Gold World News Flash |

- Crude Oil Awaits Guidance, Gold is Lower After Breaking Down

- Metanor Patiently Put Pieces Together For Gold Production

- Goldgroup Mining Inc: Going for Gold in Mexico

- Got Gold Report – Euro Shorts Cover, Silver Lame

- Grandich Client Taseko Comments Plus Gold Stock Trades

- Merv's Weekly Gold and Silver Commentary - July 02, 2010

- The double-edged sword of financial fear

- LGMR: Gold Sits Tight as US and UK Stocks Form "Death Cross"

- 2010 Mid-Year Update

- Jim?s Mailbox

- The Gold Standard Is Not the Answer

- Anatomy of a Slipstream Trade

- How to Live Normally

- Manipulation /Management : Controlling the Gold Price

- No Jobs

- An Outbreak of Fiscal Sanity in Europe? Insanity in the U.S.?

- Ken Rogoff: "China Property Market Collapse Starting"

- Need Help on FSAGX

- The Only Possible Solution To This Problem Is Massive Money Printing

- On The New York Fed's Editorial Influence Over The WSJ

- Put up or shut up thread

- Second Tropical Depression, With 60% Chance Of Becoming A Cyclone, Forming Over Macondo Zone

- Taseko's Prosperity Project, Future of Mining in British Columbia in Jeopardy

- Guest Post: Macondo History Before The Blowout

- Learning From US Endowments?

- Technically Precious with Merv

- S&P 500: Dividend Payers Are Outperforming Non-Payers

- Market ($INDU, QQQQ, Gold, and Bonds) Analysis, Plus IBM, AAP and BIDU

- Taseko’s Prosperity Project, Future of Mining in British Columbia in Jeopardy

- New Fed Monetary Stimulus Program

- LGMR: Gold Sits Tight as US and UK Stocks Form "Death Cross"

- Got Gold Report: Euro shorts cover, silver lame

- The Ticking Time Bomb That Are The Spanish Cajas

- Is a Massive Head and Shoulders Pattern Completing ... Just Like On the Eve of the Second Wave Down in the Great Depression?

- The buck stops where?

- State Default Risk Rising

- Australian Equity: Good Time for M&A Activity in Mining Sector

- Dow Repeats Great Depression Pattern: Charts

- Combating Annuities With Gold, Silver and Oil

- Gold’s Smooth, Long-Term Uptrend

- Demobilizing the National Debt

- Gold Mining Juniors: People, Not Projects

- Zeus Reads the Headlines

- Peter Grandich’s mid-year market update

- Higher Gold Prices Still Attracting Higher Skepticism

| Crude Oil Awaits Guidance, Gold is Lower After Breaking Down Posted: 05 Jul 2010 06:54 PM PDT courtesy of DailyFX.com July 05, 2010 07:34 PM Crude oil will look to this week's economic data points for guidance on near-term price direction. First on deck is the ISM Services Index set to be released early on Tuesday. Gold is drifting lower after decisively breaking lower late last week. Commodities - Energy Crude Oil Awaits Guidance Crude Oil (WTI) $71.44 -$0.70 -0.97% Crude oil is starting the new week on a down note as economic worries continue to dictate near-term price direction. Last week oil lost an enormous 8.6% after double dip fears really started to gain traction amid dismal economic reports out of the U.S. Equally disappointing figures in Europe and China did not help matters and now traders are on pins and needles awaiting this week’s readings, as they try to gauge the health of the global economic recovery. Further evidence of a slowdown or worse will likely send crude oil plummeting further, while positive readings could lead to ... | ||||||||||||||||||||

| Metanor Patiently Put Pieces Together For Gold Production Posted: 05 Jul 2010 06:54 PM PDT By Jonathan T. Orr and James West MidasLetter.com Monday, July 5, 2010 For a patient junior exploration company like Metanor Resources Inc. (TSX.V:MTO), it is a shining moment when they stand overlooking their holdings, mines, mills, drills, and roads, fold their arms and give a nod of satisfaction as they see all the pieces for a major expansion of gold production slotting into place. Metanor has carefully plotted their way to major production potential with their portfolio of varied properties, the two most promising of which, Bachelor Lake & Barry Gold Deposit, are to be found in the world's number one ranked mining jurisdiction of Quebec. The company, rather than putting all their golden eggs in one basket, have built a package of projects that are blessed with incredible infrastructure, assured access, and are all set to be driven by the ... | ||||||||||||||||||||

| Goldgroup Mining Inc: Going for Gold in Mexico Posted: 05 Jul 2010 06:54 PM PDT A Monday Morning Musing from Mickey the Mercenary Geologist [EMAIL="Contact@MercenaryGeologist.com"]Contact@MercenaryGeologist.com[/EMAIL] July 5, 2010 Regular readers of my Mercenary Musings know my opinion about gold mining in Mexico. It is simply the best place on the Earth to develop a gold mine, puro chuqui in Sonoran slang. Mexico has the requisite geological setting and gold deposits, capitalistic and entrepreneurial economy, pro-mining federal and state governments, straight forward permitting requirements, excellent infrastructure, a well-trained and experienced mining force, low labor costs, and a largely rural and low-density population outside of the major cities. As witness to my opinion, I currently cover two gold exploration companies operating in Mexico. In today’s musing, I introduce you to a newly created Mexican gold miner and review its plans to become a much larger exploration and mining company in the mid-term: Goldgroup Mining Inc... | ||||||||||||||||||||

| Got Gold Report – Euro Shorts Cover, Silver Lame Posted: 05 Jul 2010 06:54 PM PDT Gold sold off sharply, silver answers. ATLANTA – We have been on the sidelines for a while now waiting for gold and silver to correct in summer thin trading, as it usually does this time of year. It took a little longer than we thought it might, but gold finally balked as the third quarter got underway. There were actually a number of harsh reversals happening simultaneously, so gold investors shouldn’t feel alone. The U.S. dollar index repelled lower as the euro index popped and popped big. The TED spread, which is sort of a measure of bank confidence dropped for a second week, falling below 38 basis points, down more than 10 points or more than 20% in two weeks suggesting that Eurozone systemic banking fears are easing. The Big Sellers of gold and silver seem to have prevailed, finally, perhaps sending us into a summer correction. So far the sell-down hasn’t yet made it into our expected zones of support and there is no guarantee they wil... | ||||||||||||||||||||

| Grandich Client Taseko Comments Plus Gold Stock Trades Posted: 05 Jul 2010 06:54 PM PDT | ||||||||||||||||||||

| Merv's Weekly Gold and Silver Commentary - July 02, 2010 Posted: 05 Jul 2010 06:54 PM PDT For week ending 02 July 2010 Feet on the stool, beer in hand I’m TV watching the Queen in Ottawa (it’s Canada’s birthday after all) how was I to know that gold was collapsing right before everyone’s eyes. Is this the end of the world as we know it? Not yet, Obama still has more work to do. DOUBLE TOPS Lately I have been reading a lot that the various markets have formed double top patterns. You should be a little careful about these observations. Just because a stock or Index has reached a previous high price (after a period of reaction) does not make that a double top. The term “double top” refers to a bearish chart pattern BUT ONLY AFTER the price has reacted from this second high point and moved below its low reached in between the two tops. Only then is the pattern a double top pattern and a bearish one. It is very common for a stock or Index, after reaching a high and reacting lower, to climb back to its previous top ... | ||||||||||||||||||||

| The double-edged sword of financial fear Posted: 05 Jul 2010 06:54 PM PDT Worries over the fragility of the economic recovery continues to haunt investors and dominate the new headlines. The latest headlines point to a widespread expectation of a double-dip recession by later this year. The latest round of worries are focused on potential European debt troubles, soft unemployment numbers and the latest round of U.S. economic numbers that proved to be disappointing to investors. To give you an idea of the tone of last week's market, the word "fear" led the front page headlines of the Wall Street Journal at least twice last week. Last week saw asset prices across the board hit by panic surrounding Europe's sovereign debt crisis, among other concerns. Acting against the market recently has been the seasonal tendency for volume to dry up as participation diminishes in the historically slow summer vacation period. A further impediment to the market's continued progress since last year's recovery began is the fact that this the "down" ... | ||||||||||||||||||||

| LGMR: Gold Sits Tight as US and UK Stocks Form "Death Cross" Posted: 05 Jul 2010 06:54 PM PDT London Gold Market Report from Adrian Ash BullionVault 09:05 ET, Mon 5 July Gold Sits Tight as US and UK Stocks Form "Death Cross", Greece Quietly Starts to Restructure Public Debts THE PRICE OF GOLD in wholesale markets held fast to $1210 an ounce in London on Monday, moving in a tighter range than even Asian and European stocks in what one dealer called "totally lackluster" trade. European government bonds ticked higher as both Sterling and the single Euro currency edged back, nudging 10-year German bund yields down to 2.55%. Crude oil crept back above $72 per barrel, but overall commodities held flat, with silver prices slipping 10¢ per ounce to $17.80. US markets stayed closed for the Independence Day holiday, leaving the S&P with last week's 5% loss. "I don't foresee gold dropping below $1200," says Phillip Futures analyst Ong Yi Ling in Singapore, speaking to Bloomberg. "Of course, people are buying on dips." Commerzbank's Axel Rudolph, ho... | ||||||||||||||||||||

| Posted: 05 Jul 2010 06:54 PM PDT The following is automatically syndicated from Grandich's blog. You can view the original post here. Stay up to date on his model portfolio! July 05, 2010 03:59 AM At 54, I feel time is flying by and my mortality becomes more evident. They say that memory is the second thing to go. I feel like many things are going or already gone. Dizzy Dean once said, "I ain't what I used to be, but who the hell is?" Amen, Dizzy! One of the first things they teach you in driving school is never to go forward without first looking back. In order to "prophesy" (make a good guess), I'd like to first look back at what I've said and try to honestly self-evaluate my performance. No matter what grade I give myself, I put my pant legs on one leg at a time, too (and more slowly as each year passes). As the year 2007 progressed, I continued to talk about how America was robbing Peter to pay Paul, but Peter was tapped out. I was waiting for the Fed to make one more easing move that I believed would be the l... | ||||||||||||||||||||

| Posted: 05 Jul 2010 06:54 PM PDT View the original post at jsmineset.com... July 04, 2010 04:03 PM Hubris mixed with ignorance? CIGA Eric The dollar as all fiat currency is NO storehouse of the value of your life work. Over 40 US states are headed just this way. –Jim Jim, The headlines reveal all the hallmark signs of Keynesian addiction. While in many cases the abusers know their actions are detrimental, they simply cannot stop. Maybe it’s nothing more than hubris mixed with ignorance of an economic theory that has morphed well beyond the intentions of its creator. As you said, over 40 US states are headed this way. Like an addict, they have to hit rock bottom, enforced by the discipline of the market, before the epiphany that "real" or inflation adjusted standard of livings need to be lowered. Eric Illinois Stops Paying Its Bills, but Can't Stop Digging Hole He picks the papers off his desk and points to a figure in red: $5.01 billion. "This is what the state owes right now to sc... | ||||||||||||||||||||

| The Gold Standard Is Not the Answer Posted: 05 Jul 2010 06:17 PM PDT  Larry MacDonald submits: Larry MacDonald submits: I just finished reading, for the umpteenth time, the argument that gold should be bought because the gold standard will replace untrustworthy fiat currencies. I have expressed doubt about this view before. What makes it even more disappointing this time around is that the thesis was made by someone whose analysis I usually respect. Complete Story » | ||||||||||||||||||||

| Posted: 05 Jul 2010 05:57 PM PDT --I'm a very sceptical person by nature. --In relation to the markets I don't really listen to the constant stream of commentary from all those "experts". I have grown accustomed over the years to journalists wheeling out the bulls on the days when the market is up and then dragging out the bears when the market goes down. If the media was a human being you would have to conclude that they were suffering from multiple personality disorder and would have them committed. --There is zero accountability across the whole spectrum of the financial markets; from the brokers to the reporting of news. They will all happily scream their views to all who will listen but there is no one looking back on their past performance and pointing out whether they would actually make money consistently over time. And I assure you that the great bulk of them get it wrong more often than not. --Everyone is a genius in a bull market. You just have to turn up to the party with a newspaper and some darts and you can call yourself a stock picker. As Uncle Warren Buffett says, it's when the tide goes out that you find out who's swimming naked. --So with my healthy dose of scepticism and expecting that others will be in the same boat as me, I wonder how - or why - people should listen to what I have to say. What would I need to do or say that would separate my point of view from the torrent of gibberish that floods the airwaves? --My technique for analysing markets is technical, and I know that many people view technical analysis as a form of voodoo. My own view of technicals is that it is a map of human psychology that you use to give you low risk entry points into stocks. It has nothing to do with a crystal ball, or knowing the future, it is using the power of observation to realise that people do the same dumb things over and over again. --Using this observation you can find entry points into stocks where you only need to risk a very small amount of money to find out if you are wrong. That is pretty much it. No astrology. No looking at tea leaves. --In my two trading services I stand fully accountable for each and every trade that I send out to subscribers. We can look back on every single recommendation I have made. Not only when I say to get into a trade, but when we first take profit and when we get out. --I am also not sending out 20 ideas a day and then looking back selectively at the winners and forgetting about the losers like most trading services I have seen. I use a very disciplined and targeted approach to our trading and when there are no opportunities I don't send out any ideas. We sit on our hands and wait, because there is always a good opportunity around the corner. --For example our current position has three short trades in three of Australia's largest companies which we have held since the middle of April (i.e. right near the highs of this bull market) and also we have only one long position in a large gold mining company which is in the money. --Therefore, while most traders are sweating over every point move in the index hoping it will go back up again, subscribers of Slipstream Trader are making money while the market falls and have done so from the very highs. --In my other service Swarm Trader - which uses the same trading approach but focuses on small cap companies - we have just had some great news with Centennial coal being taken over. --Having just entered the stock 6 weeks ago at $3.83 we are now sitting on 52% gains with the price at $5.84 and the overall market is down over this time period. --Look, even if I blow my own trumpet on current trading performance the scepticism will remain. That's why I'm including my weekly video report, which I sent out to subscribers on the 23rd June when the ASX 200 was trading near 4500 or 300 points higher than where we are now. --In it I analyse US and Australian stock markets and predict the sell off that we have seen in the past few weeks. I also look at the Australian dollar, Euro, Oil, copper and gold. --This video update goes out to subscribers weekly and in it I look at all of the charts of the major markets around the world and analyse the current state of play. Click on the link to view video: Slipstream Trader Weekly Video report sent on 23rd June 2010. -- The video is 11 minutes long, but is worth viewing if you can elbow out some time today, so you can gain an understanding of my approach in analysing markets. -- I would include the charts of all of the markets covered so that you could see what happened since the video was sent to subscribers but it would take up too much room. If you are interested you could find them here. --I will include a couple of charts so that you can compare the price action to that predicted: Australian Dollar Daily Chart  Source: Metastock 06/07/10 Gold Daily Chart  Source: Metastock 06/07/10 --I hope that the video has been of some use to you in perhaps giving you a different perspective of how markets behave. --The 'sheeple' who write for financial news outlets certainly don't understand how markets behave - and instead feed the greed, hope and fear that causes the markets to move in the way that they do. -- I will continue to trade the markets with as little risk as possible, while also giving subscribers the opportunity to hit a few home runs every now and again. -- Currently, the Swarm Trader service is fully subscribed... but I'm looking for new members of Slipstream Trader. If you're interested in finding out more about how to make small cap gains from large cap stocks - while keeping your capital risk to a minimum, just click here. Murray Dawes Slipstream Trader | ||||||||||||||||||||

| Posted: 05 Jul 2010 05:48 PM PDT "Market failure" is the term given to instances where economists aren't doing their job. That's because there aren't really any market failures, just things that economists don't get. For example, pollution. Everyone knows about pollution, so the market must be taking it into account. But economists don't understand why people still pollute, so they call it a market failure. They don't realise that the warmth burning coal gives is more valuable than the cost of the carbon pollution it puts into the air. So, the failure is in the economists' perception, not the market's. But regardless of how you understand the term "market failure", how on earth could there be market failure in an industry that wouldn't exist without its artificial creation by government? No, we aren't talking about banking, we're talking about Super. So was Stuart Washington in The Age:

Market failure? The industry was created by regulation, so it must be a regulatory failure! But the Cooper Review continued with its ridiculous conclusions:

When you turn up to Finance 101 at Australia's universities, you learn some of the most fundamental principles of ... finance. The financial crisis has left few of them plausible. The "efficient markets hypothesis" was one of the disproven ones. (Not that it isn't still taught.) But even before efficient markets were exposed to be nonsense, nobody would have argued that an efficient market could exist in an industry that it is compulsory to participate in. And you don't even participate; you just hand over the money. Until recently, one of the remaining still potentially true financial concepts was "risk aversion" - the idea that, all else equal, people prefer less risk. But, apparently, that is out of the window too. Just call up NAB to witness the new world of finance. According to a recent customer, you will be put on hold and then witness a travesty that goes something like this:

So now you know that next time markets are getting routed again (i.e. now) NAB will be handing out loans so that "customers can continue to live normally." Meanwhile, shareholders will be having sleepless nights. And with Dan in Sydney exposing the housing industry's bubble, NAB could really be in for some trouble. Remember that Aussie banks, those pillars of risk aversion, are overexposed to residential property. Only it seems that NAB may have been a little misleading in their recorded phone message. According to Eric Johnston at The Age, "Banks bond with cash as fears rise". Bonding with cash means "pumping up their holdings of cash by a hefty $12.7 billion in recent months as fears over Europe's debt woes rise." So what on earth is NAB doing increasing lending? Who can know for sure with banks being what they are these days... Coal on the other hand, remains coal. Unlike loans, coal can't be created out of thin air. Which means that people have to go looking for it. And Thai company Banpu has found it in Centennial Coal (CEY). Yesterday Centennial accepted Banpu's takeover bid (valuing the NSW firm at about $2.5 billion) which sent shares surging more than 30 per cent to $5.83 - their highest level in two years. Our own Murray Dawes also found something in Centennial: a trading opportunity. And what a trading opportunity! Murray advised his members to enter a long position on Centennial back on 24th May when the share was trading at $3.83. He instructed a 50% profit-take on June 1st at $4.10, moving the trade's stop-loss up to 'break even'. Essentially, 'price-gapping' aside, this turned into a risk-free trade after only 6 trading days! Yesterday, the stock closed at $5.83 - up 52% on the trade's entry price. The Banpu Takeover offer stands at $6.20 per share... this would equate to a 62% gain for Murray's followers - if the deal goes through. Not a bad return on 6 weeks' work. A rarity in the modern financial world (certainly given NAB's example) Murray looks to limit risk first and foremost in any trade he recommends. That means tight stop loss management (the initial risk on the Centennial trade was less than 9% or 33c), and a measured, pragmatic approach to monitoring price action. That is to say, he doesn't just dive into a trade... he waits until he's convinced it's ready to return serious gains for his members. Then he attacks with power, pace and purpose - just like a Tour de France cyclist moving out of the pack to sprint for home... And just like he did with Centennial. Of course, Centennial is just one position Murray has on the go right now. There are more in the offing - that is, if you're interested to see how a professional trader sizes up these volatile market conditions... To check out Murray's Slipstream Trader service in more detail, just click here. Nick Hubble | ||||||||||||||||||||

| Manipulation /Management : Controlling the Gold Price Posted: 05 Jul 2010 05:30 PM PDT | ||||||||||||||||||||

| Posted: 05 Jul 2010 05:18 PM PDT

You see, the truth is that over the past several decades the game has become dramatically stacked in favor of large businesses. Big corporations have the money to lobby Congress and other governmental institutions, they get almost all the tax breaks and they are the only ones who get bailouts. They even "help" write legislation on the federal level. Many times large corporations will even lobby for more regulations for their own industry because they know that they can handle all of the rules and paperwork far easier than their smaller competitors can. After all, a large corporation with an accounting department can easily handle filling out a few thousand more forms, but for a small business with only a handful of employees that kind of paperwork is a major logistical nightmare. When it comes to hiring new employees, the federal government has made the process so complicated and so expensive for small businesses that it is hardly worth it anymore. Things have gotten so bad that more small businesses than ever are only hiring part-time workers or independent contractors. So what we actually have now is a situation where small businesses have lots of incentives not to hire more workers, and if they really do need some extra help the rules make it much more profitable to do whatever you can to keep from bringing people on as full-time employees. In a recent article for the Las Vegas Review-Journal, Wayne Allyn Root described what he is hearing from his friends who are small business owners.... I've polled all my friends who own small businesses -- many of them in the Internet and high-tech fields. They all agree that in this new Obama world of high business taxes, income taxes, payroll taxes, capital gains taxes, and workers compensation taxes, the key to success is to avoid employees. The only way to survive as a business owner today is by keeping the payroll very low and by hiring only independent contractors or part-time employees provided by temp agencies. Can the U.S. economy thrive in such an environment? Of course not. Small businesses are slowly being strangled out of existence. Unless something changes quickly, small businesses are going to continue looking for ways to shed employees rather than hire them. In the article referenced above, Wayne Allyn Root explained why this is true.... My small business-owning friends aren't creating one job. Not one. They are shedding jobs. They are learning to do more with fewer employees. They are creating high-tech businesses that don't need employees. And many business owners are making plans to leave the country. In a high-tech world where businesses can be run from anywhere, Obama has a problem. His one-trick pony -- raise taxes, raise taxes, raising taxes -- is chasing away the business owners he desperately needs to pay his bills. The U.S. government has become like the 500 pound fat guy who jumps on a horse and then gets angry when it won't move. Passing even more ridiculous regulations and raising taxes even higher is not going to fix business in America. The burdens we have placed on our small businesses have gotten worse under every single presidential administration of the past several decades. Now our great economic machine has become so overburdened and so tired that it is simply refusing to move. And this is not a short-term problem either. Yes, we have lost a ton of jobs since the beginning of the "Great Recession", but our problems go back a lot farther than that. The reality is that the U.S. population has grown by about 25 million people since they year 2000, and we needed to create millions upon millions of new jobs to support that increased population. Instead, we have lost a total of 3 million jobs since 2000. Needless to say, that is not a good trend. There are simply not enough jobs for everyone. Today, there are more than 5 unemployed Americans for every single job opening. It is becoming harder and harder to find a job, and the number of Americans who are chronically unemployed is absolutely exploding. In America today, the average time needed to find a job has risen to a record 35.2 weeks. There are millions of Americans out there tonight who feel like punching the walls or drinking themselves under the table out of frustration because they can't find a job. And many of those who are "chronically unemployed" are about to experience even more pain. So far, the U.S. Senate has refused to extend long-term unemployment benefits for about 1.3 million Americans. Without this assistance, these Americans and their families will be forced to survive on food stamps and whatever else they can scrape together. The tent cities that are popping up all over the United States are about to get a lot more crowded. So is there much hope that this is going to turn around any time soon? Unfortunately, no. Big corporations are not going to pay U.S. workers ten times more money than what they are paying employees in Malaysia, China or the Philippines just because they feel sorry for them. Small businesses are not going to hire a lot more workers as long as things stay the way that they are. In fact, many small businesses are going to continue to look for ways to cut employees. The public sector is the one place that had been hiring more workers, but due to growing concern about exploding budget deficits, there isn't going to be a lot of additional hiring in the public sector either. The truth is that there is not a lot of reason for optimism right now. The U.S. economy is being battered by a host of economic problems, and with each passing week even more economists warn that we are likely headed for the second half of a double-dip recession. So if you still have a job, be thankful. If you don't have a job, you are probably going to have to get really creative. Times are tough and they are going to get even tougher. But it is in the midst of challenging times that we find out who we really are. | ||||||||||||||||||||

| An Outbreak of Fiscal Sanity in Europe? Insanity in the U.S.? Posted: 05 Jul 2010 04:31 PM PDT From The Daily Capitalist The recent G20 meeting in Toronto came out with a joint statement endorsing "balanced and sustainable" growth for its members. It was one of those statements that are created by committees to placate all participants and don't really amount to anything. In this case, no meaningful agreements came out of the G20 meetings. Each government will just go back to doing what they have been doing and mouth high-sounding speeches of solidarity and fraternal love for their world co-leaders. What really happened in Toronto didn't come out in the official statements (they never do). But the obvious and deep division between the U.S. and Europe was the main story of the event and that was fascinating to watch. When Obama chides Merkel for Europe's (Germany's) proposed attempts at fiscal responsibility and when Merkel hits Obama for the U.S.'s fiscal profligacy, then you've got a good story. The big split has to do with whether the world should continue fiscal stimulus. The Obama Administration believes that it's too soon to stop. Recent numbers have them scared about the future of the U.S. economy and it wouldn't hurt to have some global support when they try to beggar Congress for more spending to promote economic recovery. ("See," Geithner will say, "even the Germans are begging us to spend so we can rescue the world economy.") Europe has a worse problem. Well run countries like Germany (actually about the only relatively well run economy in the EU), are being dragged down by their weak eurozone members, the well known PIIGS, lead by chief pig, Greece. They are being dragged down because they are the only ones in the EU that have the wherewithal to bail out its banks who will be in jeopardy once Greece defaults on its bonds. France should be included in this as well since their banks are also big PIIGS lenders. It will cost them a lot of money because they won't allow their banks to fail. When the Greek crisis hit the EU came up with a credit line through the IMF which they believed was big enough to buy time to reform the PIIGS. And, a trillion dollars (€750 billion) is serious money. The EU had previously provided a credit facility of €870 billion to its member banks in order to create liquidity. It seems to me that Obama came back looking worse for the argument. Here is our president lecturing the Germans on how to run their country in a fiscally unsound way. He suggested that they spend more, encourage their citizens to spend more, and worry about it later. In essence he is saying that German citizens should buy more goods rather than produce them. Merkel was not intimidated:

Germany is the world's fourth largest economy, they are successful manufacturers and exporters, and their government's deficit as a percentage of GDP in 2010 is expected to be about 5.5% versus about 10.1% in the U.S. Their fiscal stimulus was largely in the form of tax cuts rather than government spending. Manufacturing is a higher percentage of GDP than is consumer spending: This all breaks down into an argument about the efficacy of fiscal stimulus. The Germans, David Cameron, the ECB, and the IMF are worried about the longer term effects of stimulus: deficits and what the impacts will be on the euro and the PIIGS. They question Keynesian spending as a cure for recession, although many of them did it (including Germany, although Merkel was a reluctant spender). German Finance Minister Wolfgang Sch¨uble threw a grenade at Obama and said Obama's giant stimulus spending has had little impact on our country's jobless rate (9.7% at the time). He's right. On the other side of the debate is Obama, Chinese president Hu, and France's Sarkozy who believe in fiscal stimulus through government spending, and believe the Germans need to buy more goods from others (especially the weak EU members) to help revive the global economy. Hu was especially worried because the Chinese apparently buy the Keynesian stimulus idea and they need the EU and the U.S. to recovery quickly so China's export based economy doesn't tank (which it is starting to do). Merkel told her world co-leaders that Germany was not going to do that. They were opting for fiscal sanity. What happened at the G20 meeting? They came out with a compromise statement that tried to cut between the two competing ideas: reducing deficits yet mindful of a need for stimulus spending.

And how exactly do you create conditions for "robust private demand?" They view deficit cutting as "growth friendly." Let me give you the background to that statement. First, the news came in that the EU recovery was stagnating:

And,

They declined for the same reason we are declining: the artificial stimulus wore off and left no real sustainable organic growth. Then two influential institutions came out cautioning countries on fiscal deficits and that they will inhibit growth. First the IMF reported:

Forget why they say this because their comments about Chinese consumers and consumption taxes are mostly wrong. They think China should increase consumption and take up the slack caused by reduced government spending. Obviously wrong. It's as if we are all one international economic aggregate and that isn't true. Why does Germany do just fine by exporting and China doesn't? It could have something more to do with governments' share of their economies' GDP. Then the ECB, the European Central Bank under Jean-Claude Trichet came out and said:

It is as if fiscal sanity is breaking out in Europe. Budget cutting is "growth inducing?" What will we hear next, stimulus is wasteful? Where will this all end up? Germany will cut spending, perhaps raise taxes, and bring its budget deficit more in line. Maybe France and some other EU members will do the same thing. Greece has too many structural issues and will fail to reform sufficiently to prevent default. Germany will not bail them out further, but they will support their banks who lent to Greece. The euro will remain under pressure until the markets see results from fiscal sanity. Don't buy Greek bonds. Spain? Maybe they'll survive without a default. Portugal? Probably no. Ireland, Italy, probably yes. Germany will recover more quickly than the other major economies. China will have a real estate crash, more fiscal stimulus, and they won't recover until the U.S. and the EU recovers. Obama's spending alternatives are limited, so another small stimulus package will be a token to his supporters. But he won't cut the deficit to the 4.2% of GDP he promised to his G20 friends (from the current 10.1%). He won't raise taxes soon because he wants to be reelected. The economy will stall for reasons I have previously discussed. That leaves inflation and he'll do it. | ||||||||||||||||||||

| Ken Rogoff: "China Property Market Collapse Starting" Posted: 05 Jul 2010 02:58 PM PDT Tomorrow morning Bloomberg TV conducted an interview with Ken Rogoff in Hong Kong (the same way you land in New York before you take off in London via the now defunct Concorde) in which the Harvard professor recently made famous for his words of caution that overlevering sovereigns always eventually leads to economic slow down, financial collapse, and ultimately bankruptcy, warned, when discussing China real estate, that "you’re starting to see that collapse in property and it’s going to hit the banking system." With this coming days ahead of the massive Agri Bank of China IPO, it is interesting just how much influence the person who has been warning all along that the world is headed on an unsustainable path will finally have, now that the permabullish cackle of the MSM punditry has finally been discredited as futures are about to reenter triple digit reality. Oh yes, and score one for Jim Chanos, and all those who have long been warning about the inevitable Chinese bubble pop. Additionally, in discussing the suddenly prevalent topic of perpetual stimulus, and particularly envisioning Paul Krugman's thesis that the world will end unless another couple of trillion are thrown into the fire of irresponsible deficit spending, Rogoff says "I couldn't disagree more... Just to keep drinking bottles of aspirin because you are worried you are going to get a headache, or it is going to turn into a migraine, it's too much prophylaxis." Full clip although none of this is news:

| ||||||||||||||||||||

| Posted: 05 Jul 2010 02:30 PM PDT | ||||||||||||||||||||

| The Only Possible Solution To This Problem Is Massive Money Printing Posted: 05 Jul 2010 02:15 PM PDT ...or a massive cut-back in essential public services and widespread hunger: Illinois Stops Paying Its Bills, but Can't Stop Digging Hole "For the last few years, California stood more or less unchallenged as a symbol of the fiscal collapse of states during the recession. Now Illinois has shouldered to the fore, as its dysfunctional political class refuses to pay the state's bills and refuses to take the painful steps — cuts and tax increases — to close a deficit of at least $12 billion, equal to nearly half the state's budget." Here's the article link: NY Times If you think our policy makers and the guy in the Oval Office that most of you wouldn't put in charge of a hot dog stand are going to address the financial collapse in several States with anything BUT money printing, I would suggest that you off your medical marijuana for awhile. | ||||||||||||||||||||

| On The New York Fed's Editorial Influence Over The WSJ Posted: 05 Jul 2010 01:34 PM PDT One of last year's key pieces of financial reporting was Jon Hilsenrath's disclosure that then-Goldman Sachs and FRBNY director Stephen Friedman was in possession of Goldman Sachs shares while holding inside information that the Fed was willing to bailout Goldman et al forever and ever, even as a waiver to allow Friedman to buy was still in process with no formal outcome, and the Goldman/FRBNY director was loading up on even more shares. As the WSJ's Hilsenrath and Kate Kelly reported, "while it was weighing the request, Mr. Friedman bought 37,300 more Goldman shares in December. They’ve since risen $1.7 million in value." Not a shabby profit for someone who knew the system would never put him at risk of having to disgorge ill-obtained profits while in a position so conflicted, even a Chrysler-addled supreme court justice would have no problem figuring out just how blatant the systemic abuse was. Sure enough, the reporting was of sufficiently high caliber that it garnered a finalist place in this year's Gerald Loeb Awards (and seeing how ARS' "Too Big To Fail" chronology-of-events-from-the-perspective-of-Wall Street won a Loeb, it tells all you all you need to know about this particular award, and we'll leave it at that). Yet going through some of the recently made public e-mails produced on behalf of Stephen Friedman, we had a few questions as to the full independence of the WSJ when it comes to "editorial" suggestions from the Federal Reserve Board Of New York. As the below email from Fed EVP of the Communications Group, ala media liaison, Calvin Mitchell to the WSJ's Kate Kelly demonstrates, and as the final product confirms, the Fed was quite instrumental in what quotes, tangents, implications, and story lines the WSJ was allowed and not allowed to use and pursue in framing the problem of not only Friedman's conflict of interest, but that of the FRBNY board of directors itself. And seeing how Kelly and Hilsenrath caved in to every FRBNY editorial demand, one wonders just what the (s)quid-pro-quo for this particular form of alleged media capture may have been. We present FRBNY-TOWNS-R1-191200/1: We may be a little too far removed from the traditional way media is editorialized, but last time we checked we had the impression that the "independent" media would not follow the guidelines of the Federal Reserve on what is and isn't publishable, especially in the context of a piece that could easily end up having very damning implications for Goldman, the FRBNY, a "respected" director of both entities, and the entire regulatory process that allows these kinds of conflict of interest to be waived retroactively with an ex-post facto waiver, such as the case was here. Since Zero Hedge has little risk of ever being in the FRBNY's good graces (ha ha ha), we would like to present the very quotes that the FRBNY thought may have been a little too sensitive for public consumption. To wit:

"In fact the ultimate approval for the things that get done, basically, get done by the full Fed board in Washington and our board has what I've called a blanket recusal. We might get briefed that something... problematical is happening this weekend... but we not only don't get involved in that stuff, we don't want to ratify it and we don't want to get involved in it because we don't want to have a perceived responsibility that exceeds our authority." I'D SUGGEST NOT

"The audit committee... focuses on how the Fed staff has geared up to handle its responsibilities, and this is something they take very seriously and report on to the full board, and I have on occasion audited the sessions... That's administrative or ministerial as opposed to matter of policy." I'D SUGGEST NOT.

"We were very sensitive to what organization that person had come from." I'D SUGGEST NOT [Geithner's replacement, Bill Dudley, came over from Goldman Sachs, and was previously in charge of the Fed's notorious "Liberty 33" Markets Group, better known in other circles by various less politically correct acronyms] It is easy to see why the Fed was staunchly against any of these "insinuations" making the final Hilsenrath/Kelly article. Yet we would like to pick up on Ms. Kelly's line of questioning, and push this formerly confidential email out to the public, to make it clear just what are the questions that the Fed would prefer to not see discussed in a broader public arena. We do also wonder, just why it is that the WSJ journalists dropped pursuing these lines of investigation upon the merest frown of disapproval by a lowly Fed clerical worker. Just how much power over "established and independent" media does the WSJ have? Also, just how much information is the Fed feeding to publications that are in its "white list" in exchange for perpetuating a cordial relationship where the media side of the equation never discusses more than is politically acceptable (also makes the Loeb committee award to Mr. Sorkin that much more understandable). To be fair, it appears Hilsenrath did manage to get on the Fed's nerves at least once prior to the abovementioned smackdown. This can be seen in the following email from Mitchell to FRBNY General Counsel Thomas Baxter (FRBNY-TOWNS-R1-101195): Because heaven forbid someone should "impugn the integrity of Friedman or the Fed because of the so-called Goldman connection." We wonder just what high level talking-to resulted as a consequence of this almost-published scandal. Key word here being:almost. While absent additional email disclosure from Mr. Friedman, and his public production seems surprisingly sparse, we would be the last to challenge the WSJ reporters' professional integrity to pursue a story to its core, this kind of ultra-high level intermediation by none other than the Federal Reserve does bring up some rather uncomfortable questions. PS. for those wishing to do some additional due diligence, we suggest a brief perusal of Bates 195712 | ||||||||||||||||||||

| Posted: 05 Jul 2010 01:31 PM PDT Call outs are an unwritten no no here, but here goes. Goldies. I am sick of you polluting this forum with unsubstantiated posts calling for price points. I have no problems with honest prognostications of where anyone thinks the market will go, but your continual pumping of your point of view and denial of statements that turn out dead wrong degrades the quality of this forum. If it is ok with the mods here, I would like to make this simple bet. Goldies - You have called for a $15.89 print by the end of July. http://goldismoney2.com/showthread.p...4836#post54836. I feel that that is possible, but I still want to call you on that. If we do not get a print of that price by the end of this month, you will write a post apologizing for the time you have wasted for readers here and not post again until after Labor day. If it hits, I will post a formal apology for doubting you and do the same. You failed to live up to you word the three times previous I have called you on this. Now is the time to put up or shut up. | ||||||||||||||||||||

| Second Tropical Depression, With 60% Chance Of Becoming A Cyclone, Forming Over Macondo Zone Posted: 05 Jul 2010 12:03 PM PDT According to the NHC, a weather formation, centered about 50 miles south-southeast of Morgan City, Louisiana, is packing sustained winds near tropical storm force. As the map below indicates, this is above the Macondo blowout. According to Reuters, "there was a "high chance" it will become the second named storm of the 2010 Atlantic hurricane season before it makes landfall in the Terrebonne Parish area near Caillou Bay early Monday evening, the Miami-based hurricane center said." Tomorrow, the news of yet another 60% probability cyclone ramming the cleanup effort will be digested alongside the WSJ report that Libya is allegedly looking to make a staple British company part-owned by the Khadafi regime. And just in case one was not enough, it appears a second Hurricane is forming further south: "Forecasters at the hurricane center were also keeping close watch over an area of disturbed weather in the southeastern Gulf that could strengthen into a tropical depression later this week, potentially hampering oil spill clean-up efforts." From the National Hurricane Center ZCZC MIATWOAT ALL | ||||||||||||||||||||

| Taseko's Prosperity Project, Future of Mining in British Columbia in Jeopardy Posted: 05 Jul 2010 11:50 AM PDT Late Friday the Federal Review Panel came out with a report assessing the environmental impact of the mine. The Federal Review Panel did not weigh in the economic affects of this project. They made environmental recommendations ... | ||||||||||||||||||||

| Guest Post: Macondo History Before The Blowout Posted: 05 Jul 2010 11:39 AM PDT Submitted by the CEOoftheSOFA Macondo History Before the Blowout

This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||

| Posted: 05 Jul 2010 11:31 AM PDT Michael Azlen, chief executive of Frontier Capital Management, wrote an op-ed piece for the FT, Everyone can learn from US endowments:

Endowments aren't immune to downturns. In December, 2008, I wrote about how Harvard's horror will decimate pension funds and how Yale's yardstick leaves pensions in peril. Basically, pension consultants were touting the benefits of alternative investments to large US public pension funds who got into the game late - and not surprisingly, they all got slaughtered. The fact is most public pension funds lack the expertise of the staff at Harvard and Yale endowments and they can't get into the top funds, be it private equity funds or hedge funds. And even these great endowments got clobbered in 2008, mostly because they didn't realize that everyone was trying to emulate them, introducing massive systemic risk into the financial system. So what are Harvard and Yale doing now? You can track the latest news from Harvard Management Company on their site. Here are some excerpts from Jane Mendillo, HMC's CIO, given in interviews over the last year:

Harvard Management Company proceeds to add value is by adopting a hybrid investment approach:

Yale's endowment, run by investment titan David Swensen, takes a different approach, focusing almost exclusively on finding the best external managers. In a recent article, Larry Swedroe asks, Is David Swensen Lucky or Good?:

Is there a lot of hype, hope and marketing in active management? Yes and no. I believe there is a tremendous amount of fluff out there, and most active managers aren't worth the fees they're charging. This goes for long-only, hedge fund and private equity managers. But guys like David Swensen aren't stupid. They're constantly thinking years ahead when building their portfolios, and they are cementing relationships with the top money managers of the future in all asset classes. I wish anyone best of luck replicating their returns over the long-run (silly conclusion from authors). Interestingly, most Canadian pension funds have adopted Harvard's hybrid approach or moved assets internally to lower costs, increase transparency and control risk. They have the internal expertise to do this, and some are competing just fine with external managers. Net of fees, they are better off managing assets internally. I happen to think that you can gain a lot by partnering up with top talent. And top talent is only found in the top 100 hedge funds or private equity funds. In the environment we're heading in, you might want to selectively build relationships with smaller, nimbler, hungrier managers who are better paced to capitalize on opportunities as they present themselves. But given the size of large endowments and even larger pension funds, it's not really worth the hassle to find smaller managers, so most stick to internal management or allocating to bigger, well known name brands. This is especially true of large pension funds worried about reputation risk. It's too bad because what I find lacking in today's environment is investment shops that are willing to think outside the box and explore taking on new risks, new investment themes, or just new ways of thinking strategically but being nimble enough to take sizable tactical positions when opportunities arise. Everyone is reducing risk and hunkering down, but when everyone is doing the same thing, they're guaranteed to deliver mediocre results. | ||||||||||||||||||||

| Technically Precious with Merv Posted: 05 Jul 2010 10:55 AM PDT Feet on the stool, beer in hand I'm TV watching the Queen in Ottawa (it's Canada's birthday after all) how was I to know that gold was collapsing right before everyone's eyes. Is this the end of the world as we know it? ... | ||||||||||||||||||||

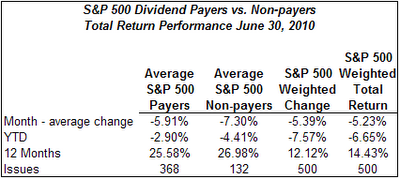

| S&P 500: Dividend Payers Are Outperforming Non-Payers Posted: 05 Jul 2010 09:59 AM PDT David I. Templeton submits: For the month of June and the first six months of 2010, the dividend payers in the S&P 500 Index are outperforming the non-paying stocks. For the month, the payers' return of -5.91% was better than the non-payers' return of -7.30%. Additionally, this year the payers have declined 2.90% versus the non-payers decline of 4.41%.  Source: Standard & Poor's Source: Standard & Poor'sOn a year over year basis as of June, dividend payments were up 5.7%, for the quarter up 2.6% and down 3.2% on a year to date basis. In a further sign that companies view future prospects as improving, ten companies initiated dividends versus 65 that either decreased or suspended payments in the first six months of 2009. Complete Story » | ||||||||||||||||||||

| Market ($INDU, QQQQ, Gold, and Bonds) Analysis, Plus IBM, AAP and BIDU Posted: 05 Jul 2010 09:20 AM PDT The stock market finished last week on a down note. It couldn't find any legs all week long, as disappointing economic data rolled out all week, and uncertainty filled the market place. Even Biggs had concerns and sold stocks ... | ||||||||||||||||||||

| Taseko’s Prosperity Project, Future of Mining in British Columbia in Jeopardy Posted: 05 Jul 2010 08:51 AM PDT Late Friday, the Federal Review Panel came out with a recommendation that will be forwarded to the Prime Minister and his cabinet assessing the environmental impact of the mine. The Federal Review Panel did not weigh in the economic affects of this project. They made environmental recommendations for Taseko to take if the mine is approved. I believe the Prime Minister, along with the Cabinet will support the British Columbia Provincial Approval based on the opinion that the economic benefits far outweigh the environmental impact. The mining industry is crucial to British Columbia's Gross Domestic Product and brings in over 8 billion dollars to British Columbia a year. A major concern is that the construction of new mines has been declining. Many mines are closing and there has been a rapid decline of economic reserves. This has seriously affected poverty levels and unemployment rates. Prosperity is British Columbia's flagship project that will bring in 400 million dollars of revenue a year and get many back to work. Now the cabinet has recommendations from the panel on what Taseko should improve if the project is approved. The project is very popular in British Columbia and I do not believe that the Prime Minister and Cabinet will go against British Columbia's approval. Their approval was based on the belief that the massive economic benefits would far outweigh the environmental loss to the local community. If the Prime Minister rules against the Province, it will have devastating effects not only on British Columbia, but on Canada and its status as a friendly mining jurisdiction. This status brings in huge amounts of investment capital which is crucial for economic development. The news related sell-off creates another opportunity for investors to buy Taseko at bargain prices. In January I recommended readers to take profit as it was time to sell on good news and when readers were up 250%. Now is the opposite time. I believe this is the time to buy when everyone else is fearful especially if you are still holding shares. Now is definitely not the time to sell into a panic. Prosperity is far from over. The news related break of the moving averages might appear negative but this decline has not shown to be high volume correction. I expect there to be a move higher as many sold off with the news coming off the wire and do not understand the macroeconomic effects of this project. Subscribers are still up over 100% even though many should have taken profits when I recommended and kept the 15% trailing stop loss which I also made sure for subscribers to have. If you did not take profits with the 15% trailing stop loss and are still holding, I would recommend waiting until September until the Cabinet and the Prime Minister make their decision which takes into consideration other variables than the environment alone and not feed into the panic selling. Disclosure: Currently do not own Taseko. | ||||||||||||||||||||

| New Fed Monetary Stimulus Program Posted: 05 Jul 2010 07:23 AM PDT From The Daily Capitalist After writing my "Inflation, Deflation, or Hyperinflation?" article, I concluded that inflation was the likely outcome based on the Fed's ability to flood the economy with money through Open Market Operations. Perhaps by buying commercial real estate debt from banks or by buying more Treasury paper the Fed could overcome the bank liquidity crunch. Apparently I missed a major weapon in the Fed's arsenal: actual distributions of cash to individuals like me. Here is a recent email I received announcing this overlooked quantitative easing method:

I hope you get your letter soon. | ||||||||||||||||||||

| LGMR: Gold Sits Tight as US and UK Stocks Form "Death Cross" Posted: 05 Jul 2010 06:50 AM PDT London Gold Market Report from Adrian Ash BullionVault 09:05 ET, Mon 5 July Gold Sits Tight as US and UK Stocks Form "Death Cross", Greece Quietly Starts to Restructure Public Debts THE PRICE OF GOLD in wholesale markets held fast to $1210 an ounce in London on Monday, moving in a tighter range than even Asian and European stocks in what one dealer called "totally lackluster" trade. European government bonds ticked higher as both Sterling and the single Euro currency edged back, nudging 10-year German bund yields down to 2.55%. Crude oil crept back above $72 per barrel, but overall commodities held flat, with silver prices slipping 10¢ per ounce to $17.80. US markets stayed closed for the Independence Day holiday, leaving the S&P with last week's 5% loss. "I don't foresee gold dropping below $1200," says Phillip Futures analyst Ong Yi Ling in Singapore, speaking to Bloomberg. "Of course, people are buying on dips." Commerzbank's Axel Rudolph, ho... | ||||||||||||||||||||

| Got Gold Report: Euro shorts cover, silver lame Posted: 05 Jul 2010 06:46 AM PDT 2:45p ET Monday, July 5, 2010 Dear Friend of GATA and Gold (and Silver): Gene Arensberg's new Got Gold Report is incredibly detailed and comprehensive, concluding with a cautious sidestepping of the gold and silver markets for the moment even as the metals are in backwardation. The report is headlined "Euro Shorts Cover, Silver Lame" and you can find it here: http://treo.typepad.com/got_gold_report/2010/07/20100704GGRUpdatePDF.pdf CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Prophecy to Become Coal Producer This Year Prophecy Resource Corp. (TSX.V: PCY) announced on May 11 that it has entered into a mine services agreement with Leighton Asia Ltd. to begin coal production this year. Production will begin with a 250,000-tonne starter pit as planned in August, with production advancing to 2 million tonnes per year in 2011. Prophecy is fully funded to production and its management team includes John Morganti, Arnold Armstrong, and Rob McEwen. For Prophecy's complete press release about its production plans, please visit: http://www.prophecyresource.com/news_2010_may11.php Join GATA here: New Orleans Investment Conference * * * Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Sona Resources Expects Positive Cash Flow from Blackdome, On May 18, 2010, Sona Resources Corp. (TSXV: SYS, Frankfurt: QS7) announced the release of a preliminary economic assessment for gold production at its flagship Blackdome and Elizabeth properties in British Columbia. Sona Executive Chairman Nick Ferris says: "We view this as a baseline scenario for gold production. The project is highly sensitive to the price of gold. A conservative valuation of gold at $1,093 per ounce would result in a pre-tax cash flow of $54 million. The assessment indicates that underground mining at the two sites would recover 183,600 ounces of gold and 62,500 ounces of silver. Permitting and infrastructure are already in place for processing ore at the Blackdome mill, with a 200-tonne per day throughput over an eight-year mine life. Our near-term goal is to continue aggressive exploration at Elizabeth and develop a million-plus-ounce gold resource, commencing production in 2013." For complete information on Sona Resources Corp. please visit: www.SonaResources.com A Canadian gold opportunity ready for growth | ||||||||||||||||||||

| The Ticking Time Bomb That Are The Spanish Cajas Posted: 05 Jul 2010 06:33 AM PDT Even with Spain's Cajas, or savings banks, completing the country's most aggressive sector restructuring in history, after nearly 90%, or 39 out of 45 merged or participated in some form of "cold fusion" and benefiting from the financial assistance of the Spanish central bank, there has been precious little written about the actual holdings of this most aggressive lender of mortgage to Spain's 20% unemployed population. Until today: a new report by CreditSights' David Watts indicates that investor worries about the Spanish banking system are very well founded and likely underestimate just how bad the true situation actually is. In "Spanish RMBS: Insider Caja Loan Books", Watts concludes that the Cajas are likely hiding losses on home loans by taking non-performing mortgages out of securitized pools. Absent this unsymmetrical onboarding of risk, the overall deterioration of the broader pool would have become ineligible as collateral in ECB refi operations. In essence, Watts says, "by buying the loans out of the mortgage pool, the cajas would be taking those weaker loans onto their own books." This implies that the 3.7% serious delinquency rate reported by the cajas is in reality far higher, and likely "underestimates their potential losses." And what's worst: as ever more delinquencies mount courtesy of austerity, and the Cajas run out of cash to constantly buy up the weakest performing loans, all of Spain is about to lose ECB collateral access to its hundreds of billions in securitized RMBS, completely locking the country out of any access to liquidity, even that of the ultimate backstop, the European Central Bank. Spain's cajas are notoriously secretive about the state of their loan books. Which is why CreditSights took a bottoms-up approach, looking at a sample of 143 Spanish residential mortgage-backed securities collateralized by 136 billion euros ($170 billion) of loans, of which 45% was originated by cajas.

As CreditSights points out, the outstanding balance of securitized Spanish resi mortgages is estimated to have reached €168 billion, representing 15.3% of all mortgage lending in the country. Yet taking advantage of ECB generosity to take on all sorts of worthless assets on the left side of the ledger supporting the euro, "even with investors globally taking a much more sceptical approach to RMBS following the US subprime crisis, issuance of RMBS in the Spanish market has remained relatively strong as issuers have retained deals primarily to use as collateral against ECB open-market operations." In essence, the ker structural difference between the US and Europe can be summarized in the previous sentence: while US banks were at least smart enough to know they need to offboard RMBS associated risk to even dumber investors, in Europe, it was the ECB which for many years running was the backstop, thus preventing the need for prudent risk management. The end result: the collapse of the Spanish deposit savings system. The chart below shows the dramatic surge in RMBS retention at about the time the subprime market in the US blew up. The primary "beneficiary" of this stupidity - the cajas. As to the reason why the cajas are avoided like the plague by virtually everyone, the chart below says it all: while everyone was enjoying the credit fuelled binge on the way up (very much as the US was), the reversion has yet to catch up with reality. The truth is that even as the quarterly change in lending has plunged, the property price index is massively higher than where it should be currently. Once the benefits of record low Euribor and other artificial props finally expire, look for Spanish real estate prices to literally plummet destroying not just the local banking system, but that of the entire interlinked European financial system. And a quick detour into Spanish CMBS. Watts explains: "As a percentage of GDP, Spanish household sector has debts of 85% and housing-related debts equivalent to around 65% of GDP. Indeed, including loans for residential development (commercial real estate lending), total housing-sector related lending is equivalent to 104% of GDP, nearly double where it was in 2003. That means that we estimate that Spanish property developers have debt equivalent to almost 30% of GDP." This is simply another massive risk overhang that the banks never offloaded, and has so far flown very successfully beneath the radar. Yet unlike RMBS, the ECB does not accept CMBS as collateral against refi ops, leading one to scratch their head why the banks were so stupid in this particular case. CreditSights has this last warning to add on Spanish development loans:

Worried yet? As to the actual results of CreditSights broader analysis of , the chart below summarizes that as the deterioration in Spanish unemployment accelerated, delinquencies remained somewhat flat, primarily courtesy of a collapsing Euribor rate. As we have pointed out recently, now that the LTRO has matured, Euribor and Libor have only one way to go: up. So back to the split between caja-originated mortgage versus those issued by the large banks, Watts confirms that there is a material underperformance when it comes to Cajas: "the most obvious takeaway is that mortgages originated by cajas have been running at higher delinquency levels than mortgages originated by Spain's commercial banks for at least the part four years." The chart below demonstrates just how much worse the Cajas books' are, even based on doctored public data, than banks: The key question posed by Watts, and whose answer is truly troubling, is the following: what is driving the volatility in the caja's mortgage performance. The explanation offered: "we believe this phenomenon might be partially explained by the removal of delinquent mortgages from Spanish RMBS pools by the originating bank during the first and second quarters of 2009. Mortgage repayments exhibited a dramatic rise during this period. The average repayment rate on securitised caja-mortgages rose by 360 bps from 6.7% in the fourth quarter of 2008 to 10.3% in the first quarter of 2009." And the punchline that should shut up "all is well in Spain" apologists once and for all:

CreditSights concludes with a somewhat much somber bigger picture analysis:

And the most dire side-effect of an avalanche of increasing delinquencies, and the resultant inability of the cajas to mask the deterioration by buying back all the worst-performing loans, would be the loss of ECB access. In the meantime, the cajas would get destroyed as they already are the proud owners of the very worst loans available: "Any mortgages that cajas have been purchasing out of their RMBS loan pools could have been artificially reducing the level of bad loans in RMBS while simultaneously undermining the quality of cajas own assets" CreditSights concludes. Our own conclusion is simpler: got STD CDS yet? And yes, at 264 bps, Spain CDS is cheaper than a deserted Salamanca hotel. | ||||||||||||||||||||

| Posted: 05 Jul 2010 06:21 AM PDT In January 2009, I pointed out:

Today, CNBC is reporting:

(Robert McHugh is saying the same thing.)

There is alot of talk of a massive new round of quantitative easing. But as long as the real problems with the economy are not fixed, the additional stimulus will just create a larger drag on the economy. | ||||||||||||||||||||

| Posted: 05 Jul 2010 05:43 AM PDT | ||||||||||||||||||||

| Posted: 05 Jul 2010 05:42 AM PDT The original post/source comes from Bespoke: Below we highlight a Bloomberg chart of 5-year CDS (credit default swap) prices for the four states that seem to be at most risk of default — California, Illinois, New Jersey, and New York. (Make sure to take note that the four prices are all on a different axis.) As shown, all four have spiked significantly recently, but just one — Illinois — has blown out to new highs versus the late 2008 spike. Illinois also has the highest risk of default of all four states, which is probably surprising to most. The fact that these are anywhere close to their 2008 highs is not a good sign considering things have supposedly gotten better since then.

Read the rest of the post (at Bespoke) and you'll see that the four states are now more likely to default than most countries! Take a look again at the above chart….its not looking good for these states. The CDS looks to head much higher by the end of the year. | ||||||||||||||||||||

| Australian Equity: Good Time for M&A Activity in Mining Sector Posted: 05 Jul 2010 05:35 AM PDT Muditha Weeratunga submits: Recently the Australian stock market went through a correction phase, partly due to the global economic worries and partly due to the new proposed super tax by the government. The super tax was targeted miners as the government wanted to rectify the two phased economy being developed in Australia. The market reacted heavily to this proposal and stocks were thrashed. But last week the new Australian Prime Minister announced a proposal for a more miner friendly tax regime, hoping to revive market confidence. Looking at the global investment environment and the cheap valuations for some of the mining related stocks this might provide the perfect catalyst for a series of M&A activities. China and Japan accounts for the biggest share of International Reserve Assets

To put it simply, Chinese investors have the money and they are looking for mining assets which can support their future plans. And to make things more interesting, they are not looking for a short term profit from their investments. Material Sector Stocks Trade at Low P/B Multiples If you run a simple EQS screen in Bloomberg for all the stocks listed in Australia with a price to tangible book value (P/B) less than 1 and then categorize them by the industry, you get a table similar to the one given below. Table 1: Cheap stocks by sector

Source: Bloomberg EQS screen According to table above, it is pretty clear most of the stocks that can be potential take over targets are concentrated around the mining space, which is being treated harshly by the market following the new tax proposals. These stocks stand out as a perfect fit for the cash rich, mineral hungry Chinese investor. Material Stocks Have Not Traded This Cheaply for a While, with a Good Free Float Rate I have run another screen from Bloomberg for the “Metal & Mining” and the “Oil, Gas & consumable Fuels” Industry group stocks to identify the number of stocks that have traded below P/B historically. Source: Bloomberg Looking at the chart, post GFC this is the first time that this many mining companies are trading below their tangible Book value. And to make the situation even more appealing to make these companies probable take over targets, 80% of these stocks have free float levels above 51%. Disclosure: No positions Complete Story » | ||||||||||||||||||||

| Dow Repeats Great Depression Pattern: Charts Posted: 05 Jul 2010 05:28 AM PDT The Dow Jones Industrial Average is repeating a pattern that appeared just before markets fell during the Great Depression, Daryl Guppy, CEO at Guppytraders.com, told CNBC Monday. "Those who don't remember history are doomed to repeat it…there was a head and shoulders pattern that developed before the Depression in 1929, then with the recovery in 1930 we had another head and shoulders pattern that preceded a fall in the market, and in the current Dow situation we see an exact repeat of that environment," Guppy said. The Dow retreated 457.33 points, or 4.5 percent last week, to close at 9,686 Friday. Guppy said a Dow fall below 9,800 confirmed the head and shoulders pattern. The Shanghai Composite is seeing a very rapid collapse, falling below 2,500, which suggests the major fall in the Dow, he added. In the European markets, Guppy says Frankfurt's Dax is witnessing a different pattern to London's FTSE. More Here.. More Bad News for BP as Arsenic Levels Rise in Seawater Around the Gulf of Mexico Read more:Here.. | ||||||||||||||||||||

| Combating Annuities With Gold, Silver and Oil Posted: 05 Jul 2010 05:05 AM PDT People are always writing me and asking questions, which can usually be divided into one of two categories. The first category is the one that I call "Is there something wrong with you that you sound/look/appear so stupid/ugly/weird?" (Answer: "Probably"), and the other, smaller category is the one I call "Other." Most of the questions this week were, as usual, in the first category, but there were a few "Other" emails, surprisingly asking me questions, as if a jerk like me would know anything about anything except that you should be buying gold, silver and oil with all your money, which is pretty much my answer to all questions. The first question was "Dear Handsome And Wise Mogambo (HAWM), You are always yammering about how the Federal Reserve is still creating So Freaking Much (SFM) excess money and credit so that the federal government, in a nightmare coming horribly true, can borrow and spend us into bankruptcy which will destroy this country. My question is, 'What about annuities?'" This is an easy one for me: I think annuities are probably the worst investment one can make, and for a variety of reasons, all of them stemming from the Federal Reserve creating the aforementioned So Freaking Much (SFM) excess money. Uh-oh. I can tell by looking at you that you have had it up-to-here with my Constant Mogambo Harangue (CMH) about how all of this new money from the Federal Reserve will create roaring inflation in consumer prices. So, in deference to your sudden sensitivity, I will not get into how all this new money will create blistering inflation in consumer prices and how that inflation will make bond prices fall as interest rates rise because bond buyers will require higher and higher interest rates to offset their losses of buying power. So, with an annuity, what we have is a promised fixed stream of income (that must already be low as result of the abnormally, weirdly, manipulated low interest rates) coupled with a seeming lack of alternatives in the popular sense, although a portfolio of gold, silver and oil is not only AN alternative, it is THE alternative, and as such, is the exact opposite, the very antithesis, the polar extreme, and even the antonym of annuities. The result is that the payout from an annuity to you is fixed, never going up, never going down, so that you will continue to lose buying power, more and more day after day, week after week, month after month, year after year, compounding and compounding your misery, as far as I can tell, until you die a horrible, painful death from starvation and other miserable privations caused by your fixed-income buying less and less until it is almost worthless, all thanks to the inflation caused by the Federal Reserve creating more and more money and the despicable federal government borrowing it and spending it, and with deficit-spending an amount that is already, as unbelievable that as it is, roughly equal to a tenth of GDP! Just the deficit! Gahhhh! We're freaking doomed! The veins in my head suddenly throbbing at the horror of such an economic catastrophe, I was on the precipice of falling into the Zone Of Loud Mogambo Outrage (ZOLMO) when my frantic, protruding eyes flashed upon a piece in the Gold Newsletter by Brien Lundin of Jefferson Financial. He notes that inflation is worse than commonly thought, and "the government has changed the CPI. People don't realize that in the 1980s and then again during the Clinton administration, the government jiggered the CPI to minimize reported inflation. Economists can argue whether these changes were justified, but the point is that they changed the unit of measurement." If you are like me, then you already knew that, and are wondering "What's in this economic mumbo-jumbo for me, a guy who is just out to make a lot of money without working?" Well, apparently he can read our thoughts, as he replied that gold is under-priced as a true hedge against inflation, and that "John Williams of Shadow Stats has gone back and recalculated what he calls the 'Alternate CPI,' which takes out the government's changes to the index. As it turns out, when you use the historical CPI that was actually in effect during the 1980s, that $850 gold price record in 1980 is equal to $7,576 in 2010 dollars." So gold is grossly under-priced, and with the Federal Reserve still creating so much money, so that the federal government can borrow the money and spend it, you would have to be an idiot NOT to bet against such preposterous economic insanity by frantically, desperately, feverishly buying gold, silver and oil. And remember; it's not for nothing that I say, "Whee! This investing stuff is easy!" The Mogambo Guru Combating Annuities With Gold, Silver and Oil originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." More articles from The Daily Reckoning…. | ||||||||||||||||||||

| Gold’s Smooth, Long-Term Uptrend Posted: 05 Jul 2010 05:04 AM PDT Bullion Vault Trying to analyze every move in the Gold Price is a waste of time. We don't see gold as an investment. We see it as real-money "crisis insurance". We bought our gold long ago…and we hope to never have to use it. Not much more "analysis" is needed here. We also encourage folks to take the "long view" when taking stock of their gold holdings. This long view – a 10-year chart of gold – is our chart of the week. You'll also notice the long-term trendline we've drawn in blue. As you can see, gold could fall all the way down to $900 an ounce and remain within the confines of its uptrend. Keep this sensible view in mind when listening to the ridiculous short-term-focused commentary that goes for "analysis" these days. Want to buy gold at live market prices today? Go to world No.1 BullionVault now… | ||||||||||||||||||||

| Demobilizing the National Debt Posted: 05 Jul 2010 05:04 AM PDT Bullion Vault The impact on the economy – and on the US Treasury's then record debts – is hard to overstate… Our chart shows three further things, however, which Washington's planners (if not private and foreign Treasury-bond holders) might want to consider today:

Still, what chance of demobilization today? Returning 10 million people to the private jobs market, amid the current economic debate, ain't going to happen. So neither, we guess here at BullionVault, will a turnaround in America's fast-rising trend of debt-to-GDP. Ready to buy gold…? | ||||||||||||||||||||