Gold World News Flash |

- China's Subtle Shift in a Basic Commodity Import

- Congress Is the Biggest Systemic Risk

- The Way Out: Why Inflation Will Be Higher Than Market Expects

- Special GSR Gold Nugget: Harry S. Dent Jr. & Chris Waltzek

- European Debt Crisis Right Around the Corner? U.S. Housing Collapse Redux on the Way?

- What's Your Home Worth...In Gold?

- Wednesday ETF Wrap-Up: GDX Soars, SCZ Sinks

- Get Prepared For Massive Launch

- Gold, Silver, Palladium: True Bull Market

- MACRO-EUROPE: The Titanic is SINKING

- Jim?s Mailbox

- Hourly Action In Gold From Trader Dan

- In The News Today

- Gold In Various Currencies

- Daily Dispatch: Three Mile Island for U.S. Oil

- Rising Federal Debt Found to Cause Intestinal Alien Syndrome

- Things

- The Deathblow for Greece, A Congress vs. Goldman Photo Reenactment, Why Gold Isn’t a

- Golden Gridlines. Are You A Player?

- When Will Gold Make its Next Big Move?

- All Aboard the Gold Train as Recognition Move Approaches

- U.S. to Declare War on Iran?

- Nortec Minerals Finnish First

- LGMR: Gold Defies Surging Dollar as "Ebola Contagion" Hits Euro

- Oh Gentle Ben??? Ben? Or Is That HAS BEEN?

- Geithner May Be CRIMINALLY Charged?

- Client Update – Evolving Gold Breakout?

- The Ultimate Currency Hedge

- Spain is in Pain - US Dollar and Gold Are Safe Havens

- Euro Slide Hurts US Multinational Corporation Profits; Roubini Eyes Sovereign Debt Defaults…

- Mickey Fulp: What Is Gold Actually Worth?

- The Gold Rush in Iraq

- International Forecaster April 2010 (#8) – Gold, Silver, Economy + More

- Gold Seeker Closing Report: Gold Gains Nearly $10 While Silver Falls Slightly

- Will Eurocrash End the Party?

- SWC; a compelling Palladium Investment

- Spain is in Pain – US Dollar & Gold Are Safe Havens

- The Client Always Comes First At Goldman... Except When He Doesn't, Which Is Also Always

- Gold Prices Hit 2010 High, Silver and Platinum Decline

- Bullion Bulls Canada interviews GATA’s Adrian Douglas

- Broad, bipartisan coalition fighting Fed in Senate

- Barrick Gold Corporation Q1 2010 Earnings Call Transcript

- Fear Is Cheap

- Learning From A Communist

- 20 Things You Will Need To Survive When The Economy Collapses And The Next Great Depression Begins

- More Extend and Pretend

- No Wonder the Eurozone is Imploding

- When you first knew...

| China's Subtle Shift in a Basic Commodity Import Posted: 28 Apr 2010 07:46 PM PDT George Fisher submits: There is a subtle economic shift going on in China that most investors are unaware of. While many investors are focused on Chinese high tech, medical, and financial opportunities, most overlook one basic commodity. This basic commodity is in short supply domestically and over 50% of domestic demand is imported, historically 80% of imports came from one country, and the imported price has tripled in the past 3 years. The China market is seriously transitioning to alternative North American suppliers. For example, shipments from just the province of British Columbia increased 4 fold in the month of Jan ’10 over Jan ’09, and annual shipments have tripled since 2007 to $365 million. The product is: Timber. China is, and will be for some time, a net importer of timber and logs. Although the government has a stated goal of being self-sufficient by 2015, the current supply deficit, along with organic demand growth of 10% annually, makes achieving the goal extremely difficult. China is developing a timber plantation industry focused on cultivating faster growing trees, but many are in the early stages of maturity. In addition, the easiest method to increase forest carbon sequestration is to reduce domestic timber harvest levels, thereby maintaining the forest cover. These factors will ensure a robust timber import market for the foreseeable future. As a low cost raw material, logs are used in various manufactured forest products, such as 2 x 4 lumber, plywood, furniture, and the various pulp products. Countries with timber assets seek the value-added jobs that manufacturing forest products bring, and there is a trade-off between exporting the raw logs or the finished 2 x 4s. Complete Story » | ||||

| Congress Is the Biggest Systemic Risk Posted: 28 Apr 2010 07:08 PM PDT Craig Pirrong submits: Blanche Lincoln has expressed uncertainty as to whether the no Federal assistance clause in her bill will survive to become law. (Here’s hoping, though the Republicans caved–I’m shocked!, shocked!–at holding up the Dodd bill which Steve Bainbridge rightly calls “evil.”) Perhaps one reason for her uncertainty is that some anonymous Fed staffers threw some “comments” on the bill over the transom. (Which raises the questions: Why do these staffers feel the need to be anonymous? Why hasn’t the Board, or Bernanke, taken a stand on this?) (We know with probability 1 that SWP’s cogent critiques had nothing to do with Lincoln’s uncertainty!) Echoing my original take, the comments trashed the dreaded section 106: Complete Story » | ||||

| The Way Out: Why Inflation Will Be Higher Than Market Expects Posted: 28 Apr 2010 07:02 PM PDT Jonathan Tunney submits: For a corporation, there is a financial condition which is quite simply the “point of no return.” This is the point where existing liabilities become so large that the service of these liabilities overwhelms the income statement and the entity enters into a downward spiral of even greater liabilities. Eventually, the entity has no choice but to stop servicing its liabilities and enter into the inevitable default. This, in fact, is the conundrum with which the federal government will have to contend in the not-too-distant future as it faces unprecedented deficits. The increase in the debt of the US as a percentage of GDP over the last few years is alarming, however it is nowhere near as alarming as what is to come. But as bleak as the fiscal future of the world’s largest economy may seem, there are simple ways to hedge against and/or profit from an inflationary resurgence which, while inevitable over the long term, is largely unpredicted by current financial markets. Complete Story » | ||||

| Special GSR Gold Nugget: Harry S. Dent Jr. & Chris Waltzek Posted: 28 Apr 2010 07:00 PM PDT | ||||

| European Debt Crisis Right Around the Corner? U.S. Housing Collapse Redux on the Way? Posted: 28 Apr 2010 06:59 PM PDT I must admit folks that I am in awe of what I see each day in the financial markets. It's also very hard to make any sense of any of it when it comes to investing. Complete Story » | ||||

| What's Your Home Worth...In Gold? Posted: 28 Apr 2010 06:45 PM PDT Joseph L. Shaefer submits: I discovered the great chart below at Chart of the Day. It basically tracks the median price of a single-family home in the United States and divides it by the price of one ounce of gold. The result tells you, in a store of value that pre-dates all paper currency and will no doubt outlive any single paper currency, what the value of US housing is today and what it has been for the past 40 years. There are those who will protest that “gold fluctuates too wildly” to provide a worthwhile indicator of value. I would disagree. While gold may fluctuate in dollar terms, or euro terms, or yen terms, it is often the value of those currencies that fluctuate around the price of gold. The long-term trend, of course, is that all paper currencies are inflated – slowly, for the most part, but inexorably. That’s why eggs that cost 61 cents a dozen, bread that cost 25 cents for a pound loaf, milk that cost 65 cents a half gallon, and gas that cost 36 cents a gallon in 1970 are, um, well, rather a bit higher today! But it can well be argued that the same ounce of gold that would have bought x quantity of all those items in 1970 will still buy roughly the same x quantity today. (Yes, even after the costs of extracting oil and natural gas have risen, even in real terms.) Complete Story » | ||||

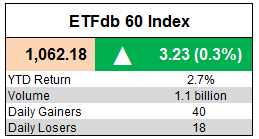

| Wednesday ETF Wrap-Up: GDX Soars, SCZ Sinks Posted: 28 Apr 2010 06:42 PM PDT ETF Database submits: Equities markets trended higher on the back of an upbeat Federal Reserve outlook on the U.S. economy and quality earnings reports. This modest uptick came despite continued worry in the euro zone over sovereign debt issues, with Spain the latest country to suffer a downgrade from ratings agency Standard and Poor’ss. Among Dow components, the biggest gainer was Dow Chemical, which saw its shares jump higher by close to 6% after the company reported net income of 41 cents a share compared to 3 cents a share in the same period a year ago according to the AP.

Complete Story » | ||||

| Get Prepared For Massive Launch Posted: 28 Apr 2010 06:08 PM PDT We have been looking at global trends and the debt markets very carefully this year so as to remain prudent about our views on the direction of gold and the Australian gold sector. This may seem like a long bow to draw however the thigh bone is connected to the knee bone when it comes to global markets and capital flows. | ||||

| Gold, Silver, Palladium: True Bull Market Posted: 28 Apr 2010 06:06 PM PDT | ||||

| MACRO-EUROPE: The Titanic is SINKING Posted: 28 Apr 2010 06:04 PM PDT This is a special Outside the Box. I got this letter from my good friend Greg Weldon last night and got permission to pass it on to you. I think it illustrates the problems that the world is facing from the sovereign debt crisis that is building in Europe. There are no good solutions here, only very difficult ones. In order to get financing, Greece must willingly put itself into a multi-year depression. And borrowing more money when it cannot afford to pay back what it has will not solve the problem. 61% of Greeks now favor leaving the euro. How has Greece responded? By banning short selling on its stock market for the next two months. That should make things better. Greeks are responding by rioting and going on strike. But you truly know when a country is dysfunctional when its AIR FORCE goes on strike. Yesterday Reuters reported that hundreds of Greek pilots called in sick in protest. The response from government? The Minister of Defense said he was "profoundly disappointed." Now t... | ||||

| Posted: 28 Apr 2010 06:04 PM PDT View the original post at jsmineset.com... April 28, 2010 08:25 AM Jim, Your note about JP Morgan ceasing the funding of tax returns struck me. When I submit my Colorado Tax Withholding on my payroll I go to a JP Morgan website which collects the payment on behalf of the state. I’m sure they aren’t the only service but it seems to me it gives them significant inside information on payroll withholding – probably across the country. Information that nobody gets but them! I bet you they have seen a dramatic reduction in withholding that confirms their views on unemployment… CIGA Mr. T Gold Stocks relative to Stocks CIGA Eric Perception must not blind you from the truth. Many investors have the perception that gold stocks have and will continue to under perform the stock market. While gold stocks have been grinding higher since 2003, they will soon accelerate relative to stocks. This will be illustrated by a sharp downward push in the U.S. Large Cap Sto... | ||||

| Hourly Action In Gold From Trader Dan Posted: 28 Apr 2010 06:04 PM PDT View the original post at jsmineset.com... April 28, 2010 09:59 AM Dear CIGAs, Hat's off to the gold bulls who were able to overpower the bullion bank line of selling at the $1162 level. After being initially repulsed from that line in yesterday's New York session when the banks seemingly threw everything but the kitchen sink at the metal, even on a day in which widespread commodity selling was the norm, the longs refused to run instead digging in their heels and fighting back. Open interest indicates the fierce contest that took place as it surged over 6,600 contracts in the most active June contract. That feat enabled them to push the closing price right up to the resistance line on the technical charts that the Comex bears had been attempting to enforce. Today, when both Euro gold and British Pound priced gold went on to make brand new all time highs today at the London PM Fix ( €880.613 and £764.218 respectively), that strength was enough to give the bulls the force necessary to ... | ||||

| Posted: 28 Apr 2010 06:04 PM PDT View the original post at jsmineset.com... April 28, 2010 10:06 AM Dear CIGAs, The following is a statement out of EU today. QE to infinity! "According to a European Commission spokesman, the 16 countries that use the euro decided not to allow any euro-zone nation to default on its debt, refuting growing speculation that Greece might default." More Jim Sinclair’s Commentary All the Fed did was change the date on their last action statement and re-issue it. The instant drop in equities today when the 3rd EU downgrade came more than likely insures (as was said here) that no sovereign EU default will be permitted. That means QE to infinity. Even Merkel did a moon walk today. Federal Reserve Maintains Low Interest Rates By SEWELL CHAN Published: April 28, 2010 The Federal Reserve on Wednesday kept short-term interest rates near zero and maintained, as it has for nearly a year, that rates would stay at that level for "an extended period." Despite intense marke... | ||||

| Posted: 28 Apr 2010 06:04 PM PDT View the original post at jsmineset.com... April 28, 2010 04:17 PM Dear Friends, Linked below are some charts of gold priced in currencies other than the US Dollar. As you can see from the charts, gold is either making new highs or is close to previous highs. What this reveals in picture form is a loss of confidence in paper currencies. This is gold reverting to its historic, age-old role as a safe haven for wealth preservation. Trader Dan Click charts to enlarge in PDF format ... | ||||

| Daily Dispatch: Three Mile Island for U.S. Oil Posted: 28 Apr 2010 06:04 PM PDT April 28, 2010 | www.CaseyResearch.com Three Mile Island for U.S. Oil Dear Reader, This morning I used my iPhone to take the photo shown here. If you look closely, you will see the shape of the hammock I had optimistically hung up two weeks ago. That my optimism seemed warranted is supported by the fact that as recently as two days ago, I was playing golf. Just goes to show, forecasting future outcomes of complex systems – weather and financial markets, to name two – is no easy matter. There are times, however, when you can identify key components of those systems that are headed in a direction that, unresolved, will almost certainly affect the broader outcome. For example, history has shown that a large volcano erupting will have a fairly predictable impact on weather. And housing bubbles or excessive government spending will, in time, lead to fairly predictable outcomes… though the specific timing when tho... | ||||

| Rising Federal Debt Found to Cause Intestinal Alien Syndrome Posted: 28 Apr 2010 06:04 PM PDT I was having breakfast with the family, and to keep from having to listen to their boring stories about their boring lives while I ate, I told them that I keep having a nightmare where a creature, not unlike in the movie Alien, is growing inside me, eating my guts out, and will soon burst out of my chest and proceed, I assume, to finishing eating what is left of me. Naturally, everybody is immediately convinced that I am haunted by these bad dreams because I have so much guilt from being such a hateful, worthless failure as a father and human being, and that my best option is to buy a lot of life insurance and then die in such a way as to trigger the double indemnity clause, leaving a lot of money for my family with which to seek at least one moment of happiness in their sad, miserable lives. Well, I told my daughter that I certainly did not need any help with financial planning, thank you very much, but I think that my problem is that I am terrified by the horrors of a corrupt, brai... | ||||

| Posted: 28 Apr 2010 06:04 PM PDT The following is automatically syndicated from Grandich's blog. You can view the original post here April 28, 2010 02:34 PM [LIST] [*]Good article on gold. But didn’t* the “Tokyo Rose” of Gold commentators (I like that name much better than “Senior Analyst” and it’s far more fitting) say for years and from hundreds of dollars lower that gold rose only because the dollar was declining? We really should thank “Tokyo Rose” for being the best contrarian indicator of all-time. [*]America has its own PIGS [*]The solution will come with a heavy price [*]The clock continues to tick [*]A must watch film – America has no idea what’s to come. [/LIST] [url]http://www.grandich.com/[/url] grandich.com... | ||||

| The Deathblow for Greece, A Congress vs. Goldman Photo Reenactment, Why Gold Isn’t a Posted: 28 Apr 2010 06:04 PM PDT The 5 min. Forecast April 28, 2010 11:36 AM by Addison Wiggin & Ian Mathias [LIST] [*] S&P deals deathblow to Greece… Dan Denning on how Greeks (and Americans) will pay the price [*] Congress grills Goldman… The 5’s photo-reenactment of another congressional boondoggle [*] Frank Holmes explains why gold still has plenty of room to rise [*] Plus, Byron King on the 100x45-mile oil spill in the Gulf, and what it means for oil investors [/LIST] When it comes to Greece, really, it’s like this: At this moment, there’s no telling what will happen to Wile and his Acme rocket. Maybe he’ll be shot off course, straight down into the canyon bed. Or the leather straps will break, and he’ll helplessly roll over the cliff’s edge. Most likely, the rocket will explode right where it rests, reducing Wile to a black stick figure of smoldering soot. But two things are for sure: 1) The fuse is lit. There’s no turning back. ... | ||||

| Golden Gridlines. Are You A Player? Posted: 28 Apr 2010 06:04 PM PDT Stewart Thomson email: [EMAIL="s2p3t4@sympatico.ca"]s2p3t4@sympatico.ca[/EMAIL] Apr 27, 2010 1. The Bugs Bunny Show continues to take comedy to new levels, surpassed only by the Angela "Euro to Zero" Merkel show. How she manages to keep a straight face while mauling the currency of her citizens, while they give her a standing ovation, is beyond my understanding. If I was in her place, I'd be on the floor screeching with laughter at the stupidity of my citizens while I ruined their currency, if I had her character. After handing the commercial banksters a $500 billion blank check after 8 hours of supposed "deliberation", she has engaged in endless weeks of rants about why the Greek govt can't get 1/100th of that amt, unless they agree to an equally endless list of supposed demands to ensure austerity. 2. Where were the demands on the commercial banksters? The real number is probably much larger than $500 billion. Only the saga of General Motors be... | ||||

| When Will Gold Make its Next Big Move? Posted: 28 Apr 2010 06:04 PM PDT When Will Gold Make its Next Big Move? By Jordan Roy-Byrne, CMT In recent commentaries, we’ve focused on the macro factors that will drive acceleration in the precious metals sector. Namely, the gradual exodus from both government and corporate bonds as authorities are forced to monetize debts in an effort to avoid rising interest rates, which would hasten default and bankruptcy. This, and not bank lending or consumer demand, is the cause of severe inflation. Predicting the timing is more difficult then the actual event. Luckily for our subscribers we constantly pour over numerous technical charts and sentiment indicators in order to advise as to favorable entry and exit points. In analyzing Gold, we find that intermarket analysis is an essential tool. Intermarket analysis is analyzing a market by comparing it to other markets. For Gold, the first study is a comparison with the S&P 500. In this chart I show Gold next to the Gold/S&P 500 ratio. ... | ||||

| All Aboard the Gold Train as Recognition Move Approaches Posted: 28 Apr 2010 06:04 PM PDT Since early 2009 we’ve written about the super-bullish long-term cup and handle pattern in Gold. It dates back to 1980 and has a logarithmic target of about $2,100. We noted that previous cup and handle patterns in Gold all reached their logarithmic target1. We expect that this move to $2,100 will be the recognition move that awakens the masses to the Gold bull market and the reality of severe inflation in the near future. Speaking of the near future, the relative strength of Gold in the face of a strong US dollar (or weak Euro) is one big hint that this recognition move is around the corner. We’ve noted this before and it is important to explain to new readers. Gold priced in foreign currencies has been leading Gold in US$ terms. It is true for the entire bull market and is quite evident in just the past few years. In the chart below we use the foreign currency ETF (UDN) to show Gold against currencies ex the US Dollar. The lower half ... | ||||

| Posted: 28 Apr 2010 06:04 PM PDT Tuesday morning trading in the Far East saw a slowly rising gold price until the dollar caught a bid on the euro's woes... and from there, gold went into a long, slow slide to its low of the day [$1,145.40 spot] a few minutes after 9:00 a.m. in New York. Then gold headed higher with a vengeance until minutes after London closed for the day... and from there, gold basically traded sideways until shortly after 2:00 p.m. in electronic trading, when another rally erupted taking gold to it's high of the day at $1,173.80 spot.. Then, either the selling stopped, or a big seller showed up to take five bucks off that price into the close of New York trading at 5:15 p.m. This was an eye-opening performance for gold on options expiry... and May isn't even a delivery month. Volume was extremely heavy. Without seeing what happened in the silver market, an outside observer would have assumed the same price pattern for silver [and all other precious metals as well]... but they ... | ||||

| Posted: 28 Apr 2010 06:04 PM PDT By Claire O'Connor and James West MidasLetter.com Wednesday, April 28, 2009 Nortec Minerals Corp. (TSX.V:NVT) is a Canadian based company with multi-continental exploration interests. Focusing at the moment on its PGP-Copper-Nickel, its Lithium and its gold properties in Finland, Nortec also has a finger in the Canadian mineral pie with a 51% interest in The Tasisuak Lake Property in Northern Labrador. On top of that, the company is presently in discussions with the Government of Ecuador for the acquisition of mining projects a little further south of the Canadian border. In an economic world where most CEOs are twiddling their thumbs, Nortec Minerals certainly seem to be breaking the mining mold. Generally, when a company is involved in so many simultaneous projects, the quality, because of the quantity, is questioned. Not necessarily with No... | ||||

| LGMR: Gold Defies Surging Dollar as "Ebola Contagion" Hits Euro Posted: 28 Apr 2010 06:04 PM PDT London Gold Market Report from Adrian Ash BullionVault 08:35 ET, Weds 28 April Gold Defies Surging Dollar as "Ebola Contagion" Hits Euro THE PRICE OF GOLD in large, wholesale gold bars held near a 4-month high vs. the Dollar early in London on Wednesday, trading above $1162 an ounce even as the US currency hit a 12-month hit against the Euro on fresh political wrangling over the Greek government bail-out. "It's not a question of the danger of contagion; contagion has already happened," said OECD secretary general Angel Gurria to journalists earlier. "This is like Ebola...threatening the stability of the financial system." Slashed to "junk bond" status yesterday by the credit rating agencies, Greek government debt continued to fall, driving two-year yields above 16%. Portuguese bonds also sank after they were downgraded two notches to "A minus" by S&P. US and German bonds eased back, while Asian stock markets extended Tuesday's slump in Western equ... | ||||

| Oh Gentle Ben??? Ben? Or Is That HAS BEEN? Posted: 28 Apr 2010 06:04 PM PDT Market Ticker - Karl Denninger View original article April 28, 2010 08:00 AM With the FOMC announcement just a couple of hours away I'd like to put forward a few things. First, as anyone with a pulse knows, Greece is in serious trouble. Yesterday Portugal was downgraded and today Spain got hit, the latter by S&P. This of course makes "contagion" no longer a theoretical exercise, and as market rates back up it will make rolling government debt "over there" more and more difficult - read: expensive. When you're running huge deficits, of course, making your debt funding more expensive just makes the deficit problem worse. As Greece has discovered this can quite-easily go from being "manageable" to "oh crap" in the space of a few weeks - or days. Ben's usual reaction to such a sovereign snowball getting some speed would be to cut rates. But wait - Bernanke is at zero. Oops. Quantitative easing? Of what? Greek and Spanish bonds? Do you t... | ||||

| Geithner May Be CRIMINALLY Charged? Posted: 28 Apr 2010 06:04 PM PDT Market Ticker - Karl Denninger View original article April 28, 2010 06:08 AM Gee, you think? [INDENT]The TARP watchdog has also criticized Treasury Secretary Timothy F. Geithner in reports and in congressional testimony for his handling of the process by which insurance giant American International Group Inc. was saved from insolvency in 2008, when Geithner was head of the Federal Reserve Bank of New York. The secrecy that enveloped the deal was unwarranted, Barofsky says, adding that his probe of an alleged New York Fed coverup in the AIG case could result in criminal or civil charges. [/INDENT]I have written extensively on this matter over the last 18 months and, in my opinion, such an outcome falls under the category of "it's about damn time!" Then there's this: [INDENT]Barofsky, a former federal prosecutor who was once the target of a kidnapping plot by Colombian drug traffickers, says he's also looking into possible insider trading connected to TARP. He says his agency... | ||||

| Client Update – Evolving Gold Breakout? Posted: 28 Apr 2010 06:04 PM PDT The following is automatically syndicated from Grandich's blog. You can view the original post here April 28, 2010 05:05 AM For months I’ve written about Evolving Gold (EVG-TSX-V $1.04- EVOGF.PK) and how it had possibly not one, but two world-class deposits but perceptions of management were IMHO depressing the share price. I’ve said it for years that management is the #1 key factor to a junior resource company’s success, or lack of. With one big move last week (And I suspect more to follow), I believe in my biased but honest opinion, EVG has vaulted back to the top of most junior resource buyers shopping list. Speculators are grasping just how significant it is to have “Tookie” Angus on board. Literally overnight, people are awakening to the realization that EVG has two awesome projects and the merits of those projects are back front and center and no longer the abilities (or lack there of) to move them forward by management. Knowing I work for the ... | ||||

| Posted: 28 Apr 2010 06:04 PM PDT | ||||

| Spain is in Pain - US Dollar and Gold Are Safe Havens Posted: 28 Apr 2010 05:47 PM PDT | ||||

| Euro Slide Hurts US Multinational Corporation Profits; Roubini Eyes Sovereign Debt Defaults… Posted: 28 Apr 2010 05:31 PM PDT | ||||

| Mickey Fulp: What Is Gold Actually Worth? Posted: 28 Apr 2010 05:02 PM PDT | ||||

| Posted: 28 Apr 2010 04:41 PM PDT There is a Gold Rush Underway in Iraq, with major implications for the rest of us. The success of the recent oil auctions in Iraq is creating a windfall for American oil services companies. Schlumberger (SLB), Baker Hughes (BHI), Weatherford (WFT), and Halliburton (HAL) have committed to drilling 2,500-3,000 new wells per year and building new pipeline and shipping terminal infrastructure that could make Iraq the world’s largest oil exporter. The value of these contracts may reach a massive $60 billion over the next six years, and could generate $1 billion in new revenues for each company per year. Two offshore terminals are already under construction, and another two are on the drawing board. If successful, the project will boost the country’s oil production from the current 2.5 million barrels a day to 12 million b/d by 2016. Iraq’s oil production peaked at 3 million b/d in 1979, and then went to nearly zero after it invaded Iran. I remember those days well, as I was issued a visa to accompany Saddam’s troops to Tehran, only to see it cancelled when the Iranians were able to mount a counter offensive. I still have the dessert camos and telephoto lenses need to cover the desert war, although the pants, regrettably, no longer fit. Iraq’s oil industry never recovered. UN sanctions limited the regime to minimal “official” exports that covered humanitarian imports like baby food and drugs. Tanker trucks smuggled out through Jordan what they could, with the proceeds going directly to Saddam’s family. When the US invaded, bails of hundred dollar bills were found stashed in private homes, the proceeds of these black market deals. American oil engineers were shocked by the poor state of Iraq’s energy infrastructure after 40 years of neglect. It all has to be rebuilt from scratch. If the new Iraqi government can provide the necessary infrastructure, and stabilize the political and security environment, it will become one of the largest changes to the landscape for international trade in decades. Those are all very big “ifs”. It will dump another Saudi Arabia’s worth of crude on the market. It will also go a long ways towards meeting China’s insatiable demand for oil, as well as that of other emerging economies, and put a long term cap on prices. Of course, this is the scenario that antiwar activists and conspiracy theorists feared eight years ago, but no one thought it would take so long to play out. With an oil man as president, a vice president from Halliburton, and a secretary of the army from Enron, who can blame them. Early in the planning of the war there was an expectation the US could defray some cost of the war with newly freed oil exports. I know, because I was there, my eight years in the Persian Gulf earning me an appointment as an outside consultant. I bailed when I saw the whole project was hopeless. The Bush administration didn't exactly welcome alternative analysis or viewpoints. Ever notice that Iraq’s oil industry was never targeted during either gulf war? These are usually prime targets in modern warfare. This is so important that I can’t believe no one else is talking about it. To see the data, charts, and graphs that support this research piece, as well as more iconoclastic and out-of-consensus analysis, please visit me at www.madhedgefundtrader.com . There, you will find the conventional wisdom mercilessly flailed and tortured daily, and my last two years of research reports available for free. You can also listen to me on Hedge Fund Radio by clicking on the “Today’s Radio Show” menu tab on the left on my home page.

| ||||

| International Forecaster April 2010 (#8) – Gold, Silver, Economy + More Posted: 28 Apr 2010 04:28 PM PDT By Bob Chapman, The International Forecaster US MARKETS

One thing the Greek crisis has shown us is that gold is a viable alternative to currencies. In spite of all the manipulation by the US government and the consistent blatant attempts to suppress both gold and silver they come back time after time. Gold finished last week strongly, as did silver and this week they will have to hold off the onslaught of our elitists, as both gold and silver options expire simultaneously. Gold was soundly bid in London as it was on the continent. Prices were assisted in London by a slowdown in growth on the fears that monetary loosening and stimulus would be needed to keep the economy from plunging again. The European Commission, ECB, and eurozone members were shocked when the Greek finance minister asked for activation of the financial support mechanism. The EC as usual lied about the request, but eventually admitted that it had been made for $90 billion. Greek bonds have risen to 11% yields and that is affecting bonds of other eurozone partners, such as Germany. Over the last five months gold expressed in euros has increased in value by 6%, as the public finally gets the message. It is called asset preservation. It is a service gold has performed for the past 6,000 years. The sludge in Washington and NYC intend to form a Financial Institutions Regulatory Administration that will allow the Fed to takeover every agency such as the CFTC and the SEC, the Comptroller of the Currency, Thrift Management and the FDIC. The Fed would be able to regulate just about everything financial. This consolidation would give the Fed enormous power to act like the SA operated in Germany from 1932 to 1945. They would cast a net out giving themselves unlimited power all under the guise of protecting Americans and others financially. Agencies won't be eliminated; they will be absorbed silently resulting in financial dictatorial power. As an example it is obvious that the SEC has become a rubber stamp for government and Wall Street. Now we find a supposedly understaffed, under funded agency is loaded with perverts who spend a good deal of their time watching pornography. This revelation has been created to convince Congress that this agency needs to be in stronger hands and who better to do that than the FED. This discovery was no coincidence. That means the privately owned Fed, which is controlled via the FOMC, which is the instrument of private shareholders, will control everyone's financial lives. Needless to say they will decide which institutions and corporations will fail and which will survive. Of course, all Illuminist connected firms will survive and corporate power will be solidified by the elitists. This monstrosity will make the FBI, CIA, IRS and Justice Department look like child's play. The next step would be to bring this regime to the entire world. Eventually it will probably have its SA-type of financial Gestapo. They will eliminate your financial freedom. They will control the infamous credit rating agencies that were used to create the credit crisis. They will set leverage guidelines, mandatory capital requirements and allow their members to continue to run roughshod over Americans. All private and public entities will report to them, including municipalities and states. It will set rules to control all credit and lending institutions. They supposedly will control all derivatives and hedge funds run by their friends. We need real regulation but not anything like this. These people are criminals. These are the people who deliberately created the credit crisis to obtain more control over the American people. A couple of additional beauties to be added would be a Consumer Protection Agency to regulate sales and business practices. The Fed will control their credit issuance and their prices. This past week the Dow gained 1.7%; the S&P 2.1%; the Russell 2000 3.8% and the Nasdaq 100 2.1%. Banks rose 5.8%; broker/dealers 3.4%; cyclicals rose 3.4%; transports 2.3%; consumers 1.9%; utilities 2.3%; high tech 0.9%; semis 1.7%; Internets 0.8% and biotechs fell 2.5%. Gold rallied $19.00; the HUI gold index gained 3.3% and the dollar gained 0.7% to 81.42. The two-year Treasury yields jumped 11 bps to 1.025% and the 10-year notes rose 5 bps to 3.82%. The 10-year German bund yield fell 2 bps to 3.06%. The Freddie Mac 30-year fixed rate mortgage was unchanged at 5.07%; the 15's fell 1 bps to 4.39%; one-year ARMs rose 9 bps to 4.22%, as the 30-year fixed rate jumbos saw rates fall 3 bps to 5.83%. Fed credit rose $20.5 billion to $2.318 trillion, up 14.4% year-to-date and 6.9% year-on-year. Fed foreign holdings of Treasury, Agency debt surged again up $21.8 billion to another record of $3.056 trillion. Custody holdings have increased $100.9 billion y-t-d or 11.1% annualized, and y-o-y 15.4%. M2 narrow money supply fell $36.2 billion to $8.467 trillion; year-on-year it grew 1.6%. Total money market fund assets fell $35 billion to $2.878 trillion. The funds are down $416 billion y-t-d and y-o-y $928 billion, or 24.4%. Total commercial paper rose $1.5 billion to $1.076 trillion. CP is off $94 billion, or 26.2% y-t-d and 27% y-o-y. Then they'll be an Office of National Insurance. A $150 billion industry funded vehicle, which will in reality bail out those too big to fail. It will guarantee obligations of solvent insured depository institutions, holding companies and affiliates. Contrary to what you have been told the Illuminist connected entities will be bailed out. The game being played at Goldman Sachs is a smoke screen created by those who control the SEC to make sure the Dodd financial reform package is passed. The hedge funds; derivatives, naked shorts, and market manipulators with black boxes will remain relatively untouched. The public needs someone to blame and it will be lower level players at Goldman. The Republican opposition will collapse and the worthless bill will pass – worthless to the public, but full of new riches for the elitists. Bailouts like those you have just seen over the past 2-1/2 years will continue. They'll be National Insurance, another name, and version of TARP and lots more GE's, GM's and AIG's. Nothing will be done about Geithner's AIG bailout and his money laundering activities. Nor will there be any investigation of the gold and silver suppression and manipulation. The latter will eventually fall of its own weight as more and more investors worldwide take possession of these metals. Needless to say the charade makes the president and the Democrats look good. It was Goldman that donated just under $1 million to the president's campaign. As you can see the mosaic all fits together. Goldman makes $13 billion after paying out $16 billion in bonuses to its employees, while receiving taxpayer subsidies. You should get it by now. You are being screwed. The dire situation with the dollar will worsen due to these antics and the elitists are well aware of that. As we write the dollar is 82.35. It is making a second attempt to break out over 82.50 We believe that will not take place. Recently William Dudley, president of the NY FED said as much. There is simply no escape. He also said interest rates would stay low indefinitely. This is whatJapan has done for 18 years and it has been a disaster. People have to be induced to add to their credit card debt and to stop saving. That supposedly will be accomplished by convincing the populace that a recovery is underway. There needs to be business investment and hiring. If you remember in the last issue we pointed out that 92% of small business owners believe there won't be a recovery for at least 14 to 18 months. Thus, we see little help from spending or hiring. The public is furious with the Fed and Wall Street. Evidence of fraud lies under every rock along with some CEO of a bank or brokerage house. In actually the real estate and the ensuing fraudulent bond fraud was the last straw in the elitist house of cards. The collapse known as the credit crisis will hobble America for years to come unless the system is purged. The Fed over the last year transferred off of bank balance sheets some $1.7 trillion in bonds, CDO's, known as toxic waste. The Fed won't tell us who they were purchased from or what was paid for them. It is another secret. The UStaxpayer will pay all the losses, as less Fed profits flow to the Treasury. Don't forget as well that the 3-card Monte game of the Fed lending money to banks at ½% and then receiving those funds back to earn 2% is also a paid for by the public to enrich the bankers. In the meantime no attempt has been made to fix the broken system. All the money is still flowing to Wall Street. A Wall Streetthat flourishes on information from the Fed secretly. This is the main reason the Fed has to be disbanded in its current form. In addition we need Glass Steagal bank to separate banking from brokerage, insurance and private equity. The end of the Act in 1999 ushered in the enabling of Wall Street to create the monster that we face today. The same thing happened in the 1920s and helped bring about the depression. The system cannot tolerate interest rates of more than 1% to 1-1/4% higher than they are now, which means the dollar will have to fall in value. Those moderate rate increases will inhibit speculation, create falling bond and stock markets and Treasury debt service will grow by about $150 billion a year. They will also push up commodity prices and the prices of gold and silver. Foreigners holding US dollar denominated assets will be penalized, as will be the purchasing power of Americans domestically as inflation rises. This brings us full circle back to gold and silver. The revelations of a few weeks ago at the CFTC hearings of LBMA leverage of 100 to one exposes a vast Ponzi scheme in that market as well as in Comex. Eventually participants will demand delivery realizing such an act will push prices higher. Then in time the exchanges won't be able to deliver and gold and silver trading on the LBMA and Comex will cease and the result will be only a cash market. Those who have sold certificates and had not purchased the underlying metal will also collapse. That leaves commerce only in gold and silver coins, bullion and shares. That is where you should be presently. These events will bring an end to this criminal enterprise and gold and silver will reach their rightful levels. We expect that a middled cash settlement will bring about the collapse and bankruptcy of many gold and silver traders and many contract holders will never be paid. These events will spell the end of the gold and silver ETFs, GLD and SLV, unless they are holding only physical silver and gold. We doubt very much that they are and how much have they leased out that will never be returned. The LBMA and the Comex are criminal enterprises and should be prosecuted as such. That applies as well to GLD and SLV if they do not have the physical bullion. If so this is a clear-cut case of criminal fraud. The Illuminists running this scam could spend the rest of their lives in jail or perhaps be hung for treason. These events would also make the Treasury insolvent if they do not have the gold they say they have and the Fed would as well be insolvent holding near worthless assets. He who has the gold will be making the rules. Eventually no foreigners will buy dollar denominated debt and dump all their dollars. Some will buy gold and silver. At that point gold will trade at $7,050 to $7,500 an ounce, if there is no inflation between now and when these events happen. … THE INTERNATIONAL FORECASTER

P. O. Box 510518, Punta Gorda, FL 33951-0518

Published and Edited by: Bob Chapman

CHECK OUT OUR WEBSITE 1-YEAR $159.95 U.S. Funds US AND CANADIAN SUBSCRIBERS: Make check payable to Robert Chapman (NOTInternational Forecaster), and mail to P.O. Box 510518, Punta Gorda, FL 33951-0518. Please include name, address, telephone number and e-mail address. Or: We accept Visa and MasterCard charges. Provide us with your card number and expiration date. We will charge your card US$159.95 for a one-year subscription. You can email us in two separate emails (1- the Credit Card Number with full name, address and your telephone number and (2- the Expiration date on the card.

NON US OR CANADIANS SUBSCRIBERS: Due to the time that it takes for your mail to arrive to us from a foreign country, we would like for you to email us as above the CC information in two separate emails.

Note: We publish twice a month by surface mail or twice a week by E-mail. bob@intforecaster.com RADIO APPEARANCES: To check out all of our radio appearances click on this link below: | ||||

| Gold Seeker Closing Report: Gold Gains Nearly $10 While Silver Falls Slightly Posted: 28 Apr 2010 04:00 PM PDT Gold traded mostly slightly higher in Asia and London and fell to its session low of $1160.48 to see a loss of $1.07 at around the open of trade in New York before it surged to as high as $1174.20 by midday and then fell back off a bit in afternoon trade, but it still ended with a gain of 0.8%. Silver fell as much as 30 cents to $17.80 in midmorning New York trade before it rose to see a 13 cent gain at $18.23 by around noon EST, but it then fell back off into the close and ended with a loss of 0.11%. | ||||

| Posted: 28 Apr 2010 03:34 PM PDT By Rick Ackerman, Rick's Picks We've featured both bullish and bearish headlines here in recent weeks, so it's time to clarify the outlook lest readers become confused. In brief, we are looking for an approximately 1400-point rally in the Dow Industrials this summer, but we're prepared to turn bearish if a change in stock market's technical condition warrants it (see chart below). So far, we're giving the bulls the benefit of the doubt based on a purely mechanical reading of the charts. But we also believe that Europe's financial crisis is starting to spin out of control, much as America's banking crisis did when Lehman Brothers went under. In Europe there is fear now, and even rioting in Greece, because no bailout measure tried so far has put deep anxieties to rest. Panic seems unavoidable at some point, and it could come in a day, a week, or a month, but probably sooner rather than later. Regarding our bullish call on the stock market, let us say up front that it goes sharply against our instincts and every shred of logic that we possess. Permabears do not come easily to the notion that stocks could rally so powerfully amidst a patently fraudulent economic recovery – a recovery that has touched almost no one we know and which, even at a very low level, cannot conceivably be sustained. Even so, putting our opinions and instincts aside, we've learned to simply trust the charts whenever there are doubts. Goldman Resists Tide This we have done, at least for the moment. As the week began, our technical runes told us it might not be a bad time to venture out on the limb with an especially bullish prediction. Thus, the headline "So Bullish on Stocks That We Feel Guilty". The commentary went on to explain why we were bullish on one stock in particular that we love to hate, Goldman Sachs (GS), even though the company's officers were at that very moment getting tarred and feathered on Capitol Hill for deceiving customers. Lo, as U.S. stocks were getting pounded on Tuesday, Goldman's shares held firm and closed up on the day. When the dust had settled, GS had traded just slightly below a key Hidden Pivot support we'd flagged at $151. The stock, a crucial bellwether for the banking sector and the stock market as a whole, has since rallied as high as 157.65. As far as we're concerned, as long as GS remains strong it will keep the broad averages buoyant. And that is why we will continue to monitor GS's vital signs very closely. Given our immediate expectations for GS and a recent, 12,471 forecast for the Dow, we were bullish as all get-out on Tuesday. Alas, stocks that day chose to take their nastiest plunge since early February. We felt, not chastised, but amused and flattered to know that Mr. Market evidently had been reading Rick's Picks. We saw the selling as a one-day affair, since it was tied directly to news that Greece's bonds had been downgraded to junk status, and that Portugal's debt had been taken down a couple of rungs as well. Long experience has taught us that it usually pays to fade a market that is being moved on headlines. That's because news is the most potent tool the Smart Money possesses to manipulate shares. If DaBoyz want to buy 'em, they wait for "bad" news and pull their bids, letting stocks fall to fire-sale levels. Political Liars But to infer that one day of manipulated selling is reason to turn bullish on the market overstates our willingness to cheerlead buyers. To repeat: We HATE this market, even if we've been able to go with the flow all the way up. Anyone who has followed the individual forecasts in Rick's Picks knows we've been continuously projecting higher prices since the bear rally began in March 2009, even as we continued to bad-mouth the economy and execrate the shameless political liars who have attempted to soft-peddle the recovery story. If you think our headlines net out to wishy-washy thinking, try tuning to our daily forecasts. They can be accessed free for seven days by clicking here. You'll have all of our services and features at your command, including a chat room that is live 24/7. (If you'd like to have Rick's Picks commentary delivered free each day to your e-mail box, click here.) >> What will gold do next?: Find out with a free one week trial of Rick's Picks. >> Join Rick for The Hidden Pivot Webinar 4/28-4/29. Find out how. © Rick Ackerman and Rick's Picks, 2010. | ||||

| SWC; a compelling Palladium Investment Posted: 28 Apr 2010 03:34 PM PDT By Sol Palha, Tactical Investor

Chinese Proverb In an article titled the Palladium; the stealth bull market, we explored the Palladium bull market and laid down the criteria necessary for Palladium to trade to the 800 ranges. We are going to post some of the excerpts of this article below before we take a look at Still water mining (SWC). It broke through the 1st resistance point at 375 with relative ease and is now attempting to break past an even stronger zone of resistance. The $465-$475 ranges make up a zone of very strong resistance, and most likely it will take several attempts before palladium manages to break past this zone; once it does though it should be clear sailing to the 550-600 ranges. The $465-$475 ranges which should have provided a zone of strong resistance, was once again taken out with ease, indicating that Palladium is in an extremely strong upward bullish phase. What is even more astounding is the fact that it has managed this in the face of a strengthening dollar; it is the only precious metal that continues to put in a series of new highs in tandem with a rising dollar. Palladium will now need to trade past the 465-475 ranges for 12 days in a row. If it can achieve this, it will set up the base for a rally that could take it all the way to the 800-890 ranges. If we had to put a time frame on this, we would say that once it trades past the 465-475 ranges for the suggested period of time, it could hit these targets within 12-18 months. It has managed to trade past the $465-475 ranges for more than 12 days in a row, laying the ground work for a move to the $800-$890 ranges. If Palladium maintains this momentum it could end up striking these targets a lot faster than we originally projected; potentially, it could hit these targets before the year is over. We have two palladium producers in North America, PAL and SWC, but SWC has a much stronger pattern and so our focus for now will be on this chap. SWC has had a tremendous run in the past 52 weeks and those who opened up positions early in the game and held onto them are now sitting on decent gains. As we do not like to chase a trend (we like to get in before the crowd jumps in) we are going to offer our long term and short to intermediate term views on this Stock. Long term view If SWC can close above $18 on a weekly basis, the odds of it testing its 3 year highs will be rather strong. We would not be surprised if after testing the $23.00-$24.00 ranges SWC experienced a small bout of profit taking. If during this round of profit taking SWC manages to stay above $12, then the next leg up should lead to a test of $30. The main leg of the battle would begin in $34-$36 ranges; if SWC can close above this level twice on a weekly basis (in other words remain above this level for 2 weekly closes in a row) or trades above this mark for 9 days in a row, the next target will fall in the $48-$51 ranges. A true bull market does not begin until its all time high is taken out; for SWC this would mean trading past the intra day high of 50.81 and above the closing high of 46.625. Once in the true bull phase, SWC should be able to at least double in price before putting in a long term top; this would equate to a target of roughly $100-$120.

Short to intermediate term outlook The above chart clearly illustrates that SWC has had a stellar run in the past 12 months; from low to high it has risen over 150%. Thus it would be normal to expect a bout of profit taking to take hold anytime. As long as it does not close below $12 on a weekly basis, the short to intermediate term outlook will remain bullish and a break past $18.00 for 3 days in a row could result in SWC trading to a new 3 year high. In the short term, we would be slightly cautious on how much new money we deployed into SWC as it would be best to wait for a pullback before committing new funds. Some stats on SWC Forward P.E. of 11.91 Average sales growth for the past 5 years has been 25% Total cash on hand 201 million Total debt 195 million % of shares held by insiders is a very healthy 52% % of shares held by institutional and mutual owners is 35% and this accounts for 72% of the float. Additional factors that support a bullish outlook for Palladium Worldwide sources of Palladium are rather limited. Over 80% of the world's Palladium is concentrated in just two countries, Russia and South Africa, with Russia's accounting for nearly half of the total Palladium supply. Russia has 3 sources of Palladium, the Norilsk Nickel mine, Gokhran and the Russian Central bank. Norilsk mines are the main source of palladium in Russia and production peaked back in the late eighties and output started to fall from the 90's, primarily due to lack of investment. Once prices started to rise in the 90's Norilsk started to invest more money into production and supplies of PGM's started to rise. However, production has started to fall again and to meet these supply short falls the Russian government has been selling Palladium from its stockpiles. This programme has now come to an end and with it roughly 125,000 pounds of Palladium will suddenly vanish from the supply chain. This is going shock the system (the shock process might already be underway) for taking out such a huge amount of Palladium of the market just when demand is rising is the perfect recipe to precipitate a run on Palladium as companies start to hoard supplies for fear of not having enough of the metal on hand. This could perhaps explain why Palladium is the only precious metal to put in a series of new highs in the face of a rising dollar. Note that world Palladium supplies fell by 1% in 2009 to 6.31 million ounces despite a 5% increase in South African output to 2.48 million ounces. This increase was off set by a drop in Canadian production due to the closure of the Lac des Lles mines at the end of 2008. Finally let's not forget the massive amount of interest the New Palladium and Platinum ETF's are creating. These two ETF's are gobbling up huge amounts of Platinum and palladium. As of March 2010, PALL holds roughly 520,000 ounces of Palladium; this ETF is barley 4 months old and its Palladium holdings have already surged past the 500,000 ounce mark. It took the London based Palladium ETF over 2 years to accumulate the same amount. Now add in the lower supplies, increased demand due to the Palladium ETF, voracious increase by the Chinese for Palladium and the eventual hoarding of this metal by the automotive sector when they realise that they could be facing a shortage, all go to ensure that Palladium has a long way to go before a long term top is in place. Our suggestion is use strong pull backs to add to your positions in both SWC and Palladium bullion whenever the opportunity presents itself. Conclusion The long term outlook for SWC is extremely bullish. The current pattern is projecting a high probability that its all time high will be taken out; the if factor has been removed and has been replaced with the when factor. In between one should expect a lot of volatility; remember that good things never come about easily; if they do they were not worth it to begin with. Unlike Palladium bullion, there are two factors that come into play for SWC. One is the price of bullion and the second is the overall health of the equity's markets. If the markets are experiencing a strong correction then SWC might not move up as fast as it normally would, even if Palladium prices are rising. Therefore, it would be wise to have a position in both Palladium bullion and SWC. Our long term targets for SWC now fall in the $100-$120 ranges. This could one day be viewed as a conservative target; once the real bullish phase of a rally begins it's not unusual for a stock to at least double in price. A real bull market begins when the all time high is taken out; in this case, it would be $46.625. From a long term perspective SWC has just begun its bullish run. Do not use a hatchet to remove a fly from your friend's forehead.

Disclosure; We have positions in Palladium bullion More articles from the Tactical Investor…. | ||||

| Spain is in Pain – US Dollar & Gold Are Safe Havens Posted: 28 Apr 2010 03:32 PM PDT By Chris Vermeulen, TheGoldAndOilGuy April 28th, 2010 It's been an interesting week with Spain being downgraded as Europe debt crisis widens. This has investors looking at the US dollar in a new light thinking that maybe it's not that bad of an investment after all. This sent the US Dollar higher along with the price of gold so far this week. The past 7 days we have seen both the US Dollar and Gold rise together which is not something that happens often. With financial crisis's popping up around the world I think the US dollar and gold will continue to strengthen (with corrections along the way). I think it will take another 12-24 months before another wave if issues arise in the financial markets and until then we just continue to focus mainly on buying the dips and corrections with the occasional short play in the larger corrections. USD, Gold And SP500 – Daily Performance Chart | ||||

| The Client Always Comes First At Goldman... Except When He Doesn't, Which Is Also Always Posted: 28 Apr 2010 03:30 PM PDT One day after the Goldman hearings, we were left with the warm and fuzzy impression that the whole Goldman farce was for nothing, and that everything the firm had been doing for the past 5 years was perfectly legitimate. The prop trading abuse, the discount window generosity, the endless abundance of flow and prop inventory commingling, the endless client rape...All these allegations must have been for naught. Which is why we were thoroughly disappointed when our sense of sudden enlightenment that we may have been wrong all along about Goldman, vanished promptly and without a trace once we had a chance to read the 2007 self-evaluation of Goldman Managing Director Michael Swenson. The line penned by Michael, who incidentally was the least like of the three Goldman SPG MDs testifying on Tuesday based on peer feedback, that broke our collective heart is the following: "Once the stress in the mortgage market started filtering into the cash market, I spent numerous hours on conference calls with clients discussing valuation methodologies for GS issued transactions in the subprime and second lien space [redacted] is prime example). I said "no" to clients who demanded that GS should "support the GSAMP" program as clients tried to gain leverage over us. Those were unpopular decisions but they saved the firm hundreds of millions of dollars." Alas, we find that all of Goldman's sincere hypocritical lies before the Senate committee were... precisely just that. As a refresher, the GSAMP, that Goldman was expected to support after demands by clients, refers to the Goldman Sachs Alternative Mortgage Product, or structured products such as the GSAMP 2006-S3 pictured below, which were originated by the firm in 2006, and which were largely wiped out by early 2007. See chart below (from Forbes):

So this is the GSAMP (in principle) that clients were asking for Goldman to support, incidentally at a time when Goldman was actively betting against it, and whose request denials were subsequently seen by Swenson as a boasting bullet that should be included in his self evaluation when demanding tens if not hundreds of millions of dollars in 2007 bonus. But lets re-read Swenson's words again:

It is hilarious that Goldman would "spend countless hours" with clients to convince them of the Goldman trade only after the stops had been hit and Goldman was actively trying to cover shorts, i.e., when the stress in the mortgage market was plainly visible for all to see. Maybe Goldman should have spent just one hour with its clients when it itself decided to go short in the first place, instead of using its clients as spitoons for its toxic, HR Giger based saliva. What is far more deplorable, is that Swenson admits that not only did the firm deny its client requests, but that these decisions lost the firm client credibility (although they saved Goldman "hundreds of millions"). And now you know why Lloyd Blankfein's statement that "the client always comes first" for Goldman is also merely anopther lie. But we all knew that. What deserves greater scrutiny is the question why Goldman thought it could get away with antagonizing clients in its pursuit for the almighty dollar? The answer is simple - Goldman knew then, just as it knows now, that it is a market monopoly, and that no matter how pissed off its clients get, they have no other options: Goldman has the biggest flow (which implicitly become prop) axes in the world, and the greatest "patzy" rolodex in the world. Well, after the implosion of every European bank, that rolodex was cut in half. But at least all the mutual and pension funds, not to mention momos, still remain, and are currently buying the market on the way up, just as Goldman keeps on hitting every new high bid. Yet the core premise remains: Goldman is a monopoly and the firm realizes this all too well. But maybe not for long. Very soon Zero Hedge will present our own proposal for regulatory reform, specifically as pertains to prop trading, which may hopefuilly make the lives of the incumbent market monopolist Goldman Sachs, for whom the client always comes last, just a tad more difficult. Full peer-reviews of the 3 Goldman MD and Fab Tourre (Swenson is the second of the four).

This posting includes an audio/video/photo media file: Download Now | ||||

| Gold Prices Hit 2010 High, Silver and Platinum Decline Posted: 28 Apr 2010 03:29 PM PDT

Gold was lifted Tuesday after Standard & Poor's downgraded Greece's and Portugal's credit rating. On Wednesday, the yellow metal received another safe-haven boost after news broke of Spain's credit rating cut by S&P's. In other markets, crude oil and U.S. stocks advanced after Federal Reserve officials reiterated their intent to keep interest rates near zero for an extended period and commented that the labor market showed signs of improvement. New York precious metal figures follow: (…) © CoinNews.net for Coin News, 2010. | | ||||

| Bullion Bulls Canada interviews GATA’s Adrian Douglas Posted: 28 Apr 2010 03:29 PM PDT 9:45p ET Wednesday, April 28, 2010 Dear Friend of GATA and Gold (and Silver): Bullion Bulls Canada this week did its first Internet radio interview — with GATA board member Adrian Douglas, who explained how the London gold market each day sells net claims to far more gold than is available to meet those claims and how this creation of vast amounts of paper gold is the primary mechanism of gold price suppression. The interview is about 40 minutes long and you can find it at the Bullion Bulls Canada Internet site here: http://www.bullionbullscanada.com/audio/BBC%20Interviews%20Adrian%20Doug… CHRIS POWELL, Secretary/Treasurer * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: This posting includes an audio/video/photo media file: Download Now | ||||

| Broad, bipartisan coalition fighting Fed in Senate Posted: 28 Apr 2010 03:29 PM PDT By Ryan Grim http://www.huffingtonpost.com/2010/04/27/broad-bipartisan-coalitio_n_553… As unusual a coalition as can be crafted in the Senate plans to fight for an amendment to the Wall Street reform bill that would open the Federal Reserve to a serious audit by the Government Accountability Office. Sponsored by Sen. Bernie Sanders, I-Vermont, the language is modeled after an amendment that passed the House, sponsored by Reps. Alan Grayson, D-Fla., and Ron Paul, R-Texas. Sanders is joined by four Republicans of varying politics: John McCain of Arizona, Jim DeMint of South Carolina, David Vitter of Louisiana, and Sam Brownback of Kansas. If Democrats in the Senate back the measure, it would have at least 63 votes, but Banking Committee Chairman Chris Dodd, D-Connecticut, is opposed and has argued against a broad audit. The chairman of the Judiciary Committee, Sen. Pat Leahy, D-Vermont, is also a cosponsor, as is Sen. Russ Feingold, D-Wisconsin. he group is actively gathering cosponsors as the Senate continues to vote to break a Republican filibuster that is preventing debate from beginning. "For nearly nine decades, the GAO has a proven track record of conducting objective, fact-based, nonpartisan, non-ideological, fair, and balanced audits. Through these audits, the GAO helped save the American taxpayers $50 billion last year alone by rooting out waste, fraud, and abuse in the federal government," reads a letter circulated by Sanders. "Let's not equate independence with secrecy. We cannot let the Fed operate in secrecy any longer. There is simply too much money at stake." The letter reads as follows: "The American people have a right to know who received over $2 trillion in financial assistance from the Federal Reserve. "Since the beginning of the financial crisis, the Federal Reserve has provided over $2 trillion in taxpayer-backed loans and other financial assistance to some of the largest financial institutions and corporations in the world. Unfortunately, the Fed is still refusing to tell the American people or the Congress who received most of this assistance, how much they received or what they are doing with this money. This money does not belong to the Federal Reserve; it belongs to the American people, and the American people have a right to know where their taxpayer dollars are going. "Therefore, during the consideration of the financial reform bill, we will offer an amendment to increase transparency at the Federal Reserve. Specifically, our amendment: "– Requires the non-partisan Government Accountability Office (GAO) to conduct an independent and comprehensive audit of the Federal Reserve within one year after the date of enactment of the financial reform bill. "– Requires the GAO to submit a report to Congress detailing its findings and conclusion of their independent audit of the Fed within 3 months. "– Requires the Federal Reserve within one month after the date of enactment to disclose the names of the financial institutions and foreign central banks that received financial assistance from the Fed since the start of the recession, how much they received, and the exact terms of this taxpayer assistance. "– Does not interfere with or dictate the monetary policies or decisions of the Federal Reserve. "Fifty-nine Senators, 320 members of Congress, and two federal courts have called on the Federal Reserve to become more transparent. "Our amendment is similar to an amendment that was offered to last year's budget resolution that passed the Senate on a bipartisan vote of 59-39 on April 1, 2009; S604, the Federal Reserve Sunshine Act, which now has 33 bipartisan co-sponsors; and the Federal Reserve Transparency Act (HR1207), which has 320 bipartisan co-sponsors (a version of which passed the House Financial Services Committee by a vote of 43-28 and was incorporated into the financial reform bill that passed the House last December). "In August 2009, the U.S. District Court for the Southern District of New York also ordered the Fed to disclose the recipients of this taxpayer assistance as a result of a Freedom of Information Act lawsuit filed by Bloomberg News. This decision was upheld by the U.S. Court of Appeals in Manhattan on March 19, 2010. "The Senate Financial Reform Bill does not do enough to make the Fed more transparent. "While the Senate financial reform bill attempts to address the lack of transparency at the Fed, as currently drafted, much of the information regarding the details of who received this financial assistance could be kept secret forever. "As long as the Federal Reserve is allowed to keep the information on their loans secret, we may never know the true financial condition of the banking system. The lack of transparency at the Fed could lead to an even bigger crisis in the future. "We now know that the lack of transparency in credit default swaps led to the $182 billion taxpayer bailout of AIG; the collapse of Lehman Brothers and precipitated the worst financial crisis since the Great Depression. "We know who received TARP funding. "Anyone with access to the Internet can go onto the Treasury Department's Website and find out exactly who received a bailout from the $700 billion TARP program. The American people have a right to know the same information from the Fed. "The Sanders Amendment does not undermine the Fed's independence. "This amendment does not take away the 'independence' of the Fed and it does not put monetary policy into the hands of Congress. "This amendment does not tell the Federal Reserve when to cut short-term interest rates or when to raise them. It does not tell the Federal Reserve what banks to lend money to and what banks not to lend money to. It does not tell the Federal Reserve what foreign central banks they can do business with and which ones it cannot do business with. It does not impose any new regulations on the Federal Reserve nor does it take any regulatory authority away from the Fed. "This amendment simply requires the GAO to conduct an independent audit of the Fed and requires the Fed to release the names of the recipients of more than $2 trillion in taxpayer-backed assistance. "For nearly nine decades, the GAO has a proven track record of conducting objective, fact-based, nonpartisan, non-ideological, fair, and balanced audits. Through these audits, the GAO helped save the American taxpayers $50 billion last year alone by rooting out waste, fraud, and abuse in the federal government. "Let's not equate independence with secrecy. We cannot let the Fed operate in secrecy any longer. There is simply too much money at stake." * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||

| Barrick Gold Corporation Q1 2010 Earnings Call Transcript Posted: 28 Apr 2010 03:29 PM PDT | ||||

| Posted: 28 Apr 2010 02:33 PM PDT Fear gives intelligence to fools, says an old proverb. Turning it around a bit, we might say that lack of fear makes fools of wise men. In the market, fear - or lack of same - finds expression in many forms. The Volatility Index, or VIX, is one of them. Known as the "fear gauge," the VIX bounces up and down based on what people are paying for options on the S&P 500. For example, if people are fearful, they tend to buy put options. Put options are like insurance against a fall in price. They pay off if the market falls. When investors pile into put options, they make the price of such options rise, and that pushes the VIX up, too. Conversely, when people are not worried, they sell those options - or at least they don't buy them. So the price falls, and so does the VIX. There has been a lot of that going on in the last year. The VIX recently hit its lowest point in 30 months, as shown by the nearby chart.  Fear looks cheap. Given all that is going on in the world, it is remarkable to find investors so complacent. The financial system is still a rather creaky affair. Leverage is still high. Banks remain undercapitalized. The credit cycle has not yet run its full course, as there are still significant credit losses hiding in the cupboards of banks. Then there are the governments of the world. The US has awful credit metrics. It is bleeding money and owes huge debts. Most of the 50 states are also bleeding money and have large debts, including giant gaps in unfunded pension liabilities. They are perhaps worse off, because unlike the US government, the states cannot print their own money. Then there is the EU. And Japan. There are only a few ways to cure such ills, and none are painless. One thing is for sure: These ills can't go on forever. In the context of all this, fear looks cheap. Conveniently, Wall Street has made fear a tradable commodity. One way to play it is through the iPath S&P 500 VIX Short-Term Futures fund. Though a mouthful, it simply aims to mimic the VIX. It trades under the ticker VXX, and started trading only this year. It's done horribly, as you would expect given the fall in the VIX. Yet it could be a nice play should we have another spike in the VIX. If fear should rear its head again, as it undoubtedly will, the VXX ought to prove nice insurance. More than just insurance, it could return three or four times your money, depending on the spike. Fear is cheap. Buy some before the price goes up. Chris Mayer | ||||