Gold World News Flash |

- Gold Savers Will Get the Last Laugh

- Gold Market Update

- Gold Market Update - May 23, 2010

- Silver Market Update - May 23, 2010

- Silver is Inching Closer to an Upside Breakout

- Hugo Salinas-Price on Money and Why Silver Should Be Legal Mexican Currency

- Jim?s Mailbox

- Got Gold Report - COT Flash May 21

- Got Gold Report – Caution Flags Still Flying for Gold, Silver

- America’s Wealthiest 25 percent of Households own 87 percent of all U.S. Wealth

- China to lend out its massive foreign exchange reserves

- High Inflation in the U.K. Worries Bank of England

- The Big Picture: Why Is It So Hard to Stop the Oil Gusher, and Why Was Such Extreme Deepwater Drilling Allowed in the First Place?

- So long guys.

- Silver Market Update

- Guest Post: US State Department Says "Conspiracy Theories Exist In The Realm Of Myth"

- Goldman's FX Clients Getting Tactically Bombed On Daily Basis Now

- GSR Bottoming, now what?

- Is The Euro and The Rally In Gold Over?

- How to Trade Market Bottoms for SP500 & Gold

- Guest Post: How To Trade Market Bottoms For SP500 And Gold

- Liquidity in Europe Hesitates

- Arbing Spot And Forward Curve Steepness

- Merryn Somerset Webb: The only currency that can't be printed on a whim

- Merryn Somerset Webb: The only currency that can't be printed on a whim

- In The News Today

- Jim's Mailbox

- Inflation-Proof Deflation Hedge

- Only A Matter Of Time

- Don't come to Kitchen unless you want burns

- Government’s mortgage-modification program a disaster

- Billionaire “Bull of Bullion” Holds Roughly $2B in Gold-Related Assets

- World’s Most Valuable Coin, 1794 Flowing Hair Silver Dollar

- Bullion Prices & Business Weekend Recap – May 22, 2010

- James Turk: Silver inching closer to an upside breakout

- LBMA gold shorts backed by central banks, Rickards tells King World News

- The Must Know Truth About Gold

- Key Market Drivers, May 24-28, 2010: Same Array of Bullish, Bearish Forces Still At Work

- Futures charts; May 24th

- Updated Probable LBO Basket: Buy Protection On CBS, CLX, DGX, OMC And SLE

- Goldman Shares Poised to Fall After Rising on False SEC Settlement Rumor

- Investing in Range-Bound Markets

- Reasons to stay bullish on silver and gold

| Gold Savers Will Get the Last Laugh Posted: 23 May 2010 06:13 PM PDT |

| Posted: 23 May 2010 06:11 PM PDT |

| Gold Market Update - May 23, 2010 Posted: 23 May 2010 06:08 PM PDT Clive Maund Although gold and silver dropped quite sharply last week, longer-term charts reveal that nothing broke technically and the reactions were in fact within normal parameters. On its 2-year chart we can see that the fine longer-term uptrend in gold from late 2008 remains in force, and that despite last week’s drop, it is still some distance from breaking down. In recent weeks it had shown signs that it would not drop with the broad stockmarket, so while the fact that it did may be rather disappointing, the flip side is that with the broad market horribly oversold and due a rally gold looks set to bounce back strongly from here. Factors which support a rally now, in addition to the nearby trendline support, are the moving averages, which are in strongly bullish alignment, the proximity of the price with the 50-day moving average and the neutralization of the RSI indicator shown at the top of the chart, which had been showing a short-term critically overbough... |

| Silver Market Update - May 23, 2010 Posted: 23 May 2010 06:08 PM PDT Clive Maund Although gold and silver dropped quite sharply last week, longer-term charts reveal that nothing broke technically and the reactions were in fact within normal parameters, and the reaction in silver was actually quite modest, given what could have happened in the circumstances. Silver’s 2-year chart puts its reaction last week into perspective. On this chart it doesn’t look like a big deal as it didn’t take it down to the bottom of the uptrend and didn’t even take it below its 200-day moving average. For reasons discussed in the Gold Market update, the broad market and PM sector are expected to stage a recovery rally shortly, and on the silver chart here we can see that it is certainly well placed to turn up again soon, for there is plenty of underlying support at and not far below the current price, arising principally from the lower channel support line and proximity of bullishly aligned moving averages, and depending on how st... |

| Silver is Inching Closer to an Upside Breakout Posted: 23 May 2010 06:07 PM PDT FGMR - Free Gold Money Report May 22, 2010 – Silver is inching closer to its long-awaited upside breakout. The huge accumulation pattern that silver has been building over the past three years is almost complete, as can be seen on the following chart. I noted in my last commentary that silver looks ready to soar and more to the point, that the developing chart pattern “will manifest its bullish significance when silver climbs above the neckline around $20”. That moment is rapidly approaching. Last week’s correction in prices may perhaps be the last one before silver’s upside breakout. Few people expect silver prices to rise during the summer, which is normally considered a quiet period for precious metal prices. Maybe the big surprise this year will be a spectacular summer rally for the precious metals. After all, that is what the silver chart is telling us. For my specific trading recommendations, see Trading.... |

| Hugo Salinas-Price on Money and Why Silver Should Be Legal Mexican Currency Posted: 23 May 2010 06:07 PM PDT Sunday, May 23, 2010 – with Scott Smith Hugo Salinas-Price The Daily Bell is pleased to present an exclusive interview with Hugo Salinas-Price (left). Introduction: Hugo Salinas Price, 75, is a successful, retired businessman who lives in Mexico. He has been a follower of the Austrian School of Economics since his youth. He has written three books in Spanish on how and why silver should be instituted as money in Mexico, in parallel with paper money, and numerous related articles in English and Spanish, posted at his website. His organization, the Mexican Civic Association Pro Silver, is actively lobbying the Mexican Congress to approve legislation, which will institute the pure silver "Libertad" ounce as money. Daily Bell: What is your campaign in Mexico for sound financial policy? Hugo Salinas-Price: I actually avoid discussing "sound financial policy" because one can argue about that till the cows come home. During the last fifteen years I have dev... |

| Posted: 23 May 2010 06:07 PM PDT View the original post at jsmineset.com... May 23, 2010 04:25 PM Dear Jim, The "Recovery" continues apace. Regards, CIGA Pedro April mass layoffs rise led by manufacturing (Reuters) – The number of mass layoffs by U.S. employers rose in April led by manufacturers who shed workers even as the economy began to recover. The Labor Department said the number of mass layoff events — defined as job cuts involving at least 50 people from a single employer — increased by 228 to 1,856 as employers shed 200,870 jobs on a seasonally adjusted basis. More… ABC of Silver (&Gold) CIGA Eric A – The surge above the 1/20/10 gap on a sign of strength on 5/11 was a technical breakout. B – The subsequent break below the 5/11 gap on a significant contraction in volume was a false breakdown that will be reversed in time. C – The retest of the 5/5 gap on decreasing volume suggests that the downside force is waning. Whatever canno... |

| Got Gold Report - COT Flash May 21 Posted: 23 May 2010 06:07 PM PDT Bottom line: COT report shows COMEX commercials not aggressive on the sell side for gold, but the largest hedgers and short sellers hammer silver futures ahead of silver plunge.Gold -0.6% and the gold LCNS -1%. Silver -1.5% and the silver LCNS zooms higher 12.8%.Details just below. ATLANTA – From the sidelines with our short-term gold-silver ammunition, but glad we hold physical metal in our longer-term arsenal, we peer into a small window of the largest traders of gold and silver futures with this special report. With the violence of the past week, both in the equity markets and in precious metals, it was easy to be anxious to get our hands on the COT data below. We don’t like being in port when there is good fishing going on. But we like violent and uncertain markets less and less as what’s left of the topside hair gets grayer. Last week’s study into the COT produced a kind of curve ball, because it suggested to those of us who fo... |

| Got Gold Report – Caution Flags Still Flying for Gold, Silver Posted: 23 May 2010 06:01 PM PDT We just wonder now whether we are about to enter the eye of the storm or the eye wall itself. Meaning, we cannot yet see enough confirmation in the data to give us comfort to set up on the short-term trading long side of our beloved precious metals – just yet. No matter how much we are itching to do just that. |

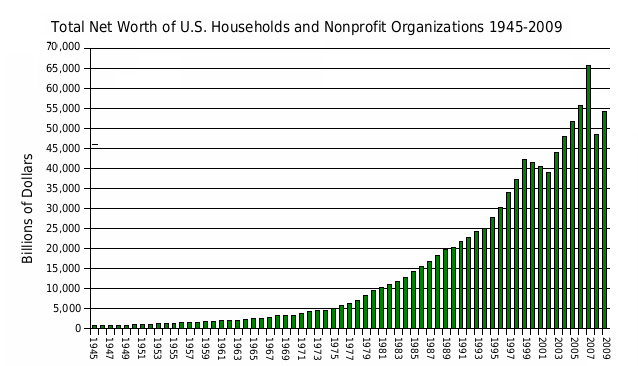

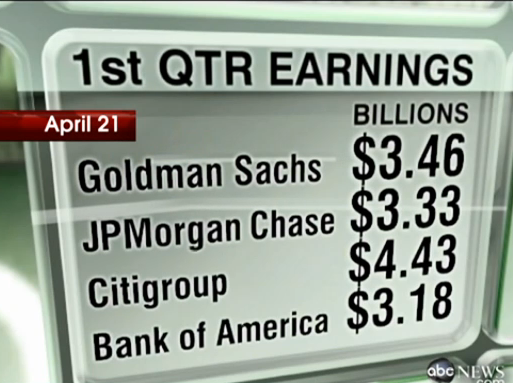

| America’s Wealthiest 25 percent of Households own 87 percent of all U.S. Wealth Posted: 23 May 2010 05:29 PM PDT A true measure of economic vitality is measured by wealth. We can look at incomesor other measures of productivity but real wealth is measured by net worth. Who controls wealth in the U.S.? According to a study from the Joint Center for Housing Studies the top 25% of U.S. households control 87% of all wealth in the country. That number comes out to a nice hefty sum of $54.2 trillion. If we look even closer at income distribution, we will find that the top 1 percent in our country control 42 percentof all financial wealth. By all measures being able to acquire a piece of financial wealth was the hallmark of the middle class of previous years. Today we have a society largely in debt to credit cards, auto loans, student loans, and immense mortgage debt. Net worth is measured by looking at assets minus liabilities and many Americans are lucky to break even while many have a negative net worth. Even after the current wealth destruction of the recession, our country has grown wealthier and wealthier over time and the trend is clear: Source: Wikipedia Yet more and more of this added wealth is filtering its way to a smaller group and not necessarily the most productive in our country. In the first quarter of 2010 some of the biggest banks in this country made continuous profits without really adding any benefit to our economy or society: Source: ABC News In fact, many of these banks simply made money by hoarding money and actually lending it back to the U.S. government (who actually bailed them out to begin with). These weren't successful companies that produced a solid product. These are the companies that failed but had politically bought out the right connections. |

| China to lend out its massive foreign exchange reserves Posted: 23 May 2010 04:42 PM PDT Looks like China aims to exchange more dollars for resources in the ground. * * * China is tapping its deep well of foreign reserves for overseas resource loans, benefiting banks through a major policy shift By Zhang Yuzhe http://english.caing.com/2010-05-20/100145743.html BEIJING -- The State Administration of Foreign Exchange (SAFE) is leading a policy adjustment that taps China's huge stash of foreign reserves for overseas loans through commercial banks. Under an evolving reform project launched in recent months, SAFE has taken initial steps toward giving policy and commercial banks authority to handle loans for intergovernmental cooperation projects. Major loan-for-oil swaps signed in recent months by China and several other countries marked a coming-out for the new policy. Dispatch continues below ... ADVERTISEMENT Prophecy Resource Corp. Appoints Rob McEwen to Advisory Board Prophecy Resource Corp. (TSX.V: PCY, OTC: PCYRF) is pleased to announce the appointment of Rob McEwen to the company's Advisory Board. McEwen is a leading Canadian mining industry entrepreneur. He is the chairman and CEO of U.S. Gold Corp. and Minera Andes Inc. McEwen was the founder and former chairman and CEO of Goldcorp Inc., whose Red Lake Mine in northwestern Ontario, Canada, is considered to be the richest gold mine in the world. During his tenure at Goldcorp, McEwen transformed the company from a collection of small companies into a mining powerhouse, growing its market capitalization from $50 million to approximately $8 billion. For Prophecy Resource Corp.'s complete statement: http://www.prophecyresource.com/news_2010_mar11b.php The adjustments are designed to help China diversify its foreign currency assets and provide a channel for some of the US$ 2.4 trillion in reserves held by the central bank. The reforms also expanded SAFE's responsibilities beyond its traditional role of managing foreign exchange reserves, effectively turning the agency into a foreign currency lender. The new forex direction dates from the end of last year, when the State Council asked SAFE to take the lead in projects including a Chinese loan-for-Russian oil exchange deal. The agency was also told to study additional innovations for policy lending. Meanwhile, SAFE has been looking at ways in which domestic financial institutions can cooperate through various loan programs to help Chinese enterprises expand abroad. Since 2009 China has signed loan-for-oil agreements worth more US$60 billion in recent months with Russia, Venezuela, Kazakhstan, Turkmenistan, and other countries. Altogether, these agreements have given China the rights to import nearly 75 million tons of crude oil every year. Under the China-Russia bilateral agreement signed February 17, for example, China will provide Russia US$25 billion in long-term loans in exchange for 15 million tons of crude oil annually between 2011 and 2030. The agreements put China's forex pool to work at a relatively young age: The nation's foreign reserves have grown substantially since the country joined the World Trade Organization in 2002. Before that, forex reserves growth was less than US$50 billion a year. But the growth rate soon jumped to an average 33 percent per year. The central bank's forex holdings have doubled to today's US$2.4 trillion from the US$1.2 trillion on hand in September 2007, when the government created an overseas investment arm, China Investment Corp. The current cash stash is far more than the government technically requires, giving policymakers a key reason to pursue policy lending. In theory, the central bank is required to retain only enough foreign currency assets with strong liquidity to handle three months of imports and short-term external debt. A reasonable upper limit for meeting this requirement now would be US$600 billion. Moreover, the central bank is interested in the policy loan project because it is actively pursuing safe, profitable investment channels for forex reserves. After getting its recent marching orders from the State Council, SAFE's first step was to sign an agreement with China Development Bank Corp. (CDB) to handle so-called "entrusted loans." The deal gave CDB authority to act as SAFE's agent for overseas investment loans, primarily to Chinese enterprises that go abroad. An entrusted loan is a three-party credit tool in China in which one non-bank entity lends to another through a cooperating bank. These are off-balance sheet transactions, and the bank receives representative fees that count as intermediate business income. Since SAFE lacks risk management capacities, such as pre- and post-loan appraisals, risk control for entrusted loans largely depend on cooperating banks such as CDB. That means "banks are essentially working for SAFE, and interest margins from foreign currency financing projects will be directly handed over to SAFE," said a commercial bank source, who added these deals include a degree of moral hazard. Based on the "basic strategic intent" of the government, "this model has some definite benefits," said one financial expert. "Still, under this new model, SAFE will be forced to take on even greater risk responsibility." And that raises a warning flag about government policy direction. "China's biggest problem is that all the risk is concentrating toward the government," the expert said. SAFE's first pick for entrusted loan projects was CDB, which took the lead in arranging many of the latest oil deals. The two agencies signed an agreement that divides overseas investments into new and old projects. CDB agreed to a commission range between 1 and 2 percent for new projects. Most of CDB's international operations last year involved loans-for-resources projects, including 10-year oil deals worth more than US$ 10 billion with countries including Russia, Brazil, and Venezuela. CDB also took the lead in syndicated loans with other banks. Not everyone at CDB is happy with the policy program. A CDB source said the bank is currently in a transition period and should expand its fund reserves for long-term, stable profits. The source said the "1 to 2 percent commission" promised by SAFE "is not high" compared with profit margins from regular loans. The new lending model also will affect cost budgeting and risk management at CDB, the source said. "The entrustment agreement between SAFE and CDB allows SAFE to directly take on new projects," the source said. "SAFE will act as the organizer and primary arranger of syndicated loans." "CDB is taking on some operations that have a relation to policy lending," said a source at the government investment arm Central Huijin Investment Ltd. "Under the current system, one may well say that this model opens up a new path. "However, it is still only suitable as a transitional arrangement." One reason for the program's temporary nature is that the government is assuming risk. But some banks are not complaining. Off-balance sheet operations protect banks from risk, said a source at Bank of China, a state-run commercial bank. Another plus is that SAFE's entrusted loan model can give banks access to additional foreign currency capital, the source said. Moreover, the model "does not take capital, reduces pressure on capital and allows banks to earn a simple commission fee," the source continued. "Hence, the merits outweigh the drawbacks." As for drawbacks, a China Eximbank source said the entrusted loan model raises the possibility of moral hazard. And SAFE assumes all risk as lender and interest payment beneficiary. "Allowing SAFE to collect interest margins means the main source of profits belongs to SAFE," a commercial bank source said, before raising a crucial question: "In this case, who would take primary responsibility for post-loan management and risk?" By taking on risk, one financial expert said, SAFE is now stepping out from behind the scenes to the center of China's financial stage. "The biggest risk involved with overseas investment projects is country risk," the Eximbank source said. "Loan amounts for medium- to long-term loans overseas are huge and limited to one country. Hence, the risk is relatively concentrated." Join GATA here: World Resource Investment Conference * * * Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Coming Friday-Sunday, June 11-13, at the Dallas-Fort Worth Airport Marriot: The conference will explore the dangers and opportunities in today's bullion markets and the need for investors to diversify bullion holdings outside of bullion banking and commodities markets. Speakers will include David Morgan of Silver-Investor.com, Gold Anti-Trust Action Committee Chairman Bill Murphy, and Duncan Cameron and Philip Judge of Anglo Far-East Bullion Co. The earliest conference attendees on Saturday will be able to schedule one-on-one interviews for personal consultation with Anglo-Far East's experts on Sunday. To learn more about and register for the Anglo Far-East Bullion conference, please visit: http://www.anglofareast.com/seminar-registration/ |

| High Inflation in the U.K. Worries Bank of England Posted: 23 May 2010 04:20 PM PDT Dr. Duru submits: (This is a adapted repost from Inflation Watch) Bank of England (BoE) Monetary Policy Committee Member Adam Posen tells CNBC in an interview (see below or click here) that stubbornly high inflation is keeping the Bank of England members up at night. However, Posen prefers this situation to deflation (as all central bankers would). Slack in resource utilization is not having the same dampening effect it is having in other industrialized countries like the U.S. I would think the steady decline in the British pound has a lot to do with the high inflation rate, but Posen claims it is not a sufficient explanation. Note well that this depreciation is essentially what the BoE, or at least Mervyn King, has desired to kickstart economic growth in the UK through higher exports, lower consumption of foreign goods, and higher domestic demand. Complete Story » |

| Posted: 23 May 2010 04:20 PM PDT

The government failed to properly ensure that BP used adequate safety measures, BP and their contractors were criminally negligent for the oil spill, and BP has tried to cover up the problem. See this. But why hasn't BP stopped the leak? Some people assume that BP hasn't stopped the oil leak because it's people are wholly incompetent. Others have asked whether BP's $75 million liability cap is motivating it to stall by taking half-hearted measures until it's relief well drilling is complete. But there is another possible explanation: the geology at the drilling site makes stopping the leak more difficult than people realize. Does the Geology of the Spill Zone Make It Harder to Stop the Oil Spill? We can't understand the big picture behind the Gulf oil spill unless we know the underwater geology of the seabed and the underlying rocks. For example, if there is solid rock beneath the leaking pipes, with channels leading to other underground spaces, then it might be possible to seal the whole spill zone, with the oil - hopefully - oozing somewhere under the seabed so that it won't spill into the ocean. If, on the other hand, there is hundreds of feet of sand or mud beneath the leaking pipes, then sealing the spill zone might not work, as the high-pressure oil gusher would just leak out somewhere else. BP has never publicly released geological cross-sections of the seabed and underlying rock. BP's Initial Exploration Plan refers to "structure contour maps" and "geological cross sections", but such drawings and information are designated "proprietary information" and have been kept under wraps. It is impossible to determine the geology from drawings publicly released by BP, such as this one: However, Roger Anderson and Albert Boulanger of Columbia University's Lamont-Doherty Earth Observatory describe the basic geology of the oil-rich parts of the Gulf:

See also this. The BP oil spill leak is occurring in the "Macondo" Prospect, Block 252, in the Mississippi Canyon Area of the Gulf (much of the oil-rich areas under the Gulf are in the Mississippi Canyon and Fan areas: "In the central Gulf of Mexico, the Mississippi Canyon and Fan system is the dominant morphologic feature"). If the geology at Block 252 of the Macondo Prospect is like that described by Anderson and Boulanger for most of the oil-rich portion of the Gulf, then it might be difficult to stop the oil gusher without completing relief wells (which will take a couple of months). Specifically, if there are salt layers on the top of the seabed, with high porosity near the surface, and salt movement, then sealing the whole leak zone might not work. The oil pressure is coming up at such high pressures (more than 2,000 pounds per square inch), that sealing the leaking riser and blowout preventer might just mean the oil squirts out somewhere else nearby, if the salty, porous rock is not solid enough to contain it. Unless the government releases details of the geology underlying the spill site, people will not have an accurate picture of the oil spill situation. And failure to release such information may prevent creative scientists from coming up with a workable solution. The first draft of Anderson and Boulanger's paper, in 2001, stated:

(exclamation point is Anderson and Boulanger's). If the geology at Block 252 is like that described by Anderson and Boulanger for most of the oil-rich portion of the Gulf, then it might be difficult to stop the oil gusher without completing relief wells (which will take a couple of months). Specifically, if there are salt layers right under the sea floor, high porosity near the surface or salt movement, then sealing the leak by plugging the risers and blowout preventer might not work. The oil pressure is coming up at such high pressures (more than 2,000 pounds per square inch), that sealing the leaking equipment at the level of the seabed might just mean the oil will flow out somewhere else nearby. The government must publicly release details of the geology under the spill site. Until it does so, people will not have be understand what is going on. And failing to release such information may prevent creative scientists from around the world from coming up with a workable solution. In addition, the first draft of Anderson and Boulanger's paper - released in 2001 - stated:

(exclamation point is Anderson and Boulanger's). In other words, while BP, its subcontractors, and the government were all negligent with regard to the Deepwater Horizon operation, it should be noted that drilling at such depths is new technology, operating in largely uncharted conditions. As such, the dangers of deepwater drilling in general should not be underestimated. The geology of the oil-rich region in the Gulf makes drilling difficult, and oil spills appear to be tough to contain in general. Oil Is Considered A National Security Issue So why are oil companies being allowed to drill so deeply under the Gulf in the first place? In other words, why has the government been so supportive of deepwater drilling in the Gulf? The answer - as Anderson and Boulanger note - is that there is a tremendous amount of more oil deep under the Gulf, and that the United States government considers oil drilling in the deep waters of the Gulf as a national security priority:

So the Department of Energy and Congress have committed to development of the deepwater Gulf oil reserves in the name of national security. This also helps explain why Obama has been pro-drilling in the Gulf. But let's take a step back and ask why the government considers oil a national security priority in the first place? Well, the U.S. military is the largest consumer of oil in the world. As NPR reported in 2007:

As Reuters pointed out in 2008:

And as I summarized last year:

Indeed, Alan Greenspan, John McCain, George W. Bush, Sarah Palin, a high-level National Security Council officer and others all say that the Iraq war was really about oil. Nobel prize winning economist Joseph Stiglitz says that the Iraq war alone will cost $3-5 trillion dollars. And economist Anita Dancs writes:

Are you starting to get the picture? Personally, I strongly believe that it is vital for our national security - and our economy - to switch from dependence on oil to a basket of alternative energies. As I pointed out Friday:

But existing national policy is to do whatever is necessary - drilling deep under the Gulf and launching our military abroad - to secure oil. Until we change our national security and energy policies, future mishaps - environmental, military and economic - may frequently occur. H/t: Rusty Shorts. |

| Posted: 23 May 2010 03:46 PM PDT |

| Posted: 23 May 2010 03:09 PM PDT |

| Guest Post: US State Department Says "Conspiracy Theories Exist In The Realm Of Myth" Posted: 23 May 2010 02:52 PM PDT Submitted by Mac Slavo of www.SHTFplan.com The US State Department’s America.gov web site, which purports to engage international audiences on issues of foreign policy, society and values, has dedicated a special section to conspiracy theories and misinformation, claiming:

Some of the conspiratorial myths “officially” debunked by the State Department include: The US military’s use of depleted uranium in combat and comparing this to radioactivity from detonations of nuclear weapons.

Never mind that the World Health Organization says that depleted uranium is weakly radioactive and a radiation dose from it would be about 60% of that from purified natural uranium with the same mass. It’s only 60% as radioactive as the real stuff, so it’s safe to use in weapons systems we’re lobbing into neighborhoods in Iraq and Afghanistan. The employment of economic hit men to entrap countries in huge amounts of debt.

Two words: Goldman Sachs. [ZH: we also recommend reading Confessions of an Economic Hitman for the truth on this matter] And, while the Amero may not be a reality now, there is only one way that the United States is going to pay off the national debt that our domestic economic hit men have strapped us with, and this is through either devaluation or all out default. In both cases the US dollar as we know it today will be completely destroyed and a new currency system will be required. Call it a theory, we think it’s fact, and if they’re doing it to our own country, why would they not do it to third-world foreigners? The State Department has also made efforts to debunk the myth that President Obama is not a US citizen.

There may be no doubt in the minds of those appointed to their posts by President Obama or those hired to write the State Departments debunking blogs, but millions of Americans question the President’s eligibility to serve for a number of reasons that include his failure to provide a legitimate Certificate of Live Birth issued by the State of Hawaii, his inability to explain his trip to Pakistan in the 1980’s when holders of US passports were not allowed into the country, and most recently, his use of a social security number issued only for residents of the State of Connecticut, in which he never lived. No government debunking of conspiracy myths would be complete without discussion of September 11th:

At the risk of sounding like Debra Medina Truthers, we’ll refrain from arguing every point, however we’d like to point out to those of our readers who have not yet viewed the popular video “Loose Change,” that they take the time to do so before swallowing this nine sentence so-called debunking of the largest crime in American history. If nothing else, we’d suggest to readers that there are many questions that went unanswered about 9/11 which include, but are not limited to, over fifty (50) missing closed circuit videos around the Pentagon that were never released to the public and the fact the Osama Bin Laden was never officially implicated for his role in the September 11th WTC plot. A couple of conspiracies which were considered myths at the time of their occurrence, yet were not debunked by the State Department’s new web site include the Gulf of Tonkin incident which lead to the Vietnam war and the CIA drug transportation rings of the 1980’s. Because of the overwhelming evidence that was uncovered by independent researchers and reluctantly released by the government, these myths and fantasies eventually became realities. We wonder if the US government may be rushing to judgment about wild imaginations and irrational fears when they have failed to answer simple questions regarding many of the conspiracy “theories” above. Naturally, many of these will remain theories until the facts are openly provided to those requesting the information, at which point they will either be conspiracy fact or non-truths. For the time being, those who seek the truth will likely remain baffled, confused and misdirected, much like the magic bullet that killed JFK, because any good conspiracy creates a web of illegible disinformation and misinformation, not from those looking for answers, but by those who have the power to provide them.

|

| Goldman's FX Clients Getting Tactically Bombed On Daily Basis Now Posted: 23 May 2010 02:11 PM PDT The latest tactical nuking of whatever remaining clients GS has in the FX (or any) arena has just been announced: from GS FX research "Stopped out of short USD/TWD with a potential loss of -1.2% May 24, 2010. We were stopped out of our tactical recommendation to be short USD/TWD at the London close on Friday with a potential loss of around -1.2%. We initiated the trade on 31 March on the back of strong macro data out of Taiwan and rising inflation which we expected the Taiwan central bank to fight via a stronger currency. While the macro arguments for the trade are still in place and the trade was well on its way towards the target a few weeks ago, the ongoing market jitters have pushed $/TWD a fraction past our stop of 32.1." For god's sake Goldman, have some pity on your clients. |

| Posted: 23 May 2010 02:02 PM PDT

Damned if I know… I am going to leave the great questions to be answered by the great minds. Is this the end of the financial world as we know it? It should be, given that it is built on lies upon lies. But here in Wonderland, things don't usually work out as they 'should', now do they? So I will just continue to specialize in my own little corner of the vast, wheezing Ponzi scheme on the verge of meltdown. Our junk bond to investment grade bond indicator has come in… sentiment has come in… VIX, US Dollar… all in. Then there is the big daddy of my personal investment (and investment avoidance) stance, the GSR. Of particular interest to me is the GSR's relationship to the gold mining sector. Now, this is a free blog and I gladly share some general things, but it is now getting serious and the serious focus must remain for the people who pay for it, in the newsletter. The time for fooling around with the Hope '09 (and Full Hubris '10) stupidity is at an end. As a bottom feeder and a buyer of peoples' misery and misperception I must now get on the job. Meanwhile, here is a chart of the GSR and its longer term correlation with HUI. Draw some conclusions (among them that gold stocks can get royally hammered even as the rising GSR indicates rising gold miner fundamentals), have patience and turn down the noise; that would be the harangues of the inflationists and now, increasingly the deflationists as well. Time to begin sorting through the debris, with patience and perspective. There, how's that for a riddle? Source: http://www.biiwii.blogspot.com/ |

| Is The Euro and The Rally In Gold Over? Posted: 23 May 2010 01:37 PM PDT |

| How to Trade Market Bottoms for SP500 & Gold Posted: 23 May 2010 01:13 PM PDT

The stock market topped in April which was expected from analyzing stocks and the indexes. Back in April I posted a few reports explaining how to read the charts to spot market tops. Today's report is about identifying market bottoms.

It does not get much more exciting than what we have seen in the past 2 months with the market topping in April and the May 6th mini market crash. This Thursday we saw panic selling which pushed the market below the May 6th low washing the market of weak positions.

For those of you who have been following me closely this year I am sure you have noticed trading has been a little slower than normal. This is due to the fact that the market corrected at the beginning of the year and we went long Feb 5th and again on Feb 25th. Since then the market rallied for 2 months and never provided another low risk entry point. In April the market became choppy and toppy and we eventually took a short position to ride the market down. Now were we are looking at another possible reversal to the upside.

Only a few trades this year which I know frustrates some individuals but if you step back and look at my trading strategy you will learn that we only need to trade a few trades a year to make some solid returns. I don't know about you but I would rather trade a few times a month and live life between trades… not trade all day every day getting bug eyed in front of the computer.

Ok enough of the boring stuff let's get into the charts…

SP500 – Stock Market Index Trading ETFs & Futures The pullback in the broad market was expected but the mini crash on May 6th really through a wrench into things for us technical analysts. We don't really know the truth about what happened that day… was it just a simple error or was it a planned error for the US government to take a massive short position to move something in their favor quickly to generate MASSIVE gains? It leaves us technicians hanging wondering if that was a shift in trend from up (accumulation) to down (distribution)?

My thoughts are if the crash was truly an error then we will see months if not another year of higher prices… But if it was a planned sell off with banks moving to the sidelines then we are most likely headed into another bear market. Personally it does not matter what happens as big money will be made in either direction. Problem is if we do go into another bear market then the majority of individuals will lose capital as investor's portfolios get smaller and smaller. That will lead to a lot of depressed people…

In short, I am neutral on the stock market for the intermediate and long term. Once we have a few more months of price action only then will I have a plan for longer term investments. But on the short term time frame the market is screaming at me with extreme sentiment levels lining up on the stock market and gold.

The daily chart of the SPY – SP500 Index shows several important points which help me time market bottoms. We have prices trading at a support zone. Buyers step back into the game here and should provide a decent bounce which started Friday Morning.

Next we have the panic selling spikes from an indicator I created. Generally the day after we see panic in the market like we did on Thursday we will see a big bounce and many times a large rally.

Down at the bottom you can see my custom market cycles which are both starting to bottom. During times like this the market has a natural tendency to move higher.

VIX – Market Volatility Daily Chart The VIX has an old saying "When the VIX is high its time to buy, When the VIX is low, its time to go". Simple analysis clearly shows the VIX trading high and at a resistance zone.

Put/Call Ratio – Daily Trading Chart This chart measures the amount of put and call options traded each day. When it is trading over 1.00 then we know for every 1 call option traded (wanting the market to go up) there is 1 put option traded (wanting the market to go down). Over 1.00 is extreme and when that many people are bearish and using leverage to profit from a drop in price then in my opinion it means everyone has already sold and the selling pressure is about to end.

Actually if you go back in time and review SP500 and this ratio you will notice 2-3 days after this ratio reaches 1.00 or higher the market bounces/bottoms.

NYSE Advance/Decline Line for Equities – Daily Chart This chart shows us how many stocks are advancing or declining on any given day. When extremes are reached look for a short term bounce or bottom 1-3 days following.

How to Identify Stock Market Bottoms with Simple Analysis: In short, I feel the market is forming a bottom here. How big of a rally will we get? I don't know because of the mixed signals from the May 6th EXTREME heavy volume selling session. As usual I focus on trading with the trend, trading the low risk setups and I manage my money/positions scaling in and out of those positions as I see fit.

If you would like to receive my Real-Time Trading Signals & Trading Education check out my website at www.FuturesTradingSignals.com

Chris Vermeulen

|

| Guest Post: How To Trade Market Bottoms For SP500 And Gold Posted: 23 May 2010 01:06 PM PDT Submitted by Chris Vermeulen, of www.TheGoldAndOilGuy.com The stock market topped in April which was expected from analyzing stocks and the indexes. Back in April I posted a few reports explaining how to read the charts to spot market tops. Today’s report is about identifying market bottoms.

VIX – Market Volatility Daily Chart The VIX has an old saying “When the VIX is high its time to buy, When the VIX is low, its time to go”. Simple analysis clearly shows the VIX trading high and at a resistance zone.

Put/Call Ratio – Daily Trading Chart This chart measures the amount of put and call options traded each day. When it is trading over 1.00 then we know for every 1 call option traded (wanting the market to go up) there is 1 put option traded (wanting the market to go down). Over 1.00 is extreme and when that many people are bearish and using leverage to profit from a drop in price then in my opinion it means everyone has already sold and the selling pressure is about to end.

NYSE Advance/Decline Line for Equities – Daily Chart This chart shows us how many stocks are advancing or declining on any given day. When extremes are reached look for a short term bounce or bottom 1-3 days following.

How to Identify Stock Market Bottoms with Simple Analysis: In short, I feel the market is forming a bottom here. How big of a rally will we get? I don’t know because of the mixed signals from the May 6th EXTREME heavy volume selling session. As usual I focus on trading with the trend, trading the low risk setups and I manage my money/positions scaling in and out of those positions as I see fit. |

| Posted: 23 May 2010 12:50 PM PDT If you're a glass half-full kind of guy, then Friday's action in stock was encouraging. Here in Australia, the indexes opened up down by almost three per cent. Yet by the end of the day, they were able to claw their way back to much smaller losses. Yes, stocks are at nine-month lows. But it felt like a victory, didn't it? Then, in Friday's U.S. session stocks staged a huge final hour rally. The Dow Jones industrials had been down below 10,000 at one point. But in a flash (a flash dash!) the index suddenly reversed itself and finished 1.24% higher. So what does that tell us? Absolutely nothing, most likely. In a market like this, what you don't know is a lot more important than what you do know. And what we do know turns out to be very little anyway. Just based on valuations, stocks are now a bit cheaper than they were a month ago. But price is not the same thing as value. And besides, there are so many known unknowns and unknown unknowns it's hard to know where to begin! But let's start on the other side of the world and tackle the question of whether there is a short-term funding crisis in Europe. Or, in plainer speech, is the Credit Crunch back and better than ever? The optimistic view is that the real economy in Europe is recovering, albeit slowly. A key purchasing manager's index in Europe hit a three-month low, but it was still positive. And the line of argument in this camp is that the real economy will grow slowly, but is nowhere near as dysfunctional and systemically unstable as financial markets are. Financial markets, for their part, are trying to digest two political moves. The first move is the legislative efforts to curb credit growth (the U.S. reform bill). That might reduce bad bank lending. But it would almost certainly limit credit growth. And in a system that requires on a lot of short-term credit to finance activity, it means less activity, lower real growth, falling asset values, and economic contraction. The second issue is the growing weight of Europe's dead hand on the market. This will feel familiar to Australian investors lately. What we mean is that one of the big results of the Greek crisis is a call for economic policy coordination. This is being euphemistically called "economic governance." But it's actually an attempt for more centralised and coordinated European regulation and policy making. Because the problem with the EU is that it's not centralised enough. The credit markets are telling us they are not convinced that Europe's policy makers can coordinate a response to huge sovereign debt levels in Spain, Greece, Portugal, and Italy. As the sense of anxiety by financial firms becomes more acute, they become a lot less trusting of each other. Banks who are unsure about what's on another bank's balance sheet don't lend. These shows up as an increase in the London Interbank Offered Rate, the rate banks charge one another in overnight lending. Bloomberg reports that, "Traders in the forward market are betting the premium of the three-month dollar London interbank offered rate, or Libor, over what investors expect the overnight federal funds rate to average known as the Libor-OIS spread will climb to about 42 basis points next month and about 61 basis points by September, according to UBS AG data. The spot spread was about 27 basis points May 21." "This is a quintessential liquidity crisis," William Cunningham tells Bloomberg. He's the head of credit strategies and fixed-income research at State Street Corporation in Boston. "It's not inconceivable to imagine a situation where the markets behave so poorly, the liquidity behaves so badly, and risk-tolerance just evaporates that particularly in Europe consumers contract, businesses stop hiring and stop investing, and economic activity halts." Granted, the current situation is nowhere near as bad as October of 2008. Libor soared by 364 basis points then and the whole inter-bank lending market was nearly frozen. But if the political climate continues to generate so much instability, the financial markets are going to get pretty cold. Does any of this have any effect on the real economy here in Australia? Well, last week the National Australia Bank sent retailer Clive Peeters into administration because the bank was unwilling to loan the electrical goods seller $38 million. That seems like chump change these days. So why cut them off? As Adele Ferguson reports in today's Age, corporate Australia is sitting on $180 billion in short-term debt it must refinance in the next two years. Over the last 18 months or so, Aussie banks have been silently hoping the economy would improve enough that extending credit to small- and mid-size firms wouldn't endanger the balance sheet. Mind you it's not the big firms that are in trouble here. During the credit crisis, big Aussie blue chips tapped the equity markets for another $90 billion in capital. This did not always benefit shareholders if the company sold equity cheaply. But it did buttress the balance sheet. The trouble is that small- and mid-sized businesses can't simply raise equity. They depend heavily on short-term bank financing. When the cost of that financing goes up because of tighter global liquidity, or when Aussie banks simply become more cautious to protect their own balance sheets, then you get the local consequence of the credit depression: the inability of smaller firms to borrow. Meanwhile, the government continues its public relations war against the mining industry. You have to wonder what the government hopes to win by trashing the industry in front of international investors like this. The obvious answer is: money! To be fair, whether production or profits should be taxed is an interesting question. And whether a tax or royalty should be levelled as the state or Federal level is also an interesting questions. By "interesting" we mean debateable if you accept at face value the government's right to tax private enterprise. We're not saying we like it. But this line of attack that, "the community has not received a fair return for its non-renewable resources during boom times" is a bit rich, isn't it? This again presumes that it is the community which owns Australia's mineral resources. Does it? Dan Denning |

| Arbing Spot And Forward Curve Steepness Posted: 23 May 2010 12:49 PM PDT On Friday we pointed out that after nearly 9 months of straight line steepening, the Treasury curve, as depicted by the spot 2s10s, has collapsed, and has flattened from 290 to 240 bps practically overnight, in what has been an unprecedentedly rapid move in the curve, driven primarily by asset liquidations. Those with exposure to spot are panicking, and have been forced to cover what amounts to billions in levered notional positions. Some (the lucky ones) only have synthetic exposure, via Constant Maturity Swaps or other Robertson/Klarman-esque contraptions, thus limiting a downside they can walk away from. They are the minority. Yet an interesting observation, coming by way of Morgan Stanley's Jim Caron, who little by little is forced to wave the white flag of surrender not only on his 5.5% call in the 10 year by Year End, but also on his all out steepening trade, is that flattening has really only occurred in the spot curve: forward yield curves, both the 1y and 2y, have surprisingly retained their steepening bias in spite of unprecedented vol and liquidations. Why is this? Caron explains. However, more relevantly, his observation that a convergence between spot and forward curves is imminent could serve as an easy (famous last words) way to pick 100 bps. From Morgan Stanley:

Fundamentally, this is a solid trade, although just like Goldman, MS has been struggling with generating any sort of positive alpha for its clients over the past 6 months. Additionally, the MS trade, as Caron admits, is contingent on stabilization in the European contagion and moderation in short-term funding. Alas, this is not our base case. Which is why we anticipate substantial further curve flattening as Libor continues its relentless creep higher. To be sure this will play out in spot, while forward curves may take some time to follow through. Which is we recommend that any convergence arb be sufficiently padded with liquidity should the spot-1y move materially wider than recent highs of 100 bps. |

| Merryn Somerset Webb: The only currency that can't be printed on a whim Posted: 23 May 2010 12:44 PM PDT By Merryn Somerset Webb http://www.ft.com/cms/s/2/d6a8da26-64fd-11df-b648-00144feab49a.html You probably think gold is in a bubble. After all, it hit new highs in dollars, pounds, and euros this week -- and has pretty much quintupled since its lows of 2001. What's more, everyone from Germany to China is still nuts for it. Earlier in the week, this newspaper reported that the Germans have been snapping up coins and gold bars faster than they did even in the aftermath of the Lehman Brothers' collapse. In the UAE you can buy bars direct from a vending machine. At Harrods you can pick up a variety of gold coins over the counter. And -- as the gold bears are keen to point out -- you can see ads for the purchase of gold all over TV. But look at the actual price of gold and it is hard to see real evidence of a bubble. Gold may have hit new highs in nominal terms, but it hasn't come close to hitting its old highs in real terms. Adjust the 1980 high of $850 for US inflation and you get a price of around $2,400 -- a level only the most bullish are predicting even now. ADVERTISEMENT Prophecy Resource Corp. Appoints Rob McEwen to Advisory Board Prophecy Resource Corp. (TSX.V: PCY, OTC: PCYRF) is pleased to announce the appointment of Rob McEwen to the company's Advisory Board. McEwen is a leading Canadian mining industry entrepreneur. He is the chairman and CEO of U.S. Gold Corp. and Minera Andes Inc. McEwen was the founder and former chairman and CEO of Goldcorp Inc., whose Red Lake Mine in northwestern Ontario, Canada, is considered to be the richest gold mine in the world. During his tenure at Goldcorp, McEwen transformed the company from a collection of small companies into a mining powerhouse, growing its market capitalization from $50 million to approximately $8 billion. For Prophecy Resource Corp.'s complete statement: http://www.prophecyresource.com/news_2010_mar11b.php Then look to the last few years. The bears would have you believe that the gold price has somehow gone "parabolic." But, in fact, the price in US dollars has risen only around 25 per cent in the last two years. Compare that with, say, shares in Rockhopper Exploration, the lucky owner of the prospects where oil was struck off the Falklands the week before last. Its shares started the month at around 40p and have since more than quadrupled. But no one is shouting "bubble!" Far from it. Instead, they are all claiming the company has seen a transformational event, which makes its shares worth more than they are even now (which arguably they are). But hasn't there been a transformational global event that has changed the case for gold too? Back when gold's bull run kicked off, there were precious few gold bugs and we tended to make the case for the metal based on likely demand for "bling" from the new middle classes of emerging markets. We mentioned only in passing the fast rising US national debt and the nagging fear that fiat currencies might not be all they were cracked up to be. Today, however, gold has reverted to its historical role as the global currency of the last resort. You no longer buy it because you think the Chinese and Russians are likely to up their consumption of gold-plated mobile phones. You buy it because you think there is a chance that governments, caught in a debt trap from which there is no honourable escape, will eventually think they have no choice but to print their way out of it. And the risk of hyperinflation is a transformational event for gold -- it being the only global currency that can't be printed on the whim of a central bank. All that said, there is a strong chance that we might see a short-term falloff in the gold price. Why? Partly because high prices are putting off India's jewellery buyers. Partly because there is likely to be a short hiatus in new investor buyers coming to the market -- if you haven't panicked yet, you will need a new crisis before you do so. But mostly because, after the mini-inflation scare following the ECB's bailout plans for Europe, we seem to be having a deflation scare. Prices may be stubbornly rising in the UK but Spain is now in outright deflation (exclude energy and food, and prices are falling) and core inflation across Europe and the US is very low. The endless money-printing across the world has not yet brought us proper inflation simply because the mechanism for passing it on isn't working very well: The banks are too busy repairing their balance sheets to lend it out. But there is nothing like deflation to bring on hyperinflation: Governments desperate to prop up prices and economies, despite being broke, print reams of money -- money that eventually enters the market in a rush, flipping deflation to inflation. If you can get a copy of Adam Ferguson's 1975 book "When Money Dies" (soon to be republished), you will find an excellent account of how this happened in the Weimar Republic. It might not happen again but, at this point, it would surely be foolhardy to discount it entirely. Finally, a word on the ads for gold on TV. There is much muttering about them being a sign of the top. But that is to misunderstand the direction of the flow. The ads aren't selling gold to willing punters. They are persuading them to sell their gold at a discount to the spot rate. That's a very different thing -- more suggestive of awareness of gold beginning to enter the public mind than of a bubble. Either way I'd ignore the ads. If you have gold, you should hang on to it. If you haven't, you should use the pull-back in price to get some. I've written here before about the Blackrock Gold & General Fund and gold ETFs but another fund that might be worth holding is Junior Mining, which specialises in smaller mining companies. ----- Merryn Somerset Webb is editor-in-chief of Money Week. The views expressed are personal. Join GATA here: World Resource Investment Conference * * * Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Anglo Far-East Bullion Co., the Original Private Bullion Custodian For two decades Anglo Far-East Bullion co. has been providing select international clientele the highest degree of privacy, security, and access to buy, hold, and sell allocated gold and silver bars. -- Allocated gold and silver bars: AFE will not only provide you with the individual bar numbers of the bullion bars you own, but you can also rest safely in the knowledge that each bar is sight-verified by a top Swiss auditor and annually checked off against AFE accounts to ensure that your metal is locked away safely. -- Guaranteed market access and liquidity: AFE buys and sells directly with LBMA-certified metal refineries only. In bypassing the commodities market exchanges such as the Comex and bullion banks, AFE provides clients a means of access to the global physical precious metals markets that may not be available to others should systemic issues in the bullion markets arise. -- Stand for delivery: If at any time you wish to take delivery of your metal, AFE will arrange to have bars shipped to you anywhere in the world. -- Zero tolerance for leverage: AFE refuses to deal with "paper gold." We believe our clients want the metal itself so they may avoid the risks of the paper markets. AFE will not introduce such risk to its clients. -- Metal vaulted outside the banking system: None of AFE's clients have to worry that their metal is exposed to encumbrances bearing on bullion banks and commodities markets. None of AFE's vaulting partners or other strategic providers are controlled or majority-owned by banks. This is by design, not by accident. -- Access to the LBMA system of refineries, vaults, and security providers. This allows AFE clients to maintain London Good Delivery status of their metal, ensuring ease of sale or transfer, while being insulated from the "paper gold" market. -- Total privacy: AFE accounts are managed as numbered accounts in the Swiss private banking tradition. At no time does identifying information such as name and address appear on any account statement or other account documents. -- Geo-political diversification: In the words of the wise King Solomon, "Place a portion of seven and eight throughout the land, for you know not where evil may arise." Many of AFE's clients choose AFE specifically because their metal is safely vaulted outside the jurisdiction they reside in. -- Iron-clad governance: By contract with AFE's vaulting provider, no access may be made to the vaults without the attendance of an agent of the vault as well as an agent of the third-party signatory trustee, in this case top Swiss auditor Grant Thornton. All metal going into and -- more importantly -- coming out of the vaults requires the approval of a third-party signatory trustee as well as a detailed, sight-verified report of each bar and serial number by the auditor. For more information and a personal consultation with one of our private account liaisons, please contact us: Anglo Far-East Bullion Co. |

| Merryn Somerset Webb: The only currency that can't be printed on a whim Posted: 23 May 2010 12:44 PM PDT By Merryn Somerset Webb http://www.ft.com/cms/s/2/d6a8da26-64fd-11df-b648-00144feab49a.html You probably think gold is in a bubble. After all, it hit new highs in dollars, pounds, and euros this week -- and has pretty much quintupled since its lows of 2001. What's more, everyone from Germany to China is still nuts for it. Earlier in the week, this newspaper reported that the Germans have been snapping up coins and gold bars faster than they did even in the aftermath of the Lehman Brothers' collapse. In the UAE you can buy bars direct from a vending machine. At Harrods you can pick up a variety of gold coins over the counter. And -- as the gold bears are keen to point out -- you can see ads for the purchase of gold all over TV. But look at the actual price of gold and it is hard to see real evidence of a bubble. Gold may have hit new highs in nominal terms, but it hasn't come close to hitting its old highs in real terms. Adjust the 1980 high of $850 for US inflation and you get a price of around $2,400 -- a level only the most bullish are predicting even now. ADVERTISEMENT Prophecy Resource Corp. Appoints Rob McEwen to Advisory Board Prophecy Resource Corp. (TSX.V: PCY, OTC: PCYRF) is pleased to announce the appointment of Rob McEwen to the company's Advisory Board. McEwen is a leading Canadian mining industry entrepreneur. He is the chairman and CEO of U.S. Gold Corp. and Minera Andes Inc. McEwen was the founder and former chairman and CEO of Goldcorp Inc., whose Red Lake Mine in northwestern Ontario, Canada, is considered to be the richest gold mine in the world. During his tenure at Goldcorp, McEwen transformed the company from a collection of small companies into a mining powerhouse, growing its market capitalization from $50 million to approximately $8 billion. For Prophecy Resource Corp.'s complete statement: http://www.prophecyresource.com/news_2010_mar11b.php Then look to the last few years. The bears would have you believe that the gold price has somehow gone "parabolic." But, in fact, the price in US dollars has risen only around 25 per cent in the last two years. Compare that with, say, shares in Rockhopper Exploration, the lucky owner of the prospects where oil was struck off the Falklands the week before last. Its shares started the month at around 40p and have since more than quadrupled. But no one is shouting "bubble!" Far from it. Instead, they are all claiming the company has seen a transformational event, which makes its shares worth more than they are even now (which arguably they are). But hasn't there been a transformational global event that has changed the case for gold too? Back when gold's bull run kicked off, there were precious few gold bugs and we tended to make the case for the metal based on likely demand for "bling" from the new middle classes of emerging markets. We mentioned only in passing the fast rising US national debt and the nagging fear that fiat currencies might not be all they were cracked up to be. Today, however, gold has reverted to its historical role as the global currency of the last resort. You no longer buy it because you think the Chinese and Russians are likely to up their consumption of gold-plated mobile phones. You buy it because you think there is a chance that governments, caught in a debt trap from which there is no honourable escape, will eventually think they have no choice but to print their way out of it. And the risk of hyperinflation is a transformational event for gold -- it being the only global currency that can't be printed on the whim of a central bank. All that said, there is a strong chance that we might see a short-term falloff in the gold price. Why? Partly because high prices are putting off India's jewellery buyers. Partly because there is likely to be a short hiatus in new investor buyers coming to the market -- if you haven't panicked yet, you will need a new crisis before you do so. But mostly because, after the mini-inflation scare following the ECB's bailout plans for Europe, we seem to be having a deflation scare. Prices may be stubbornly rising in the UK but Spain is now in outright deflation (exclude energy and food, and prices are falling) and core inflation across Europe and the US is very low. The endless money-printing across the world has not yet brought us proper inflation simply because the mechanism for passing it on isn't working very well: The banks are too busy repairing their balance sheets to lend it out. But there is nothing like deflation to bring on hyperinflation: Governments desperate to prop up prices and economies, despite being broke, print reams of money -- money that eventually enters the market in a rush, flipping deflation to inflation. If you can get a copy of Adam Ferguson's 1975 book "When Money Dies" (soon to be republished), you will find an excellent account of how this happened in the Weimar Republic. It might not happen again but, at this point, it would surely be foolhardy to discount it entirely. Finally, a word on the ads for gold on TV. There is much muttering about them being a sign of the top. But that is to misunderstand the direction of the flow. The ads aren't selling gold to willing punters. They are persuading them to sell their gold at a discount to the spot rate. That's a very different thing -- more suggestive of awareness of gold beginning to enter the public mind than of a bubble. Either way I'd ignore the ads. If you have gold, you should hang on to it. If you haven't, you should use the pull-back in price to get some. I've written here before about the Blackrock Gold & General Fund and gold ETFs but another fund that might be worth holding is Junior Mining, which specialises in smaller mining companies. ----- Merryn Somerset Webb is editor-in-chief of Money Week. The views expressed are personal. Join GATA here: World Resource Investment Conference * * * Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Anglo Far-East Bullion Co., the Original Private Bullion Custodian For two decades Anglo Far-East Bullion co. has been providing select international clientele the highest degree of privacy, security, and access to buy, hold, and sell allocated gold and silver bars. -- Allocated gold and silver bars: AFE will not only provide you with the individual bar numbers of the bullion bars you own, but you can also rest safely in the knowledge that each bar is sight-verified by a top Swiss auditor and annually checked off against AFE accounts to ensure that your metal is locked away safely. -- Guaranteed market access and liquidity: AFE buys and sells directly with LBMA-certified metal refineries only. In bypassing the commodities market exchanges such as the Comex and bullion banks, AFE provides clients a means of access to the global physical precious metals markets that may not be available to others should systemic issues in the bullion markets arise. -- Stand for delivery: If at any time you wish to take delivery of your metal, AFE will arrange to have bars shipped to you anywhere in the world. -- Zero tolerance for leverage: AFE refuses to deal with "paper gold." We believe our clients want the metal itself so they may avoid the risks of the paper markets. AFE will not introduce such risk to its clients. -- Metal vaulted outside the banking system: None of AFE's clients have to worry that their metal is exposed to encumbrances bearing on bullion banks and commodities markets. None of AFE's vaulting partners or other strategic providers are controlled or majority-owned by banks. This is by design, not by accident. -- Access to the LBMA system of refineries, vaults, and security providers. This allows AFE clients to maintain London Good Delivery status of their metal, ensuring ease of sale or transfer, while being insulated from the "paper gold" market. -- Total privacy: AFE accounts are managed as numbered accounts in the Swiss private banking tradition. At no time does identifying information such as name and address appear on any account statement or other account documents. -- Geo-political diversification: In the words of the wise King Solomon, "Place a portion of seven and eight throughout the land, for you know not where evil may arise." Many of AFE's clients choose AFE specifically because their metal is safely vaulted outside the jurisdiction they reside in. -- Iron-clad governance: By contract with AFE's vaulting provider, no access may be made to the vaults without the attendance of an agent of the vault as well as an agent of the third-party signatory trustee, in this case top Swiss auditor Grant Thornton. All metal going into and -- more importantly -- coming out of the vaults requires the approval of a third-party signatory trustee as well as a detailed, sight-verified report of each bar and serial number by the auditor. For more information and a personal consultation with one of our private account liaisons, please contact us: Anglo Far-East Bullion Co. |

| Posted: 23 May 2010 12:29 PM PDT Jim Sinclair's Commentary If the financial bill contained no significant controls, if not elimination of the OTC derivative market, it is hollow and meaningless. Wall St. money floods D.C. in finance bill fight WASHINGTON – Last Wednesday, Representative David Scott, Democrat of Georgia, mingled with insurance and financial executives and other supporters at a lunchtime fund-raiser in his honor at a chic Washington wine bar before rushing out to cast a House vote. Nearby, supporters of Representative Michael E. Capuano, Democrat of Massachusetts, gathered that evening at a Capitol Hill town house for a $1,000-a-head fund-raiser. Just as that was wrapping up, Representative Peter T. King, Republican of New York, was feted by campaign donors at nearby Nationals Park at a game against the Mets. It was just another day in the nonstop fund-raising cycle for members of the House Financial Services Committee, which has become a magnet for money from Wall Street and other deep-pocketed contributors, especially as Congress moves to finalize the most sweeping new financial regulations in seven decades. |

| Posted: 23 May 2010 12:25 PM PDT Dear Jim, The "Recovery" continues apace. Regards, April mass layoffs rise led by manufacturing (Reuters) – The number of mass layoffs by U.S. employers rose in April led by manufacturers who shed workers even as the economy began to recover. The Labor Department said the number of mass layoff events — defined as job cuts involving at least 50 people from a single employer — increased by 228 to 1,856 as employers shed 200,870 jobs on a seasonally adjusted basis.

ABC of Silver (&Gold) A – The surge above the 1/20/10 gap on a sign of strength on 5/11 was a technical breakout. B – The subsequent break below the 5/11 gap on a significant contraction in volume was a false breakdown that will be reversed in time. C – The retest of the 5/5 gap on decreasing volume suggests that the downside force is waning. Whatever cannot go down with force will reverse and attempt to go up with force. The reversal should come once the margin selling subsides in both gold and silver. |

| Inflation-Proof Deflation Hedge Posted: 23 May 2010 11:40 AM PDT |

| Posted: 23 May 2010 11:19 AM PDT |

| Don't come to Kitchen unless you want burns Posted: 23 May 2010 10:40 AM PDT This topic is about staying out the Precious Kitchen or risk getting burned. You want the proper appliances and enough space to move around. Espcecially if you have a large family of 5 to feed. Goldies recommends you load on shisk Kabobs. These are tasty spears. Getting a nice kitchen requires many dollars.  This isn't a spike but a correction to the upside. Its okay to have hardwood floors but getting hardwood walls, too, is a sign of decadence. |

| Government’s mortgage-modification program a disaster Posted: 23 May 2010 10:37 AM PDT By Sol Palha, Tactical Investor So there we have it; this great programme that was supposed to bring relief to thousands of homeowners has turned out to be a curse in disguise. Individuals had to wait months to find out if they would qualify for the programme. While waiting, they continued to make payments only to find out that in the end they did not qualify. Isn't this just lovely? You have one foot in the grave and the government instead of offering a helping hand hands you a shovel and tells you to start digging. Avoid the housing sector, and if you are aggressive consider shorting stocks such as BZH and LEN; use strong rallies to open up new positions.

The government's mortgage-modification program has left some struggling homeowners worse off than they were before. The Treasury reported Monday that nearly one in four homeowners who were offered lower payments under the Obama administration's 15-month-old effort have been weeded out of the program. Many people were removed from the trials because they failed to make payments, didn't provide all the financial documents needed to qualify or were found to be ineligible. Homeowners are first offered trial modifications under the program, which provides incentive payments to loan servicers, investors and the homeowners. If borrowers make the payments and satisfy other criteria, those trials are made permanent, ensuring a cut in payments for five years. While awaiting answers, some borrowers keep making payments, exhausting their savings in what may be a futile effort to save their homes. They also incur fees from the banks and delay taking action that might give them a fresh start in a more affordable home. Some borrowers had unrealistic expectations about loan-relief programs, which were never designed to prevent all foreclosures. Another big problem is that banks often take six to 12 months to determine whether applicants are eligible. "I had to learn the hard way and deplete my savings doing it," said Mia Parry, a manager at a mortgage brokerage in Scottsdale, Ariz., who has spent nearly two years seeking a loan modification. She now wishes she had put her home on the market. Most struggling borrowers do benefit from seeking help, said Aaron Horvath, a senior vice president at Springboard Inc., a nonprofit counseling service based in Riverside, Calif. Some win modifications, cutting monthly payments by hundreds of dollars. Others who ultimately can't get modifications at least are allowed to stay in their homes for months, making either no payments or reduced payments. But "if you're draining your savings" in a vain effort to hang onto a home, he said, you may end up worse off. Full story

Disclosure

We have no positions in the stated investments More articles from the Tactical Investor…. |

| Billionaire “Bull of Bullion” Holds Roughly $2B in Gold-Related Assets Posted: 23 May 2010 10:37 AM PDT There's a great deal of debate about where gold is headed next, but at least one billionaire investor has more than made up his mind. Thomas Kaplan, the chairman and chief investment officer of Tigris Financial Group, fears excessive government spending has failed to stop contagion in the world financial system, and that the downturn is likely to get worse before it gets any better. In light of the situation, gold is his favorite investment… by far. From The Wall Street Journal: "Many fund managers and high-rollers have allocated small percentages of their portfolios to gold as a hedge against inflation. But Mr. Kaplan is the bull of bullion. He has gone further than perhaps any other major investor, betting the majority of his wealth on gold and other precious metals. And it reflects his deeply held conviction that global economic instability could bring rising demand for gold. "Through his firm, Tigris Financial Group, and affiliates, Mr. Kaplan has loaded up on bullion and bought up properties in 17 countries on five continents, where geologists are exploring for more. Tigris subsidiaries have taken stakes in mining companies, including tiny firms that have yet to produce an ounce. "Though he won't disclose how much physical gold he owns, Mr. Kaplan, who is 47 years old, controls up to 30% of the shares in some so-called junior miners. Together, his holdings amount to a nearly $2 billion bet on gold, more than the Brazilian central bank's bullion is currently worth. 'I've reached a point where I feel the only asset I have confidence in is gold,' Mr. Kaplan said in an interview at Tigris's midtown Manhattan headquarters." Kaplan sees a bet on gold as being relatively conservative, and that either way markets turn there's hope in the yellow metal. He describes his view, "If the world does well, gold will be fine. If the world doesn't do well, gold will also do fine… but a lot of other things could collapse." His confidence largely stems from the lack of major recent gold mine discoveries, especially given how much time is required to get a new find up and running. He points out that if gold demand holds steady, or continues to increase, the supply still won't be there, and prices are likely to stay higher. You can read more about the "bull of bullion" in The Wall Street Journal's coverage of a billionaire going all-in on gold. Best, Rocky Vega, Billionaire "Bull of Bullion" Holds Roughly $2B in Gold-Related Assets originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." More articles from The Daily Reckoning…. |

| World’s Most Valuable Coin, 1794 Flowing Hair Silver Dollar Posted: 23 May 2010 10:35 AM PDT The Neil/Carter/Contursi specimen 1794 Flowing Hair silver dollar has been sold for $7,850,000, setting a new record as the world's most valuable rare coin. |

| Bullion Prices & Business Weekend Recap – May 22, 2010 Posted: 23 May 2010 10:35 AM PDT

Gold's weekly decline was the largest in nearly 15 months. Palladium and palladium posted double-digit percent losses in two days that held for the week. And crude dropped Friday for a ninth day. Although U.S. and European stocks rallied on Friday, major indexes posted weekly losses of between 3.64 percent and 5.02 percent. (…) © CoinNews.net for Coin News, 2010. | |