Gold World News Flash |

- The Continuing Relationship Shift Between The Euro And Gold

- Hourly Action In Gold From Trader Dan

- Jim?s Mailbox

- In The News Today

- Recent Volatility in Metals Nothing to Fear

- Private Currencies Give Metals Investors Hope

- MMS: Hammer Falls - But Why Now?

- Euro Declines on a Sea of Bankruptcy and Paper Promises

- Hyperinflation Watch - June 15, 2010

- Bill Murphy Hits Bullseye – again!

- Grandich Comments on Stock and Gold Market

- Adrian Day: Wanna Go 'Green'? Go Geothermal

- Another Day on the Road to Perdition

- China Gets Contrarian, Buys Greece

- Here Come The Threats: Europe

- A signal from the stock market

- LGMR: Gold Holds Below €1000 But "Risk Trade" Revived by Greek Downgrade

- Gold: Prices Coming Off All-Time High, But Bullish Trend Looks to Continue

- Special GSR Gold Nugget: Harry S. Dent Jr. & Chris Waltzek

- Stephen Roach says Chinas Housing Boom is Not a Bubble; I say "Nonsense"

- Stephen Roach says Chinas Housing Boom is Not a Bubble; I say "Nonsense"

- Hyperinflation Watch

- U.S. Dollar: Delta in the Value of a Promise

- Gold Seeker Closing Report: Gold and Silver Gain Roughly 1%

- Don't Buy the Stock Market…Buy Stocks

- Flip Flopping in the Housing Market

- BP's Irreverisible Death Spiral - If You Own The Stock: Good Luck, But Good Night

- BP's Irreverisible Death Spiral - If You Own The Stock: Good Luck, But Good Night

- Risk appetite brings S&P back above 200DMA

- Kate Welling's Seminal Interview With Themis Trading On Market Structure

- Practice What You Preach

- Jim's Mailbox

- James Turk: Hyperinflation likelihood is increasing

- Cramer Calls Market "Stupid, Rapacious, Arbitrary, Capricious And Downright Ridiculous", Tells Viewers To Stay Out

- Central Gold Trust Opens Its Entire $800 Million Base Shelf Prospectus in a Non-Dilutive Offering

- Reasons Why Gold To $10,000

- Valuable perspective on the nature of gold futures…

- Valuable perspective on the nature of gold futures…

- Avis Budget Group (NYSE:CAR) — Room For Downgrades

- Record Foreclosures in May – Increase in Homes Seized in Every State

- Beyond IWM: Five Intriguing Small Cap ETFs

- IBM, Sterling Deal Would Benefit Both Companies

- TUESDAY Market Excerpts

- US Revises Estimate For The BP Oil Spill Higher For Third Time, Now At 35,000-60,000 Per Day As BP Cries Foul Over Counterparty Exposure

- Physical Scramble Accelerates: Central GoldTrust Announces Imminent Purchase Of 20 Tonnes Of Gold

- Gold Price Update

- Gold Price Update

- Don’t Buy the Stock Market…Buy Stocks

- The Pound and Euro Trade Better

- Titanium Metals: Margins Remain Under Pressure

| The Continuing Relationship Shift Between The Euro And Gold Posted: 15 Jun 2010 07:11 PM PDT View the original post at jsmineset.com... June 15, 2010 08:37 AM My Dear Friends, The observation that I called to your attention two days ago concerning a shift in the relationship between the euro and gold was in the marketplace the next day until the COMEX knee jerk reaction early in their gold trading session. It is clearly there today. It is the relationship that matters in terms of price regardless of the reasons created by the marketplace commentators. At this moment the euro is at 1.2340 while gold is plus $11.40. We live in a currency world which is purely a mirror image of traders positions lacking fundamental reason for dollar appreciation. $1.17 was a point of no return for the euro. Repeated intervention at 1.19 has caused the short covering which is now taking place. There is however another possibilities that must be considered. India’s clear return to inflation has caught the attention of major money. The volatility of currencies cannot be overcome b... | ||||

| Hourly Action In Gold From Trader Dan Posted: 15 Jun 2010 07:11 PM PDT View the original post at jsmineset.com... June 15, 2010 10:12 AM Dear CIGAs, There has once again been another "flip" in the psychology of the gold pit. Over the years we have seen gold trading inversely to the US Dollar, get jettisoned along with a host of other commodities during the Yen carry trade unwind of late 2008, be considered a "risky" asset and get sold off when investors were nervous about the global economy, swing back to being a "risk averse", safe haven asset during the sovereign debt crisis that began with Greece, and today we are now back to gold trading as the "anti-Dollar" instead of the "anti-Euro". In other words, we have come full circle with gold now moving higher as the Dollar moves lower. Throughout the entire gamut of swings in investor psychology, gold has moved from $250 to over $1,250 in spite of the Priesthood of Prechterite's Prognostications Pronouncing its demise. The reason is really not complicated – it has entered into the minds of many that i... | ||||

| Posted: 15 Jun 2010 07:11 PM PDT View the original post at jsmineset.com... June 15, 2010 05:13 PM Hi Jim, I just read your reply to Bill’s question/statement regarding deflation vs. Inflation. Good answer. People just don’t get the currency event. It is because: 1. They are too young. 2. They have not studied history. 3. They are overwhelmed with propaganda. 4. They observe M3 contracting and finally. 5. They just don’t get the currency event. I think Harry Schultz put it best when he said some things will skyrocket (like oil) and other things will deflate (like real estate). Sometimes people see things in one dimension and can’t see past their noses. Big love, CIGA Selim Hi Jim, The current monetary system looks like it will fail. There is way too much debt across the board across all levels. Add to that $1,300T in derivatives and $150T in US government unfunded liabilities. That’s $500k in US government unfunded liabilities per US person.... | ||||

| Posted: 15 Jun 2010 07:11 PM PDT View the original post at jsmineset.com... June 15, 2010 05:22 PM "Freedom is not an entitlement, it is a responsibility, that must be guarded at all costs from all those that desire to strip it from you." –Ayn Rand Dear CIGAs, People have given up their lives, their fortunes and future for our freedom. Honor their sacrifice by taking a stand, please. I have. Jim Sinclair's Commentary Since the latter is totally impossible politically, the former must be a statement of prediction concerning the future of the Western world. Bernanke: 'Things Will Come Apart' If Entitlements Are Not Reformed and Spending Controlled Thursday, June 10, 2010 By Matt Cover, Staff Writer (CNSNews.com) – Federal Reserve Chairman Ben Bernanke delivered a frank assessment to Congress on the fate of the economy if entitlement programs are not restructured. On Wednesday, Bernanke warned that "things will come apart" if Congress allows the federal entitlement programs an... | ||||

| Recent Volatility in Metals Nothing to Fear Posted: 15 Jun 2010 07:11 PM PDT Recently, the metals markets have become far more volatile, often rising and falling upwards of three to four percentage points in just one day. That volatility, however, is nothing you should fear. In fact, it's mostly due to the extreme attention being paid to the metals markets. Silver More Important than Ever Momentarily leaving aside what we know from the work of GATA and Ted Butler - namely that both gold and silver price discovery is predominately controlled by a few dominant (bullion bank) sellers – perhaps the most volatile in the metals markets is silver. Despite owing much of its demand to industrial uses and photographic development, is still a prime target for anti-inflation investors. As gold treads toward new heights and pushes the 70:1 ratio with gold's price, investors are looking to trade in their gold holdings for silver, realizing it has yet to reach its maximum price. Of course, this is easily reflected in daily volume and pri... | ||||

| Private Currencies Give Metals Investors Hope Posted: 15 Jun 2010 07:11 PM PDT Metals investors enter the business for usually one reason: to protect their money against inflation. Obviously this wouldn't be a goal if currencies weren't generally inflated into oblivion, or if the history of the fiat currency could give investors any hope that inflation wouldn't happen. Alas, as long as governments have been charged with the task of issuing currency, they have also made it their job to inflate them out of existence. However, we should note that there are at least some people interested in honest and accountable currencies. Private Currencies Recession is said to be one of the greatest motivators for innovation, and in money, it certainly has been. In the two years since the recession began, in order to fight off a depletion of local wealth, local communities have created their own currencies. Many of these are quite popular, some of which have already distributed more than $2.3 million worth of currency that can only be used in loc... | ||||

| MMS: Hammer Falls - But Why Now? Posted: 15 Jun 2010 07:11 PM PDT Market Ticker - Karl Denninger View original article June 15, 2010 04:34 PM Oh please.... [INDENT] A former Justice Department inspector general will lead the Obama administration's revamp of the Minerals Management Service, the Interior Department agency under fire for lax oversight of oil and gas drilling in the wake of the Gulf of Mexico oil spill. [/INDENT] Wow, that was fast. 56 days. Ok Now explain why the same bone-smoking corruption laced through and through the banking industry - which we know resulted in actual criminal felony conduct (in Jefferson County Alabama along with, quite likely, other places) not to mention all sorts of things that one would call "negligence" (AIG anyone?) there was no similar shake-up at The NY Fed, The Federal Reserve, in OTS, OCC or Treasury. How in the hell, for openers, does Tim Geithner still have a job, not to mention Ben Bernanke? Let's make this Ticker simple: Why Mr. President? PS: The banks did 100x ... | ||||

| Euro Declines on a Sea of Bankruptcy and Paper Promises Posted: 15 Jun 2010 07:11 PM PDT Do you ever get the feeling that you are in some kind of weird dream, where someone is holding a pillow over your face so that you can't breathe, and you can dimly hear your children asking, "Is he dead yet, mom?" and I am thrashing around and yelling out, "No, I'm not dead, you morons!" but nobody is paying attention? Me, too! And I get the same feeling watching the collapse of the economic system, as was always confidently predicted by the Austrian Business Cycle Theory and proudly on display at Mises.org, as my head is spinning, spinning, spinning around with wild conspiracy theories to try, desperately, to explain how a country that has so many colleges and universities, and which have graduated so many self-important alumni, for so long, has allowed this to happen! And, as cold comfort as it is, it's not just us. Everybody, in every country, is in the same boat, a nice little yacht made of promises and paper instead of fiberglass and steel, now being tossed and battered by an ... | ||||

| Hyperinflation Watch - June 15, 2010 Posted: 15 Jun 2010 07:11 PM PDT June 15, 2010 – The latest financial results of the US government show that it continues to spend and borrow recklessly. As a consequence, there has been no improvement in the hyperinflationary outlook for the US dollar. Hyperinflation results when a country’s central bank turns government debt into more currency than is demanded in economic activity. It is unfortunately impossible to measure precisely the demand for currency. Nevertheless, the rate at which the government is borrowing can be used as a general guideline to determine if too much currency is being created. If government borrowing causes the debt to accumulate at rates of increase greater than the historical trend, clearly too much new debt is being added, which forces the central bank to ‘print’, i.e., turn that debt into currency. I have discussed this phenomenon before. “The [Federal Reserve] has one mission. It is to make sure that the federal government obtains a... | ||||

| Bill Murphy Hits Bullseye – again! Posted: 15 Jun 2010 07:11 PM PDT The following is automatically syndicated from Grandich's blog. You can view the original post here June 15, 2010 01:30 PM Bill Murphy and Jim Sinclair have done more to keep me on the right side of gold since just above $300. I truly can’t do without either one’s commentaries. This is from Bill’s daily letter today: [B]The gold industry is truly daffy. Not a week goes by when a number in this industry fail to give credence to my decade long statement: Never have so many known so little about their own industry. It is truly astounding and NEVER changes as the years go by…[/B] [B]*The World Gold Council promoted jewelry consumption until very recently as its main focus even as gold has been in a ten year bull market and the most consistent investment around.[/B] [B]*The senior gold producers finance the World Gold Council even though this outfit has done little to deal with the real issues affecting the gold price. As a rule producers are afraid of go... | ||||

| Grandich Comments on Stock and Gold Market Posted: 15 Jun 2010 07:11 PM PDT | ||||

| Adrian Day: Wanna Go 'Green'? Go Geothermal Posted: 15 Jun 2010 07:11 PM PDT Source: Brian Sylvester and Karen Roche of The Energy Report 06/15/2010 Investment guru Adrian Day likes "green" energy but doesn't see many ways to make money in that space, save two. In this "Coles Notes" interview with The Energy Report, Adrian gives us his favorite juniors in the geothermal sector and even offers a few of the base metals juniors that he owns. The Energy Report: Could you give us an overview of the alternative energy market? Adrian Day: We all know the story of why green energy is attractive. We all know the story about oil, the risks and buying it from unstable foreign countries. . .how dirty coal is, and so on. So, we all know the potential advantages of what we might call "green" or "alternative" energy. The big problem for me, being a realist, is that most of them don't make money. Wind, solar and biomass are really just marginal additions to energy. At least for the foreseeable future, they're marginal in the overall picture, and they're ... | ||||

| Another Day on the Road to Perdition Posted: 15 Jun 2010 07:11 PM PDT Gold was up a few dollars in early Far East trading on Monday morning... and stayed that way until it had a short rally to its high of the day [around $1,235 spot] going into the London open. From that point, gold ran into a not-for-profit seller and, except for a brief spike into an early London p.m. gold fix, gold continued to 'fall' until precisely 11:30 a.m. in New York... which was its low price of the day at $1,215.70 spot. From that low, gold attempted a rally, but each little rally got sold off before it could develop any legs... and gold finished down $6.10 on the day. Silver once again followed its own path... and its price was up nicely in the early going... but its price also got capped as well... the same moment that the gold price got hit... moments after London opened for the day. But the silver price didn't go down much... and actually began to rally sharply the moment that trading began on the Comex in New York. Si... | ||||

| China Gets Contrarian, Buys Greece Posted: 15 Jun 2010 07:11 PM PDT The 5 min. Forecast June 15, 2010 10:00 AM by Addison Wiggin & Ian Mathias [LIST] [*] China goes contrarian, picks up Greek ports [*] Chris Mayer attempts to end the “China: Boom or Bubble” debate… for now [*] Dan Amoss identifies a short selling opportunity, born from the “cash for clunkers” debacle [*] Plus, a powerful chart: Was the Fed entirely responsible for the 2009 bear market rally? [/LIST] An investment quiz to begin today’s 5 Min. Forecast. Two-part question: 1) Which country has more money to spend than any other? 2) Which nation currently represents the least-attractive investment environment? In other words, where is the one place a true contrarian would love -- where no one wants to invest? The answers lie in our favorite headline of the day: China has agreed to invest billions in Greece’s port system. After some lousy pre-crash investments in Blackstone, Morgan Stanley and Visa, Chinese state money i... | ||||

| Posted: 15 Jun 2010 07:11 PM PDT Market Ticker - Karl Denninger View original article June 15, 2010 10:04 AM You knew it was just a matter of time.... [INDENT]Democracy could 'collapse' in Greece, Spain and Portugal unless urgent action is taken to tackle the debt crisis, the head of the European Commission has warned. In an extraordinary briefing to trade union chiefs last week, Commission President Jose Manuel Barroso set out an 'apocalyptic' vision in which crisis-hit countries in southern Europe could fall victim to military coups or popular uprisings as interest rates soar and public services collapse because their governments run out of money. [/INDENT]How did that happen? Was it someone else's fault? Was it some "exogenous" event? Some natural catastrophe? Or was it profligate spending, handouts and bailouts, promises made to public employee unions and intentional, willful and wanton bubble-blowing? [INDENT]The stark warning came as it emerged that EU chiefs have begun work on an eme... | ||||

| A signal from the stock market Posted: 15 Jun 2010 07:11 PM PDT June 14, 2010 – The stock market is often acclaimed for its forecasting ability. Stock prices peak long before the downturn in economic activity that generally results in a recession and a prolonged decline in the stock market. Then after this lull in the economy, the bear market low in stock prices leads by several months the upturn in economic activity. As a consequence, since making a low in March 2009 following the turmoil surrounding the Lehman Brothers collapse, many economists have been proclaiming that the rise in the S&P 500 Index, the Dow Jones Industrial Average and other stock indices is forecasting better economic conditions. So far, it hasn’t worked out that way. The economy is fragile, with job creation being weak and unemployment therefore remaining menacingly high. Federal government revenue – which is perhaps one of the more reliable indicators of strength in the economy – is not improving after a long downtrend. A numb... | ||||

| LGMR: Gold Holds Below €1000 But "Risk Trade" Revived by Greek Downgrade Posted: 15 Jun 2010 07:11 PM PDT London Gold Market Report from Adrian Ash BullionVault 09:05 ET, Tues 15 June Gold Holds Below €1000 But "Risk Trade" Revived by Greek Downgrade, Spanish Bank Warning THE PRICE OF WHOLESALE BULLION for Dollar investor wanting to buy gold early Tuesday edged up to $1226 an ounce as stocks, commodities and currencies were also little changed. Asian stock markets ended the day flat. European equities crept higher as the Euro ticked towards Monday's two-week high just below $1.23. Crude oil held just above $75 per barrel, and silver prices crept back towards Monday's new June highs at $18.58 an ounce. Gold priced in Euros held below €1000 an ounce (€32,000 per kilo). "A lot of the risk trade has abated with a rally in the Euro," said a Chicago futures trader to Bloomberg on Monday – a "difficult session" according to one London gold dealer. "That's the biggest reason to sell gold." Gold recovered half of yesterday's earlier losses, however, after a ... | ||||

| Gold: Prices Coming Off All-Time High, But Bullish Trend Looks to Continue Posted: 15 Jun 2010 07:04 PM PDT Forexyard submits: By Russell Glaser Spot gold prices have fallen from their all-time high as the euro and global equities have staged a small comeback on positive economic data from the U.S., Europe, and China. However, this doesn’t appear to be enough to derail the long term bullish trend the commodity has been experiencing over the past 20 months. The price of spot gold has risen in the latest bullish trend from a low of $681, to a new all-time high of $1251 last week. This is an appreciation of roughly 84% since October of 2008. | ||||

| Special GSR Gold Nugget: Harry S. Dent Jr. & Chris Waltzek Posted: 15 Jun 2010 07:00 PM PDT | ||||

| Stephen Roach says Chinas Housing Boom is Not a Bubble; I say "Nonsense" Posted: 15 Jun 2010 05:49 PM PDT | ||||

| Stephen Roach says Chinas Housing Boom is Not a Bubble; I say "Nonsense" Posted: 15 Jun 2010 05:49 PM PDT | ||||

| Posted: 15 Jun 2010 05:35 PM PDT | ||||

| U.S. Dollar: Delta in the Value of a Promise Posted: 15 Jun 2010 05:14 PM PDT Annaly Salvos submits: What is a dollar? As far as we can tell, there is no legal definition of what it is, no statement that begins, “The dollar is…” Instead, the dollar is something that is defined by other things. When the Federal Reserve was created by the Federal Reserve Act of 1913, the dollar was basically defined by the amount of gold that had to be kept in reserve to back the currency, or 35 cents of gold per dollar. Theoretically, one could take their currency to Fort Knox and exchange it for gold (although it was illegal to own gold bullion between 1933 and 1974). We’d like to think that Andrew Jackson can be seen peering out from his oval with confidence, knowing that something has his back. Complete Story » | ||||

| Gold Seeker Closing Report: Gold and Silver Gain Roughly 1% Posted: 15 Jun 2010 04:00 PM PDT Gold waffled near unchanged in Asia and saw only slight gains in London, but it then surged higher in late morning New York trade and ended near its early afternoon high of $1234.95 with a gain of 0.76%. Silver climbed to as high as $18.67 by early afternoon in New York before it fell back off a bit in the last hour of trade, but it still ended with a gain of 1.03%. | ||||

| Don't Buy the Stock Market…Buy Stocks Posted: 15 Jun 2010 03:55 PM PDT Special situations look like a particularly good spot to be in these days. Why? I'll explain below... But first, it may help to take a minute to explain what a special situation is. It's actually an old concept. The best definition may be that of the great Ben Graham - famed value investor and mentor to Warren Buffett. Back in 1946, Graham gave his definition of a special situation. "In the broader sense," he wrote, "a special situation is one which a particular development is counted upon to yield a satisfactory profit in the security even though the general market does not advance." In other words, a special situation is an investment in which some event - or catalyst -promises to make you gains in the stock, even if the overall market goes nowhere. This doesn't mean special situations are immune to market forces. Of course they aren't. But as Graham says, in the typical special situation, "the result depends upon corporate developments, and not on market price." More of your gains are tied to whether or not your catalyst comes through or not. Ideally, as Graham writes, you want to be in a situation where "if your deal works out, you are sure to make a profit, but if it doesn't, you may still make a profit." There are many such opportunities, but they are often difficult to find. I have identified a number of them for the subscribers of my investment service, Mayer's Special Situations. A few of these stocks have already delivered gains. Others are still in the wait-and-see phase. AEP Industries (NASDAQ:AEPI), for example, is the target of a large activist shareholder who has proposed that the company put itself up for sale. Clearly, a sale is not essential to make AEPI a profitable investment. Perhaps management will, as they've hinted, buy back lots of stock, instead. The point is that the something out of the ordinary is happening - something that could produce a sizeable profit for shareholders. Joel Greenblatt, a successful investor who devotes a lot of attention to special situations, wrote a book entitled, You Can Be a Stock Market Genius. This book is like a handbook of special situation investing. "The underlying theme to most of these investment situations is change," he writes. "Something out of the ordinary course of business is taking place that creates an investment opportunity." Again, the list of what those out-of-the-ordinary things are is long - spinoffs, mergers, restructurings, asset sales, distributions and more. "The great thing is," Greenblatt writes, "there's always something happening." As a result, special situations are a rich vein to mine. We don't have to cover the whole field. We just have to find one or two a month and we'll have plenty of ideas, probably more than we need. For me, many of the best special situations reside in out-of-the way stocks that are simply too small for me to recommend to my large base of Capital & Crisis subscribers. Getting back to Graham, he also makes an interesting historical observation about special situations that I think is relevant to our own market today. In the years 1939-42, the overall market was not so hot. As Graham put it, "During these years, the trend was unfavorable for those owning standard issues [the big blue chips]... By contrast, many bargain industrial stocks scored substantial advances - especially since the early war years brought proportionately greater business improvement to the secondary companies than to the leaders." The idea being that if the market is going to be sluggish and the economy tepid - as I think ours will be - then you don't want to own the elephants or the headline companies. Generally speaking, you don't want to own the biggest companies, because they are the market. They are most exposed to the economic winds. It is more difficult for a very large company to grow faster than the economy, for instance. The smaller companies that occupy some niche have less binding them. Doubly so for the special situation that has some future "event" that could unlock value embedded in the stock. Special situations, I like to think, come with their own onboard motors. And that's why special situation investing is particularly attractive right now. Chris Mayer | ||||

| Flip Flopping in the Housing Market Posted: 15 Jun 2010 03:52 PM PDT Flip 'em on the way up... Subsidize 'em on the way up... Bloomberg News:

There is always a way to make money. When prices were rising, unscrupulous speculators made money by pretending houses were worth more than they really were. Now they make money by pretending they're worth less than they really are. Trouble is, no one knows exactly what things are worth. They know even less what they'll be worth tomorrow or the next day. The theories about economics and markets developed in the last 100 years are almost all nonsense. Markets are not perfect. They do not reflect the actual value of things. There's no way of knowing what the actual value is. Instead, markets are always discovering value - in fits and starts - imperfectly. They reflect reality and fantasy...the future and the past...math and muddle. When the feds pushed down interest rates following the '01 mini recession, homeowners realized that they could own more home with the same monthly payments. Houses suddenly became more valuable. This pushed up prices and led homeowners to conclude that houses were a good investment as well as a good place to hang your hat. And because the value of their collateral had increased, it enticed the mortgage industry to lend more aggressively...and ultimately, recklessly. Prices moved up even more. Happy days were here. And then, the market discovered that houses weren't really worth so much after all. Because the mortgage industry had canoodled with Wall Street and Washington to inflate house prices far beyond what people could afford to pay. The average homeowner could no longer come close to buying the average house. Fannie and Freddie, for example, backed every crackerjack mortgage scheme that came along. And then, wouldn't you know it, people had mortgage payments they couldn't meet. Prices fell. Bummer. And now comes news that Fannie and Freddie need a bigger bailout: "Fannie Freddie Fix at $160 billion, $1 trillion worst case..." Up, down...down, up. Flip 'em...flop 'em. Subsidize them...then rescue the subsidizer. Even when markets are allowed to operate freely, they can never make up their minds. But at least it's an honest confusion. Imagine what happens when the feds deliberately distort prices by raising the money supply, holding down interest rates, and subsidizing borrowers. This week, Sheila Blair, chairwoman of the Federal Deposit Insurance Corporation, admitted that the US government was instrumental in causing the blow up in the housing market. The New York Times:

We had no doubt about it. Anyone can make a mistake. But if you want to make a real mess of things, you need taxpayer support. And more thoughts... A newspaper from Victoria, Texas, reported that the Hispanic community decided to voice its displeasure with upcoming immigration law changes. How? By boycotting businesses owned by Caucasians. They then announced that the boycott was a success - reducing sales by 19%. The business community, however, claimed success too. It said shoplifting had gone down 77%. If those figures are correct, it suggests that Hispanics in Victoria buy 20% of goods sold but steal 3/4 of those that disappear from the shelves. *** "What?" Elizabeth and her husband (your editor) are both in Florida. Their youngest son, Edward, 16, was left in Maryland on his own for one night, Sunday, with careful instructions on what to do and what not to do. His brother would call him in the evening to make sure he was okay. His sister, not far away, would check on him on Monday morning. The family worried that he might be a little lonely in the house by himself. "I got there this morning," his sister reported. "He was outside with a whole group of his friends. They had the music blaring. It was only 10AM...and they were partying already. Then, I realized that some of them must have been partying all night. "I asked him what was going on... He said he had just invited a couple of friends over to celebrate the end of the school year. "He told me there wasn't anyone in the house. But when I went in I found another group of a dozen teenagers. And one girl was asleep on Henry's bed. "That was it; I shooed them all out... But at least they seemed to be pretty good kids. They didn't seem to be drinking or taking drugs..." "Oh my... We've turned into the kind of parents other parents hate," said Elizabeth when she heard the news. "We let our son turn the house into the neighborhood party central..." Regards, Bill Bonner | ||||

| BP's Irreverisible Death Spiral - If You Own The Stock: Good Luck, But Good Night Posted: 15 Jun 2010 03:52 PM PDT Fitch today downgraded BP's credit rating by SIX notches, from AA- to BBB-, one notch above junk status. The bonds plummeted in price, catapulting the yields on BP solidly into middle junk bond range. I have to say, I spent nine years trading junk bonds on Wall Street and another 11 years following the market. I can't ever recall seeing a company receive a downgrade of this magnitude and not eventually go tits up. I'm sure it's happened, but I can't think of an example. This is serious shit. Remember Enron? Fitch was the first credit rating agency to finally downgrade Enron debt, even though it had been apparent well before the downgrade that Enron was a zombie. Astonishingly, Moody's and S&P never downgraded Enron until just before it filed. We'll know how much whore and whiskey money BP has bestowed on those two rating firms based on how long it takes them to follow Fitch. I would bet whore and whiskey money that the scumbags at BP lobbied Fitch long and hard in order to avoid a downgrade to full junk status (yes this does happen and I've witnessed the process first-hand). BP's debt plunged on this downgrade. According to this news report, it sounds like large blocks of BP paper were put out to the market on a "bid wanted" basis: Someone Please Buy My Bonds. What this means is that the market for BP bonds has become very illiquid and there are large institutions who will be forced to sell once the bonds get an official junk rating. Clearly the market sees this coming based on where the yields are now, and some big funds are hoping to beat the sell rush. This is the kind of activity we started to see in the spring/summer of 2008 as the credit collapse was developing. Typically the bond market is a much better tool to use than the stock market in forecasting the direction of a company's solvency status. Right now I would interpret the Fitch/bond market activity as putting a 50/50 probability on the likelihood of BP filing bankruptcy. In addition, BP announced yesterday afternoon that it had hired Goldman, Blackstone and Credit Suisse for financial advisory services. No doubt BP selected Goldman for its deep and extensive inside connections to the Obama Administration. Blackstone and Credit Suisse are big M&A and restructuring players. My bet is that BP wants to see what a hail mary play involving putting lipstick and a gown on the pig in order to auction it off might look like. The fact of the matter is that I just can't see any Company in the world taking on the potential liability facing BP. As more and more information leaks out that Obama/BP are trying to cover up, it is looking like this blown well is taking on Armegeddon-like proportions. Yesterday an article appeared in the San Francisco Chronicle in which "a BP engineer described the doomed rig as a 'nightmare well,' according to internal documents released Monday." LINK. And Clusterstock.com carried an article today in which Matthew Simmons, arguably the most respected oil industry analyst, professed that an attempted relief well will fail and that there is a possibility that a giant undersea lake may already be covering the floor of the Gulf: "The Road" in real life? I have also had conversations with a couple people who have chatted with industry insiders. Independently, both offered the same type of assessment: this situation is completely out of control and Obama/BP are trying to cover up as much of the truth as they can; there is no way BP has a shot at containing this - the pressure that has built up in the deep rock formations is much greater than the ability of available technology to contain; the well-head will likely be blown apart; fissures are forming on the Gulf floor from which oil is already leaking into the water (as described: "BP has cracked the earth with this well"); in addition to the obvious and immediate annihilation of the Gulf ecology and environment, if this problem develops into its full potential, the effect on the ocean will have a global effect on the atmosphere and the food supplied to the world by the ocean. And in summary, I offer two rhetoricals: 1) In his Armageddon vision presented in "The Road," everyone assumes that a nuclear war had occurred, but author Cormac McCarthy never specifically identifies what happened; 2) Do you really still want to own BP stock? | ||||

| BP's Irreverisible Death Spiral - If You Own The Stock: Good Luck, But Good Night Posted: 15 Jun 2010 03:52 PM PDT Fitch today downgraded BP's credit rating by SIX notches, from AA- to BBB-, one notch above junk status. The bonds plummeted in price, catapulting the yields on BP solidly into middle junk bond range. I have to say, I spent nine years trading junk bonds on Wall Street and another 11 years following the market. I can't ever recall seeing a company receive a downgrade of this magnitude and not eventually go tits up. I'm sure it's happened, but I can't think of an example. This is serious shit. Remember Enron? Fitch was the first credit rating agency to finally downgrade Enron debt, even though it had been apparent well before the downgrade that Enron was a zombie. Astonishingly, Moody's and S&P never downgraded Enron until just before it filed. We'll know how much whore and whiskey money BP has bestowed on those two rating firms based on how long it takes them to follow Fitch. I would bet whore and whiskey money that the scumbags at BP lobbied Fitch long and hard in order to avoid a downgrade to full junk status (yes this does happen and I've witnessed the process first-hand). BP's debt plunged on this downgrade. According to this news report, it sounds like large blocks of BP paper were put out to the market on a "bid wanted" basis: Someone Please Buy My Bonds. What this means is that the market for BP bonds has become very illiquid and there are large institutions who will be forced to sell once the bonds get an official junk rating. Clearly the market sees this coming based on where the yields are now, and some big funds are hoping to beat the sell rush. This is the kind of activity we started to see in the spring/summer of 2008 as the credit collapse was developing. Typically the bond market is a much better tool to use than the stock market in forecasting the direction of a company's solvency status. Right now I would interpret the Fitch/bond market activity as putting a 50/50 probability on the likelihood of BP filing bankruptcy. In addition, BP announced yesterday afternoon that it had hired Goldman, Blackstone and Credit Suisse for financial advisory services. No doubt BP selected Goldman for its deep and extensive inside connections to the Obama Administration. Blackstone and Credit Suisse are big M&A and restructuring players. My bet is that BP wants to see what a hail mary play involving putting lipstick and a gown on the pig in order to auction it off might look like. The fact of the matter is that I just can't see any Company in the world taking on the potential liability facing BP. As more and more information leaks out that Obama/BP are trying to cover up, it is looking like this blown well is taking on Armegeddon-like proportions. Yesterday an article appeared in the San Francisco Chronicle in which "a BP engineer described the doomed rig as a 'nightmare well,' according to internal documents released Monday." LINK. And Clusterstock.com carried an article today in which Matthew Simmons, arguably the most respected oil industry analyst, professed that an attempted relief well will fail and that there is a possibility that a giant undersea lake may already be covering the floor of the Gulf: "The Road" in real life? I have also had conversations with a couple people who have chatted with industry insiders. Independently, both offered the same type of assessment: this situation is completely out of control and Obama/BP are trying to cover up as much of the truth as they can; there is no way BP has a shot at containing this - the pressure that has built up in the deep rock formations is much greater than the ability of available technology to contain; the well-head will likely be blown apart; fissures are forming on the Gulf floor from which oil is already leaking into the water (as described: "BP has cracked the earth with this well"); in addition to the obvious and immediate annihilation of the Gulf ecology and environment, if this problem develops into its full potential, the effect on the ocean will have a global effect on the atmosphere and the food supplied to the world by the ocean. And in summary, I offer two rhetoricals: 1) In his Armageddon vision presented in "The Road," everyone assumes that a nuclear war had occurred, but author Cormac McCarthy never specifically identifies what happened; 2) Do you really still want to own BP stock? | ||||

| Risk appetite brings S&P back above 200DMA Posted: 15 Jun 2010 01:48 PM PDT Volume is nowhere to be found, which means risk was heavily bid and price marched on upward today. US FI saw outflows on short-end, with 3mo bill yields going up 2.5bps, but 10yr & 30yr Tsys saw minimal offering, diverging from the breakouts witnessed in equity & commodity/FX space. The hourly chart of the 10yr Tsy yield shows a consolidation of the April-May risk aversion occurring. If yields can get a break above the 3350 level, that may indicate more risk appetite and continuation of risk rallies. If the level poses resistance and we get a selloff back to late May lows, expect risk to follow suit. SPY & AUD/USD both broke out through late May/early June cycle highs today, with SPY/ES/SPX breaking their 200DMA as well. Both risk assets have foreboding resistance levels above, however, as well as 50DMAs. The distribution in April-June is bearish, and the recent rallies off lows have been on low volume, so we are maintaining a bearish outlook with long risk hedges skewed for beta. The one asset that got bid today with little overhead resistance is gold, which is in a bullish triangle and looks primed for a breakout through 1250/oz soon. Philly, Chicago, & Empire employment are all rolling over, and with last month's abysmal private job gains in context of the census-fueled NFP gain, next month's NFP data may show some serious underwhelming. Meanwhile, the NAHB/Wells Fargo Home Builders Index rolled over to 17 this month from 22 last month vs 21 consensus, as the first-time homebuyer tax credit expired. The Empire State Manufacturing Index rose to 19.6 in June from 19.1 last month, a tad lower than the median 20.0 estimates. With May's Manufacturing PMI at 59.7, if the Empire State data is forecasting June's PMI, then we may get another month or two of PMI > 55, but if this level breaks, we will be watching closer and closer for confirmation of an imminent double-dip. Lots of talk about the ECRI WLI rolling over (presented below), and well-deserved in our opinion-- though not confirming a double-dip, it is definitely indicating a slowdown in growth and the onset of the stimulus hangover. 3mo USD LIBOR is ignoring the recent reversal into risk, as interbank liquidity continues to dry up. These issues are even more magnified in the EURIBOR market. This is not good going forward, and unless there is a roll over in LIBOR spreads, credit will continue to deteriorate and equity will have no choice but to eventually catch up, hard and fast. If the 10yr yield declines further from here, the flattening curve (3mo doesn't have much more room to fall) + widening credit spreads (both interbank and corp-Tsy/CP-Tsy) may be a harbinger for future bearish action. If risk appetite spells outflows from Tsys and sends the 10yr yield back up, risk should be bid again and rallies will have legs. But the sustainability of this whole game seems nil. After all, once rates do start rising (nominal zero floor + sov credit risk as Tsy avg maturity continues to plunge into record issuance), the whole backstopping/guaranteeing of FNM/FRE/related entities paper will be enormously bearish, as the presently artificially low borrowing costs will skyrocket, just as the sov funding costs do as well. The Fed's Maiden Lane portfolios' DV01 may be huge and terrible for financial markets, but the IR & duration risk to govt-backed paper will be grossly damaging to the US economy. Oh, and Strauss-Kahn is headed to Spain. Looks like the sov debt contagion has officially started. | ||||

| Kate Welling's Seminal Interview With Themis Trading On Market Structure Posted: 15 Jun 2010 01:48 PM PDT Some, like Sal Arnuk and Joe Saluzzi, who have long been warning about the imminent threat of a May 6-like event, only to be proven correct, not only on that score, but also on their admonitions that the entire market structure is broken, end up being interviewed by such exalted financial figures as Kate Welling. Others, like their arch nemesis Irene Aldridge, who has long been warning about the imminent extinction of all those who do not buy into the religion of "HFT or bust", end up being mocked by the cash cow from The Jon Stewart Show. We present the complete interview in which Sal and Joe deconstruct market topology, HFT, innovation, market manipulation, front running, Flash trading, collocation, VWAP, Reg NMS, and everything else you have always wanted to know but been afraid to ask. Welling@Weeden: Playing Fair: Themis Trading Picks Apart Market's Post-Reg NMS Structural Flaws

This posting includes an audio/video/photo media file: Download Now | ||||

| Posted: 15 Jun 2010 01:38 PM PDT Dear Extended Family, You know that I practice what is written. As an example of that, please see the December 2001 career review about me that was carried in Forbes. I live in a totally rural area of North Western Connecticut. I firmly believe that utilities are not one of your civil rights. There are 14,000 gallons of buried fuel made up of heating oil, diesel and gasoline. The entire property can be run by my 2x 20,000 KW marine diesel engine electric generators without any need for conservation. There are four drilled wells that feed into an underground holding tanks room in which there are two 4500 gallon tanks with only their face showing on one wall. The 9000 gallons of fresh water goes from the underground room into a 500 gallon holding tank in the house. I have three distillers that make water as Connecticut water is always hard. There are intruder lights at all entrances to the property. All driveways have metal detectors. There is a 16 camera 24 hour security system that plays on any computer I use. The security system not only shows the office entry but also scans the property and inside the barns. They can be downloaded onto a hard drive and take recorded pictures, time dated, triggered by motion. I have a 65 foot indoor pistol range capable of taking .50 caliber rounds into a Detroit bullet trap underground in a field. The range takes 800 cubic feet of air down range and exhausts into a field so you do not die from inhaling your hobby. We do farm equipment and auto repair, painting, carpentry and masonry (with the exception of chimneys) ourselves. We have a heavily populated 90,000 gallon fish pond. My root cellar is 16 by 16 by 10. My long dormant hen house is being resuscitated. We are over ridden by deer and in need would have no problem laying up meat. The equipment required for all tasks from farming to all kinds of hunting is in over supply. I am trained in all the talents of taking care of myself. Having spent many years living in developing nations in Asia and Africa, this is simply how I have lived. Why you ask, in North America? The answer is simple. It follows directly on Bill's question today concerning the proverbial but purely semantical argument of inflation vs. deflation. Hyperinflation, a currency event which is certain to occur, will disrupt for economic reasons the distribution of food, bottled water, medicine and utilities. The currency event will be that of the entire Western world, not simply the dollar. It is not the lack of these items as much as it is the disruption economically of the means of distribution that require us all to think beyond gold. Vacation homes in rural settings are smashed price wise. Owning such a residence might enhance normal family life, and become an island for those few months when distribution collapses due to hyperinflation. Don't laugh, it is going to happen to some degree. The most fun is my garden pictured below. A garden plus a root cellar means storage over the winter months for important natural food items. Our apple crop, that which is not made into sauce or cider, goes into a walk in frost room for preservation. | ||||

| Posted: 15 Jun 2010 01:13 PM PDT Hi Jim, I just read your reply to Bill's question/statement regarding deflation vs. Inflation. Good answer. People just don't get the currency event. It is because: 1. They are too young. I think Harry Schultz put it best when he said some things will skyrocket (like oil) and other things will deflate (like real estate). Sometimes people see things in one dimension and can't see past their noses. Big love,

Hi Jim, The current monetary system looks like it will fail. There is way too much debt across the board across all levels. Add to that $1,300T in derivatives and $150T in US government unfunded liabilities. That's $500k in US government unfunded liabilities per US person. When people realize that they must purchase gold to retain what purchasing power they have left, they will form a herd like mentality and the gold stocks will explode upward in price. It is only a matter of time. Gold is the ultimate fiat currency lie detector. Wall Street now owns Washington and Main Street is left to fend for themselves and piss in the wind. This is an American tragedy. Our County's founding fathers surely are quite disappointed. I believe that Main Street with eventually rebel and the 2nd American revolution will take hold. All the best,

Dear Fred, There are tons of conflicting opinions concerning negative lease rates recorded on the internet. I assume the confusion has lead to your question. The answer is simple. Central Banks are paid lease rates for lending gold yet assume the full risk of non-return of the asset which is not an attractive proposition when sovereign credit is sundering. To be paid nothing for taking the risk of non-return of the asset is not attractive to any sane person. The gold price is moving up. It simply says no interest on the part of central banks in lending gold to questionable credit, and even other central banks as questionable credits. The desire to short gold is dropping daily. The bearish opinion that it indicates central bank's over-much selling pressure is denied by the appreciation of the price of gold. It is fact that central banks have been buyers and even on balance buyers It is that simple. The confusion is that the bears are giving academic answers to a practical situation. Respectfully,

Eric, You will recall my observation that the top nuclear scientist in America had been sent by the Administration to the BP war room as advisors. Don't rule out anything as the greatest ecological disaster in the history of man continues. Regards, Nuclear Option on Gulf Oil Spill? No Way, US Says I do not advocate any particular "solution" but rather point out how quickly consensus opinion can go from "No Way" to "Let's Think about it". A week ago, consensus opinion feared lower stock and gold prices, but that will change with every up tick. There are reports that suggest that the infrastructure of the well has been damaged. If this is correct, plugging the well through traditional measures could prove very difficult. Watch consensus opinion evolve as the size of the spill continues to increase. "Probably the only thing we can do is create a weapon system and send it down 18,000 feet and detonate it, hopefully encasing the oil," Matt Simmons, a Houston energy expert and investment banker, told Bloomberg News on Friday, attributing the nuclear idea to "all the best scientists." Source: www.cnbc.com

Hi Jim, You predict hyperinflation. I can only see that happening if people have the money to spend. If their IRA is toast because the stock market has melted down, they will have no cash to spend. They have already lost the equity in their homes and most are under water. Jobs are in jeopardy, everyone is cutting back, no one is going on a spending spree. If the Administration was to eliminate the income tax and sent $10,000 checks to everyone, then prices will rise like you predict… but they won't give up taxes that easily. Ben will have to use a B-52 money drop. Deflation can occur if no one has any extra money to spend. Most businesses finance their inventory and pay interest on their loans. If their products are not moving, they will not raise prices, hell, they may take a loss so they can clean out the back room and make this months payment. Sooner or later the Government will default on its promises, it is just a matter of time. Then, interest rates will skyrocket. I just can't see how prices can rise when everyone is out of work or broke. I think they are deliberately trying to destroy America so they can give us a solution to the problem: the new world order – a one world government with the bankers in charge and our Constitution, will be history. All the new money that has to be created out of thin air has gone to the bankers, not the people. How can prices rise if the common man is destitute? CIGA Bill Dear Bill Hyperinflation is a currency, not an economic, event. That is not factored into your set of parameters leading to your conclusion. Governments do not default, they reschedule and print more money. QE can provide pieces of paper, but not buying power. All your points below that you offer to sustain deflation is the meat from which hyperinflation occurs. Governments of the Western world will provide all the fiat money to bail out everything but Main Street, but there will be no increase in buying power. I have written on this subject at least 200 times, and seem not yet been able to communicate what is an economic/political axiom. This currency event, not an economic event, has happened before and will again. Did the same conditions and formulas you put forward to sustain deflation not exist in Weimar, Zimbabwe and 34 other examples? Is not what the Western world is doing now EXACTLY what was done in Weimar, Zimbabwe and 34 other examples? Respectfully yours,

Jim Sinclair's Commentary And so it will be provided. Another event answer to Bill's question. EU chief says eurozone bailout could be increased BRUSSELS – The European Union president says EU governments will increase a massive euro750 billion ($1 trillion) bailout package if it isn't enough. EU President Herman Van Rompuy told Belgian magazine Trends Tendances on Thursday that "if the plan isn't enough, my answer is simple: in this case, we will do more." He says he doesn't think that's likely because the size of the financial rescue on offer for eurozone countries who can't repay their debts already "stunned the world." Germany is providing the largest chunk of the debt guarantees that back the fund. | ||||

| James Turk: Hyperinflation likelihood is increasing Posted: 15 Jun 2010 01:11 PM PDT 9p ET Tuesday, June 15, 2010 Dear Friend of GATA and Gold: The gap between U.S. government spending and tax revenue remains large, Freemarket Gold & Money Report editor James Turk writes tonight, and is being filled with ever more borrowing, increasing the chance of hyperinflation in the dollar. Turk's commentary is headlined "Hyperinflation Watch" and you can find it at the FGMR Internet site here: http://www.fgmr.com/no-improvement-in-the-hyperinflationary-outlook.html CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Prophecy to Become Coal Producer This Year Prophecy Resource Corp. (TSX.V: PCY) announced on May 11 that it has entered into a mine services agreement with Leighton Asia Ltd. to begin coal production this year. Production will begin with a 250,000-tonne starter pit as planned in August, with production advancing to 2 million tonnes per year in 2011. Prophecy is fully funded to production and its management team includes John Morganti, Arnold Armstrong, and Rob McEwen. For Prophecy's complete press release about its production plans, please visit: http://www.prophecyresource.com/news_2010_may11.php Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||

| Posted: 15 Jun 2010 12:36 PM PDT After catching a few soundbites of Cramer's spiel today, we were stunned: for once theStreeter did not lose his marbles over an engineered, 20 handle, 200DMA breakout rally. Quite the opposite. In what is likely a first, the Mad Money host actually told his viewers it is time to get out of the market: "I am calling this a bad rally. This market has now become more depressing than Ethan Frome. Even the good days are now bad days. It's almost as if the whole market is caught between 1st base and 2nd base. So we get an endless rotating short squeeze in oil, in the banks, in tech, in discretionary.... But once the shorts are done getting picked off, we've got no more reason to run. It is a rally that stops that a blast of future selling comes in. It is a rally that stops the moment the buyers just walk away. We used to have fundamentally based rallies - that's not how this market works." The 10 minute rant against the market by the legendary permabull is simply shocking: he actually describes all the different dimensions in which the stock market is completely busted and discredited in a way that makes us jealous: "This market is stupid. And it is hated for a very good reason. The market seems rapacious, arbitrary, capricious and downright ridiculous. It is a tale told by an idiot, full of sound and fury, signifying nothing."

| ||||

| Central Gold Trust Opens Its Entire $800 Million Base Shelf Prospectus in a Non-Dilutive Offering Posted: 15 Jun 2010 12:15 PM PDT | ||||

| Posted: 15 Jun 2010 11:51 AM PDT No wishful thinking here! As I see it gold is going to a parabolic top of $10,000 by 2012 for very good reasons - sovereign debt defaults, bankruptcies of "too big to fail" banks and other financial entities, currency inflation and devaluations - which will all contribute to rampant price inflation. Not surprisingly, I have company in that view: Money manager, Peter Schiff, told Business Week recently that, "Gold could reach $5,000 to $10,000 per ounce in the next 5 to 10 years" and highly respected economist David Rosenberg is of the opinion that "There is no doubt that gold can easily double from here." THE CAUSES 1. History is No Guide Gold has only been trading freely since President Nixon's 1971 decision to deny gold to the French and others attempting to repatriate their paper dollars for the metal. As such, there has been a scant forty years of gold production and trading since it was detached from supporting paper money. This period has also been marked by substantially higher monetary and price inflation as well as currency devaluation. 2. Market Manipulation The Commodity Futures Trading Commission (CFTC) recently held a major hearing which blew the doors off bullion metals futures trading markets in terms of what was revealed publically. I predict this public hearing will be viewed in the period ahead as the precious metals price liberation event of the decade. It is commonly known that JP Morgan Chase in the major player in commodities futures markets trading. Not only do they take massive naked short positions (betting that prices will fall), they do it with large substantial leverage. What isn't as well known though is that Chase acts as the agent for the Federal Reserve Board and other central banks in 'managing' the markets on their behalf. Central banks want 'orderly' precious metals markets and prices and currencies which don't gyrate wildly. Only then can they achieve stealth inflation in their monetary policy which is so beneficial in servicing debt. It also makes for good (meaning effective) politics. 3. Insufficient Physical Inventories In addition to what looks like a production peak in the gold mining industry (production has fallen in 5 of the last 8 years), central banks have for the first time recently become net purchasers (having bought more gold last year – 425 tons – than at any time since 1964).While it is normal for traders to roll their expiring contracts over into new paper trades, some traders accept cash in settlement rather than the metal. To the amazement of everyone the recent hearing of the CFTC - specifically Jeff Christensen's comments - inadvertently confirmed that there is little bullion in storage at the London Metals Exchange or New York's COMEX to back the metals trading. He justified this fact by noting that only one ounce of one hundred traded is paid out in physical metal. This revelation confirmed a much worse reality than even critics, such as the Gold Anti-Trust Action Committee (GATA), had expected. It seems that the Asian and Mid East buyers and owners of bullion have been removing gold from their dealers' vaults and are taking it "home" thus leaving much less than previously thought in the London, New York and Toronto vaults. More Here.. Power Blackouts And Water Shortages Threaten FloridaMore Here.. | ||||

| Valuable perspective on the nature of gold futures… Posted: 15 Jun 2010 10:26 AM PDT For anyone who might still labor under the old FinancialHouse-fostered illusions that a gold futures contract was a near equivalent for ownership of the metal itself, a stronger effort to understand the very nature and purpose of these derivatives should suffice to dispel the curse. Toward that end, the following article should take you far.

RS Comment: The parallels aren't exactly close between these two derivative instruments, but they are nonetheless instructive of their breed and, in fact, the gold and box-office futures are much closer in nature to each other than either of them are to the real world items that they each profess to represent in a financial capacity. To rephrase, a gold futures contract provides the full benefits of actual gold ownership in a flimflam way akin to a box-office futures contract serving as a substitute to an actual movie-going experience. Neither one has substance, and the only plot is a simple rehash of the financial houses trying to reformulate new profit centers for themselves out of sexy paper and gullible investors. | ||||

| Valuable perspective on the nature of gold futures… Posted: 15 Jun 2010 10:26 AM PDT For anyone who might still labor under the old FinancialHouse-fostered illusions that a gold futures contract was a near equivalent for ownership of the metal itself, a stronger effort to understand the very nature and purpose of these derivatives should suffice to dispel the curse. Toward that end, the following article should take you far.

RS Comment: The parallels aren't exactly close between these two derivative instruments, but they are nonetheless instructive of their breed and, in fact, the gold and box-office futures are much closer in nature to each other than either of them are to the real world items that they each profess to represent in a financial capacity. To rephrase, a gold futures contract provides the full benefits of actual gold ownership in a flimflam way akin to a box-office futures contract serving as a substitute to an actual movie-going experience. Neither one has substance, and the only plot is a simple rehash of the financial houses trying to reformulate new profit centers for themselves out of sexy paper and gullible investors. | ||||

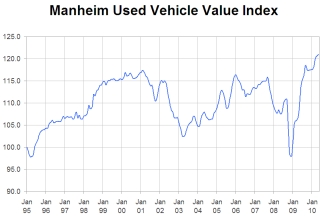

| Avis Budget Group (NYSE:CAR) — Room For Downgrades Posted: 15 Jun 2010 10:00 AM PDT Avis Budget Group (NYSE:CAR) is a New Jersey-based international company that provides car and truck rentals as well as related services. Given the latest Manheim Used Vehicle Value Index value of 121, a new record, there's plenty of reason to take a second look at this name. Here to provide additional insight on what the value means for Avis Budget is Agora Financial editor Dan Amoss. From his latest report: "We last updated Avis Budget (NYSE:CAR) when the stock was trading above $13. Amazingly, despite the rapid decline in U.S. leading economic indicators, and the return of sobriety in the corporate bond market, the sell side still focuses on scarcely relevant data like the monthly fluctuations in the Manheim Used Vehicle Value Index. On Monday, Manheim published the latest index value of 121, a new record:

"We can trace the strength in the Manheim Index back to the "cash for clunkers" giveaway to the auto companies, which needlessly destroyed hundreds of thousands of perfectly good cars — the type of cheap cars that many unemployed people rely on in their job searches. The government's destruction of the used car supply has boosted prices temporarily. But the other factor in used car pricing — demand — will remain weak as the U.S. population of registered autos stagnates or shrinks. "CAR bulls focus on the fact that strength in used vehicle prices will boost one-time gains from selling depreciated cars out of the fleet. This happens because Avis buys a new car, books depreciation charges against it as it is rented out, and then sells it (hopefully) above its book value a few years later. "Upticks in the Manheim Index can boost CAR's reported earnings. But this effect is only temporary; it will reverse once the index turns back down. Its effect on earnings should be viewed as a 'one-time' item. "Here's the main problem with the sell-side's obsession with depreciation accounting: if it wants to maintain its earnings power, Avis must reinvest the sale proceeds from old cars into a new car. This negates the fantasy that car rental companies ever generate consistent free cash flow." According to Amoss, Avis Budget can generate free cash flow when it's aggressively shrinking its fleets, but that would also be reflected in much lower earnings multiples. In light of that fact, the company is still looking at potential analyst downgrades. That's just the overview. The only way to get Amoss' actionable recommendations for CAR, and all the companies he researches, is to sign up for his newsletter, the Strategic Short Report. It's available through the Agora Financial reports page, which can be found here. Best, Rocky Vega, [Nothing in this post should be considered personalized investment advice. Agora Financial employees do not receive any type of compensation from companies covered. Investment decisions should be made in consultation with a financial advisor and only after reviewing relevant financial statements.] Avis Budget Group (NYSE:CAR) — Room For Downgrades originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." | ||||

| Record Foreclosures in May – Increase in Homes Seized in Every State Posted: 15 Jun 2010 09:58 AM PDT The month of May brought record foreclosures of US homes – for the first time, every state in the union saw an increase in seized homes. Bank repossessions are up 44% from May of 2009 to a total of 93,777. Rick Sharga, of RealtyTrac told Bloomberg, "We're nowhere near out of the woods. We're likely to set a quarterly record for home seizures if June is anything like May." Foreclosure filings have been received by 1 out of every 400 homes in the United States. The ten states with the most foreclosures in May also have very high unemployment rates – California with 72,030, then Florida, Michigan, Arizona, Illinois, Nevada, Georgia, Texas, Ohio, and New Jersey. While pundits point to leading indicators and call this economic period we are in a "recovery," it doesn't feel like that for many Americans, especially the 9.7 % who are unemployed. Gold has historically been a favorite refuge for investors among economic turmoil, and numbers like these signify that the time to protect your wealth with gold is now. | ||||

| Beyond IWM: Five Intriguing Small Cap ETFs Posted: 15 Jun 2010 09:56 AM PDT Michael Johnston submits: Although most U.S. investors build their portfolios around a core of large cap domestic equities, small-cap firms, which generally have a market capitalization’s under $2 billion, are a vital component as well. Because small cap stocks tend to have smaller customer bases, shorter operating histories, and less cash on hand, they are often more volatile than their large cap counterparts. But because they possess greater growth potential, small caps also carry potential for greater returns. Many investors elect to complement large and mid cap equity positions in their portfolio with a small cap ETF that offers exposure to a diversified basket of stocks. The most popular ETF in the Small Cap Blend ETFdb Category is the iShares Russell 2000 ETF (IWM), a fund that is comprised of 2,000 of the smallest companies in the Russell 3000 Index. IWM’s broad-based exposure–both in terms of number of securities and sector weightings–has made it the default option for investors seeking to add small caps to their portfolio. But IWM certainly isn’t the only option among small cap ETFs;below we profile five unique funds that may be worth a closer look: Complete Story » | ||||

| IBM, Sterling Deal Would Benefit Both Companies Posted: 15 Jun 2010 09:54 AM PDT Trefis submits: IBM (IBM) has signed a definitive agreement with AT&T (T) to buy its Sterling Commerce division for $1.4 billion. For Sterling Commerce, this means moving into the hands of a company that can foster its future growth as well help it compete better in its vertical. For IBM, acquiring Sterling is a worthwhile addition to its middleware software division, which constitutes around 46% of the $177 Trefis price estimate for IBM’s stock. The company plans to integrate Sterling’s platform into its popular Websphere group. Complete Story » | ||||

| Posted: 15 Jun 2010 09:46 AM PDT Gold firms on continuing safe-haven demand The COMEX August gold futures contract closed up $9.90 Tuesday at $1234.40, trading between $1221.10 and $1237.00 June 15, p.m. excerpts: see full news, 24-hr newswire… June 15th's audio MarketMinute | ||||

| Posted: 15 Jun 2010 09:30 AM PDT The US government has revised its estimate for the daily oil spill for the third time, now decidedly higher than the last iteration which was at 25,000-40,000 barrels per day. The latest estimate puts the high end another 50% higher, at 60,000 barrels. If this is indeed the case, it means that the amount of oil already having leaked could be as high a 3 million barrels, or 12 times the amount spilled in the Exxon Valdez. Whether this means that the previous estimate of a total possible BP liability and other payments of $80 billion have to be adjusted higher once again, is still unknown. We hope the president's speech at 8pm will provide some more clarity on whether or not today's BP CDS Spread around 500 is justified. In other news, and as we discussed previously, the topic of BP counterparty risk is now approaching critical mass. In an exlcusive article, Reuters has reported that "Bank of America Merrill Lynch has ordered its traders not to enter into oil trades with BP Plc. that extend beyond June 2011." In other words, BofA is limiting the duration of all derivatives to one year. It also likely means that any on the run 5 year swaps have to be immediately unwound. And one can be certain BofA is not the only one doing this.

| ||||

| Physical Scramble Accelerates: Central GoldTrust Announces Imminent Purchase Of 20 Tonnes Of Gold Posted: 15 Jun 2010 09:11 AM PDT The scramble for physical is accelerating. Following in the footsteps of PHYS and GLD, yet another gold trust announces a follow-on offering, in which the entire $800 million outstanding under the firm's previously filed Shelf will be used up. "Substantially all of the net proceeds of the offering will be used for gold bullion purchases, in keeping with the asset allocation provisions outlined in Central GoldTrust's Declaration of Trust and the related policies established by its Board of Trustees." $800 million is equivalent to 640k ounces at today's fixing, or about 20 tonnes. With this 20 tonnes of gold being sucked out of the market, and GLD's gold NAV hittinging another all time high of 1,306 tonnes, (not so) slowly all the gold is being sucked out of the system. So yes, even as stocks were off to the headless chicken races, gold once again staged a rally, which would make absolutely no sense if the market was at least a little bit less broken. The good thing is that the Fed's chairman, as confirmed by his last week's testimony, is just as clueless in justifying this "inexplicable" move in the precious metal. Perhaps if he were to look at the Frankenstein monster of a balance sheet he has created, all his questions would be answered. From the announcement:

h/t Neal | ||||

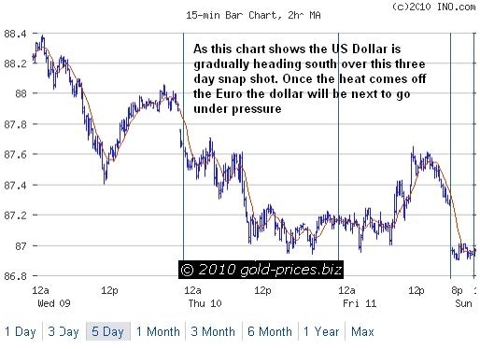

| Posted: 15 Jun 2010 09:00 AM PDT (Click to enlarge) As we mentioned recently, the dollar may well have run its course for now having been the main beneficiary of the perils that have swamped the euro. The chart above shows the US Dollar gradually heading south over this three day snap shot. Once the heat comes off the Euro the dollar will be next to go under pressure as the fundamentals look none too rosy. Complete Story » | ||||

| Posted: 15 Jun 2010 09:00 AM PDT (Click to enlarge) As we mentioned recently, the dollar may well have run its course for now having been the main beneficiary of the perils that have swamped the euro. The chart above shows the US Dollar gradually heading south over this three day snap shot. Once the heat comes off the Euro the dollar will be next to go under pressure as the fundamentals look none too rosy. | ||||

| Don’t Buy the Stock Market…Buy Stocks Posted: 15 Jun 2010 09:00 AM PDT Special situations look like a particularly good spot to be in these days. Why? I'll explain below… But first, it may help to take a minute to explain what a special situation is. It's actually an old concept. The best definition may be that of the great Ben Graham – famed value investor and mentor to Warren Buffett. Back in 1946, Graham gave his definition of a special situation. "In the broader sense," he wrote, "a special situation is one which a particular development is counted upon to yield a satisfactory profit in the security even though the general market does not advance." In other words, a special situation is an investment in which some event – or catalyst –promises to make you gains in the stock, even if the overall market goes nowhere. This doesn't mean special situations are immune to market forces. Of course they aren't. But as Graham says, in the typical special situation, "the result depends upon corporate developments, and not on market price." More of your gains are tied to whether or not your catalyst comes through or not. Ideally, as Graham writes, you want to be in a situation where "if your deal works out, you are sure to make a profit, but if it doesn't, you may still make a profit." There are many such opportunities, but they are often difficult to find. I have identified a number of them for the subscribers of my investment service, Mayer's Special Situations. A few of these stocks have already delivered gains. Others are still in the wait-and-see phase. AEP Industries (NASDAQ:AEPI), for example, is the target of a large activist shareholder who has proposed that the company put itself up for sale. Clearly, a sale is not essential to make AEPI a profitable investment. Perhaps management will, as they've hinted, buy back lots of stock, instead. The point is that the something out of the ordinary is happening – something that could produce a sizeable profit for shareholders. Joel Greenblatt, a successful investor who devotes a lot of attention to special situations, wrote a book entitled, You Can Be a Stock Market Genius. This book is like a handbook of special situation investing. "The underlying theme to most of these investment situations is change," he writes. "Something out of the ordinary course of business is taking place that creates an investment opportunity." Again, the list of what those out-of-the-ordinary things are is long – spinoffs, mergers, restructurings, asset sales, distributions and more. "The great thing is," Greenblatt writes, "there's always something happening." As a result, special situations are a rich vein to mine. We don't have to cover the whole field. We just have to find one or two a month and we'll have plenty of ideas, probably more than we need. For me, many of the best special situations reside in out-of-the way stocks that are simply too small for me to recommend to my large base of Capital & Crisis subscribers. Getting back to Graham, he also makes an interesting historical observation about special situations that I think is relevant to our own market today. In the years 1939-42, the overall market was not so hot. As Graham put it, "During these years, the trend was unfavorable for those owning standard issues [the big blue chips]… By contrast, many bargain industrial stocks scored substantial advances – especially since the early war years brought proportionately greater business improvement to the secondary companies than to the leaders." The idea being that if the market is going to be sluggish and the economy tepid – as I think ours will be – then you don't want to own the elephants or the headline companies. Generally speaking, you don't want to own the biggest companies, because they are the market. They are most exposed to the economic winds. It is more difficult for a very large company to grow faster than the economy, for instance. The smaller companies that occupy some niche have less binding them. Doubly so for the special situation that has some future "event" that could unlock value embedded in the stock. Special situations, I like to think, come with their own onboard motors. And that's why special situation investing is particularly attractive right now. Chris Mayer Don't Buy the Stock Market…Buy Stocks originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." | ||||

| The Pound and Euro Trade Better Posted: 15 Jun 2010 08:55 AM PDT Ralph Shell submits:

Complete Story » | ||||

| Titanium Metals: Margins Remain Under Pressure Posted: 15 Jun 2010 08:43 AM PDT Zacks.com submits: We are downgrading Delaware-based Titanium Metals Corporation (TIE) from Outperform to Neutral. Titanium Metals is the world's largest supplier of high quality titanium metal products. All of the company’s revenues are generated from titanium operations, mainly in the US and Europe. The company has three sub-segments: Mill Products (billet, bar, plate, sheet and strip), Melted Products (ingot, electrodes and slab) and Other Titanium Products. Complete Story » |

| You are subscribed to email updates from Gold World News Flash To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

Some investors used a recent price retreat as a buying opportunity in the wake of lingering long-term worries about debt issues in Europe and the perceived threat of potential inflation. Caesar Bryan, Gamco Gold Fund portfolio manager, said gold remains in a bull market. "I don't think that these sovereign debt issues are going away in the very short run," he said. This, coupled with loose monetary policy aimed at reviving the Western economy, provide a "decent backdrop" for gold. "We seem to see buying on any kind of weakness."…