Gold World News Flash |

- Does Another Huge Taxpayer Bailout Now Sound Appealing?

- Chevron: Future Dividend Aristocrat

- The FASB Rides Again

- Monday ETF Wrap-Up: GDX Slides, UNG Surges

- Why We Need the Fed Now More Than Ever

- Investors Flee Into Treasuries as Global Debt Concerns Intensify

- Trying to Recommit to Our Euro Trades

- What Obama and the U.S. Need to Learn from Canada

- PIMCO on British National Solvency

- Euro Debt Situation May Be Fully Priced In

- Print baby, print ... emerging value and the quest to buy inflation

- Recovery Hype and Fed Audit

- In The News Today

- You've Never Considered This 20% Income Opportunity

- Bill Gates and the Energy Research Dilemma

- The Correlation Between Morons and Government Debt

- Commodities and Gold

- Rye Patch Continuing to Grow Nevada Resources

- Richard Karn: A Bridge Too Far. . .to the Left?

- The War on Terror Becomes The War for Metals

- Nothing Like Revisionism

- Merv's Weekly Gold and Silver Commentary - June 11, 2010

- LGMR: Gold Trading "Hits Summer Lull" But Dollar-Price "Bull Trend Intact"

- Gold, Oil & SPX Trading at Key Pivot Points

- Things

- NY Times Feature No Curse on Gold

- Bernanke, Gold, And the Keynesian Endpoint

- Is China Undervalued Right Now?

- Getting Better?

- According To AXA, There Is "No Chance" European Bail Out Package Will Succeed

- Hedge Fund Third Point Discloses Xerium Technologies Position

- Why VaR Is A Joke: Morgan Stanley Admits Losses in April And May Were "Much Higher" Than Anticipated

- 9 Reasons Why Spain Is A Dead Economy Walking

- Gold Seeker Closing Report: Gold and Silver End Mixed

- James Turk: A signal from the stock market

- More fantastic money creation, then gold backing, Rickards tells King World News

- Gold, Silver, and the Mining Index with the SP 500 for the 'Quad Witch' This Week

- Remember The Whole "China Is A Currency Manipulator" Brouhaha? It's Back

- Gold Prices Update 14th June 2010

- Will Gold fall if Commodities Fall?

- Guest Post: Hydroelectric Revolution: A River Runs Through It

- These Non-Confirmations Often Occur Before Big Moves, Up or Down in the Gold Price.

- A Visual History Of The US Presidency

- Japanese Debt Crisis to Mirror that of Greece?

- US Treasury Rolls $284 Billion In Bills, $316 Billion In Total Debt In First 10 Days Of June, Cash Balance Down To $4 Billion

- Guest Post: Banking Crisis: Europe Banks The Next To Fail En Masse

- Ron Paul: “Perverse” That Jobless Lose Both Paychecks and Health Insurance

- MONDAY Market Excerpts

- Some More On S&P Resistance, And The AUDEUR From Goldman

| Does Another Huge Taxpayer Bailout Now Sound Appealing? Posted: 14 Jun 2010 07:23 PM PDT BlindReason submits: The GOP is giving the president a tough time on financial reform because it hasn't addressed Fannie Mae (FNM) / Freddie Mac (FRE) reform head on in the current financial reform bill. These are the quasi public / private institutions that keep cash flowing into real estate assets and ostensibly serve to encourage home ownership by Americans. No question these institutions need massive reform, but doing so right now could trigger another economic downturn even worse than the 2008 downturn. While one can defend the larger social benefit of home ownership, as with many things we just took this policy well beyond any reasonable excess and are in a terrible situation now. There is no question these institutions require a draconian and massive reform, but timing is an issue. Like many in the GOP argue, I think a lot of optimal reforms include severely curtailing, privatizing or eliminating these agencies entirely. They need to lose their government guarantee at the very least. We've done too many things in this country to over encourage home ownership including tax subsidies for home ownership and deductibility of mortgage interest. This has results in some nasty real estate inflation that ends up hurting the most responsible buyers, while encouraging irresponsible borrowing and lending exacerbated by congressional tinkering. Frankly, I look at countries like Canada or Denmark that get by with much more stringent loan standards, and no Fannie/Freddie and people buy houses there just fine with much more stable housing markets. We need to scale down government intervention in the real estate market over time to remove these dramatic price fluctuations. In the long run, it will make housing more affordable. However, we need not do it right this second. The problem is not enough time has passed for asset prices to stabilize and begin to reflate. Most of these price indexes started to collapse in 2007, and we need at least until 2011/2012 for many homes to stop deflating and begin to make a lot of these more whole. With the government owning one out of every two mortgages in the country, it's not exactly a disinterested party in this process. Big losses taken now would have to be covered by the American tax payer if they are taken now. Does that sound good to you at the moment? But if we wait a few years, prices will have stabilized, the loan losses will be mitigated by some profits elsewhere and more restructuring will have taken place on older loans. Any massive reform effort undertaken now could cause massive instability and make already difficult loans almost impossible to get, freezing an already challenged credit market. This almost reminds me of the "mark to market" debate. Sure it's great in theory, but theories always have to be adjusted to the practical limits of any market. People need to be practical and stop trying to score political points. I'd love to see these agencies eliminated and a freer market, but it's stupid for the government to shoot it's own balance sheet in the foot before these assets have started to inflate. When these loans start getting paid down, and assets start to rise, we can have this debate in a healthier way without setting off another crisis. Policy makers not only need to pick their battles, they have to get the timing right as well. Disclosure: No positions Complete Story » |

| Chevron: Future Dividend Aristocrat Posted: 14 Jun 2010 07:18 PM PDT Avi Morris submits: The Dow Jones Industrials have some of the biggest quality stocks, 7 are also Dividend Aristocrats (with a minimum of 25 consecutive annual dividend increases including getting through the recent credit crisis). At a time when low yields on short term investments are common, these superior stocks with respectable yields are worth attention. Complete Story » |

| Posted: 14 Jun 2010 07:10 PM PDT Bob Mcteer submits: The Federal Reserve has some—make that many—of the best economists in the world who are capable of doing the most sophisticated statistical and econometric studies and using the most sophisticated models for forecasting. The shortcomings of Fed forecasting, in my opinion, are due more to the inherent impossibility of the task than to human failure. People know this. What some people may not fully appreciate is the valuable supplemental role anecdotal information plays in informing Fed policymaking. I was reminded of this by the latest release of the Fed’s Beige Book. Each Reserve Bank has people who work diligently and systematically in compiling the information that goes into the Beige Book. They don’t just make a few random phone calls to gather on-the-ground information. They have a well-designed formal list of respondents they call regularly to ascertain whether inventories are rising or falling, what’s happening to sales, hiring, pricing power, and many other things. These surveys are structured by industry and by geography. Complete Story » |

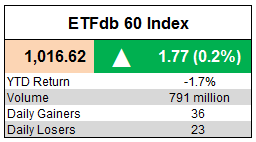

| Monday ETF Wrap-Up: GDX Slides, UNG Surges Posted: 14 Jun 2010 06:42 PM PDT Michael Johnston submits: Coming off the best weekly performance in several months, equity markets were unable to keep their momentum on Monday, as many indexes lost ground late in the day to finish in the red. Europe once again dominated the headlines, although not all the news from across the pond was bad. Moody’s cut Greece’s debt by four notches, moving it into junk status. The move seemed to be largely priced in by markets though, as bullish data reports were sufficient to offset the downgrade. The euro climbed higher against major rivals on news that factory output rose 9.5% in April from a year earlier, the best showing in more than two decades. Back in the U.S., the financial sector was once again in focus as the latest twist on reform emerged from Washington; the Financial SPDR (XLF) shed 0.4% on the day.

Complete Story » |

| Why We Need the Fed Now More Than Ever Posted: 14 Jun 2010 06:40 PM PDT Mark E. Bachmann submits: The world runs on mythology, and we should never sell short the power of myth. This is particularly true in finance because our system depends so utterly on public confidence. Confidence in American financial power is still one of the main anchors for the global economy, and at the foundation of American financial power stands confidence in the Fed. A certain cult of mystery has always surrounded the institution. It has been compared to a temple and its directors to ancient priests. Its workings are completely inscrutable to the general public and even evoke a degree of bemusement among economists who study it. Such secrecy has consequences. The Fed has always had bitter enemies, tapping into a deep root of suspicion against centralized finance in America that extends back to the days of Alexander Hamilton. Oddly, critics on both the right and left have seemingly come to regard the Fed as the source of all economic evil in the country. Conservative Republican congressman Ron Paul wants to dismantle it, and he has found some of his most fervent allies among left-liberals. Leftish conspiracy theorist Ellen Brown, author of a recent book called Web of Debt, depicts the Fed on the cover of her book as a giant spider, no doubt sucking all the blood out of America’s poor and downtrodden. Chronic secrecy makes it possible for everybody to imagine the worst. Complete Story » |

| Investors Flee Into Treasuries as Global Debt Concerns Intensify Posted: 14 Jun 2010 06:39 PM PDT What an interesting day yesterday. Let's start with the short term bond market auctions. The 3 and 6 month Treasury sales recieved record bids as investors continue their flight to safety. Complete Story » |

| Trying to Recommit to Our Euro Trades Posted: 14 Jun 2010 06:31 PM PDT Ralph Shell submits: Could it be that the bearish economic news has been drowned out by those obnoxious vuvuzelas at the world cup? Maybe the South African government should follow Washington's lead and get vuvuzela manufactures to set up an escrow fund for damages caused by noise pollution. The Obama administration has set up an escrow fund, hopeful that BP (BP) will contribute $45B into it, for disbursement to those financially damaged by the record oil spill as determined by the administration. Complete Story » |

| What Obama and the U.S. Need to Learn from Canada Posted: 14 Jun 2010 06:20 PM PDT  Shaun Rein of the China Market Research Group submits: Shaun Rein of the China Market Research Group submits: This column first appeared in Forbes. Many Americans think mainly of Eskimos and hockey when they think of Canada. Some also think of Michael J. Fox and James Cameron. They should be thinking of a functioning financial system and the most robust economy in the developed world. Unlike the U.S. and Europe, Canada has emerged relatively unscathed from the financial crisis. Its unemployment rate has been improving for the past year and stands at 8.1%. Canada's minister of finance, Jim Flaherty, is already calling for an end to government stimulus, even though the government debt stands at less than 35% of gross domestic product, less than half the level in the U.S. Why is Canada doing so well while America's doing so poorly? For one thing, its financial regulations have emphasized dullness rather than encouraged exotic financial instruments. The big five banks have never been allowed to merge, and they've only dabbled in investment banking and subprime mortgages. Also, the banks' chiefs have never received huge bonuses like Lloyd Blankfein at Goldman Sachs. In other words, the banking system has been forced to be conservative--as a banking system should be. Complete Story » |

| PIMCO on British National Solvency Posted: 14 Jun 2010 06:17 PM PDT Edward Harrison submits: PIMCO is out with its secular outlook for the UK. PIMCO Portfolio Manager and EVP Michael Amey comments on growth and inflation and their effect on UK assets in the new normal of deleveraging, greater regulation and de-globalisation. One comment he made on default risk was quite informative:

Complete Story » |

| Euro Debt Situation May Be Fully Priced In Posted: 14 Jun 2010 06:17 PM PDT Wall Street Strategies submits: By: Carlos Guillen, Research Analyst Complete Story » |

| Print baby, print ... emerging value and the quest to buy inflation Posted: 14 Jun 2010 06:05 PM PDT This week I thought I would give you an Outside the Box with a more European flavor, as I am in Tuscany at the moment and on to Paris later this week and then back here for a working weekend with partners. Life is tough. :-) Dylan Grice of Societe Generale (based in London) is fast becoming one of my favorite writers. This thought-provoking piece makes us meditate on whether central banks will print money in response to the fiscal crisis in the developed world countries. I am not certain that all central banks will print with abandon, BUT we need to think about what happens if they do. I need to hit the send button now, as we are off to watch Italy in the World Cup in a little village (Montisi) where they have set up screens in the town square. My first connection with European football live with crazy fans and all! Should be fun! Your under the Tuscan sun analyst, John Mauldin, Editor Outside the Box Print baby, print ... emerging value and the quest to buy inflation by... |

| Posted: 14 Jun 2010 06:05 PM PDT View the original post at jsmineset.com... June 14, 2010 09:19 AM Dear Greg, The Fed audit, as proposed, is a useless exercise. Regards, Jim Dear CIGAs, It seems every day I watch mainstream media there is a discussion about the ongoing so- called "recovery." Yesterday was no exception. I was watching an anchor on MSNBC ask a guest why the "recovery" is so uneven and why it was hard to maintain upward momentum? I yelled out to my TV, "Because there is no recovery!" The "recovery" story is talked about as fact, no matter what the facts really are." For example, a story on housing just last week from the Wall Street Journal said, "Bank repossessions hit a record monthly high for the second month in a row, totaling 93,777–up 1% from April and 44% from last year." (Click here for the complete story from WSJ.) Bank repos up 44% in a year! Why are "record" home repossessions not included in the "recovery"discussion? Maybe because it ... |

| Posted: 14 Jun 2010 06:05 PM PDT View the original post at jsmineset.com... June 14, 2010 10:45 AM Jim Sinclair's Commentary When an OTC derivative trades anywhere in the world, the effect is as if it trades EVERYWHERE. Merkel’s ban means nothing whatsoever. Emergency Bans on Naked CDS Trades Considered by EU (Update3) By Ben Moshinsky June 14 (Bloomberg) — National regulators may be given "emergency powers" to "prohibit or restrict" naked credit- default swaps trades, under proposals being considered by the European Union in the wake of the region's debt crisis. The measures would be "temporary in nature and subject to coordination" by the European Securities and Markets Authority, the European Commission said in a statement. The European Parliament is also scheduled to vote tomorrow on separate proposals to restrict trading in credit-default swaps. French President Nicolas Sarkozy and German Chancellor Angela Merkel called on the commission last week to speed up curbs on financial speculat... |

| You've Never Considered This 20% Income Opportunity Posted: 14 Jun 2010 06:05 PM PDT By Tom Dyson Monday, June 14, 2010 A friend has some spare money and wants to generate a little income "Just give me 5% income and I'll be happy. I don't need any more than that," he said. My friend was talking as if 5% was a modest interest rate and anyone with cash should be entitled to a minimum 5% without taking risk. "Whoa, whoa, whoa," I told him. "This isn't the 1980s." Back in the 1980s, the Fed set interest rates anywhere from 7% to 19%. Even in the 1990s, rates still averaged around 6%. You didn't have to go far for big income. But today, the Fed has set interest rates at zero percent. With the Fed's interest rates at zero, it's not possible for the average retail investor to earn more than 1% or 2% on his "safe" money. But that doesn't mean YOU have to settle for 1% or 2%. This year in DailyWealth, Steve Sjuggerud and I have already presented you with dozens of safe, big-income ideas. We've covered virtual banks paying 17%. We explained tax lien i... |

| Bill Gates and the Energy Research Dilemma Posted: 14 Jun 2010 06:05 PM PDT There is an idea that has been around for a long time, at least since the fall of 1973: All that stands between the United States and an abundant energy future is a lack of spending on research and development. It is as though the Knights Templar could find the Holy Grail, if only the Pope would commit just a few more resources to the hunt. Tens of billions of dollars have been spent on energy research, many of them fruitlessly; and some advances have been made, not the least in the kind of drilling technology that enables us to drill miles below the sea floor in the Gulf of Mexico. (Oops!) Much else has been researched and not come to market. Wind and solar have taken giant strides, but still require tax breaks and subsidies. Nuclear energy has been researched, even as its deployment has languished. Worldwide hundreds of billions of dollars have been spent on nuclear fusion with nothing to show for it. Other programs have gone by the board, from coal liquefact... |

| The Correlation Between Morons and Government Debt Posted: 14 Jun 2010 06:05 PM PDT DWS Funds is a "member of Deutsche Bank Group," which I assume because it says so right on the cover of DWS Active magazine, an outfit which has somehow, without me actually noticing, over the years taken over some holdings of mine, so that now I sit, locked in a bunker and peering out at a hostile world through a periscope, wondering how a bunch of foreigners, who almost certainly hate my guts, in this case Germans, took possession of my American mutual fund, and thus took possession of my money, probably like somebody took possession of the Federal Reserve and thus took possession of America's money, in which case we know exactly who it was, and it was Alan Greenspan and then Ben Bernanke, two villains who chaired the Federal Reserve and whose names will live in infamy because of the inflationary terrors unleashed by their irresponsible creations of more and more money, even more treacherous so than the attack on Pearl Harbor in 1941, which gave rise to that "live in infamy" phrase, ... |

| Posted: 14 Jun 2010 06:05 PM PDT Stock Market Barometer Via Stoppani 220 Milan, Italy E-mail: [EMAIL="info@stockmarketbarometer.net"]info@stockmarketbarometer.net[/EMAIL] Web site: www.stockmarket barometer.net DAILY REPORT June 15, 2010 "Throughout history, it has been the inaction of those who could have acted; the indifference of those who should have known better; the silence of the voice of justice when it mattered most; that has made it possible for evil to triumph" --- Haile Selassie There are some things that only a politician could dream up. The State of New York, in its infinite wisdom, needed to make a US $6 billion payment to their employee’s pension fund. Since the State doesn’t have the money, and no one is willing to buy their debt, lawmakers voted to allow the State and municipalities to borrow US $6 billion from the same pension fund in order to pay their obligations! If you wanted to have budget cuts, si... |

| Rye Patch Continuing to Grow Nevada Resources Posted: 14 Jun 2010 06:05 PM PDT By Claire O'Connor and James West MidasLetter.com Monday, June 14, 2009 On May 18th 2010 Rye Patch Gold announced the first NI 43-101 compliant resource estimate for the company’s 100% owned Lincoln Hill gold-silver project in Western Nevada. Combined with the Wilco and Jessup projects, two other gold-silver properties lying upon the same trend, the company’s resource inventory is now comprised of 1,182,780 ounces of gold equivalent in the measured and indicated category, plus 2,727,100 ounces of gold equivalent in the inferred category. With resource estimates for all three properties now successfully completed, Rye Patch is eager to explore the beckoning potential of the ever-reliable Oreana gold trend whilst developing a drill program for Lincoln Hill. [INDENT]"With Wilco, Jessup and now the Lincoln Hill resource estimates compl... |

| Richard Karn: A Bridge Too Far. . .to the Left? Posted: 14 Jun 2010 06:05 PM PDT Source: Brian Sylvester and Karen Roche of The Gold Report 06/14/2010 In the midst of a boots-on-the-ground survey of Australian precious and specialty metal projects, The Emerging Trends Report's Managing Editor, Richard Karn, took time between mine site visits to share his insights about the controversial Resource Super Profits Tax that's pending Down Under with The Gold Report. The Gold Report: As an American involved with the Australian mining industry, can you give us an overview of the Rudd government's proposed Resource Super Profits Tax (RSPT)? Richard Karn: Certainly, but from the outset keep two things in mind. First, the tax scheme is very complicated. Some details are murky and seem to conflict with others in a number of ways. Secondly, the mining industry itself has argued for streamlining the existing system, which entails companies paying as many as six or seven different state or territory royalties on the minerals they extract. Apparently, they we... |

| The War on Terror Becomes The War for Metals Posted: 14 Jun 2010 06:05 PM PDT The 5 min. Forecast June 14, 2010 11:45 AM by Addison Wiggin & Ian Mathias [LIST] [*] The smoking gun? Pentagon announces $1 trillion worth of metal deposits in Afghanistan [*] Legal Ponzi scheme: N.Y. “fixes” its state pension shortfall… by borrowing from the same pension fund [*] Chris Mayer offers an intriguing penny stock speculation: A “too big to fail” bank for $3 a share, trading at 75% of book value [*] Plus, your reports from the front lines: Readers on the state of (un)employment in the U.S. [/LIST] "The difference between fiction and reality? Fiction has to make sense,” fellow Baltimorean Tom Clancy once said. The biggest headline in the world today reads like a chapter straight from one of his spy novels: “U.S. Identifies Vast Riches of Minerals in Afghanistan,” trumpets The New York Times this morning. Turns out there’s iron, copper, cobalt, gold and other hi... |

| Posted: 14 Jun 2010 06:05 PM PDT Market Ticker - Karl Denninger View original article June 14, 2010 10:22 AM The WSJ is so good at it: [INDENT] But Ms. Waters and the House are hunting bigger game—to wit, the political allocation of credit. They want to put a network of operatives at the highest level of government who are responsible for making sure that regulators put the hiring of, and lending to, minorities at the top of their priority list. The House provision makes that very clear by making each diversity officer a Presidential appointee who must be confirmed by the Senate. The post, says the bill, will be "comparable to that of other senior level staff." [/INDENT] Really? You mean The Fed didn't do that itself? You mean The Fed didn't buy over a trillion dollars of Fannie and Freddie paper - debt and MBS - effectively performing the very act - that is, the politicization of credit - that you're bleating about here? [INDENT] Mull over that one for a minute. Having recently lived through a financia... |

| Merv's Weekly Gold and Silver Commentary - June 11, 2010 Posted: 14 Jun 2010 06:05 PM PDT Merv’s Precious Metals Central http://preciousmetalscentral.com Technically Precious with Merv For week ending 11 June 2010 The week started out well but didn’t finish as such. Although gold made new highs it was not decisive. Should gold drop below the $1216 mark we might be in for more downside but if it closes above the $1250 level then the bull is expected to continue. GOLD LONG TERM On the bar or candlestick charts we had made a new high in gold during the week, however, on the long term P&F chart, where we deal in “unit prices” and cut out the noise of unimportant action, we had not yet made a new high. We did reach the previous high but all that does is tell us we may have a double top pattern. Time will tell. The latest P&F action has now given us a higher level for a bear market signal should the price decide to drop. A move back to the $1155 level would now do it. However, a move to $1260 would give us the next projection to wa... |

| LGMR: Gold Trading "Hits Summer Lull" But Dollar-Price "Bull Trend Intact" Posted: 14 Jun 2010 06:05 PM PDT London Gold Market Report from Adrian Ash BullionVault 07:55 ET, Mon 14 June Gold Trading "Hits Summer Lull" But Dollar-Price "Bull Trend Intact" THE PRICE OF GOLD in wholesale trading edged lower as the US Dollar also slipped early Monday in London, reversing a 0.5% rise in Asian trade as world stock markets rose with commodity prices. Crude oil rose sharply to $75 per barrel. Major-economy government bonds fell in price, pushing 10-year interest rates above 3.25% on US Treasuries. "Blame it on the World Cup or summer lull," says one Hong Kong dealer, "but gold is losing momentum and trading interest is subsiding." "We're getting into the summer, so I wouldn't be surprised if things quieten down for a while," says Afshin Nabave, head of trading at Swiss refining group MKS Finance. "But overall, as long as the economic and political situation continues, I think gold has good chance of eventually breaking the $1250-ish area and heading for $1300." ... |

| Gold, Oil & SPX Trading at Key Pivot Points Posted: 14 Jun 2010 06:05 PM PDT Last week we saw the financial market including commodities move higher which was great to see. But the recent run up has brought both equities and commodities to their key resistance levels. With Gold, Oil and the SP500 trading near key resistance points we will most likely have some sharp movements this week so buckle up tight! Gold – Daily Chart The price of gold continues to form the large cup and handle pattern and is trading near resistance. This week I figure we will see gold make a move up or break the dotted support trend line and drop towards the blue support level. I continue to wait for a low risk setup for gold. Crude Oil – Daily Chart Crude oil has been trending down for a couple months and recently rebounded to test its resistance level. It looks as though oil is forming a bear flag which generally means we should see lower prices in the near future. But another $1-2 move up could trigger a surge of buyers if this resistance lev... |

| Posted: 14 Jun 2010 06:05 PM PDT The following is automatically syndicated from Grandich's blog. You can view the original post here June 14, 2010 04:27 AM The “blow-up” I’ve spoken about in the Middle East appears to be getting closer: [LIST] [*]Turning on Israel [*]Wimping out [*]The myth [*]Nut job and doom [*]Pieces falling into place [*]Use us as a short cut [*]What Hamas doesn’t want you to see [*]Yes they are [/LIST]And other things: [LIST] [*]Neither a borrower nor a lender be NY State isn’t [*]Reasons to own gold [*]I’ve said gold is two steps up and one step back [/LIST] [url]http://www.grandich.com/[/url] grandich.com... |

| NY Times Feature No Curse on Gold Posted: 14 Jun 2010 06:01 PM PDT Investors enamored of gold now have two supposed contrary indicators to worry about: the New York Times, which did a front-page feature over the weekend on bullion's growing popularity as an asset class; and CNBC, where a Deutsche Bank analysts on Friday predicted a $75 surge to $1300 an ounce over the next few days. |

| Bernanke, Gold, And the Keynesian Endpoint Posted: 14 Jun 2010 06:00 PM PDT |

| Is China Undervalued Right Now? Posted: 14 Jun 2010 06:00 PM PDT During the past few years, China has become an increasingly compelling destination for investment capital. But with the recent weakness in the Chinese stock market - and serious cracks showing in the façade of China's economy - does it make sense to invest in China right now? One money manager I know thinks so. In fact, he thinks that some of China's US-listed stocks are trading at low enough valuations to triple in 2010 regardless of how the economic situation unfolds... I'll introduce him to you in a minute. There are two parts of the macro backdrop that are important to understand about China. First, there has been a tremendous increase in bank lending since the end of 2008 - it's up something like fourfold. And we know from experience that when banks grow that fast, bad things tend to happen later. What happens when banks grow that fast is that they slide down the credit-quality spectrum. In short, they make tomorrow's bad loans. Secondly, we know that the Chinese government has put in place a huge stimulus plan. And again, we know from experience that when governments invest money, you inevitably wind up with "bridges to nowhere" and all kinds of boondoggles. The money doesn't flow to its best economic uses, but to political ends. In Beijing, you can see some tangible effects of this. I recently visited, for instance, the largest mall in Asia. It was built six years ago by state-run enterprises. They put it on the western edge of the city, about 40 minutes from Tiananmen. Real estate people thought it was a bad idea. It was too far away...and too big. Well, the pros turned out to be right. And today, the place is virtually empty. It was almost eerie walking through there. There were lines of bright shops with neatly dressed attendants and shelves full of the latest products from the world's best brands. But there were no customers. This place has over 10,000 free parking spaces. There is over 1.8 million square feet of retail space here - over 167,225 square meters. That's about three times the base of the Great Pyramid at Giza. It makes you wonder. Why did this place ever get built? And boy, are they losing their shirts. But then you wonder about the shops themselves. Why do they stay? How can they possibly make money here? It's all very strange. But then you go 30 minutes into town and visit another big mall packed with people. The parking lot is so full you have to wait to get in. When one car leaves, they let one in. The residential property market also feels bubbly - a lot of construction going on despite widespread tales of empty apartment buildings. One rationale we heard from people here is that the Chinese view property as a store of wealth. We heard stories of how people buy brand-new apartments and don't even attempt to rent them out. They just hold onto them. Interestingly, besides property, the Chinese also like gold as a store of wealth. China is the world's largest consumer of gold (and its largest producer), only recently passing India. So if there is a property burst, gold should be a winner. In fact, while I was here, CCTV News - China's big television network - reported that China is seeing a surge in gold buying recently as people here start to get nervous about a potential property bubble. As you can see, China's economic picture is complex - as it is everywhere, really. The US economic picture is equally murky and uncertain. However, in some ways, you don't have to figure it all out. I met with a money manager here - a low-key guy whom I cannot name. Yet his fund is up over 1,000% in 10 years. He knows the China market as well as anyone. He was short the market - that is, he was betting it would fall - as late as January, but he is now buying again. As he told us, there are some Chinese stocks that are also listed in the US that trade at very low multiples of earnings. Some of them, when you net out the cash, trade for as little as 3 times earnings. As he says, you don't really need to have a positive view on China to buy these. When asked about the China bubble, he told me. "I don't really care. I know I can buy some stocks that could well double in six months, regardless." Though even here, the market is tricky. You really have to know what you are doing. There are bad auditors and shady accounting practices here, as in the US. And there can be big gaps in quality between certain names. It's a market for which it helps to know people on the ground who know the quality of the management teams. Chris Mayer |

| Posted: 14 Jun 2010 05:56 PM PDT I've got to admit it's getting better... A little better all the time. - The Beatles Another Monday...another week... Are we getting better? And what will this week bring? More evidence that things are improving? On Friday we got word that consumer sales had fallen in May...from the month before. That is, they didn't get better; they got worse. It was no big deal except that the there's supposed to be a recovery. And May was important. Because the major stimulus efforts are coming to an end. Economists wanted to see how the economy would hold up without the government holding it up. Well, it didn't hold up very well. If the government gives you money to buy a house or to trash your car, well...if there's enough money in it you go along with the gag. But what kind of economy is it where the government gives you money to buy things? It's a phony...a fraud...an imposter... ..the government is impersonating a successful economy. And where do the feds get any money in the first place? One way or another they have to get it from you and other citizens/investors/taxpayers - the same people who didn't want to buy the thing in the first place... There is no question that many of the numbers were getting a bit better since the big blow up in '07-'09. Unemployment was still getting worse, but not as fast as it had been. Housing prices seem to have stabilized after a big drop. And consumer spending had been gradually recovering. The big question was whether the numbers would continue to improve as the feds' stimulus programs tapered off. Was all that spending really stimulating the real economy...or just simulating one? We got a preliminary answer on Friday. Numbers are notoriously dishonest and unreliable. The 5 is obviously crooked. An 8 just takes you round in circles. And the zero? It claims to be nothing at all. But if it is nothing, why have a symbol to represent it? Something funny about it. Numbers tell one story one month and another the next. One month the economy is in decline; the next it's growing. Remember, too, that the numbers are controlled by goons working for the Federal government. Can you trust 'em? We don't. We don't trust any numbers. Not even the ones we made up ourselves. But getting back to the markets, George Soros says they are 'eerily' similar to those during the lead up to the Great Depression. At first, of course, people didn't know what to make of it. The US had the strongest economy in the world. It had surpassed Britain as the world's biggest economy before the turn of the century. By 1929, the US had the world's biggest trade surplus...its tallest building...its most profitable businesses and fastest-growing wages. Imagine what it must have been like at the turn of the century. You get off the boat in New York. Your mouth drops open. There was not a single commercial building in the Old World that rose above 6 or 7 storeys. And here were hundreds of buildings up 20 storeys...30 storeys...reaching up so high, they called them 'sky-scrapers'... ..People were building railroads and bridges...and new 'auto- mobiles'...and electrifying the cities... ..and there just seemed to be no end. This was the place to make your fortune! Everybody was talking business. Everybody was getting rich. And some were getting super rich. It must have been like China today! Then, when the US market cracked in 1929, people thought it just a temporary set back. They couldn't understand or believe that the economy that had been such a great success for so many years could suddenly lose traction and begin slipping backward. They thought it was improving... They thought it was getting better... Did you read those comments we quoted last Thursday? Take another look. They show you how hard it is to realize when things have turned a corner...when they're NOT getting better any more.... "While the crash only took place six months ago, I am convinced we have now passed through the worst - and with continued unity of effort we shall rapidly recover. There has been no significant bank or industrial failure. That danger, too, is safely behind us." - Herbert Hoover, President of the United States, May 1, 1930 "...by May or June the spring recovery forecast in our letters of last December and November should clearly be apparent..." - Harvard Economic Society (HES) May 17, 1930 "Gentleman, you have come sixty days too late. The depression is over." - Herbert Hoover, responding to a delegation requesting a public works program to help speed the recovery, June 1930 "...irregular and conflicting movements of business should soon give way to a sustained recovery..." - HES June 28, 1930 "...the present depression has about spent its force..." - HES, Aug 30, 1930 "We are now near the end of the declining phase of the depression." - HES Nov 15, 1930 "Stabilization at [present] levels is clearly possible." - HES Oct 31, 1931 "All safe deposit boxes in banks or financial institutions have been sealed...and may only be opened in the presence of an agent of the IRS." - President F.D. Roosevelt, 1933 If we had more time, we'd find quotes from the current era too. Right now, we can only remember a couple of lines from Henry Paulson. When the "subprime" mortgage debacle began, he said it was "contained." And then, when it became obvious that it wasn't contained at all, he told the public that he couldn't imagine any "scenario in which the public would be called upon to bail out Wall Street." Practically the next day, Lehman Bros. went broke and the biggest taxpayer-financed bailout in history began. And now, these same people tell us that the economy is improving...that it is getting better. And they've got the numbers to prove it! And more thoughts... So, what is going on in Japan? The government has gotten by for the last 20 years by borrowing from its own citizens. It now has the biggest debt-to-GDP ratio in the world. As the private sector de-leveraged the public sector borrowed and spent - the same thing that is happening in America today. And maybe Richard Koo is right. Maybe this did prevent a deeper recession in Japan. Unemployment never rose over 5%. And the economy never actually suffered sustained negative growth levels. But so what? Investors still lost 3/4 of their money. And now Japan's prime minister has a warning. All those savers who put their money in Japanese government bonds for the last 20 years may soon wish they had bought gold. From Yahoo! Finance:

*** We're on our way down to Florida. More and more of our friends are moving to the Sunshine State. The reason: taxes. State and local levies together add about 10 percentage points to your tax rate in Maryland. Not worth worrying about if you don't have much income. But high earners have figured out that they can save a substantial amount of money by expatriating, within the US. That is, all you have to do is to leave the Old Line State and they can knock about 20% off their total tax bill. Our ancestors have been in Maryland for 300 years. But there's a time to put an end to everything. Besides, it's not the same state we knew as a child. Today, Maryland is a prosperous place - largely because it is a parasite on the rest of the nation. Last year, taxpayers sent about $2 trillion to the Washington DC metropolitan area. Investors lent it about $1.6 trillion more. And much of this money sticks around. The capitol beltway is crowded with big, expensive cars. Restaurants are packed. Housing prices are higher than in the rest of the nation. So are salaries. Maryland has become a fat leech. Regards, Bill Bonner

|

| According To AXA, There Is "No Chance" European Bail Out Package Will Succeed Posted: 14 Jun 2010 05:56 PM PDT Some late night words of caution from one of the UK's best journalists. In a report obtained by Ambrose Evans-Pritchard, French financial firm AXA is quoted as essentially saying that the chance of the Eurozone's survival is nil. Why a European bank would issue it own suicide note is unclear, although the firm's logic is sound: "The markets are very nervous because they can see that there is a fatal flaw in the system and no clear way out. We are in a very major crisis that has even broader implications than the credit crisis two years ago. The politicians have not yet twigged to this." Ms Zemek said the rescue had bought a "maximum" of 18 months respite before deeper structural damage hits home, with a "probable" default by Greece setting off a chain reaction across Southern Europe. "It would be the end of the euro as we know it. The long-term implications are at best a split in the eurozone, at worst the destruction of the euro. It is not going to end happily however you slice it." And some more doom and gloom:

All this is occurring as Merkel and Sarkozy's denial that all is good is getting progressively more transparent for the mere propaganda, and total lack of long-term planning that it is. With a near record number of EURUSD short contracts outstanding, traders should be wary of massive short covering episodes, although the fate of the EUR, just like that of the US market at this point, are both guaranteed. We will present tomorrow's ECB deposit facility usage as it becomes available. Following today's all time record of €384 billion, at this point the death of European interbank liquidity is a certainty, and unlike the US, as Bank of America points out (and as we will touch upon tomorrow), there is no simple, and US-comparable "print money" solution. Europe is on now its own. |

| Hedge Fund Third Point Discloses Xerium Technologies Position Posted: 14 Jun 2010 05:31 PM PDT Market Folly submits:

Complete Story » |

| Why VaR Is A Joke: Morgan Stanley Admits Losses in April And May Were "Much Higher" Than Anticipated Posted: 14 Jun 2010 05:16 PM PDT Zero Hedge has long contended that risk models based on VaR "predictions" are flawed and only add to systemic instability due to the ever increasing correlations across all asset classes. We now read a first hand mea culpa from Morgan Stanley's Jim Caron, in which the head of the firm's rates strategy highlights precisely this problem: the complete collapse of predictive models when multiple sigma events like the May Flash Crash and the accelerating sovereign collapse of the past several months occurs: "April and May were difficult months for us and others, judging by fund data on market performance. We did not properly discount the risks associated with peripheral Europe. As a result, we had a larger risk exposure than we should have. We measure the return potential for our positions on a per-unit-of-risk basis, similar to a Sharpe Ratio. That unit of risk turned out to be much higher than we anticipated. This will force us, and many others, to right-size our risks." We wish we could agree with the last statement. Alas, each and every risk management group at comparable prop trading desks (to that of Morgan Stanley), will undoubtedly chalk off recent events to chance, and as these "will never recur", business we will promptly return back to normal, until we see another record crash in the Dow, only this time not 1,000 but multiples thereof. As for those few remaining sane individuals who do learn from past mistakes, here is what Jim Caron suggests are the key implications of consistent underappreciation of risk:

Incidentally we agree with virtually all of Caron's observations. And we suggest that before the travesty of a FinReg piece of toilet paper is signed by the president, that someone with half a brain at least pretend to recommend some provisions to haircuts in bank risk exposure. On the other hand, if indeed the Volcker Rule in its full form is set to pass, and the only risk banks are taking on is that compensated by a commission, once prop trading groups are finally split off, a development we have been urging since May of last year, all this is moot, as no longer will banks have to worry about old tail risk, new tail risk, or any risk: they will be merely hedged books, operating in a liquid (thank you HFTs now in equity and soon in cash and CDS) market, where 6, or 666 sigma events will have no bearing on the banks' requirement to be bailed out be taxpayers imminently. |

| 9 Reasons Why Spain Is A Dead Economy Walking Posted: 14 Jun 2010 04:52 PM PDT

So will the EU step up and bail out Spain? Well, there are rumors that EU officials have begun work on a bailout package for Spain which is likely to run into the hundreds of billions of dollars, but on Monday the European Commission, the Spanish government and the German government all denied that the European Union was preparing a bailout for the Spanish economy. Of course we all know that politicians don't always tell us the truth. So who knows what is going on over there right now. But the reality is that the economy of Spain is not going to make it much longer without serious help, and some EU officials are already using apocalyptic language to describe what an economic collapse in Spain would mean. For example, EU Commission President Jose Manuel Barroso recently warned that democracy could completely collapse in Greece, Spain and Portugal unless urgent action is taken to tackle the burgeoning European debt crisis. So could democracy actually fail in those nations? Well, considering the fact that Greece, Spain and Portugal only became democracies in the 1970s, and that all three of those countries have a history of military coups, such a scenario is not that far-fetched. Without a doubt there would be serious public unrest in those nations if public services collapsed because their governments ran out of money. So are there signs that the economy of Spain is about to collapse? Well, yes, there are quite a few of them. The following are 9 reasons why Spain is a dead economy walking.... #1) Even before this most recent crisis, unemployment in Spain was approaching Great Depression levels. Spain now has the highest unemployment rate in the entire European Union. More than 20 percent of working age Spaniards were unemployed during the first quarter of 2010. If people aren't working they can't pay taxes and they can't provide for their families. #2) In an effort to stimulate the economy, Spain's socialist government has been spending unprecedented amounts of money and that skyrocketed the government budget deficit to a stunning 11.4 percent of GDP in 2009. That is completely unsustainable by any definition. #3) The total of all public and private debt in Spain has now reached 270 percent of GDP. #4) The Spanish government has accumulated way more debt than it can possibly handle, and this has forced two international ratings agencies, Fitch and Standard & Poor's, to lower Spain's long-term sovereign credit rating. These downgrades are making it much more expensive for Spain to finance its debt at a time when they simply can't afford to pay more interest on their debt. #5) There are 1.6 million unsold properties in Spain. That is six times the level per capita in the United States. Considering how bad the U.S. real estate market is, that statistic is incredibly alarming. #6) The new "green economy" in Spain has been a total flop. Socialist leaders promised that implementing hardcore restrictions on carbon emissions and forcing the nation over to a "green economy" would result in a flood of "green jobs". But that simply did not happen. In fact, a leaked internal assessment produced by the government of Spain reveals that the "green economy" has been an absolute economic nightmare for that nation. Energy prices have skyrocketed in Spain and the new "green economy" in that nation has actually lost more than two jobs for every job that it has created. But Spain so far seems unwilling to undo all of the crazy regulations that they have implemented. #7) Spain's national debt is so onerous that they are now caught in a debt spiral where anything they do will harm the economy. If they cut government expenditures in an effort to get debt under control it will devastate economic growth and crush badly needed tax revenues. But if the Spanish government keeps borrowing money their credit rating will continue to decline and they will almost certainly default. The truth is that the Spanish government is caught in a "no win" situation. #8) But even now the IMF is projecting that the Spanish economy is going nowhere fast. The International Monetary Fund says there will be no positive GDP growth in Spain until 2011, at which point it will still be below one percent. As bleak as that forecast is, many analysts believe that it is way too optimistic considering the fact that Spain's economy declined by about 3.6 percent in 2009 and things are rapidly getting worse. #9) The Spanish population has gotten used to socialist handouts and they are not going to accept public sector pay cuts, budget cuts to social programs and hefty tax increases easily. In fact, there is likely to be some very serious social unrest before all of this is said and done. On May 21st, thousands of public sector workers took to the streets of Spain to protest the government's austerity plan. But that was only an appetizer. Spain's two main unions are calling for a major one day general strike to protest the government's planned reforms of the country's labor market. The truth is that financial shock therapy does not go down very well in highly socialized nations such as Greece and Spain. In fact, the austerity measures that Spain has been pressured to implement by the IMF have proven so unpopular that many are now projecting that Spain's socialist government will be forced to call early elections. So what is going to happen in Spain? The truth is that nobody can predict for sure how things are going to play out over the coming weeks and months. But what everyone can agree on is that the stakes are incredibly high. Speaking at the World Economic Forum in Davos, Switzerland, world famous economist Nouriel Roubini put it this way: "If Greece goes under, that's a problem for the eurozone. If Spain goes under, it's a disaster." But right now the entire population of Spain (along with much of the rest of the world) is completely distracted by the World Cup. As long as the Spanish team does well, that is likely to keep the Spanish population sedated. But if the Spanish team gets knocked out of the tournament early that will put the entire Spanish population in a really, really bad mood and that could mean a really chaotic summer for the nation of Spain. |

| Gold Seeker Closing Report: Gold and Silver End Mixed Posted: 14 Jun 2010 04:00 PM PDT Gold rose as much as $5.85 to $1233.95 in Asia and then fell back off in London and New York to as low as $1216.45 by late morning before it rallied back higher in the last couple of hours of trade, but it still ended with a loss of 0.44%. Silver followed a very different pattern and rose to as high as $18.541 by about 9:35AM EST before it fell back off into the close, but it still ended with a gain of 0.66%. |

| James Turk: A signal from the stock market Posted: 14 Jun 2010 02:29 PM PDT 10:30p ET Monday, June 14, 2010 Dear Friend of GATA and Gold: Economic conditions are not improving, Freemarket Gold & Money Report publisher James Turk writes, and the U.S. stock market now is largely a function instead of Federal Reserve money creation. That creation having stalled, Turk writes, the market is faltering, so he expects a lot more debt monetization soon. Turk is founder of GoldMoney and a consultant to GATA and his new commentary is headlined "A Signal from the Stock Market." You can find it at the FGMR Internet site here: http://www.fgmr.com/signal-from-the-stock-market.html CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Prophecy to Become Coal Producer This Year Prophecy Resource Corp. (TSX.V: PCY) announced on May 11 that it has entered into a mine services agreement with Leighton Asia Ltd. to begin coal production this year. Production will begin with a 250,000-tonne starter pit as planned in August, with production advancing to 2 million tonnes per year in 2011. Prophecy is fully funded to production and its management team includes John Morganti, Arnold Armstrong, and Rob McEwen. For Prophecy's complete press release about its production plans, please visit: http://www.prophecyresource.com/news_2010_may11.php Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| More fantastic money creation, then gold backing, Rickards tells King World News Posted: 14 Jun 2010 02:17 PM PDT 10:05p ET Monday, June 14, 2010 Dear Friend of GATA and Gold: "Market analyst" is beginning to seem too pedestrian a description for James G. Rickards, senior managing director for market intelligence at the Virginia research firm Omnis, who today is back for another interview with Eric King at King World News. Maybe "planetary observer" will do for this one, in which Rickards foresees more fantastic money creation by central banks and then the International Monetary Fund via Special Drawing Rights before market conditions force the imposition of some sort of gold backing for currencies. You can find the interview at King World News here: http://www.kingworldnews.com/kingworldnews/Broadcast/Entries/2010/6/14_J... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Prophecy to Become Coal Producer This Year Prophecy Resource Corp. (TSX.V: PCY) announced on May 11 that it has entered into a mine services agreement with Leighton Asia Ltd. to begin coal production this year. Production will begin with a 250,000-tonne starter pit as planned in August, with production advancing to 2 million tonnes per year in 2011. Prophecy is fully funded to production and its management team includes John Morganti, Arnold Armstrong, and Rob McEwen. For Prophecy's complete press release about its production plans, please visit: http://www.prophecyresource.com/news_2010_may11.php Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Gold, Silver, and the Mining Index with the SP 500 for the 'Quad Witch' This Week Posted: 14 Jun 2010 02:08 PM PDT |

| Remember The Whole "China Is A Currency Manipulator" Brouhaha? It's Back Posted: 14 Jun 2010 01:25 PM PDT One of the parallel news lines that was buried in last week's oil spill, was the pick up in Chinese currency manipulation rhetoric (with the Treasury now two months behind its April 15 deadline on determining if China is an FX manipulator, indicating just how terrified of an adverse response Geithner truly is), particularly that by Chuck Shumer, whose most recent proposal is not to vote China off the face of the manipulative planet (yet all China does is peg its currency to the dollar, which is kept at its level by US Fed monetary policy - does that mean that the Fed is a currency manipulator too?), but to effectively change the entire concept of "currency manipulation" and rebrand it to "currency misalignment" thus reducing the risk of political fallout. Couple this with several complaints received by the Dept of Commerce from domestic manufacturers alleging Chinese subsidies, and the Chinese FX relations, now that global liquidity is assumed to be once again "under control", may once again deteriorate rapidly. Attached is a succinct summary from Goldman's Alec Phillips which present the key issues in the upcoming weeks over the China currency manipulation situation.

Rhetoric out of Washington signals rising trade tensions. While ultimatums on trade policy out of Congress are nothing new—lawmakers have been focused for several years on China’s foreign exchange policy, which many US manufacturers, labor unions, and others see as a source of unfair advantage—the latest round takes place in a more sensitive environment. The last heated debate over US-China trade (and specifically foreign exchange) that took place in 2005 and 2007, a fairly benign environment with reasonably strong growth and relatively low unemployment. As rhetoric heats up once again, the extremely high level of unemployment and underemployment in the US labor market could make lawmakers even more sensitive than usual to claims that China’s foreign exchange policies are impeding US economic recovery. The exhibit shows the annual unemployment rate against the customs value of imports subject to antidumping and countervailing duties approved in that year. Although these trade remedies are fairly routine—dozens of petitions are filed each year—their frequency provides an easy way to track the ebb and flow of trade policy shifts. Not surprisingly, US trade remedies have increased significantly when the unemployment rate was rising, signifying an increasingly protectionist stance during those periods. What is surprising, however, is that there has not been a more significant reaction thus far in this cycle. Given the prolonged policy reaction over the last two years—first through financial stabilization, then fiscal stimulus, and now financial reform legislation—lawmakers may have simply focused their attention on other issues this time around. That said, if the unemployment rate remains essentially unchanged over the next year as we expect, it is very possible that policymakers may finally react, albeit after a longer than usual delay. US Unemployment and Trade Remedy Actions

The main source of friction is China’s foreign exchange policy, as it has been for the last few years. Most US policymakers appear to believe that the Renminbi is undervalued against the dollar, particularly in Congress. After a respite during the financial and housing crisis in 2008-2009, rhetoric has begun to heat up, with several potential developments over the next few weeks:

Although the ongoing dispute over currency valuation has received the most attention from the market and from lawmakers, two other issues are rising in importance among US policymakers. First is China’s “indigenous innovation” rule, which grants government procurement preferences to products that use intellectual property developed and registered in China, similar to the various “Buy American” proposals which require certain purchases be of goods made in the United States. Sen. Stabenow (D-MI) has introduced legislation that would prohibit US government purchase of Chinese products or services until China has signed the GPA, which US lawmakers hope will reverse current Chinese rules on “indigenous innovation,” Although this issue has not had the same high profile as the currency issue in the political debate thus far, it is fast becoming a significant source of concern for US policymakers; the US International Trade Commission will hold public hearings on the issue this week, which could generate additional attention on the issue as well. A second issue that has emerged lately is a focus on the risks to US security from foreign holding of US debt. Last week the Senate approved an amendment that would require the Treasury to report quarterly on foreign holdings of US debt and to determine whether any country’s holdings posed a national security risk. This proposal appears aimed mainly at curbing federal spending rather than influencing international purchases of US Treasury debt, and it seems unlikely to have major ramifications. Still, there is irony in the prospect of Congress requiring an additional politically sensitive periodic report from the Treasury, as it awaits the first one on foreign exchange. |

| Gold Prices Update 14th June 2010 Posted: 14 Jun 2010 01:20 PM PDT |

| Will Gold fall if Commodities Fall? Posted: 14 Jun 2010 01:00 PM PDT The debate is on-going as to whether we are entering a period where demand for commodities will fall in price or not. The reports are there that the Chinese government will slow the Chinese economy down to the point where their hunger for resources will slow and commodity prices fall. If they do fall will the world's appetite for gold fall to? And will the gold price fall? |

| Guest Post: Hydroelectric Revolution: A River Runs Through It Posted: 14 Jun 2010 12:35 PM PDT Submitted by Martin Katusa at Casey Research Hydroelectric Revolution: A River Runs Through It Two years ago, British Columbia’s premier electric utility company, BC Hydro, issued its “Clean Power Call” – a bid for the province to achieve electric self-sufficiency through renewable energy by 2016. That aggressive goal sparked an intense competition. Renewable energy companies of all stripes were jostling each other to prove that their project was the best, and to win a coveted Electricity Purchase Agreement (EPA). When the EPAs were finally handed out, one green technology captured over half of the sixteen contracts awarded. The overwhelming winner? Not solar and wind, but a relatively obscure type of hydroelectric power that is quickly becoming all the rage: run of river. It’s no secret that hydroelectricity sits near the top of the renewable energy list. But hydro invariably conjures images of soaring concrete dams, rerouted rivers and flooding, environmental damage and displaced people. Not to mention the stiff price tag that comes with such an immense engineering project. However, as British Columbia is proving, hydroelectric power generation is not limited to just dams. For junior hydroelectric companies, these run-of-river projects are a less expensive, more efficient, and fish-friendlier way to get in on the energy game. They’re also a ground-floor investment opportunity. Run of river exploits the elevation drop of a river. Power stations are built on rivers with a consistent and steady flow, either natural or regulated by a reservoir at the head of the facility. There is no need to flood large tracts of land to keep the plant humming during the dry season; run-of-river projects simply use a weir (a small, only partially blocking dam) to divert some water via a penstock (delivery pipe). As the water flows downhill, it picks up the speed necessary to spin the turbines in the powerhouse and create electricity. The diverted water then joins the river again through a channel known as a tailrace.

Everything is done within the natural range of the river. There’s no need for the concrete monstrosities that come with large-scale damming – or the associated environmental controversy. At the most, a weir is constructed to submerge the mouth of the penstock. Capital outlays are relatively low, the ecological footprint from the projects is quite small, and if the geology is right, engineers can tailor the technology to the terrain, rather than having to wrestle with it. Run of river just might be the ultimate in green power. On the one hand, with its near-zero emissions, it stacks up favorably against conventional, polluting sources of energy. At the same time, it has a distinct advantage over other renewables, like solar and wind. There’s no need for the costly backup generation units these technologies require to operate on calm days or at night. These power plants have actually been around since the 1970s, but the technology has only started to take off in the last few years. In countries that can, and do, use hydro as a power source, the competition for contracts is becoming fierce. And thanks to the comparatively low costs, junior, small-cap companies are making out especially well, leaving the big boys to handle the staggering debt and the environmental protests associated with huge dams. Smaller-scale projects mean fewer headaches while providing excellent returns on investment. Of course, nothing’s perfect, and run of river has its challenges. One is that without a large dam or reservoir, there is no way to store energy and adjust power output according to peak periods of consumer demand. There are also still environmental issues, albeit much less drastic than with a traditional dam. Somebody will always object to new roads and transmission lines. And while the projects are usually sited away from fish-spawning grounds, aquatic life still can get trapped behind the weirs or at the mouth of the penstock. But one of the beauties of the technology is its flexibility. Engineering solutions like fish ladders, water-velocity regulators, and careful site design can mitigate many of these concerns. The smarter companies also work closely with local communities, to head off problems early on. The biggest limitation is geology. These generators can’t be built across just any old river; only regions with a favorable lay of the land will do. And the next biggest is probably politics. Some African nations that could really benefit are too unstable to attract sufficient investment capital. Other countries, like Venezuela, deter investors because of the risk of nationalization. Still, the good news is that there is immense potential to be found on almost every continent, while utilization remains in its infancy. And as construction designs improve and engineers innovate, project sites that were formerly only theoretically feasible will become economically viable. Run of river will not completely replace conventional hydro. It’s not meant to. There’s no way naturally running water can compete with something like the Three Gorges Dam across the Yangtze River in China, a project which will eventually have a total electric generating capacity of 22,500 megawatts. By comparison, the premier U.S. run-of-river plant – the Chief Joseph Dam on the Columbia River in Washington State – produces a “mere” 2,620 MW. Be aware, though, that 2,620 MW is hardly trivial. Apply the usual rule of thumb, where one megawatt will supply the needs of 500-900 average houses, and this run-of-river plant could serve as many as 2.4 million homes. Not bad. As the era of cheap fossil fuels winds down, governments and entrepreneurs alike are searching for alternative energy sources. Given run of river’s advantages – low initial cost and maintenance, flexibility, environmental friendliness – it is poised on the brink of a major construction boom, in many more places than British Columbia. It’s going to be an exciting ride, for end users and investors alike. |

| These Non-Confirmations Often Occur Before Big Moves, Up or Down in the Gold Price. Posted: 14 Jun 2010 12:00 PM PDT Gold Price Close Today : 1223.30Change: -5.60 or -0.5%Silver Price Close Today : 18.402 Change 18.0 cents or 1.0%Platinum Price Close Today: 1560.80Change: 26.50 or 1.7%Palladium Price Close... This is a summary only. Visit GOLDPRICE.ORG for the full article, gold price charts in ounces grams and kilos in 23 national currencies, and more! |

| A Visual History Of The US Presidency Posted: 14 Jun 2010 11:59 AM PDT Even though it lacks material data on the evaluation of what some will one day soon say is the most critical presidency in the history of America (the current one obviously, due to what the country will look like in its aftermath), the attached chart from timeplots.com is enough to fill several history lessons with informative and interesting data. On the other hand, what the chart is missing is data on the real rulers of the country: the Fed-Wall Street megalomaniacal manipulative moneyed complex. We hope timeplots, in the next iteration of this chart, comes up with the www.timeplots.com/FOMC_criminal_syndicate version and presents just which Wall Street firms receive how many billions in bonuses and/or bailouts under what Fed Chairman. Full link after jump: |

| Japanese Debt Crisis to Mirror that of Greece? Posted: 14 Jun 2010 11:00 AM PDT So, what is going on in Japan? The government has gotten by for the last 20 years by borrowing from its own citizens. It now has the biggest debt-to-GDP ratio in the world. As the private sector de-leveraged the public sector borrowed and spent – the same thing that is happening in America today. And maybe Richard Koo is right. Maybe this did prevent a deeper recession in Japan. Unemployment never rose over 5%. And the economy never actually suffered sustained negative growth levels. But so what? Investors still lost 3/4 of their money. And now Japan's prime minister has a warning. All those savers who put their money in Japanese government bonds for the last 20 years may soon wish they had bought gold. From Yahoo! Finance: Japan PM warns of Greece-like debt crisis Japan's new prime minister warned Friday that his country could face a financial mess like the one that has crippled Greece if it did not deal urgently with its swelling national debt. While Japan is on firmer financial footing than Greece because most of its debt is held domestically, Prime Minister Naoto Kan's blunt talk appeared designed to push forward his agenda, which may involve raising taxes. Speaking in his first address to Parliament after taking office Tuesday, Kan said Japan, the world's second-largest economy, cannot continue to let government debt swell while state finances are under pressure from an aging and declining population. "It is difficult to sustain a policy that relies too heavily on issuing debt. As we have seen with the financial confusion in the European community stemming from Greece, our finances could collapse if trust in national bonds is lost and growing national debt is left alone," he said. Japan has the largest public debt among industrialized nations at 218.6 percent of its gross domestic product in 2009, according to the International Monetary Fund. Bill Bonner Japanese Debt Crisis to Mirror that of Greece? originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." |

| Posted: 14 Jun 2010 10:58 AM PDT The US Treasury is once again running on cash fumes, with total US Treasury cash down to $4.3 billion in the Treasury's Federal Reserve account. The reason: the US Treasury has now rolled $320 billion in total treasuries in the first ten days of the month, or over $11 trillion annualized. All those paying attention to interest paid on US debt are focusing on the wrong thing: the monthly scheduled amortization of principal are now by far a much greater threat to the US Treasury than a couple of percent increase in rates. The short-date sides of the curve is getting progressively larger, contrary to the UST's previously announced plan to extend the average duration of Treasury debt. After all, why issue 10 Year+ debt and take on auction and interest risk, when courtesy of everybody rushing away from the equity market, the interest in zero interest overnight maturities is virtually infinite... Unless, of course, you are Spain, where the interest is the opposite of infinite. |

| Guest Post: Banking Crisis: Europe Banks The Next To Fail En Masse Posted: 14 Jun 2010 10:13 AM PDT Submitted by Taylor Cottam of EconomyPolitics.com (for Zero Hedge's previous analysis on Libor fixings by bank, indicating WestLB's outlier status, click here) Banking Crisis: Europe Banks the next to fail en masse Europea Well, that is exactly what is happening at West LB. "WestLB AG, the German state-owned lender bailed out during the financial crisis, is among banks paying the most to borrow for three months in euros, dollars and pounds, according to data from the British Bankers’ Association." So one could technically buy short term debt from West LB and Sell German bonds for a risk free return. Its a no brainer... or is it?

|

| Ron Paul: “Perverse” That Jobless Lose Both Paychecks and Health Insurance Posted: 14 Jun 2010 10:00 AM PDT In his most recent weekly column, Dr. Ron Paul (R-TX) describes how there's still a chance to squelch some of the worst parts of Obamacare. Specifically, his least favorite is "the mandate that forces every American either to purchase health insurance or face an IRS penalty." Here's what Ron Paul recommends instead, in his Texas Straight Talk column: "Instead of mandating the same failed entitlement healthcare schemes that are bankrupting Europe, Congress should fundamentally re-examine the case for free-market healthcare. Our current model, based on employer-provided health insurance, did not arise based on market preferences. On the contrary, it makes no sense to couple health insurance with employment. "But federal wage and price controls instituted during World War II left employers with no alternative to attract workers in a tight labor market other than offering extra benefits such as health insurance and pensions. Over time these nonwage benefits became the norm, especially since employers could deduct the cost of health insurance premiums from their income taxes while individuals could not. The perverse consequence is that employees lose both their paychecks and their health insurance when they lose their job… "…In a market system patients likely would pay cash for basic services, while maintaining relatively high-deductible catastrophic insurance for serious illnesses and accidents. The cost of most routine medical care would drop if the patient paid the bill on the spot, especially if doctors no longer needed to employ large staffs solely to deal with insurance and billing." Dr. Paul envisions medical coverage where patients pay for their most basic services and gain an appreciation for its value. Medical providers, for their part, can begin to learn and understand what constitutes a reasonable cost. He's once again sounding the alarm about a broken, government-spawned system, and you can read the details of his suggestions in Ron Paul's Texas Straight Talk column on how authoritarianism is bad for your health. Best, Rocky Vega, Ron Paul: "Perverse" That Jobless Lose Both Paychecks and Health Insurance originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." |

| Posted: 14 Jun 2010 09:58 AM PDT Gold pares losses after Greek debt downgrade The COMEX August gold futures contract closed down $5.70 Monday at $1224.50, trading between $1217.50 and $1235.90 June 14, p.m. excerpts: |

| Some More On S&P Resistance, And The AUDEUR From Goldman Posted: 14 Jun 2010 09:26 AM PDT Earlier we discussed the third sequential inability by the market to breach the 200 DMA, a very relevant technical indicator, after which the market just lost all strength and rolled over to negative. In this vein, we present the following thoughts from Goldman's sales strategists (distinctly different from other inhouse research times), who seem far more in touch with reality, and who are advocating entering into "short risk" correlated ideas as long as the marker is unable to penetrate resistance. Furthermore, as this team is usually recommends the opposite of what the traditional FX guys, which have once again totally destroyed any clients who may have listened to them, the most recent example of which was the EURUSD downgrade to 1.15 on June 9, when the pair was at 1.185, and has subsequently surged all the way to 1.23, stopping out most who got in, endorse, we are quite interested in the recommendation to establish a bearish AUD position. From Goldman:

|

| You are subscribed to email updates from Gold World News Flash To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

The

The

n banks are in a freefall similar to what happened to US banks. We saw this coming months ago when I wrote in a blog post about the

n banks are in a freefall similar to what happened to US banks. We saw this coming months ago when I wrote in a blog post about the

No comments:

Post a Comment