Gold World News Flash |

- I’ve No New News on Evolving Gold

- SP-500, GLD and GDX - Down More or Now Up?

- Gold & Gold Stocks are the Last Hope for Most

- Gold 07-06

- Client Update – Farallon Resources 2010 Outlook and Beyond

- These Bear Market Investments Pay 8% Dividends

- Libertarians Seek Rahn's Ideal State... NASA Now Muslim Space Agency

- The Quiet Crisis: U.S. Commercial Real Estate

- Hourly Action In Gold From Trader Dan

- Time And Time Again

- Obama's New Iran Sanctions: An Act of War

- Gold, Food, & Oil. Tactics Update

- LGMR: Gold Adds "Anti-Commodity" to Anti-Equity Sticker as Strong Euro Link Returns

- Client Update – Croc Still on Track to Produce 100,000 Ounces This Year

- Yukon Gold Rush and Grandich Canucks Offer

- Charts: Gold, SP 500, Silver, HUI, Gold/Euro

- In The News Today

- V-Shaped Recovery, Where Art Thou?

- Independent from What?

- Jim's Mailbox

- The Platypus Exception

- Guest Post: "So Much For The Market Being Cheap" Charting A 50-75% Downside Case In The S&P

- Gold Seeker Closing Report: Gold and Silver End Mixed

- Jeff Nielson: The seven sins of GLD

- CDS Traders Attempting Another European Ambush

- Fed Audit Failure Lends Credence to QE Rumors

- Canada Pension Plan Invests in Oilsands

- European banks use gold reserves to raise cash

- Quote du Jour

- Goldman Sees "Disturbing Signs" If Government Does Not Bow Down To Krugman, Reflate Monetary And Fiscal Bubbles

- Evening Thoughts For The Day

- IMF Gold Swaps Misrepresented

- With BIS gold swap, central banks throw the kitchen sink at gold

- Comparing Changes In Quarterly US Debt And Deficits

- Emerging Market Investing: Where the World’s Headed

- A Little Gold Trickles Out of the Trust at GLD

- TUESDAY Market Excerpts

- SP-500, GLD and GDX – Down More or Now Up?

- Sovereign Default Datapoints of the Day

- Lubrizol Corporation (NYSE:LZ) — Fallout From the Lost Cognis Bid

- The Ethics of Owning BP Stock

- This could be the greatest tragedy of the 21st century

- Gold & government spending

- This indicator could be pointing to a massive gold rally

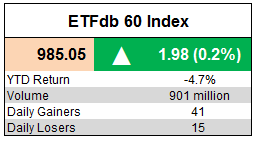

- Tuesday ETF Roundup: VXX Sinks, EWJ Rises

| I’ve No New News on Evolving Gold Posted: 06 Jul 2010 05:40 PM PDT The following is automatically syndicated from Grandich's blog. You can view the original post here. Stay up to date on his model portfolio! July 06, 2010 01:43 PM To all the “many” who are emailing and calling regarding Evolving Gold, I’ve no new news. I’ve pointed out in the past my feelings on how the company has fallen short on the IR side of things and noted my disappointment. Please be advised that I’ve let it be known “again’ today, and noted in my email this may get me fired (but I had to say what I said). The most frustrating aspect of this not the fact that I’m down a half of million dollars myself, but the fact that I can’t simply take the lost because they failed on the drill front. They have two of the best looking plays most companies would gladly be delighted to have just one. They’re drilling both as we speak and no matter how you spin it, both have great upside potential. But at the same time I feel for t... |

| SP-500, GLD and GDX - Down More or Now Up? Posted: 06 Jul 2010 05:40 PM PDT Its mid afternoon Tuesday and the markets are selling off – still. It seems like it will never end. Big red candles on every chart I look. The VIX, the temperature gauge of fear, is rising again and the news headlines are filled with gut wrenching uncertainties about US Municipals, foreign countries that are characterized as ticking time bombs and opinion that we are headed for another Great Depression. With that backdrop, how about we ponder some charts and see if this market correction is likely to stay with us for infinity and beyond or if perhaps it has not only worn out its welcome, but is also close to having its flame extinguished. Let’s begin with the SP-500 hourly chart. I made this chart online at the website www.FreeStockCharts.com. The indicator displayed below price is the True Strength Index, commonly referred to as the TSI. It is an elegantly smooth and responsive momentum indicator. First off, we’ll note that both th... |

| Gold & Gold Stocks are the Last Hope for Most Posted: 06 Jul 2010 05:40 PM PDT Tell this to a baby boomer or a middle aged person and they would be quite skeptical. Their neighborhood financial advisor or planner doesn’t advocate Gold. It is too dangerous. It could drop to $500. Gold stocks? Hell no! After failing to get you out of stocks not once but twice in the last ten years, your advisor tells you its time to play it safe. You need to save more. As we now should know by now, when it comes to the capital markets, conventional advice is eventually deadly. It identifies trends too late and fails to warn when risk increases and reward diminishes. However, most people would rather feel more comfortable than be a contrarian. Most people are too weak minded to find the answers, which usually oppose the herd. Look at the capital markets today and the trends are clear. With global growth likely to remain low to stagnant for quite some time, stocks and commodities will not help your portfolio. Treasury bonds are performing well bu... |

| Posted: 06 Jul 2010 05:40 PM PDT courtesy of DailyFX.com July 06, 2010 07:07 AM Gold has topped. Please see the latest special report for details. Near term, gold is making its way lower and most likely in an impulsive fashion. From a trading standpoint, the next opportunity will come from the short side on completion of wave iv of 3 – which should get underway soon. Jamie Saettele publishes Daily Technicals every weekday morning, COT analysis (published Friday evenings), technical analysis of currency crosses on Monday, Wednesday, and Friday (Euro and Yen crosses), and intraday trading strategy as market action dictates at the DailyFX Forum. He is the author of Sentiment in the Forex Market. Follow his intraday market commentary and trades at DailyFX Forex Stream. Send requests to receive his reports via email to [EMAIL="jsaettele@dailyfx.com"]jsaettele@dailyfx.com[/EMAIL].... |

| Client Update – Farallon Resources 2010 Outlook and Beyond Posted: 06 Jul 2010 05:39 PM PDT The following is automatically syndicated from Grandich's blog. You can view the original post here. Stay up to date on his model portfolio! July 06, 2010 01:28 PM Farallon Mining has been making steady progress on many fronts through the first half of 2010, operations have exceeded the original design capacity by 20% to 30%, cash costs are now in the lowest 10% of zinc producers worldwide. At the same time, exploration is continuing with more strong results anticipated in the near future, on both the zinc front and the also the newly announced gold zones adjacent to the mining areas at the G-9. The most recent announcement from the Company relates to the original four deposits at Campo Morado* (Reforma, El Largo, El Rey, and Narnano) These deposits host just under 1 million ounces of gold and approximately 60 million ounces of silver. (see the Farallon news release from June 29, 2010 for further details on the resource). The company has initiated a study on these deposits to determ... |

| These Bear Market Investments Pay 8% Dividends Posted: 06 Jul 2010 05:39 PM PDT By Tom Dyson Tuesday, July 6, 2010 Not all stocks pay dividends. Take Ford Motor, for example. It's one of the largest manufacturing concerns in the country. But its stock pays you no income. Here's the thing: You can still get an 8% dividend from Ford. Just use ticker symbol F-S. (If you use Yahoo Finance, type in F-PS.) Quite simply, some 200 businesses across the country, including Ford, have issued special securities to borrow money from the public. These securities trade on the stock market just like regular stocks, but they're really income securities. When you buy these securities, you're lending money to the issuing company. They have a legal obligation to pay you interest and dividends on your capital. When they've finished with your capital, they must pay you back your money in full. The key is, the dividends on these securities are four to five times higher than the average dividend paid by common stock investments. And because they're debt securi... |

| Libertarians Seek Rahn's Ideal State... NASA Now Muslim Space Agency Posted: 06 Jul 2010 05:39 PM PDT Libertarians Seek Rahn's Ideal State Tuesday, July 06, 2010 – by Staff Report What is the ideal size of the state? ... The British government is spending 50 per cent of GDP, but taking just 40 per cent in taxes. The coalition's aim is to close that gap over the next five years (still leaving a massive accumulated debt, by the way), partly by raising taxes and partly by cutting spending. The hope is that economic growth will keep the eventual figure closer to 40 per cent than to 50. What, though, is the optimum share? ... The Rahn Curve is to state spending what the Laffer Curve is to taxation. Drawing on a mass of published data and economic models, it suggests that the ideal size of the state is between 15 and 25 per cent of GDP. Less than this and property rights start to look insecure; more and competitiveness suffers. So, how do we go about getting there? Or even half way there? Any suggestions are welcome. – UK Telegraph Dominant Social ... |

| The Quiet Crisis: U.S. Commercial Real Estate Posted: 06 Jul 2010 05:39 PM PDT The 5 min. Forecast July 06, 2010 11:05 AM by Addison Wiggin & Ian Mathias [LIST] [*] The crisis that never was, or the one yet to come? The 5 checks in on commercial real estate [*] Illinois digs itself deeper… market gives 1 in 4 odds of state default [*] “Audit the Fed” is dead… how politics as usual scuttled the hope for Fed transparency [*] Plus, Bill Bonner’s brave gold forecast… gold bugs, cover your ears [/LIST] In April 2007, we issued a report headlined The Second Wave of the Housing Tsunami: 2007-2011 in which we suggested commercial real estate was likely to be the second shoe to drop in what was already an unnerving collapse in the residential housing market. Some of the more speculative plays we issued in the report panned out well for those inclined to follow them. A Countrywide put closed at a 417% gain. Another put on the “financial select” SPDR closed up 172%. And a third put on Lowe’s home imp... |

| Hourly Action In Gold From Trader Dan Posted: 06 Jul 2010 05:39 PM PDT |

| Posted: 06 Jul 2010 05:39 PM PDT View the original post at jsmineset.com... July 06, 2010 10:10 AM Dear Friends, Risk according to market pundits, blogs and for payment advisers is on one minute, and off the next, causing the gold market to roar and wane. Hedge funds are the real cause of the moves by painting the charts intentionally or by accident. Amateur technicians run and jump constantly making contributions to the gold banks from their piggy banks. Simply stated: 1. Leave your emotions at the door or get out of gold. 2. Gold is going to $1650. About that price objective I do not have the slightest doubt. 3. Gold is going to $1650 on or before January 14th, 2011. According to Armstrong the gold price will take until June of 2011 and go much higher. This is just another time like many in the past, and some in future, where you go to the hole you have dug, jump in and pull a rock over the top. Peek out daily between July 8th and July 15th. Yes, read JSMineset every day. Respectfully, Jim... |

| Obama's New Iran Sanctions: An Act of War Posted: 06 Jul 2010 05:39 PM PDT With the U.S. closed for the long weekend yesterday, not much happened in the gold market on Monday... although gold came under a bit of selling pressure starting at 1:00 p.m. in Hong Kong. Every commentator I read yesterday said that the Comex was closed yesterday... and maybe it was... but someone was trading both gold and silver after London closed yesterday. And whoever it was, stopped trading at 1:15 p.m. New York time yesterday afternoon. Volume in gold was virtually nothing when I got up yesterday morning around 11:00 a.m. Eastern time... under 10,000 contracts. But that little closing spike in the last half hour of 'Comex trading' tacked another 9,000 contracts onto the open interest in a real hurry. Don't know what to make of that. Silver's price path was similar. Volume was under 3,500 contracts. With the markets closed, there was no trading in HUI stocks. But here in Canada, the TSX Gold Index was down less than half a percent. ... |

| Gold, Food, & Oil. Tactics Update Posted: 06 Jul 2010 05:39 PM PDT Graceland Updates 4am-7am www.gracelandupdates.com Email: [EMAIL="s2p3t4@sympatico.ca"]s2p3t4@sympatico.ca[/EMAIL] July 6, 2010 1. For the past 6 months or so, I’ve tried to show the gold community the blood-relative link between GOLD and FOOD. Here’s the wheat chart. It’s been a cornucopia of profits for those who bought into the lows. Wheat Daily Chart July 6 2. I’m talking about the markets, not the survival pouches of both gold and food, although that should not be ignored either. One of my richest paid subscribers, billionaire T-Rex, has been buying massive tracts of farmland over the past few years. 3. Jim “mighty man” Rogers has done the same, and Mighty Man calls the agricultural markets the best value in the world today. 4. Value plays are where all the real wealth is built, and food is right now the ultimate value play. Here’s the Corn Chart 5. Note the Fibonacci retracement line at the 3... |

| LGMR: Gold Adds "Anti-Commodity" to Anti-Equity Sticker as Strong Euro Link Returns Posted: 06 Jul 2010 05:39 PM PDT London Gold Market Report from Adrian Ash BullionVault 08:35 ET, Tues 6 July Gold Adds "Anti-Commodity" to "Anti-Equity" Sticker as Strong Euro Link Returns THE PRICE OF gold bullion in wholesale dealing drifted lower as US dealers returned from the Independence Day holiday on Tuesday, trading below $1206 an ounce as European rose sharply, recovering one-third of last week's 5% drop. Government bonds eased back and silver bullion was little changed above $17.80 an ounce, but crude oil crept back above $73 per barrel while the broad CRB commodities index added 0.5%. The CRB index now shows a strong, positive correlation of +0.73 with New York's S&P500 equity index, according to today's chart-of-the-day from Bloomberg News. It would read +1.0 if thy moved perfectly in lock-step together, and is "rather spectacular" says a note from one London gold dealer, "given that commodities were long considered a hedge against volatility in equity markets." "Gold i... |

| Client Update – Croc Still on Track to Produce 100,000 Ounces This Year Posted: 06 Jul 2010 05:39 PM PDT The following is automatically syndicated from Grandich's blog. You can view the original post here. Stay up to date on his model portfolio! July 06, 2010 05:28 AM Crocodile Gold put out a press release this morning and reported that they are still on track to produce 100,000 ounces this year, and that they produced 8,700 ounces of gold in June, their first month of commercial production. And Croc is still receiving close to a one year high in the Australian dollar gold price of over A$1400! They also mentioned that they will be accelerating waste stripping in the Howley open pit to facilitate access to higher grade material so that it can be fed to the mill and stockpiled in preparation for the wet season. Some very positive news has come out of Australia recently regarding the proposed Australian resource super profits tax. The proposed tax will NOT apply to gold mining companies, which is excellent news for Croc. The newly appointed Prime Minister, Julia Gillard, who replac... |

| Yukon Gold Rush and Grandich Canucks Offer Posted: 06 Jul 2010 05:39 PM PDT The following is automatically syndicated from Grandich's blog. You can view the original post here. Stay up to date on his model portfolio! July 06, 2010 03:42 AM While it seems the only rush in junior resource stocks is to the exit, there is a bona-fide gold rush underway in the Yukon. After the close yesterday, Kaminak Gold released some very encouraging results that should bode well for them and the whole area play. As previously disclosed, I’ve acquired an extremely large personal position in Silver Quest Resources (SQI-TSX-V $.40 – SQIFF.PK OTC $.35). I spoke about SQI, the Yukon Gold Rush and two other clients, HTR and NDM, in the latest Prospector. If SQI doesn’t at least trade at twice it’s current price between now and the Cambridgehouse Int’l Vancouver show in January, yours truly will wear a Vancouver Canucks jersey during the show. Furthermore, I will go as far as to say “The Canucks are great” in my speeches and to anyone who ... |

| Charts: Gold, SP 500, Silver, HUI, Gold/Euro Posted: 06 Jul 2010 04:57 PM PDT |

| Posted: 06 Jul 2010 04:48 PM PDT Dear CIGAs, OTC derivatives are the entire problem. OTC derivatives are what transformed a normal four year economic correction into the disaster of a lifetime. New financial regulations do absolutely nothing to prevent a further unwind of the ever growing OTC derivatives outstanding. We are as exposed now as we have ever been to these weapons of mass financial destruction. The meltdown is moving into phase two. That chapter is usually the worst of the experience. We have yet to address the cause of the crisis With the debate about US financial reform finally, it appears, about to end, should we all feel safer and more confident that a crisis will not recur? After all, the root causes of this crisis (including derivatives) have been identified and addressed. Measures have been taken to prevent system-wide bail-outs. We agree wholeheartedly with the need for financial reform and support many of the derivatives provisions in the bill. But have we addressed what actually happened in the financial crisis? Or have we left the real culprit lurking, ready to resurface and create more instability in the financial system? It's clear today – and it was clear three years ago – that the culprit is real estate exposure. Bad lending, driven by poor underwriting standards and awful risk management, created and drove the crisis. Derivatives, of course, played a role. These financial instruments were and are a means of hedging and taking on risk. Some market participants used them to take on real estate risk. But history shows it's not the product itself that causes crises. It's the underlying risk discipline. The savings and loan crisis of 1989-90, the Japanese property bubble of the 1980s, and events such as the Panic of 1837 occurred at different times in different places. But what they and other crises have in common is a weakening in risk management standards and practices regarding real estate value and exposure. Looking at the 2007-09 financial crisis, a similar pattern emerges. The casualties had one big factor in common – real estate exposure – which they took on in different ways. First, consider AIG. While a large portion of its risk was taken via derivatives, there is no doubt that what turned bad was the underlying real estate risk. It also took large positions in the cash subprime market and its cash losses may well exceed whatever losses it suffers on its derivatives position.

Jim Sinclair's Commentary The Formula grinds on because there has been NO intervention at the cause point of this disaster. OTC derivatives simply grow and grow like the 1950s movie "The Blob." Expect lots of government layoffs at state, local level Here's another headwind for a sputtering job market: State and local governments plan many more layoffs to close wide budget gaps. Up to 400,000 workers could lose jobs in the next year as states, counties and cities grapple with lower revenue and less federal funding, says Mark Zandi, chief economist for Moody's Economy.com. The development could slow an already lackluster recovery. Friday, the Labor Department said employers cut 125,000 jobs, mostly because 225,000 temporary U.S. Census workers completed their stints. The private sector added 83,000 jobs, fewer then expected, as the jobless rate fell to 9.5% from 9.7%. Layoffs by state and local governments moderated in June, with 10,000 jobs trimmed. That was down from 85,000 job losses the first five months of the year and about 190,000 since June 2009. But the pain is likely to worsen. States face a cumulative $140 billion budget gap in fiscal 2011, which began July 1 for most, says the Center on Budget and Policy Priorities.

Jim Sinclair's Commentary Could it be that practical knowledge might just exceed a Master's Degree for years to come? Let's hear it for the OTC derivative manufacturers and distributors that brought this new world to us. Graduates warned of record 70 applicants for every job Graduates are facing the most intense scramble in a decade to get a job this summer, as a poll of employers reveals the number of applications for each vacancy has surged to nearly 70 while the number of available positions is predicted to fall by nearly 7%. The class of 2010 have been told to consider flipping burgers or stacking shelves when they leave university as leading firms in investment banking, law and IT are due to cut graduate jobs this year. Competition in the jobs market is fiercer now than for the first "post-crunch" generation of students, last year, when there were 48 applications for each vacancy. The number of applicants chasing each job is so high that nearly 78% of employers are insisting on a 2.1 degree, rendering a 2.2 marginal and effectively ruling out any graduates with a third, according to the survey published tomorrow. The Association of Graduate Recruiters polled over 200 firms including Cadbury, Marks & Spencer, JP Morgan and Vodafone and found the number of applications per vacancy had risen to 68.8 this year, the highest figure recorded. In the most hotly contested sector – makers of fast-moving consumer goods such as food, confectionery and cosmetics – there were 205 applications for each job.

Jim Sinclair's Commentary The Ski Jump is taking form! New Loan Delinquencies on the Rise Again Just when you thought things might be turning around, the mortgage crisis takes yet another little dip to the downside. Lender Processing Services just put out its May "Mortgage Monitor," and some promising trends aren't so promising anymore, specifically new delinquencies and cure rates. While the total delinquency rate rose 2.3 percent, which is not surprising given how much is in the pipeline, the 30-day delinquent bucket jumped 10 percent. That is surprising because the that number had been coming down of late. The LPS data report says that's because the "seasonal improvement period has expired," but I'm not sure normal seasonal patterns really apply to this market anymore. More likely is that home prices are not rebounding at the expected/hoped for pace, prompting more borrowers who are underwater on their loans to choose not to pay. And while the job market isn't bleeding so much anymore, it's not adding jobs back at the rate we need, nor is it re-instituting those full time jobs that were slashed to part-time, leaving many borrowers still "underemployed." So the delinquency rate nationwide now stands at 9.2 percent from this particular data set, and with the rise in new delinquencies, it won't be coming down any time soon. How do I know this? Because the report also finds that the "cure rate," which is the rate at which bad loans actually get better, i.e. the borrowers start to pay again, is getting worse. |

| V-Shaped Recovery, Where Art Thou? Posted: 06 Jul 2010 04:42 PM PDT This week was largely spent watching the recovery fall apart. Not a dramatic collapse. No market crash yet, for example. But the important indicators are giving way. On top of the bad news from housing and employment over the past few weeks, Richard Russell's famous PTI indicator finally dipped into negative territory - signaling a bear market. And the Baltic Dry Index - a measure of world trade - continued to fall. No new buyers are coming into the housing market. No new jobs are being created. Consumers are still de-leveraging. Banks are still reluctant to lend. And businesses are still loathe to expand in the face of an economy-wide de-leveraging. Automakers say they see no sign of recovery. Investors are spooked by the thought of a double-dip recession. And 10-year US Treasury notes are selling at the lowest yields in 14 months. To make matters even more unsettling, the world's governments have pledged to reduce their countercyclical spending. They won't get an argument from us on that score. They are doing the right thing. But if they follow through, it will result in the private sector and the public sector de-leveraging at the same time. This is highly deflationary. Countercyclical spending cannot stop a correction. But pro-cyclical tightening may be able to trigger a depression (as Treasury secretary Andrew Mellon's drive to balance the budget did from 1921-1930). Let me put that another way. Governments can't make bad debt go away. So they can't prevent a correction and a de-leveraging; they can only delay it. One way or another excess debt needs to be reckoned with. But when the authorities begin to tighten at the same time that the private sector is tightening, the effect will push the world into a sharper, deeper correction...even into a depression. This is a dangerous situation. This period of price deflation and debt destruction could be more dramatic than we expected. Seen through this lens, cash and gold seem preferable to stocks. The goal is not to lose money while waiting for the next great opportunity. Gold is the ultimate money. It is only useful as a store of value - and then only when other forms of money are defective. In a healthy monetary system, investors scarcely need gold. It functions best as a reserve currency and a reserve monetary asset. Your bank should have gold. You shouldn't need it. But the special conditions of our time make gold: (1) a necessity and (2) a good speculation. It is a necessity because the banking system lacks real reserves. One bank holds IOUs from other banks in place of reserves. The others do the same thing. If one fails, they all may fail. Central banks are no better. They hold the IOUs of their governments. But the governments are nearly all close to insolvency. Depending on how you look at their balance sheets, most governments in the developed world are already broke. And they are all adding more debt. At the recent G20 meeting in Canada, the world's richest nations pledged to gradually reduce their deficits. If all goes well, deficits will decline. And sovereign debt will plateau at about 100% to 150% of GDP. Governments that are reducing their deficits are headed in the right direction. There are two big questions: How far will they go? And what will happen along the way? The private sector is de-leveraging. Even $12 trillion worth of bailouts and boondoggles has not been enough to stop it. Imagine what will happen when government begins de-leveraging too! Much more could be said about this. A research report written by our friend Dylan Grice at Societe Generale revealed that it is unlikely governments can actually stay the austerity course. The only successful examples, he points out, occurred under much different circumstances - that is, when the private sector credit cycle was still in full expansion. We doubt that governments will have the stomach for deep spending cuts. It is easy to talk about austerity; it is difficult to implement it. And it is especially difficult when the economy is de-leveraging. In fact, the move towards tighter government budgets could produce a terrible outcome. It may not be enough to reduce sovereign debt levels...but still be enough to tip several national economies into depression (thus reducing GDP growth and keep debt-to-GDP ratios dangerously high). We could see greater losses to equities, bigger write-downs at banks and more bankruptcies than expected. This would clear away debt fast. And allow a speedier recovery. Gold is an insurance policy against monetary mistakes. We think we see an error coming. The Fed has nearly tripled its balance sheet since 2007. The Bank of England expanded its balance sheet fivefold. If the private sector were still expanding its use of credit, these moves would be horribly inflationary. Instead, credit is shrinking in the private sector. The inflationary policies of central banks are not being transmitted to the economy. There is no sign of consumer price inflation so far. Does that mean we're going to see much give in the gold price? We don't know. No one does. Gold went up 13% so far this year. Stocks worldwide are down 10%. Gold is clearly not responding to inflationary pressures. It is responding to uncertainty, and the increasing risk that the monetary system will fall apart. During the 1930s the price of gold doubled in sterling terms. Of course, we could be facing something more dramatic this time. In the 1930s the developed nations did not face such huge debts and deficits. They had no institutional or structural bent towards currency debasement. They were merely in a de-leveraging period and trying to get out of it. This from John Hussman:

Hussman makes an important point: it is very difficult to forecast what will happen in the markets except through the lens of our own experience. Most investors have only seen bull market/credit expansion conditions. Those conditions (although punctuated by setbacks) have dominated housing, stocks and bond markets since the early 1980s. It is therefore very difficult now to imagine how bad things could get. In 1932 for example, the S&P 500 sold for just 2.8 times the peak earnings of the pre-depression period. And this was a time when the US was still overwhelmingly the world's most dynamic, richest, fastest-growing economy - one with relatively little regulation, low taxes and great prospects for future growth. By contrast, today we seem to be approaching endgame. The neo-Keynesian plan for stimulating the economy, for example, has pretty much played itself out - except in America. So has the dollar-based monetary system. Meanwhile, the system of open-ended, debt-based financing of social welfare spending is also running out of room to maneuver. Even in the best of circumstances, it would be difficult to make the adjustments that even one of these challenges calls for. Trying to do them all at once - against the backdrop of a huge private sector debt destruction - could be disastrous. From Hussman again:

This is our view, too: deflation now, inflation later. Which is why we favor gold as insurance AND as a speculation. As insurance, it is the oldest, simplest and surest place for your money. It may or may not be overpriced at any moment. But it will never be 100% overpriced. It represents real wealth. Always will. As a speculation, it is a bet that the financial authorities really are as maladroit as they appear to be. So far, they've given no indication that they grasp what is really going on. If they did, they would immediately give up their project of trying to stop the market from correcting. They would look to their own precarious situation, immediately cut spending and immediately try to beef up their own balance sheets. (In any event, no one asked our advice...) Most likely, as Hussman argues, the feds will not abandon their neo- Keynesian stimulus. And when they realize this stimulus doesn't work they will turn to debt monetization - they will create money to buy their own bonds. This will work. It will cause inflation - possibly hyperinflation - which will wipe out much of the debt (along with much of America's counterfeit economy). Gold has been going up ever since I first recommended it to readers more than 10 years ago. The cracks in the world's monetary system are widening. But they remain just cracks. My guess is that the bull market in gold will pause during the coming deflation and then resume, probably turning into a speculative frenzy when the deflation turns into consumer price inflation. At that point - which could be 5 or 10 years ahead - we hope to trade our gold for stocks, buying the best companies at the best prices in a quarter century. Patience... Bill Bonner |

| Posted: 06 Jul 2010 04:37 PM PDT On Sunday, we celebrated America's independence from Britain. Having just come from London, it's hard to see what the fuss was all about. The English seem like decent people. The queen still has her dignity. The British government seems no worse than its American counterpart. And David Cameron appears to have a much better idea of what he is doing than the Obama team. Cameron is calling for 'austerity.' He wants the British public to make sacrifices so that British public finances can be brought back under control. We have some doubt that he will succeed. As far as we know, no democratically elected government has ever been able to reduce its debt burden DURING A CREDIT CONTRACTION. A number of governments - including the US and Britain - managed to reduce their debt in the '80s and '90s. But that was when their economies were booming. As long as the economy is growing faster than the debt, the burden of debt will decline as a percentage of GDP. The '80s and '90s were boom years. Credit was expanding. People were buying more and more things they didn't need with more and more money they didn't have. Obviously, that kind of boom can't go on forever. And when it came to an end in 2007 it changed the financial picture for governments as well as households and businesses. Tax revenues went down. Expenses went up. And so did the bailouts and boondoggles that they call 'stimulus' spending. As deficits rise, so does debt. And so do the voices who tell us that debt is nothing to worry about. Those voices - led by Paul Krugman at The New York Times - mention the debt decline of the '80s and '90s. They say we can "grow our way" out of debt this time, just like we did the last time. Here at The Daily Reckoning we don't rule out anything. The day is long past when we said anything with absolute, unshakeable conviction. Today, even when someone asks us our name, we check the initials on our undershirt just to be sure. Might the US and Britain 'grow' their way out? Well, anything is possible. But two things make it unlikely. As we said above, we're in a credit contraction. It's part of what we call the Great Correction. Growth rates are going to be low...and occasionally negative. US government deficits, on the other hand, are scheduled to be over 5% of GDP from here to kingdom come. And if David Stockman is right, they could stay over 10% of GDP for the foreseeable future. Stockman is the former head of OMB during the Reagan Administration. He predicts deficits as high as $2 trillion per year, thanks to a weak economy and strong spending by the feds. The second thing that makes it unlikely that we will be able to grow our way out of debt is the composition of the economy. More and more of it is under the control of government. 'Growth' in this economy is largely phony. It reflects activity. But not prosperity. The activity, therefore, is not the sort that you can tap to pay down your debt. Instead, it adds to the debt. You can see how this works just by imagining what would happen if the feds hired a million census takers. The economy would appear to 'grow' - maybe even faster than the debt. But the economy itself would be hollow and less able to sustain the debt burden. The other example used by Krugman et al is WWII. At the end of the war, US debt was equivalent to what it is today, as a percentage of GDP. "Hey, what's the big deal? It didn't do us any harm then," they say. But the federal government was actually in a much stronger financial position back then. While it had about the same official national debt, it faced almost no off-the-books unfunded liabilities, financial guarantees, and open-ended commitments. The last time we looked, these off-balance sheet debt items - such as for health care programs - totaled more than $50 trillion. And then, there's the private sector debt too. That's about $50 trillion too. How much net private debt was there in 1950? Almost none. In the post-war period we were in a different stage of the credit cycle. People were just beginning to spend. They didn't have a mountain of debt. They had a mountain of savings! Yes, dear reader, people made sacrifices during the war years. They had put off consuming. Then, soldiers came back from Europe and the South Pacific with pent-up demand, and real savings that they could put to work. So, the economy was ready for a credit expansion, not a contraction. People had lived through the lean years. Now they were ready for some fat ones. The economy too was ready to rock and roll. It had been converted to a war footing. Now it was ready to meet consumer demand. This is the opposite of the picture today. Few sacrifices were made over the last 50 years. Instead, the last 5 decades were a time of increasing extravagance. That's why sacrifices are necessary today. Households are only now beginning to cut back. Governments in Europe are cutting back too - or so they say. And under the sway of Krugman and other neo-Keynesians, the US government continues to run huge deficits...hoping that the debt will be refinanced and repaid, as it was after WWII. But probably the nicest thing about after WWII was that there was an AFTER WWII. The war had a beginning and an end. When it was over people were finally able to get on with their lives. The economy was ready to switch to a new phase too - from making tanks to making hot water heaters. And, finally, governments could stop borrowing and begin repaying their debt. The major trouble with today's struggle is that there is no end in sight. ******************** Americans may have fretted a bit over the holiday weekend. The news has been bad. At least, if you regard a correction as bad. California is cutting its payroll and putting others on minimum wage salaries. Illinois has run out of money and stopped paying its bills. The stock market is going down. Bond yields are at record lows. The housing credit has expired. The clunkers have all been crushed. Census workers are being awarded medals for counting above and beyond the call of duty...and sent home. The feds' stimulus didn't stimulate...their recovery didn't recover...their counter-cyclical fiscal policy didn't counter much of anything. And now it's all running out...and we're beginning to see the word 'depression' used to describe America's malaise: "Dow repeats Depression pattern," says an item on CNBC. US "trapped in Depression," says a headline at The Telegraph in London. Consumer bankruptcies are at their highest level in 5 years. Houses aren't selling. Retail sales are down. Factory orders are falling. And the cruel Senate told those whose unemployment benefits have run out to 'go fish.' "Recession Jolted Most Americans into Cheaper Living," said a recent Bloomberg headline. That's what you'd expect in a Great Correction. But who expected a Great Correction? Not many people. Instead, most expected a recovery. Whatever is going on, a recovery is not it. There were fewer jobs at the end of June than there were at the beginning of the month - 625,000 fewer. The Labor Department reported that the unemployment rate went down to 9.5% but everybody now understands that the numbers are fraudulent. The feds are just disappearing people from the unemployment rosters. In fact, they dropped 1 million Americans off the list in the last two months. These people are not 'actively' seeking employment, they say. But it now takes 35 weeks, on average, from losing a job to finding a new one - if you're able to find a new one. That's about half again as long as it took in the worst job market of our lifetimes, during the late '70s. With five people available for every job opening, naturally, a lot of people don't find work and give up. Bad odds. We only actively looked for a job once in our lives - in the early '70s. We had gotten out of college. It was time to start a career. So we looked in the paper for jobs in journalism, for which we were completely untrained. We saw an opening in Washington, DC, at a newsletter company. We put on a suit and went for an interview. The interview went well. But we didn't get the job. They wanted someone with a better haircut or a better resume. Either way, it did not look like job hunting was going to work out for us. Fortunately a friend needed help. He paid $100 a week. That wasn't much. But it was a start. We stuck with him until we were able to start our own newsletter company. Pity the poor people who are looking for a job now. Nearly 8 million jobs have been lost in the last 3 years. Many of those jobs will never come back. Recovery? Forget it. Who's going to build McMansions ever again? No one. They are relics of the Bubble Age...historical artifacts - like a Chrysler Imperial with huge fins from the '70s... But wait...it gets worse. Because even people who are working are earning less money. Hourly wage earnings are falling. Hey, maybe China will get out of this slump? No, China's economy is slowing down. And Ken Rogoff says its real estate market is beginning to collapse. Fortunately, (and here you see our Daily Reckoning sunny side coming through the clouds) a great correction is just what the country needs. Remember, you can't make bad decisions good or make debts disappear. You have to work through them...write them off, pay them off, default, foreclose, Chapter 11 or Chapter 7. That's what we have corrections for. Best to get on with it... And more sunny thoughts... Earnings in the private sector in Britain are falling at their fastest rate ever...down 1.1% in the first quarter of the year. Meanwhile, the economy is in a 'savage' recession; GDP growth was negative by 1.9% in the first quarter, the worst performance in 30 years. Willem Buiter, a former member of the Bank of England's Monetary Policy Committee, said: "The economy will be shrinking into next year. We'll be in recession and have sharply rising unemployment for the next year or year-and-a-half." Zombification continues. The purest and most obvious zombies are criminals. They make no pretense about it. They're out for blood. But what's interesting is how the pure zombies work hand in hand with the poseurs. You put a zombie in jail, for example, and before long the prison system - guards, suppliers, builders, administrators, unions - has become zombified, lobbying the state legislature for more laws, more criminal penalties, and more prisons. America has more prisons and prisoners than anywhere on earth. Why is that? Is it because Americans are worse people? Or is it because the correctional system has become a vast zombie gulag, leeching on the rest of the society? We saw an example of this kind of symbiotic zombification in The International Herald Tribune over the weekend. Chicago has no money. It also has a lot of young people who like to shoot at each other. So, the city hires full time counselors to work with 'at risk' youths...one on one...accompanying them to school and to the store and so forth. The counselors are supposed to help keep the hoodlums from going off the rails. Whether they succeed or not, we don't know. We just notice how the system drains blood from the real economy into an activity that may sound worthy, but is really just a conspiracy of zombies. An even more outrageous example comes from England, recounted to us by a new friend, an English lawyer: "There was a famous case a few years ago. Two boys, I think they were only 10 years old, snatched a two-year-old from his mother at a mall. They marched him into the woods. They used an iron bar to bash in his head. And they mutilated him in some way that was never described to the public. "These were very nasty boys. They planned the whole thing. After they killed the child they laid his body on the railroad tracks...where it was discovered. And then, the local people were horrified, of course. They put flowers on the railroad tracks to mark the site. The killers - who hadn't been caught yet - joined the mourners. Cold blooded. It's on videotape. "Finally, the police caught them. One of the boys cracked and confessed. "But what happened next was bizarre. The criminal justice system rose to defend the boys in the most remarkable manner. Since they were minors they couldn't be tried as adults. Instead, the legal establishment soon turned these monsters into 'victims.' They were appointed custodians, and counselors, and lawyers, of course, all paid for by the government. And the government provided full care...including schooling, of course, but also television and toys. Since they were underage, they could only be sent to a kind of reform school. But they only stayed there for a short time. Because the people of Liverpool were so incensed, the murderers got death threats. So they petitioned for something like the witness protection program, where their identities were changed, and they were to be supported by the government for the rest of their lives - even after they were no longer in government custody. You couldn't even find out what happened to them. They could be living next door to you and your children." Regards, Bill Bonner |

| Posted: 06 Jul 2010 04:34 PM PDT Fear and Stubbornness As this bull market matures, it is remarkable that patience with gold, despite outstanding fundamentals, always deteriorates with every down tick during paper-driven attacks. While the bull market evolves, it appears that human emotions are consistently stubborn. This stubbornness likely masks the subtle hints disclosed during the decline that suggest the downside force is weakening. The 07/01 lows was breached today on nearly 50% reduction in volume. This is a big discrepancy. Those "pushing on the string" during this attack know that what cannot break support with force will eventually reverse direction and attempt to break resistance with force. Expect fear, their only weapon against objectivity, to be pressed extremely hard as the connected shorts cover into weakness.

Hi Jim, Thanks for all your good work. I have been a chartist for over 40 years. I have never seen a chart as symmetrical as this. Notice the double overlaid right sloped head and shoulders top pattern (with a more horizontal ghost H&S top pattern) forming. Drawing all the possible future major point projections on the way down is marvelous. Measure minimum is between 79 and 80. Maximum is south of 76 or even a lot lower. WOW! Regards, Dear Larry, The currency market has become a total casino and operation. If the big players want the euro at 1.50 and the dollar at .7200 they could do it in two days. Then if they wanted to crash the euro to today's level it might take 36 hours. Main Street is in the hands of a Roulette Wheel as Bill Carleton wrote in his song on the outstanding album, Squeeze the People. Regards,

Dear Jim, Allow me to chime in here and bolster your comments to CIGA Arlen. First and foremost, what your readers need to understand is that no one who has a loan secured by a mortgage on his home is safe. Mortgage servicing companies, including Wells Fargo Bank, CitiBank, JPMorgan Chase, and Bank of America, etc. control everything. This is why, as banks, mortgage companies, and hedge funds began to fold, beginning with the Mortgage Meltdown in 2007, the acquisition of mortgage servicing rights was the name of the game. Regardless of whether Fannie Mae, Freddie Mac or a securitized Trust Fund purportedly "owns" your loan, the Servicer controls your destiny. Back in 1995, I first started seeing Servicers manufacture a default on a current loan and institute a foreclosure action even though the consumer had made every payment on time. Once this process begins, it is virtually impossible for the consumer to straighten out the problem and get back on track. This is because the Servicer's policies, procedures and technologies are set up to automatically trigger a series of unstoppable events once there is the slightest deviation e.g., an increase in your interest rate on an Adjustable Rate Note, an increase in escrow items, a late payment, or bankruptcy. Through the mortgage auditing work that I have been doing since 1991, and particularly with all of the expert report writing I have been doing over the past two years analyzing the securitization of these residential mortgage transactions, I can tell you with certainty that even though the noise has quieted down since the bailout, the house of cards is crashing down at lightning speed. I subscribe to the Bloomberg Terminal to research whether or not my client's loan is in a particular securitization trust which is tremendously helpful. For example, an attorney I am working closely with here in Massachusetts has a client who was facing a foreclosure sale date of July 15th. The foreclosing entity was Deutsche Bank National Trust Company as Trustee of the IndyMac INDA 2005-AR1 Mortgage Loan Trust-AR1. Using Bloomberg, I was able to establish that the loan in question is not being tracked as an asset of the Trust. I wrote an expert report laying out the fraud; the foreclosure was canceled; and now the foreclosing law firm is begging the attorney I am working for not to sue them. There is so much fraud throughout the system that it is unimaginable. We are now living in a criminal culture where the Banksters are running the show with impunity. Virtually every subprime securitization I have audited is suffering default rates between 20% to 57% of the entire portfolio. Each of these securitizations is a Ponzi scheme. There was never going to be enough money in the system to return the investors' principal. Those in the know (spell that SERVICERS) knew these loans were designed to fail and purchased credit default swaps and other derivatives to short the deals. This is why Jim says to Arlen below: 2. Yesterday, I sent you a list of the bailouts on which a major mortgage service company received one billion dollars. 3. If the servicer was simply a mortgage service company middle man how did it lose so much money as to need a one billion dollar bailout. The only credible explanation as to why Deutsche Bank (a Trustee for 1900 securitization Trusts) and mortgage Servicing companies such as those Jim refers to would be receiving bailouts is if they were being paid on their credit default swaps. It is clear for me to see through my use of the Bloomberg Terminal that the mortgage servicing industry is squeezing the last bit of liquidity out of the market. At these double-digit default rates, with a 50% severity loss rate, most of these Trusts will be wiped out by 2014. In historical terms, I think of this as The Civil War, and it won't be long before we see the Carpetbaggers and Scalawags (the debt buyers and junk-yard dogs, etc.) coming around to pick up the pieces. I can also tell you that 90% of the foreclosures are illegal and fraudulent and could be stopped if consumers had the right analyst and attorney working together. The problem here is that the scheme has stripped homeowners of their cash, savings, and assets in the process. Well, I could go on but I shall leave you with these thoughts to mull over. My best advice to CIGAs: follow Jim's advice and hunker down. Gold is the most stable repository of real wealth that civilized society has ever known. The dollars that have been created through the financialization of our economy via derivatives trading is totally unsustainable. Perception drives the market and when the world learns too late that that super-hyper-inflation of our currency will render it worthless, perhaps this madness will stop. Kindest regards, CIGA Marie Marie McDonnell, CFE

Dear Jim, Yesterday you spoke of mortgage payment servicers as if it was something anyone with a mortgage MUST know. I missed the point of why. Could you tell me again in simple language that is easily understood why I should be concerned and act to do something. Respectfully, Dear Arlen, 1. A service company should be a simple middle man that receives your mortgage payment and pays it to the lender for a modest fee. Regards,

Short-Covering in Gold Headlines and experts on F-TV casting doubt about gold is nothing but chatter. Follow the money. Connected money, which includes the bullion banks, continues to cover their short positions. The recent decline, yet to show up in the COT data, will only intensify this trend.

Gold Seasonality Be wary of experts suggesting that July and August are two weakest seasonal months for gold. It's not true. The time frame of July and August is neutral at best from a long-term seasonal perspective. When seasonality is further refined into the second year of the four year cycle, a must when doing comprehensive seasonality analysis, the characterization of the July and August time period turns from neutral to very positive. 1925-2009 Seasonality with the Second Year of the Four Year Cycle: Fear of holding gold is easy to sell into price weakness. Don't let negative seasonality arguments erode confidence in this secular bull market. |

| Posted: 06 Jul 2010 04:22 PM PDT Will the markets - both housing and equity - continue to be responsive to changes in the cash rate made by the Reserve Bank of Australia? Or will Aussie mortgage rates decouple from the cash rate as the global cost of capital goes up? That was just one of the many interesting questions that came out of last night's debate with Rory Robertson. If you're a pugilist or a fan of broken noses, you will be disappointed to learn the evening did not come to blows. It was spirited though. And by the end of the night, it was clear what the differences are in the positions: one camp believes things are pretty much okay here and house prices are supported by population growth and low interest rates. The other is a bunch of wacko residents of Extremistan with odd theories about what money is. More on that shortly! A hint - we are all residents of Extremistan now, thanks to 30 years of cheap money fuelled global growth. The great contraction is upon us. But the RBA was really the big newsmaker in Sydney yesterday and was not at all worried about Extremistan. The men who set the price of money in Australia decided it was neither too hot nor too cold yesterday. It's just right...for now. If it's really true that a small group of men and women can know what the price of money should be at any given moment, then we're going to write Pope Benedict and ask that he cannonise Glenn Stevens. Each interest rate decision is a kind of transubstantiation...a miracle whereby the tens of millions of private calculations in the real economy are simultaneously subsumed in the brain of the central banker...and turned into a price. Monetary miracles aside, the markets seemed to like the RBA's statement. US stocks were up and the Aussie dollar rallied. Newswires referred to the RBA's vaguely bullish comments about Asian growth. Everyone is still hoping China can do whatever it's still doing for Australia, in whatever way it's still doing it. What is it doing, anyway? It occurred to us that the correlation between low levels of Australian unemployment (around 5.6%) and Chinese resource demand is something more alleged than proven. There may actually be some proof that Chinese resource demand supports a large part of the Aussie job market. But we haven't seen it yet. If you have some, let us know. Meanwhile, the Wall Street Journal's Matt Phillips reports that the RBA's statement might not be as bullish as risk traders and yield hunters have been led to believe. He quotes this line from yesterday's announcement: "The expansion remains uneven, with the major advanced countries recording only modest growth overall, but growth in Asia and Latin America, to date, very strong. There are indications that growth in China is now starting to moderate to a more sustainable rate." "Starting to moderate..." Hmm. The issue of China's relative strength has indirect bearing on the housing argument. The bulls argue that a strong economy with low unemployment means no mortgage stress for cashed-up and fully employed homeowners. Only a rise in unemployment to U.S-like levels (officially 9.7% but likely at least twice that) would kick the legs out from under all those new first home buyers the government invited into the market. But as long as it's all good in China...she'll be right. And in what looks at least to be unambiguously good news, Australia ran a $1.65 billion trade surplus in May, according to figures released yesterday from the Australian Bureau of Statistics. Thank you coal, you black beauty you. And thank you iron ore you reddish orange beauty, you. That kind of national income may, now that we think about it, support employment indirectly. The money comes in. It has to go somewhere. Will it go to foreign shareholders? The government (taxes)? Or will it go forth into the economy and multiply? John Peters, a senior analyst at Commonwealth Bank, says the figures may force the RBA to put up rates even higher later this year. "Trade will clearly be one of the key factors to drive economic growth back to a higher level, along with dwelling investment and business investment. This type of growth in export income is a fairly significant stimulus." If he's right, then the obverse must be true too, right? That is, if booming coal and iron ore exports support the economy in strange, mysterious, and potentially stimulating ways, then crashing coal and iron ore prices undermine Australia's economy in potentially recessionary ways, do they not? Well of course they do. It's not that much of a mystery. But if you're not familiar with the argument, check out our "Exit the Dragon" report for the whole story. We'll leave it others to decide who won last night's debate. To be fair to Rory, most of the time, anyone making the orthodox, steady-as-she-goes, keep doing what you're doing argument is right. Most of the time, the extremists are wrong. But not all the time. And when they are right, the magnitude of their rightness is breath taking. More importantly, our central point last night was that central bank manipulation of the cost of capital is what creates bubbles...giant oceans of misallocated capital based on bogus price signals that encourage consumption and production out of whack with underlying demand (not supported by cheap money). Further, there is ample evidence in the last ten years that globalisation accelerates instability. Cross-border capital flows are great for investors, to be sure. But the more complicated any system gets, the more unstable it gets too. And in the chase to instantly price in and understand thousands of events each day, investors rely on models to find out where the best place to park their capital. But these models - from Long Term Capital Management's to Bear Stearns and Lehman and AIG - rarely model the extreme event (a credit depression). Statistically, their models tell them the probability is so low it is not worth preparing for. We've seen how that worked out, haven't we? And if the number of extreme financial events seems to occurring with more frequency than models would suggest, an inquiring mind would want to know why, wouldn't it? The answer, we think, is obvious. Cheap money creates credit bubbles and misallocated capital. Asset prices driven up by borrowed money eventually revert back to a mean when the money dries up. Our central argument is that Australian house prices are the last in a long line of leveraged asset booms, all of which, save Australia's housing market, have blown up. Real estate, though, unless it's a world-class cluster-storm like the U.S. subprime crisis, rarely blows up. It unwinds over many years. Buyers are generally not forced to sell and the market can remain illiquid for many years until a market clearing price emerges. In real terms, house prices stagnate. That is one possibility here in Australia. Another is that your editor is flat-out crazy and has failed to understand the basic structural forces that support house prices in Australia - immigration, restricted supply, low rates, and a pre-disposition to homeownership. For various reasons we won't go here, we think all of those arguments are tenuous, or at least variable (immigration rates can change...demand for accommodation does not automatically correlate to mortgage finance demand...interest rates are at historic lows and probably headed up). But by the end of the night, we think the debate had produced a clear difference of honest opinion. Rory, if we understand him correctly, believes the ultimate job of the central bank is to support asset prices by lowering the cash rate in times of crisis. We believe the central bank creates the crisis with an artificial cost of money that inevitably is kept low to promote growth (and keep the property spruikers happy). It ought to be the central banks role to promote and guard sound and honest money, not support asset prices. But then, we don't believe there ought to be a central bank at all. And in any event, the coming months will tell us who really determines the price of money in Australia - the RBA or the global bond market. Already Australian banks borrowing money over-seas - and Aussie banks finance at least a quarter of their domestic lending from foreign borrowing - are having to pay more than the cash rate. Funding costs are up. Rory conceded that in a genuine credit crisis, Australian banks would be hard done by. The question is whether there will be a crisis that pushes up funding costs so high Aussie banks must put up mortgage rates too. It may not have to be some crisis event, though. As we've reported in the past, public and private sector borrowing - some new short-term borrowing and some rolled over from lower rates - is set to hit nearly $5 trillion in the next 24 months. Australian banks have to compete for that capital with other global borrowers. The big saving grace now is that the difference in yields between Australian and American debt makes some Australian debt attractive on a yield basis to foreign investors. Imagine that. Investors hunting for yield through securitised residential mortgages. You could even argue, though Rory didn't, that fixed income Australian securities would be the toast of the globe if the Fed chooses to keep rates low. But our argument would be that in a second phase of the credit depression, Australian assets will be treated like the plague (as is the case with most risk plays...and Australia is considered a risk play). Without the funding, what then for house prices? What we both agree on is that no one knows what will happen. Your editor believes that the Austrian theory of the business cycle has both explanatory and predictive power when it comes to figuring out what has to happen at the end of a leveraged asset boom. But it is true - from meat pies to the platypus (both reptile AND mammal!) and in many other ways-Australia is exceptional. So will the housing market here be the only exception to the rule? Dan Denning |

| Guest Post: "So Much For The Market Being Cheap" Charting A 50-75% Downside Case In The S&P Posted: 06 Jul 2010 04:08 PM PDT Submitted by Brandon Ferro, Managing Member of Hevea Partners Some Market Thoughts worth Sharing Historical market data that suggest our current situation resembles very scary periods in times past (i.e., the 1929 crash to be specific) is beginning to pile up.

|

| Gold Seeker Closing Report: Gold and Silver End Mixed Posted: 06 Jul 2010 04:00 PM PDT Gold fell almost $20 to as low as $1189.20 by about 10AM EST, but it then bounced back higher in the last few hours of trade and ended with a loss of just 1.09%. Silver dropped to as low as $17.585 before it spiked up to as high as $18.013 around midday in New York, but it then fell back off into the close and ended with a gain of just 0.17%. |

| Jeff Nielson: The seven sins of GLD Posted: 06 Jul 2010 03:35 PM PDT 11:35p ET Tuesday, July 6, 2010 Dear Friend of GATA and Gold: Jeff Nielson of Bullion Bulls Canada has read through the prospectus for the gold exchange-traded fund GLD and is appalled. His analysis is headlined "The Seven Sins of GLD" and you can find it at Bullion Bulls Canada here: http://www.bullionbullscanada.com/index.php?option=com_content&view=arti... Or try this abbreviated link: CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Sona Resources Expects Positive Cash Flow from Blackdome, On May 18, 2010, Sona Resources Corp. (TSXV: SYS, Frankfurt: QS7) announced the release of a preliminary economic assessment for gold production at its flagship Blackdome and Elizabeth properties in British Columbia. Sona Executive Chairman Nick Ferris says: "We view this as a baseline scenario for gold production. The project is highly sensitive to the price of gold. A conservative valuation of gold at $1,093 per ounce would result in a pre-tax cash flow of $54 million. The assessment indicates that underground mining at the two sites would recover 183,600 ounces of gold and 62,500 ounces of silver. Permitting and infrastructure are already in place for processing ore at the Blackdome mill, with a 200-tonne per day throughput over an eight-year mine life. Our near-term goal is to continue aggressive exploration at Elizabeth and develop a million-plus-ounce gold resource, commencing production in 2013." For complete information on Sona Resources Corp. please visit: www.SonaResources.com A Canadian gold opportunity ready for growth Join GATA here: New Orleans Investment Conference * * * Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Prophecy to Become Coal Producer This Year Prophecy Resource Corp. (TSX.V: PCY) announced on May 11 that it has entered into a mine services agreement with Leighton Asia Ltd. to begin coal production this year. Production will begin with a 250,000-tonne starter pit as planned in August, with production advancing to 2 million tonnes per year in 2011. Prophecy is fully funded to production and its management team includes John Morganti, Arnold Armstrong, and Rob McEwen. For Prophecy's complete press release about its production plans, please visit: http://www.prophecyresource.com/news_2010_may11.php |

| CDS Traders Attempting Another European Ambush Posted: 06 Jul 2010 02:56 PM PDT Another week, another major derisking of European names. While the drop of China out of the Top 10 can only be attributed to the summer doldrums, the top countries are mimicking the World Cup Final, and are all European, amounting to over $1 billion in net notional derisked in the past week. These are Germany, Italy, Spain, Austria and the Netherlands, with Greece and Poland at 6 and 7, and Brazil, South Africa and Colombia rounding out the top 10. On the other end, by a smaller margin, the rerisking of France and Portugal amounted to just over $500 million in the past week. The most active name was Brazil with 1,109 contracts unwound or almost $10 billion in notional, even as the net change was one of derisking. It appears Europe will have no peace from CDS "speculators" testing out the ground in each and every country, until it the rolling wave of defaults finally sets in as Niall Ferguson stated earlier. Source: DTCC |

| Fed Audit Failure Lends Credence to QE Rumors Posted: 06 Jul 2010 02:46 PM PDT At the Fed, however, these bonds were sold at whatever price the banks printed on them as part of new mark to market rules. Therefore, the Fed essentially spent more than one trillion dollars to get less than one trillion dollars in assets. Knowing this fact, how can we ever expect that the Fed can bring just as many dollars out of the system as it added to it? You simply can't. All you can do is get ready for inflation. |

| Canada Pension Plan Invests in Oilsands Posted: 06 Jul 2010 01:38 PM PDT Shaun Polczer of the Calgary Herald reports, Canada Pension Plan invests in oilsands:

Although I'm not a big fan of oilsands - mostly because of environmental reasons - I think this is a good time to be investing in long-term energy projects. And if this company's thermal technology is environmentally "cleaner" than other technologies, then all the better. Still, even the best technology means emissions. Interestingly, on the same day CPPIB announced this deal, Dina O'Meara of Calgary Herald reports, Prominent U.S. congressman rejects expansion of oilsands pipeline to Gulf coast:

Oilsands are big politics up here in Canada. Mike De Souza of Canwest News Service reports, Politicians cancel oilsands pollution probe, tear up draft reports:

The politics of oilsands are very messy. I was hoping to see more money go to developing new technologies to extract oil in a much cleaner manner. I am a firm believer in clean technology, but lots more needs to be done with oilsands. |

| European banks use gold reserves to raise cash Posted: 06 Jul 2010 01:28 PM PDT By Jack Farchy http://www.ft.com/cms/s/0/e3ed5836-8949-11df-8ecd-00144feab49a.html European commercial banks have begun using their holdings of gold to raise cash with the Bank for International Settlements, in a further sign of strains in the money markets on which many rely for funding. The BIS, the so-called "central banks' central bank," took 346 tonnes of gold in exchange for foreign currency in "swap operations" in the financial year to March 31, according to a note in its latest annual report. In a gold swap, one counterparty, in this case a bank, sells its gold to the other, in this case the BIS, with an agreement to buy it back at a later date. ADVERTISEMENT Prophecy to Become Coal Producer This Year Prophecy Resource Corp. (TSX.V: PCY) announced on May 11 that it has entered into a mine services agreement with Leighton Asia Ltd. to begin coal production this year. Production will begin with a 250,000-tonne starter pit as planned in August, with production advancing to 2 million tonnes per year in 2011. Prophecy is fully funded to production and its management team includes John Morganti, Arnold Armstrong, and Rob McEwen. For Prophecy's complete press release about its production plans, please visit: http://www.prophecyresource.com/news_2010_may11.php In the past the BIS has occasionally engaged in gold swaps. There has been no mention, though, of any such operation in recent years. The gold swaps detailed in the annual report began in December last year, according to monthly data from the International Monetary Fund, and have surged since January, when the Greek debt crisis erupted. The amount raised in the operations, just over $13 billion at current prices, is small compared with the wholesale money markets. But the fact that banks are using their gold holdings to raise capital is a further indication of the stress in the sector. Euribor, the rate at which eurozone banks lend to each other, has risen for 27 successive days, while markets are nervous about the impending release of bank stress tests in Europe, scheduled to be published at the end of the month. The BIS annual report says the gold received in the swaps was held "at central banks." Talk of the swaps caused a stir in the gold market, with some traders citing it as a reason for gold's fall to a five-week low below $1,200 a troy ounce. Join GATA here: New Orleans Investment Conference * * * Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Sona Resources Expects Positive Cash Flow from Blackdome, On May 18, 2010, Sona Resources Corp. (TSXV: SYS, Frankfurt: QS7) announced the release of a preliminary economic assessment for gold production at its flagship Blackdome and Elizabeth properties in British Columbia. Sona Executive Chairman Nick Ferris says: "We view this as a baseline scenario for gold production. The project is highly sensitive to the price of gold. A conservative valuation of gold at $1,093 per ounce would result in a pre-tax cash flow of $54 million. The assessment indicates that underground mining at the two sites would recover 183,600 ounces of gold and 62,500 ounces of silver. Permitting and infrastructure are already in place for processing ore at the Blackdome mill, with a 200-tonne per day throughput over an eight-year mine life. Our near-term goal is to continue aggressive exploration at Elizabeth and develop a million-plus-ounce gold resource, commencing production in 2013." For complete information on Sona Resources Corp. please visit: www.SonaResources.com A Canadian gold opportunity ready for growth |

| Posted: 06 Jul 2010 12:30 PM PDT |

| Posted: 06 Jul 2010 12:09 PM PDT Last week, Goldman, in a piece unambiguously titled The Second Half Slowdown has Begun, made it all too clear that unless the US government were to succumb to yet another, and another, and another round of drunken sailor spending, the gratuitous ability of its sellside analyst to place crap companies on Conviction Buy lists may suddenly become mysteriously impaired as reality seeps through the gaps, thereby infuriating CEOs of worthless and overlevered widget makers, who know all too well their corporate earnings are about to be taxed through the nose by the Obama crack economic team, as their stock is about to plunge. Today, just in case the threat may have been missed by the cheap seats the first time around, here comes Jan Hatzius with the ominously titled "Disturbing Signs" which reads like Paul Krugman's induction essay into the Useless Economists' Society.

And what is unsaid: should GDP downside risk materialize, you can kiss all those Buy Rated companies goodbye, as Goldman moves to a conviction sell on everything that moves, thus wiping out about $5 trillion in stock market value. Obama: you have been warned - how will your corporate sponsors feel that for once you did what is in the interest of the people of this country, instead of the 100,000 richest folks, who just happen to pay 80% of all taxes, and proceeded to destroy the bulk of their equity values. Oh yes, and that whole thing about the Fed buying up your debt via the Goldman/JPM-led group of Primary Dealers... you can kiss that goodbye too. |

| Posted: 06 Jul 2010 11:57 AM PDT |

| Posted: 06 Jul 2010 11:50 AM PDT Dear Friends, Reports about a large gold swap done by the IMF are being colored by a glib analysis of what a swap is as compared to a lease. If the IMF was legally able to and leased this gold, I would agree with the fear of market sales as a means of bailing out euro banks or other entities. Gold swaps are done with monetary authorities. Gold leases are done with "for profit entities" such as gold banks. Gold Swaps are usually undertaken by monetary authorities. The gold is exchanged for foreign exchange deposits with an agreement that the transaction be unwound at a future time at an agreed upon price. The IMF will pay interest on the foreign exchange received. Historically swaps occur when entities like the IMF have a need for foreign exchange, but do not wish to sell the gold. In this case gold is a leveraging device for needed currency to meet requirements. Conclusion: The many reports today that characterize the large IMF gold swap as a sale of gold into the markets do not understand the difference between a swap and a lease as defined by with whom it is done and why. All that scary crap written today is just that, crap. The IMF swap so talked about today is not a threat to the gold price. In retrospect neither was the gold leasing as it was happening $1000 points lower. Certainly the swap is not and the various commentators today are not familiar with the differences. Respectfully, |