Gold World News Flash |

- Rent Seeking in Canberra

- The Greek Debacle: Severe Symptoms of a General Disease

- SEC and Its Culture of Regulatory Capture

- The ABACUS Mess: Where's the Journalistic Clarity?

- High Conviction: Don't Fight the Fed; Short U.S. Long Bonds

- Gold and Gold Miners: Miners Performing Better Than the Metal

- Hi-Ho, Silver, Aw-a-a-a-ay!

- Mickey Fulp: Bullish on Uranium and Rare Earths

- Brazil Steps Up Stimulus Exit

- A 'Unique' Financial Crisis

- Trading Week Outlook: May 2 - 7, 2010

- Brazil: Is Growth Fueling a Bubble?

- Another Day... and Another Slide Down the Every-Steepening Slippery Slope

- Hourly Action In Gold From Trader Dan

- Jim?s Mailbox

- In The News Today

- The Bittersweet Memories of Commercial Property Ownership

- Inside the First Fiscal Summit, How to Spot the Debt Crisis Coming, The Trend of 2010

- Now We See Who's Who - Too Big To Fail

- The Only Gold Indicator You Need

- Mickey Fulp: What Is Gold Actually Worth?

- The Ultimate Currency Hedge

- LGMR: Gold Targets $1226 as Greece Is Declared Bankrupt by German Press

- MAX Lays Their Cards on the Golden Table Top

- Heh, Someone Gets It (Buiter)

- Client Update – Spanish Mountain Gold, Simply Put -Undervalued!

- There is only one trade right now, and that is “Risk On.”

- PHYSICAL Gold is a Reasonable Investment Right Now

- Napa Vineyards Tank

- Gold Seeker Closing Report: Gold Falls Slightly While Silver Gains Over 2%

- Silver and Gold Prices Non Confirmation

- Prosecutors Should Investigate Goldman Sachs on Baidu Trading

- Gold and Gold Stock Relative Outperformance

- Criminal probe looks into Goldman Sachs trading

- Moore Capital fined in platinum manipulation case

- Congressman Miller Introduces Bill Breaking Up Big Banks

- Family Denied Medical Treatment Because of State's Debt

- 3 Reasons for the Commodity Bull Market

- Gold Prices Fall from 2010 Highs, Silver Soars

- Royal Canadian Mint Introduces 2010 Spring Collection

- Gold prices highest since December on euro zone debt fears

- S&P Cuts Spain’s Rating One Notch on Economic View

- Gold rises as euro zone debt fears linger

- Base metals miner Lundin returns to profit on higher prices

- Size Buyer now a Size Seller

- Gold: Look Out Above...

- Gold: Look Out Above...

| Posted: 29 Apr 2010 07:34 PM PDT A world built on debt does not have a solid foundation. A world built on sound money, secure private property, and a predictable rule of law DOES have a solid foundation (as our new friend Ron Kitching pointed out earlier this week). We do not live a world with solid financial foundations. That's what makes investing so dangerous today. Later in today's Daily Reckoning we're going to reject the heinous and misguided accusation of doom-mongering levied against us via a profanity laced e-mail tirade. But first, to the markets and the local scene. And there's some catching up to do on one of those shaky, debt-based pillars of Australian financial life, the housing market. First up is the news that mortgage lending is falling while house prices continue to rise. "Total mortgage applications fell 15 per cent in March quarter compared with the corresponding period a year earlier, the quarterly consumer credit demand index by consumer credit check company Veda Advantage showed," according to today' Age. Cris Cration of Veda said, "One consequence of a withdrawal in government incentives is a relatively sharp drop off in housing credit demand in 2010." Those "incentives" are the first home buyer's grants. Mortgage data provider Australian Finance Group says first home buyers have declined as a percentage of the new mortgage market from 28% last year to 10% this year. Once you bring forward all that demand…what then? You get now. Let us call it the "demand gap!" People who would have otherwise patiently built up a deposit and bought a home at a time that suited their finances are "brought forward" like reinforcements into the battle line. So who is going to get shot? Well, let's say you got yourself a mortgage six months ago when the RBA lowered the cash rate to 3%. The standard variable rate from any of the Big Four banks would have been higher than that. But let's say you want to refinance today (because you believe rates are rising) into a 15-year fixed rate mortgage. According to the rates at one major bank site we checked, the rate on a 15-year fixed mortgage is about 8.54%. So, if you're a first home buyer worried about an interest rate shock from rising rates and you want to lock in some stability, we reckon you're likely to pay nearly double the rate you got into your mortgage. And that would probably be pretty stressful. Of course if you think interest rates are not going up, then you wouldn't refinance and lock yourself into a fixed rate. All of which shows you how Australia's preference for variable rate loans coupled with central bankers rigging the price of money can turn a whole economy into a giant exercise in speculation. You make the biggest financial decision of your life based on factors that are influenced by unpredictable changes in the cost of money and the rate of inflation. Sounds like how you'd design a system to put people into debt to the bank and keep them there for decades. But only if rates move up, which they very well may be next week when the Reserve Bank of Australia meets to set the price of money. Based on the consumer price inflation data released yesterday (up 0.9% in the March quarter) annual Aussie inflation is running at the upper end of the RBA's tolerance/target of 3%. The IMF says in its Asia Pacific Regional Economic Outlook yesterday that the RBA will have to put up rates this year as Aussie GDP rebounds. Incidentally, we had a quick scan of the report, which you can find here. A couple of charts caught the eye. First, you can see from the IMF chart below that housing credit as a percentage of GDP is higher in Australia and New Zealand than anywhere else on the chart (and probably in the world). And the total amount of credit is dominated by housing in the Anglosphere countries, reflecting… something about their fascination with the idea of getting rich from houses, although to be fair, the banks (the ones that survived the credit crunch) HAVE gotten rich.  The second chart, below, shows that while Aussie banks (mostly the Big Four) have gone on a lending binge, the provision of credit to the corporate sector fell off a cliff. Big listed firms managed to raise equity last year (although not always in ways that boosted shareholder value, given the cost and return on capital). But smaller firms have been cut off by Aussie banks, according to the chart below.  Robert Gottliebsen made this point quite clearly today at Business Spectator when he wrote, "The Australian banking industry, as it is presently structured, is unable to fund the needs of small and medium-sized businesses." He the quotes from a UBS report we haven't seen about Australia's reliance in imported foreign capital (when you're a debt junkie, any hit will do). "As UBS research shows," Gottliebsen writes, " Australian growth in loans to both the housing and business market have been funded by overseas lenders. According to UBS, Australian banks are getting close to the upper limit of loans that overseas institutions are likely to provide to Australia. And worse still - as ANZ points out - the European crisis could contract the amount of loan money available to Australia and lift its cost." Ah yes. Greece and loan losses. ANZ's Mike Smith got on the front with the issue in the press today, including his own handy new term to describe Greece: "a rogue sovereign." The ABC reports that Smith said, "Europe is a mess and the sovereign issues have not been addressed with clarity...The uncertainty has continued and that's probably going to get worse. The contagion issue is now very real." The end result, he added, is a higher price for money for Australians. "That's where it will impact us. In terms of the funding that the Australian banks have, in terms of their wholesale funding, obviously credit spreads are going to be more volatile." Hmmn. Pop quiz! How do you kill Australia's most vital industry, its mining sector? You plunder it, that's how! The plunder begins on Sunday when the Rudd government finally unveils the Henry Review of Taxation, which, by all accounts, is likely to include a new federal resource "rent" tax to go alongside the royalties miners must already pay the States. The government could not have chosen a more apt word than rent. The government is the ultimate rent seeker. Investopedia defines "rent seeking" as, "When a company, organization or individual uses their resources to obtain an economic gain from others without reciprocating any benefits back to society through wealth creation." Frederic Bastiat calls this kind of rent seeking a form of legalised plunder, and rightly so. His description distinguishes how the government raises revenue from how entrepreneurs raise revenue, by making a profit. Profit-seeking behaviour creates a lot of things: surplus, jobs, incomes, goods, and services. And for a company to produce a profit it must serve its ultimate master: the customer. Profit-seeking serves customers. Rent-seeking is the legally-backed coercive cudgel of Canberra. But one of our friends out in Perth - a man who works in the mining industry - put the case against resource rents far better than we could in a letter to the editor that we believe was published by the Australian Financial Review. He wrote:

Couldn't have said it better. This brings us to the final part of today's Daily Reckoning on who the real heroes of the free market (not the capitalists, not the bankers, and not the regulators). But we'll preface it with a letter we received yesterday. Apologies in advance for the blue language:

With all due respect, we think the reader misunderstands our intentions with the Daily Reckoning. It's just a reckoning. Lately, that means reckoning up all the badly allocated capital, human fraud, misguided public policy, and good old fashioned greed. When you reckon all that up, the sensible investment position is to be really, really, really cautions and highly (eternally) sceptical. But that is not a hereditary disposition. It's just the position we think makes sense. Hereditarily - or really by choice - we are joyful optimists! Economic and political liberty combined have the power to unleash an astonishing variety of human potential, from the Mona Lisa to the Sham Wow! That's why the great heroes of the Austrian School of Economics are the entrepreneurs. They are the creators who bring new things into the world with their energy and skill and dedication. They might do it with other's capital (the bankers, capitalists, and investors). But it's the entrepreneurs who are always on the frontier of economic experience, looking for a new way to use resources better, more efficiently, or chase whatever their particular passion or vision is. But those entrepreneurs have many obstacles to overcome these days, from competition to regulation to the equity markets being hijacked by financial capitalists who pursue financial gain alone rather than the funding of enterprise. We don't live in a world with free enterprise at all, and perhaps never will. But we shouldn't forget that the great achievement of the free enterprise system is that without any centralised direction or organisation - it manages to harness noble and ignoble human passions to produce choice and prosperity for millions of people. And with a fair and stable legal framework, that's a kind of real justice that the plundering central planners out for social justice can never even come close to delivering. So no, we're not trying to be clever and revel in the demise of the financial system. But we do think if you want survive the collapse of this system - a system based on debt, unsustainable finances, and a rotten moral premise of theft - you had better be willing to face facts and then make a plan and then make a life. If you don't, you're going to be the real loser. Dan Denning

|

| The Greek Debacle: Severe Symptoms of a General Disease Posted: 29 Apr 2010 06:48 PM PDT ForexTraders submits: Greece is obviously run like a multinational bank. Sweep as much as you can under the carpets, fit in with the crowd, and put on a smiling face. Masking a deficit in the ballpark of 13-14% would certainly be a remarkable achievement for Madoff himself, but apart from the shock value of a national fraud, is there really that much to distinguish Greece from some of its more fortunate peers in Southern Europe? What is the distance between Spain, Portugal, or Italy, and Greece or even the U.K. in terms of economic incompetence, and monetary indiscipline? From an economic point of view, letting Greece quit the eurozone is the easiest and cleanest solution to the debt crisis. Not only would it give a strong warning about the need for fiscal discipline to potential culprits in future crises, but it would also avoid the severe consequences of bailout in terms of political stability, and electoral contentment any disruption to which will easily threaten the already tenuous and doubtful economic recovery underway. It is not even clear if eurozone nations possess the power to bailout the entire group of nations that are dependent on the goodwill of international speculators to survive the next few years. We are not only speaking about the southern members of the eurozone here, but also about the total mess that lies to the east of the monetary union at places like Hungary, Ukraine, or Romania, where the fiscal situation is hardly any marginally better than in Spain or Greece. Italian, and German banks are heavily exposed to the Balkans and the nations of the former Soviet Union, where the previous bailouts of the 2008 have only delayed the resolution of severe issues. Complete Story » |

| SEC and Its Culture of Regulatory Capture Posted: 29 Apr 2010 06:30 PM PDT Judd Bagley submits: Perspective is a funny thing. The full taxpayer cost of the S&L bailout came to an enormous, inflation-adjusted tab of around $255-billion; and yet, in the shadow of the latest spate of bank bailout checks written by Congress, that doesn’t seem like much. Similarly, the $60-billion Madoff fiasco tends to make the many Ponzi scheme busts that followed seem quaint by comparison, including the $7-billion scam allegedly carried out by Robert Allen Stanford’s firm. Just to make sure everybody agrees that $7-billion is a lot of money – keep in mind it exceeds the GNP of 40% of the nations on earth. Imagine putting a match to all the goods and services produced in one year by the people of Laos or Mongolia. Stanford is accused of doing that, and more. But because it’s just a tenth of the wealth destroyed by Madoff, Stanford may forever be regarded as a Ponzi also-ran. Complete Story » |

| The ABACUS Mess: Where's the Journalistic Clarity? Posted: 29 Apr 2010 06:29 PM PDT This is the Green Room submits: One of the problems with the latest mess is that the financial press and more specifically financial bloggers have built up a considerable amount of “[Wall] street cred” through accurate and intelligent reporting on the financial crisis. In one sense, it’s amazing that they were able to gain such a foothold (I humbly include TGR) by doing nothing more than explaining what was happening on Wall Street without holding any punches – it really speaks to how limited/timid traditional financial reporting was. Most of the discussion centered on new but relatively simple concepts like “capitalization”, “liquidity”, “debt” and – for the most daring – “CDOs”. But now the ABACUS deal has thrown a wrench in the process. We have reached a point where the nuances of these structures are so fine that the casual observer/blogger/reporter is oblivious to their significance. But we have also established an oligarchy of financial journalists/bloggers who form the authority on the ongoing recession. The problem arises when we collectively rely on those authorities for information they are not qualified to distribute. In that sense the internet is serving very well as a means of collecting and aggregating information (such as ABACUS pitchbooks) – and very poorly as an echo chamber of bad commentary and groupthink (such as ABACUS analysis). It’s not the first time this has happened – I’ve gone to task with the community a few times before. But now it is reaching a critical mass. Complete Story » |

| High Conviction: Don't Fight the Fed; Short U.S. Long Bonds Posted: 29 Apr 2010 06:20 PM PDT Chris Butler submits:

Complete Story » |

| Gold and Gold Miners: Miners Performing Better Than the Metal Posted: 29 Apr 2010 06:15 PM PDT Leisa submits: As the world wrangles with trying to determine what is "safe", gold is yet again in the spotlight. I don't plan to tell you what I think that gold is going to do...but it is worth noting that the USD is up and gold is up. That says much. Complete Story » |

| Posted: 29 Apr 2010 06:10 PM PDT |

| Mickey Fulp: Bullish on Uranium and Rare Earths Posted: 29 Apr 2010 06:04 PM PDT Mercenary Geologist, Mickey Fulp feels that much of the uranium production in the world is under the auspices of regimes or countries that are unstable or unfriendly to the West, leaving supplies vulnerable. He prefers "companies operating in Wyoming, New Mexico and the Athabasca Basin because that's where the majority of uranium has been produced in the past and will be in the future." |

| Posted: 29 Apr 2010 06:01 PM PDT Econ Grapher submits: Brazil stepped up its policy stimulus exit Thursday, increasing the selic rate 75bps to 9.5%. The decision was unanimous. The move was only expected by half of economists surveyed, and most of those expecting an increase were looking for 50bps. In its announcement the BCB noted that the move marks a continuation of the policy adjustment process (having previously raised the reserve requirements in February):

Complete Story » |

| Posted: 29 Apr 2010 05:49 PM PDT  Michael Panzner submits: Michael Panzner submits: Market old-timers (like me) have often said that the four most expensive words in the English language -- or, on Wall Street, at least -- are "this time is different." Nevertheless, the phrase usually refers to developments that the masses (or the trading crowd) view as bullish but which are, in fact, precursors to an unwelcome reversal of fortunes. However, even though a growing number of people, including a former Treasury official whose perspectives are highlighted in a Capital Gains and Games post entitled "'Budget for a Declining Nation,'" see the meltdown in U.S government finances as "unique," I'm pretty sure we should not interpret this as a sign that the fiscal pendulum will soon be swinging back in a positive direction. Complete Story » |

| Trading Week Outlook: May 2 - 7, 2010 Posted: 29 Apr 2010 05:28 PM PDT All Things Forex submits: In a market environment filled with uncertainty caused by the threat of contagion from the EU sovereign debt virus, the trading week ahead will bring a series of crucial economic data from major industrialized nations around the globe, culminating with one of the main gauges of the state of recovery in the world’s largest economy- the U.S. Non-Farm Payrolls and Employment Situation report. Complete Story » |

| Brazil: Is Growth Fueling a Bubble? Posted: 29 Apr 2010 05:20 PM PDT Brian Rezny submits: The court injunctions are cleared, and the contractors are set. Construction will begin on the $11 billion Belo Monte, the world’s third largest hydroelectric power station (behind China’s Three Gorges and Brazil’s Itaipu). Why does Brazil need two of the world’s largest hydroelectric dams? Because the economy is on track to grow 5.8% this year (according to the central bank), and with millions of Brazilians lifting themselves out of poverty, more power has to be generated to meet demand. And Brazil realizes that renewable energy is the most viable option. Complete Story » |

| Another Day... and Another Slide Down the Every-Steepening Slippery Slope Posted: 29 Apr 2010 05:17 PM PDT Gold didn't do a thing in either Far East or most of London trading on Wednesday... and gold was down about six bucks minutes after New York opened. But all that inactivity changed the moment that the London p.m. gold fix was in at 3:00 p.m. local time... 10:00 a.m. in New York. The gold fix also happened to be the nadir for the gold price on Wednesday... checking in at a low of $1,159.80 spot. Then gold jumped to its high of the day [$1,175.70 spot] at 11:45 a.m. Eastern time. At that point it got hit by 'da boyz'... and from there it drifted lower... losing $10 of it earlier gains. Gold finished down $3.40 from Tuesday's close. Silver, which hadn't done much of anything since trading began in the Far East, began to get sold off starting at 1:00 p.m. in Hong Kong. The bid disappeared at the Hong Kong close... and silver's low [like gold's] was at the London p.m. gold fix, and was reported as $17.80 spot. The high for silver was also at the same time as gold's... |

| Hourly Action In Gold From Trader Dan Posted: 29 Apr 2010 04:56 PM PDT |

| Posted: 29 Apr 2010 04:56 PM PDT View the original post at jsmineset.com... April 29, 2010 10:16 AM Jim Sinclair’s Commentary Here is a very interesting comment from my former partner, Yra Harris, concerning the Russians and the IMF as it pertains to Gold. Yra is an Uber Trader and extremely wise. Jim, After we wrote about all the Central Bank activity yesterday we found another CB that entered the fray. The Russian Central Bank cut their lending rate yesterday to 8%. This was somewhat of a surprise but the Russians feel their budget situation is healing as high energy prices are providing increased revenues into state coffers. Russia is so flush with money that we want to offer their increased wealth to solve the European debt crisis. Being that the Russians are awash in cash and the European Union is its largest energy client, we propose that they offer the debt stressed nations of Europe a type of vendor financing similar to what China provides to the U.S. The Moscovites have been buyers of the Euro curr... |

| Posted: 29 Apr 2010 04:56 PM PDT View the original post at jsmineset.com... April 29, 2010 05:34 PM Thoughts For The Day: God help us if we have to listen to Frau Merkel, the mercurial political antics on the subject of Spain, Portugal and Italy. She woke up yesterday and realized that German banks are loaded with all this debt and did her reverse moon walk. The MOPE is maddening. If you need solid proof that gold is the ultimate currency, then yesterday’s action was it. Yesterday the physical market for gold kicked the ass of the CRIMEX. This trend has been demonstrated as the spot price moves closer to the cash contract on the CRIMEX. That means Gold is the major currency and when push comes to shove, the CRIMEX will get shoved. I actually heard a major personality in the legislative say that the old derivatives could be fixed by new legislation. That it total world class crap. These guys making laws do not have a clue what they are doing. No standards means there cannot be a fix. An OTC derivative that ... |

| The Bittersweet Memories of Commercial Property Ownership Posted: 29 Apr 2010 04:56 PM PDT If you want to know where the stimulus money winds up, don't look in my wife's purse, because I have been there several fruitless times in the last few weeks, and she almost caught me twice. And don't look in my wallet, as my kids have been there several fruitless times in the last few weeks, too, until I started strapping my wallet to myself with duct tape, which stopped that "Let's look in daddy's wallet!" crap in its tracks. So where is the money? In the classic "trickle down" theory and (I assume) osmosis or something, it is supposed to, eventually, wind up as more money in everybody's pockets as a wage or profit in some fabulous Keynesian moment of transcendent glory, wherein the economy is saved from the excesses of too much money creation and too much government spending by creating even more excess money and staggeringly more government spending! Hahahaha! But that laughable result is best left to the hypothetical future, which will, alas, never get here, and the immediate an... |

| Inside the First Fiscal Summit, How to Spot the Debt Crisis Coming, The Trend of 2010 Posted: 29 Apr 2010 04:56 PM PDT The 5 min. Forecast April 29, 2010 01:10 PM by Addison Wiggin & Ian Mathias [LIST] [*] “Losing control of our own destiny” -- the sovereign debt crisis as seen from D.C. [*] How Washington works, and how it doesn’t: Scenes from the Fiscal Summit [*] What Greece crisis? Factors behind some unlikely rallies [*] The Trend of 2010: Two asset classes trading in tandem [/LIST] While we were seated in the auditorium of the Reagan International Trade Building for the 2010 Fiscal Summit yesterday, fear and loathing swept the globe. Today? Not so much. The scare from Greece’s downgrade? It’s so yesterday. The euro has bounced off its one-year low of $1.31. European stocks are up, too. Phew. An index measuring executive and consumer confidence in the 16 euro nations reached its highest level in two years. Right. Far be it from us to spoil the party, but Greece retains its role as the proverbial &ldquo... |

| Now We See Who's Who - Too Big To Fail Posted: 29 Apr 2010 04:56 PM PDT Market Ticker - Karl Denninger View original article April 29, 2010 10:07 AM Senators Kaufman, Casey, Merkley, Whitehouse and Harkin (along with others who may pile on) have introduced a 20-page amendment to actually address "too big to fail." It is refreshingly simple legislation - 20 pages of common sense. It limits balance sheet size for banks to 2% of GDP including off-balance sheet vehicles for banks, 3% for non-banks, and forces divestiture of overages. It also requires reporting and testimony before Congress if regulators fail to promptly address violations. In addition it places a hard cap of 10% of deposits in any one institution (a limit that already exists by the way, but has been wantonly violated by The Fed allowing mergers during the crisis that breached the limits - and yet there has been no requirement to divest.) This would place a balance-sheet limit of about $280 billion on a bank. This would put an instantaneous full-stop to the outrageous ... |

| The Only Gold Indicator You Need Posted: 29 Apr 2010 04:56 PM PDT By Dr. Steve Sjuggerud Wednesday, April 28, 2010 "So… where's the big gold bull market?" I asked John Doody over lunch yesterday. John writes the excellent Gold Stock Analyst newsletter, where he takes a deep look into gold and the major gold stocks every month. Before starting the newsletter in the early 1990s, John was an economics professor. Right now, John and I are at a conference on Maryland's Eastern Shore. "John, if gold is so great now, then why hasn't it soared this year?" I asked him. "It's only up like 5%." John replied. "That's a good question… In my opinion, the primary driver of the gold price is real interest rates that investors earn on their cash." In short, if investors earn nothing on their cash, then gold goes up. If investors earn high rates of interest on their cash, then gold goes down. As the chart below shows, that's the only gold indicatory you need to know. Importantly, we're talking about the "real" rate of interest... |

| Mickey Fulp: What Is Gold Actually Worth? Posted: 29 Apr 2010 04:56 PM PDT Articles by Mickey Fulp: Mercenary Geologist - Gold Speculator Source: Tim McLaughlin and Karen Roche of The Gold Report 04/28/2010 "If we have a robust gold price, we are going to have a robust junior-stock market," asserts Mickey Fulp, "The Mercenary Geologist." In this exclusive interview with The Gold Report, Mickey explains that gold evaluations may not be reflected in prices. You'll also learn that he is more bullish on a select group of companies rather than on the sector as a whole. The Gold Report: Mickey, last time we spoke with you in January, you were still digesting what happened with equities in 2009, and you weren't ready to comment on what that might mean for 2010. Now that we're into the second quarter, are you ready to comment on what last year's performance means for equities in 2010? Mickey Fulp: We spoke very early in January about 2009, which was arguably one of the best years ever for the junior resource sector. I felt it was undetermined at ... |

| Posted: 29 Apr 2010 04:56 PM PDT by Adrian Ash BullionVault Wednesday, 28 April 2010 Nothing works like gold when you need to hedge against your own currency... WEDNESDAY'S NEWS that, at last, Standard & Poor's has caught up with the bond market – and the steady trickle of fleeing bank deposits – by downgrading Spanish debt had a marked effect on the Euro. So did Tuesday's downgrade to "junk status" of Greece's government bonds. And the cut to Portugal's credit rating, too. It all had a marked effect on gold as well, not least versus the Euro, but also against the US Dollar and Japanese Yen – apparently the only beneficiaries of "Ebola contagion" in Europe... This week's action "demonstrates gold's ability to protect investors from crises that debase their own currency, but not those of other sovereign issuers," reckons Patrick Artus at French bank Natixis. Investors seeking protection against the debasement of other currencies than their own are being just pl... |

| LGMR: Gold Targets $1226 as Greece Is Declared Bankrupt by German Press Posted: 29 Apr 2010 04:56 PM PDT London Gold Market Report from Adrian Ash BullionVault 08:35 ET, Thurs 29 April Gold "Targets $1226" as Greece Is Declared "Bankrupt" by German Press and 25% Bond Yields THE PRICE OF GOLD ticked lower on Thursday morning in London, drifting 0.6% from yesterday's 4-month high for Dollar investors as stock markets rose with the Euro on calls for a sudden resolution to the Greek government-debt crisis. Commodities rallied almost 1% on average as crude oil rose back above $84 per barrel. With volatility in the options market "starting to pick up and fresh [Dollar] highs for 2010 having been achieved," says one London dealer in a note, gold's "target on the charts is now $1226." "Resistance is seen at 1193 which is the top of a 3-month bull channel off Feb.'s low at 1045," says the latest note from bullion-bank Scotia Mocatta's chart analysts. Gold's "unstoppable ascent" puts the "Fibonacci retracement at 1187.95 in sight," says Commerzbank's technical anal... |

| MAX Lays Their Cards on the Golden Table Top Posted: 29 Apr 2010 04:56 PM PDT By Claire O'Connor MidasLetter.com Thursday, April 29, 2010 MAX Resource Corp. (TSX.V: MXR) is a Canadian exploration company with a diversified portfolio of mineral exploration projects in Canada and the Western United States. The company is currently focused on gold, with three gold properties in Nevada being actively explored in 2010. At the moment, having recently intersected a mineralized zone of silicified breccia, the Table Top property is where the action is at. The Table Top is a property comprised of 171 claims (3,420 acres) located 10 miles west of the town of Winnemucca, Nevada, just off of Interstate 80. Following an extensive trenching program that had been conducted on recently acquired claims at Table Top, MAX began a 16 hole core drill program on the property on April 7th and have already had drilling success. A press releas... |

| Posted: 29 Apr 2010 04:56 PM PDT Market Ticker - Karl Denninger View original article April 29, 2010 06:18 AM Hattip Zerohedge: (The original article is here) Note the structural deficit number. This is what happens when you allow this to go on for a decade: Which in turn leads to this: That red line is actual private demand expressed as the delta (or change) in GDP. I don't have accurate debt and GDP numbers on a contemporary basis for the rest of the nations that Buiter cites, and besides, I focus on the United States anyway. Buiter posits that The Fed could eventually be "forced" to monetize - that is, try to inflate it away. This is where Buiter and I part company, because it is impossible to inflate out of a mess like this when you have social spending indexed to inflation - and our entitlement programs all are in one form or another, with the most-ridiculous, Medicare, rising at much higher rates than general inflation. As such attempting to "inflate out" won't work - it ... |

| Client Update – Spanish Mountain Gold, Simply Put -Undervalued! Posted: 29 Apr 2010 04:56 PM PDT The following is automatically syndicated from Grandich's blog. You can view the original post here April 29, 2010 05:48 AM The transformation undertaken by the management of Spanish Mountain Gold continues to be documented in the work programs that they've just disclosed. In the News Release dated April 29, 2010, they have a clear focus on the engineering aspects to help prove the viability of a potential open pit mine. *The company already has a compliant resource of approximately 4 million ounces of gold at Spanish Mountain. The next step should be the commissioning of a Preliminary Economic Assessment which can be expected shortly. It is good to see though that there is also an upside built into the program by doing both exploration drilling at Spanish Mountain (with a view of seeing if the resource area can be expanded), as well as a further round of drilling at Thunder Ridge to potentially increase the size of that quite exciting project. The Spanish Mountain project does... |

| There is only one trade right now, and that is “Risk On.” Posted: 29 Apr 2010 04:27 PM PDT I noticed that I have had trouble composing my newsletter lately because in thumbnail form, all charts now look the same, a lot like a 1952 Mercedes 300SL with its “gull wing” doors open. Looking at the long list of positions that I have recommended this year, including dollar/yen and dollar/euro, municipal, junk, and corporate bonds, emerging market ETF’s, Toyota, the US, Australian, and Canadian dollars against the euro and the yen, silver, platinum, palladium, oil, and commodities, I am stunned to see all of them working, some quite dramatically so. I can assure you this is not because I suddenly acquired the touch of Midas or the wisdom of Croesus. All assets are going up, period. Fundamental research has become an irrelevance. Earnings and GDP forecasts are being ratcheted up by the day. The S&P 500 has gone up for 400 days now without a 10% pullback and we have seen the fourth strongest stock market rally in a century. There is vastly more risk in the market than there was 13 months ago. Of course, I blame zero interest rates for everything, and the Fed’s need to inflate new bubbles to rescue us from the old ones. It also helps that Obama turned out to be a moderate in liberal clothing. How else can one explain an 82% gain in the S&P 500 in 13 months? Despite the largest borrowing binge in human history, long term interest rates are levitating just above all time lows. If everything is moving up in unison, you can expect them to go down the same way when the premise for their prosperity disappears. You have already been tipped off twice on how this movie is going to end, once on the day when the sushi hit the fan on Goldman Sachs (GS), and again when Greek debt was downgraded. Those were days when everything moved down in lockstep, and hedges proved worthless. If you are looking for another reason not to sleep at night, I’ll give you one. Investor sentiment is now 54% bullish, the highest since December, 2007. In the meantime, the Chinese stock market is rolling over like the Bismark, with the Shanghai Index’s ($SSEC) down a worrisome 10.8% YTD. You can blame the Chinese central bank’s efforts to cool down real estate speculation, which is throwing cold water on the rest of the economy. Will it also throw ice water on ours? Many of the profits that have driven US stocks to bullish extremes are contingent on selling a huge range of capital goods and commodities to China and the rest of the emerging markets, hence the disparity. This divergence can’t last, and my bet is that it breaks by American indexes joining China in a downtrend. Take that as a wakeup call, and adjust your risk controls accordingly. Keep a hair trigger on your mouse for when the dreaded “Risk Off” trade hits. To see the data, charts, and graphs that support this research piece, as well as more iconoclastic and out-of-consensus analysis, please visit me at www.madhedgefundtrader.com . There, you will find the conventional wisdom mercilessly flailed and tortured daily, and my last two years of research reports available for free. You can also listen to me on Hedge Fund Radio by clicking on the “Today’s Radio Show” menu tab on the left on my home page.

|

| PHYSICAL Gold is a Reasonable Investment Right Now Posted: 29 Apr 2010 04:14 PM PDT I believe that physical gold is a reasonable investment right now based on the following factors: 1) sovereign defaults; 2) shortages of physical deposits; 3) the dollar; 4) central banks; 5) declining production; 6) inflation; 7) deflation; 8) uncertainty and distrust in government; and 9) flight to safety. Sovereign Defaults Iceland, Dubai, Greece, Portugal, Spain ... The list of potential sovereign defaults just keeps growing. As Marc Faber said in February:

Similarly, Nouriel Roubini said today that sovereign defaults could lead to inflation:

As discussed below, inflation is usually considered bullish for gold prices. And defaults would lead to uncertainty and increased distrust in government, which are bullish as well. Shortage of Physical Deposits As whistleblower Andrew Maguire - a London metals trader formerly of Goldman Sachs - says, gold and silver bullion markets are rigged (and see this). Omnis' Jim Rickards, GATA's Adrian Douglas and others have demonstrated that the big bullion dealers and ETFs don't have nearly as much as physical bullion as they claim. Should a substantial portion of investors in these vehicles demand physical delivery at the same time, it could cause a panic in the gold market which would cause a huge run up in gold prices. The Dollar China, India, Russia and Other Gold Buyers As Lawrence Williams wrote Tuesday, gold sales by central banks are virtually-nonexistent. In fact, many central banks are buying large quantities of the shiny yellow metal. Commentators such as Ambrose Evans-Pritchard and Byron King argue that China's hunger for gold will put a floor on gold prices. Specifically, they argue that China will "buy the dips" in gold prices, effectively putting a minimum on how low gold prices can go. Indeed, former chief Merrill Lynch economist David Rosenberg argues that because China will buy a lot of gold, gold will shoot to $2,600/ounce. In December, Goldman Sachs predicted that gold will shoot past $1,400/ounce by 2011, largely on the basis of central banks becoming net buyers of gold, gold ETFs continuing to buy substantial volumes, and real estate prices being depressed. As Reuters India noted on March 29th:

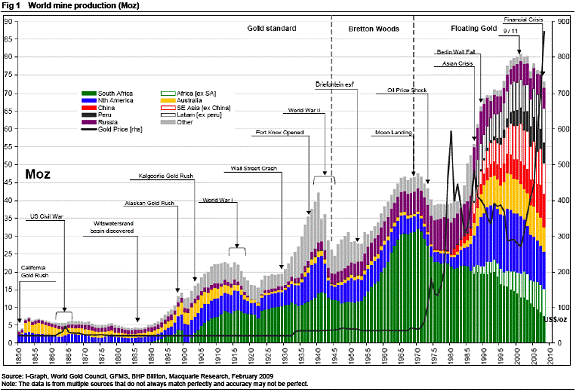

And see this. India's central bank has also bought large amounts of gold, and Russia is said to be looking to buy gold as well. Even small countries such as Sri Lanka and Mauritius are buying large quantities of gold. Declining Production China is not the only country facing declining gold production. The world's biggest gold producer - Barrick - says that the relatively easy-to-reach gold supplies are gone, and so supplies are getting more and more expensive to locate and extract:

Mining-Technology.com stated in March 2008:

Zeal Speculation and Investment wrote last July:

Also in July, Whiskey and Gunpowder posted a chart on historical gold production, and argued for decreasing production:

Of course, if the price of gold warrants ramping up, then production will increase. Just as with discussions about peak oil, the issue is not that the resource is totally running out, it is that it will be more and more expensive to extract. Inflation It is conventional wisdom that gold is a hedge against inflation. For example:

John Paulson argues that gold is something you buy-and-hold for at least the medium term:

Deflation If gold does well during times of inflation, it makes sense that it would perform poorly during deflationary periods. But Examiner.com points out that such an assumption is probably untrue. Specifically, as Examiner.com writes:

Investment analyst and financial writer Yves Smith argues that gold does well during both periods of deflation and high inflation. She argues:

Analyst Adrian Ash argues that gold's value actually increases during periods of deflation even if its price drops:

|

| Posted: 29 Apr 2010 04:01 PM PDT From The Daily Capitalist I just saw an offering of the famous Screaming Eagle 1997 cab for $52,000 for the case, or minimum 3-bottle offering at $13,000. Parker gave it 100 points. I passed. I don't think anyone told the purveyors that the market has loosened up a bit. My guess is that the offering (32 cases--1996, 1997, 1999--of the Eagle) may have been sprung loose by the economy. Some hedge fund guy blew up and ... Maybe Paulson and Kovner fought over it. For the rest of us, the great unwashed, bargains are awaiting. Here's an article from Bloomberg reciting a sad tale.

Personally, as a consumer I think I like "secular change."

The wine business is slow here in Santa Barbara County. But that doesn't seem to stop wealthy immigrants to our fair land from buying big estates here and then getting the dream vineyard and winery. Nothing like seeing your name on the label. Did I tell you Al Gore will be my new neighbor?

A lot of wineries are dumping their wine. So they won't ruin their cachet, they are creating down market labels and selling it cheap. If you're a wine enthusiast, deflation isn't that bad. |

| Gold Seeker Closing Report: Gold Falls Slightly While Silver Gains Over 2% Posted: 29 Apr 2010 04:00 PM PDT Gold reversed yesterday's after hours losses and rose in late Asian trade to see a $0.25 gain at $1171.05 in London before it fell to as low as $1161.90 by about 9AM EST, but it then chopped its way back higher in New York and ended with a loss of just 0.25%. Silver waffled near unchanged in Asia and London before it climbed higher throughout most of trade in New York and ended near its late session high of $18.558 with a gain of 2.38%. |

| Silver and Gold Prices Non Confirmation Posted: 29 Apr 2010 03:39 PM PDT Gold Price Close Today : 1168.40Change: -2.90 or -0.2%Silver Price Close Today : 18.549 Change 44.2 cents or 2.4%Platinum Price Close Today: 1729.60Change: 22.70 or 1.3%Palladium Price Close... This is a summary only. Visit GOLDPRICE.ORG for the full article, gold price charts in ounces grams and kilos in 23 national currencies, and more! |

| Prosecutors Should Investigate Goldman Sachs on Baidu Trading Posted: 29 Apr 2010 02:37 PM PDT

|

| Gold and Gold Stock Relative Outperformance Posted: 29 Apr 2010 02:20 PM PDT |

| Criminal probe looks into Goldman Sachs trading Posted: 29 Apr 2010 01:23 PM PDT By Susan Pulliam and Evan Perez http://online.wsj.com/article/SB1000142405274870357250457521465299834887... Federal prosecutors are conducting a criminal investigation into whether Goldman Sachs Group Inc. or its employees committed securities fraud in connection with its mortgage trading, people familiar with the probe say. The investigation from the Manhattan U.S. Attorney's Office, which is at a preliminary stage, stemmed from a referral from the Securities and Exchange Commission, these people say. The SEC recently filed civil securities-fraud charges against the big Wall Street firm and a trader in its mortgage group. Goldman and the trader say they have done nothing wrong and are fighting the civil charges. Prosecutors haven't determined whether they will bring charges in the case, say the people familiar with the matter. Many criminal investigations are launched that never result in any charges. ... Dispatch continues below ... ADVERTISEMENT Coming Friday-Sunday, June 11-13, at the Dallas-Fort Worth Airport Marriot: The conference will explore the dangers and opportunities in today's bullion markets and the need for investors to diversify bullion holdings outside of bullion banking and commodities markets. Speakers will include David Morgan of Silver-Investor.com, Gold Anti-Trust Action Committee Chairman Bill Murphy, and Duncan Cameron and Philip Judge of Anglo Far-East Bullion Co. The earliest conference attendees on Saturday will be able to schedule one-on-one interviews for personal consultation with Anglo-Far East's experts on Sunday. Watch future GATA Dispatches for registration information. To learn more about the Anglo Far-East Bullion Co., please visit http://www.anglofareast.com. The criminal probe raises the stakes for Goldman, Wall Street's most powerful firm. The investigation is centered on different evidence than the SEC's civil case, the people say. It couldn't be determined which Goldman deals are being scrutinized in the criminal investigation. A spokesperson for the Manhattan U.S. Attorney's office declined to comment. Goldman declined comment. The development comes amid public calls for more Wall Street accountability for the industry's role in the financial crisis. Though there are multiple ongoing criminal and civil investigations, no Wall Street executives connected with the meltdown have been convicted of criminal charges. During congressional hearings this week into Goldman's role in the crisis, legislators grilled Goldman executives for nearly 11 hours. The SEC and Justice Department often coordinate their actions on investigations. The probe underscores heightened efforts by the Manhattan U.S. Attorney's office in prosecuting white-collar and Wall Street crime. It is in the midst of pursuing the largest insider-trading case in a generation, charging 21 individuals and negotiating 11 guilty pleas in that matter. But the Goldman probe presents a significant challenge for the government. Prosecutors in the Brooklyn office of the U.S. Attorney last year lost a high-profile fraud case against two former Bear Stearns Cos. executives, in the first major criminal case linked to the financial meltdown. Prosecutors had accused the Bear Stearns employees of lying to investors in 2007 about the health of two funds that eventually collapsed. The case centered on what the government viewed as incriminating emails indicating the traders knew the mortgage market would fall but didn't disclose that view to investors. To bring any criminal charges in the Goldman matter, prosecutors would need to believe they had gathered evidence that showed that the firm or its employees knowingly committed fraud in their mortgage business. Proving such intent to break the law typically is the toughest hurdle for prosecutors to clear. Another stumbling block: Such financial cases can be highly complex. Few outside of Wall Street understand arcane products such as collateralized debt obligations, the pools of mortgage-related holdings at the heart of the SEC civil case against Goldman. On April 16, the SEC charged Goldman and an employee, Fabrice Tourre, with securities fraud in a civil suit relating to a mortgage transaction, known as Abacus 2007-AC1, a deal the government said was designed to fail. The SEC alleged that Goldman duped its clients by failing to disclose that hedge fund Paulson & Co. not only helped select the mortgages included in the deal but also bet against the transaction. Both Goldman and Mr. Tourre have denied wrongdoing. Even the SEC's case, which is subject to a lesser standard of proof than a criminal case, is viewed as a challenge for regulators. The SEC's commissioners were split 3-2 along party lines on whether the agency should bring a case. In battling the SEC charges, Goldman says its investors were sophisticated and knew the underlying securities they were buying. Goldman says it wasn't required to disclose who provided input into the deal or the views of its clients in the transaction. The congressional hearing involved numerous other mortgage deals Goldman arranged in 2006 and 2007. Lawmakers criticized Goldman and its executives for allegedly stacking the deck against clients during the market meltdown in 2007. Some of the emails released by regulators, lawmakers and Goldman suggest a callous attitude among Goldman employees toward the risks involved in some of the Goldman mortgage deals, including one in which a Goldman employee referred to a mortgage transaction the firm sold to investors as a "sh---y" deal. Over the years, the government has been reluctant to criminally charge financial firms with wrongdoing because the charge itself can cause a business to implode. Some investing clients can't or won't trade with a firm facing such a taint. Indeed, in the more than two-century history of the U.S. financial markets, no major financial firm has survived criminal charges. Securities firms E.F. Hutton & Co. and Drexel Burnham Lambert Inc. crumbled after being indicted in the 1980s. In 2002 Arthur Andersen LLP went bankrupt after it was convicted of obstruction of justice for its role in covering up an investigation into Enron Corp. The conviction was later overturned by the Supreme Court. In recent years, some financial firms have agreed to "deferred prosecutions," in which they agree to a probationary period for which they won't commit any future wrongdoing. That's what Prudential Securities Inc. famously did in 1994 when that securities firm faced criminal charges that it misled investors about the risks and rewards of limited-partnership investments. Prudential agreed to a three-year deferred prosecution, as well as fines and restitution, to end a criminal securities-fraud investigation. Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT The Silver Saver Program A unique silver savings program has been developed by trusted friends of Silver-Investor.com founder David Morgan, perhaps the world's best-known silver market commentator. In the Silver Saver Program you buy silver in select increments and at competitive prices. You enter the market through dollar cost averaging. The program is easy to start and is automatic but also easily modified if you wish. Your silver can be delivered to your door. If the program no longer meets your needs, you can stop at any time. "This program," Morgan says, "not only receives my full endorsement but also adheres to the tenets I set forth in 'The 10 Rules of Silver Investing' -- dollar cost averaging and putting real silver into your savings plan. "As an introductory promotion, if you decide participate in the Silver Saver Program, I will send you a free copy of 'Silver in the Next Decade,' one of the most important Morgan Reports I have written. And you will have the opportunity to read the Morgan Report free for 30 days. "Now more than ever it is important to accumulate physical silver and to stay informed on major economic developments. My reports cover money, metals, and mining, but I have always stressed the need to have physical metal. The Silver Saver Program will help you achieve a solid position in silver." For more information, please visit www.Silver123.net. If you would like to talk to someone about the Silver Saver Program, telephone our team at 785-727-2277. |

| Moore Capital fined in platinum manipulation case Posted: 29 Apr 2010 01:17 PM PDT Jeez, could the gold and silver markets be manipulated too? * * * By Whitney McFerron http://www.bloomberg.com/apps/news?pid=20601103&sid=atVcqHBUSuOo CHICAGO -- Moore Capital Management LP agreed to pay $25 million to settle charges that a former portfolio manager attempted to manipulate platinum and palladium futures during a surge in prices two years ago, U.S. regulators said. A portfolio manager, who wasn't identified, used buy orders in the closing moments of trading on the New York Mercantile Exchange to boost settlement prices from November 2007 through May 2008, the Commodity Futures Trading Commission said today in an e-mailed statement. The orders "frequently accounted for a significant portion of the volume" in the two thinly traded markets, the agency said. Platinum futures rose 39 percent from Nov. 1, 2007, to May 30, 2008, touching a record $2,308.80 an ounce on March 4, and palladium jumped 17 percent, touching a six-year high of $600 an ounce, also on March 4. Both palladium platinum are used in jewelry and pollution-control components for cars. New York-based Moore, which manages about $15 billion, said in a separate statement that the portfolio manager left the company in the fall of 2008. None of Moore's principals nor its current management were involved in any improper trading, and none were accused of any wrongdoing, the company said. The manager sought to influence the exchange's volume-weighted settlement price with buy orders for 20 to 100 contracts, according to the agency. A platinum contract is 50 ounces, and a palladium contract is 100 ounces. ADVERTISEMENT Prophecy Resource Corp. Appoints Rob McEwen to Advisory Board Prophecy Resource Corp. (TSX.V: PCY, OTC: PCYRF) is pleased to announce the appointment of Rob McEwen to the company's Advisory Board. McEwen is a leading Canadian mining industry entrepreneur. He is the chairman and CEO of U.S. Gold Corp. and Minera Andes Inc. McEwen was the founder and former chairman and CEO of Goldcorp Inc., whose Red Lake Mine in northwestern Ontario, Canada, is considered to be the richest gold mine in the world. During his tenure at Goldcorp, McEwen transformed the company from a collection of small companies into a mining powerhouse, growing its market capitalization from $50 million to approximately $8 billion. For Prophecy Resource Corp.'s complete statement: http://www.prophecyresource.com/news_2010_mar11b.php Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Anglo Far-East Bullion Co., the Original Private Bullion Custodian For two decades Anglo Far-East Bullion co. has been providing select international clientele the highest degree of privacy, security, and access to buy, hold, and sell allocated gold and silver bars. -- Allocated gold and silver bars: AFE will not only provide you with the individual bar numbers of the bullion bars you own, but you can also rest safely in the knowledge that each bar is sight-verified by a top Swiss auditor and annually checked off against AFE accounts to ensure that your metal is locked away safely. -- Guaranteed market access and liquidity: AFE buys and sells directly with LBMA-certified metal refineries only. In bypassing the commodities market exchanges such as the Comex and bullion banks, AFE provides clients a means of access to the global physical precious metals markets that may not be available to others should systemic issues in the bullion markets arise. -- Stand for delivery: If at any time you wish to take delivery of your metal, AFE will arrange to have bars shipped to you anywhere in the world. -- Zero tolerance for leverage: AFE refuses to deal with "paper gold." We believe our clients want the metal itself so they may avoid the risks of the paper markets. AFE will not introduce such risk to its clients. -- Metal vaulted outside the banking system: None of AFE's clients have to worry that their metal is exposed to encumbrances bearing on bullion banks and commodities markets. None of AFE's vaulting partners or other strategic providers are controlled or majority-owned by banks. This is by design, not by accident. -- Access to the LBMA system of refineries, vaults, and security providers. This allows AFE clients to maintain London Good Delivery status of their metal, ensuring ease of sale or transfer, while being insulated from the "paper gold" market. -- Total privacy: AFE accounts are managed as numbered accounts in the Swiss private banking tradition. At no time does identifying information such as name and address appear on any account statement or other account documents. -- Geo-political diversification: In the words of the wise King Solomon, "Place a portion of seven and eight throughout the land, for you know not where evil may arise." Many of AFE's clients choose AFE specifically because their metal is safely vaulted outside the jurisdiction they reside in. -- Iron-clad governance: By contract with AFE's vaulting provider, no access may be made to the vaults without the attendance of an agent of the vault as well as an agent of the third-party signatory trustee, in this case top Swiss auditor Grant Thornton. All metal going into and -- more importantly -- coming out of the vaults requires the approval of a third-party signatory trustee as well as a detailed, sight-verified report of each bar and serial number by the auditor. For more information and a personal consultation with one of our private account liaisons, please contact us: Anglo Far-East Bullion Co. |

| Congressman Miller Introduces Bill Breaking Up Big Banks Posted: 29 Apr 2010 12:57 PM PDT A friend on the Hill sent me the following internal letter being sent around the House to gather cosponsors. Too Big to Fail is Too Big to Regulate Cosponsor H.R. 5159 – The Safe, Accountable, Fair and Efficient Banking Act of 2010

April 29, 2010 Dear Colleague: We’re writing to invite you to join us as cosponsors of legislation to restrict the leverage and size of the very largest banks and financial institutions in the United States. The resolution powers in the financial regulatory reform bill that passed the House last year represent critical first-steps in addressing the problem of risk-taking by institutions that are “too big to fail.” But it has become increasingly clear that to make absolutely certain U.S. taxpayers are never again forced to rescue a giant financial institution, we must make sure that no market participant is so large that a failure would result in economic collapse. The six largest U.S. banks today have total assets estimated to be in excess of 63 percent of our national GDP. The gigantic size of megabanks, and the perception in the marketplace that they are indeed too big for the government ever to permit them to fail, gives them a competitive advantage over smaller financial institutions that distorts the market and discourages competition. The lack of competition in the banking industry, in turn, leads to ever-higher levels of risk in the system. There is no evidence that giant financial institutions perform any public service or market function that cannot be performed as well or better by smaller, and even substantially smaller, banks and financial institutions. To the contrary, all the evidence suggests that megabanks distort the market and impose substantial risk to the public. Further, the unprecedented size of the largest banks gives them enormous political power, including the ability to thwart appropriate financial regulation. As former Secretary of Labor Robert Reich correctly observed in a recent column, “the only competitive advantage to being a giant bank headquartered on Wall Street is to have the economic and political clout to get bailed out by American taxpayers when the next crisis hits.” The SAFE Banking Act of 2010 would limit the size of megabanks by prescribing statutory limits on deposits, non-depository liabilities, and leverage. These steps would require several of the largest banks to, in effect, break themselves up to come in under the limits that this law would create. Specifically, the bill would:

For more information about the SAFE Banking Act, or to become a cosponsor, please contact [removed for privacy] in Rep. Miller’s office. [Members of Congress] [Robert Reich's article "Break Up the Banks" is attached to the letter] |

| Family Denied Medical Treatment Because of State's Debt Posted: 29 Apr 2010 12:03 PM PDT WILLIAMSON-- A Carterville mom says she was denied medical care for her children because the state isn't paying its bills. As the Illinois budget crisis drags on, it's impacting more and more people. Now, some doctors in southern Illinois are limiting services for patients employed by the state or is asking those patients to pay up front. It is a vicious cycle. The state isn't paying the insurance companies, so insurance companies aren't paying doctors, and the doctors are forced to make changes some families don't like. Ashley Wright of Carterville says one of the main reasons she and her husband decided to work for SIU was for the benefits. Now it seems the most important perk - health insurance - is being compromised. "On one point, I want to be mad at the doctors because I feel like they have a moral obligation to hang in there and not bail on us when times get rough," says Ashley. During a recent check-up, Ashley's four month old son Noah was denied immunizations by his pediatrician. The doctor said Ashley's insurance provider wasn't paying its bills. Ashley doesn't know how to fight back. "We can't go after the doctors, they're not being paid. We can't go after the insurance company, they're not being paid. But how do we fight the state?" she asks. At one nearby doctor's office, they're now requesting state employees pay out of pocket to later be reimbursed. More Here.. |

| 3 Reasons for the Commodity Bull Market Posted: 29 Apr 2010 11:38 AM PDT "The wheels on the bus go round and round…round and round…round and round," according to a familiar children's song. The song never tells us what happens when the bus rips through a guardrail and plunges down a ravine. But the stock market might soon solve that mystery for us. For the better part of a year, the wheels on the stock market have been going round and round. The ride has been delightful. The smooth highway of post-crisis optimism has whisked the stock market along its way. From the 12-year lows of March 9, 2009, the S&P 500 Index has advanced more than 70%. But the road ahead looks much less inviting. The stock market must now try to steer through the narrow, rutted switchbacks of serious sovereign credit problems, resurgent inflation and a US economy that still struggles to get out of bed every morning. Earlier this week, the credit rating of Greece and the reputation of Goldman Sachs were both downgraded to "junk" status. Neither downgrade was a surprise. But both downgrades seemed to jostle the bus a little closer to the guardrail. Scary headlines should not necessarily scare the market. But scary headlines that contain subliminal messages like "the Western nations are bankrupt" or "America's most influential Wall Street firm is systematically cheating" are the kind of headlines that should scare investors…at least a little. We're not talking doom and gloom (again), folks. We're just saying that wishes aren't truths. We wish Greece could pay its bills; and we wish Goldman wasn't dishonest. But that doesn't mean we'll be tossing pennies in a wishing well and loading up on S&P 500 futures. Greece and Goldman are both serious roadside hazards. Even though they have not caused any serious crack-ups yet, they have caused some serious delays. The stock market has gone nowhere for almost a month. Commodities, by contrast, have gone somewhere. The CRB commodity index is up more than 8% from its February lows. Gold is up 10% since then. Why would commodities be rallying so noticeably, even when the stock market is not? Is the answer that the commodity market: A) Senses a budding inflationary trend in the US? "D" would get our vote. And we suspect the bullish tone in the commodities pits is something more than what Jim Rogers calls a "jiggle." We suspect the commodity markets have re-awakened for good reason…and maybe for many good reasons.

One of the good reasons to buy a bit of gold, for example, is that the world is running out of good reasons to buy euros. This currency-by-committee is coming under serious pressure, as the committee struggles to devise ways to make one plus one equal three. The chart above depicts the gold price in euros, compared to the gold price in dollars. Although gold is advancing both currencies, it is making much greater headway against the euro. Ergo, the euro is even more suspect than the dollar. Clearly, investors are becoming increasingly concerned about the euro's long-term purchasing power, and perhaps about its long-term viability. Your editors share that concern, and they are also concerned about the long-term purchasing power of a share of Goldman Sachs. But we refuse to embrace any kind of doom and gloom about either Greece or Goldman. Instead, our message is positive and bullish. We are bullish on inflation; bullish on gold; bullish on Goldman put options and most of all, bullish on volatility. Buckle-up for safety! Eric Fry 3 Reasons for the Commodity Bull Market originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." Check out our new special report Investing in Offshore Oil More articles from The Daily Reckoning…. |

| Gold Prices Fall from 2010 Highs, Silver Soars Posted: 29 Apr 2010 11:36 AM PDT

Other metals, however, registered gains with silver soaring the most at 2.4 percent. Also on Thursday, crude oil rallied to above $85 a barrel — its highest point in two weeks, while U.S. stocks marked their biggest daily gains in at least three weeks. New York precious metal figures follow: (…) © CoinNews.net for Coin News, 2010. | |

| Royal Canadian Mint Introduces 2010 Spring Collection Posted: 29 Apr 2010 11:35 AM PDT Earlier this month, the Royal Canadian Mint marked spring's arrival with a strong accent on nature in the launch of exciting new coins designed to appeal to the discerning collector and the budding coin enthusiast alike.

A number of popular series continue in this latest release of 2010, notably: the 1/25 oz. pure gold coin honoring the RCMP; the Birds of Canada 25-cent coin series celebrating the colorful Goldfinch; and the 99.999% pure gold Canadian Floral Emblems series featuring Manitoba's Prairie Crocus. (…) © Royal Canadian Mint for Coin News, 2010. | |

| Gold prices highest since December on euro zone debt fears Posted: 29 Apr 2010 11:34 AM PDT By Claudia Assis & Kate Gibson, MarketWatch April 28, 2010, 4:55 p.m. EDT SAN FRANCISCO (MarketWatch) — Gold futures finished at their highest Gold for June delivery gained $9.60, or 0.8%, to $1,171.80 an ounce on "Gold is riding the coattails of its role as the currency of fear," Prices had bounced between gains and losses in early Wednesday trade. Gold has ignored a stronger dollar in its march upward. That "just

|

| S&P Cuts Spain’s Rating One Notch on Economic View Posted: 29 Apr 2010 11:34 AM PDT * Lower growth could make it harder to cut (Updates throughout with Fitch, NEW The outlook is negative, reflecting the "In our opinion, Spain is likely to have an "We now project that real gross domestic product (GDP) The rating Analysts have said that because Spain is a "Indeed, Spain is the 800 pound gorilla in "It doesn't surprise me," said Jamie BOND SPREADS In fact, ahead of the rating action by Spain's markets rushed lower after the downgrade news, with "At this point it is going to be very Standard & Poor's has now downgraded Spain twice since the However, Javier Cantavella Nadal of S&P said the downgrade "Spain's ability to Fitch sovereign Spain's Socialist government has promised Government officials said the S&P downgrade would not put in "The important thing now is to underpin measures to Moody's "It seems to be one (downgrade) after the other. Only a few |

| Gold rises as euro zone debt fears linger Posted: 29 Apr 2010 11:34 AM PDT Jan Harvey LONDON Thu Apr 29, 2010 10:54am EDT (Reuters) – Gold

Gold on Wednesday hit its

But an upbeat

Spot gold

"Gold has benefited from the sovereign debt

"We

The euro rose on Thursday, rebounding from

Equities

Assets seen as higher

"Eventually things are

INFLATIONARY PRESSURES

"We think defaults are less likely, but

Investment interest in gold was firm, with

Holdings of a London-based gold ETP (PHAU.L)

But high prices weighed on

Among other precious

Holdings of ETF

"Now that short-term sentiment toward

|

| Base metals miner Lundin returns to profit on higher prices Posted: 29 Apr 2010 11:33 AM PDT Lundsin Mining's Q1 revenue rises on metals prices, but output was lower and shares fell as analysts' forecasts not reached. |

| Posted: 29 Apr 2010 11:31 AM PDT The Social Security Trust Fund released some data today. There are some data points worth noting, they might lead to a conclusion. But first, for the history buffs, I want to show you a “Tipping Point”. I think the exact date was March 3rd or 4th. For sure it was sometime in March that the SSTF went negative since Greenspan fixed things in 1983.

|

| Posted: 29 Apr 2010 11:15 AM PDT One very reliable directional indicator for the price of gold is The Privateer 5x3 point and figure chart, the one below goes back to 1985. I was in a lazy mood today and I think this chart pretty much speaks for itself. The P&F pattern is a double-top breakout and the odds are high that the price of gold will soon challenge the $-based all-time high, following right behind the persistent all-time highs for euro-gold that have been hit repeatedly over that past few weeks. Here's the source for this venerable chart. I am not a current subscriber to the The Privateer but was for several years: LINK (click on chart to enlarge) On another note, several people have remarked to me that it now appears, based on this week's action on the Comex, that some big money may be challenging the fraudulently massive short positions in gold and silver. Hard to say for sure, but in the face of increasingly aggressive attempts by the likes of JPM and HSBC to beat down the price of gold and silver, especially silver, the futures have been rebounding sharply almost every day. I'm not sure I would want to be short the precious metals market right now... This posting includes an audio/video/photo media file: Download Now |

| Posted: 29 Apr 2010 11:15 AM PDT One very reliable directional indicator for the price of gold is The Privateer 5x3 point and figure chart, the one below goes back to 1985. I was in a lazy mood today and I think this chart pretty much speaks for itself. The P&F pattern is a double-top breakout and the odds are high that the price of gold will soon challenge the $-based all-time high, following right behind the persistent all-time highs for euro-gold that have been hit repeatedly over that past few weeks. Here's the source for this venerable chart. I am not a current subscriber to the The Privateer but was for several years: LINK (click on chart to enlarge) On another note, several people have remarked to me that it now appears, based on this week's action on the Comex, that some big money may be challenging the fraudulently massive short positions in gold and silver. Hard to say for sure, but in the face of increasingly aggressive attempts by the likes of JPM and HSBC to beat down the price of gold and silver, especially silver, the futures have been rebounding sharply almost every day. I'm not sure I would want to be short the precious metals market right now... This posting includes an audio/video/photo media file: Download Now |

| You are subscribed to email updates from Gold World News Flash To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

Christopher Butler is a principal of

Christopher Butler is a principal of

New York gold futures on Thursday retreated slightly from their near five-month highs, breaking away from a four-day winning streak as some profit-taking was in the air.

New York gold futures on Thursday retreated slightly from their near five-month highs, breaking away from a four-day winning streak as some profit-taking was in the air.

No comments:

Post a Comment