Jim Sinclair's Commentary What OTC derivatives do not do to the international banking community, litigation will. Dozens of banks sued over subprime.

Jim Sinclair's Commentary The machine is not focused on the EU, but now on the problems of the pound. UK debt is 'twice as much as we thought' The true scale of the national debt is £2 trillion – more than twice the official figure, an alarming study shows. The black hole in the public accounts equates to £78,000 for every household in the country. The 'real' state of the national finances is exposed in a study published today by the Centre for Economics and Business Research, which warns of a series of mammoth debts that aren't revealed by the official figures. The national debt – forecast to reach £932m by next spring – does not include a number of expensive liabilities, such as the cost of civil service and town hall pensions and projects funded under the Public Finance Initiative. Putting these liabilities into the official figure would add £1.13 trillion to Britain's whopping overdraft, according to CEBR. Under the worrying scenario, the debt would jump from 62% to 138% of Britain's income. |

| Posted: 13 Jul 2010 11:43 AM PDT |

| Posted: 13 Jul 2010 11:19 AM PDT As we reported earlier, the June US budget deficit came in around as expected, at $68.4 billion. Yet an interesting observation that we have touched upon previously, is that over the same period, the US borrowed a whopping total of $210.9 billion. Once again, as has been the case over the past four years, the US borrowed far more in any deficit month, then it needed simply to close the deficit. Case in point, the June differential was $142.5 billion more borrowed than "needed", the YTD (fiscal) differential is $290 billion, and the cumulative differential since the beginning of the 2007 Fiscal year (October 2006), is a whopping $1.5 trillion. Over the past 3 years and 9 months, the US has accumulated an incremental $4.7 trillion in new debt, even as the budget deficit has grown by "only" $3.2 trillion. One wonders just what the reason for this differential is, which amounts to half the cumulative budget deficit over the same time period? The cumulative data, as well as the stunning differential between the two time series is presented on the attached chart. h/t Michael |

| Tomorrow the Gold Price Ought to Advance. Posted: 13 Jul 2010 11:08 AM PDT Gold Price Close Today : 1213.30Change : 14.80 or 1.2%Silver Price Close Today : 18.237Change : 34.0 cents or 1.9%Platinum Price Close Today : 15.24Change : -1,497.76 or -99.0%Palladium... This is a summary only. Visit GOLDPRICE.ORG for the full article, gold price charts in ounces grams and kilos in 23 national currencies, and more! |

| Stores To Empty When Hyperinflation Arrives Posted: 13 Jul 2010 10:39 AM PDT The National Inflation Association today issued a warning to all Americans that empty store shelves will likely be coming to America as a result of government price controls during the upcoming hyperinflationary crisis. This morning, NIA released a video preview of what hyperinflation will look like in the U.S. This extremely important must see video is now available on NIA's video page. NIA's six-minute video released today goes into detail about an event that took place just outside of Boston, Massachusetts in May of this year. This story was widely ignored by the nationwide mainstream media, but NIA believes it was one of the most important news events of the first half of 2010. Although this particular crisis in Boston was due to decaying infrastructure, NIA believes a currency crisis will lead to the same type of panic on a nationwide basis. NIA hopes that this video serves as a wake-up call for Americans to take the necessary steps to prepare for hyperinflation and become educated about the U.S. economy. In Zimbabwe during hyperinflation, Zimbabweans were forced to transact in gold and silver. It's only a matter of time before the U.S. dollar becomes worthless and the only Americans with wealth will be those who own gold and silver. |

| Posted: 13 Jul 2010 10:19 AM PDT Gold climbs again after Portugese debt downgrade The COMEX August gold futures contract closed up $14.80 Tuesday at $1213.50, trading between $1196.50 and $1218.80 July 13, p.m. excerpts: |

| Goldman Sachs On How To Navigate The Slowdown Posted: 13 Jul 2010 10:03 AM PDT Remember when a week ago the world was slowing down? Apparently all it takes to forget reality is for Europe to sweep the fact that its banks are insolvent under the rug courtesy of a systematic farce conducted by the very system the banks are part of, rendered even more "credible" since as of today it appears no banks will fail the stress test. On the US earnings front, a materials company beating reduced expectations and a chip maker having just record the best quarter in its history (what growth next for Intel: 80% margins? 90%? every household in China buying an i7 980 for their 7th toaster in their 5th house?), even as global trade is paradoxically stalling following an all time record month for Chinese trade? Americans may be unemployed and homeless but they sure like their iPads and their fast PCs. Either way, to remind readers that despite the latest market run up on no actual positive economic data, here is Dominic Wilson, Director of Global Macro & Markets Research at Goldman, with advice to clients on how to navigate the "slowdown."

|

| A Look at Empty Store Shelves in America Posted: 13 Jul 2010 10:00 AM PDT The National Inflation Association has produced a new video looking at how hyperinflation can lead to a run on stores. They paint the kind of picture where people are trampling one another to stock up on basic goods, like water, before their dollars lose purchasing power. Using a recent real-life example from Massachusetts in May of 2010, the clip below shows what empty retail store shelves look like in the US, and also people so desperate for supplies that the National Guard has to be called in to keep the peace. Despite the over-the-top tone of the cautionary tale and the survivalist advice it's an interesting video. A Look at Empty Store Shelves in America originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." |

| Apple: Hedge Fund Slingshot Is Back Posted: 13 Jul 2010 09:56 AM PDT Jason Schwarz submits: Dissecting the anatomy of a trade is a sophisticated process that requires full disclosure. Most investors fail to dig beneath the surface thereby missing the real opportunities. This Apple (AAPL) action on the heels of the Consumer Reports iPhone 4 downgrade is a dream scenario for hedge funds ahead of the July 20th earnings report. There is no better money making opportunity than the Apple slingshot. Apple’s pristine balance sheet, exponential growth opportunity, and innovative future product pipeline give hedge funds confidence that this stock will always bounce back after being beaten down. As a result they use any and all resources to beat it down when they can. Monday was the Consumer Reports release so what do the Hedge Funds do on Tuesday? They feed the media with stories of a recall, ‘PR experts say an iPhone 4 recall is inevitable.‘ Beyond this kind of hysteria, the truth is that under a worst case scenario Apple would recall the few million iPhone 4s that have been sold and the problem would be solved. The scope of such a recall for a company with approximately $45 billion in cash is inconsequential. A second alternative to this reception problem would be to re route antenna efficiency by way of a software update. This solution is most likely. The third alternative would be to include a free bumper cover with each iPhone 4 purchase. As a side note, Apple might be making more money from the $29 bumper than Google (GOOG) makes from its Android OS but that’s for another article on another day. Complete Story » |

| Trader alert: Stocks have reached a key level... again Posted: 13 Jul 2010 09:53 AM PDT From Bespoke Investment Group: After an uninterrupted five straight days of gains, both the S&P 500 and Nasdaq are now approaching their 50-day moving averages. Since the 'flash crash' in early May, the current attempt will mark the... Read full article (with chart)... More on stocks: The time to buy stocks has passed The No. 1 reason stocks are going to rally this month Trader alert: We could be close to a rally in stocks and gold |

| You are subscribed to email updates from Gold World News Flash To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

U.S.