Gold World News Flash |

- ReachLocal, Accretive Health IPOs Gain as Broader Markets Face Challenges

- Thoughts on the Markets, Sovereign Debt, The EU and the Right Time to Invest

- S&P 500 One Day Declines of 3% or More

- Drillers Are Oversold - Is It Bottom Fishing Time?

- the big Gold BUST! Fortune CNN - opinions?

- Housing Data: A New 'Bust-Bust' Cycle?

- Inflation: CPI vs. Core CPI vs. Food and Energy CPI

- Tedbits: The Policies of Insolvency, part III

- Tedbits: The Policies of Insolvency, part III

- The Goldsmiths—Part CXLII

- Markets, Bottoms and Dow-Gold Intersection

- Why China's Property Bulge Is Nothing Like the U.S. Mortgage Implosion

- All Gold Funds Are Not the Same

- The Logic of selling Gold in May and going away

- Model Portfolio Update 9:15PM EST

- Focus On What Matters

- The Logic of selling Gold in May and ‘going away.’

- 'Perfect storm' as market tremors hit China, Europe and the US

- Our Perspective From China, Canada vs. U.S., Behind Today’s Stock Selloff and More!

- Germany, Greece and Exiting the Eurozone

- Hourly Action In Gold From Trader Dan

- Jim?s Mailbox

- Tedbits: The Policies of Insolvency, Part II

- How to Buy Gold, Part II: Three "Must-Own" Gold Investments

- GFC1 versus GFC2

- The Danger Of Shorting Holes

- Grandich Client Update – Short But to The Point 3:15PM EST

- Chinese Citizens Buying Gold With Both Hands

- LGMR: Gold Hits 2-Week Low as "Lehman Crash" Repeated by Fund Liquidation Rumors

- First Part Accomplished 8:40AM EST

- Down Does Not Equal Oversold

- The Economic Recovery Myth

- Beauty is Truth

- Senate Passes Faux Financial "Reform" Bill

- Watch Out for the “Anti-Growth” Trade!

- Paul Kruger has lots of new friends in Europe

- Gold Seeker Closing Report: Gold and Silver Fall With Stocks, Dollar, and Oil

- China's Worst Case

- The Endless Bear Market?

- Gold Prices Drop 0.4%, Silver Falls Below $18, Platinum Pummeled

- Chinese Catch the Gold Bug

- Five Things to Consider Before You Buy That Gold ETF

- U.S. Stocks Plunge Most in Year; DOW drops 376.36 (3.6%)

- Capital Gold Group Report: Gold Prices Curb Meltdown

- Gold and Greece: not what you think

- Old pict of a Gold Buffalo

- The Swiss Did It!?

- Fed Up

- Silver will be $100 per Forbes

| ReachLocal, Accretive Health IPOs Gain as Broader Markets Face Challenges Posted: 20 May 2010 07:09 PM PDT Renaissance Capital IPO Research submits: As fears over the European debt crisis dominated the broader markets this week, IPOs also saw a pullback in deals with only two IPO pricings this week: private equity-backed Accretive Health (AH), which offers outsourced revenue cycle management services to hospitals, and ReachLocal (RLOC), an Internet marketing company that targets small businesses with its localized sales force. Both companies were forced to cut their offer prices by 20% and 28%, respectively, from the midpoints of their initial ranges, as investors pushed for a more attractive discount in the current buyer's market. Complete Story » |

| Thoughts on the Markets, Sovereign Debt, The EU and the Right Time to Invest Posted: 20 May 2010 07:00 PM PDT  Jeff Miller submits: Jeff Miller submits: Eventually market prices reflect reality. There is currently a disconnect between the two. I have been very good at predicting public policy outcomes, so let me start there. Complete Story » |

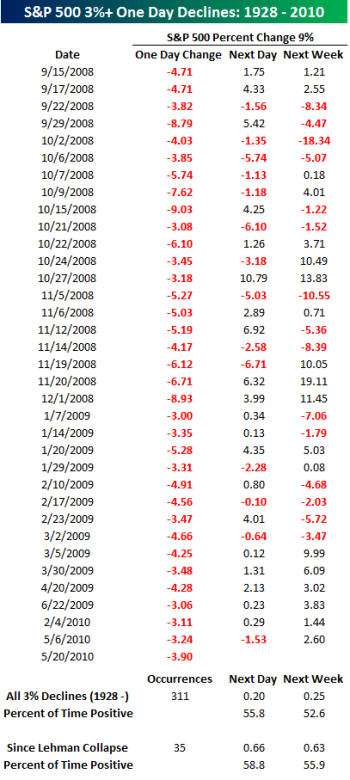

| S&P 500 One Day Declines of 3% or More Posted: 20 May 2010 06:48 PM PDT  Hickey and Walters (Bespoke) submit: Hickey and Walters (Bespoke) submit:

Thursday's 3.9% decline in the S&P 500 was the 311th time the S&P 500 has declined 3% or more since 1928. In the table above we have highlighted the 35 occurrences since the collapse of Lehman Brothers (LEHMQ.PK) in September 2008. At the bottom of the list we highlight the S&P 500's average return in the day and week after all prior occurrences, as well as the average using just the occurrences shown. Complete Story » |

| Drillers Are Oversold - Is It Bottom Fishing Time? Posted: 20 May 2010 06:25 PM PDT

Disclosure: All of the recommendation and views about the securities and companies in this report accurately reflect the personal views of the research analyst named on the cover of this report. Does not own any of the mentioned securities. Complete Story » |

| the big Gold BUST! Fortune CNN - opinions? Posted: 20 May 2010 06:25 PM PDT http://money.cnn.com/2010/05/19/news...tune/index.htm (Fortune) -- When gold prices turn skyward, like they did for the past two weeks before some recent flattening, some mix of greed, fear and uncertainty are likely ruling the market. What better time to remember what really drives prices over the long-term: market fundamentals. Through that lens, gold might not be such a hot investment. The gold market works much like any other, with supply and demand eventually equalizing, and runaway prices returning to long-term averages. Since 1980, the price of gold has averaged about $440 an ounce in U.S. dollars. But much like U.S. home prices over this decade, it can take some time for prices to return to normal. FacebookDiggTwitterBuzz Up!EmailPrintComment on this story Barclays Wealth in London predicts gold will fall to a fair value of $800 an ounce by 2012, as investors eventually dump it for riskier trades; Societe Generale, the French bank, in April 2009 predicted $800 gold by the end of 2010, though it has reversed its stance since then. Analyst John Nadler of gold deal Kitco predicts gold will fall to $900 in 2011. (See editor's note below.) Their reasoning is simple: investors are keeping prices high even as demand from non-investors is cratering. Take gold jewelry, which accounts for more than half of the world's gold market. Demand there fell 8% in the fourth quarter of 2009 and is likely to continue to fall amid high prices that turn off shoppers. For example, in India, the largest gold buying country, high gold prices this week kept Indians from purchasing metal for the gold-buying festival of Akshaya Tritiya, which in turn drove down prices. Then there's price pressure from the supply side. Higher gold prices mean miners work overtime. The supply of mine gold around the world jumped 7% last year to 2,572 tons-the second largest increase in history. Gold bullion dealer Kitco says places like China and Russia will help boost the amount of gold from mining by 4% to 6% a year through 2014. Because it costs miners about $480 on average to extract an ounce of gold, they plow ahead when prices are high, eventually leading to an oversupply situation.................. |

| Housing Data: A New 'Bust-Bust' Cycle? Posted: 20 May 2010 06:21 PM PDT Econophile submits: Again the main driver in the housing market has been tax credits. The federal government is trying to reinflate home prices and the tax credit has been their main tool. According to the latest data from CoreLogic, March home prices increased 1.7% YoY. They reported that 51 of the 100 core markets they studied increased versus a 42 market increase in February. There is a "but" to this: prices have been declining in the past three months--1.7% for January and February and another 0.3% in March. If you take out foreclosure/distressed sales from the data, from peak to trough, prices declined 21.5% through March. According to MDA DataQuick data, the market in Southern California is slowing because, among other factors, the percentage of distressed sales is declining. The flippers are starting to run out of product: Complete Story » |

| Inflation: CPI vs. Core CPI vs. Food and Energy CPI Posted: 20 May 2010 06:14 PM PDT Chris Ridder submits: Inflation was reported yesterday by bls.gov. Deflation pundits applauded, "The core CPI (which excludes food and energy) came in flat and the YoY rate is now down to 0.9% ... " (from David Rosenberg in his "Potluck with Dave" report sent out on May 19th by Gluskin Sheff & Associates Inc.). Complete Story » |

| Tedbits: The Policies of Insolvency, part III Posted: 20 May 2010 06:08 PM PDT It's time to put on your battle gear and man your stations as the "when hope turns to fear" (see 2010 outlook in Tedbits archives) moment has arrived. As the G7 financial systems lurch towards their demise, insanity is on plain display in the capitals of the developed world, with the purchasing power of all G7 currencies (Pounds, Swiss Francs, Euros and Dollars of all stripes) in free fall -- as measured in the only REAL currencies in the world: GOLD and SILVER. |

| Tedbits: The Policies of Insolvency, part III Posted: 20 May 2010 06:08 PM PDT It's time to put on your battle gear and man your stations as the "when hope turns to fear" (see 2010 outlook in Tedbits archives) moment has arrived. As the G7 financial systems lurch towards their demise, insanity is on plain display in the capitals of the developed world, with the purchasing power of all G7 currencies (Pounds, Swiss Francs, Euros and Dollars of all stripes) in free fall -- as measured in the only REAL currencies in the world: GOLD and SILVER. |

| Posted: 20 May 2010 06:03 PM PDT Gold proponents for the last couple of months have watched some major developments in the gold markets where the impacts have prompted some different interpretations. As of right now, on May 20, the most common reaction has been happiness and joy among gold investors because of price moves of precious metals. But there is some developing apprehension over the losses in the past week. For my part, there is agreement, but with a further word of caution. |

| Markets, Bottoms and Dow-Gold Intersection Posted: 20 May 2010 06:02 PM PDT |

| Why China's Property Bulge Is Nothing Like the U.S. Mortgage Implosion Posted: 20 May 2010 05:55 PM PDT Jim Trippon submits: China Economy Recovers Despite "Bubble" Rumors. Will China's Economic Growth Continue? Complete Story » |

| All Gold Funds Are Not the Same Posted: 20 May 2010 05:40 PM PDT |

| The Logic of selling Gold in May and going away Posted: 20 May 2010 05:37 PM PDT |

| Model Portfolio Update 9:15PM EST Posted: 20 May 2010 05:36 PM PDT The following is automatically syndicated from Grandich's blog. You can view the original post here May 20, 2010 05:15 PM I’ve updated model portfolio as of this evening. HAT-TSX-V continues to have quite good drill results. Stock is back to original buy area and should be part of any uranium portfolio. U-TSX is a bet on the uranium price which seems to be forming a major bottom. This comment about Continental Minerals comes from BI Research May 19, 2010: CONTINENTAL MINERALS* (KMKCF $2.17 OTC BB, +61%); BI Rank = 10.0 – Strong Buy (604) 684-6365 BC www.hdgold.com (Recommended 3/04) “Continental Minerals, which I believe is a juicy takeover target, is located in Tibetan China and has proven up 220 million tons of measured and indicated reserves in its high grade-porphyry copper-gold Xietongmen deposit grading 0.43% copper and 3.9 grams of gold per ton. This translates into 2 billion pounds of copper and 4.3 million ounces of gold. In addition, Continental's Newtongme... |

| Posted: 20 May 2010 05:36 PM PDT I know this is hard to do, especially when one is weathering draw downs. And of course a liberal dose of gloating from the bears during these times doesn't help either. But let's not get sidetracked by the little things and let's face it, the haters are going to show up every time gold corrects. We really should be used to that by now. They've been doing it for 10 years. The cold hard reality is that gold is still in a secular bull market and the naysayers are having to ply their trade from ever higher levels. So let's take a look at what's really happening shall we. ... |

| The Logic of selling Gold in May and ‘going away.’ Posted: 20 May 2010 05:36 PM PDT (Should you invest – or should you trade?) Charts courtesy Stockcharts.com Featured is the gold price in 2001. Selling in May and buying back right after Labor Day would have yielded a small profit, provided that the sale was made right at the top in May (not easy). Featured is the gold price in 2002. Selling gold at the top of trading during May and buying back after Labor Day would have produced a small profit, assuming you were smart enough to wait until the last day of May to sell your gold. Featured is the gold price in 2003. Selling in May and buying back in September would have caused a loss that year. Featured is the gold price in 2004. Selling in May and buying back in September would have produced a loss even if you were smart enough to wait till the last day in May to sell. Featured is the gold price during 2005. Selling in May and going away would have cost money that year. Featured is the gold pri... |

| 'Perfect storm' as market tremors hit China, Europe and the US Posted: 20 May 2010 05:36 PM PDT |

| Our Perspective From China, Canada vs. U.S., Behind Today’s Stock Selloff and More! Posted: 20 May 2010 05:36 PM PDT The 5 min. Forecast May 20, 2010 01:02 PM by Addison Wiggin & Ian Mathias [LIST] [*] The Great Wall, automatic weapons and you… [*] Canadians come calling in Beijing… why China’s a more attractive customer than Uncle Sam [*] Another big U.S. sell-off… The “unexpected” numbers behind it [*] Readers scold us on naked short selling, silver market manipulation… we attempt to clear the air [/LIST] Before the market opened in New York this morning, we’d visited the largest (empty) mall in Asia, fired automatic weapons at a Chinese military research facility near the Great Wall and, by chance, met the chief of a small village 40 minutes west of Beijing. We may have hindered this gentleman’s chances of getting re-elected “chief” of his village this morning. But we’re not here just to amuse ourselves. Really. We’ve been talking to private equity guys, financial writers, hedge fund manage... |

| Germany, Greece and Exiting the Eurozone Posted: 20 May 2010 05:36 PM PDT The cause célèbre these days is the potential reconstitution of the eurozone: ie, Germany leaving it, or Greece getting kicked out. To look a little deeper, today I'm sending you STRATFOR's take on these two scenarios. STRATFOR explores the geography of the continent and the historical context of the EU to understand what a German exit or a Greek expulsion might mean for the rest of the region. After you read the article, sign up here to receive more STRATFOR global intelligence reports like this one. John Mauldin Editor, Outside the Box Germany, Greece and Exiting the Eurozone By Marko Papic, Robert Reinfrank and Peter Zeihan Rumors of the imminent collapse of the eurozone continue to swirl despite the Europeans' best efforts to hold the currency union together. Some accounts in the financial world have even suggested that Germany's frustration with the crisis could cause Berlin to quit the eurozone - as soon as this past weekend, according to some ... |

| Hourly Action In Gold From Trader Dan Posted: 20 May 2010 05:36 PM PDT |

| Posted: 20 May 2010 05:36 PM PDT View the original post at jsmineset.com... May 20, 2010 01:09 PM Euro Intervention Would Buy 'Time But Little Else,' Barrow Says CIGA Eric The capital markets (gold, equity, bonds) follow time, and Barrow is right, they are running out of it. Equities cycle low March 06 2009 Important Dates Hz Date —- ——- 17.2 – 08/10/10 25.8 – 04/29/11 34.4 – 01/16/12 Any government intervention in the foreign-exchange market to support the euro after its recent plunge would "buy policy makers time but little else," according to Standard Bank Plc analyst Steven Barrow. Source: bloomberg.com More… Dear Jim, I used to get nervous on days like today. String together a few of them like we have had this week and it can be quite unsettling. Fortunately, my teacher has taught me well and with his education has come my confidence out of a greater understanding of what is truly occurring. The market will rule the day in the end a... |

| Tedbits: The Policies of Insolvency, Part II Posted: 20 May 2010 05:36 PM PDT Death, er… Debt Spirals; Blow Out and BLOW UP As the currency and financial systems of the developed world’s social-welfare-states head towards their doom, the battles between King Kong (Mother Nature and Darwin) versus Godzilla (public servants and banksters) continue. After generations of defying the reality that you must produce more than you consume, the social welfare states are being presented with the bill for their unpayable social obligations. Modern day kings and their courts in developed world capitals are learning what King Canute once did: you CANNOT stop the tides from rolling over you; man is not god; he cannot command nature or defy its laws (i.e., survival of the fittest and producing more than you consume or perish/submit to those who do) and to believe he can is FALSE. POLITICS and MAN WILL NOT PREVAIL OVER NATURE or MARKETS (which are nature). Morally and fiscally-bankrupt public servants, ratings agencies and finance ministers c... |

| How to Buy Gold, Part II: Three "Must-Own" Gold Investments Posted: 20 May 2010 05:36 PM PDT By Dr. Steve Sjuggerud Thursday, May 20, 2010 My good friend Van Simmons knows more about making money in gold than anyone I know – and probably more than anyone in the world. Yesterday, I published the beginning of a conversation we had this week. But our talk didn't end there. Van also had some surprising things to say about gold stocks. For example, I was surprised to hear Van admit he has more money in gold stocks right now than gold bullion or rare coins. He explained why: "Well, put simply, rare coins and gold stocks haven't kept up with the rise in the price of gold. Typically rare coins and gold stocks give you a lot of leverage to the price of gold. A 50% move in gold has historically meant, say, two, three, or five times your money in rare coins and gold stocks. But we haven't seen those moves yet." The chart on this page shows what he means. It's a five-year chart of the price of gold versus gold stocks, in percentage terms. Gold has nearly... |

| Posted: 20 May 2010 05:36 PM PDT By Neil Charnock www.goldoz.com.au When the Rudd Unworkable Super Tax (RUST) was first announced I stated that we may not be the only ones here in Australia to suffer from this type of tax. Governments in many countries are worried about falling revenue as economic contraction bites. Plucking the goose that lays the golden egg is now thought to be contagious according to Evy Hambro of BlackRock Investment Management Ltd. This could mean that the selling of the Australian gold stocks was over done leaving them now heavily oversold. We have had our 'Swan dive' so it is already factored in for now. The dive started two weeks ahead of the announcement of the tax proposal in the media. The industry is smarting and negotiating and I support them however I can. I have forecast that the gold stocks would be fantastic buying "at their best in May and June" this year and have not been disappointed. I am gradually loading up and have just completed an update of o... |

| Posted: 20 May 2010 05:36 PM PDT Market Ticker - Karl Denninger View original article May 20, 2010 11:25 AM It's always unwise, but especially so when you have government actors (like, for instance, the Japanese Central Bank) willing to come in and break every rule in the book (which they're immune from, of course) to screw you. If you're wondering how bad that could have been it's about $5,600 margin to trade one contract, but each TICK (0.0001) is $12.50. That was 259 ticks for the duration of the squeeze in a little less than two hours, or $3,237.50. If you were short one contract you lost about 60% of your margin in less than two hours. This is a grand way to blow your account to bits, if you're nuts enough to get involved in such a thing and not be continually watching it. Impressive stuff, and once it got going it fed on itself for a while too, no doubt having been strategically initiated right about the time the margin clerk starts looking at things. It's great to be able to man... |

| Grandich Client Update – Short But to The Point 3:15PM EST Posted: 20 May 2010 05:36 PM PDT The following is automatically syndicated from Grandich's blog. You can view the original post here May 20, 2010 11:15 AM Keeping in mind the potential conflicts of interest/biases and the fact that this is gambling/speculation (I've lost $1million+ in last two weeks on paper), here's a quick assessment of my client companies: Alderon Resources – Hope to have a report out soon. Anooraq Resources – A new management team has done wonders in turning the company around and appears poised to become a leading PGMs producer. Looking for a much improved 2nd quarter. Crescent Resources – The address play has failed to materialize. I'm to have a discussion with management in the near term to get a feel for their plans and will report back afterwards. Crocodile Gold Corp – Hindsight is 20-20 but raising 2010 production estimates only to lower them back to the original target a few months later seems to have created unnecessary disappointment. All other matters outside of potential tax... |

| Chinese Citizens Buying Gold With Both Hands Posted: 20 May 2010 05:36 PM PDT Well, by the time I hit the 'send' button on Tuesday's column in the wee hours of yesterday morning, it was obvious that Wednesday was going to be a bad day for both gold and silver... and it was. Platinum and palladium got creamed as well... especially palladium. But none of the precious metals prices went down of their own free will... they had some help. It's obvious looking at the gold graph that there were four different bouts of selling... with the first one starting at exactly 8:00 p.m. Eastern time during early Wednesday trading in the Far East. This point was also gold's high price of the day of around $1,127 spot. The next sell-off began around 9:30 a.m. in London, the third time was shortly after 9:30 a.m. in New York... and the last time was shortly before lunch. The last little sell-off just before noon took gold to its low of the day at $1,185.90 spot. Silver's high for Wednesday was its opening price in Far East trading yesterday... $18.99 spot... |

| LGMR: Gold Hits 2-Week Low as "Lehman Crash" Repeated by Fund Liquidation Rumors Posted: 20 May 2010 05:36 PM PDT London Gold Market Report from Adrian Ash BullionVault 08:40 ET, Thurs 20 May Gold Hits 2-Week Low as "Lehman Crash" Repeated by Fund Liquidation Rumors, Empty Coin-Dealer Shelves in Europe THE PRICE OF GOLD in wholesale, professional dealing fell further on Thursday in London, dropping to a two-week low vs. the Dollar as Asian stock markets closed sharply lower and an early rally in Eurozone shares flipped into a 2% plunge. The Dollar rose once again with the Japanese Yen, as crude oil lost 2% to $68 per barrel and broad commodity markets lost 1%. New data showed the Japanese economy expanding less quickly than analysts forecast, with domestic price deflation hitting 3.0% annually – the worst rate of falling prices on record, 20 years after Tokyo's stock-market and real-estate bubbles burst. "Hearing rumors of funds liquidating gold positions," said one London journalist in an email today, admitting they "might be unfounded". "We believe that one of ... |

| First Part Accomplished 8:40AM EST Posted: 20 May 2010 05:36 PM PDT The following is automatically syndicated from Grandich's blog. You can view the original post here May 20, 2010 04:43 AM In my gold comment last evening, I said “…In a perfect world, opening lower tomorrow and then closing above $1,200 would all but do the trick for me…”** My only “hedge” was possible weakness through Comex option expiration next Tuesday. With gold at $1,175 and silver $17.56 as my fat fingers type (no, I’m not the fat finger from a couple of Thursday’s ago) , high-risk speculators could go long gold and silver here. Space helmets on Captain Video! [url]http://www.grandich.com/[/url] grandich.com... |

| Posted: 20 May 2010 05:23 PM PDT Well, I said that I thought we would revisit the flash-crash lows, and we seem to be well on the way there with yesterday’s 3.9% decline on heavy volume of better than 2bln shares. I thought that would happen (although I didn’t think it would happen so quickly) since the reason the market was declining – it was pricing in a normal, or even faster-than-normal, recovery and was even a bit frothy for that, while the trends in global growth seem to be rolling over and the fissures in the financial system seem to be growing wider – had nothing to do with the sudden breakdown in liquidity we saw that one day. But the perennial bulls seem perplexed by the mathematics, as they always are. They seem not to understand the mathematical reality that for most developed nations, debt and deficits are so large and demographic trends so poor that lower spending and/or higher taxes and/or monetization are inevitable. They are enthusiastically invested in over-levered financial institutions that have not gotten significantly less levered, and moreover whose market valuations imply ongoing high leverage, wide spread, and high turnover (all of which are threatened by regulation). They welcome government intervention in messy markets, not recognizing that little good can come of quickly-written, populist government policies designed to damage the entities that add liquidity to markets, to erect barriers against trade, and to manipulate markets. Complete Story » |

| Posted: 20 May 2010 05:02 PM PDT "Beauty is truth; truth beauty," the poet, John Keats famously mused in his "Ode on a Grecian Urn." Neither Greece nor Goldman Sachs can seem to get the hang of this concept. Grecian finances, for example, illustrate an opposing principal: deception is ugly. For more than a decade, the Greeks have engaged in a mass deception - that a revenue-starved nation could finance generous social programs. The idea was never viable, feasible or legitimate. But the Greeks wanted to believe it...and so did the rest of the European Union. They all wanted to believe that Greece's last six defaults were a fluke - that the new and improved Greece would behave nothing like the old, profligate one. The truth would have been better. Greece would have been better off if it had never started its game of make-believe. If, instead of pretending it could afford the unaffordable, it had devised a plan for maintaining legitimate solvency. The Greeks didn't do that. Instead, they joined the euro bloc and pretended to "act German." For eleven years this charade succeeded. But the Greeks are not German. (They aren't even French). Like many American marriages, Greek finances inhabit a chronic state of crisis, interrupted by brief interludes of calm. But the Greeks are not unique. The nations of the West are full of deadbeats. The Spaniards and Portuguese play make-believe as well as the Greeks. And so do the Italians. But make-believe is not just a Mediterranean game; it is an international game. And no one plays it better than Uncle Sam. He also pretends to possess the means to "make good" on his debts. And so far, his creditors believe him. Your editors don't. We think the guy is "all hat and no cattle." We don't think Uncle Sam can actually afford to pay the debts he's got already, much less the trillions he's adding to his debt load year by year. Based on raw numbers, Uncle Sam belongs in a debtor's prison. But that doesn't stop him from borrowing even more money or dispensing more freebies to a populace addicted to "something-for-nothing" or enabling certain privileged financial institutions to leech from the taxpayers' jugular. This "system" won't work. It is not a system at all. It is half fairy tale, half scam. America's budget deficit, at 13% of GDP, is nearly identical to Greece's. And America's accumulated debts - at 86% of GDP - do not trail very far behind Greece's at 112% of GDP. But that comparison is hardly comforting. In absolute terms, no debtor can compare to America. As fellow Reckoner, Joel Bowman observed recently, "In a misguided effort to rescue the economy from the untold horrors of the 'abyss,' the prophets of modern central planning seek to transfer society's means of production from the most to the least productive class; from private fist to public mouth; from worker to moocher; host to parasite." In doing so, these charlatans shackle the current generation's liabilities to the income statements of futures generations. The nearby chart (which first appeared in the May 10, 2010 edition of The Daily Reckoning) shows the total "bare bones" funding requirement for various countries during the next three years.  Specifically, this chart shows the amount of borrowing that would be required by each country to fund anticipated deficits during the next three years and to re-finance all government debt coming due in the next three years...America's three-year funding requirement is not nothing. And America is certainly not immune to the kind of investor scrutiny that could produce a debt crisis...or a currency crisis. In a pinch, Greece could probably borrow $30 billion here or there to plug its revenue shortfall. But in a pinch of similar relative size, the US might not be able to borrow $7 trillion...especially not when the US is unable to scrounge up cash from its own citizens. "For the 19th consecutive month, the national budget fell disastrously short of anything close to balanced," Joel recently observed. "According to the Treasury Department's own figures April's $82.7 billion deficit was almost four times the shortfall registered in the same month last year. The official tally only tells part of the story. Sadly, it was the best part." As Addison Wiggin observed last week in The 5-Minute Forecast, "That figure of $82.7 billion is merely the 'BS' figure the Treasury puts out there when it reports the deficit. The real tell is how much the national debt grew. And in April, that figure was twice the size of the 'official' monthly deficit - $175.6 billion. "Don't look now," Addison went on, "but we're just a couple of weeks away from the national debt breaking $13 trillion. If you must know, the exact number this morning is $12,931,157,737,293.42." Historically, April tends to produce a modest surplus (or at least a mitigated deficit), thanks largely to the influx of tax receipts due around the 15th of that month. But despite the administration's assurances that the employment landscape is steadily improving, receipts were down more than $20 billion from the same month last year (2010: $245.27 billion; 2009 $266.21). Despite the severity of America's indebtedness, most people in positions of power refer to this disaster as if it were merely a broken water pipe. "We really should fix it," they say, as if we could turn a valve here or replace a gasket there and get everything running smoothly again. But no quick fix is possible. In fact based on the numbers, no long fix is possible either. This, too, is a lie...and it's not pretty. Eric J. Fry |

| Posted: 20 May 2010 04:52 PM PDT The primary trend is down... Stocks fell again yesterday. The Dow lost 66 points. The big shakeout was in the gold market - with a fall of $21. It is unusual for gold to fall more (proportionately) than stocks. So, what's the gold market trying to tell us? And why didn't it mention it before? As forecast, rates of delinquency and foreclosure are hitting new records. One of every 10 American homeowners is in trouble. Unemployment shows little sign of improvement, with hundreds of thousands of new college grads joining the jobless this month. And now this: prices are falling at the retail level too: The New York Times:

Everything is going down. Stocks. Commodities. Real Estate. China. What happened to the recovery? Is it taking a breather? Is it just 'fragile,' as most economists believe? No. It hasn't slowed down. It isn't fragile. It just doesn't exist. Paul Volcker: "Any thoughts that participants in the financial community might have had that conditions were returning to normal should by now be shattered," he said. "We are left with some very large questions: questions of understanding what happened, questions of what to do about it, and ultimately questions of political possibilities." No return to normal. No recovery. No inflation. But before you get too comfortable with falling prices, remember that they can rise suddenly. Dear readers will recall our Daily Reckoning position in the inflation/deflation debate. Asked whether we are headed towards inflation or deflation, we reply: 'Yes!' Pressed to give a more helpful response, we elaborate: 'We will have both inflation and deflation. Probably in reverse order. Prices will fall as the private sector de-leverages. But they will eventually rise, as the public sector both leverages itself with debt and then monetizes the debt by creating more dollars.' We are still in the early stages of what is to be a long period of restructuring and re-adjustment - a Great Correction. So far, the private sector has begun paying down and destroying debt. And the public sector has begun to increase its debt and destroy its own credit. Falling prices tell us that the private sector de-leveraging is continuing...and that the public has not yet lost faith in the government's money. That will come. Paul Volcker also said that "time is running out" to save US finances. You can't go on a spree, spending trillions of dollars you don't have, and not suffer the consequences eventually. Unless action is taken quickly, says Volcker, it will be too late. The Wall Street Journal reports that state pension funds may already need a $1 trillion bailout. Europe just initiated the biggest bailout to date - almost $1 trillion to bail out Greece, and spare mainly French banks from taking the losses they deserve. But Greece is in no worse shape than the US. Deficits are about the same. So is total debt, when you include the debt of Fannie Mae and other enterprises, for whose debt the feds are now responsible. And how about funding those debts? Turns out, as a proportion of GDP, America's funding requirements for this year are actually 50% greater than the Greeks. One day, investors, householders and lenders will lose confidence in the full faith and credit of the United States government. Then, even in a slumpy economy, inflation will return. People will rush to get rid of their dollars. Prices will rise, fast. This crisis has a long way to go... And more thoughts... Last night, we got in a cab and went over to a restaurant near the Peoples' Bank of China and the old city gate. We ate outside, on a rooftop terrace, looking out over the city. We were struck by awe and wonder. In the space of two decades, Beijing has turned into one of the world's biggest, most dynamic, and most appealing cities. It is 4 times New York. And five times LA. But we measure everything against Baltimore...and compared to Charm City...well...nothing is quite like Baltimore. And it's probably better that way... Beijing is striking in many ways. Coming out of the Grand Hyatt, we hopped in a cab and were immediately stuck in a traffic jam. In front of us was a Mercedes Maybach. We have only seen one of these cars before - in Germany. They are such expensive automobiles you rarely see them. And yet, we realized that there was not just one of them in front of us. There was one behind us too. It was as if we had blundered into a government motorcade...stuck between the president of Russia and the president of Dubai (if Dubai had a president). But this was just an ordinary street scene. And all around were other black, luxury automobiles. In the shopping mall under the hotel you can find any luxury brand you want. Hermes, Louis Vuitton, Gucci. And you can find dozens of fancy shopping malls in Beijing. Maybe hundreds of them. Looking out on the city lights from our restaurant terrace, we could see the town stretching out for miles in every direction. Office towers, hotels, and apartment buildings - high-rise, low-rise, in between rise - north, east, south and west. At first, we thought the center of town had probably been the site of huge government-directed investment projects. We expected the rest of the city to be miserable and poor - like the slums of Buenos Aires or 'the projects' in Baltimore. Not at all. Everywhere you look you see new buildings...construction cranes...bridges and overpasses...new restaurants...new shops... When was the last time they built an important new building in Baltimore? We can't remember. Maybe it was the Ravens' football stadium. There have been a few piddly structures erected around the harbor. But most of the building stopped with the harbor renewal projects of the '80s and '90s. Even in New York, a new building rises from time to time. But the city hasn't changed much since the '20s. It has already been built up and built out. America is what it is...and what it has been. Now, it is trying to hold onto its place...while China shoulders its way up to the bar. Regards, Bill Bonner |

| Senate Passes Faux Financial "Reform" Bill Posted: 20 May 2010 04:34 PM PDT The Senate passed a financial "reform" bill today by a 59-39 vote which won't fix any of the core problems in the financial system, and won't prevent the next financial crisis. The bill doesn't include the Volcker Rule (it wasn't even debated), doesn't break up or even substantially rein in the too big to fails, and doesn't force transparency in the derivatives market. Senator Feingold said:

Senator Cantwell agreed, saying:

Nouriel Roubini said the bill is "cosmetic", and won't stop the next crisis.

|

| Watch Out for the “Anti-Growth” Trade! Posted: 20 May 2010 04:24 PM PDT Now that most big hedge funds have completed their race to get neutral, they are holding raucous in-house debates over placing size bets on a double dip recession. This would involve reversing every trade that I have been recommending for the past 18 months, in which the hedge funds have also been running gargantuan positions, flipping from longs to shorts. On the table are new shorts in commodities, energy (USO), emerging markets (EEM), the industrial white metals of silver (SLV), platinum, (PPLT) and palladium (PALL), junk bonds (JNK), and corporate bonds. This view has traders going long the dollar and the yen (YCS) and shorting the euro (FXE), pound (FXB), and the commodity producing Australian (FXA) and Canadian dollars (FXC). Long positions would be established in the dollar, Treasury bonds, and volatility (VIX). This is not exactly a low risk trade, as it goes contrary to every long term global macro trend currently in place. If you get the double dip recession that Europe, China, and more recently, British Petroleum (BP) are trying their best to deliver, they hit a home run. If the recent diabolical market action turns out to be just a vicious head fake, then they would be selling into a hole and getting killed on the next whipsaw. They don’t call these guys the Masters of the Universe for nothing.

Stop losses and tight risk controls are the order of the day (click here for that advice at http://www.madhedgefundtrader.com/April_20__2010.html ) when “de-risking” is the dominant investment strategy, and bitter margin clerks are in the driver’s seat. For proof this is happening, you need look no further than the euro/yen cross, that great indicator of global risk taking, which has been in an absolute free fall for the last four weeks, to a gut churning ¥112. (For an explanation of why this is important click here at http://madhedgefundtrader.com/February_11__2010.html ). It hasn’t helped that credit markets have once again ground to a halt. The IPO market has gone comatose once again. The cheerleaders at CNBC have gone back to looking like they have just been kicked in the balls. You only need one ticker on your screen right now, and that is for the S&P 500 (SPX). There is now more open interest in the SPX puts than there was during the Lehman aftermath. Talk about closing the barn door after the horses have bolted. Technicians are talking about the first line in the sand at 1045. But I think that level offers all the support of a wet taco. If that doesn’t hold, then you can look at 950, which would give us a neat 22% pull back from the top. To get below that and retest the 2009 low at 667, we need a second leg down in the real estate market, which would trigger a secondary banking crisis. I don’t buy the double bottom scenario, as we have still have zero interest rates, and because most of the big players who could go under are already gone. Greece and the euro crisis alone don’t have the juice to do this alone. But I could be wrong. Suffice to say that you should only entertain the “Anti-Growth”trade if you run a global 24 hour trading desk, have a blind former frat brother for a margin clerk, and a Harvard educated legal department to make up the appropriate excuses when things blow up. Three year lock ups on client funds would also be good to have. If you don’t have all of this in place, then better to just read about it in the tabloids. The Internet is a great leveler, and enables legendary hedge fund trader, Paul Tudor Jones, and his 300 man staff to compete head to head against you. I can tell you who will win that one every time. I can’t wait to see who actually straps this one on. To see the data, charts, and graphs that support this research piece, as well as more iconoclastic and out-of-consensus analysis, please visit me at www.madhedgefundtrader.com . There, you will find the conventional wisdom mercilessly flailed and tortured daily, and my last two years of research reports available for free. You can also listen to me on Hedge Fund Radio by clicking on the “Today’s Radio Show” menu tab on the left on my home page. |

| Paul Kruger has lots of new friends in Europe Posted: 20 May 2010 04:15 PM PDT Going, going, gone. Gold is literally flying out of USA now. Torrid Demand for K-rands and U.S. $20s By Patrick A. Heller May 18, 2010 http://www.numismaster.com/ta/numis/...rticleId=10634 Demand for physical metal has soared in Europe, even as higher prices tempered demand in India and the Far East. I have tried to obtain photographs of the long lines of would-be gold buyers standing in lines on the streets outside of bullion dealerships in Europe, but could not get them by the deadline for this column. The Austrian Mint reported that it sold more gold in two weeks in late April than it had sold in the first quarter of 2010. The world's largest private refinery, Argor-Heraeus SA, reports that their sales volume has increased at least 10 times from earlier this year. The South African Mint, which produces the Krugerrand, normally sells 2,000-3,000 of these coins each week to its primary distributors. In the past two weeks, the mint has accepted individual distributor orders for as many as 30,000 coins. European demand for Krugerrands is so strong that the premium has climbed enough to make it profitable to ship supplies from the U.S. over to Europe. Perhaps as a result of the difficulty of obtaining bullion-priced coins and bars in Europe, last week we saw a surge in demand for U.S. $20 Liberties and Saint-Gaudens. One longtime dealer told me that their first order last Wednesday was for a seven-figure purchase of these coins. Prices quickly jumped at least 10 percent on circulated and lower-grade Mint State double eagles. The demand did not spill over to $10 and lower denomination coins. Right now you can purchase circulated $10 Liberties for less than half the price of the same grade of $20 Liberties, a condition I expect to be temporary. |

| Gold Seeker Closing Report: Gold and Silver Fall With Stocks, Dollar, and Oil Posted: 20 May 2010 04:00 PM PDT Gold dropped in London to see a loss of $17.85 at as low as $1174.85 by about 8:30AM EST before it climbed back higher in New York, but it still ended with a loss of 0.39%. Silver fell 3.66% to as low as $17.466 shortly after the open of trade in New York before it also bounced back higher for a bit, but it still ended with a loss of 2.26%. |

| Posted: 20 May 2010 03:36 PM PDT Before we get stuck into today's market action—and boy is there a lot of it—we did manage to put together an edited version of our Skype call with Chris Mayer, who was in the Grand Hyatt in Beijing at the time. We say "we" but it was really our video editor Ben who managed to deal with the buffering and time lapses. You find part one here and part two here. As you'll see, the Chinese picture is a lot more complex from up close than it is from far away. We talked about the economy, private equity, where Chinese stocks are listed, and the contrast between industries that are state-backed and those that are not. The call could have lasted a lot longer. Left out of the final cut was this comment from Chris, "The worst case scenario for the global economy is a full bore China collapse because there are very few answers for that." There are one or two answers, though, as you can see from the chart below. It shows the performance of the two investments we recommended in our "Exit the Dragon" report vs. the All Ordinaries since April 30th.  Thumbing through the report this morning we read this line, with emphasis added:

The big down move in the Aussie dollar in the last few days has confirmed that analysis, as has the big up-move in the first recommendation on the chart above. But Bloomberg reports earlier today that the Aussie, along with the Euro, is up on speculation that policy makers will interview to stop the big slides. They can have a crack. But if hot global investment capital flows flee risk markets and head toward what they perceive as safety, the moves in currencies could be even bigger than you expect. And we have reason to believe, as we'll explain later to Australian Wealth Gameplan readers in the weekly e-mail update, that the second investment recommendation could profit from a region that's managed to stay out of the limelight so far...Japan. But what about the broader markets? They are selling off with conviction after a brief short-covering rally. Ironically, when you restrict short selling you remove the very mechanism with which corrections are generally reversed: a short-covering rally. When shorts cover it creates the buying that's necessary to stop stocks from falling. You also get value investors wading it at lower levels. Yet policy makers—in an attempt to stop the selling—have no given traders every reason to keep selling: nobody knows what the policy is going to be tomorrow! To be fair, nobody knows anything about anything when it comes to tomorrow, except that it will probably come. If it does, it will be Saturday, which means we'd better get cracking on our update to paid subscribers. But not before noting Ross Garnaut's column in today's Australian Financial Review that government "must not be captured by private interests." It is just the sort of article that seems sensible, and so seeming, is utterly perilous for welfare of ordinary Australians. Why? The most insidious of the lines in his argument is, by our reckoning, this:

Quite obviously Garnaut suggests that it is in the public interest for Australia to pass some kind of resource rent tax in order to move toward a "more equitable distribution of income, in a way that has lower economic costs other than other measures to promote distributional equity." Huh? Leaving aside the issue of what it means for a government to base policy on promoting "distributional equity" rather than just, say respecting property and contract rights, Garnaut's argument has one humongous embedded assumption, from which another erroneous idea necessarily follows. The assumption is that there IS such a thing as the public interest. It follows that once you've established that there IS such a thing, it is the government's job to protect that interest against presumably nefarious, greedy, and rapacious private entities whose pursuit of their own benefit damages the public interest. What utter hogwash. You do have to give credit where credit is due, however. He has deployed an enormous amount of bright shiny red alluring linguistic lipstick on this pig of an argument. It sounds sensible, even if at an underlying logical level, it's self-evidently absurd. But rather than just assert its absurdity we'll say that there is no public interest. That is a term used mostly by lawyers, litigants, and policy makers who seek to justify action that would it be illegal to take against an individual. Thus, you have to fabricate and elevate a higher theoretical authority: the public interest. Before we get to the exact definition of this logical fallacy, a sensible objection should be answered: aren't there some things that promote the general welfare better than others and shouldn't we promote them? The answer to that is unequivocally yes! And the market system does promote them through the responsible stewardship of private property. People take care of what is theirs. This is proved by the tragedy of the commons, in which public property is trashed because no one takes (or has) ownership of it. What promotes the general welfare is a sound rule of law that protects individual liberty from the predations of the legislature. The general welfare is best promoted by people being free to pursue their own interests under the equal protection of a transparently made and enforce law. What promotes the public interest is the guarantee of private freedoms. Or if you want to use the lingo of the Statists, positive policy outcomes are achieved by promoting personal liberty and the rule of law. The "public interest" is in having predictable and impartial rules that don't unexpectedly or unfairly tax people for their success but punish them when they transgress the rights of others. To the extent that there IS a public interest at all, then, it's ensuring the rights of the individual to life, liberty, property, and the pursuit of happiness. Yet Garnaut's argument, in the way public interest is defined, sets a hypothetical interest of "all society" at odds with firms and individuals and then makes the government the designated and morally enlightened guardian of what's good for the public. But again, if there were such a thing as the public interest, it would probably be in protecting private citizens from the legislative and regulatory whims of those who govern them. Or preventing the government from conduction illegal searches and seizures, or prohibiting the establishment of religions, or of the right to peaceably assemble. This is why so much of the foundational law of free societies is "negative law." It is a prescription on what the government cannot and must not do. Bills of rights and charters don't define, generally, what individuals can and cannot do. They usually define precisely the limits of government power. It's in the public interest to protect individuals from the predations of government. That's a bit of political and legal theory. But logically, Garnaut is guilty of what our old classical rhetoric professor would have called the "fallacy or reification." He has "thingified" the concept of the "public interest" and pretended as if it's a real thing that has real enemies (the miners) and must be defended by real people (enlightened policy makers). It's pretty presumptuous, really. Do the people of Australia own their land? Does the Queen of England? Or do private investors own it? As a legal alien, there's only so much we know about who owns what around here. If it's the people of Australian, then it follows that any non-indigenous Australians owe, and could be coerced into paying, a rent tax to indigenous Australians. Doesn't it? Dan Denning |

| Posted: 20 May 2010 02:52 PM PDT

Bob Prechter was on Yahoo Tech Ticker on Thursday warning that "We Are On Schedule for a Very, Very Long Bear Market":

I had lunch with a fixed income manager and we talked markets. "The market wants more quantitative easing," he said. I told him "sure but Trichet said the ECB does not engage in quantitative easing". We both chuckled. I told him in a zero interest policy world (ZIRP), the only way to stimulate your economy is through your exchange rate. "That's why quantitative easing is bearish for the euro". He agreed with me that the euro is heading towards parity. On specific "conviction trades", he told me he's short Canadian Real Return Bonds, feeling that inflation expectations will wane and real rates will rise once the Bank of Canada raises interests rates in June or July. "Fundamentals are strong in Canada and inflation is not an issue". Interestingly, the WSJ carried an article on Brian Weinstein, who manages $3.1 billion BlackRock Inflation Protected Bond, the company's flagship TIPS fund, stating that he is short TIPS. Mr. Weinstein said "investors are mistaking inflation volatility for inflation -- inflation volatility means we have both inflation and deflation risk." Right now, everyone is worried about a protracted deflationary wave. There are those who fear a major crash is coming in stocks. The fixed income manager I met today told me "it's all hedge funds right now". I agreed telling him "the extreme volatility is driven by the top hedge funds who are loading up again, preparing for the next move up". Where do I see the best value going forward? The euro's demise has hammered the solar sector, so I used this as an opportunity to load up more shares. You can listen to Bob Prechter and wait for the "ultimate bottom", but my hunch is that the big hedgies are having fun toying with retail and weak institutional clients. I've had enough of doom & gloom, and I'm looking forward to the solar boom. It might not happen next week, but my bet is that solar will be the next big bubble, so I stay cool and use these sharp selloffs as a buying opportunity. Bring it on big hedgies!!! |

| Gold Prices Drop 0.4%, Silver Falls Below $18, Platinum Pummeled Posted: 20 May 2010 02:49 PM PDT

New York gold futures pared earlier losses as some investors bought on dips. It fell 0.4 percent. Silver dropped further at 2.2 percent. Platinum and palladium were driven down the most, plunging 6.8 percent and 11.0 percent, respectively. In other markets, crude oil ran its losing streak up to eight days, falling 2.3 percent, while U.S. stocks plummeted to extend recent declines. The major indexes posted losses that surrounded 4 percent. (…) © CoinNews.net for Coin News, 2010. | |

| Posted: 20 May 2010 02:48 PM PDT Patrick Chovanec submits: In a previous post, I mentioned a CCTV News report that China is seeing a recent surge of gold buying, as local investors nervous over a possible property bubble look for an alternative place to stash their cash. Here are the links to that report, both in text and video form. You can also watch my comments on the report here. According to CCTV, sales of gold for the May Day holiday in Beijing are up 70% over last year, and sales of gold bars have doubled. It notes that May is a popular season for weddings, which makes it a peak gold-buying period, but attributes this year's increase to jitters over property prices:

Another CCTV report this Tuesday suggests the shift towards gold is not limited to Beijingers, but also includes investors from Wenzhou, a southeast coastal city famous for its itinerant entrepreneurs:

I have no way of verifying these reports, but as I mentioned in my televised comments, I find it very interesting given the analogy I've always drawn between the way Chinese invest in empty apartments as a "store of value" and investment in non-productive assets like gold. So it might very well make sense that, if they are no longer so certain stockpiled real estate will act as a reliable store of value, they would opt for gold as an attractive alternative. |

| Five Things to Consider Before You Buy That Gold ETF Posted: 20 May 2010 02:48 PM PDT Tom Lydon submits: Ongoing concerns about the direction of both the U.S. and global economies has once again thrust gold ETFs into the spotlight. But before you take on this popular save-haven tool, there are five things you should know. Gold has a lot of appeal in a lot of different circumstances. Several things are driving the price to new records today: |

| U.S. Stocks Plunge Most in Year; DOW drops 376.36 (3.6%) Posted: 20 May 2010 02:45 PM PDT By Whitney Kisling and Elizabeth Stanton May 20 (Bloomberg) — A weeklong rout in stocks The Standard & Poor's 500 index plunged 3.9 percent to Tomorrow's expiration of U.S. stock options and progress on "Put your helmets on if you are long risk here," Nicolas Lenoir, chief market strategist at ICAP Futures LLC in Jersey S&P 500 Correction Gauges of financial, industrial and commodity companies Today's plunge in stocks came as the Securities and 'Question of Confidence' "It's a question of confidence," said Jack Ablin, At 1,071.59, the S&P 500 is 24 percent below its level 10 Stock futures extended declines before exchanges opened in The drop below the level may not necessarily signal more Economy Watch Today's rout came as initial jobless claims rose by 25,000 The S&P 500 has plunged about 12 percent from a 19-month 'Corrective Territory' "We are clearly in corrective territory," Robert Doll, The Chicago Board Options Exchange Volatility Index, the "It adds to the pressure," Stephen Lieber, chief Naked-Short Ban Stocks plunged yesterday as German Chancellor Angela The S&P 500 Financials Index tumbled 4.7 percent today, President Barack Obama said the financial regulation The "hordes of lobbyists" from financial firms have 'Unchartered Waters' The global slide in equities may worsen and inflows to "This is not a typical retracement," El-Erian, 51, whose The 10-year Treasury yield touched 3.2 percent today, the The benchmark U.S. Treasury note's yield may drop to 2.5 'Political Risk' "It's difficult trading Treasuries right now because we The euro erased earlier losses against the dollar amid Germany Vote on Bailout Volker Kauder, who heads Chancellor Angela Merkel's Crude oil tumbled 2.7 percent to $68.01 a barrel in New The cost to protect against defaults on U.S. corporate |

| Capital Gold Group Report: Gold Prices Curb Meltdown Posted: 20 May 2010 02:45 PM PDT by Alix Steel NEW YORK (TheStreet ) — Gold prices were reversing double-digit losses Thursday as bargain hunters beat out Gold for June delivery was rising 10 cents to $1,193.20 an ounce at the Bargain hunters were lifting the gold price as they bought the The fear that the European Union nations would not be saved by The euro resumed its fall towards its four-year low as Greece prepared for "Some have [also] used this as an excuse to take profits," says Another factor subduing the gold price is reduced risk of This news along with data from the Labor espite the respite in gold frenzy buying, the popular gold ETF, SPDR Nader says, "the fact that these funds control sizable proportions of Silver Platinum and palladium were plummeting down $88 and $37, Gold mining stocks, a more risky Shares of Freeport McMoRan Copper & Gold(FCX) The SPDR Gold Trust(GLD) was Capital Gold Group, gold group, gold, gold prices, gold news, gold coins, gold bullion, gold IRA, IRA |

| Gold and Greece: not what you think Posted: 20 May 2010 02:45 PM PDT Ken Gerbino feels that hysteria over the state of Greece and The Euro is overdone and could lead to people making the wrong investment decisions. |

| Posted: 20 May 2010 02:40 PM PDT |

| Posted: 20 May 2010 02:23 PM PDT Swiss National Bank President, Phillip Hillebrand, in an interview with the Neue Zuricher Zeitung, May 8, 2010:

There has been a lot of speculation in the past 48 hours on who did what in the FX markets as far as intervention is concerned. The Treasury Department has a “no comment”. The ECB and the SNB have been mum. I will stick my neck out and say it was the Swiss that did it. A two-day chart of Euro/CHF: The two vertical lines are evidence of market intervention. That is not just short covering. This was a size buyer that did not care if the execution was sloppy. It looks to me like an effort at “shock and awe”. Some thoughts: -As of 3/31/2010 the SNB had Euro 53b in reserves. They reported that these holdings had a mark to market loss for the Q of CHF3.1b ($2.9b). The NZZ has reported that SNB purchased an additional Euro10b in April. It should therefore come as no surprise that the SNB bought more Euros and sold more CHF in the past day and a half. -The graph shows that the FX rate was just a tad above 1.40 for a few days prior to the blow up. I suspect that this was the SNB providing support to the market on an ongoing basis. These are stabilizing efforts. It is a “containment" policy it is not “shock and awe”. -The night of the Merkel “no trading” rules the Euro/$ hit a new low. Logically there would have been pressure on the Euro/CHF. But it held. Here I suspect that “resting orders” were in place to continue the containment. -Watching the market on Wednesday I concluded that there were three separate rounds of intervention in the E/CHF. Each resulted in a spike in the rate and then a resumption of trading. The end result was a 2% backup. That is a big move in this cross. This activity all took place during peak European and NY FX markets. At that time there are thousands of players. The market is deep and big numbers can get done. The intervention required to move the market this much would have to be more than Euro 5b. -The E/CHF rate was fairly quite today. Until 2 pm. Then another demand driven gap upward. I saw no reason in the other markets for this gap. If a “real” market player wanted/needed to buy size E/CHF they would not have done it a half-hour before the futures close. This stinks of “Shock and Awe”. -The E/CHF market is a derivative of the $/Euro and $/CHF. To unwind demand for E/CHF one could buy $/CHF and sell $/Euro. The crosses have to match out with the cash prices. During European trading the CHF crosses all have big floats. But in late NY markets they do not. So if a big buyer of E/CHF appears it will result in a seller of $/Euro. (Demand for Euro). This explains why the E/$ rate went ballistic this afternoon. But why? I am not sure. There could be many motives at play. The SNB had every reason to intervene. They said they would and they did. They did what they have been doing for months. But in my opinion the shock and awe of the last few days is very atypical of the SNB. The question is, “Were they asked to change their strategy?” The ECB has shown their hand. They have not actively intervened during European markets. If they had we would know about it. The ECB would have announced their efforts publicly. The job of the ECB is to manage a downward path for the Euro. They are well aware of the collateral damage to the other markets a weak Euro could cause. They need a weaker Euro, but they can’t afford a collapse of the bond/equity market. So Trichet calls up Hillebrand and says, JCT: “Do us a favor. Make a very big bid in the E/CHF. This will help us out against the dollar, pound and Yen.” Hillebrand could have said, PH: “Okay, we will step up to the plate over the next few days. First in Europe and the next day we will attack the weak Chicago market. But here is the deal, The ECB has to cover our losses. We'll roll them for you at Libor +2.” JCT: “We’ll cover the losses. It doesn’t matter any more. Go out and kill some wolves for us.” (Heard muttering in the background: “Cheap Swiss”) There is a Fed NY role in this. All Central Banks talk to each other (they also call big market makers). For me it is not possible for the SNB to have done anything in the NY trading hours without the knowledge, advice and consent of the NY Fed. This scares me a bit. We are in very nervous times. There has been no public statement of any intervention. So this is the stealth variety. I am not suggesting that the NYFed did anything today or yesterday. But if the SNB did, they had a chat: SNB: “We are thinking of calling JPM in NY and putting in a market order to buy up to 3b E/CHF. What do you think?: NYF: “Swell idea. The S&P is in the dumper. We are getting calls from all over. If you bid for size it will roll into the dollar market and bid up the Euro across the board. Is that what you want?” SNB: “We are after the wolves today.” NYF: “Suits us, Have at em. But one suggestion, do it at 2 pm. A few weeks ago a size order in Chicago at 2:30 caused a 10% micro burst in equities. Maybe you can do that again today. Wouldn’t it be a hoot if we actually killed a whole pack of wolves! I don’t have a pipeline into the NYFed, the ECB or the SNB. This "take" on the market action in the past few days just lines up with the facts. If I am right, there are a few conclusions. -The monetary authorities are very worried and are willing to use aggressive strategies to calm instability. -Using the SNB as a single source of global currency intervention will not work for long. The ECB and the Fed are playing weak hands. They know if they intervene and fail it is lights out. So their active/visible participation is a last resort option. -Another chapter in this story will be written soon. Possibly this weekend. |

| Posted: 20 May 2010 01:00 PM PDT

So exactly what am I fed up about? I'm fed up with politicians in Washington D.C. who prance around and talk about what a good job they are doing while they pile up the biggest debt in the history of the world. We are stealing trillions of dollars from future generations, and if they get the chance they will curse us for the horrific debt that we have left them. I'm fed up with an unelected, privately-owned central bank issuing and controlling the currency of the United States. Nobody but the U.S. government should be issuing U.S. dollars. The reality is that the Federal Reserve is about as "federal" as Federal Express is, and the international bankers have used it for decades to transfer the wealth of the nation into their own pockets. I'm fed up with being told that the money I have worked so hard to earn needs to be "redistributed" to people who wouldn't know a hard day of work if it came up and bit them on the rear. I'm fed up with Tea Party activists who believe in the Constitution and who desperately want to see a return to the ideals that the American republic was founded upon being labeled as "extremists" by the media while those who are pushing a socialism and globalism on America are referred to as "centrist" and "mainstream". I'm fed up with anyone who suggests that it is a good idea for the government to get to look at an image of our naked bodies before we are allowed to get on an airplane. I'm fed up with hearing that there are banks that are "too big to fail" and that it is necessary for tax money taken from me to be used to bail them out. I'm fed up with a financial system that is so rigged that four of the biggest U.S. banks (Goldman Sachs, JPMorgan Chase, Bank of America and Citigroup) can have a "perfect quarter" with zero days of trading losses during the first quarter of 2010. I'm fed up with a financial system where the Dow can plunge nearly 1000 points in a single hour and nobody can seem to be able to figure out what happened. I'm fed up with being told that I need to reduce my "carbon footprint" when carbon dioxide does not cause global warming and over 95% of total carbon dioxide emissions would occur even if humans were not present on Earth. I'm fed up with people telling me that we should be glad to pay all the new taxes in the "health care reform" law because socialized medicine is such a good idea. I'm fed up with the open manipulation of the gold and silver markets right under the noses of the federal government. I'm fed up with politicians that spend money in order to get votes without any concern for the financial future of this nation whatsoever. I'm fed up with a government that can protect the South Korean border so well that not a single person gets through illegally for decades, and yet has done such a bad job of protecting our own border that Phoenix, Arizona has become the car theft capital of the world. I'm fed up with a government that is so embarrassed by the recent anti-illegal immigration law passed in Arizona that they apologize to the communist Chinese for it. I'm fed up with yuppies who went out and bought McMansions that they could not possibly afford whining and crying now that they are losing their houses. I'm fed up with politicians shipping our manufacturing base to the third world and then pretending that it is our fault when we can't get jobs. I'm fed up with people telling me how wonderful "free trade" and "the global economy" are while our once great manufacturing cities such as Detroit turn into rusted-out war zones. I'm fed up with international organizations such as the IMF and the WHO telling us that they want the American people to start paying global taxes. I'm fed up with politicians being treated like celebrities and rock stars when they are actually leading American right into the toilet. I'm fed up with a president and a Congress that are rapidly dismantling the strategic nuclear arsenal that has helped keep America safe for decades. I'm fed up with politicians who run over to China and beg them to keep buying even more of our debt. I'm fed up with the United Nations and members of the U.S. government claiming that there are far too many people in the world and that we need to promote population control measures all over the globe. I'm fed up with a Supreme Court that has absolutely no respect at all for the personal property rights of ordinary Americans. I'm fed up with a government that insists that freakishly-altered genetically modified crops are good for us, and that allows companies like Monsanto to ruthlessly push these "Frankenfoods" on to dinner tables all across the United States. I'm fed up with a public that is far more interested in the death of Michael Jackson and in what is going on with Jon & Kate than in the absolutely crucial economic and political issues that directly affect them and their families. I'm fed up with a government that is so incompetent when it comes to foreign policy that Russia and China are literally running circles around them. I'm fed up with a government that allows nearly a million innocent babies to be killed year in and year out. I'm fed up with watching Wall Street bankers rake in record-setting bonuses while nearly 40 million Americans are on food stamps. I'm fed up with a national debt that is impossible to pay off, a dollar that has lost over 95 percent of its value since the Federal Reserve was created and a financial system that is designed to fail. If you don't understand why the U.S. economic system is doomed, you should check out the video posted below. The inevitable collapse of the U.S. financial system is beautifully illustrated in this brand new documentary entitled "Meltup". It is one of the best videos on the economic crisis that America is facing that has ever been posted on YouTube. This video is likely to make you very mad, but after watching it you will have a much greater understanding of the economic nightmare that the United States is now facing.... So are you fed up too? Please feel free to leave a comment telling us what you are upset about.... |

| Silver will be $100 per Forbes Posted: 20 May 2010 12:23 PM PDT http://www.youtube.com/watch?v=HGPvVjfNYgs He says Silver is the place to be. NO Ted Butler nonsense. |

| You are subscribed to email updates from Gold World News Flash To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

Commodities and stocks were given black eyes on Thursday, tumbling with declines attributed to fears over Europe's ability to contain its sovereign debt crisis and increasing doubts over the strength of the global recovery.

Commodities and stocks were given black eyes on Thursday, tumbling with declines attributed to fears over Europe's ability to contain its sovereign debt crisis and increasing doubts over the strength of the global recovery.

No comments:

Post a Comment